Locomotive Market by Power Conversion Components (Rectifier, Inverter, Alternator, APU & Traction Motor), Technology (IGBT, GTO & SiC), Rolling Stock Type (Diesel & Electric Locomotive, DMU & EMU), and Region - Global Trends and Forecast to 2021

[154 Pages Report] The locomotive market for power conversion systems is primarily driven by for expansion of rail network infrastructure, increasing urbanization and environmental sustainability. With growth in urbanization and industrialization, there is going to be a substantial increase in the demand for power and related conversion systems during the forecast period.

With the extension of rail network across the globe there has been substantial increase in the production of locomotives to meet the rising demand for public transport. This has eventually resulted in the demand for power conversion systems across the globe. Hence, the market for power conversion systems is projected to grow at a CAGR of 2.92% during the forecast period, to reach a market size of USD 4.27 Billion by 2021. The base year considered for the study is 2015, and the forecast period is 2016 to 2021. The primary objective of the study is to define, describe, and forecast the global market for power conversion systems on the basis of power conversion components, technology, rolling stock type and region, and to provide detailed information regarding major factors influencing the growth of the market (drivers, restraints, opportunities and challenges).To analyze the regional markets for growth trends, future prospects, and their contribution to the overall market and to track and analyze competitive developments and other industry activities carried out by key industry participants

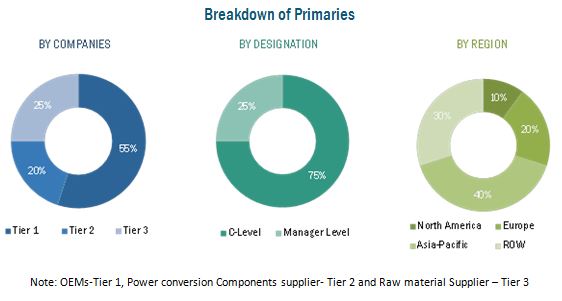

The research methodology used in the report involves various secondary sources such as Union of European Railway Industries (UNIFE), Brazilian Association of Railroad Suppliers (ABIFER), International Railway Journal (IRJ), amongst others. The market numbers are based on country-wise production of rolling stock, which is further added to arrive at the regional market. This regional data is added to derive global data. The production of rolling stock has been considered, to arrive at the market size, in terms of volume. This country-wise market size, by volume is then multiplied with the country-wise average OE price of each type of power conversion component. This results in the country-wise market size for that particular power conversion component, in terms of value. The same approach has been used to calculate the market sizes of the technology. The summation of the country-wise and regional-level market size, in terms of value, provides the global market for power conversion system size.

The figure below illustrates the break-up of the profile of industry experts who participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The locomotive market for power conversion system ecosystem consists of traction motor manufacturers such as Hitachi Ltd (Japan), CRRC Corporation Limited (China) and, AEG Power Solutions (Germany) amongst others; Auxiliary power unit manufacturers such as Turbo Power Systems (U.K.), Alstom S.A (France) and Toshiba Corporation (Japan) among others and converter manufacturers like Strukton (The Netherlands) and Siemens AG (Germany) amongst others. These OEMs integrate these components and sell them to end users to cater to their requirements.

Target Audience

- Manufacturers of rolling stock

- Manufacturers of rolling stock power conversion components

- Raw material suppliers for rolling stock or their power conversion components

- Transport authorities

- Legal and regulatory authorities

- Fleet operators

Scope of the Report

-

By Technology

- IGBT Module

- GTO Thyristor

- SiC Module

-

By Power Conversion Components:

- Rectifier

- Inverter

- Traction motor

- Alternator

- Auxiliary power conversion Unit

-

By Locomotive type

- Diesel Locomotive

- Diesel Multiple Unit (DMU)

- Electric Locomotive

- Electric Multiple Unit (EMU)

-

By Region

- North America

- Europe

- Asia-Pacific

- RoW

-

By Key Country:

-

Asia-Pacific

- India

- China

- Japan

- South Korea

-

Europe

- Germany

- U.K.

- France

-

North America

- U.S.

- Canada

- Mexico

-

RoW

- Brazil

- Russia

-

Asia-Pacific

Available Customizations

- Market for Power Conversion System, By Technology and Key Country

The locomotive market for power conversion systems is projected to grow at a CAGR of 2.92% during the forecast period, to reach a market size of USD 4.27 Billion by 2021. A wide array of upcoming rail projects, increased urbanization, and the rising demand for public transport has led to an increase in demand for locomotives and their related power conversion systems. Additionally technological advancements, such as the introduction of IGBT module, SiC module, and auxiliary power units have led to a rising demand for power conversion components. These advancements have increased the fuel-efficiency, lowered the emission levels, reduced the overall weight and have resulted in reduction of power loss while switching the state of current.

In this report, the market for power conversion systems is broadly segmented based on power conversion components into power converters (rectifier and inverter), traction motors, alternators and auxiliary power conversion units. The traction motors segment accounted for the largest market size in the market for power conversion systems, as this component assists in improving the efficiency by reducing losses, which can be categorized into iron losses, copper losses, mechanical losses, and harmonic losses. The Electric Multiple Unit (EMU) is estimated to account for the largest share of the market for power conversion systems in 2016. The market for power conversion systems for EMU (Electric Multiple Unit) is estimated to be the fastest growing segment during the forecast period.

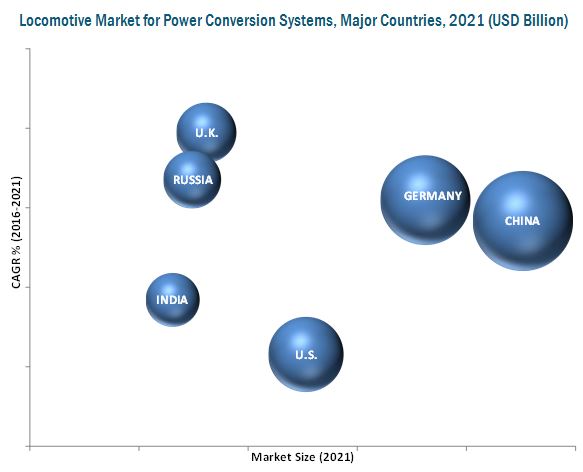

The Asia-Pacific region is estimated to dominate the power conversion system market. This growth can be credited to the improving socio-economic conditions in emerging economies such as China, India, and Japan. The sizeable populations in these countries have resulted in an increased number of government projects such as extension of rail routes, increase in production of rolling stock, advanced rail infrastructure, and the replacement of power conversion systems for better efficiency. The power conversion system market, by technology, is led by the IGBT module. The high demand for this module is credited to the advantages it offers, such as its reduced weight and lesser power loss while switching the current from AC to DC and vice-versa.

Key factors restraining the growth of the power conversion system market include the high cost of the components and its complex nature. The locomotive market for power conversion systems is dominated by a few global players such as Hitachi Ltd. (Japan), CRRC Corporation Limited (China), Bombardier Inc. (Canada), Alstom S.A. (France) and ABB (Switzerland). For instance, Hitachi Ltd. has strong product offering and they have invested heavily in R&D to retain their market position. They have adopted new product development and supply contracts as their key strategy while CRRC Corporation Limited has recently emerged by collaborating with the subsidiaries. They have adopted new product development and mergers as their key strategy to emerge as the leading player in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered in the Report

1.4 Currency

1.5 Package Size

1.6 Stakeholders

1.7 Limitations

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Factor Analysis

2.4.1 Introduction

2.4.2 Demand Side Analysis

2.4.2.1 Infrastructure: Rail Network

2.4.2.2 High-Speed Rail Links Between Major Countries

2.4.3 Supply Side Analysis

2.4.3.1 Technological Advancements

2.5 Market Size Estimation

2.5.1 Assumptions

2.5.2 Other Assumptions

3 Executive Summary (Page No. - 27)

3.1 Introduction

3.2 Asia-Pacific to Lead this Market in Terms of Value and Future Growth

3.3 Traction Motor to Lead this Market (Value)

3.4 IGBT Module to Replace the GTO Module in the Near Future

3.4.1 Global Market is Led By Diesel Locomotives

4 Premium Insights (Page No. - 32)

4.1 Global Market Size (Value), 2016 vs 2021

4.2 Global Market Size (Value), By Region & By Rolling Stock Type, 2016

4.3 Regional Market Share of Power Conversion System in Locomotives (Value), By Component

4.4 Rolling Stock Power Conversion System Market (Volume), By Technology

4.5 Rolling Stock Power Conversion Modules - Product Life Cycle Analysis

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Global Market - Report Segmentations

5.2.1.1 Locomotive Market, By Locomotive Type

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Power Conversion System Market to Be Fuelled By Growing Demand for Energy-Efficient Rolling Stock

5.3.1.2 Increase in Urbanization Will Boost the Demand for Rolling Stock

5.3.2 Restraints

5.3.2.1 Capital-Intensive Nature of Rolling Stock

5.3.3 Opportunities

5.3.3.1 Increased Demand for Rolling Stock in Emerging Market

5.3.3.2 Increase in Industrial and Mining Activities

5.3.3.3 Technological Upgradation: SiC Inverters

5.3.4 Challenges

5.3.4.1 High Overhaul & Maintenance Cost

5.4 Porter’s Five Forces Analysis

5.4.1 Threat of New Entrants

5.4.2 Threat of Substitutes

5.4.3 Bargaining Power of Suppliers

5.4.4 Bargaining Power of Buyers

5.4.5 Intensity of Competetive Rivalry

6 Locomotive Market, By Technology (Page No. - 54)

6.1 Introduction

6.2 IGBT Power Module

6.3 GTO Thyristor Module

6.4 SiC Power Module

7 Locomotive Market, By Region, Power Conversion Component & Locomotive Type (Page No. - 58)

7.1 Introduction

7.1.1 Asia-Pacific Power Conversion System Market, By Component

7.1.1.1 Rectifier Market, By Country and Locomotive Type

7.1.1.2 Inverter Market, By Country and Locomotive Type

7.1.1.3 Traction Motor Market, By Country and Locomotive Type

7.1.1.4 Alternator Market, By Country and Locomotive Type

7.1.1.5 Auxiliary Power Conversion Unit Market, By Country and Locomotive Type

7.1.2 Europe Power Conversion System Market, By Component

7.1.2.1 Rectifier Market, By Country and Locomotive Type

7.1.2.2 Inverter Market, By Country and Locomotive Type

7.1.2.3 Traction Motor Market, By Country and Locomotive Type

7.1.2.4 Alternator Market, By Country and Locomotive Type

7.1.2.5 Auxiliary Power Conversion Unit Market, By Country and Locomotive Type

7.1.3 North America Power Conversion System Market, By Component

7.1.3.1 Rectifier Market, By Country and Locomotive Type

7.1.3.2 Inverter Market, By Country and Locomotive Type

7.1.3.3 Traction Motor Market, By Country and Locomotive Type

7.1.3.4 Alternator Market, By Country and Locomotive Type

7.1.3.5 Auxiliary Power Conversion Unit Market, By Country and Locomotive Type

7.1.4 Rest of the World Power Conversion System Market, By Component

7.1.4.1 Rectifier Market, By Country and Locomotive Type

7.1.4.2 Inverter Market, By Country and Locomotive Type

7.1.4.3 Traction Motor Market, By Country and Locomotive Type

7.1.4.4 Alternator Market, By Country and Locomotive Type

7.1.4.5 Auxiliary Power Conversion Unit Market, By Country and Locomotive Type

8 Competitive Landscape (Page No. - 113)

8.1 Overview

8.2 Market Ranking Analysis: Locomotive Power Conversion Systems Market

8.3 Agreements/Partnerships/Supply Contracts/ Joint Venture

8.4 New Product Launches

8.5 Expansion

8.6 Mergers & Acquisitions

9 Company Profiles (Page No. - 120)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

9.1 Introduction

9.2 Hitachi Ltd.

9.3 Siemens AG

9.4 Crrc Corporation Ltd.

9.5 Bombardier Inc.

9.6 Alstom SA

9.7 Wabtec Corporation

9.8 Toshiba Corporation

9.9 Strukton

9.10 AEG Power Solutions

9.11 Turbo Power Systems

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

10 Appendix (Page No. - 146)

10.1 Insights of Industry Experts

10.2 Discussion Guide

10.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

10.4 Introducing RT: Real Time Market Intelligence

10.5 Available Customizations

10.6 Developments, 2014–2016

10.7 Related Reports

List of Tables (73 Tables)

Table 1 Global Market: By Locomotive Type

Table 2 Global Market: By Technology

Table 3 Global Market: By Components

Table 4 Infrastructure Investment and Maintenance Spending, By Country, (USD Billion)

Table 5 Porter’s Five Forces Analysis

Table 6 Global Locomotive Power Conversion Systems Market, By Technology, 2014–2021 (Units)

Table 7 IGBT Power Module Market, By Region, 2014-2021 (Units)

Table 8 GTO Module Market, By Region, 2014–2021 (Units)

Table 9 Global Market, By Region, 2014–2021 (Units)

Table 10 Global Market, By Region, 2014–2021 (USD Million)

Table 11 Global Market, By Locomotive Type, 2014–2021 (Units)

Table 12 Global Market, By Locomotive Type, 2014–2021 (USD Million)

Table 13 Asia-Pacific: Market, By Country, 2014–2021 (Units)

Table 14 Asia-Pacific: Market, By Country, 2014–2021 (USD Million)

Table 15 Asia-Pacific: Market, By Locomotive Type, 2014–2021 (Units)

Table 16 Asia-Pacific: Market, By Locomotive Type, 2014–2021 (USD Million)

Table 17 Rectifier: Market, By Country and By Locomotive Type, 2014–2021 (Units)

Table 18 Rectifier: Market, By Country and By Locomotive Type, 2014–2021 (USD Million)

Table 19 Inverter: Market, By Country and By Locomotive Type, 2014–2021 (Units)

Table 20 Inverter: Market, By Country and By Locomotive Type, 2014–2021 (USD Million)

Table 21 Traction Motor: Market, By Country and By Locomotive Type, 2014–2021 (Units)

Table 22 Traction Motor: Market, By Country and By Locomotive Type, 2014–2021 (USD Million)

Table 23 Alternator: Market, By Country and By Locomotive Type, 2014–2021 (Units)

Table 24 Alternator: Locomotive Power Conversion Systems Market, By Country and By Locomotive Type, 2014–2021 (USD Million)

Table 25 Auxiliary Power Conversion Unit: Market, By Country and By Locomotive Type, 2014–2021 (Units)

Table 26 Auxiliary Power Conversion Unit: Market, By Country and By Locomotive Type, 2014–2021 (USD Million)

Table 27 Europe: Market, By Country, 2014–2021 (Units)

Table 28 Europe: Market, By Country, 2014–2021 (USD Million)

Table 29 Europe: Market, By Locomotive Type, 2014–2021 (Units)

Table 30 Europe: Market, By Locomotive Type, 2014–2021 (USD Million)

Table 31 Rectifier: Market, By Country and By Locomotive Type, 2014–2021 (Units)

Table 32 Rectifier : Market, By Country and By Locomotive Type, 2014–2021 (USD Million)

Table 33 Inverter: Market, By Country and By Locomotive Type, 2014–2021 (Units)

Table 34 Inverter: Market, By Country and By Locomotive Type, 2014–2021 (USD Million)

Table 35 Traction Motor: Market, By Country and By Locomotive Type, 2014–2021 (Units)

Table 36 Traction Motor: Market, By Country and By Locomotive Type, 2014–2021 (USD Million)

Table 37 Alternator: Market, By Country and By Locomotive Type, 2014–2021 (Units)

Table 38 Alternator: Market, By Country and By Locomotive Type, 2014–2021 (USD Million)

Table 39 Auxiliary Power Conversion Unit : Market, By Country and By Locomotive Type, 2014–2021 (Units)

Table 40 Auxiliary Power Conversion Unit : Market, By Country and By Locomotive Type, 2014–2021 (USD Million)

Table 41 North America: Market, By Country, 2014–2021 (Units)

Table 42 North America: Market, By Country, 2014–2021 (USD Million)

Table 43 North America: Market, By Locomotive Type, 2014–2021 (Units)

Table 44 North America: Market, By Locomotive Type, 2014–2021 (USD Million)

Table 45 Rectifier: Market, By Country and By Locomotive Type, 2014–2021 (Units)

Table 46 Rectifier: Market, By Country and By Locomotive Type, 2014–2021 (USD Million)

Table 47 Inverter: Market, By Country and By Locomotive Type, 2014–2021 (Units)

Table 48 Inverter: Market, By Country and By Locomotive Type, 2014–2021 (USD Million)

Table 49 Traction Motor: Market, By Country and By Locomotive Type, 2014–2021 (Units)

Table 50 Traction Motor: Market, By Country and By Locomotive Type, 2014–2021 (USD Million)

Table 51 Alternator: Market, By Country and By Locomotive Type, 2014–2021 (Units)

Table 52 Alternator: Market, By Country and By Locomotive Type, 2014–2021 (USD Million)

Table 53 Auxiliary Power Conversion Unit : Market, By Country and By Locomotive Type, 2014–2021 (Units)

Table 54 Auxiliary Power Conversion Unit : Market, By Country and By Locomotive Type, 2014–2021 (USD Million)

Table 55 RoW: Market, By Country, 2014–2021 (Units)

Table 56 RoW: Market, By Country, 2014–2021 (USD Million)

Table 57 RoW: Market, By Locomotive Type, 2014–2021 (Units)

Table 58 RoW: Market, By Locomotive Type, 2014–2021 (USD Million)

Table 59 Rectifier: Market, By Country and By Locomotive Type, 2014–2021 (Units)

Table 60 Rectifier : Market, By Country and By Locomotive Type, 2014–2021 (USD Million)

Table 61 Inverter: Market, By Country and By Locomotive Type, 2014–2021 (Units)

Table 62 Inverter: Market, By Country and By Locomotive Type, 2014–2021 (USD Million)

Table 63 Traction Motor: Market, By Country and By Locomotive Type, 2014–2021 (Units)

Table 64 Traction Motor: Market, By Country and By Locomotive Type, 2014–2021 (USD Million)

Table 65 Alternator: Market, By Country and By Locomotive Type, 2014–2021 (Units)

Table 66 Alternator: Market, By Country and By Locomotive Type, 2014–2021 (USD Million)

Table 67 Auxiliary Power Conversion Unit : Market, By Country and By Locomotive Type, 2014–2021 (Units)

Table 68 Auxiliary Power Conversion Unit : Market, By Country and By Locomotive Type, 2014–2021 (USD Million)

Table 69 Market Ranking, 2015

Table 70 Agreements/Partnerships/Supply Contracts/Collaborations, 2012–2016

Table 71 New Product Development, 2012–2016

Table 72 Expansions, 2014–2016

Table 73 Joint Ventures/Mergers & Acquisitions, 2011–2015

List of Figures (52 Figures)

Figure 1 Global Markets Covered

Figure 2 Research Design

Figure 3 Research Methodology Model

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation & Region

Figure 5 Rail Network, 2015

Figure 6 Data Triangulation

Figure 7 Global Market Size Estimation Methodology: Bottom-Up Approach

Figure 8 Global Market Snapshot (2016): Asia-Pacific Estimated to Hold Maximum Market Share

Figure 9 Global Market Size, By Power Conversion Components, 2016 vs 2021

Figure 10 Global Market Share, By Technology, 2016

Figure 11 Asia-Pacific Holds the Largest Share in the Rolling Stock Market, By Locomotive Type, 2016 vs 2021

Figure 12 Attractive Market Opportunities for Power Conversion Systems in Locomotive

Figure 13 Asia-Pacific Leads this Market in 2016

Figure 14 Traction Motors Dominate this Market (Value) in 2016

Figure 15 IGBT Module to Account for Major Share in Market for Power Conversion Systems (Volume), 2016

Figure 16 Product Life Cycle of Power Modules in Rolling Stock

Figure 17 Global Market: By Locomotive Type

Figure 18 Global Market, By Technology

Figure 19 Global Market, By Components

Figure 20 Growing Need for Public Transport Estimated to Raise the Demand for Locomotive Market

Figure 21 Increasing Demand for Rolling Stock By 2021

Figure 22 Urban Population in Emerging Economies

Figure 23 Rolling Stock Infrastructure Investements, By Key Countries, (USD Billion)

Figure 24 China and India are Investing Heavily in Railway Infrastructure

Figure 25 Porter’s Five Forces Analysis (2016): Presence of Global Players Increase the Degree of Competition

Figure 26 Presence of Well-Established Players & High Entry Barriers Have the Highest Impact on Market Entrants

Figure 27 Availability of Substitutes & Technological Advancements Influence the Threat of Substitutes

Figure 28 Low Supplier Concentration & Product Differentiation Keeps the Bargaining Power of Suppliers in Check

Figure 29 High Degree of Independence Increases Bargaining Power of Buyers

Figure 30 Well Established Players & Long Term Contracts Limits the Competition

Figure 31 Locomotive Power Conversion Systems Market, By Technology, 2016 vs 2021 (Units)

Figure 32 Reduction in Power Losses With Use of SiC Module Over IGBT Module

Figure 33 Region-Wise Snapshot of the Locomotive Power Conversion Systems Market, By Volume (2016): Asia-Pacific Accounts for the Largest Market Share

Figure 34 Locomotive Power Conversion Systems Market: Emu is Expected to Have the Largest Market Size, By Volume, 2016

Figure 35 Asia-Pacific: China Leads the Market for Rolling Stock Power Conversion Systems

Figure 36 Germany is the Largest Contributor to the European Locomotive Power Conversion Systems Market

Figure 37 Companies Adopted Agreements/Partnerships/Supply Contracts/Collaborations as A Key Growth Strategy From 2012 to 2016

Figure 38 Market Evaluation Framework: Agreements/Partnerships/Supply Contracts/Joint Ventures Fuelled Market Growth From 2012 to 2016

Figure 39 Battle for Market Share: Agreements/Partnerships/Supply Contracts/Joint Ventures Was the Key Strategy

Figure 40 Hitachi Ltd.: Company Snapshot

Figure 41 Hitachi Ltd.: SWOT Analysis

Figure 42 Siemens AG: Company Snapshot

Figure 43 Siemens AG: SWOT Analysis

Figure 44 Bombardier Inc.: Company Snapshot

Figure 45 Bombardier Inc.: SWOT Analysis

Figure 46 Alstom SA: Company Snapshot

Figure 47 Alstom SA: SWOT Analysis

Figure 48 Wabtec Corporation: Company Snapshot

Figure 49 Toshiba Corporation: Company Snapshot

Figure 50 Strukton: Company Snapshot

Figure 51 AEG Power Solutions: Company Snapshot

Figure 52 Turbo Power Systems: Company Snapshot

Growth opportunities and latent adjacency in Locomotive Market

Would you be able to quote me buying only 1 table/section from this report? I am only looking for unit volume growth of diesel locomotives in america