Isobutyric Acid Market by Grade (Reagent, Industrial), Purity (<98% and <98%), Type (Synthetic, Renewable), End-Use (Animal Feed, Chemical Intermediates, Food & Flavors, Pharmaceuticals, Perfumes, Protective Coating), and Region - Global Forecast to 2028

Updated on : November 11, 2025

Isobutyric Acid Market

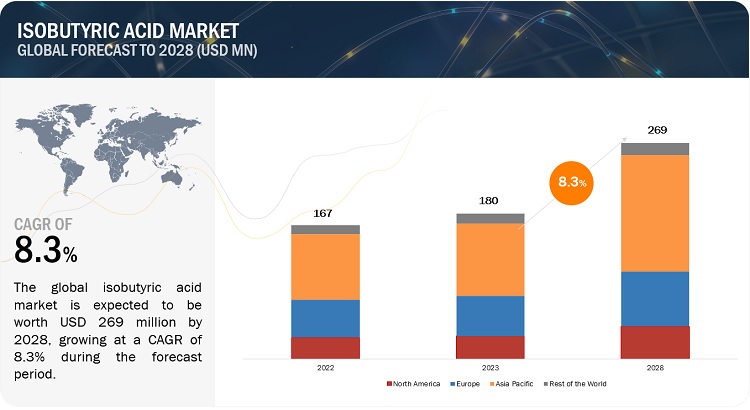

The global isobutyric acid market was valued at USD 180 million in 2023 and is projected to reach USD 269 million by 2028, growing at 8.3% cagr from 2023 to 2028. The demand for isobutyric acid is closely related to its applications in different industries. Industries such as food & flavors, pharmaceuticals, animal feed, chemicals, polymers, and agriculture utilize isobutyric acid in their processes.

Isobutyric Acid Market Forecast & Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Attractive Opportunities in the Isobutyric Acid Market

Isobutyric Acid Market Dynamics

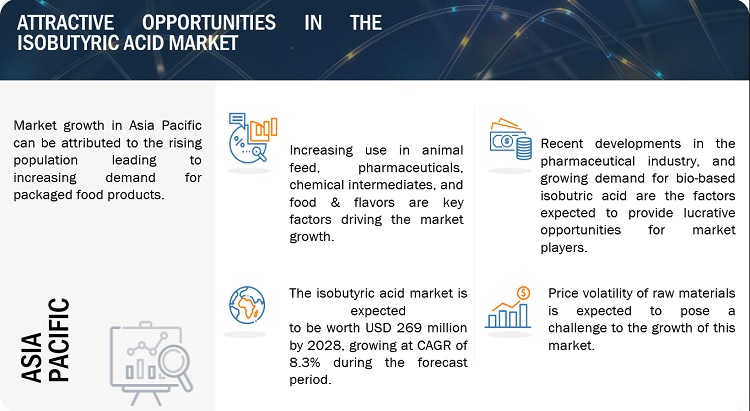

Driver: Use of isobutyric acid in food & flavor industry

Isobutyric acid is an intermediate which is utilized as a solvent in processes that produce pleasant aromas and flavors. According to EFFA, the flavoring industry, a relatively dynamic sector of the economy, spends about 10% of its annual revenue on research and development (R&D). At present, manufacturers aim at creating inventive organic flavors as a result of technological advancements addressing shifting consumer tastes and needs. Thus, the use of isobutyric acid in the growing food & flavor industry is a major driver for the Isobutyric Acid Industry.

Restraint: Health concerns associated with handling and storage of isobutyric acid

The market is expected to experience restraints due to health risks related to handling isobutyric acid. The effects of isobutyric acid inhalation include coughing, throat pain, and respiratory issues. Consuming isobutyric acid may cause a person to collapse or stomach pain. Isoutyric acid can irritate the skin, burn, cause blisters, and continuous exposure can impair vision. Thus, such health concerns restrain the growth of the market.

Opportunity: Growing demand for bio-based isobutric acid

Isobutyric acid can be produced from renewable feedstocks, making it a potential bio-based alternative to petroleum-based chemicals. The use of bio-based chemicals is being encouraged by governmental legislation and policies that support sustainability and the use of renewable resources. The discovery and manufacture of bio-based compounds such as isobutyric acid are encouraged by incentives, R&D, and renewable energy programmers, which creates opportunity for market demand.

Challenge: Price volatility of raw materials

The price volatility of raw materials for isobutyric acid can be attributed to fluctuations in the prices of various feedstocks, which can be impacted by variables such as supply-demand dynamics, geopolitical events, and changes in production capabilities. Also, as isobutyric acid can be derived from petroleum-based feedstocks, the prices of crude oil and its derivatives can have a significant impact on the raw material costs for isobutyric acid. Crude oil prices have been constantly fluctuating since the drop in 2014. The prices again dipped in 2019 and 2020, with a steady increase from Jan 2021 to March 2022. Thus, such fluctuation of crude oil prices poses a challenge for the market.

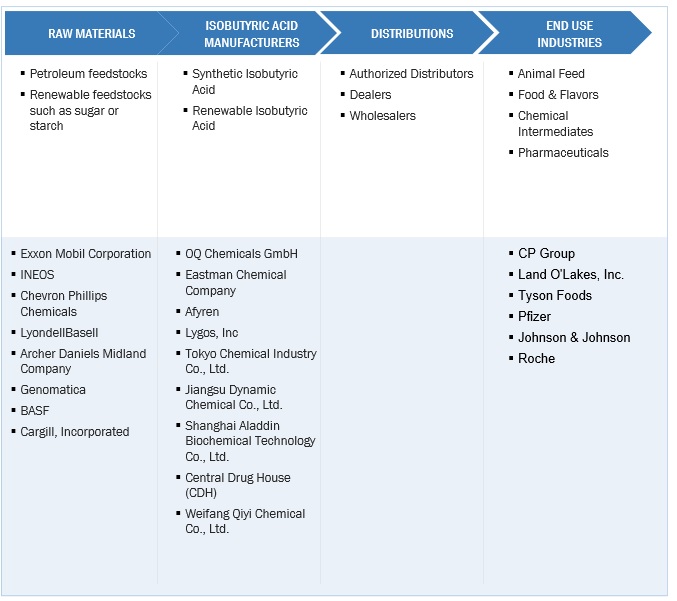

ISOBUTYRIC ACID MARKET: VALUE CHAIN

Prominent companies in this market include well-established, financially stable isobutyric acid manufacturers. These companies have been operating in the market for several years and possess a strong product portfolio and strong global sales and marketing networks. Prominent companies in this market include OQ Chemicals GmbH (Germany), Eastman Chemical Company (US), Tokyo Chemical Industry Co., Ltd. (Japan), Snowco (China), Shanghai Aladdin Biochemical Technology Co., Ltd. (China).

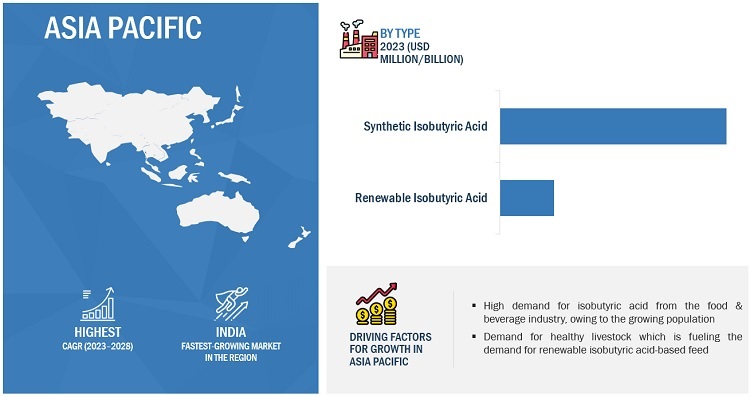

Based on type, the synthetic isobutyric acid segment is estimated to have the larger market share during the forecast period.

The synthetic isobutyric acid segment is projected to have the larger share of the isobutyric acid market during 2023 to 2028. Isobutyric acid is synthesized chemically with petroleum feedstocks as raw materials, or it can be biosynthesized with sugar or starch. Synthetic isobutyric acid is used in various end-uses such as agricultural intermediates, food & flavors, chemical intermediates, protective coatings, pharmaceutical chemicals, and fragrance ingredients. Thus, the growth of synthetic isobutyric acid segment can be attributed to the cost effectiveness and easy accessibility of raw materials which include petroleum feedstocks.

Based on end-use, the animal feed segment is estimated to have the largest market share during the forecast period.

The animal feed segment is projected to have the largest market share during 2023 to 2028. Isobutyric acid is used as a feed additive to enhance nutritional benefits and act as a growth promoter. It can also contribute to the feed flavor increasing its intake while boosting animal health. Thus, such factors will propel the growth of this segment.

Based on region, Asia Pacific is projected to account for the largest market share during the forecast period.

Increasing demand for isobutyric acid from the animal feed industry is leading to the growth of the Asia Pacific market. Also, the rising population aided with urbanization in emerging economies such as China, India, Japan, and South Korea are increasing the demand for processed food items. Isobutyric acid being used as a feed additive and a flavoring agent in food & flavor is driving the Asia Pacific market.

To know about the assumptions considered for the study, download the pdf brochure

Isobutyric Acid Market Players

OQ Chemicals GmbH (Germany), Eastman Chemical Company (US), Tokyo Chemical Industry Co., Ltd. (Japan), Snowco (China), Shanghai Aladdin Biochemical Technology Co., Ltd. (China), Afyren (France), Lygos, Inc. (US), Dow Inc. (US), Jiangsu Dynamic Chemical Co., Ltd. (China), Weifang Qiyi Chemical Co., Ltd. (China), Yufeng International Group Co., Ltd. (China), Nanjing Chemical Material Corp. (China), FUJIFILM Wako Pure Chemical Corporation (Japan), Hubei Jusheng Technology Co., Ltd. (China) are among the major players leading the market through their geographical presence, enhanced production capacities, and efficient distribution channels.

Isobutyric Acid Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2023 |

USD 180 million |

|

Revenue Forecast in 2028 |

USD 269 million |

|

CAGR |

8.3% |

|

Market Size Available for Years |

2018 to 2028 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD Million), Volume (KiloTons) |

|

Segments Covered |

Grade, Purity, Type, End-Use, and Region |

|

Geographies Covered |

Europe, Asia Pacific, North America, and RoW. |

|

Companies Covered |

The major market players include are OQ Chemicals GmbH (Germany), Eastman Chemical Company (US), Tokyo Chemical Industry Co., Ltd. (Japan), Snowco (China), Shanghai Aladdin Biochemical Technology Co., Ltd. (China), Afyren (France), Lygos, Inc. (US), Dow Inc. (US), Jiangsu Dynamic Chemical Co., Ltd. (China), Weifang Qiyi Chemical Co., Ltd. (China), Yufeng International Group Co., Ltd. (China), Nanjing Chemical Material Corp. (China), FUJIFILM Wako Pure Chemical Corporation (Japan), Hubei Jusheng Technology Co., Ltd. (China), and others |

This research report categorizes the isobutyric acid market based on grade, purity, type, end-use, and region.

Based on grade, the isobutyric acid market has been segmented as follows:

- Reagent Grade

- Industrial Grade

Based on purity, the isobutyric acid market has been segmented as follows:

- More than 98%

- Less than 98%

Based on type, the isobutyric acid market has been segmented as follows:

- Synthetic Isobutyric Acid

- Renewable Isobutyric Acid

Based on end-use, the isobutyric acid market has been segmented as follows:

- Animal Feed

- Food & Flavor

- Chemical Intermediate

- Pharmaceutical

- Others

Based on the region, the isobutyric acid market has been segmented as follows:

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific

-

Europe

- Germany

- France

- UK

- Italy

- Rest of Europe

-

North America

- US

- Canada

- Mexico

-

Rest of the World (RoW)

- Middle East & Africa

- South America

Recent Developments

- In January 2023, OQ Chemicals expanded its manufacturing capacity for carboxylic acids. The company invested in a debottlenecking and optimization project for precursors at its facilities in Germany.

- In January 2023, Afyren and Mitr Phol, a manufacturer of cane sugar and its derivatives, signed a Letter Agreement to establish a biorefinery in Thailand. As per the agreement, the second bio-based organic acid production facility for the Afyren Group would be built. It is consistent with Afyren’s build and operate development strategy, which aims at reaching markets where it sources its raw materials and its customers, with a focus on Asia and North America.

- In April 2021, Eastman Chemical Company acquired 3F Feed & Food, a European pioneer in the technological and commercial advancement of additives for animal feed and human food. Spain-based 3F's operations and assets joined Eastman's additives & functional products segment and enabled it to improve and assist the animal nutrition company's ongoing global expansion.

Frequently Asked Questions (FAQ):

What is the current size of the isobutyric acid market?

The isobutyric acid market is projected to grow from USD 180 million in 2023 to USD 269 million by 2028, at a CAGR of 8.3% from 2023 to 2028.

Which region is expected to hold the highest market share in the isobutyric acid market?

The isobutyric acid market in Asia Pacific is estimated to hold the highest market share, owing to the increase in demand for high-quality meat products which has led to the high demand for feed additives.

Which is the major end-use industry of isobutyric acid?

The animal feed segment is the major end-use industry of isobutyric acid.

Who are the major players operating in the isobutyric acid market?

The major players operating in the market include OQ Chemicals GmbH (Germany), Eastman Chemical Company (US), Tokyo Chemical Industry Co., Ltd. (Japan), Snowco (China), Shanghai Aladdin Biochemical Technology Co., Ltd. (China).

What is the total CAGR expected to record for the isobutyric acid market during 2023-2028?

The market is expected to record a CAGR of 8.3% from 2023-2028. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising demand from major end-use industriesRESTRAINTS- Health concerns associated with handling and storageOPPORTUNITIES- Potential use of SFCAs in liver disease treatment- Growing preference for bio-based isobutyric acid over petroleum-based chemicalsCHALLENGES- Price volatility of raw materials

-

6.1 ECOSYSTEM

-

6.2 VALUE CHAIN ANALYSISRAW MATERIALSMANUFACTURE OF ISOBUTYRIC ACIDDISTRIBUTION TO END USERS

-

6.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESSREVENUE SHIFT & POCKETS FOR ISOBUTYRIC ACID

-

6.4 PORTER'S FIVE FORCES ANALYSISBARGAINING POWER OF SUPPLIERSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSTHREAT OF NEW ENTRANTSINTENSITY OF COMPETITIVE RIVALRY

-

6.5 CASE STUDY ANALYSISAGILE BIOFOUNDRY ASSISTS LYGOS, INC. TO SCALE UP PRODUCTION

-

6.6 TECHNOLOGY ANALYSISINTRODUCTION- Koch synthesis- Liquid-phase oxidation of isobutyraldehyde- Biosynthesis

-

6.7 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.8 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

6.9 PATENT ANALYSISINTRODUCTIONMETHODOLOGYDOCUMENT TYPEINSIGHTSJURISDICTION ANALYSISTOP COMPANIES/APPLICANTS

- 6.10 KEY CONFERENCES & EVENTS, 2023–2024

-

6.11 PRICING ANALYSISAVERAGE SELLING PRICE, BY REGIONAVERAGE SELLING PRICE OF KEY PLAYERS, BY END USE

- 6.12 TRADE DATA

- 7.1 INTRODUCTION

-

7.2 REAGENT GRADEGROWING USE IN LAB ENVIRONMENTS TO FUEL MARKET

-

7.3 INDUSTRIAL GRADEWIDESPREAD USE IN INDUSTRIAL APPLICATIONS TO DRIVE DEMAND

- 8.1 INTRODUCTION

-

8.2 MORE THAN 98%HIGH DEMAND FROM PHARMACEUTICAL INDUSTRY TO FUEL GROWTH

-

8.3 LESS THAN 98%INCREASING USE IN INDUSTRIAL CLEANING ACTIVITIES TO PROPEL GROWTH

- 9.1 INTRODUCTION

-

9.2 SYNTHETIC ISOBUTYRIC ACIDLOW MANUFACTURING COST TO DRIVE DEMAND

-

9.3 RENEWABLE ISOBUTYRIC ACIDRISING INTEREST IN ORGANIC AND NATURAL PRODUCTS TO BOOST MARKET

- 10.1 INTRODUCTION

-

10.2 ANIMAL FEEDGROWING USE AS FEED SUPPLEMENT TO DRIVE MARKET

-

10.3 CHEMICAL INTERMEDIATESWIDESPREAD USE OF ISOBUTYRIC ACID ESTERS TO PROPEL DEMAND

-

10.4 FOOD & FLAVORSINCREASING CONSUMPTION OF PROCESSED FOOD & BEVERAGES TO FUEL MARKET

-

10.5 PHARMACEUTICALSPOTENTIAL USE IN DISEASE TREATMENT TO DRIVE MARKET

- 10.6 OTHERS

- 11.1 INTRODUCTION

-

11.2 ASIA PACIFICIMPACT OF RECESSIONCHINA- Increasing demand from animal feed industry to drive marketINDIA- Growing consumer awareness and demand for environment-friendly products to boost marketJAPAN- Rising consumption of packaged food to drive marketSOUTH KOREA- Growing food and petrochemical sectors to boost demandREST OF ASIA PACIFIC

-

11.3 EUROPEIMPACT OF RECESSIONGERMANY- Increased pharmaceutical R&D spending to drive marketFRANCE- Growing demand for poultry products to boost marketITALY- Increasing consumption of consumer-ready food to drive marketUK- Booming pharmaceutical sector to fuel marketREST OF EUROPE

-

11.4 NORTH AMERICAIMPACT OF RECESSIONUS- Growth of feed industry to boost consumption of isobutyric acidCANADA- Growth in pharmaceutical sector to drive marketMEXICO- Rising demand for processed foods to fuel market

-

11.5 REST OF THE WORLDIMPACT OF RECESSIONMIDDLE EAST & AFRICA- Increasing demand due to expansion of food & flavor sectorSOUTH AMERICA- Growth in animal feed industry to propel demand

- 12.1 INTRODUCTION

-

12.2 STRATEGIES ADOPTED BY KEY PLAYERSOVERVIEW OF STRATEGIES ADOPTED BY KEY MANUFACTURERS

-

12.3 MARKET SHARE ANALYSISRANKING OF KEY MARKET PLAYERS, 2022MARKET SHARE OF KEY PLAYERS- OQ Chemicals GmbH- Eastman Chemical Company- Tokyo Chemical Industry Co., Ltd.- Snowco- Shanghai Aladdin Biochemical Technology Co., Ltd.REVENUE ANALYSIS OF TOP 5 PLAYERS

- 12.4 COMPANY PRODUCT FOOTPRINT ANALYSIS

-

12.5 COMPANY EVALUATION QUADRANT (TIER 1)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 12.6 COMPETITIVE BENCHMARKING

-

12.7 START-UP/SME EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

12.8 COMPETITIVE SCENARIODEALSOTHER DEVELOPMENTS

-

13.1 MAJOR PLAYERSOQ CHEMICALS GMBH- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewEASTMAN CHEMICAL COMPANY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTOKYO CHEMICAL INDUSTRY CO., LTD.- Business overview- Products/Solutions/Services offered- MnM viewSNOWCO- Business overview- Products/Solutions/Services offered- Recent developments- MnM view- Strategic choices- Weaknesses and competitive threatsSHANGHAI ALADDIN BIOCHEMICAL TECHNOLOGY CO., LTD.- Business overview- Products/Solutions/Services offered- MnM viewAFYREN- Business overview- Products/Solutions/Services offered- Recent developmentsLYGOS, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsDOW INC.- Business overview- Products/Solutions/Services offeredJIANGSU DYNAMIC CHEMICAL CO., LTD.- Business overview- Products/Solutions/Services offeredWEIFANG QIYI CHEMICAL CO., LTD.- Business overview- Products/Solutions/Services offeredYUFENG INTERNATIONAL GROUP CO., LTD.- Business overview- Products/Solutions/Services offeredNANJING CHEMICAL MATERIAL CORP.- Business overview- Products/Solutions/Services offeredFUJIFILM WAKO PURE CHEMICAL CORPORATION- Business overview- Products/Solutions/Services offeredHUBEI JUSHENG TECHNOLOGY CO., LTD.- Business overview- Products/Solutions/Services offered

-

13.2 OTHER PLAYERSYANCHENG CITY CHUNZHU AROMA CO., LTD.WEN INTERNATIONAL, INC.CENTRAL DRUG HOUSEKUNSHAN ODOWELL CO., LTDSISCO RESEARCH LABORATORIES PVT. LTD.

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

-

14.3 BUTYRIC ACID MARKETMARKET DEFINITIONMARKET OVERVIEWBUTYRIC ACID MARKET, BY TYPE

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHORS DETAILS

- TABLE 1 ISOBUTYRIC ACID MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 ISOBUTYRIC ACID MARKET

- TABLE 3 AVERAGE USUAL USE LEVELS/AVERAGE MAXIMUM USE LEVELS

- TABLE 4 HAZARDS IDENTIFICATION

- TABLE 5 HANDLING & STORAGE

- TABLE 6 ISOBUTYRIC ACID MARKET: ECOSYSTEM

- TABLE 7 ISOBUTYRIC ACID MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USES (%)

- TABLE 9 KEY BUYING CRITERIA FOR TOP THREE END USES

- TABLE 10 REGULATIONS AND STANDARDS RELATED TO ISOBUTYRIC ACID MARKET

- TABLE 11 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 PATENTS: EASTMAN CHEMICAL COMPANY

- TABLE 16 PATENTS: DOW AGROSCIENCES LLC

- TABLE 17 TOP 10 PATENT OWNERS DURING LAST 10 YEARS

- TABLE 18 ISOBUTYRIC ACID MARKET: CONFERENCES & EVENTS

- TABLE 19 IMPORT DATA FOR ISOBUTYRIC ACID, 2021

- TABLE 20 EXPORT DATA FOR ISOBUTYRIC ACID, 2021

- TABLE 21 ISOBUTYRIC ACID MARKET, BY TYPE, 2018–2020 (USD MILLION)

- TABLE 22 ISOBUTYRIC ACID MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 23 ISOBUTYRIC ACID MARKET, BY TYPE, 2018–2020 (KILOTONS)

- TABLE 24 ISOBUTYRIC ACID MARKET, BY TYPE, 2021–2028 (KILOTONS)

- TABLE 25 ISOBUTYRIC ACID MARKET, BY END USE, 2018–2020 (USD MILLION)

- TABLE 26 ISOBUTYRIC ACID MARKET, BY END USE, 2021–2028 (USD MILLION)

- TABLE 27 ISOBUTYRIC ACID MARKET, BY END USE, 2018–2020 (KILOTONS)

- TABLE 28 ISOBUTYRIC ACID MARKET, BY END USE, 2021–2028 (KILOTONS)

- TABLE 29 ISOBUTYRIC ACID MARKET, BY REGION, 2018–2020 (KILOTONS)

- TABLE 30 ISOBUTYRIC ACID MARKET, BY REGION, 2021–2028 (KILOTONS)

- TABLE 31 ISOBUTYRIC ACID MARKET, BY REGION, 2018–2020 (USD MILLION)

- TABLE 32 ISOBUTYRIC ACID MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 33 ASIA PACIFIC: ISOBUTYRIC ACID MARKET, BY TYPE, 2018–2020 (KILOTONS)

- TABLE 34 ASIA PACIFIC: ISOBUTYRIC ACID MARKET, BY TYPE, 2021–2028 (KILOTONS)

- TABLE 35 ASIA PACIFIC: ISOBUTYRIC ACID MARKET, BY TYPE, 2018–2020 (USD MILLION)

- TABLE 36 ASIA PACIFIC: ISOBUTYRIC ACID MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 37 ASIA PACIFIC: ISOBUTYRIC ACID MARKET, BY END USE, 2018–2020 (KILOTONS)

- TABLE 38 ASIA PACIFIC: ISOBUTYRIC ACID MARKET, BY END USE, 2021–2028 (KILOTONS)

- TABLE 39 ASIA PACIFIC: ISOBUTYRIC ACID MARKET, BY END USE, 2018–2020 (USD MILLION)

- TABLE 40 ASIA PACIFIC: ISOBUTYRIC ACID MARKET, BY END USE, 2021–2028 (USD MILLION)

- TABLE 41 ASIA PACIFIC: ISOBUTYRIC ACID MARKET, BY COUNTRY, 2018–2020 (KILOTONS)

- TABLE 42 ASIA PACIFIC: ISOBUTYRIC ACID MARKET, BY COUNTRY, 2021–2028 (KILOTONS)

- TABLE 43 ASIA PACIFIC: ISOBUTYRIC ACID MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

- TABLE 44 ASIA PACIFIC: ISOBUTYRIC ACID MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 45 CHINA: ISOBUTYRIC ACID MARKET, BY TYPE, 2018–2020 (KILOTONS)

- TABLE 46 CHINA: ISOBUTYRIC ACID MARKET, BY TYPE, 2021–2028 (KILOTONS)

- TABLE 47 CHINA: ISOBUTYRIC ACID MARKET, BY TYPE, 2018–2020 (USD MILLION)

- TABLE 48 CHINA: ISOBUTYRIC ACID MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 49 INDIA: ISOBUTYRIC ACID MARKET, BY TYPE, 2018–2020 (KILOTONS)

- TABLE 50 INDIA: ISOBUTYRIC ACID MARKET, BY TYPE, 2021–2028 (KILOTONS)

- TABLE 51 INDIA: ISOBUTYRIC ACID MARKET, BY TYPE, 2018–2020 (USD MILLION)

- TABLE 52 INDIA: ISOBUTYRIC ACID MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 53 JAPAN: ISOBUTYRIC ACID MARKET, BY TYPE, 2018–2020 (KILOTONS)

- TABLE 54 JAPAN: ISOBUTYRIC ACID MARKET, BY TYPE, 2021–2028 (KILOTONS)

- TABLE 55 JAPAN: ISOBUTYRIC ACID MARKET, BY TYPE, 2018–2020 (USD MILLION)

- TABLE 56 JAPAN: ISOBUTYRIC ACID MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 57 SOUTH KOREA: ISOBUTYRIC ACID MARKET, BY TYPE, 2018–2020 (KILOTONS)

- TABLE 58 SOUTH KOREA: ISOBUTYRIC ACID MARKET, BY TYPE, 2021–2028 (KILOTONS)

- TABLE 59 SOUTH KOREA: ISOBUTYRIC ACID MARKET, BY TYPE, 2018–2020 (USD MILLION)

- TABLE 60 SOUTH KOREA: ISOBUTYRIC ACID MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 61 REST OF ASIA PACIFIC: ISOBUTYRIC ACID MARKET, BY TYPE, 2018–2020 (KILOTONS)

- TABLE 62 REST OF ASIA PACIFIC: ISOBUTYRIC ACID MARKET, BY TYPE, 2021–2028 (KILOTONS)

- TABLE 63 REST OF ASIA PACIFIC: ISOBUTYRIC ACID MARKET, BY TYPE, 2018–2020 (USD MILLION)

- TABLE 64 REST OF ASIA PACIFIC: ISOBUTYRIC ACID MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 65 EUROPE: ISOBUTYRIC ACID MARKET, BY TYPE, 2018–2020 (KILOTONS)

- TABLE 66 EUROPE: ISOBUTYRIC ACID MARKET, BY TYPE, 2021–2028 (KILOTONS)

- TABLE 67 EUROPE: ISOBUTYRIC ACID MARKET, BY TYPE, 2018–2020 (USD MILLION)

- TABLE 68 EUROPE: ISOBUTYRIC ACID MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 69 EUROPE: ISOBUTYRIC ACID MARKET, BY END USE, 2018–2020 (KILOTONS)

- TABLE 70 EUROPE: ISOBUTYRIC ACID MARKET, BY END USE, 2021–2028 (KILOTONS)

- TABLE 71 EUROPE: ISOBUTYRIC ACID MARKET, BY END USE, 2018–2020 (USD MILLION)

- TABLE 72 EUROPE: ISOBUTYRIC ACID MARKET, BY END USE, 2021–2028 (USD MILLION)

- TABLE 73 EUROPE: ISOBUTYRIC ACID MARKET, BY COUNTRY, 2018–2020 (KILOTONS)

- TABLE 74 EUROPE: ISOBUTYRIC ACID MARKET, BY COUNTRY, 2021–2028 (KILOTONS)

- TABLE 75 EUROPE: ISOBUTYRIC ACID MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

- TABLE 76 EUROPE: ISOBUTYRIC ACID MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 77 GERMANY: ISOBUTYRIC ACID MARKET, BY TYPE, 2018–2020 (KILOTONS)

- TABLE 78 GERMANY: ISOBUTYRIC ACID MARKET, BY TYPE, 2021–2028 (KILOTONS)

- TABLE 79 GERMANY: ISOBUTYRIC ACID MARKET, BY TYPE, 2018–2020 (USD MILLION)

- TABLE 80 GERMANY: ISOBUTYRIC ACID MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 81 FRANCE: ISOBUTYRIC ACID MARKET, BY TYPE, 2018–2020 (KILOTONS)

- TABLE 82 FRANCE: ISOBUTYRIC ACID MARKET, BY TYPE, 2021–2028 (KILOTONS)

- TABLE 83 FRANCE: ISOBUTYRIC ACID MARKET, BY TYPE, 2018–2020 (USD MILLION)

- TABLE 84 FRANCE: ISOBUTYRIC ACID MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 85 ITALY: ISOBUTYRIC ACID MARKET, BY TYPE, 2018–2020 (KILOTONS)

- TABLE 86 ITALY: ISOBUTYRIC ACID MARKET, BY TYPE, 2021–2028 (KILOTONS)

- TABLE 87 ITALY: ISOBUTYRIC ACID MARKET, BY TYPE, 2018–2020 (USD MILLION)

- TABLE 88 ITALY: ISOBUTYRIC ACID MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 89 UK: ISOBUTYRIC ACID MARKET, BY TYPE, 2018–2020 (KILOTONS)

- TABLE 90 UK: ISOBUTYRIC ACID MARKET, BY TYPE, 2021–2028 (KILOTONS)

- TABLE 91 UK: ISOBUTYRIC ACID MARKET, BY TYPE, 2018–2020 (USD MILLION)

- TABLE 92 UK: ISOBUTYRIC ACID MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 93 REST OF EUROPE: ISOBUTYRIC ACID MARKET, BY TYPE, 2018–2020 (KILOTONS)

- TABLE 94 REST OF EUROPE: ISOBUTYRIC ACID MARKET, BY TYPE, 2021–2028 (KILOTONS)

- TABLE 95 REST OF EUROPE: ISOBUTYRIC ACID MARKET, BY TYPE, 2018–2020 (USD MILLION)

- TABLE 96 REST OF EUROPE: ISOBUTYRIC ACID MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 97 NORTH AMERICA: ISOBUTYRIC ACID MARKET, BY TYPE, 2018–2020 (KILOTONS)

- TABLE 98 NORTH AMERICA: ISOBUTYRIC ACID MARKET, BY TYPE, 2021–2028 (KILOTONS)

- TABLE 99 NORTH AMERICA: ISOBUTYRIC ACID MARKET, BY TYPE, 2018–2020 (USD MILLION)

- TABLE 100 NORTH AMERICA: ISOBUTYRIC ACID MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 101 NORTH AMERICA: ISOBUTYRIC ACID MARKET, BY END USE, 2018–2020 (KILOTONS)

- TABLE 102 NORTH AMERICA: ISOBUTYRIC ACID MARKET, BY END USE, 2021–2028 (KILOTONS)

- TABLE 103 NORTH AMERICA: ISOBUTYRIC ACID MARKET, BY END USE, 2018–2020 (USD MILLION)

- TABLE 104 NORTH AMERICA: ISOBUTYRIC ACID MARKET, BY END USE, 2021–2028 (USD MILLION)

- TABLE 105 NORTH AMERICA: ISOBUTYRIC ACID MARKET, BY COUNTRY, 2018–2020 (KILOTONS)

- TABLE 106 NORTH AMERICA: ISOBUTYRIC ACID MARKET, BY COUNTRY, 2021–2028 (KILOTONS)

- TABLE 107 NORTH AMERICA: ISOBUTYRIC ACID MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

- TABLE 108 NORTH AMERICA: ISOBUTYRIC ACID MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 109 US: ISOBUTYRIC ACID MARKET, BY TYPE, 2018–2020 (KILOTONS)

- TABLE 110 US: ISOBUTYRIC ACID MARKET, BY TYPE, 2021–2028 (KILOTONS)

- TABLE 111 US: ISOBUTYRIC ACID MARKET, BY TYPE, 2018–2020 (USD MILLION)

- TABLE 112 US: ISOBUTYRIC ACID MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 113 CANADA: ISOBUTYRIC ACID MARKET, BY TYPE, 2018–2020 (KILOTONS)

- TABLE 114 CANADA: ISOBUTYRIC ACID MARKET, BY TYPE, 2021–2028 (KILOTONS)

- TABLE 115 CANADA: ISOBUTYRIC ACID MARKET, BY TYPE, 2018–2020 (USD MILLION)

- TABLE 116 CANADA: ISOBUTYRIC ACID MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 117 MEXICO: ISOBUTYRIC ACID MARKET, BY TYPE, 2018–2020 (KILOTONS)

- TABLE 118 MEXICO: ISOBUTYRIC ACID MARKET, BY TYPE, 2021–2028 (KILOTONS)

- TABLE 119 MEXICO: ISOBUTYRIC ACID MARKET, BY TYPE, 2018–2020 (USD MILLION)

- TABLE 120 MEXICO: ISOBUTYRIC ACID MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 121 REST OF THE WORLD: ISOBUTYRIC ACID MARKET, BY TYPE, 2018–2020 (KILOTONS)

- TABLE 122 REST OF THE WORLD: ISOBUTYRIC ACID MARKET, BY TYPE, 2021–2028 (KILOTONS)

- TABLE 123 REST OF THE WORLD: ISOBUTYRIC ACID MARKET, BY TYPE, 2018–2020 (USD MILLION)

- TABLE 124 REST OF THE WORLD: ISOBUTYRIC ACID MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 125 REST OF THE WORLD: ISOBUTYRIC ACID MARKET, BY END USE, 2018–2020 (KILOTONS)

- TABLE 126 REST OF THE WORLD: ISOBUTYRIC ACID MARKET, BY END USE, 2021–2028 (KILOTONS)

- TABLE 127 REST OF THE WORLD: ISOBUTYRIC ACID MARKET, BY END USE, 2018–2020 (USD MILLION)

- TABLE 128 REST OF THE WORLD: ISOBUTYRIC ACID MARKET, BY END USE, 2021–2028 (USD MILLION)

- TABLE 129 REST OF THE WORLD: ISOBUTYRIC ACID MARKET, BY REGION, 2018–2020 (KILOTONS)

- TABLE 130 REST OF THE WORLD: ISOBUTYRIC ACID MARKET, BY REGION, 2021–2028 (KILOTONS)

- TABLE 131 REST OF THE WORLD: ISOBUTYRIC ACID MARKET, BY REGION, 2018–2020 (USD MILLION)

- TABLE 132 REST OF THE WORLD: ISOBUTYRIC ACID MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 133 MIDDLE EAST & AFRICA: ISOBUTYRIC ACID MARKET, BY TYPE, 2018–2020 (KILOTONS)

- TABLE 134 MIDDLE EAST & AFRICA: ISOBUTYRIC ACID MARKET, BY TYPE, 2021–2028 (KILOTONS)

- TABLE 135 MIDDLE EAST & AFRICA: ISOBUTYRIC ACID MARKET, BY TYPE, 2018–2020 (USD MILLION)

- TABLE 136 MIDDLE EAST & AFRICA: ISOBUTYRIC ACID MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 137 SOUTH AMERICA: ISOBUTYRIC ACID MARKET, BY TYPE, 2018–2020 (KILOTONS)

- TABLE 138 SOUTH AMERICA: ISOBUTYRIC ACID MARKET, BY TYPE, 2021–2028 (KILOTONS)

- TABLE 139 SOUTH AMERICA: ISOBUTYRIC ACID MARKET, BY TYPE, 2018–2020 (USD MILLION)

- TABLE 140 SOUTH AMERICA: ISOBUTYRIC ACID MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 141 ISOBUTYRIC ACID MARKET: DEGREE OF COMPETITION

- TABLE 142 ISOBUTYRIC ACID MARKET: TYPE FOOTPRINT

- TABLE 143 ISOBUTYRIC ACID MARKET: END USE FOOTPRINT

- TABLE 144 ISOBUTYRIC ACID MARKET: COMPANY REGION FOOTPRINT

- TABLE 145 ISOBUTYRIC ACID MARKET: KEY START-UPS/SMES

- TABLE 146 ISOBUTYRIC ACID MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 147 ISOBUTYRIC ACID MARKET: DEALS, 2019–2023

- TABLE 148 ISOBUTYRIC ACID MARKET: EXPANSIONS AND INVESTMENTS, 2019–2023

- TABLE 149 OQ CHEMICALS GMBH: COMPANY OVERVIEW

- TABLE 150 OQ CHEMICALS GMBH: PRODUCTS OFFERED

- TABLE 151 OQ CHEMICALS GMBH: DEALS

- TABLE 152 OQ CHEMICALS GMBH: OTHERS

- TABLE 153 EASTMAN CHEMICAL COMPANY: COMPANY OVERVIEW

- TABLE 154 EASTMAN CHEMICAL COMPANY: PRODUCTS OFFERED

- TABLE 155 EASTMAN CHEMICAL COMPANY: DEALS

- TABLE 156 TOKYO CHEMICAL INDUSTRY CO., LTD.: COMPANY OVERVIEW

- TABLE 157 TOKYO CHEMICAL INDUSTRY CO., LTD: PRODUCTS OFFERED

- TABLE 158 SNOWCO: COMPANY OVERVIEW

- TABLE 159 SNOWCO: PRODUCTS OFFERED

- TABLE 160 SNOWCO: OTHERS

- TABLE 161 SHANGHAI ALADDIN BIOCHEMICAL TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 162 SHANGHAI ALADDIN BIOCHEMICAL TECHNOLOGY CO., LTD.: PRODUCTS OFFERED

- TABLE 163 AFYREN: COMPANY OVERVIEW

- TABLE 164 AFYREN: PRODUCTS OFFERED

- TABLE 165 AFYREN: DEALS

- TABLE 166 AFYREN: OTHERS

- TABLE 167 LYGOS, INC.: COMPANY OVERVIEW

- TABLE 168 LYGOS, INC.: PRODUCTS OFFERED

- TABLE 169 LYGOS, INC.: DEALS

- TABLE 170 LYGOS, INC.: OTHERS

- TABLE 171 DOW INC.: COMPANY OVERVIEW

- TABLE 172 DOW INC.: PRODUCTS OFFERED

- TABLE 173 JIANGSU DYNAMIC CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 174 JIANGSU DYNAMIC CHEMICAL CO., LTD.: PRODUCTS OFFERED

- TABLE 175 WEIFANG QIYI CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 176 WEIFANG QIYI CHEMICAL CO., LTD.: PRODUCTS OFFERED

- TABLE 177 YUFENG INTERNATIONAL GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 178 YUFENG INTERNATIONAL GROUP CO., LTD.: PRODUCTS OFFERED

- TABLE 179 NANJING CHEMICAL MATERIAL CORP.: COMPANY OVERVIEW

- TABLE 180 NANJING CHEMICAL MATERIAL CORP.: PRODUCTS OFFERED

- TABLE 181 FUJIFILM WAKO PURE CHEMICAL CORPORATION: COMPANY OVERVIEW

- TABLE 182 FUJIFILM WAKO PURE CHEMICAL CORPORATION: PRODUCTS OFFERED

- TABLE 183 HUBEI JUSHENG TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 184 HUBEI JUSHENG TECHNOLOGY CO., LTD.: PRODUCTS OFFERED

- TABLE 185 YANCHENG CITY CHUNZHU AROMA CO., LTD.: COMPANY OVERVIEW

- TABLE 186 WEN INTERNATIONAL, INC.: COMPANY OVERVIEW

- TABLE 187 CENTRAL DRUG HOUSE: COMPANY OVERVIEW

- TABLE 188 KUNSHAN ODOWELL CO., LTD: COMPANY OVERVIEW

- TABLE 189 SISCO RESEARCH LABORATORIES PVT. LTD.: COMPANY OVERVIEW

- TABLE 190 BUTYRIC ACID MARKET, BY TYPE, 2018–2020 (USD MILLION)

- TABLE 191 BUTYRIC ACID MARKET, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 192 BUTYRIC ACID MARKET, BY TYPE, 2018–2020 (KILOTONS)

- TABLE 193 BUTYRIC ACID MARKET, BY TYPE, 2021–2027 (KILOTONS)

- TABLE 194 BUTYRIC ACID MARKET, BY END USE, 2018–2020 (USD MILLION)

- TABLE 195 BUTYRIC ACID MARKET, BY END USE, 2021–2027 (USD MILLION)

- TABLE 196 BUTYRIC ACID MARKET, BY END USE, 2018–2020 (KILOTONS)

- TABLE 197 BUTYRIC ACID MARKET, BY END USE, 2021–2027 (KILOTONS)

- FIGURE 1 ISOBUTYRIC ACID MARKET SEGMENTATION

- FIGURE 2 ISOBUTYRIC ACID MARKET: RESEARCH DESIGN

- FIGURE 3 MAIN MATRIX CONSIDERED TO CONSTRUCT AND ASSESS DEMAND FOR ISOBUTYRIC ACID

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 6 ISOBUTYRIC ACID MARKET: DATA TRIANGULATION

- FIGURE 7 SYNTHETIC ISOBUTYRIC ACID SEGMENT TO DOMINATE MARKET BETWEEN 2023 AND 2028

- FIGURE 8 ANIMAL FEED SEGMENT TO LEAD MARKET BETWEEN 2023 AND 2028

- FIGURE 9 ASIA PACIFIC TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 10 MARKET TO WITNESS SIGNIFICANT GROWTH BETWEEN 2023 AND 2028

- FIGURE 11 ASIA PACIFIC MARKET TO RECORD HIGHEST CAGR BETWEEN 2023 AND 2028

- FIGURE 12 PHARMACEUTICALS SEGMENT TO REGISTER SIGNIFICANT CAGR BETWEEN 2023 AND 2028

- FIGURE 13 SYNTHETIC SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 14 INDIA TO RECORD HIGHEST CAGR BETWEEN 2023 AND 2028

- FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN ISOBUTYRIC ACID MARKET

- FIGURE 16 GLOBAL ANIMAL FEED PRODUCTION, 2020 (MT)

- FIGURE 17 BREAKDOWN OF GLOBAL SALES OF PHARMACEUTICALS, 2020

- FIGURE 18 ECOSYSTEM MAP OF ISOBUTYRIC ACID MARKET

- FIGURE 19 ISOBUTYRIC ACID MARKET: VALUE CHAIN

- FIGURE 20 ISOBUTYRIC ACID MARKET: FUTURE REVENUE MIX

- FIGURE 21 ISOBUTYRIC ACID MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USES

- FIGURE 23 KEY BUYING CRITERIA FOR TOP THREE END USES

- FIGURE 24 NUMBER OF GRANTED PATENTS, PATENT APPLICATIONS, AND LIMITED PATENTS

- FIGURE 25 PUBLICATION TRENDS: LAST 10 YEARS

- FIGURE 26 LEGAL STATUS OF PATENTS

- FIGURE 27 TOP JURISDICTION, BY DOCUMENT

- FIGURE 28 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

- FIGURE 29 AVERAGE SELLING PRICE OF ISOBUTYRIC ACID, BY TYPE, IN DIFFERENT REGIONS

- FIGURE 30 AVERAGE SELLING PRICES OF KEY PLAYERS FOR TOP THREE END USES

- FIGURE 31 SYNTHETIC ISOBUTYRIC ACID SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 32 ANIMAL FEED PROJECTED TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 33 ASIA PACIFIC TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 34 ASIA PACIFIC: ISOBUTYRIC ACID MARKET SNAPSHOT

- FIGURE 35 EUROPE: ISOBUTYRIC ACID MARKET SNAPSHOT

- FIGURE 36 NORTH AMERICA: ISOBUTYRIC ACID MARKET SNAPSHOT

- FIGURE 37 TOP FIVE PLAYERS IN ISOBUTYRIC ACID MARKET, 2022

- FIGURE 38 ISOBUTYRIC ACID MARKET SHARE ANALYSIS

- FIGURE 39 REVENUE ANALYSIS OF KEY COMPANIES, 2018–2022

- FIGURE 40 ISOBUTYRIC ACID MARKET: COMPANY FOOTPRINT

- FIGURE 41 COMPANY EVALUATION QUADRANT: ISOBUTYRIC ACID MARKET (TIER 1 COMPANIES)

- FIGURE 42 START-UP/SME EVALUATION QUADRANT: ISOBUTYRIC ACID MARKET

- FIGURE 43 OQ CHEMICALS GMBH: COMPANY SNAPSHOT

- FIGURE 44 EASTMAN CHEMICAL COMPANY: COMPANY SNAPSHOT

- FIGURE 45 SHANGHAI ALADDIN BIOCHEMICAL TECHNOLOGY CO., LTD.: COMPANY SNAPSHOT

- FIGURE 46 AFYREN: COMPANY SNAPSHOT

- FIGURE 47 DOW INC.: COMPANY SNAPSHOT

The study involved four major activities in estimating the current market size of isobutyric acid. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizes with industry experts across the value chain of isobutyric acid through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the size of the segments and sub-segments of the market.

Secondary Research

The research methodology used to estimate and forecast the access control market begins with capturing data on revenues of key vendors in the market through secondary research. In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, Factiva, World Bank, and Industry Journals, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; notifications by regulatory bodies; trade directories; and databases. Vendor offerings have also been taken into consideration to determine market segmentation.

Primary Research

The Isobutyric Acid Industry comprises several stakeholders, such as raw material suppliers, isobutyric acid manufacturers, and regulatory organizations in the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the isobutyric acid market. Primary sources from the demand side included directors, marketing heads, and purchase managers from various sourcing industries.

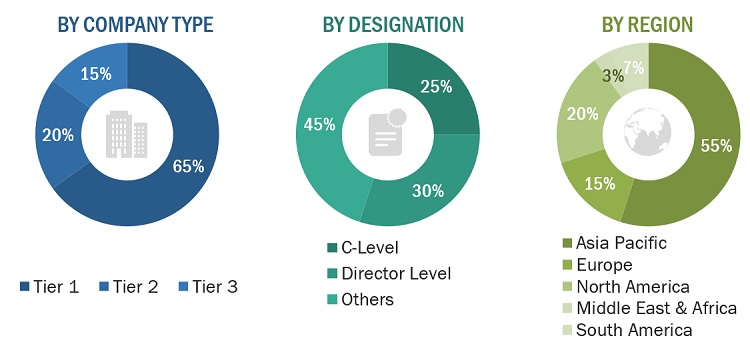

Following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

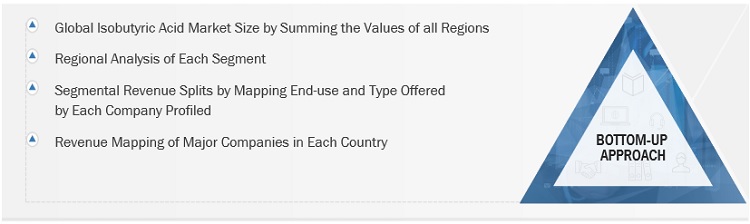

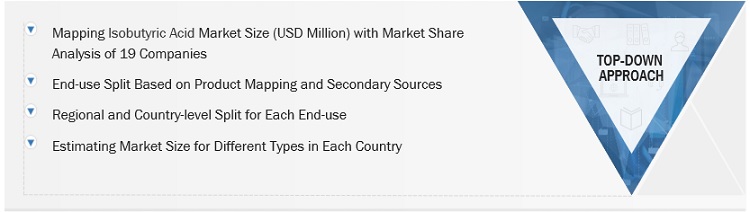

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the isobutyric acid market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the isobutyric acid market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Global Isobutyric Acid Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Isobutyric Acid Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the isobutyric acid sources.

Market definition

According to Afyren, a global biotech company, isobutyric acid is an isomer of butyric acid, consisting of four-carbon saturated monocarboxylic acid. Isobutyric acid is a branched fatty acid and has the appearance of a colorless liquid with a faint unpleasant butter odor. Isobutyric acid esters are utilized as solvents in a variety of applications where flavor and aroma quality is crucial. Isobutyric acid is available in two grades, namely reagent grade and industrial grade and can be used as a flavoring agent, feed additive, chemical intermediate or as a raw material in the synthesis of certain Active Pharmaceutical Ingredients (APIs).

Key Stakeholders

- Manufacturers of isobutyric acids

- Manufacturers in end-use industries

- Traders, distributors, and suppliers of isobutyric acids

- Regional manufacturers and chemical associations

- Contract manufacturing organizations (CMOs)

- Market research and consulting firms

- NGOs, governments, investment banks, venture capitalists, and private equity firms

- Environmental support agencies

Report Objectives:

- To analyze and forecast the market size of isobutyric acid in terms of value and volume.

- To provide detailed information regarding the major factors (drivers, restraints, challenges, and opportunities) influencing the regional market

- To analyze and forecast the global isobutyric acid market on the basis of type, end-use and region.

- To analyze the opportunities in the market for stakeholders and provide details of a competitive landscape for market leaders.

- To strategically analyze the micromarkets with respect to individual growth trends, growth prospects, and their contribution to the overall market

- To forecast the size of various market segments based on four major regions: North America, Europe, Asia Pacific, and Rest of the World (RoW), and along with their respective key countries.

- To track and analyze competitive developments, such as mergers, investments, acquisitions, expansions, partnerships, contracts, agreements, and joint ventures, in the market.

- To strategically profile the key players and comprehensively analyze their market shares and core competencies.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the client-specific needs.

The following customization options are available for the report:

- Additional country-level analysis of the isobutyric acid market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Growth opportunities and latent adjacency in Isobutyric Acid Market