Knowledge Graph Market

Knowledge Graph Market by Solution (Enterprise Knowledge Graph Platform, Graph Database Engine, Knowledge Management Toolset), Model Type (Resource Description Framework, Labeled Property Graph) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Knowledge Graph market is estimated to be worth USD 1.07 billion in 2024 and is projected to reach USD 6.94 billion by 2030 at a Compound Annual Growth Rate (CAGR) of 36.6 % during the same period. Knowledge graphs help organizations map and understand the customer journey by combining information from multiple touchpoints like interactions on websites, social media, purchase history, and customer support. Through these links and context, they create a holistic view of customer behavior and preferences. This helps businesses understand the patterns and predict the needs of their customers to provide personalized experiences at each stage of the customer lifecycle. These connections give insights that help make more effective marketing strategies, improve targeting, and optimize service delivery. All this results in improved customer satisfaction and loyalty.

KEY TAKEAWAYS

- The North America knowledge graph market accounted for a 33.0% revenue share in 2023.

- By offering, the services segment will grow the fastest during the forecast period.

- By model type, the labeled property graph (LPG) segment is expected to dominate the market.

- Neo4j, AWS, and TigerGraph were identified as some of the star player in the knowledge-graph market because they provide scalable graph engines and managed cloud services, and witness broad enterprise adoption across ecosystems.

- Metaphacts, ECCENCA, and ArangoDB, among others, have built strong startup/SME positions by focusing on enterprise knowledge-graph tooling and semantic integration, and open-source multi-model flexibility with developer ecosystems.

Knowledge graphs enhance enterprise knowledge management by reconstructing complex data into interconnected nodes and relationships, offering an intuitive way to navigate and extract information. They enable organizations to create comprehensive data ecosystems that integrate disparate sources, supporting advanced semantic search, context-driven recommendations, and data discovery. By mapping relationships across organizational knowledge, knowledge graphs drive informed decision-making, foster innovation, and strengthen collaboration across teams. They are especially valuable for large enterprises that rely on leveraging extensive structured and unstructured data to maintain productivity and competitiveness.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The knowledge graph market is undergoing significant shifts as the traditional revenue mix, dominated by software licensing, cloud/SaaS services, and analytics, transitions toward a future mix prioritizing AI-enhanced knowledge services, Data-as-a-Service (DaaS), and cognitive search applications. This change is driven by demand for new use cases, technologies, and partnerships in sectors like BFSI, healthcare, e-commerce, telecom, government, and manufacturing. For end customers, the focus is on outcomes such as enhanced decision-making, data integration, regulatory compliance, and fraud detection. These shifts mandate that enterprise clients adopt enhanced data management, scalable infrastructures, and advanced search to deliver efficient knowledge sharing, improved personalization, and actionable insights for their customers’ customers, thus accelerating innovation and research while enabling superior customer or citizen experiences.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rapid Growth in Data Volume and Complexity

-

Growing Demand for Semantic Search

Level

-

Data Quality and Integration Challenges

-

Navigation of saturated Data Management Tool Landscape

Level

-

Data unification and rapid proliferation of knowledge graphs

-

Increasing adoption in Healthcare and Lifesciences to revolutionize Data Management and enhance Patient Outcomes

Level

-

Standardization and Interoperability

-

Difficulty in demonstrating full value of Knowledge graphs through single use case

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rapid Growth in Data Volume and Complexity

The knowledge graph market benefits the most from fast-growing data volume and complexity. Business activities continually produce vast amounts of structured and unstructured data concerning social media, IoT devices, and enterprise systems. Ever-unresolved issues in typical data management have maintained challenges in data intake and analytics when this kind of data is concerned. In this sense, knowledge graphs may offer a solid approach by unifying the most diverse sources in one flexible framework. Real-time information within such systems influences business decisions with new insights. As businesses need to relate big amounts of data, knowledge graphs improve the ability to operate the data by establishing connections between data sets in order to develop a semantic understanding of the matter. Thus, increased demand for knowledge graphs is set to trigger growth in this market in various corporate sectors.

Restraint: Data Quality and Integration Challenges

Data quality and integration challenges are major obstacles in the knowledge graph market. Integration from heterogeneous data sources into a knowledge graph involves key operations of extraction, resolution, fusion, and quality management, all of which need to be carefully handled to maintain accuracy and reliability. This may result in errors due to poor data quality, specifically by yielding a knowledge graph that is not effective. As organizations scale and new sources of data enter the picture, quality becomes increasingly difficult to manage. Changes to the formats, structures, and semantics of the data may break integration processes and require ongoing / methodological adjustments. Also, the changing nature of business environments require changes in knowledge graphs at moderate intervals to show true information.

Opportunity: Data unification and rapid proliferation of knowledge graphs

The proliferation of knowledge graphs is linked to the need to unify data across many industries. Organizations now recognize that good data management needs a unified approach that brings together structured and unstructured data from many sources. Knowledge graphs are a strong tool to achieve this unity. Knowledge graphs set up a semantic structure for multiple datasets allowing companies to handle complex relationships efficiently. This capability adds great value in verticals such as healthcare where fragmented data can slow down research and clinical decision-making. By giving a unified view of information, knowledge graphs help advanced analytics and machine learning tools in finding hidden insights and drive innovation. Also, as businesses try to leverage big data to get competitive advantage, the demand for knowledge graphs is slated to grow. They make data management smoother and also help teams work better by giving a streamlined data management process for shared understanding of information across departments. This shift towards unifying data through knowledge graphs leads to a change in how companies work and make decisions in a world that relies more and more on data.

Challenge: Standardization and Interoperability

A major challenge facing the knowledge graph market is the standardization and interoperability. Without a universally accepted standard for the creation and management of a knowledge graph, data yields inconsistencies in representation because of disparate platforms in operation. Such fragmentation doesn't allow organizations to effectively share and integrate knowledge graphs and thus hampers collaboration and sharing of data processes. Moreover, a wide variety of data sources are likely to bring different formats, semantics, and ontologies into play. The lack of standardization aggravates the situation when some organizations wonder how to standardize their knowledge graphs so that they can communicate with other systems and applications without creating data silos, leading to lower utility of overall information. Additionally, with the continuous evolution of industries and the emergence of new technologies, maintaining interconnectedness between legacy systems and modern applications is growing more complex. The main way to counter these challenges is by working towards common industry standards for a framework for interoperability of the knowledge graph. Such collaboration is expected to enhance data sharing practices so that more industries are incentivized to use knowledge graph technologies and realize their full potential for innovation.

Knowledge graph Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Implemented Neo4j to analyze complex medical supply chain data, identifying root causes of defects and improving manufacturing quality. | Enhanced defect detection, reduced investigation time, and improved product quality. |

|

Utilized Stardog's Enterprise Knowledge Platform to integrate siloed datasets across engineering disciplines, enabling informed decision-making for deep space missions. | Accelerated engineering productivity, reduced risk, and ensured timely mission execution. |

|

Leveraged GraphDB to modernize legislative and open data platforms, providing clearer public information and easier access to legislative data. | Improved public access to legislative data, enhanced transparency, and facilitated data-driven decision-making. |

|

Implemented a global product and inventory management system using knowledge graph technology to harmonize and link product data across warehouses. | Reduced data preparation efforts by 50%, cut inventory by 12%, and achieved a two-fold ROI within six months. |

|

Employed TigerGraph's platform to enhance fraud detection capabilities by analyzing complex data relationships, integrating AI models for real-time insights. | Improved fraud detection accuracy and reduced financial losses through advanced graph analytics. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The knowledge graph market ecosystem is structured into several key constituents, each playing a pivotal role in driving the growth and adoption of knowledge graph technologies. Solution providers like Neo4j and Oracle develop core platforms and databases that power knowledge graph deployment across enterprises. Service providers such as AWS and Altair deliver implementation, consulting, and managed services to accelerate client adoption and maximize ROI. Data providers, represented by organizations like DBpedia and Google, offer foundational semantic data sets and linked data essential for building and training knowledge graphs. Regulatory bodies, including the European Commission and IEEE, establish standards for data security, privacy, and interoperability, ensuring market trust and compliance. This interconnected landscape enables organizations to leverage knowledge graphs for intelligent search, data integration, and advanced analytics while maintaining regulatory alignment.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Knowledge Graph Market, By Offering

The services segment in the knowledge graph market is forecasted to register the highest CAGR due to growing demand for expert guidance in deploying, customizing, and managing complex knowledge graph solutions. As organizations increasingly adopt knowledge graphs to integrate diverse data sources and enable semantic search, context-aware recommendations, and advanced analytics, they require professional services such as consulting, implementation, integration, and training. Additionally, enterprises face challenges in handling large-scale, heterogeneous, and unstructured data, which necessitates specialized expertise to optimize knowledge graph architecture, ensure interoperability, and maintain data quality. Managed services and continuous support offerings also drive recurring revenue, making the services segment more attractive. The rising focus on leveraging AI and machine learning alongside knowledge graphs further amplifies demand for professional services, as organizations seek tailored strategies, operational support, and insights to maximize value from their knowledge graph investments.

Knowledge Graph Market, By Model Type

The Labeled Property Graph (LPG) model is forecasted to hold the highest market share in the knowledge graph market due to its flexibility, scalability, and intuitive structure for representing complex relationships. LPGs allow nodes and edges to have properties, enabling rich semantic representation and easier querying of interconnected data. This makes them highly suitable for diverse enterprise applications, including fraud detection, recommendation engines, supply chain management, and customer 360 initiatives. Organizations prefer LPGs as they support real-time analytics, AI, and machine learning integration, facilitating faster insights and smarter decision-making. Additionally, major knowledge graph platforms and graph databases are optimized for LPGs, enhancing adoption across industries such as BFSI, healthcare, life sciences, and government. Their ability to efficiently handle large-scale structured and unstructured datasets, combined with simplified visualization and navigation, positions LPGs as the most widely adopted model type in the evolving knowledge graph market.

Knowledge Graph Market, By Application

Knowledge graphs play an essential role in data analytics and business intelligence by organizing and connecting data to uncover deeper insights. They make it easier to identify trends and support better decision-making enabling advanced querying, semantic search, and real-time analysis of large datasets. By combining diverse data sources such as customer behavior and market trends, they enhance data discovery, reporting, and predictive analytics. Knowledge graphs also support AI and machine learning with rich, interconnected data. They simplify data governance and ensure compliance with regulatory standards. In sectors such as finance, healthcare, and retail, they drive innovation, optimize operations, and enable personalized customer experiences. Moreover, they promote collaboration across teams and agile strategic planning, helping businesses remain competitive in a data-driven landscape.

Knowledge Graph Market, By Vertical

In the manufacturing and automotive verticals, knowledge graphs are critical for optimizing operations, improving decision-making, and driving innovation. In manufacturing, they integrate data from supply chains, production lines, and maintenance logs to provide real-time insights, enabling predictive maintenance, optimizing workflows, and reducing downtime. They also support product lifecycle management by linking design data, production processes, and quality control, ensuring efficiency and minimizing errors. In the automotive sector, knowledge graph links the disparate data across engineering, the supply chain, and customer feedback, thereby speeding the development of vehicles and accelerating cross-team collaboration. Predictive vehicle maintenance is also supported to anticipate service needs by exploiting historical and real-time data. Additionally, the assimilation of data from connected IoT devices and customer behavior supports knowledge graphs in giving personalized customer experiences, improving after-sales services, and eventually strengthening brand loyalty.

REGION

Asia Pacific to be fastest-growing region in global knowledge graph market during forecast period

The knowledge graph landscape in the Asia Pacific region is advancing rapidly, driven by initiatives across multiple sectors. In Australia, HydroKG consolidates hydrologic data from platforms such as GeoFabric and HydroATLAS, supporting precise queries on water bodies and river networks, which facilitates more effective environmental monitoring and resource management. In Japan, manufacturing enterprises leverage knowledge graphs to optimize supply chains, improve operational efficiency, and enhance predictive maintenance. Similarly, South Korea applies knowledge graphs in the telecommunications sector to deliver personalized AI-driven customer experiences, streamline service delivery, and enable data-driven decision-making. Collectively, these initiatives underscore the region’s focus on leveraging knowledge graphs for operational excellence, innovation, and enhanced stakeholder engagement.

Knowledge graph Market: COMPANY EVALUATION MATRIX

In the knowledge graph market matrix, Neo4J (Star) leads with a strong market share and extensive product footprint, driven by its robust, scalable knowledge graph platform, flexible Labeled Property Graph model, strong ecosystem, real-time analytics capabilities, and widespread adoption across industries for complex relationship mapping and advanced data-driven decision-making. Altair (Emerging Leader) is gaining visibility in the knowledge graph market by offering innovative data integration and analytics solutions, leveraging semantic modeling for enterprise insights, supporting AI-driven decision-making, and expanding adoption across industries such as manufacturing, healthcare, and supply chain management.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.07 Billion |

| Market Forecast in 2030 (Value) | USD 6.94 Billion |

| Growth Rate | CAGR of 36.6% from 2024-2030 |

| Years Considered | 2019-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Knowledge graph Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| OntoText |

|

|

| Memgraph |

|

|

RECENT DEVELOPMENTS

- October 2024 : Semantic Web Company and Ontotext have merged to form Graphwise, a new entity focused on advancing knowledge graph and AI technologies. The merger combines their expertise in semantic technologies, aiming to deliver innovative solutions for data integration, analytics, and AI-driven insights. This collaboration positions Graphwise as a leader in the knowledge graph market, enhancing its ability to tackle complex data challenges across industries.

- April 2024 : Altair acquired Cambridge Semantics to enhance its data analytics and AI capabilities. This acquisition integrates Cambridge's graph-powered data fabric technology into Altair's RapidMiner platform, enabling the creation of comprehensive knowledge graphs that improve data management and support generative AI applications.

- March 2024 : Neo4j announced a collaboration with Microsoft to enhance generative AI and data solutions, leveraging Neo4j's graph technology alongside Microsoft's cloud capabilities to improve data management and analytics for enterprise applications.

- October 2023 : TigerGraph strengthened its presence in the Asia-Pacific region by appointing Pascal as a master distributor, enhancing its distribution network to better serve customers with advanced graph analytics solutions across various industries.

Table of Contents

Methodology

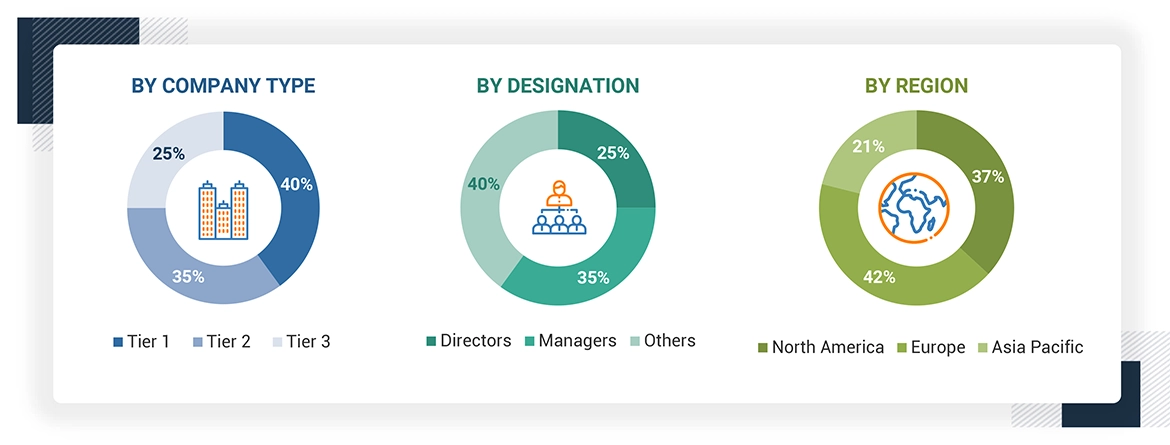

This research study involved the extensive use of secondary sources, directories, and databases, such as Dun & Bradstreet (D&B) Hoovers and Bloomberg BusinessWeek, to identify and collect information useful for a technical, market-oriented, and commercial study of the Knowledge graph market. The primary sources have been mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of the value chain of this market. In-depth interviews have been conducted with various primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information.

Secondary Research

The market for companies offering Knowledge graph solution and services to different end users has been estimated and projected based on the secondary data made available through paid and unpaid sources and by analyzing their product portfolios in the ecosystem of the Knowledge graph market. In the secondary research process, various sources such as JAX Magazine, International Journal Electrical and Computer Engineering (IJECE), and Frontiers have been referred to for identifying and collecting information for this study on the Knowledge graph market. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles by recognized authors, directories, and databases. Secondary research has been mainly used to obtain essential information about the supply chain of the market, the total pool of key players, market classification, segmentation according to industry trends to the bottommost level, regional markets, and key developments from both market- and technology-oriented perspectives that primary sources have further validated.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related critical executives from Knowledge graph service vendors, system Integrators, professional service providers, and industry associations; and key opinion leaders. Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using Knowledge graph services, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of Knowledge graph services which would impact the overall Knowledge graph market.

Note: Others include sales managers, marketing managers, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the size of the Knowledge graph market. The first approach involves estimating market size by summing up the revenue generated by companies through the sale of Knowledge graph solution and services.

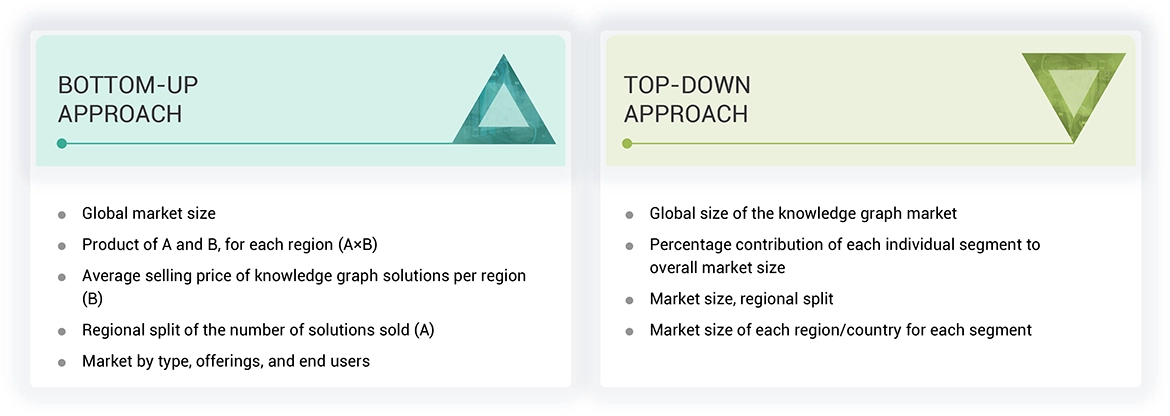

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Knowledge graph market. These methods were extensively used to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

- After arriving at the overall market size, the Knowledge graph market was divided into several segments and subsegments.

Knowledge Graph Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size, the Knowledge graph market was divided into several segments and subsegments.

The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

A knowledge graph is a structured representation of interconnected data, where entities (such as people, places, concepts, or objects) are linked through relationships, forming a network of knowledge. It uses a graph structure with nodes (representing entities) and edges (representing relationships between them) to organize and represent complex information. Knowledge graphs enable advanced data querying, semantic search, and analytics by providing a way to model real-world knowledge and their interdependencies. The value of a knowledge graph lies in its ability to integrate principles, data, and relationships to uncover new knowledge and actionable insights for users or businesses. Its design is well-suited for various use cases, such as real-time applications, search and discovery, and grounding generative AI for effective question-answering. It comprises solutions such as enterprise knowledge graph platform, knowledge graph engine, and knowledge management toolset.

Stakeholders

- Solution Providers

- Technology Vendors

- Enterprise Buyers

- System Integrators

- Consulting Firms and Sis

- Open-Source Communities

- Regulatory Bodies

- Industry Alliances

Report Objectives

- To determine, segment, and forecast the Knowledge graph market based on offerings, model type, application, vertical, and region in terms of value

- To forecast the segment’s size with respect to five main regions: North America, Europe, Asia Pacific (Asia Pacific), Latin America, and the Middle East & Africa (Middle East & Africa)

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the market

- To study the complete supply chain and related industry segments and perform a supply chain analysis

- To strategically analyze macro and micro-markets with respect to individual growth trends, prospects, and contributions to the market

- To analyze industry trends, regulatory landscape, and patents & innovations

- To analyze opportunities for stakeholders by identifying the high-growth segments

- To track and analyze competitive developments, such as agreements, partnerships, collaborations, and R&D activities

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis as per Feasibility

- Analysis for additional countries (up to five)

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Knowledge Graph Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Knowledge Graph Market