Leukapheresis Market Size, Growth, Share & Trends Analysis

Leukapheresis Market by Type (Filter, Membrane Separator, Centrifugal Device), Leukopak (Mobilized, Isolated PBMC), Application (Research [Cell & Gene Therapy, Transplantation], Therapeutic), Indication, End User, Region - Global Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY TAKEAWAYS

-

Leukapheresis Market, By RegionAsia Pacific is projected to grow at the highest CAGR of 10.0% during the forecast period in the leukapheresis market.

-

Leukapheresis Market, By TypeIn the leukapheresis market, the disposables segment accounted for a dominant share of 79.8% in 2025.

-

Leukapheresis Market, By ApplicationThe research applications segment is projected to grow at the highest CAGR of 9.0% during the forecast period in the leukapheresis market.

-

Leukapheresis Market, By End UserIn the leukapheresis market, the blood component providers & blood centers segment accounted for the largest market share of 46% in 2025.

-

Leukopaks Market, By RegionIn the leukopaks market, Asia Pacific is set to witness the fastest growth rate during the forecast period from 2026 to 2031.

-

Leukopaks Market, By TypeBy type, the mobilized leukopaks segment dominated the leukopaks market with a 69.1% share in 2025.

-

Leukopaks Market, By IndicationBy indication, the hepatocellular carcinoma segment is projected to register the highest CAGR during the forecast period in the leukopaks market.

-

Leukopaks Market, By End UserIn the leukopaks market, the academic & research institutes segment dominated the market by accounting for 64.9% market share in 2025.

-

Competitive Landscape - Key PlayersTerumo BCT (Japan) and Fresenius Kabi (Germany) are identified as star performers in the leukapheresis market, as they have a very strong installation base, sophisticated leukapheresis technologies, and broad adoption of these technologies in hospitals & blood banks.

-

Competitive Landscape - Startups/SMEsImmune Therapy Holdings AB (Sweden) and SCTbio (Czech Republic) have been identified as progressive SMEs, as they have been growing very rapidly in cell processing & cell therapy services.

The global leukapheresis market is a niche segment of the medical industry, yet to a certain extent, it is still continuously growing. The demand for leukocyte collection in hematology, oncology, and cell and gene therapy workflows is a key factor that drives growth. Besides, the worldwide improvement of the apheresis infrastructure, the increase in CAR-T and immunotherapy activities, and the broadening of the clinical trial networks in major regions also contribute to this account. North America accounts for most of the market owing to its mature CGT ecosystem; on the other hand, Europe and Asia Pacific are experiencing high growth due to the development of hospital capabilities, the increase in investment in CGT production, and the wider use of advanced apheresis technologies. The combination of these elements keeps the global market consistently growing.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The global leukapheresis market is at the core of a major transformation, where the procedure, which was mainly acute, therapeutic, and clinic-driven, is changing into a routine and indispensable cell and gene therapy workflow component. The requirement for highly pure, GMP-compliant leukocyte collections for CAR-T, TCR-T, NK-cell, and other advanced immunotherapies is the major factor behind the comprehensive refurbishment of leukapheresis processes globally. The global expansion of CGT manufacturing, increasing the number of clinical trials, and the demand for reliable, scalable cell collection capacity are some of the reasons that accelerate this transition. The combination of digitalization of apheresis workflows, the rise of decentralized and outpatient collection models, and the formation of international multi-site leukapheresis networks, is not only changing the way service is delivered but also making the leukapheresis ecosystem more standardized and globalized.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising incidence and prevalence of leukemia

-

Increased demand for leukopaks in clinical research

Level

-

High cost of therapeutic leukapheresis and leukopaks

-

High cost of cellular immunotherapies and lack of favorable reimbursement

Level

-

Growing focus on leukapheresis for pediatric patients

-

Growth opportunity in emerging economies with investments from academic institutes, pharma-biotech companies

Level

-

Concerns related to safety of blood transfusion in emerging economies

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising incidence and prevalence of leukemia

The main reasons driving the leukapheresis market globally are the rise in the incidence of leukemia across regions, especially among aging populations in major countries across North America, Europe, and Asia Pacific. Leukapheresis sees broad application both as a therapeutic intervention aimed at rapid reduction in high white blood cell counts and as a preparatory step for advanced treatments. Further helping to sustain demand worldwide is a strong network of hematology care, early diagnosis, and wider access to specialized oncology and treatment centers.

Restraint: High cost of therapeutic leukapheresis and leukopaks

The cost involved in leukapheresis procedures and leukopak processing hinders the use of the technique to a large extent, particularly in low- and middle-income regions. This increases the total cost of treatment, considering other costs involved, including sophisticated apheresis equipment, disposables, skilled laboratory personnel, and GMP processing. A number of countries with limited budgets and delayed reimbursement approvals may result in reduced procedure volumes, hampering the growth of the global market.

Opportunity: Growth opportunity in emerging economies with investments from academic institutes, pharma-biotech companies

Emerging economies present strong growth opportunities for the leukapheresis market due to increasing investments in research infrastructure and rising engagement from global clinical trial networks. Academic institutions, biotechnology companies, and public health programs in Asia Pacific, Latin America, and the Middle East are driving higher demand for leukapheresis as participation in early-stage therapy development continues to expand.

Challenge: Concerns related to safety of blood transfusion in emerging economies

Blood safety concerns linked to handling and processing outside the body remain a key issue to be overcome in the leukapheresis market across emerging regions. Variability in regulations and policies related to blood safety and traceability continues to pose hurdles. Blood-related concerns linked to infection risks and anticoagulant-related adverse events have long been at the forefront, especially in markets with developing healthcare systems.

LEUKAPHERESIS MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Provides the Spectra Optia Apheresis System, one of the most widely used continuous-flow centrifugal devices for therapeutic leukapheresis, mononuclear cell collection, and immune cell harvesting | Used extensively in CGT workflows to collect high-quality starting material for CAR-T and TCR-T manufacturing | High automation, real-time monitoring, customizable protocols, and superior MNC yield support reproducible collections for both clinical and manufacturing settings | Its broad clinical indication library and integrated disposable kits ensure consistency, safety, and scalability |

|

Provides leukapheresis systems and disposables widely used in hospitals for therapeutic leukocyte reduction and standardized cell collection supporting hematology and oncology workflows | Strong reliability, broad hospital penetration in Europe, integrated consumables portfolio, and compliance with EU clinical and safety standards ensure consistent procedural outcomes |

|

Supplies automated apheresis platforms used for efficient leukocyte separation in therapeutic leukapheresis and immune cell collection for advanced clinical applications | High automation improves cell yield consistency, reduces procedure time, enhances patient safety, and supports scalable adoption in busy European apheresis centers |

|

Miltenyi’s CliniMACS Prodigy automates cell processing using leukapheresis-derived inputs, supporting T-cell enrichment, activation, and genetic modification. Their leukopak handling workflows are critical to CGT manufacturing | Closed, automated GMP-compliant processing improves cell viability, reduces operator error, and accelerates manufacturing timelines for CAR-T and other advanced therapies |

|

Offers apheresis disposables and blood processing solutions supporting leukapheresis procedures within European hospitals and transfusion services | Cost-effective consumables, strong regional presence, and alignment with European blood safety regulations support reliable and compliant leukapheresis operations |

|

Provides leukapheresis-related systems and blood management solutions used in therapeutic leukocyte reduction and research-grade cell collection across Europe | Deep expertise in blood therapies, strong transfusion network integration, and regulatory experience enable safe procedures and dependable access to leukocyte products |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The global leukapheresis market environment consists of a wide range of related entities, such as apheresis system manufacturers, disposable kit suppliers, hospitals, blood centers, and cell processing facilities. These different groups coordinate very well with regulatory agencies, research institutions, and cell and gene therapy companies to ensure that leukocyte collection is safe, standardized, and compliant with good manufacturing practices (GMP). Tight collaboration between healthcare providers, biopharmaceutical developers, and technology partners is one of the main reasons behind the continuously increasing demand for high-quality cell material. Another factor is the combined effect of the deployment of public health care infrastructures, the increasing CGT investments, and the growing biotech ecosystem in the key regions such as North America, Europe, and the Asia Pacific, which together are rapidly driving the global uptake of leukapheresis.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Leukapheresis Market, By Type

The leukapheresis market globally is dominated by the disposables segment, because single-use sets, kits, and filters are used in each and every leukapheresis procedure. Strict regulations in major markets for infection control and blood safety promote the use of disposable parts over reusable parts. The continually increasing number of leukapheresis procedures worldwide ensures the disposables segment remains a leading contributor to the market.

Leukapheresis Market, By Application

Research applications are expected to register the highest CAGR in the global market due to the continued development of the research ecosystem for cell and gene therapy. With the rise in the number of clinical trials involving CAR-T, TCR, and other immunotherapies across major regions, there has been a rising need for cells derived from the process of leukapheresis.

Leukapheresis Market, By End User

Blood component providers & blood centers are estimated to occupy the leading market position globally due to their critical role in organizing and standardizing processes related to leukapheresis. Blood centers have established infrastructure and a trained workforce necessary for large-scale procedures and are able to undertake a large number of processes related to clinical trials, as well as the use of devices and consumables for leukapheresis.

Leukopaks Market, By Type

The mobilized leukopak segment globally accounts for a major market share because mobilized leukopaks are known to give a higher yield of target immune cells required for R&D in advanced research. The process of mobilization in research institutions and clinical trial settings is significant because it provides steady cell availability. The complexity of research in immunotherapy further fuels the demand for mobilized leukopaks.

Leukopaks Market, By Indication

The hepatocellular carcinoma segment is set to record the highest CAGR in the global leukopaks market, particularly due to the rising cases of liver cancer worldwide. Moreover, immuno-oncology studies are being extensively carried out in research institutions for the treatment of liver cancer, which has led to an increased demand for research leukopaks.

Leukopaks Market, By End User

The global leukopaks market is dominated by research and academic institutes, as they are major users of leukopaks in immunology, oncology, and translational research. Adequate public funding, developed research infrastructure, and engagement in global clinical trials drive high demand volumes. The involvement of research institutes in early-stage therapy R&D and validation creates steady demand in the global leukopaks market.

REGION

Asia Pacific is set to be the fastest-growing leukapheresis market, by region

Because of its rapidly expanding research ecosystem and increasing adoption of advanced cell and gene therapies, Asia Pacific is set to register the highest CAGR in the global leukapheresis market. Continuing the trend in the growing number of clinical trials in China, Japan, South Korea, and India, alongside the development of specialized apheresis networks at major hospitals, will further increase the volume of procedures in the region. Besides that, the growth of the leukapheresis market in the Asia Pacific region is being supported further by government initiatives, better regulatory frameworks, and an increase in collaborations between academia, biotechnology companies, and blood establishments.

LEUKAPHERESIS MARKET: COMPANY EVALUATION MATRIX

Terumo BCT is categorized as a star player for the leukapheresis market as the company has an installed base of leukapheresis systems, has been innovative with its products, and has penetrated hospitals and blood banks extensively. Miltenyi Biotec is an emerging leader in the leukapheresis market, as the focus of the company has been shifting to cell and gene therapy, which has helped the company gain prominence in the market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Fresenius Kabi (Germany)

- Terumo BCT (Japan)

- Haemonetics Corporation (US)

- Grifols S.A. (Spain)

- Macopharma (France)

- Medica S.p.A. (Italy)

- Miltenyi Biotec (Germany)

- Baxter International Inc. (US)

- Nikkiso Co., Ltd. (Japan)

- Immune Therapy Holdings AB (Sweden)

- SCTbio (Czech Republic)

- Biohope Scientific SL (Spain)

- Caltag Medsystems Ltd. (UK)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2025 (Value) | USD 83.3 Million |

| Market Forecast, 2031 (Value) | USD 138.7 Million |

| CAGR (2026–2031) | 8.9% |

| Years Considered | 2024–2031 |

| Base Year | 2025 |

| Forecast Period | 2026–2031 |

| Units Considered | Value (USD Million), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Related Segment & Geographic Reports | Europe Leukapheresis Market |

WHAT IS IN IT FOR YOU: LEUKAPHERESIS MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | Detailed assessment of leukapheresis systems and disposables by procedure type (therapeutic vs. collection), application (clinical vs. research), and technology (continuous-flow, automation level) |

|

| Company Information | Comprehensive profiles of key leukapheresis players such as Fresenius Kabi, Terumo BCT, Haemonetics, Grifols, and emerging European SMEs | Mapped competitive positioning, product portfolios, partnerships, training initiatives, and strategic moves supporting cell and gene therapy expansion in the leukapheresis market |

| Geographic Analysis | Delivered country-level analysis of the Europe leukapheresis market covering Germany, France, the UK, Italy, Spain, and emerging markets. Assessed regulatory landscape (EMA, national agencies), healthcare infrastructure, and CGT activity | Supported strategic planning by identifying high-growth countries, strong apheresis hubs, favorable reimbursement environments, and opportunities for cross-border collection networks and partnerships |

RECENT DEVELOPMENTS

- April 2023 : Fresenius Kabi (Germany) upgraded its Amicus Blue ECP system with new software versions and a flexible single-use disposable kit. This enhanced procedural efficiency, usability, and venous access options for leukapheresis and photopheresis workflows.

- January 2023 : Charles River Laboratories International, Inc. (US) launched its CliniPrime Fresh Leukopak offering, providing GMP-compliant cellular starting materials. This supported cell and gene therapy developers with high-quality leukopaks suitable for clinical and commercial manufacturing.

- August 2023 : Fresenius Kabi (Germany) and Lupagen Inc. (US) entered a strategic development and supply agreement focused on advancing technologies for cell and gene therapy delivery. The collaboration aimed to accelerate translation of advanced therapies from development to bedside use.

- May 2023 : Terumo BCT (US) introduced a specialized training program to help cell and gene therapy manufacturers optimize cell collection processes. The initiative supported faster scale-up and commercialization of advanced therapeutics through improved leukapheresis practices.

Table of Contents

Methodology

This study extensively used both primary and secondary sources. The research involved studying various factors affecting the industry to identify segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

This research study involved the usage of comprehensive secondary sources, directories, databases such as Bloomberg Business, Factiva, and Dun & Bradstreet; white papers; annual reports; company house documents; investor presentations; and SEC filings of companies. Secondary research was used to identify and collect information useful for an extensive, technical, market-oriented, and commercial study of the leukapheresis market. It was also used to identify key players in the market and classify and segment the industry based on trends to the most detailed level. Additionally, significant developments related to market and technology perspectives were noted. A database of the primary industry leaders was also created using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include project/sales/marketing/business development managers, presidents, CEOs, vice presidents, chairpersons, chief operating officers, chief strategy officers, directors, chief information officers, and chief medical information officers related to the leukapheresis market. Primary sources from the demand side include healthcare professionals from blood component providers & blood centers, academic & research institutes, pharmaceutical & biotechnology companies, and hospitals & transfusion centers.

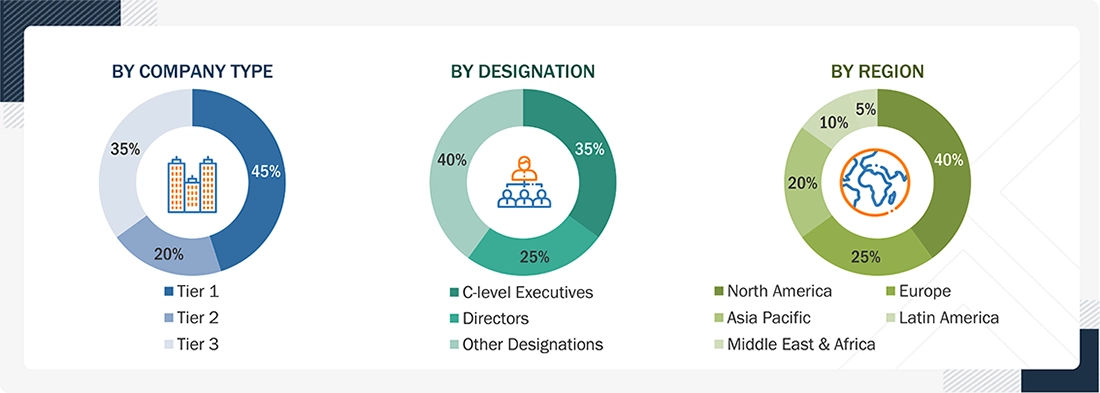

A breakdown of the primary respondents is provided below:

BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE PARTICIPANTS, BY COMPANY TYPE, DESIGNATION, AND REGION

Note 1: C-level executives include CEOs, COOs, CTOs, and VPs.

Note 2: Other designations include sales, marketing, and product managers.

Note 3: Tiers are defined based on a company’s total revenue. As of 2024: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

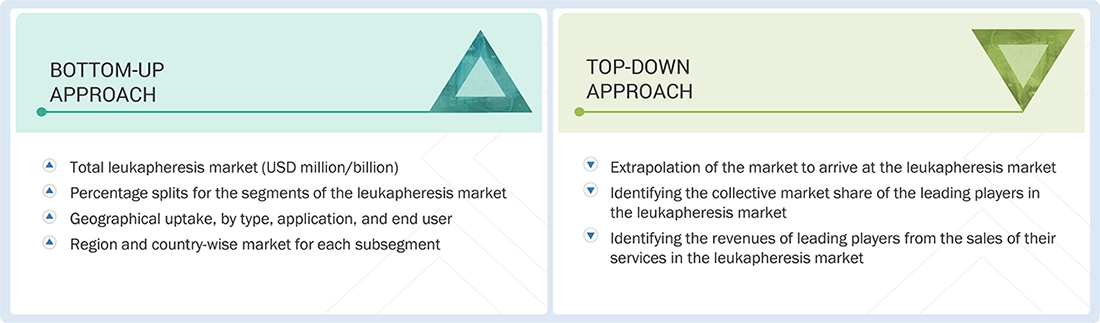

Market Size Estimation

The total size of the leukapheresis market was determined after data triangulation from three approaches, as mentioned below. After each approach, the weighted average of the three approaches was taken based on the level of assumptions used in each approach.

Data Triangulation

After arriving at the market size, the total market was divided into several segments and subsegments. Data triangulation and market breakdown procedures were employed wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments.

Market Definition

Leukapheresis is the process of separating white blood cells from the whole blood. Therapeutic leukapheresis procedures are used to treat hyperleukocytic leukemia, including acute lymphoblastic leukemia (ALL), chronic lymphocytic leukemia (CLL), multiple myeloma, and non-Hodgkin’s lymphoma.

Leukopaks are enriched leukapheresis products that contain mononuclear leukocytes (lymphocytes and monocytes) and are used to develop cell-based therapeutics

Key Stakeholders

- Apheresis device manufacturers and distributors

- Leukapheresis product manufacturers and distributors

- Leukopak manufacturers and distributors

- Pharmaceutical and biotechnology companies

- Healthcare service providers (including hospitals and transfusion centers)

- Cancer treatment centers

- Blood component providers & blood centers

- Contract research organizations (CROS)

- Academic and research institutes

- Government associations

- Market research and consulting firms

- Venture capitalists and investors

Report Objectives

- To define, describe, segment, and forecast the leukapheresis market by type, application, end user, and region, and the leukopaks market, by type, indication, end user, and region

- To provide detailed information about the factors influencing market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall leukapheresis market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the leukapheresis market in five main regions (along with their respective key countries), namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players in the leukapheresis market and comprehensively analyze their core competencies and market share

- To track and analyze competitive developments such as acquisitions, product launches, expansions, collaborations, agreements, and partnerships

Available customizations:

With the given market data, MarketsandMarkets offers customizations to meet your company’s specific needs. The following customization options are available for the report:- Company Information

Detailed analysis and profiling of additional market players (up to 5)

- Geographic Analysis

Further breakdown of the Rest of Europe leukapheresis market into Austria, Finland, and other countries

Further breakdown of the Rest of Latin America leukapheresis market into Colombia, Chile, and other countries

- Competitive Landscape Assessment

Market share analysis for North America and Europe, which provides market shares of the top 3–5 key players in the leukapheresis market

Competitive leadership mapping for established players in the US

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Leukapheresis Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Leukapheresis Market