Interventional Radiology Products Market Size, Share & Trends by type (Stents, Catheters, IVC Filter, Biopsy Needles, Embolization Devices, Accessories), Procedure Type (Angioplasty, Angiography, Thrombolysis, Embolization), Applications (Oncology) - Global Forecast to 2026

Updated on : Aug 22, 2024

Interventional Radiology Products Market Size, Share & Trends

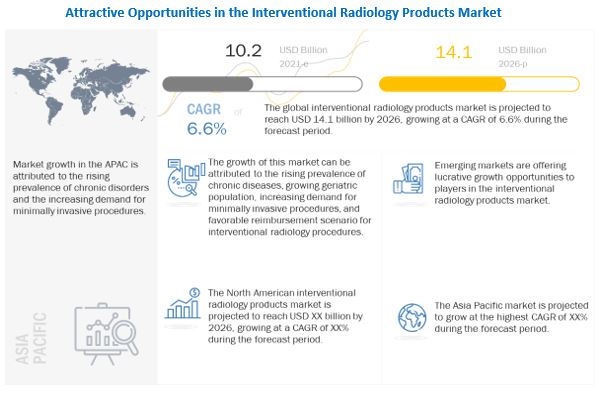

The size of global interventional radiology products market in terms of revenue was estimated to be worth $10.2 billion in 2021 and is poised to reach $14.1 billion by 2026, growing at a CAGR of 6.6% from 2021 to 2026. The comprehensive research encompasses an exhaustive examination of industry trends, meticulous pricing analysis, patent scrutiny, insights derived from conferences and webinars, identification of key stakeholders, and a nuanced understanding of market purchasing dynamics.

The growth in this market can be attributed to the rising prevalence of chronic diseases, growing geriatric population, increasing demand for minimally invasive procedures, and favorable reimbursement scenario for interventional radiology procedures. Emerging markets in Asian countries are expected to offer strong growth opportunities for players in the market. In contrast, high cost and inaccessibility of advanced therapeutics may restrict market growth to a certain extent. The interventional radiology products market is segmented based on type, procedure, application, and region.

Interventional Radiology Products Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Interventional radiology products Market Global Dynamics

Driver: Increasing demand for minimally invasive procedures

The demand for minimally invasive procedures has been increasing due to their advantages over conventional open surgery procedures. According to the American Institute of Minimally Invasive Surgery (AIMS), the benefits of minimally invasive procedures as compared to conventional open surgery procedures include increased safety, decreased scarring, faster recovery, and decreased length of hospital stay. The application areas of minimally invasive surgeries are also growing due to the increasing use of technologically advanced products and techniques, especially for the treatment of CVD, cancer, and peripheral artery disease (PAD). This is expected to positively influence the growth of the interventional radiology products market.

Restraint: High cost and inaccessibility of advanced therapeutics

Several under-developed and developing countries like India, South Africa, Afghanistan, Bhutan, and Nepal do not have centralized insurance systems and have higher out-of-pocket expenditure. This impacts the adoption of high-priced treatment procedures. For instance, according to the Journal of American Heart Association, the price of a drug-eluting stent ranges from USD 600 to USD 2,791 in India. The high cost of products and the lack of a well-defined health insurance system in developing countries are expected to hamper the adoption of advanced medical procedures.

Opportunity: Emerging markets

Emerging markets such as China, India, and Brazil offer significant growth opportunities for players operating in the interventional radiology products market. These countries are expected to witness high growth in the coming years, owing to the presence of less stringent regulatory policies and low competition. To leverage the high-growth opportunities in these markets, manufacturers are strategically focusing on expanding their presence in developing countries. Moreover, the increasing competition in mature markets is further compelling interventional radiology device manufacturers to focus on emerging markets.

Stent segment dominated the Interventional radiology products market in 2020.

Based on type, the interventional radiology products market is segmented into catheters, stents, inferior vena cava (IVC) filters, hemodynamic flow alteration devices, angioplasty balloons, thrombectomy systems, embolization devices, biopsy needles, accessories (contrast media, guidewires, balloon inflation devices, and other accessories), and other interventional radiology products (bone cements, nephrostomy tubes, and gastrostomy tubes). Stents account for the largest share of the interventional radiology products market. The large share of this segment can be attributed to the increasing incidence of cardiac diseases and cancer and the growing number of angioplasty procedures performed globally.

The cardiology segment to witness the highest CAGR during the forecast period.

Based on applications, interventional radiology products can be segmented into cardiology, urology & nephrology, oncology, gastroenterology, neurology, orthopedics, and other applications (pulmonary and gynecology). Cardiology account for the largest share of the interventional radiology products market and are expected to grow at the highest CAGR. The large share of this segment can be attributed to the rising geriatric population and the increasing prevalence of CVD across the globe.

North America was the largest regional market for interventional radiology products market in 2020.

The interventional radiology products is segmented into North America, Europe, the Asia Pacific, and the Rest of the World. In 2020, North America was the largest regional segment of the overall market, followed by Europe. The large share of the North American market can be attributed to the high prevalence of chronic diseases, growing geriatric population, increasing adoption of minimally invasive procedures, and the presence of key players in the region.

The prominent players operating in this market include Abbott (US), Medtronic (Ireland), Boston Scientific Corporation (US), Becton Dickinson and Company (US), Terumo Medical Corporation (Japan), and Cardinal Health (US)

Scope of the Interventional Radiology Products Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2021 |

$10.2 billion |

|

Projected Revenue Size by 2026 |

$14.1 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 6.6% |

|

Market Driver |

Increasing demand for minimally invasive procedures |

|

Market Opportunity |

Emerging markets |

This report categorizes the interventional radiology products market to forecast revenue and analyze trends in each of the following submarkets:

By Type

- Catheters

- Stents

- Inferior Vena Cava (IVC) Filters

- Hemodynamic Flow Alteration Devices

- Angioplasty Balloons

- Thrombectomy Systems

- Embolization Devices

- Biopsy Needles

- Accessories

- Other Interventional Radiology Products

By Procedure

- Angioplasty

- Angiography

- Embolization

- Thrombolysis

- Biopsy & Drainage

- Vertebroplasty

- Nephrostomy

- Other Procedures

By Application

- Cardiology

- Urology & Nephrology

- Oncology

- Gastroenterology

- Neurology

- Orthopedics

- Other Applications

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- RoE

-

Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific

- Rest of the World

Recent Developments:

- In 2021, Medtronic (Ireland) acquired the radial artery access portfolio from RIST Neurovascular, Inc. (US). This acquisition expanded the company’s portfolio in the interventional radiology products market and enhanced its ability to serve patients that require interventional neurovascular therapy.

- In 2020, Boston Scientific Corporation (US) signed an investment agreement to acquire Farapulse, Inc. (US) which will expand the company’s product portfolio in the interventional radiology products market.

- In 2020, Stryker (US) announced the acquisition of Wright Medical Group N.V. (Netherlands), a global medical device company focused on extremities and biologics.

Frequently Asked Questions (FAQ):

What is the impact of COVID-19 on the interventional radiology products market?

The COVID-19 pandemic has a negative impact on interventional radiology products. The reduced use of interventional radiology products due to the declining volume of elective and non-essential procedures, the lower diagnosis, reduced capital spending by customers, and a decrease in research activity due to laboratory closures and reduced clinical testing have all affected the market.

Who are the key players in the interventional radiology products market?

The prominent players operating in this market include Abbott (US), Medtronic (Ireland), Boston Scientific Corporation (US), Becton Dickinson and Company (US), Terumo Medical Corporation (Japan) and Cardinal Health (US).

Which product dominates the interventional radiology products market?

Stents account for the largest share of the interventional radiology products market. The large share of this segment can be attributed to the increasing incidence of cardiac diseases and cancer and the growing number of angioplasty procedures performed globally.

What factors are driving the interventional radiology products market?

Market growth is largely driven by factors such as rising prevalence of chronic diseases, growing geriatric population, increasing demand for minimally invasive procedures, and favorable reimbursement scenario for interventional radiology procedures.

What is the market for global interventional radiology products?

The global interventional radiology products market is projected to reach USD 14.1 billion by 2026 from USD 10.2 billion in 2021, at a CAGR of 6.6% during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS OF THE STUDY

1.3 MARKET SCOPE

FIGURE 1 INTERVENTIONAL RADIOLOGY PRODUCTS MARKET SEGMENTATION

1.3.1 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

FIGURE 3 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.2.1 GROWTH FORECAST

FIGURE 6 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

FIGURE 7 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

2.5 COVID-19 ECONOMIC ASSESSMENT

2.6 ASSESSMENT OF THE IMPACT OF COVID-19 ON THE ECONOMIC SCENARIO

FIGURE 9 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 10 RECOVERY SCENARIO OF THE GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 42)

FIGURE 11 INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 12 INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY PROCEDURE, 2021 VS. 2026 (USD MILLION)

FIGURE 13 INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY APPLICATION, 2021 VS. 2026 (USD MILLION)

FIGURE 14 INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY REGION, 2021 VS. 2026 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 45)

4.1 INTERVENTIONAL RADIOLOGY PRODUCTS MARKET OVERVIEW

FIGURE 15 INCREASING INCIDENCE OF CHRONIC DISORDERS TO DRIVE MARKET GROWTH

4.2 INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY TYPE (2021–2026)

FIGURE 16 STENTS SEGMENT TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

4.3 NORTH AMERICA: INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY TYPE AND COUNTRY (2020)

FIGURE 17 THE US DOMINATED THE NORTH AMERICAN INTERVENTIONAL RADIOLOGY PRODUCTS MARKET IN 2020

4.4 INTERVENTIONAL RADIOLOGY PRODUCTS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 18 INDIA TO REGISTER THE HIGHEST GROWTH DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 49)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 INTERVENTIONAL RADIOLOGY PRODUCTS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Rising prevalence of chronic diseases

5.2.1.2 Growing geriatric population

5.2.1.3 Increasing demand for minimally invasive procedures

5.2.1.4 Favorable reimbursement scenario for interventional radiology procedures

TABLE 1 REIMBURSEMENT FOR INTERVENTIONAL RADIOLOGY PROCEDURES IN THE US

5.2.2 RESTRAINTS

5.2.2.1 Availability of effective conventional first-level treatments

5.2.2.2 High cost and inaccessibility of advanced therapeutics

5.2.3 OPPORTUNITIES

5.2.3.1 Emerging markets

5.2.4 CHALLENGES

5.2.4.1 Entry barriers for new players

5.2.4.2 Product failures and recalls

5.3 REGULATORY LANDSCAPE

5.4 COVID-19 IMPACT ON THE INTERVENTIONAL RADIOLOGY PRODUCTS MARKET

5.5 TECHNOLOGY ANALYSIS

5.6 PRICING ANALYSIS

TABLE 2 PRICES OF INTERVENTIONAL RADIOLOGY PRODUCTS

5.7 TRADE ANALYSIS

TABLE 3 IMPORT DATA FOR INSTRUMENTS AND APPLIANCES USED IN MEDICAL, SURGICAL, OR VETERINARY SERVICES, BY COUNTRY, 2016-2020 (USD MILLION)

TABLE 4 EXPORT DATA FOR INSTRUMENTS AND APPLIANCES USED IN MEDICAL, SURGICAL, OR VETERINARY SERVICES, BY COUNTRY, 2016-2020 (USD MILLION)

TABLE 5 IMPORT DATA FOR NEEDLES, CATHETERS, AND CANNULAE USED IN MEDICAL, SURGICAL, DENTAL, OR VETERINARY PROCEDURES, BY COUNTRY, 2016-2020 (USD MILLION)

TABLE 6 EXPORT DATA FOR NEEDLES, CATHETERS, AND CANNULAE USED IN MEDICAL, SURGICAL, DENTAL, OR VETERINARY PROCEDURES, BY COUNTRY, 2016-2020 (USD MILLION)

5.8 PATENT ANALYSIS

5.9 VALUE CHAIN ANALYSIS

FIGURE 20 VALUE CHAIN ANALYSIS: MAJOR VALUE IS ADDED DURING THE MANUFACTURING AND ASSEMBLY PHASES

5.10 SUPPLY CHAIN ANALYSIS

FIGURE 21 DIRECT DISTRIBUTION: A STRATEGY PREFERRED BY PROMINENT COMPANIES

5.11 ECOSYSTEM ANALYSIS

5.11.1 ROLE IN THE ECOSYSTEM

TABLE 7 ROLE IN THE ECOSYSTEM

5.12 PORTER’S FIVE FORCES ANALYSIS

TABLE 8 PORTER’S FIVE FORCES

5.12.1 DEGREE OF COMPETITION

5.12.2 BARGAINING POWER OF SUPPLIERS

5.12.3 BARGAINING POWER OF BUYERS

5.12.4 THREAT OF SUBSTITUTES

5.12.5 THREAT OF NEW ENTRANTS

5.13 YCC SHIFT

6 INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY TYPE (Page No. - 65)

6.1 INTRODUCTION

TABLE 9 INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

6.2 STENTS

6.2.1 INCREASING ADOPTION OF DRUG-ELUTING STENTS AND BIOABSORBABLE STENTS—A KEY FACTOR DRIVING MARKET GROWTH

TABLE 10 INTERVENTIONAL RADIOLOGY STENTS MARKET, BY REGION, 2019–2026 (USD MILLION)

6.3 CATHETERS

TABLE 11 INTERVENTIONAL RADIOLOGY CATHETERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 12 INTERVENTIONAL RADIOLOGY CATHETERS MARKET, BY REGION, 2019–2026 (USD MILLION)

6.3.1 DIAGNOSTIC CATHETERS

6.3.1.1 Diagnostic catheters held the largest share of the interventional radiology catheters market

TABLE 13 INTERVENTIONAL RADIOLOGY DIAGNOSTIC CATHETERS MARKET, BY REGION, 2019–2026 (USD MILLION)

6.3.2 THERAPEUTIC CATHETERS

6.3.2.1 Increasing adoption of minimally invasive therapeutic procedures to drive market growth

TABLE 14 INTERVENTIONAL RADIOLOGY THERAPEUTIC CATHETERS MARKET, BY REGION, 2019–2026 (USD MILLION)

6.4 INFERIOR VENA CAVA FILTERS

6.4.1 INCREASING PREVALENCE OF PULMONARY EMBOLISM TO DRIVE MARKET GROWTH

TABLE 15 INTERVENTIONAL RADIOLOGY INFERIOR VENA CAVA FILTERS MARKET, BY REGION, 2019–2026 (USD MILLION)

6.5 HEMODYNAMIC FLOW ALTERATION DEVICES

6.5.1 RISING NUMBER OF REGULATORY APPROVALS AND TECHNOLOGICAL ADVANCEMENTS TO FAVOR MARKET GROWTH

TABLE 16 INTERVENTIONAL RADIOLOGY HEMODYNAMIC FLOW ALTERATION DEVICES MARKET, BY REGION, 2019–2026 (USD MILLION)

6.6 ANGIOPLASTY BALLOONS

6.6.1 RISING NUMBER OF REGULATORY APPROVALS FOR ANGIOPLASTY BALLOONS TO SUPPORT MARKET GROWTH

TABLE 17 INTERVENTIONAL RADIOLOGY ANGIOPLASTY BALLOONS MARKET, BY REGION, 2019–2026 (USD MILLION)

6.7 THROMBECTOMY SYSTEMS

6.7.1 INCREASING NUMBER OF PRODUCT INNOVATIONS AND APPROVALS TO AID MARKET GROWTH

TABLE 18 INTERVENTIONAL RADIOLOGY THROMBECTOMY SYSTEMS MARKET, BY REGION, 2019–2026 (USD MILLION)

6.8 EMBOLIZATION DEVICES

6.8.1 INCREASING INCIDENCE OF AORTIC ANEURYSMS IS A KEY FACTOR DRIVING MARKET GROWTH

TABLE 19 INTERVENTIONAL RADIOLOGY EMBOLIZATION DEVICES MARKET, BY REGION, 2019–2026 (USD MILLION)

6.9 BIOPSY NEEDLES

6.9.1 RISING PREVALENCE OF CANCER TO DRIVE THE ADOPTION OF BIOPSY NEEDLE PROCEDURES

TABLE 20 INTERVENTIONAL RADIOLOGY BIOPSY NEEDLES MARKET, BY REGION, 2019–2026 (USD MILLION)

6.10 ACCESSORIES

TABLE 21 INTERVENTIONAL RADIOLOGY ACCESSORIES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 22 INTERVENTIONAL RADIOLOGY ACCESSORIES MARKET, BY REGION, 2019–2026 (USD MILLION)

6.10.1 CONTRAST MEDIA

6.10.1.1 Contrast media segment held the largest share of the interventional radiology accessories market

TABLE 23 INTERVENTIONAL RADIOLOGY CONTRAST MEDIA MARKET, BY REGION, 2019–2026 (USD MILLION)

6.10.2 GUIDEWIRES

6.10.2.1 Rising number of surgical procedures to favor market growth

TABLE 24 INTERVENTIONAL RADIOLOGY GUIDEWIRES MARKET, BY REGION, 2019–2026 (USD MILLION)

6.10.3 BALLOON INFLATION DEVICES

6.10.3.1 Growth in the number of angioplasty procedures to drive the demand for balloon inflation devices

TABLE 25 INTERVENTIONAL RADIOLOGY BALLOON INFLATION DEVICES MARKET, BY REGION, 2019–2026 (USD MILLION)

6.10.4 OTHER ACCESSORIES

TABLE 26 INTERVENTIONAL RADIOLOGY MARKET FOR OTHER ACCESSORIES, BY REGION, 2019–2026 (USD MILLION)

6.11 OTHER INTERVENTIONAL RADIOLOGY PRODUCTS

TABLE 27 OTHER INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY REGION, 2019–2026 (USD MILLION)

7 INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY PROCEDURE (Page No. - 79)

7.1 INTRODUCTION

TABLE 28 INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

7.2 ANGIOGRAPHY

7.2.1 ANGIOGRAPHY IS THE LARGEST & FASTEST-GROWING SEGMENT OF THE INTERVENTIONAL RADIOLOGY PRODUCTS MARKET

TABLE 29 INTERVENTIONAL RADIOLOGY PRODUCTS MARKET FOR ANGIOGRAPHY, BY REGION, 2019–2026 (USD MILLION)

7.3 ANGIOPLASTY

7.3.1 RISING PREVALENCE OF STROKE TO DRIVE MARKET GROWTH

TABLE 30 NUMBER OF TRANSLUMINAL CORONARY ANGIOPLASTY PROCEDURES PERFORMED, BY COUNTRY, 2015 VS. 2018

TABLE 31 INTERVENTIONAL RADIOLOGY PRODUCTS MARKET FOR ANGIOPLASTY, BY REGION, 2019–2026 (USD MILLION)

7.4 BIOPSY & DRAINAGE

7.4.1 RISING PREVALENCE OF CANCER HAS INCREASED THE DEMAND FOR BIOPSY & DRAINAGE PROCEDURES

TABLE 32 INTERVENTIONAL RADIOLOGY PRODUCTS MARKET FOR BIOPSY & DRAINAGE, BY REGION, 2019–2026 (USD MILLION)

7.5 EMBOLIZATION

7.5.1 INCREASING DEMAND FOR EMBOLIZATION IN THE TREATMENT OF FIBROIDS TO DRIVE MARKET GROWTH

TABLE 33 INTERVENTIONAL RADIOLOGY PRODUCTS MARKET FOR EMBOLIZATION, BY REGION, 2019–2026 (USD MILLION)

7.6 THROMBOLYSIS

7.6.1 RISING PREVALENCE OF DVT TO DRIVE MARKET GROWTH

TABLE 34 INTERVENTIONAL RADIOLOGY PRODUCTS MARKET FOR THROMBOLYSIS, BY REGION, 2019–2026 (USD MILLION)

7.7 VERTEBROPLASTY

7.7.1 INCREASING CASES OF OSTEOPOROSIS TO DRIVE THE DEMAND FOR VERTEBROPLASTY PROCEDURES

TABLE 35 INTERVENTIONAL RADIOLOGY PRODUCTS MARKET FOR VERTEBROPLASTY, BY REGION, 2019–2026 (USD MILLION)

7.8 NEPHROSTOMY

7.8.1 INCREASING PREVALENCE OF KIDNEY DISEASES TO SUPPORT MARKET GROWTH

TABLE 36 INTERVENTIONAL RADIOLOGY PRODUCTS MARKET FOR NEPHROSTOMY, BY REGION, 2019–2026 (USD MILLION)

7.9 OTHER PROCEDURES

TABLE 37 NUMBER OF CHOLECYSTECTOMY PROCEDURES PERFORMED, BY COUNTRY, 2015 VS. 2018

TABLE 38 INTERVENTIONAL RADIOLOGY PRODUCTS MARKET FOR OTHER PROCEDURES, BY REGION, 2019–2026 (USD MILLION)

8 INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY APPLICATION (Page No. - 87)

8.1 INTRODUCTION

TABLE 39 INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

8.2 CARDIOLOGY

8.2.1 CARDIOLOGY IS THE LARGEST APPLICATION SEGMENT OF THE INTERVENTIONAL RADIOLOGY PRODUCTS MARKET

TABLE 40 INTERVENTIONAL RADIOLOGY PRODUCTS MARKET FOR CARDIOLOGY, BY REGION, 2019–2026 (USD MILLION)

8.3 UROLOGY & NEPHROLOGY

8.3.1 INNOVATION AND DEVELOPMENT OF PRODUCTS LIKE DRAINAGE CATHETERS TO SUPPORT MARKET GROWTH

TABLE 41 INTERVENTIONAL RADIOLOGY PRODUCTS MARKET FOR UROLOGY & NEPHROLOGY, BY REGION, 2019–2026 (USD MILLION)

8.4 ONCOLOGY

8.4.1 ONCOLOGY IS THE FASTEST-GROWING APPLICATION SEGMENT IN THE INTERVENTIONAL RADIOLOGY PRODUCTS MARKET

TABLE 42 INCREASING INCIDENCE OF CANCER, BY REGION, 2020 VS. 2030 VS. 2040 (MILLION)

TABLE 43 INTERVENTIONAL RADIOLOGY PRODUCTS MARKET FOR ONCOLOGY, BY REGION, 2019–2026 (USD MILLION)

8.5 GASTROENTEROLOGY

8.5.1 HIGH INCIDENCE OF GASTROINTESTINAL DISORDERS TO DRIVE MARKET GROWTH

TABLE 44 INTERVENTIONAL RADIOLOGY PRODUCTS MARKET FOR GASTROENTEROLOGY, BY REGION, 2019–2026 (USD MILLION)

8.6 NEUROLOGY

8.6.1 TECHNOLOGICAL ADVANCEMENTS TO SUPPORT MARKET GROWTH

TABLE 45 INTERVENTIONAL RADIOLOGY PRODUCTS MARKET FOR NEUROLOGY, BY REGION, 2019–2026 (USD MILLION)

8.7 ORTHOPEDICS

8.7.1 RISING GERIATRIC POPULATION TO AID THE GROWTH OF THIS MARKET

TABLE 46 INTERVENTIONAL RADIOLOGY PRODUCTS MARKET FOR ORTHOPEDICS, BY REGION, 2019–2026 (USD MILLION)

8.8 OTHER APPLICATIONS

TABLE 47 INTERVENTIONAL RADIOLOGY PRODUCTS MARKET FOR OTHER APPLICATIONS, BY REGION, 2019–2026 (USD MILLION)

9 INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY REGION (Page No. - 94)

9.1 INTRODUCTION

TABLE 48 INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY REGION, 2019–2026 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 22 NORTH AMERICA: INTERVENTIONAL RADIOLOGY PRODUCTS MARKET SNAPSHOT

TABLE 49 NORTH AMERICA: INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 50 NORTH AMERICA: INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 51 NORTH AMERICA: INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 52 NORTH AMERICA: INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

9.2.1 US

9.2.1.1 The US dominates the North American interventional radiology products market

TABLE 53 US: KEY MACROINDICATORS

TABLE 54 US: INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 55 US: INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 56 US: INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

9.2.2 CANADA

9.2.2.1 High burden of target diseases to drive the market in Canada

TABLE 57 CANADA: KEY MACROINDICATORS

TABLE 58 CANADA: INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 59 CANADA: INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 60 CANADA: INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

9.3 EUROPE

TABLE 61 NUMBER OF SURGICAL PROCEDURES PER 100,000 POPULATION, BY COUNTRY, 2018

TABLE 62 EUROPE: INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 63 EUROPE: INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 64 EUROPE: INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 65 EUROPE: INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Germany held the largest share of the European market in 2020

TABLE 66 GERMANY: KEY MACROINDICATORS

TABLE 67 GERMANY: INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 68 GERMANY: INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 69 GERMANY: INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

9.3.2 UK

9.3.2.1 Government insurance schemes to support market growth

TABLE 70 UK: KEY MACROINDICATORS

TABLE 71 UK: INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 72 UK: INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 73 UK: INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

9.3.3 FRANCE

9.3.3.1 Large number of interventional radiology procedures to propel market growth

TABLE 74 FRANCE: KEY MACROINDICATORS

TABLE 75 FRANCE: INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 76 FRANCE: INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 77 FRANCE: INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

9.3.4 ITALY

9.3.4.1 Rising geriatric population in the country to support the market growth

TABLE 78 ITALY: KEY MACROINDICATORS

TABLE 79 ITALY: INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 80 ITALY: INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 81 ITALY: INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

9.3.5 REST OF EUROPE (ROE)

TABLE 82 ROE: HEALTHCARE EXPENDITURE, BY COUNTRY, 2010 VS. 2018 (% OF GDP)

TABLE 83 ROE: INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 84 ROE: INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 85 ROE: INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

9.4 ASIA PACIFIC

FIGURE 23 ASIA PACIFIC: INTERVENTIONAL RADIOLOGY PRODUCTS MARKET SNAPSHOT

TABLE 86 ASIA PACIFIC: INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 87 ASIA PACIFIC: INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 88 ASIA PACIFIC: INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 89 ASIA PACIFIC: INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

9.4.1 JAPAN

9.4.1.1 Japan accounted for the largest share of the APAC market in 2020

TABLE 90 JAPAN: KEY INDICATORS

TABLE 91 JAPAN: INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 92 JAPAN: INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 93 JAPAN: INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

9.4.2 CHINA

9.4.2.1 High tobacco consumption to favor market growth

TABLE 94 CHINA: ESTIMATED ANNUAL DES VOLUME AND NUMBER OF CLASS III HOSPITALS, BY CITY (2019)

TABLE 95 CHINA: KEY INDICATORS

TABLE 96 CHINA: INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 97 CHINA: INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 98 CHINA: INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

9.4.3 INDIA

9.4.3.1 Improving healthcare infrastructure and rising number of hospitals to support market growth in India

TABLE 99 INDIA: KEY INDICATORS

TABLE 100 INDIA: INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 101 INDIA: INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 102 INDIA: INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

9.4.4 REST OF ASIA PACIFIC (ROAPAC)

TABLE 103 ROAPAC: INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 104 ROAPAC: INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 105 ROAPAC: INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

9.5 REST OF THE WORLD (ROW)

TABLE 106 ROW: INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 107 ROW: INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 108 ROW: INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 133)

10.1 OVERVIEW

FIGURE 24 KEY DEVELOPMENTS IN THE INTERVENTIONAL RADIOLOGY PRODUCTS MARKET, JANUARY 2018–APRIL 2021

10.2 MARKET SHARE ANALYSIS

TABLE 109 INTERVENTIONAL RADIOLOGY PRODUCTS MARKET: DEGREE OF COMPETITION (2020)

10.3 COMPANY EVALUATION QUADRANT

10.3.1 STARS

10.3.2 EMERGING LEADERS

10.3.3 PERVASIVE PLAYERS

10.3.4 PARTICIPANTS

FIGURE 25 INTERVENTIONAL RADIOLOGY PRODUCTS MARKET: COMPANY EVALUATION QUADRANT, 2020

10.4 COMPANY EVALUATION QUADRANT FOR SME/START-UPS

10.4.1 PROGRESSIVE COMPANIES

10.4.2 STARTING BLOCKS

10.4.3 RESPONSIVE COMPANIES

10.4.4 DYNAMIC COMPANIES

FIGURE 26 INTERVENTIONAL RADIOLOGY PRODUCTS MARKET: COMPANY EVALUATION QUADRANT FOR SME & START-UPS, 2020

10.5 COMPETITIVE SCENARIO

FIGURE 27 MARKET EVALUATION MATRIX, 2018–2021

10.5.1 DEALS

TABLE 110 DEALS

10.5.2 PRODUCT LAUNCHES

TABLE 111 PRODUCT LAUNCHES

10.5.3 OTHER DEVELOPMENTS

TABLE 112 OTHER DEVELOPMENTS

10.6 COMPANY PRODUCT FOOTPRINT

TABLE 113 COMPANY FOOTPRINT

FIGURE 28 COMPANY PRODUCT FOOTPRINT

FIGURE 29 COMPANY APPLICATION FOOTPRINT

TABLE 114 COMPANY GEOGRAPHICAL FOOTPRINT

11 COMPANY PROFILES (Page No. - 147)

11.1 KEY PLAYERS

(Business Overview, Products/Services/Solutions Offered, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)*

11.1.1 MEDTRONIC PLC

TABLE 115 MEDTRONIC: BUSINESS OVERVIEW

FIGURE 30 MEDTRONIC: COMPANY SNAPSHOT (2020)

11.1.2 BOSTON SCIENTIFIC CORPORATION

TABLE 116 BOSTON SCIENTIFIC CORPORATION: BUSINESS OVERVIEW

FIGURE 31 BOSTON SCIENTIFIC CORPORATION: COMPANY SNAPSHOT (2020)

11.1.3 BECTON, DICKINSON AND COMPANY

TABLE 117 BECTON, DICKINSON AND COMPANY: BUSINESS OVERVIEW

FIGURE 32 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT (2020)

11.1.4 ABBOTT

TABLE 118 ABBOTT: BUSINESS OVERVIEW

FIGURE 33 ABBOTT: COMPANY SNAPSHOT (2020)

11.1.5 CARDINAL HEALTH

TABLE 119 CARDINAL HEALTH: BUSINESS OVERVIEW

FIGURE 34 CARDINAL HEALTH: COMPANY SNAPSHOT (2020)

11.1.6 B. BRAUN MELSUNGEN AG

TABLE 120 B. BRAUN MELSUNGEN: BUSINESS OVERVIEW

FIGURE 35 B. BRAUN MELSUNGEN AG: COMPANY SNAPSHOT (2020)

TABLE 121 EXCHANGE RATES USED FOR THE CONVERSION OF EUR TO USD

11.1.7 STRYKER

TABLE 122 STRYKER: BUSINESS OVERVIEW

FIGURE 36 STRYKER: COMPANY SNAPSHOT (2020)

11.1.8 TERUMO MEDICAL CORPORATION

TABLE 123 TERUMO MEDICAL CORPORATION: BUSINESS OVERVIEW

FIGURE 37 TERUMO MEDICAL CORPORATION: COMPANY SNAPSHOT (2019)

TABLE 124 EXCHANGE RATES USED FOR THE CONVERSION OF JPY TO USD

11.1.9 COOK MEDICAL

TABLE 125 COOK MEDICAL: BUSINESS OVERVIEW

11.1.10 BIOSENSORS INTERNATIONAL GROUP, LTD.

TABLE 126 BIOSENSORS INTERNATIONAL GROUP, LTD.: BUSINESS OVERVIEW

11.1.11 TELEFLEX INCORPORATED

TABLE 127 TELEFLEX INCORPORATED: BUSINESS OVERVIEW

FIGURE 38 TELEFLEX INCORPORATED: COMPANY SNAPSHOT (2020)

11.1.12 IVASCULAR S.L.U.

TABLE 128 IVASCULAR S.L.U.: BUSINESS OVERVIEW

11.1.13 PENUMBRA, INC.

TABLE 129 PENUMBRA, INC.: BUSINESS OVERVIEW

FIGURE 39 PENUMBRA, INC.: COMPANY SNAPSHOT (2020)

11.1.14 BIOTRONIK SE & CO. KG

TABLE 130 BIOTRONIK SE & CO. KG: BUSINESS OVERVIEW

11.1.15 ENDOCOR GMBH

TABLE 131 ENDOCOR GMBH: BUSINESS OVERVIEW

11.1.16 MERIL LIFE SCIENCES PVT. LTD.

TABLE 132 MERIL LIFE SCIENCES PVT. LTD.: BUSINESS OVERVIEW

11.2 OTHER PLAYERS

11.2.1 PALEX MEDICAL SA

11.2.2 URESIL, LLC

11.2.3 ALVIMEDICA

11.2.4 CARDIONOVUM GMBH

11.2.5 SMT

11.2.6 MEDINOL LTD.

11.2.7 COMED B.V.

11.2.8 SCITECH

11.2.9 BALTON SP. Z O.O.

11.2.10 RONTIS CORPORATION

*Business Overview, Products/Services/Solutions Offered, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 211)

12.1 INSIGHTS FROM INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

FIGURE 39 PENUMBRA, INC.: COMPANY SNAPSHOT (2020)

11.1.14 BIOTRONIK SE & CO. KG

TABLE 130 BIOTRONIK SE & CO. KG: BUSINESS OVERVIEW

11.1.15 ENDOCOR GMBH

TABLE 131 ENDOCOR GMBH: BUSINESS OVERVIEW

11.1.16 MERIL LIFE SCIENCES PVT. LTD.

TABLE 132 MERIL LIFE SCIENCES PVT. LTD.: BUSINESS OVERVIEW

11.2 OTHER PLAYERS

11.2.1 PALEX MEDICAL SA

11.2.2 URESIL, LLC

11.2.3 ALVIMEDICA

11.2.4 CARDIONOVUM GMBH

11.2.5 SMT

11.2.6 MEDINOL LTD.

11.2.7 COMED B.V.

11.2.8 SCITECH

11.2.9 BALTON SP. Z O.O.

11.2.10 RONTIS CORPORATION

*Business Overview, Products/Services/Solutions Offered, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 211)

12.1 INSIGHTS FROM INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

This study involved four major activities in estimating the current size of the interventional radiology products market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive, technical, market-oriented, and commercial study of the interventional radiology products market. The secondary sources used for this study include European Society of Radiology/European Congress of Radiology (ESR/ECR), Society of Interventional Radiology, Asia Pacific Congress of Cardiovascular & Interventional Radiology (APCCVIR), Organisation for Economic Co-operation and Development (OECD), American Association for Cancer Research, US Food and Drug Administration (US FDA), American Medical Association (AMA), Centers for Disease Control and Prevention (CDC), World Health Organization (WHO), Eurostat, SEC Filings, Annual Reports, Expert Interviews, and MarketsandMarkets Analysis. These sources were also used to obtain key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

Primary Research

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects of the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the interventional radiology products market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research

- The revenues generated from the interventional radiology products business of leading players have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the global interventional radiology products market based on the type, procedure, application and region

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, and opportunities)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contributions to the overall interventional radiology products market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to five main regions, namely, North America, Europe, Asia Pacific, and the Rest of the World

- To strategically profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments such as acquisitions, product launches, expansions, agreements, partnerships, and R&D activities in the interventional radiology products market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Company Information

- An additional five company profiles

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Interventional Radiology Products Market