Laboratory Glassware Market by Product (Glassware (Pipette, Flasks, Containers, Petri Dishes, Slides), Plasticware (Pipette, Laboratory Beakers, Racks, Storage Boxes)), End User (Diagnostic Center, Pharmaceuticals) - Global Forecast to 2020

The global laboratory glassware market size is projected to grow at CAGR of 3.7%. The growth in this market will be majorly driven by the increasing demand for plasticware as they are flexible, easy to handle and inexpensive. Technological development has led to added advantages of using plasticware over glassware which further helping in increasing adoption rate among end users. On the other hand, the brittle nature of glass (resulting in low preference for glassware) and lack of funds (resulting in fewer research activities, thus affecting both glassware markets) are the major factors restraining the growth of this market. Specialty glass, however, is expected to offer growth opportunities for market players during the forecast period.

In this report, the laboratory glassware market is broadly segmented into glassware products, plasticware products, end users, and regions. The market is segmented into pipettes and pipette tips, storage containers, beakers, flasks, and other products, such as vials, carrier trays, racks, storage boxes, and Büchner funnels. Pipettes and pipette tips accounted for the largest share of this market. The large share of this segment can be attributed to the various advantages associated with using plastic pipettes. Plastic pipettes are largely preferred as they do not break or chip when they are used to handle hazardous chemicals or chemical substances.

The glassware market is segmented into pipettes and pipette tips, storage containers, beakers, flasks, petri dishes, and other products, such as stirring rods, slides, vials, test tubes, Büchner funnels, and measuring cylinders. The pipettes and pipette tips segment accounted for the largest share of the laboratory glassware market in 2015. This largest share can be attributed to the increasing usage of glass pipettes and pipette tips in in academic institutes and research laboratories.

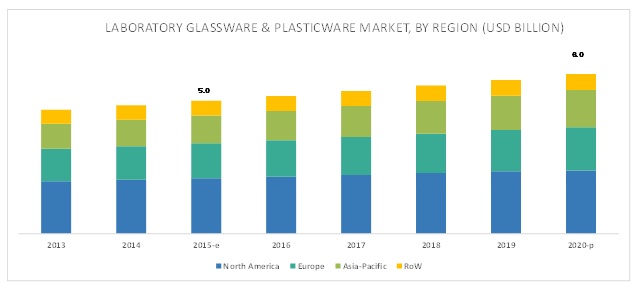

North America accounted for more than 40% of the laboratory glassware market. In this region, the application of laboratory glassware in R&D studies is the major factor attributing to its growth. However, in the coming years, the Asia-Pacific market is expected to witness the highest growth owing to the rising outsourcing activities in research and manufacturing as a result of low costs and access to skilled labor in this region.

Due to the product-driven nature of the laboratory glassware market, players primarily focused on new product launches to remain competitive. Majority of players launched pipettes or pipetting systems in the recent years. Companies launched new and advanced products to strengthen their portfolios and cater to the needs of the market.

Major players in this market include Corning, Inc. (U.S.), Eppendorf AG (Germany), Sartorius AG (Germany), and Thermo Fisher Scientific, Inc. (U.S.).

Stakeholders

- Healthcare Service Providers

- Medical Device Companies

- Diagnostic Centers

- Research Institutions

- Venture Capitalists

- Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs)

To know about the assumptions considered for the study, download the pdf brochure

Laboratory Glassware Market Report Scope

|

Particulars |

Scope |

|

Geography |

|

|

Revenue Currency |

USD |

This research report categorizes the laboratory glassware market into the following segments and subsegments

By Product

-

Glassware

- Pipettes and Pipette Tips

- Burettes

- Storage Containers

- Beakers

- Flasks

- Petri Dishes

- Others (Stirring Rods, Slides, Vials, Test Tubes, Büchner Funnels, and Measuring Cylinders)

-

Plasticware

- Pipettes and Pipette Tips

- Storage Containers

- Beakers

- Flasks

- Others (Vials, Volumetric Cylinders, Büchner Funnels, Test Tubes, and Tubing)

By End User

- Research and Academic Institutes

- Hospitals and Diagnostic Centers

- Pharmaceutical and Biotechnology Industries

- Contract Research Organizations

- Food and Beverage Industry

- Other End Users (Environmental and Chemicals/Petrochemicals Industries)

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

-

Company Information

- Detailed analysis and profiling of additional market players (up to 5).

Increasing demand for plasticware owing to its cost-effectiveness, technological advancements, and introduction of specialty glassware are driving the laboratory glassware market. However, the brittle nature of glass and lack of funds (resulting in diminished research activities) are expected to hinder the growth of this market to a certain extent in the forecast period.

By product, the pipettes and pipette tips segment is expected to be the faster growing in the laboratory glassware and plasticware market during the forecast period.

The pipettes and pipette tips segment is projected to grow at the highest CAGR between 2015 and 2020. The growth of this segment can be attributed to the increasing preference of plasticware pipettes over glassware to overcome the issue of breakage and growing use of glass pipettes in academic institutes and research laboratories.

By end user, the hospital and diagnostic centers segment is growing at the highest rate.

The research hospital and diagnostic centers segment is projected to grow at the highest rate in the market, by end user. In order to cut healthcare costs, early detection of diseases and preventative care is gaining momentum in healthcare systems of all developed countries. This is expected to drive the laboratory glassware and plasticware market as many diagnostic tests are being carried out in hospital and diagnostic centers as a precautionary measure.

North America is expected to account for the largest market share during the forecast period.

The laboratory glassware market is divided into four major regions-North America, Europe, Asia Pacific, and the Rest of the World (RoW). North America accounted for the largest share of the laboratory glassware market. The large share of the North American region is mainly attributed to the growing number of diagnostic tests, increased usage of laboratory consumables, and introduction of specially designed plasticware.

The Asia-Pacific region is expected to grow at the highest CAGR in the next five years. Growth in the APAC laboratory glassware market is mainly driven by increased R&D outsourcing, evolving mindset towards wellness, and rising healthcare expenditure in this region.

Key Market Players

Major players in this market include Corning (US), Eppendorf (Germany), Gerresheimer (Germany), and Thermo Fisher Scientific (U.S.), Sartorius (Germany).

Gerresheimer AG is one of the major players operating in the Laboratory Glassware Market. The company has a wide range of product offerings. In order to maintain its market position, the company mainly focuses on product launches and acquisition. For instance, in July 2015, the company acquired Centor (U.S.) Holding Inc., which allowed Gerresheimer boost its profitability and expand its market presence.

The company also focuses on new product launches to expand its product portfolio. In February 2016, the company launched Biopack, an eco-friendly packaging containers for pharmaceutical and cosmetic products. With this product launch, Gerresheimer expanded its portfolio in the plasticware business segment.

Recent Developments:

- In 2016, Sartorius launched a mechanical pipette, Tacta.

- In 2015, Eppendorf AG launched the epMotion 96 pipetting system for liquid handling.

- In 2014, Thermo Fisher Scientific designed a new electronic pipetting system, E1- ClipTip electronic pipette.

- In 2012, Corning Inc. acquired of the Discovery Labware business segment of Becton, Dickinson and Company (U.S.).

Key questions addressed by the report:

- Who are the major market players in the laboratory glassware and plasticware market?

- What are the regional growth trends and the largest revenue-generating regions for laboratory glassware and plasticware market?

- What are the major drivers and challenges in the laboratory glassware and plasticware market?

- What are the major product segments in the laboratory glassware and plasticware market?

- What are the major end users for laboratory glassware and plasticware?

Frequently Asked Questions (FAQ):

What is the size of Laboratory Glassware Market ?

The global Laboratory Glassware Market size is growing at a CAGR of 3.7%

What are the major growth factors of Laboratory Glassware Market ?

The growth in this market will be majorly driven by the increasing demand for plasticware as they are flexible, easy to handle and inexpensive. Technological development has led to added advantages of using plasticware over glassware which further helping in increasing adoption rate among end users.

Who all are the prominent players of Laboratory Glassware Market ?

Major players in this market include Corning, Inc. (U.S.), Eppendorf AG (Germany), Sartorius AG (Germany), and Thermo Fisher Scientific, Inc. (U.S.). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Market Size Estimation

2.2 Market Breakdown and Data Triangulation

2.2.1 Key Data From Secondary Sources

2.2.2 Key Data From Primary Sources

2.2.2.1 Key Industry Insights

2.3 Assumptions

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 28)

4.1 Laboratory Glassware Market to Grow at A Steady Rate

4.2 Laboratory Glassware Market, By Type

4.3 Geographic Analysis: Laboratory Plasticware Market, By Product

4.4 Laboratory Glassware Market, By Region

4.5 Laboratory Glassware Market, By End User

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Demand for Plasticware

5.2.1.2 Cost Effectiveness of Plasticware

5.2.1.3 Technological Advancements in Plasticware

5.2.2 Restraints

5.2.2.1 Brittle Nature of Glass

5.2.2.2 Lack of Funds Resulting in Fewer Research Activities

5.2.3 Opportunity

5.2.3.1 Specialty Glassware

5.2.4 Challenge

5.2.4.1 Automation and Improved Analytical Instrumentation

6 Laboratory Glassware Market, By Product (Page No. - 38)

6.1 Introduction

6.2 Glass Pipettes and Pipette Tips

6.3 Glass Storage Containers

6.4 Glass Flasks

6.5 Glass Beakers

6.6 Glass Petri Dishes

6.7 Glass Burettes

6.8 Other Glassware

7 Laboratory Plasticware Market, By Product (Page No. - 48)

7.1 Introduction

7.2 Plastic Pipettes and Pipette Tips

7.3 Plastic Storage Containers

7.4 Plastic Flasks

7.5 Plastic Beakers

7.6 Other Plasticware

8 Laboratory Glassware Market, By End User (Page No. - 57)

8.1 Introduction

8.2 Research and Academic Institutes

8.3 Hospitals and Diagnostic Centers

8.4 Pharmaceutical and Biotechnology Industry

8.5 Contract Research Organizations

8.6 Food and Beverage Industry

8.7 Others End Users

9 Laboratory Glassware Market, By Region (Page No. - 67)

9.1 Introduction

9.2 North America

9.2.1 U.S.

9.2.2 Canada

9.3 Europe

9.4 Asia-Pacific (APAC)

9.5 Rest of the World (RoW)

10 Competitive Landscape (Page No. - 90)

10.1 Overview

10.2 Competitive Situation and Trends

10.2.1 New Product Launches

10.2.2 Acquisition

11 Company Profile (Page No. - 93)

11.1 Introduction

11.2 Corning Inc.

11.3 Duran Group

11.4 Gerresheimer AG

11.5 Sartorius AG

11.6 Thermo Fisher Scientific

11.7 Mettler Toledo International, Inc.

11.8 Eppendorf AG

11.9 Bellco Glass, Inc.

11.10 Crystalgen Inc.

11.11 Technosklo Ltd.

*Details on Financials, Products & Services, Key Strategy, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 113)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Introducing RT: Real-Time Market Intelligence

12.4 Available Customizations

12.5 Developments

12.6 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.7 Related Reports

List of Tables (66 Tables)

Table 1 Increasing Demand for Plasticware to Drive Market Growth

Table 2 Fewer Research Activities as A Result of A Lack of Funds is A Major Factor Restraining Market Growth

Table 3 Specialty Glassware to Provide Growth Opportunities to Market Players in the Coming Years

Table 4 Growing Adoption of Automation and Improved Analytical Instrumentation A Major Market Challenge

Table 5 Laboratory Glassware Market Size, By Product, 2013–2020 (USD Million)

Table 6 Laboratory Plasticware Market Size, By Region, 2013–2020 (USD Million)

Table 7 Glass Pipettes and Pipette Tips Market Size, By Region, 2013–2020 (USD Million)

Table 8 North America: Glass Pipettes and Pipette Tips Market Size, By Country, 2013–2020 (USD Million)

Table 9 Glass Storage Containers Market Size, By Region, 2013–2020 (USD Million)

Table 10 North America: Glass Storage Containers Market Size, By Country, 2013–2020 (USD Million)

Table 11 Glass Flasks Market Size, By Region, 2013–2020 (USD Million)

Table 12 North America: Glass Flasks Market Size, By Country, 2013–2020 (USD Million)

Table 13 Glass Beakers Market Size, By Region, 2013–2020 (USD Million)

Table 14 North America: Glass Beakers Market Size, By Country, 2013–2020 (USD Million)

Table 15 Glass Petri Dishes Market Size, By Region, 2013–2020 (USD Million)

Table 16 Glass Burettes Market Size, By Region, 2013–2020 (USD Million)

Table 17 Other Glassware Market Size, By Region, 2013–2020 (USD Million)

Table 18 Laboratory Plasticware Market Size, By Type, 2013–2020 (USD Million)

Table 19 Laboratory Plasticware Market Size, By Region, 2013–2020 (USD Million)

Table 20 North America: Laboratory Plasticware Market Size, By Country, 2013–2020 (USD Million)

Table 21 Plastic Pipettes and Pipette Tips Market Size, By Region, 2013–2020 (USD Million)

Table 22 North America: Plastic Pipettes and Pipette Tips Market Size, By Country, 2013–2020 (USD Million)

Table 23 Plastic Storage Containers Market Size, By Region, 2013–2020 (USD Million)

Table 24 North America: Plastic Storage Containers Market Size, By Country, 2013–2020 (USD Million)

Table 25 Plastic Flasks Market Size, By Region, 2013–2020 (USD Million)

Table 26 North America: Plastic Flasks Market Size, By Country, 2013–2020 (USD Million)

Table 27 Plastic Beakers Market Size, By Region, 2013–2020 (USD Million)

Table 28 North America: Plastic Beakers Market Size, By Country, 2013–2020 (USD Million)

Table 29 Other Plasticware Market Size, By Region, 2013–2020 (USD Million)

Table 30 North America: Other Plasticware Market Size, By Country, 2013–2020 (USD Million)

Table 31 Laboratory Glassware Market Size, By End User, 2013–2020 (USD Million)

Table 32 Laboratory Plasticware Market Size for Research and Academic Institutes, By Region, 2013–2020 (USD Million)

Table 33 North America: Laboratory Glassware Market Size for Research and Academic Institutes, By Country, 2013–2020 (USD Million)

Table 34 Laboratory Glassware Market Size for Hospitals and Diagnostic Centers, By Region, 2013–2020 (USD Million)

Table 35 North America: Laboratory Plasticware Market Size for Hospitals and Diagnostic Centers, By Country, 2013–2020 (USD Million)

Table 36 Laboratory Glassware Market Size for Pharmaceutical and Biotechnology Industry, By Region, 2013–2020 (USD Million)

Table 37 North America: Laboratory Glassware Market Size for Pharmaceutical and Biotechnology Industry, By Country, 2013–2020 (USD Million)

Table 38 Laboratory Glassware Market Size for Contract Research Organizations, By Region, 2013–2020 (USD Million)

Table 39 North America: Laboratory Plasticware Market Size for Contract Research Organizations, By Country, 2013–2020 (USD Million)

Table 40 Laboratory Plasticware Market Size for Food and Beverage Industry, By Region, 2013–2020 (USD Million)

Table 41 North America: Laboratory Plasticware Market Size for Food and Beverage Industry, By Country, 2013–2020 (USD Million)

Table 42 Laboratory Glassware Market Size for Other End Users, By Region, 2013–2020 (USD Million)

Table 43 North America: Laboratory Glassware Market Size for Other End Users, By Country, 2013–2020 (USD Million)

Table 44 Laboratory Glassware & Plasticware Market Size, By Type, 2013–2020 (USD Million)

Table 45 Laboratory Glassware & Plasticware Market Size, By Region, 2013–2020 (USD Million)

Table 46 North America: Laboratory Glassware & Plasticware Market Size, By Country, 2013–2020 (USD Million)

Table 47 North America: Laboratory Plasticware Market Size, By Product, 2013–2020 (USD Million)

Table 48 North America: Laboratory Plasticware Market Size, By Product, 2013–2020 (USD Million)

Table 49 North America: Laboratory Glassware & Plasticware Market Size, By End User, 2013–2020 (USD Million)

Table 50 U.S.: Laboratory Glassware Market Size, By Product, 2013–2020 (USD Million)

Table 51 U.S.: Laboratory Plasticware Market Size, By Product, 2013–2020 (USD Million)

Table 52 U.S.: Laboratory Glassware & Plasticware Market Size, By End User, 2013–2020 (USD Million)

Table 53 Canada: Laboratory Glassware Market Size, By Product, 2013–2020 (USD Million)

Table 54 Canada: Laboratory Plasticware Market Size, By Product, 2013–2020 (USD Million)

Table 55 Canada: Laboratory Glassware & Plasticware Market Size, By End User, 2013–2020 (USD Million)

Table 56 Europe: Laboratory Glassware Market Size, By Product, 2013–2020 (USD Million)

Table 57 Europe: Laboratory Plasticware Market Size, By Product, 2013–2020 (USD Million)

Table 58 Europe: Laboratory Glassware & Plasticware Market Size, By End User, 2013–2020 (USD Million)

Table 59 APAC: Laboratory Glassware Market Size, By Product, 2013–2020 (USD Million)

Table 60 APAC: Laboratory Plasticware Market Size, By Product, 2013–2020 (USD Million)

Table 61 APAC: Laboratory Glassware & Plasticware Market Size, By End User, 2013–2020 (USD Million)

Table 62 RoW: Laboratory Glassware Market Size, By Product, 2013–2020 (USD Million)

Table 63 RoW: Laboratory Plasticware Market Size, By Product, 2013–2020 (USD Million)

Table 64 RoW: Laboratory Glassware & Plasticware Market Size, By End User, 2013–2020 (USD Million)

Table 65 New Product Launches 2012–2016

Table 66 Acquisitions, 2012-2016

List of Figures (47 Figures)

Figure 1 Research Design

Figure 2 Market Size Estimation Approach

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 4 Data Triangulation Methodology

Figure 5 Laboratory Glassware and Plasticware Market Snapshot (2015 vs 2020)

Figure 6 Pipette and Pipette Tips Segment to Dominate the Plasticware Market During the Forecast Period

Figure 7 Pipette and Pipette Tips Segment to Witness the Highest Growth Rate in the Laboratory Glassware Market From 2015 to 2020

Figure 8 Research and Academics Institutes Segment to Command the Largest Share in the End User Segment 2015

Figure 9 Geographical Snapshot of the Laboratory Glassware and Plasticware Market, 2015

Figure 10 New Product Launch—Dominant Growth Strategy Pursued By Market Players

Figure 11 Technological Advancements to Propel Market Growth

Figure 12 Plasticware is Expected to Command the Largest Share in 2015

Figure 13 Pipettes and Pipette Tips Segment to Account for the Largest Share in 2015

Figure 14 Pipettes and Pipette Tips Segment to Dominate the Laboratory Plasticware Market From 2015 to 2020

Figure 15 APAC to Grow at the Highest CAGR During the Forecast Period

Figure 16 Research and Academic Institutes—Major End Users in 2015

Figure 17 Laboratory Glassware and Plasticware Market: Drivers, Restraints, Opportunities, & Challenges

Figure 18 Pipettes and Pipette Tips to Dominate the Laboratory Glassware Market From 2015 to 2020

Figure 19 North America to Dominate the Glass Flasks Market From 2015 to 2020

Figure 20 North America is Expected to Dominate the Glass Burettes Market in the Forecast Period

Figure 21 The Plastic Pipettes and Pipette Tips Segment is Expected to Dominate the Laboratory Plasticware Market From 2015 to 2020

Figure 22 North America is Expected to Dominate the Plastic Flasks Market During the Forecast Period

Figure 23 APAC to Witness Highest Growth Rate in the Other Plasticware Market During the Forecast Period

Figure 24 Research and Academic Institutes are Major End Users of Laboratory Glassware and Plasticware

Figure 25 North America to Dominate the Laboratory Glassware and Plasticware Market for Hospitals and Diagnostic Centers in the Forecast Period

Figure 26 APAC Offers Highest Growth Potential for Other End Users in the Laboratory Glassware and Plasticware Market

Figure 27 Geographic Snapshot (2015): Developing Countries are Emerging as New Hotspots of Growth

Figure 28 Asia-Pacific to Witness the Highest Growth in the Laboratory Glassware and Plasticware Market

Figure 29 North American Glassware and Plasticware Market Snapshot

Figure 30 U.S. is Expected to Dominate the Laboratory Glassware and Plasticware Market in the Forecast Period

Figure 31 Hospital and Diagnostic Centers End-User Segment to Grow at the Highest Rate in North America in the Forecast Period

Figure 32 Hospitals and Diagnostic Centers End-User Segment to Show Highest Growth Rate

Figure 33 Pipette and Pipette Tips Dominate the Canadian Laboratory Plasticware Market

Figure 34 Europe Laboratory Glassware and Plasticware Market Snapshot.

Figure 35 Hospital and Diagnostic Centres End-User Segment to Grow at Fastest Rate in the Forecast Period

Figure 36 APAC Laboratory Glassware and Plasticware Market Snapshot.

Figure 37 Pipette and Pipette Tips Segment Dominates the APAC Laboratory Plasticware Market in 2015

Figure 38 Pipette and Pipette Tips Expected to Show Highest Growth in the Forecast Period

Figure 39 Companies Adopted New Product Launches as Their Key Growth Strategy

Figure 40 New Product Launches, the Key Growth Strategy in the Laboratory Glassware and Plasticware Market

Figure 41 Geographic Revenue Mix of the Top Five Market Players

Figure 42 Corning Inc.: Company Snapshot

Figure 43 Gerresheimer AG: Company Snapshot

Figure 44 Sartorius AG: Company Snapshot

Figure 45 Thermo Fisher Scientific: Company Snapshot

Figure 46 Mettler Toledo International, Inc.: Company Snapshot

Figure 47 Eppendorf AG: Company Snapshot

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Laboratory Glassware Market