Laboratory Information System (LIS) Market by Product (Standalone, Integrated), Component (Services, Software), Delivery Mode (On-premise & Cloud-based), End User (Hospital Laboratories, Independent Laboratories, POLs) and Region - Global Forecast to 2028

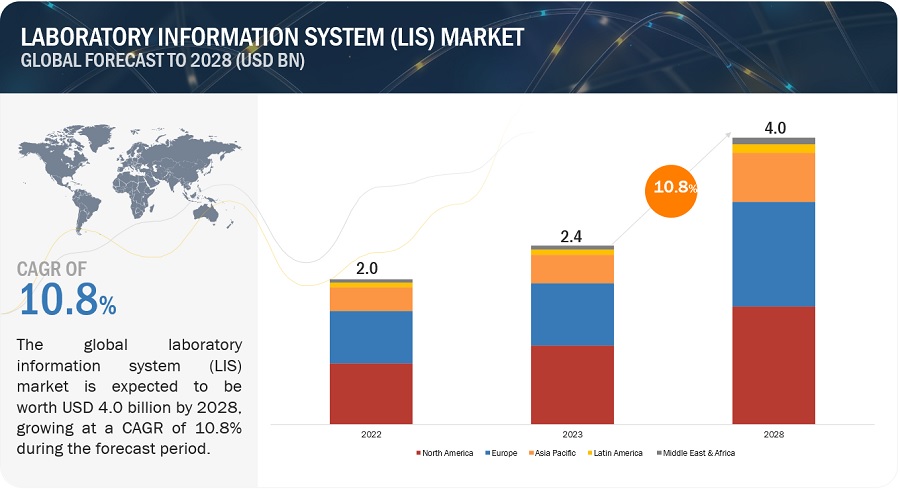

The global laboratory information system market, valued at US$2.0 billion in 2022, stood at US$2.4 billion in 2023 and is projected to advance at a resilient CAGR of 10.8% from 2023 to 2028, culminating in a forecasted valuation of US$4.0 billion by the end of the period. The expansion of molecular diagnostic techniques, including genomics and personalized medicine, and the need for automation and robotics in laboratories primarily drive the market growth. LIS helps in automating various laboratory processes, such as sample tracking, result management, and data analysis, leading to improved productivity and accuracy. Additionally, the growing need for integrated healthcare systems and the rising adoption of electronic health records (EHRs) are also driving the demand for LIS. Advancements in laboratory practices, including point-of-care testing, remote monitoring, and telemedicine, necessitate adaptable LIS solutions that can support these emerging trends and ensure secure and timely data transmission.

Attractive Opportunities in the Laboratory Information System (LIS) Market

To know about the assumptions considered for the study, Request for Free Sample Report

Laboratory Information System Market Dynamics

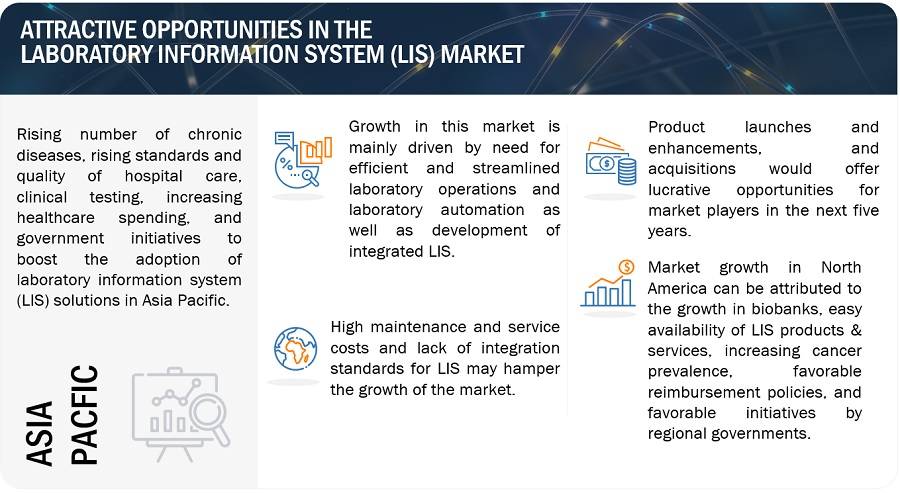

Driver: Development of integrated LIS

The demand for advanced data management solutions is on the rise with the ever-changing requirements of laboratories. As standalone LIS does not meet all laboratory requirements, modern and agile information systems are increasingly being adopted to run laboratories efficiently. This is particularly evident in the increasing integration of LIS with EHR. LIS within EHR is beneficial in financial and operational capabilities, expected to increase its adoption among healthcare providers. Integrated LIS solutions help ease lab workflow, provide standardized and quality diagnosis, enable simplified solution deployment, and help in reducing the cost associated with installing new and independent LIS systems. Moreover, integrated systems reduce the separate maintenance and service cost incurred on LIS systems.

Integrated solutions greatly assist in compliance with regulatory requirements in the life sciences industry. These solutions provide laboratory and enterprise information at a single point of access and eliminate the gaps in communication between enterprises and stakeholders. Other benefits include better laboratory workflows, reduction of the maintenance cost, easy retrieval of laboratory data, accelerated validation process, quality assurance of products, and regulatory compliance.

Restraint: Lack of integration standards for LIS

Although laboratory information systems have been around for several years, there still are numerous issues related to their integration and implementation. Various attempts are being made by associations such as SiLA (Standardization in Lab Automation) and the IQ Consortium (International Consortium for Innovation and Quality in Pharmaceutical Development) to introduce new interfaces and data management standards to facilitate the integration of these systems. However, as of now, the lack of integration standards is a major concern in the laboratory arena, and there is very little evidence of a universal solution emerging. This acts as a major barrier to the greater adoption of LIS among prospective end users. Currently, with no unified strategy, laboratories are largely continuing to follow conventional procedures, regardless of their efficiency.

Opportunity: Rising demand for personalized medicine

Personalized medicine involves using the uniqueness of each patient’s pathology and physiology to tailor treatment and prevention procedures for gaining optimal results. The need for personalized medicine is on the rise owing to the growth in the aging population and the increasing incidence of chronic diseases such as cancer. For these disease conditions, personalized medicine offers opportunities to provide targeted therapies to destroy tumor cells with less impact on other healthy cells. In personalized medicine, pathology data is required to prescribe the best possible therapy. LIS solutions can be beneficial in this regard as these solutions offer advanced functions, such as digital pathology and companion algorithms, for specimen slide diagnosis to help detect cancer cells and thus enable early diagnosis.

Personalized medicine is gaining importance across the globe and has attracted significant support. The Marcus Program in Precision Medicine Innovation (MPPMI) aims to foster innovation in precision medicine by fostering creative, high-risk, high-impact team science projects supporting the precision medicine continuum. Thus, the growth in demand and rising support for personalized medicine are expected to offer significant growth opportunities to players operating in the LIS market.

Challenge: Requirement of specialized LIS solutions

Most medium and large clinical diagnostic laboratories comprise specialized laboratory units for chemistry, microbiology, and hematology. These laboratories have unique workflow needs and hence require unique LIS solutions to meet these requirements. Furthermore, some laboratories require customizable non-clinical functionalities such as client connectivity and billing. Coming up with solutions that cater to the unique requirements of these specialized laboratory units is a major challenge for LIS vendors.

Laboratory Information System (LIS) Market Ecosystem

The ecosystem of the LIS market comprises data center providers, cloud professional service vendors, software developers, medical institutions, healthcare providers, blood banks, nursing homes, and independent laboratories. Laboratory information system vendors offer different modules and provide access to trained professionals and industry experts at a lower cost. These vendors have large-scale technical teams to develop and support the needs of their customers. These vendors leverage advanced technologies to deliver greater efficiency and offer services to end users to maximize laboratory efficiency and productivity. Product launches and enhancements, and acquisitions are the major strategies these vendors use to provide end-to-end solutions in the laboratory information system (LIS) market.

Based on the component, the software segment of laboratory information system industry is expected to register the highest CAGR during the forecast period.

The software segment of laboratory information system market is anticipated to register the highest CAGR during the forecast period. This is primarily owing to the increasing demand for user-friendly, comprehensive, and integrated LIS software. A typical LIS software performs operations such as registration of test requests; production of specimen collection sheets and identification labels; confirmation of specimen collection; production of aliquot labels; workload inquiry; production of worksheets; manual as well as automated entry of test results; results inquiry; and generation of preliminary reports, final reports, statistical reports, and daily activities reports, and billing.

Based on delivery mode, the on-premise segment is anticipated to dominate the laboratory information system industry in 2023.

Based on deployment, the laboratory information system market is segmented into on-premise LIS and cloud-based LIS. The on-premises segment is expected to dominate the laboratory information system (LIS) market from 2023 to 2028 due to security concerns among users and higher control over the system. On-premise models offer multivendor architecture, which lowers the risk of data breaches and external attacks. Buyers mainly opt for these delivery models due to the security benefits associated with them. The on-premises segment is expected to dominate the healthcare data monetization market from 2023 to 2028 due to security concerns among users and higher control over the system. On-premise LIS solutions offer benefits such as increased control and security over sensitive data, compliance with regulatory requirements, faster data processing, and the ability to customize and tailor the solution to specific laboratory needs,

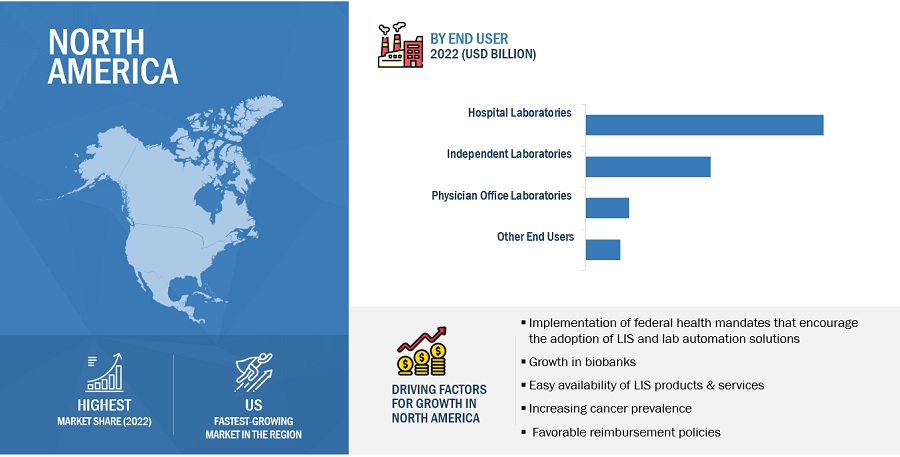

Hospital laboratories are expected to acquire the largest size of laboratory information system industry market by end-user.

Based on the end user, the laboratory information system market is broadly segmented into hospital laboratories, independent laboratories, physician office laboratories (POLs), and other end users (blood banks, retail clinics, public health labs, and nursing homes). The hospital laboratories segment is expected to dominate the market during the forecast period. The use of LIS in hospitals and hospital laboratories can significantly reduce waiting times for patients and improve the quality of diagnostics. Moreover, LIS can facilitate long-distance discussions with experts and make digital slide images of specimens (such as blood smears or frozen sections) available online. Owing to these benefits, hospitals across the world are increasingly adopting LIS.

To know about the assumptions considered for the study, download the pdf brochure

North America is expected to account for the largest share in the laboratory information system industry in 2023

The global laboratory information system market has been segmented based on region: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2023, North America is expected to account for the largest market share, followed by Europe. The large share of North America in the global laboratory information system (LIS) market can be attributed to the growth in biobanks, easy availability of LIS products & services, increasing cancer prevalence, favorable reimbursement policies, and favorable initiatives by regional governments. Moreover, most of the leading players in the laboratory information system (LIS) market have their headquarters in North America.

The laboratory information system market is dominated by a few globally established players such as

- Orchard Software Corporation (US)

- Clinisys (US)

- Oracle Corporation (US)

- Computer Programs and Systems, Inc. (US)

- CompuGroup Medical (Germany)

Scope of the Laboratory Information System Industry

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$2.4 billion |

|

Projected Revenue by 2028 |

$4.0 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 10.8% |

|

Market Driver |

Development of integrated LIS |

|

Market Opportunity |

Rising demand for personalized medicine |

This research report categorizes the global laboratory information system market to forecast revenue and analyze trends in each of the following submarkets:

By Product

- Standalone LIS

- Integrated LIS

By Component

- Software

- Services

By Delivery Mode

- On-premise LIS

- Cloud-based LIS

By End User

- Hospital Laboratories

- Independent Laboratories

- Physician Office Laboratories

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Australia & New Zealand

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

Recent Developments of Laboratory Information System Industry

- In May 2023, Clinisys acquired Promium, a provider of laboratory information management systems for environmental and analytical testing laboratories. This acquisition strengthens Clinisys' position in public health and toxicology diagnostics and supports its global expansion.

- In January 2023, Orchard Software Corporation announced the release of its new Enterprise Toxicology solution, which aimed to enhance patient care in toxicology laboratories by providing information system tools. The solution offers features such as an integrated workflow engine, plate mapping tools for patient safety, medication consistency interpretation, and customizable report formats.

- In November 2022, Oracle Cerner and LabCorp formed a new collaboration to streamline lab operations for a leading nonprofit Catholic health system. Labcorp would manage hospital-based laboratories in 10 states using Cerner's laboratory information system (LIS), aiming to enhance patient care and improve lab efficiency.

- In November 2022, CompuGroup Medical (CGM) announced two add-on acquisitions in the areas of data solutions and US laboratory information systems. The acquisition of Medicus LIS strengthens CGM's position as a software leader in the independent US laboratory segment, while the acquisition of GHG business operations complements CGM's portfolio of data-based solutions for the healthcare sector.

- In August 2022, Sparta Community Hospital, a critical access hospital in Sparta, Illinois, provided healthcare services to previously underserved areas through their Mobile Health Clinic. The hospital partnered with the Grand American World Trapshooting Championships to offer healthcare services. They leveraged the Evident EHR solution offered by Computer Programs and Systems, Inc. to provide primary care during the event. Sparta Community Hospital runs the full Evident EHR in its inpatient and clinic care settings.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global laboratory information system market?

The global laboratory information system market boasts a total revenue value of $4.0 billion by 2028.

What is the estimated growth rate (CAGR) of the global laboratory information system market?

The global laboratory information system market has an estimated compound annual growth rate (CAGR) of 10.8% and a revenue size in the region of $2.4 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Need for laboratory automation- Development of integrated LIS- Rising prevalence of chronic diseases- Growing demand for LIS in biobanks/biorepositories- Need to comply with regulatory requirements- Increasing adoption of LIS to enhance lab efficiencyRESTRAINTS- High maintenance and service costs- Lack of integration standards for LISOPPORTUNITIES- Growing popularity of cloud-based LIS- Growth potential of emerging countries- Rising demand for personalized medicineCHALLENGES- Interfacing with diverse laboratory instruments- Requirement of specialized LIS solutions- Data storage challenges- Dearth of trained laboratory professionals

- 6.1 INTRODUCTION

-

6.2 OVERVIEW OF KEY INDUSTRY TRENDSSHIFT TO VALUE-BASED AND PATIENT-CENTRIC CAREMOBILE APPLICATIONS AND POINT-OF-CARE TESTINGADVANCED ANALYTICS AND ARTIFICIAL INTELLIGENCE (AI)

- 6.3 PORTER’S FIVE FORCES ANALYSIS

- 6.4 PRICING ANALYSIS

-

6.5 TECHNOLOGY ANALYSISMACHINE LEARNINGARTIFICIAL INTELLIGENCEINTERNET OF THINGSBLOCKCHAINCLOUD COMPUTING

-

6.6 REGULATORY ANALYSISNORTH AMERICAEUROPEASIA PACIFICMIDDLE EAST & AFRICALATIN AMERICA

-

6.7 ECOSYSTEM ANALYSIS

- 6.8 VALUE CHAIN ANALYSIS

-

6.9 CASE STUDY ANALYSISCASE STUDY 1CASE STUDY 2CASE STUDY 3

-

6.10 PATENT ANALYSIS

- 6.11 KEY CONFERENCES & EVENTS (Q1 2023–Q2 2024)

-

6.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

6.13 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 7.1 INTRODUCTION

-

7.2 STANDALONE LISENHANCED DATA SECURITY AND USER-FRIENDLY NATURE OF STANDALONE LIS TO SUPPORT ADOPTION

-

7.3 INTEGRATED LISINCREASING END-USER PREFERENCE FOR SINGLE SOLUTIONS WITH MULTIPLE MODULES TO BOOST DEMAND

- 8.1 INTRODUCTION

-

8.2 SERVICESHEAVY DEPENDENCY OF END USERS ON SERVICE PROVIDERS TO DRIVE GROWTH

-

8.3 SOFTWARESOFTWARE SEGMENT TO WITNESS HIGHER GROWTH DURING FORECAST PERIOD

- 9.1 INTRODUCTION

-

9.2 ON-PREMISE LISABILITY TO USE CUSTOMIZED SOLUTIONS TO DRIVE DEMAND FOR ON-PREMISE DELIVERY

-

9.3 CLOUD-BASED LISCLOUD-BASED LIS SEGMENT TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

- 10.1 INTRODUCTION

-

10.2 HOSPITAL LABORATORIESAFFORDABILITY AND AVAILABILITY OF INTEGRATED LIS SOLUTIONS TO DRIVE DEMAND

-

10.3 INDEPENDENT LABORATORIESGROWING NEED TO MANAGE WORKFLOWS AND ENHANCE BILLING PROCESSES TO DRIVE ADOPTION

-

10.4 PHYSICIAN OFFICE LABORATORIESABILITY TO ASSIST PHYSICIANS IN LABORATORY AND CLINICAL FUNCTIONS TO BOOST MARKET

- 10.5 OTHER END USERS

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- Favorable regulatory and reimbursement scenario to drive use of LISCANADA- Rising awareness of lab automation to drive market growth

-

11.3 EUROPEEUROPE: RECESSION IMPACTGERMANY- Germany to dominate LIS market in EuropeUK- Government initiatives to propel adoption of LISFRANCE- Strong focus on adoption of advanced technologies to favor market growthITALY- Need to automate workflows and effectively manage samples to boost market growthSPAIN- Growing focus on improving laboratory workflows to support adoption of LISREST OF EUROPE

-

11.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTCHINA- High prevalence of chronic diseases to drive implementation of LISJAPAN- Growing geriatric population to increase market demandINDIA- Rapid growth in healthcare industry to drive demand for laboratory information systemsAUSTRALIA & NEW ZEALAND- Increasing investments in research to provide opportunities for growthREST OF ASIA PACIFIC

-

11.5 LATIN AMERICARISING AWARENESS OF HCIT SOLUTIONS TO SUPPORT MARKET GROWTHLATIN AMERICA: RECESSION IMPACT

-

11.6 MIDDLE EAST & AFRICAIMPROVING HEALTHCARE INFRASTRUCTURE AND FOCUS ON SAFETY MEASURES TO BOOST GROWTHMIDDLE EAST & AFRICA: RECESSION IMPACT

- 12.1 OVERVIEW

- 12.2 STRATEGIES ADOPTED BY KEY MARKET PLAYERS

- 12.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS, 2022

- 12.4 MARKET SHARE ANALYSIS

-

12.5 COMPANY EVALUATION QUADRANT FOR KEY PLAYERSSTARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

-

12.6 COMPANY EVALUATION QUADRANT FOR START-UPS/SMESPROGRESSIVE COMPANIESDYNAMIC COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKSLABORATORY INFORMATION SYSTEMS MARKET: COMPETITIVE BENCHMARKING

- 12.7 LABORATORY INFORMATION SYSTEMS MARKET: COMPANY FOOTPRINT

-

12.8 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHES & ENHANCEMENTSDEALSOTHER DEVELOPMENTS

-

13.1 KEY PLAYERSORCHARD SOFTWARE CORPORATION- Business overview- Products & services offered- Recent developments- MnM viewCLINISYS- Business overview- Products & services offered- Recent developments- MnM viewORACLE CORPORATION- Business overview- Products & services offered- Recent developments- MnM viewCOMPUTER PROGRAMS AND SYSTEMS, INC.- Business overview- Products & services offered- Recent developments- MnM viewCOMPUGROUP MEDICAL- Business overview- Products & services offered- Recent developments- MnM viewSOFT COMPUTER CONSULTANTS, INC. (SCC SOFT COMPUTER)- Business overview- Products & services offered- Recent developmentsAMERICAN SOFT SOLUTIONS CORP.- Business overview- Products & services offeredEPIC SYSTEMS CORPORATION- Business overview- Products & services offered- Recent developmentsALTERA DIGITAL HEALTH- Business overview- Products & services offeredASPYRA- Business overview- Products & services offeredCOMP PRO MED INC.- Business overview- Products & services offeredCOMPUTER SERVICE & SUPPORT, INC.- Business overview- Products & services offeredCLINICAL SOFTWARE SOLUTIONS- Business overview- Products & services offeredGPI S.P.A.- Business overview- Products & services offeredLIGOLAB INFORMATION SYSTEM- Business overview- Products & services offered- Recent developmentsLABWARE- Business overview- Products & services offered- Recent developmentsLABVANTAGE SOLUTIONS, INC.- Business overview- Products & Services offered- Recent developmentsXIFIN, INC.- Business overview- Products & services offered- Recent developmentsSEACOAST LABORATORY DATA SYSTEMS- Business overview- Products & services offeredVERADIGM LLC- Business overview- Products & services offered- Recent developments

-

13.2 OTHER PLAYERSWEBPATHLABAPEX HEALTHWARETECHNIDATAPATHAGILITYHEX LABORATORY SYSTEMSCLINSISALPHASOFTDENDI, INC.

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 ASSUMPTIONS FOR RESEARCH STUDY

- TABLE 4 LIMITATIONS AND ASSOCIATED RISKS

- TABLE 5 VENDORS OFFERING ABILITY TO USE ARTIFICIAL INTELLIGENCE WITH LIS

- TABLE 6 LABORATORY INFORMATION SYSTEMS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 7 LABORATORY INFORMATION SYSTEMS MARKET: AVERAGE PRICING

- TABLE 8 LABORATORY INFORMATION SYSTEMS MARKET: PRICING ANALYSIS, BY COMPANY TIER

- TABLE 9 ROLE OF MARKET PLAYERS IN LABORATORY INFORMATION SYSTEMS ECOSYSTEM

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- TABLE 11 KEY BUYING CRITERIA, BY END USER (%)

- TABLE 12 LABORATORY INFORMATION SYSTEMS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 13 STANDALONE LABORATORY INFORMATION SYSTEMS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 14 NORTH AMERICA: STANDALONE LABORATORY INFORMATION SYSTEMS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 15 EUROPE: STANDALONE LABORATORY INFORMATION SYSTEMS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 16 ASIA PACIFIC: STANDALONE LABORATORY INFORMATION SYSTEMS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 17 INTEGRATED LABORATORY INFORMATION SYSTEMS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 18 NORTH AMERICA: INTEGRATED LABORATORY INFORMATION SYSTEMS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 19 EUROPE: INTEGRATED LABORATORY INFORMATION SYSTEMS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 20 ASIA PACIFIC: INTEGRATED LABORATORY INFORMATION SYSTEMS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 21 LABORATORY INFORMATION SYSTEMS MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 22 LABORATORY INFORMATION SYSTEM SERVICES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 23 NORTH AMERICA: LABORATORY INFORMATION SYSTEM SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 24 EUROPE: LABORATORY INFORMATION SYSTEM SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 25 ASIA PACIFIC: LABORATORY INFORMATION SYSTEM SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 26 LABORATORY INFORMATION SYSTEM SOFTWARE MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 27 NORTH AMERICA: LABORATORY INFORMATION SYSTEM SOFTWARE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 28 EUROPE: LABORATORY INFORMATION SYSTEM SOFTWARE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 29 ASIA PACIFIC: LABORATORY INFORMATION SYSTEM SOFTWARE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 30 LABORATORY INFORMATION SYSTEMS MARKET, BY DELIVERY MODE, 2021–2028 (USD MILLION)

- TABLE 31 ON-PREMISE LABORATORY INFORMATION SYSTEMS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 32 NORTH AMERICA: ON-PREMISE LABORATORY INFORMATION SYSTEMS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 33 EUROPE: ON-PREMISE LABORATORY INFORMATION SYSTEMS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 34 ASIA PACIFIC: ON-PREMISE LABORATORY INFORMATION SYSTEMS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 35 CLOUD-BASED LABORATORY INFORMATION SYSTEMS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 36 NORTH AMERICA: CLOUD-BASED LABORATORY INFORMATION SYSTEMS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 37 EUROPE: CLOUD-BASED LABORATORY INFORMATION SYSTEMS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 38 ASIA PACIFIC: CLOUD-BASED LABORATORY INFORMATION SYSTEMS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 39 LABORATORY INFORMATION SYSTEMS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 40 LABORATORY INFORMATION SYSTEMS MARKET FOR HOSPITAL LABORATORIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 41 NORTH AMERICA: LABORATORY INFORMATION SYSTEMS MARKET FOR HOSPITAL LABORATORIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 42 EUROPE: LABORATORY INFORMATION SYSTEMS MARKET FOR HOSPITAL LABORATORIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 43 ASIA PACIFIC: LABORATORY INFORMATION SYSTEMS MARKET FOR HOSPITAL LABORATORIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 44 LABORATORY INFORMATION SYSTEMS MARKET FOR INDEPENDENT LABORATORIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 45 NORTH AMERICA: LABORATORY INFORMATION SYSTEMS MARKET FOR INDEPENDENT LABORATORIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 46 EUROPE: LABORATORY INFORMATION SYSTEMS MARKET FOR INDEPENDENT LABORATORIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 47 ASIA PACIFIC: LABORATORY INFORMATION SYSTEMS MARKET FOR INDEPENDENT LABORATORIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 48 LABORATORY INFORMATION SYSTEMS MARKET FOR PHYSICIAN OFFICE LABORATORIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 49 NORTH AMERICA: LABORATORY INFORMATION SYSTEMS MARKET FOR PHYSICIAN OFFICE LABORATORIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 50 EUROPE: LABORATORY INFORMATION SYSTEMS MARKET FOR PHYSICIAN OFFICE LABORATORIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 51 ASIA PACIFIC: LABORATORY INFORMATION SYSTEMS MARKET FOR PHYSICIAN OFFICE LABORATORIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 52 LABORATORY INFORMATION SYSTEMS MARKET FOR OTHER END USERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 53 NORTH AMERICA: LABORATORY INFORMATION SYSTEMS MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 54 EUROPE: LABORATORY INFORMATION SYSTEMS MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 55 ASIA PACIFIC: LABORATORY INFORMATION SYSTEMS MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 56 LABORATORY INFORMATION SYSTEMS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 57 NORTH AMERICA: LABORATORY INFORMATION SYSTEMS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 58 NORTH AMERICA: LABORATORY INFORMATION SYSTEMS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 59 NORTH AMERICA: LABORATORY INFORMATION SYSTEMS MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 60 NORTH AMERICA: LABORATORY INFORMATION SYSTEMS MARKET, BY DELIVERY MODE, 2021–2028 (USD MILLION)

- TABLE 61 NORTH AMERICA: LABORATORY INFORMATION SYSTEMS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 62 US: LABORATORY INFORMATION SYSTEMS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 63 US: LABORATORY INFORMATION SYSTEMS MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 64 US: LABORATORY INFORMATION SYSTEMS MARKET, BY DELIVERY MODE, 2021–2028 (USD MILLION)

- TABLE 65 US: LABORATORY INFORMATION SYSTEMS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 66 CANADA: LABORATORY INFORMATION SYSTEMS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 67 CANADA: LABORATORY INFORMATION SYSTEMS MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 68 CANADA: LABORATORY INFORMATION SYSTEMS MARKET, BY DELIVERY MODE, 2021–2028 (USD MILLION)

- TABLE 69 CANADA: LABORATORY INFORMATION SYSTEMS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 70 EUROPE: LABORATORY INFORMATION SYSTEMS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 71 EUROPE: LABORATORY INFORMATION SYSTEMS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 72 EUROPE: LABORATORY INFORMATION SYSTEMS MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 73 EUROPE: LABORATORY INFORMATION SYSTEMS MARKET, BY DELIVERY MODE, 2021–2028 (USD MILLION)

- TABLE 74 EUROPE: LABORATORY INFORMATION SYSTEMS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 75 GERMANY: LABORATORY INFORMATION SYSTEMS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 76 GERMANY: LABORATORY INFORMATION SYSTEMS MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 77 GERMANY: LABORATORY INFORMATION SYSTEMS MARKET, BY DELIVERY MODE, 2021–2028 (USD MILLION)

- TABLE 78 GERMANY: LABORATORY INFORMATION SYSTEMS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 79 UK: LABORATORY INFORMATION SYSTEMS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 80 UK: LABORATORY INFORMATION SYSTEMS MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 81 UK: LABORATORY INFORMATION SYSTEMS MARKET, BY DELIVERY MODE, 2021–2028 (USD MILLION)

- TABLE 82 UK: LABORATORY INFORMATION SYSTEMS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 83 FRANCE: LABORATORY INFORMATION SYSTEMS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 84 FRANCE: LABORATORY INFORMATION SYSTEMS MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 85 FRANCE: LABORATORY INFORMATION SYSTEMS MARKET, BY DELIVERY MODE, 2021–2028 (USD MILLION)

- TABLE 86 FRANCE: LABORATORY INFORMATION SYSTEMS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 87 ITALY: LABORATORY INFORMATION SYSTEMS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 88 ITALY: LABORATORY INFORMATION SYSTEMS MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 89 ITALY: LABORATORY INFORMATION SYSTEMS MARKET, BY DELIVERY MODE, 2021–2028 (USD MILLION)

- TABLE 90 ITALY: LABORATORY INFORMATION SYSTEMS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 91 SPAIN: LABORATORY INFORMATION SYSTEMS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 92 SPAIN: LABORATORY INFORMATION SYSTEMS MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 93 SPAIN: LABORATORY INFORMATION SYSTEMS MARKET, BY DELIVERY MODE, 2021–2028 (USD MILLION)

- TABLE 94 SPAIN: LABORATORY INFORMATION SYSTEMS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 95 REST OF EUROPE: LABORATORY INFORMATION SYSTEMS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 96 REST OF EUROPE: LABORATORY INFORMATION SYSTEMS MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 97 REST OF EUROPE: LABORATORY INFORMATION SYSTEMS MARKET, BY DELIVERY MODE, 2021–2028 (USD MILLION)

- TABLE 98 REST OF EUROPE: LABORATORY INFORMATION SYSTEMS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 99 ASIA PACIFIC: LABORATORY INFORMATION SYSTEMS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 100 ASIA PACIFIC: LABORATORY INFORMATION SYSTEMS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 101 ASIA PACIFIC: LABORATORY INFORMATION SYSTEMS MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 102 ASIA PACIFIC: LABORATORY INFORMATION SYSTEMS MARKET, BY DELIVERY MODE, 2021–2028 (USD MILLION)

- TABLE 103 ASIA PACIFIC: LABORATORY INFORMATION SYSTEMS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 104 CHINA: LABORATORY INFORMATION SYSTEMS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 105 CHINA: LABORATORY INFORMATION SYSTEMS MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 106 CHINA: LABORATORY INFORMATION SYSTEMS MARKET, BY DELIVERY MODE, 2021–2028 (USD MILLION)

- TABLE 107 CHINA: LABORATORY INFORMATION SYSTEMS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 108 JAPAN: LABORATORY INFORMATION SYSTEMS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 109 JAPAN: LABORATORY INFORMATION SYSTEMS MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 110 JAPAN: LABORATORY INFORMATION SYSTEMS MARKET, BY DELIVERY MODE, 2021–2028 (USD MILLION)

- TABLE 111 JAPAN: LABORATORY INFORMATION SYSTEMS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 112 INDIA: LABORATORY INFORMATION SYSTEMS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 113 INDIA: LABORATORY INFORMATION SYSTEMS MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 114 INDIA: LABORATORY INFORMATION SYSTEMS MARKET, BY DELIVERY MODE, 2021–2028 (USD MILLION)

- TABLE 115 INDIA: LABORATORY INFORMATION SYSTEMS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 116 AUSTRALIA & NEW ZEALAND: LABORATORY INFORMATION SYSTEMS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 117 AUSTRALIA & NEW ZEALAND: LABORATORY INFORMATION SYSTEMS MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 118 AUSTRALIA & NEW ZEALAND: LABORATORY INFORMATION SYSTEMS MARKET, BY DELIVERY MODE, 2021–2028 (USD MILLION)

- TABLE 119 AUSTRALIA & NEW ZEALAND: LABORATORY INFORMATION SYSTEMS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 120 REST OF ASIA PACIFIC: LABORATORY INFORMATION SYSTEMS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 121 REST OF ASIA PACIFIC: LABORATORY INFORMATION SYSTEMS MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 122 REST OF ASIA PACIFIC: LABORATORY INFORMATION SYSTEMS MARKET, BY DELIVERY MODE, 2021–2028 (USD MILLION)

- TABLE 123 REST OF ASIA PACIFIC: LABORATORY INFORMATION SYSTEMS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 124 LATIN AMERICA: LABORATORY INFORMATION SYSTEMS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 125 LATIN AMERICA: LABORATORY INFORMATION SYSTEMS MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 126 LATIN AMERICA: LABORATORY INFORMATION SYSTEMS MARKET, BY DELIVERY MODE, 2021–2028 (USD MILLION)

- TABLE 127 LATIN AMERICA: LABORATORY INFORMATION SYSTEMS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 128 MIDDLE EAST & AFRICA: LABORATORY INFORMATION SYSTEMS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 129 MIDDLE EAST & AFRICA: LABORATORY INFORMATION SYSTEMS MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 130 MIDDLE EAST & AFRICA: LABORATORY INFORMATION SYSTEMS MARKET, BY DELIVERY MODE, 2021–2028 (USD MILLION)

- TABLE 131 MIDDLE EAST & AFRICA: LABORATORY INFORMATION SYSTEMS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 132 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN LABORATORY INFORMATION SYSTEMS MARKET, JANUARY 2021–MAY 2023

- TABLE 133 LABORATORY INFORMATION SYSTEMS MARKET: DETAILED LIST OF KEY SMES/START-UPS

- TABLE 134 LABORATORY INFORMATION SYSTEMS MARKET: COMPETITIVE BENCHMARKING OF KEY SMES SMES/START-UPS

- TABLE 135 BY DELIVERY MODE: COMPANY FOOTPRINT

- TABLE 136 BY END USER: COMPANY FOOTPRINT

- TABLE 137 BY REGION: COMPANY FOOTPRINT

- TABLE 138 COMPANY FOOTPRINT

- TABLE 139 LABORATORY INFORMATION SYSTEMS MARKET: PRODUCT LAUNCHES & ENHANCEMENTS, 2021–2023

- TABLE 140 LABORATORY INFORMATION SYSTEMS MARKET: DEALS, 2021–2023

- TABLE 141 LABORATORY INFORMATION SYSTEMS MARKET: OTHER DEVELOPMENTS, 2021–2023

- TABLE 142 ORCHARD SOFTWARE CORPORATION: COMPANY OVERVIEW

- TABLE 143 CLINISYS: COMPANY OVERVIEW

- TABLE 144 ORACLE CORPORATION: COMPANY OVERVIEW

- TABLE 145 COMPUTER PROGRAMS AND SYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 146 COMPUGROUP MEDICAL: COMPANY OVERVIEW

- TABLE 147 SOFT COMPUTER CONSULTANTS, INC.: COMPANY OVERVIEW

- TABLE 148 AMERICAN SOFT SOLUTIONS CORP.: COMPANY OVERVIEW

- TABLE 149 EPIC SYSTEMS CORPORATION: COMPANY OVERVIEW

- TABLE 150 ALTERA DIGITAL HEALTH: COMPANY OVERVIEW

- TABLE 151 ASPYRA: COMPANY OVERVIEW

- TABLE 152 COMP PRO MED INC.: COMPANY OVERVIEW

- TABLE 153 COMPUTER SERVICE & SUPPORT, INC.: COMPANY OVERVIEW

- TABLE 154 CLINICAL SOFTWARE SOLUTIONS: COMPANY OVERVIEW

- TABLE 155 GPI S.P.A.: COMPANY OVERVIEW

- TABLE 156 LIGOLAB INFORMATION SYSTEM: COMPANY OVERVIEW

- TABLE 157 LABWARE: COMPANY OVERVIEW

- TABLE 158 LABVANTAGE SOLUTIONS, INC.: COMPANY OVERVIEW

- TABLE 159 XIFIN, INC.: COMPANY OVERVIEW

- TABLE 160 SEACOAST LABORATORY DATA SYSTEMS: COMPANY OVERVIEW

- TABLE 161 VERADIGM LLC: COMPANY OVERVIEW

- FIGURE 1 LABORATORY INFORMATION SYSTEMS MARKET: MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 RESEARCH APPROACH

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 6 APPROACH FOR ASSESSING SUPPLY OF LABORATORY INFORMATION SYSTEMS SOLUTIONS

- FIGURE 7 REVENUES GENERATED BY COMPANIES FROM SALES OF LABORATORY INFORMATION SYSTEMS SOLUTIONS

- FIGURE 8 REVENUE SHARE ANALYSIS ILLUSTRATION

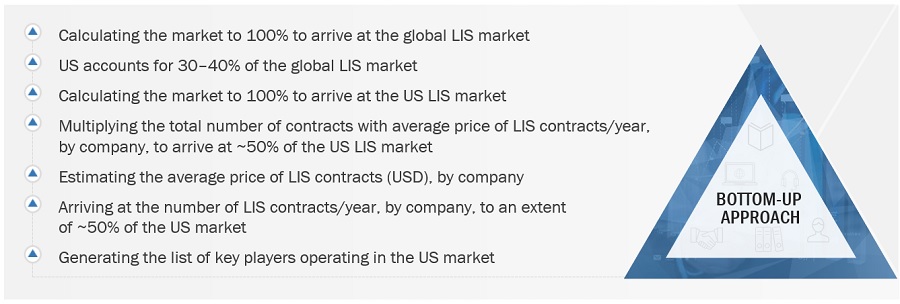

- FIGURE 9 BOTTOM-UP APPROACH

- FIGURE 10 TOP-DOWN APPROACH

- FIGURE 11 DATA TRIANGULATION METHODOLOGY

- FIGURE 12 LABORATORY INFORMATION SYSTEMS MARKET, BY PRODUCT, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 LABORATORY INFORMATION SYSTEMS MARKET, BY COMPONENT, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 LABORATORY INFORMATION SYSTEMS MARKET, BY DELIVERY MODE, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 LABORATORY INFORMATION SYSTEMS MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 LABORATORY INFORMATION SYSTEMS MARKET: REGIONAL SNAPSHOT

- FIGURE 17 DEVELOPMENT OF INTEGRATED LIS TO DRIVE MARKET GROWTH

- FIGURE 18 NORTH AMERICA TO DOMINATE LABORATORY INFORMATION SYSTEMS MARKET DURING FORECAST PERIOD

- FIGURE 19 INDIA TO REGISTER HIGHEST REVENUE GROWTH FROM 2023 TO 2028

- FIGURE 20 HOSPITAL LABORATORIES AND US DOMINATED MARKET IN NORTH AMERICA IN 2022

- FIGURE 21 STANDALONE LIS SEGMENT HELD LARGER MARKET SHARE IN 2022

- FIGURE 22 SERVICES SEGMENT TO DOMINATE MARKET IN 2028

- FIGURE 23 CLOUD-BASED LIS TO REGISTER HIGHER GROWTH RATE DURING FORECAST PERIOD

- FIGURE 24 HOSPITAL LABORATORIES TO ACCOUNT FOR LARGEST MARKET SHARE IN 2028

- FIGURE 25 LABORATORY INFORMATION SYSTEMS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 26 LABORATORY INFORMATION SYSTEMS MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 27 LABORATORY INFORMATION SYSTEMS MARKET: ECOSYSTEM

- FIGURE 28 LABORATORY INFORMATION SYSTEMS MARKET: VALUE CHAIN

- FIGURE 29 TOP PATENT OWNERS AND APPLICANTS FOR HEALTHCARE IT SOLUTIONS (JANUARY 2011–JUNE 2023)

- FIGURE 30 LABORATORY INFORMATION SYSTEMS MARKET: PATENT ANALYSIS (JANUARY 2011–JUNE 2023)

- FIGURE 31 REVENUE SHIFT IN LABORATORY INFORMATION SYSTEMS MARKET

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 33 KEY BUYING CRITERIA, BY END USER

- FIGURE 34 INDIA TO EMERGE AS NEW HOTSPOT DURING FORECAST PERIOD

- FIGURE 35 NORTH AMERICA HELD LARGEST SHARE OF LABORATORY INFORMATION SYSTEMS MARKET IN 2022

- FIGURE 36 NORTH AMERICA: LABORATORY INFORMATION SYSTEMS MARKET SNAPSHOT

- FIGURE 37 ASIA PACIFIC: LABORATORY INFORMATION SYSTEMS MARKET SNAPSHOT

- FIGURE 38 REVENUE SHARE ANALYSIS OF KEY MARKET PLAYERS, 2022

- FIGURE 39 LABORATORY INFORMATION SYSTEMS MARKET: MARKET SHARE ANALYSIS, 2022

- FIGURE 40 LABORATORY INFORMATION SYSTEMS MARKET: COMPANY EVALUATION QUADRANT FOR KEY PLAYERS, 2022

- FIGURE 41 LABORATORY INFORMATION SYSTEMS MARKET: COMPANY EVALUATION QUADRANT FOR START-UPS/SMES, 2022

- FIGURE 42 ORACLE CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 43 COMPUTER PROGRAMS AND SYSTEMS, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 44 COMPUGROUP MEDICAL: COMPANY SNAPSHOT (2022)

- FIGURE 45 GPI S.P.A.: COMPANY SNAPSHOT (2022)

- FIGURE 46 VERADIGM LLC: COMPANY SNAPSHOT (2021)

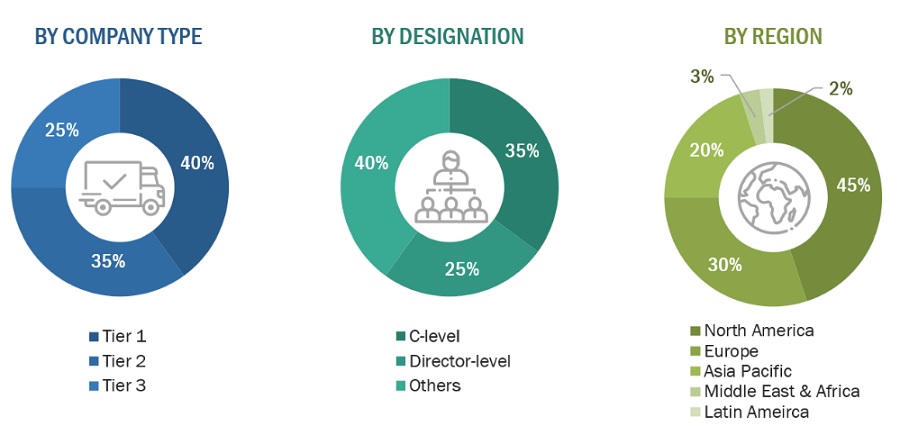

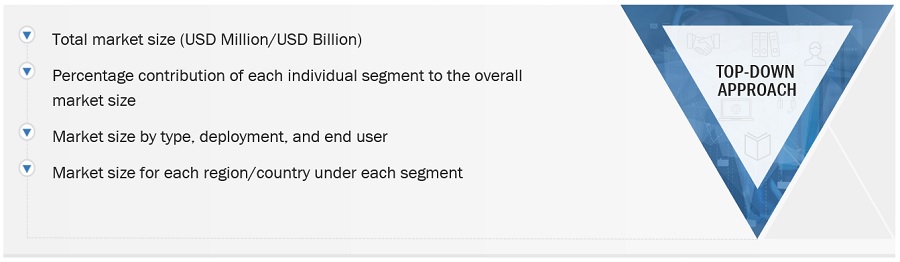

The study involved major activities in estimating the current size of the global Laboratory information systems market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study involved the use of widespread secondary sources; directories; databases, such as D&B, Bloomberg Business, and Factiva; white papers; government sources; corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and professional associations; and company house documents. Secondary research was used to identify and collect information for this extensive, technical, market-oriented, and commercial study of the Laboratory information systems market. It was also used to obtain important information about the top players, market classification and segmentation according to industry trends to the bottom-most level, geographic markets, technology perspectives, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the Laboratory information systems market. The primary sources from the demand side include key executives from hospital laboratories, independent laboratories, physician office laboratories, blood banks, nursing homes, public health labs, and retail clinics. After the complete market engineering process (which includes calculations for the market statistics, market breakdown, market size estimation, market forecasts, and data triangulation), extensive primary research has been conducted to gather information and verify and validate the critical numbers obtained.

Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to type, deployment, end user, and region.

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, and product managers.

Note: Tiers are defined based on a company’s total revenue, as of 2021: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down (segmental analysis of major segments) and bottom-up approaches (assessment of utilization/adoption/penetration trends by product, component, delivery mode, end-user, and region) were used to estimate and validate the total size of the Laboratory information systems market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions has been determined through both primary and secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Laboratory information systems Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Definition

A laboratory information systems is a software system specifically designed to manage and streamline the operations of a laboratory. It serves as a comprehensive information management tool that automates and integrates various laboratory processes, including test ordering, sample tracking, result entry, quality control, inventory management, reporting, and storing specimen data.

LIS systems typically include features such as test catalog management, sample tracking, instrument interface connectivity, result validation, data analysis, report generation, and billing integration. LIS has traditionally been adept at sending laboratory test orders to lab instruments, tracking those orders, and recording the results, typically to a searchable database for future reference. Laboratories with a dedicated LIS can strengthen the country public health by sharing data between laboratories, clinicians, and public health networks. Physicians and lab technicians use LIS to coordinate a variety of inpatient and outpatient medical testing, including hematology, chemistry, immunology, and microbiology.

Key Stakeholders

- Laboratory information systems solution providers

- Platform providers

- Technology providers

- Healthcare providers

- Hospitals

- Clinics

- System Integrators

- Physician groups and organizations

- Clinical laboratories, medical laboratories, research laboratories, and other healthcare facilities

- Forums, alliances, and associations

- Distributors

- Venture capitalists

- Government organizations

- Institutional investors and investment banks

- Investors/Shareholders

- Consulting companies in the LIS sector

- Raw material and component manufacturers

Objectives of the Study

- To define, describe, and forecast the laboratory information systems market, by product, component, delivery mode, end-user, and region

- To provide detailed information regarding the major drivers, restraints, opportunities, and challenges influencing market growth

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the overall laboratory information systems market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the laboratory information systems market in five main regions (along with their respective key countries): North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

- To provide key industry insights such as supply chain analysis, regulatory analysis, patent analysis, and recession impact analysis

- To profile the key players in the laboratory information systems market and comprehensively analyze their core competencies

- To track and analyze competitive developments such as product launches & enhancements, partnerships, acquisitions, sales contracts, agreements, collaborations, expansions, and R&D activities of the leading players in the laboratory information systems market

- To benchmark players within the laboratory information systems market using the Competitive Leadership Mapping framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offering

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Latin American laboratory information systems market into Brazil, Mexico, and the rest of Latin America.

- Further breakdown of the Middle East & Africa laboratory information systems market into the UAE, Saudi Arabia, South Africa, and the rest of MEA countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Laboratory Information System (LIS) Market