Low Power Wide Area Network Market by Connectivity Technology (SIGFOX, LoRaWAN, Weigthless and Others), Technology Service, Network Deployment, Application, Verticals and Region - Global Forecast to 2021

[121 Pages Report] MarketsandMarkets predicts the global Low Power Wide Area Network market to grow from USD 1.01 Billion in 2016 to USD 24.46 Billion by 2021, at a Compound Annual Growth Rate (CAGR) of 89.3%. 2015 has been considered as the base year while the forecast period is 2016-2021.

This report aims to estimate the market size and future growth potential of the LPWAN market across different segments such as connectivity technologies, technology services, network deployments, applications, verticals, and regions. The report aims to analyze each sub-segment with respect to individual growth trends and contribution towards the overall market and to provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry specific challenges). The aim is to deliver competitive intelligence from market analysis and devise revenue growth strategies from the market size and forecast statistics.

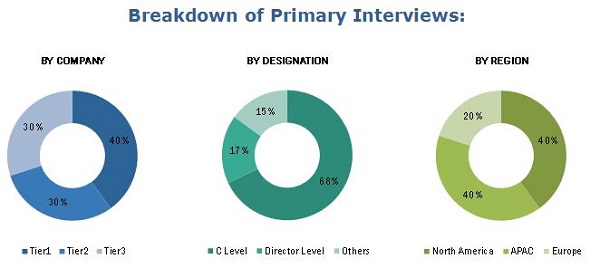

Top-down and bottom-up approaches were used to estimate and validate the size of the global Low Power Wide Area Network market and to estimate the size of various other dependent subsegments. The key players in the market were identified through secondary research and their market shares in respective regions were determined through primary and secondary research. This entire procedure includes the study of annual and financial reports of top market players and extensive interviews for key insights from industry leaders. All percentage shares, splits, and breakdowns were determined by using secondary sources and verified through primary sources. All possible parameters that affect the market are covered in this research study, have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added with detailed inputs. The breakdown of profiles of primary discussion with the participants is depicted in the below figure: Extensive interviews with key people such as CEOs, VPs, directors, and executives were conducted.

To know about the assumptions considered for the study, download the pdf brochure

The LPWAN ecosystem comprises analytics vendors, such as Semtech Corporation (California), LORIOT (Switzerland), NWave Technologies (London), SIGFOX (France), WAVIoT (Texas), Actility (France), Ingenu (San Diego), Link Labs (Maryland), Weightless SIG, and Senet, Inc. (Portsmouth), and various others such as service providers and enterprises. Other stakeholders of the Low Power Wide Area Network market include telecom operators such as Vodafone (U.K.) and Orange (France), among others who integrate these smart devices and sell them to end users to cater to their unique business requirements.

Key Target Audience For Low Power Wide Area Network Market

- LPWAN Solution Providers

- Telecom Operators

- Mobile Network Operators (MNOs)

- Mobile Service Providers

- OEMs

- Solution Providers

Scope of the Low Power Wide Area Network Market Report

|

Report Metrics |

Details |

|

Market size available for years |

2016–2021 |

|

Base year considered |

2015 |

|

Forecast period |

2016–2021 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Connectivity Technology, Technology Service, Network Deployment, Application, Verticals and Region |

|

Geographies covered |

North America, Europe, MEA, APAC and Latin America |

|

Companies covered |

Semtech Corporation (California), LORIOT (Switzerland), NWave Technologies (London), SIGFOX (France), WAVIoT (Texas), Actility (France), Ingenu (San Diego), Link Labs (Maryland), Weightless SIG, and Senet, Inc. (Portsmouth). |

The research report categorizes the market to forecast the revenues and analyze the trends in each of the following sub-markets:

On the basis of Connectivity Technologies:

- SIGFOX

- LoRaWAN

- Weightless

- Others

On the basis of Technology Services:

- Managed Services

- Professional Services

On the basis of Network Deployments:

- Public Sector

- Private Sector

Low Power Wide Area Network Market By Applications

- Smart Waste Management

- Smart Buildings

- Smart Gas and Water Metering

- Smart Streetlights

- Smart Parking

- Livestock Monitoring

- Others

On the basis of Verticals:

- Agriculture

- Smart Logistic and Transportation

- Healthcare

- Industrial Manufacturing

- Oil and Gas

- Consumer Electronics

- Others

On the basis of Regions:

- North America

- Europe

- Asia-Pacific (APAC)

- Middle East & Africa (MEA)

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Product matrix, which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Further breakdown of the North American market into the U.S. and Canada

Further breakdown of the APAC market into India, China, and others

Company Information

Detailed analysis and profiling of additional market players (up to five)

Also early buyers will receive 10% customization on the Low Power Wide Area Network market report or other related report. Under customization, further segmentation of regions into different countries can be provided.

The Low Power Wide Area Network (LPWAN) market size is expected to grow from USD 1.01 Billion in 2016 to USD 24.46 Billion by 2021, at an estimated Compound Annual Growth Rate (CAGR) of 89.3% during the forecast period. Major growth drivers of the LPWAN market are increasing adoption of IoT/M2M devices, rising need of long range connectivity between these devices, and low power and low cost of LPWAN technologies. These factors are expected to shape the future of the Low Power Wide Area Network market.

The LPWAN technology market in this report has been defined as the summation of spending on SIGFOX, LoRaWAN, Weightless, and others that include Neul, Nwave, Random Phase Multiple Access (RPMA), and NB-IOT. Given the immediate need for LPWAN in IoT deployments, multiple connectivity technologies have emerged offering the right balance of bandwidth, battery life, power consumption, and distance range and the right cost.

The market consists of professional services and managed services. The increasing integration of IoT and Machine-to-Machine (M2M) across various industries is expected to remain the primary driver for the growth of market. Managed services are expected to grow at a higher CAGR. These managed service providers leverage partnerships with prime satellite and mobile networks to offer high-end managed services to application providers, system integrators, and end user clients.

The LPWAN network deployment market in this report has been defined as the summation of spending by public sector and private sector. Private sector is expected to occupy a larger share of the market while public sector is expected grow at a higher CAGR. Municipal authorities are focusing on developing their public infrastructures such as smart cities to improve citywide services like trash, parking, streetlights, water meters and leak detectors, and more.

Application in smart gas and water metering is expected to witness the highest growth rate. Smart meter rollouts represents a paradigm shift to understand the energy consumption at all the levels in the power grid. The mass adoption of LPWAN technology will promote greater standardization between different smart meter manufacturers and vendors.

The Low Power Wide Area Network market in the oil and gas vertical is expected to witness wide adoption. The implementation of the technology will offer overall plant automation, process optimization, supply chain optimization, increased safety, integrated business processes, and corporate social responsibility.

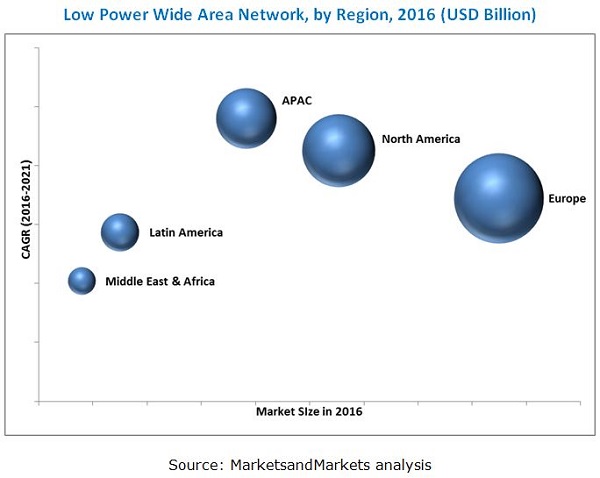

The global LPWAN market has been segmented on the basis of regions into North America, Asia Pacific (APAC), Europe, Middle East and Africa (MEA), and Latin America to provide a region-specific analysis in the report. Europe occupies the largest share in the market while APAC is expected to grow with the highest CAGR. China, Japan, India, and Australia are the most potential countries adopting M2M communication applications. A sweeping change has transformed the wireless M2M communication modules industry in the past years in the region.

The Low Power Wide Area Network market faces challenges such as lack of governance and privacy and security concerns. LPWAN uses open standards and hence deployment of LPWAN is expected to become easy. However, open standards for LPWAN are projected as a risk factor due to the privacy intrusion. Open standards of M2M communication through LPWAN are likely to upsurge the threat of confidentiality interference.

Major vendors that offer LPWAN technologies are Semtech Corporation (California), LORIOT (Switzerland), NWave Technologies (London), SIGFOX (France), WAVIoT (Texas), Actility (France), Ingenu (San Diego), Link Labs (Maryland), Weightless SIG, and Senet, Inc. (Portsmouth). The dominant players in the market include Semtech, NWave, SIGFOX and WAVIoT. The companies have adopted different types of organic and inorganic growth strategies such as new product launches, partnerships and collaborations, and mergers and acquisitions to expand their offerings in the Low Power Wide Area Network market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.3.1 Assumptions

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 27)

4.1 Attractive Market Opportunities in the Market

4.2 Global Market – By Connectivity Technology

4.3 Global LPWAN Market

4.4 Lifecycle Analysis, By Region 2016

4.5 Market, By Region

4.6 LPWAN Region Wise Adoption Scenario

5 Low Power Wide Area Network Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Connectivity Technology

5.2.2 By Technology Service

5.2.3 By Network Deployment

5.2.4 By Application

5.2.5 By Vertical

5.2.6 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Rising Need of Long Range Connectivity Between Devices

5.3.1.2 Increasing Adoption of Iot/M2m Applications

5.3.1.3 Low Power Consumption

5.3.1.4 Low Cost of LPWAN Technology

5.3.2 Restraints

5.3.2.1 High Data Traffic

5.3.2.2 Lack of Governance

5.3.2.3 Privacy and Security Concerns

5.3.3 Opportunities

5.3.3.1 Rising Need of Connectivity in Large Enterprises and Smes

5.3.3.2 Emerging Smart Cities and Smart Buildings

5.3.3.3 Deployment of Intelligent Devices

5.3.4 Challenges

5.3.4.1 Lack of Universal LPWAN Standards

6 Low Power Wide Area Network Market: Industry Trends (Page No. - 39)

6.1 Introduction

6.2 Evolution

6.3 Value Chain Analysis

6.4 Strategic Benchmarking

7 Low Power Wide Area Network Market Analysis, By Connectivity Technology (Page No. - 42)

7.1 Introduction

7.2 Sigfox

7.3 Lorawan

7.4 Weigthless

7.5 Others

8 Market Analysis, By Technology Service (Page No. - 48)

8.1 Introduction

8.2 Professional Services

8.3 Managed Services

9 Market Analysis, By Network Deployment (Page No. - 52)

9.1 Introduction

9.2 Private Sector

9.3 Public Sector

10 Low Power Wide Area Network Market Analysis, By Application (Page No. - 55)

10.1 Introduction

10.2 Smart Waste Management

10.3 Smart Bulidings

10.4 Smart Gas and Water Metering

10.5 Smart Parking

10.6 Smart Streetlight

10.7 Livestock Monitoring

10.8 Others

11 Low Power Wide Area Network Market Analysis, By Vertical (Page No. - 62)

11.1 Introduction

11.2 Agriculture

11.3 Logistics and Transportation

11.4 Healthcare

11.5 Industrial Manufacturing

11.6 Oil and Gas

11.7 Consumer Electronics

11.8 Others

12 Geographic Analysis (Page No. - 70)

12.1 Introduction

12.2 North America

12.3 Europe

12.4 Asia-Pacific

12.5 Middle East and Africa

12.6 Latin America

13 Competitive Landscape (Page No. - 88)

13.1 Overview

13.2 Competitive Situation and Trends

13.2.1 New Product Launches and Enhancements

13.2.2 Partnerships, Agreements and Collaborations

13.2.3 Mergers and Acquisitions

13.2.4 Integration and Expansions

14 Company Profiles (Page No. - 94)

(Overview, Products & Services, Strategies & Insights, Developments and MnM View)*

14.1 Semtech Corporation

14.2 Loriot

14.3 Nwave Technologies

14.4 Sigfox

14.5 Waviot

14.6 Actility

14.7 Ingenu

14.8 Link Labs, Inc.

14.9 Weightless SIG

14.10 Senet, Inc.

*Details on Overview, Products & Services, Strategies & Insights, Developments and MnM View Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 114)

15.1 Industry Experts

15.2 Discussion Guide

15.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.4 Introducing RT: Real-Time Market Ntelligence

15.5 Related Reports

List of Tables (58 Tables)

Table 1 Global Low Power Wide Area Network Market Size and Growth Rate,2014-2021 (USD Million, Y-O-Y %)

Table 2 Market Size, By Connectivity Technology,2014-2021 (USD Million)

Table 3 Sigfox: Market Size, By Region, 2014-2021 (USD Million)

Table 4 LoRaWAN: Market Size, By Region, 2014-2021 (USD Million)

Table 5 Weightless: Market Size, By Region, 2014-2021 (USD Million)

Table 6 Others: Market Size, By Region, 2014-2021 (USD Million)

Table 7 LPWAN Market Size, By Technology Service, 2014-2021 (USD Million)

Table 8 Professional Services: Market Size, By Region,2014-2021 (USD Million)

Table 9 Managed Services: Market Size, By Region,2014-2021 (USD Million)

Table 10 Low Power Wide Area Network Market Size, By Network Deployment, 2014-2021 (USD Million)

Table 11 Private Sector: Market Size, By Region, 2014-2021 (USD Million)

Table 12 Public Sector: Market Size, By Region, 2016-2021 (USD Million)

Table 13 Market Size, By Application, 2014-2021 (USD Million)

Table 14 Smart Waste Management: Market Size, By Region,2014-2021 (USD Million)

Table 15 Smart Buildings: Market Size, By Region, 2014-2021 (USD Million)

Table 16 Smart Gas and Water Metering: Market Size, By Region,2014-2021 (USD Million)

Table 17 Smart Parking: Market Size, By Region, 2014-2021 (USD Million)

Table 18 Smart Streetlight: Market Size, By Region,2014-2021 (USD Million)

Table 19 Livestock Monitoring: Market Size, By Region,2014-2021 (USD Million)

Table 20 Others: Market Size, By Region, 2014-2021 (USD Million)

Table 21 Low Power Wide Area Network Market Size, By Vertical, 2014-2021 (USD Million)

Table 22 Agriculture: Market Size, By Region, 2014-2021 (USD Million)

Table 23 Logistics and Transportation: Market Size, By Region,2014-2021 (USD Million)

Table 24 Healthcare: Market Size, By Region, 2014-2021 (USD Million)

Table 25 Industrial Manufacturing: LPWAN Market Size, By Region,2014-2021 (USD Million)

Table 26 Oil and Gas: Market Size, By Region, 2014-2021 (USD Million)

Table 27 Consumer Electronics: Market Size, By Region,2014-2021 (USD Million)

Table 28 Others: Market Size, By Region, 2014-2021 (USD Million)

Table 29 Low Power Wide Area Network Market Size, By Region, 2014-2021 (USD Million)

Table 30 North America: Market Size, By Connectivity Technology,2014-2021 (USD Million)

Table 31 North America: Market Size, By Technology Service,2014-2021 (USD Million)

Table 32 North America: Market Size, By Network Deployment,2014-2021 (USD Million)

Table 33 North America: LPWAN Market Size, By Application,2014-2021 (USD Million)

Table 34 North America: Market Size, By Verticals,2014-2021 (USD Million)

Table 35 Europe: Market Size, By Connectivity Technology,2014-2021 (USD Million)

Table 36 Europe: Market Size, By Technology Service,2014-2021 (USD Million)

Table 37 Europe: Market Size, By Network Deployment,2014-2021 (USD Million)

Table 38 Europe: Market Size, By Application, 2014-2021 (USD Million)

Table 39 Europe: Market Size, By Vertical, 2014-2021 (USD Million)

Table 40 Asia-Pacific: Market Size, By Connectivity Technology,2014-2021 (USD Million)

Table 41 Asia-Pacific: Market Size, By Technology Service,2014-2021 (USD Million)

Table 42 Asia-Pacific: LPWAN Market Size, By Network Deployment,2014-2021 (USD Million)

Table 43 Asia-Pacific: Market Size, By Application, 2014-2021 (USD Million)

Table 44 Asia-Pacific: Market Size, By Vertical, 2014-2021 (USD Million)

Table 45 Middle East and Africa: Market Size, By Connectivity Technology, 2014-2021 (USD Million)

Table 46 Middle East and Africa: Market Size, By Technology Service, 2014-2021 (USD Million)

Table 47 Middle East and Africa: LPWAN Market Size, By Network Deployment, 2014-2021 (USD Million)

Table 48 Middle East and Africa: Market Size, By Application,2014-2021 (USD Million)

Table 49 Middle East and Africa: Market Size, By Vertical,2014-2021 (USD Million)

Table 50 Latin America: Market Size, By Connectivity Technology,2014-2021 (USD Million)

Table 51 Latin America: Market Size, By Technology Service,2014-2021 (USD Million)

Table 52 Latin America: Market Size, By Network Deployment,2014-2021 (USD Million)

Table 53 Latin America: LPWAN Market Size, By Application,2014-2021 (USD Million)

Table 54 Latin America: Market Size, By Vertical, 2014-2021 (USD Million)

Table 55 New Product Launches and Enhancements, 2014-2016

Table 56 Partnerships, Agreements, and Collaborations, 2014-2016

Table 57 Mergers and Acquisitions, 2014-2016

Table 58 Integration and Expansions, 2014-2016

List of Figures (42 Figures)

Figure 1 Global Low Power Wide Area Network Market

Figure 2 LPWAN Market: Research Design

Figure 3 Breakdown of Primary Interview: By Company Type, Designation, and Region

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Market Size, By Connectivity Technology (2016 & 2021): Sigfox is Expected to Dominate the Market Throughout the Forecast Period

Figure 8 LPWAN Market Size, By User Type (2016 & 2021): Professional Services Segment is Expected to Have the Largest Market Share

Figure 9 Market Share, By Network Deployment (2021): Public Network is Expected Have the Largest Market Share

Figure 10 Low Power Wide Area Network Market Size, By Application (2016 & 2021): Smart Gas and Water Metering is Expected to Lead the Market

Figure 11 LPWAN Market Size, Application Snapshot (2016 & 2021): Oil and Gas Vertical is Expected to Lead the Market

Figure 12 Global Market Share – Europe is Estimated to Hold the Largest Market Share in 2016

Figure 13 The Global Market Presents Lucrative Opportunities

Figure 14 LPWAN Market By Connectivity Technology, 2014–2021, (USD Million)

Figure 15 Europe is Estimated to Hold the Maximum Share in the Market (2016)

Figure 16 Regional Lifecycle – Middle East and Africa and Latin America are Expected to Be in the Introductory Phase in 2016

Figure 17 Asia-Pacific is Expected to Have the Highest Growth Potential During the Forecast Period

Figure 18 Asia-Pacific Market to Grow Faster Than Other Regions

Figure 19 Low Power Wide Area Network Market Segmentation

Figure 20 Market Segmentation: By Connectivity Technology

Figure 21 Market Segmentation: By Technology Service

Figure 22 Market Segmentation: By Network Deployment

Figure 23 Market Segmentation: By Application

Figure 24 LPWAN Market Segmentation: By Vertical

Figure 25 Market Segmentation: By Region

Figure 26 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 27 Market: Value Chain Analysis

Figure 28 LPWAN Market: Value Chain Analysis

Figure 29 Strategic Benchmarking: Partnerships, Collaborations and Agreements Was the Key Growth Strategy Adopted By Key Market Players From 2014 to 2016

Figure 30 Sigfox is Expected to Hold the Largest Market Share During the Forecast Period

Figure 31 Managed Services Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 32 Public Network is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 33 Smart Gas and Water Metering Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 34 Oil and Gas Vertical is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 35 Asia-Pacific is Projected to Exhibit the Highest Growth in the Low Power Wide Area Network Market

Figure 36 Geographic Snapshot: Asia-Pacific Estimated to Account for the Largest Share in the LPWAN Market

Figure 37 Europe Market Snapshot

Figure 38 Asia-Pacific Market Snapshot

Figure 39 Companies Adopted Partnerships and Agreements as the Key Growth Strategy Over the Last Three Years

Figure 40 Market Evaluation Framework

Figure 41 Battle for Market Share: New Product Launches and Enhancements Was the Key Strategy for the Growth of the LPWAN Market

Figure 42 Semtech Corporation: Company Snapshot

Growth opportunities and latent adjacency in Low Power Wide Area Network Market