Dental Laboratories Market Size, Growth, Share & Trends Analysis

Dental Laboratories Market By Practice (Orthodontics), Product [Material (Metal Ceramic, Glass Ceramic), Equipment (CAD/CAM System), Software (Lab management)], Technology (Digital), and Consumer (Dental Hospitals, DSOs) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global dental laboratories market, valued at US$8.66 billion in 2024, stood at US$9.20 billion in 2025 and is projected to advance at a resilient CAGR of 7.3% from 2024 to 2030, culminating in a forecasted valuation of US$13.09 billion by the end of the period. Advancements in dental technologies—including CAD/CAM systems, 3D printing, intraoral scanning, and high-performance restorative materials—are enabling greater precision, faster turnaround times, and improved aesthetic outcomes compared to traditional manual techniques. These innovations enhance clinical efficiency, support better prosthetic accuracy, and elevate overall patient satisfaction. Rising dental disease burden, increasing oral health awareness, and growing adoption of digital dentistry solutions are driving the global demand for dental laboratory services.

KEY TAKEAWAYS

-

BY REGIONThe North America dental laboratories market accounted for a 31.8% revenue share in 2024.

-

BY PRODUCTBy product, the software segment is expected to register the highest CAGR of 10.9% during the forecast period.

-

BY PRACTICEBy practice, the orthodontics segment is projected to grow at the fastest rate of 12.2% from 2025 to 2030.

-

BY TECHNOLOGYBy technology, the digital segment is expected to dominate the market.

-

BY CONSUMER TYPEBy consumer type, the dental hospitals & clinics segment is expected to dominate the market.

-

Competitive LandscapeDentsply Sirona, Envista, and Ivoclar Vivadent AG were identified as key players in the global dental laboratories market, given their strong market share and extensive product footprint.

-

Competitive LandscapeStructo, Sprintray Inc., and HeyGears have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The global dental laboratories market is witnessing steady growth, driven by several key factors. The rising incidence of dental disorders—supported by aging populations, dietary shifts, and lifestyle-related oral health challenges—is increasing the demand for high-quality restorative and prosthetic solutions. In addition, the growing adoption of digital dentistry, including CAD/CAM systems, 3D printing, and intraoral scanning technologies, along with innovations in materials, workflow automation, and lab–clinic integration, is expanding the efficiency, precision, and scalability of dental laboratory services worldwide

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The dental laboratories market is experiencing a shift from traditional manual fabrication methods toward advanced, digitally driven production workflows. Emerging trends include the widespread adoption of CAD/CAM systems, next-generation 3D-printing technologies supported by specialized resins and materials, and increasing demand for custom devices such as teeth-whitening trays and patient-specific appliances. At the same time, the development of advanced restorative materials—including zirconia, lithium disilicate, hybrid ceramics, and bioactive materials—is enabling superior strength, aesthetics, and clinical performance. These innovations are creating high-growth opportunities, fueled by the need for faster turnaround, higher precision, and more predictable restorative outcomes. Dental clinics, DSOs, and laboratories worldwide are rapidly embracing these disruptive technologies, reshaping the future of dental restoration and prosthetic manufacturing.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising cases of dental caries and subsequent increase in tooth repair procedures

-

Increasing outsourcing of manufacturing functions to dental laboratories

Level

-

High cost of dental equipment and materials

-

Increasing surgical costs and lack of access to reimbursement

Level

-

Rapid growth of dental service organizations

-

Growing focus on emerging economies and rising disposable income levels

Level

-

Pricing pressure faced by prominent market players

-

Dearth of skilled lab professionals

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising cases of dental caries and subsequent increase in tooth repair procedures

The rising prevalence of dental caries is leading to a significant increase in tooth repair and restorative procedures, thereby boosting demand for dental laboratory products and solutions. According to the WHO Global Oral Health Status Report (2022), oral diseases affect nearly 3.5 billion people worldwide, with 2 billion individuals suffering from caries of permanent teeth and 514 million children affected by caries of primary teeth. As more patients present with decayed and missing teeth (DMT)—especially in middle-income countries, where three out of four people experience oral diseases—the need for crowns, bridges, dentures, and other lab-fabricated restorations continues to rise. This growing treatment burden is also prompting dental professionals to adopt advanced materials and digitally enabled fabrication techniques. As the volume of caries-related restorative procedures increases, the demand for precise, durable, and aesthetically superior restorations continues to strengthen across dental care settings.

Restraint: High cost of dental equipment and materials

The dental laboratories market is constrained by the high cost of advanced materials and fabrication technologies, which significantly elevates overall operational expenditure. Premium restorative options such as zirconia, silicate-based ceramics, and porcelain can substantially increase production costs, as the choice of material directly influences pricing—often resulting in a 60–70% cost gap between high-end and lower-cost alternatives. Alongside this, investments in digital systems such as CAD/CAM mills, 3D printers, scanners, and casting units further add to financial pressures, especially for smaller laboratories with limited capital. These escalating costs also reduce price flexibility for laboratories, making it challenging for them to serve cost-sensitive markets. In many emerging regions, high import duties and limited availability of affordable raw materials further amplify cost burdens, collectively restricting broader market adoption.

Opportunity: Rapid growth of dental service organizations

The rapid expansion of Dental Service Organizations (DSOs) presents a significant growth opportunity for the dental laboratories market. As DSOs continue consolidating independent practices into large, multi-clinic networks, their need for standardized, reliable, and high-volume laboratory support is increasing sharply. According to the ADA Health Policy Institute, 13% of dentists in the US were affiliated with a DSO in 2022—up from 10.4% in 2019 and 8.8% in 2017—with substantially higher adoption among dentists less than 10 years out of dental school. This expanding footprint is creating strong demand for lab partners that can deliver consistent quality, fast turnaround times, and the ability to scale across regional or national networks. Moreover, DSOs increasingly prefer centralized procurement and long-term vendor agreements, offering laboratories opportunities to secure stable, recurring, and high-volume business. As DSOs continue to expand across the US and make inroads in Europe and APAC, the need for digitally enabled, technology-driven laboratory solutions is expected to grow, positioning labs with advanced capabilities to benefit the most.

Challenge: Pricing pressure faced by prominent market players

Manufacturers of dental materials and equipment face significant pricing pressure as they strive to compete in highly fragmented global markets. While leading companies have established strong international positions, expanding into local and emerging markets remains challenging due to significant variations in product affordability. In developed regions such as the US and the UK, the cost of dental prosthetics—and consequently the premium materials and equipment used to produce them—ranges from USD 300 to 1,400, supporting higher-priced, high-performance inputs. In contrast, laboratories in countries such as Mexico, Costa Rica, and India operate in highly price-sensitive environments, where comparable prosthetic costs are 60–70% lower, compelling them to favor low-cost materials and basic equipment. This wide pricing gap restricts manufacturers’ ability to maintain premium margins, intensifies competition from low-cost regional suppliers, and forces global players to constantly balance competitive pricing with product quality, innovation, and profitability.

dental-lab-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Cercon Zirconia is a high-strength multilayer zirconia material designed for indirect restorations such as crowns, bridges, and full-arch solutions, offering enhanced translucency and compatibility with CAD/CAM production. | Provides exceptional durability and fracture resistance, delivers natural esthetics with gradient shading, reduces remakes through predictable performance, and supports streamlined digital fabrication. |

|

Centrifico Casting Machine is a centrifugal casting system used to produce metal crowns, partial denture frameworks, and precision components with controlled and uniform metal flow. | Ensures consistent casting quality with minimal porosity, enhances accuracy of complex metal restorations, improves lab throughput, and supports a wide range of dental alloys and indications. |

|

Lava CNC 240 is a compact, high-precision milling unit engineered for zirconia, glass ceramics, wax, and resin materials, enabling automated subtractive manufacturing in a digital lab environment. | Delivers highly accurate and repeatable milling results, supports multi-material workflows, shortens turnaround times, and increases production efficiency and reduces manual intervention. |

|

PrograScan PS5 Scanner is a high-resolution extraoral scanning system designed to capture precise digital impressions for crowns, bridges, implant restorations, and full-arch prosthetics. | Offers exceptional scanning accuracy and detail reproduction, accelerates digital case acceptance, strengthens clinic-lab communication, reduces errors, and standardizes workflows. |

|

Planmeca Creo C5 Dental 3D Printer is a professional 3D printing platform for manufacturing models, splints, surgical guides, temporary restorations, and custom appliances using biocompatible materials. | Enables rapid, high-precision fabrication, increases output for high-volume labs, supports diverse clinical and lab applications, reduces production costs, and enhances customization capability. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The dental laboratories market operates within a multifaceted ecosystem comprising diverse stakeholders who collectively enable innovation, workflow efficiency, and service delivery. Dental materials and equipment manufacturers develop advanced CAD/CAM systems, 3D printers, milling units, and high-performance restorative materials that form the technological backbone of modern laboratories. Distributors and supply partners ensure seamless availability of these products to dental labs, clinics, DSOs, and academic institutions. Dental clinics and practitioners—including general dentists, prosthodontists, and orthodontists—serve as key intermediaries, prescribing restorations and collaborating closely with laboratories to ensure accuracy and clinical success. Patients form the ultimate end-user base, relying on laboratory-fabricated crowns, bridges, dentures, aligners, and custom devices for functional and aesthetic oral rehabilitation. Professional dental associations promote quality standards, training, and best practices, while government and regulatory bodies oversee safety, certification, and compliance for materials, devices, and laboratory operations. Together, this interconnected network shapes the operational, regulatory, and innovation landscape of the global dental laboratories market.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Dental Laboratories Market, By Product

Based on product, the global dental laboratories market is divided into three main segments: materials, equipment, and software. Among them, the materials segment held the largest share in 2024, driven by the growing demand for durable, aesthetically pleasing, and biocompatible restorative solutions. Popular materials such as metal-ceramics and CAD/CAM options like zirconia are widely used to support digital workflows and deliver precise, efficient restorations. The segment’s growth is further boosted by innovations in high-performance ceramics and composites, increasing patient demand for natural-looking dental restorations, and broader adoption of digital dentistry technologies across laboratories worldwide.

Dental Laboratories Market, By Practice

Based on practice type, the global dental laboratories market is segmented into four main categories: restorative, orthodontics, implants, and prosthodontics. Among them, the restoratives segment held the largest share due to the growing demand for crowns, bridges, veneers, inlays, and onlays, which are used to repair or replace damaged or decayed teeth. The increasing patient preference for aesthetic, natural-looking restorations, combined with the growing focus on minimally invasive dental procedures, has fueled market growth. The segment is also benefiting from the adoption of high-strength and long-lasting restorative materials, which improve durability and clinical outcomes. Furthermore, the demand for single-visit restorations and chairside solutions has intensified the need for precise and reliable restorative products.

Dental Laboratories Market, By Consumer Type

The global dental laboratories market is segmented by consumer type into three categories: dental hospitals & clinics, DSOs, and other end users. Among them, the dental hospitals & clinics segment holds the largest share due to their high patient volumes, broad range of restorative and prosthetic procedures, and consistent demand for laboratory-fabricated crowns, bridges, dentures, and veneers. Their access to specialized dental professionals, adoption of advanced diagnostic technologies, and ability to manage complex clinical cases further strengthen their reliance on both external and in-house laboratory services. The expanding clinical infrastructure also supports market growth. According to the American Dental Association (ADA), the number of dentists in the US increased from 201,117 in 2020 to 202,304 in 2023, with over 78% in general practice—directly feeding routine restorative case volumes. Additionally, the steady rise in dental clinics across emerging markets, coupled with growing awareness of oral health and increasing patient spending on aesthetic and restorative treatments, continues to reinforce this segment’s dominant position.

REGION

Asia Pacific to be fastest-growing region in global dental laboratories market during forecast period

The Asia Pacific region is expected to witness the highest CAGR in the dental laboratories market during the forecast period. The rising incidence of dental disorders, increasing awareness of oral health, and growing adoption of digital technologies, such as CAD/CAM systems, intraoral scanners, and 3D printing, are driving market expansion. The region’s large and aging population, along with rising healthcare expenditures, is fueling the demand for high-quality, aesthetically pleasing, and affordable restorative and prosthetic dental solutions. Moreover, improvements in dental care infrastructure, growing disposable incomes, and the rapid digitalization of dental clinics and laboratories are anticipated to accelerate the growth of the Asia Pacific dental laboratories market.

dental-lab-market: COMPANY EVALUATION MATRIX

In the dental laboratories market matrix, Dentsply Sirona (Star) holds a leading position due to its extensive digital dentistry ecosystem, strong global reach, and broad portfolio of CAD/CAM systems and materials. Amann Girrbach (Emerging Leader) is rapidly gaining traction with its precision-focused CAD/CAM systems and growing adoption among mid-sized labs, positioning it strongly for upward movement in the matrix. Dentsply Sirona continues to strengthen its leadership through integrated workflows and sustained investment in advanced manufacturing technologies. Meanwhile, Amann Girrbach is expanding its footprint through cost-efficient digital solutions and increasing acceptance in high-precision restorative workflows.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 8.66 BN |

| Market Forecast in 2030 (Value) | USD 13.09 BN |

| Growth Rate | CAGR of 7.3% from 2025–2030 |

| Years Considered | 2023–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD BN), Volume (Thousand Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | By Practice: Restorative, Orthodontics, Implants, Prosthodontics I By Product: Materials, Equipment, Software I By Technology: Digital, Conventional I By Consumer Type: Dental Hospitals & Clinics, DSOs, Other End Users |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, GCC Countries, and the Middle East & Africa |

WHAT IS IN IT FOR YOU: dental-lab-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Volume Analysis | Market assessment by volume (units) for dental materials & equipment used in dental laboratories |

|

| Company Information | Key players: Dentsply Sirona (US), Envista (US), Solventum (US), Ivoclar Vivadent AG (Liechtenstein), GC Corporation (Japan). Top 3–5 players market share analysis at the APAC and European country level | Insights on revenue shifts toward emerging innovations |

| Disease Prevalence |

RECENT DEVELOPMENTS

- October 2025 : Ivoclar launched its IPS e.max Ceram Art line—a new suite of ready-to-use stain, glaze, and structure pastes that enable more efficient, high-precision ceramic restoration characterization.

- October 2025 : Ivoclar and vhf expanded their partnership so that vhf’s Z4 and E4 milling machines are now officially approved to work with Ivoclar’s IPS e.max CAD materials, making the CAD/CAM workflow smoother and more reliable.

- June 2025 : Kuraray Noritake Dental Inc. announced plans to expand the production capacity for ceramic dental materials at its Miyoshi Plant, Japan.

- June 2024 : Dentsply Sirona launched DS Core Light, a new subscription option that provides users with 1 TB of storage space for order and design files. This allows labs to digitize models of physical impressions and design proposals and share them with dentists via DS Core, even if the dentist is not yet a user.

- December 2022 : Planmeca launched the PlanMill 60 S, a 5-axis laboratory milling unit capable of both wet and dry processing of discs, blocks, and implant abutments for a wide range of restorative indications.

Table of Contents

Methodology

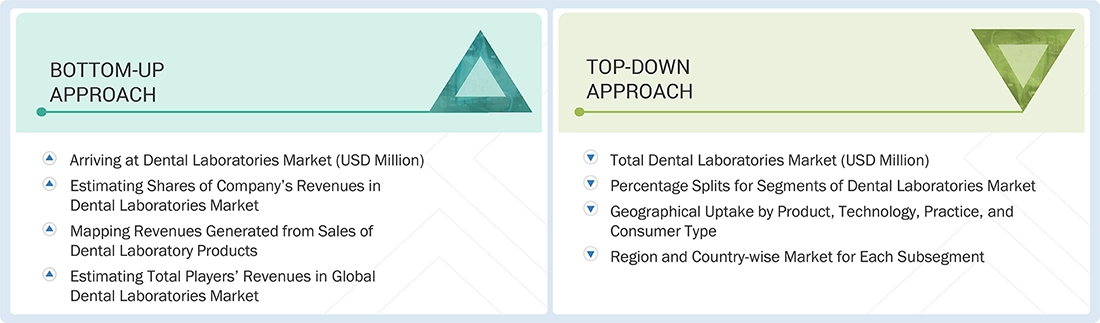

The study involved four key activities aimed at estimating the current size of the dental laboratories market. First, extensive secondary research was conducted to gather information about the market, including related and parent markets. Next, these findings, assumptions, and market size estimates were validated through primary research with industry experts across the value chain. Both top-down and bottom-up approaches were employed to arrive at a comprehensive estimate of the overall market size. Finally, market breakdown and data triangulation techniques were used to determine the sizes of various segments and subsegments within the market.

Secondary Research

The secondary research process involved the extensive use of various sources, including directories and databases such as Bloomberg Business, Factiva, and D&B Hoovers. Additionally, the research utilized white papers, annual reports, company house documents, investor presentations, and SEC filings. The aim was to gather information essential for a detailed, technical, and market-oriented study of the dental laboratories market. This research provided critical insights about key players in the industry, as well as market classification and segmentation based on current trends, down to the finest details. Furthermore, a database of leading industry players was developed through this secondary research.

Primary Research

In the primary research process, interviews were conducted with various stakeholders from both the supply and demand sides to gather qualitative and quantitative information for this report. On the supply side, we interviewed industry experts, including CEOs, vice presidents, marketing & sales directors, technology & innovation directors, and other key executives from notable companies and organizations involved in the dental laboratories market. For the demand side, our discussions included industry experts, purchasing and sales managers, doctors, and personnel from research organizations. This primary research was crucial for validating market segmentation, identifying key industry players, and gathering insights into important trends and market dynamics.

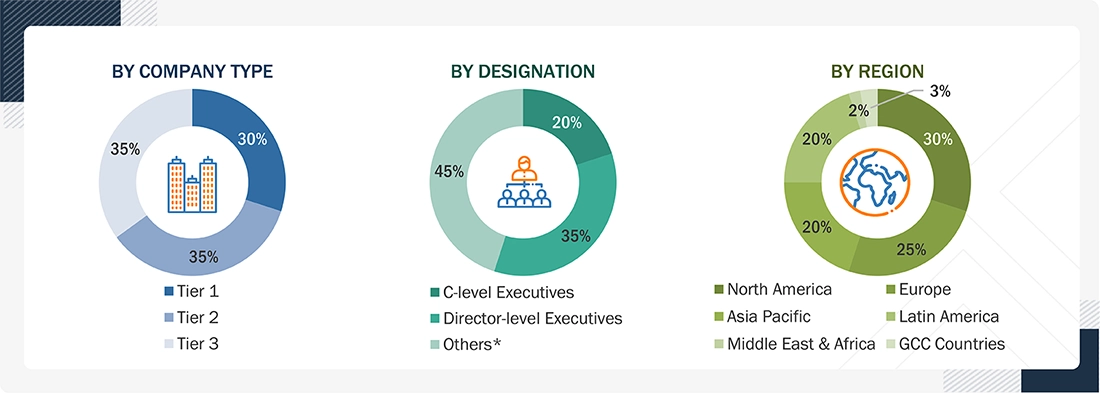

A breakdown of the primary respondents for the dental laboratories market is provided below:

Others include sales, marketing, and product managers.

Note 1: C-level executives include CEOs, COOs, CTOs, and VPs.

Note 2: Companies are classified into tiers based on their total revenue. As of 2024: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the dental laboratories market is as follows. The market sizing was conducted on a global scale.

Country-level Analysis: The size of the dental laboratories market was obtained from the annual presentations of leading players and secondary data available in the public domain. The share of products in the overall dental laboratories market was obtained from secondary data and validated by primary participants to arrive at the total dental laboratories market. Primary participants further validated the numbers.

Geographic Market Assessment (By Region and Country): The geographic assessment was done using the following approaches:

Approach 1: Geographic revenue contributions/splits of leading players in the market (wherever available) and respective growth trends

Approach 2: Geographic adoption trends for individual product segments by end users and growth prospects for each of the segments (assumptions and indicative estimates validated from primary interviews)

At each point, the assumptions and approaches were validated by industry experts who were contacted during primary research. Considering the limitations of data available from secondary research, revenue estimates for individual companies (for the overall dental laboratories market and geographic market assessment) were ascertained based on a detailed analysis of their respective product offerings, geographic reach/strength (direct or through distributors or suppliers), and the shares of the leading players in a particular region or country.

Dental Laboratories Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

The dental laboratories market comprises the materials, equipment, and specialized digital solutions used by dental laboratories to design, fabricate, and supply customized dental products supporting clinical treatment workflows. It includes laboratory production systems, CAD/CAM technologies, workflow and design software, and a range of indirect restorative materials that enable dental technicians to deliver high-precision, consistent, and efficient outputs as part of the broader dental care continuum.

Key Stakeholders

- Dental lab product manufacturers & distributors

- Dental lab-side equipment manufacturers & distributors

- Dental indirect restorative material suppliers & distributors

- Dental laboratories & lab groups

- Contract research organizations

- Laboratory technicians

- Government associations and dental practitioners

- Trade associations and industry bodies

- Market research and consulting firms

- Venture capitalists and investors

Report Objectives

- To define, describe, segment, analyze, and forecast the global dental laboratories market by product, practice, technology, consumer type, and region

- To provide detailed information about the factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To analyze micromarkets concerning individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To profile the key players in the dental laboratories market and comprehensively analyze their core competencies

- To track and analyze competitive developments such as agreements, collaborations, and partnerships; acquisitions; and product approvals & launches in the dental laboratories market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Company Information

- Detailed analysis and profiling of additional market players

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Dental Laboratories Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Dental Laboratories Market

Felipe

Oct, 2022

What are the latest technological trends in dental laboratories market?.

Shen

Oct, 2022

Which segment to dominate the revenue share in market?.

Dewei

Oct, 2022

Which key factors should be taken into consideration for revenue expansion?.