Lignosulfonates Market by Product (Sodium Lignosulfonate, Calcium Lignosulfonate, Magnesium Lignosulfonate, Others), Application (Oil Well Additives, Concrete Additives, Animal Feed Binders, Dust Control, Others), and Region - Global Forecast to 2027

Lignosulfonates Market

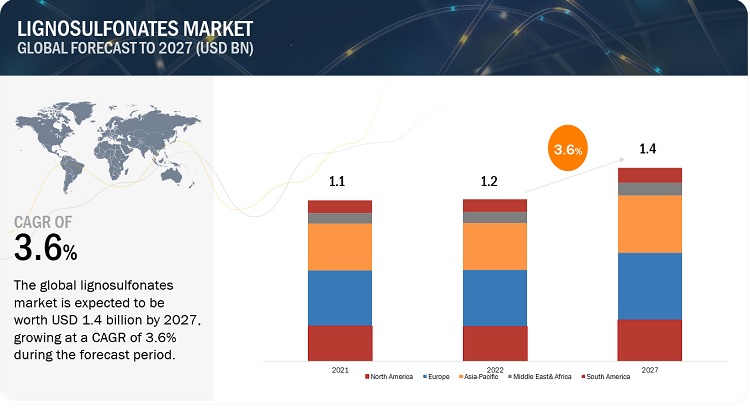

The global lignosulfonates market was valued at USD 1.2 billion in 2022 and is projected to reach USD 1.4 billion by 2027, growing at a cagr 3.6% from 2022 to 2027. The market has observed stable growth throughout the study period and is expected to continue with the same trend during the forecast period. Rising regulations on air pollution in various countries are expected to provide a push to the growth of the market in the upcoming years.

Attractive Opportunities in the Lignosulfonates Market

To know about the assumptions considered for the study, Request for Free Sample Report

Lignosulfonates Market Dynamics

Driver: Binding and stabilization characteristics of lignosulfonates drive their usage in road dust control application

Lignosulfonates are particularly effective in road dust control applications. Lignosulfonates not only hold roads together better than calcium flakes and chlorides, but they are also greener and cost-effective as compared to these alternatives. The application of lignosulfonates for dust control is non-corrosive and non-toxic to nearby plants and wildlife.

Restraint: High water solubility of product

Lignosulfonates have high water solubility and may leach from the surface of the road during the rainy season which may lead to a reduction in the binding capability of the road and heavier dust production. In some cases, lignosulfonates may increase the water-carrying capacity of the concrete mixture, leading to the failure of the final infrastructure product.

Opportunity: Potential applications in water treatment

In the circulating water treatment system, the complex reaction between lignosulfonates and zinc is used to store zinc in the water and slowly disperse zinc ions to inhibit corrosion of the water system. Lignosulfonates have a dispersing ability, making them a suitable dispersant, integrator, and corrosion-reducing agent. It helps to control suspended solids and iron scale in the water body.

Challenge: Separation and product purification of lignosulfonates

Lignosulfonates are required to be separated from the spent liquor for increased commercial value. Despite worldwide use, ultrafiltration is not the most economical method for the separation of lignosulfonates. Additionally, the membrane separation method may not be selective to lignosulfonates due to a molecular weight overlap with hemicelluloses in solutions, which affects the separation.

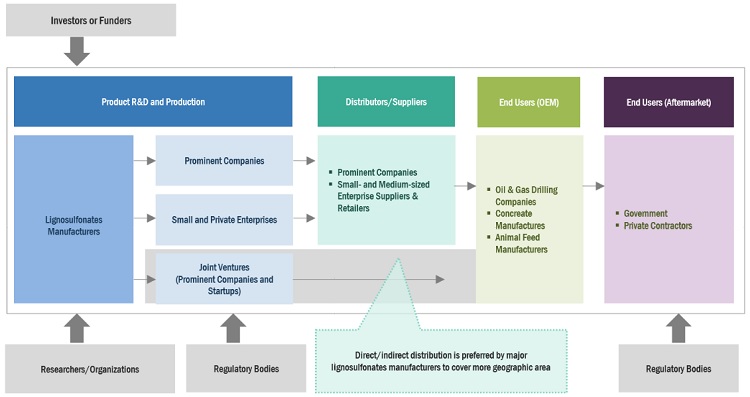

Lignosulfonates Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of lignosulfonates. These companies have been operating in the market for several years and possess a diversified product portfolio and strong global sales and marketing networks. Prominent companies in this market include Borregaard (Norway), Rayonier Advanced Materials (US), Sappi Limited (South Africa), Domsjo Fabriker (Sweden), and Nippon Paper Industries Co., Ltd. (Japan)

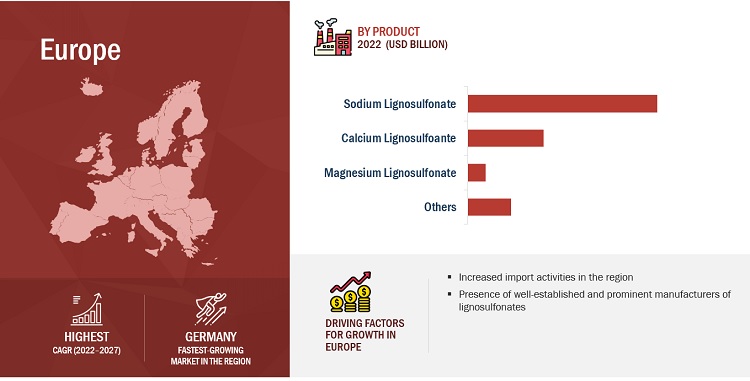

Based on product, the sodium lignosulfonate segment is projected to grow at a significant CAGR during the forecast period.

The demand for sodium lignosulfonate is increasing exponentially mainly due to its properties and the ability to be used in diverse applications. Sodium lignosulfonate is used more commonly as its properties, such as binding capacity and viscosity, are suitable for a range of applications, including oil well stabilization and animal feed binders.

Based on application, the concrete additives segment accounts for the largest share of the overall market

Based on application, concreate additives segment accounts for highest share. Pulp & paper currently is the most extensive application in the nanocellulose market. Lignosulfonate can increase the compressive strength of cement concrete. Many admixtures used in the construction sector are lignosulfonate-based compounds. Lignosulfonates acts as a retarder and water reducer for concrete.

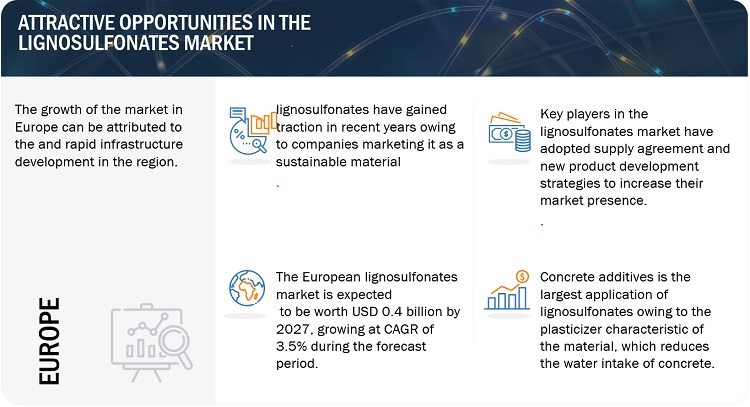

Europe is expected to account for the largest share of the global market during the forecast period.

Based on the region, Europe accounts for the largest share. The demand of lignosulfonate is increasing in various applications in Europe such as concreate additives, dust control, oil additives among others. Europe is also one of the major exporters of lignosulfonates. Germany, France, and Italy hold the major share in European lignosulfonate market.

To know about the assumptions considered for the study, download the pdf brochure

Lignosulfonates Market Players

Borregaard (Norway), Rayonier Advanced Materials (US), Sappi Limited (South Africa), Domsjo Fabriker (Sweden), Nippon Paper Industries Co., Ltd. (Japan), Ingevity (US), Burgo Group (Italy), Dallas Group of America, Inc. (US), Green Agrochem (China), Tokyo Chemical Industry (Japan), Tianjin Yeats Additive Co., Ltd. (China) Shenyang Xingzhenghe Chemical Co., Ltd. (China), Cardinal Chemicals Pvt Ltd. (India), Abelin Polymers (India), Henan Yulin Chemical Co., Ltd. (China) and others are among the key players leading the market through their innovative offerings, enhanced production capacities, and efficient distribution channels.

Lignosulfonates Market Report Scope

|

Report Metric |

Details |

|

Market Size Available for Years |

2019 to 2027 |

|

Base Year Considered |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Units |

Value (USD Million), Volume (Kiloton) |

|

Segments Covered |

Product, Application, and Region |

|

Geographies Covered |

Europe, Asia Pacific, North America, Middle East & Africa, and South America |

|

Companies Covered |

The major market players include Borregaard (Norway), Rayonier Advanced Materials (US), Sappi Limited (South Africa), Domsjo Fabriker (Sweden), Nippon Paper Industries Co., Ltd. (Japan), Ingevity (US), Burgo Group (Italy), Dallas Group of America, Inc. (US), Green Agrochem (China), Tokyo Chemical Industry (Japan), Tianjin Yeats Additive Co., Ltd. (China) Shenyang Xingzhenghe Chemical Co., Ltd. (China), Cardinal Chemicals Pvt Ltd. (India), Abelin Polymers (India), Henan Yulin Chemical Co., Ltd. (China) and others |

This research report categorizes the lignosulfonates industry based on product, application, and region.

Based on product, the lignosulfonates market has been segmented as follows:

- Sodium Lignosulfonate

- Calcium Lignosulfonate

- Magnesium Lignosulfonate

- Others

Based on application, the lignosulfonates market has been segmented as follows:

- Oil Well Additives

- Concrete Additives

- Animal Feed Binders

- Dust Control

- Others

Based on the region, the lignosulfonates market has been segmented as follows:

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia Pacific (Malaysia, Indonesia, and Thailand)

-

Europe

- Germany

- UK

- France

- Spain

- Russia

- Italy

- Rest of Europe (Belgium, Norway, Netherland, and Sweden)

-

North America

- US

- Canada

- Mexico

-

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Rest of MEA (Israel, Kuwait, and Qatar)

-

South America

- Brazil

- Argentina

- Rest of South America (Chile, Paraguay, and Uruguay)

Recent Developments

- In October 2020, Borregaard and Sappi Group, who are the owners of Lignotech South Africa, decided to discontinue lignin production in South Africa.

- In June 2018, Borregaard and Rayonier Advanced Materials formed a joint venture for lignin production in Florida.

- In March 2017, Sappi Limited entered into an agreement with Cellmark to increase its global sales of Hansa lignin products.

Frequently Asked Questions (FAQ):

What is the key driver and opportunity for lignosulfonates market?

The binding and stabilization characteristics of lignosulfonates in road dust control application and potential applications in water treatment is the major driver and opportunity.

Which region is expected to hold the highest market share in the lignosulfonates market?

The lignosulfonates market in Europe will dominate the market share in 2021, showcasing strong demand from major applications such as concrete additives and animal feed binders.

What are the major applications of lignosulfonates?

Concrete additives and animal feed binders are the major applications of lignosulfonates.

Who are the major manufacturers of lignosulfonates?

The key manufacturers operating in the market include Borregaard (Norway), Rayonier Advanced Materials (US), Sappi Limited (South Africa), Domsjo Fabriker (Sweden), and Nippon Paper Industries Co., Ltd. (Japan).

What is the total CAGR expected to record for the lignosulfonates market during 2022-2027?

The market is expected to record a CAGR of 3.6% from 2022-2027.

Are lignosulfonates environmentally friendly?

Yes, lignosulfonates are derived from natural wood and are biodegradable, making them a more sustainable option compared to synthetic chemicals.

How does lignosulfonates benefit the construction industry in the UK?

Lignosulfonates act as plasticizers in concrete, improving workability and strength, while reducing water requirements, making them valuable for construction projects in the UK.

Who are the key players in the lignosulfonates market?

Major manufacturers include Borregaard (Norway), Rayonier Advanced Materials (US), Sappi Limited (South Africa), and Nippon Paper Industries Co., Ltd. (Japan).

What challenges does the lignosulfonates market face?

Challenges include complexities in production processes and competition from alternative products like calcium chloride and magnesium chloride.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing usage in road dust control due to binding and stabilizing characteristics- Increasing oil extraction activities- Growing demand for stabilized animal feed- Requirement of high-binding capacity in concreteRESTRAINTS- High water solubility of products- Inorganic electrolyte contentOPPORTUNITIES- Potential applications in water treatmentCHALLENGES- Separation and product purification of lignosulfonates

-

5.3 PORTER’S FIVE FORCES ANALYSISBARGAINING POWER OF SUPPLIERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.4 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 VALUE CHAIN ANALYSIS

-

6.2 TECHNOLOGY ANALYSISKEY PROCESSES TO PRODUCE LIGNOSULFONATES AND SULFONATED LIGNIN- Lignosulfonates from sulfite spent liquor- Sulfonated lignin from kraft black liquor- Sulfuric acid treatment- Nitration

-

6.3 ECOSYSTEM ANALYSIS

-

6.4 CASE STUDY ANALYSISSTUDY ON IMPACT OF PROPERTIES OF LIGNOSULFONATES ON THEIR END-USE APPLICATIONS- Objective- Solution statement

-

6.5 PATENT ANALYSISPATENT PUBLICATION TRENDSINSIGHTSJURISDICTION ANALYSISTOP COMPANIES/APPLICANTS- List of major patents

- 6.6 KEY CONFERENCES & EVENTS, 2023–2024

-

6.7 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATIONS PERTAINING TO USE OF LIGNOSULFONATES

- 6.8 TRENDS/DISRUPTION IMPACT

- 6.9 AVERAGE SELLING PRICE ANALYSIS

- 6.10 TRADE DATA STATISTICS

- 7.1 INTRODUCTION

-

7.2 SODIUM LIGNOSULFONATEDIVERSE APPLICATIONS TO DRIVE DEMAND

-

7.3 CALCIUM LIGNOSULFONATEUSAGE AS FERTILIZER DISPERSANTS TO SUPPORT SEGMENT GROWTH

-

7.4 MAGNESIUM LIGNOSULFONATEUSE AS ADHESIVES, STRENGTHENING AGENTS, AND WATER SHUTOFF AGENTS TO DRIVE DEMAND

- 7.5 OTHERS

- 8.1 INTRODUCTION

-

8.2 OIL WELL ADDITIVESMULTIPLE ROLES IN OIL WELL DRILLING INDUSTRY TO INCREASE DEMAND

-

8.3 CONCRETE ADDITIVESEXTENSIVE USE IN ADMIXTURES IN CONSTRUCTION SECTOR TO DRIVE MARKET

-

8.4 ANIMAL FEED BINDERSDEMAND FOR LIGNOSULFONATE AGGLOMERATE-RICH MINERAL COMPONENTS IN ANIMAL FEED TO SUPPORT MARKET GROWTH

-

8.5 DUST CONTROLLONG-LASTING DUST CONTROL SURFACE TO DRIVE USAGE

- 8.6 OTHERS

- 9.1 INTRODUCTION

-

9.2 EUROPEIMPACT OF RECESSION ON EUROPEGERMANY- Construction industry to drive marketFRANCE- Demand for concrete additives to support market growthITALY- Increased infrastructural activities to drive marketUK- Limited construction activities to hamper market growthSPAIN- Demand for livestock to drive marketRUSSIA- Petroleum industry to generate demandREST OF EUROPE

-

9.3 ASIA PACIFICIMPACT OF RECESSION ON ASIA PACIFICCHINA- Construction sector to fuel consumption of lignosulfonateJAPAN- Rapid urbanization to drive marketINDIA- Construction industry to boost demandSOUTH KOREA- Oil well additive applications to drive marketAUSTRALIA- Increased demand for livestock to drive marketREST OF ASIA PACIFIC

-

9.4 NORTH AMERICAUS- Rising demand for US-produced crude oil in Europe to drive marketCANADA- Large-scale production of hardwood and softwood chips to support market growthMEXICO- Growing pulp & paper sector to provide lucrative opportunities for market players

-

9.5 SOUTH AMERICAIMPACT OF RECESSION ON SOUTH AMERICABRAZIL- Paper & pulp industry to lead marketARGENTINA- Construction industry to create more demandREST OF SOUTH AMERICA

-

9.6 MIDDLE EAST & AFRICAIMPACT OF RECESSION ON MIDDLE EAST & AFRICASAUDI ARABIA- Petrochemical industry to drive marketUAE- Oil & gas industry to influence demand growthSOUTH AFRICA- Demand for animal feed additives to boost marketREST OF MIDDLE EAST & AFRICA

- 10.1 INTRODUCTION

-

10.2 STRATEGIES ADOPTED BY KEY PLAYERSOVERVIEW OF STRATEGIES ADOPTED BY KEY LIGNOSULFONATE MANUFACTURERS

-

10.3 MARKET SHARE ANALYSISRANKING OF KEY MARKET PLAYERS, 2021- Borregaard- Rayonier Advanced Materials- Sappi Limited- Domsjö Fabriker- Nippon Paper Industries Co., Ltd.REVENUE ANALYSIS OF TOP 5 PLAYERS

- 10.4 COMPANY FOOTPRINT ANALYSIS

-

10.5 COMPANY EVALUATION QUADRANT, 2021STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 10.6 COMPETITIVE BENCHMARKING

-

10.7 STARTUP/SME EVALUATION QUADRANT, 2021PROGRESSIVE COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKSDYNAMIC COMPANIES

-

10.8 COMPETITIVE SCENARIO AND TRENDSDEALSOTHER DEVELOPMENTS

-

11.1 MAJOR PLAYERSBORREGAARD- Business overview- Products offered- Recent developments- MnM viewRAYONIER ADVANCED MATERIALS- Business overview- Products offered- MnM viewSAPPI LIMITED- Business overview- Products offered- Recent developments- MnM viewDOMSJÖ FABRIKER- Business overview- Products offered- MnM viewNIPPON PAPER INDUSTRIES CO., LTD.- Business overview- Products offered- MnM viewINGEVITY- Business overview- Products offeredBURGO GROUP- Business overview- Products offeredTHE DALLAS GROUP OF AMERICA- Business overview- Products offeredGREEN AGROCHEM- Business overview- Products offeredSHENYANG XINGZHENGHE CHEMICAL CO., LTD.- Business overview- Products offeredABELIN POLYMERS- Business overview- Products offeredTIANJIN YEATS ADDITIVE CO., LTD.- Business overview- Products offeredCARDINAL CHEMICALS PVT LTD.- Business overview- Products offeredTOKYO CHEMICAL INDUSTRY- Business overview- Products offeredHENAN YULIN CHEMICAL CO., LTD.- Business overview- Products offered

-

11.2 OTHER PLAYERSHARBIN FECINO CHEMICAL CO., LTD.- Business overview- Products offeredKARJALA PULP- Business overview- Products offeredXINYI FEIHUANG CHEMICAL CO., LTD.- Business overview- Products offeredWUHAN XINYINGDA CHEMICALS CO., LTD.- Business overview- Products offeredWUHAN EAST CHINA CHEMICAL CO., LTD- Business overview- Products offeredPACIFIC DUST CONTROL, INC.- Business overview- Products offeredJINAN YUANSHENG CHEMICAL TECHNOLOGY CO., LTD.- Business overview- Products offeredINNOVA PRIORITY SOLUTIONS- Business overview- Products offeredHENAN KINGSUN CHEMICAL CO., LTD.- Business overview- Products offeredSHANDONG SINO-CHANCE NEW MATERIAL TECHNOLOGY CO., LTD.- Business overview- Products offered

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 LIGNOSULFONATES MARKET, BY PRODUCT

- TABLE 2 LIGNOSULFONATES MARKET, BY APPLICATION

- TABLE 3 LIGNOSULFONATES MARKET, BY REGION

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

- TABLE 5 KEY BUYING CRITERIA, BY APPLICATION

- TABLE 6 LIGNOSULFONATES MARKET ECOSYSTEM

- TABLE 7 LIGNOSULFONATES MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2023–2024

- TABLE 8 AVERAGE PRICE OF LIGNOSULFONATES, BY REGION (USD/TON)

- TABLE 9 AVERAGE PRICE OF LIGNOSULFONATES, BY PRODUCT (USD/TON)

- TABLE 10 IMPORT DATA BY COUNTRY IN 2021 (USD THOUSAND)

- TABLE 11 EXPORT DATA BY COUNTRY IN 2021 (USD THOUSAND)

- TABLE 12 LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (KILOTON)

- TABLE 13 LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (KILOTON)

- TABLE 14 LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

- TABLE 15 LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- TABLE 16 SODIUM LIGNOSULFONATES MARKET, BY REGION, 2019–2021 (KILOTON)

- TABLE 17 SODIUM LIGNOSULFONATES MARKET, BY REGION, 2022–2027 (KILOTON)

- TABLE 18 SODIUM LIGNOSULFONATES MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 19 SODIUM LIGNOSULFONATES MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 20 CALCIUM LIGNOSULFONATES MARKET, BY REGION, 2019–2021 (KILOTON)

- TABLE 21 CALCIUM LIGNOSULFONATES MARKET, BY REGION, 2022–2027 (KILOTON)

- TABLE 22 CALCIUM LIGNOSULFONATES MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 23 CALCIUM LIGNOSULFONATES MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 24 MAGNESIUM LIGNOSULFONATES MARKET, BY REGION, 2019–2021 (KILOTON)

- TABLE 25 MAGNESIUM LIGNOSULFONATES MARKET, BY REGION, 2022–2027 (KILOTON)

- TABLE 26 MAGNESIUM LIGNOSULFONATES MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 27 MAGNESIUM LIGNOSULFONATES MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 28 OTHER LIGNOSULFONATE PRODUCTS MARKET, BY REGION, 2019–2021 (KILOTON)

- TABLE 29 OTHER LIGNOSULFONATE PRODUCTS MARKET, BY REGION, 2022–2027 (KILOTON)

- TABLE 30 OTHER LIGNOSULFONATE PRODUCTS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 31 OTHER LIGNOSULFONATE PRODUCTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 32 LIGNOSULFONATES MARKET, BY APPLICATION, 2019–2021 (KILOTON)

- TABLE 33 LIGNOSULFONATES MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 34 LIGNOSULFONATES MARKET FOR OIL WELL ADDITIVES, BY REGION, 2019–2021 (KILOTON)

- TABLE 35 LIGNOSULFONATES MARKET FOR OIL WELL ADDITIVES, BY REGION, 2022–2027 (KILOTON)

- TABLE 36 LIGNOSULFONATES MARKET FOR CONCRETE ADDITIVES, BY REGION, 2019–2021 (KILOTON)

- TABLE 37 LIGNOSULFONATES MARKET FOR CONCRETE ADDITIVES, BY REGION, 2022–2027 (KILOTON)

- TABLE 38 LIGNOSULFONATES MARKET FOR ANIMAL FEED BINDERS, BY REGION, 2019–2021 (KILOTON)

- TABLE 39 LIGNOSULFONATES MARKET FOR ANIMAL FEED BINDERS, BY REGION, 2022–2027 (KILOTON)

- TABLE 40 LIGNOSULFONATES MARKET FOR DUST CONTROL, BY REGION, 2019–2021 (KILOTON)

- TABLE 41 LIGNOSULFONATES MARKET FOR DUST CONTROL, BY REGION, 2022–2027 (KILOTON)

- TABLE 42 LIGNOSULFONATES MARKET FOR OTHER APPLICATIONS, BY REGION, 2019–2021 (KILOTON)

- TABLE 43 LIGNOSULFONATES MARKET FOR OTHER APPLICATIONS, BY REGION, 2022–2027 (KILOTON)

- TABLE 44 LIGNOSULFONATES MARKET, BY REGION, 2019–2021 (KILOTON)

- TABLE 45 LIGNOSULFONATES MARKET, BY REGION, 2022–2027 (KILOTON)

- TABLE 46 LIGNOSULFONATES MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 47 LIGNOSULFONATES MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 48 EUROPE: LIGNOSULFONATES MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 49 EUROPE: LIGNOSULFONATES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 50 EUROPE: LIGNOSULFONATES MARKET, BY COUNTRY, 2019–2021 (KILOTON)

- TABLE 51 EUROPE: LIGNOSULFONATES MARKET, BY COUNTRY, 2022–2027 (KILOTON)

- TABLE 52 EUROPE: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

- TABLE 53 EUROPE: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- TABLE 54 EUROPE: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (KILOTON)

- TABLE 55 EUROPE: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (KILOTON)

- TABLE 56 EUROPE: LIGNOSULFONATES MARKET, BY APPLICATION, 2019–2021 (KILOTON)

- TABLE 57 EUROPE: LIGNOSULFONATES MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 58 GERMANY: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

- TABLE 59 GERMANY: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- TABLE 60 GERMANY: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (KILOTON)

- TABLE 61 GERMANY: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (KILOTON)

- TABLE 62 GERMANY: LIGNOSULFONATES MARKET, BY APPLICATION, 2019–2021 (KILOTON)

- TABLE 63 GERMANY: LIGNOSULFONATES MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 64 FRANCE: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

- TABLE 65 FRANCE: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- TABLE 66 FRANCE: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (KILOTON)

- TABLE 67 FRANCE: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (KILOTON)

- TABLE 68 FRANCE: LIGNOSULFONATES MARKET, BY APPLICATION, 2019–2021 (KILOTON)

- TABLE 69 FRANCE: LIGNOSULFONATES MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 70 ITALY: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

- TABLE 71 ITALY: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- TABLE 72 ITALY: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (KILOTON)

- TABLE 73 ITALY: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (KILOTON)

- TABLE 74 ITALY: LIGNOSULFONATES MARKET, BY APPLICATION, 2019–2021 (KILOTON)

- TABLE 75 ITALY: LIGNOSULFONATES MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 76 UK: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

- TABLE 77 UK: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- TABLE 78 UK: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (KILOTON)

- TABLE 79 UK: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (KILOTON)

- TABLE 80 UK: LIGNOSULFONATES MARKET, BY APPLICATION, 2019–2021 (KILOTON)

- TABLE 81 UK: LIGNOSULFONATES MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 82 SPAIN: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

- TABLE 83 SPAIN: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- TABLE 84 SPAIN: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (KILOTON)

- TABLE 85 SPAIN: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (KILOTON)

- TABLE 86 SPAIN: LIGNOSULFONATES MARKET, BY APPLICATION, 2019–2021 (KILOTON)

- TABLE 87 SPAIN: LIGNOSULFONATES MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 88 RUSSIA: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

- TABLE 89 RUSSIA: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- TABLE 90 RUSSIA: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (KILOTON)

- TABLE 91 RUSSIA: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (KILOTON)

- TABLE 92 RUSSIA: LIGNOSULFONATES MARKET, BY APPLICATION, 2019–2021 (KILOTON)

- TABLE 93 RUSSIA: LIGNOSULFONATES MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 94 REST OF EUROPE: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

- TABLE 95 REST OF EUROPE: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- TABLE 96 REST OF EUROPE: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (KILOTON)

- TABLE 97 REST OF EUROPE: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (KILOTON)

- TABLE 98 REST OF EUROPE: LIGNOSULFONATES MARKET, BY APPLICATION, 2019–2021 (KILOTON)

- TABLE 99 REST OF EUROPE: LIGNOSULFONATES MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 100 ASIA PACIFIC: LIGNOSULFONATES MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 101 ASIA PACIFIC: LIGNOSULFONATES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 102 ASIA PACIFIC: LIGNOSULFONATES MARKET, BY COUNTRY, 2019–2021 (KILOTON)

- TABLE 103 ASIA PACIFIC: LIGNOSULFONATES MARKET, BY COUNTRY, 2022–2027 (KILOTON)

- TABLE 104 ASIA PACIFIC: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (KILOTON)

- TABLE 105 ASIA PACIFIC: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (KILOTON)

- TABLE 106 ASIA PACIFIC: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

- TABLE 107 ASIA PACIFIC: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- TABLE 108 ASIA PACIFIC: LIGNOSULFONATES MARKET, BY APPLICATION, 2019–2021 (KILOTON)

- TABLE 109 ASIA PACIFIC: LIGNOSULFONATES MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 110 CHINA: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (KILOTON)

- TABLE 111 CHINA: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (KILOTON)

- TABLE 112 CHINA: LIGNOSULFONATES MARKET SIZE, BY PRODUCT, 2019–2021 (USD MILLION)

- TABLE 113 CHINA: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- TABLE 114 CHINA: LIGNOSULFONATES MARKET, BY APPLICATION, 2019–2021 (KILOTON)

- TABLE 115 CHINA: LIGNOSULFONATES MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 116 JAPAN: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (KILOTON)

- TABLE 117 JAPAN: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (KILOTON)

- TABLE 118 JAPAN: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

- TABLE 119 JAPAN: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- TABLE 120 JAPAN: LIGNOSULFONATES MARKET, BY APPLICATION, 2019–2021 (KILOTON)

- TABLE 121 JAPAN: LIGNOSULFONATES MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 122 INDIA: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (KILOTON)

- TABLE 123 INDIA: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (KILOTON)

- TABLE 124 INDIA: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

- TABLE 125 INDIA: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- TABLE 126 INDIA: LIGNOSULFONATES MARKET, BY APPLICATION, 2019–2021 (KILOTON)

- TABLE 127 INDIA: LIGNOSULFONATES MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 128 SOUTH KOREA: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (KILOTON)

- TABLE 129 SOUTH KOREA: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (KILOTON)

- TABLE 130 SOUTH KOREA: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

- TABLE 131 SOUTH KOREA: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- TABLE 132 SOUTH KOREA: LIGNOSULFONATES MARKET, BY APPLICATION, 2019–2021 (KILOTON)

- TABLE 133 SOUTH KOREA: LIGNOSULFONATES MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 134 AUSTRALIA: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (KILOTON)

- TABLE 135 AUSTRALIA: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (KILOTON)

- TABLE 136 AUSTRALIA: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

- TABLE 137 AUSTRALIA: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- TABLE 138 AUSTRALIA: LIGNOSULFONATES MARKET, BY APPLICATION, 2019–2021 (KILOTON)

- TABLE 139 AUSTRALIA: LIGNOSULFONATES MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 140 REST OF ASIA PACIFIC: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (KILOTON)

- TABLE 141 REST OF ASIA PACIFIC: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (KILOTON)

- TABLE 142 REST OF ASIA PACIFIC: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

- TABLE 143 REST OF ASIA PACIFIC: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- TABLE 144 REST OF ASIA PACIFIC: LIGNOSULFONATES MARKET, BY APPLICATION, 2019–2021 (KILOTON)

- TABLE 145 REST OF ASIA PACIFIC: LIGNOSULFONATES MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 146 NORTH AMERICA: LIGNOSULFONATES MARKET, BY COUNTRY, 2019–2021 (KILOTON)

- TABLE 147 NORTH AMERICA: LIGNOSULFONATES MARKET, BY COUNTRY, 2022–2027 (KILOTON)

- TABLE 148 NORTH AMERICA: LIGNOSULFONATES MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 149 NORTH AMERICA: LIGNOSULFONATES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 150 NORTH AMERICA: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (KILOTON)

- TABLE 151 NORTH AMERICA: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (KILOTON)

- TABLE 152 NORTH AMERICA: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

- TABLE 153 NORTH AMERICA: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- TABLE 154 NORTH AMERICA: LIGNOSULFONATES MARKET, BY APPLICATION, 2019–2021 (KILOTON)

- TABLE 155 NORTH AMERICA: LIGNOSULFONATES MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 156 US: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (KILOTON)

- TABLE 157 US: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (KILOTON)

- TABLE 158 US: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

- TABLE 159 US: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- TABLE 160 US: LIGNOSULFONATES MARKET, BY APPLICATION, 2019–2021 (KILOTON)

- TABLE 161 US: LIGNOSULFONATES MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 162 CANADA: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (KILOTON)

- TABLE 163 CANADA: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (KILOTON)

- TABLE 164 CANADA: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

- TABLE 165 CANADA: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- TABLE 166 CANADA: LIGNOSULFONATES MARKET, BY APPLICATION, 2019–2021 (KILOTON)

- TABLE 167 CANADA: LIGNOSULFONATES MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 168 MEXICO: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (KILOTON)

- TABLE 169 MEXICO: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (KILOTON)

- TABLE 170 MEXICO: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

- TABLE 171 MEXICO: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- TABLE 172 MEXICO: LIGNOSULFONATES MARKET, BY APPLICATION, 2019–2021 (KILOTON)

- TABLE 173 MEXICO: LIGNOSULFONATES MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 174 SOUTH AMERICA: LIGNOSULFONATES MARKET, BY COUNTRY, 2019–2021 (KILOTON)

- TABLE 175 SOUTH AMERICA: LIGNOSULFONATES MARKET, BY COUNTRY, 2022–2027 (KILOTON)

- TABLE 176 SOUTH AMERICA: LIGNOSULFONATES MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 177 SOUTH AMERICA: LIGNOSULFONATES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 178 SOUTH AMERICA: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (KILOTON)

- TABLE 179 SOUTH AMERICA: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (KILOTON)

- TABLE 180 SOUTH AMERICA: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

- TABLE 181 SOUTH AMERICA: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- TABLE 182 SOUTH AMERICA: LIGNOSULFONATES MARKET, BY APPLICATION, 2019–2021 (KILOTON)

- TABLE 183 SOUTH AMERICA: LIGNOSULFONATES MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 184 BRAZIL: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (KILOTON)

- TABLE 185 BRAZIL: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (KILOTON)

- TABLE 186 BRAZIL: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

- TABLE 187 BRAZIL: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- TABLE 188 BRAZIL: LIGNOSULFONATES MARKET, BY APPLICATION, 2019–2021 (KILOTON)

- TABLE 189 BRAZIL: LIGNOSULFONATES MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 190 ARGENTINA: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (KILOTON)

- TABLE 191 ARGENTINA: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (KILOTON)

- TABLE 192 ARGENTINA: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

- TABLE 193 ARGENTINA: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- TABLE 194 ARGENTINA: LIGNOSULFONATES MARKET, BY APPLICATION, 2019–2021 (KILOTON)

- TABLE 195 ARGENTINA: LIGNOSULFONATES MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 196 REST OF SOUTH AMERICA: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (KILOTON)

- TABLE 197 REST OF SOUTH AMERICA: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (KILOTON)

- TABLE 198 REST OF SOUTH AMERICA: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

- TABLE 199 REST OF SOUTH AMERICA: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- TABLE 200 REST OF SOUTH AMERICA: LIGNOSULFONATES MARKET, BY APPLICATION, 2019–2021 (KILOTON)

- TABLE 201 REST OF SOUTH AMERICA: LIGNOSULFONATES MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 202 MIDDLE EAST & AFRICA: LIGNOSULFONATES MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 203 MIDDLE EAST & AFRICA: LIGNOSULFONATES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 204 MIDDLE EAST & AFRICA: LIGNOSULFONATES MARKET, BY COUNTRY, 2019–2021 (KILOTON)

- TABLE 205 MIDDLE EAST & AFRICA: LIGNOSULFONATES MARKET, BY COUNTRY, 2022–2027 (KILOTON)

- TABLE 206 MIDDLE EAST & AFRICA: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (KILOTON)

- TABLE 207 MIDDLE EAST & AFRICA: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (KILOTON)

- TABLE 208 MIDDLE EAST & AFRICA: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

- TABLE 209 MIDDLE EAST & AFRICA: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- TABLE 210 MIDDLE EAST & AFRICA: LIGNOSULFONATES MARKET, BY APPLICATION, 2019–2021 (KILOTON)

- TABLE 211 MIDDLE EAST & AFRICA: LIGNOSULFONATES MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 212 SAUDI ARABIA: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (KILOTON)

- TABLE 213 SAUDI ARABIA: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (KILOTON)

- TABLE 214 SAUDI ARABIA: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

- TABLE 215 SAUDI ARABIA: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- TABLE 216 SAUDI ARABIA: LIGNOSULFONATES MARKET, BY APPLICATION, 2019–2021 (KILOTON)

- TABLE 217 SAUDI ARABIA: LIGNOSULFONATES MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 218 UAE: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (KILOTON)

- TABLE 219 UAE: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (KILOTON)

- TABLE 220 UAE: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

- TABLE 221 UAE: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- TABLE 222 UAE: LIGNOSULFONATES MARKET, BY APPLICATION, 2019–2021 (KILOTON)

- TABLE 223 UAE: LIGNOSULFONATES MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 224 SOUTH AFRICA: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (KILOTON)

- TABLE 225 SOUTH AFRICA: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (KILOTON)

- TABLE 226 SOUTH AFRICA: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

- TABLE 227 SOUTH AFRICA: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- TABLE 228 SOUTH AFRICA: LIGNOSULFONATES MARKET, BY APPLICATION, 2019–2021 (KILOTON)

- TABLE 229 SOUTH AFRICA: LIGNOSULFONATES MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 230 REST OF MIDDLE EAST & AFRICA: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (KILOTON)

- TABLE 231 REST OF MIDDLE EAST & AFRICA: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (KILOTON)

- TABLE 232 REST OF MIDDLE EAST & AFRICA: LIGNOSULFONATES MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

- TABLE 233 REST OF MIDDLE EAST & AFRICA: LIGNOSULFONATES MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- TABLE 234 REST OF MIDDLE EAST & AFRICA: LIGNOSULFONATES MARKET, BY APPLICATION, 2019–2021 (KILOTON)

- TABLE 235 REST OF MIDDLE EAST & AFRICA: LIGNOSULFONATES MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 236 LIGNOSULFONATES MARKET: PRODUCT FOOTPRINT

- TABLE 237 LIGNOSULFONATES MARKET: APPLICATION FOOTPRINT

- TABLE 238 LIGNOSULFONATES MARKET: COMPANY REGION FOOTPRINT

- TABLE 239 LIGNOSULFONATES MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 240 LIGNOSULFONATES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 241 LIGNOSULFONATES MARKET: DEALS (2017–2022)

- TABLE 242 LIGNOSULFONATES MARKET: OTHER DEVELOPMENTS (2017–2022)

- TABLE 243 BORREGAARD: COMPANY OVERVIEW

- TABLE 244 RAYONIER ADVANCED MATERIALS: COMPANY OVERVIEW

- TABLE 245 SAPPI LIMITED: COMPANY OVERVIEW

- TABLE 246 DOMSJÖ FABRIKER: COMPANY OVERVIEW

- TABLE 247 NIPPON PAPER INDUSTRIES CO., LTD.: COMPANY OVERVIEW

- TABLE 248 INGEVITY: COMPANY OVERVIEW

- TABLE 249 BURGO GROUP: COMPANY OVERVIEW

- TABLE 250 THE DALLAS GROUP OF AMERICA: COMPANY OVERVIEW

- TABLE 251 GREEN AGROCHEM: COMPANY OVERVIEW

- TABLE 252 SHENYANG XINGZHENGHE CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 253 ABELIN POLYMERS.: COMPANY OVERVIEW

- TABLE 254 TIANJIN YEATS ADDITIVE CO., LTD.: COMPANY OVERVIEW

- TABLE 255 CARDINAL CHEMICALS PVT LTD.: COMPANY OVERVIEW

- TABLE 256 TOKYO CHEMICAL INDUSTRY: COMPANY OVERVIEW

- TABLE 257 HENAN YULIN CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 258 HARBIN FECINO CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 259 KARJALA PULP: COMPANY OVERVIEW

- TABLE 260 XINYI FEIHUANG CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 261 WUHAN XINYINGDA CHEMICALS CO., LTD.: COMPANY OVERVIEW

- TABLE 262 WUHAN EAST CHINA CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 263 PACIFIC DUST CONTROL, INC.: COMPANY OVERVIEW

- TABLE 264 JINAN YUANSHENG CHEMICAL TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 265 INNOVA PRIORITY SOLUTIONS.: COMPANY OVERVIEW

- TABLE 266 HENAN KINGSUN CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 267 SHANDONG SINO-CHANCE NEW MATERIAL TECHNOLOGY CO., LTD: COMPANY OVERVIEW

- FIGURE 1 LIGNOSULFONATES MARKET SEGMENTATION

- FIGURE 2 LIGNOSULFONATES MARKET: RESEARCH DESIGN

- FIGURE 3 BASE NUMBER CALCULATION METHODOLOGY: SUPPLY–SIDE APPROACH (VOLUME)

- FIGURE 4 BASE NUMBER CALCULATION METHODOLOGY: DEMAND–SIDE APPROACH (VOLUME)

- FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 SODIUM LIGNOSULFONATE TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 9 EUROPE ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

- FIGURE 10 GROWING DEMAND FOR OIL WELLS AND CONCRETE ADDITIVES TO DRIVE MARKET FROM 2022 TO 2027

- FIGURE 11 SODIUM LIGNOSULFONATE TO BE FASTEST-GROWING SEGMENT BETWEEN 2022 AND 2027

- FIGURE 12 OIL WELL ADDITIVES TO BE FASTEST-GROWING APPLICATION OF LIGNOSULFONATES

- FIGURE 13 SODIUM LIGNOSULFONATE AND CONCRETE ADDITIVES ACCOUNTED FOR LARGEST SHARES

- FIGURE 14 CHINA TO OFFER LUCRATIVE GROWTH OPPORTUNITIES DURING FORECAST PERIOD

- FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN LIGNOSULFONATES MARKET

- FIGURE 16 PRODUCTION OF OIL, BY COUNTRY IN 2021

- FIGURE 17 LIGNOSULFONATES MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- FIGURE 19 KEY BUYING CRITERIA, BY APPLICATION

- FIGURE 20 LIGNOSULFONATES MARKET: VALUE CHAIN ANALYSIS

- FIGURE 21 ECOSYSTEM MAPPING: LIGNOSULFONATES MARKET

- FIGURE 22 PATENT APPLICATIONS VS. GRANTED PATENTS

- FIGURE 23 YEAR-WISE NUMBER OF PATENTS, 2014–2022

- FIGURE 24 CHINA ACCOUNTED FOR HIGHEST NUMBER OF PATENTS, 2014–2022

- FIGURE 25 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

- FIGURE 26 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR LIGNOSULFONATES MARKET

- FIGURE 27 AVERAGE SELLING PRICE OF LIGNOSULFONATES, BY PRODUCT TYPE (USD/TON)

- FIGURE 28 SODIUM LIGNOSULFONATE TO BE FASTEST-GROWING SEGMENT IN OVERALL MARKET

- FIGURE 29 OIL WELL ADDITIVES TO BE FASTEST-GROWING SEGMENT OF OVERALL MARKET

- FIGURE 30 REGIONAL SNAPSHOT: CHINA TO SHOW FASTEST GROWTH

- FIGURE 31 EUROPE: LIGNOSULFONATES MARKET SNAPSHOT

- FIGURE 32 ASIA PACIFIC: LIGNOSULFONATES MARKET SNAPSHOT

- FIGURE 33 NORTH AMERICA: LIGNOSULFONATES MARKET SNAPSHOT

- FIGURE 34 RANKING OF TOP FIVE PLAYERS IN LIGNOSULFONATES MARKET, 2021

- FIGURE 35 REVENUE ANALYSIS OF KEY COMPANIES, 2017–2021

- FIGURE 36 LIGNOSULFONATES MARKET: COMPANY FOOTPRINT

- FIGURE 37 LIGNOSULFONATES MARKET: BUSINESS STRATEGY EXCELLENCE

- FIGURE 38 COMPANY EVALUATION QUADRANT FOR LIGNOSULFONATES MARKET, 2021

- FIGURE 39 STARTUP/SME EVALUATION QUADRANT FOR LIGNOSULFONATES MARKET

- FIGURE 40 BORREGAARD: COMPANY SNAPSHOT

- FIGURE 41 RAYONIER ADVANCED MATERIALS: COMPANY SNAPSHOT

- FIGURE 42 SAPPI LIMITED: COMPANY SNAPSHOT

- FIGURE 43 NIPPON PAPER INDUSTRIES CO., LTD.: COMPANY SNAPSHOT

- FIGURE 44 INGEVITY: COMPANY SNAPSHOT

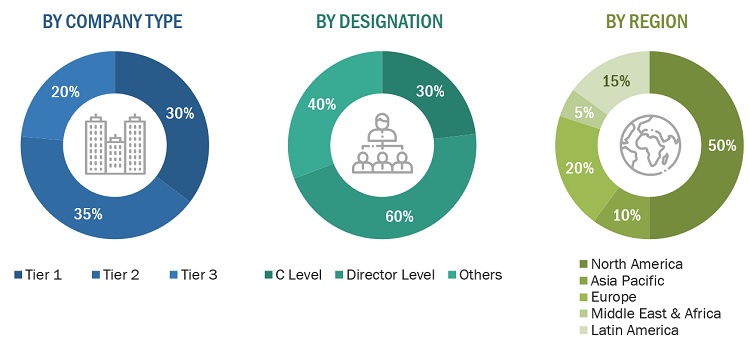

The study involved four major activities in estimating the current market size of lignosulfonates. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizes with industry experts across the value chain of lignosulfonates through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the size of the segments and sub-segments of the market.

Secondary Research

The research methodology used to estimate and forecast the access control market begins with capturing data on revenues of key vendors in the market through secondary research. In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, Factiva, World Bank, and Industry Journals, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; notifications by regulatory bodies; trade directories; and databases. Vendor offerings have also been taken into consideration to determine market segmentation.

Primary Research

The lignosulfonates industry comprises several stakeholders, such as raw material suppliers, paper & pulp manufacturers, end-product manufacturers, and regulatory organizations, in the supply chain. The demand side of this market is characterized by the development of oil well additives, cocreate additives, animal feed binders, dust control and other applications. Advancements in technology characterize the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

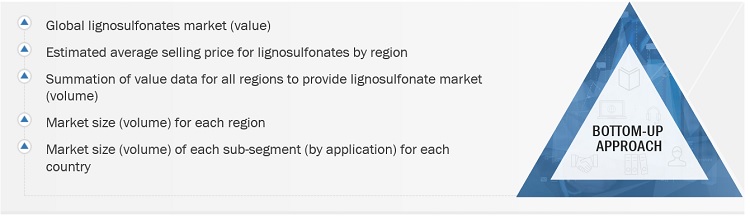

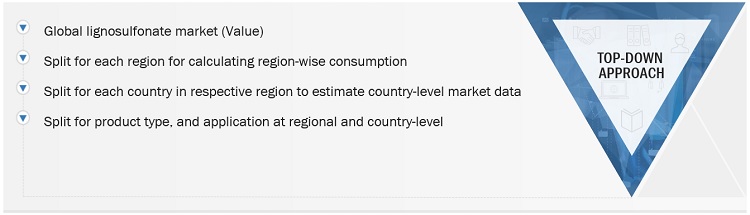

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the lignosulfonates market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the lignosulfonates market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Global Lignosulfonates Market Size: Bottom Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Lignosulfonates Market Size: Top Down Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the oil well additives, cocreate additives, animal feed binders, dust control and other applications.

Market definition

According to Green Agrochem, lignosulfonates, also known as sulfonated lignin, are water-soluble anionic polyelectrolyte polymers. They are obtained as by-products during the production of wood pulp through the sulfite pulping process. The process involves the mixing of sulfur dioxide (SO2) with an aqueous solution of a base to generate a raw liquor used for cooking wood. In water, the sulfur dioxide forms sulfurous acid (H2SO3), which removes the hydroxyl group and sulfonates the lignin, allowing it to be solubilized and separated from the cellulose.

Key Stakeholder

- Lignosulfonates’ manufacturers, traders, distributors, and suppliers

- Paper and pulp manufacturers

- Lignin suppliers

- Raw material suppliers

- Governments and research organizations

- Regulatory bodies and associations

- Industry associations

- Contract manufacturing organizations (CMOs)

- NGOs, investment banks, venture capitalists, and private equity firms

- End-use industries

Report Objectives:

- To analyze and forecast the market size of lignosulfonates in terms of value and volume.

- To provide detailed information regarding the major factors (drivers, restraints, challenges, and opportunities) influencing the regional market

- To analyze and forecast the global lignosulfonates market on the basis of product and application.

- To analyze the opportunities in the market for stakeholders and provide details of a competitive landscape for market leaders.

- To strategically analyze the micromarkets1 with respect to individual growth trends, growth prospects, and their contribution to the overall market

- To forecast the size of various market segments based on five major regions: North America, Europe, Asia Pacific, the Middle East & Africa, and South America, along with their respective key countries.

- To track and analyze the competitive developments, such as expansion, merger & acquisition, new product development, and contract & agreement, in the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the client-specific needs.

The following customization options are available for the report:

- Additional country-level analysis of the lignosulfonates market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Lignosulfonates Market