Intraoperative Radiation Therapy Market Size, Share & Trends by Technology (Electron IORT, Brachytherapy), Products & Services (Accelerators, Treatment Planning system, Applicators, Afterloaders, Accessories), Application (Breast, Brain, Lung Cancer) & Region - Global Forecast to 2025

Market Growth Outlook Summary

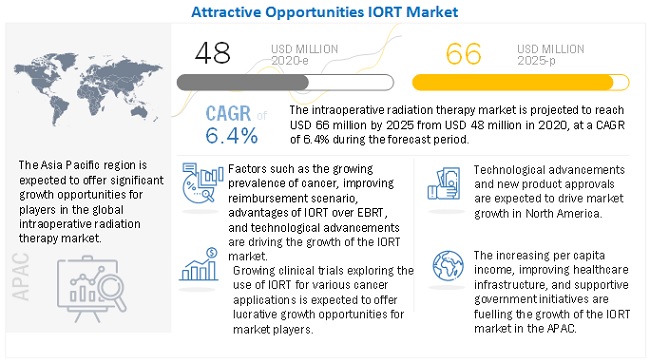

The global intraoperative radiation therapy market in terms of revenue was estimated to be worth $48 million in 2020 and is poised to reach $66 million by 2025, growing at a CAGR of 6.4% from 2020 to 2025. The comprehensive research encompasses an exhaustive examination of industry trends, meticulous pricing analysis, patent scrutiny, insights derived from conferences and webinars, identification of key stakeholders, and a nuanced understanding of market purchasing dynamics.

The report contains recent developments undertaken by market players as well as their strategic overview. The report also contains MNM views for major market players. The rising incidence of cancer, technological advancements, and advantages offered by IORT over conventional radiotherapy are the major factors driving the growth of the global market. Additionally, growing clinical trials exploring the use of IORT for various cancer applications is expected to offer lucrative growth opportunities to market players.

To know about the assumptions considered for the study, Request for Free Sample Report

Intraoperative Radiation Therapy Market Dynamics

Driver: Growing global prevalence of cancer

The IORT procedure is associated with various advantages such as targeted radiation, limited treatment time, high precision and radiation control, and minimal radiation exposure of normal tissue. This is especially true for breast cancer, as this mode offers women a choice of breast-sparing treatment (lumpectomy). The increasing prevalence of breast cancer is, therefore, a key factor driving the market growth. The growing prevalence of cancer will increase the adoption of IORT procedures. Some key statistics in this regard have been mentioned below:

- In 2020, 276,480 new cases of invasive breast cancer and 48,530 new cases of non-invasive breast cancer were reported in the US (Source: Breastcancer.org).

- In 2018, around 17.0 million new cases of cancer were reported worldwide; this figure is expected to reach 27.5 million by 2040 (Source: International Agency for Research on Cancer).

- According to the American Cancer Society, in 2018, around 1.8 million new cases of cancer were diagnosed in the US.

Restraint: Dearth of trained personnel

A high level of accuracy is needed at every step of the process to achieve maximum tumor control and ensure minimal risk to normal tissue. Procedural errors can occur due to interconnectivity issues between different treatment planning and delivery and monitoring systems, thus increasing risks for patients. These complexities associated with IORT pose a challenge towards its widespread adoption in cancer treatment.

Opportunity: Growing applications of IORT

Over the years, IORT has found significant applications as a breast-conserving treatment. Technological advancements in this field, coupled with the growing applications of IORT, has resulted in the increasing collaboration between a large number of manufacturers and research institutes to conduct clinical trials to study the applications and efficacy of IORT for other cancer types. The primary aim of these clinical trials is to analyze and evaluate the feasibility of IORT treatment across various cancer applications. Some of the recent trials and projects include:

- In 2019, IntraOp Medical, Inc. (US), in collaboration with the Massachusetts General Hospital, initiated a study to investigate the effectivity of electron beam intraoperative radiation therapy following chemoradiation in patients with pancreatic cancer.

- In 2018, A.C. Camargo Cancer Center collaborated with Carl Zeiss Meditec AG (Germany) to sponsor the “Focal Intraoperative Radiotherapy after Resection of Brain Metastases” trial.

Challenge: Risk of radiation exposure

The high radiation doses involved with therapeutic exposures have the potential to cause harm to not only the patients opting for treatment but also to the healthcare staff and people in the surrounding areas in case there is involuntary radiation exposure. This may result in various side-effects, such as vomiting, diarrhea, and nausea.

By product & service, the product segment is expected to be the largest contributor to the intraoperative radiation therapy market

On the basis of product & service, the market is segmented into IORT products and services. In 2019, the products segment is expected to account for the largest market share. The larger share of this segment can be attributed to their growing availability; development of technologically advanced mobile systems/accelerators, treatment planning, and growing applications of IORT products in cancer treatment.

By technology, the electron IORT segment of intraoperative radiation therapy market, is expected to grow at the highest rate during the forecast period

Based on technology, the market is segmented into electron IORT and intraoperative brachytherapy. The electron IORT segment is expected to grow at the highest rate in the global market in 2019. The growth of this segment can be attributed to the wide range of benefits associated with it, including lesser treatment time, better depth of penetration, and optimal dose homogeneity

By application, the breast cancer segment is expected to be the largest contributor to the intraoperative radiation therapy market

On the basis of application, the market is segmented into breast cancer, brain tumor, gastrointestinal cancer, head & neck cancer, colorectal cancer, endometrial and cervical cancer, lung cancer, and other cancers. The breast cancer application segment is expected to dominate the global market during the forecast period. This can be primarily attributed to factors such as the non-invasive nature of radiotherapy, rising incidence of breast cancer, and high success rates achieved with IORT.

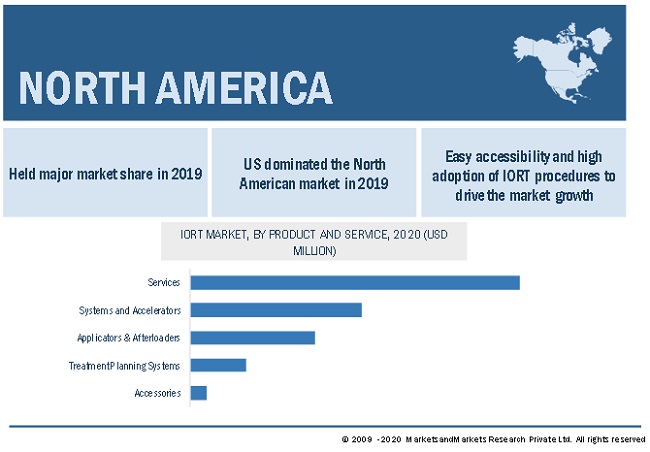

North America is expected to command the largest share of the Intraoperative radiation therapy market in 2019

North America, comprising the US and Canada, accounted major share of the global market in 2019. The major factors driving market growth in this region are the easy availability and high adoption of IORT for cancer treatment, the rising incidence of cancer, and significant per capita annual healthcare expenditure in the US and Canada. Furthermore, associations such as the American Society for Radiation Oncology (ASTRO) have advocated the use of low-energy IORT, which has contributed to its increased adoption in North America.

To know about the assumptions considered for the study, download the pdf brochure

The Asia Pacific region is expected to grow at the fastest rate in the intraoperative radiation therapy market during the forecast period

The report covers the global market across five major geographies, namely, Europe, North America, Asia Pacific, Latin America, and MEA. North America commanded the largest share of the global market in 2019. Growing healthcare expenditure, the implementation of supportive government initiatives, and the rising incidence of cancer are the key factors driving the global market in the APAC. As per GLOBOCAN 2018, a total of 911,014 new breast cancer cases were diagnosed in Asia in 2018, and this number is expected to increase by 229,650 in 2030. Furthermore, the geriatric population (aged 65 years and above) in the Asia Pacific is projected to reach 1.3 billion by 2050 (~25% of the total population in the region) from 420 million in 2010 (Source: UN Population Division). The growth of this population segment will correspondingly increase the prevalence of a wide range of diseases (including cancer) and provide significant growth opportunities for market players.

The major players in the Intraoperative radiation therapy market are ZEISS Group (Germany), iCAD, Inc. (US), Eckert & Ziegler (Germany), Elekta AB (Sweden), GMV Innovating Solutions (Spain), Sensus Healthcare, Inc. (US), IntraOp Medical, Inc. (US), Isoray, Inc. (US), Becton, Dickinson and Company (US), Sordina IORT Technologies (Italy), Varian Medical Systems, Inc. (US), SeeDos Ltd. (UK), IsoAid LLC (US), Ariane Medical Systems Ltd. (UK), Panacea Medical Technologies Pvt. Ltd. (India), Salutaris Medical Devices (US), Brainlab AG (Germany), RaySearch Laboratories (Sweden), REMEDI Co., Ltd. (South Korea), Merit Medical Systems, Inc. (US), among others.

ZEISS is among the pioneer companies that combined surgery with radiotherapy to develop and introduce intraoperative radiation therapy to the cancer treatment field. The flagship product of the company, INTRABEAM, is one of the most widely used IORT products across the globe. INTRABEAM is a revolutionary, intraoperative form of radiation therapy for early-stage breast cancers. It allows radiation treatment and breast-conserving surgery to be performed simultaneously. As a result, the need for several weeks of external radiation therapy following surgery can often be minimized or eliminated. The strong foothold of the company in the global market can be attributed to its wide geographic reach. ZEISS has a direct presence in almost 50 countries and more than 30 production sites and 25 R&D facilities. ZEISS has a sound custom services support set up, which helps it to strengthen its customer relationships and presence in the market.

Scope of the Intraoperative Radiation Therapy Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2020 |

$48 million |

|

Projected Revenue Size by 2025 |

$66 million |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 6.4% |

|

Market Driver |

Growing global prevalence of cancer |

|

Market Opportunity |

Growing applications of IORT |

This report has segmented the global intraoperative radiation therapy market to forecast revenue and analyze trends in each of the following submarkets:

By Product & Service

- Products

- Systems/Accelerators

- Applicators & Afterloaders

- Treatment Planning Systems

- Accessories

- Services

By Technology

- Electron IORT

- Intraoperative Brachytherapy

By Application

- Breast Cancer

- Brain Tumor

- Gastrointestinal Cancer

- Head & Neck Cancer

- Colorectal Cancer

- Endometrial & Cervical Cancer

- Lung Cancer

- Other Cancers (penile cancer and prostate cancer)

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- RoAPAC

-

Latin America

- Brazil

- Mexico

- RoLA

- Middle East & Africa

Recent Developments of Intraoperative Radiation Therapy Industry

- In 2020, Elekta AB launched Geneva, a universal gynecological applicator for brachytherapy.

- In 2019, Varian acquired Cancer Treatment Services International (CTSI), a US-based oncology solutions division that provides cancer care professional services to healthcare providers worldwide. The acquisition expanded Varian’s access to technology-driven cancer care .

- In 2018, Varian launched the Bravos afterloader system for high-dose-rate (HDR) brachytherapy treatments

Frequently Asked Questions (FAQs):

What is the projected market value of the global intraoperative radiation therapy market?

The global market of intraoperative radiation therapy is projected to reach USD 66 million.

What is the estimated growth rate (CAGR) of the global intraoperative radiation therapy market for the next five years?

The global intraoperative radiation therapy market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.4% from 2020 to 2025.

What are the major revenue pockets in the intraoperative radiation therapy market currently?

North America, comprising the US and Canada, accounted major share of the global market in 2019. The major factors driving market growth in this region are the easy availability and high adoption of IORT for cancer treatment, the rising incidence of cancer, and significant per capita annual healthcare expenditure in the US and Canada. Furthermore, associations such as the American Society for Radiation Oncology (ASTRO) have advocated the use of low-energy IORT, which has contributed to its increased adoption in North America.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY USED FOR THE STUDY

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 23)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primaries

FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: GLOBAL MARKET

2.2 MARKET ESTIMATION METHODOLOGY

FIGURE 3 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.2.1 REVENUE MAPPING-BASED MARKET ESTIMATION

2.2.2 END USER-BASED MARKET ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION: GLOBAL MARKET

2.2.3 PRIMARY RESEARCH VALIDATION

2.3 DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION METHODOLOGY

2.4 RESEARCH ASSUMPTIONS

2.5 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 32)

FIGURE 6 INTRAOPERATIVE RADIATION THERAPY MARKET, BY PRODUCT & SERVICE, 2020 VS. 2025 (USD MILLION)

FIGURE 7 GLOBAL MARKET SHARE, BY TECHNOLOGY, 2020 VS. 2025

FIGURE 8 GLOBAL MARKET, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

FIGURE 9 GEOGRAPHICAL SNAPSHOT OF THE GLOBAL MARKET

4 PREMIUM INSIGHTS (Page No. - 36)

4.1 INTRAOPERATIVE RADIATION THERAPY MARKET OVERVIEW

FIGURE 10 GROWING PREVALENCE OF CANCER IS DRIVING THE GROWTH OF THE GLOBAL MARKET

4.2 GLOBAL MARKET, BY PRODUCT & SERVICE, 2020 VS. 2025 (USD MILLION)

FIGURE 11 IORT PRODUCTS TO REGISTER A HIGHER GROWTH RATE DURING THE FORECAST PERIOD

4.3 NORTH AMERICA: INTRAOPERATIVE RADIATION THERAPY PRODUCTS MARKET, BY TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 12 SYSTEMS & ACCELERATORS SEGMENT WILL CONTINUE TO DOMINATE THE NORTH AMERICAN MARKET IN 2025

4.4 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2020 VS. 2025 (USD MILLION)

FIGURE 13 ELECTRON IORT SEGMENT TO REGISTER THE HIGHEST GROWTH IN THE APAC MARKET

4.5 EUROPE: MARKET, BY APPLICATION & COUNTRY (2019)

FIGURE 14 BREAST CANCER SEGMENT ACCOUNTED FOR THE LARGEST SHARE OF THE EUROPEAN MARKET IN 2019

4.6 GLOBAL MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 15 CHINA TO REGISTER THE HIGHEST GROWTH DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 41)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 GLOBAL MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growing global prevalence of cancer

5.2.1.2 Improving reimbursement scenario

TABLE 1 NATIONAL AVERAGE MEDICARE REIMBURSEMENT CPT CODES, 2019

5.2.1.3 Procedural advantages over EBRT

5.2.1.4 Technological advancements

5.2.2 RESTRAINTS

5.2.2.1 Dearth of trained personnel

5.2.2.2 Strong market positioning of alternative therapies

TABLE 2 ALTERNATIVES TO IORT PROCEDURES

5.2.3 OPPORTUNITIES

5.2.3.1 Emerging economies offer high growth potential

5.2.3.2 Growing applications of IORT

5.2.4 CHALLENGES

5.2.4.1 Risk of radiation exposure

5.3 IMPACT OF COVID-19 ON THE GLOBAL MARKET

5.4 GLOBAL REGULATORY SCENARIO

5.4.1 NORTH AMERICA

5.4.1.1 US

TABLE 3 US: MEDICAL DEVICE CLASSIFICATION

TABLE 4 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

5.4.1.2 Canada

TABLE 5 CANADA: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

FIGURE 17 CANADA: REGULATORY APPROVAL PROCESS FOR MEDICAL DEVICES

5.4.2 EUROPE

FIGURE 18 EUROPE: REGULATORY APPROVAL PROCESS FOR MEDICAL DEVICES (MDR)

5.4.3 ASIA PACIFIC

5.4.3.1 Japan

TABLE 6 JAPAN: MEDICAL DEVICE CLASSIFICATION UNDER PMDA

5.4.3.2 China

TABLE 7 CHINA: CLASSIFICATION OF MEDICAL DEVICES

5.4.3.3 India

5.5 VALUE CHAIN ANALYSIS: GLOBAL MARKET

FIGURE 19 VALUE CHAIN ANALYSIS: MAXIMUM VALUE ADDED DURING THE MANUFACTURING PHASE

5.6 ECOSYSTEM COVERAGE: GLOBAL RADIOTHERAPY MARKET

6 INTRAOPERATIVE RADIATION THERAPY MARKET, BY PRODUCT & SERVICE (Page No. - 59)

6.1 INTRODUCTION

TABLE 8 GLOBAL MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

6.2 IORT PRODUCTS

TABLE 9 INTRAOPERATIVE RADIATION THERAPY PRODUCTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 10 INTRAOPERATIVE RADIATION THERAPY PRODUCTS MARKET, BY REGION, 2018–2025 (USD MILLION)

6.2.1 INTRAOPERATIVE RADIATION THERAPY PRODUCTS MARKET, BY TECHNOLOGY

TABLE 11 INTRAOPERATIVE RADIATION THERAPY PRODUCTS MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

6.2.2 INTRAOPERATIVE RADIATION THERAPY PRODUCTS MARKET, BY APPLICATION

TABLE 12 INTRAOPERATIVE RADIATION THERAPY PRODUCTS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

6.2.3 SYSTEMS & ACCELERATORS

6.2.3.1 Affordability of systems & accelerators is supporting their adoption

TABLE 13 GLOBAL MARKET FOR SYSTEMS & ACCELERATORS, BY REGION, 2018–2025 (USD MILLION)

6.2.3.2 global market for systems & accelerators, by technology

TABLE 14 GLOBAL MARKET FOR SYSTEMS & ACCELERATORS, BY TECHNOLOGY, 2018–2025 (USD MILLION)

6.2.3.3 global market for systems & accelerators, by application

TABLE 15 GLOBAL MARKET FOR SYSTEMS & ACCELERATORS, BY APPLICATION, 2018–2025 (USD MILLION)

6.2.4 APPLICATORS & AFTERLOADERS

6.2.4.1 Growing approvals of applicators & afterloaders for the treatment of different cancer types is supporting the growth of this segment

TABLE 16 GLOBAL MARKET FOR APPLICATORS & AFTERLOADERS, BY REGION, 2018–2025 (USD MILLION)

6.2.4.2 global market for applicators & afterloaders, by technology

TABLE 17 GLOBAL MARKET FOR APPLICATORS & AFTERLOADERS, BY TECHNOLOGY, 2018–2025 (USD MILLION)

6.2.4.3 global market for applicators & afterloaders, by application

TABLE 18 GLOBAL MARKET FOR APPLICATORS & AFTERLOADERS, BY APPLICATION, 2018–2025 (USD MILLION)

6.2.5 TREATMENT PLANNING SYSTEMS

6.2.5.1 Technological advancements & growing regulatory approvals are supporting market growth

TABLE 19 GLOBAL MARKET FOR TREATMENT PLANNING SYSTEMS, BY REGION, 2018–2025 (USD MILLION)

6.2.5.2 global market for treatment planning systems, by technology

TABLE 20 GLOBAL MARKET FOR TREATMENT PLANNING SYSTEMS, BY TECHNOLOGY, 2018–2025 (USD MILLION)

6.2.5.3 global market for treatment planning systems, by application

TABLE 21 GLOBAL MARKET FOR TREATMENT PLANNING SYSTEMS, BY APPLICATION, 2018–2025 (USD MILLION)

6.2.6 ACCESSORIES

6.2.6.1 Growing number of IORT procedures to drive the adoption of IORT accessories

TABLE 22 GLOBAL MARKET FOR ACCESSORIES, BY REGION, 2018–2025 (USD MILLION)

6.2.6.2 global market for accessories, by technology

TABLE 23 GLOBAL MARKET FOR ACCESSORIES, BY TECHNOLOGY, 2018–2025 (USD MILLION)

6.2.6.3 global market for accessories, by application

TABLE 24 GLOBAL MARKET FOR ACCESSORIES, BY APPLICATION, 2018–2025 (USD MILLION)

6.3 IORT SERVICES

6.3.1 NEED FOR FREQUENT SOFTWARE UPGRADES TO DRIVE MARKET GROWTH

TABLE 25 GLOBAL MARKET FOR SERVICES, BY REGION, 2018–2025 (USD MILLION)

6.3.2 GLOBAL MARKET FOR SERVICES, BY TECHNOLOGY

TABLE 26 GLOBAL MARKET FOR SERVICES, BY TECHNOLOGY, 2018–2025 (USD MILLION)

6.3.3 GLOBAL MARKET FOR SERVICES, BY APPLICATION

TABLE 27 GLOBAL MARKET FOR SERVICES, BY APPLICATION, 2018–2025 (USD MILLION)

7 INTRAOPERATIVE RADIATION THERAPY MARKET, BY TECHNOLOGY (Page No. - 73)

7.1 INTRODUCTION

TABLE 28 GLOBAL MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

7.2 ELECTRON IORT

7.2.1 MINIMAL TREATMENT TIME OF THIS PROCEDURE HAS INCREASED ITS ADOPTION IN THE MARKET

TABLE 29 PROMISING CLINICAL TRIALS FOR ELECTRON IORT

TABLE 30 ELECTRON IORT MARKET, BY REGION, 2018–2025 (USD MILLION)

7.3 INTRAOPERATIVE BRACHYTHERAPY

7.3.1 LOWER COST THAN IOERT & BETTER DOSIMETRIC DISTRIBUTION ARE THE KEY FACTORS SUPPORTING MARKET GROWTH

TABLE 31 INTRAOPERATIVE BRACHYTHERAPY MARKET, BY REGION, 2018–2025 (USD MILLION)

8 INTRAOPERATIVE RADIATION THERAPY MARKET, BY APPLICATION (Page No. - 77)

8.1 INTRODUCTION

TABLE 32 GLOBAL MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

8.2 BREAST CANCER

8.2.1 GROWING NUMBER OF BREAST CANCER CASES ACROSS THE GLOBE IS FUELING THE ADOPTION OF IORT

TABLE 33 GLOBAL MARKET FOR BREAST CANCER, BY REGION, 2018–2025 (USD MILLION)

8.3 BRAIN TUMOR

8.3.1 GROWING NUMBER OF BRAIN TUMOR CASES TO DRIVE MARKET GROWTH

TABLE 34 GLOBAL MARKET FOR BRAIN TUMOR, BY REGION, 2018–2025 (USD MILLION)

8.4 GASTROINTESTINAL CANCER

8.4.1 IORT OFFERS A SUITABLE ALTERNATIVE FOR GASTROINTESTINAL CANCER TREATMENT AS OPPOSED TO SURGERY OR CONVENTIONAL RADIATION

TABLE 35 GLOBAL MARKET FOR GASTROINTESTINAL CANCER, BY REGION, 2018–2025 (USD MILLION)

8.5 HEAD & NECK CANCER

8.5.1 IORT IS HIGHLY EFFICIENT IN THE TREATMENT OF HEAD & NECK CANCER AS IT OFFERS BETTER TUMOR CONTROL

TABLE 36 GLOBAL MARKET FOR HEAD & NECK CANCER, BY REGION, 2018–2025 (USD MILLION)

8.6 COLORECTAL CANCER

8.6.1 IORT IS PROVEN EFFECTIVE FOR ADVANCED LOCAL AND RECURRENT COLORECTAL CANCER TREATMENT IN COMBINATION WITH PREOPERATIVE EBRT

TABLE 37 GLOBAL MARKET FOR COLORECTAL CANCER, BY REGION, 2018–2025 (USD MILLION)

8.7 ENDOMETRIAL & CERVICAL CANCER

8.7.1 IORT IN COMBINATION WITH RADICAL RESECTION PROCEDURES IS A CURATIVE OPTION FOR PATIENTS WITH RECURRENT ENDOMETRIAL CANCER

TABLE 38 GLOBAL MARKET FOR ENDOMETRIAL & CERVICAL CANCER, BY REGION, 2018–2025 (USD MILLION)

8.8 LUNG CANCER

8.8.1 ALTERNATIVE TREATMENT OPTIONS FOR LUNG CANCER IS EXPECTED TO HAMPER THE GROWTH OF THIS SEGMENT

TABLE 39 GLOBAL MARKET FOR LUNG CANCER, BY REGION, 2018–2025 (USD MILLION)

8.9 OTHER CANCERS

TABLE 40 GLOBAL MARKET FOR OTHER CANCERS, BY REGION, 2018–2025 (USD MILLION)

9 INTRAOPERATIVE RADIATION THERAPY MARKET, BY REGION (Page No. - 86)

9.1 INTRODUCTION

TABLE 41 GLOBAL MARKET, BY REGION, 2018–2025 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 20 NORTH AMERICA: INTRAOPERATIVE RADIATION THERAPY MARKET SNAPSHOT

TABLE 42 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 43 NORTH AMERICA: MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 44 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 45 NORTH AMERICA: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

9.2.1 US

9.2.1.1 Higher adoption rate of innovative technologies to support market growth in the US

TABLE 46 US: MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Surge in the incidence of cancer and favorable government guidelines to support the market growth

TABLE 47 CANADA: MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

9.3 EUROPE

TABLE 48 EUROPE: INTRAOPERATIVE RADIATION THERAPY MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 49 EUROPE: MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 50 EUROPE: MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 51 EUROPE: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Growing awareness about advanced cancer treatment is expected to fuel the adoption of IORT products in Germany

TABLE 52 GERMANY: INTRAOPERATIVE RADIATION THERAPY MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

9.3.2 UK

9.3.2.1 Initiatives by public & private organizations to increase awareness about IORT

TABLE 53 UK: INTRAOPERATIVE RADIATION THERAPY MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

9.3.3 FRANCE

9.3.3.1 Preference for conventional radiotherapy is restraining the growth of the IORT market in France

TABLE 54 FRANCE: MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

9.3.4 SPAIN

9.3.4.1 Growing geriatric population to support market growth

TABLE 55 SPAIN: MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

9.3.5 ITALY

9.3.5.1 Rising awareness activities to support market growth

TABLE 56 ITALY: MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

9.3.6 REST OF EUROPE

TABLE 57 REST OF EUROPE: MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

9.4 ASIA PACIFIC

FIGURE 21 ASIA PACIFIC: INTRAOPERATIVE RADIATION THERAPY MARKET SNAPSHOT

TABLE 58 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 59 ASIA PACIFIC: MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 60 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 61 ASIA PACIFIC: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

9.4.1 CHINA

9.4.1.1 Increasing patient pool and government initiatives for healthcare development are fueling the market growth

TABLE 62 CHINA: MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

9.4.2 JAPAN

9.4.2.1 Presence of universal healthcare reimbursement scenario and rising breast cancer cases—key factors driving market growth

TABLE 63 JAPAN: MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

9.4.3 INDIA

9.4.3.1 Government initiatives to improve cancer treatment to drive market growth in India

TABLE 64 INDIA: INTRAOPERATIVE RADIATION THERAPY MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

9.4.4 SOUTH KOREA

9.4.4.1 Rising R&D and promising clinical trials in the country to positively impact market growth

TABLE 65 SOUTH KOREA: MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

9.4.5 AUSTRALIA

9.4.5.1 Rising research investments and awareness campaigns are the key factors supporting market growth

TABLE 66 AUSTRALIA: MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

9.4.6 REST OF ASIA PACIFIC

TABLE 67 REST OF ASIA PACIFIC: MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

9.5 LATIN AMERICA

TABLE 68 LATIN AMERICA: INTRAOPERATIVE RADIATION THERAPY MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 69 LATIN AMERICA: MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 70 LATIN AMERICA: MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 71 LATIN AMERICA: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

9.5.1 BRAZIL

9.5.1.1 Brazil is a key market in Latin America owing to the modernization of healthcare facilities

TABLE 72 BRAZIL: MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

9.5.2 MEXICO

9.5.2.1 Availability of advanced care and increasing awareness programs are fueling market growth in Mexico

TABLE 73 MEXICO: MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

9.5.3 REST OF LATIN AMERICA

TABLE 74 REST OF LATIN AMERICA: MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

9.6 MIDDLE EAST & AFRICA

9.6.1 IMPROVING HEALTHCARE INFRASTRUCTURE AND INCREASING PUBLIC-PRIVATE INVESTMENTS TO DRIVE MARKET GROWTH IN THE MEA

TABLE 75 MIDDLE EAST & AFRICA: MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 76 MIDDLE EAST & AFRICA: MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 77 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 116)

10.1 OVERVIEW

FIGURE 22 KEY DEVELOPMENTS IN THE INTRAOPERATIVE RADIATION THERAPY MARKET FROM 2017 TO 2020

10.2 MARKET SHARE ANALYSIS

FIGURE 23 GLOBAL MARKET SHARE, BY KEY PLAYER, 2019

10.3 KEY MARKET DEVELOPMENTS

10.3.1 PRODUCT LAUNCHES & APPROVALS

10.3.2 ACQUISITIONS

10.3.3 PARTNERSHIPS, COLLABORATIONS, AND AGREEMENTS

10.3.4 EXPANSIONS

11 COMPANY EVOLUTION MATRIX AND COMPANY PROFILES (Page No. - 121)

11.1 COMPETITIVE EVALUATION MATRIX AND METHODOLOGY

11.1.1 COMPETITIVE LEADERSHIP MAPPING: MAJOR MARKET PLAYERS (2019)

11.1.2 STARS

11.1.3 EMERGING LEADERS

11.1.4 EMERGING COMPANIES

11.1.5 PERVASIVE

FIGURE 24 COMPETITIVE LEADERSHIP MAPPING: OVERALL MARKET (2019)

FIGURE 25 COMPETITIVE LEADERSHIP MAPPING: EMERGING PLAYERS (2019)

11.2 COMPANY PROFILES

(Business overview, Products offered, Recent developments, MNM view)*

11.2.1 ZEISS GROUP

FIGURE 26 ZEISS GROUP: COMPANY SNAPSHOT (2019)

11.2.2 ICAD, INC.

FIGURE 27 ICAD, INC.: COMPANY SNAPSHOT (2019)

11.2.3 ECKERT & ZIEGLER

FIGURE 28 ECKERT & ZIEGLER: COMPANY SNAPSHOT (2019)

11.2.4 ARIANE MEDICAL SYSTEMS LTD.

11.2.5 BECTON, DICKINSON AND COMPANY

FIGURE 29 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT (2019)

11.2.6 ELEKTA AB

FIGURE 30 ELEKTA AB: COMPANY SNAPSHOT (2019)

11.2.7 GMV INNOVATING SOLUTIONS

11.2.8 INTRAOP MEDICAL, INC.

11.2.9 ISOAID, LLC

11.2.10 ISORAY, INC.

FIGURE 31 ISORAY, INC.: COMPANY SNAPSHOT (2019)

11.2.11 PANACEA MEDICAL TECHNOLOGIES PVT. LTD.

11.2.12 SEEDOS LTD.

11.2.13 SENSUS HEALTHCARE, INC.

FIGURE 32 SENSUS HEALTHCARE, INC.: COMPANY SNAPSHOT (2019)

11.2.14 S.I.T. SORDINA IORT TECHNOLOGIES S.P.A.

11.2.15 VARIAN MEDICAL SYSTEMS, INC.

FIGURE 33 VARIAN MEDICAL SYSTEMS, INC.: COMPANY SNAPSHOT (2019)

*Business overview, Products offered, Recent developments, MNM view might not be captured in case of unlisted companies.

11.2.16 OTHER COMPANIES

11.2.16.1 Salutaris Medical Devices

11.2.16.2 Brainlab AG

11.2.16.3 RaySearch Laboratories

11.2.16.4 REMEDI Co., Ltd.

11.2.16.5 Merit Medical Systems

12 APPENDIX (Page No. - 152)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, fundamental market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B), white papers, annual reports, companies house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the intraoperative radiation therapy (IORT) market. A database of the key industry leaders was also prepared using secondary research.

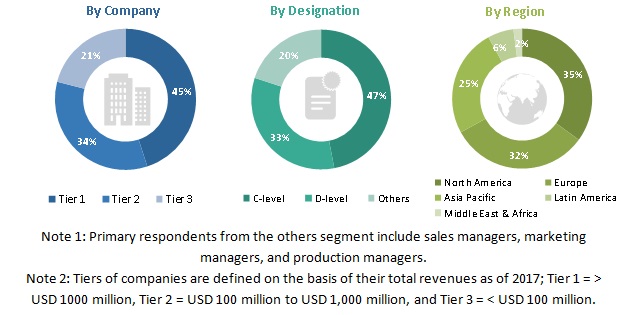

Primary Research

Primary research was conducted after acquiring extensive knowledge about the global Intraoperative radiation therapy market scenario through secondary research. Primary interviews were conducted with market experts from both the demand-side (such as CROs, hospitals, transplant centers, healthcare service providers, commercial service providers, academia, and research organizations) and supply-side respondents (such as presidents, CEOs, vice presidents, directors, general managers, heads of business units, and senior managers) across five major geographies, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East, and Africa. Approximately 60% of the primary interviews were conducted with stakeholders from the demand side, while those from the supply side accounted for the remaining 40%. Primary data for this report was collected through questionnaires, emails, and telephonic interviews.

A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

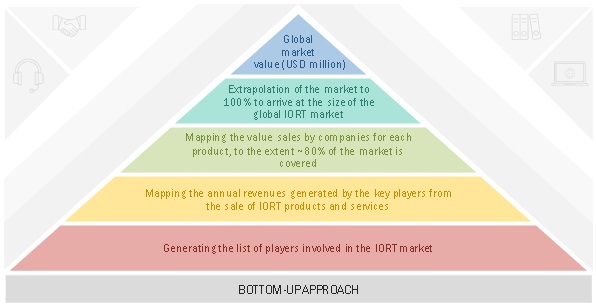

Market Estimation Methodology

A detailed market estimation approach was followed to estimate and validate the size of the global Intraoperative radiation therapy market and other dependent submarkets.

- The key players in the global market were identified through secondary research, and their global market shares were determined through primary and secondary research.

- The research methodology includes the study of the annual and quarterly financial reports of the top market players as well as interviews with industry experts for key insights on the global market.

- All percentage shares, splits, and breakdowns were determined by using secondary sources and verified through primary sources.

- All the possible parameters that affect the market segments covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

The above-mentioned data was consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Product Base Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation:

After deriving the overall Intraoperative radiation therapy market value data from the market size estimation process, the total market value data was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments, data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various qualitative and quantitative variables as well as by analyzing regional trends for both the demand- and supply-side macroindicators.

Report Objectives:

- To define, describe, and forecast the Intraoperative radiation therapy market on the basis of product, technology, application, and region

- To provide detailed information regarding the major factors influencing the growth potential of the global market (drivers, restraints, opportunities, challenges, and trends)

- To analyze the micromarkets with respect to individual growth trends, future prospects, and contributions to the global market

- To analyze key growth opportunities in the global market for key stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of market segments and/or subsegments with respect to five major regions, namely, North America (US and Canada), Europe (Germany, France, the UK, Italy, Spain, and the RoE), Asia Pacific (Japan, China, India, and the RoAPAC), Latin America (Brazil, Mexico, and RoLATAM), and the Middle East & Africa

- To profile the key players in the global market and comprehensively analyze their market shares and core competencies

- To track and analyze the competitive developments undertaken in the global market, such as product launches; agreements, partnerships, and collaborations; expansions; and mergers & acquisitions

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the present global intraoperative radiation therapy market report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top five companies

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the Rest of Europe market into Belgium, Austria, the Czech Republic, Denmark, Greece, Poland, and Russia, among other

- Further breakdown of the Rest of Asia Pacific market into wan, New Zealand, Vietnam, the Philippines, Singapore, Malaysia, Thailand, and Indonesia among other

- Further breakdown of the Latin American market into Argentina, Chile, Peru, and Colombia, among other

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Intraoperative Radiation Therapy Market