Irrigation Automation Market by System (Automatic, Semi-automatic), Component (Controllers, Valves, Sprinklers, Sensors, Other components), Irrigation Type (Sprinkler, Drip, Surface), Automation Type, End-Use and Region - Global Forecast to 2027

Report Outlook

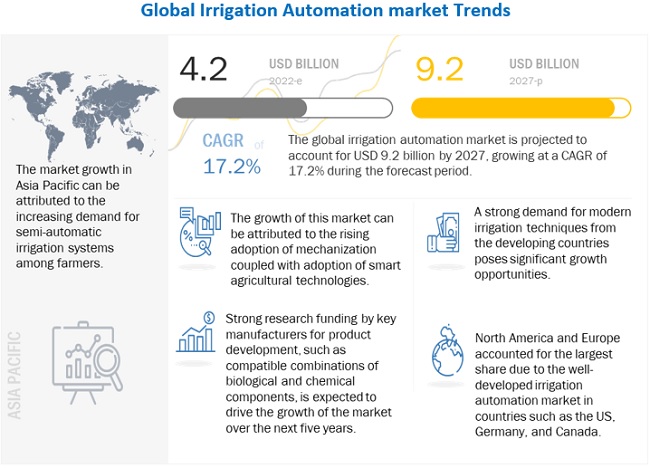

The global irrigation automation market was valued at USD 4.2 billion in 2022 and is expected to grow at a CAGR of 17.2% during the forecast period.

Increasing government support to mechanize agriculture especially in the developing countries, adoption of smart irrigation technologies, and need for water conservation are some of the key factors promoting the growth of market during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

Irrigation Automation Market Growth Insights

How has the rising awareness of automated irrigation technologies among farmers benefited the industry?

There are various benefits associated with the adoption of automated irrigation at the farm level. With the increase in the cost of labor and electricity, the awareness of farmers about automated irrigation technologies has increased. In Australia, several trials have been conducted to provide benefits to farmers by using automated irrigation systems. Most farmers noticed a significant drop in the daily power consumption and reduced time and effort toward the irrigation process. Through automation, farmers were able to reduce the number of visits to farms, which helped decrease labor costs. The installation of an automated irrigation system also improves precision in agriculture as it determines the exact volume of water and the time of the irrigation process. This precision helps lower crop losses faced by farmers and improves the overall yield.

Why is lack of data management and aggregation hampering the groeth of irrigation automation?

Data management and aggregation are the major challenges in the irrigation automation market. The data obtained from farms using smart agricultural tools are highly important, as they help make productive decisions. There is no industry standard for managing the agricultural data; this makes the task difficult for growers. The challenge is to standardize the data management system throughout the industry to enable the uniformity of operations. Many growers or farmers are not aware of the effective use of data for decision-making purposes. Hence, it is important to provide farmers and growers with proper data management tools and techniques to acquire, manage, process, and use data effectively.

The data collected is raw, which is then processed on the basis of context, relevance, and priority and presented in a manner that could be used to make decisions. The adoption rate of smart agriculture technologies and tools will increase if farmers or growers are provided with easy data management devices and other solutions for use in an efficient manner to improve their day-to-day activities.

How is government creating opportunity for the growth of irrigation automation?

Most farmers in developing countries use conventional irrigation techniques (surface irrigation). To improve the efficiency of irrigation systems in developing countries, governments across many countries are providing subsidies for the purchase of drip and sprinkler systems. In India, from 2015, farmers were eligible for a 35–40% subsidy on the purchase of drip irrigation systems for their farms under the Pradhan Mantri Krishi Sinchayee Yojana. Likewise, even countries in Africa have policies that support the adoption of sprinkler and drip irrigation. The African governments have a series of agricultural subsidies that help farmers implement technical advancements at farm levels, such as purchasing and reinstalling farm irrigation products (sprinklers and drip irrigation products). This shift from traditional irrigation techniques to a more mechanized method is primarily due to the heavy loss of water and low crop yields as a result of waterlogging. The shift toward adopting drip and sprinkler irrigation for water efficiency would eventually drive the market’s growth.

How does the fragmented land holdings impacting the market growth?

Most developing countries face the problem of small landholdings. An automated irrigation system comprises various devices, such as sensors, flow meters, and controllers. Irrigation systems are expensive and relatively more feasible for large farms situated in North America, South America, and Europe, where the farmers also have higher purchasing power. For instance, 85% of the agricultural households in India hold less than two hectares of land. The implementation of smart technologies is not feasible in small farms due to high installation costs and low returns on investments. Land fragmentation leads to an improper allocation of inputs and resources, which further leads to high production costs. Implementing irrigation automation technologies in fragmented land leads to the wastage of time, money, and resources as managing, supervising, and collecting data from the scattered land is a difficult task. This makes the attainment of economies of scale from irrigation automation technologies difficult for small farmers.

Irrigation Automation Market by Automation Type Insights

By automation type, the real-time feedback system segment is dominating the irrigation automation market during the forecast period.

Real-time feedback is the method of making irrigation decisions based on the real-time demand for plants. With real-time feedback systems, farmers can get real-time data on the various stages of irrigation on their field through laptops or mobile phones. Real-time feedback systems have benefitted farmers by reducing irrigation costs, crop losses, production time, and pesticide application while improving yield and quality. With the increasing problem of water scarcity, the need for irrigation efficiency is growing. A sensor-based irrigation network sends real-time data from the fields to the irrigation management software, which decides the irrigation schedule. The segment is anticipated to maintain its dominant position throughout the forecast period.

Irrigation Automation Market by Irrigation Type Insights

By irrigation type segment, the drip irrigation segment is dominating the market.

The drip irrigation segment dominated the market in 2021. Drips provide root-to-root irrigation and the highest level of water conservation. Although these systems are less cost-effective, they offer a life span of about ten years once installed. Developed countries such as the US, Canada, the UK, and Germany uses drip irrigation for agricultural purposes. In India and China, the state and national government irrigation projects use drip systems due to their low maintenance and efficiency.

Irrigation Automation Market by End-Use Insights

By end use, non-agricultural segment is projected to be the dominant segment in the market during the forecast period.

The non-agricultural usage of irrigation automation market generally uses the sprinkler system, which is more effective for gardening than drips because they cover a larger area. It is estimated that as much as 50% of the residential outdoor water used is wasted through evaporation, wind, or runoff due to improper irrigation system design, installation, and maintenance. Faced with increasingly stringent water usage regulations, growers are adopting ways to fine-tune their irrigation systems.

Automated drip irrigation systems have a life span of more than ten years and a higher efficiency rate. This is the most adopted Irrigation Type system in countries like the US, Canada, Brazil, and Spain for vegetable and row crops.

To know about the assumptions considered for the study, download the pdf brochure

Irrigation Automation Market by Regional Insights

North America is projected to be the dominating region in the irrigation automation market during the forecast period.

North America has shown progressive growth in the conservation of natural resources. The adoption rate of irrigation automation systems is the highest in North America due to the various initiatives taken up by the local government in this region for water conservation. For instance, in 2006, the US EPA came up with a water conservation plan known as WaterSense to ensure the water usage across industries meet required standards and is used efficiently. This initiative observes the water-saving efficiency of various companies' different products and rates them accordingly. WaterSense partners with irrigation professionals, homebuilders, manufacturers, retailers and distributors, and utilities to encourage innovation in manufacturing and support sustainable jobs across America. EPA issued a few specifications to recognize certification programs for irrigation professionals in system design, maintenance and installation, and system auditing. Initiatives like these encourage consumers to conserve water and adopt sustainable irrigation practices.

Key Players in Irrigation Automation Market

Key players in this market include Netafim (Israel), Lindsay Corporation (US), The Toro Company (US), Jain Irrigation Systems (India), Valmont Industries Inc. (US), Rain Bird (US), Galcon (Israel), BACCARA (Israel), Hunter Industries (US), Irritec S.p.A (Italy), Superior (US), Weathermatic (US), Nelson Irrigation (US), Calsense (US), HydroPoint Data Systems (US), and Rubicon Water (Australia). These players in this market are focusing on increasing their presence through mergers & acquisitions, and partnerships. The irrigation automation companies have a strong presence in North America, and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

Irrigation Automation Market Scope

|

Report Metric |

Details |

|

Market size value in 2022 |

US $4.2 Billion |

|

Revenue Forecast in 2027 |

US $9.2 Billion |

|

Growth Rate |

CAGR of 17.2% |

|

Forecast period considered |

2022–2027 |

|

Units considered |

Value (USD Billion) |

|

Regions covered |

North America, Europe, Asia Pacific, South America, and RoW |

|

Companies studied |

|

Irrigation Automation Market Segmentation

This research report categorizes the market based on system, irrigation type, component, automaion type, end use, and region

Based on system, the market has been segmented as follows:

- Automatic

- Semi-automatic

Based on Irrigation Type, the market has been segmented as follows:

- Sprinkler

- Drip

- Surface

Based on the Component, the market has been segmented as follows:

- Controllers

-

Sensors

- Weather-based

- Soil

- Fertigation

- Valves

- Sprinklers

- Other compoenents

Based on the Automation Type, the market has been segmented as follows:

- Time-based

- Volume-based

- Real-time Feedback

- Computer-based Irrigation Control

Based on the End Use, the market has been segmented as follows:

-

Agricultural

- Open Field

- Greehouse

-

Non-agricultural

- Residential

- Turf & Landscape

- Golf Courses

Based on the region, the market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- South America

- RoW (RoW includes Middle East & Africa)

Recent Developments

- In January 2022, The Toro Company announced that it acquired privately-held Intimidator Group, based in Batesville, Arkansas, involved in designing and manufacturing Spartan Mowers, a professional line of zero-turn mowers known for performance, durability, and distinctive styling. Sold through an established dealer network, Spartan Mowers came with strong brand recognition in southern regions of the US, appealing to rural markets and large acreage customers. Intimidator Group was also involved in designing and manufacturing a line of powerful and versatile side-by-side utility vehicles that perform well in tough terrains.

- In May 2021, Valmont Industries Inc acquired Prospera (Israel). The crop analytics startup Prospera was acquired for USD 300 million. The partners claimed they now operated the largest vertically integrated AI company in agriculture, focusing on digitizing center pivot irrigation systems.

- In March 2021, The Toro Company announced that it acquired Left Hand Robotics, Inc. The acquisition supported The Toro Company’s leadership strategy in next-generation technologies, including alternative power, smart connected, and autonomous products. The terms of the transaction were not disclosed.

- Based in Longmont, Colorado, Left Hand Robotics was recognized for developing innovative autonomous solutions for turf and snow management. Its patent-pending software and advanced technologies for autonomous navigation were designed to provide professional contractors and grounds managers with solutions to improve its operational efficiency and tackle outdoor tasks with precision.

- In August 2020, Lindsay Corporation launched FieldNET with WaterTrend, a powerful new feature with critical crop water usage insights to aid in effective and efficient irrigation decision-making. It allowed growers to remotely monitor and control all aspects of its existing pivot and lateral irrigation systems, regardless of the equipment’s age or brand, from a smartphone, tablet or computer 24-hours a day.

- In May 2020, Irrigation Automation Systems partnered with Dos Rios Inc. (US) of Colusa, CA. Dos installed XR3000 II system to each engine and successfully demonstrated remote start and monitoring of diesel-driven pumps for irrigation systems. This allowed Dos Rios to closely monitor use, ideal for maintenance of each engine.

- In February 2020, Rain Bird launched ESP-LXIVM series controllers that provide large, challenging sites with advanced water management tools, diagnostics, and a host of new-to-the-industry features. This helped enhance its offerings, giving it an edge over competitors.

Frequently Asked Questions (FAQ):

Which players are involved in manufacturing of irrigation automation market?

The key players in this market include Netafim (Israel), Lindsay Corporation (US), The Toro Company (US), Jain Irrigation Systems (India), Valmont Industries Inc. (US), Rain Bird (US), Galcon (Israel), BACCARA (Israel), Hunter Industries (US), Irritec S.p.A (Italy), Superior (US), Weathermatic (US), Nelson Irrigation (US), Calsense (US), HydroPoint Data Systems (US), and Rubicon Water (Australia).

The irrigation automation market is highly competitive with the leading companies holding the major mare share. These companies are devising strategies to maintain their leadership position. North America and Europe have strong manufacturing capabilities and is witnessing growth in the development of new products and solutions.

How big is the market for irrigation automation?

The global irrigation automation market size is projected to reach USD 9.2 billion by 2027.

What are the potential challenges to the irrigation automation market?

Most of the companies operating in the irrigation automation market are located in developed countries. To import these products to the developing countries adds up the cost increasing the prices of final product. These costs are likely to increase during the forecast period posing higher challenges for the market growth.

What are the key market trends in the irrigation automation market?

The major trends that heavily impacted the automation market in the agriculture sector include AI/ML, IoT and data analytics which played an important role in boosting the automation market. An increase in farm sizes and the adoption of advanced farming techniques, such as electrostatic spray systems and VRT, are also expected to drive the market. Agricultural drones and robots are being adopted for application as well, which would drive the demand for agricultural sprayers. To reduce the overall cost of automation systems, many farmers are shifting toward adopting solar technology. Government support programs are being extended towards the adoption of solar technology for the process of spraying application. Increasing penetration of sprayers among various end-user crop types, such as cereals, oilseeds, and fruits & vegetables, is expected to change the business revenue mix for manufacturers of sprayers in the next 3–5 years.

What are the key development strategies undertaken by companies in the irrigation automation market?

Strategies such as new product launches, investments into expansion and development, research initiatives are the key strategies being used by large players to achieve differential positioning in the global market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 41)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

TABLE 1 INCLUSION AND EXCLUSION

1.4 REGIONS COVERED

1.5 PERIODIZATION CONSIDERED

1.6 CURRENCY CONSIDERED

TABLE 2 USD EXCHANGE RATES CONSIDERED, 2015–2021

1.7 UNITS CONSIDERED

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 47)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

2.1.2.2 List of Key Primary Interview Participants

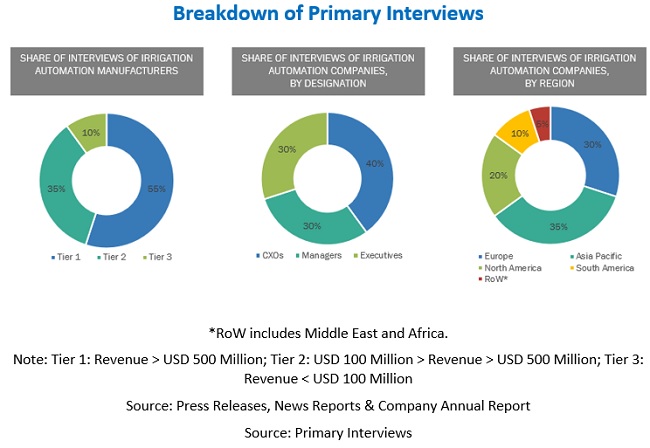

2.1.2.3 Breakdown of primary interviews

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.2.4 Primary sources

2.2 MARKET SIZE ESTIMATION

FIGURE 4 IRRIGATION AUTOMATION MARKET SIZE ESTIMATION (SUPPLY-SIDE)

FIGURE 5 DEMAND-SIDE ASPECTS OF MARKET SIZING

2.2.1 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.2.2 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 7 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.4 ASSUMPTIONS FOR THE STUDY

2.5 RESEARCH LIMITATIONS & ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 57)

TABLE 3 MARKET SNAPSHOT, 2022 VS. 2027

FIGURE 9 MARKET SIZE FOR IRRIGATION AUTOMATION, BY SYSTEM, 2022 VS. 2027 (USD MILLION)

FIGURE 10 MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 11 MARKET SIZE FOR IRRIGATION AUTOMATION, BY COMPONENT, 2022 VS. 2027 (USD MILLION)

FIGURE 12 MARKET SIZE FOR IRRIGATION AUTOMATION, BY END USE, 2022 VS. 2027 (USD MILLION)

FIGURE 13 MARKET SHARE, BY REGION, 2021

4 PREMIUM INSIGHTS (Page No. - 61)

4.1 ATTRACTIVE OPPORTUNITIES IN THE MARKET

FIGURE 14 INCREASING NEED FOR WATER CONSERVATION TO PROPEL THE GROWTH OF THE MARKET

4.2 IRRIGATION AUTOMATION MARKET: GROWTH RATE OF MAJOR REGIONAL SUBMARKETS

FIGURE 15 INDIA TO BE THE FASTEST-GROWING MARKET FOR IRRIGATION AUTOMATION DURING THE FORECAST PERIOD

4.3 ASIA PACIFIC: MARKET FOR IRRIGATION AUTOMATION, BY KEY TYPE & COUNTRY

FIGURE 16 CHINA ACCOUNTED FOR THE LARGEST SHARE IN THE ASIA PACIFIC MARKET IN 2022

4.4 MARKET, BY IRRIGATION TYPE

FIGURE 17 DRIP IRRIGATION SEGMENT TO DOMINATE THE MARKET IN 2022

4.5 MARKET, BY AUTOMATION TYPE

FIGURE 18 REAL-TIME FEEDBACK SYSTEM SEGMENT TO DOMINATE THE MARKET IN 2022

4.6 MARKET FOR IRRIGATION AUTOMATION, BY COMPONENT

FIGURE 19 CONTROLLERS SEGMENT TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

4.7 MARKET FOR IRRIGATION AUTOMATION, BY REGION

FIGURE 20 ASIA PACIFIC TO DOMINATE THE OF IRRIGATION AUTOMATION DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 65)

5.1 INTRODUCTION

5.2 MACROECONOMIC INDICATORS

5.2.1 INCREASE IN AREA UNDER IRRIGATION

5.2.1.1 Growth in the population size to drive the demand for food

FIGURE 21 WORLD POPULATION GROWTH SCENARIO, 1700–2050 (MILLION)

5.3 MARKET DYNAMICS

FIGURE 22 GOVERNMENT SUPPORT TOWARD THE IMPROVEMENT OF IRRIGATION EFFICIENCY TO DRIVE THE GROWTH OF THE MARKET

5.3.1 DRIVERS

5.3.1.1 Increased mechanization and adoption of smart agricultural technologies

FIGURE 23 LEVEL OF MECHANIZATION OF AGRICULTURE IN CERTAIN COUNTRIES

5.3.1.2 Government initiatives to promote water conservation

5.3.1.3 Awareness among farmers about the benefits of automated irrigation technologies

5.3.2 RESTRAINTS

5.3.2.1 High costs associated with the installation and lack of technical knowledge

5.3.2.2 Data management and data aggregation in irrigation automation systems

5.3.3 OPPORTUNITIES

5.3.3.1 Government subsidies on automated farming technology

5.3.3.2 Presence of large farms across the globe

FIGURE 24 IRRIGATED AREA AND TOTAL CULTIVATED LAND, BY COUNTRY, 2021 (MHA)

5.3.4 CHALLENGES

5.3.4.1 Lack of good infrastructure for the efficient functioning of irrigation automation market systems

5.3.4.2 Implementation of automated irrigation in fragmented land holdings

5.4 IMPACT OF COVID-19 ON MARKET DYNAMICS

5.5 TRENDS/DISRUPTIONS IMPACTING THE CUSTOMER’S BUSINESS

5.6 PRICING ANALYSIS

TABLE 4 IRRIGATION CONTROLLERS SELLING PRICE, BY KEY COMPANY, 2021 (USD)

TABLE 5 IRRIGATION WATER FLOW METERS SELLING PRICE, BY KEY COMPANY, 2021 (USD)

5.7 VALUE CHAIN ANALYSIS

FIGURE 25 VALUE CHAIN ANALYSIS

5.8 MARKET ECOSYSTEM

5.9 TECHNOLOGY ANALYSIS

5.9.1 INTEGRATION OF IOT WITH AUTOMATION IN IRRIGATION

5.9.2 INTEGRATION OF ARTIFICIAL INTELLIGENCE WITH IRRIGATION SYSTEMS

5.9.3 REMOTE SENSING AND IRRIGATION INTELLIGENCE

5.9.3.1 Remote sensing for soil moisture estimation

5.9.4 TEMPUS DC SERIES CONTROLLERS

5.9.5 CLOUD-BASED PLATFORM FOR IRRIGATION AUTOMATION

5.10 PATENT ANALYSIS

5.10.1 INTRODUCTION

FIGURE 26 NUMBER OF PATENTS APPROVED FOR IRRIGATION AUTOMATION, 2016–2020

TABLE 6 MAJOR PATENTS RELATED TO IRRIGATION AUTOMATION, 2018–2022

5.11 TRADE ANALYSIS

5.11.1 IMPORT SCENARIO

5.11.1.1 Import scenario

TABLE 7 IMPORT DATA, BY COUNTRY, 2017–2020 (USD MILLION)

5.11.2 EXPORT SCENARIO

5.11.2.1 Export scenario

TABLE 8 EXPORT DATA, BY COUNTRY, 2016–2020 (USD MILLION)

5.12 KEY CONFERENCES & EVENTS

TABLE 9 IRRIGATION AUTOMATION MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2022–2023

5.13 TARIFF AND REGULATORY LANDSCAPE

5.13.1 TARIFF

TABLE 10 US: MFN TARIFFS FOR IRRIGATION AUTOMATION PRODUCTS EXPORTED, 2021

TABLE 11 CHINA: MFN TARIFFS FOR IRRIGATION AUTOMATION PRODUCTS EXPORTED, 2021

5.13.1.1 Positive impact of tariffs on irrigation automation

5.13.1.2 Negative impact of tariffs on irrigation automation

5.14 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.14.1 US

5.14.1.1 United States Department of Agriculture (USDA)

5.14.2 EUROPE

5.14.2.1 Regulation 167/2013 on wheeled agricultural or forestry tractors

5.14.3 ASIA PACIFIC

5.15 PORTER’S FIVE FORCES ANALYSIS

TABLE 12 IMPACT OF PORTER’S FIVE FORCES ON THE MARKET

FIGURE 27 MARKET FOR IRRIGATION AUTOMATION: PORTER’S FIVE FORCES ANALYSIS

5.15.1 THREAT OF COMPETITIVE RIVALRY

5.15.2 BARGAINING POWER OF SUPPLIERS

5.15.3 BARGAINING POWER OF BUYERS

5.15.4 THREAT OF SUBSTITUTES

5.15.5 THREAT OF NEW ENTRANTS

5.16 CASE STUDIES

5.16.1 HYDROPOINT’S WEATHERTRAK HELPS LEED PLATINUM RESEARCH CAMPUS ACHIEVE SUSTAINABILITY GOALS

5.16.2 DROUGHT MANAGEMENT IN CALIFORNIA’S OJAI VALLEY WITH IOT BASED SOLUTIONS

5.17 KEY STAKEHOLDERS & BUYING CRITERIA

5.17.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 28 INFLUENCE OF STAKEHOLDERS IN BUYING IRRIGATION AUTOMATION PRODUCTS

TABLE 13 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR IRRIGATION AUTOMATION PRODUCTS

5.17.2 BUYING CRITERIA

FIGURE 29 KEY BUYING CRITERIA FOR IRRIGATION AUTOMATION PRODUCTS

TABLE 14 KEY BUYING CRITERIA FOR IRRIGATION AUTOMATION PRODUCTS

6 IRRIGATION AUTOMATION MARKET, BY SYSTEM (Page No. - 89)

6.1 INTRODUCTION

FIGURE 30 MARKET SIZE FOR IRRIGATION AUTOMATION, BY SYSTEM, 2022 VS. 2027 (USD MILLION)

TABLE 15 MARKET SIZE FOR IRRIGATION AUTOMATION, BY SYSTEM, 2019–2021 (USD MILLION)

TABLE 16 MARKET SIZE FOR IRRIGATION AUTOMATION, BY SYSTEM, 2022–2027 (USD MILLION)

6.2 AUTOMATIC

6.2.1 FULLY AUTOMATIC SYSTEMS PROVIDE GROWERS THE FLEXIBILITY TO ADJUST THE CONTROLS PERIODICALLY

TABLE 17 AUTOMATIC: MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 18 AUTOMATIC: MARKET SIZE FOR IRRIGATION AUTOMATION, BY REGION, 2022–2027 (USD MILLION)

6.3 SEMI-AUTOMATIC

6.3.1 SEMI-AUTOMATIC IRRIGATION SYSTEMS ARE MORE PREFERRED DUE TO THEIR COST-EFFECTIVENESS AND THE ABILITY TO RESET AFTER EVERY IRRIGATION CYCLE

TABLE 19 SEMI-AUTOMATIC: MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 20 SEMI-AUTOMATIC: MARKET SIZE FOR IRRIGATION AUTOMATION, BY REGION, 2022–2027 (USD MILLION)

7 MARKET, BY COMPONENT (Page No. - 95)

7.1 INTRODUCTION

FIGURE 31 MARKET SIZE, BY COMPONENT, 2022 VS. 2027 (USD MILLION)

FIGURE 32 STRUCTURE OF IRRIGATION AUTOMATION PROCESS WITH BASIC COMPONENTS

TABLE 21 MARKET SIZE FOR IRRIGATION AUTOMATION, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 22 MARKET SIZE FOR IRRIGATION AUTOMATION, BY COMPONENT, 2022–2027 (USD MILLION)

7.2 CONTROLLERS

7.2.1 CONTROLLERS PERFORM THE TRIPLE ACTION OF MONITORING, CONTROLLING, AND ANALYZING WATER LEVELS, AIDING THEIR GROWTH AMONG FARMERS

TABLE 23 CONTROLLERS: MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 24 CONTROLLERS:MARKET SIZE FOR IRRIGATION AUTOMATION, BY REGION, 2022–2027 (USD MILLION)

7.3 VALVES

7.3.1 VALVES ARE EFFECTIVE IN THE MODULATION OF FLOW RATE AS WELL AS PREVENTION OF BACKFLOW ALONG WITH ON-OFF CONTROL

TABLE 25 VALVES: IRRIGATION AUTOMATION MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 26 VALVES: MARKET SIZE FOR IRRIGATION AUTOMATION, BY REGION, 2022–2027 (USD MILLION)

7.4 SENSORS

7.4.1 WASTAGE OF WATER DUE TO UNNECESSARY IRRIGATION DURING WINDY AND RAINY WEATHER CAN BE CONTROLLED USING SENSORS

7.4.2 WEATHER-BASED SENSORS

7.4.3 SOIL-BASED SENSORS

7.4.4 FERTIGATION SENSORS

TABLE 27 SENSORS: MARKET SIZE FOR IRRIGATION AUTOMATION, BY REGION, 2019–2021 (USD MILLION)

TABLE 28 SENSORS: MARKET SIZE FOR IRRIGATION AUTOMATION, BY REGION, 2022–2027 (USD MILLION)

7.5 SPRINKLERS

7.5.1 SHIFT TOWARD EFFICIENT WATERING BY LANDSCAPE AND GOLF COURSE OWNERS IS INCREASING THE DEMAND FOR AUTOMATED SPRINKLER SYSTEMS

TABLE 29 SPRINKLERS: MARKET SIZE FOR IRRIGATION AUTOMATION, BY REGION, 2019–2021 (USD MILLION)

TABLE 30 SPRINKLERS: MARKET SIZE FOR IRRIGATION AUTOMATION, BY REGION, 2022–2027 (USD MILLION)

7.6 OTHER COMPONENTS

7.6.1 COMPONENTS SUCH AS FLOW METERS AND PRESSURE GAUGES ASSIST THE IRRIGATION AUTOMATION PROCESS BY DETERMINING THE PRESSURE AND WATER FLOW

TABLE 31 OTHER COMPONENTS: MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 32 OTHER COMPONENTS: MARKET SIZE FOR IRRIGATION AUTOMATION, BY REGION, 2022–2027 (USD MILLION)

8 MARKET, BY AUTOMATION TYPE (Page No. - 105)

8.1 INTRODUCTION

FIGURE 33 IRRIGATION AUTOMATION MARKET SIZE, BY AUTOMATION TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 33 MARKET SIZE FOR IRRIGATION AUTOMATION, BY AUTOMATION TYPE, 2019–2021 (USD MILLION)

TABLE 34 MARKET SIZE FOR IRRIGATION AUTOMATION, BY AUTOMATION TYPE, 2022–2027 (USD MILLION)

8.2 TIME-BASED SYSTEM

8.2.1 TIME-BASED SYSTEMS OPTIMIZE THE IRRIGATION SCHEDULE AIDING IN BETTER YIELD

TABLE 35 TIME-BASED SYSTEM: MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 36 TIME-BASED SYSTEM: MARKET SIZE FOR IRRIGATION AUTOMATION, BY REGION, 2022–2027 (USD MILLION)

8.3 VOLUME-BASED SYSTEM

8.3.1 VOLUME-BASED SYSTEMS ARE VERSATILE AS THEY CAN FUNCTION WITHOUT A POWER SOURCE

TABLE 37 VOLUME-BASED SYSTEM: MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 38 VOLUME-BASED SYSTEM: MARKET SIZE FOR IRRIGATION AUTOMATION, BY REGION, 2022–2027 (USD MILLION)

8.4 REAL-TIME FEEDBACK SYSTEM

8.4.1 GROWING AWARENESS AMONG FARMERS ABOUT THE AVAILABILITY OF REAL-TIME DATA ON THE IRRIGATION PROCESS LED TO AN INCREASED DEMAND FOR THIS SYSTEM

TABLE 39 REAL-TIME FEEDBACK SYSTEM: MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 40 REAL-TIME FEEDBACK SYSTEM: MARKET SIZE FOR IRRIGATION AUTOMATION, BY REGION, 2022–2027 (USD MILLION)

8.5 COMPUTER-BASED IRRIGATION CONTROL SYSTEM

8.5.1 R&D EFFORTS TO LAUNCH AFFORDABLE COMPUTER-BASED IRRIGATION CONTROL SYSTEMS TO IMPROVE FARM PRODUCTIVITY IN DEVELOPING REGIONS

TABLE 41 COMPUTER-BASED IRRIGATION CONTROL SYSTEM: MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 42 COMPUTER-BASED IRRIGATION CONTROL SYSTEM: MARKET SIZE FOR IRRIGATION AUTOMATION, BY REGION, 2022–2027 (USD MILLION)

9 IRRIGATION AUTOMATION MARKET, BY IRRIGATION TYPE (Page No. - 113)

9.1 INTRODUCTION

FIGURE 34 MARKET SIZE, BY IRRIGATION TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 43 MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2019–2021 (USD MILLION)

TABLE 44 MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (USD MILLION)

TABLE 45 MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2019–2021 (MILLION HA)

TABLE 46 MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (MILLION HA)

9.2 DRIP IRRIGATION

9.2.1 AUTOMATION SYSTEMS INCREASE THE EFFICIENCY OF THE DRIP IRRIGATION PROCESS BY ALLOWING IRRIGATION BASED ON REAL-TIME DATA

TABLE 47 DRIP IRRIGATION: MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 48 DRIP IRRIGATION: MARKET SIZE FOR IRRIGATION AUTOMATION, BY REGION, 2022–2027 (USD MILLION)

TABLE 49 DRIP MARKET, BY REGION, 2019–2021 (MILLION HA)

TABLE 50 DRIP MARKET, BY REGION, 2022–2027 (MILLION HA)

9.3 SPRINKLER IRRIGATION

9.3.1 HIGH USAGE OF SPRINKLER SYSTEMS IN PROFESSIONAL LAWNS AND GOLF COURSES INCREASES THE DEMAND FOR THE AUTOMATION PROCESS

TABLE 51 SPRINKLER IRRIGATION: MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 52 SPRINKLER IRRIGATION: MARKET SIZE FOR IRRIGATION AUTOMATION, BY REGION, 2022–2027 (USD MILLION)

TABLE 53 SPRINKLER IRRIGATION: MARKET SIZE FOR IRRIGATION AUTOMATION, BY REGION, 2019–2021 (MILLION HA)

TABLE 54 SPRINKLER IRRIGATION: MARKET SIZE FOR IRRIGATION AUTOMATION, BY REGION, 2022–2027 (MILLION HA)

9.4 SURFACE IRRIGATION

9.4.1 HIGH LABOR REQUIREMENTS AND LOW WATER USE EFFICIENCY INCREASE THE DEMAND FOR AUTOMATION IN SURFACE IRRIGATION SYSTEMS

TABLE 55 SURFACE IRRIGATION: IRRIGATION AUTOMATION MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 56 SURFACE IRRIGATION: MARKET SIZE FOR IRRIGATION AUTOMATION, BY REGION, 2022–2027 (USD MILLION)

TABLE 57 SURFACE IRRIGATION: MARKET SIZE FOR IRRIGATION AUTOMATION, BY REGION, 2019–2021 (MILLION HA)

TABLE 58 SURFACE IRRIGATION: MARKET SIZE FOR IRRIGATION AUTOMATION, BY REGION, 2022–2027 (MILLION HA)

10 MARKET, BY END USE (Page No. - 123)

10.1 INTRODUCTION

FIGURE 35 MARKET SIZE, BY END USE, 2022 VS. 2027 (USD MILLION)

TABLE 59 MARKET SIZE FOR IRRIGATION AUTOMATION, BY END USE, 2019–2021 (USD MILLION)

TABLE 60 MARKET SIZE FOR IRRIGATION AUTOMATION, BY END USE, 2022–2027 (USD MILLION)

10.2 AGRICULTURAL

10.2.1 REAL-TIME MONITORING OF SOIL CONDITIONS AND LESS HUMAN INTERVENTION RESULT IN AN INCREASED DEMAND FOR IRRIGATION AUTOMATION

10.2.2 GREENHOUSES

10.2.3 OPEN FIELDS

TABLE 61 MARKET SIZE IN AGRICULTURAL END USES, BY REGION, 2019–2021 (USD MILLION)

TABLE 62 MARKET SIZE IN AGRICULTURAL END USES, BY REGION, 2022–2027 (USD MILLION)

10.3 NON-AGRICULTURAL

10.3.1 STRINGENT RULES ABOUT EFFICIENT WATER USAGE IN LANDSCAPES AND LAWS ARE MAKING GROWERS SHIFT TOWARD AUTOMATED IRRIGATION METHODS

10.3.2 RESIDENTIAL

10.3.3 TURF & LANDSCAPES

10.3.4 GOLF COURSES

TABLE 63 MARKET SIZE IN NON-AGRICULTURAL END USES, BY REGION, 2019–2021 (USD MILLION)

TABLE 64 MARKET SIZE IN NON-AGRICULTURAL END USES, BY REGION, 2022–2027 (USD MILLION)

11 IRRIGATION AUTOMATION MARKET, BY REGION (Page No. - 130)

11.1 INTRODUCTION

TABLE 65 MARKET SIZE FOR IRRIGATION AUTOMATION, BY REGION, 2019–2021 (MILLION HA)

TABLE 66 MARKET SIZE FOR IRRIGATION AUTOMATION, BY REGION, 2022–2027 (MILLION HA)

TABLE 67 MARKET SIZE FOR IRRIGATION AUTOMATION, BY REGION, 2019–2021 (USD MILLION)

TABLE 68 MARKET SIZE FOR IRRIGATION AUTOMATION, BY REGION, 2022–2027 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 36 NORTH AMERICA: MARKET SNAPSHOT

TABLE 69 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2021 (MILLION HA)

TABLE 70 NORTH AMERICA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY COUNTRY, 2022–2027 (MILLION HA)

TABLE 71 NORTH AMERICA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 72 NORTH AMERICA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 73 NORTH AMERICA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2019–2021 (MILLION HA)

TABLE 74 NORTH AMERICA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (MILLION HA)

TABLE 75 NORTH AMERICA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2019–2021 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (USD MILLION)

TABLE 77 NORTH AMERICA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY SYSTEM, 2019–2021 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY AUTOMATION TYPE, 2019–2021 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY AUTOMATION TYPE, 2022–2027 (USD MILLION)

TABLE 83 NORTH AMERICA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY END USE, 2019–2021 (USD MILLION)

TABLE 84 NORTH AMERICA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY END USE, 2022–2027 (USD MILLION)

11.2.1 UNITED STATES

11.2.1.1 Pressure on the agricultural industry by government regulations to decrease the water footprint in irrigation driving the market

FIGURE 37 US HARVESTED ACRES IRRIGATED FOR SELECTED MAJOR IRRIGATED CROPS, 2017

TABLE 85 UNITED STATES: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019–2021 (MILLION HA)

TABLE 86 UNITED STATES: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (MILLION HA)

TABLE 87 UNITED STATES: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2019–2021 (USD MILLION)

TABLE 88 UNITED STATES: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (USD MILLION)

11.2.2 CANADA

11.2.2.1 Decrease in annual precipitation increased the water scarcity in the region that led growers to adopt more efficient irrigation ways

FIGURE 38 CANADA: IRRIGATION WATER USED FOR DIFFERENT CROPS, 2020

TABLE 89 CANADA: MARKET SIZE, BY IRRIGATION TYPE, 2019–2021 (MILLION HA)

TABLE 90 CANADA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (MILLION HA)

TABLE 91 CANADA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2019–2021 (USD MILLION)

TABLE 92 CANADA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (USD MILLION)

11.2.3 MEXICO

11.2.3.1 Mexico witnessed an increase in surface irrigation automation systems

TABLE 93 MEXICO: MARKET SIZE, BY IRRIGATION TYPE, 2019–2021 (MILLION HA)

TABLE 94 MEXICO: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (MILLION HA)

TABLE 95 MEXICO: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2019–2021 (USD MILLION)

TABLE 96 MEXICO: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (USD MILLION)

11.3 EUROPE

FIGURE 39 EUROPE: IRRIGABLE AND IRRIGATED AREAS FOR DIFFERENT COUNTRIES, 2016 (THOUSAND HA)

TABLE 97 EUROPE: IRRIGATION AUTOMATION MARKET SIZE, BY COUNTRY, 2019–2021 (MILLION HA)

TABLE 98 EUROPE: MARKET SIZE FOR IRRIGATION AUTOMATION, BY COUNTRY, 2022–2027 (MILLION HA)

TABLE 99 EUROPE: MARKET SIZE FOR IRRIGATION AUTOMATION, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 100 EUROPE: MARKET SIZE FOR IRRIGATION AUTOMATION, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 101 EUROPE: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2019–2021 (MILLION HA)

TABLE 102 EUROPE: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (MILLION HA)

TABLE 103 EUROPE: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2019–2021 (USD MILLION)

TABLE 104 EUROPE: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (USD MILLION)

TABLE 105 EUROPE: MARKET SIZE FOR IRRIGATION AUTOMATION, BY SYSTEM, 2019–2021 (USD MILLION)

TABLE 106 EUROPE: MARKET SIZE FOR IRRIGATION AUTOMATION, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 107 EUROPE: MARKET SIZE FOR IRRIGATION AUTOMATION, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 108 EUROPE: MARKET SIZE FOR IRRIGATION AUTOMATION, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 109 EUROPE: MARKET SIZE FOR IRRIGATION AUTOMATION, BY AUTOMATION TYPE, 2019–2021 (USD MILLION)

TABLE 110 EUROPE: MARKET SIZE FOR IRRIGATION AUTOMATION, BY AUTOMATION TYPE, 2022–2027 (USD MILLION)

TABLE 111 EUROPE: MARKET SIZE FOR IRRIGATION AUTOMATION, BY END USE, 2019–2021 (USD MILLION)

TABLE 112 EUROPE: MARKET SIZE, BY END USE, 2022–2027 (USD MILLION)

11.3.1 SPAIN

11.3.1.1 Regulations for water used in agriculture imposed by the Spanish government drive the market for irrigation automation

TABLE 113 SPAIN: MARKET SIZE, BY IRRIGATION TYPE, 2019–2021 (MILLION HA)

TABLE 114 SPAIN: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (MILLION HA)

TABLE 115 SPAIN: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2019–2021 (USD MILLION)

TABLE 116 SPAIN: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (USD MILLION)

11.3.2 FRANCE

11.3.2.1 Golf courses and lawns demand more automation systems that allow growers to adjust and control irrigation remotely

TABLE 117 FRANCE: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019–2021 (MILLION HA)

TABLE 118 FRANCE: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (MILLION HA)

TABLE 119 FRANCE: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2019–2021 (USD MILLION)

TABLE 120 FRANCE: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (USD MILLION)

11.3.3 GERMANY

11.3.3.1 Decreasing annual precipitation rates, as well as groundwater levels, drive the market for the irrigation automation process in Germany

FIGURE 40 IRRIGATION WITH GROUNDWATER AND SURFACE WATER IN DIFFERENT FEDERAL STATES OF GERMANY, 2017 (HA)

TABLE 121 GERMANY: MARKET SIZE, BY IRRIGATION TYPE, 2019–2021 (MILLION HA)

TABLE 122 GERMANY: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (MILLION HA)

TABLE 123 GERMANY: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2019–2021 (USD MILLION)

TABLE 124 GERMANY: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (USD MILLION)

11.3.4 UNITED KINGDOM

11.3.4.1 Dual benefits of saving water and money by reducing water bills drive the market in the UK

TABLE 125 UNITED KINGDOM: MARKET SIZE, BY IRRIGATION TYPE, 2019–2021 (MILLION HA)

TABLE 126 UNITED KINGDOM: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (MILLION HA)

TABLE 127 UNITED KINGDOM: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2019–2021 (USD MILLION)

TABLE 128 UNITED KINGDOM: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (USD MILLION)

11.3.5 ITALY

11.3.5.1 Improved golf course management drives the market for more efficient watering techniques in the region

TABLE 129 ITALY: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019–2021 (MILLION HA)

TABLE 130 ITALY: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (MILLION HA)

TABLE 131 ITALY: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2019–2021 (USD MILLION)

TABLE 132 ITALY: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (USD MILLION)

11.3.6 RUSSIA

11.3.6.1 Drastic climate change and declining soil fertility drive the market for fertigation and weather-based sensors in the region

TABLE 133 RUSSIA: MARKET SIZE, BY IRRIGATION TYPE, 2019–2021 (MILLION HA)

TABLE 134 RUSSIA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (MILLION HA)

TABLE 135 RUSSIA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2019–2021 (USD MILLION)

TABLE 136 RUSSIA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (USD MILLION)

11.3.7 REST OF EUROPE

11.3.7.1 Cost of a fully automated irrigation system is one of the major hindering factors in its adoption by farmers

TABLE 137 REST OF EUROPE: MARKET SIZE, BY IRRIGATION TYPE, 2019–2021 (MILLION HA)

TABLE 138 REST OF EUROPE: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (MILLION HA)

TABLE 139 REST OF EUROPE: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2019–2021 (USD MILLION)

TABLE 140 REST OF EUROPE: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (USD MILLION)

11.4 ASIA PACIFIC

TABLE 141 ASIA PACIFIC: IRRIGATION AUTOMATION MARKET SIZE, BY COUNTRY, 2019–2021 (MILLION HA)

TABLE 142 ASIA PACIFIC: MARKET SIZE FOR IRRIGATION AUTOMATION, BY COUNTRY, 2022–2027 (MILLION HA)

TABLE 143 ASIA PACIFIC: MARKET SIZE FOR IRRIGATION AUTOMATION, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 144 ASIA PACIFIC: MARKET SIZE FOR IRRIGATION AUTOMATION, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 145 ASIA PACIFIC: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2019–2021 (MILLION HA)

TABLE 146 ASIA PACIFIC: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (MILLION HA)

TABLE 147 ASIA PACIFIC: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2019–2021 (USD MILLION)

TABLE 148 ASIA PACIFIC: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (USD MILLION)

TABLE 149 ASIA PACIFIC: MARKET SIZE FOR IRRIGATION AUTOMATION, BY SYSTEM, 2019–2021 (USD MILLION)

TABLE 150 ASIA PACIFIC: MARKET SIZE FOR IRRIGATION AUTOMATION, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 151 ASIA PACIFIC: MARKET SIZE FOR IRRIGATION AUTOMATION, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 152 ASIA PACIFIC: MARKET SIZE FOR IRRIGATION AUTOMATION, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 153 ASIA PACIFIC: MARKET SIZE FOR IRRIGATION AUTOMATION, BY AUTOMATION TYPE, 2019–2021 (USD MILLION)

TABLE 154 ASIA PACIFIC: MARKET SIZE FOR IRRIGATION AUTOMATION, BY AUTOMATION TYPE, 2022–2027 (USD MILLION)

TABLE 155 ASIA PACIFIC: MARKET SIZE FOR IRRIGATION AUTOMATION, BY END USE, 2019–2021 (USD MILLION)

TABLE 156 ASIA PACIFIC: MARKET SIZE, BY END USE, 2022–2027 (USD MILLION)

11.4.1 CHINA

11.4.1.1 Government policies are targeted at strengthening irrigation infrastructure for better water management

TABLE 157 CHINA: MARKET SIZE, BY IRRIGATION TYPE, 2019–2021 (MILLION HA)

TABLE 158 CHINA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (MILLION HA)

TABLE 159 CHINA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2019–2021 (USD MILLION)

TABLE 160 CHINA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (USD MILLION)

11.4.2 INDIA

11.4.2.1 Poor management of water resources and changes in rainfall patterns led to less availability of water for agriculture

TABLE 161 INDIA: MARKET SIZE, BY IRRIGATION TYPE, 2019–2021 (MILLION HA)

TABLE 162 INDIA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (MILLION HA)

TABLE 163 INDIA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2019–2021 (USD MILLION)

TABLE 164 INDIA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (USD MILLION)

11.4.3 JAPAN

11.4.3.1 Japan is moving toward robotic farm systems, which increase productivity with minimum use of water, energy, and labor

TABLE 165 JAPAN: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019–2021 (MILLION HA)

TABLE 166 JAPAN: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (MILLION HA)

TABLE 167 JAPAN: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2019–2021 (USD MILLION)

TABLE 168 JAPAN: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (USD MILLION)

11.4.4 AUSTRALIA

11.4.4.1 Reducing freshwater level in the Murray-Darling basin pressurizes farmers to adopt more efficient water use techniques in agriculture

TABLE 169 AUSTRALIA: MARKET SIZE, BY IRRIGATION TYPE, 2019–2021 (MILLION HA)

TABLE 170 AUSTRALIA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (MILLION HA)

TABLE 171 AUSTRALIA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2019–2021 (USD MILLION)

TABLE 172 AUSTRALIA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (USD MILLION)

11.4.5 REST OF ASIA PACIFIC

11.4.5.1 Growing cultivation of water-demanding crops led to the adoption of surface irrigation automation systems

TABLE 173 REST OF ASIA PACIFIC: MARKET SIZE, BY IRRIGATION TYPE, 2019–2021 (MILLION HA)

TABLE 174 REST OF ASIA PACIFIC: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (MILLION HA)

TABLE 175 REST OF ASIA PACIFIC: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2019–2021 (USD MILLION)

TABLE 176 REST OF ASIA PACIFIC: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (USD MILLION)

11.5 SOUTH AMERICA

TABLE 177 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2021 (MILLION HA)

TABLE 178 SOUTH AMERICA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY COUNTRY, 2022–2027 (MILLION HA)

TABLE 179 SOUTH AMERICA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 180 SOUTH AMERICA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 181 SOUTH AMERICA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2019–2021 (MILLION HA)

TABLE 182 SOUTH AMERICA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (MILLION HA)

TABLE 183 SOUTH AMERICA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2019–2021 (USD MILLION)

TABLE 184 SOUTH AMERICA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (USD MILLION)

TABLE 185 SOUTH AMERICA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY SYSTEM, 2019–2021 (USD MILLION)

TABLE 186 SOUTH AMERICA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 187 SOUTH AMERICA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 188 SOUTH AMERICA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 189 SOUTH AMERICA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY AUTOMATION TYPE, 2019–2021 (USD MILLION)

TABLE 190 SOUTH AMERICA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY AUTOMATION TYPE, 2022–2027 (USD MILLION)

TABLE 191 SOUTH AMERICA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY END USE, 2019–2021 (USD MILLION)

TABLE 192 SOUTH AMERICA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY END USE, 2022–2027 (USD MILLION)

11.5.1 BRAZIL

11.5.1.1 Water scarcity and farm characteristics induced the use of efficient irrigation systems in Brazil

TABLE 193 BRAZIL: MARKET SIZE, BY IRRIGATION TYPE, 2019–2021 (MILLION HA)

TABLE 194 BRAZIL: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (MILLION HA)

TABLE 195 BRAZIL: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2019–2021 (USD MILLION)

TABLE 196 BRAZIL: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (USD MILLION)

11.5.2 ARGENTINA

11.5.2.1 Increasing water pollution due to industrial activities and chemical runoff from farms limit the water availability in Argentina leading to the increasing focus on water conservation for agriculture

TABLE 197 ARGENTINA: IRRIGATION AUTOMATION MARKET SIZE, BY IRRIGATION TYPE, 2019–2021 (MILLION HA)

TABLE 198 ARGENTINA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (MILLION HA)

TABLE 199 ARGENTINA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2019–2021 (USD MILLION)

TABLE 200 ARGENTINA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (USD MILLION)

11.5.3 REST OF SOUTH AMERICA

11.5.3.1 Government is enforcing rules to improve irrigation systems and infrastructure to enable better use of natural resources

TABLE 201 REST OF SOUTH AMERICA: MARKET SIZE, BY IRRIGATION TYPE, 2019–2021 (MILLION HA)

TABLE 202 REST OF SOUTH AMERICA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (MILLION HA)

TABLE 203 REST OF SOUTH AMERICA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2019–2021 (USD MILLION)

TABLE 204 REST OF SOUTH AMERICA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (USD MILLION)

11.6 REST OF THE WORLD

TABLE 205 REST OF THE WORLD: MARKET SIZE, BY COUNTRY, 2019–2021 (MILLION HA)

TABLE 206 REST OF THE WORLD: MARKET SIZE FOR IRRIGATION AUTOMATION, BY COUNTRY, 2022–2027 (MILLION HA)

TABLE 207 REST OF THE WORLD: MARKET SIZE FOR IRRIGATION AUTOMATION, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 208 REST OF THE WORLD: MARKET SIZE FOR IRRIGATION AUTOMATION, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 209 REST OF THE WORLD: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2019–2021 (MILLION HA)

TABLE 210 REST OF THE WORLD: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (MILLION HA)

TABLE 211 REST OF THE WORLD: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2019–2021 (USD MILLION)

TABLE 212 REST OF THE WORLD: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (USD MILLION)

TABLE 213 REST OF THE WORLD: MARKET SIZE FOR IRRIGATION AUTOMATION, BY SYSTEM, 2019–2021 (USD MILLION)

TABLE 214 REST OF THE WORLD: MARKET SIZE FOR IRRIGATION AUTOMATION, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 215 REST OF THE WORLD: MARKET SIZE FOR IRRIGATION AUTOMATION, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 216 REST OF THE WORLD: MARKET SIZE FOR IRRIGATION AUTOMATION, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 217 REST OF THE WORLD: MARKET SIZE FOR IRRIGATION AUTOMATION, BY AUTOMATION TYPE, 2019–2021 (USD MILLION)

TABLE 218 REST OF THE WORLD: MARKET SIZE FOR IRRIGATION AUTOMATION, BY AUTOMATION TYPE, 2022–2027 (USD MILLION)

TABLE 219 REST OF THE WORLD: MARKET SIZE FOR IRRIGATION AUTOMATION, BY END USE, 2019–2021 (USD MILLION)

TABLE 220 REST OF THE WORLD (ROW): IRRIGATION AUTOMATION MARKET SIZE, BY END USE, 2022–2027 (USD MILLION)

11.6.1 MIDDLE EAST

11.6.1.1 Arid climatic conditions and depleting groundwater reserves are two significant factors driving the market in the region

TABLE 221 MIDDLE EAST: MARKET SIZE, BY IRRIGATION TYPE, 2019–2021 (MILLION HA)

TABLE 222 MIDDLE EAST: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (MILLION HA)

TABLE 223 MIDDLE EAST: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2019–2021 (USD MILLION)

TABLE 224 MIDDLE EAST: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (USD MILLION)

11.6.2 AFRICA

11.6.2.1 Changes in climate and decreasing amount of rainfall demand efficient water management solutions

TABLE 225 AFRICA: MARKET SIZE, BY IRRIGATION TYPE, 2019–2021 (MILLION HA)

TABLE 226 AFRICA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (MILLION HA)

TABLE 227 AFRICA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2019–2021 (USD MILLION)

TABLE 228 AFRICA: MARKET SIZE FOR IRRIGATION AUTOMATION, BY IRRIGATION TYPE, 2022–2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 193)

12.1 OVERVIEW

12.2 KEY PLAYER STRATEGIES

12.3 REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 41 REVENUE ANALYSIS OF KEY PLAYERS IN THE MARKET, 2018–2021 (USD MILLION)

12.4 MARKET SHARE ANALYSIS, 2021

FIGURE 42 IRRIGATION AUTOMATION MARKET SHARE ANALYSIS, 2018–2021

TABLE 229 MARKET: DEGREE OF COMPETITION

12.5 COVID-19-SPECIFIC COMPANY RESPONSE

12.6 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

12.6.1 STARS

12.6.2 PERVASIVE PLAYERS

12.6.3 EMERGING LEADERS

12.6.4 PARTICIPANTS

FIGURE 43 MARKET FOR IRRIGATION AUTOMATION, COMPANY EVALUATION QUADRANT, 2021 (OVERALL MARKET)

12.6.5 PRODUCT FOOTPRINT

TABLE 230 COMPANY FOOTPRINT, BY SYSTEM

TABLE 231 COMPANY FOOTPRINT, BY COMPONENT

TABLE 232 COMPANY FOOTPRINT, BY END USE

TABLE 233 COMPANY REGIONAL, BY FOOTPRINT

TABLE 234 OVERALL COMPANY FOOTPRINT

12.6.6 COMPETITIVE BENCHMARKING

TABLE 235 MARKET: DETAILED LIST OF KEY STARTUPS/ SMES

TABLE 236 MARKET FOR IRRIGATION AUTOMATION: COMPETITIVE BENCHMARKING OF KEY STARTUPS/ SMES

12.7 IRRIGATION AUTOMATION MARKET, START-UP/SME EVALUATION QUADRANT, 2020

12.7.1 PROGRESSIVE COMPANIES

12.7.2 STARTING BLOCKS

12.7.3 RESPONSIVE COMPANIES

12.7.4 DYNAMIC COMPANIES

FIGURE 44 MARKET FOR IRRIGATION AUTOMATION: COMPANY EVALUATION QUADRANT, 2020 (STARTUP/SMES)

12.8 COMPETITIVE SCENARIO AND TRENDS

12.8.1 MARKET

12.8.2 PRODUCT LAUNCHES

TABLE 237 MARKET FOR IRRIGATION AUTOMATION: NEW PRODUCT LAUNCHES, JANUARY 2018– MAY 2022

12.8.3 DEALS

TABLE 238 MARKET FOR IRRIGATION AUTOMATION: DEALS, JANUARY 2018–MAY 2022

13 COMPANY PROFILES (Page No. - 212)

(Business Overview, Products Offered, MnM View, Key Strengths/Right to win, Strategic choices made, and Weakness and competitive threats)*

13.1 NETAFIM

TABLE 239 NETAFIM: BUSINESS OVERVIEW

TABLE 240 NETAFIM: PRODUCTS OFFERED

13.2 LINDSAY CORPORATION

TABLE 241 LINDSAY CORPORATION: BUSINESS OVERVIEW

FIGURE 45 LINDSAY CORPORATION: COMPANY SNAPSHOT

TABLE 242 LINDSAY CORPORATION SYNGENTA: PRODUCTS OFFERED

TABLE 243 LINDSAY CORPORATION: PRODUCT LAUNCHES

TABLE 244 LINDSAY CORPORATION: DEALS

13.3 VALMONT INDUSTRIES INC.

TABLE 245 VALMONT INDUSTRIES INC.: BUSINESS OVERVIEW

FIGURE 46 VALMONT INDUSTRIES INC.: COMPANY SNAPSHOT

TABLE 246 VALMONT INDUSTRIES INC.: PRODUCTS OFFERED

TABLE 247 VALMONT INDUSTRIES INC.: PRODUCT LAUNCHES

TABLE 248 VALMONT INDUSTRIES INC.: DEALS

13.4 THE TORO COMPANY

TABLE 249 THE TORO COMPANY: IRRIGATION AUTOMATION MARKET BUSINESS OVERVIEW

FIGURE 47 THE TORO COMPANY: COMPANY SNAPSHOT

TABLE 250 THE TORO COMPANY: PRODUCTS OFFERED

TABLE 251 THE TORO COMPANY: DEALS

13.5 JAIN IRRIGATION SYSTEMS

TABLE 252 JAIN IRRIGATION SYSTEMS: BUSINESS OVERVIEW

FIGURE 48 JAIN IRRIGATION SYSTEMS: COMPANY SNAPSHOT

TABLE 253 JAIN IRRIGATION SYSTEMS: PRODUCTS OFFERED

13.6 HUNTER INDUSTRIES

TABLE 254 HUNTER INDUSTRIES: BUSINESS OVERVIEW

TABLE 255 HUNTER INDUSTRIES: PRODUCTS OFFERED

13.7 RAIN BIRD

TABLE 256 RAIN BIRD: BUSINESS OVERVIEW

TABLE 257 RAIN BIRD: PRODUCTS OFFERED

TABLE 258 RAIN BIRD: PRODUCT LAUNCHES

TABLE 259 RAIN BIRD: DEALS

13.8 HYDROPOINT DATA SYSTEMS

TABLE 260 HYDROPOINT DATA SYSTEMS: BUSINESS OVERVIEW

TABLE 261 HYDROPOINT DATA SYSTEMS: PRODUCTS OFFERED

13.9 WEATHERMATIC

TABLE 262 WEATHERMATIC: BUSINESS OVERVIEW

TABLE 263 WEATHERMATIC: PRODUCTS OFFERED

TABLE 264 WEATHERMATIC: DEALS

13.10 NELSON IRRIGATION

TABLE 265 NELSON IRRIGATION: BUSINESS OVERVIEW

TABLE 266 NELSON IRRIGATION: PRODUCTS OFFERED

13.11 CALSENSE

TABLE 267 CALSENSE: BUSINESS OVERVIEW

TABLE 268 CALSENSE: PRODUCTS OFFERED

13.12 GALCON

TABLE 269 GALCON: BUSINESS OVERVIEW

TABLE 270 GALCON: PRODUCTS OFFERED

13.13 RUBICON WATER

TABLE 271 RUBICON WATER: BUSINESS OVERVIEW

TABLE 272 RUBICON WATER: PRODUCTS OFFERED

13.14 IRRITEC S.P.A

TABLE 273 IRRITEC S.P.A: BUSINESS OVERVIEW

TABLE 274 PLANT HEALTH CARE: PRODUCTS OFFERED

13.15 MOTTECH WATER SOLUTIONS LTD.

TABLE 275 MOTTECH WATER SOLUTIONS LTD.: IRRIGATION AUTOMATION MARKET BUSINESS OVERVIEW

TABLE 276 MOTTECH WATER SOLUTIONS LTD.: PRODUCTS OFFERED

13.16 WATERBIT INC.

TABLE 277 WATERBIT INC.: BUSINESS OVERVIEW

TABLE 278 WATERBIT INC.: PRODUCTS OFFERED

13.17 GROWLINK

TABLE 279 GROWLINK: BUSINESS OVERVIEW

TABLE 280 AGRAUXINE: PRODUCTS OFFERED

13.18 RANCH SYSTEMS

TABLE 281 RANCH SYSTEMS: BUSINESS OVERVIEW

TABLE 282 RANCH SYSTEMS: PRODUCTS OFFERED

13.19 BLURAIN

TABLE 283 BLURAIN: BUSINESS OVERVIEW

TABLE 284 BLURAIN: PRODUCTS OFFERED

13.2 AVANIJAL AGRI AUTOMATION PVT LTD.

TABLE 285 AVANIJAL AGRI AUTOMATION PVT LTD.: BUSINESS OVERVIEW

TABLE 286 AVANIJAL AGRI AUTOMATION PVT LTD.: PRODUCTS OFFERED

13.21 IRRIGATION AUTOMATION SYSTEMS

TABLE 287 IRRIGATION AUTOMATION SYSTEMS: BUSINESS OVERVIEW

TABLE 288 IRRIGATION AUTOMATION SYSTEMS: PRODUCTS OFFERED

TABLE 289 IRRIGATION AUTOMATION SYSTEMS: NEW PRODUCT LAUNCHES

TABLE 290 IRRIGATION AUTOMATION SYSTEMS: DEALS

13.22 SIGNATURE CONTROL SYSTEMS, INC.

TABLE 291 SIGNATURE CONTROLS SYSTEMS, INC.: BUSINESS OVERVIEW

TABLE 292 SIGNATURE CONTROLS SYSTEMS, INC.: PRODUCTS OFFERED

13.23 SUPERIOR

TABLE 293 SUPERIOR: BUSINESS OVERVIEW

TABLE 294 SUPERIOR: PRODUCTS OFFERED

13.24 HOLMAN INDUSTRIES

TABLE 295 HOLMAN INDUSTRIES: BUSINESS OVERVIEW

TABLE 296 HOLMAN INDUSTRIES: PRODUCTS OFFERED

13.25 BACCARA

TABLE 297 BACCARA: BUSINESS OVERVIEW

TABLE 298 BACCARA: PRODUCTS OFFERED

*Details on Business Overview, Products Offered, MnM View, Key Strengths/Right to win, Strategic choices made, and Weakness and competitive threats might not be captured in case of unlisted companies.

14 ADJACENT AND RELATED MARKETS (Page No. - 270)

14.1 INTRODUCTION

TABLE 299 ADJACENT MARKETS TO THE IRRIGATION AUTOMATION MARKET

14.2 LIMITATIONS

14.3 SMART IRRIGATION MARKET

14.3.1 MARKET DEFINITION

14.3.2 MARKET OVERVIEW

14.3.3 SMART IRRIGATION MARKET, BY COMPONENT

TABLE 300 SMART IRRIGATION MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

14.3.4 SMART IRRIGATION MARKET, BY APPLICATION

TABLE 301 SMART IRRIGATION MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

14.3.5 SMART IRRIGATION MARKET, BY REGION

TABLE 302 SMART IRRIGATION MARKET, BY REGION, 2021–2026 (USD MILLION)

14.4 SMART WATER MANAGEMENT MARKET

14.4.1 MARKET DEFINITION

14.4.2 MARKET OVERVIEW

14.4.3 SMART WATER MANAGEMENT MARKET, BY OFFERING

TABLE 303 SMART WATER MANAGEMENT MARKET, BY OFFERING, 2021–2026 (USD MILLION)

14.4.4 SMART WATER MANAGEMENT MARKET, BY END USER

TABLE 304 SMART WATER MANAGEMENT MARKET, BY END USER, 2021–2026 (USD MILLION)

14.4.5 SMART WATER MANAGEMENT MARKET, BY REGION

TABLE 305 SMART WATER MANAGEMENT MARKET, BY REGION, 2021–2026 (USD MILLION)

15 APPENDIX (Page No. - 277)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

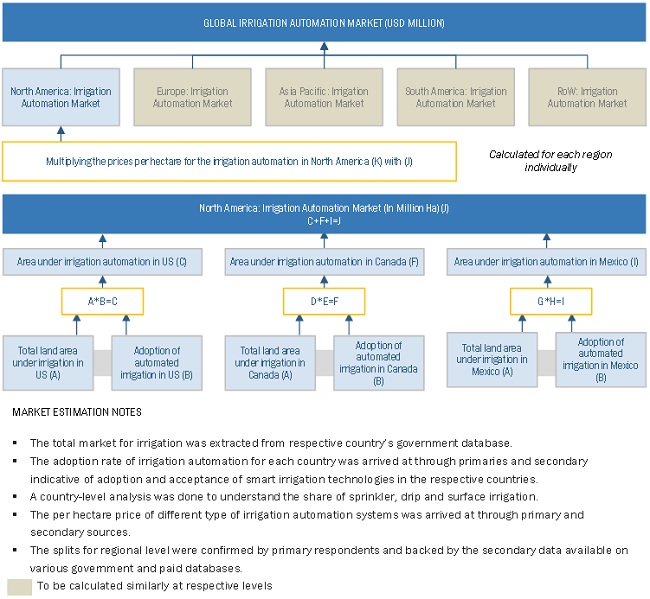

The study involved four major steps in estimating the size of the irrigation automation market. Exhaustive secondary research was done to collect information on the market, as well as the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources, such as irrigation automation manufacturers, Food and Agriculture Organization (FAO), US Department of Agriculture (USDA), Association of Equipment Manufacturers (AEM), Agricultural co-operative societies, Commercial research & development (R&D) organizations and financial institutions, International Commission on Irrigation and Drainage (ICID), and Federation of Indian Chambers of Commerce and Industry (FICCI) were referred to identify and collect information for this study.

The secondary sources also include agricultural journals, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and paid databases.

Secondary research was mainly conducted to obtain critical information about the industry’s supply chain, the total pool of key players, and market classification & segmentation according to the industry trends to the bottom-most level, and geographical markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The overall market comprises several stakeholders in the supply chain, which include global and regional irrigation automation manufacturers, dealers, as well as manufacturers of automation products. Primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders, regional irrigation automation dealers and manufacturers. The primary sources from the supply side include irrigation automation processing units, research institutions involved in R&D, and key opinion leaders.

The irrigation automation market is driven potentially by factors such as reducing water levels, increasing need for sustainable use of water resources, and improving efficiency while reducing costs.Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information

To know about the assumptions considered for the study, download the pdf brochure

Irrigation Automation Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the market. These approaches have also been used extensively to estimate the size of various dependent submarkets. The research methodology used to estimate the market size includes the following details:

Top-Down

- The key players in the industry and the market were identified through extensive secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary resources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from leaders, such as CEOs, directors, and marketing executives.

Bottom-Up

- The market sizes were analyzed based on the share of each irrigation type at regional and country levels. Thus, the global market for irrigation automation was estimated with a bottom-up approach to the irrigation type at the country level.

- Based on the demand from each automation type, offerings of key players, and the region-wise market share of major players, the global market for the automation type was estimated.

- All macroeconomic and microeconomic factors affecting the growth of the market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Global Irrigation Automation Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall irrigation automation market size from the estimation process explained above, the total market was split into several segments and subsegments. To estimate the overall market and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

- Determining and projecting the size of the market, with respect to system, irrigation type, component, automaion type, end use and regional markets, ranging from 2019 -2021 as historic period, and 2022 to 2027 as forecast period

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- Analyzing the micromarkets, with respect to individual growth trends, prospects, and their contribution to the total market

- Identifying and profiling the key players in the market

-

Providing a comparative analysis of market leaders on the basis of the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions

- Analyzing the value chain and products offered across key regions and their impact on the growth of the prominent market players

- Providing insights on key product innovations and investments in the irrigation automation market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific scientific needs.

The following customization options are available for the report:

Product Analysis:

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Europe market for irrigation automation into Denmark, Greece, Hungary, Netherlands, Portugal, and Poland

- Further breakdown of the Rest of Asia Pacific market for irrigation automation into Vietnam, Philippnes, Malaysia, Indonesia, and South Korea

- Further breakdown of the Rest of South America market irrigation automation into Peru and Chile

- Further breakdown of other countries in the RoW irrigation automation market into Middle East and Africa

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Irrigation Automation Market