Wireless Connectivity Market Size, Share, Statistics and Industry Growth Analysis by Connectivity (Wi-Fi, Bluetooth Classic, Bluetooth 4X, Bluetooth 5X, ZigBee, Z-Wave, UWB, NFC, Thread, GNSS, Cellular, EnOcean, Sigfox, LoRa, LTE Cat-M1, NB-IoT), End-use and Region - Global Forecast to 2027

Updated on : October 22, 2024

The Wireless Connectivity Market is poised for remarkable growth, driven by escalating demand for seamless communication and connectivity across various sectors, including consumer electronics, automotive, and smart infrastructure. As the world increasingly embraces the Internet of Things (IoT), the need for reliable and high-speed wireless solutions continues to rise. Key trends shaping the market include the widespread adoption of 5G technology, which promises faster data transfer rates and enhanced network reliability, as well as advancements in Wi-Fi standards, such as Wi-Fi 6 and beyond. Additionally, the growing emphasis on smart cities and industrial automation is further fueling the demand for innovative wireless connectivity solutions. Looking ahead, the future of the Wireless Connectivity Market appears bright, with ongoing developments in technology and infrastructure expected to support the evolution of connected devices and applications, ultimately enhancing user experiences and operational efficiencies across industries.

Wireless Connectivity Market Size & Share

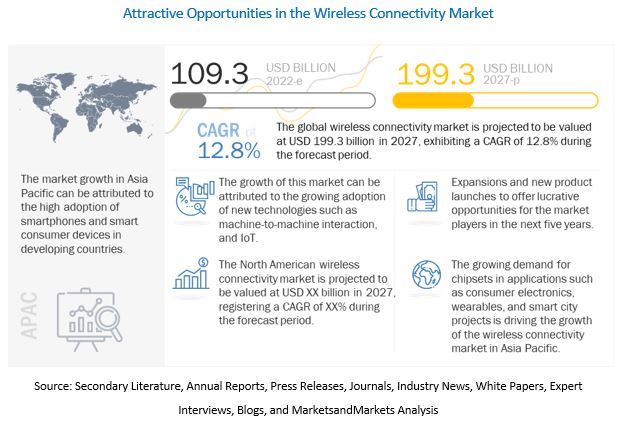

Global wireless connectivity market size is projected to reach USD 199.3 billion by 2027, growing at a CAGR of 12.8% from 2022 to 2027. Several significant factors, including as the rising demand for wireless sensors to create smart infrastructure, the rising rate of internet penetration, and the soaring acceptance of the Internet of Things, are driving the market expansion (IoT). In addition, it's anticipated that the development of 5G networks, notably in the automotive industry, and significant funding from governments throughout the world for R&D will boost demand for the wireless connectivity industry.

To know about the assumptions considered for the study, Request for Free Sample Report

Wireless Connectivity Market Dynamics

Driver : Sizable internet penetration rate

In last decade, internet penetration rate has increased rapidly in developed countries of North America and Europe. Based on Internet World Usage Statistics, in 2022, there were 54.2% internet users in Asia, 13.9% in Europe, and 6.5% in North America internet users. The Middle East and Africa countries are witnessing highest growth rate in internet adoption. Even internet usage on mobile devices is increasing. Thus, the rising requirement of internet connectivity is expected to drive the demand for smart devices based on wireless connectivity technology. Globally, the number of machine-to-machine (M2M) connections is expected to grow by more than 2 times within five years. M2M connections include connections in a manufacturing facility, delivery vehicle, and warehouse asset tracking systems. In addition to the abovementioned factors, the rising number of internet users, growing 5G technology adoption, and increasing IoT and M2M connections are significantly fueling the demand for wireless connectivity.

Restraint: Sensors and peripheral devices are high power consuming

Significant power consumers include peripherals and sensors which are the backbone of wireless connectivity network. Depending on the communication protocols different sensors have different energy consumption rates. Despite the availability of technologies like ultra-low-power processors, tiny mobile sensors, and wireless networking, effective power management and optical power consumption are still required in loT devices. Another pressing problem is connectivity burden because many devices must be linked simultaneously. An ordinary smart house might include ten to fifteen linked lights, appliances, thermostats, and other gadgets, each with its own power requirements. The efficiency of the line power is also increased using equipment like smart meters. The key challenge is the power management of devices employing wireless technologies, like Wi-Fi, as it is not practical to regularly replace the batteries of hundreds of sensors, actuators, and other linked devices within loT systems. Even though chip makers are already working on producing ultra-low-power chips and modules, power management is still a problem in the wearable technology sector. The development of battery technology for portable gadgets also brings with it problems for weight and space reduction.

Opportunity : Growing need for cross-domain applications

Cross-domain expertise and collaborations are required to realize the full potential of wireless technologies. Organizations and businesses have exponential growth opportunities in the IoT and cloud computing ecosystems. Organizations can capture and adapt to increasing cloud and IoT trends, along with technological innovations.

The capacity or the ability of organizations to achieve success depends on cross-sector collaborations and approaches to business models. For instance, Huawei Technologies (China) offers a new operating system called LiteOS, targeting many different segments, including smart homes, wearable devices, the Internet of Vehicles, smart metering, and the industrial internet. As a result, Huawei Technologies (China) opened up many different market segments within the IoT ecosystem. This allows the company to target a range of applications in the IoT space without facing the problem of interoperability between networks.

In February 2020, Quectel wireless solutions, the supplier of cellular and GNSS chipsets, announced that it is collaborating with Microsoft and Qualcomm Technologies to integrate its new LPWA chipsets BG95 with Microsoft’s Azure Device SDK to provide direct and secure connections to Azure IoT Hub and to offer full support for Azure device management capabilities. The partnership with Quectel and Qualcomm Technologies will help to bring together ultra-low-power cellular chipsets and Azure to drive their digital transformation. The BG95 module is the first Qualcomm 9205 platform to support IoT Plug and Play, accelerating LPWAN solution deployments such as smart meters and asset trackers that connect seamlessly to the IoT.

Challenge: Increasing privacy and security concerns with IoT

The scale of connected devices is increased and made simpler via wireless connectivity. However, the massive increase in smartphone penetration and the quick spread of public Wi-Fi networks has increased the potential of numerous undetected threats, including identity theft, hacking, and jamming. A significant amount of data is being produced as the number of connected devices rises along with the adoption rate of loT in more applications. Within enterprises, a wide variety of devices are already installed on the same network. For instance, Researchers at the Check Point Institute for Information Security (CPIIS), based in Israel, found that hackers can access the loT network using smart lightbulbs and then gather data from internet networks in homes, businesses, or even smart cities.

Nb-IoT technology segment to exhibit highest CAGR in wireless connectivity market, in terms of volume NB-IoT is an LPWAN radio technology standard developed to connect a wide range of cellular devices and services for agriculture, smart cities, utilities, and manufacturing applications. Currently, more than 140 telecom operators in 69 countries have invested in NB-IoT networks. It is expected that in the near future, telecom operators and IC manufacturers are expected to increase the commercialization and development of NB-IoT devices and services. Some of the key developments related to the same have been provided below.

In June 2022, 1NCE doubled its NB-IoT footprint with expansion in the United States, Taiwan, Belgium, Denmark, Sweden, Norway, Croatia, Finland, and the Slovak Republic. This development has pushed the company among the leading providers of NB-IoT technology.

Consumer electronics segment to hold largest size of wireless connectivity market

The consumer electronics segment includes smart consumer appliances. With the emergence of a number of smart appliances that can connect to the internet and smartphones, the IoT technology market in the consumer electronics segment is expected to witness healthy growth, and so is the wireless connectivity market. Smart appliances, also known as intelligent appliances, can measure and control their energy usage and communicate with homeowners and utility departments. These appliances can be connected to smart energy meters or home energy management systems and can help reduce electricity usage in off-peak hours. Owing to the huge potential in the consumer electronics market space, companies are aiming to expand their market presence with organic or inorganic development. For instance, in May 2022, Mediatek Inc. launched the world’s first Wi-Fi 7 Platforms for access points for retail and consumer electronics clients.

Wireless Communication Industry Analysis

The wireless communication industry analysis is experiencing significant growth, driven by the increasing demand for Wi-Fi and other wireless connectivity solutions across various sectors. As businesses and consumers alike seek faster, more reliable internet connections, the wireless sector is evolving to meet these needs. The proliferation of smart devices, the expansion of 5G networks, and the growing adoption of IoT (Internet of Things) are all contributing to the transformation of wireless communication technologies. Wi-Fi remains a dominant force in providing high-speed internet for both personal and enterprise use, while the broader wireless ecosystem—including Bluetooth, Zigbee, and emerging technologies like Li-Fi—is ensuring seamless connectivity across homes, offices, and industrial applications. As the demand for wireless connectivity continues to rise, the wireless communication market is expected to see sustained growth, with innovations aimed at enhancing bandwidth, reducing latency, and expanding coverage to meet the needs of an increasingly connected world.Asia Pacific to dominate wireless connectivity market during forecast period

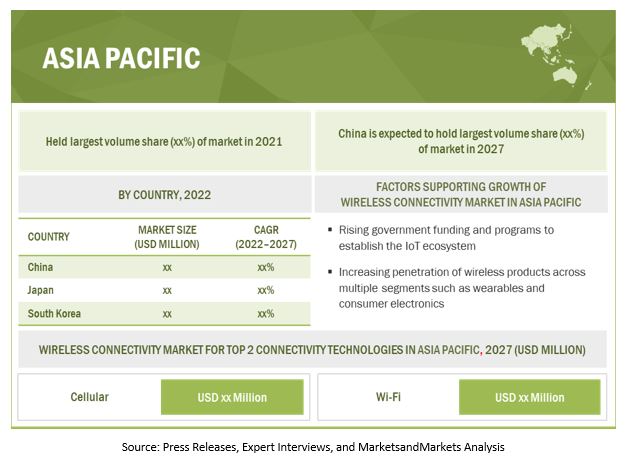

The greatest client base in the world is in APAC, and digital technologies used in this region have a bigger potential to revolutionize. The wireless connectivity market in APAC is anticipated to expand significantly over the coming years due to the loT market's steady expansion and the region's high concentration of the world's population. Thus, there is a greater need for the industrial revolution, smart consumer electronics, and the number of new M2M connections per year in this area. Given the large population bases in some of the developing nations in the Asia-Pacific region, including China, India, and Thailand, as well as related issues like healthcare and energy management, wireless connectivity technologies appear to have more potential to raise living standards.

To know about the assumptions considered for the study, download the pdf brochure

China is witnessing high adoption of the Internet of Things platform owing to the financial and strategic involvement of the government in the R&D of IoT-related technologies. As China is a major hub of semiconductor fabrication and manufacturing industries, its involvement in the implementation and development of the Industrial Internet of Things (IIoT) and supporting wireless connectivity technologies is crucial for the growth of these markets. IoT has penetrated various verticals in China, such as agriculture, automotive, railways, aviation, manufacturing, healthcare, and food & beverage. China is one of the fastest-growing economies in the world, with a huge population base and steadily increasing per capita income.

Top Wireless Connectivity Companies - Key Market Players:

The wireless connectivity companies have implemented various types of organic as well as inorganic growth strategies, such as new product launches, and acquisitions to strengthen their offerings in the market. The major players in the Wireless Connectivity market Intel Corporation (US), Texas Instruments Incorporated (US), Qualcomm Incorporated (US), Broadcom (US), STMicroelectronics N.V. (Switzerland), NXP Semiconductors N.V. (Netherlands), Microchip Technology Inc. (US), MediaTek Inc. (Taiwan), and Renesas Electronics Corporation (Japan) were the companies that dominated the wireless connectivity market in 2021. The other companies profiled in the report are Infineon Technologies AG (Germany), EnOcean (Germany), Nexcom International Co., Ltd. (Taiwan), Skyworks Solutions, Inc. (US), Murata Manufacturing Co., Ltd. (Japan), Nordic Semiconductor (Norway), Expressif Systems (China), CEVA, Inc. (US), Peraso Technologies, Inc. (Canada), Panasonic Corporation (Japan), BehrTech (Canada), Skyworks Solutions, Inc. (US), Semtech (US), MeiG Smart Technology Co., Ltd. (China), Neoway Technology (China), and XIAMEN CHEERZING IoT Technology Co., Ltd. (China).

Wireless Connectivity Market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 109.3 Billion |

| Projected Market Size | USD 199.3 Billion |

| Growth Rate | 12.8% CAGR |

|

Years considered |

2018–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD million/billion) |

|

Segments covered |

|

|

Regions covered |

|

|

Market Leaders |

|

| Top Companies in North America |

|

| Key Market Driver | Sizable internet penetration rate |

| Key Market Opportunity | Growing need for cross-domain applications |

|

Largest Growing Region |

Asia Pacific |

| Largest Market Share Segment | Consumer electronics |

| Largest Application Market Share | Aerospace application |

In this report, the overall Wireless Connectivity market has been segmented based on connectivity type, application, and region.

Wireless Connectivity Market , By Connectivity Type:

- Wi-Fi

- Bluetooth Classic

- Bluetooth 4X

- Bluetooth 5X

- ZigBee

- Z-Wave

- UWB

- NFC

- Thread

- GNSS

- Cellular

- EnOcean

- Sigfox

- LoRa

- LTE Cat-M1

- NB-IoT

- Others

By End Use:

- Wearable Devices

- Healthcare

- Consumer Electronics

- Building Automation

- Automotive & Transportation

- Others

By Type:

- LPWAN

- Cellular M2M

- WPAN

- Satellite (GNSS)

- WLAN

By Region:

-

North America

- US

- Canada

- Mexico

-

Europe

- UK

- Germany

- France

- Italy

- Rest of Europe

-

APAC

- China

- Japan

- South Korea

- Rest of Asia Pacific

-

Rest of the World

- Middle East and Africa

- South America

Recent Developments in Wireless Connectivity Industry

- In June 2022, Texas Instruments expanded its wireless connectivity product portfolio with the launch of MCUs, which offer BLE at half the price of competing devices.

- In June 2022, Qualcomm Technologies, Inc., announced the launch of an RF Front-End connectivity solution to amplify the route signal between the SOC and the antenna, thereby increasing the performance of Wi-Fi and Bluetooth.

- In June 2022, Infineon Technologies AG introduced AIROC CYW20820 Bluetooth & Bluetooth LE SoC for better performance, low power consumption, and better flexibility for IoT applications.

- In June 2022, Murata Manufacturing Co., Ltd. announced the launch of "Type ABR," a compact wireless module containing a built-in wireless MCU ("88MW320") from NXP semiconductors, which can enable Wi-Fi functionality just by entering some simple commands.

Frequently Asked Questions (FAQs):

Who are the top 5 players in the Wireless Connectivity market?

The major vendors operating in the industry market Qualcomm Technologies, Inc., Broadcom, Texas Instruments, Intel Corporation, and NXP Semiconductors.

What are their major strategies to strengthen their market presence?

The major strategies adopted by these players are product launches and developments.

Which major countries are considered in the European region?

The report includes an analysis of the UK, Germany, France, Italy, and the Rest of Europe.

Which major countries are considered in the APAC region?

The report includes an analysis of China, Japan, South Korea, and the Rest of Asia Pacific.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 34)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

FIGURE 1 MARKETS COVERED

1.3.1 GEOGRAPHIC SCOPE

FIGURE 2 WIRELESS CONNECTIVITY MARKET: REGIONAL SCOPE

1.3.2 YEARS CONSIDERED

FIGURE 3 WIRELESS CONNECTIVITY MARKET: FORECAST YEARS

1.4 CURRENCY CONSIDERED

1.5 PACKAGE SIZE

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 39)

2.1 RESEARCH DATA

FIGURE 4 WIRELESS CONNECTIVITY MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 List of major secondary sources

2.1.1.2 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key industry insights

2.1.2.2 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

FIGURE 5 PROCESS FLOW OF MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 46)

3.1 GROWTH RATE ASSUMPTIONS/GROWTH FORECASTS

FIGURE 9 LPWAN-ENABLED CONNECTIVITY TYPE SEGMENT TO REGISTER HIGHEST CAGR BETWEEN 2022 AND 2027

FIGURE 10 CELLULAR SEGMENT TO GENERATE HIGHEST MARKET OPPORTUNITY FROM 2022 TO 2027

FIGURE 11 WIRELESS CONNECTIVITY MARKET IN ASIA PACIFIC TO EXHIBIT HIGHEST CAGR BETWEEN 2022 AND 2027

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN WIRELESS CONNECTIVITY MARKET, 2022–2027 (USD BILLION)

FIGURE 12 INCREASING DEMAND FOR WIRELESS SENSOR NETWORKS FOR DEVELOPING SMART INFRASTRUCTURE IS DRIVING GROWTH OF WIRELESS CONNECTIVITY MARKET

4.2 WIRELESS CONNECTIVITY MARKET, BY END-USE

FIGURE 13 CONSUMER ELECTRONICS SEGMENT HELD LARGEST SHARE OF WIRELESS CONNECTIVITY MARKET IN 2022

4.3 WIRELESS CONNECTIVITY MARKET IN ASIA PACIFIC, BY CONNECTIVITY TECHNOLOGY AND COUNTRY

FIGURE 14 CELLULAR TECHNOLOGY AND CHINA ARE LARGEST SHAREHOLDERS OF WIRELESS CONNECTIVITY MARKET IN ASIA PACIFIC IN 2022

4.4 WIRELESS CONNECTIVITY MARKET, BY REGION

FIGURE 15 ASIA PACIFIC TO REGISTER HIGHEST CAGR BETWEEN 2022 AND 2027

5 MARKET OVERVIEW (Page No. - 52)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 MARKET DYNAMICS: WIRELESS CONNECTIVITY MARKET

5.2.1 DRIVERS

FIGURE 17 WIRELESS CONNECTIVITY MARKET DRIVERS AND THEIR IMPACT

5.2.1.1 Increasing demand for wireless sensors to develop smart infrastructure

5.2.1.2 Growing internet penetration rate

FIGURE 18 GLOBAL MACHINE-TO-MACHINE CONNECTIONS FROM 2018 TO 2025 (BILLION UNITS)

FIGURE 19 GLOBAL IOT CONNECTIONS, 2020 & 2026 (BILLION UNITS)

5.2.1.3 Surging adoption of Internet of Things

FIGURE 20 GLOBAL IOT-CONNECTED DEVICES, 2015–2025

5.2.1.4 Rising demand for low-power wide-area networks in IoT applications

5.2.2 RESTRAINTS

FIGURE 21 MARKET RESTRAINTS AND THEIR IMPACT

5.2.2.1 High power consumption by wireless sensors, terminals, and connected devices

5.2.2.2 Lack of uniform communication standards

5.2.3 OPPORTUNITIES

FIGURE 22 MARKET OPPORTUNITIES AND THEIR IMPACT

5.2.3.1 Development of 5G network, particularly in automotive sector

FIGURE 23 GLOBAL VEHICLE PRODUCTION, 2017–2021 (MILLION UNITS)

5.2.3.2 Significant financial support from governments worldwide for R&D in Internet of Things

TABLE 1 GOVERNMENT FUNDING PLANS FOR INTERNET OF THINGS

5.2.3.3 Growing need for cross-domain applications

5.2.4 CHALLENGES

FIGURE 24 WIRELESS CONNECTIVITY MARKET CHALLENGES AND THEIR IMPACT

5.2.4.1 Increasing privacy and security concerns in the age of IoT

5.3 VALUE CHAIN ANALYSIS

FIGURE 25 VALUE CHAIN ANALYSIS OF WIRELESS CONNECTIVITY ECOSYSTEM: SOLUTION & PLATFORM PROVIDERS ADD MAXIMUM VALUE

5.4 ECOSYSTEM ANALYSIS

FIGURE 26 WIRELESS CONNECTIVITY MARKET: ECOSYSTEM

TABLE 2 WIRELESS CONNECTIVITY ECOSYSTEM

5.5 WIRELESS CONNECTIVITY ASP ANALYSIS

5.6 TECHNOLOGY ANALYSIS

5.6.1 COMPLEMENTARY TECHNOLOGY

5.6.1.1 Message queuing telemetry transport

5.6.2 ADJACENT TECHNOLOGY

5.6.2.1 5G

5.7 PORTER’S FIVE FORCES ANALYSIS

TABLE 3 WIRELESS CONNECTIVITY MARKET: PORTER’S FIVE FORCES ANALYSIS

5.8 CASE STUDY ANALYSIS

5.8.1 HEALTHCARE

5.8.2 BUILDING AUTOMATION

5.8.3 RETAIL

5.9 TRADE ANALYSIS

TABLE 4 EXPORT DATA FOR HS CODE 851769 FOR TOP COUNTRIES, 2017–2021 (THOUSAND USD)

FIGURE 27 EXPORT DATA FOR HS CODE 851769 FOR TOP COUNTRIES, 2017–2021 (THOUSAND UNITS)

TABLE 5 IMPORT DATA FOR HS CODE 851769 FOR TOP COUNTRIES, 2017–2021 (THOUSAND USD)

FIGURE 28 IMPORT DATA FOR HS CODE 851769 FOR TOP COUNTRIES, 2017–2021 (THOUSAND UNITS)

5.10 PATENT ANALYSIS

FIGURE 29 WIRELESS CONNECTIVITY: PATENT ANALYSIS

5.11 TARIFF AND REGULATORY LANDSCAPE

5.11.1 REGULATORY LANDSCAPE

5.11.2 TARIFF

TABLE 6 TARIFF FOR ELECTRONIC-INTEGRATED CIRCUITS AS PROCESSORS AND CONTROLLERS EXPORTED BY US, 2020

TABLE 7 TARIFF FOR ELECTRONIC-INTEGRATED CIRCUITS AS PROCESSORS AND CONTROLLERS EXPORTED BY CHINA, 2020

TABLE 8 TARIFF FOR ELECTRONIC-INTEGRATED CIRCUITS AS PROCESSORS AND CONTROLLERS EXPORTED BY GERMANY, 2020

6 WIRELESS CONNECTIVITY MARKET, BY CONNECTIVITY TECHNOLOGY (Page No. - 76)

6.1 INTRODUCTION

FIGURE 30 NB-IOT TECHNOLOGY SEGMENT TO EXHIBIT HIGHEST CAGR IN WIRELESS CONNECTIVITY MARKET, IN TERMS OF VOLUME, FROM 2022 TO 2027

TABLE 9 MARKET, BY CONNECTIVITY TECHNOLOGY, 2018–2021 (MILLION UNITS)

TABLE 10 MARKET, BY CONNECTIVITY TECHNOLOGY, 2022–2027 (MILLION UNITS)

6.2 WI-FI

TABLE 11 MARKET FOR WI-FI TECHNOLOGY, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 12 MARKET FOR WI-FI TECHNOLOGY, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 13 MARKET FOR WI-FI TECHNOLOGY, BY REGION, 2018–2021 (USD MILLION)

TABLE 14 MARKET FOR WI-FI TECHNOLOGY, BY REGION, 2022–2027 (USD MILLION)

6.2.1 WI-FI, BY BAND

6.2.1.1 Single band

6.2.1.1.1 Overlapping channels with limited capacity

6.2.1.2 Dual band

6.2.1.2.1 High data rate applications such as video streaming and gaming

6.2.1.3 Tri band

6.2.1.3.1 High data transfer rate with negligible congestion

TABLE 15 WIRELESS CONNECTIVITY MARKET FOR WI-FI TECHNOLOGY, BY BAND, 2018–2021 (MILLION UNITS)

TABLE 16 MARKET FOR WI-FI TECHNOLOGY, BY BAND, 2022–2027 (MILLION UNITS)

6.3 BLUETOOTH CLASSIC

6.3.1 USED TO TRANSFER DATA OVER SHORT DISTANCES

TABLE 17 WIRELESS CONNECTIVITY MARKET FOR BLUETOOTH CLASSIC TECHNOLOGY, BY REGION, 2018–2022 (MILLION UNITS)

TABLE 18 MARKET FOR BLUETOOTH CLASSIC TECHNOLOGY, BY REGION, 2018–2022 (USD MILLION)

6.4 BLUETOOTH 4X

6.4.1 OPTIMIZED VERSION OF PROPRIETARY WIRELESS BLUETOOTH TECHNOLOGY

TABLE 19 MARKET FOR BLUETOOTH 4X TECHNOLOGY, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 20 MARKET FOR BLUETOOTH 4X TECHNOLOGY, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 21 MARKET FOR BLUETOOTH 4X TECHNOLOGY, BY REGION, 2018–2021 (USD MILLION)

TABLE 22 MARKET FOR BLUETOOTH 4X TECHNOLOGY, BY REGION, 2022–2027 (USD MILLION)

6.5 BLUETOOTH 5X

6.5.1 USED IN WIRELESS HEADPHONES AND OTHER AUDIO HARDWARE

TABLE 23 MARKET FOR BLUETOOTH 5X TECHNOLOGY, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 24 MARKET FOR BLUETOOTH 5X TECHNOLOGY, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 25 MARKET FOR BLUETOOTH 5X TECHNOLOGY, BY REGION, 2018–2021 (USD MILLION)

TABLE 26 MARKET FOR BLUETOOTH 5X TECHNOLOGY, BY REGION, 2022–2027 (USD MILLION)

6.6 ZIGBEE

6.6.1 PERSONAL AREA NETWORKS WITH SMALL AND LOW-POWER DIGITAL RADIOS

TABLE 27 MARKET FOR ZIGBEE TECHNOLOGY, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 28 MARKET FOR ZIGBEE TECHNOLOGY, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 29 MARKET FOR ZIGBEE TECHNOLOGY, BY REGION, 2018–2021 (USD MILLION)

TABLE 30 MARKET FOR ZIGBEE TECHNOLOGY, BY REGION, 2022–2027 (USD MILLION)

6.7 Z-WAVE

6.7.1 USED TO CREATE WIRELESS MESH NETWORK

TABLE 31 MARKET FOR Z-WAVE TECHNOLOGY, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 32 MARKET FOR Z-WAVE TECHNOLOGY, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 33 MARKET FOR Z-WAVE TECHNOLOGY, BY REGION, 2018–2021 (USD MILLION)

TABLE 34 MARKET FOR Z-WAVE TECHNOLOGY, BY REGION, 2022–2027 (USD MILLION)

6.8 THREAD

6.8.1 IPV6-BASED MESH NETWORKING PROTOCOL

TABLE 35 MARKET FOR THREAD TECHNOLOGY, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 36 MARKET FOR THREAD TECHNOLOGY, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 37 MARKET FOR THREAD TECHNOLOGY, BY REGION, 2018–2021 (USD MILLION)

TABLE 38 MARKET FOR THREAD TECHNOLOGY, BY REGION, 2022–2027 (USD MILLION)

6.9 NEAR-FIELD COMMUNICATIONS

6.9.1 ENABLES COMMUNICATION BETWEEN DEVICES WHEN PLACED IN PROXIMITY

TABLE 39 MARKET FOR NFC TECHNOLOGY, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 40 MARKET FOR NFC TECHNOLOGY, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 41 MARKET FOR NFC TECHNOLOGY, BY REGION, 2018–2021 (USD MILLION)

TABLE 42 MARKET FOR NFC TECHNOLOGY, BY REGION, 2022–2027 (USD MILLION)

6.10 GLOBAL NAVIGATION SATELLITE SYSTEMS

6.10.1 POPULAR TECHNOLOGY FOR MOBILITY

TABLE 43 MARKET FOR GNSS TECHNOLOGY, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 44 MARKET FOR GNSS TECHNOLOGY, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 45 MARKET FOR GNSS TECHNOLOGY, BY REGION, 2018–2021 (USD MILLION)

TABLE 46 MARKET FOR GNSS TECHNOLOGY, BY REGION, 2022–2027 (USD MILLION)

6.11 ENOCEAN

6.11.1 USED FOR WIRELESS SENSORS, CONTROLLERS, AND GATEWAYS

TABLE 47 MARKET FOR ENOCEAN TECHNOLOGY, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 48 MARKET FOR ENOCEAN TECHNOLOGY, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 49 MARKET FOR ENOCEAN TECHNOLOGY, BY REGION, 2018–2021 (USD MILLION)

TABLE 50 WIRELESS CONNECTIVITY MARKET FOR ENOCEAN TECHNOLOGY, BY REGION, 2022–2027 (USD MILLION)

6.12 CELLULAR

6.12.1 WIRELESS NETWORKS DISTRIBUTED OVER LAND AREAS CALLED CELLS

6.12.2 2G

6.12.3 3G

6.12.4 4G+

6.12.5 5G

TABLE 51 MARKET FOR CELLULAR TECHNOLOGY, BY TECHNOLOGY, 2018–2021 (MILLION UNITS)

TABLE 52 MARKET FOR CELLULAR TECHNOLOGY, BY TECHNOLOGY, 2022–2027 (MILLION UNITS)

TABLE 53 MARKET FOR CELLULAR TECHNOLOGY, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 54 MARKET FOR CELLULAR TECHNOLOGY, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 55 MARKET FOR CELLULAR TECHNOLOGY, BY REGION, 2018–2021 (USD MILLION)

TABLE 56 WIRELESS CONNECTIVITY MARKET FOR CELLULAR TECHNOLOGY, BY REGION, 2022–2027 (USD MILLION)

6.13 UWB

6.13.1 IDEAL FOR SHORT-RANGE DATA TRANSMISSION

TABLE 57 MARKET FOR UWB TECHNOLOGY, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 58 WIRELESS COMMUNICATION MARKET FOR UWB TECHNOLOGY, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 59 MARKET FOR UWB TECHNOLOGY, BY REGION, 2018–2021 (USD MILLION)

TABLE 60 MARKET FOR UWB TECHNOLOGY, BY REGION, 2022–2027 (USD MILLION)

6.14 LORA

6.14.1 LONG-RANGE, LOW-POWER WIRELESS PLATFORM

TABLE 61 MARKET FOR LORA TECHNOLOGY, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 62 MARKET FOR LORA TECHNOLOGY, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 63 WIRELESS CONNECTIVITY MARKET FOR LORA TECHNOLOGY, BY REGION, 2018–2021 (USD MILLION)

TABLE 64 MARKET FOR LORA TECHNOLOGY, BY REGION, 2022–2027 (USD MILLION)

6.15 SIGFOX

6.15.1 LOW-POWER WIDE-AREA NETWORK COVERAGE

TABLE 65 MARKET FOR SIGFOX TECHNOLOGY, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 66 MARKET FOR SIGFOX TECHNOLOGY, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 67 WIRELESS CONNECTIVITY MARKET FOR SIGFOX TECHNOLOGY, BY REGION, 2018–2021 (USD MILLION)

TABLE 68 MARKET FOR SIGFOX TECHNOLOGY, BY REGION, 2022–2027 (USD MILLION)

6.16 NB-IOT

6.16.1 LOW COST, WIDE COVERAGE, AND LONG BATTERY LIFE

TABLE 69 MARKET FOR NB- IOT TECHNOLOGY, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 70 MARKET FOR NB-IOT TECHNOLOGY, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 71 MARKET FOR NB-IOT TECHNOLOGY, BY REGION, 2018–2021 (USD MILLION)

TABLE 72 WIRELESS CONNECTIVITY MARKET FOR NB-IOT TECHNOLOGY, BY REGION, 2022–2027 (USD MILLION)

6.17 LTE CAT M1

6.17.1 LONGER BATTERY LIFE, EXTENDED RANGE, AND DEEP PENETRATION IN BUILDINGS AND BASEMENTS

TABLE 73 MARKET FOR LTE-CAT M1 TECHNOLOGY, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 74 MARKET FOR LTE-CAT M1 TECHNOLOGY, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 75 WIRELESS CONNECTIVITY MARKET FOR LTE-CAT M1 TECHNOLOGY, BY REGION, 2018–2021 (USD MILLION)

TABLE 76 MARKET FOR LTE-CAT M1 TECHNOLOGY, BY REGION, 2022–2027 (USD MILLION)

6.18 OTHERS

TABLE 77 WIRELESS CONNECTIVITY MARKET FOR OTHER TECHNOLOGIES, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 78 MARKET FOR OTHER TECHNOLOGIES, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 79 WIRELESS CONNECTIVITY MARKET FOR OTHER TECHNOLOGIES, BY REGION, 2018–2021 (USD MILLION)

TABLE 80 MARKET FOR OTHER TECHNOLOGIES, BY REGION, 2022–2027 (USD MILLION)

7 WIRELESS CONNECTIVITY MARKET, BY TYPE (Page No. - 124)

7.1 INTRODUCTION

FIGURE 31 WPAN-ENABLED CHIPSETS SEGMENT TO HOLD LARGEST SHARE OF WIRELESS CONNECTIVITY MARKET FROM 2022 TO 2027

TABLE 81 MARKET, BY TYPE, 2018–2021 (MILLION UNITS)

TABLE 82 WIRELESS CONNECTIVITY MARKET, BY TYPE, 2022–2027 (MILLION UNITS)

TABLE 83 MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 84 MARKET, BY TYPE, 2022–2027 (USD MILLION)

7.2 WIRELESS LOCAL AREA NETWORK

7.2.1 EXPONENTIAL GROWTH IN BANDWIDTH AND HIGHER THROUGHPUT

TABLE 85 WIRELESS CONNECTIVITY MARKET FOR WLAN, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 86 MARKET FOR WLAN, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 87 MARKET FOR WLAN, BY REGION, 2018–2021 (USD MILLION)

TABLE 88 MARKET FOR WLAN, BY REGION, 2022–2027 (USD MILLION)

7.3 WIRELESS PERSONAL AREA NETWORK

7.3.1 HIGH ADOPTION OF WPAN TECHNOLOGY ATTRIBUTED TO ITS LOW COST, FLEXIBILITY, SECURITY, AND EASE OF USE

TABLE 89 WIRELESS CONNECTIVITY MARKET FOR WPAN, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 90 MARKET FOR WPAN, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 91 MARKET FOR WPAN, BY REGION, 2018–2021 (USD MILLION)

TABLE 92 MARKET FOR WPAN, BY REGION, 2022–2027 (USD MILLION)

7.4 SATELLITE

7.4.1 GNSS TECHNOLOGY WIDELY USED FOR NAVIGATION SOLUTIONS

TABLE 93 MARKET FOR GNSS, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 94 MARKET FOR GNSS, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 95 WIRELESS CONNECTIVITY MARKET FOR GNSS, BY REGION, 2018–2021 (USD MILLION)

TABLE 96 MARKET FOR GNSS, BY REGION, 2022–2027 (USD MILLION)

7.5 LOW-POWER WIDE-AREA NETWORK

7.5.1 LOW POWER CONSUMPTION OF LPWAN TECHNOLOGY IDEAL FOR SEVERAL APPLICATIONS

TABLE 97 MARKET FOR LPWAN, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 98 MARKET FOR LPWAN, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 99 MARKET FOR LPWAN, BY REGION, 2018–2021 (USD MILLION)

TABLE 100 MARKET FOR LPWAN, BY REGION, 2022–2027 (USD MILLION)

7.6 CELLULAR

7.6.1 INCREASING ADOPTION OF 5G TO PROPEL GROWTH OF CELLULAR TECHNOLOGY

TABLE 101 MARKET FOR CELLULAR, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 102 MARKET FOR CELLULAR, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 103 MARKET FOR CELLULAR, BY REGION, 2018–2021 (USD MILLION)

TABLE 104 MARKET FOR CELLULAR, BY REGION, 2022–2027 (USD MILLION)

8 WIRELESS CONNECTIVITY MARKET, BY END-USE (Page No. - 140)

8.1 INTRODUCTION

FIGURE 32 CONSUMER ELECTRONICS SEGMENT TO HOLD LARGEST SIZE OF WIRELESS CONNECTIVITY MARKET BETWEEN 2022 AND 2027

TABLE 105 WIRELESS CONNECTIVITY MARKET, BY END-USE, 2018–2021 (MILLION USD)

TABLE 106 MARKET, BY END-USE, 2022–2027 (MILLION USD)

8.2 WEARABLE DEVICES

8.2.1 SURGING DEMAND FOR SMARTWATCHES, HEARABLES, AND HEAD-MOUNTED DISPLAYS TO DRIVE MARKET

8.3 HEALTHCARE

8.3.1 INCREASING TREND OF REMOTE HEALTH MONITORING TO SUPPORT MARKET GROWTH

8.4 CONSUMER ELECTRONICS

8.4.1 GROWING ADOPTION OF SMART APPLIANCES, SMARTPHONES, AND LAPTOPS TO DRIVE MARKET

8.5 BUILDING AUTOMATION

8.5.1 RISING SMART CITY PROJECTS WORLDWIDE TO BOOST MARKET GROWTH

8.6 AUTOMOTIVE & TRANSPORTATION

8.6.1 EXPANDING CONNECTED CARS MARKET

8.6.2 INCREASING VEHICLE FLEET TO PROLIFERATE DEMAND FOR IOT-BASED ASSET TRACKERS

8.7 OTHERS

9 REGIONAL ANALYSIS (Page No. - 148)

9.1 INTRODUCTION

FIGURE 33 WIRELESS CONNECTIVITY MARKET, BY GEOGRAPHY

FIGURE 34 ASIA PACIFIC TO DOMINATE WIRELESS CONNECTIVITY MARKET DURING FORECAST PERIOD

TABLE 107 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 108 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 109 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 110 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

9.2 NORTH AMERICA

FIGURE 35 NORTH AMERICA: WIRELESS CONNECTIVITY MARKET SNAPSHOT

TABLE 111 MARKET IN NORTH AMERICA, BY CONNECTIVITY TECHNOLOGY, 2018–2021 (MILLION UNITS)

TABLE 112 MARKET IN NORTH AMERICA, BY CONNECTIVITY TECHNOLOGY, 2022–2027 (MILLION UNITS)

TABLE 113 NORTH AMERICAN WIRELESS CONNECTIVITY MARKET FOR WI-FI TECHNOLOGY, BY BAND, 2018–2021 (MILLION UNITS)

TABLE 114 NORTH AMERICAN WIRELESS CONNECTIVITY MARKET FOR WI-FI TECHNOLOGY, BY BAND, 2022–2027 (MILLION UNITS)

TABLE 115 MARKET IN NORTH AMERICA, BY TYPE, 2018–2021 (MILLION UNITS)

TABLE 116 MARKET IN NORTH AMERICA, BY TYPE, 2022–2027 (MILLION UNITS)

TABLE 117 MARKET IN NORTH AMERICA, BY TYPE, 2018–2021 (USD MILLION)

TABLE 118 MARKET IN NORTH AMERICA, BY TYPE, 2022–2027 (USD MILLION)

TABLE 119 MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (MILLION UNITS)

TABLE 120 WIRELESS CONNECTIVITY MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (MILLION UNITS)

TABLE 121 MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 122 MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

9.2.1 US

9.2.1.1 Increasing adoption of smart homes, smart medical equipment, and connected cars

9.2.2 CANADA

9.2.2.1 Growing adoption of advanced technologies by small and medium enterprises

9.2.3 MEXICO

9.2.3.1 Rising use of advanced technologies by traditional companies

9.3 EUROPE

FIGURE 36 EUROPE: WIRELESS CONNECTIVITY MARKET SNAPSHOT

TABLE 123 WIRELESS CONNECTIVITY MARKET IN EUROPE, BY CONNECTIVITY TECHNOLOGY, 2018–2021 (MILLION UNITS)

TABLE 124 MARKET IN EUROPE, BY CONNECTIVITY TECHNOLOGY, 2022–2027 (MILLION UNITS)

TABLE 125 MARKET IN EUROPE FOR WI-FI TECHNOLOGY, BY BAND, 2018–2021 (MILLION UNITS)

TABLE 126 MARKET IN EUROPE FOR WI-FI TECHNOLOGY, BY BAND, 2022–2027 (MILLION UNITS)

TABLE 127 MARKET IN EUROPE, BY TYPE, 2018–2021 (MILLION UNITS)

TABLE 128 MARKET IN EUROPE, BY TYPE, 2022–2027 (MILLION UNITS)

TABLE 129 MARKET IN EUROPE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 130 WIRELESS CONNECTIVITY MARKET IN EUROPE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 131 MARKET IN EUROPE, BY COUNTRY, 2018–2021 (MILLION UNITS)

TABLE 132 MARKET IN EUROPE, BY COUNTRY, 2022–2027 (MILLION UNITS)

TABLE 133 MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 134 WIRELESS CONNECTIVITY MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

9.3.1 UK

9.3.1.1 Growing adoption of wireless technologies in consumer applications

9.3.2 FRANCE

9.3.2.1 Increasing investments in R&D to modernize industrial sector

9.3.3 GERMANY

9.3.3.1 Rising deployment of smart factory solutions due to adoption of Industry 4.0

9.3.4 ITALY

9.3.4.1 High focus on digital development

9.3.5 REST OF EUROPE

9.4 ASIA PACIFIC

FIGURE 37 ASIA PACIFIC: WIRELESS CONNECTIVITY MARKET SNAPSHOT

TABLE 135 MARKET IN ASIA PACIFIC, BY CONNECTIVITY TECHNOLOGY, 2018–2021 (MILLION UNITS)

TABLE 136 MARKET IN ASIA PACIFIC, BY CONNECTIVITY TECHNOLOGY, 2022–2027 (MILLION UNITS)

TABLE 137 MARKET IN ASIA PACIFIC FOR WI-FI TECHNOLOGY, BY BAND, 2018–2021 (MILLION UNITS)

TABLE 138 WIRELESS CONNECTIVITY MARKET IN ASIA PACIFIC FOR WI-FI TECHNOLOGY, BY BAND, 2022–2027 (MILLION UNITS)

TABLE 139 MARKET IN ASIA PACIFIC, BY TYPE, 2018–2021 (MILLION UNITS)

TABLE 140 MARKET IN ASIA PACIFIC, BY TYPE, 2022–2027 (MILLION UNITS)

TABLE 141 WIRELESS CONNECTIVITY MARKET IN ASIA PACIFIC, BY TYPE, 2018–2021 (USD MILLION)

TABLE 142 MARKET IN ASIA PACIFIC, BY TYPE, 2022–2027 (USD MILLION)

TABLE 143 MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (MILLION UNITS)

TABLE 144 MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (MILLION UNITS)

TABLE 145 WIRELESS CONNECTIVITY MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 146 MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

9.4.1 CHINA

9.4.1.1 Growing adoption of IoT technology

9.4.2 JAPAN

9.4.2.1 Increasing use of wireless connectivity solutions in IoT applications

9.4.3 SOUTH KOREA

9.4.3.1 Surging advancements in cellular technologies

9.4.4 REST OF APAC

9.5 ROW

TABLE 147 MARKET IN ROW, BY CONNECTIVITY TECHNOLOGY, 2018–2021 (MILLION UNITS)

TABLE 148 MARKET IN ROW, BY CONNECTIVITY TECHNOLOGY, 2022–2027 (MILLION UNITS)

TABLE 149 MARKET IN ROW FOR WI-FI TECHNOLOGY, BY BAND, 2018–2021 (MILLION UNITS)

TABLE 150 MARKET IN ROW FOR WI-FI TECHNOLOGY, BY BAND, 2022–2027 (MILLION UNITS)

TABLE 151 MARKET IN ROW, BY TYPE, 2018–2021 (MILLION UNITS)

TABLE 152 MARKET IN ROW, BY TYPE, 2022–2027 (MILLION UNITS)

TABLE 153 MARKET IN ROW, BY TYPE, 2018–2021 (USD MILLION)

TABLE 154 MARKET IN ROW, BY TYPE, 2022–2027 (USD MILLION)

TABLE 155 MARKET IN ROW, BY COUNTRY, 2018–2021 (MILLION UNITS)

TABLE 156 MARKET IN ROW, BY COUNTRY, 2022–2027 (MILLION UNITS)

TABLE 157 MARKET IN ROW, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 158 WIRELESS CONNECTIVITY MARKET IN ROW, BY COUNTRY, 2022–2027 (USD MILLION)

9.5.1 MIDDLE EAST & AFRICA

9.5.2 SOUTH AMERICA

10 COMPETITIVE LANDSCAPE (Page No. - 186)

10.1 OVERVIEW

10.2 REVENUE ANALYSIS

FIGURE 38 THREE-YEAR REVENUE ANALYSIS OF TOP 5 PLAYERS IN WIRELESS CONNECTIVITY MARKET

10.3 MARKET SHARE ANALYSIS (2021)

TABLE 159 WIRELESS CONNECTIVITY MARKET: MARKET SHARE ANALYSIS

10.4 COMPANY EVALUATION QUADRANT, 2021

10.4.1 STARS

10.4.2 PERVASIVE PLAYERS

10.4.3 EMERGING LEADERS

10.4.4 PARTICIPANTS

FIGURE 39 WIRELESS CONNECTIVITY MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2021

10.5 SMALL AND MEDIUM ENTERPRISES EVALUATION QUADRANT, 2021

10.5.1 PROGRESSIVE COMPANIES

10.5.2 RESPONSIVE COMPANIES

10.5.3 DYNAMIC COMPANIES

10.5.4 STARTING BLOCKS

FIGURE 40 WIRELESS CONNECTIVITY MARKET (GLOBAL), SME EVALUATION QUADRANT, 2021

TABLE 160 MARKET: COMPANY FOOTPRINT

TABLE 161 MARKET: CONNECTIVITY TYPE FOOTPRINT

TABLE 162 MARKET: END-USE FOOTPRINT

TABLE 163 MARKET: REGIONAL FOOTPRINT

10.6 COMPETITIVE SCENARIO AND TRENDS

10.6.1 PRODUCT LAUNCHES

TABLE 164 WIRELESS CONNECTIVITY MARKET: PRODUCT LAUNCHES, JANUARY 2018–JUNE 2022

10.6.2 DEALS

TABLE 165 WIRELESS CONNECTIVITY MARKET: DEALS

11 COMPANY PROFILES (Page No. - 219)

11.1 KEY PLAYERS

(Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View)*

11.1.1 INTEL CORPORATION

TABLE 166 INTEL CORPORATION: BUSINESS OVERVIEW

FIGURE 41 INTEL CORPORATION: COMPANY SNAPSHOT

TABLE 167 INTEL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 168 INTEL CORPORATION: PRODUCT LAUNCHES

TABLE 169 INTEL CORPORATION: DEALS

11.1.2 TEXAS INSTRUMENTS

TABLE 170 TEXAS INSTRUMENTS: BUSINESS OVERVIEW

FIGURE 42 TEXAS INSTRUMENTS: COMPANY SNAPSHOT

TABLE 171 TEXAS INSTRUMENTS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 172 TEXAS INSTRUMENTS: PRODUCT LAUNCHES

TABLE 173 TEXAS INSTRUMENTS: DEALS

11.1.3 QUALCOMM TECHNOLOGIES, INC.

TABLE 174 QUALCOMM TECHNOLOGIES, INC.: BUSINESS OVERVIEW

FIGURE 43 QUALCOMM TECHNOLOGIES, INC.: COMPANY SNAPSHOT

TABLE 175 QUALCOMM TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 176 QUALCOMM TECHNOLOGIES, INC.: PRODUCT LAUNCHES

TABLE 177 QUALCOMM TECHNOLOGIES, INC.: DEALS

11.1.4 BROADCOM

TABLE 178 BROADCOM: BUSINESS OVERVIEW

FIGURE 44 BROADCOM: COMPANY SNAPSHOT

TABLE 179 BROADCOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 180 BROADCOM: PRODUCT LAUNCHES

TABLE 181 BROADCOM: DEALS

11.1.5 STMICROELECTRONICS

TABLE 182 STMICROELECTRONICS: BUSINESS OVERVIEW

FIGURE 45 STMICROELECTRONICS: COMPANY SNAPSHOT

TABLE 183 STMICROELECTRONICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 184 STMICROELECTRONICS: PRODUCT LAUNCHES

TABLE 185 STMICROELECTRONICS: DEALS

11.2 OTHER KEY PLAYERS

11.2.1 NXP SEMICONDUCTORS

TABLE 186 NXP SEMICONDUCTORS: BUSINESS OVERVIEW

FIGURE 46 NXP SEMICONDUCTORS: COMPANY SNAPSHOT

TABLE 187 NXP SEMICONDUCTORS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 188 NXP SEMICONDUCTORS: PRODUCT LAUNCHES

TABLE 189 NXP SEMICONDUCTORS: DEALS

11.2.2 MICROCHIP TECHNOLOGY INC.

TABLE 190 MICROCHIP TECHNOLOGY INC.: BUSINESS OVERVIEW

FIGURE 47 MICROCHIP TECHNOLOGY INC.: COMPANY SNAPSHOT

TABLE 191 MICROCHIP TECHNOLOGY INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 192 MICROCHIP TECHNOLOGY INC.: PRODUCT LAUNCHES

11.2.3 MEDIATEK INC.

TABLE 193 MEDIATEK INC.: BUSINESS OVERVIEW

FIGURE 48 MEDIATEK INC.: COMPANY SNAPSHOT

TABLE 194 MEDIATEK INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 195 MEDIATEK INC.: PRODUCT LAUNCHES

TABLE 196 MEDIATEK INC.: DEALS

11.2.4 INFINEON TECHNOLOGIES AG

TABLE 197 INFINEON TECHNOLOGIES AG: BUSINESS OVERVIEW

FIGURE 49 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

TABLE 198 INFINEON TECHNOLOGIES AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 199 INFINEON TECHNOLOGIES AG: PRODUCT LAUNCHES

TABLE 200 INFINEON TECHNOLOGIES AG: DEALS

11.2.5 RENESAS ELECTRONICS CORPORATION

TABLE 201 RENESAS ELECTRONICS CORPORATION: BUSINESS OVERVIEW

FIGURE 50 RENESAS ELECTRONICS CORPORATION: COMPANY SNAPSHOT

TABLE 202 RENESAS ELECTRONICS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 203 RENESAS ELECTRONICS CORPORATION: PRODUCT LAUNCHES

TABLE 204 RENESAS ELECTRONICS CORPORATION: DEALS

11.2.6 NEXCOM INTERNATIONAL CO., LTD.

TABLE 205 NEXCOM INTERNATIONAL CO., LTD.: BUSINESS OVERVIEW

TABLE 206 NEXCOM INTERNATIONAL CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 207 NEXCOM INTERNATIONAL CO., LTD.: PRODUCT LAUNCHES

11.2.7 SKYWORKS SOLUTIONS INC.

TABLE 208 SKYWORKS SOLUTIONS INC.: BUSINESS OVERVIEW

FIGURE 51 SKYWORKS SOLUTIONS INC.: COMPANY SNAPSHOT

TABLE 209 SKYWORKS SOLUTIONS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 210 SKYWORKS SOLUTIONS INC.: PRODUCT LAUNCHES

TABLE 211 SKYWORKS SOLUTIONS INC.: DEALS

11.2.8 MURATA MANUFACTURING CO., LTD.

TABLE 212 MURATA MANUFACTURING CO., LTD.: BUSINESS OVERVIEW

FIGURE 52 MURATA MANUFACTURING CO., LTD.: COMPANY SNAPSHOT

TABLE 213 MURATA MANUFACTURING CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 214 MURATA MANUFACTURING CO., LTD.: PRODUCT LAUNCHES

TABLE 215 MURATA MANUFACTURING CO., LTD.: DEALS

11.2.9 NORDIC SEMICONDUCTOR

TABLE 216 NORDIC SEMICONDUCTOR: BUSINESS OVERVIEW

FIGURE 53 NORDIC SEMICONDUCTOR: COMPANY SNAPSHOT

TABLE 217 NORDIC SEMICONDUCTOR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 218 NORDIC SEMICONDUCTOR: PRODUCT LAUNCHES

TABLE 219 NORDIC SEMICONDUCTOR: DEALS

11.2.10 SEMTECH

TABLE 220 SEMTECH: BUSINESS OVERVIEW

FIGURE 54 SEMTECH: COMPANY SNAPSHOT

TABLE 221 SEMTECH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 222 SEMTECH: PRODUCT LAUNCHES

TABLE 223 SEMTECH: DEALS

*Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

11.3 INNOVATORS

11.3.1 ENOCEAN GMBH

11.3.2 ESPRESSIF SYSTEMS (SHANGHAI) CO., LTD.

11.3.3 CEVA, INC.

11.3.4 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC

11.3.5 PERASO TECHNOLOGIES INC.

11.3.6 PANASONIC HOLDINGS CORPORATION

11.3.7 BEHR TECHNOLOGIES INC.

11.3.8 MEIG SMART TECHNOLOGY

11.3.9 NEOWAY TECHNOLOGY

11.3.10 XIAMEN CHEERZING IOT TECHNOLOGY CO., LTD

12 APPENDIX (Page No. - 287)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 CUSTOMIZATION OPTIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

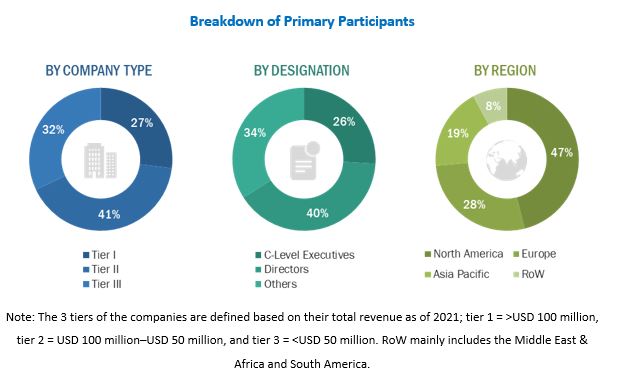

The study involves four major activities for estimating the size of the wireless connectivity market. Exhaustive secondary research has been conducted to collect information related to the market. The next step has been the validation of these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Top-down and bottom-up approaches have been used to estimate and validate the size of the wireless connectivity market and other dependent submarkets. The leading players in the market have been identified through secondary research, and their market share in the key regions has been determined through primary and secondary research. This entire procedure includes the study of the annual and financial reports of the top players and extensive interviews with the industry experts such as chief executive officers, vice presidents, directors, and marketing executives for the key insights.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. Secondary sources such as World Bank, The Organization for Economic Co-operation and Development (OECD), European Telecommunications Network Operators’ Association, LoRa Alliance, and IoT M2M council among others have been used to identify and collect information for an extensive technical and commercial study of the Wireless Connectivity market.

Primary Research

Extensive primary research was conducted after understanding and analyzing the wireless connectivity market through secondary research. Several primary interviews were conducted with key opinion leaders from both the demand- and supply-side vendors across major regions—North America, Europe, APAC, and RoW. Approximately 40% of the primary interviews were conducted with the demand-side vendors and 60% with the supply-side vendors. This primary data was mainly collected through telephonic interviews/web conferences, which consist of 80% of total primary interviews, as well as questionnaires and e-mails.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The wireless connectivity market consists of connectivity type: Wi-Fi, Bluetooth Classic, Bluetooth 4X, Bluetooth 5X, ZigBee, Z-Wave, UWB, NFC, Thread, GNSS, Cellular, EnOcean, Sigfox, LoRa, LTE Cat-M1, NB-IoT, and Others. A Wireless Connectivity is usually employed in following end use; wearable devices, healthcare, consumer electronics, building automation, automotive & transportation, and others. Top-down and bottom-up approaches have been used to estimate and validate the size of the wireless connectivity market and other dependent submarkets. The leading players in the market have been identified through secondary research, and their market share in the key regions has been determined through primary and secondary research. This entire procedure includes the study of the annual and financial reports of the top players and extensive interviews with the industry experts such as chief executive officers, vice presidents, directors, and marketing executives for the key insights.

Data Triangulation

After arriving at the overall market size from the market size estimation process explained earlier, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market has been validated using both top-down and bottom-up approaches.

Study Objectives:

- To describe and forecast the Wireless Connectivity market, in terms of value and volume, by connectivity type and application.

- To describe and forecast the Wireless Connectivity market, in terms of value, for four main regions – North America, Europe, APAC, and Rest of the World.

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To study the complete value chain of the Wireless Connectivity market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the Wireless Connectivity ecosystem

- To profile key players and comprehensively analyze their market position in terms of ranking and core competencies2, and provide a detailed competitive landscape of the market

- To analyze the competitive developments, such as joint ventures, collaborations, agreements, contracts, partnerships, mergers & acquisitions, new product developments, and research and development (R&D), in the Wireless Connectivity market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report.

Company information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Wireless Connectivity Market

I am looking for go to market strategy for emerging wireless technologies. I would also like to know their adoption in various industries.

We need wireless connectivity market for our future marketing strategies. Please share the scope and research methodology to arrive at the market value.

I am interested wireless connectivity market and looking for information on current status and trends of wireless connectivity and applications where the technologies are being adopted.

I want to understand wireless connectivity market and looking for information on traditional cellular, satellite, wired, LPWAN, other long range wireless, and Short range wireless connectivity technologies.

Please share research methodology used to arrive at the wireless connectivity market report.