Medical Refrigerators Market by Type, End Use (Blood Banks, Pharmaceutical Companies, Hospital & Pharmacies, Research Institutes, Medical Laboratories, Diagnostic Centre), & Region(North America, Europe, APAC, MEA, South America) - Global Forecast to 2026

Updated on : August 25, 2025

Medical Refrigerators Market

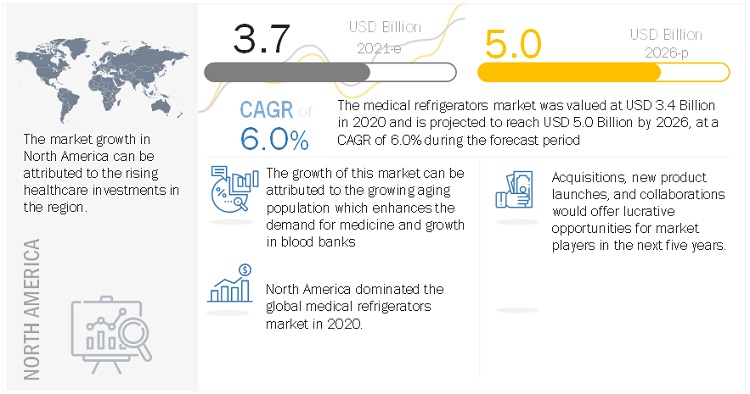

The global medical refrigerators market was valued at USD 3.7 billion in 2021 and is projected to reach USD 5.0 billion by 2026, growing at 6.0% cagr from 2021 to 2026. Medical refrigerators are used by medical experts in hospitals, clinics, surgery centers, research laboratories, pharmacies, and other medical facilities.

Global Medical Refrigerators Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the global medical refrigerators market

The pandemic is estimated to have an impact on various factors of the value chain of the medical refrigerators market, which is expected to reflect during the forecast period, especially in the year 2020. The impact of COVID-19 is as follows:

The pandemic has led to a significant increase in the demand for medical refrigerators. Most hospitals/healthcare facilities are currently trying to expand patient monitoring to home care settings or other temporary setups to provide optimal care.

COVID-19 has led to a significant surge in demand for medical equipment such as medical refrigerators, both in the hospital and home care settings. Manufacturers are increasingly focusing on expanding their portfolios to meet the increasing need for these devices. During the first quarter of 2020, the market witnessed an increase in demand for medical refrigerators in response to COVID-19. However, the demand and adoption of medical refrigerators have been constant throughout the year, and the trend has continued well in the first half of 2021.

Medical Refrigerators Market Dynamics

Driver: Increasing demand for blood storage centers and blood banks

The rising number of surgeries, coupled with the increasing prevalence of disorders including anemia and cancer, is resulting in an increase in blood transfusion procedures. It is critical to maintain optimal temperature and hygiene during the storage and transportation of blood as well as blood components. The American National Red Cross estimates that nearly 16 million blood components are transfused each year in the US. With the increase in the demand for blood transfusions, there is an unmet need for blood storage centers and blood banks, which, in turn, is driving the growth of the medical refrigerators and freezers market.

Opportunity: Increasing research & development investments in medical science by government organizations

According to the American Association for the Advancement of Science (AAAS), US investment in medical and health research and development (R&D) increased by 6.4% from 2017 to 2018; it reached USD 194.2 billion in 2018. The Australian government’s National Health and Medical Research Council (NHMRC) has a yearly budget of USD 900 million for medical research. The increase in focus towards providing better medical services to people across the globe has resulted in developed economies, health organizations, and philanthropists investing heavily in R&D activities, providing various opportunities in the market.

Challenge: High cost of equipment

Medical refrigerators are designed to store biomedical samples at low temperatures and are used in hospitals, blood banks, research institutes, and by the biological pharmaceutical industry. The cost of medical refrigerators is very high. In addition, medical experts and physicians are required to operate these freezers. Both these factors make refrigerators & freezers expensive equipment. Therefore, the consumption of such refrigerators among pharmacies, clinics, and small hospitals is almost negligible.

By product type, ultra-low-temperature freezers segment is expected to grow at a faster rate during 2021-2026, by volume

Ultra-low-temperature freezers segment is expected to grow at a faster rate during the forecast period. Ultra-low temperature freezers are used for long-term storage in laboratories, universities, hospitals, or scientific research facilities. Advancements in drug discovery and development and increasing genomics research activities are expected to be the major drivers for the ultra-low temperature freezers market.

By end use, blood banks segment is expected to grow at a faster rate during 2021-2026, by volume

The blood banks segment is expected to grow at a faster rate during the forecast period. Blood banks is a place where blood or blood plasma is collected, stored, and processed for storage under refrigeration for future use in blood transfusion procedures. Increased demand for safe blood due to high prevalence of blood transfusion cases is driving the demand.

By region, Middle East & Africa is expected to grow at a faster rate during 2021-2026, by volume

Middle East & Africa is expected to grow at a faster rate during the forecast period. The Middle East & Africa represents a relatively smaller market for medical refrigerators as compared to other geographic regions. However, due to expectations of significant growth in the pharmaceutical market in the region, the overall outlook is promising. Factors, such as the increasing aging population, growing awareness of healthcare, increasing prevalence of chronic diseases, and increase in discretionary incomes have increased the demand for healthcare services in this region.

To know about the assumptions considered for the study, download the pdf brochure

Medical Refrigerators Market Players

The key market players include Thermo Fisher Scientific Inc. (US), Blue Star Limited (India), Haier Biomedical (China), Aucma (China), Standex International Corporation (US), Godrej & Boyce Manufacturing Co Ltd. (India), Helmer Scientific Inc. (US), Vestfrost Solutions (Denmark), Zhongke Meiling Cryogenics Company Limited (China), Fiochetti (Italy), PHC Holdings Corporation (Japan), Follett LLC (US), Labcold (UK), Dulas Ltd. (UK), HMG India (India). These players have adopted product launches, expansions, contract, partnerships, and agreements as their growth strategies.

Medical Refrigerators Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 3.7 billion |

|

Revenue Forecast in 2026 |

USD 5.0 billion |

|

CAGR |

6.0% |

|

Market Size Available for Years |

2019–2026 |

|

Base Year Considered |

2020 |

|

Forecast Period |

2021–2026 |

|

Forecast Units |

Value (USD Million) |

|

Segments Covered |

Product Type, End Use, and Region |

|

Geographies Covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies Covered |

Thermo Fisher Scientific Inc. (US), Blue Star Limited (India), Haier Biomedical (China), Aucma (China), Standex International Corporation (US), Godrej & Boyce Manufacturing Co Ltd. (India), Helmer Scientific Inc. (US), Vestfrost Solutions (Denmark), Zhongke Meiling Cryogenics Company Limited (China), Fiochetti (Italy), PHC Holdings Corporation (Japan), Follett LLC (US), Labcold (UK), Dulas Ltd. (UK), and HMG India (India), Felix Storch, Inc. (US), Migali (US), So-Low Environmental Equipment Co. (US), TempArmour Refrigeration (Canada), Indrel Scientific (Brazil), Carelab Technology (India), Tritec (Germany), Bioline Technologies (India), Philipp Krisch GMBH (Germany), and LEC Medical (England) (Total of 25 companies) |

This research report categorizes the medical refrigerators market based on product type, end use, and region.

Based on Product Type, the medical refrigerators market has been segmented as follows:

- Blood Bank Refrigerator & Plasma Freezer

- Laboratory Refrigerator & Freezer

- Pharmacy Refrigerator & Freezer

- Chromatography Refrigerator & Freezer

- Enzyme Refrigerator & Freezer

- Ultra-Low-Temperature freezers

- Cryogenic Storage Systems

Based on End Use the medical refrigerators market has been segmented as follows:

- Blood Banks

- Pharmaceutical Companies

- Hospital & Pharmacies

- Research Institutes

- Medical Labroratories

- Diagnostic Centre

Based on Region, the medical refrigerators market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Recent Developments

- In July 2018, Thermo Fisher Scientific developed a new series of TSG compact refrigerators to meet the needs of clinical laboratories and patient care facilities for cold storage equipment.

- In August 2019, Helmer Scientific launched professional medical refrigerators with OptiCool cooling technology in its GX Solution Refrigerator line.

Frequently Asked Questions (FAQ):

What is the current size of the global medical refrigerators market?

The global medical refrigerators market is projected to grow from USD 3.7 billion in 2021 to reach USD 5.0 billion by 2026, at a CAGR of 6.0% during the forecast period

Who are the leading players in the global medical refrigerators market?

The leading companies in the medical refrigerators market include Thermo Fisher Scientific Inc. (US), Blue Star Limited (India), Haier Biomedical (China), Aucma (China), Standex International Corporation (US), Godrej & Boyce Manufacturing Co Ltd. (India), Helmer Scientific Inc. (US), Vestfrost Solutions (Denmark), Zhongke Meiling Cryogenics Company Limited (China), Fiochetti (Italy), PHC Holdings Corporation (Japan), Follett LLC (US), Labcold (UK), Dulas Ltd. (UK), HMG India (India). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 36)

1.1 OBJECTIVES OF STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.4 INCLUSIONS & EXCLUSIONS

1.4.1 MEDICAL REFRIGERATORS MARKET, BY REGION: INCLUSIONS & EXCLUSIONS

1.5 YEARS CONSIDERED FOR STUDY

1.6 CURRENCY

1.7 UNIT CONSIDERED

1.8 LIMITATIONS

1.9 STAKEHOLDERS

1.1 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 41)

2.1 RESEARCH DATA

FIGURE 1 MEDICAL REFRIGERATORS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary interviews

2.2 MATRIX CONSIDERED FOR DEMAND-SIDE

FIGURE 2 MAIN MATRIX CONSIDERED WHILE CONSTRUCTING AND ASSESSING DEMAND FOR MEDICAL REFRIGERATORS

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 5 METHODOLOGY FOR SUPPLY-SIDE SIZING OF MEDICAL REFRIGERATORS MARKET

FIGURE 6 METHODOLOGY FOR SUPPLY-SIDE SIZING OF MEDICAL REFRIGERATORS MARKET (2/2)

2.3.2.1 Calculations for supply-side analysis

2.3.3 FORECAST

2.4 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

2.5 DATA TRIANGULATION

FIGURE 7 MEDICAL REFRIGERATORS MARKET: DATA TRIANGULATION

2.5.1 KEY ASSUMPTIONS WHILE CALCULATING DEMAND-SIDE MARKET SIZE

2.5.2 LIMITATIONS

2.5.3 RISK ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 49)

TABLE 1 MEDICAL REFRIGERATORS MARKET

FIGURE 8 BLOOD BANK REFRIGERATORS & PLASMA FREEZERS SEGMENT TO LEAD MEDICAL REFRIGERATORS MARKET

FIGURE 9 BLOOD BANKS SEGMENT TO LEAD MEDICAL REFRIGERATORS MARKET DURING FORECAST PERIOD

FIGURE 10 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF MEDICAL REFRIGERATORS MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 53)

4.1 ATTRACTIVE OPPORTUNITIES IN MEDICAL REFRIGERATORS MARKET

FIGURE 11 MEDICAL REFRIGERATORS MARKET TO WITNESS MODERATE GROWTH DURING FORECAST PERIOD

4.2 MEDICAL REFRIGERATORS MARKET, BY REGION

FIGURE 12 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE IN MEDICAL REFRIGERATORS MARKET DURING FORECAST PERIOD

4.3 MEDICAL REFRIGERATORS MARKET, BY PRODUCT TYPE

FIGURE 13 LABORATORY REFRIGERATORS TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

4.4 MEDICAL REFRIGERATORS MARKET, BY END USER

FIGURE 14 BLOOD BANKS TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 55)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing demand for blood storage centers and blood banks

5.2.1.2 Technological advancements in medical refrigerators

5.2.1.3 Positive impact of COVID-19

FIGURE 16 IMPACT OF DRIVERS ON MEDICAL REFRIGERATORS MARKET

5.2.2 RESTRAINTS

5.2.2.1 Use of refurbished devices

FIGURE 17 IMPACT OF RESTRAINTS ON MEDICAL REFRIGERATORS MARKET

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing research & development investments in medical science by government organizations

5.2.3.2 High life expectancy

FIGURE 18 IMPACT OF OPPORTUNITIES ON MEDICAL REFRIGERATORS MARKET

5.2.4 CHALLENGES

5.2.4.1 High cost of equipment

5.2.4.2 Lack of awareness about medical equipment

FIGURE 19 IMPACT OF CHALLENGES ON MEDICAL REFRIGERATORS MARKET

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 20 PORTER’S FIVE FORCES ANALYSIS OF MEDICAL REFRIGERATORS MARKET

TABLE 2 MEDICAL REFRIGERATORS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 BARGAINING POWER OF SUPPLIERS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 VALUE CHAIN ANALYSIS

FIGURE 21 MEDICAL REFRIGERATORS: VALUE CHAIN ANALYSIS

5.5 ECOSYSTEM

FIGURE 22 MEDICAL REFRIGERATORS ECOSYSTEM

TABLE 3 MEDICAL REFRIGERATORS MARKET: ECOSYSTEM/MARKET MAP

5.6 TRADE DATA

TABLE 4 IMPORT DATA OF REFRIGERATORS, FREEZERS, AND OTHER REFRIGERATING OR FREEZING EQUIPMENT

TABLE 5 EXPORT DATA OF REFRIGERATORS, FREEZERS, AND OTHER REFRIGERATING OR FREEZING EQUIPMENT

5.7 TECHNOLOGY ANALYSIS

5.8 POLICIES AND REGULATIONS

5.8.1 EUROPE

5.8.1.1 EU F-Gas regulations

5.8.1.2 Montreal protocol

5.8.1.3 Denmark

5.8.1.4 Austria

5.8.2 NORTH AMERICA

5.8.2.1 Significant New Alternative Policy (SNAP) by EPA

5.8.3 ASIA PACIFIC

5.8.3.1 Japan: Revised F-Gas law

5.8.3.2 China - FECO: First Catalogue of Recommended Substitutes for HCFCs

5.9 CASE STUDY ANALYSIS

5.10 PRICE ANALYSIS

FIGURE 23 ASIA PACIFIC PRICE ANALYSIS, BY PRODUCT TYPE, 2020 AND 2026

FIGURE 24 EUROPE PRICE ANALYSIS, BY PRODUCT TYPE, 2020 AND 2026

FIGURE 25 NORTH AMERICA: PRICE ANALYSIS, BY PRODUCT TYPE, 2020 AND 2026

FIGURE 26 REST OF THE WORLD: PRICE ANALYSIS, BY PRODUCT TYPE, 2020 AND 2026

6 MEDICAL REFRIGERATORS PATENT ANALYSIS (Page No. - 70)

6.1 INTRODUCTION

6.2 METHODOLOGY

6.3 DOCUMENT TYPE

FIGURE 27 NUMBER OF GRANTED PATENTS, PATENT APPLICATIONS, AND LIMITED PATENTS

FIGURE 28 PUBLICATION TRENDS - LAST 10 YEARS

6.4 INSIGHT

FIGURE 29 LEGAL STATUS OF PATENTS

6.4.1 JURISDICTION ANALYSIS

FIGURE 30 TOP JURISDICTION, BY DOCUMENT

6.4.2 TOP COMPANIES/APPLICANTS

FIGURE 31 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

TABLE 6 LIST OF PATENTS BY WESTPORT POWER INC.

TABLE 7 LIST OF PATENTS BY BROOKS AUTOMATION INC.

TABLE 8 LIST OF PATENTS BY CHICAGO BRIDGE & IRON CO.

TABLE 9 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

7 IMPACT OF COVID-19 ON MEDICAL REFRIGERATORS MARKET (Page No. - 75)

7.1 INTRODUCTION

7.1.1 IMPACT OF COVID-19 ON LIVES AND LIVELIHOOD

7.2 IMPACT OF COVID-19 ON MEDICAL REFRIGERATORS MARKET

7.3 IMPACT OF COVID-19 ON REGIONS

7.3.1 ASIA PACIFIC

7.3.2 NORTH AMERICA

7.3.3 EUROPE

7.3.4 MIDDLE EAST & AFRICA

7.3.5 SOUTH AMERICA

8 MEDICAL REFRIGERATORS MARKET, BY DESIGN TYPE (Page No. - 78)

8.1 INTRODUCTION

8.2 COUNTERTOP MEDICAL REFRIGERATOR

8.3 UNDERCOUNTER MEDICAL REFRIGERATOR

8.4 FLAMMABLE MATERIAL STORAGE REFRIGERATOR

8.5 EXPLOSION-PROOF REFRIGERATOR

9 MEDICAL REFRIGERATORS MARKET, BY DOOR TYPE (Page No. - 80)

9.1 INTRODUCTION

9.2 SINGLE DOOR

9.3 DOUBLE DOOR

10 MEDICAL REFRIGERATORS MARKET, BY PRODUCT TYPE (Page No. - 81)

10.1 INTRODUCTION

FIGURE 32 BLOOD BANK REFRIGERATORS & PLASMA FREEZERS TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

TABLE 10 MEDICAL REFRIGERATORS MARKET SIZE, BY PRODUCT TYPE, 2017–2019 (USD MILLION)

TABLE 11 MEDICAL REFRIGERATOR MARKET SIZE, BY PRODUCT TYPE, 2020–2026 (USD MILLION)

TABLE 12 MEDICAL REFRIGERATORS MARKET SIZE, BY PRODUCT TYPE, 2017–2019 (UNIT)

TABLE 13 MEDICAL REFRIGERATOR MARKET SIZE, BY PRODUCT TYPE, 2020–2026 (UNIT)

10.2 BLOOD BANK REFRIGERATORS & PLASMA FREEZERS

10.2.1 BLOOD BANKS APPLICATION TO DRIVE THE BLOOD BANK REFRIGERATORS & PLASMA FREEZERS MARKET

TABLE 14 MEDICAL REFRIGERATORS MARKET SIZE FOR BLOOD BANK REFRIGERATORS & PLASMA FREEZERS, BY REGION, 2017–2019 (USD MILLION)

TABLE 15 MEDICAL REFRIGERATOR MARKET SIZE FOR BLOOD BANK REFRIGERATORS & PLASMA FREEZERS, BY REGION, 2020–2026 (USD MILLION)

TABLE 16 MEDICAL REFRIGERATORS MARKET SIZE FOR BLOOD BANK REFRIGERATORS & PLASMA FREEZERS, BY REGION, 2017–2019 (UNIT)

TABLE 17 MEDICAL REFRIGERATOR MARKET SIZE FOR BLOOD BANK REFRIGERATORS & PLASMA FREEZERS, BY REGION, 2020–2026 (UNIT)

10.3 LABORATORY REFRIGERATORS & FREEZERS

10.3.1 NORTH AMERICA TO LEAD THE LABORATORY REFRIGERATORS & FREEZERS MARKET

TABLE 18 MEDICAL REFRIGERATORS MARKET SIZE FOR LABORATORY REFRIGERATORS & FREEZERS, BY REGION, 2017–2019 (USD MILLION)

TABLE 19 MEDICAL REFRIGERATOR MARKET SIZE FOR LABORATORY REFRIGERATORS & FREEZERS, BY REGION, 2020–2026 (USD MILLION)

TABLE 20 MEDICAL REFRIGERATORS MARKET SIZE FOR LABORATORY REFRIGERATORS & FREEZERS, BY REGION, 2017–2019 (UNIT)

TABLE 21 MEDICAL REFRIGERATOR MARKET SIZE FOR LABORATORY REFRIGERATORS & FREEZERS, BY REGION, 2020–2026 (UNIT)

10.4 PHARMACY REFRIGERATORS & FREEZERS

10.4.1 GROWTH IN PHARMACEUTICAL INDUSTRY TO DRIVE PHARMACY REFRIGERATORS & FREEZERS MARKET

TABLE 22 MEDICAL REFRIGERATORS MARKET SIZE FOR PHARMACY REFRIGERATORS & FREEZERS, BY REGION, 2017–2019 (USD MILLION)

TABLE 23 MEDICAL REFRIGERATOR MARKET SIZE FOR PHARMACY REFRIGERATORS & FREEZERS, BY REGION, 2020–2026 (USD MILLION)

TABLE 24 MEDICAL REFRIGERATORS MARKET SIZE FOR PHARMACY REFRIGERATORS & FREEZERS, BY REGION, 2017–2019 (UNIT)

TABLE 25 MEDICAL REFRIGERATOR MARKET SIZE FOR PHARMACY REFRIGERATORS & FREEZERS, BY REGION, 2020–2026 (UNIT)

10.5 CHROMATOGRAPHY REFRIGERATORS & FREEZERS

10.5.1 RISE IN RESEARCH ACTIVITIES IN MEDICAL FIELD TO BOOST MARKET

TABLE 26 MEDICAL REFRIGERATORS MARKET SIZE FOR CHROMATOGRAPHY REFRIGERATORS & FREEZERS, BY REGION, 2017–2019 (USD MILLION)

TABLE 27 MEDICAL REFRIGERATOR MARKET SIZE FOR CHROMATOGRAPHY REFRIGERATORS & FREEZERS, BY REGION, 2020–2026 (USD MILLION)

TABLE 28 MEDICAL REFRIGERATORS MARKET SIZE FOR CHROMATOGRAPHY REFRIGERATORS & FREEZERS, BY REGION, 2017–2019 (UNIT)

TABLE 29 MEDICAL REFRIGERATOR MARKET SIZE FOR CHROMATOGRAPHY REFRIGERATORS & FREEZERS, BY REGION, 2020–2026 (UNIT)

10.6 ENZYME REFRIGERATORS & FREEZERS

10.6.1 MIDDLE EAST & AFRICA TO BE FASTEST-GROWING REGION FOR ENZYME REFRIGERATORS & FREEZERS MARKET

TABLE 30 MEDICAL REFRIGERATORS MARKET SIZE FOR ENZYME REFRIGERATORS & FREEZERS, BY REGION, 2017–2019 (USD MILLION)

TABLE 31 MEDICAL REFRIGERATOR MARKET SIZE FOR ENZYME REFRIGERATORS & FREEZERS, BY REGION, 2020–2026 (USD MILLION)

TABLE 32 MEDICAL REFRIGERATORS MARKET SIZE FOR ENZYME REFRIGERATORS & FREEZERS, BY REGION, 2017–2019 (UNIT)

TABLE 33 MEDICAL REFRIGERATOR MARKET SIZE FOR ENZYME REFRIGERATORS & FREEZERS, BY REGION, 2020–2026 (UNIT)

10.7 ULTRA-LOW TEMPERATURE FREEZERS

10.7.1 DEMAND FROM MEDICAL LABORATORIES AND RESEARCH INSTITUTES TO DRIVE MARKET

TABLE 34 MEDICAL REFRIGERATORS MARKET SIZE FOR ULTRA-LOW TEMPERATURE FREEZERS, BY REGION, 2017–2019 (USD MILLION)

TABLE 35 MEDICAL REFRIGERATOR MARKET SIZE FOR ULTRA-LOW TEMPERATURE FREEZERS, BY REGION, 2020–2026 (USD MILLION)

TABLE 36 MEDICAL REFRIGERATORS MARKET SIZE FOR ULTRA-LOW TEMPERATURE FREEZERS, BY REGION, 2017–2019 (UNIT)

TABLE 37 MEDICAL REFRIGERATOR MARKET SIZE FOR ULTRA-LOW TEMPERATURE FREEZERS, BY REGION, 2020–2026 (UNIT)

10.8 CRYOGENIC STORAGE SYSTEMS

10.8.1 INCREASED R&D ON DNA MODIFICATION TECHNIQUES IS A MAJOR DRIVER FOR GROWTH OF SEGMENT

TABLE 38 MEDICAL REFRIGERATORS MARKET SIZE FOR CRYOGENIC STORAGE SYSTEMS, BY REGION, 2017–2019 (USD MILLION)

TABLE 39 MEDICAL REFRIGERATOR MARKET SIZE FOR CRYOGENIC STORAGE SYSTEMS, BY REGION, 2020–2026 (USD MILLION)

TABLE 40 MEDICAL REFRIGERATORS MARKET SIZE FOR CRYOGENIC STORAGE SYSTEMS, BY REGION, 2017–2019 (UNIT)

TABLE 41 MEDICAL REFRIGERATOR MARKET SIZE FOR CRYOGENIC STORAGE SYSTEMS, BY REGION, 2020–2026 (UNIT)

11 MEDICAL REFRIGERATORS MARKET, BY END USER (Page No. - 96)

11.1 INTRODUCTION

FIGURE 33 BLOOD BANKS SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

TABLE 42 MEDICAL REFRIGERATORS MARKET SIZE, BY END USER, 2017–2019 (USD MILLION)

TABLE 43 MEDICAL REFRIGERATOR MARKET SIZE, BY END USER, 2020–2026 (USD MILLION)

TABLE 44 MEDICAL REFRIGERATORS MARKET SIZE, BY END USER, 2017–2019 (UNIT)

TABLE 45 MEDICAL REFRIGERATOR MARKET SIZE, BY END USER, 2020–2026 (UNIT)

11.2 BLOOD BANKS

11.2.1 INCREASED DEMAND FOR SAFE BLOOD DUE TO HIGH PREVALENCE OF BLOOD TRANSFUSION CASES IS DRIVING DEMAND

TABLE 46 MEDICAL REFRIGERATORS MARKET SIZE FOR BLOOD BANKS, BY REGION, 2017–2019 (USD MILLION)

TABLE 47 MEDICAL REFRIGERATOR MARKET SIZE FOR BLOOD BANKS, BY REGION, 2020–2026 (USD MILLION)

TABLE 48 MEDICAL REFRIGERATORS MARKET SIZE FOR BLOOD BANKS, BY REGION, 2017–2019 (UNIT)

TABLE 49 MEDICAL REFRIGERATOR MARKET SIZE FOR BLOOD BANKS, BY REGION, 2020–2026 (UNIT)

11.3 PHARMACEUTICAL COMPANIES

11.3.1 GROWTH IN RESEARCH ACTIVITIES IN DEVELOPING NATIONS IS DRIVING DEMAND

TABLE 50 MEDICAL REFRIGERATORS MARKET SIZE FOR PHARMACEUTICAL COMPANIES, BY REGION, 2017–2019 (USD MILLION)

TABLE 51 MEDICAL REFRIGERATOR MARKET SIZE FOR PHARMACEUTICAL COMPANIES, BY REGION, 2020–2026 (USD MILLION)

TABLE 52 MEDICAL REFRIGERATORS MARKET SIZE FOR PHARMACEUTICAL COMPANIES, BY REGION, 2017–2019 (UNIT)

TABLE 53 MEDICAL REFRIGERATOR MARKET SIZE FOR PHARMACEUTICAL COMPANIES, BY REGION, 2020–2026 (UNIT)

11.4 HOSPITALS & PHARMACIES

11.4.1 INFRASTRUCTURE ADVANCEMENTS IN HEALTHCARE SECTOR DRIVING DEMAND

TABLE 54 MEDICAL REFRIGERATORS MARKET SIZE FOR HOSPITALS & PHARMACIES, BY REGION, 2017–2019 (USD MILLION)

TABLE 55 MEDICAL REFRIGERATOR MARKET SIZE FOR HOSPITALS & PHARMACIES, BY REGION, 2020–2026 (USD MILLION)

TABLE 56 MEDICAL REFRIGERATORS MARKET SIZE FOR HOSPITALS & PHARMACIES, BY REGION, 2017–2019 (UNIT)

TABLE 57 MEDICAL REFRIGERATOR MARKET SIZE FOR HOSPITALS & PHARMACIES, BY REGION, 2020–2026 (UNIT)

11.5 RESEARCH INSTITUTES

11.5.1 INCREASE IN RESEARCH & DEVELOPMENT ACTIVITIES IN PHARMACEUTICAL SECTOR TO DRIVE DEMAND

TABLE 58 MEDICAL REFRIGERATORS MARKET SIZE FOR RESEARCH INSTITUTES, BY REGION, 2017–2019 (USD MILLION)

TABLE 59 MEDICAL REFRIGERATOR MARKET SIZE FOR RESEARCH INSTITUTES, BY REGION, 2020–2026 (USD MILLION)

TABLE 60 MEDICAL REFRIGERATORS MARKET SIZE FOR RESEARCH INSTITUTES, BY REGION, 2017–2019 (UNIT)

TABLE 61 MEDICAL REFRIGERATOR MARKET SIZE FOR RESEARCH INSTITUTES, BY REGION, 2020–2026 (UNIT)

11.6 MEDICAL LABORATORIES

11.6.1 GROWING AWARENESS REGARDING TIMELY DIAGNOSIS OF DISEASES, ESPECIALLY IN RAPID AGING POPULATIONS, TO DRIVE MARKET

TABLE 62 MEDICAL REFRIGERATORS MARKET SIZE FOR MEDICAL LABORATORIES, BY REGION, 2017–2019 (USD MILLION)

TABLE 63 MEDICAL REFRIGERATOR MARKET SIZE FOR MEDICAL LABORATORIES, BY REGION, 2020–2026 (USD MILLION)

TABLE 64 MEDICAL REFRIGERATORS MARKET SIZE FOR MEDICAL LABORATORIES, BY REGION, 2017–2019 (UNIT)

TABLE 65 MEDICAL REFRIGERATOR MARKET SIZE FOR MEDICAL LABORATORIES, BY REGION, 2020–2026 (UNIT)

11.7 DIAGNOSTIC CENTERS

11.7.1 DEMAND FROM MEDICAL LABORATORIES AND RESEARCH INSTITUTES TO DRIVE MARKET FOR ULTRA-LOW TEMPERATURE FREEZERS

TABLE 66 MEDICAL REFRIGERATORS MARKET SIZE FOR DIAGNOSTIC CENTERS, BY REGION, 2017–2019 (USD MILLION)

TABLE 67 MEDICAL REFRIGERATOR MARKET SIZE FOR DIAGNOSTIC CENTERS, BY REGION, 2020–2026 (USD MILLION)

TABLE 68 MEDICAL REFRIGERATORS MARKET FOR DIAGNOSTIC CENTERS, BY REGION, 2017–2019 (UNIT)

TABLE 69 MEDICAL REFRIGERATOR MARKET FOR DIAGNOSTIC CENTERS, BY REGION, 2020–2026 (UNIT)

12 MEDICAL REFRIGERATORS MARKET SIZE, BY REGION (Page No. - 109)

12.1 INTRODUCTION

FIGURE 34 NORTH AMERICA TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

TABLE 70 MEDICAL REFRIGERATORS MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 71 MEDICAL REFRIGERATOR MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 72 MEDICAL REFRIGERATORS MARKET SIZE, BY REGION, 2017–2019 (UNIT)

TABLE 73 MEDICAL REFRIGERATOR MARKET SIZE, BY REGION, 2020–2026 (UNIT)

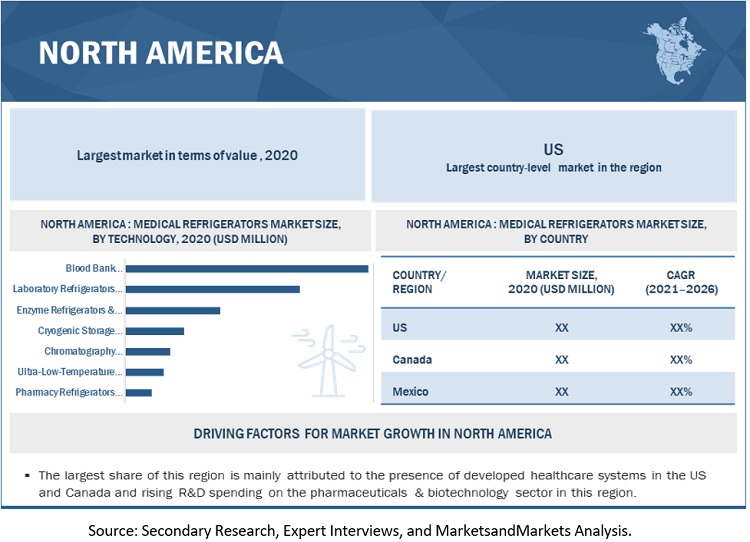

12.2 NORTH AMERICA

FIGURE 35 NORTH AMERICA: MEDICAL REFRIGERATORS MARKET SNAPSHOT

TABLE 74 NORTH AMERICA: MEDICAL REFRIGERATOR MARKET SIZE, BY PRODUCT TYPE, 2017–2019 (USD MILLION)

TABLE 75 NORTH AMERICA: MARKET SIZE, BY PRODUCT TYPE, 2020–2026 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET SIZE, BY PRODUCT TYPE, 2017–2019 (UNIT)

TABLE 77 NORTH AMERICA: MARKET SIZE, BY PRODUCT TYPE, 2020–2026 (UNIT)

TABLE 78 NORTH AMERICA: MARKET SIZE, BY END USER, 2017–2019 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET SIZE, BY END USER, 2020–2026 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET SIZE, BY END USER, 2017–2019 (UNIT)

TABLE 81 NORTH AMERICA: MARKET SIZE, BY END USER, 2020–2026 (UNIT)

TABLE 82 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 83 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 84 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2019 (UNIT)

TABLE 85 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (UNIT)

12.2.1 US

12.2.1.1 US accounted for largest share in North American medical refrigerators market

TABLE 86 US: MEDICAL REFRIGERATORS MARKET SIZE, BY END USER, 2017–2019 (USD MILLION)

TABLE 87 US: MEDICAL REFRIGERATOR MARKET SIZE, BY END USER, 2020–2026 (USD MILLION)

TABLE 88 US: MARKET SIZE, BY END USER, 2017–2019 (UNIT)

TABLE 89 US: MARKET SIZE, BY END USER, 2020–2026 (UNIT)

12.2.2 CANADA

12.2.2.1 Growth in pharmaceutical industry to propel market

TABLE 90 CANADA: MEDICAL REFRIGERATORS MARKET SIZE, BY END USER, 2017–2019 (USD MILLION)

TABLE 91 CANADA: MEDICAL REFRIGERATOR MARKET SIZE, BY END USER, 2020–2026 (USD MILLION)

TABLE 92 CANADA: MARKET SIZE, BY END USER, 2017–2019 (UNIT)

TABLE 93 CANADA: MARKET SIZE, BY END USER, 2020–2026 (UNIT)

12.2.3 MEXICO

12.2.3.1 Increasing demand for medicines to enhance the market growth

TABLE 94 MEXICO: MEDICAL REFRIGERATORS MARKET SIZE, BY END USER, 2017–2019 (USD MILLION)

TABLE 95 MEXICO: MEDICAL REFRIGERATOR MARKET SIZE, BY END USER, 2020–2026 (USD MILLION)

TABLE 96 MEXICO: MARKET SIZE, BY END USER, 2017–2019 (UNIT)

TABLE 97 MEXICO: MARKET SIZE, BY END USER, 2020–2026 (UNIT)

12.3 EUROPE

FIGURE 36 EUROPE: MEDICAL REFRIGERATORS MARKET SNAPSHOT

TABLE 98 EUROPE: MEDICAL REFRIGERATOR MARKET SIZE, BY PRODUCT TYPE, 2017–2019 (USD MILLION)

TABLE 99 EUROPE: MARKET SIZE, BY PRODUCT TYPE, 2020–2026 (USD MILLION)

TABLE 100 EUROPE: MARKET SIZE, BY PRODUCT TYPE, 2017–2019 (UNIT)

TABLE 101 EUROPE: MARKET SIZE, BY PRODUCT TYPE, 2020–2026 (UNIT)

TABLE 102 EUROPE: MARKET SIZE, BY END USER, 2017–2019 (USD MILLION)

TABLE 103 EUROPE: MARKET SIZE, BY END USER, 2020–2026 (USD MILLION)

TABLE 104 EUROPE: MARKET SIZE, BY END USER, 2017–2019 (UNIT)

TABLE 105 EUROPE: MARKET SIZE, BY END USER, 2020–2026 (UNIT)

TABLE 106 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 107 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 108 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2019 (UNIT)

TABLE 109 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2026 (UNIT)

12.3.1 GERMANY

12.3.1.1 Growing aging population to drive market

TABLE 110 GERMANY: MEDICAL REFRIGERATORS MARKET SIZE, BY END USER, 2017–2019 (USD MILLION)

TABLE 111 GERMANY: MEDICAL REFRIGERATOR MARKET SIZE, BY END USER, 2020–2026 (USD MILLION)

TABLE 112 GERMANY: MARKET SIZE, BY END USER, 2017–2019 (UNIT)

TABLE 113 GERMANY: MARKET SIZE, BY END USER, 2020–2026 (UNIT)

12.3.2 FRANCE

12.3.2.1 Government support to medical & pharmaceutical industry has led to growth of medical refrigerators market

TABLE 114 FRANCE: MEDICAL REFRIGERATORS MARKET SIZE, BY END USER, 2017–2019 (USD MILLION)

TABLE 115 FRANCE: MEDICAL REFRIGERATOR MARKET SIZE, BY END USER, 2020–2026 (USD MILLION)

TABLE 116 FRANCE: MARKET SIZE, BY END USER, 2017–2019 (UNIT)

TABLE 117 FRANCE: MARKET SIZE, BY END USER, 2020–2026 (UNIT)

12.3.3 UK

12.3.3.1 Investment by pharmaceutical industry in R&D is driving market

TABLE 118 UK: MEDICAL REFRIGERATORS MARKET SIZE, BY END USER, 2017–2019 (USD MILLION)

TABLE 119 UK: MEDICAL REFRIGERATOR MARKET SIZE, BY END USER, 2020–2026 (USD MILLION)

TABLE 120 UK: MARKET SIZE, BY END USER, 2017–2019 (UNIT)

TABLE 121 UK: MARKET SIZE, BY END USER, 2020–2026 (UNIT)

12.3.4 ITALY

12.3.4.1 Blood banks to be fastest-growing segment during forecast period

TABLE 122 ITALY: MEDICAL REFRIGERATORS MARKET SIZE, BY END USER, 2017–2019 (USD MILLION)

TABLE 123 ITALY: MEDICAL REFRIGERATOR MARKET SIZE, BY END USER, 2020–2026 (USD MILLION)

TABLE 124 ITALY: MARKET SIZE, BY END USER, 2017–2019 (UNIT)

TABLE 125 ITALY: MARKET SIZE, BY END USER, 2020–2026 (UNIT)

12.3.5 TURKEY

12.3.5.1 Rise in investment in healthcare services driving local market

TABLE 126 TURKEY: MEDICAL REFRIGERATORS MARKET SIZE, BY END USER, 2017–2019 (USD MILLION)

TABLE 127 TURKEY: MEDICAL REFRIGERATOR MARKET SIZE, BY END USER, 2020–2026 (USD MILLION)

TABLE 128 TURKEY: MARKET SIZE, BY END USER, 2017–2019 (UNIT)

TABLE 129 TURKEY: MARKET SIZE, BY END USER, 2020–2026 (UNIT)

12.3.6 REST OF EUROPE

TABLE 130 REST OF EUROPE: MEDICAL REFRIGERATORS MARKET SIZE, BY END USER, 2017–2019 (USD MILLION)

TABLE 131 REST OF EUROPE: MEDICAL REFRIGERATOR MARKET SIZE, BY END USER, 2020–2026 (USD MILLION)

TABLE 132 REST OF EUROPE: MARKET SIZE, BY END USER, 2017–2019 (UNIT)

TABLE 133 REST OF EUROPE: MARKET SIZE, BY END USER, 2020–2026 (UNIT)

12.4 ASIA PACIFIC

FIGURE 37 ASIA PACIFIC: MEDICAL REFRIGERATORS MARKET SNAPSHOT

TABLE 134 ASIA PACIFIC: MEDICAL REFRIGERATOR MARKET SIZE, BY PRODUCT TYPE, 2017–2019 (USD MILLION)

TABLE 135 ASIA PACIFIC: MARKET SIZE, BY PRODUCT TYPE, 2020–2026 (USD MILLION)

TABLE 136 ASIA PACIFIC: MARKET SIZE, BY PRODUCT TYPE, 2017–2019 (UNIT)

TABLE 137 ASIA PACIFIC: MARKET SIZE, BY PRODUCT TYPE, 2020–2026 (UNIT)

TABLE 138 ASIA PACIFIC: MARKET SIZE, BY END USER, 2017–2019 (USD MILLION)

TABLE 139 ASIA PACIFIC: MARKET SIZE, BY END USER, 2020–2026 (USD MILLION)

TABLE 140 ASIA PACIFIC: MARKET SIZE, BY END USER, 2017–2019 (UNIT)

TABLE 141 ASIA PACIFIC: MARKET SIZE, BY END USER, 2020–2026 (UNIT)

TABLE 142 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 143 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 144 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2017–2019 (UNIT)

TABLE 145 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2026 (UNIT)

12.4.1 CHINA

12.4.1.1 Growing population and investment in healthcare services driving market

TABLE 146 CHINA: MEDICAL REFRIGERATORS MARKET SIZE, BY END USER, 2017–2019 (USD MILLION)

TABLE 147 CHINA: MEDICAL REFRIGERATOR MARKET SIZE, BY END USER, 2020–2026 (USD MILLION)

TABLE 148 CHINA: MARKET SIZE, BY END USER, 2017–2019 (UNIT)

TABLE 149 CHINA: MARKET SIZE, BY END USER, 2020–2026 (UNIT)

12.4.2 JAPAN

12.4.2.1 Growing aging population and government initiatives toward healthcare sector driving market

TABLE 150 JAPAN: MEDICAL REFRIGERATORS MARKET SIZE, BY END USER, 2017–2019 (USD MILLION)

TABLE 151 JAPAN: MEDICAL REFRIGERATOR MARKET SIZE, BY END USER, 2020–2026 (USD MILLION)

TABLE 152 JAPAN: MARKET SIZE, BY END USER, 2017–2019 (UNIT)

TABLE 153 JAPAN: MARKET SIZE, BY END USER, 2020–2026 (UNIT)

12.4.3 SOUTH KOREA

12.4.3.1 Increasing R&D in healthcare sector related to vaccines and medicines to drive market

TABLE 154 SOUTH KOREA: MEDICAL REFRIGERATORS MARKET SIZE, BY END USER, 2017–2019 (USD MILLION)

TABLE 155 SOUTH KOREA: MEDICAL REFRIGERATOR MARKET SIZE, BY END USER, 2020–2026 (USD MILLION)

TABLE 156 SOUTH KOREA: MARKET SIZE, BY END USER, 2017–2019 (UNIT)

TABLE 157 SOUTH KOREA: MARKET SIZE, BY END USER, 2020–2026 (UNIT)

12.4.4 INDIA

12.4.4.1 Growing number of hospitals to drive market

TABLE 158 INDIA: MEDICAL REFRIGERATORS MARKET SIZE, BY END USER, 2017–2019 (USD MILLION)

TABLE 159 INDIA: MEDICAL REFRIGERATOR MARKET SIZE, BY END USER, 2020–2026 (USD MILLION)

TABLE 160 INDIA: MARKET SIZE, BY END USER, 2017–2019 (UNIT)

TABLE 161 INDIA: MARKET SIZE, BY END USER, 2020–2026 (UNIT)

12.4.5 THAILAND

12.4.5.1 Growing number of medical tourists to boost demand for medical refrigerators

TABLE 162 THAILAND: MEDICAL REFRIGERATORS MARKET SIZE, BY END USER, 2017–2019 (USD MILLION)

TABLE 163 THAILAND: MEDICAL REFRIGERATOR MARKET SIZE, BY END USER, 2020–2026 (USD MILLION)

TABLE 164 THAILAND: MARKET SIZE, BY END USER, 2017–2019 (UNIT)

TABLE 165 THAILAND: MARKET SIZE, BY END USER, 2020–2026 (UNIT)

12.4.6 INDONESIA

12.4.6.1 Growing investment in healthcare sector to propel demand

TABLE 166 INDONESIA: MEDICAL REFRIGERATORS MARKET SIZE, BY END USER, 2017–2019 (USD MILLION)

TABLE 167 INDONESIA: MEDICAL REFRIGERATOR MARKET SIZE, BY END USER, 2020–2026 (USD MILLION)

TABLE 168 INDONESIA: MARKET SIZE, BY END USER, 2017–2019 (UNIT)

TABLE 169 INDONESIA: MARKET SIZE, BY END USER, 2020–2026 (UNIT)

12.4.7 REST OF ASIA PACIFIC

TABLE 170 REST OF ASIA PACIFIC: MEDICAL REFRIGERATORS MARKET SIZE, BY END USER, 2017–2019 (USD MILLION)

TABLE 171 REST OF ASIA PACIFIC: MEDICAL REFRIGERATOR MARKET SIZE, BY END USER, 2020–2026 (USD MILLION)

TABLE 172 REST OF ASIA PACIFIC: MARKET SIZE, BY END USER, 2017–2019 (UNIT)

TABLE 173 REST OF ASIA PACIFIC: MARKET SIZE, BY END USER, 2020–2026 (UNIT)

12.5 MIDDLE EAST & AFRICA

TABLE 174 MIDDLE EAST & AFRICA: MEDICAL REFRIGERATORS MARKET SIZE, BY PRODUCT TYPE, 2017–2019 (USD MILLION)

TABLE 175 MIDDLE EAST & AFRICA: MEDICAL REFRIGERATOR MARKET SIZE, BY PRODUCT TYPE, 2020–2026 (USD MILLION)

TABLE 176 MIDDLE EAST & AFRICA: MARKET SIZE, BY PRODUCT TYPE, 2017–2019 (UNIT)

TABLE 177 MIDDLE EAST & AFRICA: MARKET SIZE, BY PRODUCT TYPE, 2020–2026 (UNIT)

TABLE 178 MIDDLE EAST & AFRICA: MARKET SIZE, BY END USER, 2017–2019 (USD MILLION)

TABLE 179 MIDDLE EAST & AFRICA: MARKET SIZE, BY END USER, 2020–2026 (USD MILLION)

TABLE 180 MIDDLE EAST & AFRICA: MARKET SIZE, BY END USER, 2017–2019 (UNIT)

TABLE 181 MIDDLE EAST & AFRICA: MARKET SIZE, BY END USER, 2020–2026 (UNIT)

TABLE 182 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 183 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 184 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2017–2019 (UNIT)

TABLE 185 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2020–2026 (UNIT)

12.5.1 SAUDI ARABIA

12.5.1.1 Saudi Arabia to lead Middle East & African medical refrigerators market

TABLE 186 SAUDI ARABIA: MEDICAL REFRIGERATORS MARKET SIZE, BY END USER, 2017–2019 (USD MILLION)

TABLE 187 SAUDI ARABIA: MEDICAL REFRIGERATOR MARKET SIZE, BY END USER, 2020–2026 (USD MILLION)

TABLE 188 SAUDI ARABIA: MARKET SIZE, BY END USER, 2017–2019 (UNIT)

TABLE 189 SAUDI ARABIA: MARKET SIZE, BY END USER, 2020–2026 (UNIT)

12.5.2 EGYPT

12.5.2.1 Rising incidence of a number of chronic diseases to drive demand

TABLE 190 EGYPT: MEDICAL REFRIGERATORS MARKET SIZE, BY END USER, 2017–2019 (USD MILLION)

TABLE 191 EGYPT: MEDICAL REFRIGERATOR MARKET SIZE, BY END USER, 2020–2026 (USD MILLION)

TABLE 192 EGYPT: MARKET SIZE, BY END USER, 2017–2019 (UNIT)

TABLE 193 EGYPT: MARKET SIZE, BY END USER, 2020–2026 (UNIT)

12.5.3 UAE

12.5.3.1 Growing population and lifestyle-related diseases to propel market

TABLE 194 UAE: MEDICAL REFRIGERATORS MARKET SIZE, BY END USER, 2017–2019 (USD MILLION)

TABLE 195 UAE: MEDICAL REFRIGERATOR MARKET SIZE, BY END USER, 2020–2026 (USD MILLION)

TABLE 196 UAE: MARKET SIZE, BY END USER, 2017–2019 (UNIT)

TABLE 197 UAE: MARKET SIZE, BY END USER, 2020–2026 (UNIT)

12.5.4 SOUTH AFRICA

12.5.4.1 Rising investments in medical drugs segment to propel market

TABLE 198 SOUTH AFRICA: MEDICAL REFRIGERATORS MARKET SIZE, BY END USER, 2017–2019 (USD MILLION)

TABLE 199 SOUTH AFRICA: MEDICAL REFRIGERATOR MARKET SIZE, BY END USER, 2020–2026 (USD MILLION)

TABLE 200 SOUTH AFRICA: MARKET SIZE, BY END USER, 2017–2019 (UNIT)

TABLE 201 SOUTH AFRICA: MARKET SIZE, BY END USER, 2020–2026 (UNIT)

12.5.5 REST OF MIDDLE EAST & AFRICA

TABLE 202 REST OF MIDDLE EAST & AFRICA: MEDICAL REFRIGERATORS MARKET SIZE, BY END USER, 2017–2019 (USD MILLION)

TABLE 203 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END USER, 2020–2026 (USD MILLION)

TABLE 204 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END USER, 2017–2019 (UNIT)

TABLE 205 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END USER, 2020–2026 (UNIT)

12.6 SOUTH AMERICA

TABLE 206 SOUTH AMERICA: MEDICAL REFRIGERATORS MARKET SIZE, BY PRODUCT TYPE, 2017–2019 (USD MILLION)

TABLE 207 SOUTH AMERICA: MEDICAL REFRIGERATOR MARKET SIZE, BY PRODUCT TYPE, 2020–2026 (USD MILLION)

TABLE 208 SOUTH AMERICA: MARKET SIZE, BY PRODUCT TYPE, 2017–2019 (UNIT)

TABLE 209 SOUTH AMERICA: MARKET SIZE, BY PRODUCT TYPE, 2020–2026 (UNIT)

TABLE 210 SOUTH AMERICA: MARKET SIZE, BY END USER, 2017–2019 (USD MILLION)

TABLE 211 SOUTH AMERICA: MARKET SIZE, BY END USER, 2020–2026 (USD MILLION)

TABLE 212 SOUTH AMERICA: MARKET SIZE, BY END USER, 2017–2019 (UNIT)

TABLE 213 SOUTH AMERICA: MARKET SIZE, BY END USER, 2020–2026 (UNIT)

TABLE 214 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 215 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 216 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2019 (UNIT)

TABLE 217 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (UNIT)

12.6.1 BRAZIL

12.6.1.1 Brazil to lead South American medical refrigerators market

TABLE 218 BRAZIL: MEDICAL REFRIGERATORS MARKET SIZE, BY END USER, 2017–2019 (USD MILLION)

TABLE 219 BRAZIL: MEDICAL REFRIGERATOR MARKET SIZE, BY END USER, 2020–2026 (USD MILLION)

TABLE 220 BRAZIL: MARKET SIZE, BY END USER, 2017–2019 (UNIT)

TABLE 221 BRAZIL: MARKET SIZE, BY END USER, 2020–2026 (UNIT)

12.6.2 ARGENTINA

12.6.2.1 Rapidly growing geriatric population to fuel market for medical refrigerators

TABLE 222 ARGENTINA: MEDICAL REFRIGERATORS MARKET SIZE, BY END USER, 2017–2019 (USD MILLION)

TABLE 223 ARGENTINA: MEDICAL REFRIGERATOR MARKET SIZE, BY END USER, 2020–2026 (USD MILLION)

TABLE 224 ARGENTINA: MARKET SIZE, BY END USER, 2017–2019 (UNIT)

TABLE 225 ARGENTINA: MARKET SIZE, BY END USER, 2020–2026 (UNIT)

12.6.3 REST OF SOUTH AMERICA

TABLE 226 REST OF SOUTH AMERICA: MEDICAL REFRIGERATORS MARKET SIZE, BY END USER, 2017–2019 (USD MILLION)

TABLE 227 REST OF SOUTH AMERICA: MARKET SIZE, BY END USER, 2020–2026 (USD MILLION)

TABLE 228 REST OF SOUTH AMERICA: MARKET SIZE, BY END USER, 2017–2019 (UNIT)

TABLE 229 REST OF SOUTH AMERICA: MEDICAL REFRIGERATORS MARKET SIZE, BY END USER, 2020–2026 (UNIT)

13 COMPETITIVE LANDSCAPE (Page No. - 177)

13.1 KEY PLAYERS’ STRATEGIES

TABLE 230 OVERVIEW OF KEY STRATEGIES ADOPTED BY TOP PLAYERS, 2018–2021

13.2 MARKET SHARE ANALYSIS

FIGURE 38 MARKET SHARE ANALYSIS OF TOP 5 PLAYERS VS. OTHERS IN MEDICAL REFRIGERATORS MARKET, 2020

13.2.1 THERMO FISHER SCIENTIFIC INC.

13.2.2 HAIER BIOMEDICAL

13.2.3 HELMER SCIENTIFIC INC.

13.2.4 PHC HOLDINGS CORPORATION

13.2.5 FOLLETT LLC

FIGURE 39 MEDICAL REFRIGERATORS MARKET: PRODUCT TYPE FOOTPRINT

TABLE 231 MEDICAL REFRIGERATOR MARKET: DOOR TYPE FOOTPRINT

TABLE 232 MEDICAL REFRIGERATORS MARKET: END-USE FOOTPRINT

13.3 COMPANY EVALUATION QUADRANT

13.3.1 STAR

13.3.2 PERVASIVE

13.3.3 EMERGING LEADER

13.3.4 PARTICIPANT

FIGURE 40 MEDICAL REFRIGERATORS MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2020

13.4 COMPETITIVE LEADERSHIP MAPPING OF SME, 2020

13.4.1 PROGRESSIVE COMPANIES

13.4.2 RESPONSIVE COMPANIES

13.4.3 STARTING BLOCKS

13.4.4 DYNAMIC COMPANIES

FIGURE 41 OTHER PLAYERS/SMES EVALUATION MATRIX FOR MEDICAL REFRIGERATORS MARKET

13.5 COMPETITIVE SCENARIO

TABLE 233 MEDICAL REFRIGERATORS MARKET: PRODUCT LAUNCHES, 2018–2021

TABLE 234 MEDICAL REFRIGERATOR MARKET: DEALS, 2018–2021

TABLE 235 MEDICAL REFRIGERATORS MARKET: OTHER DEVELOPMENTS, 2018–2021

14 COMPANY PROFILES (Page No. - 190)

14.1 KEY COMPANIES

(Business Overview, Products/solutions/services offered, Product offerings, Recent Developments, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats)*

14.1.1 THERMO FISHER SCIENTIFIC INC.

TABLE 236 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

FIGURE 42 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT

14.1.2 HAIER BIOMEDICAL

TABLE 237 HAIER BIOMEDICAL: COMPANY OVERVIEW

14.1.3 HELMER SCIENTIFIC INC.

TABLE 238 HELMER SCIENTIFIC INC.: COMPANY OVERVIEW

14.1.4 PHC HOLDINGS CORPORATION

TABLE 239 PHC HOLDINGS CORPORATION: COMPANY OVERVIEW

FIGURE 43 PHC HOLDINGS CORPORATION: COMPANY SNAPSHOT

14.1.5 FOLLETT LLC

TABLE 240 FOLLETT LLC: COMPANY OVERVIEW

14.1.6 BLUE STAR LIMITED

TABLE 241 BLUE STAR LIMITED: COMPANY OVERVIEW

FIGURE 44 BLUE STAR LIMITED: COMPANY SNAPSHOT

14.1.7 AUCMA

TABLE 242 AUCMA: COMPANY OVERVIEW

14.1.8 STANDEX INTERNATIONAL CORPORATION

TABLE 243 STANDEX INTERNATIONAL CORPORATION: COMPANY OVERVIEW

FIGURE 45 STANDEX INTERNATIONAL CORPORATION: COMPANY SNAPSHOT

14.1.9 GODREJ & BOYCE MFG. CO. LTD.

TABLE 244 GODREJ & BOYCE MFG. CO. LTD.: COMPANY OVERVIEW

FIGURE 46 GODREJ & BOYCE MFG. CO. LTD.: COMPANY SNAPSHOT

14.1.10 VESTFROST SOLUTIONS

TABLE 245 VESTFROST SOLUTIONS: COMPANY OVERVIEW

14.1.11 ZHONGKE MEILING CRYOGENICS COMPANY LIMITED

TABLE 246 ZHONGKE MEILING CRYOGENICS COMPANY LIMITED: COMPANY OVERVIEW

14.1.12 FIOCHETTI

TABLE 247 FIOCHETTI: COMPANY OVERVIEW

14.1.13 LABCOLD

TABLE 248 LABCOLD: COMPANY OVERVIEW

TABLE 249 LABCOLD: PRODUCT OFFERINGS

14.1.14 DULAS LTD.

TABLE 250 DULAS LTD.: COMPANY OVERVIEW

TABLE 251 DULAS LTD.: PRODUCT OFFERINGS

14.1.15 HMG INDIA

TABLE 252 HMG INDIA: COMPANY OVERVIEW

*Details on Business Overview, Products/solutions/services offered, Product offerings, Recent Developments, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats might not be captured in case of unlisted companies.

14.2 OTHER PLAYERS

14.2.1 FELIX STORCH, INC.

TABLE 253 FELIX STORCH, INC.: COMPANY OVERVIEW

14.2.2 MIGALI

TABLE 254 MIGALI: COMPANY OVERVIEW

14.2.3 SO-LOW ENVIRONMENTAL EQUIPMENT CO.

TABLE 255 SO-LOW ENVIRONMENTAL EQUIPMENT CO.: COMPANY OVERVIEW

14.2.4 TEMPARMOUR REFRIGERATION

TABLE 256 TEMPARMOUR REFRIGERATION: COMPANY OVERVIEW

14.2.5 INDREL SCIENTIFIC

TABLE 257 INDREL SCIENTIFIC: COMPANY OVERVIEW

14.2.6 CARE LAB TECHNOLOGY

TABLE 258 CARE LAB TECHNOLOGY: COMPANY OVERVIEW

14.2.7 TRITEC

TABLE 259 TRITEC: COMPANY OVERVIEW

14.2.8 BIOLINE TECHNOLOGIES

TABLE 260 BIOLINE TECHNOLOGIES: COMPANY OVERVIEW

14.2.9 PHILIPP KIRSCH GMBH

TABLE 261 PHILIPP KRISCH GMBH: COMPANY OVERVIEW

14.2.10 LEC MEDICAL

TABLE 262 LEC MEDICAL: COMPANY OVERVIEW

15 APPENDIX (Page No. - 238)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

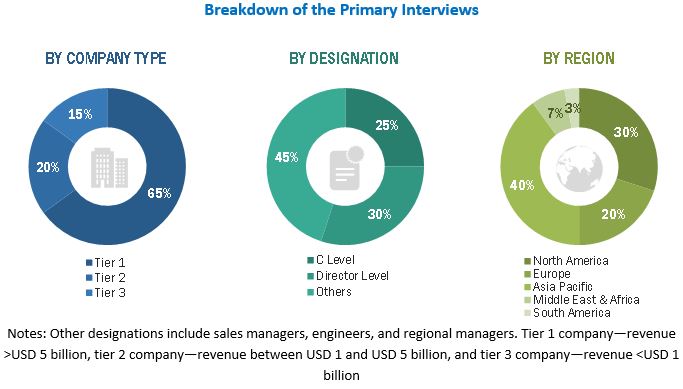

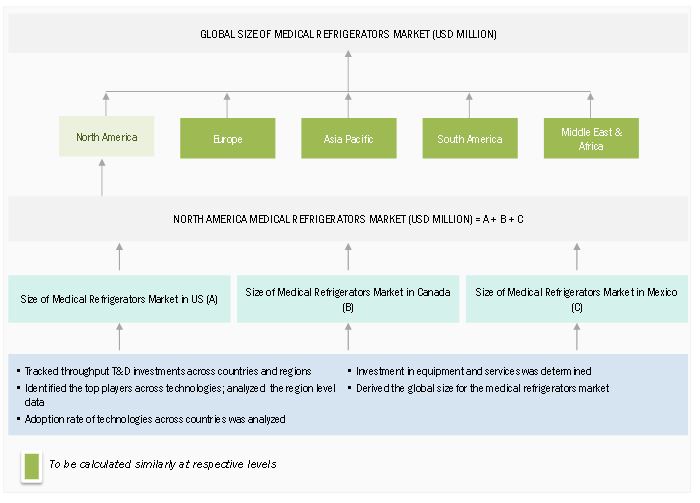

The study involved four major activities in estimating the current size of the medical refrigerators market. Exhaustive secondary research was done to collect information on the market, peer markets, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the medical refrigerators value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include annual reports; press releases and investor presentations of companies; white papers; certified publications; and articles by recognized authors, gold- and silver-standard websites, medical refrigerator manufacturing companies, regulatory bodies, trade directories, and databases. The secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It has also been used to obtain information about key developments from a market-oriented perspective.

Primary Research

The medical refrigerators market comprises several stakeholders, such as raw material suppliers, processors, end-use industries, and regulatory organizations in the supply chain. The demand side of the market is characterized by the presence of medical refrigerator manufacturers, importers/exporters, and manufacturers engaged in the production of various products. The supply side is characterized by the presence of key technology providers for medical refrigerator, end users, researchers, and service providers.

In the primary research process, various primary sources from the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side included key opinion leaders, executives, vice presidents, and CEOs of construction companies. The primary sources from the supply side included research institutions involved in R&D activities to introduce new technologies, key opinion leaders, distributors, and medical refrigerator manufacturing companies.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the total size of the medical refrigerators market. These approaches have also been used extensively to estimate the size of various dependent subsegments of the market. The research methodology used to estimate the market size included the following:

The following segments provide details about the overall market size estimation process employed in this study

- The key players in the market were identified through secondary research.

- The market shares in the respective regions were identified through both primary and secondary research.

- The value chain and market size of the medical refrigerators market, in terms of volume and value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of annual and financial reports of the top market players and interviews with industry experts, such as CEOs, VPs, directors, sales managers, and marketing executives, for key insights, both quantitative and qualitative.

Global Medical Refrigerators Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained below, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market was validated using both the top-down and bottom-up approaches.

Report Objectives

Market Intelligence

- To analyze and forecast the size of the medical refrigerators market in terms of value and volume

- To define, describe, and forecast the market size by product type, end use, and region

- To forecast the market size with respect to five main regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa, and South America

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze the market segments with respect to individual growth trends, prospects, and their contribution to the market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as product launches, expansions, contract, partnerships, and agreements as in the medical refrigerators market

Competitive Intelligence

- To identify and profile the key players in the medical refrigerators market

- To determine the top players offering various products in the medical refrigerators market

- To provide a comparative analysis of the market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- To understand the competitive landscape of the market and identify the key growth strategies adopted by the leading players across key regions

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Medical Refrigerators Market