LED Chips Market - Advanced technologies, Global Forecast and Winning Imperatives (2010 -2015)

The global LED chips market is analyzed and forecasted from 2010 to 2015.

There are various lighting sources available in the market including fluorescent lighting, tungsten photonic lighting, incandescent lighting, and LED lighting. The growth of market for LED chips-based lighting is expected to overpower the declining of incandescent lighting.

LED chips are used in a wide variety of applications; ranging from lighting (automotive lighting, street lighting, and general illumination) to backlighting for panels in consumer electronics (such as LCD TVs, laptops, and phones). The driving factor behind the demand for LED backlighting for application in LCD screens is its quality of picture due to the higher degree of brightness and power efficiency. LED backlit LCD television sets have better brightness than CCFL television sets and ultimately deliver better picture quality. The increasing demand for cost-effective and energy-efficient lighting and a number of other factors are boosting the global demand for LED chips and therefore most of the developments in the LED chip market aim at providing more efficient and advanced products that will not only give more brightness, but also consume less power.

While conventional products are still popular in the market, their market share is going down at a rapid pace as they are not cost efficient. LED chips offer high brightness and power efficiency; and also have lower carbon emissions than traditional technologies such as incandescent and halogen lighting. This aspect has made LED lighting popular with government organizations, which are now putting LED lighting in public places and government offices.

LED chips are available in various colors; namely infrared, red, green, yellow, blue, white. The blue LED chip market holds the highest share and the red LED is the second largest segment in the LED chip market.

When used for illumination purposes, LEDs are also more cost-effective than traditional lighting sources. The global LED chips market is thus witnessing an increasing demand, and companies are expanding their manufacturing capabilities to meet this demand. High brightness LED chips currently enjoy high growth as the backlighting application in TVs is shifting from traditional CCFL technology to LED technology.

The heat-sensitivity of LED chips reduces their efficiency and lifespan, especially in applications such as industrial units and manufacturing plants, where there is a high degree of ambient heat. However, ongoing R&D to improve thermal management is expected to boost the LED chip industry.

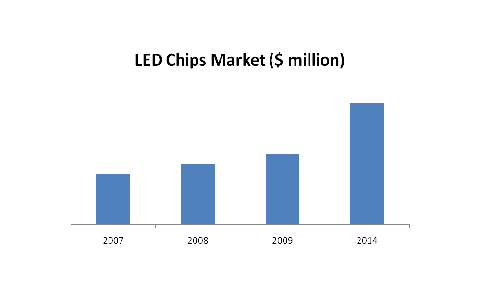

The LED chips market is estimated to grow from $3,162 million in 2009 to $8,536 million in 2014 at a CAGR of 22% from 2009 to 2014. Backlighting is expected to form the largest application in 2014 with an estimated market size of $4,015 million. This is mainly due to the growing trend of LED backlighting in LCD panels such as netbooks, televisions, and PC monitors.

Scope of the report

This research report categorizes the global LED Chips market on the basis of different applications of LED chips, the LED chips with different colors, and geographical analysis; forecasting revenues, and analyzing trends in the e-waste management market.

On the basis of applications

The different types of applications covered in the report are backlighting, illumination, signs, and signals.

On the basis of colors

The different types of colored LED chips are discussed in the report, namely, infrared, red, green, yellow, blue, white.

On the basis of geography

North America, Europe, Asia-Pacific, and ROW are covered in the report.

The report will provide market data, market drivers, trends and opportunities, top-selling products, key players, and competitive outlook. It will also provide market tables for covering the applications and sub segments. In addition, the report will provide more than 20 company profiles for the market.

Global LED Chips Market (2010 – 2015)

The global LED chips market is currently witnessing a high demand owing to the new applications such as LCD backlighting and illumination. Companies are expanding their manufacturing capabilities to meet with the demand. The emission of carbon from the LED chips-based lighting is comparatively less as compared to the competitive technologies such as incandescent and halogen lighting. This aspect has made LED lighting popular with the government organizations, which are now putting LED-based lighting in public places, government offices, and streets.

High brightness and power efficiency are the two main advantages of the LED chips market. The global LED chips market is estimated to grow from $3,162 million in 2009 to $8,536 million in 2014, at a CAGR of 22% from 2009 to 2014.

Environmental concerns are driving the need for green and low-power-consuming lighting systems and therefore most of the developments in the LED chip market aim at providing more efficient and advanced products that will not only give more brightness, but also consume less power. The major players in this market include Cree Inc. (U.S.), Epistar (Taiwan), Nichia (Japan), OSRAM Opto Semiconductors GmbH (Germany), and Philips Lumileds (U.S.).

Source: MarketsandMarkets

Table Of Contents

Executive Summary

Market Overview

Applications Wise Market

Color Wise Market

Geographic Analysis

Competitive Landscape

1 Introduction

1.1 Key Take-Aways

1.2 Report Description

1.3 Markets Covered

1.4 Stakeholders

1.5 Research Methodology

2 Summary

3 Market Overview

3.1 Evolution Of LED (Light-Emitting Diode)

3.2 AN Overview Of LED Chips

3.2.1 Multi-Chip LED

3.2.2 Single Chip LED

3.3 Compounds

3.3.1 Gallium Nitride

3.3.2 Gallium Arsenide

3.3.3 Gallium Phosphide

3.4 Market Trends OF LED Chips

3.5 Industry Life Cycle Of LED Chips

3.6 Demand Versus Supply Analysis

3.7 The Porter Five Forces Model

3.7.1 High Threat From New Entrants

3.7.2 Threat From The Product Substitutes

3.7.3 Supplier Bargaining Power

3.7.4 Customer¡¯s Bargaining Power

3.7.5 Competition From Other Firms

3.8 Potential Of LED Chips In Consumer Electronics Market

3.9 LED TV ¨C The Latest Application Of LED Chips

3.10 RPCVD Technology ¨C New Dimension Of LED Chip Manufacturing

4 Market Analysis

4.1 Drivers

4.1.1 Backlighting Application Boosting The LED Chip Market

4.1.2 Power Efficiency Of LED Chips

4.1.3 R&D Investments And Government Initiatives

4.2 Restraints & Opportunities

4.2.1 Shortage Of The MOCVD Tool

4.2.2 Concentration Of Manufacturing Units In South East Asia Increasing The Shipment Cost

4.2.3 Lower Price Of Competing Technologies

4.2.4 Growing Number Of Applications

5 RevenuE Forecast

5.1 Revenue For LED Chips From Various Applications

5.1.1 Backlighting

5.1.2 Illumination

5.1.3 Automotive

5.1.4 Signs & Signal

5.1.5 Others

5.2 Revenue For Various LED Chips

5.2.1 Blue LED Chips

5.2.2 RED LED Chips

5.2.3 Green LED Chips

5.2.4 Others

6 Competitive Landscape

7 Geographical Analysis

7.1 North America

7.2 Europe

7.3 Apac

7.4 Row

8 Patents Analysis

9 Company Profiles

9.1 Bright LED Electronics Corporation

9.2 AVA Technologies Inc.

9.3 Bridgelux

9.4 Cree

9.5 Dowa Electronics Materials Co Ltd

9.6 Epistar Corporation

9.7 Formosa Epitaxy

9.8 Goldeneye INC.

9.9 Hitachi Cable

9.10 Huga Optech

9.11 Kingbright

9.12 Nichia Corporation

9.13 Optek Technology Ltd

9.14 Osa Opto Light Gmbh

9.15 Osram Opto Semiconductors

9.16 Perkin Elmer

9.17 Philips LumiLEDs

9.18 SemiLEDs

9.19 Seoul Semiconductors

9.20 Showa Denko

9.21 Teckore

List Of Tables

Summary Table Global LED Chips Market By Applications 2007 ¨C 2014 ($Million)

Table 1 Advantages Of LED

Table 2 Disadvantages Of LED

Table 3 Comparison Between Single Chip LED And Multi Chip LED

Table 4 Comparison Of Various Gallium Compounds On Different Parameters

Table 5 Comparison Of Manufacturing Costs For Mocvd And Rpcvd Technologies

Table 6 Cost Comparison Of LED Chip Based Bulb And Incandescent Bulb

Table 7 LED Chip Revenue, By Application 2007 -2014 ($Million)

Table 8 Initiatives From Governments In Different Countries To Phase Out Incandescent Bulbs

Table 9 Comparison Between LED Lighting And Conventional Lighting In Automotives

Table 10 LED Chip Market By Color 2007-2014 ($Million)

Table 11 Mergers And Acquisition (2007- January 2010)

Table 12 Agreements, Collaborations, Partnerships And Joint Ventures (2008 ¨C March 2010)

Table 13 New Product Development And Expansions (2007 - April 2010)

List Of Figures

Figure 1 Development Of LED Family

Figure 2 Price And Brightness Levels Of Various Gallium Compounds

Figure 3 Trend Analysis Of LED Chip Market (1990 ¨C 2014)

Figure 4 Product Life Cycle Of LED Chip Industry

Figure 5 Demand And Supply Analysis Of LED Chip Market

Figure 6 Porter Five Forces Model For LED Chips

Figure 7 Penetration Rate Of LED Chips In Various Domains Of Consumer Electronics

Figure 8 Comparison Of Growth Rate Of Lcd Tvs And LED Backlit Lcd Tvs

Figure 9 Transition In Backlighting Technology

Figure 10 Cost Gap Analysis Of LED And Competitive Technologies (2010 - 2014)

Figure 11 Life Cycle For Backlighting Application

Figure 12 Market For LED Chips From Application In Backlighting

Figure 13 Long Run Average Cost Curve Of LED Backlit And Ccfl Backlit Lcd Panels

Figure 14 Market For LED Chips From Application In Illumination

Figure 15 Cost Versus Performance Of Major Lighting Technologies

Figure 16 Product Life Cycle For LED And Other Lighting Sources

Figure 17 Market For LED Chips Market From Application In Automotive Sector

Figure 18 Market Penetration Of LED Chip For Application In Automotive Industry

Figure 19 The Price Curve Of LED Chips For Automotive Applications

Figure 20 Global Penetration Of LED Chips For Use In Traffic Signals

Figure 21 LED Chip Market For Signs And Signals Application

Figure 22 Life Cycle Of Signs & Signals Application Of LED Chips

Figure 23 Comparison Between Global Gdp Growth And LED Signage Market

Figure 24 LED Chip Market For Other Applications

Figure 25 Blue LED Chip Market

Figure 26 Comparison Of Blue Chip LED And Ccfl

Figure 27 Red LED Chip Market

Figure 28 Green LED Chips Market

Figure 29 Market For Other LED Chips

Figure 30 Industries Growth Strategy

Figure 31 Growth Rate Of World LED Chip Market By Year

Figure 32 North American LED Chip Market

Figure 33 European LED Chip Market

Figure 34 Apac LED Chip Market

Figure 35 Row LED Chip Market

Figure 36 Patent Registrations In Various Regions

Figure 37 Number Of Patents Filed Increasing Over Years

Growth opportunities and latent adjacency in LED Chips Market