Marine Actuators and Valves Market by Product ((Actuators (Linear, Rotary), Valves (Quarter Turn Valves, Multi-Turn Valves)), Platform, Sales Channel, Design Characteristics, Material, Application, Component, and Region - Global Forecast to 2027

Update: 10/22/2024

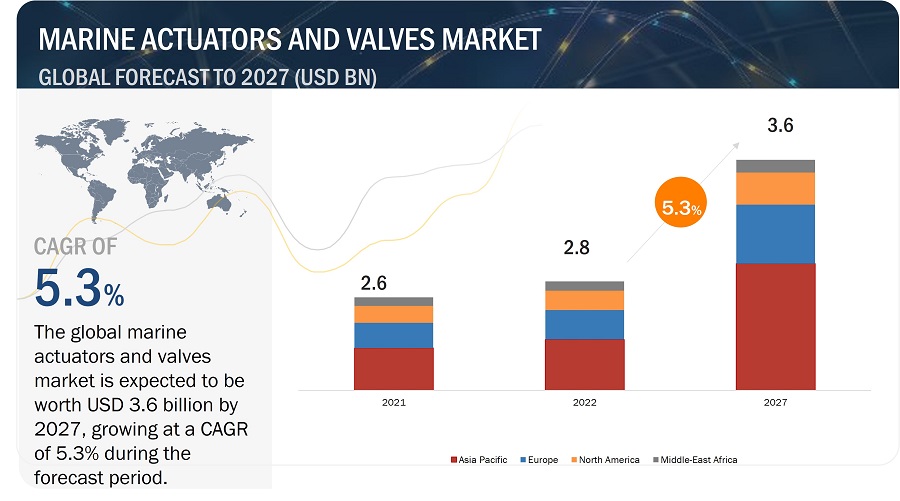

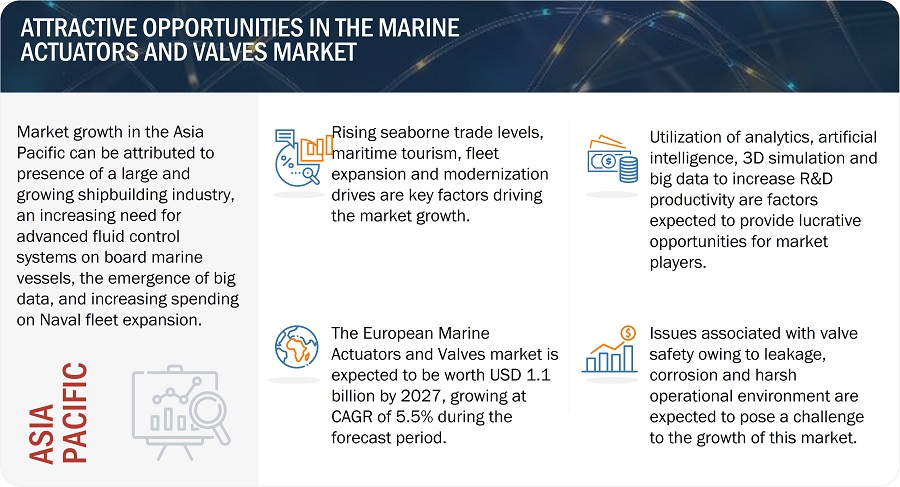

The Marine Actuators and Valves Market size is expected to reach USD 3.6 Billion by 2027 from USD 2.8 Billion in 2022, at a Compound Annual Growth Rate (CAGR) of 5.3% from 2022 to 2027. The key factor driving the growth of the worldwide Marine Actuators and Valves Industry is the increase in global commercial trade and the spike in demand for high-precision motion control devices on board marine vessels. Additionally, the growing commercial and defence fleets of nations worldwide is driving the market for marine actuators and valves that can meet the requirements of sustainable marine transportation.

Marine Actuators and Valves Market Forecast to 2027

To know about the assumptions considered for the study, Request for Free Sample Report

Marine Actuators and Valves Market Dynamics

Marine Actuators and Valves Industry Driver: Increased Global Seaborne Trade

Bulk cargo trade and transport through sea routes have increased over the years as ships are more economical than other transportation means. This has led to the growth of global seaborne trade. For instance, 90% of world trade is carried out through seaways due to competitive freight costs (Source: International Chamber of Shipping). According to UNCTAD, global trade was estimated at USD 32 trillion in 2022, with USD 25 trillion in products and USD 7 trillion in services. These projections reflect a 10% rise in goods trade and a 15% increase in services trade by 2021. The demand for raw materials such as oil, gas, and minerals, which are often found in remote places that require being transported by sea to reach global markets, has further boosted seaborne trade. Improvements in maritime technology, such as larger vessels and more efficient port operations, have made it easier and cheaper to carry commodities by water. This has contributed to the rise of seaborne trade and allowed it to become a more efficient and cost-effective means of transportation.

Marine Actuators and Valves Industry Restraint: Stringent Regulatory Norms to Be Complied by the Valve and Actuator Manufacturers

The marine industry is highly regulated, mainly due to the potential risks associated with marine operations. Many bilateral, national, and international regulations and standards bind the actions of manufacturers of marine actuators and valves and related components such as cylinders, drives, manifolds, and servo valves. Countries worldwide have different regulatory bodies governing the operational safety of commercial and military ships. For instance, the International Maritime Organization (IMO) has laid down regulations that must be adhered to by the manufacturers of marine actuators, valves, and associated components to ensure safe operations and minimize risks associated with the use of defective components.

Additionally, components used in commercial and military ships must undergo stringent quality checks and rigorous testing to meet the required safety levels and reduce the risk of faulty components. All components must undergo a one-time inspection before being integrated into commercial and military ships. However, it is challenging for manufacturers of marine actuators, valves, and related components to comply with all stringent regulatory norms and deliver quality products.

Marine Actuators and Valves Industry Opportunity: Growing Use of Inland Waterways

Inland waterborne transport (IWT) has contributed to the development of mature economies over many centuries and created several navigable rivers and canals worldwide. Significant growth has been registered in inland waterways transport of goods and passengers in the past decade. The inland waterway is an inexpensive and environment-friendly medium for transporting goods. One horsepower (hp) of engine power moves 150 kg on the road, 500 kg on the rail, and 4,000 kg on water, whereas one liter of fuel moves 24 tons/km on the road, 85 tons/km on the rail, and 105 tons/km on water. Inland waterways, therefore, help save transport and logistics costs; moreover, goods can be transferred more smoothly and faster via inland waterways than roadways or railways.

Inland waterways in India are estimated to save nearly USD 15 million annually in transporting coal. A substantial effort has been made in recent years to develop India's inland waterways. The government has launched the Jal Marg Vikas Project, which aims to develop the National Waterway-1 (NW-1), a 1,620 km long waterway on the Ganges River, between Haldia in West Bengal and Varanasi in Uttar Pradesh. The project is being implemented by the Inland Waterways Authority of India (IWAI) and is expected to be completed by 2023. The development of inland waterways in India is expected to provide several benefits, including cost-effective mode of transportation, improved connectivity and reduction in road congestion. The growth of inland waterways transport would also promote the manufacturing of marine vessels, such as tugs, propelled barges, ferries, and other goods and passenger transport vessels. This, in turn, would boost the demand for marine valves and actuators.

Marine Actuators and Valves Industry Challenge: Power Consumption, Noise, and Leakage Issues Associated With Actuators and Valves

The most challenging stage in the installation of actuators and valves is designing a circuit that consumes low energy. Actuators consume more energy than sensors, and a faulty actuator can increase electricity consumption. High power and capacity and low weight of electrical actuators are the main reasons for their increased demand in various applications, such as fuel and propulsion systems, liquid cargo systems, and refrigeration systems. However, due to the probability of defective circuit designs, customers may not prefer purchasing actuators. Hence, power consumption issues, especially in faulty actuators, act as a challenge for the manufacturers of actuators.

In addition, the lack of maintenance of conventional actuators may lead to excessive noise and oil leakage. Further, actuator systems can fail over a long period due to dampening their tubes’ inside edges. Moreover, while in operation, these actuators make a high noise; hence, it is sometimes necessary to place them in a separate room to limit sound pollution. These are some of the operational challenges accompanying the usage of valves and actuators on board a marine vessel.

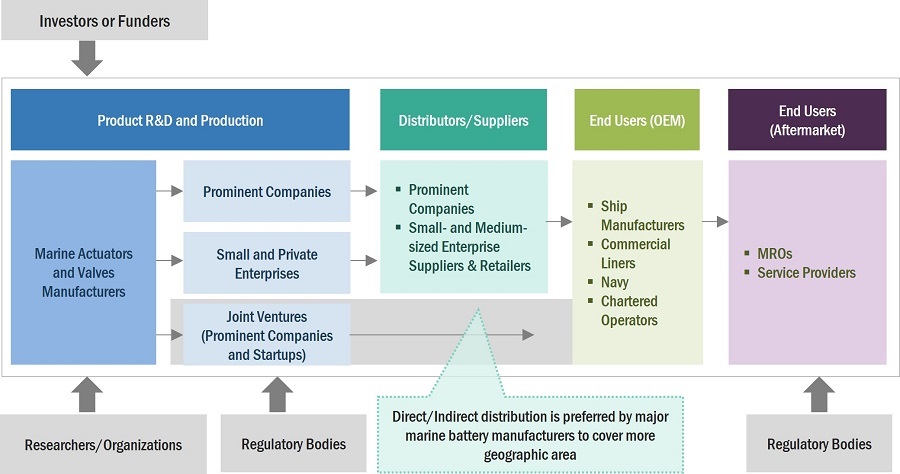

Marine Actuators And Valves Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of Marine actuators and valves. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. The prominent companies are Moog Inc. (US), Honeywell International Inc. (US), Rotork plc (UK), Emerson (US), Curtiss-Wright Corporation (US), IMI plc (UK), Flowserve Corporation (US), Rockwell Automation (US) and Kitz Corporation (Japan). Commercial Passenger vessel operators, cargo operators, oil tanker operators, private cruise liners, global naval forces, MROs, and chartered operators are some of the leading consumers of marine actuators and valves.

Commercial Segment to Dominate Market Share During the Forecast Period

Based on Ship Type, the Marine Actuators and Valves market has been segmented into commercial, defense and unmanned vessels. One of the primary factors propelling the commercial segment is the increased global commercial seaborne trade, increasing cargo vessel deliveries and increasing maritime tourism. The need to design safe actuators and valves systems with high performance, and improved life is driving this segment.

Rotary Actuators to Have the Highest CAGR for Actuator Type in Marine Actuators and Valves Market During the Forecast Period

Based on product type, the market has been segmented into valves (quarter-turn and multi-turn valves) and actuators (linear and rotary actuators). By valve type quarter-turn valves are expected to have the major market share during the forecasted period, while rotary actuators are expected to lead the actuator segment during the years 2022-2027. Quarter-turn valves will hold the largest market share because of their extensive application areas in liquid cargo systems, firefighting systems, as well as fuel and propulsion systems in marine vessels.

Stainless Steel Segment to Witness Higher Demand During the Forecast Period

Based on Material, the marine Actuators and Valves market has been classified into stainless steel, aluminum, alloy-based and others. Others include rubber, copper and plastic materials. Corrosion resistance, higher reliability, and lightweight are few characteristics being considered for the selection of marine actuators and valves.

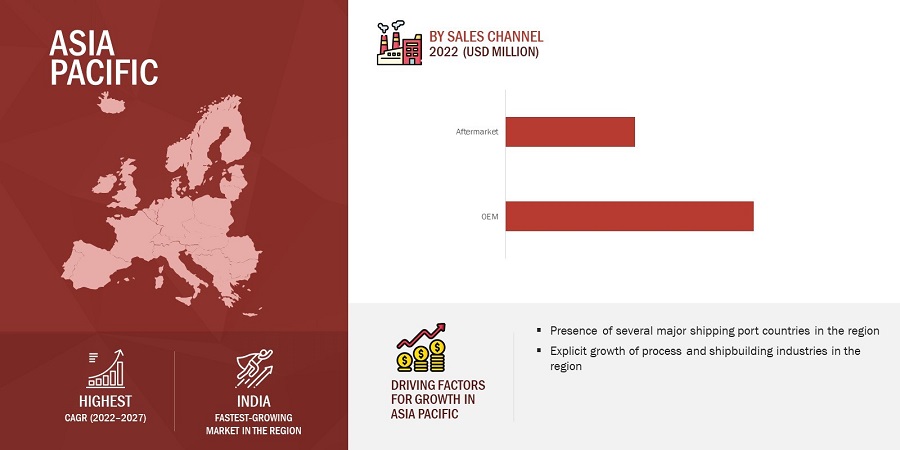

OEM to Acquire the Largest Market Share During the Forecast Period

Based on Sales Channel, the marine actuators and valves market has been classified into OEM and Aftermarket. The ongoing fleet expansion programs of several end users, such as cargo and freight operators and global naval force, drive the OEM segment of the market. Increasing demand for commercial ships, such as containers, bulk carriers, tankers, and naval ships, is fueling the growth of the marine actuators and valves market for the OEM segment.

Asia Pacific is Projected to Hold the Highest Market Share During the Forecast Period

Marine Actuators and Valves Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Asia Pacific leads the marine actuators and valves market due presence of big players, OEMs, and component manufacturers which are some of the factors expected to boost the growth of the marine Actuators and Valves market in the region. A rise in seaborne trade has led to an increase in demand for ships worldwide for the transportation of manufactured goods. The rising number of ships, the growth of the shipping industry, and growing awareness about carbon emissions are projected to increase the demand for marine actuators and valvesbatteries in the Asia Pacific region. China, South Korea and Japan hold more than 90% share of global shipbuilding industry. These are some of the factors fuelling the growth of marine valves and actuators market in the region.

Marine Actuators and Valves Industry Companies: Top Key Market Players

The Marine Actuators and Valves Companies are dominated by globally established players such as Moog Inc. (US), Honeywell International Inc. (US), Rotork plc (UK), Emerson (US), Curtiss-Wright Corporation (US), IMI plc (UK), Flowserve Corporation (US), Rockwell Automation (US) and Kitz Corporation (Japan).

Scope of the Report

|

Report Metric |

Details |

|

Estimated Market Size

|

USD 2.8 Billion in 2022

|

|

Projected Market Size

|

USD 3.6 Billion by 2027

|

|

Growth Rate

|

CAGR of 5.3%

|

|

Market Size Available for Years |

2018-2027 |

|

Base Year Considered |

2021 |

|

Forecast Period |

2022-2027 |

|

Forecast Units |

Value (USD Million/Billion) |

|

Segments Covered |

By Platform, By Product, By Mechanism, By Material, By Design Characteristics, By Component, By Application, By Sales Channel, By Region |

|

Geographies Covered |

North America, Europe, Asia-Pacific, Middle East Rest of the World |

|

Companies Covered |

Moog Inc. (US), Honeywell International Inc. (US), Rotork plc (UK), Emerson (US), Curtiss-Wright Corporation (US), IMI plc (UK), Flowserve Corporation (US), Rockwell Automation (US) and Kitz Corporation (Japan) amongst others. |

Marine Actuators and Valves Market Highlights

This research report categorizes the Marine Actuators and Valves market based on Platform, Product, Mechanism, Material, Design Characteristics, Component, Application, Sales Channel and Region.

|

Segment |

Subsegment |

|

By Platform |

|

|

By Product |

|

|

By Mechanism |

|

|

By Material |

|

|

By Design Characteristics |

|

|

By Component |

|

|

By Application |

|

|

By Sales Channel |

|

|

By Region |

|

Recent Developments

- In April 2022, Hunt Valves, US a subsidiary of Fairbanks Morse Defense, signed a contract with Newsport News Shipbuilding worth USD 2 million for the supply of valves and actuators for naval defense applications.

- In May 2020, CIRCOR International, Inc. was awarded six contracts to supply ball valves for the US Navy's Virginia Class Submarine Block V programme. Six hipments of valves worth $18 million would be delivered over the next three years under the contracts from 2020 to 2023.

- In February 2018, Moog Inc. acquired VUES Brno. VUES is based in Mostecká street, Brno, Czech Republic, with other facilities in Jarni and Slavkov u Brna. VUES manufactures specialised electric motors, generators, and solutions. The company provides solutions for a wide range of applications in the automation, automobile testing, energy, and industrial areas.

- In January 2021, Rotork plc launched an advanced analytics software for managing intelligent flow control assets. Intelligent Asset Management (IAM) is a cloud-based asset management solution that manages intelligent actuators and the flow control devices they run.

- In April 2020, AUMA Riester GmbH Co. & Kg. launched a smart actuators series called as ‘PROFOX’ which are compatible with gate, butterfly, ball, and globe valves. There are multi-turn versions with torques ranging from 10 to 100 Nm and part-turn versions with torques ranging from 32 to 600 Nm. PROFOX's built-in intelligence makes it suitable for both basic open-close duty and difficult modulating applications.

Frequently Asked Questions (FAQ):

What Are Your Views on the Growth Prospect of the Marine Actuators and Valves Market?

The Marine Actuators and Valves Market is being driven by end-user fleet modernization initiatives, as well as an expanding order book and the delivery of new-generation marine vessels.

What Are the Key Sustainability Strategies Adopted by Leading Players Operating in the Marine Actuators and Valves Market?

Key players have adopted various organic and inorganic strategies to strengthen their position in the Marine Actuators and Valves market. The major players include Moog Inc. (US), Honeywell International Inc. (US), Rotork plc (UK), Emerson (US), Curtiss-Wright Corporation (US), IMI plc (UK), Flowserve Corporation (US), Rockwell Automation (US) and Kitz Corporation (Japan). These players have adopted various strategies, such as acquisitions, contracts, expansions, new product launches, and partnerships & agreements, to expand their presence in the market.

What Are the New Emerging Technologies and Use Cases Disrupting the Marine Actuators and Valves Market?

Some of the major emerging technologies and use cases disrupting the market include electric actuator technology. Advancements in electric actuators technology, such as improvements in materials such as steel and alloys, robustness, efficiency, and electromagnetic designs, are expected to increase the demand for electric actuators for marine vessels over the future. Such advancements in electric actuators have increased the power density while offering superior performance in a wide range of applications at a reduced cost. As a result, electrical systems were increasingly being replaced with mechanical and hydraulic systems.

Who Are the Key Players and Innovators in the Ecosystem of the Marine Actuators and Valves Market?

The key players in the Marine Actuators and Valves market include Moog Inc. (US), Honeywell International Inc. (US), Rotork plc (UK), Emerson (US), Curtiss-Wright Corporation (US), IMI plc (UK), Flowserve Corporation (US), Rockwell Automation (US) and Kitz Corporation (Japan) to name a few.

Which Region is Expected to Hold the Highest Market Share in the Marine Actuators and Valves Market?

The Marine Actuators and Valves market in Asia Pacific is projected to hold the highest market share during the forecast period due to the presence of several large ship manufacturers and operators in the region, as well as the presence of major passenger and inland and sea-faring vessel operators in the region. Growing naval fleet size of the Asia Pacific countries also contributes to drive the demand for the market in the region.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Requirement for high-performance motion control devices- Increased global seaborne trade- Booming maritime tourism industryRESTRAINTS- Stringent regulatory norms for valve and actuator manufacturersOPPORTUNITIES- Increased demand for technologically-advanced actuators in marine vessels- Growing use of inland waterwaysCHALLENGES- Power consumption, noise, and leakage issues in actuators and valves

-

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSESREVENUE SHIFT AND NEW REVENUE POCKETS IN MARINE ACTUATORS AND VALVES MARKET

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 AVERAGE SELLING PRICE ANALYSIS

- 5.6 SHIP DELIVERIES VOLUME, BY TYPE, 2O22–2027

-

5.7 ECOSYSTEM ANALYSISPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESEND USERS

- 5.8 PORTER’S FIVE FORCES ANALYSIS

- 5.9 IMPACT OF ECONOMIC RECESSION ON MARINE ACTUATORS AND VALVES MARKET

-

5.10 CASE STUDY ANALYSISMOOG’S VALVES TO DELIVER ENERGY SAVINGS AND REDUCE EMISSIONS

-

5.11 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 TECHNOLOGICAL ADVANCEMENTS IN MARINE ACTUATORS AND VALVESADOPTION OF ELECTRIC ACTUATORS IN MARINE VESSELS AND SURFACE SHIPSDEVELOPMENT OF ACTUATION SYSTEMS FOR AUTONOMOUS UNDERWATER VEHICLESIMPLEMENTATION OF EXPLOSION-PROOF ACTUATORSUSE OF ADVANCED MATERIALS IN MARINE ACTUATORS AND VALVES

-

6.3 EMERGING TRENDS IN FULL BODY SCANNER MANUFACTURING3D SIMULATION SOFTWAREBIG DATAARTIFICIAL INTELLIGENCE

- 6.4 SUPPLY CHAIN ANALYSIS

-

6.5 USE CASE ANALYSISACTUATOR SENSOR INTERFACE TO ALLOW SIMPLE ON/OFF VALVE INTEGRATION IN MARINE APPLICATIONSELECTRIC ACTUATORS TO BE SIMPLE METHOD FOR OPENING AND CLOSING ENGINE HATCHES ON BOATS

-

6.6 INNOVATION AND PATENT ANALYSIS

- 7.1 INTRODUCTION

-

7.2 VALVESQUARTER-TURN VALVES- Ball valves- Butterfly valves- Plug valves- Other quarter-turn valvesMULTI-TURN VALVES- Globe valves- Gate valves- Diaphragm valves- Other multi-turn valves

-

7.3 ACTUATORSLINEAR ACTUATORS- Rod-type linear actuators- Screw-type linear actuators- Belt-type linear actuatorsROTARY ACTUATORS- Quarter-turn actuators- Multi-turn actuators

- 8.1 INTRODUCTION

-

8.2 PNEUMATICCOMPACT PNEUMATIC LINEAR ACTUATORS TO BE USED IN COMMERCIAL SHIPBUILDING INDUSTRY

-

8.3 HYDRAULICHYDRAULIC ACTUATORS TO BE ADOPTED IN STEERING MECHANISM OF MARINE VESSELS

-

8.4 ELECTRICLOW-MAINTENANCE MARINE ACTUATORS AND VALVES TO INCREASE DEMAND IN SHIPBUILDING INDUSTRY

-

8.5 MECHANICALMECHANICAL ACTUATORS TO FIND APPLICATIONS IN SHIP COMPONENTS

-

8.6 MANUALMANUAL VALVES TO BE DEPLOYED IN CARGO VESSELS FOR FLOW CONTROL APPLICATIONS

-

8.7 HYBRIDTECHNOLOGICAL ADVANCEMENTS TO ENABLE HIGHER ADOPTION OF ELECTRO-HYDRAULIC ACTUATORS IN MARINE APPLICATIONS

- 9.1 INTRODUCTION

-

9.2 VALVE COMPONENTSVALVE BODIES- Increased demand for maintenance and repair services for commercial and defense ships to drive segmentVALVE BONNETS- High adoption of casted and forged valve bonnets in marine vessels to propel segmentVALVE TRIMS- Regular maintenance and repair activities to increase demand

-

9.3 ACTUATOR COMPONENTSCYLINDERS- Increased use of advanced materials while manufacturing cylinders to fuel marketDRIVES- High penetration rate of drives to control motor speedMANIFOLDS- Technological advancements in manifolds to add extra protection

- 10.1 INTRODUCTION

-

10.2 VALVE SIZEUP TO 1”- Up to 1” control valves to be increasingly used in commercial vessels>1” TO 4”- >1" to 4 marine valves to be most commonly used in marine vessels>4” TO 6”- >4" to 6" marine valves to be used in medium-pressure applications>6” TO 9”- >6" to 9" valves to be increasingly used in defense vessels>9” TO 15”- >9” TO 15” marine valves to be used in oil tankers15” AND ABOVE- >15” valves to be commonly used in aircraft carriers

-

10.3 ACTUATORS, BY THRUST<10 KN10 KN TO 100 KN>100 KN

-

10.4 ACTUATORS, BY TORQUE<10 KNM10 KNM TO 100 KNM>100 KNM

- 11.1 INTRODUCTION

-

11.2 BALLAST AND BILGE SYSTEMSGROWING FLEET OF CARGO VESSELS TO DRIVE MARKETBALLAST TANKSBILGESSLOP TANKS

-

11.3 FUEL AND PROPULSION SYSTEMSINCREASING SHIPBUILDING ACTIVITIES IN ASIA PACIFIC TO AUGMENT MARKETWATER TREATMENT PLANTSHEAT EXCHANGERSFUEL TANKSWATER SEPARATION SYSTEMSBOILERSAIR DAMPERSSUPERHEATERSTURBINESCONDENSERSGENERATORSSTEERING

-

11.4 LIQUID CARGO SYSTEMSRISING PROCUREMENT OF TANKER VESSELS TO FUEL MARKETMANIFOLDSCARGO TANKS

-

11.5 REFRIGERATION SYSTEMSSURGING DEMAND FOR HIGH-ENDURANCE AND LONG-RANGE ADVANCED MARINE VESSELS TO PROPEL MARKET

-

11.6 HVAC SYSTEMSINCREASING NEED FOR ADVANCED MARINE ACTUATORS AND VALVES TO FUEL MARKET

-

11.7 FIREFIGHTING SYSTEMSRISING FIRE SAFETY ISSUES ON MARINE VESSELS TO AID MARKET

-

11.8 PORTABLE WATER SYSTEMSINCREASING MARITIME TOURISM TO INCREASE ADOPTION OF HIGH-END MARINE ACTUATORS AND VALVES

- 11.9 OTHER APPLICATIONS

- 12.1 INTRODUCTION

-

12.2 COMMERCIAL VESSELSPASSENGER VESSELS- Yachts- Passenger ferries- Cruise shipsCARGO VESSELS- Container vessels- Bulk carriers- Oil tankers- Gas tankers- Dry cargo vesselsOTHER COMMERCIAL VESSELS- Dredgers- Barges & tugboats- Research vessels

-

12.3 DEFENSE VESSELSDESTROYERS- Increasing use of destroyers for protecting large vessels to augment demandFRIGATES- Growing demand for protecting merchant convoys to augment marketCORVETTES- Growing focus of China to strengthen naval security to aid marketSUBMARINES- Rising demand for technologically-advanced submarines to drive marketAIRCRAFT CARRIERS- Increasing need for advanced aircraft carriers to propel marketAMPHIBIOUS SHIPS- Growing number of US Navy’s warfare programs to increase demand for valves and actuators

-

12.4 UNMANNED UNDERWATER VEHICLESREMOTELY OPERATED VEHICLES- Increased offshore explorations and security checks to drive marketAUTONOMOUS UNDERWATER VEHICLES- Higher potential for underwater operations and better payload capacity to provide accurate data

- 13.1 INTRODUCTION

-

13.2 ALUMINUMALUMINUM ACTUATORS AND VALVES TO BE LARGELY USED IN COMMERCIAL SHIPS

-

13.3 STAINLESS STEELSTAINLESS STEEL VALVES AND ACTUATORS TO BE USED IN RECREATIONAL BOATS

-

13.4 ALLOY-BASEDBRASS AND BRONZE MATERIAL-BASED VALVES AND ACTUATORS TO FIND APPLICATIONS IN COMMERCIAL SHIPS

- 13.5 OTHER MATERIALS

- 14.1 INTRODUCTION

-

14.2 OEMINCREASED MANUFACTURING OF COMMERCIAL SHIPS WITH ADVANCED TECHNOLOGY-BASED COMPONENTS TO BOOST SEGMENT

-

14.3 AFTERMARKETINCREASED EMPHASIS ON REPLACEMENT OF AGING SYSTEMS AND COMPONENTS TO IMPROVE OPERATIONAL EFFICIENCY

-

15.1 INTRODUCTIONREGIONAL RECESSION IMPACT ANALYSIS

-

15.2 NORTH AMERICAPESTLE ANALYSIS: NORTH AMERICAUS- Increasing fleet sizes in maritime industry to drive marketCANADA- Increasing number of strategic decisions to develop indigenous marine industry

-

15.3 EUROPEPESTLE ANALYSIS: EUROPENORWAY- Government regulations for sustainable maritime ecosystem to drive marketSWEDEN- Stringent IMO 2020 rule and demand for new vessels to augment marketNETHERLANDS- Push toward zero-emission ships to fuel marketDENMARK- Increased government investments in shipbuilding sector to drive marketUK- Rising focus on shipbuilding activities to boost marketFINLAND- Major focus on green marine technologies to augment marketREST OF EUROPE

-

15.4 ASIA PACIFICCHINA- Presence of several shipbuilding companies to propel marketSOUTH KOREA- Increasing focus on building environmentally-friendly ships to boost demandJAPAN- Growing attraction toward fishing and cruising to boost demandAUSTRALIA- Rising focus of Australian government on manufacturing commercial vessels to propel marketINDIA- Increasing defense expenditure on naval vessels to accelerate demand for marine actuators and valvesREST OF ASIA PACIFIC

-

15.5 MIDDLE EASTSAUDI ARABIA- Increasing need to retrofit commercial vessels to propel marketUAE- Rising trade and exports with increasing number of shipbuilding activities to aid marketISRAEL- Rising dependence on maritime trade to increase demand for marine actuators and valvesTURKEY- Increased construction of new ships and redevelopment of old ones to fuel marketREST OF MIDDLE EAST

-

15.6 REST OF THE WORLDLATIN AMERICA- Brazil to dominate Latin American marine valves and actuators market during forecast periodAFRICA- South Africa to be potential market for marine actuators and valves during forecast period

- 16.1 INTRODUCTION

- 16.2 COMPETITIVE OVERVIEW

- 16.3 MARKET RANKING ANALYSIS OF KEY PLAYERS, 2022

- 16.4 MARKET SHARE ANALYSIS, 2022

- 16.5 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS, 2022

-

16.6 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

16.7 START-UP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 16.8 COMPETITIVE BENCHMARKING

-

16.9 COMPETITIVE SCENARIOPRODUCT LAUNCHES/DEVELOPMENTSDEALSEXPANSIONS

- 17.1 INTRODUCTION

-

17.2 KEY PLAYERSMOOG INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHONEYWELL INTERNATIONAL INC.- Business overview- Products/Solutions/Services offered- MnM viewROTORK PLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewEMERSON- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCURTISS-WRIGHT CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBURKERT FLUID CONTROL SYSTEMS- Business overview- Products/Solutions/Services offered- Recent developmentsFLOWSERVE CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsIMI PLC- Business overview- Products/Solutions/Services offered- Recent developmentsSCHLUMBERGER NV- Business overview- Products/Solutions/Services offeredKITZ CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsDIAKONT- Business overview- Products/Solutions/Services offered- Recent developmentsULTRA MOTION- Business overview- Products/Solutions/Services offeredAVK GROUP- Business overview- Products/Solutions/Services offered- Recent developmentsHUNT VALVE- Business overview- Products/Solutions/Services offered- Recent developmentsWOODWARD INC.- Business overview- Products/Solutions/Services offeredAUMA RIESTER GMBH & CO.- Business overview- Products/Solutions/Services offered- Recent developmentsROCKWELL AUTOMATION- Business overview- Products/Solutions/Services offeredWARTSILA CORPORATION- Business overview- Products/Solutions/Services offeredSAMSON GROUP- Business overview- Products/Solutions/Services offeredATLAS MARINE VALVES- Business overview- Products/Solutions/Services offered

-

17.3 OTHER PLAYERSJOHNSON VALVES- Products/Solutions/Services offeredMESON AB- Products/Solutions/Services offeredHAWA VALVES- Products/Solutions/Services offered

- 18.1 DISCUSSION GUIDE

- 18.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 18.3 CUSTOMIZATION OPTIONS

- 18.4 RELATED REPORTS

- 18.5 AUTHOR DETAILS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 AVERAGE SELLING PRICE, BY VALVE AND ACTUATOR TYPE

- TABLE 3 VOLUME PROJECTIONS FOR NEW DELIVERIES OF MARINE VESSELS FROM 2022 TO 2027

- TABLE 4 MARINE ACTUATORS AND VALVES MARKET ECOSYSTEM

- TABLE 5 PORTER’S FIVE FORCES ANALYSIS

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF MARINE ACTUATOR AND VALVE PRODUCTS AND SYSTEMS (%)

- TABLE 7 KEY BUYING CRITERIA FOR MARINE ACTUATOR AND VALVE PRODUCTS AND SYSTEMS

- TABLE 8 INNOVATIONS AND PATENT REGISTRATIONS

- TABLE 9 MARINE ACTUATORS AND VALVES MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

- TABLE 10 MARINE ACTUATORS AND VALVES MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- TABLE 11 MARINE ACTUATORS AND VALVES MARKET, BY VALVE TYPE, 2018–2021 (USD MILLION)

- TABLE 12 MARINE ACTUATORS AND VALVES MARKET, BY VALVE TYPE, 2022–2027 (USD MILLION)

- TABLE 13 MARINE ACTUATORS AND VALVES MARKET, BY VALVE TYPE, QUARTER-TURN VALVES 2018–2021 (USD MILLION)

- TABLE 14 MARINE ACTUATORS AND VALVES MARKET, BY VALVE TYPE, QUARTER-TURN VALVES 2022–2027 (USD MILLION)

- TABLE 15 MARINE ACTUATORS AND VALVES MARKET, BY VALVE TYPE, MULTI-TURN VALVES 2018–2021 (USD MILLION)

- TABLE 16 MARINE ACTUATORS AND VALVES MARKET, BY VALVE TYPE, MULTI-TURN VALVES 2022–2027 (USD MILLION)

- TABLE 17 MARINE ACTUATORS AND VALVES MARKET, BY ACTUATOR TYPE, 2018–2021 (USD MILLION)

- TABLE 18 MARINE ACTUATORS AND VALVES MARKET, BY ACTUATOR TYPE, 2022–2027 (USD MILLION)

- TABLE 19 MARINE ACTUATORS AND VALVES MARKET, BY MECHANISM, 2018–2021 (USD MILLION)

- TABLE 20 MARINE ACTUATORS AND VALVES MARKET, BY MECHANISM, 2022–2027 (USD MILLION)

- TABLE 21 MARINE ACTUATORS AND VALVES MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 22 MARINE ACTUATORS AND VALVES MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 23 MARINE ACTUATORS AND VALVES MARKET FOR VALVE COMPONENTS, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 24 MARINE ACTUATORS AND VALVES MARKET FOR VALVE COMPONENTS, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 25 MARINE ACTUATORS AND VALVES MARKET FOR ACTUATOR COMPONENTS, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 26 MARINE ACTUATORS AND VALVES MARKET FOR ACTUATOR COMPONENTS, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 27 MARINE VALVES MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 28 MARINE VALVES MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 29 MARINE ACTUATORS MARKET, BY THRUST, 2018–2021 (USD MILLION)

- TABLE 30 MARINE ACTUATORS MARKET, BY THRUST, 2022–2027(USD MILLION)

- TABLE 31 MARINE ACTUATORS MARKET, BY TORQUE, 2018–2021 (USD MILLION)

- TABLE 32 MARINE ACTUATORS MARKET, BY TORQUE, 2022–2027 (USD MILLION)

- TABLE 33 MARINE ACTUATORS AND VALVES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 34 MARINE ACTUATORS AND VALVES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 35 MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 36 MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 37 MARINE ACTUATORS AND VALVES MARKET FOR COMMERCIAL VESSELS, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 38 MARINE ACTUATORS AND VALVES MARKET FOR COMMERCIAL VESSELS, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 39 PASSENGER VESSELS MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 40 PASSENGER VESSELS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 41 CARGO VESSELS MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 42 CARGO VESSELS MARKET, BY TYPE,2022–2027 (USD MILLION)

- TABLE 43 OTHER COMMERCIAL VESSELS MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 44 OTHER COMMERCIAL VESSELS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 45 MARINE ACTUATORS AND VALVES MARKET FOR DEFENSE VESSELS, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 46 MARINE ACTUATORS AND VALVES MARKET FOR DEFENSE VESSELS, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 47 MARINE ACTUATORS AND VALVES MARKET FOR UNMANNED UNDERWATER VEHICLES, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 48 MARINE ACTUATORS AND VALVES MARKET FOR UNMANNED UNDERWATER VEHICLES, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 49 MARINE ACTUATORS AND VALVES MARKET, BY MATERIAL, 2018–2021 (USD MILLION)

- TABLE 50 MARINE ACTUATORS AND VALVES MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

- TABLE 51 MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2018–2021 (USD MILLION)

- TABLE 52 MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2022–2027 (USD MILLION)

- TABLE 53 REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 54 MARINE ACTUATORS AND VALVES MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 55 MARINE ACTUATORS AND VALVES MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 56 NORTH AMERICA: MARINE ACTUATORS AND VALVES MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 57 NORTH AMERICA: MARINE ACTUATORS AND VALVES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 58 NORTH AMERICA: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2018–2021 (USD MILLION)

- TABLE 59 NORTH AMERICA: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2022–2027 (USD MILLION)

- TABLE 60 NORTH AMERICA: MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 61 NORTH AMERICA: MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 62 US: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2018–2021 (USD MILLION)

- TABLE 63 US: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2022–2027 (USD MILLION)

- TABLE 64 US: MARINE ACTUATORS AND VALVES MARKET SIZE, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 65 US: MARINE ACTUATORS AND VALVES MARKET SIZE, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 66 CANADA: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2018–2021 (USD MILLION)

- TABLE 67 CANADA: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2022–2027 (USD MILLION)

- TABLE 68 CANADA: MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 69 CANADA: MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 70 EUROPE: MARINE ACTUATORS AND VALVES MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 71 EUROPE: MARINE ACTUATORS AND VALVES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 72 EUROPE: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2018–2021 (USD MILLION)

- TABLE 73 EUROPE: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2022–2027 (USD MILLION)

- TABLE 74 EUROPE: MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 75 EUROPE: MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 76 NORWAY: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2018–2021 (USD MILLION)

- TABLE 77 NORWAY: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2022–2027 (USD MILLION)

- TABLE 78 NORWAY: MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 79 NORWAY: MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 80 SWEDEN: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2018–2021 (USD MILLION)

- TABLE 81 SWEDEN: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2022–2027 (USD MILLION)

- TABLE 82 SWEDEN: MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 83 SWEDEN: MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 84 NETHERLANDS: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2018–2021 (USD MILLION)

- TABLE 85 NETHERLANDS: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2022–2027 (USD MILLION)

- TABLE 86 NETHERLANDS: MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 87 NETHERLANDS: MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 88 DENMARK: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2018–2021 (USD MILLION)

- TABLE 89 DENMARK: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2022–2027 (USD MILLION)

- TABLE 90 DENMARK: MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 91 DENMARK: MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 92 UK: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2018–2021 (USD MILLION)

- TABLE 93 UK: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2022–2027 (USD MILLION)

- TABLE 94 UK: MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 95 UK: MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 96 FINLAND: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2018–2021 (USD MILLION)

- TABLE 97 FINLAND: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2022–2027 (USD MILLION)

- TABLE 98 FINLAND: MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 99 FINLAND: MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 100 REST OF EUROPE: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2018–2021 (USD MILLION)

- TABLE 101 REST OF EUROPE: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2022–2027 (USD MILLION)

- TABLE 102 REST OF EUROPE: MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 103 REST OF EUROPE: MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 104 ASIA PACIFIC: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2018–2021 (USD MILLION)

- TABLE 105 ASIA PACIFIC: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2022–2027 (USD MILLION)

- TABLE 106 ASIA PACIFIC: MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 107 ASIA PACIFIC: MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 108 ASIA PACIFIC: MARINE ACTUATORS AND VALVES, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 109 ASIA PACIFIC: MARINE ACTUATORS AND VALVE MARKETS, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 110 CHINA: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2018–2021 (USD MILLION)

- TABLE 111 CHINA: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2022–2027 (USD MILLION)

- TABLE 112 CHINA: MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 113 CHINA: MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 114 SOUTH KOREA: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2018–2021 (USD MILLION)

- TABLE 115 SOUTH KOREA: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2022–2027 (USD MILLION)

- TABLE 116 SOUTH KOREA: MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 117 SOUTH KOREA: MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 118 JAPAN: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2018–2021 (USD MILLION)

- TABLE 119 JAPAN: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2022–2027 (USD MILLION)

- TABLE 120 JAPAN: MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 121 JAPAN: MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 122 AUSTRALIA: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2018–2021 (USD MILLION)

- TABLE 123 AUSTRALIA: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2022–2027 (USD MILLION)

- TABLE 124 AUSTRALIA: MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 125 AUSTRALIA: MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 126 INDIA: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2018–2021 (USD MILLION)

- TABLE 127 INDIA: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2022–2027 (USD MILLION)

- TABLE 128 INDIA: MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 129 INDIA: MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 130 REST OF ASIA PACIFIC: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2018–2021 (USD MILLION)

- TABLE 131 REST OF ASIA PACIFIC: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2022–2027 (USD MILLION)

- TABLE 132 REST OF ASIA PACIFIC: MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 133 REST OF ASIA PACIFIC: MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 134 MIDDLE EAST: MARINE ACTUATORS AND VALVES MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 135 MIDDLE EAST: MARINE ACTUATORS AND VALVES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 136 MIDDLE EAST: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2018–2021 (USD MILLION)

- TABLE 137 MIDDLE EAST: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2022–2027 (USD MILLION)

- TABLE 138 MIDDLE EAST: MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 139 MIDDLE EAST: MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 140 SAUDI ARABIA: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2018–2021 (USD MILLION)

- TABLE 141 SAUDI ARABIA: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2022–2027 (USD MILLION)

- TABLE 142 SAUDI ARABIA: MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 143 SAUDI ARABIA: MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 144 UAE: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2018–2021 (USD MILLION)

- TABLE 145 UAE: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2022–2027 (USD MILLION)

- TABLE 146 UAE: MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 147 UAE: MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 148 ISRAEL: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2018–2021 (USD MILLION)

- TABLE 149 ISRAEL: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2022–2027 (USD MILLION)

- TABLE 150 ISRAEL: MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 151 ISRAEL: MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 152 TURKEY: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2018–2021 (USD MILLION)

- TABLE 153 TURKEY: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2022–2027 (USD MILLION)

- TABLE 154 TURKEY: MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 155 TURKEY: MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 156 REST OF MIDDLE EAST: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2018–2021 (USD MILLION)

- TABLE 157 REST OF MIDDLE EAST: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2022–2027 (USD MILLION)

- TABLE 158 REST OF MIDDLE EAST: MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 159 REST OF MIDDLE EAST: MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 160 REST OF THE WORLD: MARINE ACTUATORS AND VALVES MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 161 REST OF THE WORLD: MARINE ACTUATORS AND VALVES MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 162 REST OF THE WORLD: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2018–2021 (USD MILLION)

- TABLE 163 REST OF THE WORLD: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2022–2027 (USD MILLION)

- TABLE 164 REST OF THE WORLD: MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 165 REST OF THE WORLD: MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 166 LATIN AMERICA: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2018–2021 (USD MILLION)

- TABLE 167 LATIN AMERICA: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2022–2027 (USD MILLION)

- TABLE 168 LATIN AMERICA: MARINE ACTUATORS AND VALVES MARKET SIZE, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 169 LATIN AMERICA: MARINE ACTUATORS AND VALVES MARKET SIZE, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 170 AFRICA: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2018–2021 (USD MILLION)

- TABLE 171 AFRICA: MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2022–2027 (USD MILLION)

- TABLE 172 AFRICA: MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 173 AFRICA: MARINE ACTUATORS AND VALVES MARKET SIZE, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 174 KEY DEVELOPMENTS BY LEADING PLAYERS IN MARINE ACTUATORS AND VALVES MARKET BETWEEN 2018 AND 2022

- TABLE 175 DEGREE OF COMPETITION

- TABLE 176 COMPANY PRODUCT FOOTPRINT

- TABLE 177 COMPANY INDUSTRY FOOTPRINT

- TABLE 178 COMPANY GEOGRAPHICAL FOOTPRINT

- TABLE 179 MARINE ACTUATORS AND VALVES MARKET: KEY START-UPS/SMES

- TABLE 180 MARINE ACTUATORS AND VALVES MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, MAY 2018–DECEMBER 2022

- TABLE 181 MARINE ACTUATORS AND VALVES MARKET: DEALS, FEBRUARY 2018–FEBRUARY 2023

- TABLE 182 MARINE ACTUATORS AND VALVES MARKET: EXPANSIONS, OCTOBER 2018–NOVEMBER 2018

- TABLE 183 MOOG INC.: COMPANY OVERVIEW

- TABLE 184 MOOG INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 185 MOOG INC.: PRODUCT DEVELOPMENTS

- TABLE 186 MOOG INC.: DEALS

- TABLE 187 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 188 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 189 ROTORK PLC: COMPANY OVERVIEW

- TABLE 190 ROTORK PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 191 ROTORK PLC: PRODUCT LAUNCHES

- TABLE 192 ROTORK PLC: DEALS

- TABLE 193 EMERSON: COMPANY OVERVIEW

- TABLE 194 EMERSON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 EMERSON: PRODUCT LAUNCHES

- TABLE 196 EMERSON: DEALS

- TABLE 197 CURTISS-WRIGHT CORPORATION: COMPANY OVERVIEW

- TABLE 198 CURTISS-WRIGHT CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 CURTISS-WRIGHT CORPORATION: DEALS

- TABLE 200 BURKERT FLUID CONTROL SYSTEMS: COMPANY OVERVIEW

- TABLE 201 BURKERT FLUID CONTROL SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 202 BURKERT FLUID CONTROL SYSTEMS: PRODUCT LAUNCHES

- TABLE 203 BURKERT FLUID CONTROL SYSTEMS: DEALS

- TABLE 204 FLOWSERVE CORPORATION: COMPANY OVERVIEW

- TABLE 205 FLOWSERVE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 FLOWSERVE CORPORATION: PRODUCT DEVELOPMENTS

- TABLE 207 FLOWSERVE CORPORATION: DEALS

- TABLE 208 IMI PLC: COMPANY OVERVIEW

- TABLE 209 IMI PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 IMI PLC: DEALS

- TABLE 211 SCHLUMBERGER NV: COMPANY OVERVIEW

- TABLE 212 SCHLUMBERGER NV: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 KITZ CORPORATION: COMPANY OVERVIEW

- TABLE 214 KITZ CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 215 KITZ CORPORATION: DEALS

- TABLE 216 DIAKONT: COMPANY OVERVIEW

- TABLE 217 DIAKONT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 DIAKONT: PRODUCT LAUNCHES

- TABLE 219 DIAKONT: DEALS

- TABLE 220 ULTRA MOTION: COMPANY OVERVIEW

- TABLE 221 ULTRA MOTION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 AVK GROUP: COMPANY OVERVIEW

- TABLE 223 AVK GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 224 AVK GROUP: DEALS

- TABLE 225 HUNT VALVE: COMPANY OVERVIEW

- TABLE 226 HUNT VALVE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 227 HUNT VALVE: DEALS

- TABLE 228 WOODWARD INC.: COMPANY OVERVIEW

- TABLE 229 WOODWARD INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 230 AUMA RIESTER GMBH & CO.: COMPANY OVERVIEW

- TABLE 231 AUMA RIESTER GMBH & CO.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 232 AUMA RIESTER GMBH & CO.: PRODUCT DEVELOPMENTS

- TABLE 233 ROCKWELL AUTOMATION: COMPANY OVERVIEW

- TABLE 234 ROCKWELL AUTOMATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 WARTSILA CORPORATION: COMPANY OVERVIEW

- TABLE 236 WARTSILA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 237 SAMSON GROUP: COMPANY OVERVIEW

- TABLE 238 SAMSON GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 239 ATLAS MARINE VALVES: COMPANY OVERVIEW

- TABLE 240 ATLAS MARINE VALVES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 241 JOHNSON VALVES: COMPANY OVERVIEW

- TABLE 242 JOHNSON VALVES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 243 MESON AB: COMPANY OVERVIEW

- TABLE 244 MESON AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 245 HAWA VALVES: COMPANY OVERVIEW

- TABLE 246 HAWA VALVES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- FIGURE 1 MARINE ACTUATORS AND VALVES MARKET SEGMENTATION

- FIGURE 2 MARINE ACTUATORS AND VALVES MARKET: REGIONAL SEGMENTATION

- FIGURE 3 REPORT PROCESS FLOW

- FIGURE 4 MARINE ACTUATORS AND VALVES MARKET: RESEARCH DESIGN

- FIGURE 5 NAVAL DEFENSE BUDGET BY US

- FIGURE 6 BREAKDOWN OF US NAVAL DEFENSE BUDGET

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 9 DATA TRIANGULATION: MARINE ACTUATORS AND VALVES MARKET

- FIGURE 10 STUDY ASSUMPTIONS

- FIGURE 11 ELECTRIC MECHANISM TO LEAD MARINE ACTUATORS AND VALVES MARKET IN 2027

- FIGURE 12 OEM SEGMENT TO ACCOUNT FOR LARGER SIZE OF MARINE ACTUATORS AMD VALVES MARKET IN 2027

- FIGURE 13 VALVES TO HOLD LARGER SIZE OF MARINE ACTUATORS AMD VALVES MARKET DURING FORECAST PERIOD

- FIGURE 14 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 15 INCREASE IN SEABORNE TRADE AND RISE IN PROCUREMENT OF ADVANCED VESSELS TO DRIVE MARKET

- FIGURE 16 ACTUATORS TO ACCOUNT FOR LARGER SHARE OF MARINE ACTUATORS AND VALVES MARKET DURING FORECAST PERIOD

- FIGURE 17 STAINLESS STEEL TO HOLD LARGEST MARKET SHARE DURING STUDY PERIOD

- FIGURE 18 VALVE BODIES TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 19 CYLINDERS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 20 MARINE ACTUATORS AND VALVES MARKET DYNAMICS

- FIGURE 21 VALUE CHAIN ANALYSIS

- FIGURE 22 MARINE ACTUATORS AND VALVES MARKET ECOSYSTEM MAP

- FIGURE 23 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 24 RECESSION IMPACT ANALYSIS ON MARINE ACTUATORS AND VALVES MARKET

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF MARINE ACTUATOR AND VALVE PRODUCTS AND SYSTEMS

- FIGURE 26 KEY BUYING CRITERIA FOR MARINE ACTUATOR AND VALVE PRODUCTS AND SYSTEMS

- FIGURE 27 SUPPLY CHAIN ANALYSIS

- FIGURE 28 MARINE ACTUATORS AND VALVES MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- FIGURE 29 MARINE ACTUATORS AND VALVES MARKET, BY MECHANISM, 2022–2027 (USD MILLION)

- FIGURE 30 MARINE ACTUATORS AND VALVES MARKET, BY VALVE COMPONENT, 2022–2027 (USD MILLION)

- FIGURE 31 MARINE ACTUATORS AND VALVES MARKET, BY ACTUATOR COMPONENT, 2022–2027 (USD MILLION)

- FIGURE 32 MARINE VALVES MARKET, BY VALVE SIZE, 2022–2027 (USD MILLION)

- FIGURE 33 MARINE ACTUATORS MARKET, BY THRUST, 2022–2027 (USD MILLION)

- FIGURE 34 MARINE ACTUATORS AND VALVES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- FIGURE 35 MARINE ACTUATORS AND VALVES MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- FIGURE 36 MARINE ACTUATORS AND VALVES MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

- FIGURE 37 MARINE ACTUATORS AND VALVES MARKET, BY SALES CHANNEL, 2022–2027 (USD MILLION)

- FIGURE 38 MARINE ACTUATORS AND VALVES MARKET: REGIONAL SNAPSHOT

- FIGURE 39 NAVAL BUDGET TREND, BY REGION (2019–2022)

- FIGURE 40 NORTH AMERICA: MARINE ACTUATORS AND VALVES MARKET SNAPSHOT

- FIGURE 41 EUROPE: MARINE ACTUATORS AND VALVES MARKET SNAPSHOT

- FIGURE 42 ASIA PACIFIC: MARINE ACTUATORS AND VALVES MARKET SNAPSHOT

- FIGURE 43 RANKING ANALYSIS OF TOP FIVE PLAYERS: MARINE ACTUATORS AND VALVES MARKET, 2022

- FIGURE 44 SHARE OF TOP PLAYERS IN MARINE ACTUATORS AND VALVES MARKET, 2022

- FIGURE 45 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS IN MARINE ACTUATORS AND VALVES MARKET

- FIGURE 46 MARINE ACTUATORS AND VALVES MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 47 MARINE ACTUATORS AND VALVES MARKET: START-UP/SME EVALUATION MATRIX, 2022

- FIGURE 48 MOOG INC.: COMPANY SNAPSHOT

- FIGURE 49 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 50 ROTORK PLC: COMPANY SNAPSHOT

- FIGURE 51 EMERSON: COMPANY SNAPSHOT

- FIGURE 52 CURTISS-WRIGHT CORPORATION: COMPANY SNAPSHOT

- FIGURE 53 FLOWSERVE CORPORATION: COMPANY SNAPSHOT

- FIGURE 54 IMI PLC: COMPANY SNAPSHOT

- FIGURE 55 SCHLUMBERGER NV: COMPANY SNAPSHOT

- FIGURE 56 KITZ CORPORATION: COMPANY SNAPSHOT

- FIGURE 57 WOODWARD INC.: COMPANY SNAPSHOT

- FIGURE 58 ROCKWELL AUTOMATION: COMPANY SNAPSHOT

- FIGURE 59 WARTSILA CORPORATION: COMPANY SNAPSHOT

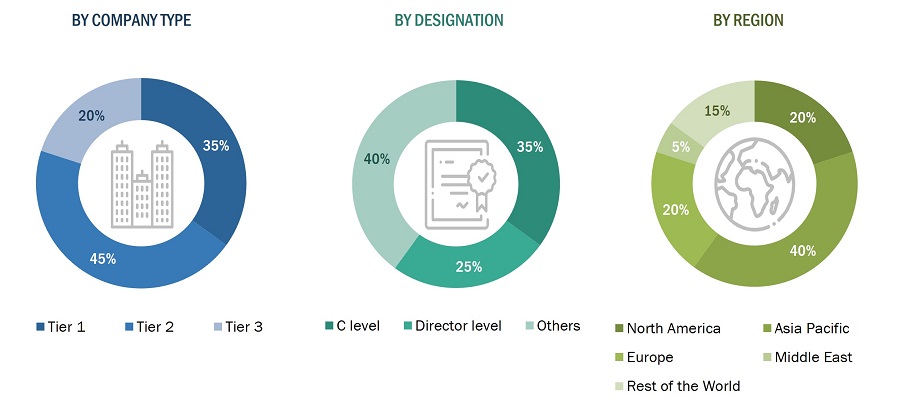

The study involved four major activities in estimating the current market size for the Marine Actuators and Valves market. Exhaustive secondary research was conducted to collect information on the market, the peer markets, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg, BusinessWeek, International Maritime Organization, Dow Jones Factiva and different magazines, were referred to identify and collect information for this study. Secondary sources also included annual reports, press releases & investor presentations of companies, certified publications, articles by recognized authors, and simulator databases.

Primary Research

The Marine Actuators and Valves market comprises several stakeholders, such as raw material providers, marine actuators and valves manufacturers and suppliers, and regulatory organizations in the supply chain. While the demand side of this market is characterized by various end users, the supply side is characterized by technological advancements in actuators and valves chemistries and safe actuators and valves systems. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

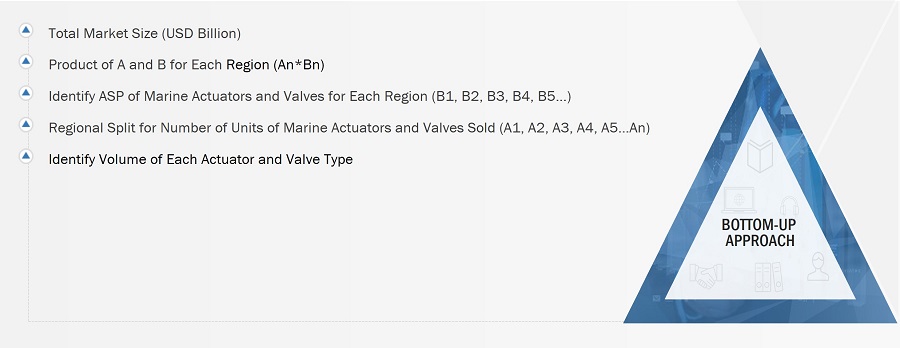

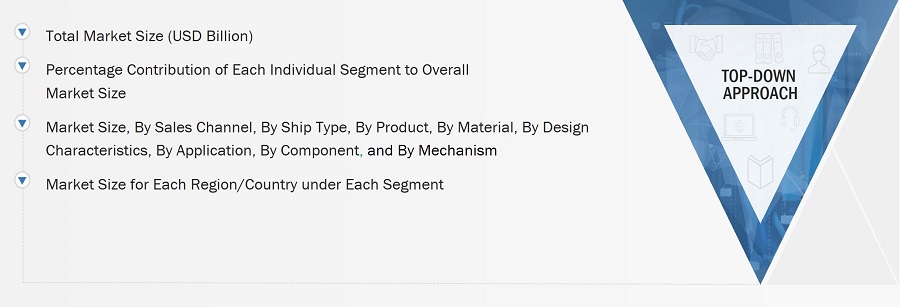

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Marine Actuators and Valves market. These methods were also used extensively to estimate the size of various subsegments of the market. The research methodology used to estimate the market size includes the following:

- Key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Market size estimation methodology: Bottom-up Approach

The bottom-up approach was employed to arrive at the overall size of the Marine Actuators and Valves market from the demand for such systems and components by end users in each country, and the average cost of Actuators and Valves systems was multiplied by the new ship deliveries and MRO fleet, respectively. These calculations led to the estimation of the overall market size.

Market size estimation methodology: Top-down Approach

In the top-down approach, the overall market size was used to estimate the size of the individual markets (mentioned in market segmentation) through percentage splits obtained from secondary and primary research.

The most appropriate and immediate parent market size was used to calculate the specific market segments to implement the top-down approach. The bottom-up approach was also implemented to validate the market segment revenues obtained.

A market share was then estimated for each company to verify the revenue share used earlier in the bottom-up approach. With data triangulation procedures and validation through primaries, the overall parent market size and each market size were determined and confirmed in this study. The data triangulation procedure used for this study is explained in the market breakdown and triangulation section.

Data Triangulation

After arriving at the overall market size-using the market size estimation process explained above-the market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides of the Marine Actuators and Valves market.

Market Definition

The marine actuators and valves market report covers pneumatic, hybrid, electric, and manual actuators and valves used in commercial, defense, and unmanned underwater vehicles (UUVs). A pneumatic actuator is a device that turns energy into mechanical motion, often in the form of compressed air. Electric actuators are devices that may induce the motion of a load or an action that requires a force, such as clamping, by using an electric motor to provide the necessary force. The report also covers actuators and valves by design characteristics, material, and application areas onboard a marine vessel.

Key Stakeholders

Ship Manufacturers, marine component manufacturers, private and small enterprises, distributors/suppliers/retailers, and end users are the key stakeholders in the marine actuators and valves market ecosystem. Investors, funders, academic researchers, distributors, service providers, and industries are major influencers in the market.

Report Objectives

- To identify and analyze key drivers, restraints, challenges, and opportunities influencing the growth of the Marine Actuators and Valves market

- To analyze the impact of macro and micro indicators on the market

- To forecast the market size of segments for five regions, namely, North America, Europe, Asia Pacific, Middle East and Rest of the World along with major countries in each of these regions

- To strategically analyze micro markets with respect to individual technological trends, prospects, and their contribution to the overall market

- To strategically profile key market players and comprehensively analyze their market ranking and core competencies

- To provide a detailed competitive landscape of the market, along with an analysis of business and corporate strategies, such as contracts, agreements, partnerships, and expansions.

- To identify detailed financial positions, key products, unique selling points, and key developments of leading companies in the market

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Marine Actuators and Valves Market