Light Electric Vehicles (LEVs) Market by Vehicle Category, Application (Personal Mobility, Shared Mobility, Recreation & Sports, Commercial), Power Output (Less than 6 kW, 6-9 kW, 9-15 kW), Component Type, Vehicle Type Region - Global Forecast to 2027

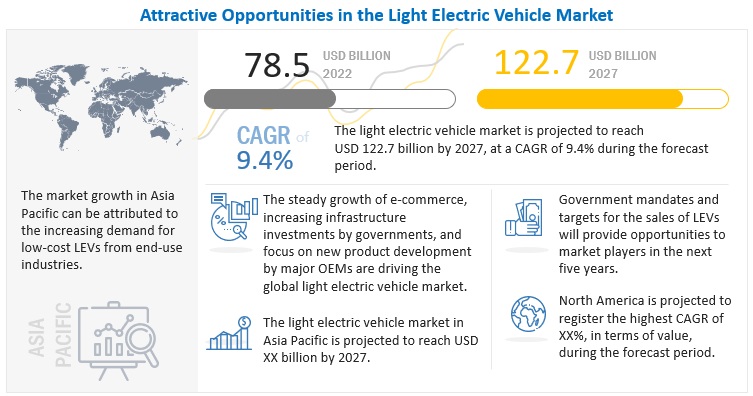

[409 Pages Report] The light electric vehicle (LEVs) market size was valued at USD 78.5 billion in 2022 and is expected to reach USD 122.7 billion by 2027, registering a CAGR of 9.4%. This study mapped electric industrial vehicles, autonomous forklifts, delivery robots, electric bikes, electric scooters, electric motorcycles, neighbourhood electric vehicles, electric lawn mowers (robotic and manual), and automated guided vehicles. Rapid electrification of neighbourhood vehicles, scooters, and motorcycles, usage of e-bikes for multiple roles in urban commute, recreation, and sports, and increased shift to use of battery-operated material handling vehicles (e.g., forklifts, aisle trucks, tow-tractors, and others) for indoor applications have all increased demand for low-emission alternatives to off-road vehicles (e.g., ATVs and UTVs), lawnmowers, and other household items. Additionally, the demand for e-scooters and e-motorcycles is anticipated to increase more quickly than that of other LEVS due to the rapid deployment of charging stations throughout nations and initiatives and actions taken by local governments to minimise emissions and traffic on roadways.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: Government incentives and subsidies

The With increasing concerns raised over the environmental impact of conventional vehicles, governments around the world are encouraging the adoption of vehicles using alternative sources of fuel. In developing countries like India and China, LEVs are being made a compulsory part of operational fleets for purposes such as geofenced passenger hauling, last-mile delivery, and other commercial purposes. Developed countries like the Netherlands are aiming to use only electric vehicles with zero emissions for all commercial and governmental purposes by the end of 2025. Governments like Mexico are also providing tax incentives at various stages of EV deployment, like vehicle purchase, charging, and infrastructure developments.

Restraint: Limited range and high initial ownership cost of LEVs than ICE Counterparts

The growth of the Light electric vehicle market has been restrained due to range limitations. Unlike ICE vehicles LEVs do not have fuel tanks for energy storage and quick refueling. A fully charged battery can cover a limited range, which is generally lower than the ICE counterpart. Currently, most electric two-wheelers like e-scooters, e-motorcycles, and e-bikes have a range of up to 100–120 miles and with 6-8 hours of charge time, consumers with a need to travel more than 100 miles per day are reluctant to purchase LEVs. Industrial vehicles also suffer from limited battery range and long charging times limiting their usage per day. The solution for this problem is battery swap station on which governments and private players are focusing alike. With standardization of battery type and size, the application of battery swap stations can be bought into wider general use countering the aforementioned issues.

LEVs are costlier than gasoline-powered light vehicles. The LEVs usually cost around USD 5,000-7,000 higher than their ICE counterparts in the North American region. Most of the consumers cannot afford brand-new and expensive models. The cathode price affects the price of the batteries to a great extent, because raw materials such as cobalt, nickel, lithium, and magnesium are expensive. The battery of an LEV needs frequent charging, which increases the requirement for additional equipment such as electric chargers. Recent developments in the light electric vehicle (LEVs) market have pressed OEMs to invest more money in the development of such products reducing their initial cost of ownership. Polaris's ICE ranger models such as Ranger 570, Ranger SP 570 and Ranger 1000 costs less than the Ranger EV Kinetic.

Opportunity: Use of battery swapping for electric utility vehicles

Battery swapping at the LEV charging stations is a new trend that eliminates the time for charging batteries for LEV users. Although level 3 EV charging can charge an electric vehicle in 30–60 minutes and ultra-fast charging can charge in 15–30 minutes, they are not compatible with LEVs. Therefore, battery swapping is a great alternative for LEVs. Companies such as NIO have installed over 300 battery swapping stations by July 2021 and plan to install around 4,000 more by 2025 in China. Its swapping stations have been used about 2.9 million times globally, with approximately 1,000 battery-swapping stations designed outside China. Shell signed an agreement with NIO in November 2021 to develop such battery-swapping EV charging stations jointly. This has created a new opportunity for battery-as-a-service in LEV charging. The battery swapping stations are expected to attract more electric utility vehicle customers as they will not have to wait for more charging time. The swap stations will also reduce the upfront cost of the electric utility vehicles as the battery ownership will be replaced by battery leasing.

Challenge: Lack of compatibility, interchangeability, and standardization

Since the Light Electric Vehicle (LEVs) market is at a developing stage, the competition is high along with patented designs for faster and better technologies associated to motors, batteries, ecosystems, and others, which makes it hard for OEMs to have a standardized, interchangeable and all compatible systems and vehicles. To handle this issue, in August 2022, National Institution for Transforming India (NITI) Ayog, a research and advisory organization for the Government of India drafted the Battery Swapping Policy, which has mentioned the technical aspects of standardization that would facilitate interoperability across the battery swapping ecosystem. The battery standardization would make this process easier as every EV has the same battery making it reliable to swap disregarding which company manufactured the battery.

Rising demand for Light electric vehicle (LEVs) in personal mobility and industrial applications to drive the less than 6 kW segment

The growing demand for LEVs with low seating capacity is further likely to augment the sales of electric scooters and electric bikes with low power (less than 6 kW) for personal commutes and shared mobility applications. Owing to their high demand, Chinese players are exporting these low-power LEVs to North America and Europe at relatively lower costs. Therefore, the growing demand for personal mobility will drive the less than 6 kW power output segment during the forecast period. Most of the electric two-wheelers have a power output of less than 6 kW. These low-power two-wheelers are used for delivery purposes and personal transportation, among others. For instance, the Yadea C1S Pro, which comes with a power output of 2.2 kW to 3.9 kW, is suitable for small applications, such as warehouse management. The Center-Steering Electric Counterbalanced Lift Truck “8FBE Series” has a power output of 4.9 kW and is used for smaller applications. Government promotions and schemes have also led to increased sales of less than 6 kW power output e-bikes over the years. Hence, the above-mentioned factors would drive the growth of the less than 6 kW segment

Battery pack segment to lead Light electric vehicle (LEVs) market during the forecast period

In the current scenario, lithium-ion batteries are the preferred choice for LEVs like e-ATVs/UTVs, e-scooters, e-motorcycles, e-bikes, etc. because of their higher energy density, longer life, and zero maintenance effect compared to lead-acid batteries. The only factor impacting the adoption of lithium-ion batteries is their high cost and availability of raw materials for their production. Invented in 1859, the lead-acid battery is still found in many electric utility vehicles. The lead-acid battery offers a limited capacity despite its significant bulk and weight; still, it has the advantage of being both inexpensive and easy to produce and recycle. However, due to growing environmental awareness, the hazardous nature of lead-acid batteries is now restraining their usage in LEVs.

With the growing environmental concerns, many countries have adopted eco-friendly battery types. Lead-acid batteries had a huge demand in the past couple of years, mainly in electric two-wheelers such as e-bikes and e-scooter. But with the introduction of lithium-ion batteries in LEVs, the scenario of the battery market has changed a lot. Lithium-ion batteries provide many benefits over lead-acid batteries. They are compact, have a high energy density, and exhibit fewer heating problems. Most LEVs are fitted with lithium-ion batteries. Also, advancements in technology, battery manufacturers are developing alternate solutions for lithium-ion batteries in the form of lithium-polymer batteries, graphene lithium batteries, and others. Battery manufacturers are investing to develop and expand their capacities. For instance, in April 2022, Phylion Battery Co., Ltd. (China) invested nearly USD 776 million in a 16 GWh plant for battery manufacturing. Other major LEV battery manufacturers include LG Chem (South Korea), Samsung SDI (South Korea), HK Kingbopower Technology (China), and Optimumnano Energy Co., Ltd. (China).

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The light electric vehicle (LEVs) market is primarily dominated by players like Textron Inc. (US), Polaris Inc. (US), John Deere (US), Yamaha Motor Co. Ltd. (Japan), Club Car Inc. (US), and BMW AG (Germany). The top key players in the e-ATV/UTV segment of the LEV market are Polaris Inc. (US), Toyota Industries (Japan), John Deere (US), and Textron Inc. (US). The top key players in the e-Bike segment of the LEV market are Accell Group NV (Netherlands), Merida Industry Co. Ltd. (Taiwan), Giant Manufacturing Co. Ltd. (Taiwan), and Yamaha Motor Company (Japan). The top key players in the e-scooter/motorcycle segment of the LEV market are Yadea Grup Holding Ltd. (China), Niu International (China), Zhejiang Luyuan Electric Vehicles Co. Ltd. (China), Hero Electric (India), and Jiangsu Xinri E-Vehicle (China). The top key players in the neighborhood electric vehicles segment of the LEV market are Textron Inc. (US), Yamaha Motor Co. Ltd. (Japan), The Toro Company (US), and John Deere (US). The top key players in the e-lawn mowers segment of the LEV market are John Deere (US), Honda Motor Co. Ltd. (Japan), The Toro Company (US), Yamabiko Corporation (Japan), and Husqvarna (Austria). The top key players in the light electric industrial vehicles segment of the LEV market are BYD (China), Yutong (China), and AB Volvo (Sweden). These players have worked on providing offerings for the LEV ecosystem. They have initiated partnerships to develop their LEV technology and offer best-in-class products to their customers.

Scope of the Report

|

Report Metric |

Details |

|

Market Size Available for Years |

2018–2027 |

|

Base Year Considered |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Units |

Value (USD Million/Billion) and Volume (USD Thousand) |

|

Segments Covered |

vehicle category, application, power output, component type, Vehicle Type, and region. |

|

Geographies Covered |

North America, Europe and Asia Pacific |

|

Companies Covered |

Textron Inc. (US), Polaris Inc. (US), John Deere (US), Yamaha Motor Co. Ltd., Club Car Inc. (US), and BMW AG (Germany) |

This research report categorizes the light electric vehicle (LEVs) market based on vehicle category, application, power output, component type, Vehicle Type, and region.

By vehicle category

- 2-wheelers

- 3-wheelers

- 4-wheelers

By application

- Personal Mobility

- Shared Mobility

- Recreation & Sports

- Commercial

By power output

- Less than 6 kW

- 6-9 kW

- 9-15 kW

By component type

- battery pack

- electric motor (Propulsion Motor)

- motor controller

- inverters

- power controller

- e-brake booster

- power electronics

By Vehicle Type

- e-ATV/UTV

- e-bike

- e-scooter

- e-motorcycle

- neighborhood electric vehicle (golf cart/others)

- e-lawn mower (robotic e-lawn mower and manual e-lawn mower)

- electric industrial vehicle (aisle trucks, forklifts etc.)

- autonomous forklifts, delivery robots (Autonomous inventory robots)

- Automated guided vehicles (AGV)

By Region

-

Asia Pacific

- China

- Japan

- India

- South Korea

-

Europe

- France

- Germany

- Spain

- Italy

- UK

-

North America

- US

- Canada

Recent Developments

- In June 2022, Club Car announced the acquisition of Melex, which Garia bought in 2021 to help it expand its utility business, and Garia A/S, a maker of electric street-legal low-speed cars with a focus on the utility, consumer, and golf industries. Based in Poland, Melex is a producer of light utility vehicles.

- In April 2022, Sansera Engineering Limited revealed that it has received orders from BMW Motorrad for two packages of 26 aluminum forged and machined parts totaling about USD 37.5 million over a ten-year period. Sansera has built a cutting-edge facility for aluminum forging and machining, including solution heat treatment and anodizing, at one of its sites in Bengaluru, where these parts will be produced.

- In March, 2022, A subsidiary of Textron Inc., Textron Ground Support Equipment Inc., has announced that it will work with General Motors (GM) and Powertrain Control Solutions (PCS) to electrify its broad range of products. For Textron GSE products alone, GM and PCS have created an integrated driveline that makes use of GM's lithium-ion battery systems. Textron GSE will be able to benefit from GM's expertise in electric propulsion systems thanks to the driveline.

- In February 2022, In the United States and Canada, Wallbox N.V. and Polaris Inc. announced a new collaboration. Polaris will sell the 40 Amp version of Wallbox's best-selling charger, the Pulsar Plus, in order to make it even faster for customers to charge their electric vehicles. This revelation comes in the wake of Polaris' recent unveiling of the 2023 RANGER XP Kinetic. Off-road vehicles are a particular fit for Pulsar Plus 40 Amp because to its NEMA connection, which offers greater versatility for agricultural and rural charging areas.

- In December 2021, The RANGER XP Kinetic, an all-terrain all electric UTV, was unveiled by Polaris Inc. The RANGER XP Kinetic sets a new benchmark for UTV performance and productivity with a completely new electric powertrain developed via Polaris' relationship with Zero Motorcycles®. It offers unmatched capabilities, unmatched durability, and refined performance.

- In December 2021, in a cooperative effort to create electric two-wheelers, TVS Motor Company and BMW Motorrad announced they are extending and expanding their long-standing collaboration. Future BMW Motorrad product development and delivery, supply chain management, and industrialization are all included in the scope of work for TVS Motor Company. A variety of goods and technology have been identified by both businesses as having the potential to bring about significant business advantages. By utilizing cutting-edge technology in the field of future mobility and taking into consideration the universal needs of many client segments across multiple Light electric vehicle (LEVs) markets, BMW and TVS will create shared platforms. These shared platforms will be used to create unique items for both businesses, which will then sell their wares internationally. In the following 24 months, the first product created through this collaboration will be unveiled.

- In September 2021, BMW AG debuted the BMW Motorrad CE 02 concept vehicle, which is neither a classic motorcycle nor a scooter, is an exciting and highly emotional mobility offer for personal transportation with a range of 90km and top speed of 90kmph.

- In June 2021, In collaboration with AYRO, Inc., Club Car announced the release of the Club Car Current, a brand-new electric UTV. The Club Car Current bridges the gap between large trucks and tiny utility carts by providing low-speed logistics and freight services. It also possesses the agility and adaptability needed on campuses and in urban settings. The Club Car Current is available with a flat bed, pickup, or van box in three distinct bed configurations to handle any project. With a 72V AC electric engine and a range of up to 57 miles, the Club Car Current is perfectly suited for use as an all-purpose work vehicle.

- In June 2021, E-Z-GO announced its new vehicle, the E-Z-GO Liberty, the industry’s first vehicle to offer four forward-facing seats in a compact, golf-car-sized footprint. Powered by a high-performance, zero-maintenance Samsung SDI lithium-ion battery system, the Liberty provides a premium driving experience.

Frequently Asked Questions (FAQ):

What is the current size of the light electric vehicle market?

The current size of the light electric vehicle market is estimated at USD 78.5 billion in 2022.

Who are the winners in the light electric vehicle market?

The light electric vehicle market is primarily dominated by players like Textron Inc., Polaris Inc., John Deere, Yamaha Motor Co., Ltd., Club Car Inc., and BMW AG. The top key players in the e-ATV/utv segment of the LEV market are Polaris Inc., Toyota Industries, John Deere, and Textron Inc. The top key players in the e-Bike segment of LEV market are Accell Group NV, Merida Industry Co. Ltd, Giant Manufacturing Co. Ltd., and Yamaha Motor Company. The top key players in the e-scooter/motorcycle segment of LEV market are Yadea Grup Holding Ltd., Niu International, Zhejiang Luyuan Electric Vehicles Co. Ltd., Hero Electric, and Jiangsu Xinri E-Vehicle. The top key players in the neighborhood electric vehicles segment of LEV market are Textron Inc., Yamaha Motor Co. Ltd. The Toro Company, and John Deere. The top key players in the e-lawn mowers segment of LEV market are John Deere, Honda Motor Co. Ltd., The Toro Company, Yamabiko Corporation, and Husqvarna. The top key players in the light electric industrial vehicles segment of the LEV market are BYD, Yutong, AB Volvo, and CAF. They have initiated partnerships to develop their EUV technology and offer best-in-class products to their customers.

Which region will have the fastest-growing market for LEVs?

North America will be the fastest-growing region in the light electric vehicle market due to the huge volume of investments in the region and the high demand for Powersports and commercial transport using LEVs.

What are the key technologies affecting the light electric vehicle market?

The key technologies affecting the light electric vehicle market are the 5G network, the internet of things (IoT), 3D modeling, artificial intelligence, connected vehicles, and new battery technologies. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

TABLE 1 LIGHT ELECTRIC VEHICLE (LEVs) MARKET DEFINITION, BY VEHICLE TYPE

TABLE 2 MARKET DEFINITION, BY COMPONENT

1.2.1 INCLUSIONS & EXCLUSIONS

TABLE 3 INCLUSIONS & EXCLUSIONS IN MARKET

1.3 MARKET SCOPE

FIGURE 1 MARKETS COVERED

1.3.1 REGIONS COVERED

1.3.2 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 4 CURRENCY EXCHANGE RATES

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 2 LIGHT ELECTRIC VEHICLE (LEVs) MARKET: RESEARCH DESIGN

FIGURE 3 RESEARCH DESIGN MODEL

2.1.1 SECONDARY DATA

2.1.1.1 Key secondary sources for light electric vehicle (LEVs) market

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 List of participating companies for primary research

2.1.2.2 Key industry insights

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

2.1.2.3 Major objectives of primary research

2.2 MARKET SIZE ESTIMATION

FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.2.1 BOTTOM-UP APPROACH

FIGURE 6 BOTTOM-UP APPROACH: MARKET

2.2.2 TOP-DOWN APPROACH

FIGURE 7 TOP-DOWN APPROACH: MARKET

FIGURE 8 TOP-DOWN APPROACH: BY COMPONENT, MARKET

FIGURE 9 MARKET: MARKET ESTIMATION NOTES

FIGURE 10 MARKET: RESEARCH DESIGN & METHODOLOGY – DEMAND SIDE

2.3 DATA TRIANGULATION

FIGURE 11 DATA TRIANGULATION METHODOLOGY

FIGURE 12 MARKET GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS AND OPPORTUNITIES

2.4 FACTOR ANALYSIS

2.4.1 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

2.5 RESEARCH ASSUMPTIONS

2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 51)

FIGURE 14 LIGHT ELECTRIC VEHICLE (LEVs) MARKET, BY REGION, 2022–2027 (VOLUME)

FIGURE 15 BY VEHICLE TYPE, E-MOTORCYCLE SEGMENT PROJECTED TO REGISTER HIGHEST CAGR FROM 2022 TO 2027

FIGURE 16 BY COMPONENT, BATTERY PACK SEGMENT ESTIMATED TO LEAD MARKET FROM 2022 TO 2027

4 PREMIUM INSIGHTS (Page No. - 56)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MARKET

FIGURE 17 INCREASING ADOPTION BY END-USE INDUSTRIES AND GOVERNMENT INCENTIVES TO DRIVE MARKET IN NEXT FIVE YEARS

4.2 MARKET, BY REGION

FIGURE 18 ASIA PACIFIC ESTIMATED TO DOMINATE MARKET IN 2022

4.3 MARKET, BY VEHICLE TYPE

FIGURE 19 E-BIKE SEGMENT PROJECTED TO LEAD MARKET FROM 2022 TO 2027

4.4 MARKET, BY VEHICLE CATEGORY

FIGURE 20 3-WHEELER SEGMENT PROJECTED TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

4.5 MARKET, BY APPLICATION

FIGURE 21 PERSONAL MOBILITY SEGMENT EXPECTED TO LEAD MARKET FROM 2022 TO 2027

4.6 MARKET, BY POWER OUTPUT

FIGURE 22 9-15 KW SEGMENT PROJECTED TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

4.7 MARKET, BY COMPONENT

FIGURE 23 BATTERY PACK SEGMENT ESTIMATED TO LEAD MARKET IN 2022

5 MARKET OVERVIEW (Page No. - 60)

5.1 INTRODUCTION

TABLE 5 LEV AND LEV COMPONENTS MARKET: IMPACT OF MARKET DYNAMICS

5.2 MARKET DYNAMICS

FIGURE 24 LIGHT ELECTRIC VEHICLES: MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Low operating and maintenance costs

FIGURE 25 TCO OF LEVS VS. ICE VEHICLES PER DISTANCE DRIVEN, 2022 (USD)

FIGURE 26 TCO OF LEVS VS. ICE VEHICLES PER DISTANCE DRIVEN, 2025 (USD)

5.2.1.2 Government incentives and subsidies

TABLE 6 GOVERNMENT INCENTIVES, BY COUNTRY

FIGURE 27 AVERAGE FINANCIAL SUBSIDIES AT EV PURCHASE, BY COUNTRY, 2021 (USD)

FIGURE 28 GOVERNMENT TARGETS TO PHASE OUT ICE VEHICLES, 2025–2040

5.2.1.3 Advancements in battery technologies

FIGURE 29 AVERAGE ENERGY DENSITY (WH/L) OF LI-ION BATTERIES, 2017–2031

5.2.1.4 Rising demand from recreational and commercial applications

FIGURE 30 BATTERY SWAPPING SYSTEM

5.2.1.5 Advancements in renewable energy sector

FIGURE 31 VIRTUAL POWER PLANT (VPP) SYSTEM

5.2.2 RESTRAINTS

5.2.2.1 Lack of charging infrastructure and limited vehicle range

FIGURE 32 COUNTRY-WISE EV CHARGER DENSITY

5.2.2.2 High initial cost of ownership

5.2.2.3 Increasing concerns regarding recycling of LEV components

5.2.3 OPPORTUNITIES

5.2.3.1 Decreasing prices of components

FIGURE 33 AVERAGE PRICE OF LIGHT ELECTRIC INDUSTRIAL VEHICLES VS. DIESEL ENGINE VEHICLES, 2022–2030

5.2.3.2 New revenue pockets in Asia Pacific, Africa, and Europe

5.2.3.3 Increasing R&D for advancements

FIGURE 34 BATTERY TECHNOLOGY LANDSCAPE, BY MATERIAL

5.2.4 CHALLENGES

5.2.4.1 Lack of compatibility, interchangeability, and standardization

FIGURE 35 INDIA: BATTERY SWAP STATION FOR LEV (CHARGEZONE)

5.2.4.2 Fluctuating prices of raw materials leading to increasing cost of battery-operated industrial vehicles

FIGURE 36 COPPER (LME) PRICE TREND, JANUARY 2019–AUGUST 2022 (USD PER METRIC TON)

5.3 SUPPLY CHAIN ANALYSIS

FIGURE 37 LEV AND LEV COMPONENTS MARKET: SUPPLY CHAIN ANALYSIS

TABLE 7 LEV AND LEV COMPONENTS MARKET: ECOSYSTEM

5.3.1 RAW MATERIAL SUPPLIERS

5.3.2 COMPONENT MANUFACTURERS

5.3.3 OEMS

5.4 PORTER'S FIVE FORCES

FIGURE 38 PORTER'S FIVE FORCES: LEV AND LEV COMPONENTS MARKET

TABLE 8 LEV AND LEV COMPONENTS MARKET: PORTER'S FIVE FORCES

5.4.1 THREAT OF SUBSTITUTES

5.4.2 THREAT OF NEW ENTRANTS

5.4.3 BARGAINING POWER OF BUYERS

5.4.4 BARGAINING POWER OF SUPPLIERS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

5.5 MACROECONOMIC INDICATORS

5.5.1 GDP TREND AND FORECAST FOR MAJOR ECONOMIES

TABLE 9 GDP TREND AND FORECAST, MAJOR ECONOMIES, 2018–2026 (USD BILLION)

5.6 BUYING CRITERIA ANALYSIS FOR LEV MARKET

5.6.1 RIDE-HAILING FLEETS

5.6.2 PERSONAL VEHICLE FLEETS

5.6.3 INDUSTRIAL APPLICATIONS

5.6.4 PERSONAL AND COMMERCIAL APPLICATIONS

5.6.5 BUYING CRITERIA

FIGURE 39 KEY BUYING CRITERIA FOR LEVS FOR PERSONAL AND COMMERCIAL/INDUSTRIAL USE

TABLE 10 KEY BUYING CRITERIA FOR LEVS FOR PERSONAL AND COMMERCIAL/INDUSTRIAL USE

5.6.6 KEY STAKEHOLDERS IN BUYING PROCESS

TABLE 11 INFLUENCE OF KEY STAKEHOLDERS ON BUYING LIGHT ELECTRIC VEHICLES FOR COMMERCIAL/INDUSTRIAL USE (%)

5.7 TECHNOLOGY ANALYSIS

5.7.1 SWAPPABLE BATTERIES AND BATTERY SWAPPING STATIONS

FIGURE 40 TCO OF ICE VS. BATTERY SWAPPING POWERED VEHICLES, 2022

5.7.2 SMART CHARGING SYSTEMS

FIGURE 41 SMART EV CHARGING SYSTEM

5.7.3 IOT FOR AUTOMATED MATERIAL HANDLING

FIGURE 42 IOT FOR AUTOMATED MATERIAL HANDLING IN WAREHOUSES

5.7.4 AI FOR MATERIAL HANDLING

5.8 ECOSYSTEM ANALYSIS

FIGURE 43 LEV AND LEV COMPONENTS MARKET: ECOSYSTEM ANALYSIS

5.8.1 OEMS

5.8.2 RAW MATERIAL SUPPLIERS

5.8.3 COMPONENT MANUFACTURERS

5.9 TRENDS AND DISRUPTIONS: LIGHT ELECTRIC VEHICLE (LEVs) MARKET

FIGURE 44 LEV AND LEV COMPONENTS MARKET: TRENDS AND DISRUPTIONS

5.10 AVERAGE SELLING PRICE ANALYSIS OF LEV AND LEV COMPONENTS

TABLE 12 AVERAGE SELLING PRICE (ASP), BY LEV TYPE

TABLE 13 AVERAGE SELLING PRICE (ASP), BY LEV COMPONENT TYPE

FIGURE 45 PRICE TREND ANALYSIS OF LI-ION BATTERY PER KWH, 2010–2030

5.11 TRADE ANALYSIS

TABLE 14 TRADE ANALYSIS: HS CODE - 870310

TABLE 15 TRADE ANALYSIS: HS CODE - 842710

5.12 PATENT ANALYSIS

5.12.1 INTRODUCTION

FIGURE 46 PUBLICATION TRENDS, 2010–2022

TABLE 16 PATENT ANALYSIS: LEV AND LEV COMPONENTS MARKET (ACTIVE PATENTS)

TABLE 17 LEV AND LEV COMPONENTS MARKET: PATENTED DOCUMENTS (PUBLISHED, FILED, AND GRANTED)

5.13 CASE STUDY ANALYSIS

5.13.1 THYSSENKRUPP'S DECISION FOR FLEXIBLE AUTOMATION

5.13.2 TOYOTA'S AUTOMATED FORKLIFTS SUPPORT ELM LEBLANC'S 4.0 INDUSTRY SOLUTION

5.13.3 INDUCTIVE CHARGING SYSTEM FOR INDUSTRIAL/MATERIAL HANDLING VEHICLES

5.13.4 CLUB CAR'S TEMPO 2+2 FOR KETTERING GENERAL HOSPITAL

5.13.5 GOLF CARTS FOR PERSONAL MOBILITY

5.14 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 18 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 19 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 20 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.15 REGULATORY FRAMEWORK

FIGURE 47 EMISSION REDUCTION FRAMEWORK OF MAJOR COUNTRIES, 2021

TABLE 21 EURO VI STANDARDS 2021: EUROPEAN EMISSION NORMS

TABLE 22 US III STANDARDS 2021: US EMISSION NORMS

TABLE 23 CHINA 6A, 6B STANDARDS 2021: CHINA EMISSION NORMS

TABLE 24 JAPAN WLTC STANDARDS 2021: JAPAN EMISSION NORMS

TABLE 25 BRAZIL L-6 STANDARDS 2021: BRAZIL EMISSION NORMS

5.16 CONFERENCES & EVENTS

TABLE 26 LEV AND LEV COMPONENTS MARKET: CONFERENCES & EVENTS

5.17 SCENARIO ANALYSIS (2022–2027)

5.17.1 MARKET: MOST LIKELY SCENARIO

TABLE 27 MARKET: MOST LIKELY SCENARIO, BY REGION, 2022–2027 (THOUSAND UNITS)

5.17.2 MARKET: OPTIMISTIC SCENARIO

TABLE 28 MARKET: OPTIMISTIC SCENARIO, BY REGION, 2022–2027 (THOUSAND UNITS)

5.17.3 MARKET: PESSIMISTIC SCENARIO

TABLE 29 MARKET: PESSIMISTIC SCENARIO, BY REGION, 2022–2027 (THOUSAND UNITS)

6 LIGHT ELECTRIC VEHICLE (LEVs) MARKET, BY VEHICLE TYPE (Page No. - 106)

6.1 INTRODUCTION

FIGURE 48 BY VEHICLE TYPE, E-MOTORCYCLE SEGMENT PROJECTED TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 30 MARKET, BY VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 31 MARKET, BY VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 32 MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 33 MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

6.1.1 OPERATIONAL DATA

TABLE 34 LIGHT ELECTRIC VEHICLE MODELS OFFERED BY COMPANIES, BY VEHICLE TYPE

6.1.2 ASSUMPTIONS

TABLE 35 ASSUMPTIONS: BY VEHICLE TYPE

6.1.3 RESEARCH METHODOLOGY

6.2 ELECTRIC ATV/UTV

6.2.1 INCREASED RECREATIONAL AND AGRICULTURAL ACTIVITIES TO DRIVE MARKET

TABLE 36 E-ATV/UTV: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 37 E-ATV/UTV: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 38 E-ATV/UTV: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 39 E-ATV/UTV: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 E-BIKE

6.3.1 GOVERNMENT SUPPORT AND INITIATIVES TO INCREASE E-BIKE SALES

TABLE 40 E-BIKE: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 41 E-BIKE: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 42 E-BIKE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 43 E-BIKE: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.4 E-SCOOTER

6.4.1 RISE IN DEMAND FOR ENERGY-EFFICIENT MODES OF COMMUTING TO BOOST MARKET

TABLE 44 E-SCOOTER: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 45 E- SCOOTER: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 46 E- SCOOTER: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 47 E- SCOOTER: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.5 E-MOTORCYCLE

6.5.1 INCREASE IN DEMAND FOR PERFORMANCE ELECTRIC TWO-WHEELERS TO DRIVE SEGMENT

TABLE 48 E- MOTORCYCLE: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 49 E- MOTORCYCLE: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 50 E- MOTORCYCLE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 51 E- MOTORCYCLE: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.6 NEIGHBORHOOD ELECTRIC VEHICLE

6.6.1 GROWTH OF HOTELS AND RESORTS TO DRIVE DEMAND

TABLE 52 NEIGHBORHOOD ELECTRIC VEHICLE: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 53 NEIGHBORHOOD ELECTRIC VEHICLE: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 54 NEIGHBORHOOD ELECTRIC VEHICLE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 55 NEIGHBORHOOD ELECTRIC VEHICLE: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.7 E-LAWN MOWER

6.7.1 GOVERNMENT REGULATIONS, DEVELOPMENTS IN BATTERIES, AND LAUNCHES OF VARIOUS ELECTRIC MANUAL/ROBOTIC LAWN MOWER TO DRIVE MARKET

TABLE 56 ELECTRIC LAWN MOWER: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 57 ELECTRIC LAWN MOWER: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 58 ELECTRIC LAWN MOWER: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 59 ELECTRIC LAWN MOWER: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.7.2 ROBOTIC E-LAWN MOWER

6.7.2.1 Europe estimated to become largest market for robotic e-lawn mowers

TABLE 60 ROBOTIC E-LAWN MOWER: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 61 ROBOTIC E-LAWN MOWER: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 62 ROBOTIC E-LAWN MOWER: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 63 ROBOTIC E-LAWN MOWER: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.7.3 MANUAL E-LAWN MOWER

6.7.3.1 Growing demand for robotic mowers to impact manual e-lawn mower market

TABLE 64 MANUAL E-LAWN MOWER: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 65 MANUAL E-LAWN MOWER: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 66 MANUAL E-LAWN MOWER: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 67 MANUAL E-LAWN MOWER: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.8 ELECTRIC INDUSTRIAL VEHICLE

6.8.1 GROWING CO2 EMISSION CONCERNS TO DRIVE SEGMENT

FIGURE 49 CO2 EMISSION REDUCTION BY TOYOTA INDUSTRIES CORPORATION

FIGURE 50 KEY BENEFITS OF ELECTRIC FORKLIFTS

TABLE 68 IC ENGINES VS ELECTRIC MOTORS

TABLE 69 ELECTRIC INDUSTRIAL VEHICLE: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 70 ELECTRIC INDUSTRIAL VEHICLE: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 71 ELECTRIC INDUSTRIAL VEHICLE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 72 ELECTRIC INDUSTRIAL VEHICLE: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.9 AUTONOMOUS FORKLIFT

6.9.1 FOCUS ON ZERO-EMISSION WORKING ENVIRONMENT TO DRIVE DEMAND

TABLE 73 AUTONOMOUS FORKLIFT: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 74 AUTONOMOUS FORKLIFT: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 75 AUTONOMOUS FORKLIFT: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 76 AUTONOMOUS FORKLIFT: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.10 DELIVERY ROBOT

6.10.1 INCREASING USE OF ROBOTS FOR GROCERY DELIVERIES TO DRIVE MARKET

TABLE 77 DELIVERY ROBOT: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 78 DELIVERY ROBOT: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 79 DELIVERY ROBOT: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 80 DELIVERY ROBOT: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.11 AUTOMATED GUIDED VEHICLE

6.11.1 AUTOMATED GUIDED VEHICLES IDEAL FOR HANDLING LARGE VOLUMES OF LOAD AND OFTEN HAVE SIMPLER GUIDE PATH

TABLE 81 AUTOMATED GUIDED VEHICLE: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 82 AUTOMATED GUIDED VEHICLE: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 83 AUTOMATED GUIDED VEHICLE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 84 AUTOMATED GUIDED VEHICLE: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.12 KEY PRIMARY INSIGHTS

7 LIGHT ELECTRIC VEHICLE (LEVs) MARKET, BY VEHICLE CATEGORY (Page No. - 138)

7.1 INTRODUCTION

FIGURE 51 BY VEHICLE CATEGORY, 2-WHEELER SEGMENT TO DOMINATE MARKET FROM 2022 TO 2027

TABLE 85 MARKET, BY VEHICLE CATEGORY, 2018–2021 (THOUSAND UNITS)

TABLE 86 MARKET, BY VEHICLE CATEGORY, 2022–2027 (THOUSAND UNITS)

7.1.1 OPERATIONAL DATA

TABLE 87 LIGHT ELECTRIC VEHICLE MODELS, BY VEHICLE CATEGORY

7.1.2 ASSUMPTIONS

TABLE 88 ASSUMPTIONS: BY VEHICLE CATEGORY

7.1.3 RESEARCH METHODOLOGY

7.2 2-WHEELER

7.2.1 GROWING SALES OF E-BIKES, E-SCOOTERS, AND E-MOTORCYCLES TO DRIVE SEGMENT

TABLE 89 2-WHEELER: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 90 2-WHEELER: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

7.3 3-WHEELER

7.3.1 GROWING ADOPTION BY LOGISTICS COMPANIES TO DRIVE SEGMENT

TABLE 91 3-WHEELER: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 92 3-WHEELER: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

7.4 4-WHEELER

7.4.1 GROWING USE IN WAREHOUSES, MANUFACTURING PLANTS, AND GOLF COURSES TO DRIVE SEGMENT

TABLE 93 4-WHEELER: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 94 4-WHEELER: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

7.5 KEY PRIMARY INSIGHTS

8 LIGHT ELECTRIC VEHICLE (LEVs) MARKET, BY APPLICATION (Page No. - 147)

8.1 INTRODUCTION

FIGURE 52 BY APPLICATION, PERSONAL MOBILITY SEGMENT PROJECTED TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 95 MARKET, BY APPLICATION, 2018–2021 (THOUSAND UNITS)

TABLE 96 MARKET, BY APPLICATION, 2022–2027 (THOUSAND UNITS)

8.1.1 OPERATIONAL DATA

TABLE 97 POPULAR AND UPCOMING LEVS WORLDWIDE

8.1.2 ASSUMPTIONS

TABLE 98 ASSUMPTIONS: BY APPLICATION

8.1.3 RESEARCH METHODOLOGY

8.2 PERSONAL MOBILITY

8.2.1 VARIED RANGE OF PRODUCTS CLUBBED WITH GOVERNMENT INCENTIVES AND REDUCING PRICES TO DRIVE SEGMENT

TABLE 99 PERSONAL MOBILITY: MARKET SIZE, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 100 PERSONAL MOBILITY: MARKET SIZE, BY REGION, 2022–2027 (THOUSAND UNITS)

8.3 SHARED MOBILITY

8.3.1 HIGH INITIAL COST OF OWNERSHIP AND LOW OPERATIONAL AND MAINTENANCE COSTS TO DRIVE SEGMENT

TABLE 101 SHARED MOBILITY: MARKET SIZE, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 102 SHARED MOBILITY: MARKET SIZE, BY REGION, 2022–2027 (THOUSAND UNITS)

8.4 RECREATION & SPORTS

8.4.1 GROWING DEMAND FOR OUTDOOR LEISURE AND RECREATIONAL ACTIVITIES TO INCREASE DEMAND

TABLE 103 RECREATION & SPORTS: MARKET SIZE, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 104 RECREATION & SPORTS: MARKET SIZE, BY REGION, 2022–2027 (THOUSAND UNITS)

8.5 COMMERCIAL

8.5.1 GROWING DEMAND IN AGRICULTURE AND INDUSTRIAL APPLICATIONS TO INCREASE SALES OF LEVS

TABLE 105 COMMERCIAL: MARKET SIZE, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 106 COMMERCIAL: MARKET SIZE, BY REGION, 2022–2027 (THOUSAND UNITS)

8.6 KEY PRIMARY INSIGHTS

9 LIGHT ELECTRIC VEHICLE (LEVs) MARKET, BY POWER OUTPUT (Page No. - 160)

9.1 INTRODUCTION

FIGURE 53 BY POWER OUTPUT, LESS THAN 6 KW SEGMENT PROJECTED TO LEAD MARKET FROM 2022 TO 2027

TABLE 107 MARKET, BY POWER OUTPUT, 2018–2021 (THOUSAND UNITS)

TABLE 108 MARKET, BY POWER OUTPUT, 2022–2027 (THOUSAND UNITS)

9.1.1 OPERATIONAL DATA

TABLE 109 LIGHT ELECTRIC VEHICLE MODELS, BY POWER OUTPUT

9.1.2 ASSUMPTIONS

TABLE 110 ASSUMPTIONS: BY POWER OUTPUT

9.1.3 RESEARCH METHODOLOGY

9.2 LESS THAN 6 KW

9.2.1 RISING DEMAND FOR LEVS IN PERSONAL MOBILITY AND INDUSTRIAL APPLICATIONS TO DRIVE SEGMENT

TABLE 111 LESS THAN 6 KW: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 112 LESS THAN 6 KW: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

9.3 6–9 KW

9.3.1 GROWTH OF E-COMMERCE AND HOSPITALITY SECTORS TO DRIVE SEGMENT

TABLE 113 6–9 KW: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 114 6–9 KW: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

9.4 9–15 KW

9.4.1 RISING DEMAND FROM INDUSTRIAL FACILITIES, CONSTRUCTION SITES, WAREHOUSES, PUBLIC TRANSPORTATION, AND AIRPORT FACILITIES TO DRIVE SEGMENT

TABLE 115 9–15 KW: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 116 9–15 KW: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

9.5 KEY PRIMARY INSIGHTS

10 LIGHT ELECTRIC VEHICLE (LEVs) MARKET, BY COMPONENT (Page No. - 168)

10.1 INTRODUCTION

FIGURE 54 MARKET, BY COMPONENT, 2022 VS. 2027 (USD MILLION)

TABLE 117 MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 118 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

10.1.1 OPERATIONAL DATA

TABLE 119 LIGHT ELECTRIC VEHICLE: MAJOR COMPANIES, BY COMPONENT

10.1.2 RESEARCH METHODOLOGY

10.1.3 ASSUMPTIONS

TABLE 120 ASSUMPTIONS: BY COMPONENT

10.2 BATTERY PACK

TABLE 121 BATTERY PACK: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 122 BATTERY PACK: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 ELECTRIC MOTOR

TABLE 123 ELECTRIC MOTOR: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 124 ELECTRIC MOTOR: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.4 MOTOR CONTROLLER

FIGURE 55 SIMPLIFIED BLOCK DIAGRAM OF COMMONLY USED MOTOR CONTROLLERS IN LEVS

TABLE 125 MOTOR CONTROLLER: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 126 MOTOR CONTROLLER: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.5 INVERTER

TABLE 127 INVERTER: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 128 INVERTER: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.6 POWER CONTROLLER

TABLE 129 POWER CONTROLLER: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 130 POWER CONTROLLER: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.7 E-BRAKE BOOSTER

TABLE 131 E-BRAKE BOOSTER: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 132 E-BRAKE BOOSTER: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.8 POWER ELECTRONICS

TABLE 133 POWER ELECTRONICS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 134 POWER ELECTRONICS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.9 KEY INDUSTRY INSIGHTS

11 LIGHT ELECTRIC VEHICLE (LEVs) MARKET, BY REGION (Page No. - 184)

11.1 INTRODUCTION

FIGURE 56 LEV MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 135 LEV MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 136 LEV MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 137 LEV MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 138 LEV MARKET, BY REGION, 2022–2027(USD MILLION)

FIGURE 57 COMPONENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 139 COMPONENT: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 140 COMPONENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

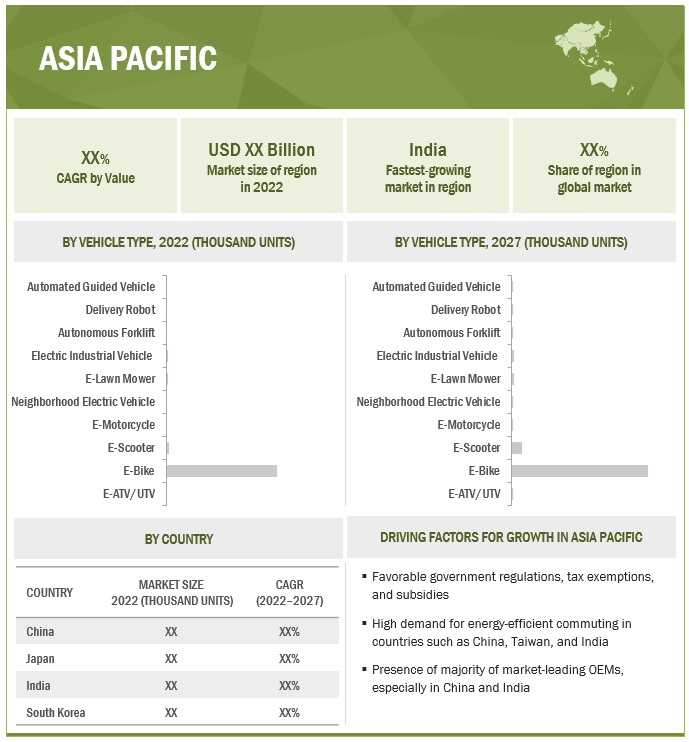

11.2 ASIA PACIFIC

FIGURE 58 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 141 ASIA PACIFIC: LEV MARKET, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 142 ASIA PACIFIC: LEV MARKET, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

TABLE 143 ASIA PACIFIC: LEV MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 144 ASIA PACIFIC: LEV MARKET, BY COUNTRY, 2022–2027(USD MILLION)

TABLE 145 ASIA PACIFIC: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 146 ASIA PACIFIC: LIGHT ELECTRIC VEHICLE (LEVs) MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

11.2.1 CHINA

11.2.1.1 LEVs in demand for commercial and industrial use due to availability of renewable energy sources

TABLE 147 CHINA: MARKET, BY VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 148 CHINA: MARKET, BY VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 149 CHINA: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 150 CHINA: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

11.2.2 JAPAN

11.2.2.1 Technological advancements to benefit and drive demand for LEVs

TABLE 151 JAPAN: MARKET, BY VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 152 JAPAN: MARKET, BY VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 153 JAPAN: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 154 JAPAN: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

11.2.3 INDIA

11.2.3.1 Light electric vehicle market to witness rapid growth

FIGURE 59 INCENTIVE AND REGULATORY LANDSCAPE FOR LEVS IN INDIA

TABLE 155 INDIA: MARKET, BY VEHICLE TYPE, 2018–2021 (UNITS)

TABLE 156 INDIA: MARKET, BY VEHICLE TYPE, 2022–2027 (UNITS)

TABLE 157 INDIA: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 158 INDIA: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

11.2.4 SOUTH KOREA

11.2.4.1 Significant growth in demand for LEVs for commercial and industrial use

TABLE 159 SOUTH KOREA: MARKET, BY VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 160 SOUTH KOREA: MARKET, BY VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 161 SOUTH KOREA: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 162 SOUTH KOREA: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

11.3 EUROPE

FIGURE 60 EUROPE: MARKET SNAPSHOT

TABLE 163 EUROPE: LEV MARKET, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 164 EUROPE: LEV MARKET, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

TABLE 165 EUROPE: LEV MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 166 EUROPE: LEV MARKET, BY COUNTRY, 2022–2027(USD MILLION)

TABLE 167 EUROPE: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 168 EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

11.3.1 FRANCE

11.3.1.1 E-ATV/UTV and neighborhood electric vehicle segments to dominate LEV market

TABLE 169 FRANCE: MARKET, BY VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 170 FRANCE: MARKET, BY VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 171 FRANCE: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 172 FRANCE: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

11.3.2 GERMANY

11.3.2.1 Setting up of charging corridors to boost LEV demand

TABLE 173 GERMANY: MARKET, BY VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 174 GERMANY: MARKET, BY VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 175 GERMANY: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 176 GERMANY: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

11.3.3 SPAIN

11.3.3.1 Government focus on replacing existing transportation fleets to impact market positively

TABLE 177 SPAIN: MARKET, BY VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 178 SPAIN: MARKET, BY VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 179 SPAIN: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 180 SPAIN: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

11.3.4 ITALY

11.3.4.1 Government incentives to generate higher demand for LEVs & LEV component

TABLE 181 ITALY: MARKET, BY VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 182 ITALY: MARKET, BY VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 183 ITALY: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 184 ITALY: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

11.3.5 UK

11.3.5.1 Increasing adoption in recreation & sports sector to drive market

FIGURE 61 UK EV ROADMAP

TABLE 185 UK: MARKET, BY VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 186 UK: MARKET, BY VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 187 UK: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 188 UK: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

11.4 NORTH AMERICA

FIGURE 62 NORTH AMERICA EV BATTERY INITIATIVES

TABLE 189 NORTH AMERICA: LEV MARKET, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 190 NORTH AMERICA: LEV MARKET, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

TABLE 191 NORTH AMERICA: LEV MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 192 NORTH AMERICA: LEV MARKET, BY COUNTRY, 2022–2027(USD MILLION)

TABLE 193 NORTH AMERICA: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 194 NORTH AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

11.4.1 US

11.4.1.1 Growing inclination toward automation in end-use industries to accelerate market growth

TABLE 195 US: MARKET, BY VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 196 US: MARKET, BY VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 197 US: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 198 US: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

11.4.2 CANADA

11.4.2.1 E-ATV/UTV segment to dominate light electric vehicle market

TABLE 199 CANADA: MARKET, BY VEHICLE TYPE, 2018–2021 (UNITS)

TABLE 200 CANADA: MARKET, BY VEHICLE TYPE, 2022–2027 (UNITS)

TABLE 201 CANADA: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 202 CANADA: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 237)

12.1 OVERVIEW

12.2 MARKET RANKING ANALYSIS: LIGHT ELECTRIC VEHICLES

12.2.1 MARKET RANKING ANALYSIS: E-ATV/UTV

TABLE 203 MARKET RANKING ANALYSIS: E-ATV/UTV, 2021

12.2.2 MARKET RANKING ANALYSIS: E-BIKE

TABLE 204 MARKET RANKING ANALYSIS: E-BIKE, 2021

12.2.3 MARKET RANKING ANALYSIS: E-SCOOTER/MOTORCYCLE

TABLE 205 MARKET RANKING ANALYSIS: E-SCOOTER/MOTORCYCLE, 2021

12.2.4 MARKET RANKING ANALYSIS: NEIGHBORHOOD ELECTRIC VEHICLES

TABLE 206 MARKET RANKING ANALYSIS: NEIGHBORHOOD ELECTRIC VEHICLES, 2021

12.2.5 MARKET RANKING ANALYSIS: E-LAWN MOWERS

TABLE 207 MARKET RANKING ANALYSIS: E-LAWN MOWERS, 2021

12.2.6 MARKET RANKING ANALYSIS: ELECTRIC INDUSTRIAL VEHICLES

TABLE 208 MARKET RANKING ANALYSIS: ELECTRIC INDUSTRIAL VEHICLES, 2021

12.2.7 MARKET RANKING ANALYSIS: AUTONOMOUS FORKLIFT

TABLE 209 MARKET RANKING ANALYSIS: AUTONOMOUS FORKLIFT, 2021

12.2.8 MARKET RANKING ANALYSIS: AUTOMATED GUIDED VEHICLES

TABLE 210 MARKET RANKING ANALYSIS: AUTOMATED GUIDED VEHICLES, 2021

12.3 MARKET RANKING ANALYSIS: LEV COMPONENTS

TABLE 211 LEV COMPONENTS MARKET RANKING ANALYSIS, 2021

12.3.1 NIDEC CORPORATION

12.3.2 ROBERT BOSCH GMBH

12.3.3 AISIN CORPORATION

12.3.4 BORGWARNER INC.

12.3.5 ZF FRIEDRICHSHAFEN AG

12.4 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS

FIGURE 63 TOP PUBLIC/LISTED PLAYERS IN E-ATV/UTV MARKET, 2017–2021

FIGURE 64 TOP PUBLIC/LISTED PLAYERS IN E-BIKE MARKET, 2017–2021

FIGURE 65 TOP PUBLIC/LISTED PLAYERS IN E-SCOOTER/MOTORCYCLE MARKET, 2017–2021

FIGURE 66 TOP PUBLIC/LISTED PLAYERS IN NEIGHBORHOOD ELECTRIC VEHICLES MARKET, 2017–2021

FIGURE 67 TOP PUBLIC/LISTED PLAYERS IN E-LAWN MOWERS MARKET, 2017–2021

FIGURE 68 TOP PUBLIC/LISTED PLAYERS IN LIGHT ELECTRIC INDUSTRIAL VEHICLES MARKET, 2017–2021

FIGURE 69 TOP PUBLIC/LISTED PLAYERS IN LEV COMPONENTS MARKET, 2017–2021

12.5 COMPETITIVE SCENARIO

12.5.1 NEW PRODUCT LAUNCHES

TABLE 212 NEW PRODUCT LAUNCHES: LIGHT ELECTRIC VEHICLES, 2018–2022

TABLE 213 NEW PRODUCT LAUNCHES: LEV COMPONENTS, 2018–2022

12.5.2 DEALS

TABLE 214 DEALS: LIGHT ELECTRIC VEHICLES, 2018–2022

TABLE 215 DEALS: LEV COMPONENTS, 2018–2022

12.5.3 OTHERS

TABLE 216 OTHERS: LIGHT ELECTRIC VEHICLES, 2018–2022

TABLE 217 OTHERS: LEV COMPONENTS, 2018–2022

12.6 COMPANY EVALUATION QUADRANT: LIGHT ELECTRIC VEHICLES MARKET

12.6.1 STARS

12.6.2 EMERGING LEADERS

12.6.3 PERVASIVE PLAYERS

12.6.4 PARTICIPANTS

FIGURE 70 LIGHT ELECTRIC VEHICLES MARKET: COMPANY EVALUATION QUADRANT, 2022

TABLE 218 LEV MARKET: COMPANY FOOTPRINT, 2022

TABLE 219 LEV MARKET: PRODUCT FOOTPRINT, 2022

TABLE 220 LEV MARKET: REGIONAL FOOTPRINT, 2022

12.7 COMPANY EVALUATION QUADRANT: LEV COMPONENTS MARKET

12.7.1 STARS

12.7.2 EMERGING LEADERS

12.7.3 PERVASIVE PLAYERS

12.7.4 PARTICIPANTS

FIGURE 71 LEV COMPONENTS MARKET: COMPANY EVALUATION QUADRANT, 2022

TABLE 221 LEV COMPONENTS MARKET: COMPANY FOOTPRINT, 2022

TABLE 222 LEV COMPONENTS MARKET: PRODUCT FOOTPRINT, 2022

TABLE 223 LEV COMPONENTS MARKET: REGIONAL FOOTPRINT, 2022

13 COMPANY PROFILES (Page No. - 278)

(Business overview, Products offered, Recent developments & MnM View)*

13.1 KEY PLAYERS (LIGHT ELECTRIC VEHICLE MANUFACTURERS)

13.1.1 BMW AG

TABLE 224 BMW AG: BUSINESS OVERVIEW

FIGURE 72 BMW AG: COMPANY SNAPSHOT

TABLE 225 BMW AG: PRODUCTS OFFERED

TABLE 226 BMW AG: NEW PRODUCT LAUNCHES

TABLE 227 BMW AG: DEALS

13.1.2 AURO ROBOTICS

TABLE 228 AURO ROBOTICS: BUSINESS OVERVIEW

TABLE 229 AURO ROBOTICS: PRODUCTS OFFERED

TABLE 230 AURO ROBOTICS: NEW PRODUCT LAUNCHES

TABLE 231 AURO ROBOTICS: DEALS

TABLE 232 AURO ROBOTICS: OTHERS

13.1.3 CLUB CAR INC.

TABLE 233 CLUB CAR INC.: BUSINESS OVERVIEW

TABLE 234 CLUB CAR INC.: PRODUCTS OFFERED

TABLE 235 CLUB CAR INC.: NEW PRODUCT LAUNCHES

TABLE 236 CLUB CAR INC.: DEALS

13.1.4 POLARIS INC.

TABLE 237 POLARIS INC.: BUSINESS OVERVIEW

FIGURE 73 POLARIS INC.: COMPANY SNAPSHOT

FIGURE 74 POLARIS: MARKET OPPORTUNITY

FIGURE 75 POLARIS: OFF-ROAD SEGMENT GROWTH RESULTS

TABLE 238 POLARIS INC.: PRODUCTS OFFERED

TABLE 239 POLARIS INC.: NEW PRODUCT LAUNCHES

TABLE 240 POLARIS INC.: DEALS

13.1.5 TEXTRON INC.

TABLE 241 TEXTRON INC.: BUSINESS OVERVIEW

FIGURE 76 TEXTRON INC.: COMPANY SNAPSHOT

FIGURE 77 TEXTRON: COMPARISON OF E-Z-GO WITH OTHER ELECTRIC GOLF CARTS

TABLE 242 TEXTRON INC.: PRODUCTS OFFERED

TABLE 243 TEXTRON INC.: NEW PRODUCT LAUNCHES

TABLE 244 TEXTRON INC.: DEALS

TABLE 245 TEXTRON: OTHERS

13.1.6 TOYOTA INDUSTRIES CORPORATION

TABLE 246 TOYOTA INDUSTRIES CORPORATION: BUSINESS OVERVIEW

FIGURE 78 TOYOTA INDUSTRIES CORPORATION: COMPANY SNAPSHOT

FIGURE 79 TOYOTA INDUSTRIES CORPORATION: SEGMENT-WISE GROWTH

TABLE 247 TOYOTA INDUSTRIES CORPORATION: PRODUCTS OFFERED

TABLE 248 TOYOTA INDUSTRIES CORPORATION: NEW PRODUCT LAUNCHES

TABLE 249 TOYOTA INDUSTRIES CORPORATION: DEALS

13.1.7 JOHN DEERE

TABLE 250 JOHN DEERE: BUSINESS OVERVIEW

FIGURE 80 JOHN DEERE: COMPANY SNAPSHOT

TABLE 251 JOHN DEERE: PRODUCTS OFFERED

TABLE 252 JOHN DEERE: NEW PRODUCT LAUNCHES

TABLE 253 JOHN DEERE: DEALS

TABLE 254 JOHN DEERE: OTHERS

13.1.8 KION GROUP

TABLE 255 KION GROUP: BUSINESS OVERVIEW

FIGURE 81 KION GROUP: COMPANY SNAPSHOT

FIGURE 82 KION GROUP: INDUSTRY PERFORMANCE, 2021

TABLE 256 KION GROUP: PRODUCTS OFFERED

TABLE 257 KION GROUP: NEW PRODUCT LAUNCHES

TABLE 258 KION GROUP: DEALS

13.1.9 BYD AUTO CO., LTD.

TABLE 259 BYD AUTO CO., LTD.: BUSINESS OVERVIEW

FIGURE 83 BYD AUTO CO., LTD.: COMPANY SNAPSHOT

FIGURE 84 BYD AUTO CO., LTD.: RANGE OF ELECTRIC FORKLIFTS

TABLE 260 BYD AUTO CO., LTD.: PRODUCTS OFFERED

TABLE 261 BYD AUTO CO., LTD.: NEW PRODUCT LAUNCHES

TABLE 262 BYD AUTO CO., LTD.: DEALS

13.1.10 ARI MOTORS

TABLE 263 ARI MOTORS: BUSINESS OVERVIEW

TABLE 264 ARI MOTORS: PRODUCTS OFFERED

TABLE 265 ARI MOTORS: NEW PRODUCT LAUNCHES

TABLE 266 ARI MOTORS: DEALS

13.1.11 WAEV INC.

TABLE 267 WAEV INC.: BUSINESS OVERVIEW

TABLE 268 WAEV INC.: PRODUCTS OFFERED

TABLE 269 WAEV INC.: NEW PRODUCT LAUNCHES

TABLE 270 WAEV INC.: DEALS

13.1.12 COLUMBIA VEHICLE GROUP INC.

TABLE 271 COLUMBIA VEHICLE GROUP INC.: BUSINESS OVERVIEW

TABLE 272 COLUMBIA VEHICLE GROUP INC.: PRODUCTS OFFERED

TABLE 273 COLUMBIA VEHICLE GROUP INC.: NEW PRODUCT LAUNCHES

TABLE 274 COLUMBIA VEHICLE GROUP INC.: DEALS

13.1.13 YAMAHA MOTOR CO., LTD.

TABLE 275 YAMAHA MOTOR CO., LTD.: BUSINESS OVERVIEW

FIGURE 85 YAMAHA MOTOR CO., LTD.: COMPANY SNAPSHOT

TABLE 276 YAMAHA MOTOR CO., LTD.: PRODUCTS OFFERED

TABLE 277 YAMAHA MOTOR CO., LTD.: NEW PRODUCT LAUNCHES

13.1.14 GODREJ MATERIAL HANDLING

TABLE 278 GODREJ MATERIAL HANDLING: BUSINESS OVERVIEW

TABLE 279 GODREJ MATERIAL HANDLING: PRODUCTS OFFERED

TABLE 280 GODREJ MATERIAL HANDLING: NEW PRODUCT LAUNCHES

TABLE 281 GODREJ MATERIAL HANDLING: DEALS

13.1.15 ADDAX MOTORS

TABLE 282 ADDAX MOTORS: BUSINESS OVERVIEW

TABLE 283 ADDAX MOTORS: PRODUCTS OFFERED

TABLE 284 ADDAX MOTORS: NEW PRODUCT LAUNCHES

TABLE 285 ADDAX MOTORS: DEALS

13.1.16 MARSHELL

TABLE 286 MARSHELL: BUSINESS OVERVIEW

TABLE 287 MARSHELL: PRODUCTS OFFERED

13.2 KEY PLAYERS (LEV COMPONENT MANUFACTURERS)

13.2.1 NIDEC CORPORATION

TABLE 288 NIDEC CORPORATION: BUSINESS OVERVIEW

FIGURE 86 NIDEC CORPORATION: COMPANY SNAPSHOT

TABLE 289 NIDEC CORPORATION: PRODUCTS OFFERED

TABLE 290 NIDEC CORPORATION: NEW PRODUCT LAUNCHES

TABLE 291 NIDEC CORPORATION: DEALS

TABLE 292 NIDEC CORPORATION: OTHERS

13.2.2 AISIN CORPORATION

TABLE 293 AISIN CORPORATION: BUSINESS OVERVIEW

FIGURE 87 AISIN CORPORATION: COMPANY SNAPSHOT

TABLE 294 AISIN CORPORATION: PRODUCTS OFFERED

TABLE 295 AISIN CORPORATION: NEW PRODUCT LAUNCHES

TABLE 296 AISIN CORPORATION: DEALS

TABLE 297 AISIN CORPORATION: OTHERS

13.2.3 BORGWARNER INC.

TABLE 298 BORGWARNER INC.: BUSINESS OVERVIEW

FIGURE 88 BORGWARNER INC.: COMPANY SNAPSHOT

TABLE 299 BORGWARNER INC.: PRODUCTS OFFERED

TABLE 300 BORGWARNER INC.: NEW PRODUCT LAUNCHES

TABLE 301 BORGWARNER INC.: DEALS

TABLE 302 BORGWARNER INC.: OTHERS

13.2.4 ROBERT BOSCH GMBH

TABLE 303 ROBERT BOSCH GMBH: BUSINESS OVERVIEW

FIGURE 89 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

TABLE 304 ROBERT BOSCH GMBH: SUPPLY AGREEMENTS

TABLE 305 ROBERT BOSCH GMBH: PRODUCTS OFFERED

TABLE 306 ROBERT BOSCH GMBH: NEW PRODUCT LAUNCHES

TABLE 307 ROBERT BOSCH GMBH: DEALS

TABLE 308 ROBERT BOSCH GMBH: OTHERS

13.2.5 ZF FRIEDRICHSHAFEN AG

TABLE 309 ZF FRIEDRICHSHAFEN AG: BUSINESS OVERVIEW

FIGURE 90 ZF FRIEDRICHSHAFEN AG: COMPANY SNAPSHOT

TABLE 310 ZF FRIEDRICHSHAFEN AG: PRODUCTS OFFERED

TABLE 311 ZF FRIEDRICHSHAFEN AG: NEW PRODUCT LAUNCHES

TABLE 312 ZF FRIEDRICHSHAFEN AG: DEALS

TABLE 313 ZF FRIEDRICHSHAFEN AG: OTHERS

13.2.6 NINGBO YINZHOU HENTACH ELECTROMECHANICAL CO., LTD.

TABLE 314 NINGBO YINZHOU HENTACH ELECTROMECHANICAL CO., LTD: BUSINESS OVERVIEW

TABLE 315 NINGBO YINZHOU HENTACH ELECTROMECHANICAL CO., LTD: PRODUCTS OFFERED

13.2.7 MOTOR APPLIANCE CORPORATION (MAC)

TABLE 316 MOTOR APPLIANCE CORPORATION(MAC): BUSINESS OVERVIEW

TABLE 317 MOTOR APPLIANCE CORPORATION(MAC): PRODUCTS OFFERED

13.2.8 MAHLE GROUP

TABLE 318 MAHLE GROUP: BUSINESS OVERVIEW

FIGURE 91 MAHLE GROUP: COMPANY SNAPSHOT

TABLE 319 MAHLE GROUP: PRODUCTS OFFERED

TABLE 320 MAHLE GROUP: NEW PRODUCT LAUNCHES

TABLE 321 MAHLE GROUP: DEALS

TABLE 322 MAHLE GROUP: OTHERS

13.2.9 ACCELERATED SYSTEMS INC.

TABLE 323 ACCELERATED SYSTEMS INC.: BUSINESS OVERVIEW

TABLE 324 ACCELERATED SYSTEMS INC.: PRODUCTS OFFERED

TABLE 325 ACCELERATED SYSTEMS INC.: DEALS

13.2.10 CURTIS INSTRUMENTS INC.

TABLE 326 CURTIS INSTRUMENTS INC.: BUSINESS OVERVIEW

TABLE 327 CURTIS INSTRUMENTS INC.: PRODUCTS OFFERED

TABLE 328 CURTIS INSTRUMENTS INC.: NEW PRODUCT LAUNCHES

TABLE 329 CURTIS INSTRUMENTS INC.: DEALS

TABLE 330 CURTIS INSTRUMENTS INC.: OTHERS

13.2.11 QS MOTOR LTD.

TABLE 331 QS MOTOR LTD.: BUSINESS OVERVIEW

TABLE 332 QS MOTOR LTD.: PRODUCTS OFFERED

13.2.12 CRYSTALYTE MOTORS

TABLE 333 CRYSTALYTE MOTORS: BUSINESS OVERVIEW

TABLE 334 CRYSTALYTE MOTORS: PRODUCTS OFFERED

13.2.13 PROTEAN ELECTRIC

TABLE 335 PROTEAN ELECTRIC: BUSINESS OVERVIEW

TABLE 336 PROTEAN ELECTRIC: PRODUCTS OFFERED

TABLE 337 PROTEAN ELECTRIC: DEALS

TABLE 338 PROTEAN ELECTRIC: OTHERS

13.2.14 NTN GROUP

TABLE 339 NTN GROUP: BUSINESS OVERVIEW

FIGURE 92 NTN GROUP: COMPANY SNAPSHOT

TABLE 340 NTN GROUP: PRODUCTS OFFERED

13.2.15 NSK LTD.

TABLE 341 NSK LTD.: BUSINESS OVERVIEW

FIGURE 93 NSK LTD.: COMPANY SNAPSHOT

TABLE 342 NSK LTD.: PRODUCTS OFFERED

TABLE 343 NSK LTD.: NEW PRODUCT LAUNCHES

13.2.16 ELAPHE PROPULSION TECHNOLOGIES LTD.

TABLE 344 ELAPHE PROPULSION TECHNOLOGIES LTD.: BUSINESS OVERVIEW

TABLE 345 ELAPHE PROPULSION TECHNOLOGIES LTD.: PRODUCTS OFFERED

TABLE 346 ELAPHE PROPULSION TECHNOLOGIES LTD.: DEALS

*Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

13.3 OTHER PLAYERS

13.3.1 GOVECS GROUP

13.3.2 LIT MOTORS INC.

13.3.3 MAGNA INTERNATIONAL

13.3.4 CONTINENTAL AG

13.3.5 WETTSEN CORPORATION

13.3.6 EVUM MOTORS

13.3.7 ALKE

13.3.8 CFMOTO

13.3.9 PILOTCAR ELECTRIC VEHICLES

13.3.10 BALKANCAR RECORD

13.3.11 DRR USA

13.3.12 LINHAI

13.3.13 NEBULA AUTOMOTIVE PVT. LIMITED

13.3.14 AMERICAN LANDMASTER

13.3.15 ECO CHARGER

13.3.16 EXCAR

13.3.17 SUZHOU EAGLE ELECTRIC VEHICLE

13.3.18 POWERLAND AGRO TRACTOR VEHICLES

13.3.19 CROSSFIRE MOTORCYCLES

13.3.20 VOLCON

13.3.21 TESLA INC.

13.3.22 AUTO RENNEN INDIA

13.3.23 SMART CART

14 RECOMMENDATION (Page No. - 401)

14.1 ASIA PACIFIC TO BE KEY MARKET FOR LEVS

14.2 KEY FOCUS AREAS FOR LEV MANUFACTURERS: RISING E-COMMERCE SECTOR AND STANDARD SAFETY FEATURES

14.3 CONCLUSION

15 APPENDIX (Page No. - 403)

15.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

15.2 DISCUSSION GUIDE

15.3 KNOWLEDGESTORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

15.4 AVAILABLE CUSTOMIZATIONS

15.5 RELATED REPORTS

15.6 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the Light Electric Vehicle (LEVs) Market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down approach was employed to estimate the total market size. Thereafter, market breakdown and data triangulation were used in estimating the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications (for example, publications of automobile OEMs), automotive component associations, American Automobile Association (AAA), European Alternative Fuels Observatory (EAFO), International Energy Agency (IEA), country-level automotive associations, automobile magazines, articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases (for example, Marklines and Factiva) were used to identify and collect information for an extensive commercial study of the Light Electric Vehicle (LEVs) Market.

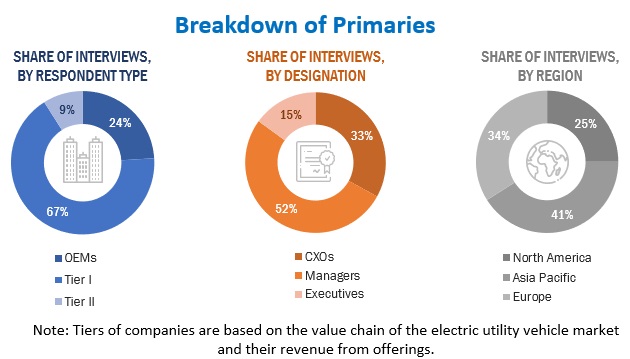

Primary Research

Extensive primary research was conducted after acquiring an understanding of the Light electric vehicle (LEVs) Market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand (country-level government associations, trade associations, institutes, R&D centers, OEMs/vehicle manufacturers) and supply (component manufacturers, software providers) sides across four major regions, namely North America, Europe and Asia Pacific. Approximately 17% and 83% of primary interviews were conducted from the demand and supply sides, respectively. Primary data was collected through questionnaires, emails, and telephonic interviews.

Primary data was collected through questionnaires, emails, and telephonic interviews. Primary interviews were conducted from various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint of the report. After interacting with industry participants, brief sessions were conducted with experienced independent consultants to reinforce the findings from the primaries. This, along with the in-house subject matter experts’ opinions, has led to the findings delineated in the rest of this report. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down approach was used to estimate and validate the total size of the Light Electric Vehicle (LEVs) Market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s future supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from the supply side.

Report Objectives

- To segment and forecast the Light electric vehicle (LEVs) market size in terms of volume (Thousand Units) and value (USD Million/Billion)

- To define, describe, and forecast the Light electric vehicle (LEVs) market based on by vehicle category, application, power output, component type, vehicle type, and region

- To segment the market and forecast its size, by volume and value, based on region (North America, Europe, and Asia Pacific)

- To segment and forecast the market based on vehicle category (2-wheelers, 3-wheelers, 4-wheelers)

- To segment and forecast the market based on application (Personal Mobility, Shared Mobility, Recreation & Sports, commercial)

- To segment and forecast the market based on power output ( less than 6 kW, 6-9 kW, 9-15 kW)

- To segment and forecast the market based on component type (battery pack, electric motor, motor controller, inverters, power controller, e-brake booster, power electronics)

- To segment and forecast the market based on Vehicle Type (e-atv/utv, e-bike, e-scooter, e-motorcycle, neighborhood electric vehicle, e-lawn mower (robotic e-lawn mower and manual e-lawn mower), electric industrial vehicle, autonomous forklifts, delivery robots, Automated guided vehicles)

- To analyze the technological developments impacting the Light Electric Vehicle

- To analyze opportunities for stakeholders and the competitive landscape for market leaders

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, challenges, and opportunities)

- To strategically analyze markets with respect to individual growth trends, prospects, and contributions to the total market

-

To study the following with respect to the market

- Value Chain Analysis

- Ecosystem

- Porter’s Five Forces Analysis

- Technology Analysis

- Trade Analysis

- Case Study Analysis

- Patent Analysis

- Regulatory Landscape

- Average Selling Price Analysis

- Buying Criteria

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as deals (joint ventures, mergers & acquisitions, partnerships, collaborations), new product development, and other activities carried out by key industry participants

Available Customizations

With the given market data, MarketsandMarkets offers customizations in line with company-specific needs.

- Light Electric Market, By vehicle category at each vehicle type

- Light Electric Component Market by component type at each vehicle type

Company Information

- Profiling of Additional Market Players (Up to 5

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Light Electric Vehicles (LEVs) Market