Laboratory Software Market Size, Growth, Share & Trends Analysis

Laboratory Software Market by Solution (LIMS, ELN, LES, EDC, QMS), Technology (Al), Function (Workflow, Quality, Compliance, Analytics, Reporting) Industry (Pharma, Biotech, NGS, Genomics, Chemical, Petro, Agri, FnB, Oil, Gas) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

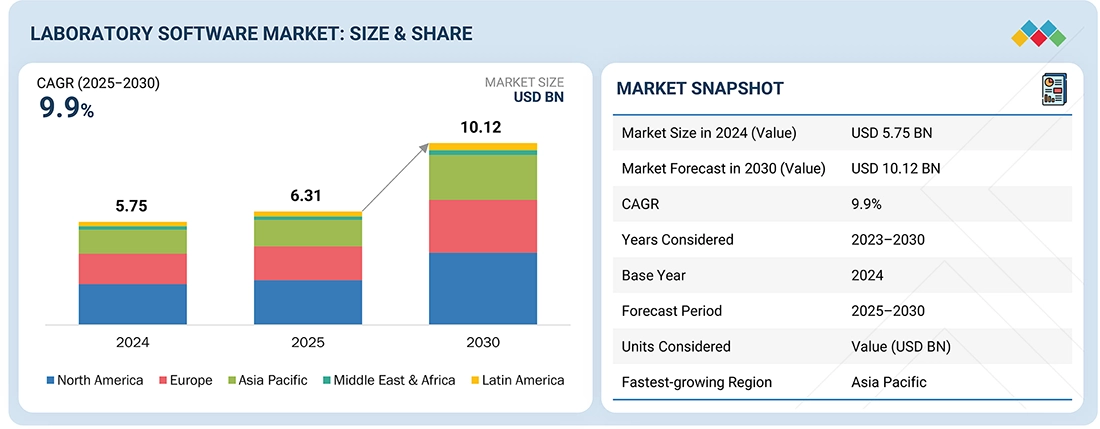

The global laboratory software market is projected to reach USD 10.12 billion by 2030 from USD 6.31 billion in 2025, at a high CAGR of 9.9% during the forecast period. The increasing complexity of data in pharmaceuticals, biotechnology, and diagnostics is driving organizations to adopt advanced tools that enhance efficiency, accuracy, and regulatory compliance.

KEY TAKEAWAYS

-

BY REGIONThe North American laboratory software market dominated, with the largest share of 39% in 2024.

-

BY SOLUTION TYPEBy solution type, the laboratory information management systems segment is projected to grow at the fastest rate of 12.4% from 2025 to 2030.

-

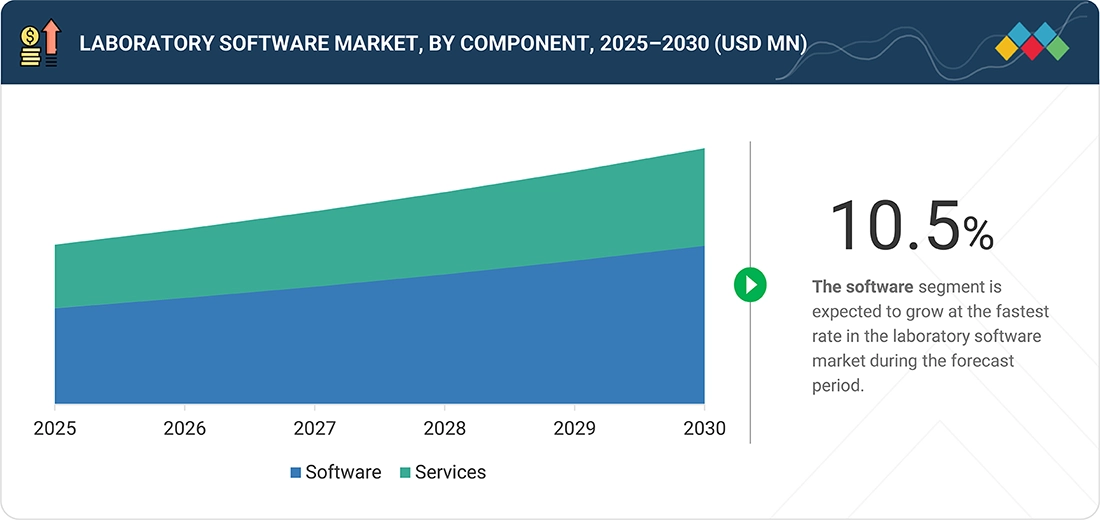

BY COMPONENTBy component, the software segment is expected to register the highest CAGR of 10.5% during the forecast period.

-

BY TECHNOLOGY MATURITYBy technology maturity, the NextGen (AI enabled) lab software holds a significant share in the laboratory software market

-

BY FUNCTIONBy function, the sample & workflow management is growing at a substantial rate during the forecast period.

-

BY INDUSTRYBy industry, life science industries segment is expected to register the highest CAGR during the forecast period.

-

COMPETITIVE LANDSCAPEThermo Fisher Scientific, LabWare, and Waters Corporation were identified as some of the star players in the laboratory software market (global), given their strong market share and product footprint.

The laboratory software market is driven by the rising need for efficient data management, increasing lab automation to boost productivity, and growing regulatory requirements for data integrity and traceability. Additionally, the expansion of R&D activities in pharmaceuticals, biotechnology, and diagnostics, along with the shift toward cloud-based and AI-enabled solutions, is accelerating adoption.

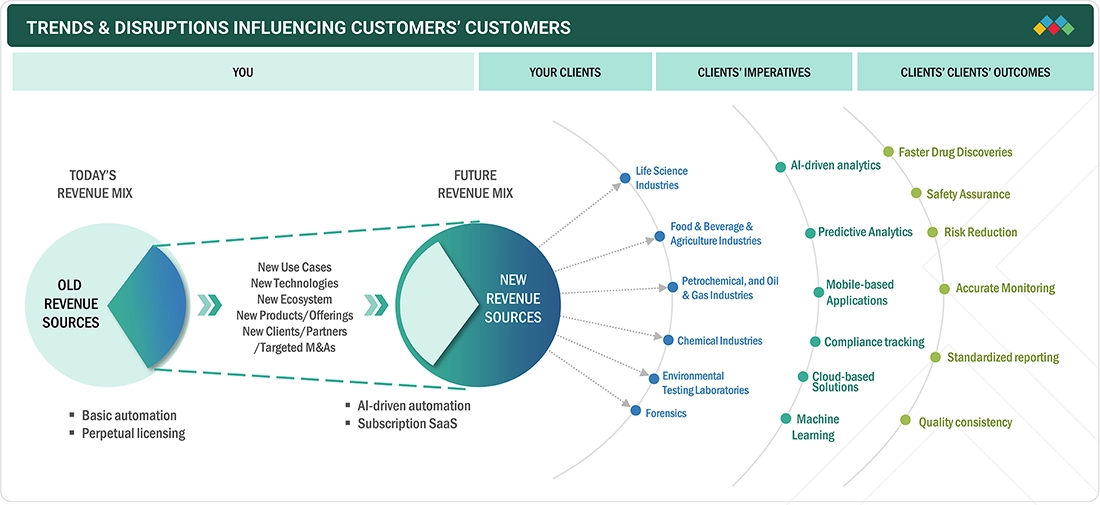

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The laboratory software market is undergoing a significant transformation as laboratories adopt AI, cloud platforms, and automation to manage increasing data demands and enhance efficiency. Increasing regulatory pressure and the need for faster, accurate results are pushing organizations toward integrated digital systems that support predictive insights, compliance, and standardized workflows. These technology-driven shifts are redefining how laboratories operate and compete in a rapidly advancing scientific landscape.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing need for laboratory automation

-

Increasing focus on multiple enterprise and integrated lab informatics solutions

Level

-

High implementation, maintenance, and service costs

-

Lack of integration standards

Level

-

Rising demand for real-time data and analytics

-

Increasing use of lab informatics in cannabis industry

Level

-

Dearth of skilled medical laboratory technicians

-

Limited adoption of lab informatics solutions in SMEs

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing need for laboratory automation

Lab automation reduces human errors associated with repetitive tasks, such as pipetting and plate movement. This, in turn, improves the accuracy of results. According to a study in the Journal of Laboratory Automation, error rates for fully automated operations range from 1% to 5%, and those for semi-automated operations range from 1% to 10%. In comparison, those for manual operations range from 10% to 30%. The proper use of integrated workstations, automated analyzers, and total laboratory automation (TLA) enables the reassignment of skilled laboratory staff to tasks that contribute significantly more value to operations. The exponential increase in data produced by laboratory systems has created a need for efficient data storage, analysis, and sharing methods. Laboratory informatics solutions offer an effective solution to this demand, as these solutions significantly facilitate, advance, and improve the productivity and efficiency of laboratory processes

Restraint: High implementation, maintenance, and service costs

While lab informatics solutions offer numerous benefits in streamlining laboratory workflows and enhancing data management, the costs associated with maintaining and servicing these systems can pose challenges for organizations, particularly smaller laboratories or those with limited budgets. Limited budgets may force organizations to allocate resources to other critical areas, resulting in delayed or limited implementation of lab informatics. As a result, the growth potential of the lab informatics market may be hindered, as a significant portion of potential customers may find it financially unfeasible to invest in expensive maintenance and service contracts. Additionally, organizations carefully evaluate the ROIs before investing in lab informatics. High maintenance and service costs can impact the perceived value and ROIs of these solutions. If the costs outweigh the anticipated benefits, organizations may be reluctant to adopt or expand their use of lab informatics.

Opportunity: Rising demand for real-time data and analytics

The growing demand for real-time data and analytics across various industries such as life sciences, pharmaceuticals, food & beverage, and chemicals presents a significant opportunity for the lab informatics market. As these industries increasingly rely on data-driven decision-making, advanced lab informatics solutions that provide immediate access to accurate and actionable data are paramount. Lab informatics systems, such as LIMS, ELN, and CDS, offer robust data management and analytics capabilities that enable real-time monitoring, analysis, and reporting. This allows organizations to enhance operational efficiency, ensure regulatory compliance, and accelerate research and development processes

Challenge: Dearth of skilled medical laboratory technicians

With the growing shift toward digitization, the adoption of IT solutions has increased significantly in the healthcare industry over the last decade. As a result, the demand for skilled IT professionals and personnel with advanced analytical skills to interpret data from HCIT solutions, including lab informatics, is increasing; however, a significant demand-supply gap persists in the industry. This shortage of trained and skilled personnel may limit the adoption of lab informatics, especially in pharmaceutical, biotechnology, and medical device companies, which account for over 50% of the lab informatics market. Moreover, due to severe time constraints and increasing budget cuts, CROs and pharmaceutical companies are reluctant to invest time and money in training their research employees. Such factors are expected to limit the adoption of lab informatics to a certain extent in the coming year.

lab-informatic-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Cloud-based medical billing and RCM solutions integrating automated claims scrubbing, eligibility verification, coding support, and real-time analytics to improve end-to-end billing efficiency | Enhances claim accuracy, accelerates reimbursement cycles, reduces denials, and supports data-driven financial performance for healthcare providers |

|

AI-enabled billing and revenue cycle tools embedded within EHR platforms to streamline charge capture, automate coding workflows, and improve payer compliance. | Improves billing accuracy, lowers administrative burden, strengthens audit readiness, and optimizes collections for ambulatory care and physician groups |

|

Integrated healthcare ERP and billing platforms that leverage machine learning for automated coding, claims adjudication modeling, payment integrity checks, and denial-prevention analytics | Accelerates billing operations, reduces claim rework, enhances payer–provider transparency, and improves financial forecasting and cash-flow stability |

|

Comprehensive billing, RCM services, and reimbursement support tools that streamline prior authorizations, claims management, and specialty drug billing | Improves reimbursement efficiency for high-cost therapies, reduces administrative delays, enhances compliance, and supports specialty clinics with end-to-end revenue optimization |

|

AI-driven medical billing platform offering automated charge entry, predictive denial management, medical coding assistance, and performance analytics for multi-specialty practices. | Shortens billing cycles, increases clean-claim rates, reduces operational costs, and enhances overall practice financial health through intelligent RCM automation |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

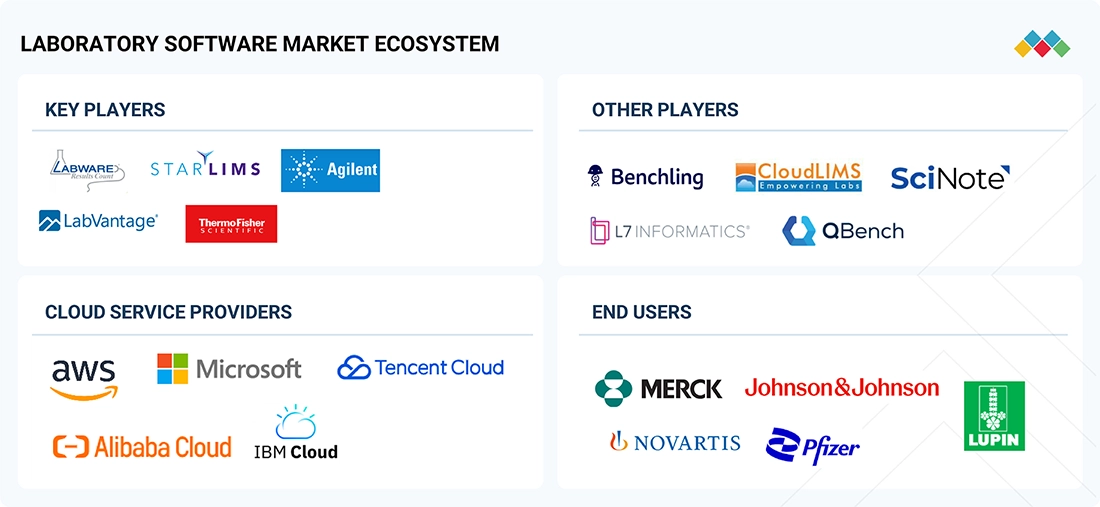

MARKET ECOSYSTEM

The laboratory software market ecosystem comprises key players (Agilent Technologies, Waters Corporation, LabLynx, Dassault Systèmes) providing an integrated platform for laboratory software solutions, including LIMS, LES, ELN, and others; other players (Benchling, CloudLIMS, SciNote) offering specialized niche solutions; cloud service providers (AWS, Microsoft Azure, IBM Cloud) delivering secure; and end users (Johnson & Johnson, F. Hoffmann-La Roche AG, Merck & Co., Inc.) implementing laboratory software solutions.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Laboratory Software Market, By Solution Type

In 2024, laboratory information management systems hold the largest share of the laboratory software market due to their central role in managing high volumes of data, ensuring workflow automation, and maintaining regulatory compliance across various lab environments. Their ability to integrate with instruments, streamline sample lifecycle management, and support multi-site operations makes them the primary choice for pharma, biotech, diagnostics, and environmental testing laboratories. As labs increasingly adopt digital solutions to improve efficiency and traceability, LIMS remains the dominant core platform within the broader lab informatics ecosystem.

Laboratory Software Market, By Function

In 2024, quality and compliance control hold a significant share of the laboratory software market as regulated industries, particularly pharmaceuticals, biotechnology, and healthcare, must consistently meet stringent standards for data integrity, traceability, and audit readiness. These software solutions ensure adherence to GxP, ISO, FDA 21 CFR Part 11, and other regulatory requirements by enabling secure data capture, automated audit trails, electronic signatures, deviation tracking, and standardized documentation. As laboratories face increasing scrutiny from regulatory bodies and heightened expectations for product safety and reliability, quality and compliance control software becomes essential for maintaining operational credibility and reducing compliance risks, thereby driving its strong adoption across the market.

Laboratory Software Market, By Component

In 2024, the software segment holds the largest share of the laboratory software market as laboratories rely heavily on advanced digital platforms to manage scientific data and streamline operations. These systems serve as the central hub for coordinating workflows, maintaining secure data records, and enabling connectivity across analytical instruments and enterprise systems. With continuous advancements in cloud infrastructure, automation capabilities, and intelligent data handling features, labs are increasingly prioritizing software adoption to improve turnaround times, enhance reproducibility, and support remote or multi-location research environments. This growing dependence on sophisticated digital tools firmly positions software as the primary revenue driver within the market.

Laboratory Software Market, By Technology Maturity

In 2024, NextGen (AI enabled) lab software holds a significant share in the market as laboratories increasingly adopt intelligent digital solutions that enhance decision-making, automate complex workflows, and improve data quality. By integrating machine learning, predictive analytics, and real-time monitoring, these platforms help identify anomalies earlier, optimize resource utilization, and accelerate research outcomes. As labs move toward fully connected and autonomous environments, AI-driven solutions are becoming essential for handling high-volume data, supporting compliance, and driving faster, more accurate scientific insights fueling strong demand and rapid adoption across the industry...

Laboratory Software Market, By Industry

In 2024, the life science industries segment holds the largest share of the laboratory software market, driven by substantial R&D activities in pharmaceuticals, biotechnology, and drug discovery. These sectors generate large volumes of complex data and operate under strict regulatory frameworks, making advanced informatics tools essential for efficient workflow management, data integrity, and compliance. With ongoing innovations in genomics, personalized medicine, and biologics, life science companies continue to expand their reliance on LIMS and related software to accelerate research productivity and maintain high-quality standards.

REGION

Asia Pacific to be fastest-growing region in laboratory software market during forecast period

The Asia Pacific is the fastest-growing region in the laboratory software market, driven by the expansion of the pharmaceutical and biotechnology industries, increasing investments in healthcare infrastructure, and the growing adoption of automation across research and clinical laboratories. Rising regulatory standards, government initiatives supporting digital transformation, and the presence of emerging CRO and CDMO hubs are further accelerating demand for advanced lab informatics solutions. As organizations in the region continue to modernize their laboratory environments, the adoption of LIMS and related software is expected to rise rapidly over the coming years.

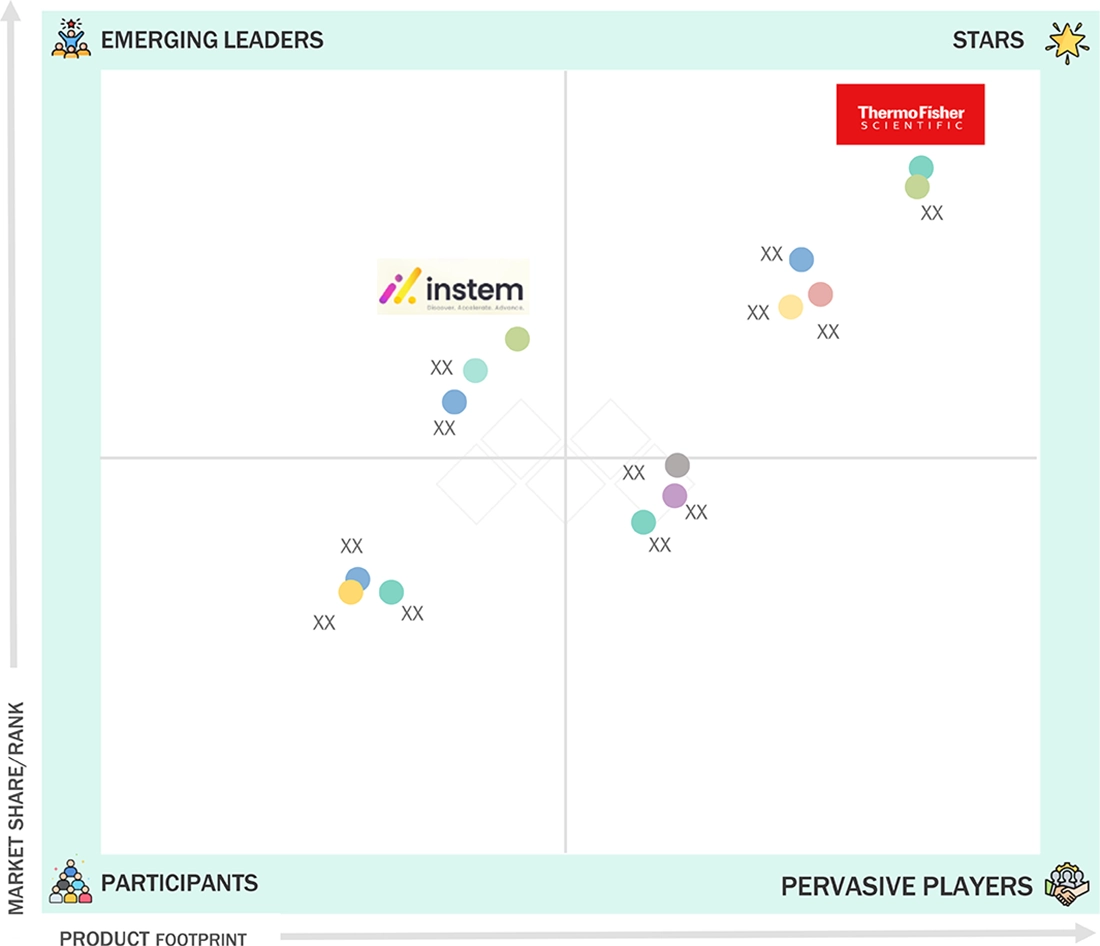

lab-informatic-market: COMPANY EVALUATION MATRIX

In the laboratory software market matrix, Thermo Fisher Scientific (Star) leads with a dominant market position, due extensive portfolio of LIMS, laboratory informatics, and automation solutions that cater to a wide range of industries including pharmaceuticals, biotechnology, and diagnostics. The company’s deep clinical expertise, global presence, and focus on predictive, strengthen its leadership in this market. Instem (Emerging Leader) is rapidly gaining traction through its Matrix Gemini LIMS platform.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Thermo Fisher Scientific Inc. (US)

- LabVantage Solutions Inc. (US)

- LabWare (US)

- STARLIMS Corporation (US)

- Agilent Technologies (US)

- Waters Corporation (US)

- LabLynx LIMS (US)

- Dassault Systèmes (France)

- Revvity (Perkinelmer) (US)

- Confience (US)

- Labworks (US)

- IDBS (UK)

- Instem (UK)

- Novatek International (Canada)

- Agaram Technologies Pvt Ltd (India)

- Siemens (Germany)

- Caliber Technologies (US)

- Clinsys (US)

- Labtrack (US)

- Labkey (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 5.75 BN |

| Market Forecast in 2030 (value) | USD 10.12 BN |

| Growth Rate | CAGR of 9.9% from 2025-2030 |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

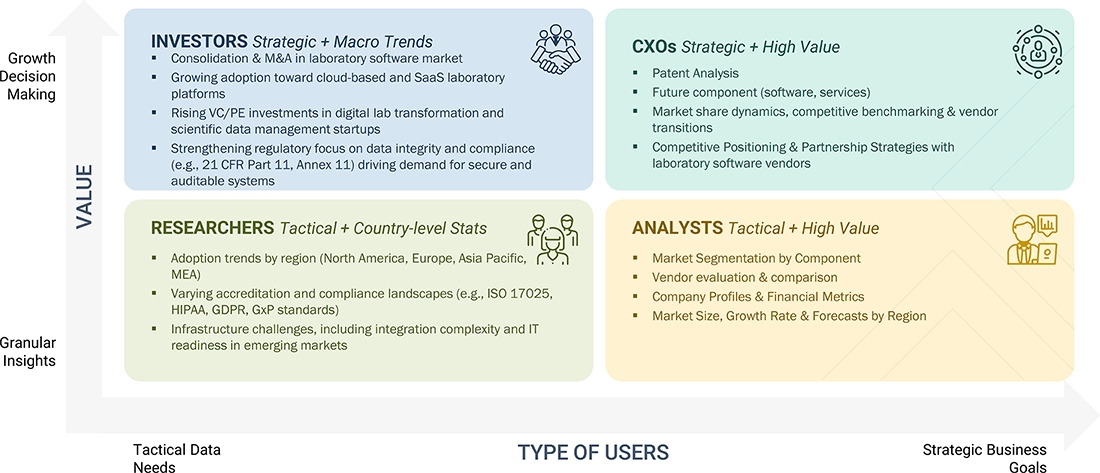

WHAT IS IN IT FOR YOU: lab-informatic-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Local Competitive Landscape | Profiles of key laboratory software (e.g., Thermo Fisher, LabWare, LabVantage) covering product capabilities, deployment models (cloud / on-premise), pricing approaches, integration with lab instruments, and AI-driven automation features. | Enables competitive benchmarking, identifies functional and compliance gaps, and supports vendor selection, partnership evaluation, and market positioning strategies. |

| Regional Market Entry Strategy | Assessment of regional standards and regulations (e.g., FDA 21 CFR Part 11, EU Annex 11), digital-health infrastructure maturity, lab workflow digitization levels, and procurement pathways across pharma, biotech, healthcare, and environmental labs. | Reduces barriers to market entry, accelerates time-to-market, ensures readiness for local regulatory and compliance requirements, and supports successful rollout with labs and research institutions. |

| Local Risk & Opportunity Assessment | Identification of data privacy requirements, cybersecurity maturity in labs, instrument-connectivity challenges, cloud adoption readiness, and opportunities in high-growth R&D areas such as genomics and biologics. | Supports proactive risk mitigation, strengthens compliance strategy, and highlights emerging opportunities across automation, analytics, and specialized lab segments. |

| Technology Adoption by Region | Mapping of LIMS, ELN, and lab automation adoption across North America, Europe, and the Asia Pacific; analysis of migration to cloud LIMS, AI-enabled quality assurance, interoperability with CDS/ERP systems, and drivers like increased R&D spending and testing volume. | Guides regional product development focus and go-to-market strategy for scalable, integration-ready solutions aligned with digital transformation priorities in laboratories. |

RECENT DEVELOPMENTS

- Mach 2025 : LabVantage partnered with Lasec to expand its offering of end-to-end laboratory solutions across Southern Africa and Africa more broadly, helping labs digitally transform, improve operations, and enhance compliance.

- October 2025 : LaWare partnered with the Association of Public Health Laboratories to implement LabWare’s LIMS across several public health laboratories, aiming to build a resilient and self-sustaining diagnostic network.

- June 2024 : Thermo Fisher will distribute Labguru’s Electronic Lab Notebook (ELN) module alongside its own LIMS and lab operations software, enabling customers to streamline research workflows, enhance data traceability, and improve collaboration.

Table of Contents

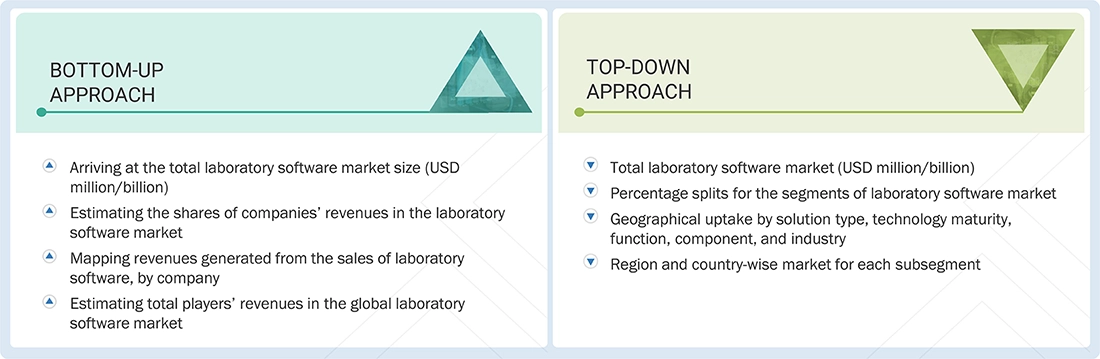

Methodology

The study involved several key activities to estimate the current size of the laboratory software market. Extensive secondary research was conducted to gather information on this market. The next step was to validate the findings, assumptions, and size estimates by consulting industry experts throughout the value chain through primary research. Various methods, including top-down and bottom-up approaches, were employed to estimate the overall market size. Following this, market segmentation and data triangulation techniques were utilized to determine the size of specific segments and subsegments within the laboratory software market.

Secondary Research

This research study involved the wide use of secondary sources, directories, databases such as Dun & Bradstreet, Bloomberg Businessweek, and Factiva; white papers, annual reports, and companies’ house documents, investor presentations; and the SEC filings of companies. Secondary research was employed to identify and collect information relevant to an in-depth, technical, market-oriented, and commercial study of the laboratory informatics market. It was also used to obtain important information about key players and market classification & segmentation, according to industry trends, down to the most detailed level, as well as key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

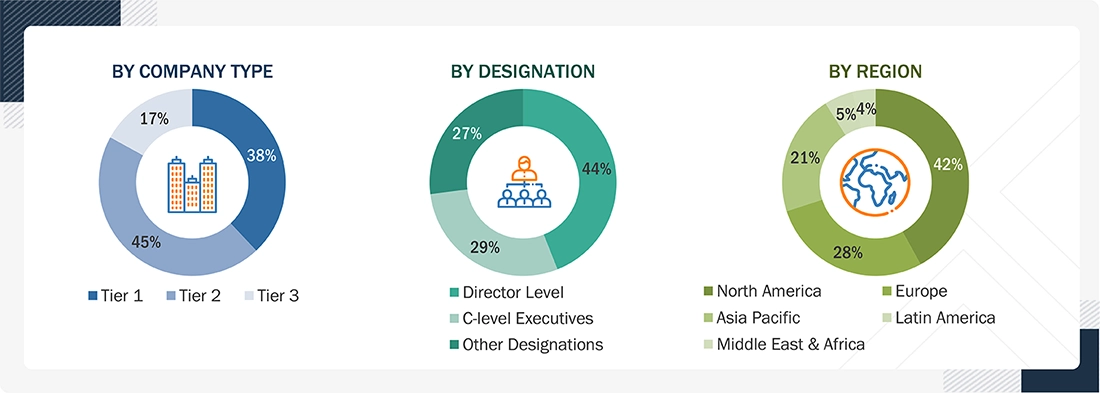

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources are mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess prospects. Primary research was conducted to identify segmentation types, industry trends, key players, and key market dynamics, including drivers, restraints, opportunities, challenges, and strategies adopted by key players.

Note: Other designations include sales managers, marketing managers, and product managers.

Note: Tiers are defined based on a company’s total revenue, as of 2024: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (revenue share analysis of leading players) and the top-down approach (assessment of utilization/adoption/penetration trends, by solution type, component, technology maturity, function, industry, and region).

Laboratory Software Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size, using the market size estimation processes, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the Laboratory Software Market.

Market Definition

Laboratory software refers to solutions designed specifically to support laboratory operations, including the management of scientific data, laboratory workflows, instruments, compliance, and documentation. It encompasses data acquisition, laboratory automation, instrument interfacing, laboratory networking, data processing, specialized data management systems, laboratory information management systems, scientific data management systems (including data mining and data warehousing), and knowledge management (including the use of electronic laboratory notebooks), among other areas.

Key Stakeholders

- Laboratory Software Providers

- Platform Providers

- Technology Providers

- System Integrators

- Healthcare IT Service Providers

- Pharmaceutical & Biotechnology Companies

- Research and Consulting Firms

- Process Industries

- Forums, Alliances, and Associations

- Distributors

- Venture Capitalists

- Government Organizations

- Academic Research Institutes

- Institutional Investors and Investment Banks

- Investors/Shareholders

- Consulting Companies

- Raw Material and Component Manufacturers

Report Objectives

- To define, describe, and forecast the global laboratory software market based on solution type, component, function, technology maturity, industry, and region

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of

- To analyze the competitive landscape for market leaders

- To forecast the size of the market segments with respect to five main regions, namely, North America, Europe, Asia, Latin America, and the Middle East & Africa

- To profile key market players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments such as acquisitions, product launches and upgrades, expansions, agreements, partnerships, and R&D activities in the Laboratory Software market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs.

The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the Rest of Europe Laboratory Software Market into Denmark, Norway, and others

- Further breakdown of the Rest of Asian Laboratory Software Market into Vietnam, New Zealand, and others

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Laboratory Software Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Laboratory Software Market

Freddie

Jun, 2022

Which are the major growth influencing factors for the Laboratory Informatics Market?.

William

Jun, 2022

Which are the major growth boosting factors for the North American region in the Laboratory Informatics Market?.

Archie

Jun, 2022

By type of solutions, which of the segment will hold the major share of the Laboratory Informatics Market?.