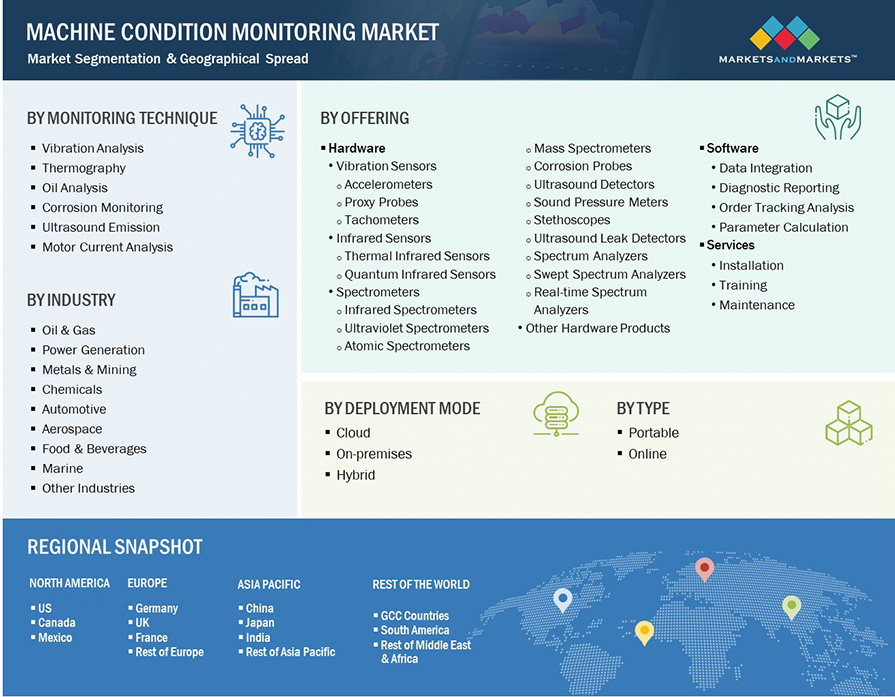

Machine Condition Monitoring Market Size, Share, Growth and Trends Analysis Report by Technique (Vibration Monitoring, Thermography, Oil Analysis, Ultrasound Emission), Offering (Vibration Sensors, Infrared Sensors, Spectrometers, Corrosion Probes, Spectrum Analyzers), Region - Global Forecast to 2029

Machine Condition Monitoring Market

Machine Condition Monitoring Market and Top Companies

- Emerson Electric- Emerson Electric manufactures process control systems, valves, and analytical instruments. Condition monitoring solutions offered by the company include vibration transmitters, online condition monitoring solutions, machinery protection systems with embedded prediction capabilities, integrated condition monitoring solutions for power and water applications, route-based vibration analyzers, and machinery health monitors for the power industry.

- General Electric- General Electric (GE) develops and manufactures power generators, aircraft engines, water processors, medical imaging equipment, security solutions, and different types of industrial products. In addition, the company offers services for business and consumer financing, online computing, and media content. GE provides machine condition monitoring solutions, primarily for the oil & gas sector. The company offers machine condition monitoring solutions through its Power segment. In 2002, GE acquired Bently Nevada (US), a leading provider of machinery protection and condition monitoring solutions. The company currently offers its machine condition monitoring systems under the brand name Bently Nevada.

- Honeywell International- Honeywell International is a diversified technology and manufacturing company serving its customers worldwide. The company operates through four major segments—Aerospace, Performance Material and Technologies, Safety and Productivity Solutions, and Honeywell Building Technologies. The company majorly offers machine condition monitoring solutions and related products and services through the Safety and Productivity Solutions segment. It offers automation and control solutions for process and hybrid applications, such as refining, in oil & gas; pulp & paper; mining, minerals, metals; chemicals; and pharmaceuticals industries.

- National Instruments- National Instruments is one of the leading providers of automated test equipment and virtual instrumentation software. The company offers machine condition monitoring solutions for end users from the industrial, heavy equipment, transportation, oil & gas, wind energy, and power generation markets. Machine condition monitoring offerings of the company include vibration sensors, pressure sensors, temperature sensors, load cells, acoustic sensors, the NI InsightCM Enterprise Software, embedded control and monitoring systems, and the CompactRIO monitoring platform. National Instruments offers machine condition monitoring solutions through its Product business segment.

- SKF- SKF is one of the global key players in manufacturing bearings, seals, lubrication management systems, maintenance products, power transmission products, mechatronics, condition monitoring systems, and related services. SKF offers machine condition monitoring solutions through its Industrial segment. The company offers an extensive range of condition monitoring products, including thermometers, thermal cameras, vibration measurement tools, tachometers, stroboscopes, ultrasonic instruments, and electrical discharge detectors.

Machine Condition Monitoring Market and Top Industries

- Power Generation- Power generation is one of the emerging industries that has witnessed rapid adoption of machine condition monitoring systems. Increased investments in information technology (IT) by the players in the power generation industry to optimize operations and ensure high profitability drive the adoption of condition monitoring systems in power generation plants. This industry is facing challenges owing to the elevated demand for power and energy losses during generation and distribution. Companies are expected to generate power at low costs and monitor their processes for unwanted changes in the power supply. Hence, machine condition monitoring systems and solutions play a crucial role in the power sector.

- Oil & Gas- Asset performance and security are crucial for upstream or downstream operations in oil and gas plants. Companies operating in the oil & gas industry are looking for effective ways to meet the rising energy requirements, as well as reduce operating costs and improve the efficiency of their plants. Several developments are taking place in this industry to meet the growing global energy demand. Moreover, oil and gas companies are researching new technologies to increase their output. As these companies are carrying out their drilling operations in remote offshore locations, the need to improve the safety and efficiency of these offshore plants is continuously increasing. This leads to the requirement of machine condition monitoring systems within the industry.

- Metals & mining - Metals & mining companies must ensure supply cost containment, supply chain visibility, and risk management while considering the increasing demand for metals and ongoing globalization. Several companies adopt automation solutions to stay competitive, enhance profitability and productivity, and reduce operating costs while improving their safety.Machine condition monitoring enables the metals & mining industry to collect data that can be used by internal and external members. This data is used to instantly access, review, distribute, and archive documents regarding the health and operational efficiency of machines deployed in mines. The industry has started using predictive analytics and modeling technologies to improve accessibility and the operational efficiency of machines.

Machine Condition Monitoring Market and Top Monitoring Techniques

- Vibration monitoring - Vibration monitoring is the most widely used technique for machine condition monitoring. Vibration may be defined as a cyclic or periodic displacement of a machine from its static position owing to its back-and-forth motion. This motion is mainly caused by oscillating various components, such as belts, gears, bearings, and drive motors. Vibration monitoring can detect imbalances, misalignments, and wear almost three months before the breakdown occurs. This technique also provides an opportunity to improve energy consumption in manufacturing plants since misaligned water pumps consume 15% more energy than well-aligned pumps.

- Thermography - Thermography, as a monitoring technique, has matured and is widely used to measure the temperature of machines in real time. Thermography is also known as thermal imaging. The process enables the early detection of equipment flaws and faulty industrial processes, thereby reducing system downtime, breakdowns, and maintenance costs. This machine condition monitoring technique has several applications, including detecting misalignment, improper lubrication, imbalances, stress, and wear in mechanical parts. It also identifies overheating, pipe leaks, and pressure vessel weaknesses in electrical equipment. Infrared thermography has become a popular method for predictive maintenance and non-destructive testing.

- Oil Analysis - The oil analysis technique is only applicable to machine oils, fluids, and lubricants. This technique helps detect overheating, wear, and contamination of oils or lubricants. For instance, high levels of iron often indicate dirt and grit. Being spotted on time, can reduce the gearbox failures by 50%. By avoiding contamination, the bearing failure can be decreased by 75%. Further, to prevent machinery failures, there are several oil analysis tests, such as ferrography, water presence tests, infrared spectroscopy, ultraviolet spectroscopy, viscosity tests, dielectric strength tests, iron content (particle quantification index), ICP/spectroscopy, microbial analysis, potentiometric titration (total acid number/total base number), and sediment tests.

Updated on : October 22, 2024

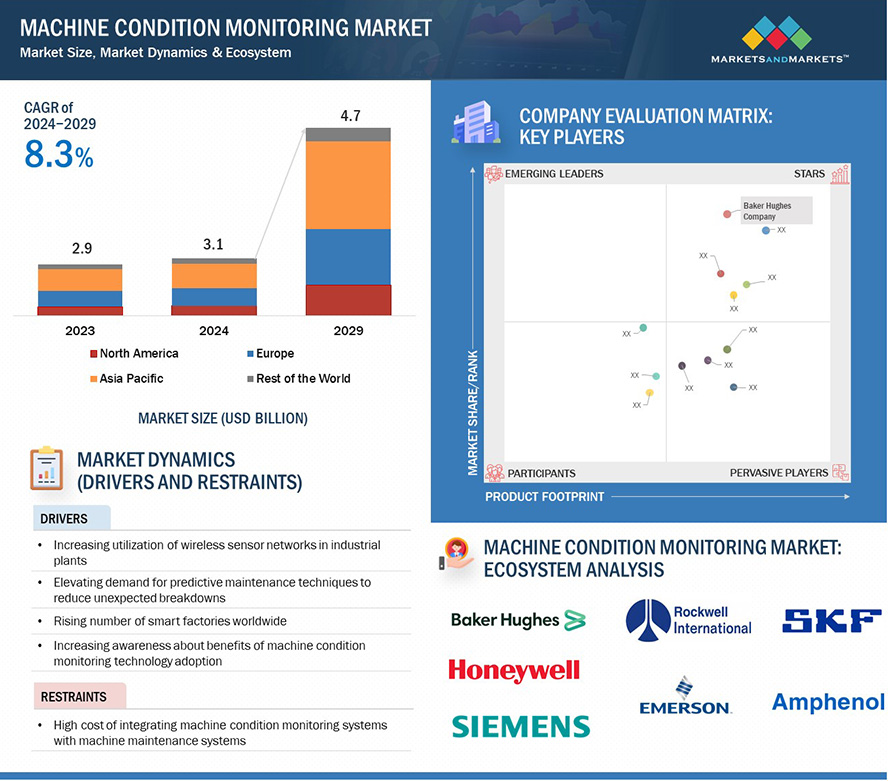

Machine Condition Monitoring Market Size & Growth

The global Machine Condition Monitoring Market was valued at USD 3.1 billion in 2024 and is projected to grow from USD 3.37 billion in 2025 to USD 4.7 billion by 2029, at a CAGR of 8.3% during the forecast period. Key growth drivers include the increasing utilization of wireless sensor networks in industrial plants, a rising demand for predictive maintenance techniques to reduce unexpected breakdowns, and the proliferation of smart factories worldwide. Additionally, advancements in big data analytics and machine learning are poised to further enhance the adoption of machine condition monitoring technologies.

Key Takeaways:

• The global Machine Condition Monitoring Market was valued at USD 3.1 billion in 2024 and is projected to grow from USD 3.37 billion in 2025 to USD 4.7 billion by 2029, at a CAGR of 8.3% during the forecast period. By Product: Vibration sensors are seeing increased use by automotive and oil & gas companies, driven by their applicability in process control and quality assurance.

• By Application: The emphasis on maximizing plant efficiency and safety accelerates the adoption of corrosion monitoring techniques.

• By Technology: Integration of big data analytics and machine learning into machine condition monitoring is creating new opportunities for predictive maintenance.

• By End User: Power generation emerges as a key industry with rapid adoption of machine condition monitoring systems, aided by increased IT investments to optimize operations.

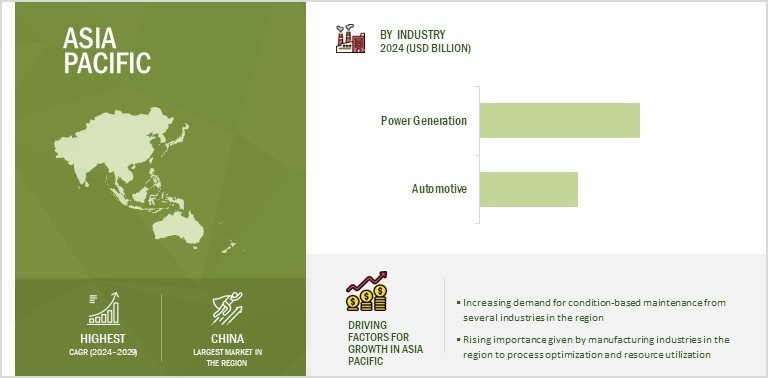

• By Region: ASIA PACIFIC is expected to grow fastest at a 9.2% CAGR, fueled by expanding industrialization and technological advancements across sectors.

• Ecosystem Dynamics: The high cost of integrating condition monitoring systems with existing maintenance systems remains a restraint, countered by opportunities through secured cloud computing platforms and IIoT integration.

• Competitive Landscape: Companies like Emerson Electric, GE, Honeywell International, National Instruments, and SKF lead the market, offering diverse solutions ranging from vibration monitoring to integrated condition monitoring systems.

In conclusion, the Machine Condition Monitoring Market is poised for significant growth, driven by technological innovations and the rising demand for predictive maintenance solutions. The integration of advanced analytics and cloud-based platforms presents substantial growth opportunities, especially in rapidly industrializing regions like Asia Pacific. As industries strive for operational efficiency and reduced downtime, the adoption of condition monitoring systems will likely continue to accelerate, paving the way for a more connected and efficient industrial ecosystem..

The growing demand for machine condition monitoring is driven by increasing industrial automation, the need for predictive maintenance, and the focus on minimizing equipment downtime. Advancements in sensor technology and data analytics allow for real-time monitoring, helping companies optimize equipment performance and reduce maintenance costs. Additionally, rising inclination towards wireless communication technology is a significant driver for the growth of the machine condition monitoring market. Wireless systems offer real-time data transmission, easy installation, and cost efficiency, making them ideal for remote monitoring and large-scale industrial operations.

Predictive maintenance assures safe and continuous plant operations with improved safety of employees by reducing the chances of sudden breakdowns of equipment. This technique can be implemented on a large scale, especially in capital-intensive industries, such as automotive and oil & gas. Several predictive maintenance tools such as vibration analyzers, ultrasonic analyzers, and oil analyzers are available in the machine condition monitoring market to monitor the condition of machines and equipment by identifying the symptoms of wear and other failures in advance.

Machine Condition Monitoring Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Machine Condition Monitoring Market Trends and Dynamics:

DRIVERS: Rising inclination towards wireless communication technology

Mechanical failure of industrial equipment is among the most common causes of unplanned production halts, which result in shutdowns of industrial plants and subsequent economic losses. Hence, companies are continuously focused on developing and adopting suitable solutions to reduce maintenance costs and ensure the safety of workers. With the introduction of wireless communication technology, small and easy-to-install sensors are deployed in areas wherein fixed cabling is not feasible to acquire high-frequency condition monitoring data. This technology overcomes barriers posed by factors such as location, length of cables, and availability of spaces to install cables and facilitates remote monitoring of machinery.

RESTRAINTS: Reliability issues in prediction capabilities of machine condition monitoring systems

Some operators rely on their instincts and experiences to judge the condition of machines, which is not always a reliable option. There may be instances wherein operators can overrule the analysis based on their personal experiences or lack trust in the prediction capabilities of condition monitoring technology. Experienced operators are at times skeptical about the diagnostics and predictions provided by machine condition monitoring systems owing to mistakes made by these machines in the form of dropped metrics, service outages, and unreliable or false alerting signals.

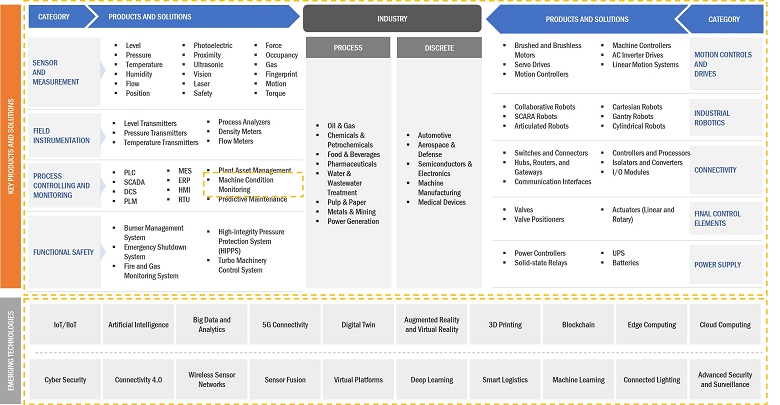

OPPORTUNITIES: Integration of big data analytics and machine learning in machine condition monitoring

The advent of machine learning, coupled with efficient big data analytics and a parallel processing framework, is transforming the machine condition monitoring industry. Big data analytics has accelerated the data analysis process by condition monitoring systems owing to their capability to handle large volumes of data. Machine learning carries out easy benchmarking of machine performance, enables transparency in data, and supports efficient collaboration among different processes monitored and controlled by condition monitoring systems. Big data-enabled condition monitoring helps companies lower the overall cost of ownership of assets and enables them to run their business efficiently and with improved profit margins.

CHALLENGES: Unavilability of technical expertise at remote locations

Machines Several companies deploy machine condition monitoring systems to achieve operational excellence in their manufacturing processes by reducing equipment failures. It is a predictive maintenance strategy wherein the main objective is to determine the current health condition of assets and predict their future behavior to carry out maintenance at the most appropriate time. This results in a decreased downtime and consequently increased productivity. The efficiency of machine condition monitoring systems depends on the technical expertise of operators to accurately measure and analyze data. As oil and gas production facilities and power generation plants are located at remote locations, the availability of experts at these locations acts as a challenge. Technical expertise is necessary for system optimization, software updates, system networking, data transmissions, etc. Therefore, it becomes difficult to implement machine condition monitoring systems in locations where access to expertise is difficult.

Machine Health Monitoring Market Insights

The machine health monitoring market is rapidly growing as industries increasingly recognize the benefits of proactive maintenance. By using advanced sensors and data analytics, companies can continuously monitor the condition of their equipment, detecting early signs of wear or malfunction. This approach, known as predictive maintenance, allows businesses to address issues before they lead to costly breakdowns, helping reduce downtime and improve overall efficiency. With the rise of Industry 4.0, machine health monitoring is evolving, incorporating artificial intelligence (AI) and machine learning (ML) to provide even more precise diagnostics. This is especially valuable in sectors like manufacturing, energy, and oil and gas, where reliable machinery is essential for uninterrupted operations and safety.

Machine Condition Monitoring Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers such as Emerson Electric Co. (US), Honeywell International Inc. (US), SKF (Sweden), and Amphenol Corporation (US). These companies have been operating in the market for several years and possess a diversified product portfolio and strong global sales and marketing networks. Along with the well-established companies, there are a large number of small and medium companies operating in the machine condition monitoring market, such as Machine Saver (US) and LogiLube, LLC (US).

Machine Condition Monitoring Market Segmentation

Software segment is expected to grow with highest CAGR during the forecast period.

Machine condition monitoring software plays an important role in simplifying the defect analysis process by implementing sophisticated algorithms preprogrammed to suit the maintenance requirements of manufacturers. The successful monitoring of the machinery in industrial plants is highly dependent on the software installed in them. Integrated software solutions help minimize downtime of industrial plants and maximize the performance of machines, which further reduces their overall maintenance costs. For instance, vibration monitoring software plays an important role in simplifying the defect analysis process by implementing sophisticated algorithms preprogrammed to fulfill the machine maintenance requirements of manufacturers. This software works with vibration monitors and portable data collectors to establish and implement condition-based predictive maintenance programs.

The machine condition monitoring market for cloud segment is projected to grow with substantial CAGR during the forecast period.

Cloud deployment type of machine condition monitoring solutions and systems involves the use of the internet and the engagement of third-party vendors. Its key advantage is that it helps enterprises understand the real-time condition of assets from remote locations. Further, the key advantages of using a cloud-based platform are the superior flexibility, convenience, and scalability offered by it, which allows business owners to continue with their business operations even in unforeseen circumstances. Cloud platforms can help reduce the requirement for human staff as such models facilitate remote monitoring of machines on the shop floor during difficult situations.

Machine Condition Monitoring Industry Regional Analysis

The machine condition monitoring market in Asia Pacific is projected to hold the substantial market share from 2024 to 2029.

Machine Condition Monitoring Market Statistics by Region

To know about the assumptions considered for the study, download the pdf brochure

The machine condition monitoring market growth in Asia Pacific has been studied for China, Japan, India, and Rest of Asia Pacific. The region is emerging to be the world’s most powerful economy owing to the increased spending on improving economic stability. Asia Pacific is witnessing a surge in the deployment of machine condition monitoring systems and solutions. China, one of the top manufacturing countries in the world, has been adopting real-time machine monitoring systems to increase the operational efficiency and production of its manufacturing plants. The rising maintenance costs of the manufacturing industry have forced companies to adopt advanced technologies such as predictive maintenance to optimize maintenance processes and minimize operating costs. Condition monitoring helps manufacturers reduce their operating costs by predicting the failure of critical assets in advance so that sudden breakdowns and subsequent financial losses can be avoided.

China is one of the fastest-growing economies in the world. With its flourishing automotive and manufacturing sectors, China has become one of the key adopters of machine condition monitoring solutions in the world. Thus, there is a high potential for both the development and sales of machine condition monitoring systems and software solutions in this country. The country is rapidly adopting automation solutions in its thriving industrial sector. This is leading to the increased adoption of advanced manufacturing technologies and creating requirements for machine condition monitoring.

Top Machine Condition Monitoring Companies - Key Market Players

- Emerson Electric Co. (US),

- Honeywell International Inc. (US),

- SKF (Sweden),

- Amphenol Corporation (US),

- General Electric (US) are among a few top players in the machine condition monitoring companies.

Machine Condition Monitoring Market Report Scope

|

Report Metric |

Details |

|

Estimated Value |

USD 3.1 billion in 2024 |

|

Expected Value |

USD 4.7 billion by 2029 |

|

Growth Rate |

CAGR of 8.3% |

|

Market Size Available for Years |

2020–2029 |

|

Base Year |

2023 |

|

Forecast Period |

2024–2029 |

|

Units |

Value (USD Million/Billion) |

|

Segments Covered |

Application, Equipment Procurement, Offering, Monitoring Technique, Monitoring Process, Deployment Type, and Industry |

|

Geographic Regions Covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies Covered |

Major Players: Emerson Electric Co. (US), Honeywell International Inc. (US), SKF (Sweden), Amphenol Corporation (US), PARKER HANNIFIN CORP. (US), General Electric (US), Rockwell Automation (US), Schaeffler AG (Germany), Siemens (Germany), Teledyne Technologies Incorporated (US), Analog Devices, Inc. (US) and Others - (Total 25 players have been covered) |

Machine Condition Monitoring Market Highlights

This research report categorizes the machine condition monitoring market by applications, equipment procurement,

|

Segment |

Subsegment |

|

By Applications: |

|

|

By Equipment Procurement: |

|

|

By Offering: |

|

|

By Monitoring Technique: |

|

|

By Deployment Type: |

|

|

By Monitoring Process: |

|

|

By Industry: |

|

|

By Region |

|

Recent Developments in Machine Condition Monitoring Industry

- In November 2023, SKF has expanded its condition monitoring portfolio with the introduction of the SKF Enlight Collect IMx-1-EX sensor solution. This innovative wireless monitoring system enables proactive identification of machine faults, preventing costly and disruptive downtime.

- In June 2022, Siemens acquired Senseye, a leading provider of AI-powered solutions for industrial machinery performance. With this acquisition Siemens expanded its portfolio in the field of innovative predictive maintenance and asset intelligence.

- In March 2021, Emerson Electric Co. introduced a complete portfolio of corrosion and erosion monitoring systems fully integrated with the Plantweb digital ecosystem through the new Rosemount 4390 series of corrosion and erosion wireless transmitters and Plantweb Insight Non-Intrusive Corrosion application. The monitoring portfolio turns existing offline corrosion probes into online tools to monitor the risk of corrosion or erosion in oil and gas processing activities.

Frequently Asked Questions(FAQs):

What is the total CAGR expected to be recorded for the machine condition monitoring market size during 2024-2029?

The global machine condition monitoring market is expected to record a CAGR of 8.3% from 2024–2029.

What are the driving factors for the machine condition monitoring market share?

Rising inclination towards wireless communication technology and growing adoption of predictive maintenance technique to reduce sudden breakdowns are some of the driving factors for the machine condition monitoring market.

Which industry will grow at a fast rate in the future?

Automotive and aerospace industry is expected to grow at the highest CAGR during the forecast period.

Which are the significant players operating in the machine condition monitoring market?

Emerson Electric Co. (US), Honeywell International Inc. (US), SKF (Sweden), General Electric (US), and Amphenol Corporation (US) are among a few top players in the machine condition monitoring market.

Which region will grow at a fast rate in the future?

The machine condition monitoring market in Asia Pacific is expected to grow at the highest CAGR during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing utilization of wireless sensor networks in industrial plants- Elevating demand for predictive maintenance techniques to reduce unexpected breakdowns- Rising number of smart factories worldwide- Increasing awareness about benefits of machine condition monitoring technology adoptionRESTRAINTS- High cost of integrating machine condition monitoring systems with machine maintenance systemsOPPORTUNITIES- Integration of big data analytics and machine learning into machine condition monitoring- Advent of secured cloud computing platform- Integration of IIoT systems with existing manufacturing systemsCHALLENGES- Unavailability of technical expertise at remote locations- Additional costs associated with retrofitting existing systems

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 ECOSYSTEM ANALYSIS

-

5.5 PRICING ANALYSISAVERAGE SELLING PRICE TREND OF MACHINE CONDITION MONITORING SYSTEMAVERAGE SELLING PRICE OF VIBRATION SENSORS PROVIDED BY KEY PLAYERSAVERAGE SELLING PRICE TREND, BY REGION

-

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.7 TECHNOLOGY ANALYSISINTERNET OF THINGS (IOT)CLOUD COMPUTING TECHNOLOGYMULTI-PARAMETER CONDITION MONITORINGCLOUD-BASED PREDICTIVE MAINTENANCE (MAINTENANCE–AS–A–SERVICE)

-

5.8 PORTER’S FIVE FORCES ANALYSISBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESINTENSITY OF COMPETITIVE RIVALRY

-

5.9 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.10 CASE STUDY ANALYSIS

-

5.11 TRADE ANALYSISIMPORT SCENARIOEXPORT SCENARIO

-

5.12 PATENT ANALYSIS

- 5.13 KEY CONFERENCES AND EVENTS, 2024–2025

-

5.14 TARIFFS, REGULATORY LANDSCAPE, AND STANDARDSTARIFFS FOR HS CODE 903190-COMPLIANT PARTS FOR MACHINE CHECKING AND MEASURINGREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSSTANDARDS

- 6.1 INTRODUCTION

- 6.2 PUMPS

- 6.3 CHILLERS

- 6.4 MOTORS

- 6.5 BEARINGS

- 6.6 OTHER APPLICATIONS

- 7.1 INTRODUCTION

- 7.2 ORIGINAL EQUIPMENT MANUFACTURERS (OEMS)

- 7.3 END USERS

- 8.1 INTRODUCTION

-

8.2 VIBRATION MONITORINGINCLINATION TOWARD PREDICTIVE MAINTENANCE TO BOOST DEMAND FOR VIBRATION MONITORING TECHNIQUE

-

8.3 THERMOGRAPHYRISING FOCUS ON COST SAVINGS AND ENERGY EFFICIENCY OPTIMIZATION TO ACCELERATE ADOPTION OF THERMOGRAPHY

-

8.4 OIL ANALYSISPRESENCE OF WEAR PARTICLES AND OTHER CONTAMINANTS IN OIL TO INCREASE DEMAND FOR OIL ANALYSIS TECHNIQUE

-

8.5 CORROSION MONITORINGEMPHASIS ON MAXIMIZING PLANT EFFICIENCY AND SAFETY TO PROMOTE USE OF CORROSION MONITORING TECHNIQUE

-

8.6 ULTRASOUND EMISSIONNEED TO DETECT DEFECTS IN ELECTRIC EQUIPMENT TO STIMULATE DEMAND FOR ULTRASOUND EMISSION TECHNIQUE

-

8.7 MOTOR CURRENT ANALYSISRISING UTILIZATION OF MOTOR CURRENT ANALYSIS FOR EARLY DETECTION OF FAULTS IN MACHINERY TO DRIVE MARKET

- 9.1 INTRODUCTION

-

9.2 HARDWAREVIBRATION SENSORS- Rising use by automotive and oil & gas companies in process control and quality assurance applications to drive market- Accelerometers- Proximity probes- TachometersINFRARED SENSORS- Increasing deployment in thermography applications to spot unusual heat patterns to fuel segmental growth- Thermal infrared sensors- Quantum infrared sensorsSPECTROMETERS- Surging adoption to detect contamination, degradation, and cross-contamination in synthetic and petroleum-based lubricants and fluids to stimulate market growth- Infrared spectrometers- Ultraviolet spectrometers- Atomic spectrometers- Mass spectrometersULTRASOUND DETECTORS- Surging adoption of predictive maintenance and quality control measures by industrial players to boost demand- Sound pressure meters- Stethoscopes- Ultrasound leak detectorsSPECTRUM ANALYZERS- Significant focus on safe and efficient operation of industrial plants to drive market- Swept spectrum analyzers- Real-time spectrum analyzersCORROSION PROBES- Pressing need to mitigate corrosion risks in petroleum and chemical processing plants to accelerate demandOTHER HARDWARE PRODUCTS

-

9.3 SOFTWAREINTEGRATION OF SOFTWARE INTO MACHINE CONDITION MONITORING SYSTEM TO SIMPLIFY DEFECT ANALYSIS PROCESS TO DRIVE MARKETDATA INTEGRATIONDIAGNOSTIC REPORTINGORDER TRACKING ANALYSISPARAMETER CALCULATION

-

9.4 SERVICESSTRONG FOCUS OF MANUFACTURERS ON LONG-TERM RELIABILITY, PERFORMANCE OPTIMIZATION, AND CUSTOMER SATISFACTION TO BOOST DEMANDINSTALLATIONTRAININGMAINTENANCE

- 10.1 INTRODUCTION

-

10.2 ON-PREMISESSIGNIFICANT FOCUS ON ENSURING COMPLETE DATA CONTROL AND SECURITY TO ACCELERATE SEGMENTAL GROWTH

-

10.3 CLOUDSUPERIOR FLEXIBILITY, CONVENIENCE, AND SCALABILITY TO INCREASE ADOPTION OF CLOUD MODEL

- 11.1 INTRODUCTION

-

11.2 ONLINENEED FOR REAL-TIME DATA REGARDING VARIATIONS IN MACHINE PERFORMANCE FOR PROMPT DECISION-MAKING TO DRIVE MARKET

-

11.3 PORTABLECOST-EFFECTIVENESS AND MAXIMIZED PRODUCTION OUTPUT TO BOOST DEMAND

- 12.1 INTRODUCTION

-

12.2 OIL & GASRISING ADOPTION OF SMART FACTORY SOLUTIONS TO BOOST CONDITION MONITORING SYSTEM DEMAND

-

12.3 POWER GENERATIONINCREASING FOCUS ON IMPROVING POWER PLANT EFFICIENCY AND RELIABILITY TO PROMOTE ADOPTION OF MACHINE MONITORING SYSTEMS

-

12.4 METALS & MININGGREATER EMPHASIS ON PREVENTING CATASTROPHIC SYSTEM FAILURES AND UNSCHEDULED DOWNTIME TO BOOST DEPLOYMENT OF VIBRATION SENSORS

-

12.5 CHEMICALSHIGH ADOPTION OF AUTOMATION SOLUTIONS BY CHEMICAL MANUFACTURERS TO CREATE NEED FOR MACHINE MONITORING SYSTEMS

-

12.6 AUTOMOTIVEGROWING DEPLOYMENT OF IIOT TO AUTOMATE AND DIGITALIZE MANUFACTURING PROCESSES TO CREATE OPPORTUNITIES FOR MARKET PLAYERS

-

12.7 AEROSPACERISING ADOPTION OF AI AND IOT TECHNOLOGIES BY AEROSPACE COMPANIES TO ELEVATE DEMAND FOR MACHINE MONITORING SOLUTIONS

-

12.8 FOOD & BEVERAGESSURGING DEMAND FOR FOOD PRODUCTS WITH LONGER SHELF LIFE TO FACILITATE ADOPTION OF MACHINE MONITORING SOLUTIONS

-

12.9 MARINEGROWING RELIANCE ON PREDICTIVE MAINTENANCE MODEL TO AUGMENT ADOPTION OF MACHINE MONITORING SYSTEMS

- 12.10 OTHER INDUSTRIES

- 13.1 INTRODUCTION

-

13.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- Increasing adoption of IIoT technologies by manufacturing firms to drive marketCANADA- Rising deployment of smart factory solutions to fuel market growthMEXICO- Growing implementation of automation solutions in industrial plants to support market growth

-

13.3 EUROPEEUROPE: RECESSION IMPACTGERMANY- Thriving automotive sector to contribute to market growthUK- Rising use of IoT devices by manufacturers to foster market growthFRANCE- Booming aerospace industry to create opportunities for machine condition monitoring system providersREST OF EUROPE

-

13.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTCHINA- Surging adoption of automation technologies owing to increasing labor costs to drive marketJAPAN- Shrinking workforce and aging population to boost adoption of advanced machine condition monitoring systems in smart factoriesINDIA- Digital India and Make in India initiatives to create opportunities for market playersREST OF ASIA PACIFIC

-

13.5 REST OF THE WORLD (ROW)ROW: RECESSION IMPACTGCC COUNTRIES- Strong presence of oil & gas industry to fuel market growth- Saudi Arabia- UAE- Rest of GCC countriesREST OF MIDDLE EAST & AFRICA- Flourishing mining industry to support market growthSOUTH AMERICA- Emergence of region as manufacturing hub to create growth opportunities

- 14.1 INTRODUCTION

- 14.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 14.3 REVENUE ANALYSIS OF KEY PLAYERS IN MACHINE CONDITION MONITORING MARKET

- 14.4 MARKET SHARE ANALYSIS, 2023

-

14.5 EVALUATION MATRIX FOR KEY COMPANIES, 2023STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT ANALYSIS

-

14.6 EVALUATION MATRIX FOR STARTUPS/SMES, 2023PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

- 14.7 COMPETITIVE SCENARIO AND TRENDS

-

15.1 KEY PLAYERSBAKER HUGHES COMPANY- Business overview- Products offered- MnM viewEMERSON ELECTRIC CO.- Business overview- Products offered- Recent developments- MnM viewAMPHENOL CORPORATION- Business overview- Products offered- Recent developments- MnM viewHONEYWELL INTERNATIONAL INC.- Business overview- Products offered- Recent developments- MnM viewSKF- Business overview- Products offered- Recent developments- MnM viewANALOG DEVICES, INC.- Business overview- Products offeredGENERAL ELECTRIC- Business overview- Products offeredPARKER HANNIFIN CORP- Business overview- Products offeredROCKWELL AUTOMATION- Business overview- Products offeredSCHAEFFLER AG- Business overview- Products offered- Recent developmentsSIEMENS- Business overview- Products offered- Recent developmentsTELEDYNE TECHNOLOGIES INCORPORATED- Business overview- Products offered

-

15.2 OTHER COMPANIES3D SIGNALSBANNER ENGINEERING CORP.CRYSTAL INSTRUMENTSECOLIBRIUMFLUKE CORPORATIONIFM ELECTRONIC GMBHLOGILUBE, LLCMACHINE SAVERPETASENSE INC.SAMOTICSSPM INSTRUMENT ABSYMPHONYAIUPTIMEWORKS

- 16.1 INTRODUCTION

-

16.2 TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGIONINTRODUCTIONNORTH AMERICA- US- Canada- Mexico

- 17.1 INSIGHTS FROM INDUSTRY EXPERTS

- 17.2 DISCUSSION GUIDE

- 17.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 17.4 CUSTOMIZATION OPTIONS

- 17.5 RELATED REPORTS

- 17.6 AUTHOR DETAILS

- TABLE 1 RISK ANALYSIS

- TABLE 2 KEY COMPANIES AND THEIR ROLE IN ECOSYSTEM

- TABLE 3 AVERAGE SELLING PRICE OF VIBRATION SENSORS OFFERED BY KEY PLAYERS

- TABLE 4 AVERAGE SELLING PRICES OF MACHINE CONDITION MONITORING HARDWARE EQUIPMENT

- TABLE 5 AVERAGE SELLING PRICE OF MACHINE CONDITION MONITORING SYSTEM, BY REGION

- TABLE 6 MACHINE CONDITION MONITORING MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY INDUSTRY

- TABLE 8 KEY BUYING CRITERIA FOR TOP 3 INDUSTRIES

- TABLE 9 STEEL ROLLING MILL DEPLOYED ONLINE CONDITION MONITORING SYSTEM TO PREVENT CATASTROPHIC BEARING FAILURE

- TABLE 10 EMERSON ELECTRIC INSTALLED VIBRATION TRANSMITTER IN BARKING POWER STATION TO REDUCE PLANT DOWNTIME

- TABLE 11 SIG EMPLOYED APM STRATEGY SOLUTION TO REDUCE UNPLANNED DOWNTIME

- TABLE 12 TOP 20 PATENT OWNERS IN US IN LAST 10 YEARS (2014–2023)

- TABLE 13 INNOVATIONS AND PATENT REGISTRATIONS PERTAINING TO MACHINE CONDITION MONITORING, 2022–2023

- TABLE 14 LIST OF CONFERENCES AND EVENTS

- TABLE 15 AVERAGE TARIFF (ESTIMATED) APPLIED BY COUNTRY (%)

- TABLE 16 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 MACHINE CONDITION MONITORING-RELATED STANDARDS

- TABLE 21 MARKET, BY MONITORING TECHNIQUE, 2020–2023 (USD MILLION)

- TABLE 22 MARKET, BY MONITORING TECHNIQUE, 2024–2029 (USD MILLION)

- TABLE 23 VIBRATION MONITORING: MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 24 VIBRATION MONITORING: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 25 VIBRATION MONITORING: MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 26 VIBRATION MONITORING: MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 27 VIBRATION MONITORING: MARKET, BY INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 28 VIBRATION MONITORING: MACHINE HEALTH MONITORING MARKET, BY INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 29 THERMOGRAPHY: EQUIPMENT MONITORING MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 30 THERMOGRAPHY: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 31 THERMOGRAPHY: MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 32 THERMOGRAPHY: MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 33 THERMOGRAPHY: MARKET, BY INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 34 THERMOGRAPHY: EQUIPMENT MONITORING MARKET, BY INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 35 OIL ANALYSIS: MACHINE HEALTH MONITORING MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 36 OIL ANALYSIS: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 37 OIL ANALYSIS: MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 38 OIL ANALYSIS: MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 39 OIL ANALYSIS: MARKET, BY INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 40 OIL ANALYSIS: MACHINE CONDITION MONITORING MARKET, BY INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 41 CORROSION MONITORING: MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 42 CORROSION MONITORING: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 43 CORROSION MONITORING: MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 44 CORROSION MONITORING: MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 45 CORROSION MONITORING: MARKET, BY INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 46 CORROSION MONITORING: MACHINE HEALTH MONITORING MARKET, BY INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 47 ULTRASOUND EMISSION: MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 48 ULTRASOUND EMISSION: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 49 ULTRASOUND EMISSION: MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 50 ULTRASOUND EMISSION: MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 51 ULTRASOUND EMISSION: MARKET, BY INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 52 ULTRASOUND EMISSION: EQUIPMENT MONITORING MARKET, BY INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 53 MOTOR CURRENT ANALYSIS: MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 54 MOTOR CURRENT ANALYSIS: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 55 MOTOR CURRENT ANALYSIS: MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 56 MOTOR CURRENT ANALYSIS: MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 57 MOTOR CURRENT ANALYSIS: MARKET, BY INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 58 MOTOR CURRENT ANALYSIS: MACHINE HEALTH MONITORING MARKET, BY INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 59 MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 60 MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 61 MARKET, 2020–2023 (THOUSAND UNITS)

- TABLE 62 MARKET, 2024–2029 (THOUSAND UNITS)

- TABLE 63 MARKET, BY HARDWARE TYPE, 2020–2023 (USD MILLION)

- TABLE 64 MACHINE HEALTH MONITORING MARKET, BY HARDWARE TYPE, 2024–2029 (USD MILLION)

- TABLE 65 HARDWARE: MARKET, BY MONITORING TECHNIQUE, 2020–2023 (USD MILLION)

- TABLE 66 HARDWARE: MARKET, BY MONITORING TECHNIQUE, 2024–2029 (USD MILLION)

- TABLE 67 LIST OF MACHINE CONDITION MONITORING SOFTWARE PROVIDERS AND THEIR HEADQUARTERS

- TABLE 68 SOFTWARE: MARKET, BY MONITORING TECHNIQUE, 2020–2023 (USD MILLION)

- TABLE 69 SOFTWARE: EQUIPMENT MONITORING MARKET, BY MONITORING TECHNIQUE, 2024–2029 (USD MILLION)

- TABLE 70 MACHINE CONDITION MONITORING MARKET, BY DEPLOYMENT MODE, 2020–2023 (USD MILLION)

- TABLE 71 MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

- TABLE 72 MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 73 MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 74 ONLINE: MACHINE HEALTH MONITORING MARKET, BY MONITORING TECHNIQUE, 2020–2023 (USD MILLION)

- TABLE 75 ONLINE: MARKET, BY MONITORING TECHNIQUE, 2024–2029 (USD MILLION)

- TABLE 76 ONLINE: MARKET, BY INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 77 ONLINE: MARKET, BY INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 78 PORTABLE: MARKET, BY MONITORING TECHNIQUE, 2020–2023 (USD MILLION)

- TABLE 79 PORTABLE: MARKET, BY MONITORING TECHNIQUE, 2024–2029 (USD MILLION)

- TABLE 80 PORTABLE: MARKET, BY INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 81 PORTABLE: MARKET, BY INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 82 MARKET, BY INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 83 MACHINE HEALTH MONITORING MARKET, BY INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 84 OIL & GAS: EQUIPMENT MONITORING MARKET, BY MONITORING TECHNIQUE, 2020–2023 (USD MILLION)

- TABLE 85 OIL & GAS: MARKET, BY MONITORING TECHNIQUE, 2024–2029 (USD MILLION)

- TABLE 86 OIL & GAS: MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 87 OIL & GAS: MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 88 OIL & GAS: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 89 OIL & GAS: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 90 POWER GENERATION: MARKET, BY MONITORING TECHNIQUE, 2020–2023 (USD MILLION)

- TABLE 91 POWER GENERATION: MARKET, BY MONITORING TECHNIQUE, 2024–2029 (USD MILLION)

- TABLE 92 POWER GENERATION: MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 93 POWER GENERATION: MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 94 POWER GENERATION: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 95 POWER GENERATION: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 96 METALS & MINING: MARKET, BY MONITORING TECHNIQUE, 2020–2023 (USD MILLION)

- TABLE 97 METALS & MINING: MARKET, BY MONITORING TECHNIQUE, 2024–2029 (USD MILLION)

- TABLE 98 METALS & MINING: MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 99 METALS & MINING: MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 100 METALS & MINING: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 101 METALS & MINING: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 102 CHEMICALS: MACHINE CONDITION MONITORING MARKET, BY MONITORING TECHNIQUE, 2020–2023 (USD MILLION)

- TABLE 103 CHEMICALS: MARKET, BY MONITORING TECHNIQUE, 2024–2029 (USD MILLION)

- TABLE 104 CHEMICALS: MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 105 CHEMICALS: MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 106 CHEMICALS: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 107 CHEMICALS: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 108 AUTOMOTIVE: MARKET, BY MONITORING TECHNIQUE, 2020–2023 (USD MILLION)

- TABLE 109 AUTOMOTIVE: MARKET, BY MONITORING TECHNIQUE, 2024–2029 (USD MILLION)

- TABLE 110 AUTOMOTIVE: MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 111 AUTOMOTIVE: MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 112 AUTOMOTIVE: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 113 AUTOMOTIVE: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 114 AEROSPACE: MARKET, BY MONITORING TECHNIQUE, 2020–2023 (USD MILLION)

- TABLE 115 AEROSPACE: MARKET, BY MONITORING TECHNIQUE, 2024–2029 (USD MILLION)

- TABLE 116 AEROSPACE: MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 117 AEROSPACE: MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 118 AEROSPACE: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 119 AEROSPACE: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 120 FOOD & BEVERAGES: MARKET, BY MONITORING TECHNIQUE, 2020–2023 (USD MILLION)

- TABLE 121 FOOD & BEVERAGES: MARKET, BY MONITORING TECHNIQUE, 2024–2029 (USD MILLION)

- TABLE 122 FOOD & BEVERAGES: MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 123 FOOD & BEVERAGES: MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 124 FOOD & BEVERAGES: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 125 FOOD & BEVERAGES: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 126 MARINE: MARKET, BY MONITORING TECHNIQUE, 2020–2023 (USD MILLION)

- TABLE 127 MARINE: MARKET, BY MONITORING TECHNIQUE, 2024–2029 (USD MILLION)

- TABLE 128 MARINE: MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 129 MARINE: MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 130 MARINE: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 131 MARINE: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 132 OTHER INDUSTRIES: MARKET, BY MONITORING TECHNIQUE, 2020–2023 (USD MILLION)

- TABLE 133 OTHER INDUSTRIES: MARKET, BY MONITORING TECHNIQUE, 2024–2029 (USD MILLION)

- TABLE 134 OTHER INDUSTRIES: MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 135 OTHER INDUSTRIES: MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 136 OTHER INDUSTRIES: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 137 OTHER INDUSTRIES: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 138 MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 139 MACHINE CONDITION MONITORING MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 140 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 141 NORTH AMERICA: MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 142 NORTH AMERICA: MARKET, BY INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 143 NORTH AMERICA: MARKET, BY INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 144 EUROPE: MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 145 EUROPE: MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 146 EUROPE: MARKET, BY INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 147 EUROPE: MARKET, BY INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 148 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 149 ASIA PACIFIC: MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 150 ASIA PACIFIC: MARKET, BY INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 151 ASIA PACIFIC: MARKET, BY INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 152 ROW: MARKET, BY GEOGRAPHY, 2020–2023 (USD MILLION)

- TABLE 153 ROW: MARKET, BY GEOGRAPHY, 2024–2029 (USD MILLION)

- TABLE 154 ROW: MARKET, BY INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 155 ROW: MARKET, BY INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 156 MARKET, BY GCC COUNTRY, 2020–2023 (USD MILLION)

- TABLE 157 MARKET, BY GCC COUNTRY, 2024–2029 (USD MILLION)

- TABLE 158 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 159 MACHINE CONDITION MONITORING MARKET SHARE ANALYSIS (2023)

- TABLE 160 OVERALL FOOTPRINT: KEY COMPANIES (25 COMPANIES)

- TABLE 161 INDUSTRY FOOTPRINT: KEY COMPANIES (25 COMPANIES)

- TABLE 162 REGION FOOTPRINT: KEY COMPANIES (25 COMPANIES)

- TABLE 163 DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 164 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (5 COMPANIES)

- TABLE 165 OVERALL FOOTPRINT: STARTUPS/SMES (5 COMPANIES)

- TABLE 166 MARKET: PRODUCT LAUNCHES

- TABLE 167 MARKET: DEALS

- TABLE 168 BAKER HUGHES COMPANY: COMPANY OVERVIEW

- TABLE 169 BAKER HUGHES COMPANY: PRODUCTS OFFERED

- TABLE 170 EMERSON ELECTRIC CO.: COMPANY OVERVIEW

- TABLE 171 EMERSON ELECTRIC CO.: PRODUCTS OFFERED

- TABLE 172 EMERSON ELECTRIC CO.: PRODUCT LAUNCHES

- TABLE 173 EMERSON ELECTRIC CO.: DEALS

- TABLE 174 AMPHENOL CORPORATION: COMPANY OVERVIEW

- TABLE 175 AMPHENOL CORPORATION: PRODUCTS OFFERED

- TABLE 176 AMPHENOL CORPORATION: PRODUCT LAUNCHES

- TABLE 177 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 178 HONEYWELL INTERNATIONAL INC.: PRODUCTS OFFERED

- TABLE 179 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES

- TABLE 180 SKF: COMPANY OVERVIEW

- TABLE 181 SKF: PRODUCTS OFFERED

- TABLE 182 SKF: PRODUCT LAUNCHES

- TABLE 183 SKF: DEALS

- TABLE 184 ANALOG DEVICES, INC.: COMPANY OVERVIEW

- TABLE 185 ANALOG DEVICES, INC.: PRODUCTS OFFERED

- TABLE 186 GENERAL ELECTRIC: COMPANY OVERVIEW

- TABLE 187 GENERAL ELECTRIC: PRODUCTS OFFERED

- TABLE 188 PARKER HANNIFIN CORP: COMPANY OVERVIEW

- TABLE 189 PARKER HANNIFIN CORP: PRODUCTS OFFERED

- TABLE 190 ROCKWELL AUTOMATION: COMPANY OVERVIEW

- TABLE 191 ROCKWELL AUTOMATION: PRODUCTS OFFERED

- TABLE 192 SCHAEFFLER AG: COMPANY OVERVIEW

- TABLE 193 SCHAEFFLER AG: PRODUCTS OFFERED

- TABLE 194 SCHAEFFLER AG: PRODUCT LAUNCHES

- TABLE 195 SIEMENS: COMPANY OVERVIEW

- TABLE 196 SIEMENS: PRODUCTS OFFERED

- TABLE 197 SIEMENS: DEALS

- TABLE 198 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY OVERVIEW

- TABLE 199 TELEDYNE TECHNOLOGIES INCORPORATED: PRODUCTS OFFERED

- TABLE 200 TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 201 TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 202 NORTH AMERICA: TEST AND MEASUREMENT EQUIPMENT MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 203 NORTH AMERICA: TEST AND MEASUREMENT EQUIPMENT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 204 NORTH AMERICA: TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 205 NORTH AMERICA: TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 206 NORTH AMERICA: TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE, 2019–2022 (USD MILLION)

- TABLE 207 NORTH AMERICA: TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- FIGURE 1 MACHINE CONDITION MONITORING MARKET SEGMENTATION

- FIGURE 2 MARKET: REGIONAL SCOPE

- FIGURE 3 MARKET: RESEARCH DESIGN

- FIGURE 4 MARKET: RESEARCH APPROACH

- FIGURE 5 MARKET: TOP-DOWN APPROACH

- FIGURE 6 MARKET: BOTTOM-UP APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 RESEARCH ASSUMPTIONS

- FIGURE 10 MARKET, 2020–2029 (USD BILLION)

- FIGURE 11 ONLINE MACHINE CONDITION MONITORING SYSTEMS TO DOMINATE MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 12 VIBRATION MONITORING TECHNIQUE TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

- FIGURE 13 POWER GENERATION INDUSTRY TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

- FIGURE 14 NORTH AMERICA DOMINATED GLOBAL MARKET IN 2023

- FIGURE 15 GROWING DEMAND FROM AUTOMOTIVE AND AEROSPACE INDUSTRIES TO DRIVE MARKET

- FIGURE 16 VIBRATION MONITORING TECHNIQUE TO ACCOUNT FOR LARGEST MARKET SHARE IN 2029

- FIGURE 17 POWER GENERATION INDUSTRY TO CAPTURE LARGEST MARKET SHARE IN 2029

- FIGURE 18 POWER GENERATION INDUSTRY AND US TO HOLD LARGEST SHARE OF NORTH AMERICAN MARKET IN 2029

- FIGURE 19 INDIA TO EXHIBIT HIGHEST CAGR IN GLOBAL MARKET DURING FORECAST PERIOD

- FIGURE 20 GLOBAL MACHINE CONDITION MONITORING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 22 MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 23 MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 24 MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 25 MACHINE CONDITION MONITORING VALUE CHAIN

- FIGURE 26 ECOSYSTEM MAPPING

- FIGURE 27 AVERAGE SELLING PRICE OF MACHINE CONDITION MONITORING SYSTEM, 2019–2023

- FIGURE 28 AVERAGE SELLING PRICE TREND OF VIBRATION SENSORS, BY KEY PLAYER

- FIGURE 29 TRENDS INFLUENCING CUSTOMER BUSINESS

- FIGURE 30 UTILIZATION OF IOT PLATFORMS BY CONDITION MONITORING SYSTEM USERS

- FIGURE 31 ADVANTAGES OF CLOUD-BASED MACHINE CONDITION MONITORING

- FIGURE 32 INDUSTRIAL DEVELOPMENT MODEL

- FIGURE 33 DATA EXCHANGE IN CLOUD-BASED MAINTENANCE FRAMEWORK

- FIGURE 34 MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 INDUSTRIES

- FIGURE 36 KEY BUYING CRITERIA FOR TOP 3 INDUSTRIES

- FIGURE 37 IMPORT VALUE OF PARTS FOR MACHINE CHECKING AND MEASUREMENT, BY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 38 EXPORTS VALUE OF PARTS FOR MACHINE CHECKING AND MEASUREMENT, BY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 39 TOP 10 PATENT APPLICANTS IN LAST 10 YEARS

- FIGURE 40 NUMBER OF PATENTS GRANTED PER YEAR, 2014–2023

- FIGURE 41 PUMPS ACCOUNTED FOR LARGEST SHARE OF MARKET, BY APPLICATION, IN 2023

- FIGURE 42 ORIGINAL EQUIPMENT MANUFACTURERS CAPTURED MAJORITY OF MARKET SHARE IN 2023

- FIGURE 43 MARKET, BY MONITORING TECHNIQUE

- FIGURE 44 VIBRATION MONITORING TECHNIQUE TO ACCOUNT FOR LARGEST MARKET SHARE IN 2029

- FIGURE 45 ADVANTAGES OF OIL ANALYSIS TECHNIQUE

- FIGURE 46 MARKET, BY OFFERING

- FIGURE 47 HARDWARE SEGMENT TO HOLD LARGER MARKET SIZE IN 2029

- FIGURE 48 MARKET, BY DEPLOYMENT MODE

- FIGURE 49 ON-PREMISES SEGMENT TO HOLD LARGER MARKET SHARE THROUGHOUT FORECAST PERIOD

- FIGURE 50 LIMITATIONS OF ON-PREMISES DEPLOYMENT

- FIGURE 51 ADVANTAGES OF CLOUD DEPLOYMENT

- FIGURE 52 MACHINE CONDITION MONITORING MARKET, BY TYPE

- FIGURE 53 ONLINE SEGMENT TO LEAD MARKET FROM 2024 TO 2029

- FIGURE 54 MARKET, BY INDUSTRY

- FIGURE 55 AUTOMOTIVE INDUSTRY TO RECORD HIGHEST CAGR IN MARKET FROM 2024 TO 2029

- FIGURE 56 MARKET, BY REGION

- FIGURE 57 INDIA TO EXHIBIT HIGHEST CAGR IN GLOBAL MARKET DURING FORECAST PERIOD

- FIGURE 58 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 59 US TO ACCOUNT FOR LARGEST SHARE OF NORTH AMERICAN MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 60 EUROPE: MARKET SNAPSHOT

- FIGURE 61 GERMANY TO LEAD EUROPEAN MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 62 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 63 CHINA TO GAIN LARGEST MARKET SHARE IN ASIA PACIFIC THROUGHOUT FORECAST PERIOD

- FIGURE 64 GCC COUNTRIES TO DOMINATE MARKET IN ROW IN 2024

- FIGURE 65 FIVE-YEAR REVENUE ANALYSIS OF KEY PLAYERS IN MARKET, 2018–2022

- FIGURE 66 INDUSTRY CONCENTRATION, 2023

- FIGURE 67 MARKET: KEY COMPANY EVALUATION MATRIX, 2023

- FIGURE 68 MACHINE CONDITION MONITORING MARKET: STARTUPS/SMES EVALUATION MATRIX, 2023

- FIGURE 69 BAKER HUGHES COMPANY: COMPANY SNAPSHOT

- FIGURE 70 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

- FIGURE 71 AMPHENOL CORPORATION: COMPANY SNAPSHOT

- FIGURE 72 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 73 SKF: COMPANY SNAPSHOT

- FIGURE 74 ANALOG DEVICES, INC.: COMPANY SNAPSHOT

- FIGURE 75 GENERAL ELECTRIC: COMPANY SNAPSHOT

- FIGURE 76 PARKER HANNIFIN CORP: COMPANY SNAPSHOT

- FIGURE 77 ROCKWELL AUTOMATION: COMPANY SNAPSHOT

- FIGURE 78 SCHAEFFLER AG: COMPANY SNAPSHOT

- FIGURE 79 SIEMENS: COMPANY SNAPSHOT

- FIGURE 80 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY SNAPSHOT

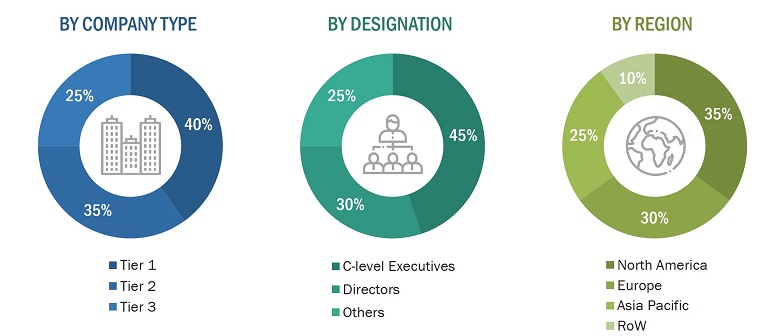

The study involved four major activities in estimating the current size of the machine condition monitoring market. Exhaustive secondary research has been done to collect information on the market, peer, and parent markets. The next step has been to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the total market size. After that, market breakdown and data triangulation methods were used to estimate the market size of segments and subsegments. Two sources of information—secondary and primary—have been used to identify and collect information for an extensive technical and commercial study of the machine condition monitoring market.

Secondary Research

Secondary sources include company websites, magazines, industry news, associations, and databases (Factiva and Bloomberg). These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Primary Research

Primary sources mainly consist of several experts from the core and related industries, along with preferred machine condition monitoring system providers, distributors, alliances, standards, and certification organizations related to various segments of this industry’s value chain.

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts such as Chief Experience Officers (CXOs), Vice Presidents (VPs), and Directors from business development, marketing, product development/innovation teams, and related key executives from machine condition monitoring system providers, such as Emerson Electric Co. (US), Honeywell International Inc. (US), SKF (Sweden), and Amphenol Corporation (US); research organizations, distributors, industry associations, and key opinion leaders. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

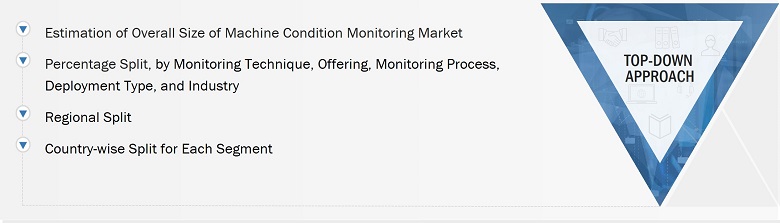

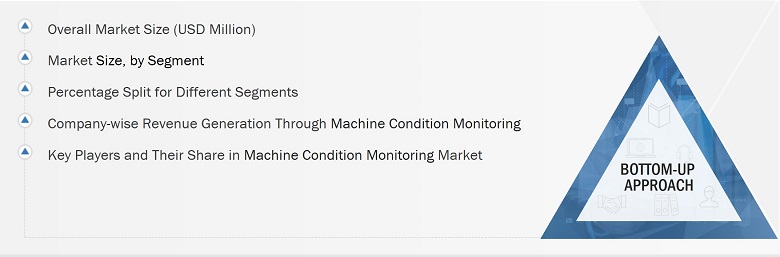

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the machine condition monitoring market. These methods have also been used extensively to estimate the size of various subsegments in the market. The following research methodology has been used to estimate the market size:

- Major players in the industry and markets have been identified through extensive secondary research.

- The industry’s value chain and market size (in terms of value) have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Machine Condition Monitoring Market: Top-down Approach

In the top-down approach, the overall market size has been used to estimate the size of the individual market segments (mentioned in market segmentation) through percentage splits from secondary and primary research. For specific market segments, the size of the most appropriate immediate parent market has been used to implement the top-down approach. The bottom-up approach has also been implemented for data obtained from secondary research to validate the market size of various segments.

Machine Condition Monitoring Market: Bottom-up Approach

The bottom-up approach has been used to arrive at the overall size of the machine condition monitoring market from the revenues of the key players and their market shares. Calculations based on revenues of key companies identified in the market led to the estimation of their overall market size.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. The market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Market Definition

The machine condition monitoring process includes periodic or continuous collection, analysis, interpretation, and diagnosis of data to determine the operational state and condition of machines for detecting potential failures before they turn into functional failures. This approach is different from traditional methods wherein the maintenance personnel manually controls the process of determining the condition of machines. The machine condition monitoring optimizes equipment readiness while reducing maintenance and staff requirements. This technique is widely used in several industries, such as chemicals, oil & gas, aerospace & defense, power generation, automotive, heavy equipment, and manufacturing.

Key Stakeholders

- Asset management consultants specializing in physical asset management

- Associations and regulatory authorities developing standards related to plant maintenance

- Government bodies, venture capitalists, and private equity firms

- Manufacturers of hardware such as vibration sensors, accelerometers, IR sensors, ultrasound detectors, and other instruments used in machine condition monitoring

- Maintenance service providers, as well as manufacturers and suppliers of machine condition monitoring systems

- Research institutes and organizations

Report Objectives

- To define and forecast the machine condition monitoring market regarding application, equipment procurement, offering, monitoring technique, monitoring process, deployment type, and industry.

- To describe and forecast the market and its value segments for four regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW), along with their respective countries.

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micro-markets concerning individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of the machine condition monitoring market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the market

- To strategically profile key players and comprehensively analyze their market position regarding ranking and core competencies, along with a detailed market competitive landscape.

- To analyze strategic approaches such as agreements, collaborations, and partnerships in the machine condition monitoring market

- To provide an analysis of the recession impact on the growth of the market and its segments

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Machine Condition Monitoring Market

With IoT offering a single platform where the companies can integrate all the data and process them accordingly, IoT is creating new opportunities for the companies that require machine condition monitoring solutions. How will condition monitoring be impacted by IoT platform?

Major industries such as oil & gas and power generation are impacted by advent of Industry 4.0 and adoption of related solutions, How will Industry 4.0 address the machine condition monitoring needs of these industries in next 3-4 years?

The disposition of end-user industries towards predictive maintenance to avoid the probable faults in processes and unplanned shutdowns is increasing. How will machine condition monitoring solutions support in efficient predictive maintenance?

The growth of the machine condition monitoring market can be attributed to the rapid developments and advancements in the industries as well as the rising need for predictive maintenance. How will be the growth trend of the market for next 3–5 years owing to these advancements?

Cloud-based deployment helps enterprises in understanding the real-time condition of the asset from a remote location and makes the machine condition monitoring easier. How will the trend of cloud-based and on-premises deployment for condition monitoring vary in the coming 2–3 years?