MDI, TDI, and Polyurethane Market by Application (Flexible Foams, Rigid Foams, Paints & Coatings, Elastomers, Adhesives & Sealants), End-Use (Construction, Furniture & Interiors, Electronics & Appliances, Automotive, Footwear) - Global Forecast to 2026

Updated on : March 20, 2024

MDI TDI & Polyurethane Market

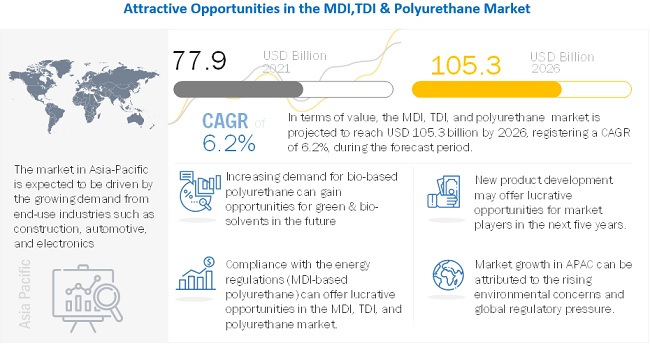

MDI, TDI & Polyurethane market size was valued at USD 77.9 billion in 2021 and is projected to reach USD 105.3 billion by 2026, growing at 6.2% cagr from 2021 to 2026. The market is mainly driven by the rising demand for MDI, TDI & Polyurethane in applications such as rigid foams, flexible foam, paints & coatings, elastomers, adhesives & sealants and others. Factors such as compliance with energy regulation, environmental sustainability need, and versatility & unique properties will drive the MDI, TDI & polyurethane market. APAC is the key market for MDI, TDI & Polyurethane, globally, followed by Europe and North America, in terms of volume and value.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on Synthetic Leather Market

The global pandemic has affected almost every sector in the world. The MDI, TDI and polyurethane market is expected to be negatively affected due to disruptions in the global supply chain. The market is highly dependent on the building & construction, automotive and consumer goods industries. China is a major market for electronic components and construction. Strict lockdowns in the country’s major provinces affected construction activities in the country. The demand for construction equipment declined significantly in the first quarter of 2020, mainly due to the outbreak of COVID-19. China is among the largest producers of polyurethane. However, disruptions in the supply of raw materials have weakened the production of polyurethane in the country. North America and Europe have also been severely affected by COVID-19; hence, an economic recession is expected in the US, Canada, Italy, and Spain in the next two to three years.

According to the European Association of Flexible Polyurethane Foam Blocks Manufacturers, the production of polyurethane flexible foam in Europe saw a dip in the first half of 2020 due to a lack of demand, government decisions and reduced workforce availability. All the European foam plants that produce for the automotive industry were closed. Foam plants which supply mainly the bedding and furniture industry were closed down in Southern Europe and production was heavily reduced in other regions. The greatest demand is still for online sales articles or medical mattresses but is far from closing the gap for all other lost production volumes.

Market Dynamics

Driver: Compliance with energy regulations

MDI-based polyurethane insulation is the most effective insulation material available and is a major contributor to energy conservation. Rigid insulation foams are used extensively in residential, commercial, and leisure construction as well as in appliances such as refrigerators and commercial cold storage. The growing success and increased use of MDI-based polyurethane foams are boosted by the fact that they are recyclable, safe, and environmentally responsible. Polyurethane is a significant contributor to energy conservation in refrigerators and today is used in almost all refrigerators.

Restraints: Toxicity and environmental concerns

Isocyanates are not only highly toxic and hazardous, and they also result in polyurethane being heavily dependent on fossil fuels. This poses a serious sustainability issue for market participants which are not only looking to reduce dependence on fossil fuels to reduce environmental impact to maintain business continuance. Excessive exposure to MDI can cause various skin disorders and diseases. According to EPA (Environmental Protection Agency), workers exposed to isocyanate applications, such as spray coating and heated processes, are more likely of getting asthma. MDI can also react with water from humidity in the air causing hydrolysis of MDI, thereby forming MDA. MDA also possesses certain hazardous characteristics, and if released to air, it can further contaminate soil and surrounding water. These factors pose a serious sustainability issue for market participants which are looking to reduce environmental impact to maintain business continuance.

Opportunities: Phosgene-free MDI production

Phosgene is the primary raw material for the production of diisocyanates such as MDI, TDI, and polycarbonates. It is a highly toxic and reactive gas and was used as a chemical weapon in the First World War, and thus its use is highly controversial. Toxicity concerns regarding phosgene have forced market participants to strive to find alternative technologies. Many efforts have been made to avoid the use of phosgene in industrial production processes as companies nowadays have become environment conscious and project themselves as green organizations. Also, they have to comply with stringent environmental regulations and safety standards as governments pose heavy environmental restrictions. Extensive research has been conducted on developing a phosgene-free production process for MDI, but none of them have achieved commercialization. The major market participants such as The Dow Chemical Co. (U.S.), BASF SE (Germany), and Huntsman Corporation (U.S.) have been exploring phosgene-free routes to MDI such as by synthesis of methyl phenyl carbamate (MPC) from aniline and dimethyl carbonate (DMC) feedstock and condensation of MPC with formaldehyde to form methylene diphenyl dicarbamate (MDC).

“Flexible foam is the largest application for MDI, TDI & polyurethane market in 2020”

With flexible polyurethane foams, manufacturers of furniture, bedding, and automotive sectors can address the issues of sustainability and energy conservation more efficiently. Flexible foam is one of the most widely used materials in the bedding & furniture industry. It is mainly used in home & office furniture, bedding, mattresses, pillows, seating, and carpet underlay. Packaging and automotive are other growing end-use industries for flexible foams. Flexible polyurethane foams help automobile manufacturers with weight reduction, vibration absorption, fuel efficiency, and durability of vehicles. As cushioning materials, flexible polyurethane foams provide support, resiliency, comfort, durability, and handling strength. All of these benefits result in better gas mileage and a more comfortable ride. The demand growth of flexible polyurethane foams is expected to be driven by increasing energy efficiency requirements globally, as the governments and organizations have to comply with international norms and regulations.

“Construction is estimated to be the largest end-use industry of Polyurethane market between 2021 and 2026.”

Polyurethane finds multiple applications in the construction industry. Flexible and semi-rigid foams are used in paints, coatings, and adhesives. These products are extensively used in construction. Rigid foams are widely used as structural and insulation foams in buildings. Construction has the largest share in the polyurethane market. Polyurethane finds high demand for building or remodeling homes, offices, and other buildings. The high demand is backed by its lightweight, ease of installation, durability, reliability, and versatile nature. The most important application of polyurethane in buildings is insulation. The rigid foam has unique insulating properties that make it ideal for walls and roofs of new homes and remodeling of existing homes. Insulation is usually required in cavity walls, roofs, floors, around pipes, and boilers. Polyurethane is an affordable, durable, and safe method of reducing carbon emissions that lead to global warming. Polyurethane can dramatically reduce heat loss in homes and offices in cold weather. During summer, they play an important role in keeping buildings cool, reducing the need for air conditioning.

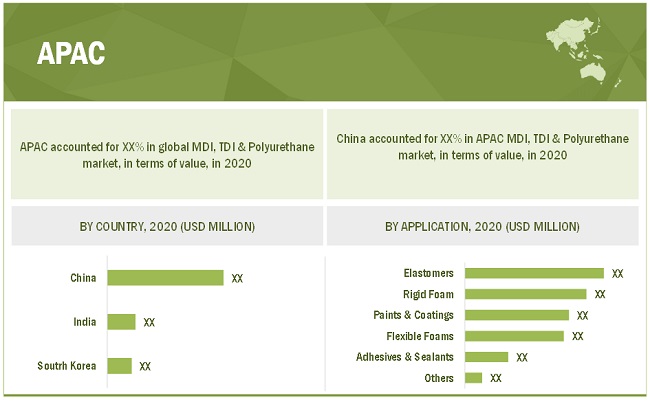

“APAC is estimated to be the largest MDI, TDI & Polyurethane market during the forecast period, in terms of value and volume.”

Asia-Pacific is one of the most crucial markets of MDI, TDI, and Polyurethane. In terms of global plastic consumption. Owing to the current economic conditions in mature markets such as the U.S. and Western Europe and rapidly increasing domestic consumption, Asia-Pacific has emerged as the leading produces as well as consumer of MDI, TDI, and polyurethane. The construction and bedding & furniture sectors of the region have a leading share in the polyurethane market. Transportation, automotive, and footwear manufacturers are setting up or expanding their manufacturing bases in this region to leverage from the low manufacturing cost. China dominates the MDI, TDI, and polyurethane market in Asia-Pacific. The growing construction industry in the country as well as rebound in construction activities are the main drivers for the MDI, TDI, and polyurethane market.

To know about the assumptions considered for the study, download the pdf brochure

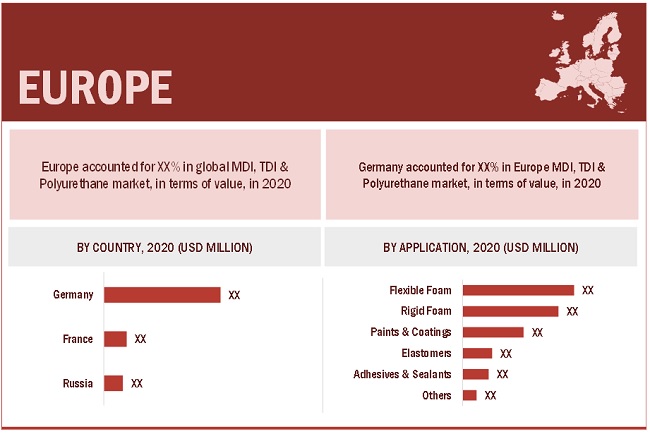

Europe is estimated to be the second largest MDI, TDI & Polyurethane market during the forecast period.

Europe is one of the leading markets for MDI, TDI, and polyurethane. The key countries in the European market include Germany, Russia, and France, which together hold a significant share of the overall European market. The market of Europe is heavily regulated with REACH (Registration, Evaluation, Authorization and Restriction of Chemical Substances) closely monitoring and issuing guidelines to ensure a high level of protection of environment and human health from the risks that can be posed by chemicals. The focus on sustainability is significant in Europe, which is why, it is the most regulated market, especially when it comes to certifying and commercializing new plastic products. This also provides a huge opportunity to the bio-based polyurethane market in the region. The footwear and automotive industries provide a huge potential for the growth of the MDI, TDI, and polyurethane market.

Key Market Players

The key market players profiled in the report include BASF SE (Germany), The Dow Chemical Company (US), DuPont De Nemours, Inc. (US), Huntsman Corporation (US), Covestro AG (Germany), LANXESS AG (Germany), Mitsui Chemicals Inc. (Japan), Wanhua Chemical Group Co. Ltd. (China), and Woodbridge Foam Corporation (Canada).

Scope Of The Report

|

Report Metric |

Details |

|

Years considered for the study |

2016-2025 |

|

Base Year |

2020 |

|

Forecast period |

2021–2026 |

|

Units considered |

Volume (Kiloton); Value (USD Million) |

|

Segments |

Application, End-Use Industry, and Region |

|

Regions |

APAC, North America, Europe, Middle East & Africa, and South America |

|

Companies |

BASF SE (Germany), The Dow Chemical Company (US), DuPont De Nemours, Inc. (US), Huntsman Corporation (US), Covestro AG (Germany), LANXESS AG (Germany), Mitsui Chemicals Inc. (Japan), Wanhua Chemical Group Co. Ltd. (China), and Woodbridge Foam Corporation (Canada). |

This report categorizes the global MDI, TDI & Polyurethane market based on application, end-use industry, and region.

On the basis of application, the MDI, TDI & Polyurethane market has been segmented as follows:

- Rigid Foam

- Flexible Foam

- Paints & Coatings

- Elastomers

- Adhesives & Sealants

- Others

On the basis of end-use industry, the Polyurethane market has been segmented as follows:

- Furniture & Interior

- Construction

- Electronics & Appliances

- Footwear

- Automotive

- Others

On the basis of region, the MDI, TDI & Polyurethane market has been segmented as follows:

- APAC

- North America

- Europe

- Middle East & Arica

- South America

Recent Developments

- In February 2020, Huntsman has acquired Icynene-Lapolla which doubled existing spray polyurethane foam business.

- In July 2019, Covestro AG acquired equity investment in Erlangen based German startup Hyderogenious Technologies to promote the development of international infrastructure.

- In July 2019, Mitsui chemicals Inc. agreed for a strategic partnership with Elephantech towards developing a sustainable solution and to expand the mass production system of the business.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of MDI, TDI & polyurethane?

Increasing demand from footwear industry and construction industry is driving the market

What are different type of major end-use industries of polyurethane?

It is classified as footwear, automotive, construction, electronics & appliances, and furniture & interiors.

What is the biggest Restraint for MDI, TDI & polyurethane?

Stringent regulations on environmental impact are the major restraint of the market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 23)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 MDI, TDI, AND POLYURETHANE MARKET: INCLUSIONS & EXCLUSIONS

1.2.2 MDI, TDI, AND POLYURETHANE: MARKET DEFINITION AND INCLUSIONS, BY APPLICATION

1.2.3 MDI, TDI, AND POLYURETHANE: MARKET DEFINITION AND INCLUSIONS, BY END-USE INDUSTRY

1.3 MARKET SCOPE

1.3.1 REGIONS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 BASE NUMBER CALCULATION

2.1.1 SUPPLY-SIDE APPROACH

2.1.2 DEMAND-SIDE APPROACH

2.2 FORECAST NUMBER CALCULATION

2.2.1 SUPPLY SIDE

2.2.2 DEMAND SIDE

2.3 RESEARCH DATA

2.3.1 SECONDARY DATA

2.3.2 PRIMARY DATA

2.3.2.1 Primary interviews – demand and supply-side

2.3.2.2 Breakdown of primary interviews

2.3.2.3 Key industry insights

2.4 MARKET SIZE ESTIMATION

2.4.1 BOTTOM-UP APPROACH

2.4.2 TOP-DOWN APPROACH

2.5 DATA TRIANGULATION

2.6 FACTOR ANALYSIS

2.7 ASSUMPTIONS

2.8 LIMITATIONS & RISKS ASSOCIATED WITH MDI, TDI & POLYURETHANE MARKET

3 EXECUTIVE SUMMARY (Page No. - 37)

4 PREMIUM INSIGHTS (Page No. - 41)

4.1 ATTRACTIVE OPPORTUNITIES IN THE MDI, TDI, AND POLYURETHANE MARKET

4.2 APAC: MDI, TDI, AND POLYURETHANE MARKET, BY APPLICATION AND COUNTRY

4.3 MDI, TDI, AND POLYURETHANE MARKET, BY REGION

4.4 MDI, TDI, AND POLYURETHANE MARKET, REGION VS APPLICATION

4.5 MDI, TDI, AND POLYURETHANE MARKET ATTRACTIVENESS

5 MARKET OVERVIEW (Page No. - 44)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS OF MDI, TDI, AND POLYURETHANE MARKET

5.2.1 DRIVERS

5.2.1.1 Growth in end-use industries

5.2.1.2 Compliance with energy regulations

5.2.1.3 Environment sustainability needs

5.2.1.4 Versatility and unique properties

5.2.2 RESTRAINTS

5.2.2.1 Toxicity and environmental concerns

5.2.2.2 Stringent regulations by the governing bodies

5.2.2.3 Eco-friendly substitutes

5.2.3 OPPORTUNITIES

5.2.3.1 Phosgene-free MDI production

5.2.3.2 Increasing demand for bio-based polyurethane

5.2.4 CHALLENGES

5.2.4.1 Fluctuation in the prices due to high cost of raw materials and logistics

5.3 PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF SUBSTITUTES

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 MACROECONOMIC INDICATORS

5.4.1 GDP TRENDS AND FORECAST OF MAJOR ECONOMIES

5.5 COVID-19 IMPACT

5.5.1 INTRODUCTION

5.5.2 COVID-19 HEALTH ASSESSMENT

5.5.3 COVID-19 ECONOMIC ASSESSMENT

5.5.3.1 COVID-19 Impact on the Economy—Scenario Assessment

5.6 IMPACT OF COVID-19: CUSTOMER ANALYSIS

6 INDUSTRY TRENDS (Page No. - 58)

6.1 SUPPLY CHAIN ANALYSIS

6.1.1 RAW MATERIALS & PRODUCTION

6.1.2 PROCESSING

6.1.3 DISTRIBUTION

6.1.4 END-USE INDUSTRIES

6.2 TECHNOLOGICAL ANALYSIS

6.3 MDI, TDI AND POLYURETHANE MARKET: REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIO

6.3.1 NON-COVID-19 SCENARIO

6.3.2 OPTIMISTIC SCENARIO

6.3.3 PESSIMISTIC SCENARIO

6.3.4 REALISTIC SCENARIO

6.4 SHIFT IN REVENUE STREAMS DUE TO MEGATRENDS IN END-USE INDUSTRIES

6.5 CONNECTED MARKETS: ECOSYSTEM

6.6 CASE STUDIES

6.7 TRADE DATA STATISTICS

6.8 AVERAGE SELLING PRICE

6.9 REGULATORY LANDSCAPE

6.9.1 REGULATIONS RELATED TO MDI, TDI AND POLYURETHANE

6.10 PATENT ANALYSIS

6.10.1 APPROACH

6.10.2 DOCUMENT TYPE

6.10.3 JURISDICTION ANALYSIS

6.10.4 TOP APPLICANTS

7 MDI, TDI, AND POLYURETHANE MARKET, BY APPLICATION (Page No. - 78)

7.1 INTRODUCTION

7.2 RIGID FOAMS

7.2.1 MEET THE DEMAND FOR INSULATING AND STRUCTURAL FOAMS IN THE CONSTRUCTION INDUSTRY

7.3 FLEXIBLE FOAMS

7.3.1 FURNITURE AND AUTOMOTIVE SECTORS DRIVE THE DEMAND FOR FLEXIBLE FOAMS

7.4 PAINTS & COATINGS

7.4.1 WIDELY USED TO SHIELD AND ENHANCE EXPOSED SURFACES

7.5 ELASTOMERS

7.5.1 MANUFACTURED TO MEET THE NEEDS OF THE FOOTWEAR INDUSTRY

7.6 ADHESIVES & SEALANTS

7.6.1 WIDELY USED IN THE CONSTRUCTION AND AUTOMOTIVE INDUSTRIES

7.7 OTHERS

8 POLYURETHANE MARKET, BY END-USE INDUSTRY (Page No. - 94)

8.1 INTRODUCTION

8.2 FURNITURE & INTERIORS

8.2.1 BEDDING

8.2.2 UPHOLSTERY

8.2.3 OTHERS

8.3 CONSTRUCTION

8.3.1 INSULATION

8.3.2 BONDING

8.3.3 OTHERS

8.4 ELECTRONICS & APPLIANCES

8.4.1 REFRIGERATOR

8.4.2 AIR CONDITIONER

8.4.3 OTHERS

8.5 AUTOMOTIVE

8.5.1 VEHICLE INTERIORS

8.5.2 VEHICLE EXTERIORS

8.6 FOOTWEAR

8.6.1 SOLES

8.6.2 ADHESIVES

8.7 OTHERS

8.7.1 PACKAGING

8.7.2 APPAREL

8.7.3 MARINE

8.7.4 MEDICAL

9 MDI, TDI & POLYURETHANE MARKET, BY REGION (Page No. - 110)

9.1 INTRODUCTION

9.2 NORTH AMERICA

9.2.1 NORTH AMERICA MDI, TDI & POLYURETHANE MARKET, BY APPLICATION

9.2.2 NORTH AMERICA POLYURETHANE MARKET, BY END-USE INDUSTRY

9.2.3 NORTH AMERICA MDI, TDI & POLYURETHANE MARKET, BY COUNTRY

9.2.3.1 US

9.2.3.2 Canada

9.2.3.3 Mexico

9.3 EUROPE

9.3.1 EUROPE MDI, TDI & POLYURETHANE MARKET, BY APPLICATION

9.3.2 EUROPE POLYURETHANE MARKET, BY END-USE INDUSTRY

9.3.3 EUROPE MDI, TDI & POLYURETHANE MARKET, BY COUNTRY

9.3.3.1 Germany

9.3.3.2 UK

9.3.3.3 France

9.3.3.4 Italy

9.3.3.5 Russia

9.3.3.6 Turkey

9.4 ASIA PACIFIC

9.4.1 ASIA PACIFIC MDI, TDI & POLYURETHANE MARKET, BY APPLICATION

9.4.2 ASIA PACIFIC POLYURETHANE MARKET, BY END-USE INDUSTRY

9.4.3 ASIA PACIFIC MDI, TDI & POLYURETHANE MARKET, BY COUNTRY

9.4.3.1 China

9.4.3.1.1 Favorable market conditions to influence the Polyurethane market in the country

9.4.3.2 India

9.4.3.2.1 Increasing standard of living to drive polyurethane market

SOURCE: SECONDARY RESEARCH, EXPERT INTERVIEWS, AND MARKETSANDMARKETS ANALYSIS

9.4.3.3 Thailand

9.4.3.3.1 Presence of OEM manufacturing facilities providing growth opportunity

9.4.3.4 South Korea

9.4.3.4.1 Investments in upcoming construction projects to drive the polyurethane market

9.4.3.5 Japan

9.4.3.5.1 Redevelopment projects to boost polyurethane market

9.4.3.6 Vietnam

9.4.3.6.1 Government undertaken infrastructure projects to drive the polyurethane market

9.4.3.7 Taiwan

9.4.3.7.1 Policies enhancing economic development and regional integration between countries

9.4.3.8 Singapore

9.4.3.8.1 Integrated infrastructure-based projects to drive the market

9.5 SOUTH AMERICA

9.5.1 SOUTH AMERICA MDI, TDI & POLYURETHANE MARKET, BY APPLICATION

9.5.2 SOUTH AMERICA POLYURETHANE MARKET, BY END-USE INDUSTRY

9.5.3 SOUTH AMERICA MDI, TDI & POLYURETHANE MARKET, BY COUNTRY

9.5.3.1 Brazil

9.5.3.1.1 Rapid industrialization to influence polyurethane market

9.5.3.2 Argentina

9.5.3.2.1 Improving economic conditions expected to support polyurethane market

9.6 MIDDLE EAST & AFRICA

9.6.1 MIDDLE EAST & AFRICA MDI, TDI & POLYURETHANE MARKET, BY APPLICATION

9.6.2 MIDDLE EAST & AFRICA POLYURETHANE MARKET, BY END-USE INDUSTRY

9.6.3 MIDDLE EAST & AFRICA MDI, TDI & POLYURETHANE MARKET, BY COUNTRY

9.6.3.1 UAE

9.6.3.1.1 Growing commercial and residential sector to drive polyurethane demand

9.6.3.2 Saudi Arabia

9.6.3.2.1 Government initiatives to diversify economy supporting market growth

9.6.3.3 South Africa

9.6.3.3.1 Development in construction sector to drive demand for polyurethanes

10 COMPETITIVE LANDSCAPE (Page No. - 194)

10.1 INTRODUCTION

10.2 MARKET EVALUATION FRAMEWORK

10.3 MARKET SHARE ANALYSIS

10.3.1 MDI MARKET SHARE ANALYSIS

10.3.1.1 Ranking of Key Market Players, 2020

10.3.1.2 Market Share of Key Players

10.3.1.2.1 Wanhua Chemicals Group Co. Ltd.

10.3.1.2.2 Covestro AG

10.3.1.2.3 BASF SE

10.3.1.2.4 Huntsman Corporation

10.3.1.2.5 The Dow Chemical Company

10.3.1.3 Company Revenue Analysis of Key Players, MDI

10.3.2 TDI MARKET SHARE ANALYSIS

10.3.2.1 Ranking of Key Market Players, 2020

10.3.2.2 Market Share of Key Players

10.3.2.2.1 Covestro AG

10.3.2.2.2 BASF SE

10.3.2.2.3 Mitsui Chemicals Inc.

10.3.2.2.4 Wanhua Chemicals Group Co. Ltd.

10.3.2.3 Company Revenue Analysis of Key Players, TDI

10.3.3 POLYURETHANE MARKET SHARE ANALYSIS

10.3.3.1 Ranking of Key Market Players, 2020

10.3.3.2 Market Share of Key Players

10.3.3.2.1 BASF SE

10.3.3.2.2 Covestro AG

10.3.3.2.3 The Dow Chemical Company

10.3.3.2.4 Huntsman Corporation

10.3.3.2.5 Mitsui Chemicals Inc.

10.3.3.3 Company Revenue Analysis of Key Players, Polyurethane

10.4 COMPANY PRODUCT FOOTPRINT ANALYSIS

10.5 COMPANY EVALUATION MATRIX (TIER 1)

10.5.1 TERMINOLOGY/NOMENCLATURE

10.5.1.1 Stars

10.5.1.2 Emerging Leaders

10.5.2 STRENGTH OF PRODUCT PORTFOLIO

10.5.3 BUSINESS STRATEGY EXCELLENCE

10.6 START-UP/SMES EVALUATION MATRIX

10.6.1 TERMINOLOGY/NOMENCLATURE

10.6.1.1 Responsive companies

10.6.1.2 Dynamic companies

10.6.1.3 Starting blocks

10.6.2 STRENGTH OF PRODUCT PORTFOLIO

10.6.3 BUSINESS STRATEGY EXCELLENCE

10.7 COMPETITIVE SITUATIONS AND TRENDS

10.7.1 PRODUCT LAUNCHES

10.7.2 DEALS

10.7.3 OTHER DEVELOPMENTS

11 COMPANY PROFILES (Page No. - 218)

11.1 MAJOR PLAYERS

11.1.1 BASF SE

11.1.1.1 BUSINESS OVERVIEW

11.1.1.2 BASF SE: COMPANY OVERVIEW

11.1.1.3 PRODUCTS OFFERED

11.1.1.4 BASF SE: RECENT DEVELOPMENTS

11.1.1.5 BASF SE: NEW PRODUCT LAUNCH

11.1.1.6 WINNING IMPERATIVES

11.1.1.7 CURRENT FOCUS AND STRATEGIES

11.1.1.8 THREAT FROM COMPETITORS

11.1.1.9 RIGHT TO WIN

11.1.2 THE DOW CHEMICAL COMPANY

11.1.2.1 BUSINESS OVERVIEW

11.1.2.2 THE DOW CHEMICAL COMPANY: COMPANY OVERVIEW

11.1.2.3 PRODUCTS OFFERED

11.1.2.4 THE DOW CHEMICAL COMPANY: RECENT DEVELOPMENTS

11.1.2.5 WINNING IMPERATIVES

11.1.2.6 CURRENT FOCUS AND STRATEGIES

11.1.2.7 THREAT FROM COMPETITORS

11.1.2.8 RIGHT TO WIN

11.1.3 DUPONT DE NEMOURS, INC.

11.1.3.1 BUSINESS OVERVIEW

11.1.3.2 DUPONT DE NEMOURS, INC.: COMPANY OVERVIEW

11.1.3.3 PRODUCTS OFFERED

11.1.3.4 DUPONT DE NEMOURS, INC.: RECENT DEVELOPMENTS

11.1.3.5 WINNING IMPERATIVES

11.1.3.6 CURRENT FOCUS AND STRATEGIES

11.1.3.7 THREAT FROM COMPETITORS

11.1.3.8 RIGHT TO WIN

11.1.4 HUNTSMAN CORPORATION

11.1.4.1 BUSINESS OVERVIEW

11.1.4.2 HUNTSMAN CORPORATION: COMPANY OVERVIEW

11.1.4.3 PRODUCTS OFFERED

11.1.4.4 HUNTSMAN CORPORATION: RECENT DEVELOPMENTS

11.1.4.5 WINNING IMPERATIVES

11.1.4.6 CURRENT FOCUS AND STRATEGIES

11.1.4.7 THREAT FROM COMPETITORS

11.1.4.8 RIGHT TO WIN

11.1.5 COVESTRO AG

11.1.5.1 BUSINESS OVERVIEW

11.1.5.2 COVESTRO AG: COMPANY OVERVIEW

11.1.5.3 PRODUCTS OFFERED

11.1.5.4 COVESTRO AG: RECENT DEVELOPMENTS

11.1.5.5 WINNING IMPERATIVES

11.1.5.6 CURRENT FOCUS AND STRATEGIES

11.1.5.7 THREAT FROM COMPETITORS

11.1.5.8 RIGHT TO WIN

11.1.6 LANXESS AG

11.1.6.1 BUSINESS OVERVIEW

11.1.6.2 LANXESS AG: BUSINESS OVERVIEW

11.1.6.3 PRODUCTS OFFERED

11.1.6.4 LANXESS AG: RECENT DEVELOPMENTS

11.1.6.5 WINNING IMPERATIVES

11.1.6.6 CURRENT FOCUS AND STRATEGIES

11.1.6.7 THREAT FROM COMPETITORS

11.1.6.8 RIGHT TO WIN

11.1.7 MITSUI CHEMICALS INC.

11.1.7.1 BUSINESS OVERVIEW

11.1.7.2 MITSUI CHEMICALS INC.: COMPANY OVERVIEW

11.1.7.2.1 PRODUCTS OFFERED

11.1.7.3 MITSUI CHEMICALS INC.: RECENT DEVELOPMENTS

11.1.7.4 WINNING IMPERATIVES

11.1.7.5 CURRENT FOCUS AND STRATEGIES

11.1.7.6 THREAT FROM COMPETITORS

11.1.7.7 RIGHT TO WIN

11.1.8 WANHUA CHEMICALS GROUP CO., LTD.

11.1.8.1 BUSINESS OVERVIEW

11.1.8.2 WANHUA CHEMICALS GROUP CO. LTD.: COMPANY OVERVIEW

11.1.8.3 PRODUCTS OFFERED

11.1.8.4 WANHUA CHEMICALS GROUP CO. LTD.: RECENT DEVELOPMENTS

11.1.8.5 WINNING IMPERATIVES

11.1.8.6 CURRENT FOCUS AND STRATEGIES

11.1.8.7 THREAT FROM COMPETITORS

11.1.8.8 RIGHT TO WIN

11.1.9 WOODBRIDGE FOAM CORPORATION

11.1.9.1 BUSINESS OVERVIEW

11.1.9.2 WOODBRIDGE FOAM CORPORATION: COMPANY OVERVIEW

11.1.9.3 PRODUCTS OFFERED

11.1.9.4 WOODBRIDGE FOAM CORPORATION: RECENT DEVELOPMENTS

11.1.9.5 RIGHT TO WIN

11.1.10 CHEMATUR ENGINEERING AB

11.1.10.1 Business overview

11.1.10.2 CHEMATUR ENGINEERING AB: COMPANY OVERVIEW

11.1.10.3 PRODUCTS OFFERED

11.2 START-UP/SMSE PLAYERS

11.2.1 COIM S.P.a.

11.2.2 FIX Holdings Inc.

11.2.3 Cangzhou Dahua Group Co. Ltd

11.2.4 Kumho Mitsui Chemicals Inc.

11.2.5 ITWC Inc.

11.2.6 Tosoh corporation

11.2.7 Recticel

11.2.8 Shandong INOV Polyurethane Co. Ltd.

11.2.9 Trelleborg Ab

11.2.10 Manali Petrochemicals Ltd.

11.2.11 Kuwait Polyurethane Industries Co.

11.2.12 Springfeel Polyurethane Foams Private Limited

11.2.13 Ningbo Best Polyurethane Co., Ltd.

11.2.14 Arian Polyurethane JSC

12 ADJACENT & RELATED MARKETS (Page No. - 248)

12.1 INTRODUCTION

12.2 LIMITATIONS

12.3 PLASTIC ANTIOXIDANTS MARKET

12.3.1 MARKET DEFINITION

12.3.2 MARKET OVERVIEW

12.4 POLYURETHANE DISPERSIONS MARKET, BY REGION

12.4.1 APAC

12.4.2 EUROPE

12.4.3 NORTH AMERICA

12.4.4 MIDDLE EAST & AFRICA

12.4.5 SOUTH AMERICA

13 APPENDIX (Page No. - 260)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

LIST OF TABLES (256 TABLE)

TABLE 1 MDI, TDI AND POLYURETHANE MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 2 TRENDS AND FORECAST OF REAL GDP, BY MAJOR ECONOMY, ANNUAL PERCENTAGE CHANGE, 2019–2026

TABLE 3 MDI, TDI AND POLYURETHANE MARKET: SUPPLY CHAIN

TABLE 4 IMPORT OF POLYURETHANE, BY REGION, 2012-2019 (USD BILLION)

TABLE 5 EXPORT OF POLYURETHANE, BY REGION, 2012-2019 (USD BILLION)

TABLE 6 AVERAGE SELLING PRICES OF MDI, TDI AND POLYURETHANE, BY REGION (USD 000’/KG)

TABLE 7 MDI, TDI, AND POLYURETHANE MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 8 MDI, TDI, AND POLYURETHANE MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 9 MDI, TDI, AND POLYURETHANE MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 10 MDI, TDI, AND POLYURETHANE MARKET SIZE, BY APPLICATION, 2020-2026 (KILOTON)

TABLE 11 MDI, TDI, AND POLYURETHANE MARKET SIZE IN RIGID FOAMS, BY REGION, 2016–2019 (USD MILLION)

TABLE 12 MDI, TDI, AND POLYURETHANE MARKET SIZE IN RIGID FOAMS, BY REGION, 2020-2026 (USD MILLION)

TABLE 13 MDI, TDI, AND POLYURETHANE MARKET SIZE IN RIGID FOAMS, BY REGION, 2016–2019 (KILOTON)

TABLE 14 MDI, TDI, AND POLYURETHANE MARKET SIZE IN RIGID FOAMS, BY REGION, 2020-2026 (KILOTON)

TABLE 15 MDI, TDI, AND POLYURETHANE MARKET SIZE IN FLEXIBLE FOAMS, BY REGION, 2016–2019 (USD MILLION)

TABLE 16 MDI, TDI, AND POLYURETHANE MARKET SIZE IN FLEXIBLE FOAMS, BY REGION, 2020–2026 (USD MILLION)

TABLE 17 MDI, TDI, AND POLYURETHANE MARKET SIZE IN FLEXIBLE FOAMS, BY REGION, 2016–2019 (KILOTON)

TABLE 18 MDI, TDI, AND POLYURETHANE MARKET SIZE IN FLEXIBLE FOAMS, BY REGION, 2020–2026 (KILOTON)

TABLE 19 MDI, TDI, AND POLYURETHANE MARKET SIZE IN PAINTS & COATINGS, BY REGION, 2016–2019 (USD MILLION)

TABLE 20 MDI, TDI, AND POLYURETHANE MARKET SIZE IN PAINTS & COATINGS, BY REGION, 2020–2026 (USD MILLION)

TABLE 21 MDI, TDI, AND POLYURETHANE MARKET SIZE IN PAINTS & COATINGS, BY REGION, 2016–2019 (KILOTON)

TABLE 22 MDI, TDI, AND POLYURETHANE MARKET SIZE IN PAINTS & COATINGS, BY REGION, 2020–2026 (KILOTON)

TABLE 23 MDI, TDI, AND POLYURETHANE MARKET SIZE IN ELASTOMERS, BY REGION, 2016–2019 (USD MILLION)

TABLE 24 MDI, TDI, AND POLYURETHANE MARKET SIZE IN ELASTOMERS, BY REGION, 2020–2026 (USD MILLION)

TABLE 25 MDI, TDI, AND POLYURETHANE MARKET SIZE IN ELASTOMERS, BY REGION, 2016–2019 (KILOTON)

TABLE 26 MDI, TDI, AND POLYURETHANE MARKET SIZE IN ELASTOMERS, BY REGION, 2020–2026 (KILOTON)

TABLE 27 MDI, TDI, AND POLYURETHANE MARKET SIZE IN ADHESIVES & SEALANTS, BY REGION, 2016–2019 (USD MILLION)

TABLE 28 MDI, TDI, AND POLYURETHANE MARKET SIZE IN ADHESIVES & SEALANTS, BY REGION, 2020–2026 (USD MILLION)

TABLE 29 MDI, TDI, AND POLYURETHANE MARKET SIZE IN ADHESIVES & SEALANTS, BY REGION, 2016–2019 (KILOTON)

TABLE 30 MDI, TDI, AND POLYURETHANE MARKET SIZE IN ADHESIVES & SEALANTS, BY REGION, 2020–2026 (KILOTON)

TABLE 31 MDI, TDI, AND POLYURETHANE MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2016–2019 (USD MILLION)

TABLE 32 MDI, TDI, AND POLYURETHANE MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2020–2026 (USD MILLION)

TABLE 33 MDI, TDI, AND POLYURETHANE MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2016–2019 (KILOTON)

TABLE 34 MDI, TDI, AND POLYURETHANE MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2020–2026 (KILOTON)

TABLE 35 POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 36 POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

TABLE 37 POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 38 POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (KILOTON)

TABLE 39 POLYURETHANE MARKET SIZE IN FURNITURE & INTERIORS, BY REGION, 2016–2019 (USD MILLION)

TABLE 40 POLYURETHANE MARKET SIZE IN FURNITURE & INTERIORS, BY REGION, 2020-2026 (USD MILLION)

TABLE 41 POLYURETHANE MARKET SIZE IN FURNITURE & INTERIORS, BY REGION, 2016–2019 (KILOTON)

TABLE 42 POLYURETHANE MARKET SIZE IN FURNITURE & INTERIORS, BY REGION, 2020-2026 KILOTON)

TABLE 43 POLYURETHANE MARKET SIZE IN CONSTRUCTION, BY REGION, 2016–2019 (USD MILLION)

TABLE 44 POLYURETHANE MARKET SIZE IN CONSTRUCTION, BY REGION, 2020-2026 (USD MILLION)

TABLE 45 POLYURETHANE MARKET SIZE IN CONSTRUCTION, BY REGION, 2016-2019 (KILOTON)

TABLE 46 POLYURETHANE MARKET SIZE IN CONSTRUCTION, BY REGION, 2020–2026 (KILOTON)

TABLE 47 POLYURETHANE MARKET SIZE IN ELECTRONICS & APPLIANCES, BY REGION, 2016–2019 (USD MILLION)

TABLE 48 POLYURETHANE MARKET SIZE IN ELECTRONICS & APPLIANCES, BY REGION, 2020–2026 (USD MILLION)

TABLE 49 POLYURETHANE MARKET SIZE IN ELECTRONICS & APPLIANCES, BY REGION, 2016–2019 (KILOTON)

TABLE 50 POLYURETHANE MARKET SIZE IN ELECTRONICS & APPLIANCES, BY REGION, 2020–2026 (KILOTON)

TABLE 51 POLYURETHANE MARKET SIZE IN AUTOMOTIVE, BY REGION, 2016–2019 (USD MILLION)

TABLE 52 POLYURETHANE MARKET SIZE IN AUTOMOTIVE, BY REGION, BY REGION,2020–2026 (USD MILLION)

TABLE 53 POLYURETHANE MARKET SIZE IN AUTOMOTIVE, BY REGION, 2016–2019 (KILOTON)

TABLE 54 POLYURETHANE MARKET SIZE IN AUTOMOTIVE, BY REGION, 2020–2026 (KILOTON)

TABLE 55 POLYURETHANE MARKET SIZE IN FOOTWEAR, BY REGION, 2016–2019 (USD MILLION)

TABLE 56 POLYURETHANE MARKET SIZE IN FOOTWEAR, BY REGION, 2020–2026 (USD MILLION)

TABLE 57 POLYURETHANE MARKET SIZE IN FOOTWEAR, BY REGION, 2016–2019 (KILOTON)

TABLE 58 POLYURETHANE MARKET SIZE IN FOOTWEAR, BY REGION, 2020–2026 (KILOTON)

TABLE 59 POLYURETHANE MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2016–2019 (USD MILLION)

TABLE 60 POLYURETHANE MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2020–2026 (USD MILLION)

TABLE 61 POLYURETHANE MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2016–2019 (KILOTON)

TABLE 62 POLYURETHANE MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2020–2026 (KILOTON)

TABLE 63 MDI, TDI & POLYURETHANE MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 64 MDI, TDI & POLYURETHANE MARKET SIZE, BY REGION, 2020-2026 (USD MILLION)

TABLE 65 MDI, TDI & POLYURETHANE MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 66 MDI, TDI & POLYURETHANE MARKET SIZE, BY REGION, 2020-2026 (KILOTON)

TABLE 67 NORTH AMERICA: MDI, TDI & POLYURETHANE MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 68 NORTH AMERICA: MDI, TDI & POLYURETHANE MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 69 NORTH AMERICA: MDI, TDI & POLYURETHANE MARKET SIZE, BY APPLICATION, 2016-2019 (KILOTON)

TABLE 70 NORTH AMERICA: MDI, TDI & POLYURETHANE MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

TABLE 71 NORTH AMERICA: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 72 NORTH AMERICA: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020-2026 (USD MILLION)

TABLE 73 NORTH AMERICA: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

TABLE 74 NORTH AMERICA: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020-2026 (KILOTON)

TABLE 75 NORTH AMERICA: MDI, TDI & POLYURETHANE MARKET SIZE, BY COUNTRY, 2016-2019 (USD MILLION)

TABLE 76 NORTH AMERICA: MDI, TDI & POLYURETHANE MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 77 NORTH AMERICA: MDI, TDI & POLYURETHANE MARKET SIZE, BY COUNTRY, 2016-2019 (KILOTON)

TABLE 78 NORTH AMERICA: MDI, TDI & POLYURETHANE MARKET SIZE, BY COUNTRY, 2020–2026 (KILOTON)

TABLE 79 US: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 80 US: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020-2026 (USD MILLION)

TABLE 81 US: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

TABLE 82 US: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020-2026 (KILOTON)

TABLE 83 CANADA: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 84 CANADA: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

TABLE 85 CANADA: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

TABLE 86 CANADA: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (KILOTON)

TABLE 87 MEXICO: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 88 MEXICO: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

TABLE 89 MEXICO: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

TABLE 90 MEXICO: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (KILOTON)

TABLE 91 EUROPE: MDI, TDI & POLYURETHANE MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 92 EUROPE: MDI, TDI & POLYURETHANE MARKET SIZE, BY APPLICATION, 2020-2026 (USD MILLION)

TABLE 93 EUROPE: MDI, TDI & POLYURETHANE MARKET SIZE, BY APPLICATION, 2016-2019 (KILOTON)

TABLE 94 EUROPE: MDI, TDI & POLYURETHANE MARKET SIZE, BY APPLICATION, 2020-2026 (KILOTON)

TABLE 95 EUROPE: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 96 EUROPE: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020-2026 (USD MILLION)

TABLE 97 EUROPE: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

TABLE 98 EUROPE: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020-2026 (KILOTON)

TABLE 99 EUROPE: MDI, TDI & POLYURETHANE MARKET SIZE, BY COUNTRY, 2016-2019 (USD MILLION)

TABLE 100 EUROPE: MDI, TDI & POLYURETHANE MARKET SIZE, BY COUNTRY, 2020-2026 (USD MILLION)

TABLE 101 EUROPE: MDI, TDI & POLYURETHANE MARKET SIZE, BY COUNTRY, 2016-2019 (KILOTON)

TABLE 102 EUROPE: MDI, TDI & POLYURETHANE MARKET SIZE, BY COUNTRY, 2020-2026 (KILOTON)

TABLE 103 GERMANY: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 104 GERMANY: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

TABLE 105 GERMANY: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

TABLE 106 GERMANY: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

TABLE 107 UK: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 108 UK: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

TABLE 109 UK: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

TABLE 110 UK: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (KILOTON)

TABLE 111 FRANCE: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 112 FRANCE: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

TABLE 113 FRANCE: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

TABLE 114 FRANCE: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

TABLE 115 ITALY: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 116 ITALY: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

TABLE 117 ITALY: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

TABLE 118 ITALY: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (KILOTON)

TABLE 119 RUSSIA: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 120 RUSSIA: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

TABLE 121 RUSSIA: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

TABLE 122 RUSSIA: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (KILOTON)

TABLE 123 TURKEY: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 124 TURKEY: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

TABLE 125 TURKEY: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

TABLE 126 TURKEY: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (KILOTON)

TABLE 127 ASIA PACIFIC: MDI, TDI & POLYURETHANE MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 128 ASIA PACIFIC: MDI, TDI & POLYURETHANE MARKET SIZE, BY APPLICATION, 2020-2026 (USD MILLION)

TABLE 129 ASIA PACIFIC: MDI, TDI & POLYURETHANE MARKET SIZE, BY APPLICATION, 2016-2019 (KILOTON)

TABLE 130 ASIA PACIFIC: MDI, TDI & POLYURETHANE MARKET SIZE, BY APPLICATION, 2020-2026 (KILOTON)

TABLE 131 ASIA PACIFIC: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 132 ASIA PACIFIC: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020-2026 (USD MILLION)

TABLE 133 ASIA PACIFIC: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

TABLE 134 ASIA PACIFIC: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020-2026 (KILOTON)

TABLE 135 ASIA PACIFIC: MDI, TDI & POLYURETHANE MARKET SIZE, BY COUNTRY, 2016-2019 (USD MILLION)

TABLE 136 ASIA PACIFIC: MDI, TDI & POLYURETHANE MARKET SIZE, BY COUNTRY, 2020-2026 (USD MILLION)

TABLE 137 ASIA PACIFIC: MDI, TDI & POLYURETHANE MARKET SIZE, BY COUNTRY, 2016-2019 (KILOTON)

TABLE 138 ASIA PACIFIC: MDI, TDI & POLYURETHANE MARKET SIZE, BY COUNTRY, 2020-2026 (KILOTON)

TABLE 139 CHINA: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 140 CHINA: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

TABLE 141 CHINA: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

TABLE 142 CHINA: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (KILOTON)

TABLE 143 INDIA: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 144 INDIA: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

TABLE 145 INDIA: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

TABLE 146 INDIA: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (KILOTON)

TABLE 147 THAILAND: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 148 THAILAND: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

TABLE 149 THAILAND: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

TABLE 150 THAILAND: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (KILOTON)

TABLE 151 SOUTH KOREA: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 152 SOUTH KOREA: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

TABLE 153 SOUTH KOREA: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

TABLE 154 SOUTH KOREA: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (KILOTON)

TABLE 155 JAPAN: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 156 JAPAN: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

TABLE 157 JAPAN: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

TABLE 158 JAPAN: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (KILOTON)

TABLE 159 VIETNAM: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 160 VIETNAM: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

TABLE 161 VIETNAM: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

TABLE 162 VIETNAM: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (KILOTON)

TABLE 163 TAIWAN: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 164 TAIWAN: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

TABLE 165 TAIWAN: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

TABLE 166 TAIWAN: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (KILOTON)

TABLE 167 SINGAPORE: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 168 SINGAPORE: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

TABLE 169 SINGAPORE: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

TABLE 170 SINGAPORE: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (KILOTON)

TABLE 171 SOUTH AMERICA: MDI, TDI & POLYURETHANE MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 172 SOUTH AMERICA: MDI, TDI & POLYURETHANE MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 173 SOUTH AMERICA: MDI, TDI & POLYURETHANE MARKET SIZE, BY APPLICATION, 2016-2019 (KILOTON)

TABLE 174 SOUTH AMERICA: MDI, TDI & POLYURETHANE MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

TABLE 175 SOUTH AMERICA: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 176 SOUTH AMERICA: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

TABLE 177 SOUTH AMERICA: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

TABLE 178 SOUTH AMERICA: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (KILOTON)

TABLE 179 SOUTH AMERICA: MDI, TDI & POLYURETHANE MARKET SIZE, BY COUNTRY, 2016-2019 (USD MILLION)

TABLE 180 SOUTH AMERICA: MDI, TDI & POLYURETHANE MARKET SIZE, BY COUNTRY, 2020-2026 (USD MILLION)

TABLE 181 SOUTH AMERICA: MDI, TDI & POLYURETHANE MARKET SIZE, BY COUNTRY, 2016-2019 (KILOTON)

TABLE 182 SOUTH AMERICA: MDI, TDI & POLYURETHANE MARKET SIZE, BY COUNTRY, 2020-2026 (KILOTON)

TABLE 183 BRAZIL: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 184 BRAZIL: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

TABLE 185 BRAZIL: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

TABLE 186 BRAZIL: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (KILOTON)

TABLE 187 ARGENTINA: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 188 ARGENTINA: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

TABLE 189 ARGENTINA: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

TABLE 190 ARGENTINA: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (KILOTON)

TABLE 191 MIDDLE EAST & AFRICA: MDI, TDI & POLYURETHANE MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 192 MIDDLE EAST & AFRICA: MDI, TDI & POLYURETHANE MARKET SIZE, BY APPLICATION, 2020-2026 (USD MILLION)

TABLE 193 MIDDLE EAST & AFRICA: MDI, TDI & POLYURETHANE MARKET SIZE, BY APPLICATION, 2016-2019 (KILOTON)

TABLE 194 MIDDLE EAST & AFRICA: MDI, TDI & POLYURETHANE MARKET SIZE, BY APPLICATION, 2020-2026 (KILOTON)

TABLE 195 MIDDLE EAST & AFRICA: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 196 MIDDLE EAST & AFRICA: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020-2026 (USD MILLION)

TABLE 197 MIDDLE EAST & AFRICA: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

TABLE 198 MIDDLE EAST & AFRICA: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020-2026 (KILOTON)

TABLE 199 MIDDLE EAST & AFRICA: MDI, TDI & POLYURETHANE MARKET SIZE, BY COUNTRY, 2016-2019 (USD MILLION)

TABLE 200 MIDDLE EAST & AFRICA: MDI, TDI & POLYURETHANE MARKET SIZE, BY COUNTRY, 2020-2026 (USD MILLION)

TABLE 201 MIDDLE EAST & AFRICA: MDI, TDI & POLYURETHANE MARKET SIZE, BY COUNTRY, 2016-2019 (KILOTON)

TABLE 202 MIDDLE EAST & AFRICA: MDI, TDI & POLYURETHANE MARKET SIZE, BY COUNTRY, 2020-2026 (KILOTON)

TABLE 203 UAE: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 204 UAE: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020-2026 (USD MILLION)

TABLE 205 UAE: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

TABLE 206 UAE: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020-2026 (KILOTON)

TABLE 207 SAUDI ARABIA: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 208 SAUDI ARABIA: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020-2026 (USD MILLION)

TABLE 209 SAUDI ARABIA: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

TABLE 210 SAUDI ARABIA: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020-2026 (KILOTON)

TABLE 211 SOUTH AFRICA: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 212 SOUTH AFRICA: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020-2026 (USD MILLION)

TABLE 213 SOUTH AFRICA: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

TABLE 214 SOUTH AFRICA: POLYURETHANE MARKET SIZE, BY END-USE INDUSTRY, 2020-2026 (KILOTON)

TABLE 215 MDI MARKET: DEGREE OF COMPETITION

TABLE 216 TDI MARKET: DEGREE OF COMPETITION

TABLE 217 POLYURETHANE MARKET: DEGREE OF COMPETITION

TABLE 218 MDI, TDI AND POLYURETHANE MARKET: COMPANY PRODUCT FOOTPRINT

TABLE 219 MDI, TDI AND POLYURETHANE MARKET: APPLICATION FOOTPRINT

TABLE 220 MDI, TDI AND POLYURETHANE MARKET: END-USE INDUSTRY FOOTPRINT

TABLE 221 MDI, TDI AND POLYURETHANE MARKET: COMPANY REGION FOOTPRINT

TABLE 222 MDI, TDI, AND POLYURETHANE MARKET: PRODUCT LAUNCHES, JANUARY 2018- DECEMBER 2021

TABLE 223 MDI, TDI, AND POLYURETHANE MARKET: DEALS, JANUARY 2018- JANUARY 2021

TABLE 224 MDI, TDI, AND POLYURETHANE MARKET: EXPANSIONS, INVESTMENTS, AND INNOVATIONS, JANUARY 2016- JANUARY 2021

TABLE 225 POLYURETHANE DISPERSIONS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

TABLE 226 POLYURETHANE DISPERSIONS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 227 APAC: POLYURETHANE DISPERSIONS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 228 APAC: POLYURETHANE DISPERSIONS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 229 APAC: POLYURETHANE DISPERSIONS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 230 APAC: POLYURETHANE DISPERSIONS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 231 APAC: POLYURETHANE DISPERSIONS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 232 APAC: POLYURETHANE DISPERSIONS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 233 EUROPE: POLYURETHANE DISPERSIONS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 234 EUROPE: POLYURETHANE DISPERSIONS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 235 EUROPE: POLYURETHANE DISPERSIONS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 236 EUROPE: POLYURETHANE DISPERSIONS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 237 EUROPE: POLYURETHANE DISPERSIONS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 238 EUROPE: POLYURETHANE DISPERSIONS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 239 NORTH AMERICA: POLYURETHANE DISPERSIONS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 240 NORTH AMERICA: POLYURETHANE DISPERSIONS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 241 NORTH AMERICA: POLYURETHANE DISPERSIONS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 242 NORTH AMERICA: POLYURETHANE DISPERSIONS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 243 NORTH AMERICA: POLYURETHANE DISPERSIONS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 244 NORTH AMERICA: POLYURETHANE DISPERSIONS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 245 MIDDLE EAST & AFRICA: POLYURETHANE DISPERSIONS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 246 MIDDLE EAST & AFRICA: POLYURETHANE DISPERSIONS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 247 MIDDLE EAST & AFRICA: POLYURETHANE DISPERSIONS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 248 MIDDLE EAST & AFRICA: POLYURETHANE DISPERSIONS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 249 MIDDLE EAST & AFRICA: POLYURETHANE DISPERSIONS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 250 MIDDLE EAST & AFRICA: POLYURETHANE DISPERSIONS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 251 SOUTH AMERICA: POLYURETHANE DISPERSIONS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 252 SOUTH AMERICA: POLYURETHANE DISPERSIONS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 253 SOUTH AMERICA: POLYURETHANE DISPERSIONS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 254 SOUTH AMERICA: POLYURETHANE DISPERSIONS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 255 SOUTH AMERICA: POLYURETHANE DISPERSIONS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 256 SOUTH AMERICA: POLYURETHANE DISPERSIONS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

LIST OF FIGURES (63 FIGURES)

FIGURE 1 MDI, TDI & POLYURETHANE MARKET: BOTTOM-UP APPROACH

FIGURE 2 MDI, TDI & POLYURETHANE MARKET: TOP-DOWN APPROACH

FIGURE 3 MDI, TDI & POLYURETHANE MARKET: DATA TRIANGULATION

FIGURE 4 ELECTRONICS & APPLIANCES TO BE THE FASTEST-GROWING INDUSTRY FOR THE POLYURETHANE MARKET DURING THE FORECAST PERIOD

FIGURE 5 FLEXIBLE FOAM TO BE THE LARGEST APPLICATION OF MDI, TDI, AND POLYURETHANE

FIGURE 6 APAC ACCOUNTED FOR THE LARGEST SHARE OF MDI, TDI, AND POLYURETHANE MARKET IN 2020

FIGURE 7 MDI, TDI, AND POLYURETHANE MARKET TO REGISTER MODERATE GROWTH DURING THE FORECAST PERIOD

FIGURE 8 CHINA LED THE APAC MDI, TDI, AND POLYURETHANE MARKET IN 2020

FIGURE 9 APAC TO BE FASTEST-GROWING MARKET BETWEEN 2021 AND 2026

FIGURE 10 RIGID FOAM ACCOUNTED FOR THE LARGEST SHARE IN MOST OF THE REGIONS IN 2020

FIGURE 11 INDIA TO BE THE FASTEST-GROWING MARKET BETWEEN 2021 AND 2026

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE MDI, TDI, AND POLYURETHANE MARKET

FIGURE 13 PORTER’S FIVE FORCES ANALYSIS

FIGURE 14 COUNTRY-WISE SPREAD OF COVID-19

FIGURE 15 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2021

FIGURE 16 FACTORS IMPACTING THE GLOBAL ECONOMY

FIGURE 17 SCENARIOS OF COVID-19 IMPACT

FIGURE 18 MDI, TDI, AND POLYURETHANE MARKET: SUPPLY CHAIN

FIGURE 19 MARKET SIZE UNDER REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIO

FIGURE 20 MDI, TDI, AND POLYURETHANE MARKET: CHANGING REVENUE MIX

FIGURE 21 MDI, TDI, AND POLYURETHANE MARKET: ECOSYSTEM

FIGURE 22 POLYURETHANE IMPORT, BY KEY COUNTRIES (2012-2019)

FIGURE 23 POLYURETHANE EXPORT, BY KEY COUNTRIES, (2012-2019)

FIGURE 24 PATENTS REGISTERED FOR MDI, TDI, AND POLYURETHANES, 2010–2020

FIGURE 25 PATENT PUBLICATION TRENDS FOR MDI, TDI, AND POLYURETHANES, 2010–2020

FIGURE 26 MAXIMUM PATENTS FILED BY COMPANIES IN THE US

FIGURE 27 DOW GLOBAL TECHNOLOGIES LLC REGISTERED MAXIMUM NUMBER OF PATENTS BETWEEN 2010 AND 2020

FIGURE 28 RIGID FOAMS APPLICATION TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 29 ELECTRONICS & APPLIANCES INDUSTRY TO GROW AT THE HIGHEST CAGR BETWEEN 2021 AND 2026

FIGURE 30 ASIA PACIFIC DOMINATED MDI, TDI & POLYURETHANE MARKET DURING FORECAST PERIOD

FIGURE 31 NORTH AMERICA MARKET SNAPSHOT: US TO LEAD MDI, TDI & POLYURETHANE MARKET DURING FORECAST PERIOD

FIGURE 32 US: SECOND-LARGEST MARKET FOR MDI, TDI & POLYURETHANE GLOBALLY

FIGURE 33 EUROPE MARKET SNAPSHOT: GERMANY TO LEAD THE MDI, TDI & POLYURETHANE MARKET DURING THE FORECAST PERIOD

FIGURE 34 GERMANY: LARGEST CONSUMER OF MDI, TDI & POLYURETHANE IN EUROPE

FIGURE 35 ASIA PACIFIC MARKET SNAPSHOT: CHINA TO LEAD MDI, TDI & POLYURETHANE MARKET

FIGURE 36 MDI, TDI, AND POLYURETHANE MARKET EVALUATION FRAMEWORK, 2019-2021

FIGURE 37 RANKING OF TOP FIVE PLAYERS IN THE MDI MARKET, 2020

FIGURE 38 WANHUA CHEMICALS GROUP CO. LTD. IS THE LEADING PLAYER IN THE MDI MARKET

FIGURE 39 TOP 5 PLAYERS CONSTITUTE MAJORITY SHARE IN THE MDI MARKET

FIGURE 40 RANKING OF TOP FIVE PLAYERS IN THE TDI MARKET, 2020

FIGURE 41 COVESTRO AG IS THE LEADING PLAYER IN THE TDI MARKET

FIGURE 42 TOP 4 PLAYERS CONSTITUTE MAJORITY SHARE IN THE TDI MARKET

FIGURE 43 RANKING OF TOP FIVE PLAYERS IN THE POLYURETHANE MARKET, 2020

FIGURE 44 BASF SE IS THE LEADING PLAYER IN THE POLYURETHANE MARKET

FIGURE 45 TOP 5 PLAYERS CONSTITUTE MAJORITY SHARE IN THE POLYURETHANE MARKET

FIGURE 46 COMPANY EVALUATION MATRIX FOR MDI, TDI AND POLYURETHANE MARKET (TIER 1)

FIGURE 47 STARTUP/SMES EVALUATION MATRIX FOR MDI, TDI, AND POLYURETHANE MARKET

FIGURE 48 BASF SE: COMPANY SNAPSHOT

FIGURE 49 BASF SE: WINNING IMPERATIVES

FIGURE 50 THE DOW CHEMICAL COMPANY: COMPANY SNAPSHOT

FIGURE 51 THE DOW CHEMICAL COMPANY: WINNING IMPERATIVES

FIGURE 52 DUPONT DE NEMOURS, INC.: COMPANY SNAPSHOT

FIGURE 53 DUPONT DE NEMOURS, INC.: WINNING IMPERATIVES

FIGURE 54 HUNTSMAN CORPORATION: COMPANY SNAPSHOT

FIGURE 55 HUNTSMAN CORPORATION: WINNING IMPERATIVES

FIGURE 56 COVESTRO AG: COMPANY SNAPSHOT

FIGURE 57 COVESTRO AG: WINNING IMPERATIVES

FIGURE 58 LANXESS AG: COMPANY SNAPSHOT

FIGURE 59 LANXESS AG: WINNING IMPERATIVES

FIGURE 60 MITSUI CHEMICALS INC.: COMPANY SNAPSHOT

FIGURE 61 MITSUI CHEMICALS INC.: WINNING IMPERATIVES

FIGURE 62 WANHUA CHEMICALS GROUP CO., LTD.: COMPANY SNAPSHOT

FIGURE 63 WANHUA CHEMICALS GROUP CO LTD.: WINNING IMPERATIVES

Overview on MDI Market

MDI, or Methylene Diphenyl Diisocyanate, is a type of chemical compound used in the production of polyurethane. The MDI market is primarily driven by the demand for polyurethane products in various industries such as construction, automotive, and furniture.

MDI, TDI (Toluene Diisocyanate), and Polyurethane are all interlinked markets. MDI and TDI are the primary raw materials used in the production of polyurethane. TDI is primarily used in the production of flexible polyurethane foam, whereas MDI is used in the production of rigid polyurethane foam. The demand for polyurethane products drives the demand for MDI, TDI, and other raw materials.

The MDI market is expected to continue growing in the coming years due to the increasing demand for polyurethane products in various industries. The growth in the MDI market is expected to positively impact the TDI and polyurethane markets as well, as these markets are all interconnected.

Futuristic Growth Use-cases of MDI Market

The MDI market is expected to experience significant growth in the construction industry, as rigid polyurethane foam is widely used for insulation purposes in buildings. The increasing demand for energy-efficient buildings is expected to drive the growth of the MDI market in this sector. Additionally, the automotive industry is expected to be a significant growth area for the MDI market, as polyurethane is increasingly used in the production of lightweight vehicles.

Top players in MDI Market

The top players in the MDI market include companies like BASF SE, Covestro AG, Dow Inc., Huntsman Corporation, Mitsui Chemicals Inc., Wanhua Chemical Group Co., Ltd., and others.

MDI Market Impact on Other Industries

The MDI market is expected to impact several other industries in the future. For instance, the furniture industry is expected to benefit from the use of MDI-based polyurethane foam in cushioning materials. The packaging industry is also expected to be impacted by the MDI market, as polyurethane foam is increasingly used for protective packaging. Additionally, the use of polyurethane foam in the aerospace industry is expected to increase, driven by the need for lightweight and fuel-efficient aircraft.

Speak to our Analyst today to know more about MDI Market!

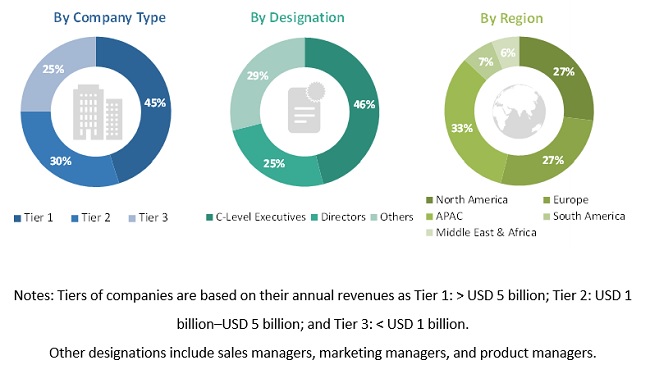

The study involved four major activities to estimate the market size for MDI, TDI & Polyurethane. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. Findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives.

Primary Research

The MDI, TDI & Polyurethane market comprises several stakeholders such as raw material suppliers, manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development in end-use industries such as footwear, furniture & interiors, automotive, construction, electronics & appliances and others. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the MDI, TDI & Polyurethane market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

The key players in the industry have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of volume and value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To analyze and forecast the size of the MDI, TDI & Polyurethane market, in terms of volume and value

- To provide detailed information regarding key factors, such as drivers, restraints, and opportunities, and challenges influencing the growth of the market

- To define, describe, and segment the MDI, TDI & Polyurethane market on the basis of application and end-use industry

- To forecast the size of the market segments for regions such as APAC, North America, Europe, South America, and the Middle East & Africa

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contribution to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To analyze competitive developments such as expansion, new product launch, merger & acquisition, and agreement in the MDI, TDI & Polyurethane market

- To strategically profile key players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in MDI, TDI, and Polyurethane Market

Rigid polyurethane (PUR) and polyisocyanurate (PIR) for Construction application

Data on MDI PU Market in India. Current market size, market share by players, past growth, future trends, challenges and Opportunities.

Information on Indias MDI market

Looking for general information on MDI and TDI

Pu system house manufacturer wants technical data sheet & with price CIF Sonipat & against LC 90 days basis

signify the increased use of PU in todays market.

Report requirement on PU biodegradation

General information on MDI, TDI and Polyurethane industry in US and impact on workforce working in this sector

Information on toluene diisocyanate (TDI) market in Europe

Interested in Polyurethanes industry insights

General information on MDI market and production

Global PU foam market share in automotive along with the companies operating such as Dow Chemical, BASF, Bayer Material Science, and Huntsman

Price analysis of tdi and polyol.

information on Isocyanide (MDI & TDI) market

Looking for price of MDI TDI market

Market information of Hot Melt Adhesive market raw materials

General inquiry on MDI and payment creteria

Capacities and forecasts of MDI & TDI by location

Capacities & Capacity forecasts by location for MDI, TDI and PO in addition to market data and forecasts.