Long Fiber Thermoplastics Market by Fiber Type (Glass, Carbon), Resin Type (PA, PP, PEEK, PPA), Manufacturing Process (Injection Molding, Pultrusion, Direct-LFT (D-LFT)), End-use Industry and Region - Global Forecast to 2027

Updated on : August 25, 2025

Long Fiber Thermoplastics Market

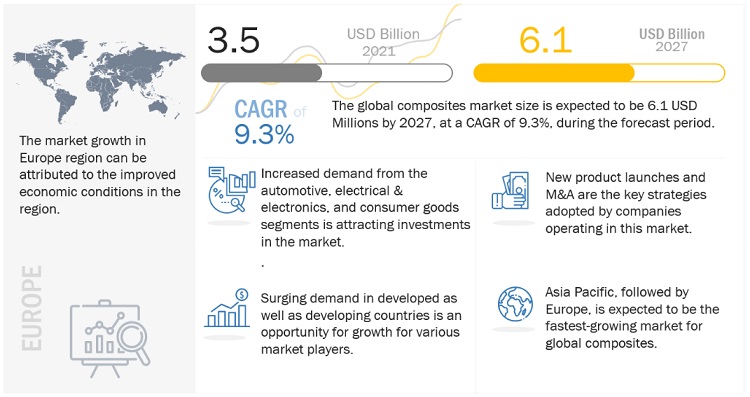

The long fiber thermoplastics market is projected to reach USD 6.1 billion by 2027, at a CAGR of 9.3%. The market is growing because of the rise in the demand from electrical & electronics, and automotive industries.

Attractive Opportunities in the Long Fiber Thermoplastics Market

To know about the assumptions considered for the study, Request for Free Sample Report

Increasing demand for fuel efficient vehicles to drive the market

Stringent regulations are imposed on the automotive industry to reduce carbon dioxide (CO2) emissions that have an adverse effect on the global climate. Long fiber thermoplastics provide high strength, design flexibility, dimensional stability, and reduced weight. The reduction of weight in vehicles saves energy, minimizes brake and tire wear, and reduces emissions. Reducing the weight of an automobile by merely 50 kg (110 lbs) can reduce up to 5 g of CO2/km and increase fuel economy by up to 2%. This encourages the industry to focus on fuel-efficient vehicles, which can reduce greenhouse gas emissions (GHGs). For instance, cutting 11kg (24.2 lbs) from each of the 70 million light-vehicle engines could save up to 908 million liters (240 million gallons) of refined fuel or nine million barrels of crude oil. Eliminating 5 kg–7 kg (11 lbs–15.4 lbs) from the 40 million automotive transmissions would save up to 350 million liters (90 million gallons) of refined gasoline fuel or 3.4 million barrels of crude oil. These eliminations can be made by using long fiber thermoplastics in the parts of vehicles to reduce weight. Thus, long fiber thermoplastics are likely to be used for lightweight solutions for vehicles to reduce overall weight and gain fuel efficiency to meet various government norms.

High processing & manufacturing costs to restrict the market growth

The manufacturing of long fiber thermoplastics consists of several steps, including performing, molding, curing, cooling, and trimming before the final assembly. The processes used to manufacture these composites are pultrusion, compression molding, and injection molding, which require complex and expensive machinery. This results in a high manufacturing cost of long fiber thermoplastics, which in turn increases the cost of the final product. This high cost is a major restraint for the OEMs in the supply chain to use long fiber thermoplastics. Although these composites have many applications in various sectors, they are not yet commercially feasible in some of these sectors. These applications of long fiber thermoplastics can gain momentum only if the cost of production is reduced, resulting in cheaper component production costs.

Use of long fiber thermoplastics in various end-use industries to create lucrative opportunities for the market

The use of long fiber thermoplastics is increasing as manufacturers in different industries are increasingly adopting these composites. They are already being used in automotive parts, sporting goods, and other industries, as they offer several advantages, such as lightweight, corrosion resistance, toughness, and thermal conductivity, compared to traditional materials. Long fiber thermoplastics are being increasingly used because of their various advantages in consumer goods due to their functional performance, high-temperature tolerance, and dimensional stability. They are used in interior and exterior washing machines, freezers, electric appliances, and other applications. Glass fibers are preferred in the electrical industry as insulators for electrical conductors because of their mechanical strength and temperature stability. More significant opportunities in industries, such as marine, medical, industrial, and construction, for long fiber thermoplastics will propel the market growth.

Developing low cost technologies to be a major challenge for market growth

Long fiber thermoplastics are highly capital-intensive and require high-investment equipment for their manufacturing. New technologies need to be developed to produce low-cost glass fibers and long fiber thermoplastics to commercialize the end products. Production and development projects are undertaken to reduce the manufacturing costs of long fiber thermoplastic composite products through technology and process solutions. The development of low-cost long fiber thermoplastics would enable their use in a wide range of applications. The identification and development of low-cost technologies for the commercial production of low-cost fiber composites is a major concern for governments, research laboratories, and global glass fiber producers.

Glass fiber type accounted for the largest market share, in terms of value and volume

Glass fiber-based Long fiber thermoplastics usage is increasing owing to the increased consumption in automobile, and electrical & electronics applications. The increasing market is owing to the high stiffness, high performance and high strength to weight ratio of glass long fiber thermoplastics.

PP resin accounted for largest market share in resin segment in terms of value and volume

The market's dominant segment is made up of long fiber thermoplastics made of PP resin. Propylene monomers are combined to create PP resin. It is employed in both consumer and industrial applications. Its qualities and versatility in manufacturing methods make it the best material for a variety of applications. The most typical uses are those for consumer products, electronic devices, and car hoods, among others.

Injection molding is the largest segment of long fiber thermoplastics in terms of value and volume.

Injection molding is a fast, high-volume, closed molding process that uses, most commonly reinforced thermoplastics composites, such as nylon with chopped glass fiber. It is used for producing parts by injecting molten material into a mold. In this process, the material for the part is fed into a heated barrel, mixed, and injected into a mold cavity. This process offers low-cost tooling, which is economical for low production volumes or the production of large components. It is widely applicable in transportation and electrical & electronics industries to produce bumpers for vehicles, panels for electrical equipment, enclosures for medical devices, and other applications.

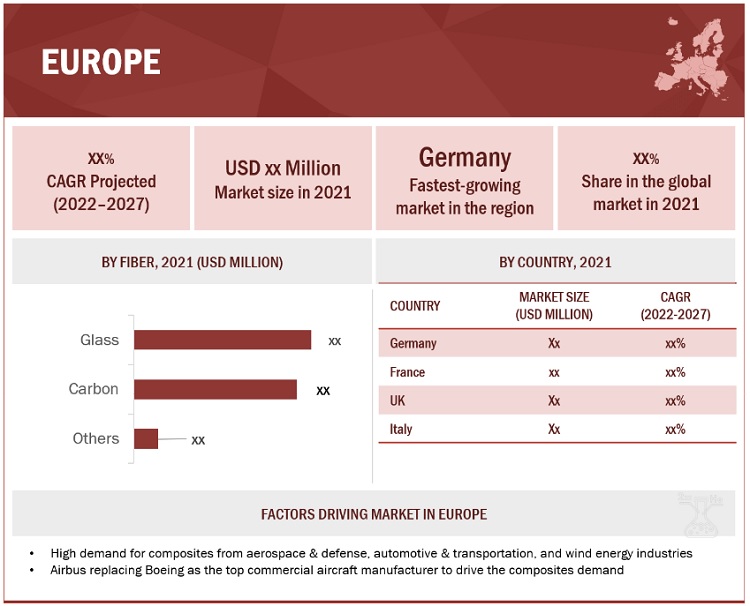

European region held the largest market share in the Long fiber thermoplastics market

Europe accounts for the largest share of the global Long Fiber Thermoplastics Industry due to major carbon and glass fiber manufacturers in Germany, France, and UK. The market in the automotive sector, which is a prominent user of long fiber thermoplastics, is growing significantly in the region. The electronics end-use industry, which is also among the major users of long fiber thermoplastics, is witnessing significant growth in the European region due to the growing focus of OEMs on manufacturing electric vehicles. These factors have helped the demand for long fiber thermoplastics to grow in the region.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The major players active in the market are Celanese Corporation (US), SABIC (Saudi Arabia), Lanxess AG (Germany), BASF SE (Germany), Mitsubishi Chemical Group Corporation (Japan), Avient Corporation (US), Daicel Polymer Ltd. (Japan), Asahi Kasei Corporation (Japan), RTP Company, Inc. (US), Solvay SA (Belgium) are some of the key players in the long fiber thermoplastics market. These companies are involved in adopting various inorganic and organic strategies to increase their foothold in the long fiber thermoplastics industry. The study includes an in-depth competitive analysis of these companies in the long fiber thermoplastics market, with their company profiles, recent developments, and key market strategies.

These companies are involved in adopting various inorganic and organic strategies to increase their foothold in the Long fiber thermoplastics industry. The study includes an in-depth competitive analysis of these key players in the Long fiber thermoplastics market, with their company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Metric |

Details |

|

Years considered for the study |

2018–2021 |

|

Base year |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Value (USD Million/USD Billion), Volume (Kiloton) |

|

Segments |

Fiber Type, Resin Type, Manufacturing Process, End-use Industry and Region |

|

Regions |

Europe, North America, APAC, MEA, and South America |

|

Companies |

Celanese Corporation (US), SABIC (Saudi Arabia), Lanxess AG (Germany), BASF SE (Germany), Mitsubishi Chemical Group Corporation (Japan), Avient Corporation (US), Daicel Polymer Ltd. (Japan), Asahi Kasei Corporation (Japan), RTP Company, Inc. (US), Solvay SA (Belgium) |

This research report categorizes the long fiber thermoplastics market based on fiber type, resin type, manufacturing process, end-use industry, and region.

By Fiber Type:

- Glass

- Carbon

- Other Fibers

By Resin Type:

- PA

- PP

- PEEK

- PPA

- Other Resins

By End-use Industry:

- Automotive

- Consumer goods

- Sporting Goods

- Electrical & Electronics

- Others

By Manufacturing Process:

- Injection Molding

- Pultrusion

- Direct-LFT (D-LFT)

- Others

By Region:

- North America

- Europe

- APAC

- MEA

- South America

Recent Developments

- In December 2022, Solvay S.A. partnered with Electronic Fluorocarbons (EFC) to gain exclusive distribution rights for its products in North America.

- In November 2022, Celanese Corporation acquired a majority of the stake in the Mobility & Materials Business of DuPont, which improves its thermoplastics and elastomer product portfolio.

- In May 2022, Lanxess AG has acquired the DSM Engineering Materials business from Royal DSM, invested jointly by Advent International and Lanxess AG.

- In March 2022, Celanese Corporation and Mitsubishi Gas Chemical Company (MGC) formed a joint venture named Korea Engineering Plastics Co. (KEP), which allows the company to have an improved portfolio of its engineered materials division.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the Long fiber thermoplastics market?

Increasing demand for fuel efficient vehicles to boost the Long fiber thermoplastics market.

Which is the largest country-level market for Long fiber thermoplastics market?

Germany is the largest Long fiber thermoplastics market due to high demand from well-established end-use industries.

What are the factors contributing to the final price of Long fiber thermoplastics market?

Raw material plays a vital role in the costs. The cost of these materials contributes largely to the final pricing of long fiber thermoplastics.

What are the challenges in the Long fiber thermoplastics market?

Development of low-cost production technology is the major challenge in the long fiber thermoplastics market.

Which type of resin holds the largest market share?

PP resin long fiber thermoplastics hold the largest share due to low cost and ease of manufacturing.

How is the Long fiber thermoplastics market aligned?

The market is growing at a significant pace. It is a potential market and many manufacturers are planning business strategies to expand their business.

Who are the major manufacturers?

Celanese Corporation (US), SABIC (Saudi Arabia), Lanxess AG (Germany), BASF SE (Germany), Mitsubishi Chemical Group Corporation (Japan), Avient Corporation (US), Daicel Polymer Ltd. (Japan), Asahi Kasei Corporation (Japan), RTP Company, Inc. (US), Solvay SA (Belgium)

What are the fiber types for long fiber thermoplastics?

Glass, carbon are the major material types fibers used for long fiber thermoplastics

What are the major applications for long fiber thermoplastics?

The major applications for long fiber thermoplastics are automotive, Consumer goods, sporting goods, and electrical & electronics.

What is the biggest restraint in the long fiber thermoplastics market?

High processing and manufacturing cost. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increased demand for fuel-efficient vehicles- Exceptional properties over short fiber thermoplastics- Less generation of VOCs and recyclabilityRESTRAINTS- Weaker mechanical properties and higher cost than thermosets- High processing and manufacturing costsOPPORTUNITIES- Use of long fiber thermoplastics in various end use industriesCHALLENGES- Need to reduce capital and technology costs- High R&D cost

-

5.3 PORTER’S FIVE FORCES ANALYSISBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESINTENSITY OF COMPETITIVE RIVALRY

- 5.4 SUPPLY CHAIN ANALYSIS

-

5.5 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.6 TECHNOLOGY ANALYSIS

-

5.7 ECOSYSTEM: LONG FIBER THERMOPLASTICS MARKET

- 5.8 VALUE CHAIN ANALYSIS

-

5.9 KEY MARKETS FOR IMPORT/EXPORTCHINAUSGERMANYFRANCEINDIA

- 5.10 PRICING ANALYSIS

- 5.11 AVERAGE SELLING PRICES OF KEY PLAYERS, BY FIBER TYPE

- 5.12 AVERAGE SELLING PRICES, BY MANUFACTURING PROCESS

- 5.13 AVERAGE SELLING PRICES, BY RESIN TYPE

- 5.14 AVERAGE SELLING PRICES, BY END USE INDUSTRY

- 5.15 AVERAGE SELLING PRICES

-

5.16 LONG FIBER THERMOPLASTICS MARKET: OPTIMISTIC, PESSIMISTIC, AND REALISTIC SCENARIOSOPTIMISTIC SCENARIOPESSIMISTIC SCENARIOREALISTIC SCENARIO

- 5.17 KEY CONFERENCES AND EVENTS

-

5.18 TARIFFS AND REGULATIONSREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.19 LONG FIBER THERMOPLASTICS PATENT ANALYSISINTRODUCTIONMETHODOLOGYDOCUMENT TYPEINSIGHTSLEGAL STATUS OF PATENTSJURISDICTION ANALYSISTOP APPLICANTS ANALYSISLIST OF PATENTS BY ARKEMA FRANCELIST OF PATENTS BY DAICEL POLYMER LTD.LIST OF PATENTS BY LX HAUSYS LTD.TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

- 5.20 CASE STUDY ANALYSIS

- 5.21 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- 6.1 INTRODUCTION

-

6.2 POLYPROPYLENE (PP)USED IN CONSUMER AND INDUSTRIAL APPLICATIONSPP: LONG FIBER THERMOPLASTICS MARKET, BY REGION

-

6.3 POLYAMIDE (PA)REDUCES AUTOMOTIVE WEIGHTPA: LONG FIBER THERMOPLASTICS MARKET, BY REGION

-

6.4 POLYETHER ETHER KETONE (PEEK)PRODUCES COMPLEX SHAPES QUICKLY, CATERING TO HUGE DEMAND FROM AUTOMOTIVE INDUSTRYPEEK: LONG FIBER THERMOPLASTICS MARKET, BY REGION

-

6.5 POLYPHTHALAMIDE (PPA)WIDELY USED TO REPLACE METALS IN SOME APPLICATIONSPPA: LONG FIBER THERMOPLASTICS MARKET, BY REGION

-

6.6 OTHER RESINSPOLYBUTYLENE TEREPHTHALATE (PBT)POLYPHENYLENE SULFIDE (PPS)OTHER RESINS: LONG FIBER THERMOPLASTICS MARKET, BY REGION

- 7.1 INTRODUCTION

-

7.2 GLASSEXCELLENT CHEMICAL PROPERTIESGLASS: LONG FIBER THERMOPLASTICS MARKET, BY REGION

-

7.3 CARBONINCREASING DEMAND FROM AUTOMOTIVE AND SPORTING GOODS INDUSTRIESCARBON: LONG FIBER THERMOPLASTICS MARKET, BY REGION

-

7.4 OTHER FIBERSFINDS INCREASING DEMAND FROM CONSUMER AND SPORTING GOODSOTHER FIBERS: LONG FIBER THERMOPLASTICS MARKET, BY REGION

- 8.1 INTRODUCTION

-

8.2 INJECTION MOLDINGMOST COMMONLY REINFORCED THERMOPLASTIC COMPOSITEINJECTION MOLDING: LONG FIBER THERMOPLASTICS MARKET, BY REGION

-

8.3 PULTRUSIONHIGHLY AUTOMATED PROCESS WITH MAJOR DEMAND FROM AUTOMOTIVE INDUSTRYPULTRUSION: LONG FIBER THERMOPLASTICS MARKET, BY REGION

-

8.4 DIRECT-LFT (D-LFT)IMPROVES PROPERTIES OF LONG FIBER THERMOPLASTICSD-LFT: LONG FIBER THERMOPLASTICS MARKET, BY REGION

-

8.5 OTHER PROCESSESCOMPRESSION MOLDINGEXTRUSIONOTHER PROCESSES: LONG FIBER THERMOPLASTICS MARKET, BY REGION

- 9.1 INTRODUCTION

-

9.2 AUTOMOTIVEUSED IN HOODS, SUNROOF FRAMES, SEATS, DOORS, AND LUGGAGE COMPARTMENTSINTERIOR COMPONENTSEXTERIOR COMPONENTSLONG FIBER THERMOPLASTICS MARKET IN AUTOMOTIVE, BY REGION

-

9.3 ELECTRICAL & ELECTRONICSIMPROVES WEIGHT, THERMAL RESISTANCE, AND ROBUSTNESSLONG FIBER THERMOPLASTICS MARKET IN ELECTRICAL & ELECTRONICS, BY REGION

-

9.4 CONSUMER GOODSTHERMOPLASTICS TO PROVIDE COST-EFFECTIVE SOLUTIONS FOR CONSUMER GOODSLONG FIBER THERMOPLASTICS MARKET IN CONSUMER GOODS, BY REGION

-

9.5 SPORTING GOODSSTRONG, TOUGH, AND LIGHTWEIGHT PROPERTIES INCREASE DEMAND FOR LONG FIBER THERMOPLASTICSLONG FIBER THERMOPLASTICS MARKET IN SPORTING GOODS, BY REGION

-

9.6 OTHER INDUSTRIESMARINEAEROSPACELONG FIBER THERMOPLASTICS MARKET IN OTHER INDUSTRIES, BY REGION

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY FIBER TYPENORTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY MANUFACTURING PROCESSNORTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY RESIN TYPENORTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRYNORTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY COUNTRY- US- Canada- Mexico

-

10.3 EUROPEEUROPE: LONG FIBER THERMOPLASTICS MARKET, BY FIBER TYPEEUROPE: LONG FIBER THERMOPLASTICS MARKET, BY MANUFACTURING PROCESSEUROPE: LONG FIBER THERMOPLASTICS MARKET, BY RESIN TYPEEUROPE: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRYEUROPE: LONG FIBER THERMOPLASTICS MARKET, BY COUNTRY- Germany- France- UK- Italy- Rest of Europe

-

10.4 ASIA PACIFICASIA PACIFIC: LONG FIBER THERMOPLASTICS MARKET, BY FIBER TYPEASIA PACIFIC: LONG FIBER THERMOPLASTICS MARKET, BY MANUFACTURING PROCESSASIA PACIFIC: LONG FIBER THERMOPLASTICS MARKET, BY RESIN TYPEASIA PACIFIC: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRYASIA PACIFIC: LONG FIBER THERMOPLASTICS MARKET, BY COUNTRY- China- Japan- India- South Korea- Rest of Asia Pacific

-

10.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: LONG FIBER THERMOPLASTICS MARKET, BY FIBER TYPEMIDDLE EAST & AFRICA: LONG FIBER THERMOPLASTICS MARKET, BY MANUFACTURING PROCESSMIDDLE EAST & AFRICA: LONG FIBER THERMOPLASTICS MARKET, BY RESIN TYPEMIDDLE EAST & AFRICA: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRYMIDDLE EAST & AFRICA: LONG FIBER THERMOPLASTICS MARKET, BY COUNTRY- UAE- Saudi Arabia- Rest of Middle East & Africa

-

10.6 SOUTH AMERICASOUTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY FIBER TYPESOUTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY MANUFACTURING PROCESSSOUTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY RESIN TYPESOUTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRYSOUTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY COUNTRY- Brazil- Argentina- Rest of South America

- 11.1 INTRODUCTION

- 11.2 MARKET SHARE ANALYSIS

- 11.3 MARKET RANKING

- 11.4 MARKET EVALUATION FRAMEWORK

- 11.5 REVENUE ANALYSIS OF TOP MARKET PLAYERS

-

11.6 COMPANY EVALUATION MATRIXSTARSPERVASIVE PLAYERSPARTICIPANTSEMERGING LEADERSSTRENGTH OF PRODUCT PORTFOLIOBUSINESS STRATEGY EXCELLENCE

-

11.7 STARTUP/SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

12.1 MAJOR PLAYERSCELANESE CORPORATION- Business overview- Products offered- Recent developments- MnM viewSABIC- Business overview- Products offered- MnM viewLANXESS AG- Business overview- Products offered- Recent developments- MnM viewBASF SE- Business overview- Products offered- Recent developments- MnM viewMITSUBISHI CHEMICAL GROUP CORPORATION- Business overview- Products offered- Recent developments- MnM viewAVIENT CORPORATION- Business overview- Products offered- Recent developments- MnM viewDAICEL POLYMER LTD.- Business overview- Products offered- MnM viewASAHI KASEI CORPORATION- Business overview- Products offered- Recent developments- MnM viewRTP COMPANY, INC.- Business overview- Products offered- MnM viewSOLVAY SA- Business overview- Products offered- Recent developments- MnM view

-

12.2 OTHER COMPANIESSBHPPTECHNOCOMPOUND GMBHDIEFFENBACHERKINGFASAMBARK LFT CO., LTD.TORAY INDUSTRIES, INC.SUMITOMO CHEMICAL COMPANY LTD.

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 LONG FIBER THERMOPLASTICS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 2 LONG FIBER THERMOPLASTICS MARKET: COMPANIES AND THEIR ROLE IN ECOSYSTEM

- TABLE 3 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END USE INDUSTRIES

- TABLE 4 KEY BUYING CRITERIA FOR TOP 3 END USE INDUSTRIES

- TABLE 5 COMPARATIVE STUDY OF PREPREG MANUFACTURING PROCESSES

- TABLE 6 AVERAGE SELLING PRICES OF KEY PLAYERS, BY FIBER TYPE (USD/KG)

- TABLE 7 LONG FIBER THERMOPLASTICS AVERAGE SELLING PRICE, BY REGION

- TABLE 8 LONG FIBER THERMOPLASTICS MARKET: CAGR (BY VALUE) IN OPTIMISTIC, PESSIMISTIC, AND REALISTIC SCENARIOS

- TABLE 9 DETAILED LIST OF CONFERENCES AND EVENTS RELATED TO LONG FIBER THERMOPLASTICS AND RELATED MARKETS, 2022–2024

- TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 LONG FIBER THERMOPLASTICS: GLOBAL PATENTS

- TABLE 15 LONG FIBER THERMOPLASTICS MARKET, BY RESIN TYPE, 2019–2021 (USD MILLION)

- TABLE 16 LONG FIBER THERMOPLASTICS MARKET, BY RESIN TYPE, 2019–2021 (KILOTON)

- TABLE 17 LONG FIBER THERMOPLASTICS MARKET, BY RESIN TYPE, 2022–2027 (USD MILLION)

- TABLE 18 LONG FIBER THERMOPLASTICS MARKET, BY RESIN TYPE, 2022–2027 (KILOTON)

- TABLE 19 PP: LONG FIBER THERMOPLASTICS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 20 PP: LONG FIBER THERMOPLASTICS MARKET, BY REGION, 2019–2021 (KILOTON)

- TABLE 21 PP: LONG FIBER THERMOPLASTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 22 PP: LONG FIBER THERMOPLASTICS MARKET, BY REGION, 2022–2027 (KILOTON)

- TABLE 23 PA: LONG FIBER THERMOPLASTICS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 24 PA: LONG FIBER THERMOPLASTICS MARKET, BY REGION, 2019–2021 (KILOTON)

- TABLE 25 PA: LONG FIBER THERMOPLASTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 26 PA: LONG FIBER THERMOPLASTICS MARKET, BY REGION, 2022–2027 (KILOTON)

- TABLE 27 PEEK: LONG FIBER THERMOPLASTICS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 28 PEEK: LONG FIBER THERMOPLASTICS MARKET, BY REGION, 2019–2021 (KILOTON)

- TABLE 29 PEEK: LONG FIBER THERMOPLASTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 30 PEEK: LONG FIBER THERMOPLASTICS MARKET, BY REGION, 2022–2027 (KILOTON)

- TABLE 31 PPA: LONG FIBER THERMOPLASTICS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 32 PPA: LONG FIBER THERMOPLASTICS MARKET, BY REGION, 2019–2021 (KILOTON)

- TABLE 33 PPA: LONG FIBER THERMOPLASTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 34 PPA: LONG FIBER THERMOPLASTICS MARKET, BY REGION, 2022–2027 (KILOTON)

- TABLE 35 OTHER RESINS: LONG FIBER THERMOPLASTICS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 36 OTHER RESINS: LONG FIBER THERMOPLASTICS MARKET, BY REGION, 2019–2021 (KILOTON)

- TABLE 37 OTHER RESINS: LONG FIBER THERMOPLASTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 38 OTHER RESINS: LONG FIBER THERMOPLASTICS MARKET SIZE, BY REGION, 2022–2027 (KILOTON)

- TABLE 39 LONG FIBER THERMOPLASTICS MARKET, BY FIBER TYPE, 2019–2021 (USD MILLION)

- TABLE 40 LONG FIBER THERMOPLASTICS MARKET, BY FIBER TYPE, 2019–2021 (KILOTON)

- TABLE 41 LONG FIBER THERMOPLASTICS MARKET, BY FIBER TYPE, 2022–2027 (USD MILLION)

- TABLE 42 LONG FIBER THERMOPLASTICS MARKET, BY FIBER TYPE, 2022–2027 (KILOTON)

- TABLE 43 GLASS: LONG FIBER THERMOPLASTICS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 44 GLASS: LONG FIBER THERMOPLASTICS MARKET, BY REGION, 2019–2021 (KILOTON)

- TABLE 45 GLASS: LONG FIBER THERMOPLASTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 46 GLASS: LONG FIBER THERMOPLASTICS MARKET, BY REGION, 2022–2027 (KILOTON)

- TABLE 47 CARBON: LONG FIBER THERMOPLASTICS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 48 CARBON: LONG FIBER THERMOPLASTICS MARKET, BY REGION, 2019–2021 (KILOTON)

- TABLE 49 CARBON: LONG FIBER THERMOPLASTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 50 CARBON: LONG FIBER THERMOPLASTICS MARKET, BY REGION, 2022–2027 (KILOTON)

- TABLE 51 OTHER FIBERS: LONG FIBER THERMOPLASTICS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 52 OTHER FIBERS: LONG FIBER THERMOPLASTICS MARKET, BY REGION, 2019–2021 (KILOTON)

- TABLE 53 OTHER FIBERS: LONG FIBER THERMOPLASTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 54 OTHER FIBERS: LONG FIBER THERMOPLASTICS MARKET, BY REGION, 2022–2027 (KILOTON)

- TABLE 55 LONG FIBER THERMOPLASTICS MARKET, BY MANUFACTURING PROCESS, 2019–2021 (USD MILLION)

- TABLE 56 LONG FIBER THERMOPLASTICS MARKET, BY MANUFACTURING PROCESS, 2019–2021 (KILOTON)

- TABLE 57 LONG FIBER THERMOPLASTICS MARKET, BY MANUFACTURING PROCESS, 2022–2027 (USD MILLION)

- TABLE 58 LONG FIBER THERMOPLASTICS MARKET, BY MANUFACTURING PROCESS, 2022–2027 (KILOTON)

- TABLE 59 INJECTION MOLDING: LONG FIBER THERMOPLASTICS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 60 INJECTION MOLDING: LONG FIBER THERMOPLASTICS MARKET, BY REGION, 2019–2021 (KILOTON)

- TABLE 61 INJECTION MOLDING: LONG FIBER THERMOPLASTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 62 INJECTION MOLDING: LONG FIBER THERMOPLASTICS MARKET, BY REGION, 2022–2027 (KILOTON)

- TABLE 63 PULTRUSION: LONG FIBER THERMOPLASTICS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 64 PULTRUSION: LONG FIBER THERMOPLASTICS MARKET, BY REGION, 2019–2021 (KILOTON)

- TABLE 65 PULTRUSION: LONG FIBER THERMOPLASTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 66 PULTRUSION: LONG FIBER THERMOPLASTICS MARKET, BY REGION, 2022–2027 (KILOTON)

- TABLE 67 D-LFT: LONG FIBER THERMOPLASTICS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 68 D-LFT: LONG FIBER THERMOPLASTICS MARKET, BY REGION, 2019–2021 (KILOTON)

- TABLE 69 D-LFT: LONG FIBER THERMOPLASTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 70 D-LFT: LONG FIBER THERMOPLASTICS MARKET, BY REGION, 2022–2027 (KILOTON)

- TABLE 71 OTHER PROCESSES: LONG FIBER THERMOPLASTICS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 72 OTHER PROCESSES: LONG FIBER THERMOPLASTICS MARKET, BY REGION, 2019–2021 (KILOTON)

- TABLE 73 OTHER PROCESSES: LONG FIBER THERMOPLASTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 74 OTHER PROCESSES: LONG FIBER THERMOPLASTICS MARKET, BY REGION, 2022–2027 (KILOTON)

- TABLE 75 LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 76 LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 77 LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 78 LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 79 LONG FIBER THERMOPLASTICS MARKET IN AUTOMOTIVE, BY REGION, 2019–2021 (USD MILLION)

- TABLE 80 LONG FIBER THERMOPLASTICS MARKET IN AUTOMOTIVE, BY REGION, 2019–2021 (KILOTON)

- TABLE 81 LONG FIBER THERMOPLASTICS MARKET IN AUTOMOTIVE, BY REGION, 2022–2027 (USD MILLION)

- TABLE 82 LONG FIBER THERMOPLASTICS MARKET IN AUTOMOTIVE, BY REGION, 2022–2027 (KILOTON)

- TABLE 83 LONG FIBER THERMOPLASTICS MARKET IN ELECTRICAL & ELECTRONICS, BY REGION, 2019–2021 (USD MILLION)

- TABLE 84 LONG FIBER THERMOPLASTICS MARKET IN ELECTRICAL & ELECTRONICS, BY REGION, 2019–2021 (KILOTON)

- TABLE 85 LONG FIBER THERMOPLASTICS MARKET IN ELECTRICAL & ELECTRONICS, BY REGION, 2022–2027 (USD MILLION)

- TABLE 86 LONG FIBER THERMOPLASTICS MARKET IN ELECTRICAL & ELECTRONICS, BY REGION, 2022–2027 (KILOTON)

- TABLE 87 LONG FIBER THERMOPLASTICS MARKET IN CONSUMER GOODS, 2019–2021 (USD MILLION)

- TABLE 88 LONG FIBER THERMOPLASTICS MARKET IN CONSUMER GOODS, BY REGION, 2019–2021 (KILOTON)

- TABLE 89 LONG FIBER THERMOPLASTICS MARKET IN CONSUMER GOODS, BY REGION, 2022–2027 (USD MILLION)

- TABLE 90 LONG FIBER THERMOPLASTICS MARKET IN CONSUMER GOODS, BY REGION, 2022–2027 (KILOTON)

- TABLE 91 LONG FIBER THERMOPLASTICS MARKET IN SPORTING GOODS, BY REGION, 2019–2021 (USD MILLION)

- TABLE 92 LONG FIBER THERMOPLASTICS MARKET IN SPORTING GOODS, BY REGION, 2019–2021 (KILOTON)

- TABLE 93 LONG FIBER THERMOPLASTICS MARKET IN SPORTING GOODS, BY REGION, 2022–2027 (USD MILLION)

- TABLE 94 LONG FIBER THERMOPLASTICS MARKET IN SPORTING GOODS, BY REGION, 2022–2027 (KILOTON)

- TABLE 95 LONG FIBER THERMOPLASTICS MARKET IN OTHER INDUSTRIES, BY REGION, 2019–2021 (USD MILLION)

- TABLE 96 LONG FIBER THERMOPLASTICS MARKET IN OTHER INDUSTRIES, BY REGION, 2019–2021 (KILOTON)

- TABLE 97 LONG FIBER THERMOPLASTICS MARKET IN OTHER INDUSTRIES, BY REGION, 2022–2027 (USD MILLION)

- TABLE 98 LONG FIBER THERMOPLASTICS MARKET IN OTHER INDUSTRIES, BY REGION, 2022–2027 (KILOTON)

- TABLE 99 LONG FIBER THERMOPLASTICS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 100 LONG FIBER THERMOPLASTICS MARKET, BY REGION, 2019–2021 (KILOTON)

- TABLE 101 LONG FIBER THERMOPLASTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 102 LONG FIBER THERMOPLASTICS MARKET, BY REGION, 2022–2027 (KILOTON)

- TABLE 103 NORTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY FIBER TYPE, 2019–2021 (USD MILLION)

- TABLE 104 NORTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY FIBER TYPE, 2019–2021 (KILOTON)

- TABLE 105 NORTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY FIBER TYPE, 2022–2027 (USD MILLION)

- TABLE 106 NORTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY FIBER TYPE, 2022–2027 (KILOTON)

- TABLE 107 NORTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY MANUFACTURING PROCESS, 2019–2021 (USD MILLION)

- TABLE 108 NORTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY MANUFACTURING PROCESS, 2019–2021 (KILOTON)

- TABLE 109 NORTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY MANUFACTURING PROCESS, 2022–2027 (USD MILLION)

- TABLE 110 NORTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY MANUFACTURING PROCESS, 2022–2027 (KILOTON)

- TABLE 111 NORTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY RESIN TYPE, 2019–2021 (USD MILLION)

- TABLE 112 NORTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY RESIN TYPE, 2019–2021 (KILOTON)

- TABLE 113 NORTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY RESIN TYPE, 2022–2027 (USD MILLION)

- TABLE 114 NORTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY RESIN TYPE, 2022–2027 (KILOTON)

- TABLE 115 NORTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 116 NORTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 117 NORTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 118 NORTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 119 NORTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 120 NORTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY COUNTRY, 2019–2021 (KILOTON)

- TABLE 121 NORTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 122 NORTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY COUNTRY, 2022–2027 (KILOTON)

- TABLE 123 US: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 124 US: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 125 US: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 126 US: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 127 CANADA: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 128 CANADA: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 129 CANADA: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 130 CANADA: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 131 MEXICO: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 132 MEXICO: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 133 MEXICO: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 134 MEXICO: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 135 EUROPE: LONG FIBER THERMOPLASTICS MARKET, BY FIBER TYPE, 2019–2021 (USD MILLION)

- TABLE 136 EUROPE: LONG FIBER THERMOPLASTICS MARKET, BY FIBER TYPE, 2019–2021 (KILOTON)

- TABLE 137 EUROPE: LONG FIBER THERMOPLASTICS MARKET, BY FIBER TYPE, 2022–2027 (USD MILLION)

- TABLE 138 EUROPE: LONG FIBER THERMOPLASTICS MARKET, BY FIBER TYPE, 2022–2027 (KILOTON)

- TABLE 139 EUROPE: LONG FIBER THERMOPLASTICS MARKET, BY MANUFACTURING PROCESS, 2019–2021 (USD MILLION)

- TABLE 140 EUROPE: LONG FIBER THERMOPLASTICS MARKET, BY MANUFACTURING PROCESS, 2019–2021 (KILOTON)

- TABLE 141 EUROPE: LONG FIBER THERMOPLASTICS MARKET, BY MANUFACTURING PROCESS, 2022–2027 (USD MILLION)

- TABLE 142 EUROPE: LONG FIBER THERMOPLASTICS MARKET, BY MANUFACTURING PROCESS, 2022–2027 (KILOTON)

- TABLE 143 EUROPE: LONG FIBER THERMOPLASTICS MARKET, BY RESIN TYPE, 2019–2021 (USD MILLION)

- TABLE 144 EUROPE: LONG FIBER THERMOPLASTICS MARKET, BY RESIN TYPE, 2019–2021 (KILOTON)

- TABLE 145 EUROPE: LONG FIBER THERMOPLASTICS MARKET, BY RESIN TYPE, 2022–2027 (USD MILLION)

- TABLE 146 EUROPE: LONG FIBER THERMOPLASTICS MARKET, BY RESIN TYPE, 2022–2027 (KILOTON)

- TABLE 147 EUROPE: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 148 EUROPE: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 149 EUROPE: LONG FIBER THERMOPLASTICS MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 150 EUROPE: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 151 EUROPE: LONG FIBER THERMOPLASTICS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 152 EUROPE: LONG FIBER THERMOPLASTICS MARKET, BY COUNTRY, 2019–2021 (KILOTON)

- TABLE 153 EUROPE: LONG FIBER THERMOPLASTICS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 154 EUROPE: LONG FIBER THERMOPLASTICS MARKET, BY COUNTRY, 2022–2027 (KILOTON)

- TABLE 155 GERMANY: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 156 GERMANY: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 157 GERMANY: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 158 GERMANY: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 159 FRANCE: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 160 FRANCE: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 161 FRANCE: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 162 FRANCE: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 163 UK: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 164 UK: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 165 UK: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 166 UK: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 167 ITALY: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 168 ITALY: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 169 ITALY: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 170 ITALY: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 171 REST OF EUROPE: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 172 REST OF EUROPE: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 173 REST OF EUROPE: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 174 REST OF EUROPE: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 175 ASIA PACIFIC: LONG FIBER THERMOPLASTICS MARKET, BY FIBER TYPE, 2019–2021 (USD MILLION)

- TABLE 176 ASIA PACIFIC: LONG FIBER THERMOPLASTICS MARKET, BY FIBER TYPE, 2019–2021 (KILOTON)

- TABLE 177 ASIA PACIFIC: LONG FIBER THERMOPLASTICS MARKET, BY FIBER TYPE, 2022–2027 (USD MILLION)

- TABLE 178 ASIA PACIFIC: LONG FIBER THERMOPLASTICS MARKET, BY FIBER TYPE, 2022–2027 (KILOTON)

- TABLE 179 ASIA PACIFIC: LONG FIBER THERMOPLASTICS MARKET, BY MANUFACTURING PROCESS, 2019–2021 (USD MILLION)

- TABLE 180 ASIA PACIFIC: LONG FIBER THERMOPLASTICS MARKET, BY MANUFACTURING PROCESS, 2019–2021 (KILOTON)

- TABLE 181 ASIA PACIFIC: LONG FIBER THERMOPLASTICS MARKET, BY MANUFACTURING PROCESS, 2022–2027 (USD MILLION)

- TABLE 182 ASIA PACIFIC: LONG FIBER THERMOPLASTICS MARKET, BY MANUFACTURING PROCESS, 2022–2027 (KILOTON)

- TABLE 183 ASIA PACIFIC: LONG FIBER THERMOPLASTICS MARKET, BY RESIN TYPE, 2019–2021 (USD MILLION)

- TABLE 184 ASIA PACIFIC: LONG FIBER THERMOPLASTICS MARKET, BY RESIN TYPE, 2019–2021 (KILOTON)

- TABLE 185 ASIA PACIFIC: LONG FIBER THERMOPLASTICS MARKET, BY RESIN TYPE, 2022–2027 (USD MILLION)

- TABLE 186 ASIA PACIFIC: LONG FIBER THERMOPLASTICS MARKET, BY RESIN TYPE, 2022–2027 (KILOTON)

- TABLE 187 ASIA PACIFIC: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 188 ASIA PACIFIC: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 189 ASIA PACIFIC: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 190 ASIA PACIFIC: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 191 ASIA PACIFIC: LONG FIBER THERMOPLASTICS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 192 ASIA PACIFIC: LONG FIBER THERMOPLASTICS MARKET, BY COUNTRY, 2019–2021 (KILOTON)

- TABLE 193 ASIA PACIFIC: LONG FIBER THERMOPLASTICS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 194 ASIA PACIFIC: LONG FIBER THERMOPLASTICS MARKET, BY COUNTRY, 2022–2027 (KILOTON)

- TABLE 195 CHINA: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 196 CHINA: LONG FIBER THERMOPLASTICS MARKET, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 197 CHINA: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 198 CHINA: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 199 JAPAN: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 200 JAPAN: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 201 JAPAN: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 202 JAPAN: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 203 INDIA: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 204 INDIA: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 205 INDIA: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 206 INDIA: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 207 SOUTH KOREA: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 208 SOUTH KOREA: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 209 SOUTH KOREA: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 210 SOUTH KOREA: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 211 REST OF ASIA PACIFIC: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 212 REST OF ASIA PACIFIC: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 213 REST OF ASIA PACIFIC: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 214 REST OF ASIA PACIFIC: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 215 MIDDLE EAST & AFRICA: LONG FIBER THERMOPLASTICS MARKET, BY FIBER TYPE, 2019–2021 (USD MILLION)

- TABLE 216 MIDDLE EAST & AFRICA: LONG FIBER THERMOPLASTICS MARKET, BY FIBER TYPE, 2019–2021 (KILOTON)

- TABLE 217 MIDDLE EAST & AFRICA: LONG FIBER THERMOPLASTICS MARKET, BY FIBER TYPE, 2022–2027 (USD MILLION)

- TABLE 218 MIDDLE EAST & AFRICA: LONG FIBER THERMOPLASTICS MARKET, BY FIBER TYPE, 2022–2027 (KILOTON)

- TABLE 219 MIDDLE EAST & AFRICA: LONG FIBER THERMOPLASTICS MARKET, BY MANUFACTURING PROCESS, 2019–2021 (USD MILLION)

- TABLE 220 MIDDLE EAST & AFRICA: LONG FIBER THERMOPLASTICS MARKET, BY MANUFACTURING PROCESS, 2019–2021 (KILOTON)

- TABLE 221 MIDDLE EAST & AFRICA: LONG FIBER THERMOPLASTICS MARKET, BY MANUFACTURING PROCESS, 2022–2027 (USD MILLION)

- TABLE 222 MIDDLE EAST & AFRICA: LONG FIBER THERMOPLASTICS MARKET, BY MANUFACTURING PROCESS, 2022–2027 (KILOTON)

- TABLE 223 MIDDLE EAST & AFRICA: LONG FIBER THERMOPLASTICS MARKET, BY RESIN TYPE, 2019–2021 (USD MILLION)

- TABLE 224 MIDDLE EAST & AFRICA: LONG FIBER THERMOPLASTICS MARKET, BY RESIN TYPE, 2019–2021 (KILOTON)

- TABLE 225 MIDDLE EAST & AFRICA: LONG FIBER THERMOPLASTICS MARKET, BY RESIN TYPE, 2022–2027 (USD MILLION)

- TABLE 226 MIDDLE EAST & AFRICA: LONG FIBER THERMOPLASTICS MARKET, BY RESIN TYPE, 2022–2027 (KILOTON)

- TABLE 227 MIDDLE EAST & AFRICA: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 228 MIDDLE EAST & AFRICA: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 229 MIDDLE EAST & AFRICA: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 230 MIDDLE EAST & AFRICA: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 231 MIDDLE EAST & AFRICA: LONG FIBER THERMOPLASTICS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 232 MIDDLE EAST & AFRICA: LONG FIBER THERMOPLASTICS MARKET, BY COUNTRY, 2019–2021 (KILOTON)

- TABLE 233 MIDDLE EAST & AFRICA: LONG FIBER THERMOPLASTICS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 234 MIDDLE EAST & AFRICA: LONG FIBER THERMOPLASTICS MARKET, BY COUNTRY, 2022–2027 (KILOTON)

- TABLE 235 UAE: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 236 UAE: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 237 UAE: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 238 UAE: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 239 SAUDI ARABIA: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 240 SAUDI ARABIA: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 241 SAUDI ARABIA: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 242 SAUDI ARABIA: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 243 REST OF MIDDLE EAST & AFRICA: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 244 REST OF MIDDLE EAST & AFRICA: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 245 REST OF MIDDLE EAST & AFRICA: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 246 REST OF MIDDLE EAST & AFRICA: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 247 SOUTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY FIBER TYPE, 2019–2021 (USD MILLION)

- TABLE 248 SOUTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY FIBER TYPE, 2019–2021 (KILOTON)

- TABLE 249 SOUTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY FIBER TYPE, 2022–2027 (USD MILLION)

- TABLE 250 SOUTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY FIBER TYPE, 2022–2027 (KILOTON)

- TABLE 251 SOUTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY MANUFACTURING PROCESS, 2019–2021 (USD MILLION)

- TABLE 252 SOUTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY MANUFACTURING PROCESS, 2019–2021 (KILOTON)

- TABLE 253 SOUTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY MANUFACTURING PROCESS, 2022–2027 (USD MILLION)

- TABLE 254 SOUTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY MANUFACTURING PROCESS, 2022–2027 (KILOTON)

- TABLE 255 SOUTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY RESIN TYPE, 2019–2021 (USD MILLION)

- TABLE 256 SOUTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY RESIN TYPE, 2019–2021 (KILOTON)

- TABLE 257 SOUTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY RESIN TYPE, 2022–2027 (USD MILLION)

- TABLE 258 SOUTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY RESIN TYPE, 2022–2027 (KILOTON)

- TABLE 259 SOUTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 260 SOUTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 261 SOUTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 262 SOUTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 263 SOUTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 264 SOUTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY COUNTRY, 2019–2021 (KILOTON)

- TABLE 265 SOUTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 266 SOUTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY COUNTRY, 2022–2027 (KILOTON)

- TABLE 267 BRAZIL: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 268 BRAZIL: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 269 BRAZIL: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 270 BRAZIL: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 271 ARGENTINA: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 272 ARGENTINA: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 273 ARGENTINA: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 274 ARGENTINA: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 275 REST OF SOUTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 276 REST OF SOUTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 277 REST OF SOUTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 278 REST OF SOUTH AMERICA: LONG FIBER THERMOPLASTICS MARKET, BY END USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 279 DEGREE OF COMPETITION: LONG FIBER THERMOPLASTICS MARKET

- TABLE 280 LONG FIBER THERMOPLASTICS MARKET: DEALS, 2017–2022

- TABLE 281 LONG FIBER THERMOPLASTICS MARKET: OTHER DEVELOPMENTS, 2017–2022

- TABLE 282 LONG FIBER THERMOPLASTICS MARKET: NEW PRODUCT DEVELOPMENTS, 2017–2022

- TABLE 283 COMPANY PRODUCT FOOTPRINT

- TABLE 284 COMPANY END USE INDUSTRY FOOTPRINT

- TABLE 285 COMPANY REGION FOOTPRINT

- TABLE 286 CELANESE CORPORATION: COMPANY OVERVIEW

- TABLE 287 SABIC: COMPANY OVERVIEW

- TABLE 288 LANXESS AG: COMPANY OVERVIEW

- TABLE 289 BASF SE: COMPANY OVERVIEW

- TABLE 290 MITSUBISHI CHEMICAL GROUP CORPORATION: COMPANY OVERVIEW

- TABLE 291 AVIENT CORPORATION: COMPANY OVERVIEW

- TABLE 292 DAICEL POLYMER LTD.: COMPANY OVERVIEW

- TABLE 293 ASAHI KASEI CORPORATION: COMPANY OVERVIEW

- TABLE 294 RTP COMPANY, INC.: COMPANY OVERVIEW

- TABLE 295 SOLVAY SA: COMPANY OVERVIEW

- TABLE 296 SBHPP: COMPANY OVERVIEW

- TABLE 297 TECHNOCOMPOUND GMBH: COMPANY OVERVIEW

- TABLE 298 DIEFFENBACHER: COMPANY OVERVIEW

- TABLE 299 KINGFA: COMPANY OVERVIEW

- TABLE 300 SAMBARK LFT CO., LTD.: COMPANY OVERVIEW

- TABLE 301 TORAY INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 302 SUMITOMO CHEMICAL COMPANY LTD.: COMPANY OVERVIEW

- FIGURE 1 LONG FIBER THERMOPLASTICS MARKET SEGMENTATION

- FIGURE 2 LONG FIBER THERMOPLASTICS MARKET: RESEARCH DESIGN

- FIGURE 3 LONG FIBER THERMOPLASTICS MARKET: RESEARCH APPROACH

- FIGURE 4 LONG FIBER THERMOPLASTICS MARKET: BOTTOM-UP APPROACH

- FIGURE 5 LONG FIBER THERMOPLASTICS MARKET: TOP-DOWN APPROACH

- FIGURE 6 LONG FIBER THERMOPLASTICS MARKET: DATA TRIANGULATION

- FIGURE 7 GLASS FIBER LONG FIBER THERMOPLASTICS DOMINATED MARKET IN 2021

- FIGURE 8 PP ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

- FIGURE 9 INJECTION MOLDING PROCESS EXHIBITED LARGEST MARKET SHARE IN 2021

- FIGURE 10 AUTOMOTIVE INDUSTRY TO WITNESS HIGHEST MARKET GROWTH BETWEEN 2022 AND 2027

- FIGURE 11 EUROPE EXPERIENCED HIGHEST GROWTH IN LONG FIBER THERMOPLASTICS MARKET IN 2021

- FIGURE 12 SIGNIFICANT GROWTH EXPECTED IN LONG FIBER THERMOPLASTICS MARKET BETWEEN 2022 AND 2027

- FIGURE 13 GLASS LONG FIBER THERMOPLASTICS SEGMENT REGISTERED HIGHEST MARKET SHARE IN 2021

- FIGURE 14 PP-BASED LONG FIBER THERMOPLASTICS SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

- FIGURE 15 INJECTION MOLDING CONTRIBUTED HIGHEST SHARE TO MANUFACTURING PROCESS SEGMENT IN 2021

- FIGURE 16 AUTOMOTIVE INDUSTRY DOMINATED MARKET IN TERMS OF VALUE IN 2021

- FIGURE 17 EUROPE SHOWED HIGHEST MARKET SHARE (VOLUME) IN 2021

- FIGURE 18 CHINA TO BE FASTEST-GROWING LONG FIBER THERMOPLASTICS MARKET DURING FORECAST PERIOD

- FIGURE 19 LONG FIBER THERMOPLASTICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 LONG FIBER THERMOPLASTICS MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END USE INDUSTRIES

- FIGURE 22 KEY BUYING CRITERIA FOR TOP 3 END USE INDUSTRIES

- FIGURE 23 VALUE CHAIN ANALYSIS: LONG FIBER THERMOPLASTICS MARKET

- FIGURE 24 AVERAGE SELLING PRICES OF KEY PLAYERS FOR FIBER TYPES (USD/KG)

- FIGURE 25 AVERAGE SELLING PRICES FOR DIFFERENT MANUFACTURING PROCESSES (USD/KG)

- FIGURE 26 AVERAGE SELLING PRICES BASED ON RESIN TYPE (USD/KG)

- FIGURE 27 AVERAGE SELLING PRICES BASED ON END USE INDUSTRY (USD/KG)

- FIGURE 28 GLOBAL PATENT ANALYSIS, BY DOCUMENT TYPE

- FIGURE 29 GLOBAL PATENT PUBLICATION TREND ANALYSIS: LAST 10 YEARS

- FIGURE 30 LONG FIBER THERMOPLASTICS MARKET: LEGAL STATUS OF PATENTS

- FIGURE 31 GLOBAL JURISDICTION ANALYSIS

- FIGURE 32 ARKEMA ACCOUNTED FOR HIGHEST NUMBER OF PATENTS

- FIGURE 33 PP RESIN TO DOMINATE LONG FIBER THERMOPLASTICS MARKET FROM 2022 TO 2027

- FIGURE 34 EUROPE TO BE LARGEST POLYPROPYLENE LONG FIBER THERMOPLASTICS MARKET DURING FORECAST PERIOD

- FIGURE 35 ASIA PACIFIC TO BE DOMINANT POLYAMIDE LONG FIBER THERMOPLASTICS MARKET (2022–2027)

- FIGURE 36 EUROPE TO WITNESS LARGEST MARKET SHARE IN PEEK SEGMENT DURING FORECAST PERIOD

- FIGURE 37 ASIA PACIFIC TO HAVE LARGEST MARKET SHARE IN POLYAMIDE LONG FIBER THERMOPLASTICS MARKET (2022–2027)

- FIGURE 38 GLASS FIBER SEGMENT TO DOMINATE LONG FIBER THERMOPLASTICS MARKET DURING FORECAST PERIOD

- FIGURE 39 DEMAND FOR GLASS LONG FIBER THERMOPLASTICS TO BE HIGHEST IN ASIA PACIFIC FROM 2022 TO 2027

- FIGURE 40 ASIA PACIFIC EXPECTED TO HOLD LARGEST MARKET SHARE OF CARBON LONG FIBER THERMOPLASTICS MARKET DURING FORECAST PERIOD

- FIGURE 41 NORTH AMERICA TO ACCOUNT FOR HIGHER MARKET SHARE IN FIBER TYPE MARKET (2022–2027)

- FIGURE 42 INJECTION MOLDING TO DOMINATE LONG FIBER THERMOPLASTICS MARKET (2022–2027)

- FIGURE 43 HIGHEST DEMAND FOR GLASS FIBER TYPE TO BE EXPECTED IN ASIA PACIFIC FROM 2022 TO 2027

- FIGURE 44 ASIA PACIFIC TO HAVE DOMINANT MARKET SHARE FOR CARBON LONG FIBER THERMOPLASTICS DURING FORECAST PERIOD

- FIGURE 45 NORTH AMERICA TO BE LARGEST OTHER FIBER TYPE LONG FIBER THERMOPLASTICS MARKET

- FIGURE 46 AUTOMOTIVE INDUSTRY TO REGISTER HIGHEST MARKET SHARE IN LONG FIBER THERMOPLASTICS MARKET

- FIGURE 47 EUROPE TO HOLD MAJOR MARKET SHARE OF AUTOMOTIVE INDUSTRY DURING FORECAST PERIOD

- FIGURE 48 ASIA PACIFIC TO HAVE HIGHEST SHARE OF ELECTRICAL & ELECTRONICS SEGMENT (2022–2027)

- FIGURE 49 NORTH AMERICA TO HAVE LARGEST MARKET SHARE IN CONSUMER GOODS SEGMENT DURING FORECAST PERIOD

- FIGURE 50 NORTH AMERICA TO REGISTER HIGHEST MARKET SHARE OF SPORTING GOODS SEGMENT FROM 2022 TO 2027

- FIGURE 51 GERMANY TO BE FASTEST-GROWING LONG FIBER THERMOPLASTICS MARKET DURING FORECAST PERIOD

- FIGURE 52 NORTH AMERICA: LONG FIBER THERMOPLASTICS MARKET SNAPSHOT

- FIGURE 53 EUROPE: LONG FIBER THERMOPLASTICS MARKET SNAPSHOT

- FIGURE 54 ASIA PACIFIC: LONG FIBER THERMOPLASTICS MARKET SNAPSHOT

- FIGURE 55 MARKET SHARE OF TOP COMPANIES IN LONG FIBER THERMOPLASTICS MARKET

- FIGURE 56 RANKING OF TOP FIVE PLAYERS IN LONG FIBER THERMOPLASTICS MARKET

- FIGURE 57 LONG FIBER THERMOPLASTICS MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2020

- FIGURE 58 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN LONG FIBER THERMOPLASTICS MARKET

- FIGURE 59 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN LONG FIBER THERMOPLASTICS MARKET

- FIGURE 60 LONG FIBER THERMOPLASTICS MARKET: SMALL AND MEDIUM-SIZED ENTERPRISES MAPPING, 2020

- FIGURE 61 CELANESE CORPORATION: COMPANY SNAPSHOT

- FIGURE 62 SABIC: COMPANY SNAPSHOT

- FIGURE 63 LANXESS AG: COMPANY SNAPSHOT

- FIGURE 64 BASF SE: COMPANY SNAPSHOT

- FIGURE 65 MITSUBISHI CHEMICAL GROUP CORPORATION: COMPANY SNAPSHOT

- FIGURE 66 AVIENT CORPORATION: COMPANY SNAPSHOT

- FIGURE 67 ASAHI KASEI CORPORATION: COMPANY SNAPSHOT

- FIGURE 68 SOLVAY SA: COMPANY SNAPSHOT

The study involved two major activities in estimating the current size of the long fiber thermoplastics market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation procedures were used to determine the extent of market segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva were referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The Long Fiber Thermoplastics Industry comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of mainly the transportation, wind energy, aerospace & defense, construction & infrastructure end-use industries. Advancements in technology and diverse applications in various end-use industries describe the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

Notes: Tiers of companies are selected based on their ownership and revenues in 2020.

Others include sales managers, marketing managers, and product managers.

Source: Secondary Research, Expert Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total long fiber thermoplastics market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall long fiber thermoplastics market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the whole market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, mainly from the automotive, aerospace & defense, consumer goods, electrical & electronics end-use industries.

Report Objectives

- To define, describe, and forecast the size of the long fiber thermoplastics market, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze and forecast the market based on resin type, fiber type, manufacturing process, and end-use industry

- To analyze and project the market based on five regions, namely, Europe, North America, Asia Pacific (APAC), the Middle East & Africa (MEA), and South America

- To strategically analyze the micromarkets concerning individual growth trends, prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of Rest of APAC long fiber thermoplastics market

- Further breakdown of Rest of Europe long fiber thermoplastics market

- Further breakdown of Rest of NA long fiber thermoplastics market

- Further breakdown of Rest of MEA long fiber thermoplastics market

- Further breakdown of Rest of South American long fiber thermoplastics market

Company Information

- Detailed analysis and profiling of additional market players (up to 10)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Long Fiber Thermoplastics Market

Does this report cover the unidirectional continuous thermoplastic fiberglass tape/sheet? Not pelletized LFT for injection molding?