IVD Contract Manufacturing Market by Device Type (Consumables, Equipment), Technology (Immunoassay, Clinical Chemistry, Molecular Diagnostics, Microbiology, Hematology, Coagulation), Service (Manufacturing, Assay Development) - Global Forecast to 2028

Market Growth Outlook Summary

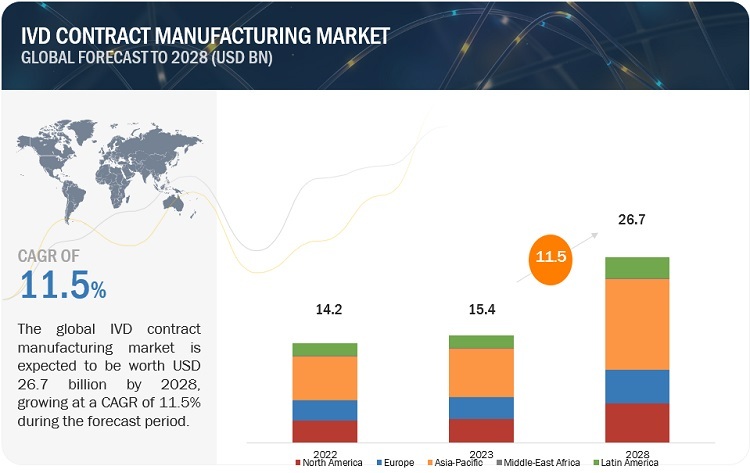

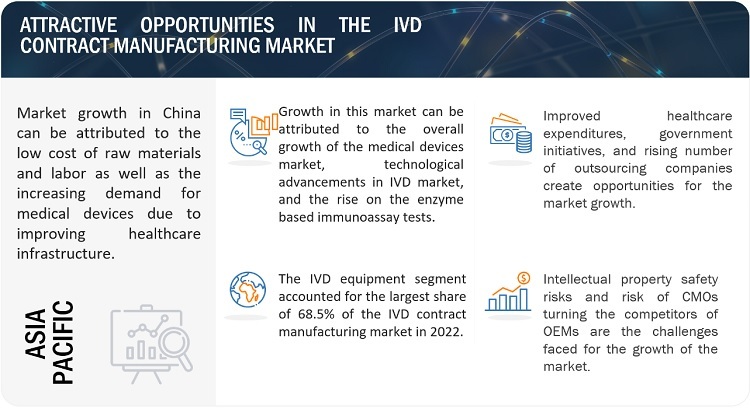

The global IVD contract manufacturing market, valued at US$14.2 billion in 2022, stood at US$15.4 billion in 2023 and is projected to advance at a resilient CAGR of 11.5% from 2023 to 2028, culminating in a forecasted valuation of US$26.7 billion by the end of the period. Growth in this market can primarily be attributed to the growing need for less costly and better equipments, increased need for IVD OEMs to establish themselves in the high potential market and emerge as a budding player in other allied markets, reduced risk of development failure, and reduction in cross contamination of IVD consumables at the CMO facility, and emergence of small scaled outsourcing facilities in emerging nations. However, the rising shortage of skilled labour, risk of patent infringement, and other Intellectual property safety failures, create a barrier to the growth of the market.

IVD Contract Manufacturing Market Opportunities

To know about the assumptions considered for the study, Request for Free Sample Report

IVD Contract Manufacturing Market Dynamics

Driver: Growth in the IVD devices market in developing countries

In the coming years, China and India are expected to drive growth in the Asia Pacific region. Over 100% GDP growth is anticipated in China and India between 2020 and 2040. Emerging economies may benefit from the growth. In order to take advantage of the numerous opportunities and set up businesses in the Asia Pacific region, foreign investment will also rise in this region. Additionally, the region will use IVD devices more frequently as a result of the rising number of diagnostic public-private partnerships and government grants, which will spur a rise in contract manufacturing.

Restraint: Protecting IP is a key challenge in contract manufacturing

Protecting IP is a key challenge in contract manufacturing, as OEMs need to ensure that their proprietary information and technology are not shared with competitors or third parties. When a brand outsources its production to a third-party manufacturer, it exposes itsintellectual property(IP) to the risk of theft or infringement. It is particularly true for products that rely heavily on patented or proprietary technology or processes. This creates a glitch in obtaining contracts from mid to large scale manufcturers.

Opportunity: Increasing healthcare expenditure, infrastructure, and awareness in developing countries

China, India, and other emerging economies offer significant growth opportunities for companies operating in the medical device contract manufacturing market. China and India have laxer regulatory standards than other developing nations. One of the main factors influencing the demand for IVD devices in emerging nations is the rising prevalence of various chronic and infectious diseases, together with the rising cost of healthcare. Another important driver is the rising desire for home healthcare. Due to this, numerous manufacturers have established operations in these nations.

Challenge: Lack of constant innovation to balance technological capabilities against costs and budgetary cuts observed by end users

For firms to compete in a complicated industry like IVD, ongoing innovation is essential. These developments aid contract manufacturers by accelerating the process, lowering the margin of error, and luring clients. In recent years, CMOs have developed a number of significant capabilities, including automated manufacturing, automated labs, and automated processes. All of this, however, has a price. CMOs have substantial difficulties managing the need for cutting-edge technologies while juggling intense financial pressures.

Additionally, the budgetary cuts are observed in end users in the European region, mainly due to the economic slowdown in the past few years. Owing to such budget cuts, many end users cannot afford costly medical devices and prefer lower-priced alternatives (such as refurbished devices) or undertake the upgradation of existing medical equipment and devices. This inturn reduces the contract lots quantity obtained by the CMOs from IVD brands.

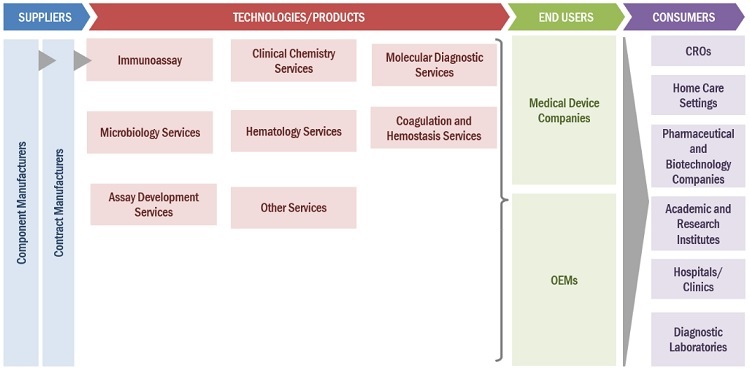

IVD Contract Manufacturing Market Ecosystem

Leading players in this market include well-established and financially stable manufacturers of IVD devices & consumables and service providers. These companies have been operating in the market for several years and possess a diversified product portfolio, advanced technologies, and strong global presence.

The IVD consumables segment of IVD contract manufacturing industry is expected to register the highest CAGR during the forecast period.

Based on device type, the IVD contract manufacturing market is segmented into IVD consumables and IVD equipment's. In 2022, the IVD consumables segment is expected to register the highest CAGR during the forecast period. Numerous advantages like cost savings, reduced risk, reduced period length to market the product post production, increased speed of development, and acceesibility to new technologies. CMOs can provide greater flexibility in terms of production volume, batch size, and product mix. This can be helpful for companies that are developing new products or that have fluctuating demand. For example, a CMO may be able to produce small batches of a new product to test the market, or they may be able to increase production volume to meet demand for an existing product.

The immunoassay segment of the IVD contract manufacturing industry, acquired the largest share in the technology market.

Based on technology, the IVD contract manufacturing market is segmented into immunoassay, clinical chemistry, molecular diagnostics, microbiology, hematology, and coagulation & hemosatsis. . The imunoassay segment is acquired the largest share in the market followed by the clinical chemistry segment. The adoption of enzyme linked immunoassay rapid tests has increased due to their ability to provide testing in remote areas or emergencies where no sophisticated or advanced technology is available for disease screening. This supports the market growth.

The assay development segment of the IVD contract manufacturing industry is expected to grow at the highest CAGR during the forecast period.

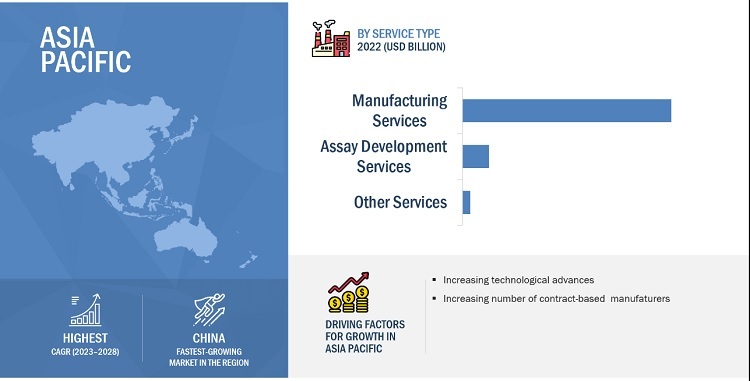

Based on the service type, the IVD contract manufacturing market is segmented into manufacturing services, assay development services, and other services like maintenance services, testing services, distributorship services, and post sales customer support services. The assay development services segment is expected to grow at the highest CAGR during the forecast period. Large number of contract manufacturers providing assay services for numerous analyzers and consumables developed by the OEMs and the enormous rise in new and efficient tests for immunoassays, molecular diagnostic tests, clinical chemistry testing, etc. are factors that influence the growth of the market.

APAC is estimated to be the fastest-growing region of the IVD contract manufacturing industry.

The global IVD contract manufacturing market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2022, APAC is estimated to be the fastest-growing regional market for IVD. The high growth in this market can majorly be attributed to the increased government initiatives to boost the outsourcing capabilities of small-scale outsourced players, the low raw material to finished goods production costs, and cheap labour is obtained in this region.

To know about the assumptions considered for the study, download the pdf brochure

The prominent players in the IVD contract manufacturing market include KMC Systems (US), Cenogenics Corporation (US), Nova Biomedical (US), Cone Bioproducts (US), Invetech (US), Avioq Inc. (US), Meridian Bioscience Inc. (US), Kimball Electronics Inc. (US), Nemera (France), Viant Medical Holdings Inc. (US), Phillips Medsize Corporation (US), Nolato GW, Inc. (US), Stratec (Germany), Fujirebio (Japan), Biokit (Spain), Affinity Lifescience (Canada), Sekisui (US), and Prestige Diagnostics (Ireland).

IVD Contract Manufacturing Market Report Scope

|

Report Metric |

Details |

|

Market Revenue in 2023 |

USD 15.0 billion |

|

Projected Revenue by 2028 |

USD 25.5 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 11.2% |

|

Market Driver |

Growth in the IVD devices market in developing countries |

|

Market Opportunity |

Increasing healthcare expenditure, infrastructure, and awareness in developing countries |

The study categorizes the IVD Contract Manufacturing Market to forecast revenue and analyze trends in each of the following submarkets:

By Device Type

- IVD Equipment

- IVD Consumables

By Technology

- Immunoassay

- Clinical Chemistry

- Molecular Diagnostics

- Microbiology

- Hematology

- Coagulation & Hemostasis

- Others

By Service Type

- Manufacturing Services

- Assay Development Services

- Other Services

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of Asia Pacific

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

Recent Developments of IVD Contract Manufacturing Market

- In November 2022, Jabil Inc., expanded its developmental capabilities by opening a design center in Wrolaw, Poland. This would allow the company to develop leading-edge technologies for multiple industries including the automotive and healthcare sectors.

- In September 2021, TE connectivity acquired Toolbox Medical Innovations (US), Wi Inc. (US), and microLIQUID (Spain). The entities leverage design and manufacturing capabilities in the United States and Europe and are focused on serving a global client base ranging from startups to multinationals in the life science, IVD and cell therapy markets.

Frequently Asked Questions (FAQ):

What is the projected growth rate of the global IVD contract manufacturing market between 2023 and 2028?

The global IVD contract manufacturing market is projected to grow from USD 15.4 billion in 2023 to USD 26.7 billion by 2028, demonstrating a robust CAGR of 11.5%.

What are the key factors driving the IVD contract manufacturing market?

The major drivers of the IVD contract manufacturing market include the growing IVD devices market, increasing healthcare expenditure, OEM demand for cost reduction, and the need for reduced contamination and development risks.

What are the main challenges in the IVD contract manufacturing market?

Challenges facing the IVD contract manufacturing market include intellectual property protection, budgetary constraints in certain regions, and labor shortages that may affect production timelines and quality.

Which regions are expected to show the highest growth in the IVD contract manufacturing market?

The Asia Pacific region, led by China and India, is expected to be the fastest-growing market for IVD contract manufacturing, driven by low production costs, abundant labor, and increasing healthcare infrastructure development.

What are the key technologies used in IVD contract manufacturing?

Key technologies in IVD contract manufacturing include immunoassay, clinical chemistry, molecular diagnostics, microbiology, hematology, and coagulation & hemostasis, with immunoassay leading in market share.

How is the increasing healthcare expenditure in developing countries impacting the IVD contract manufacturing market?

Rising healthcare expenditure in developing countries, particularly in China and India, is increasing the demand for IVD devices, driving growth in contract manufacturing as governments support diagnostic partnerships and technological development.

What role does intellectual property protection play in the IVD contract manufacturing market?

Protecting intellectual property (IP) is critical in the IVD contract manufacturing market, as OEMs must ensure that proprietary technology and processes are not leaked to competitors, a challenge that impacts trust in outsourcing production.

What are the main services provided by IVD contract manufacturers?

IVD contract manufacturers provide a range of services, including manufacturing, assay development, and other services like maintenance, testing, distributorship, and post-sales customer support.

Which device type is expected to show the highest growth in the IVD contract manufacturing market?

The IVD consumables segment is expected to register the highest growth during the forecast period, due to its cost-efficiency, reduced risks, and the flexibility it offers in production volume and batch sizes.

What advancements are influencing the growth of the IVD contract manufacturing market?

Technological advancements such as automation in manufacturing processes, labs, and diagnostics, are driving efficiency and speed in the IVD contract manufacturing market, helping companies reduce costs and increase productivity.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing outsourcing activity by IVD manufacturers- High cost of in-house IVD manufacturingRESTRAINTS- IP protection concerns and possibility of theftOPPORTUNITIES- Growth potential of emerging economiesCHALLENGES- Lack of skilled labor

-

5.3 INDUSTRY TRENDSAUTOMATION OF CLINICAL LABORATORY TECHNIQUESMICROFLUIDICS-BASED POC AND LAB-ON-A-CHIP DIAGNOSTIC DEVICES FOR LABORATORY TESTING

-

5.4 PORTER’S FIVE FORCES ANALYSISTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF BUYERSTHREAT OF NEW ENTRANTS

-

5.5 TARIFF AND REGULATORY LANDSCAPEREGULATORY ANALYSIS- North America- Europe- Asia Pacific- South KoreaREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.6 KEY CONFERENCES AND EVENTS IN 2022–2023

-

5.7 PATENT ANALYSISPATENT PUBLICATION TRENDS FOR IVD DEVICESINSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSISPATENT PUBLICATION TRENDS FOR IVD DEVICES

-

5.8 TECHNOLOGY ANALYSISKEY TECHNOLOGIES: IVD CONTRACT MANUFACTURING MARKETADJACENT TECHNOLOGIES

- 5.9 SUPPLY CHAIN ANALYSIS

-

5.10 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.11 ECOSYSTEM ANALYSIS

- 5.12 REVENUE SOURCES TO SHIFT TOWARD TECHNOLOGY-BASED SOLUTIONS

- 5.13 IVD CONTRACT MANUFACTURING MARKET: RECESSION IMPACT

- 6.1 INTRODUCTION

-

6.2 CONSUMABLESCONSUMABLES TO DOMINATE IVD CONTRACT MANUFACTURING MARKET

-

6.3 EQUIPMENTAUTOMATION, ADVANCEMENTS, AND EMPHASIS ON EFFICIENT DIAGNOSTICS TO DRIVE MARKET

- 7.1 INTRODUCTION

- 7.2 IMMUNOASSAYS

- 7.3 RISING PREVALENCE OF CANCER TO DRIVE GROWTH

-

7.4 CLINICAL CHEMISTRYGROWING INCIDENCE OF LIFESTYLE DISEASES TO DRIVE DEMAND FOR CLINICAL CHEMISTRY ASSAY TESTING

-

7.5 MOLECULAR DIAGNOSTICSTECHNOLOGICAL INNOVATION IN PCR TESTING TO BOOST GROWTH

-

7.6 HEMATOLOGYRISING ADOPTION OF AUTOMATED HEMATOLOGY ANALYZERS TO DRIVE MARKET

-

7.7 MICROBIOLOGYRISING PREVALENCE OF MICROBIAL INFECTIONS TO DRIVE MARKET

-

7.8 COAGULATION & HEMOSTASISGROWING USE OF ANTICOAGULATION THERAPY IN SURGICAL PROCEDURES TO DRIVE MARKET

- 7.9 OTHER TECHNOLOGIES

- 8.1 INTRODUCTION

-

8.2 MANUFACTURING SERVICESMANUFACTURING SERVICES TO HOLD LARGEST MARKET SHARE TILL 2028

-

8.3 ASSAY DEVELOPMENTLOW-COST SETUP, EFFICIENCY, AND HIGH THROUGHPUT TO DRIVE DEMAND FOR ASSAY DEVELOPMENT

- 8.4 OTHER SERVICES

- 9.1 INTRODUCTION

-

9.2 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTCHINA- Low labor costs and rapidly changing healthcare infrastructure to drive marketJAPAN- Universal healthcare reimbursement policies to propel marketINDIA- Rising contract manufacturing capabilities to support growthAUSTRALIA- Need for advanced medical and diagnostic tools to fuel growthSOUTH KOREA- Rising spending on innovative IVD technologies to support market growthREST OF ASIA PACIFIC

-

9.3 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- Increasing in-house manufacturing costs to encourage shift to contract manufacturingCANADA- Strong presence of key contract manufacturing companies to drive market

-

9.4 EUROPEEUROPE: RECESSION IMPACTGERMANY- Germany to hold largest market shareFRANCE- Increasing government pressure to reduce healthcare costs and budgetary constraintsUK- Risng adoption of genome-based testing and increasing accessibility of IVDITALY- Rising incidence of chronic illnesses to drive marketSPAIN- Increasing adoption of home-use medical devices to drive marketREST OF EUROPE

-

9.5 LATIN AMERICALATIN AMERICA: RECESSION IMPACTMEXICO- Mexico to hold largest share of Latin American marketBRAZIL- Favorable government initiatives and willingness to pay for better healthcare to drive marketREST OF LATIN AMERICA

-

9.6 MIDDLE EAST & AFRICAGROWING HEALTHCARE INVESTMENTS AND INFRASTRUCTURAL IMPROVEMENTS TO DRIVE MARKETMIDDLE EAST & AFRICA: RECESSION IMPACT

- 10.1 OVERVIEW

- 10.2 KEY STRATEGIES ADOPTED BY PLAYERS

- 10.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

- 10.4 MARKET SHARE ANALYSIS

-

10.5 COMPANY EVALUATION MATRIX, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 10.6 COMPETITIVE BENCHMARKING

-

10.7 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

11.1 KEY PLAYERSJABIL INC.- Business overview- Products offered- Recent developments- MnM viewSANMINA CORPORATION- Business overview- Products & services offered- Recent developments- MnM viewTE CONNECTIVITY- Business overview- Services offered- Recent developments- MnM viewCELESTICA, INC.- Business overview- Services offered- Recent developments- MnM viewWEST PHARMACEUTICAL SERVICES, INC.- Business overview- Services offered- Recent developments- MnM viewSAVYON DIAGNOSTICS, LTD.- Business overview- Products & services offered- Recent developmentsKMC SYSTEMS- Business overview- Services offered- Recent developmentsCENOGENICS CORPORATION- Business overview- Products & services offeredNOVA BIOMEDICAL- Business overview- Products & services offered- Recent developmentsCONE BIOPRODUCTS- Business overview- Services offeredINVETECH- Business overview- Services offered- Recent developmentsAVIOQ, INC.- Business overview- Services offered- Recent developmentsMERIDIAN BIOSCIENCE, INC.- Business overview- Services offered- Recent developmentsKIMBALL ELECTRONICS, INC.- Business overview- Services offered- Recent developmentsNEMERA- Business overview- Services offeredVIANT MEDICAL HOLDINGS, INC.- Business overview- Products offered- Recent developmentsPHILLIPS-MEDISIZE CORPORATION- Business overview- Products & services offered- Recent developmentsNOLATO GW, INC.- Business overview- Products offered- Recent developmentsSTRATEC SE- Business overview- Services offeredTHERMO FISHER SCIENTIFIC, INC.- Business overview- Products offered- Recent developmentsFUJIREBIO- Business overview- Products & services offered- Recent developmentsBIOKIT (WERFEN)- Business overview- Products & services offered- Recent developments

-

11.2 OTHER COMPANIESAFFINITY LIFESCIENCESEKISUIPRESTIGE DIAGNOSTICS

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 STANDARD CURRENCY CONVERSION RATES (UNIT OF USD)

- TABLE 2 RISK ASSESSMENT: IVD CONTRACT MANUFACTURING MARKET

- TABLE 3 MARKET DYNAMICS: IMPACT ANALYSIS

- TABLE 4 IVD CONTRACT MANUFACTURING MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 5 US: CLASSIFICATION OF MEDICAL EQUIPMENT

- TABLE 6 US: TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS

- TABLE 7 CANADA: RISK, TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS

- TABLE 8 EUROPE: RISK, TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS

- TABLE 9 JAPAN: CLASSIFICATION OF IVD REAGENTS IN JAPAN

- TABLE 10 JAPAN: TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS

- TABLE 11 CHINA: TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS

- TABLE 12 SOUTH KOREA: TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 IVD CONTRACT MANUFACTURING MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 19 IVD DEVICES: LIST OF MAJOR PATENTS

- TABLE 20 KEY BUYING CRITERIA FOR IVD PRODUCTS

- TABLE 21 IVD CONTRACT MANUFACTURING MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 22 IVD CONTRACT MANUFACTURING MARKET FOR CONSUMABLES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 23 IVD CONTRACT MANUFACTURING MARKET FOR EQUIPMENT, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 24 IVD CONTRACT MANUFACTURING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 25 IVD CONTRACT MANUFACTURING MARKET FOR IMMUNOASSAYS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 26 IVD CONTRACT MANUFACTURING MARKET FOR CLINICAL CHEMISTRY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 27 IVD CONTRACT MANUFACTURING MARKET FOR MOLECULAR DIAGNOSTICS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 28 IVD CONTRACT MANUFACTURING MARKET FOR HEMATOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 29 IVD CONTRACT MANUFACTURING MARKET FOR MICROBIOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 30 IVD CONTRACT MANUFACTURING MARKET FOR COAGULATION & HEMOSTASIS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 31 IVD CONTRACT MANUFACTURING MARKET FOR OTHER TECHNOLOGIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 32 IVD CONTRACT MANUFACTURING MARKET, BY SERVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 33 MANUFACTURING SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 34 ASSAY DEVELOPMENT SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 35 OTHER SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 36 IVD CONTRACT MANUFACTURING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 37 ASIA PACIFIC: IVD CONTRACT MANUFACTURING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 38 ASIA PACIFIC: IVD CONTRACT MANUFACTURING MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 39 ASIA PACIFIC: IVD CONTRACT MANUFACTURING MARKET, BY SERVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 40 ASIA PACIFIC: IVD CONTRACT MANUFACTURING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 41 CHINA: KEY MACROINDICATORS

- TABLE 42 CHINA: IVD CONTRACT MANUFACTURING MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 43 CHINA: IVD CONTRACT MANUFACTURING MARKET, BY SERVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 44 CHINA: IVD CONTRACT MANUFACTURING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 45 JAPAN: KEY MACROINDICATORS

- TABLE 46 JAPAN: IVD CONTRACT MANUFACTURING MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 47 JAPAN: IVD CONTRACT MANUFACTURING MARKET, BY SERVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 48 JAPAN: IVD CONTRACT MANUFACTURING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 49 INDIA: KEY MACROINDICATORS

- TABLE 50 INDIA: IVD CONTRACT MANUFACTURING MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 51 INDIA: IVD CONTRACT MANUFACTURING MARKET, BY SERVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 52 INDIA: IVD CONTRACT MANUFACTURING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 53 AUSTRALIA: KEY MACROINDICATORS

- TABLE 54 AUSTRALIA: IVD CONTRACT MANUFACTURING MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 55 AUSTRALIA: IVD CONTRACT MANUFACTURING MARKET, BY SERVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 56 AUSTRALIA: IVD CONTRACT MANUFACTURING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 57 SOUTH KOREA: KEY MACROINDICATORS

- TABLE 58 SOUTH KOREA: IVD CONTRACT MANUFACTURING MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 59 SOUTH KOREA: IVD CONTRACT MANUFACTURING MARKET, BY SERVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 60 SOUTH KOREA: IVD CONTRACT MANUFACTURING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 61 REST OF ASIA PACIFIC: IVD CONTRACT MANUFACTURING MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 62 REST OF ASIA PACIFIC: IVD CONTRACT MANUFACTURING MARKET, BY SERVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 63 REST OF ASIA PACIFIC: IVD CONTRACT MANUFACTURING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: IVD CONTRACT MANUFACTURING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 65 NORTH AMERICA: IVD CONTRACT MANUFACTURING MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 66 NORTH AMERICA: IVD CONTRACT MANUFACTURING MARKET, BY SERVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 67 NORTH AMERICA: IVD CONTRACT MANUFACTURING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 68 US: KEY MACROINDICATORS

- TABLE 69 US: IVD CONTRACT MANUFACTURING MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 70 US: IVD CONTRACT MANUFACTURING MARKET, BY SERVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 71 US: IVD CONTRACT MANUFACTURING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 72 CANADA: KEY MACROINDICATORS

- TABLE 73 CANADA: IVD CONTRACT MANUFACTURING MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 74 CANADA: IVD CONTRACT MANUFACTURING MARKET, BY SERVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 75 CANADA: IVD CONTRACT MANUFACTURING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 76 EUROPE: IVD CONTRACT MANUFACTURING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 77 EUROPE: IVD CONTRACT MANUFACTURING MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 78 EUROPE: IVD CONTRACT MANUFACTURING MARKET, BY SERVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 79 EUROPE: IVD CONTRACT MANUFACTURING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 80 GERMANY: KEY MACROINDICATORS

- TABLE 81 GERMANY: IVD CONTRACT MANUFACTURING MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 82 GERMANY: IVD CONTRACT MANUFACTURING MARKET, BY SERVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 83 GERMANY: IVD CONTRACT MANUFACTURING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 84 FRANCE: KEY MACROINDICATORS

- TABLE 85 FRANCE: IVD CONTRACT MANUFACTURING MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 86 FRANCE: IVD CONTRACT MANUFACTURING MARKET, BY SERVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 87 FRANCE: IVD CONTRACT MANUFACTURING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 88 UK: KEY MACROINDICATORS

- TABLE 89 UK: IVD CONTRACT MANUFACTURING MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 90 UK: IVD CONTRACT MANUFACTURING MARKET, BY SERVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 91 UK: IVD CONTRACT MANUFACTURING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 92 ITALY: KEY MACROINDICATORS

- TABLE 93 ITALY: IVD CONTRACT MANUFACTURING MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 94 ITALY: IVD CONTRACT MANUFACTURING MARKET, BY SERVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 95 ITALY: IVD CONTRACT MANUFACTURING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 96 SPAIN: KEY MACROINDICATORS

- TABLE 97 SPAIN: IVD CONTRACT MANUFACTURING MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 98 SPAIN: IVD CONTRACT MANUFACTURING MARKET, BY SERVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 99 SPAIN: IVD CONTRACT MANUFACTURING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 100 REST OF EUROPE: IVD CONTRACT MANUFACTURING MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 101 REST OF EUROPE: IVD CONTRACT MANUFACTURING MARKET, BY SERVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 102 REST OF EUROPE: IVD CONTRACT MANUFACTURING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 103 LATIN AMERICA: IVD CONTRACT MANUFACTURING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 104 LATIN AMERICA: IVD CONTRACT MANUFACTURING MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 105 LATIN AMERICA: IVD CONTRACT MANUFACTURING MARKET, BY SERVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 106 LATIN AMERICA: IVD CONTRACT MANUFACTURING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 107 MEXICO: KEY MACROINDICATORS

- TABLE 108 MEXICO: IVD CONTRACT MANUFACTURING MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 109 MEXICO: IVD CONTRACT MANUFACTURING MARKET, BY SERVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 110 MEXICO: IVD CONTRACT MANUFACTURING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 111 BRAZIL: KEY MACROINDICATORS

- TABLE 112 BRAZIL: IVD CONTRACT MANUFACTURING MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 113 BRAZIL: IVD CONTRACT MANUFACTURING MARKET, BY SERVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 114 BRAZIL: IVD CONTRACT MANUFACTURING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 115 REST OF LATIN AMERICA: IVD CONTRACT MANUFACTURING MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 116 REST OF LATIN AMERICA: IVD CONTRACT MANUFACTURING MARKET, BY SERVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 117 REST OF LATIN AMERICA: IVD CONTRACT MANUFACTURING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 118 MIDDLE EAST & AFRICA: IVD CONTRACT MANUFACTURING MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 119 MIDDLE EAST & AFRICA: IVD CONTRACT MANUFACTURING MARKET, BY SERVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 120 MIDDLE EAST & AFRICA: IVD CONTRACT MANUFACTURING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 121 OVERALL COMPANY FOOTPRINT

- TABLE 122 OMPANY FOOTPRINT ANALYSIS, BY PRODUCT TYPE

- TABLE 123 COMPANY FOOTPRINT ANALYSIS, BY SERVICE TYPE

- TABLE 124 COMPANY FOOTPRINT ANALYSIS, BY REGION

- TABLE 125 PRODUCT LAUNCHES (JANUARY 2020–MAY 2023)

- TABLE 126 DEALS (JANUARY 2020–MAY 2023)

- TABLE 127 OTHER DEVELOPMENTS (JANUARY 2020–MAY 2023)

- TABLE 128 JABIL INC.: COMPANY OVERVIEW

- TABLE 129 SANMINA CORPORATION: COMPANY OVERVIEW

- TABLE 130 TE CONNECTIVITY: COMPANY OVERVIEW

- TABLE 131 CELESTICA, INC.: COMPANY OVERVIEW

- TABLE 132 WEST PHARMACEUTICALS SERVICES, INC.: COMPANY OVERVIEW

- TABLE 133 SAVYON DIAGNOSTICS, LTD.: COMPANY OVERVIEW

- TABLE 134 KMC SYSTEMS: COMPANY OVERVIEW

- TABLE 135 CENOGENICS CORPORATION: COMPANY OVERVIEW

- TABLE 136 NOVA BIOMEDICAL: COMPANY OVERVIEW

- TABLE 137 CORE BIOPRODUCTS: COMPANY OVERVIEW

- TABLE 138 INVETECH: COMPANY OVERVIEW

- TABLE 139 AVIOQ, INC.: COMPANY OVERVIEW

- TABLE 140 MERIDIAN BIOSCIENCE, INC.: COMPANY OVERVIEW

- TABLE 141 KIMBALL ELECTRONICS, INC.: COMPANY OVERVIEW

- TABLE 142 NEMERA: COMPANY OVERVIEW

- TABLE 143 VIANT MEDICAL HOLDINGS, INC.: COMPANY OVERVIEW

- TABLE 144 PHILLIPS-MEDISIZE CORPORATION: COMPANY OVERVIEW

- TABLE 145 NOLATO GW, INC.: COMPANY OVERVIEW

- TABLE 146 STRATEC SE: COMPANY OVERVIEW

- TABLE 147 THERMO FISHER SCIENTIFIC, INC.: COMPANY OVERVIEW

- TABLE 148 FUJIREBIO: COMPANY OVERVIEW

- TABLE 149 BIOKIT: COMPANY OVERVIEW

- FIGURE 1 IVD CONTRACT MANUFACTURING MARKET SEGMENTATION

- FIGURE 2 IVD CONTRACT MANUFACTURING MARKET: REGIONAL SEGMENTATION

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 PRIMARY SOURCES

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY SIDE AND DEMAND SIDE PARTICIPANTS

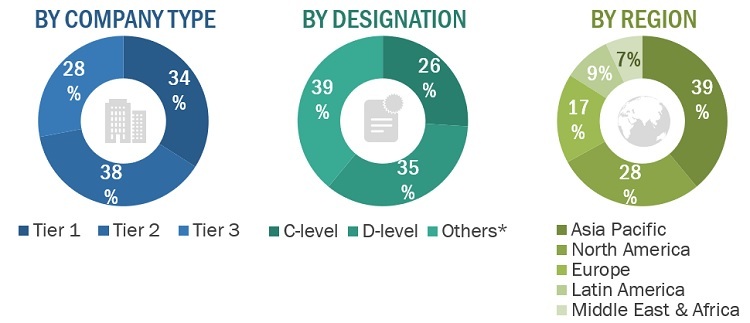

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 7 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE): BY END-USER, DESIGNATION, AND REGION

- FIGURE 8 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 9 REVENUE SHARE ANALYSIS ILLUSTRATION: JABIL INC.

- FIGURE 10 SUPPLY-SIDE ANALYSIS: IVD CONTRACT MANUFACTURING MARKET (2022)

- FIGURE 11 DEMAND-SIDE ESTIMATION FOR IVD CONTRACT MANUFACTURING MARKET

- FIGURE 12 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES (2023–2028)

- FIGURE 13 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 14 MARKET DATA TRIANGULATION METHODOLOGY

- FIGURE 15 IVD CONTRACT MANUFACTURING MARKET, BY PRODUCT TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 IVD CONTRACT MANUFACTURING MARKET, BY SERVICE TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 17 IVD CONTRACT MANUFACTURING MARKET, BY TECHNOLOGY, 2023 VS. 2028 (USD MILLION)

- FIGURE 18 IVD CONTRACT MANUFACTURING MARKET: GEOGRAPHICAL SNAPSHOT, 2022

- FIGURE 19 TECHNOLOGICAL ADVANCEMENTS IN IVD TO DRIVE MARKET

- FIGURE 20 CHINA TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 21 ASIA PACIFIC TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 22 ASIA PACIFIC TO DOMINATE MARKET IN 2028

- FIGURE 23 MARKET DYNAMICS: IVD CONTRACT MANUFACTURING MARKET

- FIGURE 24 ASIA PACIFIC: HEALTHCARE EXPENDITURE, 2010–2020 (% OF GDP)

- FIGURE 25 IVD CONTRACT MANUFACTURING MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 26 EUROPE: IVDR TIMELINE

- FIGURE 27 REGULATORY PROCESS FOR IVD DEVICES IN JAPAN

- FIGURE 28 INDIA: REGULATORY PROCESS FOR IVD DEVICES

- FIGURE 29 PATENT PUBLICATION TRENDS (JANUARY 2013–JULY 2023)

- FIGURE 30 TOP APPLICANTS AND OWNERS (COMPANIES/INSTITUTES) FOR IVD DEVICES PATENTS (JANUARY 2013–JULY 2023)

- FIGURE 31 TOP 10 APPLICANT COUNTRIES/REGIONS FOR IVD DEVICES PATENTS (JANUARY 2013–JULY 2023)

- FIGURE 32 IVD CONTRACT MANUFACTURING MARKET: SUPPLY CHAIN (2022)

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF IVD PRODUCTS

- FIGURE 34 KEY BUYING CRITERIA FOR IVD PRODUCTS

- FIGURE 35 IVD CONTRACT MANUFACTURING MARKET: ECOSYSTEM ANALYSIS (2022)

- FIGURE 36 REVENUE SOURCES TO SHIFT TOWARD TECHNOLOGY-BASED SOLUTIONS

- FIGURE 37 IVD CONTRACT MANUFACTURING MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 38 ASIA PACIFIC: IVD CONTRACT MANUFACTURING MARKET SNAPSHOT

- FIGURE 39 TOP MARKET PLAYERS DOMINATE IVD CONTRACT MANUFACTURING MARKET

- FIGURE 40 IVD CONTRACT MANUFACTURING MARKET SHARE ANALYSIS, BY KEY PLAYER, 2022

- FIGURE 41 IVD CONTRACT MANUFACTURING MARKET: COMPANY EVALUATION QUADRANT (2022)

- FIGURE 42 JABIL INC.: COMPANY SNAPSHOT (2022)

- FIGURE 43 SANMINA CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 44 TE CONNECTIVITY: COMPANY SNAPSHOT (2022)

- FIGURE 45 CELESTICA, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 46 WEST PHARMACEUTICAL SERVICES, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 47 ELBIT SYSTEMS: COMPANY SNAPSHOT (2022)

- FIGURE 48 FORTIVE: COMPANY SNAPSHOT (2022)

- FIGURE 49 MERIDIAN BIOSCIENCE, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 50 KIMBALL ELECTRONICS, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 51 NOLATO GW, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 52 STRATEC SE: COMPANY SNAPSHOT (2022)

- FIGURE 53 THERMO FISHER SCIENTIFIC, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 54 H.U. GROUP: COMPANY SNAPSHOT (2022)

- FIGURE 55 WERFEN: COMPANY SNAPSHOT (2022)

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

This research study involved the usage of comprehensive secondary sources; directories; databases such as Bloomberg Business, Factiva, and Dun & Bradstreet; white papers; annual reports; company house documents; investor presentations; and SEC filings of companies. Secondary research was used to identify and collect information useful for an extensive, technical, market-oriented, and commercial study of the IVD Contract Manufacturing Industry. It was also used to obtain important information about the key players, market classification and segmentation according to industry trends to the bottommost level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Extensive primary research was conducted after obtaining information regarding the IVD Contract Manufacturing Market scenario through secondary research. Several primary interviews were conducted with market experts from both, the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interview. The primary sources included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives from IVD contract manufacturer; system integrators; component providers; distributors; and key opinion leaders/consultants.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. The primary sources from the supply side and demand side are detailed below.

A breakdown of the primary respondents is provided below:

Breakdown Of Primary Interviews: Supply-Side Participants, By Company Type, Designation, And Region

Note 1: C-level primaries include CEOs, COOs, CTOs, and VPs.

Note 2: Other primaries include sales managers, marketing managers, and product managers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2020: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

Breakdown of Primary Interviews: By Company Type, Designation, and Region

Note: Others include department heads and research scientists

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the IVD Contract Manufacturing Industry was arrived at after data triangulation from two different approaches, as mentioned below. After each approach, the weighted average of all approaches was taken based on the level of assumptions used in each approach.

Global IVD Contract Manufacturing Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global IVD Contract Manufacturing Market Size: Top-Down Approach

Data Triangulation

After arriving at the market size, the total market was divided into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments, data triangulation and market breakdown procedures were employed, wherever applicable. The following figure shows the market validation, source structure, and data triangulation methodology implemented in this report’s market engineering process.

Market Definition

IVD contract manufacturing is a process wherein a manufacturing company makes IVD equipment or consumables that can be sold later by other companies. IVD contract manufacturers specialize in a certain process or task and offer expertise due to their frequent practice of manufacturing. These companies may also offer assay development, maintenance services, testing services, and distribution services to Original Equipment Manufacturers or Small and Mid-Size organizations.

Key Stakeholders

- Original Equipment Manufacturers

- Suppliers and distributors of IVD equipment

- Small and Mid-size IVD manufactures

- Government bodies/municipal corporations

- Venture capitalists

- US Food and Drug Administration (US FDA)

- European Union (EU)

Objectives of the Study

- To describe, analyze, and forecast the IVD Contract Manufacturing Market, by device type, service type, technology, and region.

- To describe and forecast the IVD Contract Manufacturing Industry for key regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the IVD Contract Manufacturing Industry

- To strategically analyze the ecosystem, regulations, patenting trend, value chain, Porter’s five forces, and prices pertaining to the market under study

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for market players.

- To profile key players and comprehensively analyze their market shares and core competencies2 in the IVD Contract Manufacturing Industry.

- To analyze competitive developments such as collaborations, acquisitions, product launches, expansions, and R&D activities in the IVD Contract Manufacturing Market

Available customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the RoE IVD Contract Manufacturing Industry into Austria, Finland, and others

- Further breakdown of the RoLATAM IVD Contract Manufacturing Industry into Argentina, Colombia, Chile, and others

Competitive Landscape Assessment

Market share analysis for the North America and Europe region, which provides market shares of the top 3–5 key players in the IVD Contract Manufacturing Industry

- Competitive leadership mapping for established players in the US

Growth opportunities and latent adjacency in IVD Contract Manufacturing Market