Laboratory Equipment Services Market by Type (Repair & Maintenance, Calibration, Validation), Contract (Standard, Custom), Equipment (Analytical, Equipment, General, Support), Service Provider (OEM), and End User (Pharmaceutical) - Global Forecast to 2024

Inquire Now to get the global numbers on Laboratory Equipment Services Market

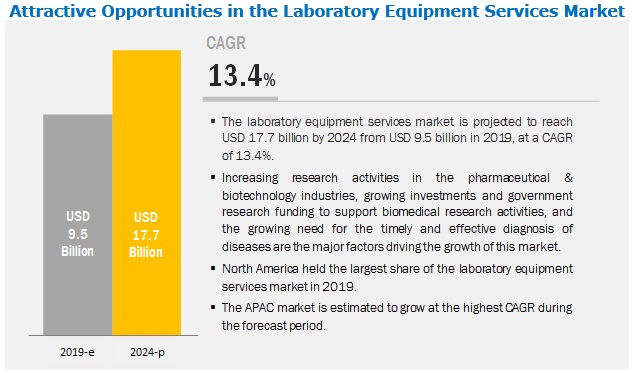

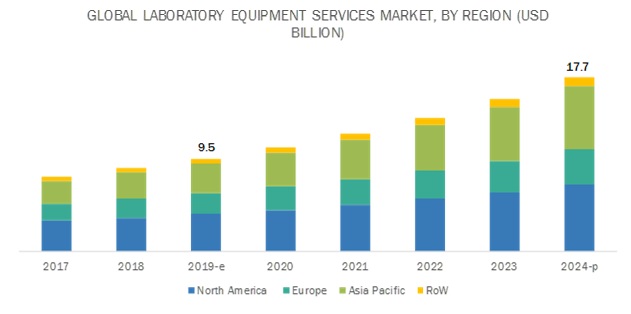

[135 Pages Report] The laboratory equipment service market is projected to reach USD 17.7 billion by 2024 from USD 9.5 million in 2019, at a CAGR of 13.4% between 2019 and 2024. Growth in the laboratory equipment service market is driven mainly by an increasing number of research activities in pharmaceutical and biotechnology industries, growing need for the effective and timely diagnosis of diseases, and the rising investments and government research funding to support biomedical research activities. However, the shift from lab-based diagnosis to home-based/POC testing and the high cost of service contracts are the major factors restraining the growth of this market.

The pharmaceutical & biotechnology companies to dominate the laboratory equipment services market in 2019

By end-user, the biomedical equipment services market is segmented into pharmaceutical & biotechnology companies, clinical & diagnostic laboratories, and academic & research institutions. In 2019, the pharmaceutical & biotechnology companies segment is expected to dominate the market. The dominant share of this segment is primarily attributed to the increased volume of drug discovery research in these companies.

The APAC market is expected to grow at the highest CAGR during the forecast period

North America is projected to dominate the market in 2019. On the other hand, the APAC region is expected to witness the highest CAGR during the forecast period. An increasing number of CROs, a growing number of life science R&D activities, rising import of laboratory equipment, and the rising presence of major market players in emerging countries such as India and China are some of the key factors driving the growth of the market in the Asia Pacific region.

Key Market Players

Prominent players in the laboratory equipment services market are Agilent Technologies (US), Waters Corporation (US), Thermo Fisher Scientific, Inc. (US), PerkinElmer, Inc. (US), Danaher Corporation (US), Eppendorf (Germany), Pace Analytical Services, Inc. (US), Becton, Dickinson, and Company (US), Bio-Rad Laboratories, Inc. (US), and Siemens Healthineers (Germany).

Agilent Technologies provides core bio-analytical and electronic measurement solutions to the communications, electronics, life sciences, and chemical analysis industries. The company operates through three business segments, namely, Life Sciences & Applied Markets, Diagnostics & Genomics, and Agilent CrossLab. It offers a wide range of laboratory instrument services through its Agilent CrossLab segment.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

:

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2017–2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Type, Equipment Type, Service Provider, Contract Type, End-User, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Companies covered |

Agilent Technologies (US), Thermo Fisher Scientific Inc. (US), Waters Corporation (US), Danaher Corporation (US), and Siemens Heathineers (Germany), Eppendorf AG (Germany), PerkinElmer, Inc. (US), Pace Analytical Services, Inc. (US), Bio-Rad Laboratories, Inc. (US), and Becton, Dickinson and Company (US). |

The research report categorizes the market into the following segments and subsegments:

Laboratory Equipment Services Market, by Equipment Type

- Analytical Equipment

- General Equipment

- Specialty Equipment

- Support Equipment

Laboratory Equipment Services Market, by Type

- Repair and Maintenance

- Calibration

- Validation

- Other Services

Laboratory Equipment Services Market, by Service Providers

- OEMs

- Third-party Service Providers

- Other Service Providers

Laboratory Equipment Services Market, by Contract Type

- Standard Service Contract

- Customized Service Contract

Laboratory Equipment Services Market, by Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Spain

- Italy

- RoE

-

Asia Pacific

- China

- India

- Japan

- RoAPAC

- Rest of the World

Recent Developments

- In 2018, Agilent opened its new logistics hub in Shanghai to enable faster delivery of parts, supplies, and consumables to laboratories in China.

- In 2018, Thermo Fisher Scientific announced to open multiple Global Customer Solution Centers. These centers will focus on meeting the demands of scientists in food, beverage, pharmaceutical, and biotech laboratories by developing critical workflows and integrated solutions.

- In 2017, Agilent opened its Agilent Customer and Technology Center at the Agilent campus in Waldbronn. This center will strengthen the company’s presence in Germany.

Critical Questions Answered in the Report:

- Which regions are likely to grow at the highest CAGR?

- What are the recent trends affecting the market?

- Who are the key players in the market and how intense is the competition?

- What are the application areas of laboratory equipment services?

- What are the challenges hindering the adoption of maintenance services?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Market Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Market Data Validation and Triangulation

2.4 Assumptions for the Study

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Market Overview

4.2 North America: Biomedical Equipment Services Market, By Equipment Type, 2018

4.3 Market: Geographic Snapshot

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Market Drivers

5.2.1.1 Increasing Research Activity in the Pharmaceutical and Biotechnology Industries

5.2.1.2 Growing Need for Timely and Effective Diagnosis of Diseases

5.2.1.3 Growing Investment and Government Funding to Support Biomedical Research Activities

5.2.2 Restraints

5.2.2.1 Shift From Lab-Based Diagnosis to Home-Based/Poc Testing

5.2.2.2 High Cost of Service Contracts

5.2.3 Opportunities

5.2.3.1 Increasing Demand for Laboratory Automation

5.2.3.2 Growth in Asset Management Companies

5.2.4 Challenges

5.2.4.1 Limited Scope for Innovation

6 Market, By Equipment Type (Page No. - 40)

6.1 Introduction

6.2 Analytical Equipment

6.2.1 Analytical Equipment are Extremely Fragile and Expensive And, Therefore, Require Frequent Servicing, Which is a Major Factor Driving Market Growth

6.3 General Equipment

6.3.1 High Equipment Cost and Replacement Value Will Aid Market Growth in the Forecast Period

6.4 Specialty Equipment

6.4.1 Timely Servicing, Maintenance, and Upgrading of Specialty Equipment is Crucial for Accurate Research Outcomes—A Key Market Driver

6.5 Support Equipment

6.5.1 Growing Trend of Lab Automation May Limit the use of Support Equipment in the Future, Which May Negatively Affect Market Growth

7 Market, By Type (Page No. - 45)

7.1 Introduction

7.2 Repair and Maintenance Services

7.2.1 Effective Repair & Maintenance Increases Equipment Lifespan, Reduces Overall Service Costs

7.3 Calibration Services

7.3.1 Need for Efficient and Accurate Functioning Ensures Sustained Demand for Calibration Services

7.4 Validation Services

7.4.1 Validation Helps in Complying With Regulations and Guidelines

7.5 Other Services

8 Market, By Service Provider (Page No. - 50)

8.1 Introduction

8.2 Original Equipment Manufacturers

8.2.1 End Users Opt for Services Offered By Original Equipment Manufacturers Owing to the Service Quality and Easy Access to Spare Parts

8.3 Third-Party Service Providers

8.3.1 Third-Party Service Providers Offer Advantages Such as Lower-Cost Services and Multi-Brand Support

8.4 Other Service Providers

9 Market, By Contract Type (Page No. - 54)

9.1 Introduction

9.2 Standard Service Contracts

9.2.1 Standard Contracts Cover a Wide Range of Maintenance Services

9.3 Customized Service Contracts

9.3.1 Specificity of Customized Contracts is Driving Demand, But Higher Cost Affects Customer Preference

10 Market, By End User (Page No. - 58)

10.1 Introduction

10.2 Pharmaceutical & Biotechnology Companies

10.2.1 Growing Adoption of Lab Automation to Increase the Requirement of Maintenance Services, as Errors in Functioning Can Stop Automated Processes in Laboratories

10.3 Clinical & Diagnostic Laboratories

10.3.1 Operational Inefficiency of Lab Equipment and Delayed Repair and Maintenance Can Negatively Impact the Early Diagnosis and Treatment of Diseases

10.4 Academic & Research Institutions

10.4.1 Government Funding to Increase the Affordability of Research Institutes to Purchase Advanced Laboratory Equipment

11 Laboratory Equipment Services Market, By Region (Page No. - 63)

11.1 Introduction

11.2 North America

11.2.1 US

11.2.1.1 Government Initiatives and Strategic Developments By Market Players to Drive Market Growth in the US

11.2.2 Canada

11.2.2.1 Availability of Government Funding for Research Activities and Laboratory Consolidation to Drive Market Growth in Canada

11.3 Asia Pacific

11.3.1 China

11.3.1.1 High Pace of Research and Availability of Funding Have Fueled Market Growth in China

11.3.2 India

11.3.2.1 Government Initiatives Have Strengthened the Life Science Industry in India

11.3.3 Japan

11.3.3.1 Strong Healthcare System in Japan is a Key Component of the Demand for Services

11.3.4 Rest of Asia Pacific

11.4 Europe

11.4.1 Germany

11.4.1.1 Strong Research Infrastructure and Manufacturing Base Support Germany’s Market Dominance

11.4.2 France

11.4.2.1 Government Initiatives to Boost R&D Activities Will Ensure Market Growth in France

11.4.3 UK

11.4.3.1 UK is One of the Major Markets for Lab Equipment Services in Europe

11.4.4 Italy

11.4.4.1 Strong Government Support for Research has Stimulated Market Growth in Italy

11.4.5 Spain

11.4.5.1 High Activity in the Spanish Pharmaceutical Sector Will Drive Demand for Services

11.4.6 Rest of Europe

11.5 Rest of the World

12 Competitive Landscape (Page No. - 104)

12.1 Overview

12.2 Market Ranking Analysis, 2018

12.3 Competitive Scenario

12.4 Competitive Leadership Mapping

12.4.1 Visionary Leaders

12.4.2 Innovators

12.4.3 Dynamic Differentiators

12.4.4 Emerging Companies

13 Company Profiles (Page No. - 108)

(Business Overview, Services Offered, Recent Developments, and MnM View)*

13.1 Agilent Technologies

13.2 Thermo Fisher Scientific, Inc.

13.3 Waters Corporation

13.4 Danaher Corporation

13.5 Eppendorf AG

13.6 PerkinElmer, Inc.

13.7 Pace Analytical Services, LLC.

13.8 Becton, Dickinson and Company

13.9 Bio-Rad Laboratories, Inc.

13.10 Siemens Healthineers

* Business Overview, Services Offered, Recent Developments, and MnM View Might Not be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 128)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.3 Available Customizations

14.4 Related Reports

14.5 Author Details

List of Tables (110 Tables)

Table 1 Company Drug Pipelines, 2018

Table 2 Top Investors in R&D, 2016 Vs. 2017

Table 3 Laboratory Equipment Services Market, By Equipment Type, 2017–2024 (USD Million)

Table 4 Market for Analytical Equipment, By Region, 2017–2024 (USD Million)

Table 5 Market for General Equipment, By Region, 2014–2021 (USD Million)

Table 6 Market for Specialty Equipment, By Region, 2017–2024 (USD Million)

Table 7 Market for Support Equipment, By Region, 2017–2024 (USD Million)

Table 8 Biomedical Equipment Services Market, By Type, 2017–2024 (USD Million)

Table 9 Repair and Maintenance Services Market, By Region, 2017–2024 (USD Million)

Table 10 Calibration Services Market, By Region, 2017–2024 (USD Million)

Table 11 Validation Services Market, By Region, 2017–2024 (USD Million)

Table 12 Other Services Market, By Region, 2017–2024 (USD Million)

Table 13 Market, By Service Provider, 2017–2024 (USD Million)

Table 14 Market for Original Equipment Manufacturers, By Region, 2017–2024 (USD Million)

Table 15 Laboratory Equipment Services Market for Third-Party Service Providers, By Region, 2017–2024 (USD Million)

Table 16 Market for Other Service Providers, By Region, 2017–2024 (USD Million)

Table 17 Market, By Contract Type, 2017–2024 (USD Million)

Table 18 Standard Laboratory Equipment Service Contracts Market, By Region, 2017–2024 (USD Million)

Table 19 Customized Laboratory Equipment Service Contracts Market, By Region, 2017–2024 (USD Million)

Table 20 Market, By End User, 2017–2024 (USD Million)

Table 21 Biomedical Equipment Services Market for Pharmaceutical & Biotechnology Companies, By Region, 2017–2024 (USD Million)

Table 22 Market for Clinical & Diagnostic Laboratories, By Region, 2017–2024 (USD Million)

Table 23 Market for Academic & Research Institutions, By Region, 2017–2024 (USD Million)

Table 24 Laboratory Equipment Services Market, By Region, 2017–2024 (USD Million)

Table 25 North America: Market, By Country, 2017–2024 (USD Million)

Table 26 North America: Market, By Equipment Type, 2017–2024 (USD Million)

Table 27 North America: Market, By Type, 2017–2024 (USD Million)

Table 28 North America: Market, By Service Provider, 2017–2024 (USD Million)

Table 29 North America: Market, By Contract Type, 2017–2024 (USD Million)

Table 30 North America: Biomedical Equipment Services Market, By End User, 2017–2024 (USD Million)

Table 31 US: Market, By Equipment Type, 2017–2024 (USD Million)

Table 32 US: Laboratory Equipment Services Market, By Type, 2017–2024 (USD Million)

Table 33 US: Market, By Service Provider, 2017–2024 (USD Million)

Table 34 US: Market, By Contract Type, 2017–2024 (USD Million)

Table 35 US: Market, By End User, 2017–2024 (USD Million)

Table 36 Canada: Market, By Equipment Type, 2017–2024 (USD Million)

Table 37 Canada: Biomedical Equipment Services Market, By Type, 2017–2024 (USD Million)

Table 38 Canada: Market, By Service Provider, 2017–2024 (USD Million)

Table 39 Canada: Market, By Contract Type, 2017–2024 (USD Million)

Table 40 Canada: Market, By End User, 2017–2024 (USD Million)

Table 41 APAC: Market, By Country, 2017–2024 (USD Million)

Table 42 APAC: Market, By Equipment Type, 2017–2024 (USD Million)

Table 43 APAC: Laboratory Equipment Services Market, By Type, 2017–2024 (USD Million)

Table 44 APAC: Market, By Service Provider, 2017–2024 (USD Million)

Table 45 APAC: Biomedical Equipment Services Market, By Contract Type, 2017–2024 (USD Million)

Table 46 APAC: Market, By End User, 2017–2024 (USD Million)

Table 47 China: Market, By Equipment Type, 2017–2024 (USD Million)

Table 48 China: Market, By Type, 2017–2024 (USD Million)

Table 49 China: Market, By Service Provider, 2017–2024 (USD Million)

Table 50 China: Biomedical Equipment Services Market, By Contract Type, 2017–2024 (USD Million)

Table 51 China: Market, By End User, 2017–2024 (USD Million)

Table 52 India: Market, By Equipment Type, 2017–2024 (USD Million)

Table 53 India: Laboratory Equipment Services Market, By Type, 2017–2024 (USD Million)

Table 54 India: Market, By Service Provider, 2017–2024 (USD Million)

Table 55 India: Market, By Contract Type, 2017–2024 (USD Million)

Table 56 India: Market, By End User, 2017–2024 (USD Million)

Table 57 Japan: Market, By Equipment Type, 2017–2024 (USD Million)

Table 58 Japan: Market, By Type, 2017–2024 (USD Million)

Table 59 Japan: Market, By Service Provider, 2017–2024 (USD Million)

Table 60 Japan: Biomedical Equipment Services Market, By Contract Type, 2017–2024 (USD Million)

Table 61 Japan: Market, By End User, 2017–2024 (USD Million)

Table 62 RoAPAC: Market, By Equipment Type, 2017–2024 (USD Million)

Table 63 RoAPAC: Market, By Type, 2017–2024 (USD Million)

Table 64 RoAPAC: Market, By Service Provider, 2017–2024 (USD Million)

Table 65 RoAPAC: Market, By Contract Type, 2017–2024 (USD Million)

Table 66 RoAPAC: Laboratory Equipment Services Market, By End User, 2017–2024 (USD Million)

Table 67 Europe: Biomedical Equipment Services Market, By Country, 2017–2024 (USD Million)

Table 68 Europe: Market, By Equipment Type, 2017–2024 (USD Million)

Table 69 Europe: Market, By Type, 2017–2024 (USD Million)

Table 70 Europe: Market, By Service Provider, 2017–2024 (USD Million)

Table 71 Europe: Market, By Contract Type, 2017–2024 (USD Million)

Table 72 Europe: Market, By End User, 2017–2024 (USD Million)

Table 73 Germany: Market, By Equipment Type, 2017–2024 (USD Million)

Table 74 Germany: Laboratory Equipment Services Market, By Type, 2017–2024 (USD Million)

Table 75 Germany: Biomedical Equipment Services Market, By Service Provider, 2017–2024 (USD Million)

Table 76 Germany: Market, By Contract Type, 2017–2024 (USD Million)

Table 77 Germany: Market, By End User, 2017–2024 (USD Million)

Table 78 France: Market, By Equipment Type, 2017–2024 (USD Million)

Table 79 France: Market, By Type, 2017–2024 (USD Million)

Table 80 France: Market, By Service Provider, 2017–2024 (USD Million)

Table 81 France: Market, By Contract Type, 2017–2024 (USD Million)

Table 82 France: Biomedical Equipment Services Market, By End User, 2017–2024 (USD Million)

Table 83 UK: Market, By Equipment Type, 2017–2024 (USD Million)

Table 84 UK: Market, By Type, 2017–2024 (USD Million)

Table 85 UK: Market, By Service Provider, 2017–2024 (USD Million)

Table 86 UK: Market, By Contract Type, 2017–2024 (USD Million)

Table 87 UK: Laboratory Equipment Services Market, By End User, 2017–2024 (USD Million)

Table 88 Italy: Market, By Equipment Type, 2017–2024 (USD Million)

Table 89 Italy: Market, By Type, 2017–2024 (USD Million)

Table 90 Italy: Market, By Service Provider, 2017–2024 (USD Million)

Table 91 Italy: Laboratory Equipment Services Market, By Contract Type, 2017–2024 (USD Million)

Table 92 Italy: Market, By End User, 2017–2024 (USD Million)

Table 93 Spain: Market, By Equipment Type, 2017–2024 (USD Million)

Table 94 Spain: Biomedical Equipment Services Market, By Type, 2017–2024 (USD Million)

Table 95 Spain: Market, By Service Provider, 2017–2024 (USD Million)

Table 96 Spain: Market, By Contract Type, 2017–2024 (USD Million)

Table 97 Spain: Market, By End User, 2017–2024 (USD Million)

Table 98 RoE: Market, By Equipment Type, 2017–2024 (USD Million)

Table 99 RoE: Biomedical Equipment Services Market, By Type, 2017–2024 (USD Million)

Table 100 RoE: Market, By Service Provider, 2017–2024 (USD Million)

Table 101 RoE: Market, By Contract Type, 2017–2024 (USD Million)

Table 102 RoE: Market, By End User, 2017–2024 (USD Million)

Table 103 RoW: Market, By Equipment Type, 2017–2024 (USD Million)

Table 104 RoW: Biomedical Equipment Services Market, By Type, 2017–2024 (USD Million)

Table 105 RoW: Laboratory Equipment Services Market, By Service Provider, 2017–2024 (USD Million)

Table 106 RoW: Market, By Contract Type, 2017–2024 (USD Million)

Table 107 RoW: Market, By End User, 2017–2024 (USD Million)

Table 108 Acquisitions (2015–2019)

Table 109 Expansions (2015–2019)

Table 110 Partnerships (2015–2019)

List of Figures (32 Figures)

Figure 1 Laboratory Equipment Services Market: Research Methodology

Figure 2 Research Design

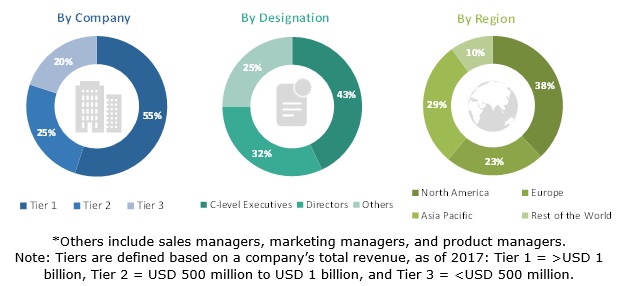

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation Methodology

Figure 7 Market, By Type, 2019 Vs. 2024

Figure 8 Biomedical Equipment Services Market, By Equipment Type, 2019 Vs. 2024 (USD Billion)

Figure 9 Biomedical Equipment Services Market, By Service Contract, 2019 Vs. 2024 (USD Billion)

Figure 10 Market, By End User, 2019 Vs. 2024 (USD Billion)

Figure 11 Geographical Snapshot of the Market

Figure 12 Increasing Number of Life Science R&D Activities to Drive the Growth of the Market

Figure 13 Analytical Equipment Segment to Account for the Largest Share of the North American Market in 2018

Figure 14 Asia Pacific Market to Grow at the Highest CAGR During the Forecast Period

Figure 15 Biomedical Equipment Services Market: Drivers, Restraints, Opportunities, and Challenges

Figure 16 Analytical Equipment to Register the Highest Growth Rate in the Market During the Forecast Period

Figure 17 Market, By Type

Figure 18 Market, By Contract Type

Figure 19 Pharmaceutical & Biotechnology Companies to Dominate the Laboratory Equipment Services Market During the Forecast Period

Figure 20 North America: Market Snapshot

Figure 21 Asia Pacific: Market Snapshot

Figure 22 Market Ranking of Key Players, 2018

Figure 23 Biomedical Equipment Services Market (Global) Competitive Leadership Mapping, 2018

Figure 24 Agilent Technologies: Company Snapshot

Figure 25 Thermo Fisher Scientific, Inc.: Company Snapshot

Figure 26 Waters Corporation: Company Snapshot

Figure 27 Danaher Corporation: Company Snapshot

Figure 28 Eppendorf AG: Company Snapshot

Figure 29 PerkinElmer, Inc.: Company Snapshot

Figure 30 Becton, Dickinson and Company: Company Snapshot

Figure 31 Bio-Rad Laboratories, Inc.: Company Snapshot

Figure 32 Siemens AG: Company Snapshot

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, companies house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the laboratory equipment services market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the biomedical equipment services market. The primary sources from the demand side included industry experts, such as researchers and scientists, and industry experts from medical devices companies. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends & key market dynamics.

A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (segmental analysis of major segments) and top-down approach (assessment of utilization/adoption/penetration trends, by type, equipment type, contract type, service provider, end-user, and region).

Data Triangulation

After arriving at the market size, the market was divided into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments & subsegments.

Objectives of the Study

- To define, describe, segment, and forecast the global laboratory equipment services market by type, equipment type, service providers, contract type, end-user, and region

- To provide detailed information about the factors influencing market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze micro markets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market in four main regions along with their respective key countries (North America, Europe, Asia Pacific, and the Rest of the World)

- To profile key players in the global market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments such as expansions and agreement of the leading players in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- A further breakdown of the Rest of World

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Laboratory Equipment Services Market