Medical Power Supply Market by Converter Type (AC-DC, DC-DC), Application (MRI, ECG, EEG, PET, CT Scan, Ultrasound, X-ray, RF Mammography, Surgical Equipment, Dental Equipment), Manufacturing Type (Enclosed, External, U Bracket) & Region - Global Forecast to 2027

Medical Power Supply Market Overview and Growth Projections

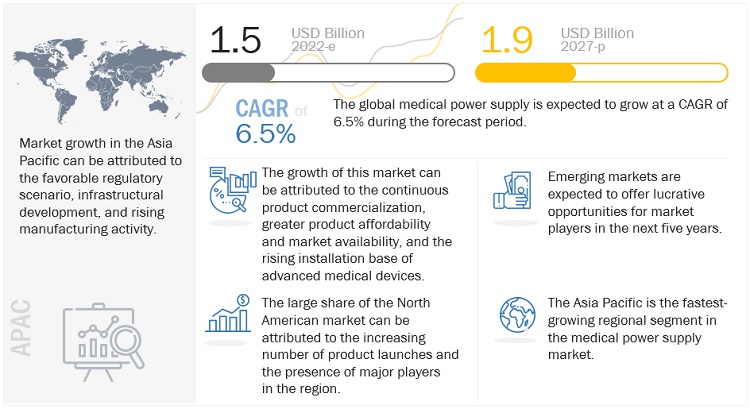

Medical power supply market growth forecasted to transform from $1.5 billion in 2022 to $1.9 billion by 2027, driven by a CAGR of 6.5%. The growth of this market can be attributed to the continuous product commercialization, greater product affordability and market availability, and the rising installation base of advanced medical devices. While, emerging markets are expected to offer lucrative opportunities for market players in the next five years.

Global Medical Power Supply Market Trends

e- Estimated; p- Projected

To know about the assumptions considered for the study, Request for Free Sample Report

Medical Power Supply Market Dynamics

Driver: Growing adoption of home-use healthcare products

The aging population more prone to develop chronic disorders is another key factor fueling the demand for home healthcare products. The American Medical Association (AMA) estimates that at least 60% of individuals aged 65 years and above will be living with more than one chronic condition by 2030. The growing preference for home healthcare is expected to provide growth opportunities for players operating in the medical power supply industry. The focus has shifted to designing and producing small and efficient supply units. Recent approvals in this regard include:

- In May 2022, LYMA Life Ltd. launched an at-home and medical-grade laser-based skincare device in the US, that treats a host of skin conditions such as wrinkles, fine lines, scaring, sagging, and rosacea, among others.

- In April 2022, Biotricity Inc. launched commercial sales of Biotres, a wireless wearable cardiac monitoring device. The device is an FDA-approved three-lead device that offers early detection of cardiac arrhythmias with continuous ECG recording capabilities.

Restraint: safety standards and regulatory compliance

The Restriction of Hazardous Substances (RoHS) and Electronic Waste Directive (Europe) also impose restrictions on product commercialization for DC power supply manufacturers. The primary goal of safety/regulatory standards for power supplies used for electrical equipment testing is to protect against fire, electric shock, and injury. Products meeting these requirements may be identified by a safety mark from the associated standards organization or by a mark indicating compliance with local legislation within a defined economic area or trading zone. Such requirements erect additional market entry/expansion barriers for medical power supply manufacturers to enter new markets.

Opportunity: Emerging high-voltage DC power sources

A high-voltage power supply assembly uses a complex power conversion circuit to provide higher voltage potential. High-voltage AC-DC power supply units use filtering and shielding techniques for high stability, low ripple, noise & EMI/RFI, and well-regulated output levels. The integration of high-voltage units into precision measurement devices and sensitive medical equipment is likely to provide a lucrative opportunity in this market.

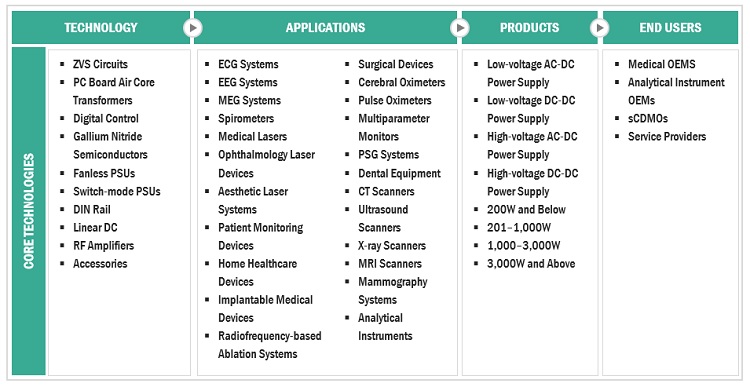

Medical Power Supply Market Ecosystem:

Source: Knowledge Store

By manufacturing type, standard power supply segment accounted for the largest share of the medical power supply industry during the forecast period.

Based on manufacturing type, the medical power supply market is segmented into standard, customized, and CF Rating power supplies. Standard power supplies hold the largest share of the overall market by manufacturing type. Their optimal design and the availability of a broad product portfolio with a vast range of power outputs (WATT) drive demand for standard power supplies. An emerging trend in this market is outsourcing power supply procurement needs, resulting in a favorable environment for new power supply vendors. This is expected to support market growth.

By converter type, 201–500W power range AC-DC power supply segment of the medical power supply industry is expected to grow at the fastest rate during the forecast period.

Based on the converter type, the medical power supply market is segmented into AC-DC power supply, and DC-DC power supply. AC-DC power supply products further sub-segmented into 200W and less, 201-500W, 501-1000W, 1,000-3,000W and 3000W and above. The 201-500W power range supplies are expected to register significant growth rate over the forecast period. The growing focus on minimizing the power consumption of medical equipment is the key factor driving the growth of this segment.

In terms of architecture type, enclosed power supply segment of the medical power supply industry to hold major share in 2022

Based on architecture, the medical power supply market is segmented into enclosed, open-frame, external, U-bracket, configurable, and encapsulated power supply. The enclosed power supply segment dominates the market. The large share of this market segment is due to the availability of advanced, compact, enclosed power supplies offering high efficiency and low leakage current (resulting in less power consumption).

To know about the assumptions considered for the study, download the pdf brochure

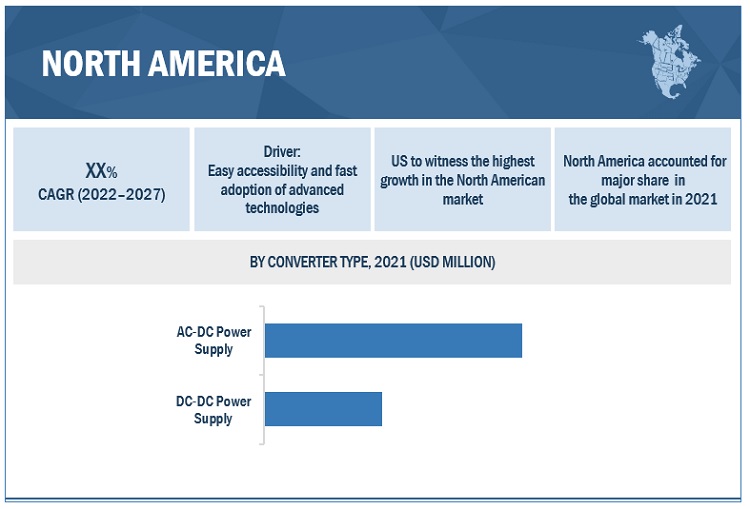

North America is expected to be the largest region of the medical power supply industry during the forecast period.

North America held major share of the medical power supply market in 2021 and the trend is expected to continue over the forecast period. The strong presence of key market players and supportive regulatory guidelines drive market growth. North America is home to most tier 1 companies providing medical power supplies. The key players in the North American market include Astrodyne TDI (US), Bel Fuse, Inc. (US), SL Power Electronics (US), and GlobTek Inc. (US). Regulatory authorities such as the American National Standards Institute (ANSI) and the Canadian Standards Association (CSA) have imposed stringent regulations on designing and manufacturing power supplies.

As of 2021, prominent players in the market are Advanced Energy Industries, Inc (US), TDK Corporation (Japan), Delta Electronics, Inc. (Taiwan), SL Power Electronics (US), XP Power (Singapore), Bel Fuse Inc. (US), COSEL Co. Ltd. (Japan), FRIWO Gerätebau GmbH (Germany), SynQor, Inc. (US), GlobTek, Inc.(US), MEAN WELL Enterprises Co. Ltd. (Taiwan), Spellman High Voltage Electronics Corporation (US), and Astrodyne TDI (US), among others.

Delta Electronics: Due to technological advancements and excellent operations management, Delta has become an indispensable long-term strategic partner for many world-class manufacturers. The company has received accolades for its Switch Mode Power Supplies (SMPS), brushless DC fans, cooling systems, and miniaturized key component. The company focuses on inorganic strategies, such as acquisitions, to strengthen its offerings and global reach and sustain its presence in this market.

Scope of the Medical Power Supply Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2022 |

$1.5 billion |

|

Projected Revenue Size by 2027 |

$1.9 billion |

|

Industry Growth Rate |

Poised to grow at a CAGR of 6.5% |

|

Market Driver |

Growing adoption of home-use healthcare products |

|

Market Opportunity |

Emerging high-voltage DC power sources |

This report has segmented the global Medical Power Supply market to forecast revenue and analyze trends in each of the following submarkets:

By Converter Type

-

AC-DC Power Supply

- 200W and less

- 201-500W

- 501-1,000W

- 1,001-3,000W

- 3,001W and above

-

DC-DC Power Supply

- 30W and less

- 31-60W

- 61W and above

By Application

-

Diagnostic Imaging Systems

- MRI Systems

- X-ray Systems

- CT Scanners

- Ultrasound Systems

- Mammography Systems

- PET Systems

- Other Diagnostic Imaging Systems

-

Patient Monitoring Equipment

- ECG Monitors

- EEG Monitors

- MEG Monitors

- Multiparameter Monitors

- Other Patient Monitoring Equipment

-

Surgical Equipment

- RF-based Ablation Systems

- Electric & Electroporation Ablation Systems

- Light & Laser-based Ablation Systems

- Aesthetic Laser Systems

- Ophthalmology Laser Devices

- Other Surgical Equipment

- Dental Equipment

- Home Use & Wearable Equipment

- Implantable Medical Devices

- Other Applications

By Architecture

- Enclosed Power Supply

- Open Frame Power Supply

- External Power Supply

- U-Bracket Power Supply

- Encapsulated Power Supply

- Configurable Power supply

By Manufacturing Type

- Standard Power Supply

- Customized Power Supply

- CF Rating Power Supply

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of Asia Pacific

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

Recent Developments of Medical Power Supply Industry

- In July 2022, Advanced Energy Industries expanded its SL Power SLB series with the launch of a 300 W power supply.

- In July 2022, Wall Industries, Inc. introduced four DC/DC converters (DCSMU1, DCSMU2, DCMHP06, and DCMHPL20) ranging from 1 to 20 watts and two AC or DC power supplies (PSAMPS45 and PSAMPS65) at 45 and 65 watts

- In June 2022, XP Power launched compact medical desktop power supplies. This AQM AC/DC power supply is a space-saving fan-less solution for home healthcare and hospital applications

- In April 2022, Wall Industries, Inc. introduced five new variants to expand its PSSW family of open frame AC/DC supplies. The models include PSSW120, PSSW225, PSSW350, PSSW450, and PSSW550

- In April 2022, Advanced Energy Industries acquired SL Power Electronics Corporation, a provider of customized power solutions for medical and advanced industrial applications, from Steel Partners Holdings L.P. The acquisition expanded Advanced Energy’s medical power solution offerings through the addition of a complementary portfolio of products and its ability to meet the growing needs of industrial and medical customers

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global medical power supply market?

The global medical power supply market boasts a total revenue value of $1.9 billion by 2027.

What is the estimated growth rate (CAGR) of the global medical power supply market?

The global medical power supply market has an estimated compound annual growth rate (CAGR) of 6.5% and a revenue size in the region of $1.5 billion in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.4 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 1 MEDICAL POWER SUPPLY MARKET: RESEARCH DESIGN METHODOLOGY

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primaries

FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY SIDE AND DEMAND SIDE PARTICIPANTS

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach 1: Company revenue estimation approach

2.2.1.2 Approach 2: Customer-based market estimation

FIGURE 5 BOTTOM-UP APPROACH FOR MARKET SIZE ESTIMATION

2.2.1.3 Growth forecast

2.2.1.4 CAGR projections

FIGURE 6 CAGR PROJECTIONS: SUPPLY SIDE ANALYSIS

2.3 DATA TRIANGULATION APPROACH

FIGURE 7 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS

2.5 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 47)

FIGURE 8 GLOBAL MARKET, BY CONVERTER TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 9 GLOBAL MARKET, BY ARCHITECTURE, 2022 VS. 2027 (USD MILLION)

FIGURE 10 GLOBAL MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 11 APAC TO SHOW HIGHEST GROWTH DURING 2022–2027

4 PREMIUM INSIGHTS (Page No. - 51)

4.1 MEDICAL POWER SUPPLY INDUSTRY OVERVIEW

FIGURE 12 HEALTHCARE INFRASTRUCTURAL DEVELOPMENT INITIATIVES TO DRIVE MARKET GROWTH

4.2 AC-DC MEDICAL POWER SUPPLY INDUSTRY SHARE, BY POWER RANGE, 2022 VS. 2027

FIGURE 13 201W–500W POWER RANGE TO REGISTER SIGNIFICANT GROWTH DUE TO TECHNOLOGICAL ADVANCEMENTS

4.3 APAC MARKET, BY COUNTRY AND ARCHITECTURE

FIGURE 14 JAPAN HOLDS LARGEST SHARE OF APAC MARKET

4.4 NORTH AMERICA MARKET, BY APPLICATION

FIGURE 15 PATIENT MONITORING EQUIPMENT TO ACCOUNT FOR LARGEST MARKET SHARE

4.5 GEOGRAPHICAL SNAPSHOT

FIGURE 16 MARKET IN CHINA TO REGISTER HIGHEST CAGR

5 MARKET OVERVIEW (Page No. - 55)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 MEDICAL POWER SUPPLY INDUSTRY: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increased market penetration of portable and integrated medical devices

5.2.1.2 Growing adoption of home-use healthcare products

5.2.1.3 Increased research spending on energy-efficient power supplies

5.2.1.4 Technology evolution in power supplies and ecosystem

5.2.1.4.1 ZVS circuit

5.2.1.4.2 PC Board Core Transformers

5.2.1.4.3 Digital control and fan-less medical power supplies

5.2.1.4.4 Emergence of gallium nitride-based semiconductors

5.2.2 RESTRAINTS

5.2.2.1 Stringent regulatory compliance and safety standards

5.2.3 OPPORTUNITIES

5.2.3.1 Economic development and increased healthcare expenditure in emerging countries

5.2.3.2 Emerging high-voltage DC power sources

5.2.3.3 Increasing accessibility of products

5.2.4 CHALLENGES

5.2.4.1 Grey market for low-quality products

5.2.4.2 Difficult adaption of device system interface

5.2.4.3 Technical limitations of power supply

5.3 PORTER’S FIVE FORCES ANALYSIS

TABLE 1 GLOBAL MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 DEGREE OF COMPETITION

5.4 REGULATORY ANALYSIS

TABLE 2 KEY REGULATORY BODIES AND GOVERNMENT AGENCIES

5.4.1 KEY REGULATORY GUIDELINES

5.4.1.1 US

5.4.1.2 Europe

5.4.1.3 Japan

5.4.1.4 China

TABLE 3 OTHER REGULATORY COMPLIANCE AND SAFETY STANDARDS

5.5 ECOSYSTEM ANALYSIS

5.6 VALUE CHAIN ANALYSIS

5.6.1 R&D

5.6.2 PROCUREMENT AND PRODUCT DEVELOPMENT

5.6.3 MARKETING, SALES, DISTRIBUTION, AND POST-SALES SERVICES

FIGURE 18 VALUE CHAIN ANALYSIS: MAXIMUM VALUE ADDED DURING MANUFACTURING PHASE

5.7 PATENT ANALYSIS

FIGURE 19 PATENT DETAILS FOR MEDICAL POWER SUPPLIES (JANUARY 2012– JULY 2022)

5.8 TRADE ANALYSIS

TABLE 4 IMPORT DATA FOR POWER SUPPLIES (HS CODE 850431), BY COUNTRY, 2017-2021 (UNITS/TONS)

TABLE 5 EXPORT DATA FOR POWER SUPPLIES (HS CODE 850431), BY COUNTRY, 2017-2021 (UNITS/TONS)

5.9 KEY CONFERENCES AND EVENTS (2022–2024)

TABLE 6 GLOBAL MARKET: DETAILED LIST OF MAJOR CONFERENCES AND EVENTS

5.10 CASE STUDIES

5.10.1 DELIVERY OF ADVANCED POWER SOLUTIONS

TABLE 7 CASE–1: PROVIDE SMALLER MULTI-FUNCTIONAL SYSTEMS WITH MIXED TECHNOLOGIES

5.10.2 COMPACT POWER SUPPLIES

TABLE 8 CASE–2: DESIGN AND DELIVER COMPACT CONTROLLERS AND PANEL METERS

6 MEDICAL POWER SUPPLY MARKET, BY CONVERTER TYPE (Page No. - 76)

6.1 INTRODUCTION

TABLE 9 GLOBAL MARKET, BY CONVERTER TYPE, 2020–2027 (USD MILLION)

6.2 AC-DC POWER SUPPLY

TABLE 10 AC-DC MEDICAL POWER SUPPLY INDUSTRY, BY POWER RANGE, 2020–2027 (USD MILLION)

TABLE 11 MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2.1 MARKET, BY APPLICATION

TABLE 12 MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

6.2.2 MARKET, BY ARCHITECTURE

TABLE 13 MARKET, BY ARCHITECTURE, 2020–2027 (USD MILLION)

6.2.3 MARKET, BY MANUFACTURING TYPE

TABLE 14 MARKET, BY MANUFACTURING TYPE, 2020–2027 (USD MILLION)

6.2.4 200W AND LESS

6.2.4.1 Growing usage of AC-DC power supplies in wearable medical devices to boost demand

TABLE 15 200W AND LESS MEDICAL POWER SUPPLY INDUSTRY, BY REGION, 2020–2027 (USD MILLION)

6.2.4.2 market, by application

TABLE 16 MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

6.2.5 201–500W

6.2.5.1 Technological evolution to boost demand for 201–500W units

TABLE 17 MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2.5.2 market, by application

TABLE 18 201–500W MEDICAL POWER SUPPLY INDUSTRY, BY APPLICATION, 2020–2027 (USD MILLION)

6.2.6 501–1,000W

6.2.6.1 Availability of power units with natural convection cooling operation drives market growth

TABLE 19 MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2.6.2 market, by application

TABLE 20 MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

6.2.7 1,001–3,000W

6.2.7.1 Introduction of high-voltage AC-DC units to drive segment growth

TABLE 21 1,000–3,000W MEDICAL POWER SUPPLY INDUSTRY, BY REGION, 2020–2027 (USD MILLION)

6.2.7.2 market, by application

TABLE 22 MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

6.2.8 3,001W AND ABOVE

6.2.8.1 Emergence of programmable AC-DC power supply for high power ranges to drive segment growth

TABLE 23 MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2.8.2 market, by application

TABLE 24 3,001W AND ABOVE MEDICAL POWER SUPPLY INDUSTRY, BY APPLICATION, 2020–2027 (USD MILLION)

6.3 DC-DC POWER SUPPLY

TABLE 25 MARKET, BY POWER RANGE, 2020–2027 (USD MILLION)

TABLE 26 MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3.1 MARKET, BY APPLICATION

TABLE 27 MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

6.3.2 DC-DC MEDICAL POWER SUPPLY INDUSTRY, BY ARCHITECTURE

TABLE 28 MARKET, BY ARCHITECTURE, 2020–2027 (USD MILLION)

6.3.3 MARKET, BY MANUFACTURING TYPE

TABLE 29 MARKET, BY MANUFACTURING TYPE, 2020–2027 (USD MILLION)

6.3.4 30W AND LESS

6.3.4.1 Growing preference for high-voltage and low-power DC-DC converters to drive segment growth

TABLE 30 MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3.4.2 market, by application

TABLE 31 30W AND LESS MEDICAL POWER SUPPLY INDUSTRY, BY APPLICATION, 2020–2027 (USD MILLION)

6.3.5 31–60W

6.3.5.1 Availability of custom-designed DC power supplies for medical & healthcare devices to drive market growth

TABLE 32 MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3.5.2 market, by application

TABLE 33 3MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

6.3.6 61W AND ABOVE

6.3.6.1 Growing usage of 61W and above power range in mobile medical devices to propel growth

TABLE 34 MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3.6.2 61W and above medical power supply industry, by application

TABLE 35 MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

7 MEDICAL POWER SUPPLY MARKET, BY ARCHITECTURE (Page No. - 96)

7.1 INTRODUCTION

TABLE 36 GLOBAL MARKET, BY ARCHITECTURE, 2020–2027 (USD MILLION)

7.2 ENCLOSED POWER SUPPLY

7.2.1 AVAILABILITY OF ENCLOSED SOLUTIONS FOR VAST POWER AND VOLTAGE SPECTRUM TO DRIVE MARKET GROWTH

TABLE 37 ENCLOSED POWER SUPPLY MARKET, BY REGION, 2020–2027 (USD MILLION)

7.3 OPEN-FRAME POWER SUPPLY

7.3.1 OPEN-FRAME ARCHITECTURE IS USED IN TEMPERATURE-SENSITIVE MEDICAL INSTRUMENTS

TABLE 38 OPEN-FRAME POWER SUPPLY MARKET, BY REGION, 2020–2027 (USD MILLION)

7.4 EXTERNAL POWER SUPPLY

7.4.1 HIGH DEMAND FOR PORTABLE MEDICAL DEVICES TO DRIVE MARKET GROWTH

TABLE 39 EXTERNAL POWER SUPPLY MARKET, BY REGION, 2020–2027 (USD MILLION)

7.5 ENCAPSULATED POWER SUPPLY

7.5.1 DEVELOPMENT OF COMPACT ENCAPSULATED POWER SUPPLIES TO DRIVE SEGMENT GROWTH

TABLE 40 ENCAPSULATED POWER SUPPLY MARKET, BY REGION, 2020–2027 (USD MILLION)

7.6 U-BRACKET POWER SUPPLY

7.6.1 EASE OF INSTALLATION TO DRIVE END-USER DEMAND

TABLE 41 U-BRACKET POWER SUPPLY MARKET, BY REGION, 2020–2027 (USD MILLION)

7.7 CONFIGURABLE POWER SUPPLY

7.7.1 INTRODUCTION OF PROGRAMMABLE POWER UNITS TO INCREASE DEMAND FOR CONFIGURABLE POWER SUPPLY

TABLE 42 CONFIGURABLE POWER SUPPLY MARKET, BY REGION, 2020–2027 (USD MILLION)

8 MEDICAL POWER SUPPLY MARKET, BY APPLICATION (Page No. - 104)

8.1 INTRODUCTION

TABLE 43 GLOBAL MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.2 PATIENT MONITORING EQUIPMENT

TABLE 44 GLOBAL MARKET FOR PATIENT MONITORING EQUIPMENT, BY TYPE, 2020–2027 (USD MILLION)

TABLE 45 GLOBAL MARKET FOR PATIENT MONITORING EQUIPMENT, BY REGION, 2020–2027 (USD MILLION)

8.2.1 ECG MONITORS

8.2.1.1 Low cost and minimal power requirement of ECG devices to drive market growth

TABLE 46 GLOBAL MARKET FOR ECG MONITORS, BY REGION, 2020–2027 (USD MILLION)

8.2.2 MULTIPARAMETER MONITORS

8.2.2.1 Rising production volume of multiparameter monitors to drive market growth

TABLE 47 GLOBAL MARKET FOR MULTIPARAMETER MONITORS, BY REGION, 2020–2027 (USD MILLION)

8.2.3 EEG MONITORS

8.2.3.1 Growing usage of external AC-DC power supplies drives market growth

TABLE 48 GLOBAL MARKET FOR EEG MONITORS, BY REGION, 2020–2027 (USD MILLION)

8.2.4 MEG MONITORS

8.2.4.1 Declining MEG procurement likely to hinder segment growth

TABLE 49 GLOBAL MARKET FOR MEG MONITORS, BY REGION, 2020–2027 (USD MILLION)

8.2.5 OTHER PATIENT MONITORING EQUIPMENT

TABLE 50 GLOBAL MARKET FOR OTHER PATIENT MONITORING EQUIPMENT, BY REGION, 2020–2027 (USD MILLION)

8.3 DIAGNOSTIC IMAGING SYSTEMS

TABLE 51 GLOBAL MARKET FOR DIAGNOSTIC IMAGING SYSTEMS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 52 GLOBAL MARKET FOR DIAGNOSTIC IMAGING SYSTEMS, BY REGION, 2020–2027 (USD MILLION)

8.3.1 MRI SYSTEMS

8.3.1.1 Innovation and advancements in MRI applications support demand for power supply units

TABLE 53 GLOBAL MARKET FOR MRI SYSTEMS, BY REGION, 2020–2027 (USD MILLION)

8.3.2 CT SCANNERS

8.3.2.1 Growing emphasis on maintaining patient safety to drive demand for customized medical-grade power supply units

TABLE 54 GLOBAL MARKET FOR CT SCANNERS, BY REGION, 2020–2027 (USD MILLION)

8.3.3 X-RAY SYSTEMS

8.3.3.1 Availability of refurbished devices drives power supply component adoption in emerging markets

TABLE 55 GLOBAL MARKET FOR X-RAY SYSTEMS, BY REGION, 2020–2027 (USD MILLION)

8.3.4 ULTRASOUND SYSTEMS

8.3.4.1 Increasing demand for small power supply units for por TABLE ultrasound devices to drive market growth

TABLE 56 GLOBAL MARKET FOR ULTRASOUND SYSTEMS, BY REGION, 2020–2027 (USD MILLION)

8.3.5 MAMMOGRAPHY SYSTEMS

8.3.5.1 Mammography systems segment to grow at high CAGR

TABLE 57 GLOBAL MARKET FOR MAMMOGRAPHY SYSTEMS, BY REGION, 2020–2027 (USD MILLION)

8.3.6 PET SYSTEMS

8.3.6.1 High cost of PET and its components hinders market growth

TABLE 58 GLOBAL MARKET FOR PET SYSTEMS, BY REGION, 2020–2027 (USD MILLION)

8.3.7 OTHER DIAGNOSTIC IMAGING SYSTEMS

TABLE 59 GLOBAL MARKET FOR OTHER DIAGNOSTIC IMAGING SYSTEMS, BY REGION, 2020–2027 (USD MILLION)

8.4 HOME USE & WEARABLE EQUIPMENT

8.4.1 THREAT OF PANDEMICS SUCH AS COVID-19 DRIVES DEMAND FOR POWER SUPPLY UNITS FOR HOME MEDICAL EQUIPMENT

TABLE 60 GLOBAL MARKET FOR HOME USE & WEARABLE EQUIPMENT, BY REGION, 2020–2027 (USD MILLION)

8.5 SURGICAL EQUIPMENT

TABLE 61 GLOBAL MARKET FOR SURGICAL EQUIPMENT, BY TYPE, 2020–2027 (USD MILLION)

TABLE 62 GLOBAL MARKET FOR SURGICAL EQUIPMENT, BY REGION, 2020–2027 (USD MILLION)

8.5.1 AESTHETIC LASER SYSTEMS

8.5.1.1 Increasing acceptance of aesthetic procedures to fuel power supply demands

TABLE 63 POWER RANGE FOR AESTHETIC LASER SYSTEMS

TABLE 64 MEDICAL POWER SUPPLY INDUSTRY FOR AESTHETIC LASER SYSTEMS, BY REGION, 2020–2027 (USD MILLION)

8.5.2 OPHTHALMOLOGY LASER DEVICES

8.5.2.1 Implementation of modular DC power supply in ophthalmology laser devices to fuel market growth

TABLE 65 POWER RANGE FOR OPHTHALMIC LASERS

TABLE 66 GLOBAL MARKET FOR OPHTHALMOLOGY LASER DEVICES, BY REGION, 2020–2027 (USD MILLION)

8.5.3 LIGHT & LASER-BASED ABLATION SYSTEMS

8.5.3.1 Rapid regulatory approval process to drive technology adoption and market growth

TABLE 67 GLOBAL MARKET FOR LIGHT & LASER-BASED ABLATION SYSTEMS, BY REGION, 2020–2027 (USD MILLION)

8.5.4 RF-BASED ABLATION SYSTEMS

8.5.4.1 Increased demand for RF ablation to drive market for medical power supplies

TABLE 68 GLOBAL MARKET FOR RF-BASED ABLATION SYSTEMS, BY REGION, 2020–2027 (USD MILLION)

8.5.5 ELECTRIC & ELECTROPORATION ABLATION SYSTEMS

8.5.5.1 High success rate of electric & electroporation power units to drive market growth

TABLE 69 GLOBAL MARKET FOR ELECTRIC & ELECTROPORATION ABLATION SYSTEMS, BY REGION, 2020–2027 (USD MILLION)

8.5.6 OTHER SURGICAL EQUIPMENT

TABLE 70 GLOBAL MARKET FOR OTHER SURGICAL EQUIPMENT, BY REGION, 2020–2027 (USD MILLION)

8.6 DENTAL EQUIPMENT

8.6.1 DEMAND FOR INBUILT POWER UNITS IN DENTAL EQUIPMENT TO DRIVE GROWTH IN THIS MARKET

TABLE 71 GLOBAL MARKET FOR DENTAL EQUIPMENT, BY REGION, 2020–2027 (USD MILLION)

8.7 IMPLANTABLE MEDICAL DEVICES

8.7.1 HIGH COST AND LIMITED APPLICATIONS LIMIT SEGMENT GROWTH

TABLE 72 GLOBAL MARKET FOR IMPLANTABLE MEDICAL DEVICES, BY REGION, 2020–2027 (USD MILLION)

8.8 OTHER MEDICAL DEVICES

TABLE 73 POWER RANGE FOR DIFFERENT ANALYTICAL INSTRUMENTS

TABLE 74 GLOBAL MARKET FOR OTHER MEDICAL DEVICES, BY REGION, 2020–2027 (USD MILLION)

9 MEDICAL POWER SUPPLY MARKET, BY MANUFACTURING TYPE (Page No. - 128)

9.1 INTRODUCTION

TABLE 75 GLOBAL MARKET, BY MANUFACTURING TYPE, 2020–2027 (USD MILLION)

9.2 STANDARD POWER SUPPLY

9.2.1 GROWING NUMBER OF STANDARD POWER SUPPLY VENDORS TO BOOST MARKET GROWTH

TABLE 76 STANDARD POWER SUPPLY MARKET, BY REGION, 2020–2027 (USD MILLION)

9.3 CF RATING POWER SUPPLY

9.3.1 RISING INSTALLATION BASE FOR CARDIAC DEVICES TO BOOST MARKET

TABLE 77 CF RATING POWER SUPPLY MARKET, BY REGION, 2020–2027 (USD MILLION)

9.4 CUSTOMIZED POWER SUPPLY

9.4.1 DEMAND FOR CUSTOM SUPPLIES HAS RISEN IN RECENT YEARS

TABLE 78 CUSTOMIZED POWER SUPPLY MARKET, BY REGION, 2020–2027 (USD MILLION)

10 MEDICAL POWER SUPPLY MARKET, BY REGION (Page No. - 132)

10.1 INTRODUCTION

TABLE 79 GLOBAL MARKET, BY REGION, 2020–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 20 NORTH AMERICA: MEDICAL POWER SUPPLY INDUSTRY SNAPSHOT

TABLE 80 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET, BY CONVERTER TYPE, 2020–2027 (USD MILLION)

TABLE 82 NORTH AMERICA: AC-DC MARKET, BY POWER RANGE, 2020–2027 (USD MILLION)

TABLE 83 NORTH AMERICA: DC-DC MARKET, BY POWER RANGE, 2020–2027 (USD MILLION)

TABLE 84 NORTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 85 NORTH AMERICA: MARKET FOR SURGICAL EQUIPMENT, BY TYPE, 2020–2027 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET FOR DIAGNOSTIC IMAGING SYSTEMS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET FOR PATIENT MONITORING EQUIPMENT, BY TYPE, 2020–2027 (USD MILLION)

TABLE 88 NORTH AMERICA: MARKET, BY ARCHITECTURE, 2020–2027 (USD MILLION)

TABLE 89 NORTH AMERICA: MARKET, BY MANUFACTURING TYPE, 2020–2027 (USD MILLION)

10.2.1 US

10.2.1.1 Expansion and advancement in medical equipment industry to drive market growth

TABLE 90 US: MARKET, BY CONVERTER TYPE, 2020–2027 (USD MILLION)

TABLE 91 US: AC-DC MARKET, BY POWER RANGE, 2020–2027 (USD MILLION)

TABLE 92 US: DC-DC MARKET, BY POWER RANGE, 2020–2027 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Rising installation of medical devices to drive Canadian market

TABLE 93 CANADA: MARKET, BY CONVERTER TYPE, 2020–2027 (USD MILLION)

TABLE 94 CANADA: MARKET, BY POWER RANGE, 2020–2027 (USD MILLION)

TABLE 95 CANADA: MARKET, BY POWER RANGE, 2020–2027 (USD MILLION)

10.3 ASIA PACIFIC

FIGURE 21 ASIA PACIFIC: MEDICAL POWER SUPPLY MARKET SNAPSHOT

TABLE 96 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 97 ASIA PACIFIC: MARKET, BY CONVERTER TYPE, 2020–2027 (USD MILLION)

TABLE 98 ASIA PACIFIC: AC-DC MARKET, BY POWER RANGE, 2020–2027 (USD MILLION)

TABLE 99 ASIA PACIFIC: DC-DC MARKET, BY POWER RANGE, 2020–2027 (USD MILLION)

TABLE 100 ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 101 ASIA PACIFIC: MARKET, FOR SURGICAL EQUIPMENT, BY TYPE, 2020–2027 (USD MILLION)

TABLE 102 ASIA PACIFIC: MARKET, FOR DIAGNOSTIC IMAGING SYSTEMS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 103 ASIA PACIFIC: MARKET, FOR PATIENT MONITORING EQUIPMENT, BY TYPE, 2020–2027 (USD MILLION)

TABLE 104 ASIA PACIFIC: MARKET, BY ARCHITECTURE, 2020–2027 (USD MILLION)

TABLE 105 ASIA PACIFIC: MARKET, BY MANUFACTURING TYPE, 2020–2027 (USD MILLION)

10.3.1 JAPAN

10.3.1.1 Japan dominates APAC medical power supply industry

TABLE 106 JAPAN: MARKET, BY CONVERTER TYPE, 2020–2027 (USD MILLION)

TABLE 107 JAPAN: AC-DC MARKET, BY POWER RANGE, 2020–2027 (USD MILLION)

TABLE 108 JAPAN: DC-DC MARKET, BY POWER RANGE, 2020–2027 (USD MILLION)

10.3.2 CHINA

10.3.2.1 Stringent regulations for high-pollution sectors to drive market growth

TABLE 109 CHINA: MARKET, BY CONVERTER TYPE, 2020–2027 (USD MILLION)

TABLE 110 CHINA: AC-DC MARKET, BY POWER RANGE, 2020–2027 (USD MILLION)

TABLE 111 CHINA: DC-DC MARKET, BY POWER RANGE, 2020–2027 (USD MILLION)

10.3.3 INDIA

10.3.3.1 Government initiatives and increased manufacturing activity in healthcare sector to drive market

TABLE 112 INDIA: MARKET, BY CONVERTER TYPE, 2020–2027 (USD MILLION)

TABLE 113 INDIA: AC-DC MARKET, BY POWER RANGE, 2020–2027 (USD MILLION)

TABLE 114 INDIA: DC-DC MARKET, BY POWER RANGE, 2020–2027 (USD MILLION)

10.3.4 SOUTH KOREA

10.3.4.1 Increasing production of medical devices by local manufacturers to fuel market

TABLE 115 SOUTH KOREA: MARKET, BY CONVERTER TYPE, 2020–2027 (USD MILLION)

TABLE 116 SOUTH KOREA: MARKET, BY POWER RANGE, 2020–2027 (USD MILLION)

TABLE 117 SOUTH KOREA: MARKET, BY POWER RANGE, 2020–2027 (USD MILLION)

10.3.5 AUSTRALIA

10.3.5.1 Australia witnessing rising demand for power supplies in medical laboratories

TABLE 118 AUSTRALIA: MARKET, BY CONVERTER TYPE, 2020–2027 (USD MILLION)

TABLE 119 AUSTRALIA: MARKET, BY POWER RANGE, 2020–2027 (USD MILLION)

TABLE 120 AUSTRALIA: MARKET, BY POWER RANGE, 2020–2027 (USD MILLION)

10.3.6 REST OF ASIA PACIFIC

TABLE 121 ROAPAC: MARKET, BY CONVERTER TYPE, 2020–2027 (USD MILLION)

TABLE 122 ROAPAC: MARKET, BY POWER RANGE, 2020–2027 (USD MILLION)

TABLE 123 ROAPAC: MARKET, BY POWER RANGE, 2020–2027 (USD MILLION)

10.4 EUROPE

TABLE 124 EUROPE: MEDICAL POWER SUPPLY MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 125 EUROPE: MARKET, BY CONVERTER TYPE, 2020–2027 (USD MILLION)

TABLE 126 EUROPE: AC-DC MARKET, BY POWER RANGE, 2020–2027 (USD MILLION)

TABLE 127 EUROPE: DC-DC MARKET, BY POWER RANGE, 2020–2027 (USD MILLION)

TABLE 128 EUROPE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 129 EUROPE: MARKET FOR SURGICAL EQUIPMENT, BY TYPE, 2020–2027 (USD MILLION)

TABLE 130 EUROPE: MARKET FOR DIAGNOSTIC IMAGING SYSTEMS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 131 EUROPE: MARKET FOR PATIENT MONITORING EQUIPMENT, BY TYPE, 2020–2027 (USD MILLION)

TABLE 132 EUROPE: MARKET, BY ARCHITECTURE, 2020–2027 (USD MILLION)

TABLE 133 EUROPE: MARKET, BY MANUFACTURING TYPE, 2020–2027 (USD MILLION)

10.4.1 GERMANY

10.4.1.1 Germany dominates European medical power supply industry

TABLE 134 GERMANY: MARKET, BY CONVERTER TYPE, 2020–2027 (USD MILLION)

TABLE 135 GERMANY: MARKET, BY POWER RANGE, 2020–2027 (USD MILLION)

TABLE 136 GERMANY: MARKET, BY POWER RANGE, 2020–2027 (USD MILLION)

10.4.2 UK

10.4.2.1 Expansion of power supply vendors driving market growth

TABLE 137 UK: MARKET, BY CONVERTER TYPE, 2020–2027 (USD MILLION)

TABLE 138 UK: MARKET, BY POWER RANGE, 2020–2027 (USD MILLION)

TABLE 139 UK: MARKET, BY POWER RANGE, 2020–2027 (USD MILLION)

10.4.3 FRANCE

10.4.3.1 Growing demand for medical power supplies to boost market growth

TABLE 140 FRANCE: MARKET, BY CONVERTER TYPE, 2020–2027 (USD MILLION)

TABLE 141 FRANCE: MARKET, BY POWER RANGE, 2020–2027 (USD MILLION)

TABLE 142 FRANCE: MARKET, BY POWER RANGE, 2020–2027 (USD MILLION)

10.4.4 ITALY

10.4.4.1 Increasing government investments in medical devices contribute to market growth

TABLE 143 ITALY: MARKET, BY CONVERTER TYPE, 2020–2027 (USD MILLION)

TABLE 144 ITALY: MARKET, BY POWER RANGE, 2020–2027 (USD MILLION)

TABLE 145 ITALY: MARKET, BY POWER RANGE, 2020–2027 (USD MILLION)

10.4.5 SPAIN

10.4.5.1 Focus on early disease diagnostics supports medical device adoption in Spain

TABLE 146 SPAIN: MARKET, BY CONVERTER TYPE, 2020–2027 (USD MILLION)

TABLE 147 SPAIN: MARKET, BY POWER RANGE, 2020–2027 (USD MILLION)

TABLE 148 SPAIN: MARKET, BY POWER RANGE, 2020–2027 (USD MILLION)

10.4.6 REST OF EUROPE

TABLE 149 ROE: MARKET, BY CONVERTER TYPE, 2020–2027 (USD MILLION)

TABLE 150 ROE: AC-DC MARKET, BY POWER RANGE, 2020–2027 (USD MILLION)

TABLE 151 ROE: DC-DC MARKET, BY POWER RANGE, 2020–2027 (USD MILLION)

10.5 LATIN AMERICA

TABLE 152 LATIN AMERICA: MEDICAL POWER SUPPLY MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 153 LATIN AMERICA: MARKET, BY CONVERTER TYPE, 2020–2027 (USD MILLION)

TABLE 154 LATIN AMERICA: AC-DC MARKET, BY POWER RANGE, 2020–2027 (USD MILLION)

TABLE 155 LATIN AMERICA: DC-DC MARKET, BY POWER RANGE, 2020–2027 (USD MILLION)

TABLE 156 LATIN AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 157 LATIN AMERICA: MARKET FOR SURGICAL EQUIPMENT, BY TYPE, 2020–2027 (USD MILLION)

TABLE 158 LATIN AMERICA: MARKET FOR DIAGNOSTIC IMAGING SYSTEMS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 159 LATIN AMERICA: AL POWER SUPPLY MARKET FOR PATIENT MONITORING EQUIPMENT, BY TYPE, 2020–2027 (USD MILLION)

TABLE 160 LATIN AMERICA: MARKET, BY ARCHITECTURE, 2020–2027 (USD MILLION)

TABLE 161 LATIN AMERICA: MARKET, BY MANUFACTURING TYPE, 2020–2027 (USD MILLION)

10.5.1 BRAZIL

10.5.1.1 Stringent regulations to monitor medical & healthcare devices likely to drive market growth

TABLE 162 BRAZIL: MARKET, BY CONVERTER TYPE, 2020–2027 (USD MILLION)

TABLE 163 BRAZIL: AC-DC MARKET, BY POWER RANGE, 2020–2027 (USD MILLION)

TABLE 164 BRAZIL: DC-DC MARKET, BY POWER RANGE, 2020–2027 (USD MILLION)

10.5.2 MEXICO

10.5.2.1 Increasing expenditure on healthcare to fuel market growth

TABLE 165 MEXICO: MARKET, BY CONVERTER TYPE, 2020–2027 (USD MILLION)

TABLE 166 MEXICO: AC-DC MARKET, BY POWER RANGE, 2020–2027 (USD MILLION)

TABLE 167 MEXICO: DC-DC MARKET, BY POWER RANGE, 2020–2027 (USD MILLION)

10.5.3 REST OF LATIN AMERICA

TABLE 168 ROLATAM: MARKET, BY CONVERTER TYPE, 2020–2027 (USD MILLION)

TABLE 169 ROLATAM: AC-DC MARKET, BY POWER RANGE, 2020–2027 (USD MILLION)

TABLE 170 ROLATAM: DC-DC MARKET, BY POWER RANGE, 2020–2027 (USD MILLION)

10.6 MIDDLE EAST & AFRICA

10.6.1 INFRASTRUCTURAL IMPROVEMENTS, GROWING INVESTMENTS IN HEALTHCARE SUPPORT MARKET GROWTH

TABLE 171 MEA: MEDICAL POWER SUPPLY MARKET, BY CONVERTER TYPE, 2020–2027 (USD MILLION)

TABLE 172 MEA: AC-DC MARKET, BY POWER RANGE, 2020–2027 (USD MILLION)

TABLE 173 MEA: DC-DC MARKET, BY POWER RANGE, 2020–2027 (USD MILLION)

TABLE 174 MEA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 175 MEA: MARKET FOR SURGICAL EQUIPMENT, BY TYPE, 2020–2027 (USD MILLION)

TABLE 176 MEA: MARKET FOR DIAGNOSTIC IMAGING SYSTEMS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 177 MEA: MARKET FOR PATIENT MONITORING EQUIPMENT, BY TYPE, 2020–2027 (USD MILLION)

TABLE 178 MEA: MARKET, BY ARCHITECTURE, 2020–2027 (USD MILLION)

TABLE 179 MEA: MARKET, BY MANUFACTURING TYPE, 2020–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 186)

11.1 OVERVIEW

11.2 KEY PLAYER STRATEGIES

11.3 REVENUE SHARE ANALYSIS

FIGURE 22 REVENUE SHARE ANALYSIS OF TOP FIVE PLAYERS IN MEDICAL POWER SUPPLY MARKET (2019-2021)

11.4 MARKET SHARE ANALYSIS

FIGURE 23 GLOBAL MARKET SHARE BY KEY PLAYER, 2021

TABLE 180 GLOBAL MARKET: DEGREE OF COMPETITION

11.5 COMPANY EVALUATION QUADRANT FOR MAJOR PLAYERS (2021)

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE PLAYERS

11.5.4 PARTICIPANTS

FIGURE 24 GLOBAL MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

11.6 COMPANY EVALUATION QUADRANT FOR START-UPS/SMES (2021)

11.6.1 PROGRESSIVE COMPANIES

11.6.2 RESPONSIVE COMPANIES

11.6.3 DYNAMIC COMPANIES

11.6.4 STARTING BLOCKS

FIGURE 25 GLOBAL MARKET: COMPETITIVE LEADERSHIP MAPPING (SMES/START-UPS)

11.7 COMPETITIVE BENCHMARKING

TABLE 181 OVERALL FOOTPRINT ANALYSIS

TABLE 182 PRODUCT FOOTPRINT ANALYSIS

TABLE 183 REGIONAL FOOTPRINT ANALYSIS

11.8 COMPETITIVE SCENARIO

11.8.1 PRODUCT LAUNCHES AND APPROVALS

11.8.2 DEALS

11.8.3 OTHER DEVELOPMENTS

12 COMPANY PROFILES (Page No. - 200)

12.1 MAJOR PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

12.1.1 ADVANCED ENERGY INDUSTRIES

TABLE 184 ADVANCED ENERGY INDUSTRIES: COMPANY OVERVIEW

FIGURE 26 ADVANCED ENERGY INDUSTRIES: COMPANY SNAPSHOT (2021)

12.1.2 TDK-LAMBDA CORPORATION

TABLE 185 TDK CORPORATION: COMPANY OVERVIEW

FIGURE 27 TDK CORPORATION: COMPANY SNAPSHOT (2021)

12.1.3 DELTA ELECTRONICS INC.

TABLE 186 DELTA ELECTRONICS: COMPANY OVERVIEW

FIGURE 28 DELTA ELECTRONICS: COMPANY SNAPSHOT (2021)

12.1.3.2 Products/services/solutions offered

12.1.4 SL POWER ELECTRONICS

TABLE 187 SL POWER ELECTRONICS: COMPANY OVERVIEW

12.1.5 XP POWER

TABLE 188 XP POWER: COMPANY OVERVIEW

FIGURE 29 XP POWER: COMPANY SNAPSHOT (2021)

12.1.6 BEL FUSE

TABLE 189 BEL FUSE: COMPANY OVERVIEW

FIGURE 30 BEL FUSE: COMPANY SNAPSHOT (2021)

12.2 OTHER PLAYERS

12.2.1 COSEL CO. LTD.

TABLE 190 COSEL CO. LTD.: COMPANY OVERVIEW

FIGURE 31 COSEL CO. LTD.: COMPANY SNAPSHOT (2021)

12.2.2 FRIWO GERÄTEBAU GMBH

TABLE 191 FRIWO GERÄTEBAU GMBH: COMPANY OVERVIEW

FIGURE 32 FRIWO GROUP: COMPANY SNAPSHOT (2021)

12.2.3 SYNQOR

TABLE 192 SYNQOR: COMPANY OVERVIEW

12.2.4 GLOBTEK, INC.

TABLE 193 GLOBTEK INC.: COMPANY OVERVIEW

12.2.5 MEAN WELL ENTERPRISES

TABLE 194 MEAN WELL ENTERPRISES: COMPANY OVERVIEW

12.2.6 SPELLMAN HIGH VOLTAGE ELECTRONICS CORPORATION

TABLE 195 SPELLMAN HIGH VOLTAGE ELECTRONICS CORPORATION: COMPANY OVERVIEW

12.2.7 ASTRODYNE TDI

TABLE 196 ASTRODYNE TDI: COMPANY OVERVIEW

12.2.8 INVENTUS POWER

TABLE 197 INVENTUS POWER: COMPANY OVERVIEW

12.2.9 WALL INDUSTRIES INC.

12.2.10 OTHER COMPANIES

12.2.10.1 Traco Electronic AG

12.2.10.2 Cincon Electronics

12.2.10.3 FSP Group

12.2.10.4 Murata Manufacturing Co., Ltd.

12.2.10.5 RECOM Power GmbH

12.2.10.6 FranMar International Inc.

12.2.10.7 HDP Power (SEACOMP)

12.2.10.8 TRI-MAG, LLC

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 284)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATION OPTIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

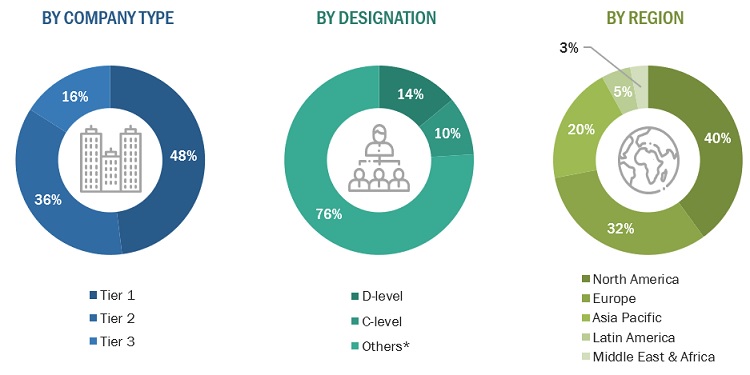

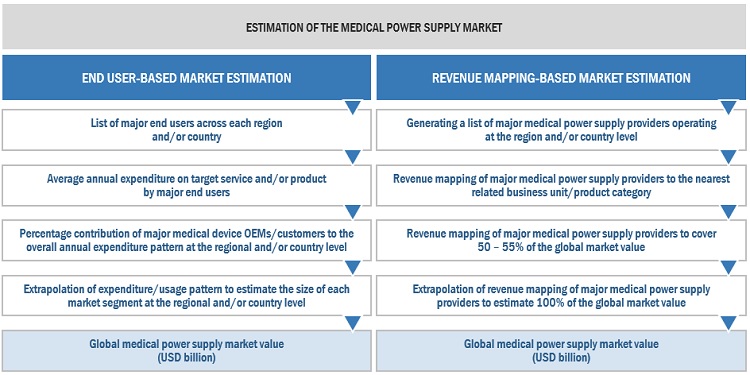

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the medical power supply market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations in the medical power supply market. The primary sources from the demand side include medical OEMs, Analytical instrument OEMs, CDMOs and service providers, among others. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends & key market dynamics.

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note: Companies are classified into tiers based on their total revenue. As of 2019, Tier 1 = >USD 1,000 million, Tier 2 = USD 500–1,000 million, and Tier 3 =

To know about the assumptions considered for the study, download the pdf brochure

Market Estimation Methodology

In this report, the global medical power supply market's size was arrived at by using the revenue share analysis of leading players. For this purpose, key players in the market were identified, and their revenues from the medical power supply business were determined through various insights gathered during the primary and secondary research phases. Secondary research included the study of the annual and financial reports of the top market players. In contrast, primary research included extensive interviews with key opinion leaders, such as CEOs, directors, and key marketing executives.

To calculate the global market value, segmental revenues were calculated based on the revenue mapping of major solution/service providers. This process involved the following steps:

- Generating a list of major global players operating in the medical power supply market

- Mapping annual revenues generated by major global players from the medical power supply segment (or nearest reported business unit/product category)

- Revenue mapping of major players to cover major share of the global market share, as of 2021

- Extrapolating the global value of the medical power supply industry

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the global medical power supply market was split into segments and subsegments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the medical power supply market was validated using both top-down and bottom-up approaches.

Objectives of the Study

- To define, describe, and forecast the Medical Power Supply market on the basis of converter type, application, architecture, manufacturing type, and region

- To provide detailed information regarding the major factors influencing the growth potential of the global Medical Power Supply market (drivers, restraints, opportunities, challenges, and trends)

- To analyze the micromarkets with respect to individual growth trends, future prospects, and contributions to the global Medical Power Supply market

- To analyze key growth opportunities in the global Medical Power Supply market for key stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of market segments and/or subsegments with respect to five major regions, namely, North America (US and Canada), Europe (Germany, France, the UK, Italy, Spain, and the RoE), Asia Pacific (Japan, China, India, and the RoAPAC), Latin America (Brazil, Mexico, and RoLATAM), and the Middle East & Africa

- To profile the key players in the global Medical Power Supply market and comprehensively analyze their market shares and core competencies

- To track and analyze the competitive developments undertaken in the global Medical Power Supply market, such as product launches; agreements; expansions; and mergers & acquisitions

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the present global medical power supply market report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top five companies

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the Rest of Europe medical power supply market into Belgium, Austria, the Czech Republic, Denmark, Greece, Poland, and Russia, among other

- Further breakdown of the Rest of Asia Pacific medical power supply market into New Zealand, Vietnam, the Philippines, Singapore, Malaysia, Thailand, and Indonesia among other

- Further breakdown of the Latin American medical power supply market into Argentina, Chile, Peru, and Colombia, among other

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Medical Power Supply Market

The report is very interesting, I want to know more about Medical Power Supply Market - Growth, Trends and Forecasts (2022 - 2027)

In what way COVID19 is Impacting the global growth of the Medical Power Supply Market?

Can you enlighten us about the key players operating in the global Medical Power Supply Market?