Animal Intestinal Health Market by Additive (Probiotics, Prebiotics, Phytogenics, Immunostimulants), Livestock (Poultry, Swine, Ruminant, Aquaculture), Form (Dry, Liquid), Source, Region - Global Forecast to 2027

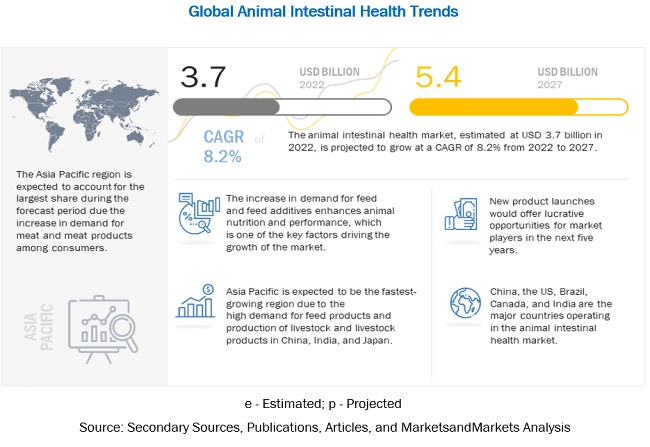

The global animal intestinal health market is estimated to reach $5.4 billion by 2027, growing at a 8.2% compound annual growth rate (CAGR). The global market size was valued $3.7 billion in 2022. Key factors, such as an increase in the consumption of compound feed and feed additives, steady growth in the market for meat and meat products, and a shift toward natural growth promoters have contributed to the growth of the market. However, the high price of feed additives and the lack of awareness in developing countries pertaining to the right ratio for mixing these additives in compound feed products are expected to inhibit the market's growth during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Drivers: Increasing application of animal health ingredients in feed products to enhance livestock production and to ultimately improve animal protein quality

The rise in population, incomes, and urbanization are the key factors, which contribute to the unprecedented growth of the livestock sector. The result is increased consumption of food products, such as meat, eggs, and milk has increased. As demand is anticipated to rise, the increased production demand for healthy and nutritive poultry meat will propel the market growth. The increase in awareness among consumers about the health benefits associated with the consumption of animal protein, such as improved bone health, immunity, and reduction in protein deficiencies, is also one of the several factors due to which the demand for livestock products remains high. The increase in demand for livestock products has led the stakeholders to use to feed addtitives such as probiotics, prebiotics and phytogenics to improve the animal health. For instance, digestive disorders such as stomach ulcers, swine dysentery, and transmissible gastroentrities among others are common in pigs. In order to avoid this orders and ensure effective animal health the feed additives such as phytogenics are being used in pigs.

Restraints: Introduction of stringent regulations pertaining to use of functional feed additives

International organizations, such as the US Food and Drug Administration (FDA), the US Center of Veterinary Medicine (CVM), the World Health Organization (WHO), the European Commission (EC), the European Food Safety Authority (EFSA), Australian Pesticides and Veterinary Medicines Authority (APVMA), Natural Health Product Directorate (NHPD), and the National Health Surveillance Agency (ANVISA) regulate the usage of various additives in feed products and issue stringent regulations for probiotic manufacturers. These organizations control the usage of different chemicals and ingredients used in feed processing. Regulatory initiatives pose challenges to various feed additives and add to the overall cost of developing the product. The major compound feed manufacturers are also required to submit patent and approval applications to launch new products in different countries, which adds to the cost of products. The approval processes are lengthy and usually consume more time.

Opportunities: Shift toward natural growth promoters (NGPs) due to increase in awareness about feed and food safety

Antimicrobial growth promoters (AGPs) are antibiotics that enhance the overall growth rate and production performance. The extended use of antibiotics results in the development of resistant bacteria and piling up antibiotic residue in the animals. With the increased awareness among consumers about the consequences of its presence in livestock products, a ban on the use of AGPs was proposed by the EU. This was primarily done to reduce the antibiotic resistance among pathogens in farm animals, thereby reducing the risk of its transmission to humans through food products. The subsequent shift to natural growth promoters, such as probiotics, prebiotics, phytogenics, and immunostimulants, contributes to the growth of the market

Challenges: Cost of active ingredients utilized in development of phytogenic feed additives

Essential extracts from various spices and herbs are the most important raw materials used in the production of feed phytogenics. However, the prices of essential oils are high, which has hindered the growth of the feed phytogenics market. The average price of clove leaf oil in Madagascar was USD 10/kg in 2021. Moreover, adverse weather conditions and a rise in demand for spices are projected to lead to a rise in prices. Likewise, the export price for rosemary herb oil also increased in countries, such as Portugal, Spain, and Tunisia. The high cost of transportation also adds to the raw material cost, thereby driving the overall cost of products upwards.

The probiotics segment, by additive dominates the market in terms of value.

The probiotics segment is expected to account for the largest share in the market by 2027 due to the high adoption of additives among livestock breeders. A majority of the key players are focusing on offering probiotic products to improve the intestinal health of livestock species.

The poultry segment, by livestock held the largest in terms of value.

The poultry segment is expected to account for the largest share during the forecast period, as most products cater to the requirements of poultry. Animal intestinal health products help to reduce incidences of diarrhea. They also stabilize intestinal microflora and enhance nutrient digestibility and digestive functions among poultry species. These products help poultry species gain weight and facilitate a higher feed conversion ratio. Since the population of poultry species is expected to grow, the demand for compound feed products for poultry species is expected to increase.

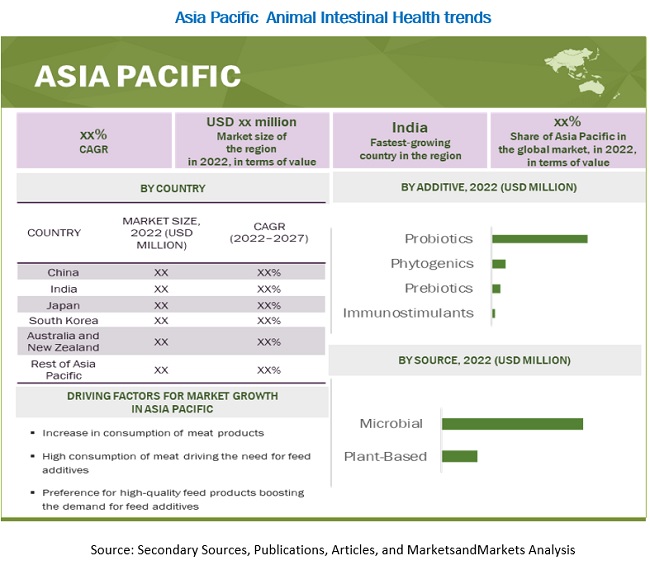

Asia Pacific is the fastest growing region.

Asia Pacific is expected to account for the largest share during the forecast period. This is due to the increase in the demand for meat and meat products in countries such as China, India, and South Korea. The demand for poultry products is expected to be significantly high in the Asia Pacific region, which is expected to lead to a rise in demand for feed products for broilers and layers. With the westernization of diets in the emerging countries in the Asia Pacific region, the demand for beef and pork meat is expected to grow, which would also encourage the growth of the market studied

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The key players in this market include Cargill, Incorporated (US), Koninklijke DSM N.V. (Netherlands), Archer Daniels Midland Company (US), DuPont de Nemours, Inc. (US), and Evonik Industries (Germany), Novozymes (Denmark), Nutreco (Netherlands), Chr. Hansen Holdings (Denmark), and Bluestar Adisseo Pvt Ltd. (China).

Scope of the report

|

Report Metric |

Details |

|

Base Year |

2021 |

|

Animal Intestinal Health Market Size in 2022 |

$3.7 billion |

|

2027 Value Projection |

$5.4 billion |

|

Forecast Period 2022 to 2027 CAGR |

8.2% |

|

Tables, Figures, & No. of Pages |

181 market data Tables and 49 Figures spread through 263 Pages |

|

Regions covered |

North America, Asia Pacific, Europe, South America, and Rest of the World |

|

Companies studied |

|

This research report categorizes the Animal intestinal health market based on Additive, Livestock, Form, Function, Source, and Region

By Additive

- Probiotics

- Prebiotics

- Phytogenics

- Immunostimulants

By Livestock

- Poultry

- Ruminants

- Swine

- Aquaculture

- Other Livestock

By Form

- Dry

- Liquid

By Function

- Metabolism

- Weight Gain

- Nutrient Digestion

- Disease Prevention

- Bone and Joint Health

By Source

- Microbial

- Plant Based

By Region

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

Recent Developments

- In May 2021, CHR Hansen developed a new product using two strains of different species of Bacilli, Bacillus licheniformis and Bacillus subtilis, isolated from nature to support gut health in ruminants.

- In November 2020, Evonik's Animal Nutrition business line launched Ecobiol Fizz, the first probiotic for chicken in effervescent tablet form. The product contains a microbial strain of the species Bacillus amyloliquefaciens, which is used to stabilize the intestinal microbiota of broilers and chickens reared for laying, particularly during stressful periods, such as breeding.

- In September 2020, ADM Animal Nutrition launched Forage First GS for its high-quality nutritional support for gastrointestinal health. Its unique blend of ingredients supports a healthy gastric pH while protecting and strengthening the stomach lining of the equine.

- In January 2020, Kemin Industries launched phytogenic feed additive adds to the comprehensive line-up of poultry gut health solutions from Kemin Animal Nutrition and Health, North America. It is a proprietary formulation of natural, gut-health-fortifying ingredients designed as a cost-effective solution for producers to minimize the impact of challenges, such as enteric diseases, on poultry performance.

Frequently Asked Questions (FAQ):

How big is the animal intestinal health market?

From 2022 to 2027, the animal intestinal health market is estimated to increase at an 8.2% CAGR (compound annual growth rate) to USD 5.4 billion, up from USD 3.7 billion in 2022.

Which players are involved in the manufacturing of animal intestinal health market?

The key players in this market include Cargill, Incorporated (US), Koninklijke DSM N.V. (Netherlands), Archer Daniels Midland Company (US), DuPont de Nemours, Inc. (US), and Evonik Industries (Germany), Novozymes (Denmark), Nutreco (Netherlands), Chr. Hansen Holdings (Denmark), and Bluestar Adisseo Pvt Ltd. (China).

Is there Oceania (New Zealand and Australia) specific information (market size, players, growth rate) for animal intestinal health market?

On request, We will provide details on market size, key players, growth rate of this industry in the Oceania region. Also, you can let us know if there are any other countries of your interest.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 38)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

1.3.1 REGIONS COVERED

1.4 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED, 2019–2021

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 43)

2.1 RESEARCH DATA

FIGURE 2 ANIMAL INTESTINAL HEALTH MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary interviews

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY VALUE CHAIN, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 4 ANIMAL INTESTINAL HEALTH MARKET SIZE ESTIMATION: SUPPLY SIDE (1/2)

FIGURE 5 ANIMAL INTESTINAL HEALTH (AIH) MARKET SIZE ESTIMATION: SUPPLY SIDE (2/2)

FIGURE 6 ANIMAL INTESTINAL HEALTH MARKET SIZE ESTIMATION: DEMAND SIDE

2.2.1 BOTTOM-UP APPROACH

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION METHODOLOGY

2.4 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.4.1 ASSUMPTIONS

2.4.2 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 53)

FIGURE 10 PROBIOTICS SEGMENT EXPECTED TO ACCOUNT FOR LARGEST MARKET SIZE BY 2027

FIGURE 11 POULTRY SEGMENT EXPECTED TO ACCOUNT FOR LARGEST MARKET SIZE BY 2027

FIGURE 12 DRY FORM SEGMENT EXPECTED TO ACCOUNT FOR A LARGER MARKET SHARE BY 2022

FIGURE 13 MICROBIAL SEGMENT EXPECTED TO ACCOUNT FOR LARGER MARKET SIZE BY 2027

FIGURE 14 ASIA PACIFIC EXPECTED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

4 PREMIUM INSIGHTS (Page No. - 57)

4.1 OPPORTUNITIES IN ANIMAL INTESTINAL HEALTH MARKET

FIGURE 15 INCREASE IN DEMAND FOR FEED AND FEED ADDITIVES DRIVING GROWTH OF ANIMAL INTESTINAL HEALTH MARKET

4.2 ANIMAL INTESTINAL HEALTH MARKET, BY ADDITIVE

FIGURE 16 PROBIOTICS SEGMENT EXPECTED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

4.3 ASIA PACIFIC: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK AND KEY COUNTRIES

FIGURE 17 CHINA AND POULTRY SEGMENT EXPECTED TO ACCOUNT FOR SIGNIFICANT MARKET SHARE IN ASIA PACIFIC MARKET IN 2022

4.4 ANIMAL INTESTINAL HEALTH MARKET, BY FORM AND REGION

FIGURE 18 DRY SEGMENT EXPECTED TO ACCOUNT FOR LARGER MARKET SHARE IN 2022

4.5 ANIMAL INTESTINAL HEALTH MARKET, BY MAJOR REGIONAL SUBMARKETS

FIGURE 19 INCREASING CONSUMPTION OF MEAT IS EXPECTED TO DRIVE THE GROWTH IN ASIA PACIFIC REGION

5 MARKET OVERVIEW (Page No. - 60)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 ANIMAL INTESTINAL HEALTH MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increased production of compound feed

FIGURE 21 GLOBAL COMPOUND FEED PRODUCTION, 2012–2021 (MILLION METRIC TONS)

FIGURE 22 COMPOUND FEED PRODUCTION, BY TOP 7 COUNTRIES, 2016–2020 (MILLION METRIC TONS)

5.2.1.2 Rising demand for animal protein

TABLE 2 PER CAPITA CONSUMPTION OF LIVESTOCK PRODUCTS, BY REGION

5.2.1.3 Intestinal disorders among livestock

5.2.2 RESTRAINTS

5.2.2.1 Stringent regulations for use of feed additives

5.2.3 OPPORTUNITIES

5.2.3.1 Innovations and technological advancements in feed industry

5.2.3.2 Increased awareness about feed and food safety

5.2.4 CHALLENGES

5.2.4.1 High cost of feed additives

5.2.4.1.1 R&D costs associated with development of probiotics

5.2.4.1.2 High cost of active ingredients used in development of phytogenic feed additives

6 INDUSTRY TRENDS (Page No. - 67)

6.1 INTRODUCTION

6.2 TRENDS IMPACTING CUSTOMERS’ BUSINESS

FIGURE 23 TRENDS IMPACTING ANIMAL INTESTINAL HEALTH MARKET

6.3 VALUE CHAIN

FIGURE 24 VALUE CHAIN ANALYSIS

6.4 TRADE ANALYSIS

FIGURE 25 EXPORT OF LIVESTOCK SPECIES, 2016–2021 (USD MILLION)

6.5 TECHNOLOGY ANALYSIS

6.6 PATENT ANALYSIS

TABLE 3 KEY PATENTS PERTAINING TO ANIMAL INTESTINAL HEALTH, 2019–2022

6.7 ECOSYSTEM MAP

6.7.1 ANIMAL INTESTINAL HEALTH MARKET: ECOSYSTEM MAP

FIGURE 26 FEED AND ANIMAL NUTRITION: ECOSYSTEM MAP

6.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 4 PORTER’S FIVE FORCES ANALYSIS

6.8.1 THREAT OF NEW ENTRANTS

6.8.2 THREAT OF SUBSTITUTES

6.8.3 BARGAINING POWER OF SUPPLIERS

6.8.4 BARGAINING POWER OF BUYERS

6.8.5 INTENSITY OF COMPETITIVE RIVALRY

6.9 CASE STUDIES

6.9.1 REGULATIONS ON ANTIBIOTICS LEADING TO A SHIFT TOWARD PROBIOTICS

6.10 PRICING ANALYSIS

6.10.1 ANIMAL INTESTINAL HEALTH MARKET: AVERAGE SELLING PRICE TREND ANALYSIS

TABLE 5 AVERAGE SELLING PRICE, BY ADDITIVE, 2019–2027 (USD/KG)

6.11 REGULATORY FRAMEWORK

6.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6.11.2 CODEX ALIMENTARIUS COMMISSION (CAC)

6.11.2.1 North America

6.11.2.2 Europe

6.11.2.3 Asia Pacific

6.12 KEY STAKEHOLDERS AND BUYING CRITERIA

6.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING ANIMAL INTESTINAL HEALTH PRODUCTS

TABLE 6 INFLUENCE OF STAKEHOLDERS ON TOP THREE PRODUCT TYPES

6.12.2 BUYING CRITERIA

FIGURE 28 KEY BUYING CRITERIA FOR ADDITIVES

TABLE 7 KEY BUYING CRITERIA FOR ADDITIVES

6.13 KEY CONFERENCES AND EVENTS, 2022–2023

TABLE 8 ANIMAL INTESTINAL HEALTH MARKET: DETAILED LIST OF CONFERENCES & EVENTS, BY REGION, 2022–2023

7 ANIMAL INTESTINAL HEALTH MARKET, BY ADDITIVE (Page No. - 84)

7.1 INTRODUCTION

FIGURE 29 PROBIOTICS SEGMENT EXPECTED TO DOMINATE ANIMAL INTESTINAL HEALTH MARKET BY 2027

TABLE 9 ANIMAL INTESTINAL HEALTH MARKET, BY ADDITIVE, 2019–2021 (USD MILLION)

TABLE 10 ANIMAL INTESTINAL HEALTH MARKET, BY ADDITIVE, 2022–2027 (USD MILLION)

TABLE 11 ANIMAL INTESTINAL HEALTH MARKET, BY ADDITIVE, 2019–2021 (KT)

TABLE 12 ANIMAL INTESTINAL HEALTH MARKET, BY ADDITIVE, 2022–2027 (KT)

7.2 PROBIOTICS

7.2.1 PROBIOTIC MICROORGANISMS OFFER HEALTH BENEFITS

TABLE 13 PROBIOTICS: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 14 PROBIOTICS: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 15 PROBIOTICS: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019–2021 (KT)

TABLE 16 PROBIOTICS: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2022–2027 (KT)

7.3 PREBIOTICS

7.3.1 PREBIOTICS INDUCE GROWTH OF BENEFICIAL GUT BACTERIA

7.3.1.1 Oligosaccharides

7.3.1.2 Inulin

7.3.1.3 Other additives

TABLE 17 PREBIOTICS: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 18 PREBIOTICS: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 19 PREBIOTICS: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019–2021 (KT)

TABLE 20 PREBIOTICS: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2022–2027 (KT)

7.4 PHYTOGENICS

7.4.1 PHYTOGENIC FEED ADDITIVES OFFER MORE THAN FLAVORING PROPERTIES

7.4.1.1 Essential oils

7.4.1.2 Flavonoids

7.4.1.3 Saponins

7.4.1.4 Oleoresins

7.4.1.5 Other additives

TABLE 21 PHYTOGENICS: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 22 PHYTOGENICS: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 23 PHYTOGENICS: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019–2021 (KT)

TABLE 24 PHYTOGENICS: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2022–2027 (KT)

7.5 IMMUNOSTIMULANTS

7.5.1 IMMUNOSTIMULANTS IMPROVE IMMUNITY AND REDUCE STRESS AND DISEASES IN AQUACULTURE

TABLE 25 IMMUNOSTIMULANTS: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 26 IMMUNOSTIMULANTS: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 27 IMMUNOSTIMULANTS: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019–2021 (KT)

TABLE 28 IMMUNOSTIMULANTS: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2022–2027 (KT)

8 ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK (Page No. - 98)

8.1 INTRODUCTION

FIGURE 30 POULTRY SEGMENT EXPECTED TO DOMINATE ANIMAL INTESTINAL HEALTH MARKET DURING FORECAST PERIOD

TABLE 29 ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019–2021 (USD MILLION)

TABLE 30 ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

TABLE 31 ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019–2021 (KT)

TABLE 32 ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2022–2027 (KT)

8.2 POULTRY

8.2.1 FEED ADDITIVES ENHANCE POULTRY PERFORMANCE

TABLE 33 POULTRY: ANIMAL INTESTINAL HEALTH MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 34 POULTRY: ANIMAL INTESTINAL HEALTH MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 35 POULTRY: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 36 POULTRY: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 37 POULTRY: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019–2021 (KT)

TABLE 38 POULTRY: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2022–2027 (KT)

8.2.1.1 Broilers

8.2.1.2 Layers

8.2.1.3 Turkey

8.2.1.4 Other poultry species

8.3 SWINE

8.3.1 RISE IN PORK TRADE AND CONCERNS OVER MEAT SAFETY

TABLE 39 PROBIOTIC MICROORGANISMS USED IN SWINE FEED

TABLE 40 SWINE: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 41 SWINE: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 42 SWINE: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019–2021 (KT)

TABLE 43 SWINE: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2022–2027 (KT)

8.4 RUMINANTS

8.4.1 FEED ADDITIVES BOOST PRODUCTION EFFICIENCY IN RUMINANTS

TABLE 44 RUMINANTS: ANIMAL INTESTINAL HEALTH MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 45 RUMINANTS: ANIMAL INTESTINAL HEALTH MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 46 RUMINANTS: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 47 RUMINANTS: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 48 RUMINANTS: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019–2021 (KT)

TABLE 49 RUMINANTS: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2022–2027 (KT)

8.4.1.1 Dairy cattle

8.4.1.2 Beef cattle

8.4.1.3 Calves

8.4.1.4 Other ruminant species

8.5 AQUACULTURE

8.5.1 FEED ADDITIVES IMPROVE FEED QUALITY AND ENHANCE AQUACULTURE PERFORMANCE

TABLE 50 AQUACULTURE: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 51 AQUACULTURE: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 52 AQUACULTURE: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019–2021 (KT)

TABLE 53 AQUACULTURE: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2022–2027 (KT)

8.6 OTHER LIVESTOCK

8.6.1 PHYTOGENIC-BASED ANIMAL INTESTINAL PRODUCTS IMPROVE DIGESTIBILITY IN PETS

TABLE 54 OTHER LIVESTOCK: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 55 OTHER LIVESTOCK: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 56 OTHER LIVESTOCK: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019–2021 (KT)

TABLE 57 OTHER LIVESTOCK: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2022–2027 (KT)

9 ANIMAL INTESTINAL HEALTH MARKET, BY FORM (Page No. - 114)

9.1 INTRODUCTION

FIGURE 31 DRY SEGMENT EXPECTED TO DOMINATE ANIMAL INTESTINAL HEALTH MARKET DURING FORECAST PERIOD

TABLE 58 ANIMAL INTESTINAL HEALTH MARKET, BY FORM, 2019–2021 (USD MILLION)

TABLE 59 ANIMAL INTESTINAL HEALTH MARKET, BY FORM, 2022–2027 (USD MILLION)

TABLE 60 ANIMAL INTESTINAL HEALTH MARKET, BY FORM, 2019–2021 (KT)

TABLE 61 ANIMAL INTESTINAL HEALTH MARKET, BY FORM, 2022–2027 (KT)

9.2 DRY

9.2.1 EASE OF STORAGE AND TRANSPORTATION

TABLE 62 DRY FORM: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019–2021(USD MILLION)

TABLE 63 DRY FORM: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 64 DRY FORM: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019–2021(KT)

TABLE 65 DRY FORM: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2022–2027 (KT)

9.3 LIQUID

9.3.1 LIQUID SUPPLEMENTS PROVIDE UNIFORM TEXTURE TO FINAL PRODUCTS

TABLE 66 LIQUID FORM: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 67 LIQUID FORM: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 68 LIQUID FORM: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019–2021 (KT)

TABLE 69 LIQUID FORM: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2022–2027 (KT)

10 ANIMAL INTESTINAL HEALTH MARKET, BY FUNCTION (Page No. - 122)

10.1 METABOLISM

10.1.1 ADDITIVES IMPROVE SURVIVAL AND IMPLANTATION OF LIVE MICROBIAL DIETARY SUPPLEMENTS IN GI TRACT

10.2 WEIGHT GAIN

10.2.1 FEED ADDITIVES IMPROVE PRODUCTION AND PERFORMANCE OF RUMINANTS

10.3 NUTRIENT DIGESTION

10.3.1 FEED ADDITIVES IMPROVE DIGESTIBILITY OF NUTRIENTS

10.4 DISEASE PREVENTION

10.4.1 USE OF FEED ADDITIVES PREVENTS DISEASES IN ANIMALS AND IMPROVES HEALTH

10.5 BONE AND JOINT HEALTH

10.5.1 PREBIOTICS BETTER CALCIUM METABOLISM AND BONE HEALTH

11 ANIMAL INTESTINAL HEALTH MARKET, BY SOURCE (Page No. - 125)

11.1 INTRODUCTION

FIGURE 32 MICROBIAL SEGMENT EXPECTED TO DOMINATE ANIMAL INTESTINAL HEALTH MARKET DURING FORECAST PERIOD

TABLE 70 ANIMAL INTESTINAL HEALTH MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 71 ANIMAL INTESTINAL HEALTH MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 72 ANIMAL INTESTINAL HEALTH MARKET, BY SOURCE, 2019–2021 (KT)

TABLE 73 ANIMAL INTESTINAL HEALTH MARKET, BY SOURCE, 2022–2027 (KT)

11.2 MICROBIAL

11.2.1 PROBIOTICS PREPARED USING BACILLUS SUBTILIS AND STREPTOCOCCI IMPROVE EFFICIENCY IN POULTRY AND SWINE

TABLE 74 MICROBIAL: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 75 MICROBIAL: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 76 MICROBIAL: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019–2021 (KT)

TABLE 77 MICROBIAL: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2022–2027 (KT)

11.3 PLANT-BASED

11.3.1 PLANT-BASED SUBSTANCES IMPROVE NUTRIENT DIGESTIBILITY IN ANIMALS

TABLE 78 PLANT-BASED: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 79 PLANT-BASED: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 80 PLANT-BASED: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019–2021 (KT)

TABLE 81 PLANT-BASED: ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2022–2027 (KT)

12 ANIMAL INTESTINAL HEALTH MARKET, BY REGION (Page No. - 133)

12.1 INTRODUCTION

FIGURE 33 INDIA EXPECTED TO WITNESS HIGH GROWTH IN ANIMAL INTESTINAL HEALTH MARKET BETWEEN 2022 AND 2027

TABLE 82 ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 83 ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 84 ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2019–2021 (KT)

TABLE 85 ANIMAL INTESTINAL HEALTH MARKET, BY REGION, 2022–2027(KT)

12.2 NORTH AMERICA

FIGURE 34 NORTH AMERICA: MARKET SNAPSHOT

TABLE 86 NORTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 87 NORTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 88 NORTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY ADDITIVE, 2019–2021 (USD MILLION)

TABLE 89 NORTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY ADDITIVE, 2022–2027 (USD MILLION)

TABLE 90 NORTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY ADDITIVE, 2019–2021 (KT)

TABLE 91 NORTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY ADDITIVE, 2022–2027 (KT)

TABLE 92 NORTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019–2021 (USD MILLION)

TABLE 93 NORTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

TABLE 94 NORTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019–2021 (KT)

TABLE 95 NORTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2022–2027 (KT)

TABLE 96 NORTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 97 NORTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 98 NORTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY SOURCE, 2019–2021 (KT)

TABLE 99 NORTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY SOURCE, 2022–2027 (KT)

TABLE 100 NORTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY FORM, 2019–2021 (USD MILLION)

TABLE 101 NORTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY FORM, 2022–2027 (USD MILLION)

TABLE 102 NORTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY FORM, 2019–2021 (KT)

TABLE 103 NORTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY FORM, 2022–2027 (KT)

12.2.1 US

12.2.1.1 Rise in consumption of poultry products

TABLE 104 US: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019–2021 (USD MILLION)

TABLE 105 US: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

12.2.2 CANADA

12.2.2.1 Food safety concerns and government regulations

TABLE 106 CANADA: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019–2021 (USD MILLION)

TABLE 107 CANADA: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

12.2.3 MEXICO

12.2.3.1 Rise in import of high-quality meat products

TABLE 108 MEXICO: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019–2021 (USD MILLION)

TABLE 109 MEXICO: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

12.3 EUROPE

TABLE 110 EUROPE: ANIMAL INTESTINAL HEALTH MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 111 EUROPE: ANIMAL INTESTINAL HEALTH MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 112 EUROPE: ANIMAL INTESTINAL HEALTH MARKET, BY ADDITIVE, 2019–2021 (USD MILLION)

TABLE 113 EUROPE: ANIMAL INTESTINAL HEALTH MARKET, BY ADDITIVE, 2022–2027 (USD MILLION)

TABLE 114 EUROPE: ANIMAL INTESTINAL HEALTH MARKET, BY ADDITIVE, 2019–2021 (KT)

TABLE 115 EUROPE: ANIMAL INTESTINAL HEALTH MARKET, BY ADDITIVE, 2022–2027 (KT)

TABLE 116 EUROPE: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019–2021 (USD MILLION)

TABLE 117 EUROPE: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

TABLE 118 EUROPE: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019–2021 (KT)

TABLE 119 EUROPE: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2022–2027 (KT)

TABLE 120 EUROPE: ANIMAL INTESTINAL HEALTH MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 121 EUROPE: ANIMAL INTESTINAL HEALTH MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 122 EUROPE: ANIMAL INTESTINAL HEALTH MARKET, BY SOURCE, 2019–2021 (KT)

TABLE 123 EUROPE: ANIMAL INTESTINAL HEALTH MARKET, BY SOURCE, 2022–2027 (KT)

TABLE 124 EUROPE: ANIMAL INTESTINAL HEALTH MARKET, BY FORM, 2019–2021 (USD MILLION)

TABLE 125 EUROPE: ANIMAL INTESTINAL HEALTH MARKET, BY FORM, 2022–2027 (USD MILLION)

TABLE 126 EUROPE: ANIMAL INTESTINAL HEALTH MARKET, BY FORM, 2019–2021 (KT)

TABLE 127 EUROPE: ANIMAL INTESTINAL HEALTH MARKET, BY FORM, 2022–2027 (KT)

12.3.1 SPAIN

12.3.1.1 Increased demand for meat and dairy products

TABLE 128 SPAIN: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019–2021 (USD MILLION)

TABLE 129 SPAIN: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

12.3.2 GERMANY

12.3.2.1 Focus on offering high-quality meat products

TABLE 130 GERMANY: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019–2021 (USD MILLION)

TABLE 131 GERMANY: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

12.3.3 FRANCE

12.3.3.1 Rising instances of disease outbreaks

TABLE 132 FRANCE: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019–2021 (USD MILLION)

TABLE 133 FRANCE: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

12.3.4 ITALY

12.3.4.1 Need for alternative growth promoters encourage use of probiotics

TABLE 134 ITALY: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019–2021 (USD MILLION)

TABLE 135 ITALY: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

12.3.5 UK

12.3.5.1 Intensive farming results in high use of premium quality nutrients in animal intestinal health products

TABLE 136 UK: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019–2021 (USD MILLION)

TABLE 137 UK: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

12.3.6 REST OF EUROPE

12.3.6.1 Need for alternatives to antibiotic growth promoters encourage demand for phytogenics

TABLE 138 REST OF EUROPE: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019–2021 (USD MILLION)

TABLE 139 REST OF EUROPE: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

12.4 ASIA PACIFIC

FIGURE 35 ASIA PACIFIC: REGIONAL SNAPSHOT

TABLE 140 ASIA PACIFIC: ANIMAL INTESTINAL HEALTH MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 141 ASIA PACIFIC: ANIMAL INTESTINAL HEALTH MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 142 ASIA PACIFIC: ANIMAL INTESTINAL HEALTH MARKET, BY ADDITIVE, 2019–2021 (USD MILLION)

TABLE 143 ASIA PACIFIC: ANIMAL INTESTINAL HEALTH MARKET, BY ADDITIVE, 2022–2027 (USD MILLION)

TABLE 144 ASIA PACIFIC: ANIMAL INTESTINAL HEALTH MARKET, BY ADDITIVE, 2019–2021 (KT)

TABLE 145 ASIA PACIFIC: ANIMAL INTESTINAL HEALTH MARKET, BY ADDITIVE, 2022–2027 (KT)

TABLE 146 ASIA PACIFIC: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019–2021 (USD MILLION)

TABLE 147 ASIA PACIFIC: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

TABLE 148 ASIA PACIFIC: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019–2021 (KT)

TABLE 149 ASIA PACIFIC: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2022–2027 (KT)

TABLE 150 ASIA PACIFIC: ANIMAL INTESTINAL HEALTH MARKET, BY FORM, 2019–2021 (USD MILLION)

TABLE 151 ASIA PACIFIC: ANIMAL INTESTINAL HEALTH MARKET, BY FORM, 2022–2027 (USD MILLION)

TABLE 152 ASIA PACIFIC: ANIMAL INTESTINAL HEALTH MARKET, BY FORM, 2019–2021 (KT)

TABLE 153 ASIA PACIFIC: ANIMAL INTESTINAL HEALTH MARKET, BY FORM, 2022–2027 (KT)

TABLE 154 ASIA PACIFIC: ANIMAL INTESTINAL HEALTH MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 155 ASIA PACIFIC: ANIMAL INTESTINAL HEALTH MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 156 ASIA PACIFIC: ANIMAL INTESTINAL HEALTH MARKET, BY SOURCE, 2019–2021 (KT)

TABLE 157 ASIA PACIFIC: ANIMAL INTESTINAL HEALTH MARKET, BY SOURCE, 2022–2027 (KT)

12.4.1 CHINA

12.4.1.1 High consumption of meat

TABLE 158 CHINA: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019–2021 (USD MILLION)

TABLE 159 CHINA: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

12.4.2 JAPAN

12.4.2.1 Preference for high-quality feed products

TABLE 160 JAPAN: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019–2021 (USD MILLION)

TABLE 161 JAPAN: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

12.4.3 INDIA

12.4.3.1 Growing demand for high-quality poultry products

TABLE 162 INDIA: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019–2021 (USD MILLION)

TABLE 163 INDIA: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

12.4.4 SOUTH KOREA

12.4.4.1 Increase in consumption of meat products

TABLE 164 SOUTH KOREA: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019–2021 (USD MILLION)

TABLE 165 SOUTH KOREA: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

12.4.5 AUSTRALIA & NEW ZEALAND

12.4.5.1 High consumption of meat products

TABLE 166 AUSTRALIA & NEW ZEALAND: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019–2021 (USD MILLION)

TABLE 167 AUSTRALIA & NEW ZEALAND: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

12.4.6 REST OF ASIA PACIFIC

12.4.6.1 Commercialization of livestock products

TABLE 168 REST OF ASIA PACIFIC: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019–2021 (USD MILLION)

TABLE 169 REST OF ASIA PACIFIC: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

12.5 SOUTH AMERICA

TABLE 170 SOUTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 171 SOUTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 172 SOUTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY ADDITIVE, 2019–2021 (USD MILLION)

TABLE 173 SOUTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY ADDITIVE, 2022–2027 (USD MILLION)

TABLE 174 SOUTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY ADDITIVE, 2019–2021 (KT)

TABLE 175 SOUTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY ADDITIVE, 2022–2027 (KT)

TABLE 176 SOUTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019–2021 (USD MILLION)

TABLE 177 SOUTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

TABLE 178 SOUTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2022–2027 (KT)

TABLE 179 SOUTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 180 SOUTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 181 SOUTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY SOURCE, 2019–2021 (KT)

TABLE 182 SOUTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY SOURCE, 2022–2027 (KT)

TABLE 183 SOUTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY FORM, 2019–2021 (USD MILLION)

TABLE 184 SOUTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY FORM, 2022–2027 (USD MILLION)

TABLE 185 SOUTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY FORM, 2019–2021 (KT)

TABLE 186 SOUTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY FORM, 2022–2027 (KT)

12.5.1 BRAZIL

12.5.1.1 High demand for meat products due to high purchasing power of people

TABLE 187 BRAZIL: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019–2021 (USD MILLION)

TABLE 188 BRAZIL: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

12.5.2 ARGENTINA

12.5.2.1 Growth in animal husbandry sector

TABLE 189 ARGENTINA: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019–2021 (USD MILLION)

TABLE 190 ARGENTINA: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

12.5.3 REST OF SOUTH AMERICA

12.5.3.1 Increased awareness among farmers about importance of feed supplements

TABLE 191 REST OF SOUTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019–2021 (USD MILLION)

TABLE 192 REST OF SOUTH AMERICA: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

12.6 REST OF THE WORLD

TABLE 193 REST OF THE WORLD: ANIMAL INTESTINAL HEALTH MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 194 REST OF THE WORLD: ANIMAL INTESTINAL HEALTH MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 195 REST OF THE WORLD: ANIMAL INTESTINAL HEALTH MARKET, BY ADDITIVE, 2019–2021 (USD MILLION)

TABLE 196 REST OF THE WORLD: ANIMAL INTESTINAL HEALTH MARKET, BY ADDITIVE, 2022–2027 (USD MILLION)

TABLE 197 REST OF THE WORLD: ANIMAL INTESTINAL HEALTH MARKET, BY ADDITIVE, 2019–2021 (KT)

TABLE 198 REST OF THE WORLD: ANIMAL INTESTINAL HEALTH MARKET, BY ADDITIVE, 2022–2027 (KT)

TABLE 199 REST OF THE WORLD: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019–2021 (USD MILLION)

TABLE 200 REST OF THE WORLD: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

TABLE 201 REST OF THE WORLD: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019–2021 (KT)

TABLE 202 REST OF THE WORLD: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2022–2027 (KT)

TABLE 203 REST OF THE WORLD: ANIMAL INTESTINAL HEALTH MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 204 REST OF THE WORLD: ANIMAL INTESTINAL HEALTH MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 205 REST OF THE WORLD: ANIMAL INTESTINAL HEALTH MARKET, BY SOURCE, 2019–2021 (KT)

TABLE 206 REST OF THE WORLD: ANIMAL INTESTINAL HEALTH MARKET, BY SOURCE, 2022–2027 (KT)

TABLE 207 REST OF THE WORLD: ANIMAL INTESTINAL HEALTH MARKET, BY FORM, 2019–2021 (USD MILLION)

TABLE 208 REST OF THE WORLD: ANIMAL INTESTINAL HEALTH MARKET, BY FORM, 2022–2027 (USD MILLION)

TABLE 209 REST OF THE WORLD: ANIMAL INTESTINAL HEALTH MARKET, BY FORM, 2019–2021 (KT)

TABLE 210 REST OF THE WORLD: ANIMAL INTESTINAL HEALTH MARKET, BY FORM, 2022–2027 (KT)

12.6.1 MIDDLE EAST

12.6.1.1 High demand for animal-based protein products

TABLE 211 MIDDLE EAST: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019–2021 (USD MILLION)

TABLE 212 MIDDLE EAST: ANIMAL INTESTINAL HEALTH MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.6.2 AFRICA

12.6.2.1 Improvement in livestock health

TABLE 213 AFRICA: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2019–2021 (USD MILLION)

TABLE 214 AFRICA: ANIMAL INTESTINAL HEALTH MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 187)

13.1 OVERVIEW

13.2 MARKET EVALUATION FRAMEWORK

FIGURE 36 MARKET EVALUATION FRAMEWORK, 2019–2022

13.3 MARKET SHARE ANALYSIS

TABLE 215 ANIMAL INTESTINAL HEALTH MARKET SHARE ANALYSIS, 2021

13.4 REVENUE ANALYSIS FOR KEY COMPANIES, 2019–2021 (USD BILLION)

FIGURE 37 REVENUE ANALYSIS OF KEY COMPANIES, 2019–2021 (USD BILLION)

13.5 COMPANY EVALUATION QUADRANT

13.5.1 STARS

13.5.2 EMERGING LEADERS

13.5.3 PERVASIVE PLAYERS

13.5.4 PARTICIPANTS

FIGURE 38 ANIMAL INTESTINAL HEALTH MARKET: COMPANY EVALUATION QUADRANT FOR KEY PLAYERS, 2021

13.6 STARTUP EVALUATION QUADRANT

13.6.1 PROGRESSIVE COMPANIES

13.6.2 STARTING BLOCKS

13.6.3 RESPONSIVE COMPANIES

13.6.4 DYNAMIC COMPANIES

FIGURE 39 ANIMAL INTESTINAL HEALTH MARKET: COMPANY EVALUATION QUADRANT FOR SMES/STARTUPS, 2021

13.7 PRODUCT FOOTPRINT (KEY PLAYERS)

TABLE 216 COMPANY FOOTPRINT, BY LIVESTOCK

TABLE 217 COMPANY FOOTPRINT, BY ADDITIVE

TABLE 218 COMPANY FOOTPRINT, BY REGION

TABLE 219 OVERALL COMPANY FOOTPRINT

13.7.1 COMPETITIVE BENCHMARKING OF KEY PLAYERS

TABLE 220 ANIMAL INTESTINAL HEALTH MARKET: DETAILED LIST OF KEY PLAYERS

13.7.2 COMPETITIVE BENCHMARKING OF SMES/OTHER PLAYERS

TABLE 221 ANIMAL INTESTINAL HEALTH MARKET: DETAILED LIST OF SMES/OTHER PLAYERS

13.8 PRODUCT LAUNCHES, DEALS, AND OTHER DEVELOPMENTS

13.8.1 NEW PRODUCT LAUNCHES

TABLE 222 ANIMAL INTESTINAL HEALTH MARKET: NEW PRODUCT LAUNCHES, 2019–2021

13.8.2 OTHER DEVELOPMENTS

TABLE 223 ANIMAL INTESTINAL HEALTH MARKET: OTHER DEVELOPMENTS, 2019–2020

13.8.3 DEALS

TABLE 224 ANIMAL INTESTINAL HEALTH MARKET: DEALS, 2020-2021

14 COMPANY PROFILES (Page No. - 202)

(Business Overview, Products Offered, Recent Developments, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats)*

14.1 KEY PLAYERS

14.1.1 ADM

TABLE 225 ADM: BUSINESS OVERVIEW

FIGURE 40 ADM: COMPANY SNAPSHOT

TABLE 226 ADM: PRODUCTS OFFERED

TABLE 227 ADM: OTHERS, 2021

TABLE 228 ADM: PRODUCT LAUNCHES, 2020

14.1.2 KONINKLIJKE DSM N.V.

TABLE 229 KONINKLIJKE DSM N.V.: BUSINESS OVERVIEW

FIGURE 41 KONINKLIJKE DSM N.V.: COMPANY SNAPSHOT

TABLE 230 KONINKLIJKE DSM N.V.: PRODUCTS OFFERED

TABLE 231 KONINKLIJKE DSM N.V.: DEALS, 2020

14.1.3 DUPONT NUTRITION & BIOSCIENCES (DANISCO ANIMAL NUTRITION)

TABLE 232 DUPONT NUTRITION & BIOSCIENCES: BUSINESS OVERVIEW

FIGURE 42 DUPONT NUTRITION & BIOSCIENCES: COMPANY SNAPSHOT

TABLE 233 DUPONT NUTRITION & BIOSCIENCES: PRODUCTS OFFERED

TABLE 234 DUPONT NUTRITION & BIOSCIENCES: DEALS, 2019–2021

TABLE 235 DUPONT NUTRITION & BIOSCIENCES: PRODUCT LAUNCHES, 2019

TABLE 236 DUPONT NUTRITION & BIOSCIENCES: OTHERS, 2020

14.1.4 CARGILL INCORPORATED

TABLE 237 CARGILL INCORPORATED: BUSINESS OVERVIEW

FIGURE 43 CARGILL INC.: COMPANY SNAPSHOT

TABLE 238 CARGILL INCORPORATED: PRODUCTS OFFERED

TABLE 239 CARGILL INCORPORATED: DEALS, 2020

TABLE 240 CARGILL INCORPORATED: OTHERS, 2022

14.1.5 NOVOZYMES

TABLE 241 NOVOZYMES: BUSINESS OVERVIEW

FIGURE 44 NOVOZYMES: COMPANY SNAPSHOT

TABLE 242 NOVOZYMES: PRODUCTS OFFERED

TABLE 243 NOVOZYMES: DEALS, 2020

14.1.6 KEMIN INDUSTRIES INC.

TABLE 244 KEMIN INDUSTRIES INC.: BUSINESS OVERVIEW

TABLE 245 KEMIN INDUSTRIES INC.: PRODUCTS OFFERED

TABLE 246 KEMIN INDUSTRIES: PRODUCT LAUNCHES, 2020

14.1.7 NUTRECO

TABLE 247 NUTRECO: BUSINESS OVERVIEW

FIGURE 45 NUTRECO: COMPANY SNAPSHOT

TABLE 248 NUTRECO: PRODUCTS OFFERED

TABLE 249 NUTRECO: DEALS 2019-2020

14.1.8 CHR. HANSEN HOLDING A/S

TABLE 250 CHR. HANSEN HOLDING A/S: BUSINESS OVERVIEW

FIGURE 46 CHR. HANSEN HOLDING A/S: COMPANY SNAPSHOT

TABLE 251 CHR. HANSEN HOLDING A/S: PRODUCTS OFFERED

TABLE 252 CHR. HANSEN HOLDING A/S: PRODUCT LAUNCHES, 2019–2021

TABLE 253 CHR. HANSEN HOLDING A/S: DEALS, 2020

14.1.9 BLUESTAR ADISSEO CO. LTD.

TABLE 254 BLUESTAR ADISSEO: BUSINESS OVERVIEW

FIGURE 47 BLUESTAR ADISSEO CO. LTD.: COMPANY SNAPSHOT

TABLE 255 BLUESTAR ADISSEO CO. LTD.: PRODUCTS OFFERED

TABLE 256 BLUESTAR ADISSEO CO. LTD.: DEALS, 2020

14.1.10 ALLTECH

TABLE 257 ALLTECH: BUSINESS OVERVIEW

TABLE 258 ALLTECH: PRODUCTS OFFERED

14.1.11 EVONIK INDUSTRIES

TABLE 259 EVONIK INDUSTRIES: BUSINESS OVERVIEW

FIGURE 48 EVONIK INDUSTRIES: COMPANY SNAPSHOT

TABLE 260 EVONIK INDUSTRIES: PRODUCTS OFFERED

TABLE 261 EVONIK INDUSTRIES: PRODUCT LAUNCHES, 2020

14.1.12 LALLEMAND INC.

TABLE 262 LALLEMAND INC.: BUSINESS OVERVIEW

TABLE 263 LALLEMAND INC.: PRODUCTS OFFERED

TABLE 264 LALLEMAND INC.: OTHER DEVELOPMENTS, 2019-2020

14.1.13 BIORIGIN

TABLE 265 BIORIGIN: BUSINESS OVERVIEW

TABLE 266 BIORIGIN: PRODUCTS OFFERED

TABLE 267 BIORIGIN: DEALS, 2019

14.1.14 LAND O’LAKES

TABLE 268 LAND O’LAKES: BUSINESS OVERVIEW

FIGURE 49 LAND O’LAKES: COMPANY SNAPSHOT

TABLE 269 LAND O’LAKES: PRODUCTS OFFERED

TABLE 270 LAND O’LAKES: OTHERS, 2019

TABLE 271 LAND O’LAKES: DEALS, 2019

14.1.15 LESAFFRE

TABLE 272 LESAFFRE: BUSINESS OVERVIEW

TABLE 273 LESAFFRE: PRODUCTS OFFERED

TABLE 274 LESAFFRE: OTHER DEVELOPMENTS, 2019-2020

TABLE 275 LESAFFRE: PRODUCT LAUNCHES, 2019

14.1.16 CALPIS CO LTD

TABLE 276 CALPIS CO LTD.: BUSINESS OVERVIEW

14.1.17 AB VISTA

14.1.18 PURE CULTURES

14.1.19 DR. ECKEL ANIMAL NUTRITION GMBH & CO. KG

14.1.20 UNIQUE BIOTECH

*Details on Business Overview, Products Offered, Recent Developments, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats might not be captured in case of unlisted companies.

15 ADJACENT AND RELATED MARKETS (Page No. - 252)

15.1 INTRODUCTION

TABLE 277 ADJACENT MARKETS TO ANIMAL INTESTINAL HEALTH

15.2 LIMITATIONS

15.3 PHYTOGENIC FEED ADDITIVES MARKET

15.3.1 MARKET DEFINITION

15.3.2 MARKET OVERVIEW

TABLE 278 PHYTOGENIC FEED ADDITIVES MARKET, BY SOURCE, 2016–2019 (USD MILLION)

TABLE 279 PHYTOGENIC FEED ADDITIVES MARKET, BY SOURCE, 2020–2025 (USD MILLION)

15.4 PROBIOTICS IN ANIMAL FEED MARKET

15.4.1 MARKET DEFINITION

TABLE 280 PROBIOTICS IN ANIMAL FEED MARKET, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 281 PROBIOTICS IN ANIMAL FEED MARKET, BY LIVESTOCK, 2021–2026 (USD MILLION)

16 APPENDIX (Page No. - 255)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 AVAILABLE CUSTOMIZATION

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

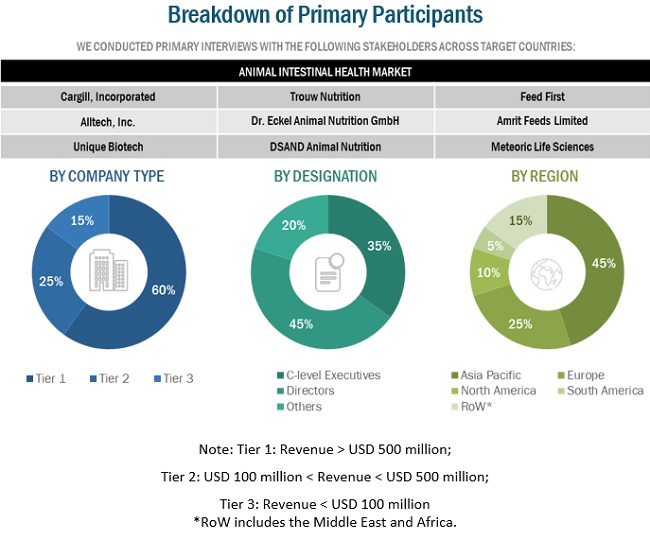

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of Animal intestinal health market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information as well as to assess prospects.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases, were referred to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology oriented perspectives.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following:

The key players in the industry and market have been identified through extensive secondary research.

All macroeconomic and microeconomic factors affecting the growth of the Animal Intestinal Health were considered while estimating the market size.

All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

Report Objectives

- To define, segment, and project the global market for Animal intestinal health on the basis of Additive, Livestock, Form, Function, Source, and Region

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To project the size of the market and its submarkets, in terms of value and volume, with respect to the regions (along with the key countries)

- To strategically profile the key players and comprehensively analyze their market position and core competencies

- To analyze the competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & developments in the Animal intestinal health market.

Target Audience

- Animal intestinal health raw material suppliers

- Animal intestinal health manufacturers

- Government and research organizations

- Associations, regulatory bodies, and other industry-related bodies:

- United States Department of Agriculture (USDA)

- Association of American Feed Control Officials (AAFCO)

- The Compound Feed Manufacturers Association (CLFMA)

- The EU Association of Specialty Feed Ingredients and their Mixtures (FEFANA)

- International Feed Industry Federation (IFIF)

- Food and Agriculture Organisation (FAO)

- Animal Feed Manufacturers Association (AFMA)

How Animal Gut Health is Driving Growth in the Animal Intestinal Health Market

Animal Gut Health has a significant impact on the Animal Intestinal Health Market, as a healthy gut microbiota is essential for maintaining the overall health and well-being of animals. The gut microbiota is a complex ecosystem of microorganisms that play a vital role in digestion, immune function, and overall health in animals. When the balance of microorganisms in the gut is disrupted, it can lead to a range of health problems, including diarrhea, reduced feed intake, and poor growth.Products and solutions that promote animal gut health, such as probiotics, prebiotics, enzymes, and other feed additives, can help to maintain a healthy balance of microorganisms in the gut and prevent these health problems from occurring. These products work by promoting the growth of beneficial microorganisms in the gut and inhibiting the growth of harmful microorganisms, thereby maintaining a healthy gut microbiota and promoting overall animal health.

There are several future trends in the Animal Gut Health market that are expected to shape the industry in the coming years. Some of these trends include:

- Increased focus on natural solutions: As consumers become more interested in sustainable and eco-friendly agriculture practices, there is a growing demand for natural solutions to promote animal gut health. This has led to an increased interest in products such as plant-based feed additives, essential oils, and other natural products that can promote a healthy gut microbiota.

- Advanced diagnostics and monitoring tools: With the advancement of technology, there is a growing interest in developing advanced diagnostics and monitoring tools that can help farmers and producers track and optimize the health of their animals' gut microbiota. These tools can include microbiome sequencing, fecal analysis, and other diagnostic tests that can provide insights into the health of the gut microbiota and help identify potential health issues before they become a problem.

- Personalized nutrition and feed management: There is growing interest in personalized nutrition and feed management solutions that can optimize the gut health of individual animals based on their unique microbiome composition and dietary needs. This can help to improve animal performance and reduce the risk of health problems.

- Integration of gut health into overall animal health management: As the importance of gut health in overall animal health becomes more widely recognized, there is a growing trend towards integrating gut health into overall animal health management. This includes developing holistic animal health programs that focus on promoting a healthy gut microbiota in addition to other aspects of animal health.

The Intersection of Livestock Gut Health Market and Animal Intestinal Health Market: Common Features and Future Prospects

- The Livestock Gut Health Market and Animal Intestinal Health Market are focused on developing solutions to promote healthy gut microbiota in animals, with a particular emphasis on livestock animals such as cattle, swine, and poultry.

- The Livestock Gut Health Market is focused specifically on livestock animals and includes a wide range of products and solutions designed to promote healthy gut microbiota in these animals. This includes products such as probiotics, prebiotics, enzymes, and feed additives that are formulated specifically for livestock animals.

- The Animal Intestinal Health Market, on the other hand, has a broader scope and includes products and solutions designed to promote gut health in a wide range of animals, including livestock animals, companion animals, and even humans. This market includes products such as probiotics, prebiotics, and other solutions that are formulated for a wide range of animal species.

Overall, both the Livestock Gut Health Market and Animal Intestinal Health Market are expected to continue to grow in the coming years, driven by a range of factors related to animal health, welfare, and sustainability. As these markets continue to evolve, we can expect to see the development of new and innovative solutions that promote healthy gut microbiota in animals and help to improve their overall health and well-being.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Rest of Europe includes Belgium, Norway, Sweden, and other EU & non-EU countries.

- Rest of Asia Pacific includes Indonesia, the Philippines, Malaysia, Singapore, and Vietnam.

- Rest of South America includes Chile, Colombia, Paraguay, and other South American countries.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Animal Intestinal Health Market