Transmission Fluids Market

Transmission Fluids Market by Type (Automatic Transmission Fluids, Manual Transmission Fluids, Other Types), Base Oil (Mineral, Synthetic, Semi-Synthetic), End-Use Industry (Automotive, Off-Road Vehicle), and Region - Global Forecast to 2029

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The transmission fluids market is estimated to grow from USD 15.67 billion in 2024 to USD 19.70 billion by 2029, at a CAGR of 4.7%. Developments in fluid formulation technologies have a significant impact on the transmission fluids market, creating fluid formulations that address the changing demands of modern vehicles. These advances in their chemistry have led to fluids with improved thermal stability, better friction control, and increased oxidation resistance, which enables smoother gear shifting, less wear, and longer drain intervals. These high-performance formulations are particularly tailored to address the intricate needs of advanced transmission systems, each requiring specialized fluid properties for its optimum functionality.

KEY TAKEAWAYS

-

BY TYPETransmission fluids market is segmented into automatic transmission fluids, manual transmission fluids, and other types (dual-clutch transmission fluids, and continuously variable transmission fluids). The automatic transmission fluids segment dominated the transmission fluids, in 2023. The increasing consumer demand for convenience and ease of driving has contributed to the global adoption of automatic cars. With growing urbanization and traffic congestion, drivers prefer automatic transmissions owing to their smoother performance and lower driver fatigue. This increased production of automatic cars directly translates to higher demand for automatic transmission fluids (ATFs), which are crucial to provide smooth gear shifts, minimizing friction, and extending transmission life.

-

BY BASE OILTransmission fluids market is segmented into mineral oil, synthetic oil, and semi-synthetic oil. Synthetic oil was the largest segment of transmission fluids, in terms of value, in 2023. Synthetic oils provide superior stability and performance at extreme temperatures and are thus the best choice for modern transmissions operating under high stress. They have a uniform molecular structure, which provides uniform lubrication to minimize friction and wear even at cold starts or high temperatures. This consistency is important for vehicles in areas of changing climates or harsh driving conditions.

-

BY END-USE INDUSTRYThe transmission fluids market is segmented into automotive (passenger vehicle and commercial vehicle), and off-road vehicle (construction & mining and agriculture). Automotive industry dominated the global transmission fluids market, in terms of value, in 2023. Growing demand for commercial vehicles fueled by e-commerce, logistics, and infrastructure developments are driving the demand for transmission fluids in the automotive industry. Heavy duty trucks, buses, and utility vehicles need high-performance transmission fluids that can perform well in stressful operating conditions including heavy loads and longer operational times.

-

BY REGIONAsia Pacific was the largest market for transmission fluids, in terms of value, in 2023. The dominance is attributed to the increasing population in the region, improving economic conditions such as rising GDP & disposable incomes. The region benefits from competitive local manufacturing, with lower production costs and an extensive supply chain supporting the transmission fluids market. The presence of major chemical companies and lubricant manufacturers ensures steady fluid supply at competitive prices, fostering market expansion.

-

COMPETITIVE LANDSCAPELeading market participants focus on innovation, sustainable product advancements, and strategic partnerships through collaborations, acquisitions, and new product developments. Major players such as ExxonMobil, Shell, BP, TotalEnergies, and Chevron are expanding their portfolios of transmission fluids to meet the rising demand for high-performance, energy-efficient, and environmentally responsible lubricants across automotive, industrial machinery, and transportation applications.

The emerging markets are undergoing rapid industrialization and urbanization, resulting in high growth rates in vehicle sales and massive infrastructure development. As the population increases and cities expand, the need for passenger and commercial vehicles also rises, and thus the demand for effective and long-lasting transmission fluids. Growing industries like construction, logistics, and agriculture also contribute to growing demand for heavy-duty vehicles, which further lead to the higher consumption of specialized transmission fluids.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers’ business in the transmission fluids market is shaped by tightening emission regulations, evolving mobility trends, and advancements in drivetrain technologies across automotive and industrial sectors. Consumers of transmission fluids include automotive OEMs, commercial vehicle manufacturers, construction equipment producers, and industrial machinery operators, who depend on these fluids for efficient power transfer, heat dissipation, wear protection, and extended transmission life. Developments such as the shift toward electric and hybrid vehicles, increasing focus on low-viscosity and energy-efficient formulations, and stricter environmental compliance norms influence procurement strategies, operating costs, and performance requirements for end users.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Expanding automotive industry

-

Advancements in transmission technologies

Level

-

Fluctuating crude oil prices

-

Growing environmental concerns and challenge of fluid disposal

Level

-

Rising demand for electric and hybrid vehicles

-

Growing demand in emerging markets

Level

-

Increasing complexity of modern transmission systems

-

Competition from alternative lubricants

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Implementation of stringent emission regulations

Stringent emission control regulations imposed by governments and regulatory agencies worldwide are leading the market for transmission fluids mostly. As the automotive industry is under increasing pressure to reduce greenhouse gas emissions and improve fuel efficiency, manufacturers are compelled to adopt new technologies and materials that contribute to these ends. Transmission fluids are an integral component of this shift because they directly impact the efficiency of transmission systems, which subsequently impacts vehicle performance and emissions. Modern transmission fluids are formulated to reduce friction and provide smoother gear changes, reducing the energy consumed to operate the transmission. Lower energy consumption reduces fuel consumption and emissions of carbon dioxide. For example, because of such regulations as the European Union's CO2 standard and the United States' Corporate Average Fuel Economy (CAFE) regulation, manufacturers are widely using low-viscosity transmission fluids that reduce drag and enhance mechanical efficiency.

Restraints: Environmental concerns

Environmental issues related to the disposal of use transmission fluids pose a major restraint for the industry. With increasingly stringent regulations on waste management across the world, manufacturers must deal with the issue of proper disposal and recycling of used transmission fluids. Improper disposal of used transmission fluids can result in soil and water contamination, so it is crucial for manufacturers to make their products environmentally friendly and in line with these regulations. Governments worldwide are enforcing increasingly strict environmental guidelines that require manufacturers to develop fluids that are biodegradable or contain fewer hazardous substances. While this shift is aimed at reducing the environmental footprint of automotive products, it increases production cost since companies have to invest in green formulations and waste reduction methods.

Opportunities: Increasing demand in emerging markets

Increasing demand in emerging markets present a significant opportunity in the transmission fluids market. The market for transmission fluids is witnessing strong growth in emerging economies due to high-speed industrialization, urbanization, and increasing disposable incomes. With the automotive sector in markets such as Asia-Pacific growing further, the demand for transmission fluids is likely to increase in line. The growth of the automotive sector in countries such as China, India, and Brazil are being fueled by an increasing middle class, improved infrastructure, and the accessibility of financing options, all of which are contributing to higher vehicle sales and production. Commercial and passenger cars in such markets is highly demanded, which also drives the demand for transmission fluids

Challenges: Increasing complexity of modern transmission systems

Increasing complexity of the modern transmission systems is one of the major challenges for the companies competing in the transmission fluids market. With improved automobile technology, transmissions are being more complex in nature, and technologies such as dual-clutch transmissions (DCT), continuously variable transmissions (CVT), and hybrid/electric vehicle powertrains require specialized fluid formulations. Transmission fluids must address these changing needs, which calls for ongoing research and development to advance fluid formulations, keeping them compatible with new technologies. These

Transmission Fluids Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Mobil EV Cool Drive e-transmission/e-axle fluids targeting wear protection, thermal-oxidative stability, anti-foam, and cooling for high-torque electric drives | Extends fluid and component life while improving heat dissipation and material compatibility in electrified drivelines |

|

Portfolio covers ATF and heavy-duty transmission oils plus dedicated e-fluids for e-transmissions, e-axles, battery thermal management, and e-greases co-engineered with OEMs | Improves drivetrain efficiency, thermal management, copper compatibility, and electrical properties for sealed EV units over long life cycles |

|

Next-gen multi-vehicle ATF additives including hybrid-ready, ultra-low-viscosity capable chemistries plus sulfur-free e-driveline technology for copper compatibility | Enhances fuel economy, anti-shudder durability, and electrical/material compatibility for EV/hybrid units while supporting extended drain intervals |

|

Castrol ON e-Transmission fluids for wet and multispeed e-motor transmissions and e-coolants/e-greases for EV range and durability across passenger and commercial vehicles | Low-viscosity, low-conductivity fluids enhance shifting, reduce losses, and help batteries tolerate ultra-fast charging via advanced dielectric thermal management |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The transmission fluids ecosystem comprises base oil suppliers, additive manufacturers, formulators, distributors, and end users. Base oil suppliers provide mineral, synthetic, or bio-based oils that serve as the foundation for transmission fluid formulations, while additive manufacturers supply friction modifiers, anti-wear agents, detergents, dispersants, and viscosity improvers. Formulators blend these components using advanced refining, additive optimization, and testing technologies to develop fluids that deliver superior lubrication, thermal stability, oxidation resistance, and smooth gear shifting performance. Distributors connect fluid manufacturers with key end-use industries such as automotive, construction, agriculture, and industrial machinery, ensuring consistent availability, technical support, and adherence to OEM and regulatory standards. End users including vehicle manufacturers, fleet operators, and service centers utilize transmission fluids to ensure efficient power transfer, reduced wear, and extended transmission life. The value chain is driven by trends such as the electrification of vehicles, demand for low-viscosity and energy-efficient fluids, and innovation in synthetic and eco-friendly formulations aligned with sustainability goals.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Transmission Fluids Market , By Type

The automatic transmission fluids segment is expected to be the largest segment in the transmission fluids market during the forecast period. Government regulatory bodies all over the world are enforcing stricter fuel efficiency and emission regulations, encouraging the manufacturers to innovate and improve the performance of vehicles. Modern automatic transmissions, such as multi-speed automatic and dual-clutch transmissions have been crucial in complying with these standards because they can maximize gear ratios, minimize fuel usage, and minimize emissions without sacrificing driving comfort. Thus, automatic transmission fluids play a critical role here, facilitating seamless gear changes, minimizing internal friction, and adding to thermal stability

Transmission Fluids Market , By Base Oil

The mineral oil segment is expected to be the third-fastest-growing segment in the transmission fluids market during the forecast period. Simple processing techniques like distillation and solvent extraction are used in transmission fluids production from mineral oils and they require less sophisticated machinery and less input of energy to be produced. Manufacturers can effectively produce these mineral oils in bulk quantities owing to lower operation costs and faster processing times. The ease of production also translates to a robust supply chain that allows for fast response to market variations. This stability benefits manufacturers, distributors, and end users, especially in price-sensitive markets with high demand for low-cost lubricants.

Transmission Market, By End-Use

The off-road vehicle segment is projected to be the second fastest-growing application segment in the transmission fluids market during the forecast period. Global infrastructure development projects, including large-scale projects including roads, bridges, railways, airports, and city expansion, are significant drivers of the demand for construction equipment, driving the demand for transmission fluids. Governments and the private sector are investing significantly in infrastructure to spur economic expansion, increase connectivity, and fuel urbanization. This generates a surge in the utilization of heavy-duty equipment such as excavators, bulldozers, cranes, and heavy haul trucks with heavy workloads and harsh operating conditions. These equipment requires high-performance transmission fluids for effective power transfer, to reduce wear, and maintain reliability with prolonged working, leading to consistent market demand.

REGION

Asia Pacific to be the largest & fastest growing region in global transmission fluids market during forecast period

Asia Pacific is the largest consumer of transmission fluids. The dominance of Asia Pacific in the transmission fluids market is fueled by its status as an automotive manufacturing hub, with top automobile-producing countries such as China, Japan, South Korea, and India leading the vehicle production. These countries combined occupy a large percentage of world automobile output, producing enormous numbers of passenger cars, commercial vehicles, and heavy-duty equipment. Ongoing investments in expanding manufacturing capacities, technological developments, and strong export networks further augment the vehicle production. This enormous production generates the demand for transmission fluids, both for factory fills and subsequent aftermarket maintenance, cementing Asia Pacific’s position as the largest regional market globally.

Transmission Fluids Market: COMPANY EVALUATION MATRIX

In the transmission fluids market, ExxonMobil Corporation leads with a strong global presence and an extensive portfolio of high-performance lubricants and advanced synthetic transmission fluids engineered to deliver superior wear protection, thermal stability, and fuel efficiency. The company’s focus on innovation, formulation excellence, and long-drain performance has positioned it as a trusted partner for automotive OEMs, industrial equipment manufacturers, and fleet operators worldwide. ExxonMobil’s continuous R&D advancements in synthetic base oils and additive technologies including its flagship Mobil and Mobil 1 transmission fluid lines enable optimal performance under severe operating conditions while meeting evolving OEM specifications and environmental standards. Its commitment to sustainability, energy efficiency, and emission reduction, combined with strategic collaborations with vehicle manufacturers and technology partners, reinforces ExxonMobil’s leadership in driving next-generation transmission fluid solutions for both conventional and electric vehicles.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2023 | USD 14.99 Billion |

| Revenue Forecast in 2030 | USD 19.70 Billion |

| Growth Rate | CAGR of 4.69% from 2024-2029 |

| Actual data | 2020-2029 |

| Base year | 2023 |

| Forecast period | 2024-2029 |

| Units considered | Value (USD Million), Volume (Million Liters) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | By Base oil: Mineral oil, Synthetic oil, and Semi-synthetic oil By Type: Automatic, Manual, and Other types By End-Use: Automotive, and Off-road vehicle |

| Regional Scope | Asia Pacific, Europe, North America, Middle East & Africa, and South America |

WHAT IS IN IT FOR YOU: Transmission Fluids Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Europe-based Transmission System OEM | • Analysis of fluid-gearbox compatibility across electric, hybrid, and ICE vehicles • Study of low-viscosity fluid trends for energy efficiency and EV drivetrain performance | • Optimize supplier selection and lubricant integration for new EV platforms • Reduce power losses and enhance component durability • Accelerate transition to e-transmission fluid solutions |

| Global Additive Supplier | • Evaluation of additive chemistry performance (friction modifiers, viscosity improvers, antioxidants, anti-wear agents) in next-gen transmission fluids • Tracking of OEM and regulatory trends driving formulation innovation | • Align additive R&D pipeline with evolving e-mobility needs • Strengthen partnerships with global and regional blenders • Position as innovation leader in high-performance, low-viscosity additives |

RECENT DEVELOPMENTS

- November 2024 : TotalEnergies SE launched a fully synthetic transmission fluid offering superior performance, fuel efficiency, and durability. It covers 95% of light vehicles and meets strict modern ATF and CVT standards.

- August 2024 : Lukoil launched specialized fluid for electric vehicles, ensuring stable motor and transmission performance.

- September 2023 : Exxon Mobil Corporation launched the Mobil Multipurpose ATF that ensures smooth, consistent shifting and reliable performance across Asian, European, and North American vehicles, offering all-weather protection and extended transmission life for a dependable driving experience.

- August 2022 : The strategic partnership between BYD and Castrol enhances EV transmission fluid supply, promotes Castrol ON products, and strengthens sustainability goals through advanced drivetrain solutions, retail network promotions, and competitive motorsport collaborations.

- November 2021 : Shell and Nissan e.dams collaborated on Nissan Formula E Team's Gen3 car, focusing on developing high-performance E-transmission fluids and E-greases to enhance EV efficiency, with innovations benefiting both racing and road-going electric vehicles.

Table of Contents

Methodology

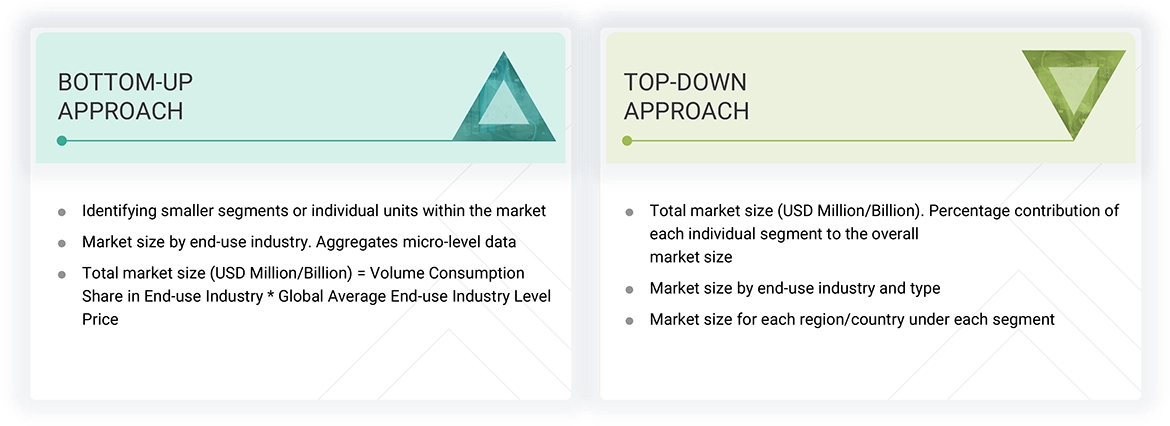

The study involved four major activities in estimating the market size for transmission fluids. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Post that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

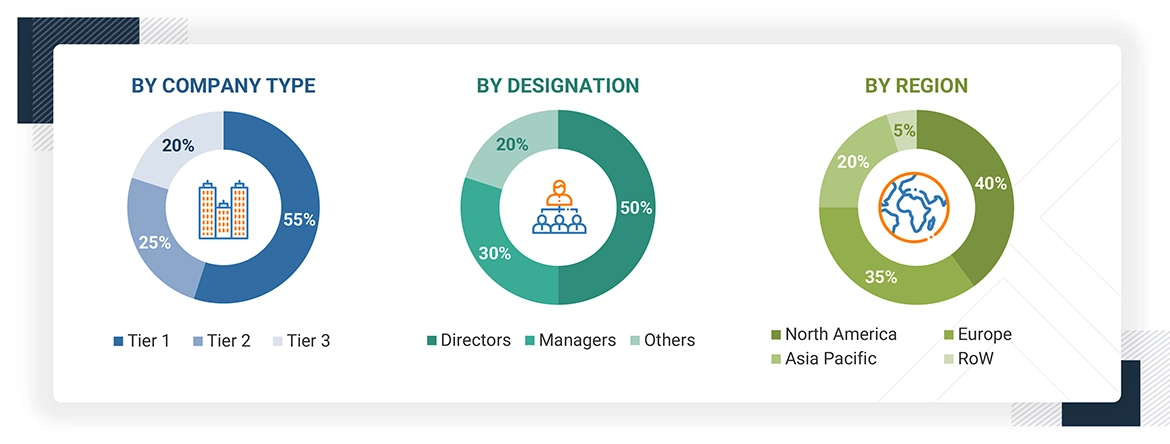

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. The findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Primary Research

The Transmission fluids market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the automotive, medical, construction and others. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative informations.

Breakdown of Primary Participants

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2023 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

| COMPANY NAME | DESIGNATION | |

|---|---|---|

| Exxon Mobil Corporation | Senior Manager | |

| Shell plc | Innovation Manager | |

| BP P.L.C. | Vice-President | |

| Chevron Corporation | Production Supervisor | |

| TotalEnergies SE | Sales Manager | |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Transmission fluids market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Transmission fluids Market: Bottom-Up and Top-Down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the transmission fluids industry.

Market Definition

According to the European Automobile Manufacturers' Association, transmission fluids are the fluids that lubricate the transmission components of the vehicle to deliver optimum performance. They help in protecting the gears and bearings from wear and tear. Even in extreme pressure conditions, it acts as a hydraulic fluid to enable shifting, provides frictional properties to safeguard smooth, consistent shifts, and manages heat. Transmission fluids are specially formulated for use in variable temperature conditions and heavy load carrying machines used in construction, agriculture, and mining. These fluids play an essential role in helping the transmission system to operate efficiently throughout its life cycle and thereby improving the gear life, synchronizer life, and shift quality.

Stakeholders

- Transmission fluids Manufacturers

- Transmission fluids Traders, Distributors, and Suppliers

- End-use Market Participants of Different Segments of Transmission fluids

- Government and Research Organizations

- Associations and Industrial Bodies

- Research and Consulting Firms

- R&D Institutions

- Environment Support Agencies

- Investment Banks and Private Equity Firms

Report Objectives

- To define, describe, and forecast the transmission fluids market in terms of value and volume

- To provide detailed information regarding the drivers, opportunities, restraints, and challenges influencing market growth

- To estimate and forecast the market size by type, base oil, end-use industry, and region

- To forecast the size of the market for five main regions: Asia Pacific, Europe, North America, South America, and the Middle East & Africa, along with their key countries

- To strategically analyze micromarkets1 with respect to their growth trends, prospects, and contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as deals and expansions, in the market

- To analyze the impact of the recession on the market

- To strategically profile key players and comprehensively analyze their growth strategies

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Transmission Fluids Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Transmission Fluids Market