Peripheral Vascular Devices Market Size, Growth, Share & Trends Analysis

Peripheral Vascular Devices Market by Type (Angioplasty Balloon & Angioplasty Stent, Catheters (IVUS/OCT), Plaque Modification, Vascular Closure Devices, Balloon Inflation Devices, Hemodynamic Flow Alteration), End User - Global Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global peripheral vascular devices market, valued at USD 9.55 billion in 2025, stood at USD 10.02 billion in 2026 and is projected to advance at a resilient CAGR of 5.7% from 2026 to 2031, culminating in a forecasted valuation of USD13.22 billion by the end of the period. This market has been experiencing significant growth, primarily driven by the rising incidence of peripheral artery disease (PAD) and similar conditions. This increase is largely attributed to the expanding elderly population, as well as the rising rates of diabetes, obesity, and smoking. Additionally, more efficient payment systems for endovascular surgeries and a growing preference among patients for less-invasive treatments—characterized by quicker recovery times and shorter hospital stays—are key factors contributing to the faster adoption of these devices. Advancements in the use of stents, balloons, atherectomy techniques, and imaging systems are continually improving clinical outcomes and expanding treatment options. Furthermore, the emergence of new markets with advanced healthcare systems, along with increasing technological advancements and awareness of peripheral vascular interventions, strongly supports market growth.

KEY TAKEAWAYS

-

ANGIOPLASTY STENTS MARKETThe angioplasty stents segment is expected to register a CAGR of 4.3% during the forecast period.

-

ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS MARKETThe endovascular aneurysm repair stent grafts segment is expected to register a CAGR of 6.8% during the forecast period.

-

INFERIOR CAVA FILTERS MARKETThe retrievable filters segment held a market share of 71.4% in 2025.

-

CATHETERS MARKETThe guiding catheters segment held a market share of 48.7% in 2025.

-

ANGIOPLASTY BALLOONS MARKETThe old/normal balloons segment dominated the market, with a share of 48.3%, in 2025.

-

PLAQUE MODIFICATION DEVICES MARKETThe atherectomy devices segment accounted for the largest share of 65.5% in 2025.

-

HEMODYNAMIC FLOW ALTERATION DEVICES MARKETThe embolic protection devices segment dominated the market, with a share of 63.7%, in 2025.

-

OTHER PERIPHERAL VASCULAR DEVICES MARKETThe guidewires segment held the largest share of 44.0% of the market in 2025.

-

COMPETITIVE LANDSCAPE - KEY PLAYERSBoston Scientific Corporation (US), Medtronic (US), Abbott (US), B. Braun SE (Germany), and Terumo Corporation (Japan) were identified the star players in the peripheral vascular devices market, given their extensive reach in the US and their comprehensive product portfolios.

-

COMPETITIVE LANDSCAPE - STARTUPSMeril Life Sciences Pvt. Ltd. (India), ALVIMEDICA (Turkey), CARDIONOVUM GMBH (Germany), SMT (India), and Medinol Ltd. (Israel) are emerging players as they specialize in peripheral vascular devices.

The market for peripheral vascular devices is anticipated to grow due to several factors, including the rising incidence of peripheral artery disease and diabetes, an increasingly aging global population, and a preference for minimally invasive endovascular procedures that reduce hospital stays and recovery times. Additionally, ongoing technological advancements, such as drug-coated balloons, advanced stents, atherectomy systems, and image-guided navigation, are not only improving patient care but also expanding the range of patients eligible for treatment. Furthermore, the market is being propelled by investments in healthcare infrastructure, a shift toward performing more procedures in ambulatory surgical centers, and increased awareness and early diagnosis of vascular disorders, particularly in developing countries.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The global market for peripheral vascular devices is experiencing rapid growth, driven by the needs of the medical sector, new technologies, and evolving care delivery models. Conditions such as peripheral artery disease (PAD), diabetes, and chronic limb-threatening ischemia are prevalent among the elderly population, contributing to an increase in peripheral interventions worldwide. The medical community is increasingly moving toward less-invasive endovascular procedures, which offer lower complication rates, faster patient recovery, and reduced overall treatment costs. This trend has accelerated the adoption of low-profile catheters, guidewires, balloons, stents, atherectomy systems, and embolic protection devices. Additionally, advanced imaging and physiology-based tools, such as intravascular ultrasound (IVUS), optical coherence tomography (OCT), and real-time flow and perfusion assessments, are being integrated into these procedures. This integration enhances the precision of treatments, allowing for the management of more complex peripheral lesions. Furthermore, the shift of certain peripheral procedures to outpatient clinics and ambulatory surgical centers in developed regions is increasing the demand for efficient and cost-effective peripheral vascular devices. This is supported by the growth of catheterization lab infrastructure and improved access to care in emerging economies. Alongside these factors, the digital transformation of vascular labs—through AI-assisted imaging, workflow automation, and data-driven clinical decision support—is significantly contributing to market growth. Moreover, value-based care models, pricing pressures, and changes in regulatory and clinical evidence requirements are intensifying competition. This dynamic environment is driving manufacturers to continuously innovate, differentiate their product portfolios, and establish global strategic partnerships.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rapid growth in geriatric population and resulting increase in disease prevalence

-

Favorable reimbursement scenario for peripheral vascular procedures

Level

-

Availability of alternative treatment options

-

Shortage of skilled professionals with expertise in peripheral vascular devices

Level

-

High growth potential in emerging markets

Level

-

Product failures and device recalls

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rapid growth in geriatric population and resulting increase in disease prevalence

As the number of elderly people worldwide increases rapidly, this demographic shift has positively impacted the growth of the peripheral vascular devices market. Older adults are particularly susceptible to various diseases, such as peripheral artery disease, atherosclerosis, and diabetes, which often require medical procedures and devices for diagnosis and treatment. As this population ages, there will be a greater demand for procedures such as angioplasty, stenting, atherectomy, and thrombectomy. There will also be an increasing need for less invasive, low-risk devices that facilitate faster recovery in elderly patients. Consequently, the market for peripheral vascular devices is expected to grow steadily in response to these demands.

Restraint: Availability of alternative treatment options

The peripheral vascular devices market is facing challenges due to the rapid rise in alternative treatment options. These alternatives enable certain patient groups to avoid invasive and device-based procedures. One significant area of improvement is in pharmacological therapies, where the use of drugs is becoming more widely accepted. Specifically, drug therapy for patients with peripheral vascular disease has seen remarkable advancements with the introduction of better antiplatelet agents, anticoagulants, lipid-lowering medications, and diabetes management strategies. These improvements contribute to effective disease control and symptom relief in the early and moderate stages of the disease. Additionally, supervised exercise therapy, lifestyle modification programs, and non-invasive vascular care pathways are increasingly recommended in clinical guidelines to delay or potentially eliminate the need for endovascular procedures. These alternatives are often less expensive and carry lower risks, which can limit the volume of procedures performed and hinder the adoption of devices, especially in cost-sensitive healthcare systems and value-based care environments.

Opportunity: High growth potential in emerging markets

The peripheral vascular devices market is experiencing significant growth opportunities, particularly in emerging markets, due to the rising incidence of obesity. Factors such as urbanization, lack of physical activity, and unhealthy eating habits contribute to the increase in obesity in regions like Asia Pacific, Latin America, and the Middle East. This rise in obesity is linked to a higher prevalence of diabetes, hypertension, and peripheral artery disease. At the same time, medical infrastructure in these areas is improving, making interventional care more accessible. Increased healthcare spending and heightened awareness among medical professionals have led to a growing number of procedures being performed. This combination of factors drives the demand for cost-effective and less-invasive peripheral vascular devices that can accommodate high patient volumes. As a result, emerging economies are playing a key role in the growth of the market.

Challenge: Product failures and device recalls

The peripheral vascular devices market is significantly affected by product failures and recalls, which are eroding clinician trust, causing supply chain disruptions, and attracting increased scrutiny from regulatory bodies. Various issues, such as stent fractures, balloon failures, coating delamination, and thrombotic complications, can lead to adverse patient outcomes. These complications often result in recalls and post-market investigations. As a consequence of these events, manufacturers are compelled to invest more in compliance, experience delays in product launches, and face potential legal and reputational challenges. Consequently, healthcare providers may become wary of adopting new technologies, leading to slower acceptance rates. This situation will heighten the demand for robust clinical evidence, stringent quality control, and validated long-term performance.

PERIPHERAL VASCULAR DEVICES MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Boston Scientific has a vast worldwide footprint in the peripheral vascular devices market, offering a wide range of products, including peripheral stents, drug-coated balloons, atherectomy systems, thrombectomy devices, embolic protection devices, and guidewires. The company's products are frequently used in the treatment of complex cases of peripheral artery disease (PAD), including below-the-knee and chronic total occlusion (CTO) cases, as well as calcified-lesion types of PAD, in both hospital cath labs and ASCs. Moreover, the firm is actively broadening its clinical application areas through its robust clinical trials and non-invasive, peripheral-intervention-focused innovations. | Boston Scientific's peripheral devices facilitate precise lesion management, minimize restenosis, and enhance long-term vessel patency. These devices are compatible with existing cath lab infrastructure and are backed by strong clinical evidence. They are user-friendly, allowing physicians to efficiently address complex cases. As a result, patients experience quicker recoveries and lower treatment costs. |

|

Medtronic offers a comprehensive range of peripheral vascular devices, including drug-coated balloons, peripheral stents, endovascular grafts, and catheter-based delivery systems for both arterial and venous interventions. These products aid in the treatment of peripheral artery disease (PAD), venous thromboembolism, and complex peripheral lesions across a diverse patient population, from standard cases to high-risk individuals. Medtronic's solutions are increasingly recognized and utilized in outpatient and minimally invasive treatment settings. | Medtronic's peripheral technologies play a vital role in improving procedural safety, treatment durability, and overall process efficiency. The company's significant investments in innovation, physician training, and long-term clinical outcomes enable healthcare providers to perform effective revascularization while significantly reducing complication rates. As a result, Medtronic's devices are ideal for value-based and cost-sensitive healthcare systems. |

|

Abbott has established a strong presence in peripheral vascular interventions through its extensive portfolio of vascular devices. This portfolio includes vessel closure systems, peripheral stents, and endovascular therapy solutions used to treat peripheral artery disease (PAD) and to perform complex peripheral procedures in catheterization laboratories and vascular centers. Additionally, the company provides support for lesion assessment and procedural planning through integrated solutions that enhance the overall treatment workflow. | Abbott's products enable efficient and controlled peripheral interventions by improving access area management, reducing procedure time, and ensuring safer vascular closure. This leads to more reliable device performance and ultimately better clinical outcomes. Its product range enhances hospital efficiency during procedures and supports faster patient recovery, making treatment pathways more cost-effective. |

|

BD plays a crucial role in peripheral vascular care through its range of vascular access and intervention devices, including IV catheters, access systems, and imaging-guided procedural tools. These solutions not only support peripheral interventions but also enhance related therapies. BD's products have become standard practice in hospitals and ambulatory settings, enabling easier access to procedures, improving overall process effectiveness, and meeting the diverse interventional needs in vascular disease management. | BD’s portfolio improves clinical workflows and enhances procedure safety by providing reliable vascular access and reducing complications such as infiltration and needlestick injuries. Additionally, it facilitates quicker readiness for interventions. This approach not only supports hospitals in implementing universal access protocols and more efficient use but also minimizes procedural delays, ultimately leading to a better patient experience. |

|

Terumo plays a crucial role in peripheral vascular interventions with its comprehensive range of guidewires, sheaths, catheters, and endovascular therapy devices for both peripheral artery disease (PAD) and complex cases. The company’s innovations are present in diagnostic angiography and therapeutic interventions, enabling navigation through challenging anatomical areas and facilitating treatment for both standard- and high-risk patients. | With the exception of the artificial intelligence line-up, Terumo’s devices are known for their excellent trackability, superior grip, and procedural accuracy. These features enable doctors to perform complex procedures with improved device deliverability and stability. Additionally, these devices facilitate achieving intervention goals, reduce the risk of complications, and enhance workflow. Therefore, they are ideal for busy catheterization laboratories and advanced peripheral intervention units. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The global peripheral vascular devices market is a complex and interconnected system that involves various stakeholders, including manufacturers, hospitals, outpatient surgical centers, health authorities, insurance companies, and clinical research networks. Key players such as Boston Scientific, Medtronic, Abbott, Terumo, Cook Medical, and Becton, Dickinson and Company form the backbone of this market, supporting high-volume endovascular treatments for peripheral artery disease, venous disorders, and complicated vascular diseases worldwide. The main product categories within this market include peripheral stents, drug-coated and specialty balloons, guidewires, atherectomy systems, thrombectomy devices, embolic protection systems, and vascular access products. The value chain extends from original equipment manufacturers (OEMs) to contract manufacturers, component suppliers, sterilization service providers, and packaging vendors. All of these parties actively work to ensure quality, regulatory compliance, and global scalability. The primary consumers are hospitals, academic medical centers, and outpatient and ambulatory vascular clinics. However, growth in some segments has slowed due to various challenges, such as inconsistent levels of clinical evidence for different lesion types, the need for physician training, lack of reimbursement, and the necessity of integrating with existing catheter lab setups. Regulatory bodies and health technology assessment organizations in North America, Europe, and Asia Pacific significantly influence product approvals, pricing, and market access timelines. Additionally, professional societies and global clinical trial networks play a crucial role in developing guidelines and providing essential evidence. Overall, this market is continually evolving with new innovations, an increasing focus on treating complex peripheral lesions, and a shifting balance of power among the leading players.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Angioplasty Stents Market

In 2025, drug-eluting stents dominated the angioplasty stents market. These stents demonstrate better clinical outcomes compared to bare-metal stents, as they significantly reduce neointimal hyperplasia and improve long-term vessel patency. As a result, doctors are increasingly willing to use them. Additionally, the market benefits from ongoing research and developments in polymer coatings and drug delivery systems. There is also a gradual shift towards utilizing endovascular therapies for complex peripheral lesions, along with physicians' growing preference for durable and minimally invasive solutions.

Endovascular Aneurysm Repair Stent Grafts Market

In 2025, abdominal aortic aneurysm stent grafts dominated the endovascular aneurysm repair stent grafts market. This market is positively impacted by the increasing number of patients with aneurysms, particularly among the elderly and individuals with high blood pressure, a history of smoking, or heart disease. Additionally, there is a strong clinical preference for performing endovascular aneurysm repair rather than open surgery due to the lower perioperative risks, shorter hospital stays, and faster recovery times associated with EVAR. Market growth is also supported by the improved production of low-profile, modular, and advanced stent graft designs that can accommodate complex anatomical conditions. Furthermore, advancements in imaging techniques and the growing number of specialized vascular centers offering these treatments are contributing to the expansion of this market segment.

Inferior Cava Filters Market

In 2025, retrievable filters dominated the inferior vena cava filters market. The rise in the adoption of these filters in the peripheral vascular devices market is primarily due to the increasing incidence of venous thromboembolism (VTE) and the growing population of patients who cannot undergo anticoagulant therapy for extended periods. There is a progressive clinical trend towards using temporary measures against pulmonary embolism, especially in cases involving trauma, surgery, and high-risk patients, which is accelerating the usage of these filters. Additionally, market growth is attributed to the introduction of new filter designs that offer easier retrieval, fewer long-term complications, and improved safety during procedures. There is also a growing knowledge among doctors and enhanced methods for patient follow-up contributing to this trend.

Catheters Market

In 2025, angiography catheters are leading the catheters market. Their success in the peripheral vascular devices sector is driven by the increasing prevalence of peripheral artery disease and other vascular disorders that require precise imaging for intervention. Many patients are opting for minimally invasive endovascular procedures. Additionally, angiography is being utilized for procedure planning and follow-up care. Continuous improvements in catheter design—such as enhanced trackability, better torque response, and improved radiopacity—are also contributing to their growing clinical adoption. Furthermore, the expansion of catheterization laboratories, a rising elderly population, and improved access to interventional vascular care, especially in developing countries, are all supporting market growth.

Angioplasty Balloons Market

In 2025, old/normal balloons dominated the angioplasty balloons market. The success of these conventional balloons in the peripheral vascular devices market is primarily due to their lower costs, ease of use, and high clinical acceptance for lesion preparation, as well as pre- and post-dilatation in peripheral interventions. These balloons maintain their primary position in many applications and are often preferred in situations where high volumes and cost are significant concerns, particularly in hospitals with limited reimbursement for advanced technologies. Their excellent compatibility with various guidewires and stent systems, along with a consistent demand from emerging economies and routine peripheral angioplasty cases, continues to drive market growth.

Plaque Modification Devices Market

In 2025, atherectomy devices dominated the plaque modification devices market. This market is experiencing growth due to the increasing incidence of peripheral artery disease (PAD) and the presence of complicated, calcified lesions that are difficult to manage with conventional angioplasty or stenting alone. These devices benefit patients throughout the entire procedure by enabling precise control over plaque removal, opening the vessel, and ensuring proper stent placement. The advancement of various atherectomy technologies—including directional, rotational, orbital, and laser systems—coupled with a rising preference for minimally invasive peripheral interventions and a growing inclination among physicians for vessel-preserving strategies, is further driving market growth in this sector.

Hemodynamic Flow Alteration Devices Market

In 2025, embolic protection devices dominated the hemodynamic flow alteration devices market. Their increasing popularity in the peripheral vascular devices segment is largely attributed to the rising incidence of peripheral artery disease and the gradual shift towards endovascular treatments, which carry a risk of distal embolization. Enhanced awareness among doctors regarding complications associated with these interventions, such as embolic strokes and tissue death, is driving the demand for devices that can enhance patient safety. Additionally, technological innovations that improve the deliverability, capture efficiency, and compatibility of these devices with blood vessels, along with their growing use in complex peripheral interventions and minimally invasive procedures, are further contributing to market growth.

Other Peripheral Vascular Devices Market

In 2025, guidewires held a prominent position in the peripheral vascular devices market. The growth of guidewires in this sector is driven by the increasing number of minimally invasive endovascular procedures for treating peripheral artery disease and other vascular disorders. Guidewires are essential at all stages of these interventions, as they assist with lesion crossing, device delivery, and procedural precision, continuously sustaining demand. Additionally, technological advancements—such as enhanced torque control, improved coatings for better trackability, and specialized designs for addressing complex and calcified lesions—are contributing to market growth. The expansion of catheterization lab infrastructures and the rising global adoption of peripheral interventions further accelerate this trend.

Peripheral Vascular Devices Market, by End User

In 2025, hospitals led the peripheral vascular devices market in terms of end users. The hospitals sector is the primary driver of the growing demand for these devices, as they are equipped to handle a high volume of complex peripheral vascular cases. These cases require modern infrastructure, multidisciplinary expertise, and comprehensive post-surgical care. Hospitals are increasingly adopting hybrid operating rooms, advanced imaging systems, and specialized vascular teams, enabling them to effectively treat severe cases of peripheral artery disease, chronic total occlusions, and high-risk patients. Additionally, favorable reimbursement rates for inpatient procedures, a rising number of emergency admissions due to vascular complications, and hospitals' roles as major centers for clinical trials and the adoption of new technologies all contribute to their strong position as the primary end users of peripheral vascular devices.

REGION

Heading

Paragraph Content

PERIPHERAL VASCULAR DEVICES MARKET: COMPANY EVALUATION MATRIX

The peripheral vascular devices market is dominated by major players such as Boston Scientific, Medtronic, Abbott, BD, and Terumo Corporation. These companies control a significant portion of the market through their extensive product lines, which cater to both peripheral arterial and venous procedures. Boston Scientific and Medtronic are leaders in the industry, offering a wide range of integrated products that include stents, drug-coated balloons, atherectomy, and thrombectomy devices. Their success is backed by strong clinical evidence and ongoing innovation, particularly for the treatment of complex and calcified lesions. Abbott enhances its position in the market with endovascular solutions that facilitate procedures and a strong emphasis on the adoption of minimally invasive therapies. Meanwhile, BD plays a crucial role in the ecosystem with its robust presence in vascular access, introducer systems, and procedural support tools that improve workflow efficiency. Terumo stands out as a key international competitor by providing advanced guidewires, catheters, and sheath platforms, which are essential for complex peripheral medical procedures.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Boston Scientific Corporation (US)

- Medtronic (US)

- Becton, Dickinson and Company (US)

- Abbott (US)

- Terumo Corporation (Japan)

- Abbott (US)

- Edwards LifeSciences Corporation (US)

- Cook (US)

- Cordis (US)

- iVascular S.L.U (Spain)

- Biosensors International Group, Ltd (Singapore)

- Koninklijke Philips N.V. (Netherlands)

- InSitu Technologies, Inc. (US)

- Meril Life Sciences (India)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 9.55 Billion |

| Market Forecast in 2031 (Value) | USD 13.22 Billion |

| Growth Rate | CAGR of 5.7% from 2026–2031 |

| Years Considered | 2024–2031 |

| Base Year | 2025 |

| Forecast Period | 2026–2031 |

| Units Considered | Value (USD Million/Billion), Volume (Thousand/Million Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Related Segment & Geographic Reports | China & Japan Peripheral Vascular Devices Market |

WHAT IS IN IT FOR YOU: PERIPHERAL VASCULAR DEVICES MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | A thorough evaluation of the most significant peripheral vascular device categories was performed in the worldwide market covering peripheral stents (bare-metal, drug-eluting, and covered stents), balloon catheters (standard, specialty, cutting, scoring, and drug-coated balloons), guidewires, atherectomy systems (directional, rotational, orbital, and laser), thrombectomy and embolic protection devices, vascular access solutions, and intravascular imaging devices like IVUS and OCT. Among the key technological developments that were evaluated were low-profile and long-length devices, better drug-delivery coatings, and the use of cutting-edge imaging techniques in the treatment of calcified lesions, among others. Other factors that were evaluated include the FDA PMA and 510(k) regulatory pathways, reimbursement frameworks, safety and effectiveness outcomes, and product differentiation strategies used by the major manufacturers. | Hospitals and other healthcare providers were able to pinpoint the best peripheral vascular technologies that were both clinically effective and commercially viable by matching up the performance of the devices with real-world outcomes, the preferences of physicians, the complexity of the lesions, and the risk profiles of the patients. The insights thus obtained were very helpful in making decisions regarding the optimization of the portfolio, adoption of technology, and developing products in a way that they would be in line with trends such as minimally invasive endovascular therapy, treatment of complex and below-the-knee lesions, and the growing demand for durable long-term patency and limb salvage outcomes. |

| Company Information | Detailed profiles were formulated for the main global and regional players participating in the peripheral vascular devices market, like Boston Scientific, Medtronic, Abbott, Terumo, Cook Medical, Becton, Dickinson and Company, and new regional manufacturers. The evaluation included product ranges, patented technologies, R&D pipelines, clinical trials, manufacturing locations, regulatory authorizations, marketing strategies, and alliances. The competitive positioning of each company was assessed in the categories of peripheral stents, drug-coated balloons, atherectomy, thrombectomy, embolic protection, and imaging-enabled interventions, and the effect of recent mergers, acquisitions, licensing agreements, and joint development projects was also taken into account. | Through the analysis, one was able to recognize the competitive dynamics, the area's technological leadership, and the ecosystem partnerships in the peripheral vascular market more clearly. The customers received help in the assessment of the collaborators, acquisition, and distribution partners, besides getting a better view of the long-term growth strategies, portfolio gaps, and differentiation options in the segments such as complex PAD, chronic limb-threatening ischemia, and outpatient peripheral interventions which are high-growth areas. |

| Geographic Analysis | The market for peripheral vascular devices was thoroughly investigated in the important regions of North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa, with consideration of the countries with the highest procedure volumes and the places where growth is emerging. The research took into account the differences in prevalence of PAD per region, healthcare infrastructure, minimally invasive procedures acceptance, physician distribution, reimbursement policies, cath lab and hybrid OR availability, and the trend of moving towards outpatient and ambulatory vascular care. The areas of excellence, the clusters of innovation, and the locations of manufacturing or R&D were also examined with the option of deep dives into a particular region or global benchmarking at the request of the client. | This regional analysis empowered strategic market planning through the recognition of areas with high-growth potentials geographies, procedural hotspots, and favorable reimbursement environments. Thus, the clients had the opportunity to fine-tune their market entry and expansion strategies, to model the sales and distribution for maximum efficiency, to choose the best clinical trial sites, and to collaborate with the most important vascular centers, thus taking advantage of such trends as ASC expansion, rising PAD awareness, and increasing demand for advanced peripheral endovascular therapies in both developed and emerging markets. |

RECENT DEVELOPMENTS

- July 2025 : Medtronic announced it has entered into an exclusive US distribution agreement with Japan-based Future Medical Design Co., Ltd. (FMD) to sell specialty and workhorse peripheral guidewires. This agreement includes the first 400 cm, 0.018" peripheral guidewire available in the US, expanding the Medtronic portfolio for transradial access for the treatment of peripheral arterial disease (PAD).

- March 2024 : Boston Scientific Corporation announced it has received US Food and Drug Administration (FDA) approval for the AGENT Drug-Coated Balloon (DCB), which is indicated for the treatment of coronary in-stent restenosis (ISR) in patients with coronary artery disease. ISR is the obstruction or narrowing of a stented vessel by plaque or scar tissue.

- April 2023 : Abbott completed the acquisition of Cardiovascular Systems, Inc. (CSI), a medical device company with an innovative atherectomy system used in treating peripheral and coronary artery disease.

Table of Contents

Methodology

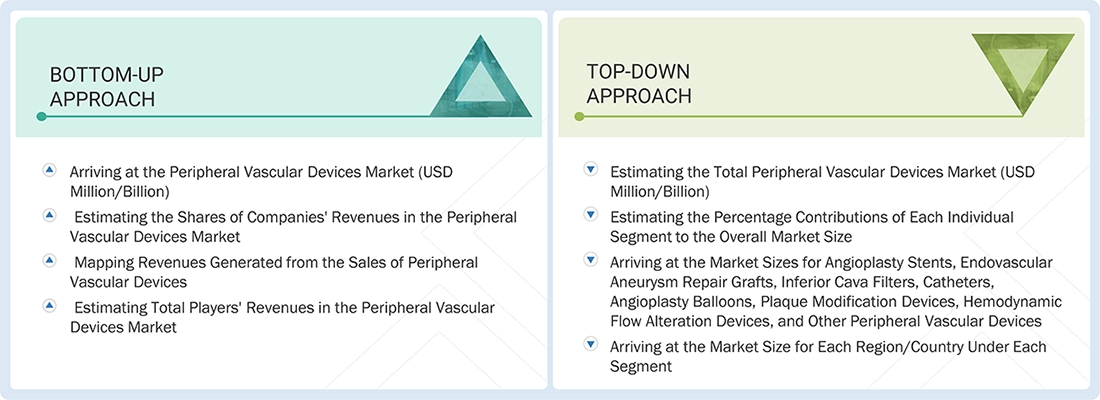

This study involved four major activities in estimating the size of the peripheral vascular devices market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing estimates with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the peripheral vascular devices market. The information was used to identify key players in the market and to classify and segment it at a detailed level, in line with industry trends. Additionally, important developments related to market and technology perspectives were noted. A database of the leading industry figures was created through secondary research.

Primary Research

Extensive primary research was conducted after obtaining secondary research on the peripheral vascular devices market. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries in North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included a range of industry experts, such as Chief X Officers (CXOs), vice presidents (VPs), directors from business development, marketing, and product development or innovation teams, along with other key executives from manufacturers and distributors operating in the peripheral vascular devices market, as well as key opinion leaders.

Primary interviews were conducted to gather insights into market statistics, revenue from products and services, market breakdowns, market size estimates, market forecasting, and data triangulation. Primary research also helped in understanding the various trends in technology, applications, verticals, and regions. Stakeholders from the demand side were interviewed to understand the buyer’s perspective on the suppliers, products, and their current usage, and the future outlook of their business, which will affect the overall market.

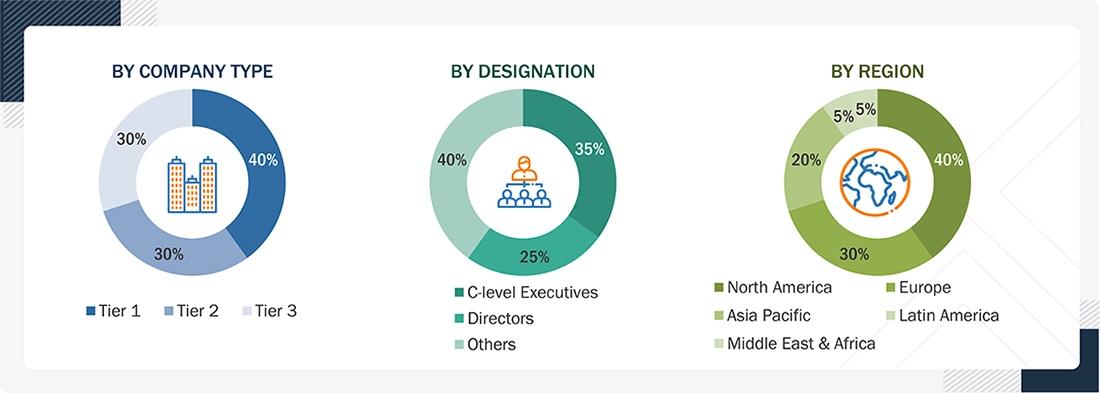

The following is a breakdown of the primary respondents:

Note 1: C-level executives include CEOs, COOs, CTOs, and VPs.

Note 2: Others include sales, marketing, and product managers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2025: Tier 1=>USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, Tier 3=<USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the peripheral vascular devices market includes the following details.

The market sizing of the market was undertaken from the global side.

Country-level Analysis: The size of the peripheral vascular devices market was obtained from the annual presentations of leading players and secondary data available in the public domain. The share of products in the overall peripheral vascular devices market was obtained from secondary data and validated by primary participants to arrive at the total peripheral vascular devices market. Primary participants further validated the numbers.

Geographic Market Assessment (by Region & Country): The geographic assessment was done using the following approaches:

Approach 1: Geographic revenue contributions/splits of leading players in the market (wherever available) and respective growth trends

Approach 2: Geographic adoption trends for individual product segments by end users and growth prospects for each of the segments (assumptions and indicative estimates validated from primary interviews)

At each point, the assumptions and approaches were validated through industry experts contacted during primary research. Considering the limitations of data available from secondary research, revenue estimates for individual companies (for the overall peripheral vascular devices market and geographic market assessment) were ascertained based on a detailed analysis of their respective product offerings, geographic reach/strength (direct or through distributors or suppliers), and the shares of the leading players in a particular region or country.

Global Peripheral Vascular Devices Market Size: Top-down and Bottom-up Approach

Data Triangulation

The market was split into several segments and subsegments after determining the overall market size, using the market sizing processes. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and determine the exact statistics for each market segment and subsegment. The data was triangulated by examining various factors and trends on both the demand and supply sides of the peripheral vascular devices market.

Market Definition

Peripheral vascular devices are medical equipment and instruments used to diagnose, treat, or manage peripheral vascular diseases in patients. It pertains to diseases or disorders involving the arteries, veins, and lymphatic vessels outside the heart and brain. The overall application of peripheral vascular devices is to treat PAD, DVT, and other vascular disorders. It facilitates procedures that are intended to restore normal blood flow, remove clots, and keep the vessel open. Examples include balloon catheters, stents, guidewires, atherectomy devices, and vascular grafts.

Stakeholders

- Medical Device Manufacturers

- Interventional Cardiologists and Vascular Surgeons

- Hospitals and Ambulatory Surgical Centers (ASCs)

- Healthcare Institutions (Hospitals and Outpatient Clinics)

- Distributors and Suppliers

- Research Institutes

- Health Insurance Payers

- World Health Organization (WHO)

- Organisation for Economic Co-operation and Development (OECD)

- National Institutes of Health (NIH)

- Centers for Disease Control and Prevention (CDC)

- Annual Reports/SEC Filings, Investor Presentations, and Press Releases of Key Players

- White Papers, Journals/Magazines, and News Articles

- Paid Databases, such as Factiva, D&B Hoovers, and Bloomberg Business

Report Objectives

- To define, describe, segment, and forecast the global peripheral vascular devices market by type (angioplasty stents, endovascular aneurysm repair stent grafts, inferior cava filters, catheters, angioplasty balloons, plaque modification devices, hemodynamic flow alteration devices, and other devices), end user, and region

- To provide detailed information about the factors influencing market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets concerning individual growth trends, prospects, and contributions to the overall peripheral vascular devices market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the peripheral vascular devices market in five main regions along with their respective key countries: North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile key players in the global peripheral vascular devices market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments such as acquisitions, expansions, partnerships, agreements, collaborations, and product launches & approvals

- To benchmark players within the peripheral vascular devices market using the "Company Evaluation Matrix" framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Peripheral Vascular Devices Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Peripheral Vascular Devices Market