Laboratory Equipment Services Market Size, Growth, Share & Trends Analysis

Laboratory Equipment Services Market by Service Type (Installation, Repair, Breakdown, and Maintenance; Calibration; Qualification & Validation; Preventive Maintenance Services; Training, Education & Certification Services; Others), Service Provider (OEM Services, Third Party Service Providers, Distributor Led Services), Equipment Type (Analytical Equipment, General Equipment, Specialty Equipment, Support Equipment), Contract Type (Gold Support Plan, Silver Support Plan, Platinum Support Plan, Customized Support Plan, Other Support Plans) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The laboratory equipment services market, valued at US$20.5 billion in 2024, stood at US$23.5 billion in 2025 and is projected to advance at a resilient CAGR of 15.0% from 2025 to 2030, culminating in a forecasted valuation of US$54.5 billion by the end of the period. The market growth is driven by rising regulatory and quality compliance requirements. The installation, repair, breakdown, and maintenance services segment remains the leading segment of the market. The future outlook will likely be shaped by the rising adoption of remote monitoring, predictive maintenance, and IOT

KEY TAKEAWAYS

-

BY REGIONNorth America accounted for a 40.2% share of the global laboratory equipment services market in 2024.

-

BY SERVICE TYPEBy service type, the Installation, repair, breakdown, and maintenance segment is expected to register the highest CAGR of 12.0% during the forecast period.

-

BY SERVICE PROVIERBy service provider, the OEM services segment is expected to register the highest CAGR of 14.1% during the forecast period.

-

BY EQUIPMENT TYPEBy equipment type, the analytical equipment segment is expected to dominate the market, growing at the highest CAGR of 13.8%.

-

BY CONTRACT TYPEBy contract type, the gold support plan segment accounted for a 41.7% share of the overall market in 2024.

-

COMPETITIVE LANDSCAPE - KEY PLAYERSAgilent Technologies (US), Thermo Fisher Scientific (US), Eppendorf SE (Germany), and Waters Corporation (US) were identified as some of the star players in the laboratory equipment services market (global), given their strong market share and service footprint.

-

COMPETITIVE LANDSCAPE - STARTUPSPACE (US), GenTech Scientific (US), Esco Micro Pte. Ltd. (Singapore), MYCO Instrumentation, Inc. (US), Scientific Instrument Center (US), Analytical Technologies Group (US), BME Lab and Science (Canada), Sartorius AG (Germany), Henderson Biomedical (UK), Laboratory Advanced Solutions (US), PEAK BIOSERVICES (US), among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The market is shaped by a set of interconnected trends that are redefining competitive dynamics. The first major trend is the increase in outsourced maintenance, calibration, testing, and repair services, as laboratories, especially in the pharmaceutical, biotech, and clinical sectors, seek to reduce costs while ensuring long-term equipment availability and regulatory compliance. Second, the introduction of automation, robotics, and integrated data management systems has increased the complexity of laboratory equipment, thereby increasing the demand for specialized external service providers.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The global laboratory equipment services market is experiencing strong growth, driven by several key trends. First, there is a rising trend to outsource maintenance, calibration, testing, and repair services, as laboratories, especially in the pharmaceutical, biotech, and clinical sectors, seek to reduce costs while ensuring long-term equipment availability and regulatory compliance. Second, the introduction of automation, robotics, and integrated data management systems has increased the complexity of laboratory equipment, increasing the demand for specialized external service providers. Third, there has been a marked increase in multivendor service models, where a single vendor maintains equipment from multiple OEMs. This simplifies asset management and reduces logistics costs. Additionally, innovations such as IoT-based predictive maintenance allow service providers to optimize performance, minimize downtime, and predict outages.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing automation and digitalization of laboratories

Level

-

High cost of service contracts and OEM maintenance

Level

-

Rising adoption of remote monitoring, predictive maintenance, and IoT

Level

-

Long equipment downtime resulting from supply chain delays

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing automation and digitalization of laboratories

The global laboratory equipment services market is propelled by the transition towards automation and digitization in research and clinical diagnostics. Globally, laboratories are adapting automated equipment, AI-powered analytical tools, and digital data management systems to enhance efficiency, precision, and productivity. This change is generating demand for specialized services in installation, calibration, validation, maintenance, and repair to ensure that increasingly complex equipment functions effectively. Automation helps laboratories minimize manual mistakes, optimize workflows, and speed up testing and analytical procedures, providing essential benefits in fields such as pharmaceuticals, biotechnology, and clinical diagnostics. Hence, laboratories are allocating greater resources to advanced equipment like automated liquid handlers, high-throughput analyzers, digital microscopes, and integrated workflow systems. These technologies need increased service intervals, remote monitoring features, and specialized technical skills, creating more opportunities for both OEM and third-party service providers.

Restraint: High cost of service contracts and OEM maintenance

The high cost of OEM maintenance and service contracts is one of the major barriers to the global laboratory equipment services market. It can be challenging for many laboratories, especially small and medium-sized ones, to allocate substantial funds for regular maintenance and long-term service contracts. Although OEM service contracts guarantee authentic parts and excellent assistance, they are typically more expensive, which limits their accessibility for institutions with tight budgets.

Opportunity: Rising adoption of remote monitoring, predictive maintenance, and IoT

The newest generation of laboratory equipment is technologically advanced, which includes advanced internal software, high-fidelity sensors, and Internet of Things (IoT) connectivity right out of the box. This technological advancement enables a significant shift in service delivery, shifting maintenance from costly, scheduled, and often delayed site visits to real-time, remote intervention. Service providers can securely access instrument diagnostic logs, remotely push necessary software updates, and perform calibration adjustments without needing to send a technician. The continuous stream of IoT data allows for the application of Machine Learning to predict component failure based on operational patterns and anomalies. This proactive, data-driven remote servicing model drastically reduces the total cost of equipment ownership for the lab, minimizes workflow disruption, and opens a lucrative opportunity for service providers to offer high-margin, guaranteed-uptime service contracts.

Challenge: Long equipment downtime resulting from supply chain delays

Since laboratories depend significantly on prompt access to parts, components, and replacement units to keep instruments operating, extended equipment downtime due to supply chain delays is a significant concern in the global laboratory equipment services market. Various laboratory systems, including mass spectrometers, sequencers, incubators, and chromatography equipment, rely on highly specialized parts that are obtained from international vendors. Any disturbance in the supply chain, whether due to geopolitical tensions, transportation bottlenecks, or manufacturing backlogs, can drastically restrict the availability of these crucial parts. As a result, service providers face extended repairs and maintenance turnaround times. This leads to prolonged downtime that directly impacts laboratory productivity.

LABORATORY EQUIPMENT SERVICES MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Maintenance & repair services, preventive maintenance plans, calibration & instrument qualification (IQ/OQ/PQ), compliance services, remote diagnostics, multi-instrument service plans | Maximizes equipment uptime | Ensures regulatory compliance | Reduces operational disruption | Offers wide instrument coverage for simplified vendor management | Supports high-throughput labs |

|

Calibration, maintenance & repair for analytical instruments (chromatography, spectroscopy, MS systems), equipment performance verification, compliance services, service contracts, spare-parts support | High-reliability servicing for complex analytical instruments | Ensures precision & data accuracy | Supports regulatory compliance | Extends equipment lifespan | Trusted by pharma & biotech labs |

|

Full life-cycle services, including installation, commissioning, qualification (IQ/OQ), preventive maintenance & service contracts, accredited calibration (pipettes, balances, liquid handling), repairs, spare-part support | Ensures high accuracy and reproducibility | Supports GMP/GLP compliance | Minimizes downtime | Provides traceable, ISO-compliant calibration | Predictable maintenance costs with contract plans |

|

Installation, validation & qualification (IQ/OQ/PQ), calibration, preventive maintenance, repair, pipette calibration, multi-vendor equipment servicing, equipment relocation, asset & inventory management | Vendor-agnostic service simplifies lab operations | Improves compliance and traceability | Reduces downtime | Supports cost-effective lifecycle management | Ideal for multi-vendor laboratories |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The laboratory equipment services market is supported by a layered ecosystem comprising service providers, end users, and regulators. Leading service providers include Thermo Fisher Scientific, Agilent Technologies, Avantor, and Eppendorf. End users include pharmaceutical & biotech companies, clinical research organizations, research institutions, and diagnostic laboratories. Regulators such as the USFDA, EMA, NMPA, and PMDA play a crucial role. This interconnected ecosystem ensures market continuity, but also drives competitive pressure and pricing challenges at every level.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Laboratory Equipment Services Market, By Service Type

By service type, the installation, repair, breakdown & maintenance segment lead the overall laboratory equipment services market. Whenever a new instrument is installed, or when existing equipment malfunctions or degrades, labs rely on professional service providers for correct installation, configuration, repairs, and ongoing maintenance. These services restore equipment to working order after breakdowns and help prevent failures that could disrupt lab operations. Calibration services ensure that instruments perform within their specified accuracy and precision limits. For analytical, diagnostic, and research labs, especially those working under stringent quality, regulatory, or scientific standards, regular calibration is critical to maintain the validity of measurements, reproducibility of results, and compliance with regulatory norms. Qualification & Validation: covers services such as installation qualification (IQ), operational qualification (OQ), performance qualification (PQ), essentially verifying that equipment is installed correctly, operates as intended, and delivers performance that meets regulatory or internal standards. Preventive Maintenance Services: Rather than waiting for breakdowns, many labs are increasingly adopting scheduled preventive maintenance service routines aimed at minimizing the risk of failure, prolonging equipment life, and ensuring consistent performance. Contract/Managed Services: Under this sub-segment, labs subscribe to ongoing service plans (contracts) that typically bundle maintenance, calibration, repair, and sometimes other support services over a defined period. Training, Education & Certification Services: As laboratory equipment becomes more advanced with automation, software integration, and strict regulatory oversight, there is a growing need for trained personnel who can operate, maintain, calibrate, and validate these instruments properly. Training and certification services help ensure correct usage, compliance with quality standards, and safe operation. Other Services (e.g., Refurbished Equipment Services): This category covers ancillary or less common services such as refurbishment of used equipment (cleaning, part replacement, re-certification), resale support, asset re-deployment, disposal services, or specialized consultancy.

Laboratory Equipment Services Market, By Service Provider

OEM services remain the main focus, accounting for the largest market share. As OEMs design and manufacture equipment, they possess deep technical knowledge, access to original replacement parts, and original software/firmware updates, along with a comprehensive understanding of equipment specifications. This ensures maximum compatibility, reliability, and regulatory compliance, especially for complex and high-value analytical and clinical instruments. For laboratories with complex equipment (such as high-end analytical instruments, diagnostic analyzers, and biopharmaceutical laboratory equipment), OEM services have become the default choice for many institutions because they ensure optimal performance, warranty protection, and risk mitigation. Third-party service providers (independent or non-OEM) also play an important role. These providers offer maintenance, calibration, repair, and support services, often covering tools from multiple manufacturers, and often at a low cost. These tend to be popular in laboratories with disparate equipment portfolios (equipment from different manufacturers), cost-constrained laboratories, or regions where OEM presence is weak or lagging.

Laboratory Equipment Services Market, By Equipment Type

the analytical equipment segment holds the major share and dominates the market; this dominance reflects its widespread use, high complexity and high servicing needs. Analytical equipment includes highly accurate and sophisticated equipment such as spectrometers, chromatographs, mass spectrometers, and advanced imaging equipment used for quantitative and qualitative analysis, diagnostics, research and development, materials testing, and quality control. General equipment refers to more common laboratory equipment such as centrifuges, basic microscopes, balances, pH meters, incubators (depending on classification), and other common laboratory equipment. These instruments form the basis of daily experimental work in laboratories, clinical laboratories, academic institutions, and industrial laboratories. Specialty Equipment are specialized equipment designed for specific niche applications, such as advanced cell culture systems, automated liquid handling workstations, DNA sequencers, flow cytometers, high-end imaging systems, or other specialized devices used in highly specialized research or diagnostics. Support equipment includes laboratory accessory or auxiliary equipment such as incubators, autoclaves, freezers, environmental controls, storage, and in some cases safety equipment, or other infrastructure equipment that supports analytical or general laboratory operations.

Laboratory Equipment Services Market, By Contract Type

Based on contract type, the Gold support plan segment accounts for the largest share of the overall laboratory equipment services market. Gold plans are widely adopted as they offer robust service coverage that meets the needs of most standard laboratories without the premium cost of top-tier plans like Platinum. The Silver Support Plan is a more cost-effective option for laboratories with moderate usage or non-critical equipment. This typically includes scheduled preventive maintenance and sometimes limited on-site support, but may not include unlimited labor and parts coverage. Platinum Support Plans provide on-site repair and maintenance, preventive maintenance visits (typically more frequent), priority and optional 24/7 coverage, parts and labor coverage, software updates, and, in some cases, training or testing services. Customized support plans offer tailored solutions to your lab's specific needs.

REGION

North America is expected to hold a significant market share in global laboratory equipment services market

North America remains the largest and most developed market for laboratory equipment services, supported by strong infrastructure, the expansion of pharmaceutical and biotech research and development. Asia Pacific is the fastest-growing region, driven by increasing investment in research and development by the private and government entities. Europe shows steady adoption of therapies. Meanwhile, Latin America and the Middle East are emerging as high-growth markets, especially Brazil and the Gulf states, where pharmaceutical and biotech research investment is booming.

LABORATORY EQUIPMENT SERVICES MARKET: COMPANY EVALUATION MATRIX

Leaders such as Thermo Fisher Scientific and Agilent Technologies hold significant market shares and continue to drive innovation, with Waters Corporation maintaining dominance through its brand strength and a wide range of services. Challengers such as Eppendorf and Solvd are growing quickly, often using regional strengths to challenge the leader's dominance. Niche innovators like Revance focus on unique services, such as customized plans. This landscape shows a market where innovation, timely service delivery, and pricing strategies will shape long-term leadership roles.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 23.5 Billion |

| Market Forecast in 2031 (value) | USD 54.5 Billion |

| Growth Rate | 15.0% |

| Years Considered | 2024–2031 |

| Base Year | 2025 |

| Forecast Period | 2025–2031 |

| Units Considered | Value (USD Million), Volume (Procedure) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, the Middle East & Africa, and Latin America |

WHAT IS IN IT FOR YOU: LABORATORY EQUIPMENT SERVICES MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Medical Aesthetic Company |

|

|

| Medical Aesthetic Manufacturer |

|

|

RECENT DEVELOPMENTS

- October 2025 : Flagship Lab Services (US) announced the expansion of mobile lab equipment services in San Diego, San Francisco, and Boston. The expansion is built on Flagship's 2023 acquisition of biotechnical services, Inc. As part of this expansion, Flagship launched a new lab equipment services microsite, providing lab managers with an easier way to request calibration, validation, repair, or preventive maintenance from their local teams.

- May 2023 : CBRE (US) offers calibration, maintenance, and repair, primarily for biopharma clients. Announced after the acquisition of Full Spectrum Group, CBRE scaled its Lab Services offering to support clients of varying sizes across multiple industries.

Table of Contents

Methodology

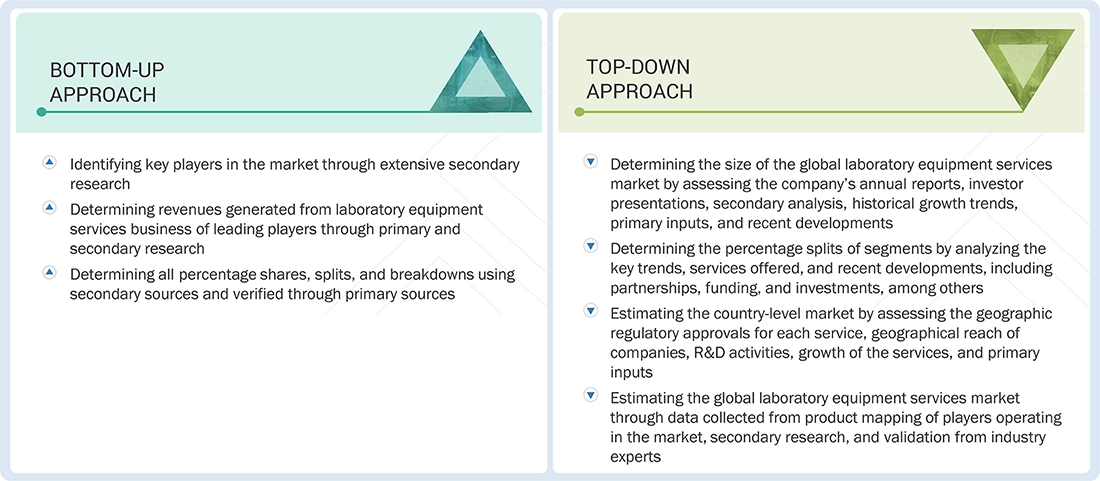

The size of the laboratory equipment services market was determined based on primary studies to ensure precision. Initial data for the market and related niches were collected from 3 to 5 secondary sources. This information was then validated through primary research to confirm assumptions and overall market size. Both top-down and bottom-up methods were used to estimate the total market, which was then broken down into segment and subsegment sizes. Finally, data triangulation was performed to verify the accuracy of the data findings.

Secondary Research

Secondary research sources included directories, Factiva, white papers, Bloomberg Business, annual reports, SEC filings, business filings, and investor presentations. These sources provided valuable insights into market leaders, sector divisions, and technological differences within various segments of the laboratory equipment services industry.

Primary Research

Primary research involved both quantitative and qualitative insights collected through interviews with key stakeholders. On the demand side, participants included researchers, department heads, and staff from diagnostic centers, clinical research organizations, and research institutes. On the supply side, interviews were held with CEOs, area sales managers, territory and regional sales managers, and other top executives from relevant companies. These direct conversations helped verify the secondary research findings and provided an opportunity to directly ask questions and confirm details and assumptions.

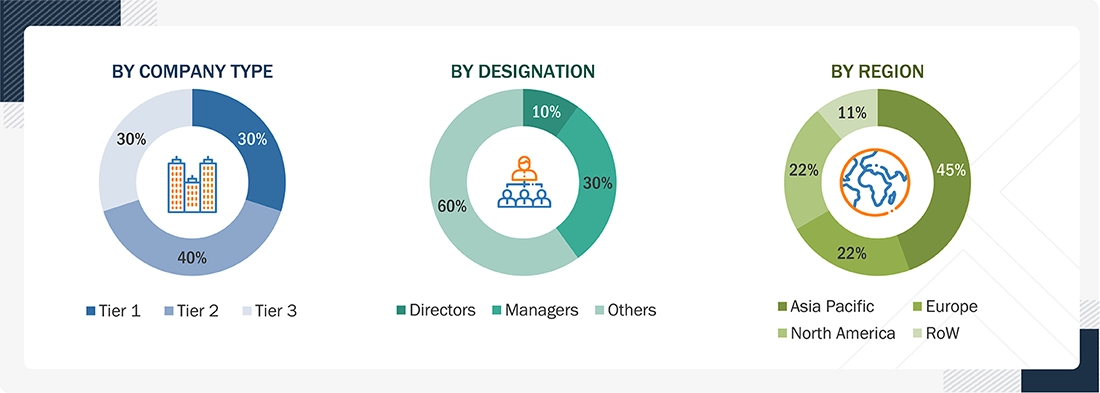

A breakdown of the primary respondents is provided below:

Note 1: Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers

Note 2: Companies are classified into tiers based on their total revenue. As of 2024, Tier 1 = >USD 1 billion, Tier 2 = <USD 500 million, and Tier 3 = <USD 100 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

This report used the revenue share analysis of major companies to assess the size of the global laboratory equipment services market. This analysis involved identifying key market players and calculating their revenue from laboratory equipment services using data collected during both primary and secondary research phases. One part of the secondary research included reviewing the annual and financial reports of leading market companies. In contrast, primary research consisted of detailed interviews with influential thought leaders, including directors, CEOs, and key marketing executives.

To determine the overall market value, the segmental revenue was calculated by mapping the revenue of the leading solution and service providers. The process involved several steps.

- Making a list of leading international companies in the laboratory equipment service industry

- Charting annual profits made by leading companies in the laboratory equipment services sector (or the closest stated business unit/product category)

- 2024 revenue mapping of leading companies to cover a significant portion of the global market

- Calculating the global value of the laboratory equipment services industry

Laboratory Equipment Services Market: Bottom-up and Top-down Approach

Market Definition

Laboratory equipment maintenance services provide the professional support your laboratory equipment needs to operate correctly, safely, and efficiently throughout its lifecycle. Laboratory equipment services are activities related to the installation, calibration, maintenance, repair, testing and management of laboratory equipment used in research, clinical diagnostics, biotechnology, pharmaceutical and industrial testing. These services ensure that your equipment operates accurately, meets regulatory standards, and remains reliable in everyday use. This market includes services provided by OEMs, third-party service providers, and in-house technology teams that strive to reduce equipment downtime, extend equipment life, and support high-quality laboratory operations.

Data Triangulation

To ensure accurate data, the laboratory equipment services market was divided into various segments and subsegments. A data triangulation process that used both top-down and bottom-up approaches was applied. This involved analyzing factors and trends from both the demand and supply sides to validate the findings for each segment. The combination of this segmentation with the triangulation process helps ensure that the market data is both accurate and reliable.

Key Stakeholders

- Service providers of laboratory equipment’s

- Researchers such as clinical research organizations, research institutes, diagnostic laboratories

- Research professionals, including scientists, pathologist

- Regulatory bodies overseeing product standards and safety

Objectives of the Study

- To define, describe, and forecast the laboratory equipment services market based on service type, service provider, equipment type, contract type, and region

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the revenue of the market segments with respect to five regions: North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players and comprehensively analyze their market ranking and core competencies

- To benchmark players within the market using a proprietary Company Evaluation Matrix framework, which analyzes market players on various parameters within the broad categories of business strategy excellence and strength of product portfolio

- To analyze competitive developments such as product launches, agreements, expansions, collaborations, and acquisitions in the CT Simulators market

Customization Options

Using market data, MarketsandMarkets offers customization according to your company's requirements. Here are the available customization options for the global laboratory equipment services market.

Service Analysis

- Service matrix, which gives a detailed comparison of the service portfolios of the top fifteen companies.

Company Information

- Detailed analysis and profiling of additional market players (up to 15)

Geographic Analysis

- Further breakdown of the Rest of European laboratory equipment services market into Russia, Belgium, the Netherlands, Switzerland, Austria, Finland, Sweden, Poland, and Portugal, among others

- Further breakdown of the Rest of Asia Pacific laboratory equipment services market into Singapore, Taiwan, New Zealand, the Philippines, Malaysia, and other Asia Pacific countries

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Laboratory Equipment Services Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Laboratory Equipment Services Market