Regenerated Cellulose Market by Type (Fibers (Viscose, Lyocell, Modal), Films), Manufacturing Process, Source, End-user Industry (Fabrics, Automotive, Agriculture, Packaging) and Region (North America, Europe, APAC, Rest of the World) - Forecast to 2027

Updated on : August 28, 2025

Regenerated Cellulose Market

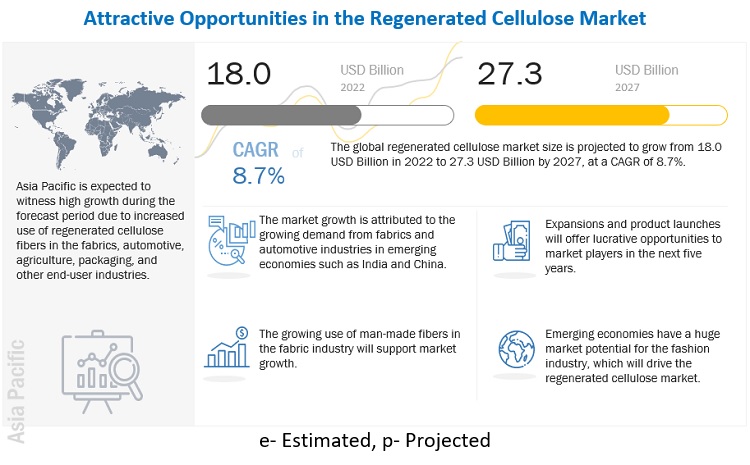

The global regenerated cellulose market was valued at USD 18.0 billion in 2022 and is projected to reach USD 27.3 billion by 2027, growing at 8.7% cagr from 2022 to 2027. Regenerated cellulose is a group of materials that are produced simply from the natural cellulose via physical dissolution and regeneration. The regeneration is the eco-friendly process in which the re-usage of harmful chemicals can occur. Nowadays, the rising demand for eco-friendly fibers from various end-use industries such as Fabric Industry, Automotive Industry, Agriculture Industry, Packaging Industry, and others is driving the market for regenerated cellulose. The key factors which fuelled the growing demand for regenerated cellulose in emerging economies are the adoption of new innovative manufacturing technologies, changing lifestyles, rapid urbanization, and others.

The increasing awareness about personal hygiene, biodegradability, and sustainability is the key factor in increasing the demand from various end-use industries such as the fabric industry, automotive industry, agriculture industry, packaging industry, and others are generating new opportunities for the market. The products from regenerated cellulose are environment-friendly and biodegradable in nature, which helps to penetrate the wide market of regenerated cellulose.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Pandemic Impact

Due to the COVID-19 pandemic, there was a disruption in the supply chains, a decline in the demand of end-use industries, and a shortage of labour which led to the suspension of operation resulted in the declined growth of the regenerated cellulose market. However, during the COVID-19 pandemic period, the demand for medical and nutrition goods was rising supporting the market for regenerated cellulose. Additionally, the rapid recovery of several end-use industries such as automotive, agriculture, and fabric will support the growth of the market in the forecast period.

Regenerated Cellulose Market Dynamics

Driver: The rising demand for eco-friendly fabrics across the globe drives the market.

The eco-friendly fabrics which are produced from regenerated cellulose drive the market in emerging economies such as India, China, and other ASEAN countries. These fibers help to stabilize the earth’s climate by reducing the level of Green House Gas Emissions (GHGs) and other harmful pollutants during the production process. Viscose is the most essential fiber which comes in the category of regenerated cellulose. It constitutes approximately 79% of the share of all artificial cellulose fibers which are used in the textile industry. Due to its excellent breathability, smooth, silky, lustrous, good absorbency, and other good mechanical properties, it is highly used in textile and apparel industries. The demand from these industries is likely to propel the market for regenerated cellulose.

Restraint: Shortage of raw materials and capital-intensive operation

Regenerated cellulose is derived from natural cellulose pulp, and natural cellulose pulp comes from trees that are grown in responsibly managed forests. However, there are many third-party organizations available that have a business in selling natural cellulose pulp, which complies with Sustainable Forestry Initiative (SFI) certification standards. But, there is a scarcity of resources and raw materials such as water and natural cellulose pulp significantly impact the business operations of cellulose fiber manufacturing firms.

Several key manufacturers have created new reservoirs closer to plant locations to have a sufficient supply of water to produce regenerated cellulose fibers. These type of setups requires a huge amount of investment which may not be useful in the long run in the case of societal challenges. For instance, the shortage of wood due to forest degradation and the scarcity of freshwater resources in the world is mainly due to the overuse and wastage of water, which will hamper the operation of the cellulose fiber manufacturing business.

The operational and infrastructural costs of the manufacturing plant mainly depend upon the price of raw materials and application areas for which manufacturers plan to produce regenerated cellulose. As production of pulp and fibers involves energy-intensive processes and hence requires a high amount of investment. This increment in the prices of regenerated cellulose attracts a lower demand from the consumer end. Hence, both shortage of raw material and high prices of the regenerated cellulose affects the market of regenerated cellulose.

Opportunities: Use of Regenerated cellulose in personal care and hygienic products

Regenerated cellulose is produced from the natural cellulose pulp which comes from a wide variety of trees. Hence it is used in making various personal hygiene products such as sanitary pads and diapers owing to their absorbency, flexibility, and reliability properties. Moreover, these products are biodegradable in nature which does not degrade the environment severely. Increasing awareness regarding personal hygiene and the high demand for personal hygienic products are the major key factors that drive the market for regenerated cellulose.

Challenges: Usage of Cellulose acetate products

The market growth of regenerated cellulose can be affected by the Government regulations that ban smoking in public areas. Stringent rules and regulations of the government, due to several health risks associated with smoking are the key factor to restrict the demand for cellulose acetate to a certain extent in the global market. Therefore, cellulose acetate suppliers need to invest significantly to revamp their operations to comply with the new regulations.

Regenerated Cellulose Market Ecosystem

By End Use Industry, Fabric Industry accounted for the highest CAGR during the forecast period

Fabric Industry is the fastest growing end use industry segment for regenerated cellulose market owing to the increasing use of regenerated cellulose in variety of fabrics such as fashionable dresses, ethnic wear, inner wear, outerwear, sportswear, beddings, rugs, draperies, carpets, curtains, blankets, cushions, and many more to provide several charactertics such as comfort, softness, lustre, breathability, absorbency, and others.

By Type, Fibers segment accounted for the highest CAGR during the forecast period

Fibers are estimated to be the quickest rising market during the forecast period owing to increasing demand for eco-friendly products which helps to strengthen sustainability. The regenerated cellulosic fibers have some excellent properties such as high wet tenacity, good absorbency, soft, lustrous, easily dyeable, biodegradability, good drape ability, and others which helps them to use as an alternative to synthetic fibers.

By Source, Wood Pulp accounted for the largest share in 2021

Wood Pulp is estimated to be the largest market for Regenerated Cellulose Market. Regenerated cellulose derived from wood pulp is widely used in several applications, especially where high tensile strength, high wet tenacity, high abrasion resistance, and excellent absorbing capacity are required. With the help of these properties, they are used in wide applications such as in the making of tire cords, farming ropes, and others

By Manufacturing Process, the Regenerated Cellulose Market Viscose segment accounted for the largest share in 2021

Viscose is estimated to be the largest market for Regenerated Cellulose Market. Viscose Manufacturing technology, is used in several end-use industry, especially fabric industry to manufacture fashionable dresses, innerwear, outerwear, sportswear, bedding, curtains, rugs, towels, and others. The viscose technology used to enhance several charatertics of fabrics such as absorbency, lightweight, better washability , temperature resistance, smoothness, softness, high wet tenacity, high tensile strength, high abrasion resistance, etc.

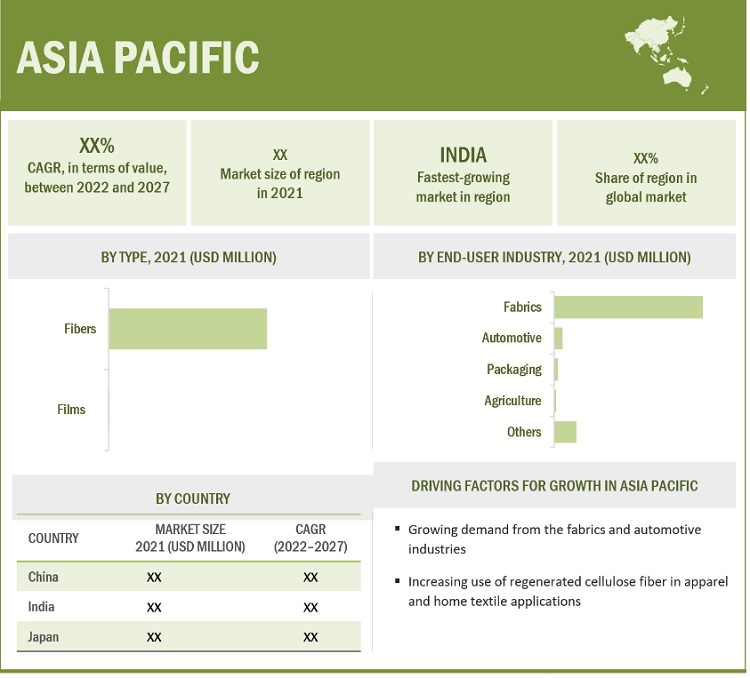

APAC is projected to account for the highest CAGR in the regenerated cellulose market during the forecast period

APAC is estimated to be the fastest growing market for regenerated cellulose during the forecast period. Regenerated cellulose market is witnessing significant growth in several emerging economies in the region such as India, China, and Japan, owing to the rising awareness regarding rising disposable income, sustaninability and the increasing use of environment friendly raw materials in sevral end-use industries such as fabric, automotive, and packaging industries. Additionally, the growth of end use industries major in the region will further boosts the demand of the regenerated cellulose market.

To know about the assumptions considered for the study, download the pdf brochure

Regenerated Cellulose Market Players

Regenerated Cellulose comprises major manufacturers such as Sateri (China), Lenzing AG (Austria), Grasim Industries Limited (India), Kelheim Fibres GmbH (Germany), Fulida Group (China), and Eastman Chemical Company (US) are the key players operating in the Regenerated Cellulose Market. Expansions, acquisitions, joint ventures, and new product developments are some of the major strategies adopted by these key players to enhance their positions in the Regenerated Cellulose Market.

Regenerated Cellulose Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 18.0 billion |

|

Revenue Forecast in 2027 |

USD 27.3 billion |

|

CAGR |

8.7% |

|

Years Considered |

2015–2027 |

|

Base year |

2021 |

|

Forecast period |

2022–2027 |

|

Unit considered |

Value (USD Billion), and Volume (Kilotons) |

|

Segments |

Type, Source, Manufacturing Process, End User Industry, and Region |

|

Regions |

Asia-Pacific, North America, Europe, and the Rest of the World (ROW) |

|

Companies |

The major players are Sateri (China), Lenzing AG (Austria), Grasim Industries Ltd. (India), Eastman Chemical Company (US), GP Cellulose, LLC (US), and others are covered in the Regenerated Cellulose market. |

This research report categorizes the global regenerated cellulose market on the basis of Type, Source, Manufacturing Process, Application, and Region.

Regenerated Cellulose Market by Type

- Fiber

- Film

Regenerated Cellulose Market by Source

- Wood-Pulp

- Non-Wood Pulp

- Recycled Pulp/De-inked Pulp

Regenerated Cellulose Market by Manufacturing Process

- Viscose

- Cuprammonium

- N-methyl-morpholine-N-oxide (NMMO)

- Acetate

Regenerated Cellulose Market by End Use Industry

- Fabric

- Automotive

- Agriculture

- Packaging

- Others

Regenerated Cellulose Market by Region

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (ROW)

The market has been further analyzed for the key countries in each of these regions.

Recent Developments

- In March 2022, an agreement was signed between Grasim Industries Limited Swedish textile-to-textile recycling innovator (Renewcell) for providing high-quality LIVA REVIVA fibers.

- In March 2022, the world’s largest lyocell production plant was opened up by Lenzing AG in Thailand. The production capacity of this plant is 100,000 tons.

- In May 2022, a Belgium-based company i.e., UTEXBEL collaborated with Lenzing AG for producing uniforms for security personnel of the Belgian Federal Public Service for Justice (FPS Justice).

- In January 2022, GP Cellulose, LLC., invested USD 80 Million to expand its fluff pulp production capacity.

- In March 2021, Eastman Chemical Company planned to increase the production capacity of NAIA filament yarn by more than 50% by 2022.

- In October 2021, Kelheim Fibres GmbH collaborated with Renewcell to produce superior quality viscose fibers.

- In November 2021, Grasim Industries Limited expanded its viscose production capacity by 300 tons per day.

- In February 2021, Lenzing AG introduced new zero-carbon lyocell fibers namely TENCEL and TENCEL REFIBRA, under the brand name of TENCEL.

- In March 2021, Sateri has planned to expand the production capacity by 500,000 tons by 2025.

- In February 2021, Sateri launched its recycled fiber namely FINEX.

- In July 2021, Sateri collaborated with Infinited Fiber Company, to scale up the next-generation fiber technology.

Frequently Asked Questions (FAQ):

How big is the Regenerated Cellulose Market?

Regenerated Cellulose Market worth $27.3 billion by 2027.

What is the growth rate of Regenerated Cellulose Market?

Regenerated Cellulose Market grows at a CAGR of 8.7% during the forecast period.

What are the major drivers driving the growth of the Regenerated Cellulose Market?

The major drivers influencing the growth of the Regenerated cellulose market are increasing demand for fashionable fabrics, across the globe.

What are the major challenges in the Regenerated Cellulose Market?

The major challenge in the Regenerated Cellulose market is the government’s stringent rules and regulations on smoking in public areas which are derived from acetate fiber.

What are the restraining factors in Regenerated Cellulose Market?

The major restraining factor faced by the regenerated cellulose market is the shortage of raw material and energy extensive processes.

What is the key opportunity in the regenerated cellulose Market?

Rising the demand for personal hygienic products has a new opportunity to regenerated the cellulose market.

What is the impact of the COVID-19 pandemic on the regenerated cellulose Market?

There was a decline in the market of regenerated cellulose across the globe due to the COVID-19 pandemic, however, there is no impact on the other industries which include the health industry. Owing to COVID-19, demand from the Medical & Healthcare industry has increased whereas, in transportation, Manufacturing plants (other than healthcare and packaging), and others, the demand for regenerated cellulose declined. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 51)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.4 STUDY SCOPE

1.4.1 REGENERATED CELLULOSE MARKET SEGMENTATION

1.4.2 GEOGRAPHIC SCOPE

1.4.3 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

1.6 UNIT CONSIDERED

1.7 LIMITATIONS

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 55)

2.1 RESEARCH DATA

FIGURE 1 REGENERATED CELLULOSE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Critical secondary inputs

2.1.2 PRIMARY DATA

2.1.2.1 Critical primary inputs

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 SUPPLY SIDE: VALIDATING MARKET SIZE OF KEY PLAYERS

FIGURE 2 MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS

2.2.2 BOTTOM-UP MARKET SIZE ESTIMATION: ESTIMATING OVERALL DEMAND BY CALCULATING MARKET SHARE OF EACH COUNTRY

FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP ANALYSIS

2.3 DATA TRIANGULATION

FIGURE 4 REGENERATED CELLULOSE MARKET: DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 64)

TABLE 1 REGENERATED CELLULOSE MARKET SNAPSHOT

FIGURE 5 FIBERS SEGMENT ACCOUNTED FOR LARGER SHARE OF REGENERATED CELLULOSE MARKET IN 2021

FIGURE 6 VISCOSE FIBERS ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

FIGURE 7 FABRICS SEGMENT ACCOUNTED FOR LARGER MARKET SHARE THAN AUTOMOTIVE SEGMENT IN 2021

FIGURE 8 VISCOSE MANUFACTURING PROCESS CAPTURED LARGER MARKET SHARE THAN NMMO PROCESS IN 2021

FIGURE 9 WOOD PULP SEGMENT ACCOUNTED FOR LARGER MARKET SHARE THAN NON-WOOD PULP SEGMENT IN 2021

FIGURE 10 ASIA PACIFIC CAPTURED LARGEST SHARE OF REGENERATED CELLULOSE MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 69)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN REGENERATED CELLULOSE MARKET

FIGURE 11 RISING DEMAND FOR MAN-MADE FIBERS IN FABRICS INDUSTRY TO DRIVE MARKET GROWTH

4.2 REGENERATED CELLULOSE MARKET IN ASIA PACIFIC, BY TYPE AND COUNTRY

FIGURE 12 FIBERS AND CHINA ACCOUNTED FOR LARGEST SHARE OF REGENERATED CELLULOSE MARKET, BY TYPE AND COUNTRY, RESPECTIVELY, IN 2021

4.3 REGENERATED CELLULOSE MARKET FOR KEY COUNTRIES

FIGURE 13 SOUTH AFRICA TO REGISTER HIGHEST CAGR IN GLOBAL REGENERATED CELLULOSE MARKET

5 MARKET OVERVIEW (Page No. - 71)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN REGENERATED CELLULOSE MARKET

5.2.1 DRIVERS

5.2.1.1 Surging use of man-made cellulosic fibers in textile and apparel products

5.2.1.2 Increasing focus of automotive industry on reducing carbon footprint

FIGURE 15 GLOBAL MOTOR VEHICLE PRODUCTION, 2006–2021 (UNITS)

5.2.1.3 Rising demand for biofibers having minimal resistance to environmental degradation

5.2.1.4 Increasing adoption of rayon as substitute for silk and cotton

5.2.2 RESTRAINTS

5.2.2.1 Scarcity of raw materials, along with capital-intensive business operations

5.2.2.2 Availability of cheaper substitutes such as synthetic fibers

5.2.3 OPPORTUNITIES

5.2.3.1 Adoption of new technologies to produce and dissolve regenerated cellulose

5.2.3.2 Use of regenerated cellulose fibers in personal care and hygiene products

5.2.4 CHALLENGES

5.2.4.1 Stringent rules and regulations with respect to cellulose acetate products

5.2.5 INDUSTRY TRENDS

5.2.5.1 Rising focus of manufacturing firms on achieving net-zero emission targets by 2050

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 16 REGENERATED CELLULOSE MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 BARGAINING POWER OF BUYERS

5.3.3 INTENSITY OF COMPETITIVE RIVALRY

5.3.4 THREAT OF NEW ENTRANTS

5.3.5 THREAT OF SUBSTITUTES

TABLE 2 REGENERATED CELLULOSE MARKET: PORTER’S FIVE FORCES ANALYSIS

5.4 PATENT ANALYSIS

FIGURE 17 NUMBER OF GRANTED PATENTS, BY REGENERATED CELLULOSE FIBER TYPE, 2015–2021

FIGURE 18 JURISDICTION-WISE GRANTED PATENTS TILL DATE, BY FIBER TYPE

TABLE 3 NUMBER OF GRANTED, APPLIED, AND LIMITED PATENTS, BY FIBER TYPE (TILL 2020)

TABLE 4 PATENT DETAILS

5.5 KEY EXPORTING AND IMPORTING COUNTRIES

TABLE 5 GLOBAL AND TOP COUNTRIES IMPORTING VISCOSE FIBERS, 2017–2021 (TON)

TABLE 6 GLOBAL AND TOP COUNTRIES EXPORTING VISCOSE FIBERS, 2017–2021 (TON)

TABLE 7 GLOBAL AND TOP COUNTRIES IMPORTING ACETATE FIBERS, 2017–2021 (TON)

TABLE 8 GLOBAL AND TOP COUNTRIES EXPORTING ACETATE FIBERS, 2017–2021 (TON)

TABLE 9 INTENSITY OF TRADE, BY KEY COUNTRY

5.6 CASE STUDY ANALYSIS

5.7 SUPPLY CHAIN ANALYSIS

FIGURE 19 SUPPLY CHAIN OF REGENERATED CELLULOSE MARKET

5.8 PRICING ANALYSIS

FIGURE 20 AVERAGE SELLING PRICE OF REGENERATED CELLULOSE, BY REGION, 2021 (USD/TON)

TABLE 10 AVERAGE SELLING PRICE OF REGENERATED CELLULOSE, BY TYPE AND REGION, 2021 (USD/TON)

5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

FIGURE 21 FOCUS ON SUSTAINABLE DEVELOPMENT WILL BRING CHANGE IN FUTURE REVENUE MIX

5.10 KEY CONFERENCES AND EVENTS, 2022–2023

5.11 MACROECONOMIC INDICATORS

5.11.1 GLOBAL GDP OUTLOOK

TABLE 11 WORLDWIDE GDP GROWTH PROJECTION, 2019–2026 (USD BILLION)

5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 22 INFLUENCE OF STAKEHOLDERS IN TOP 3 END-USER INDUSTRIES ON BUYING PROCESS

TABLE 12 INFLUENCE OF STAKEHOLDERS IN TOP 3 END-USER INDUSTRIES ON BUYING PROCESS

5.12.2 BUYING CRITERIA

FIGURE 23 TOP 3 END-USER INDUSTRIES’ BUYING CRITERIA

TABLE 13 KEY BUYING CRITERIA FOR TOP 3 END-USER INDUSTRIES

5.13 ADJACENT AND RELATED MARKETS

5.13.1 INTRODUCTION

5.13.2 LIMITATIONS

5.13.3 NON-WOVEN FABRICS MARKET

5.13.3.1 Market definition

5.13.3.2 Non-woven fabrics market, by application

TABLE 14 NON-WOVEN FABRICS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 15 NON-WOVEN FABRICS MARKET, BY APPLICATION, 2018–2025 (KILOTON)

5.14 ECOSYSTEM MAP

5.15 TECHNOLOGY OVERVIEW

5.15.1 ACETATE

5.15.2 VISCOSE

5.15.3 MODAL

5.15.4 LYOCELL

5.16 REGULATIONS AND STANDARDS

TABLE 16 CURRENT STANDARD CODES FOR REGENERATED CELLULOSE

6 REGENERATED CELLULOSE FIBER MARKET, BY TYPE (Page No. - 97)

6.1 INTRODUCTION

FIGURE 24 FIBERS SEGMENT TO LEAD REGENERATED CELLULOSE MARKET BETWEEN 2022 AND 2027

TABLE 17 REGENERATED CELLULOSE MARKET, BY TYPE, 2015–2020 (KILOTON)

TABLE 18 REGENERATED CELLULOSE MARKET, BY TYPE, 2021–2027 (KILOTON)

TABLE 19 REGENERATED CELLULOSE MARKET, BY TYPE, 2015–2020 (USD MILLION)

TABLE 20 REGENERATED CELLULOSE MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 21 REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2015–2020 (KILOTON)

TABLE 22 REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2021–2027 (KILOTON)

TABLE 23 REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2015–2020 (USD MILLION)

TABLE 24 REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2021–2027 (USD MILLION)

6.2 FIBERS

6.2.1 TEXTILE, PACKAGING, AND AUTOMOTIVE INDUSTRIES TO CONTRIBUTE MOST TO MARKET GROWTH

TABLE 25 FIBERS: REGENERATED CELLULOSE MARKET, BY REGION, 2015–2020 (KILOTON)

TABLE 26 FIBERS: REGENERATED CELLULOSE MARKET, BY REGION, 2021–2027 (KILOTON)

TABLE 27 FIBERS: REGENERATED CELLULOSE MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 28 FIBERS: REGENERATED CELLULOSE MARKET, BY REGION, 2021–2027 (USD MILLION)

6.2.2 VISCOSE

6.2.2.1 Textile industry to witness high demand for viscose cellulose fibers

TABLE 29 VISCOSE FIBERS: REGENERATED CELLULOSE MARKET, BY REGION, 2015–2020 (KILOTON)

TABLE 30 VISCOSE FIBERS: REGENERATED CELLULOSE MARKET, BY REGION, 2021–2027 (KILOTON)

TABLE 31 VISCOSE FIBERS: REGENERATED CELLULOSE FIBER MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 32 VISCOSE FIBERS: REGENERATED CELLULOSE FIBER MARKET, BY REGION, 2021–2027 (USD MILLION)

6.2.3 MODAL

6.2.3.1 Fungus and shrinkage resistance qualities make modal fibers sui TABLE for automotive applications

TABLE 33 MODAL FIBERS: REGENERATED CELLULOSE MARKET, BY REGION, 2015–2020 (KILOTON)

TABLE 34 MODAL FIBERS: REGENERATED CELLULOSE MARKET, BY REGION, 2021–2027 (KILOTON)

TABLE 35 MODAL FIBERS: REGENERATED CELLULOSE MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 36 MODAL FIBERS: REGENERATED CELLULOSE MARKET, BY REGION, 2021–2027 (USD MILLION)

6.2.4 LYOCELL

6.2.4.1 Textile and pulp & paper industries to support demand for lyocell fibers

TABLE 37 LYOCELL FIBERS: REGENERATED CELLULOSE MARKET, BY REGION, 2015–2020 (KILOTON)

TABLE 38 LYOCELL FIBERS: REGENERATED CELLULOSE MARKET, BY REGION, 2021–2027 (KILOTON)

TABLE 39 LYOCELL FIBERS: REGENERATED CELLULOSE MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 40 LYOCELL FIBERS: REGENERATED CELLULOSE MARKET, BY REGION, 2021–2027 (USD MILLION)

6.2.5 OTHERS

6.2.5.1 Acetate

6.2.5.2 Cupro

TABLE 41 OTHER FIBERS: REGENERATED CELLULOSE MARKET, BY REGION, 2015–2020 (KILOTON)

TABLE 42 OTHER FIBERS: REGENERATED CELLULOSE MARKET, BY REGION, 2021–2027 (KILOTON)

TABLE 43 OTHER FIBERS: REGENERATED CELLULOSE MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 44 OTHER FIBERS: REGENERATED CELLULOSE MARKET, BY REGION, 2021–2027 (USD MILLION)

6.3 FILMS

6.3.1 PACKAGING INDUSTRY TO WITNESS HIGH DEMAND FOR REGENERATED CELLULOSE FILMS

TABLE 45 FILMS: REGENERATED CELLULOSE MARKET, BY REGION, 2015–2020 (KILOTON)

TABLE 46 FILMS: REGENERATED CELLULOSE MARKET, BY REGION, 2021–2027 (KILOTON)

TABLE 47 FILMS: REGENERATED CELLULOSE MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 48 FILMS: REGENERATED CELLULOSE MARKET, BY REGION, 2021–2027 (USD MILLION)

7 REGENERATED CELLULOSE MARKET, BY SOURCE (Page No. - 111)

7.1 INTRODUCTION

FIGURE 25 WOOD PULP SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE THROUGHOUT FORECAST PERIOD

TABLE 49 REGENERATED CELLULOSE MARKET, BY SOURCE, 2015–2020 (KILOTON)

TABLE 50 REGENERATED CELLULOSE MARKET, BY SOURCE, 2021–2027 (KILOTON)

TABLE 51 REGENERATED CELLULOSE MARKET, BY SOURCE, 2015–2020 (USD MILLION)

TABLE 52 REGENERATED CELLULOSE MARKET, BY SOURCE, 2021–2027 (USD MILLION)

7.2 WOOD PULP

7.2.1 SUSTAINABLE, BIODEGRADABLE, AND RENEWABLE SOURCE USED TO PRODUCE CELLULOSIC FIBERS

TABLE 53 WOOD PULP: REGENERATED CELLULOSE MARKET, BY REGION, 2015–2020 (KILOTON)

TABLE 54 WOOD PULP: REGENERATED CELLULOSE MARKET, BY REGION, 2021–2027 (KILOTON)

TABLE 55 WOOD PULP: REGENERATED CELLULOSE MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 56 WOOD PULP: REGENERATED CELLULOSE MARKET, BY REGION, 2021–2027 (USD MILLION)

7.3 NON-WOOD PULP

7.3.1 WOOD SCARCITY DUE TO DEFORESTATION PROMPTS USE OF NON-WOOD PULP

TABLE 57 NON-WOOD PULP: REGENERATED CELLULOSE MARKET, BY REGION, 2015–2020 (KILOTON)

TABLE 58 NON-WOOD PULP: REGENERATED CELLULOSE MARKET, BY REGION, 2021–2027 (KILOTON)

TABLE 59 NON-WOOD PULP: REGENERATED CELLULOSE MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 60 NON-WOOD PULP: REGENERATED CELLULOSE MARKET, BY REGION, 2021–2027 (USD MILLION)

7.4 RECYCLED/DE-INKED PULP

7.4.1 ENABLES PRODUCTION OF SUSTAINABLE CELLULOSE AT LOWER COST

TABLE 61 RECYCLED PULP/DE-INKED PULP: REGENERATED CELLULOSE MARKET, BY REGION, 2015–2020 (KILOTON)

TABLE 62 RECYCLED PULP/DE-INKED PULP: REGENERATED CELLULOSE MARKET, BY REGION, 2021–2027 (KILOTON)

TABLE 63 RECYCLED PULP/DE-INKED PULP: REGENERATED CELLULOSE MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 64 RECYCLED PULP/DE-INKED PULP: REGENERATED CELLULOSE MARKET, BY REGION, 2021–2027 (USD MILLION)

8 REGENERATED CELLULOSE MARKET, BY MANUFACTURING PROCESS (Page No. - 119)

8.1 INTRODUCTION

FIGURE 26 VISCOSE PROCESS TO CAPTURE LARGEST SHARE OF REGENERATED CELLULOSE MARKET BETWEEN 2022 AND 2027

TABLE 65 REGENERATED CELLULOSE MARKET, BY MANUFACTURING PROCESS, 2015–2020 (KILOTON)

TABLE 66 REGENERATED CELLULOSE MARKET, BY MANUFACTURING PROCESS, 2021–2027 (KILOTON)

TABLE 67 REGENERATED CELLULOSE MARKET, BY MANUFACTURING PROCESS, 2015–2020 (USD MILLION)

TABLE 68 REGENERATED CELLULOSE MARKET, BY MANUFACTURING PROCESS, 2021–2027 (USD MILLION)

8.2 VISCOSE

8.2.1 PROCESS INVOLVES USE OF WOOD PULP TO EXTRACT AND PURIFY CELLULOSE

TABLE 69 VISCOSE: REGENERATED CELLULOSE MARKET, BY REGION, 2015–2020 (KILOTON)

TABLE 70 VISCOSE: REGENERATED CELLULOSE MARKET, BY REGION, 2021–2027 (KILOTON)

TABLE 71 VISCOSE: REGENERATED CELLULOSE MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 72 VISCOSE: REGENERATED CELLULOSE MARKET, BY REGION, 2021–2027 (USD MILLION)

8.3 CUPRAMMONIUM

8.3.1 USEFUL FOR PREPARING REGENERATED CELLULOSIC FIBERS FROM TEXTILE WASTE

TABLE 73 CUPRAMMONIUM: REGENERATED CELLULOSE MARKET, BY REGION, 2015–2020 (KILOTON)

TABLE 74 CUPRAMMONIUM: REGENERATED CELLULOSE MARKET, BY REGION, 2021–2027 (KILOTON)

TABLE 75 CUPRAMMONIUM: REGENERATED CELLULOSE MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 76 CUPRAMMONIUM: REGENERATED CELLULOSE MARKET, BY REGION, 2021–2027 (USD MILLION)

8.4 N-METHYL-MORPHOLINE-N-OXIDE (NMMO)

8.4.1 ECO-FRIENDLY METHOD TO PRODUCE REGENERATED CELLULOSE FIBERS

TABLE 77 NMMO: REGENERATED CELLULOSE MARKET, BY REGION, 2015–2020 (KILOTON)

TABLE 78 NMMO: REGENERATED CELLULOSE MARKET, BY REGION, 2021–2027 (KILOTON)

TABLE 79 NMMO: REGENERATED CELLULOSE MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 80 NMMO: REGENERATED CELLULOSE MARKET, BY REGION, 2021–2027 (USD MILLION)

8.5 ACETATE PRODUCTION

8.5.1 USE OF ACETATE FIBERS IN CIGARETTE FILTERS TO DRIVE MARKET

TABLE 81 ACETATE PRODUCTION: REGENERATED CELLULOSE MARKET, BY REGION, 2015–2020 (KILOTON)

TABLE 82 ACETATE PRODUCTION: REGENERATED CELLULOSE MARKET, BY REGION, 2021–2027 (KILOTON)

TABLE 83 ACETATE PRODUCTION: REGENERATED CELLULOSE MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 84 ACETATE PRODUCTION: REGENERATED CELLULOSE MARKET, BY REGION, 2021–2027 (USD MILLION)

9 REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY (Page No. - 129)

9.1 INTRODUCTION

FIGURE 27 FABRICS SEGMENT TO DOMINATE REGENERATED CELLULOSE MARKET THROUGHOUT FORECAST PERIOD

TABLE 85 REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2015–2020 (KILOTON)

TABLE 86 REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2021–2027 (KILOTON)

TABLE 87 REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2015–2020 (USD MILLION)

TABLE 88 REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2021–2027 (USD MILLION)

9.2 FABRICS

9.2.1 LIKELY TO COMMAND REGENERATED CELLULOSE MARKET THROUGHOUT FORECAST PERIOD

TABLE 89 FABRICS: REGENERATED CELLULOSE MARKET, BY REGION, 2015–2020 (KILOTON)

TABLE 90 FABRICS: REGENERATED CELLULOSE MARKET, BY REGION, 2021–2027 (KILOTON)

TABLE 91 FABRICS: REGENERATED CELLULOSE MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 92 FABRICS: REGENERATED CELLULOSE MARKET, BY REGION, 2021–2027 (USD MILLION)

9.3 AUTOMOTIVE

9.3.1 INCREASING TIRE PRODUCTION TO DRIVE MARKET

FIGURE 28 GLOBAL TIRE PRODUCTION, 2014–2021 (MILLION TON)

TABLE 93 AUTOMOTIVE: REGENERATED CELLULOSE MARKET, BY REGION, 2015–2020 (KILOTON)

TABLE 94 AUTOMOTIVE: REGENERATED CELLULOSE MARKET, BY REGION, 2021–2027 (KILOTON)

TABLE 95 AUTOMOTIVE: REGENERATED CELLULOSE MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 96 AUTOMOTIVE: REGENERATED CELLULOSE MARKET, BY REGION, 2021–2027 (USD MILLION)

9.4 PACKAGING

9.4.1 STRINGENT REGULATIONS FOR PRODUCT PACKAGING TO SUPPORT MARKET GROWTH

TABLE 97 PACKAGING: REGENERATED CELLULOSE MARKET, BY REGION, 2015–2020 (KILOTON)

TABLE 98 PACKAGING: REGENERATED CELLULOSE MARKET, BY REGION, 2021–2027 (KILOTON)

TABLE 99 PACKAGING: REGENERATED CELLULOSE MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 100 PACKAGING: REGENERATED CELLULOSE MARKET, BY REGION, 2021–2027 (USD MILLION)

9.5 AGRICULTURE

9.5.1 USE OF REGENERATED CELLULOSE AS REPLACEMENT FOR PLASTIC

TABLE 101 AGRICULTURE: REGENERATED CELLULOSE MARKET, BY REGION, 2015–2020 (KILOTON)

TABLE 102 AGRICULTURE: REGENERATED CELLULOSE MARKET, BY REGION, 2021–2027 (KILOTON)

TABLE 103 AGRICULTURE: REGENERATED CELLULOSE MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 104 AGRICULTURE: REGENERATED CELLULOSE MARKET, BY REGION, 2021–2027 (USD MILLION)

9.6 OTHERS

TABLE 105 OTHERS: REGENERATED CELLULOSE MARKET, BY REGION, 2015–2020 (KILOTON)

TABLE 106 OTHERS: REGENERATED CELLULOSE MARKET, BY REGION, 2021–2027 (KILOTON)

TABLE 107 OTHERS: REGENERATED CELLULOSE MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 108 OTHERS: REGENERATED CELLULOSE MARKET, BY REGION, 2021–2027 (USD MILLION)

10 REGENERATED CELLULOSE MARKET, BY REGION (Page No. - 141)

10.1 INTRODUCTION

FIGURE 29 REGIONAL SNAPSHOT: RAPIDLY GROWING MARKETS ARE EMERGING AS NEW HOTSPOTS

TABLE 109 REGENERATED CELLULOSE MARKET, BY REGION, 2015–2020 (KILOTON)

TABLE 110 REGENERATED CELLULOSE MARKET, BY REGION, 2021–2027 (KILOTON)

TABLE 111 REGENERATED CELLULOSE MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 112 REGENERATED CELLULOSE MARKET, BY REGION, 2021–2027 (USD MILLION)

10.2 ASIA PACIFIC

FIGURE 30 ASIA PACIFIC: REGENERATED CELLULOSE MARKET SNAPSHOT

TABLE 113 ASIA PACIFIC: REGENERATED CELLULOSE MARKET, BY COUNTRY, 2015–2020 (KILOTON)

TABLE 114 ASIA PACIFIC: REGENERATED CELLULOSE MARKET, BY COUNTRY, 2021–2027 (KILOTON)

TABLE 115 ASIA PACIFIC: REGENERATED CELLULOSE MARKET, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 116 ASIA PACIFIC: REGENERATED CELLULOSE MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 117 ASIA PACIFIC: REGENERATED CELLULOSE MARKET, BY TYPE, 2015–2020 (KILOTON)

TABLE 118 ASIA PACIFIC: REGENERATED CELLULOSE MARKET, BY TYPE, 2021–2027 (KILOTON)

TABLE 119 ASIA PACIFIC: REGENERATED CELLULOSE MARKET, BY TYPE, 2015–2020 (USD MILLION)

TABLE 120 ASIA PACIFIC: REGENERATED CELLULOSE MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 121 ASIA PACIFIC: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2015–2020 (USD MILLION)

TABLE 122 ASIA PACIFIC: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2021–2027 (USD MILLION)

TABLE 123 ASIA PACIFIC: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2015–2020 (USD MILLION)

TABLE 124 ASIA PACIFIC: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2021–2027 (USD MILLION)

TABLE 125 ASIA PACIFIC: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2015–2020 (KILOTON)

TABLE 126 ASIA PACIFIC: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2021–2027 (KILOTON)

TABLE 127 ASIA PACIFIC: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2015–2020 (USD MILLION)

TABLE 128 ASIA PACIFIC: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2021–2027 (USD MILLION)

TABLE 129 ASIA PACIFIC: REGENERATED CELLULOSE MARKET, BY MANUFACTURING PROCESS, 2015–2020 (KILOTON)

TABLE 130 ASIA PACIFIC: REGENERATED CELLULOSE MARKET, BY MANUFACTURING PROCESS, 2021–2027 (KILOTON)

TABLE 131 ASIA PACIFIC: REGENERATED CELLULOSE MARKET, BY MANUFACTURING PROCESS, 2015–2020 (USD MILLION)

TABLE 132 ASIA PACIFIC: REGENERATED CELLULOSE MARKET, BY MANUFACTURING PROCESS, 2021–2027 (USD MILLION)

TABLE 133 ASIA PACIFIC: REGENERATED CELLULOSE MARKET, BY SOURCE, 2015–2020 (KILOTON)

TABLE 134 ASIA PACIFIC: REGENERATED CELLULOSE MARKET, BY SOURCE, 2021–2027 (KILOTON)

TABLE 135 ASIA PACIFIC: REGENERATED CELLULOSE MARKET, BY SOURCE, 2015–2020 (USD MILLION)

TABLE 136 ASIA PACIFIC: REGENERATED CELLULOSE MARKET, BY SOURCE, 2021–2027 (USD MILLION)

10.2.1 CHINA

10.2.1.1 Rising production of EVs to spur demand for regenerated cellulose

TABLE 137 CHINA: REGENERATED CELLULOSE MARKET, BY TYPE, 2015–2020 (KILOTON)

TABLE 138 CHINA: REGENERATED CELLULOSE MARKET, BY TYPE, 2021–2027 (KILOTON)

TABLE 139 CHINA: REGENERATED CELLULOSE MARKET, BY TYPE, 2015–2020 (USD MILLION)

TABLE 140 CHINA: REGENERATED CELLULOSE MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 141 CHINA: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2015–2020 (USD MILLION)

TABLE 142 CHINA: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2021–2027 (USD MILLION)

TABLE 143 CHINA: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2015–2020 (USD MILLION)

TABLE 144 CHINA: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2021–2027 (USD MILLION)

TABLE 145 CHINA: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2015–2020 (KILOTON)

TABLE 146 CHINA: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2021–2027 (KILOTON)

TABLE 147 CHINA: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2015–2020 (USD MILLION)

TABLE 148 CHINA: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2021–2027 (USD MILLION)

10.2.2 JAPAN

10.2.2.1 Strong focus of apparel brands on production capacity expansion to boost market

TABLE 149 JAPAN: REGENERATED CELLULOSE MARKET, BY TYPE, 2015–2020 (KILOTON)

TABLE 150 JAPAN: REGENERATED CELLULOSE MARKET, BY TYPE, 2021–2027 (KILOTON)

TABLE 151 JAPAN: REGENERATED CELLULOSE MARKET, BY TYPE, 2015–2020 (USD MILLION)

TABLE 152 JAPAN: REGENERATED CELLULOSE MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 153 JAPAN: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2015–2020 (KILOTON)

TABLE 154 JAPAN: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2021–2027 (KILOTON)

TABLE 155 JAPAN: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2015–2020 (USD MILLION)

TABLE 156 JAPAN: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2021–2027 (USD MILLION)

TABLE 157 JAPAN: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2015–2020 (KILOTON)

TABLE 158 JAPAN: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2021–2027 (KILOTON)

TABLE 159 JAPAN: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2015–2020 (USD MILLION)

TABLE 160 JAPAN: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2021–2027 (USD MILLION)

10.2.3 PAKISTAN

10.2.3.1 Rising export of textile products to fuel demand for regenerated cellulose

TABLE 161 PAKISTAN: REGENERATED CELLULOSE MARKET, BY TYPE, 2015–2020 (KILOTON)

TABLE 162 PAKISTAN: REGENERATED CELLULOSE MARKET, BY TYPE, 2021–2027 (KILOTON)

TABLE 163 PAKISTAN: REGENERATED CELLULOSE MARKET, BY TYPE, 2015–2020 (USD MILLION)

TABLE 164 PAKISTAN: REGENERATED CELLULOSE MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 165 PAKISTAN: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2015–2020 (KILOTON)

TABLE 166 PAKISTAN: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2021–2027 (KILOTON)

TABLE 167 PAKISTAN: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2015–2020 (USD MILLION)

TABLE 168 PAKISTAN: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2021–2027 (USD MILLION)

TABLE 169 PAKISTAN: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2015–2020 (KILOTON)

TABLE 170 PAKISTAN: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2021–2027 (KILOTON)

TABLE 171 PAKISTAN: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2015–2020 (USD MILLION)

TABLE 172 PAKISTAN: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2021–2027 (USD MILLION)

10.2.4 INDIA

10.2.4.1 China Plus One strategy to prove beneficial for Indian textile

FIGURE 31 AUTOMOBILE PRODUCTION IN INDIA, 2019–2021 (MILLION)

TABLE 173 INDIA: REGENERATED CELLULOSE MARKET, BY TYPE, 2015–2020 (KILOTON)

TABLE 174 INDIA: REGENERATED CELLULOSE MARKET, BY TYPE, 2021–2027 (KILOTON)

TABLE 175 INDIA: REGENERATED CELLULOSE MARKET, BY TYPE, 2015–2020 (USD MILLION)

TABLE 176 INDIA: REGENERATED CELLULOSE MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 177 INDIA: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2015–2020 (KILOTON)

TABLE 178 INDIA: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2021–2027 (KILOTON)

TABLE 179 INDIA: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2015–2020 (USD MILLION)

TABLE 180 INDIA: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2021–2027 (USD MILLION)

TABLE 181 INDIA: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2015–2020 (KILOTON)

TABLE 182 INDIA: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2021–2027 (KILOTON)

TABLE 183 INDIA: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2015–2020 (USD MILLION)

TABLE 184 INDIA: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2021–2027 (USD MILLION)

10.2.5 INDONESIA

10.2.5.1 High textile production to create opportunities for market players

TABLE 185 INDONESIA: REGENERATED CELLULOSE MARKET, BY TYPE, 2015–2020 (KILOTON)

TABLE 186 INDONESIA: REGENERATED CELLULOSE MARKET, BY TYPE, 2021–2027 (KILOTON)

TABLE 187 INDONESIA: REGENERATED CELLULOSE MARKET, BY TYPE, 2015–2020 (USD MILLION)

TABLE 188 INDONESIA: REGENERATED CELLULOSE MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 189 INDONESIA: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2015–2020 (USD MILLION)

TABLE 190 INDONESIA: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2021–2027 (USD MILLION)

TABLE 191 INDONESIA: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2015–2020 (USD MILLION)

TABLE 192 INDONESIA: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2021–2027 (USD MILLION)

TABLE 193 INDONESIA: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2015–2020 (KILOTON)

TABLE 194 INDONESIA: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2021–2027 (KILOTON)

TABLE 195 INDONESIA: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2015–2020 (USD MILLION)

TABLE 196 INDONESIA: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2021–2027 (USD MILLION)

10.2.6 REST OF ASIA PACIFIC

TABLE 197 REST OF ASIA PACIFIC: REGENERATED CELLULOSE MARKET, BY TYPE, 2015–2020 (KILOTON)

TABLE 198 REST OF ASIA PACIFIC: REGENERATED CELLULOSE MARKET, BY TYPE, 2021–2027 (KILOTON)

TABLE 199 REST OF ASIA PACIFIC: REGENERATED CELLULOSE MARKET, BY TYPE, 2015–2020 (USD MILLION)

TABLE 200 REST OF ASIA PACIFIC: REGENERATED CELLULOSE MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 201 REST OF ASIA PACIFIC: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2015–2020 (KILOTON)

TABLE 202 REST OF ASIA PACIFIC: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2021–2027 (KILOTON)

TABLE 203 REST OF ASIA PACIFIC: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2015–2020 (USD MILLION)

TABLE 204 REST OF ASIA PACIFIC: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2021–2027 (USD MILLION)

TABLE 205 REST OF ASIA PACIFIC: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2015–2020 (KILOTON)

TABLE 206 REST OF ASIA PACIFIC: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2021–2027 (KILOTON)

TABLE 207 REST OF ASIA PACIFIC: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2015–2020 (USD MILLION)

TABLE 208 REST OF ASIA PACIFIC: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2021–2027 (USD MILLION)

10.3 NORTH AMERICA

FIGURE 32 NORTH AMERICA: REGENERATED CELLULOSE MARKET SNAPSHOT

TABLE 209 NORTH AMERICA: REGENERATED CELLULOSE MARKET, BY COUNTRY, 2015–2020 (KILOTON)

TABLE 210 NORTH AMERICA: REGENERATED CELLULOSE MARKET, BY COUNTRY, 2021–2027 (KILOTON)

TABLE 211 NORTH AMERICA: REGENERATED CELLULOSE MARKET, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 212 NORTH AMERICA: REGENERATED CELLULOSE MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 213 NORTH AMERICA: REGENERATED CELLULOSE MARKET, BY TYPE, 2015–2020 (KILOTON)

TABLE 214 NORTH AMERICA: REGENERATED CELLULOSE MARKET, BY TYPE, 2021–2027 (KILOTON)

TABLE 215 NORTH AMERICA: REGENERATED CELLULOSE MARKET, BY TYPE, 2015–2020 (USD MILLION)

TABLE 216 NORTH AMERICA: REGENERATED CELLULOSE MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 217 NORTH AMERICA: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2015–2020 (USD MILLION)

TABLE 218 NORTH AMERICA: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2021–2027 (USD MILLION)

TABLE 219 NORTH AMERICA: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2015–2020 (USD MILLION)

TABLE 220 NORTH AMERICA: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2021–2027 (USD MILLION)

TABLE 221 NORTH AMERICA: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2015–2020 (KILOTON)

TABLE 222 NORTH AMERICA: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2021–2027 (KILOTON)

TABLE 223 NORTH AMERICA: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2015–2020 (USD MILLION)

TABLE 224 NORTH AMERICA: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2021–2027 (USD MILLION)

TABLE 225 NORTH AMERICA: REGENERATED CELLULOSE MARKET, BY MANUFACTURING PROCESS, 2015–2020 (KILOTON)

TABLE 226 NORTH AMERICA: REGENERATED CELLULOSE MARKET, BY MANUFACTURING PROCESS, 2021–2027 (KILOTON)

TABLE 227 NORTH AMERICA: REGENERATED CELLULOSE MARKET, BY MANUFACTURING PROCESS, 2015–2020 (USD MILLION)

TABLE 228 NORTH AMERICA: REGENERATED CELLULOSE MARKET, BY MANUFACTURING PROCESS, 2021–2027 (USD MILLION)

TABLE 229 NORTH AMERICA: REGENERATED CELLULOSE MARKET, BY SOURCE, 2015–2020 (KILOTON)

TABLE 230 NORTH AMERICA: REGENERATED CELLULOSE MARKET, BY SOURCE, 2021–2027 (KILOTON)

TABLE 231 NORTH AMERICA: REGENERATED CELLULOSE MARKET, BY SOURCE, 2015–2020 (USD MILLION)

TABLE 232 NORTH AMERICA: REGENERATED CELLULOSE MARKET, BY SOURCE, 2021–2027 (USD MILLION)

10.3.1 US

10.3.1.1 Thriving fabrics and automotive industries to drive market growth

TABLE 233 US: REGENERATED CELLULOSE MARKET, BY TYPE, 2015–2020 (KILOTON)

TABLE 234 US: REGENERATED CELLULOSE MARKET, BY TYPE, 2021–2027 (KILOTON)

TABLE 235 US: REGENERATED CELLULOSE MARKET, BY TYPE, 2015–2020 (USD MILLION)

TABLE 236 US: REGENERATED CELLULOSE MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 237 US: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2015–2020 (KILOTON)

TABLE 238 US: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2021–2027 (KILOTON)

TABLE 239 US: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2015–2020 (USD MILLION)

TABLE 240 US: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2021–2027 (USD MILLION)

TABLE 241 US: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2015–2020 (KILOTON)

TABLE 242 US: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2021–2027 (KILOTON)

TABLE 243 US: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2015–2020 (USD MILLION)

TABLE 244 US: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2021–2027 (USD MILLION)

10.3.2 CANADA

10.3.2.1 Increasing investments in fabrics industry to drive market

TABLE 245 CANADA: REGENERATED CELLULOSE MARKET, BY TYPE, 2015–2020 (KILOTON)

TABLE 246 CANADA: REGENERATED CELLULOSE MARKET, BY TYPE, 2021–2027 (KILOTON)

TABLE 247 CANADA: REGENERATED CELLULOSE MARKET, BY TYPE, 2015–2020 (USD MILLION)

TABLE 248 CANADA: REGENERATED CELLULOSE MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 249 CANADA: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2015–2020 (KILOTON)

TABLE 250 CANADA: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2021–2027 (KILOTON)

TABLE 251 CANADA: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2015–2020 (USD MILLION)

TABLE 252 CANADA: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2021–2027 (USD MILLION)

TABLE 253 CANADA: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2015–2020 (KILOTON)

TABLE 254 CANADA: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2021–2027 (KILOTON)

TABLE 255 CANADA: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2015–2020 (USD MILLION)

TABLE 256 CANADA: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2021–2027 (USD MILLION)

10.3.3 MEXICO

10.3.3.1 Faster adoption of fashion clothes by young population to boost market

TABLE 257 MEXICO: REGENERATED CELLULOSE MARKET, BY TYPE, 2015–2020 (KILOTON)

TABLE 258 MEXICO: REGENERATED CELLULOSE MARKET, BY TYPE, 2021–2027 (KILOTON)

TABLE 259 MEXICO: REGENERATED CELLULOSE MARKET, BY TYPE, 2015–2020 (USD MILLION)

TABLE 260 MEXICO: REGENERATED CELLULOSE MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 261 MEXICO: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2015–2020 (KILOTON)

TABLE 262 MEXICO: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2021–2027 (KILOTON)

TABLE 263 MEXICO: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2015–2020 (USD MILLION)

TABLE 264 MEXICO: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2021–2027 (USD MILLION)

TABLE 265 MEXICO: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2015–2020 (KILOTON)

TABLE 266 MEXICO: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2021–2027 (KILOTON)

TABLE 267 MEXICO: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2015–2020 (USD MILLION)

TABLE 268 MEXICO: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2021–2027 (USD MILLION)

10.4 EUROPE

TABLE 269 EUROPE: REGENERATED CELLULOSE MARKET, BY COUNTRY, 2015–2020 (KILOTON)

TABLE 270 EUROPE: REGENERATED CELLULOSE MARKET, BY COUNTRY, 2021–2027 (KILOTON)

TABLE 271 EUROPE: REGENERATED CELLULOSE MARKET, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 272 EUROPE: REGENERATED CELLULOSE MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 273 EUROPE: REGENERATED CELLULOSE MARKET, BY TYPE, 2015–2020 (KILOTON)

TABLE 274 EUROPE: REGENERATED CELLULOSE MARKET, BY TYPE, 2021–2027 (KILOTON)

TABLE 275 EUROPE: REGENERATED CELLULOSE MARKET, BY TYPE, 2015–2020 (USD MILLION)

TABLE 276 EUROPE: REGENERATED CELLULOSE MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 277 EUROPE: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2015–2020 (USD MILLION)

TABLE 278 EUROPE: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2021–2027 (USD MILLION)

TABLE 279 EUROPE: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2015–2020 (USD MILLION)

TABLE 280 EUROPE: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2021–2027 (USD MILLION)

TABLE 281 EUROPE: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2015–2020 (KILOTON)

TABLE 282 EUROPE: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2021–2027 (KILOTON)

TABLE 283 EUROPE: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2015–2020 (USD MILLION)

TABLE 284 EUROPE: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2021–2027 (USD MILLION)

TABLE 285 EUROPE: REGENERATED CELLULOSE MARKET, BY MANUFACTURING PROCESS, 2015–2020 (KILOTON)

TABLE 286 EUROPE: REGENERATED CELLULOSE MARKET, BY MANUFACTURING PROCESS, 2021–2027 (KILOTON)

TABLE 287 EUROPE: REGENERATED CELLULOSE MARKET, BY MANUFACTURING PROCESS, 2015–2020 (USD MILLION)

TABLE 288 EUROPE: REGENERATED CELLULOSE MARKET, BY MANUFACTURING PROCESS, 2021–2027 (USD MILLION)

TABLE 289 EUROPE: REGENERATED CELLULOSE MARKET, BY SOURCE, 2015–2020 (KILOTON)

TABLE 290 EUROPE: REGENERATED CELLULOSE MARKET, BY SOURCE, 2021–2027 (KILOTON)

TABLE 291 EUROPE: REGENERATED CELLULOSE MARKET, BY SOURCE, 2015–2020 (USD MILLION)

TABLE 292 EUROPE: REGENERATED CELLULOSE MARKET, BY SOURCE, 2021–2027 (USD MILLION)

10.4.1 GERMANY

10.4.1.1 Improving lifestyle and increasing purchasing power to create opportunities for market players

FIGURE 33 GERMANY: AUTOMOTIVE PRODUCTION AND SALES, 2019–2021 (MILLION UNIT)

TABLE 293 GERMANY: REGENERATED CELLULOSE MARKET, BY TYPE, 2015–2020 (KILOTON)

TABLE 294 GERMANY: REGENERATED CELLULOSE MARKET, BY TYPE, 2021–2027 (KILOTON)

TABLE 295 GERMANY: REGENERATED CELLULOSE MARKET, BY TYPE, 2015–2020 (USD MILLION)

TABLE 296 GERMANY: REGENERATED CELLULOSE MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 297 GERMANY: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2015–2020 (USD MILLION)

TABLE 298 GERMANY: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2021–2027 (USD MILLION)

TABLE 299 GERMANY: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2015–2020 (USD MILLION)

TABLE 300 GERMANY: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2021–2027 (USD MILLION)

TABLE 301 GERMANY: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2015–2020 (KILOTON)

TABLE 302 GERMANY: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2021–2027 (KILOTON)

TABLE 303 GERMANY: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2015–2020 (USD MILLION)

TABLE 304 GERMANY: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2021–2027 (USD MILLION)

10.4.2 UK

10.4.2.1 Increasing demand for EVs to provide impetus to regenerated cellulose market

TABLE 305 UK: REGENERATED CELLULOSE MARKET, BY TYPE, 2015–2020 (KILOTON)

TABLE 306 UK: REGENERATED CELLULOSE MARKET, BY TYPE, 2021–2027 (KILOTON)

TABLE 307 UK: REGENERATED CELLULOSE MARKET, BY TYPE, 2015–2020 (USD MILLION)

TABLE 308 UK: REGENERATED CELLULOSE MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 309 UK: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2015–2020 (KILOTON)

TABLE 310 UK: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2021–2027 (KILOTON)

TABLE 311 UK: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2015–2020 (USD MILLION)

TABLE 312 UK: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2021–2027 (USD MILLION)

TABLE 313 UK: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2015–2020 (KILOTON)

TABLE 314 UK: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2021–2027 (KILOTON)

TABLE 315 UK: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2015–2020 (USD MILLION)

TABLE 316 UK: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2021–2027 (USD MILLION)

10.4.3 FRANCE

10.4.3.1 Growing consumption of regenerated cellulose in textile industry to accelerate market growth

TABLE 317 FRANCE: REGENERATED CELLULOSE MARKET, BY TYPE, 2015–2020 (KILOTON)

TABLE 318 FRANCE: REGENERATED CELLULOSE MARKET, BY TYPE, 2021–2027 (KILOTON)

TABLE 319 FRANCE: REGENERATED CELLULOSE MARKET, BY TYPE, 2015–2020 (USD MILLION)

TABLE 320 FRANCE: REGENERATED CELLULOSE MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 321 FRANCE: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2015–2020 (USD MILLION)

TABLE 322 FRANCE: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2021–2027 (USD MILLION)

TABLE 323 FRANCE: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2015–2020 (USD MILLION)

TABLE 324 FRANCE: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2021–2027 (USD MILLION)

TABLE 325 FRANCE: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2015–2020 (KILOTON)

TABLE 326 FRANCE: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2021–2027 (KILOTON)

TABLE 327 FRANCE: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2015–2020 (USD MILLION)

TABLE 328 FRANCE: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2021–2027 (USD MILLION)

10.4.4 ITALY

10.4.4.1 Growing textile industry to accelerate market growth

TABLE 329 ITALY: REGENERATED CELLULOSE MARKET, BY TYPE, 2015–2020 (KILOTON)

TABLE 330 ITALY: REGENERATED CELLULOSE MARKET, BY TYPE, 2021–2027 (KILOTON)

TABLE 331 ITALY: REGENERATED CELLULOSE MARKET, BY TYPE, 2015–2020 (USD MILLION)

TABLE 332 ITALY: REGENERATED CELLULOSE MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 333 ITALY: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2015–2020 (USD MILLION)

TABLE 334 CELLULOSE MARKET, BY FIBER TYPE, 2021–2027 (USD MILLION)

TABLE 335 ITALY: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2015–2020 (USD MILLION)

TABLE 336 ITALY: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2021–2027 (USD MILLION)

TABLE 337 ITALY: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2015–2020 (KILOTON)

TABLE 338 ITALY: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2021–2027 (KILOTON)

TABLE 339 ITALY: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2015–2020 (USD MILLION)

TABLE 340 ITALY: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2021–2027 (USD MILLION)

10.4.5 SPAIN

10.4.5.1 Changing fashion trends to create opportunities for market players

TABLE 341 SPAIN: REGENERATED CELLULOSE MARKET, BY TYPE, 2015–2020 (KILOTON)

TABLE 342 SPAIN: REGENERATED CELLULOSE MARKET, BY TYPE, 2021–2027 (KILOTON)

TABLE 343 SPAIN: REGENERATED CELLULOSE MARKET, BY TYPE, 2015–2020 (USD MILLION)

TABLE 344 SPAIN: REGENERATED CELLULOSE MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 345 SPAIN: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2015–2020 (USD MILLION)

TABLE 346 SPAIN: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2021–2027 (USD MILLION)

TABLE 347 SPAIN: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2015–2020 (USD MILLION)

TABLE 348 SPAIN: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2021–2027 (USD MILLION)

TABLE 349 SPAIN: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2015–2020 (KILOTON)

TABLE 350 SPAIN: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2021–2027 (KILOTON)

TABLE 351 SPAIN: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2015–2020 (USD MILLION)

TABLE 352 SPAIN: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2021–2027 (USD MILLION)

10.4.6 TURKEY

10.4.6.1 Promising textile industry to lead to increased requirement for regenerated cellulose

TABLE 353 TURKEY: REGENERATED CELLULOSE MARKET, BY TYPE, 2015–2020 (KILOTON)

TABLE 354 TURKEY: REGENERATED CELLULOSE MARKET, BY TYPE, 2021–2027 (KILOTON)

TABLE 355 TURKEY: REGENERATED CELLULOSE MARKET, BY TYPE, 2015–2020 (USD MILLION)

TABLE 356 TURKEY: REGENERATED CELLULOSE MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 357 TURKEY: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2015–2020 (KILOTON)

TABLE 358 TURKEY: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2021–2027 (KILOTON)

TABLE 359 TURKEY: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2015–2020 (USD MILLION)

TABLE 360 TURKEY: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2021–2027 (USD MILLION)

TABLE 361 TURKEY: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2015–2020 (KILOTON)

TABLE 362 TURKEY: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2021–2027 (KILOTON)

TABLE 363 TURKEY: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2015–2020 (USD MILLION)

TABLE 364 TURKEY: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2021–2027 (USD MILLION)

10.4.7 REST OF EUROPE

TABLE 365 REST OF EUROPE: REGENERATED CELLULOSE MARKET, BY TYPE, 2015–2020 (KILOTON)

TABLE 366 REST OF EUROPE: REGENERATED CELLULOSE MARKET, BY TYPE, 2021–2027 (KILOTON)

TABLE 367 REST OF EUROPE: REGENERATED CELLULOSE MARKET, BY TYPE, 2015–2020 (USD MILLION)

TABLE 368 REST OF EUROPE: REGENERATED CELLULOSE MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 369 REST OF EUROPE: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2015–2020 (KILOTON)

TABLE 370 REST OF EUROPE: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2021–2027 (KILOTON)

TABLE 371 REST OF EUROPE: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2015–2020 (USD MILLION)

TABLE 372 REST OF EUROPE: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2021–2027 (USD MILLION)

TABLE 373 REST OF EUROPE: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2015–2020 (KILOTON)

TABLE 374 REST OF EUROPE: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2021–2027 (KILOTON)

TABLE 375 REST OF EUROPE: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2015–2020 (USD MILLION)

TABLE 376 REST OF EUROPE: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2021–2027 (USD MILLION)

10.5 REST OF THE WORLD (ROW)

TABLE 377 ROW: REGENERATED CELLULOSE MARKET, BY COUNTRY, 2015–2020 (KILOTON)

TABLE 378 ROW: REGENERATED CELLULOSE MARKET, BY COUNTRY, 2021–2027 (KILOTON)

TABLE 379 ROW: REGENERATED CELLULOSE MARKET, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 380 ROW: REGENERATED CELLULOSE MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 381 ROW: REGENERATED CELLULOSE MARKET, BY TYPE, 2015–2020 (KILOTON)

TABLE 382 ROW: REGENERATED CELLULOSE MARKET, BY TYPE, 2021–2027 (KILOTON)

TABLE 383 ROW: REGENERATED CELLULOSE MARKET, BY TYPE, 2015–2020 (USD MILLION)

TABLE 384 ROW: REGENERATED CELLULOSE MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 385 ROW: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2015–2020 (KILOTON)

TABLE 386 ROW: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2021–2027 (KILOTON)

TABLE 387 ROW: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2015–2020 (USD MILLION)

TABLE 388 ROW: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2021–2027 (USD MILLION)

TABLE 389 ROW: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2015–2020 (KILOTON)

TABLE 390 ROW: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2021–2027 (KILOTON)

TABLE 391 ROW: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2015–2020 (USD MILLION)

TABLE 392 ROW: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2021–2027 (USD MILLION)

TABLE 393 ROW: REGENERATED CELLULOSE MARKET, BY MANUFACTURING PROCESS, 2015–2020 (KILOTON)

TABLE 394 ROW: REGENERATED CELLULOSE MARKET, BY MANUFACTURING PROCESS, 2021–2027 (KILOTON)

TABLE 395 ROW: REGENERATED CELLULOSE MARKET, BY MANUFACTURING PROCESS, 2015–2020 (USD MILLION)

TABLE 396 ROW: REGENERATED CELLULOSE MARKET, BY MANUFACTURING PROCESS, 2021–2027 (USD MILLION)

TABLE 397 ROW: REGENERATED CELLULOSE MARKET, BY SOURCE, 2015–2020 (KILOTON)

TABLE 398 ROW: REGENERATED CELLULOSE MARKET, BY SOURCE, 2021–2027 (KILOTON)

TABLE 399 ROW: REGENERATED CELLULOSE MARKET, BY SOURCE, 2015–2020 (USD MILLION)

TABLE 400 ROW: REGENERATED CELLULOSE MARKET, BY SOURCE, 2021–2027 (USD MILLION)

10.5.1 BRAZIL

10.5.1.1 Fabrics industry to have highest contribution to market growth

TABLE 401 BRAZIL: REGENERATED CELLULOSE MARKET, BY TYPE, 2015–2020 (KILOTON)

TABLE 402 BRAZIL: REGENERATED CELLULOSE MARKET, BY TYPE, 2021–2027 (KILOTON)

TABLE 403 BRAZIL: REGENERATED CELLULOSE MARKET, BY TYPE, 2015–2020 (USD MILLION)

TABLE 404 BRAZIL: REGENERATED CELLULOSE MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 405 BRAZIL: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2015–2020 (KILOTON)

TABLE 406 BRAZIL: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2021–2027 (KILOTON)

TABLE 407 BRAZIL: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2015–2020 (USD MILLION)

TABLE 408 BRAZIL: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2021–2027 (USD MILLION)

TABLE 409 BRAZIL: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2015–2020 (KILOTON)

TABLE 410 BRAZIL: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2021–2027 (KILOTON)

TABLE 411 BRAZIL: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2015–2020 (USD MILLION)

TABLE 412 BRAZIL: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2021–2027 (USD MILLION)

10.5.2 SOUTH AFRICA

10.5.2.1 Textile industry to offer growth potential to market players

TABLE 413 SOUTH AFRICA: REGENERATED CELLULOSE MARKET, BY TYPE, 2015–2020 (KILOTON)

TABLE 414 SOUTH AFRICA: REGENERATED CELLULOSE MARKET, BY TYPE, 2021–2027 (KILOTON)

TABLE 415 SOUTH AFRICA: REGENERATED CELLULOSE MARKET, BY TYPE, 2015–2020 (USD MILLION)

TABLE 416 SOUTH AFRICA: REGENERATED CELLULOSE MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 417 SOUTH AFRICA: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2015–2020 (KILOTON)

TABLE 418 SOUTH AFRICA: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2021–2027 (KILOTON)

TABLE 419 SOUTH AFRICA: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2015–2020 (USD MILLION)

TABLE 420 SOUTH AFRICA: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2021–2027 (USD MILLION)

TABLE 421 SOUTH AFRICA: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2015–2020 (KILOTON)

TABLE 422 SOUTH AFRICA: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2021–2027 (KILOTON)

TABLE 423 SOUTH AFRICA: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2015–2020 (USD MILLION)

TABLE 424 SOUTH AFRICA: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2021–2027 (USD MILLION)

10.5.3 OTHER COUNTRIES

TABLE 425 OTHER COUNTRIES: REGENERATED CELLULOSE MARKET, BY TYPE, 2015–2020 (KILOTON)

TABLE 426 OTHER COUNTRIES: REGENERATED CELLULOSE MARKET, BY TYPE, 2021–2027 (KILOTON)

TABLE 427 OTHER COUNTRIES: REGENERATED CELLULOSE MARKET, BY TYPE, 2015–2020 (USD MILLION)

TABLE 428 OTHER COUNTRIES: REGENERATED CELLULOSE MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 429 OTHER COUNTRIES: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2015–2020 (KILOTON)

TABLE 430 OTHER COUNTRIES: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2021–2027 (KILOTON)

TABLE 431 OTHER COUNTRIES: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2015–2020 (USD MILLION)

TABLE 432 OTHER COUNTRIES: REGENERATED CELLULOSE MARKET, BY FIBER TYPE, 2021–2027 (USD MILLION)

TABLE 433 OTHER COUNTRIES: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2015–2020 (KILOTON)

TABLE 434 OTHER COUNTRIES: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2021–2027 (KILOTON)

TABLE 435 OTHER COUNTRIES: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2015–2020 (USD MILLION)

TABLE 436 OTHER COUNTRIES: REGENERATED CELLULOSE MARKET, BY END-USER INDUSTRY, 2021–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 251)

11.1 INTRODUCTION

TABLE 437 EXPANSION IS KEY STRATEGY ADOPTED BY MARKET PLAYERS BETWEEN 2018 AND 2021

11.2 MARKET SHARE ANALYSIS

FIGURE 34 MARKET SHARE OF KEY PLAYERS, 2021

TABLE 438 REGENERATED CELLULOSE FI MARKET: DEGREE OF COMPETITION

11.3 STRATEGIES ADOPTED BY KEY PLAYERS

TABLE 439 STRATEGIC POSITIONING OF KEY PLAYERS

11.4 COMPANY EVALUATION QUADRANT

11.4.1 STARS

11.4.2 PERVASIVE COMPANIES

11.4.3 PARTICIPANTS

11.4.4 EMERGING LEADERS

FIGURE 35 REGENERATED CELLULOSE MARKET: COMPANY EVALUATION MATRIX, 2021

11.5 STARTUPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION QUADRANT

11.5.1 RESPONSIVE COMPANIES

11.5.2 DYNAMIC COMPANIES

11.5.3 STARTING BLOCKS

FIGURE 36 STARTUPS AND SMES EVALUATION MATRIX, 2021

11.6 REVENUE ANALYSIS OF TOP PLAYERS

FIGURE 37 REVENUE ANALYSIS OF KEY COMPANIES FOR PAST FOUR YEARS

11.7 COMPETITIVE BENCHMARKING

TABLE 440 DETAILED LIST OF KEY STARTUP/SMES

TABLE 441 COMPETITIVE BENCHMARKING OF KEY PLAYERS

11.8 COMPETITIVE SCENARIOS AND TRENDS

11.8.1 PRODUCT LAUNCHES

TABLE 442 REGENERATED CELLULOSE MARKET: PRODUCT LAUNCHES, 2018 TO 2022

11.8.2 DEALS

TABLE 443 REGENERATED CELLULOSE MARKET: DEALS, 2018 TO 2022

11.8.3 OTHER DEVELOPMENTS

TABLE 444 REGENERATED CELLULOSE MARKET: EXPANSIONS, 2018 TO 2022

12 COMPANY PROFILES (Page No. - 262)

(Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

12.1 KEY PLAYERS

12.1.1 SATERI

TABLE 445 SATERI: BUSINESS OVERVIEW

TABLE 446 SATERI: PRODUCT LAUNCHES

TABLE 447 SATERI: DEALS

TABLE 448 SATERI: OTHERS

FIGURE 38 SATERI'S PERFORMANCE IN REGENERATED CELLULOSE FIBER MARKET

12.1.2 LENZING AG

TABLE 449 LENZING AG: BUSINESS OVERVIEW

FIGURE 39 LENZING AG: COMPANY SNAPSHOT

TABLE 450 LENZING AG: PRODUCT LAUNCHES

TABLE 451 LENZING AG: DEALS

TABLE 452 LENZING AG: OTHERS

FIGURE 40 LENZING AG’S PERFORMANCE IN REGENERATED CELLULOSE FIBER MARKET

12.1.3 GRASIM INDUSTRIES LIMITED

TABLE 453 GRASIM INDUSTRIES LIMITED: BUSINESS OVERVIEW

FIGURE 41 GRASIM INDUSTRIES LIMITED: COMPANY SNAPSHOT

TABLE 454 GRASIM INDUSTRIES LIMITED: DEALS

TABLE 455 GRASIM INDUSTRIES LIMITED: OTHERS

FIGURE 42 GRASIM INDUSTRIES’ PERFORMANCE IN REGENERATED CELLULOSE FIBER MARKET

12.1.4 KELHEIM FIBRES GMBH

TABLE 456 KELHEIM FIBRES GMBH: BUSINESS OVERVIEW

TABLE 457 KELHEIM FIBRES GMBH: DEALS

FIGURE 43 KELHEIM FIBRES’ PERFORMANCE IN REGENERATED CELLULOSE FIBER MARKET

12.1.5 FULIDA GROUP

TABLE 458 FULIDA GROUP: BUSINESS OVERVIEW

FIGURE 44 FULIDA GROUP'S PERFORMANCE IN REGENERATED CELLULOSE FIBER MARKET

12.1.6 CFF GMBH & CO. KG

TABLE 459 CFF GMBH & CO. KG: BUSINESS OVERVIEW

TABLE 460 CFF GMBH & CO. KG: DEALS

FIGURE 45 CFF GMBH’S PERFORMANCE IN REGENERATED CELLULOSE FIBER MARKET

12.1.7 EASTMAN CHEMICAL COMPANY

TABLE 461 EASTMAN CHEMICAL COMPANY: BUSINESS OVERVIEW

FIGURE 46 EASTMAN CHEMICAL COMPANY: COMPANY SNAPSHOT

TABLE 462 EASTMAN CHEMICAL COMPANY: PRODUCT LAUNCHES

TABLE 463 EASTMAN CHEMICAL COMPANY: DEALS

TABLE 464 EASTMAN CHEMICAL COMPANY: OTHERS

FIGURE 47 EASTMAN CHEMICAL COMPANY'S PERFORMANCE IN REGENERATED CELLULOSE FIBER MARKET

12.1.8 GP CELLULOSE, LLC

TABLE 465 GP CELLULOSE, LLC: BUSINESS OVERVIEW

TABLE 466 GP CELLULOSE, LLC: OTHERS

FIGURE 48 GP CELLULOSE’S PERFORMANCE IN REGENERATED CELLULOSE FIBER MARKET

12.2 OTHER PLAYERS

12.2.1 CENTURY TEXTILE AND INDUSTRIES LIMITED

TABLE 467 CENTURY TEXTILE AND INDUSTRIES LIMITED: COMPANY OVERVIEW

12.2.2 TANGSHAN SANYOU GROUP., LTD.

TABLE 468 TANGSHAN SANYOU GROUP CO., LTD.: COMPANY OVERVIEW

12.2.3 HUBEI GOLDEN RING NEW MATERIALS TECH LIMITED

TABLE 469 HUBEI GOLDEN RING NEW MATERIALS TECH LIMITED: COMPANY OVERVIEW

12.2.4 CELANESE CORPORATION

TABLE 470 CELANESE CORPORATION: COMPANY OVERVIEW

12.2.5 XINXIANG CHEMICAL FIBER CO., LTD.

TABLE 471 XINXIANG CHEMICAL FIBER CO., LTD.: COMPANY OVERVIEW

12.2.6 JIANGSU AOYANG TECHNOLOGY CORPORATION LIMITED

TABLE 472 JIANGSU AOYANG TECHNOLOGY CORPORATION LIMITED: COMPANY OVERVIEW

12.2.7 BARNET INTELLIGENT MATERIALS

TABLE 473 BARNET INTELLIGENT MATERIALS: COMPANY OVERVIEW

12.2.8 SNIACE, S.A.

TABLE 474 SNIACE, S.A.: COMPANY OVERVIEW

12.2.9 HE-TEX HOLDINGS LIMITED

TABLE 475 HE-TEX HOLDINGS LIMITED: COMPANY OVERVIEW

12.2.10 SAMIL SPINNING CO.,LTD

TABLE 476 SAMIL SPINNING CO., LTD: COMPANY OVERVIEW

12.2.11 SICHUAN PUSH ACETATI

TABLE 477 SICHUAN PUSH ACETATI: COMPANY OVERVIEW

12.2.12 COMPOSITION MATERIALS CO., INC.

TABLE 478 COMPOSITION MATERIALS CO., INC.: COMPANY OVERVIEW

12.2.13 CONTEMPORA FABRICS INC.

TABLE 479 CONTEMPORA FABRICS INC.: COMPANY OVERVIEW

12.2.14 KOBO PRODUCTS INC.

TABLE 480 KOBO PRODUCTS INC.: COMPANY OVERVIEW

12.2.15 BEAVER MANUFACTURING COMPANY, INC.

TABLE 481 BEAVER MANUFACTURING COMPANY, INC.: COMPANY OVERVIEW

12.2.16 ASAHI KASEI CORP.

TABLE 482 ASAHI KASEI CORP.: COMPANY OVERVIEW

12.2.17 DAICEL CORP.

TABLE 483 DAICEL CORP.: COMPANY OVERVIEW

*Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 302)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 CUSTOMIZATION OPTIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

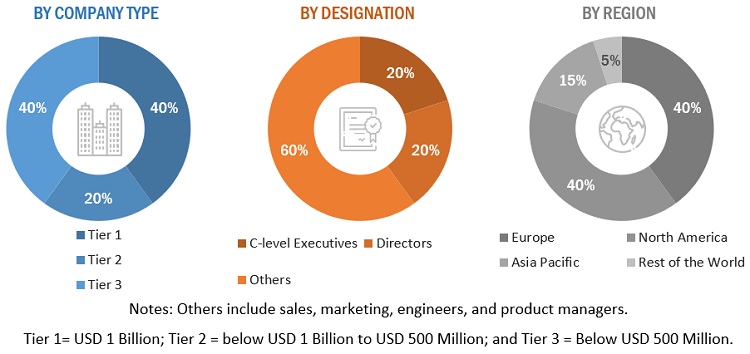

This research involved the use of extensive secondary sources and databases, such as Factiva and Bloomberg, to identify and collect information useful for a technical and market-oriented study of the regenerated cellulose market. Primary sources included industry experts from related industries and preferred suppliers, manufacturers, distributors, technologists, standards & certification organizations, and organizations related to all segments of the value chain of this industry. In-depth interviews have been conducted with various primary respondents, such as key industry participants, subject matter experts (SMEs), executives of key companies, and industry consultants, to obtain and verify critical qualitative and quantitative information as well as to assess growth prospects.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases, and investor presentations of companies; white papers; and publications from recognized websites and databases have been referred to for identifying and collecting information. Secondary research has been used to obtain key information about the industry's supply chain, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market-and technology-oriented perspectives.

Primary Research

The Regenerated Cellulose market comprises several stakeholders in the supply chain, which include suppliers, processors, and end-product manufacturers. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies in the regenerated cellulose market. Primary sources from the supply side include associations and institutions involved in the regenerated cellulose industry, key opinion leaders, and processing players.

Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the global Regenerated Cellulose market. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares split, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players along with extensive interviews with key officials, such as directors and marketing executives.

Market Size Estimation: Bottom-Up Approach

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market was split into several segments and subsegments. To complete the overall market size estimation process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size has been validated by using both the top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the global regenerated cellulose market in terms of value

- To provide insights regarding the significant factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze and forecast the market based on source, type, manufacturing process, region, and end-use application.

- To forecast the market size, in terms of value, with respect to four main regions: North America, Europe, Asia Pacific, and the Rest of the World.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape

- To strategically profile key players in the market

- To analyze competitive developments in the market, such as new product launches, capacity expansions, and mergers & acquisitions

- To strategically profile the leading players and comprehensively analyze their key developments in the market

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Product Analysis:

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- Further breakdown of the Rest of the APAC Regenerated Cellulose market

- Further breakdown of the Rest of Europe’s Regenerated Cellulose market

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Regenerated Cellulose Market