Lubricant Anti-wear Agents Market by Type (ZDDP, Phosphate, Phosphite, Phosphonate) by Application (Engine Oil, Automotive Gear Oil, Automotive Transmission Fluid, Hydraulic oil, Metalworking Fluid, Grease) and Region - Global forecast to 2025

Updated on : April 17, 2024

Lubricant Anti-wear Agents Market

Lubricant Anti-wear Agents Market size was valued at USD 698 million in 2020 and is projected to reach USD 784 million by 2025, growing at 2.4% cagr from 2020 to 2025. The growing demand from automotive industry is driving the lubricant anti-wear agents industry growth.

The agreements, as well as plant expansions made by many prominent players in the lubricant anti-wear agents industry, are one of the key factors. The lucrative market opportunities in the regions of Brazil, Russia, India, and China (BRIC), as well as the rising demand for renewable energy, are expected to boost the lubricant anti-wear agent market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Lubricant anti-wear agents Market

The pandemic is estimated to have huge impact on the end-use industries of lubricant anti-wear agents, which is expected to reflect during the forecast period, especially in the year 2020-2021. The various impact of COVID-19 are as follows:

- Impact on automotive industry: The automotive sector that includes engine oil, automotive gear oil, and automotive transmission fluid is heavily impacted by the COVID-19. The demand for cars and commercial vehicles is expected to see decline throughout 2020 and 2021. More than 80% of automobile production in North America has come to a halt due to the COVID-19 pandemic. Europe and Asia Pacific are witnessing a similar situation. Companies such as Ford, General Motors, Fiat Chrysler Automobiles, Honda, and Tesla have stopped production temporarily. Even if these companies resume production after the pandemic subsides, economic instability and reduction in the purchasing power of consumers will have an adverse effect on the automotive industry.

- Impact on metalworking fluid: The impact of COVID-19 on the metalworking fluid is projected to vary in different regions across the world. It is due to the fact that the demand for metalworking fluid depends on the demand from various end-use industries such as electronics, aerospace, logistics, and manufacturing. However, owing to supply chain disruptions, logistics slowdowns, unavailability of the workforce, and reduced demand have stalled industrial activity globally and impacted many industries—including all end-use industries of metalworking fluids.

- Impact on Hydraulic oils: Hydraulic oils are commonly used in industrial applications, mostly as heat and power transferring medium. The demand for hydraulic oil is highly dependent on its end users as it is closely associated with the growth of various industries, such as construction, metals & mining, and manufacturing.

- Impact on Grease: The demand for grease depends on the consumption of grease products from its end-use industries, which include automotive and manufacturing. The automotive industry has seen the impact of the coronavirus crisis evolve from a supply shock to a global demand shock. Automotive sales are expected to drop by 14-22% in 2020 across China, the US, and Europe due to a mismatch of supply and demand. Additionally, with production activities at an all-time low across the globe, spurred by the lack of demand from the consumer end, the production of grease is also likely to be affected.

Lubricant Anti-wear Agents Market Dynamics

Driver: Increasing demand for the automotive sector

The increasing sales of passenger cars and commercial vehicles drive the lubricating oil additives market in the automotive industry. Lubricant anti-wear agents are majorly used in engine oil, gear oil, transmission fluid, and hydraulic fluid to prevent adhesive wear and protect metal components. According to the European Automobile Manufacturers Association, total motor vehicles increased from 302,461,697 in 2017 to 308,392,804 in 2018 in the European Union, reflecting an increase of 6.030,000 motor vehicles. In addition, the motorization rate in the Asia Pacific has been constantly increasing over the past five years. The key countries contributing to the growth in this region include China, India, Japan, South Korea, and Indonesia.

According to the National Investment Promotion & Facilitation Agency, in India annual production of vehicles reached USD 29.08 million in 2018 as compared to USD 25.33 million in 2017. India is expected to emerge as the world’s third-largest passenger vehicle market by 2021. In FY 2018-19, passenger vehicles sales increased by 2.70%, two-wheeler by 4.86%, and three-wheeler by 10.27% as compared to FY 2017-18. According to Trading Economics, car sales in China increased 12.8 percent year-on-year reaching 2.57 million in September 2020. Thus, rising demand for motor vehicles is expected to lead to an increase in the demand for lubricants which is expected to increase the demand for lubricant anti-wear agents.

Restraint: Drive towards alternative fuels

Global warming is a worldwide concern associated with the use of petroleum products. Their use leads to various negative impacts on the environment which result in rising sea levels, high temperatures, severe flooding, and droughts which are already increasingly common. According to the Union of Concerned Scientists, collectively, cars and trucks account for approximately one-fifth of all US emissions, emittingapproximately 24 pounds of carbon dioxide and other global-warming gases for every gallon of gas used. This has resulted in the development of various types of alternative fuels that can replace gasoline and lower environmental pollution. According to U.S. Department of Energy, natural gas emits approximately 6% to 11% lower levels of GHGs than gasoline throughout the fuel lifecycle. Some of the alternative fuels for gasoline and diesel are Hydrogen, Biodiesel, Ethanol, Natural gas, and Propane

Opportunity: Lucrative market opportunities from BRIC countries

BRICS countries (Brazil, Russia, India, China, and South Africa) together are expected to account for a large market for lubricant anti-wear agents during the forecast period. According to World Bank estimates, approximately 41% of the world’s population is in the BRICS countries which is 31% higher than the 10% share of population of the G7 (Canada, France, Germany, Italy, Japan, UK, and US) countries, and this population is expected to increase further. The BRICS countries together account for over a fifth of the global economy. According to International Monetary Fund (IMF) projections, between 2016 and 2021 the BRICS nations are expected to account for approximately half the world growth. To meet the demands of the large population, governments in these countries are highly focused on industrial development. With

the strengthening of financial infrastructure in these countries, foreign and domestic investments are expected to increase exponentially in the next five years. This is expected to boost all the associated sectors, thereby driving the growth of related industries such as lubricant anti-wear agents.

Challenge: Fluctuating prices of crude oil

Oil prices play a crucial role in the lubricant additive sector, and thus any structural changes in the oil market impact the lubricant anti-wear agents market. The fluctuations of prices of crude oil places lubricant anti-wear agent producers in adverse situations, which, in turn, affect profitability. The fluctuating crude oil prices during the last few years have affected the lubricant anti-wear agent value chain as crude oil is the raw material for anti-wear additives. Countries that consume large amounts of energy have been coping with oil prices above USD 100 per barrel since 2011, which had fallen to approximately USD 50 per barrel in March 2020. Therefore, fluctuating crude oil prices have created uncertainties for lubricant anti- wear producers. Due to fluctuating base oil prices, the decision to buy crude oil becomes difficult as manufacturers are unsure of the prices at which they should buy crude oil

The captive segment of lubricant anti-wear agents market, by sales channel, is expected at fastest rate fro 2020 to 2025

A captive sales channel is a business unit of a company that supports operations such as manufacturing and commercial, among others. It is an independent entity that operates and undertakes operational tieups with the parent company. This helps the company minimize the total costs incurred in the production of lubricants for various applications and maintain the desired quality standards of additives. In a captive sales channel, the role of additive suppliers such as lubricant additive component manufacturers and package manufacturers who provide ready-to-use lubricant additive packages is eliminated. This offers a competitive edge in terms of price to companies such as BASF SE and Lubrizol Corporation.

Based on application, the engine oil segment is projected to dominate the lubricant anti-wear agents market from 2020 to 2025

Based on the application, the lubricant anti-wear agents industry has been segmented into engine oil, automotive gear oil, automotive transmission fluid, hydraulic oil, grease, metalworking fluid, and others. The other application in lubricant anti-wear agentss includes turbine oil, compressor oil, and industrial gear oil. The engine oil application segment is projected to lead the market during the forecast period in terms of both value and volume. The growth of this segment can be attributed to the increase in the automotive sector in the developing regions. Furthermore, the surge in the population in the regions of Asia Pacific is driving the demand for the automotive industry, and thus propelling the market for the engine oil application segment of the lubricant anti-wear agents.

To know about the assumptions considered for the study, download the pdf brochure

The Asia Pacific is projected to lead the lubricant anti-wear agents market during the forecast period

The Asia Pacific region is estimated to be the largest market for lubricant anti-wear agents in 2019. China, Japan, and India are the significant consumers of lubricant anti-wear agents in this region. Increasing GDP led by the rising industrial activities in the Asia Pacific region has increased the demand for lubricant anti-wear agents in this region. Furthermore, the growth of transportation, power generation, mining, and other sectors are responsible for the growth of the lubricant anti-wear agent market in the Asia Pacific.

Lubricant Anti-wear Agents Market Players

Afton Chemical (US), BASF SE (Germany), Chevron Oronite (US), Solvay (Belgium), LANXESS (Germany) are some of the leading players operating in the lubricant anti-wear agents market. These players have adopted the strategies of agreements, expansions, new product launches, acquisitions, collaborations, contracts, investments, and divestments to enhance their position in the market.

Lubricant Anti-wear Agents Market Report Scope

|

Report Metric |

Details |

|

Market Size Available for Years |

2018–2025 |

|

Base Year Considered |

2019 |

|

Forecast Period |

2020–2025 |

|

Forecast Units |

Value (USD Million and Kilotons) |

|

Segments Covered |

By type, By Application, By sales channel, and Region |

|

Geographies Covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies Covered |

Afton Chemical (US), BASF SE (Germany), Chevron Oronite (US), Solvay (Belgium), LANXESS (Germany), and other. Other includes rest 17 Companies |

This research report categorizes the lubricant anti-wear agents market based on type, application, sales channel, and region.

Based on type, the lubricant anti-wear agents market is segmented as follows:

- Zinc Dialkldithiophosphate (ZDDP)

-

P-Derivative

- Phosphate

- Phosphonate

- phosphite

Based on Application, the lubricant anti-wear agents market is segmented as follows:

- Engine Oil

- Automotive Gear Oil

- Automotive Transmission Fluid

- Metal working Fluid

- Greases

- Hydraulic Oil

- Others

Based on Sales Channel, the lubricant anti-wear agents market is segmented as follows:

- Merchant

- Captive

Based on Region, the lubricant anti-wear agents market is segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In August 2020, Afton Chemical Company is investing in Gasoline Performance Additives (GPA) blending capabilities at its Singapore chemical additive manufacturing facility in order to focus on globally lean supply chain solutions that are expected to enable quicker support and effective supply in Asia. This is also expected to provide the additional infrastructure needed to support the company’s long-term growth plans globally.

- In July 2020, Chevron Oronite entered into an agreement with quantiQ Distribuidora Ltda to be their distributor in Brazil. Under the contract, quantiQ Distribuidora Ltda is expected to distribute Chevron Oronite lubricant additives which is expected to strengthen the supply chain of the company..

- In September 2018, Afton Chemical expanded its chemical additive manufacturing facility in Jurong Island, Singapore to produce core engine oil additives such as advanced ashless dispersants and anti-wear agents required in the Asia Pacific region..

Frequently Asked Questions (FAQ):

What is the current size of the global lubricant anti-wear agents market?

The global lubricant anti-wear agents market is estimated to be USD 698 million in 2020 and projected to reach to USD 784 million by 2025, at a CAGR of 2.4%.

Who are the leading players in the global lubricant anti-wear agents market?

Afton Chemical (US), BASF SE (Germany), Chevron Oronite (US), Solvay (Belgium), LANXESS (Germany) fall under the leading manufacturers in the evolving lubricant anti-wear agents market.

What is the COVID-19 impact on lubricant anti-wear agents end-use industries?

COVID-19 outbreak is expected to have a major impact on the various end-use industries of global demand for lubricant anti-wear agents market. The outbreak and the spread of the COVID-19 led to major disruptions across end-use industries such as automotive, manufacturing, mining and metalworking, thereby resulting in reduced demand for lubricant anti-wear agents products, particularly during the years 2020-2021.

What is the estimated size of the lubricant anti-wear agents market in 2019?

The market size of lubricant anti-wear agents market in 2019 was USD 768 millon.

What are the mejor applications of lubricant anti-wear agents?

The major application of lubricant anti-wear agents are Engine Oil, Automotive gear Oil, Automotive Transmission Fluid, and Hydraulic Oil. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 34)

1.1 OBJECTIVES OF THE STUDY

1.2 DEFINITION

1.2.1 LUBRICANT ANTI-WEAR AGENTS MARKET, BY TYPE: INCLUSIONS & EXCLUSIONS

TABLE 1 LUBRICANT ANTI-WEAR AGENT MARKET, BY TYPE: INCLUSIONS & EXCLUSIONS

1.2.2 LUBRICANT ANTI-WEAR AGENTS MARKET, BY APPLICATION: INCLUSIONS & EXCLUSIONS

TABLE 2 LUBRICANT ANTI-WEAR AGENT MARKET, BY APPLICATION: INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 38)

2.1 RESEARCH DATA

FIGURE 1 LUBRICANT ANTI-WEAR AGENTS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

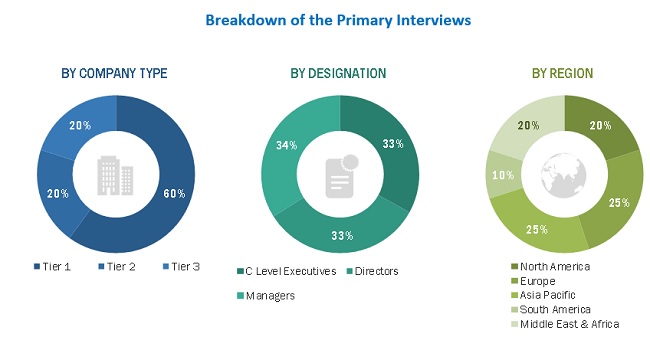

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

FIGURE 2 MARKET SIZE ESTIMATION (DEMAND SIDE): LUBRICANT ANTI-WEAR AGENTS MARKET

FIGURE 3 MARKET SIZE ESTIMATION (SUPPLY SIDE): LUBRICANT ANTI-WEAR AGENTS MARKET

2.3 MARKET ENGINEERING PROCESS

2.3.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.4 DATA TRIANGULATION

2.5 ASSUMPTIONS

2.6 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 47)

TABLE 3 LUBRICANT ANTI-WEAR AGENTS MARKET SNAPSHOT

FIGURE 6 ZDDP PROJECTED TO LEAD BASE OIL MARKET DURING FORECAST PERIOD, IN TERMS OF VALUE

FIGURE 7 ENGINE OIL SEGMENT PROJECTED TO LEAD LUBRICANT ANTI-WEAR AGENT MARKET DURING FORECAST PERIOD

FIGURE 8 ASIA PACIFIC ESTIMATED TO ACCOUNT FOR LARGEST SHARE OF LUBRICANT ANTI-WEAR AGENTS MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 51)

4.1 ATTRACTIVE OPPORTUNITIES IN THE LUBRICANT ANTI-WEAR AGENTS MARKET

FIGURE 9 INCREASING USE OF ANTI-WEAR AGENTS IN DIFFERENT HIGH-PERFORMANCE ENGINE OILS TO DRIVE GROWTH OF THE MARKET

4.2 LUBRICANT ANTI-WEAR AGENT MARKET, BY REGION

FIGURE 10 ASIA PACIFIC TO ACCOUNT FOR LARGEST SIZE OF THE LUBRICANT ANTI-WEAR AGENTS MARKET FROM 2020 TO 2025 IN TERMS OF VOLUME

4.3 ASIA PACIFIC LUBRICANT ANTI-WEAR AGENT MARKET, BY COUNTRY AND APPLICATION

FIGURE 11 ENGINE OIL SEGMENT AND CHINA TO ACCOUNT FOR LARGEST SHARES OF ASIA PACIFIC LUBRICANT ANTI-WEAR AGENTS MARKET IN 2020 IN TERMS OF VOLUME

4.4 LUBRICANT ANTI-WEAR AGENTS MARKET, BY SALES CHANNEL

FIGURE 12 MERCHANT SEGMENT TO ACCOUNT FOR THE LARGER SIZE OF THE LUBRICANT ANTI-WEAR AGENTS MARKET IN 2020 IN TERMS OF VOLUME

4.5 LUBRICANT ANTI-WEAR AGENT MARKET, BY APPLICATION

FIGURE 13 ENGINE OIL SEGMENT TO ACCOUNT FOR THE LARGEST SIZE OF THE LUBRICANT ANTI-WEAR AGENTS MARKET FROM 2020 TO 2025 IN TERMS OF VOLUME

5 MARKET OVERVIEW (Page No. - 54)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 14 LUBRICANT ANTI-WEAR AGENTS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing demand from the automotive sector

FIGURE 15 GLOBAL: COMMERCIAL VEHICLE SALES

TABLE 4 RISE IN THE NUMBER OF MOTOR VEHICLES IN USE

5.2.1.2 High economic growth in the Asia Pacific led by increasing industrial activity

TABLE 5 INDUSTRIAL GROWTH RATE OF EMERGING COUNTRIES IN ASIA PACIFIC (2018)

5.2.2 RESTRAINTS

5.2.2.1 Drive towards alternative fuels

TABLE 6 NUMBER OF NATURAL GAS VEHICLES (NGV) AND STATIONS IN 2019

5.2.2.2 Rising competition from unorganized and fragmented market

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing demand for renewable energy

FIGURE 16 GLOBAL: WIND ENERGY INSTALLED CAPACITY IN MEGAWATT (MW)

5.2.3.2 Increasing market opportunities from BRICS countries

5.2.4 CHALLENGES

5.2.4.1 Fluctuations in prices of crude oil

FIGURE 17 CRUDE OIL PRICES

5.2.4.2 Rising demand for hybrid and electric vehicles

FIGURE 18 GLOBAL: ELECTRIC CAR SALES

5.2.4.3 Impact of COVID-19

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 19 LUBRICANT ANTI-WEAR AGENTS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 BARGAINING POWER OF BUYERS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 THREAT OF NEW ENTRANTS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 INDUSTRY OUTLOOK

5.4.1 AUTOMOTIVE INDUSTRY

TABLE 7 SALE OF NEW VEHICLES IN KEY COUNTRIES OF THE ASIA PACIFIC, 2018 (UNITS)

TABLE 8 SALE OF NEW VEHICLES IN KEY COUNTRIES OF NORTH AMERICA, 2018 (UNITS)

TABLE 9 SALE OF NEW VEHICLE IN KEY COUNTRIES OF EUROPE, 2018 (UNITS)

TABLE 10 SALE OF NEW VEHICLES IN KEY COUNTRIES OF SOUTH AMERICA, 2018 (UNITS)

TABLE 11 SALE OF NEW VEHICLES IN KEY COUNTRIES OF THE MIDDLE EAST & AFRICA, 2018 (UNITS)

5.5 VALUE CHAIN ANALYSIS

5.6 TRADE DATA

TABLE 12 LUBRICANT TRADE DATA BY MAJOR COUNTRIES, 2017 (KILOTONS)

5.7 PATENT ANALYSIS

5.8 TRENDS IN AVERAGE SELLING PRICES

TABLE 13 AVERAGE PRICES OF LUBRICANT ANTI-WEAR AGENT TYPES, BY REGION (USD/TON)

5.9 REGULATORY LANDSCAPE

6 COVID-19 IMPACT ON LUBRICANT MARKET ECOSYSTEM (Page No. - 68)

6.1 COVID-19 ECONOMIC ASSESSMENT

FIGURE 20 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

6.1.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 21 CRITERIA IMPACTING THE GLOBAL ECONOMY

6.2 CRITICAL COVID-19 FACTORS IMPACTING THE LUBRICANTS MARKET IN 2020

6.3 LUBRICANTS MARKET PROJECTIONS BASED ON DRIVING FACTORS AND COVID-19 IMPACT

6.4 VALUE CHAIN OF LUBRICANTS INDUSTRY

FIGURE 22 LUBRICANTS MARKET: ECOSYSTEM

FIGURE 23 IMPACT OF COVID-19 ON LUBRICANTS - KEY HOTSPOTS OF ACTIVITIES GAINING MOMENTUM

6.5 KEY TAKEAWAYS

FIGURE 24 IMPACT OF COVID-19 ON LUBRICANT ECOSYSTEM

6.5.1 IMPACT ON TRANSPORTATION

FIGURE 25 LUBRICANTS TRANSPORTATION VALUE CHAIN TO BE ADVERSELY AFFECTED

6.5.2 IMPACT ON INDUSTRIAL APPLICATIONS

FIGURE 26 MIX IMPACT ON LUBRICANTS INDUSTRIAL VALUE CHAIN THROUGH 2021

6.6 FACTORS DRIVING THE GROWTH

6.6.1 DISRUPTION IN THE AUTOMOTIVE INDUSTRY

6.6.1.1 Impact on customers’ output & strategies to resume/improve production

TABLE 14 AUTOMOTIVE COMPANIES’ ANNOUNCEMENTS

6.6.1.2 Customer’s most impacted regions

6.6.1.3 Risk assessment and opportunities

TABLE 15 OPPORTUNITY ASSESSMENT IN AUTOMOTIVE INDUSTRY– SHORT-TERM STRATEGIES TO MANAGE COST STRUCTURE AND SUPPLY CHAINS

6.6.1.4 MnM viewpoint on growth outlook and new market opportunities

7 LUBRICANT ANTI-WEAR AGENTS MARKET, BY SALES CHANNEL (Page No. - 80)

7.1 INTRODUCTION

FIGURE 27 MERCHANT SEGMENT TO DOMINATE THE LUBRICANT ANTI-WEAR AGENTS MARKET, BY SALES CHANNEL DURING THE FORECAST PERIOD

TABLE 16 LUBRICANT ANTI-WEAR AGENT MARKET SIZE, BY SALES CHANNEL, 2018–2025 (USD MILLION)

TABLE 17 LUBRICANT ANTI-WEAR AGENTS MARKET SIZE, BY SALES CHANNEL, 2018–2025 (KILOTONS)

7.2 CAPTIVE

7.2.1 COMPETITIVE EDGE IN TERMS OF PRICE IS EXPECTED TO DRIVE THE SEGMENT

TABLE 18 CAPTIVE LUBRICANT ANTI-WEAR AGENTS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 19 CAPTIVE LUBRICANT ANTI-WEAR AGENT MARKET SIZE, BY REGION, 2018–2025 (KILOTONS)

7.3 MERCHANT

7.3.1 REQUIREMENT OF MINIMUM INVESTMENTS ON FIXED ASSETS EXPECTED TO PROPEL DEMAND FOR THE SEGMENT

TABLE 20 MERCHANT LUBRICANT ANTI-WEAR AGENTS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 21 MERCHANT LUBRICANT ANTI-WEAR AGENT MARKET SIZE, BY REGION, 2018–2025 (KILOTONS)

8 LUBRICANT ANTI-WEAR AGENTS MARKET, BY APPLICATION (Page No. - 84)

8.1 INTRODUCTION

FIGURE 28 ENGINE OIL SEGMENT TO LEAD THE LUBRICANT ANTI-WEAR AGENTS MARKET DURING THE FORECAST PERIOD

TABLE 22 LUBRICANT ANTI-WEAR AGENT MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 23 LUBRICANT ANTI-WEAR AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

8.2 AUTOMOTIVE

8.2.1 RISING DEMAND FOR ENGINE OIL FROM PASSENGER AND COMMERCIAL VEHICLES EXPECTED TO INCREASE DEMAND IN THE SEGMENT

8.2.1.1 Impact of COVID-19 on the automotive industry

8.2.2 ENGINE OIL

TABLE 24 ENGINE OIL LUBRICANT ANTI-WEAR AGENTS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 25 ENGINE OIL LUBRICANT ANTI-WEAR AGENT MARKET SIZE, BY REGION, 2018–2025 (KILOTONS)

8.2.3 AUTOMOTIVE GEAR OIL

TABLE 26 AUTOMOTIVE GEAR OIL LUBRICANT ANTI-WEAR AGENTS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 27 AUTOMOTIVE GEAR OIL LUBRICANT ANTI-WEAR AGENT MARKET SIZE, BY REGION, 2018–2025 (KILOTONS)

8.2.4 AUTOMOTIVE TRANSMISSION FLUID

TABLE 28 AUTOMOTIVE TRANSMISSION FLUID LUBRICANT ANTI-WEAR AGENTS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 29 AUTOMOTIVE TRANSMISSION FLUID LUBRICANT ANTI-WEAR AGENT MARKET SIZE, BY REGION, 2018–2025 (KILOTONS)

8.3 INDUSTRIAL

8.3.1 LUBRICANT ANTI-WEAR AGENTS USED IN HYDRAULIC OIL AND METALWORKING FLUID EXPECTED TO DRIVE DEMAND FOR THIS SEGMENT

8.3.1.1 Impact of COVID-19 on the industrial sector

8.3.2 HYDRAULIC OIL

8.3.2.1 Impact of COVID-19 on hydraulic oil

TABLE 30 HYDRAULIC OIL LUBRICANT ANTI-WEAR AGENTS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 31 HYDRAULIC OIL LUBRICANT ANTI-WEAR AGENT MARKET SIZE, BY REGION, 2018–2025 (KILOTONS)

8.3.3 METAL WORKING FLUID

8.3.3.1 Impact of COVID-19 on metal working fluid

TABLE 32 METAL WORKING FLUID LUBRICANT ANTI-WEAR AGENTS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 33 METAL WORKING FLUID LUBRICANT ANTI-WEAR AGENT MARKET SIZE, BY REGION, 2018–2025 (KILOTONS)

8.3.4 GREASE

8.3.4.1 Impact of COVID-19 on grease

TABLE 34 GREASE LUBRICANT ANTI-WEAR AGENTS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 35 GREASE LUBRICANT ANTI-WEAR AGENT MARKET SIZE, BY REGION, 2018–2025 (KILOTONS)

8.3.5 OTHERS

TABLE 36 OTHER LUBRICANT ANTI-WEAR AGENTS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 37 OTHER LUBRICANT ANTI-WEAR AGENT MARKET SIZE, BY REGION, 2018–2025 (KILOTONS)

9 LUBRICANT ANTI-WEAR AGENTS MARKET, BY TYPE (Page No. - 96)

9.1 INTRODUCTION

FIGURE 29 ZDDP SEGMENT TO LEAD THE LUBRICANT ANTI-WEAR AGENTS MARKET DURING THE FORECAST PERIOD

TABLE 38 LUBRICANT ANTI-WEAR AGENT MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 39 LUBRICANT ANTI-WEAR AGENTS MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

9.2 ZINC DIALKLDITHIOPHOSPHATE (ZDDP)

9.2.1 WEAR, OXIDATION, AND CORROSION PROTECTION PROPERTIES ARE EXPECTED TO DRIVE DEMAND

TABLE 40 ZDDP LUBRICANT ANTI-WEAR AGENTS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 41 ZDDP LUBRICANT ANTI-WEAR AGENT MARKET SIZE, BY REGION, 2018–2025 (KILOTONS)

9.3 P-DERIVATIVE

9.3.1 RISING DEMAND FOR P-DERIVATIVE IN VARIOUS APPLICATIONS IS EXPECTED TO DRIVE THE MARKET DURING THE FORECAST PERIOD

TABLE 42 P-DERIVATIVE LUBRICANT ANTI-WEAR AGENTS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 43 P-DERIVATIVE LUBRICANT ANTI-WEAR AGENT MARKET SIZE, BY REGION, 2018–2025 (KILOTONS)

9.3.2 PHOSPHONATE

9.3.3 PHOSPHATE

9.3.4 PHOSPHITE

10 LUBRICANT ANTI-WEAR AGENTS MARKET, BY REGION (Page No. - 101)

10.1 INTRODUCTION

FIGURE 30 ASIA PACIFIC TO BE LARGEST MARKET FOR LUBRICANT ANTI-WEAR AGENTS DURING FORECAST PERIOD

TABLE 44 LUBRICANT ANTI-WEAR AGENTS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 45 LUBRICANT ANTI-WEAR AGENT MARKET SIZE, BY REGION, 2018–2025 (KILOTONS)

10.2 ASIA PACIFIC

FIGURE 31 ASIA PACIFIC: LUBRICANT ANTI-WEAR AGENTS MARKET SNAPSHOT

TABLE 46 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 47 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTONS)

TABLE 48 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 49 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

TABLE 50 ASIA PACIFIC: ZDDP LUBRICANT ANTI-WEAR AGENT MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 51 ASIA PACIFIC: ZDDP MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTONS)

TABLE 52 ASIA PACIFIC: PHOSPHATE LUBRICANT ANTI-WEAR AGENTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 53 ASIA PACIFIC: PHOSPHATE MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTONS)

TABLE 54 ASIA PACIFIC: PHOSPHITE MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 55 ASIA PACIFIC: PHOSPHITE MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTONS)

TABLE 56 ASIA PACIFIC: PHOSPHONATE LUBRICANT ANTI-WEAR AGENT MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 57 ASIA PACIFIC: PHOSPHONATE MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTONS)

TABLE 58 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 59 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 60 ASIA PACIFIC: LUBRICANTS ANTI-WEAR AGENTS MARKET SIZE, BY SALES CHANNEL, 2018–2025 (USD MILLION)

TABLE 61 ASIA PACIFIC: MARKET SIZE, BY SALES CHANNEL, 2018–2025 (KILOTONS)

10.2.1 CHINA

10.2.1.1 Increasing population drives the demand for lubricant anti-wear agents in China

TABLE 62 CHINA: LUBRICANT ANTI-WEAR AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 63 CHINA: MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 64 CHINA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 65 CHINA: LUBRICANT ANTI-WEAR AGENT MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

10.2.1.2 Impact of COVID-19 on China

10.2.2 JAPAN

10.2.2.1 Increase in the production of passenger cars is expected to increase demand in Japan

TABLE 66 JAPAN: LUBRICANT ANTI-WEAR AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 67 JAPAN: MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 68 JAPAN: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 69 JAPAN: MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

10.2.2.2 Impact of COVID-19 on Japan

10.2.3 SOUTH KOREA

10.2.3.1 Increase in demand for passenger cars along with the largest shipbuilding industry expected to drive the market

TABLE 70 SOUTH KOREA: LUBRICANT ANTI-WEAR AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 71 SOUTH KOREA: MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 72 SOUTH KOREA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 73 SOUTH KOREA: MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

10.2.3.2 Impact of COVID-19 on South Korea

10.2.4 INDIA

10.2.4.1 Rapid urbanization and rising population to boost demand for lubricant anti-wear agents in India

TABLE 74 INDIA: LUBRICANT ANTI-WEAR AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 75 INDIA: MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 76 INDIA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 77 INDIA: MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

10.2.4.2 Impact of COVID-19 on India

10.2.5 INDONESIA

10.2.5.1 Government initiatives towards renewables in power sector expected to drive the market

TABLE 78 INDONESIA: LUBRICANT ANTI-WEAR AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 79 INDONESIA: MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 80 INDONESIA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 81 INDONESIA: MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

10.2.5.2 Impact of COVID-19 on Indonesia

10.2.6 THAILAND

10.2.6.1 Rising production of automotive parts to drive demand for lubricant anti-wear agents

TABLE 82 THAILAND: LUBRICANT ANTI-WEAR AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 83 THAILAND: MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 84 THAILAND: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 85 THAILAND: LUBRICANTS ANTI-WEAR AGENT MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

10.2.6.2 Impact of COVID-19 on Thailand

10.2.7 REST OF ASIA PACIFIC

10.2.7.1 Rising demand for motor vehicles expected to drive the market

TABLE 86 REST OF ASIA PACIFIC: LUBRICANT ANTI-WEAR AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 87 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 88 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 89 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

10.3 EUROPE

FIGURE 32 EUROPE: LUBRICANT ANTI-WEAR AGENTS MARKET SNAPSHOT

TABLE 90 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 91 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTONS)

TABLE 92 EUROPE: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 93 EUROPE: MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

TABLE 94 EUROPE: ZDDP LUBRICANT ANTI-WEAR AGENTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 95 EUROPE: ZDDP MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTONS)

TABLE 96 EUROPE: PHOSPHATE LUBRICANT ANTI-WEAR AGENTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 97 EUROPE: PHOSPHATE MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTONS)

TABLE 98 EUROPE: PHOSPHITE MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 99 EUROPE: PHOSPHITE MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTONS)

TABLE 100 EUROPE: PHOSPHONATE MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 101 EUROPE: PHOSPHONATE MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTONS)

TABLE 102 EUROPE: LUBRICANT ANTI-WEAR AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 103 EUROPE: LUBRICANT ANTI-WEAR MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 104 EUROPE: MARKET SIZE, BY SALES CHANNEL, 2018–2025 (USD MILLION)

TABLE 105 EUROPE: LUBRICANTS ANTI-WEAR AGENTS MARKET SIZE, BY SALES CHANNEL, 2018–2025 (KILOTONS)

10.3.1 GERMANY

10.3.1.1 Lubricant anti-wear agents market majorly driven by the automobile industry in Germany

TABLE 106 GERMANY: LUBRICANT ANTI-WEAR AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 107 GERMANY: MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 108 GERMANY: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 109 GERMANY: MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

10.3.1.2 Impact of COVID-19 on Germany

10.3.2 RUSSIA

10.3.2.1 Rising middle class population with automotive being the vital sector in the country are expected to drive the market

TABLE 110 RUSSIA: LUBRICANT ANTI-WEAR AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 111 RUSSIA: MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 112 RUSSIA: LUBRICANTS ANTI-WEAR MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 113 RUSSIA: LUBRICANT ANTI-WEAR AGENT MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

10.3.2.2 Impact of COVID-19 on Russia

10.3.3 FRANCE

10.3.3.1 Presence of some of the major automotive companies is expected to drive the market

TABLE 114 FRANCE: LUBRICANT ANTI-WEAR AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 115 FRANCE: LUBRICANTS ANTI-WEAR AGENT MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 116 FRANCE: LUBRICANTS ANTI-WEAR MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 117 FRANCE: LUBRICANTS ANTI-WEAR AGENT MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

10.3.3.2 Impact of COVID-19 on France

10.3.4 ITALY

10.3.4.1 Growth in the wind energy and hydroelectricity sectors expected to enhance the market due to the increase in the number of turbines

TABLE 118 ITALY: LUBRICANT ANTI-WEAR AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 119 ITALY: MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 120 ITALY: LUBRICANTS ANTI-WEAR AGENTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 121 ITALY: LUBRICANT ANTI-WEAR AGENT MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

10.3.4.2 Impact of COVID-19 on Italy

10.3.5 UK

10.3.5.1 Growth in the industrial sector expected to drive the market

TABLE 122 UK: LUBRICANT ANTI-WEAR AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 123 UK: LUBRICANTS ANTI-WEAR AGENT MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 124 UK: LUBRICANT ANTI-WEAR MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 125 UK: LUBRICANTS ANTI-WEAR AGENT MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

10.3.5.2 Impact of COVID-19 on the UK

10.3.6 SPAIN

10.3.6.1 Industrial sector contributing a significant share to the GDP is expected to drive the market

TABLE 126 SPAIN: LUBRICANT ANTI-WEAR AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 127 SPAIN: MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 128 SPAIN: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 129 SPAIN: MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

10.3.6.2 Impact of COVID-19 on Spain

10.3.7 REST OF EUROPE

10.3.7.1 Automotive sector enhancing the demand for lubricant anti-wear agents

TABLE 130 REST OF EUROPE: LUBRICANT ANTI-WEAR AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 131 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 132 REST OF EUROPE: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 133 REST OF EUROPE: MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

10.4 NORTH AMERICA

FIGURE 33 NORTH AMERICA: LUBRICANT ANTI-WEAR AGENTS MARKET SNAPSHOT

TABLE 134 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 135 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTONS)

TABLE 136 NORTH AMERICA: LUBRICANTS ANTI-WEAR AGENTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 137 NORTH AMERICA: LUBRICANT ANTI-WEAR AGENT MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

TABLE 138 NORTH AMERICA: ZDDP LUBRICANTS ANTI-WEAR AGENT MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 139 NORTH AMERICA: ZDDP MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTONS)

TABLE 140 NORTH AMERICA: PHOSPHATE LUBRICANT ANTI-WEAR AGENTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 141 NORTH AMERICA: PHOSPHATE MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTONS)

TABLE 142 NORTH AMERICA: PHOSPHITE MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 143 NORTH AMERICA: PHOSPHITE MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTONS)

TABLE 144 NORTH AMERICA: PHOSPHONATE MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 145 NORTH AMERICA: PHOSPHONATE MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTONS)

TABLE 146 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 147 NORTH AMERICA: LUBRICANT MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 148 NORTH AMERICA: MARKET SIZE, BY SALES CHANNEL, 2018–2025 (USD MILLION)

TABLE 149 NORTH AMERICA: LUBRICANTS MARKET SIZE, BY SALES CHANNEL, 2018–2025 (KILOTONS)

10.4.1 US

10.4.1.1 Increase in the production of passenger cars and commercial vehicles expected to fuel demand

TABLE 150 US: LUBRICANT ANTI-WEAR AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 151 US: MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 152 US: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 153 US: MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

10.4.1.2 Impact of COVID-19 on the US

10.4.2 CANADA

10.4.2.1 Increasing initiatives towards the development of wind and hydroelectricity are expected to propel demand

TABLE 154 CANADA: LUBRICANT ANTI-WEAR AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 155 CANADA: MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 156 CANADA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 157 CANADA: MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

10.4.2.2 Impact of COVID-19 on Canada

10.4.3 MEXICO

10.4.3.1 Automotive sector along with initiatives for the development of wind and hydroelectricity are expected to propel demand

TABLE 158 MEXICO: LUBRICANT ANTI-WEAR AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 159 MEXICO: MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 160 MEXICO: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 161 MEXICO: LUBRICANT ANTI-WEAR AGENT MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

10.4.3.2 Impact of COVID-19 on Mexico

10.5 MIDDLE EAST & AFRICA

TABLE 162 MIDDLE EAST & AFRICA: LUBRICANT ANTI-WEAR AGENTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 163 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTONS)

TABLE 164 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 165 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

TABLE 166 MIDDLE EAST & AFRICA: ZDDP MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 167 MIDDLE EAST & AFRICA: ZDDP MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTONS)

TABLE 168 MIDDLE EAST & AFRICA: PHOSPHATE LUBRICANT ANTI-WEAR AGENTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 169 MIDDLE EAST & AFRICA: PHOSPHATE MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTONS)

TABLE 170 MIDDLE EAST & AFRICA: PHOSPHITE MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 171 MIDDLE EAST & AFRICA: PHOSPHITE MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTONS)

TABLE 172 MIDDLE EAST & AFRICA: PHOSPHONATE MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 173 MIDDLE EAST & AFRICA: PHOSPHONATE MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTONS)

TABLE 174 MIDDLE EAST & AFRICA: LUBRICANT ANTI-WEAR AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 175 MIDDLE EAST & AFRICA: LUBRICANT MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 176 MIDDLE EAST & AFRICA: MARKET SIZE, BY SALES CHANNEL, 2018–2025 (USD MILLION)

TABLE 177 MIDDLE EAST & AFRICA: MARKET SIZE, BY SALES CHANNEL, 2018–2025 (KILOTONS)

10.5.1 SAUDI ARABIA

10.5.1.1 Growing infrastructure is expected to drive the market

TABLE 178 SAUDI ARABIA: LUBRICANT ANTI-WEAR AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 179 SAUDI ARABIA: MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 180 SAUDI ARABIA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 181 SAUDI ARABIA: LUBRICANT ANTI-WEAR AGENT MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

10.5.1.2 Impact of COVID-19 on Saudi Arabia

10.5.2 TURKEY

10.5.2.1 Growth in the industrial sector is expected to drive the market

TABLE 182 TURKEY: LUBRICANT ANTI-WEAR AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 183 TURKEY: MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 184 TURKEY: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 185 TURKEY: MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

10.5.3 IRAN

10.5.3.1 Growth in industrial production is expected to drive the market

TABLE 186 IRAN: LUBRICANT ANTI-WEAR AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 187 IRAN: MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 188 IRAN: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 189 IRAN: MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

10.5.4 REST OF MIDDLE EAST & AFRICA

10.5.4.1 Rising construction sector is expected to propel demand

TABLE 190 REST OF MIDDLE EAST & AFRICA: LUBRICANT ANTI-WEAR AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 191 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 192 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 193 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

10.6 SOUTH AMERICA

TABLE 194 SOUTH AMERICA: LUBRICANT ANTI-WEAR AGENTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 195 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTONS)

TABLE 196 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 197 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

TABLE 198 SOUTH AMERICA: ZDDP LUBRICANT ANTI-WEAR AGENT MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 199 SOUTH AMERICA: ZDDP MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTONS)

TABLE 200 SOUTH AMERICA: PHOSPHATE LUBRICANT ANTI-WEAR AGENTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 201 SOUTH AMERICA: PHOSPHATE MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTONS)

TABLE 202 SOUTH AMERICA: PHOSPHITE MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 203 SOUTH AMERICA: PHOSPHITE MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTONS)

TABLE 204 SOUTH AMERICA: PHOSPHONATE MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 205 SOUTH AMERICA: PHOSPHONATE MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTONS)

TABLE 206 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 207 SOUTH AMERICA: LUBRICANT MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 208 SOUTH AMERICA: MARKET SIZE, BY SALES CHANNEL, 2018–2025 (USD MILLION)

TABLE 209 SOUTH AMERICA: LUBRICANT ANTI-WEAR AGENT MARKET SIZE, BY SALES CHANNEL, 2018–2025 (KILOTONS)

10.6.1 BRAZIL

10.6.1.1 High demand for engine oils due increase in the production of passenger cars is expected to drive demand in Brazil

TABLE 210 BRAZIL: LUBRICANT ANTI-WEAR AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 211 BRAZIL: MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 212 BRAZIL: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 213 BRAZIL: MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

10.6.1.2 Impact of COVID-19 on Brazil

10.6.2 ARGENTINA

10.6.2.1 Argentina was the second-largest market for lubricant anti-wear agents in South America in 2019

TABLE 214 ARGENTINA: LUBRICANT ANTI-WEAR AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 215 ARGENTINA: MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 216 ARGENTINA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 217 ARGENTINA: MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

10.6.2.2 Impact of COVID-19 on Argentina

10.6.3 COLOMBIA

10.6.3.1 Initiatives in renewable energy sector with increasing demand for motor vehicles are expected to lead to the high demand for lubricant anti-wear agents

TABLE 218 COLOMBIA: LUBRICANT ANTI-WEAR AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 219 COLOMBIA: MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 220 COLOMBIA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 221 COLOMBIA: MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

10.6.4 REST OF SOUTH AMERICA

10.6.4.1 Rise in the demand for engine oil is expected to drive the market

TABLE 222 REST OF SOUTH AMERICA: LUBRICANT ANTI-WEAR AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 223 REST OF SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 224 REST OF SOUTH AMERICA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 225 REST OF SOUTH AMERICA: LUBRICANT ANTI-WEAR AGENT MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

11 COMPETITIVE LANDSCAPE (Page No. - 184)

11.1 OVERVIEW

FIGURE 34 KEY DEVELOPMENTS IN THE LUBRICANT ANTI-WEAR AGENTS MARKET, 2016–2019

11.2 COMPETITIVE LEADERSHIP MAPPING (OVERALL MARKET)

11.2.1 STAR

11.2.2 EMERGING LEADERS

11.2.3 PERVASIVE

11.2.4 PARTICIPANTS

FIGURE 35 COMPETITIVE LEADERSHIP MAPPING (OVERALL MARKET)

11.3 COMPETITIVE LEADERSHIP MAPPING OF SMES

11.3.1 PROGRESSIVE COMPANIES

11.3.2 RESPONSIVE COMPANIES

11.3.3 STARTING BLOCKS

11.3.4 DYNAMIC COMPANIES

FIGURE 36 COMPETITIVE LEADERSHIP MAPPING OF START-UPS, 2019

11.4 MARKET SHARE, 2018

FIGURE 37 AFTON CHEMICAL LED THE LUBRICANT ANTI-WEAR AGENTS MARKET IN 2019

11.5 COMPETITIVE SCENARIO

11.5.1 NEW PRODUCT LAUNCHES

11.5.2 MERGERS & ACQUISITIONS

11.5.3 CONTRACTS & AGREEMENTS

11.5.4 INVESTMENTS & EXPANSIONS

12 COMPANY PROFILES (Page No. - 192)

12.1 AFTON CHEMICAL

12.1.1 PRODUCTS OFFERED

12.1.2 RECENT DEVELOPMENTS

12.1.3 MNM VIEW

12.1.3.1 Key strengths/right to win

12.1.3.2 Strategic choices made

12.1.3.3 Weaknesses and competitive threats

12.2 BASF SE

12.2.1 BUSINESS OVERVIEW

FIGURE 38 BASF SE: COMPANY SNAPSHOT

12.2.2 PRODUCTS OFFERED

12.2.3 RECENT DEVELOPMENTS

12.2.4 MNM VIEW

12.2.4.1 Key strengths/right to win

12.2.4.2 Strategic choices made

12.2.4.3 Weaknesses and competitive threats

12.3 CHEVRON ORONITE

12.3.1 PRODUCTS OFFERED

12.3.2 RECENT DEVELOPMENTS

12.3.3 MNM VIEW

12.3.3.1 Key strengths/right to win

12.3.3.2 Strategic choices made

12.3.3.3 Weaknesses and competitive threats

12.4 SOLVAY

FIGURE 39 SOLVAY: COMPANY SNAPSHOT

12.4.1 PRODUCTS OFFERED

12.4.2 RECENT DEVELOPMENTS

12.4.3 MNM VIEW

12.4.3.1 Key strengths/right to win

12.4.3.2 Strategic choices made

12.4.3.3 Weaknesses and competitive threats

12.5 LANXESS

FIGURE 40 LANXESS: COMPANY SNAPSHOT

12.5.1 PRODUCTS OFFERED

12.5.2 RECENT DEVELOPMENTS

12.5.3 MNM VIEW

12.5.3.1 Key strengths/right to win

12.5.3.2 Strategic choices made

12.5.3.3 Weaknesses and competitive threats

12.6 KING INDUSTRIES

12.6.1 PRODUCTS OFFERED

12.6.2 RECENT DEVELOPMENTS

12.7 LUBRIZOL CORPORATION

12.7.1 PRODUCTS OFFERED

12.7.2 RECENT DEVELOPMENTS

12.8 PRASOL CHEMICALS

12.8.1 PRODUCTS OFFERED

12.8.2 RECENT DEVELOPMENTS

12.9 ITALMATCH CHEMICALS S.P.A

12.9.1 PRODUCTS OFFERED

12.9.2 RECENT DEVELOPMENTS

12.10 ISRAEL CHEMICALS (ICL)

FIGURE 41 ISRAEL CHEMICALS: COMPANY SNAPSHOT

12.10.1 PRODUCTS OFFERED

12.10.2 RECENT DEVELOPMENTS

12.11 CLARIANT

FIGURE 42 CLARIANT: COMPANY SNAPSHOT

12.11.1 PRODUCTS OFFERED

12.11.2 RECENT DEVELOPMENTS

12.12 JINZHOU KANGTAI LUBRICANT ADDITIVES

12.12.1 PRODUCTS OFFERED

12.12.2 RECENT DEVELOPMENTS

12.13 WUXI SOUTH PETROLEUM ADDITIVES

12.13.1 PRODUCTS OFFERED

12.13.2 RECENT DEVELOPMENTS

12.14 TRANSASIA PETROCHEM

12.14.1 PRODUCTS OFFERED

12.14.2 RECENT DEVELOPMENTS

12.15 DORF KETAL CHEMICALS

12.16 SEQENS

12.17 REPSOL

12.18 AMSOIL

12.19 ZPLUS, LLC

12.20 INFINEUM

12.21 XINXIANG RICHFUL LUBE ADDITIVE

12.22 CAMGUARD

13 APPENDIX (Page No. - 218)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the lubricant anti-wear agents market. Exhaustive secondary research was done to collect information on the market, peer markets, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the lubricant anti-wear agents value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this study include Hoovers, Bloomberg, BusinessWeek, and Dun & Bradstreet, were referred for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles by recognized authors, authenticated directories, and databases. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by primary research.

Primary Research

The lubricant anti-wear agents market comprises several stakeholders, such as raw material suppliers, manufacturers, distributors, end-use products’ manufacturers, and regulatory organizations in the supply chain.

As part of the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report on the lubricant anti-wear agents market. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, technology and innovation directors, and related key executives from various key companies and organizations operating in the lubricant anti-wear agents market. Primary sources from the demand side included directors, marketing heads, and purchase managers from various end-use industries.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the lubricant anti-wear agents market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the lubricant anti-wear agents market, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and experts.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. In orde to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition to this, the market size was validated using both top-down and bottom-up approaches.

Report Objectives

- To analyze and forecast the size of the lubricant anti-wear agents market, in terms of value and volume

- To define, segment, and estimate the lubricant anti-wear agents market by type, sales channel, application, and region

- To project the size of the market segments, in terms of volume and value, with respect to five main regions, namely, Asia Pacific, North America, Europe, Middle East & Africa, and South America

- To provide detailed information regarding the crucial factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the lubricant anti-wear agents market for stakeholders and provide a competitive landscape of the market

- To track and analyze competitive developments, such as business expansions, agreements, new product launches, acquisitions, investments, and partnerships in the lubricant anti-wear agents market

- To strategically profile key players and comprehensively analyze their market share and core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- A further breakdown of the regional market on the basis of country

- A detailed comparison of product portfolios of various companies

- Details and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Lubricant Anti-wear Agents Market