Medical Vacuum System Market by Product (Standalone, Centralized, Portable), Technology (Dry Claw, Oil Sealed Rotary Vane, Liquid Ring), Application (Diagnostic, Wound Care, GYN), End user (Pharmaceutical, Diagnostic Labs) - Global Forecast to 2024

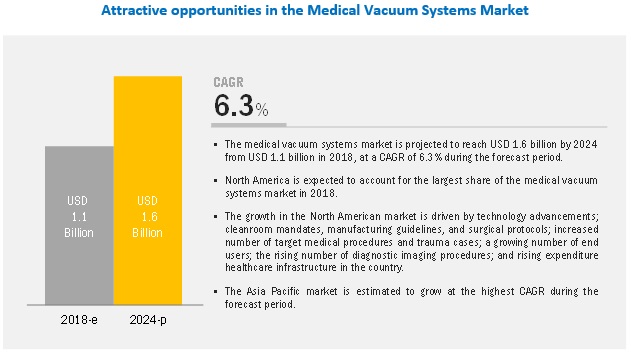

The Medical Vacuum System Market is estimated to grow at a CAGR of 6.3% to reach USD 1.6 billion by 2024. Factors such technological advancements in vacuum systems, stringent regulatory frameworks mandating the use of vacuum systems, the increasing number of target surgical procedures across major markets, and the rising number of Diagnostic Imaging procedures are driving the growth of the global medical vacuum systems market.

By product type, standalone vacuum systems account for the largest share of the medical vacuum system market

On the basis of product type, the market is segmented into standalone vacuum systems centralized vacuum systems, portable vacuum systems, and accessories. The standalone vacuum systems segment is expected to hold the largest share of the market mainly due to the huge end-user base for compact/standalone products, high adoption of these systems among dental clinics and research labs, and their advantages in the aforementioned settings.

Therapeutic applications dominate the medical vacuum system market, by application

On the basis of application, the global medical vacuum systems industry is segmented into pharma-biotech manufacturing, therapeutic applications, diagnostic applications, and research applications. The therapeutic applications segment accounted for the largest share of the market in 2018 due to the rising incidence of dental caries and other periodontal diseases, increasing use of NPWT for diabetic ulcer management, and the increasing number of target medical procedures across major markets.

Hospitals, surgical centers, and ambulatory care centers segment account for the largest share of the medical vacuum system market, by end user

On the basis of end user, the market is segmented into hospitals, surgical centers, and ambulatory care centers; diagnostic laboratories; pharmaceutical and biotechnology manufacturers; and research laboratories and academic institutes. Hospitals, surgical centers, and ambulatory care centers accounted for the largest share of this market, primarily due to the high demand for vacuum systems and a growing number of target procedures conducted annually. This, in turn, is attributed to technological advancements such as device miniaturization and the procedural efficiency of vacuum systems in this application area.

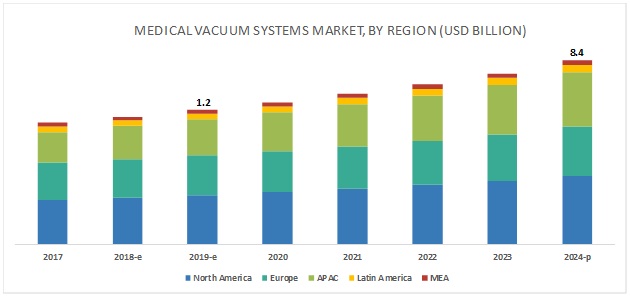

North America accounts for the largest share of the medical vacuum systems market

This report covers the medical vacuum systems market across five major geographies North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. North America is expected to command the largest share of the medical vacuum systems market mainly due to stringent regulatory norms for cleanroom maintenance, manufacturing guidelines and surgical protocols, technological advancement, the rising number of target surgical procedures, a growing end-user base, and increasing expenditure healthcare infrastructure in the region.

Atlas Copco AB (Sweden), Gardner Denver Holdings (US), Busch Holding GmbH (Germany), Drägerwerk AG & Co. KGaA (Germany), Asahi Kasei ZOLL Medical Corporation (Japan), Olympus Corporation (Japan), ConvaTec (UK), INTEGRA Holdings (US), Allied Healthcare Products Inc. (US), Medela AG (Switzerland), Air Techniques (US), Laerdal Medical (Norway), Precision Medical, Inc. (US), Medicop (Slovenia), and Ohio Medical Corporation (US) are the major players operating in the medical vacuum systems market.

Medical Vacuum System Market Scope

|

Report Metric |

Details |

|

Market Size Available for Years |

2017–2024 |

|

Base Year Considered |

2017 |

|

Forecast Period |

2018–2024 |

|

Currency Used |

Value (USD Million) |

|

Segments Covered |

Product Type, Technology, Application, End User, and Region |

|

Geographies Covered |

North America, Europe, the Asia Pacific, Latin America, Middle East & Africa |

|

Companies Covered |

15 major players, including Atlas Copco AB (Sweden), Gardner Denver Holdings (US), Busch Holding GmbH (Germany), Drägerwerk AG & Co. KGaA (Germany), and Asahi Kasei ZOLL Medical Corporation (Japan) |

In this report, the global medical vacuum systems market has been segmented based on product type, technology, application, end user, and region.

By Product Type

- Standalone vacuum systems

- Centralized vacuum systems

- Portable and compact vacuum systems

- Accessories

By Technology

- Oil-sealed rotary vane technology

- Dry rotary vane technology

- Dry claw pump technology

- Oil-sealed liquid ring technology

- Water-sealed liquid ring technology

By Application

- Pharma-biotech manufacturing

-

Therapeutic applications

- Anesthesiology applications

- Gynecology applications

- Wound care applications

- Dental applications

- Diagnostic applications

- Research applications

By End User

- Hospitals, surgical centers, and ambulatory care centers

- Pharmaceutical and biotechnology manufacturers

- Diagnostic laboratories

- Research laboratories and academic institutes

By Region

-

North America

- US

- Canada

- Europe

-

Germany

- UK

- France

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

Recent Developments

- In November 2018, Busch LLC (Germany) and Pfeiffer Vacuum Technology AG (Germany) entered into a strategic cooperation agreement in order to enhance segments such as sales & services, R&D developments, and improve the vacuum product line.

- In October 2018, ConvaTec (UK) received the US FDA 510(k) Clearance for its Avelle Negative Pressure Wound Therapy System.

- In March 2018, Atlas Copco AB (Sweden) acquired Walker Filtration for USD 38.68 million for enhancing its vacuum business.

Key Questions Addressed in This Report

- What are the strategies adopted by the top market players to penetrate markets in emerging regions?

- Who are the major players offering vacuum pumps for NPWT across major geographies?

- What revenue impact will standalone & centralized vacuum systems have in the market during the forecast period?

- Which type of vacuum systems are used in every end-user setup, and why?

- Which product and technology type is used in dental, gynecology, wound care, and anesthesiology setups?

- What is the adoption pattern for dry claw vacuum pumps and oil & oil-less rotary vane vacuum pumps across the globe?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency Used for the Study

1.5 Market Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Research

2.1.2 Primary Research

2.2 Market Estimation Methodology

2.2.1 Revenue-Based Market Estimation

2.2.2 Usage Pattern-Based Market Estimation

2.2.3 Primary Research Validation

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

2.5 Research Limitations

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 35)

4.1 Medical Vacuum Systems: Market Overview

4.2 Medical Vacuum Systems Market, By Product Type, 2018 vs 2024 (USD Million)

4.3 Medical Vacuum Systems Market, By Technology, 2018 vs 2024 (USD Million)

4.4 Medical Vacuum Systems Market, By Application, 2018 vs 2024 (USD Million)

4.5 Medical Vacuum Systems Market, By End User, 2018 vs 2024 (USD Million)

4.6 Medical Vacuum Systems Market: Geographical Snapshot

5 Market Overview (Page No. - 40)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Technological Advancements in Vacuum Systems

5.2.1.2 Stringent Regulatory Frameworks Mandating the Use of Vacuum Systems

5.2.1.3 Increasing Number of Target Surgical Procedures Across Major Markets

5.2.1.4 Rising Number of Diagnostic Imaging Procedures

5.2.2 Restraints

5.2.2.1 High Cost of Products

5.2.3 Opportunities

5.2.3.1 Emerging Markets

5.2.4 Challenges

5.2.4.1 Procedural Limitations

6 Medical Vacuum Systems Market, By Product Type (Page No. - 45)

6.1 Introduction

6.2 Standalone Vacuum Systems

6.2.1 Standalone Systems Feature Compact Size and Low Energy Requirements

6.2.2 Standalone Vacuum Systems Market Split, By Technology

6.2.3 Standalone Vacuum Systems Market Split, By Application

6.2.4 Standalone Vacuum Systems Market Split, By Therapeutic Applications

6.2.5 Standalone Vacuum Systems Market Split, By End User

6.3 Centralized Vacuum Systems

6.3.1 Product Affordability and Efficiency to Drive Market Growth

6.3.2 Centralized Vacuum Systems Market Split, By Technology

6.3.3 Centralized Vacuum Systems Market Split, By Application

6.3.4 Centralized Vacuum Systems Market Split, By Therapeutic Applications

6.3.5 Centralized Vacuum Systems Market Split, By End User

6.4 Portable and Compact Vacuum Systems

6.4.1 Adoption of Portable and Compact Vacuum Systems Will Be High in Respiratory and Emergency/Trauma Care Settings

6.4.2 Portable and Compact Vacuum Systems Market Split, By Technology

6.4.3 Portable and Compact Vacuum Systems Market Split, By Application

6.4.4 Portable and Compact Vacuum Systems Market Split, By Therapeutic Applications

6.4.5 Portable and Compact Vacuum Systems Market Split, By End User

6.5 Accessories

6.5.1 Increasing Installation of Vacuum Systems Will Propel the Demand for Accessories

6.5.2 Medical Vacuum System Accessories Market Split, By Technology

6.5.3 Medical Vacuum System Accessories Market Split, By Application

6.5.4 Medical Vacuum System Accessories Market Split, By Therapeutic Applications

6.5.5 Medical Vacuum System Accessories Market Split, By End User

7 Medical Vacuum Systems Market, By Technology (Page No. - 59)

7.1 Introduction

7.2 Oil-Sealed Rotary Vane Technology

7.2.1 High Operational Stability has Ensured the Adoption of Oil-Sealed Rotary Vane Systems

7.3 Dry Rotary Vane Technology

7.3.1 Lack of Lubrication and Sewage Costs Minimizes Need for Maintenance in Dry Rotary Vane Systems

7.4 Dry Claw Vacuum Pump Technology

7.4.1 High Installation Costs May Hinder Market Growth

7.5 Oil-Sealed Liquid Ring Technology

7.5.1 Oil-Sealed Liquid Ring Systems Find High Use in Hospital & Lab Cleanrooms

7.6 Water-Sealed Liquid Ring Technology

7.6.1 Low Maintenance and Operation Costs are Driving Market Growth

8 Medical Vacuum Systems Market, By Application (Page No. - 67)

8.1 Introduction

8.2 Therapeutic Applications

8.2.1 Anesthesiology Applications

8.2.1.1 Anesthesiology Applications Hold the Largest Share of the Therapeutic Applications Market

8.2.2 Wound Care Applications

8.2.2.1 Rising Diabetes & Chronic Wound Incidence Will Drive Market Growth

8.2.3 Gynecology Applications

8.2.3.1 Dearth of Technicians in Rural Areas May Hinder Market Growth

8.2.4 Dental Applications

8.2.4.1 High Use of Advanced Vacuum Products and Demand for Cosmetic Dentistry Have Sustained the Demand for Market Products

8.3 Pharma-Biotech Manufacturing

8.3.1 Regulatory Guidelines Have Driven the Use of Vacuum Systems in Pharma-Biotech Applications

8.4 Diagnostic Applications

8.4.1 Increasing Number of Diagnostic Laboratories Will Accelerate the Adoption of Vacuum Systems

8.5 Research Applications

8.5.1 Centralized and Independent Vacuum Systems Find High Use in Research Applications

9 Medical Vacuum Systems Market, By End User (Page No. - 78)

9.1 Introduction

9.2 Hospitals, Surgical Centers, and Ambulatory Care Centers

9.2.1 Growing Demand for Surgeries Will Boost Market Growth

9.3 Pharmaceutical and Biotechnology Manufacturers

9.3.1 Favorable Regulations and Technological Advancements Have Contributed to Market Growth

9.4 Diagnostic Laboratories

9.4.1 Increasing Number of Diagnostic Procedures Will Boost the Demand for Vacuum Pumps

9.5 Research Laboratories and Academic Institutes

9.5.1 Growth in Research Activity Will Support the Demand for Vacuum System in Laboratories

10 Medical Vacuum Systems Market, By Region (Page No. - 84)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.1.1 The US is the Largest Market for Medical Vacuum Systems

10.2.2 Canada

10.2.2.1 High Burden of Chronic Diseases to Drive Market Growth in Canada

10.3 Europe

10.3.1 Germany

10.3.1.1 Increasing Healthcare Expenditure in Germany to Drive Market Growth

10.3.2 France

10.3.2.1 Presence of Stringent Regulations on Cleanroom and Drug Dispensing Requirements Will Boost Market Growth

10.3.3 UK

10.3.3.1 Stringent Regulations By the Mhra to Drive the Adoption of Advanced Vacuum Technologies in the UK

10.3.4 Rest of Europe

10.4 Asia Pacific

10.4.1 Japan

10.4.1.1 Significant Growth in the Geriatric Population to Drive the Demand for Medical Vacuum Systems in Japan

10.4.2 China

10.4.2.1 Rising Prevalence of Chronic Respiratory Diseases to Drive Market Growth in China

10.4.3 India

10.4.3.1 Growing Pharmaceutical and Biotechnology Industries to Promote the Growth of the Medical Vacuum Systems Market in India

10.4.4 Rest of Asia Pacific

10.5 Latin America

10.5.1 Brazil

10.5.1.1 Rapid Increase in the Geriatric Population to Drive the Growth of the Medical Vacuum Systems Market in Brazil

10.5.2 Mexico

10.5.2.1 High Rate of Obesity and the Rising Prevalence of Respiratory Diseases to Drive the Demand for Medical Vacuum Systems in Mexico

10.5.3 Rest of Latin America

10.6 Middle East & Africa

10.6.1 Ongoing Infrastructure Development Activities to Drive Market Growth in the MEA Region

11 Competitive Landscape (Page No. - 117)

11.1 Introduction

11.2 Competitive Leadership Mapping

11.2.1 Terminology/Nomenclature

11.2.1.1 Visionary Leaders

11.2.1.2 Innovators

11.2.1.3 Dynamic Differentiators

11.2.1.4 Emerging Companies

11.3 Competitive Scenario (2015-2019)

11.4 Market Share Analysis of Key Players (2017)

12 Company Profiles (Page No. - 123)

12.1 Air Techniques

12.1.1 Business Overview

12.1.2 Products Offered

12.1.3 Recent Developments (2015-2019)

12.2 Allied Healthcare Products, Inc

12.2.1 Business Overview

12.2.2 Products Offered

12.3 Zoll Medical Corporation (An Asahi Kasei Group Company)

12.3.1 Business Overview

12.3.2 Products Offered

12.3.3 Recent Developments (2015-2019)

12.3.4 MnM View

12.4 Atlas Copco AB

12.4.1 Business Overview

12.4.2 Products Offered

12.4.3 Recent Developments (2015-2019)

12.4.4 MnM View

12.5 Busch Holding GmbH

12.5.1 Business Overview

12.5.2 Products Offered

12.5.3 Recent Developments (2015-2019)

12.5.4 MnM View

12.6 Convatec

12.6.1 Business Overview

12.6.2 Products Offered

12.6.3 Recent Developments (2015-2019)

12.7 Drägerwerk AG & Co. KGaA

12.7.1 Business Overview

12.7.2 Products Offered

12.7.3 MnM View

12.8 Gardner Denver

12.8.1 Business Overview

12.8.2 Products Offered

12.8.3 MnM View

12.9 Integra Biosciences AG

12.9.1 Business Overview

12.9.2 Products Offered

12.9.3 Recent Developments (2015-2019)

12.10 Laerdal Medical

12.10.1 Business Overview

12.10.2 Products Offered

12.11 Medela Holding AG

12.11.1 Business Overview

12.11.2 Products Offered

12.12 Medicop

12.12.1 Business Overview

12.12.2 Products Offered

12.13 Ohio Medical Corporation

12.13.1 Business Overview

12.13.2 Products Offered

12.14 Olympus Corporation

12.14.1 Business Overview

12.14.2 Products Offered

12.14.3 MnM View

12.15 Precision Medical, Inc.

12.15.1 Business Overview

12.15.2 Products Offered

13 Appendix (Page No. - 151)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Available Customizations

13.4 Related Reports

13.5 Author Details

List of Tables (91 Tables)

Table 1 Major Advanced Medical Vacuum Systems Commercialized During 2015–2018

Table 2 Medical Vacuum Systems Market, By Product Type, 2017–2024 (USD Million)

Table 3 Standalone Vacuum Systems Market, By Region, 2017–2024 (USD Million)

Table 4 Standalone Vacuum Systems Market, By Technology, 2017–2024 (USD Million)

Table 5 Standalone Vacuum Systems Market, By Application, 2017–2024 (USD Million)

Table 6 Standalone Vacuum Systems Market for Therapeutic Applications, By Type, 2017–2024 (USD Million)

Table 7 Standalone Vacuum Systems Market, By End User, 2017–2024 (USD Million)

Table 8 Centralized Vacuum Systems Market, By Region, 2017–2024 (USD Million)

Table 9 Centralized Vacuum Systems Market, By Technology, 2017–2024 (USD Million)

Table 10 Centralized Vacuum Systems Market, By Application, 2017–2024 (USD Million)

Table 11 Centralized Vacuum Systems Market for Therapeutic Applications, By Type, 2017–2024 (USD Million)

Table 12 Centralized Vacuum Systems Market, By End User, 2017–2024 (USD Million)

Table 13 Portable and Compact Vacuum Systems Market, By Region, 2017–2024 (USD Million)

Table 14 Portable and Compact Vacuum Systems Market, By Technology, 2017–2024 (USD Million)

Table 15 Portable and Compact Vacuum Systems Market, By Application, 2017–2024 (USD Million)

Table 16 Portable and Compact Vacuum Systems Market for Therapeutic Applications, By Type, 2017–2024 (USD Million)

Table 17 Portable and Compact Vacuum Systems Market, By End User, 2017–2024 (USD Million)

Table 18 Medical Vacuum System Accessories Market, By Region, 2017–2024 (USD Million)

Table 19 Medical Vacuum System Accessories Market, By Technology, 2017–2024 (USD Million)

Table 20 Medical Vacuum System Accessories Market, By Application, 2017–2024 (USD Million)

Table 21 Medical Vacuum System Accessories Market for Therapeutic Applications, By Type, 2017–2024 (USD Million)

Table 22 Medical Vacuum System Accessories Market, By End User, 2017–2024 (USD Million)

Table 23 Market, By Technology, 2017–2024 (USD Million)

Table 24 Market for Oil-Sealed Rotary Vane Technology, By Region, 2017–2024 (USD Million)

Table 25 Market for Dry Rotary Vane Technology, By Region, 2017–2024 (USD Million)

Table 26 Market for Dry Claw Vacuum Pump Technology, By Region, 2017–2024 (USD Million)

Table 27 Market for Oil-Sealed Liquid Ring Technology, By Region, 2017–2024 (USD Million)

Table 28 Market for Water-Sealed Liquid Ring Technology, By Region, 2017–2024 (USD Million)

Table 29 Market, By Application, 2017–2024 (USD Million)

Table 30 Market for Therapeutic Applications, By Type, 2017–2024 (USD Million)

Table 31 Market for Therapeutic Applications, By Region, 2017–2024 (USD Million)

Table 32 Market for Anesthesiology Applications, By Region, 2017–2024 (USD Million)

Table 33 Market for Wound Care Applications, By Region, 2017–2024 (USD Million)

Table 34 Market for Gynecology Applications, By Region, 2017–2024 (USD Million)

Table 35 Market for Dental Applications, By Region, 2017–2024 (USD Million)

Table 36 Market for Pharma-Biotech Manufacturing, By Region, 2017–2024 (USD Million)

Table 37 Market for Diagnostic Applications, By Region, 2017–2024 (USD Million)

Table 38 Market for Research Applications, By Region, 2017–2024 (USD Million)

Table 39 Market, By End User, 2017–2024 (USD Million)

Table 40 Market for Hospitals, Surgical Centers, and Ambulatory Care Centers, By Region, 2017–2024 (USD Million)

Table 41 Market for Pharmaceutical and Biotechnology Manufacturers, By Region, 2017–2024 (USD Million)

Table 42 Market for Diagnostic Laboratories, By Region, 2017–2024 (USD Million)

Table 43 Market for Research Laboratories and Academic Institutes, By Region, 2017–2024 (USD Million)

Table 44 Market, By Region, 2017–2024 (USD Million)

Table 45 Market, By Country, 2017–2024 (USD Million)

Table 46 North America: Market, By Country, 2017–2024 (USD Million)

Table 47 North America: Market, By Product Type, 2017–2024 (USD Million)

Table 48 North America: Market, By Technology, 2017–2024 (USD Million)

Table 49 North America: Market, By Application, 2017–2024 (USD Million)

Table 50 North America: Market for Therapeutic Applications, By Type, 2017–2024 (USD Million)

Table 51 North America: Market, By End User, 2017–2024 (USD Million)

Table 52 US: Market, By Product Type, 2017–2024 (USD Million)

Table 53 Canada: Market, By Product Type, 2017–2024 (USD Million)

Table 54 Europe: Market, By Country, 2017–2024 (USD Million)

Table 55 Europe: Market, By Product Type, 2017–2024 (USD Million)

Table 56 Europe: Market, By Technology, 2017–2024 (USD Million)

Table 57 Europe: Market, By Application, 2017–2024 (USD Million)

Table 58 Europe: Market for Therapeutic Applications, By Type, 2017–2024 (USD Million)

Table 59 Europe: Market, By End User, 2017–2024 (USD Million)

Table 60 Germany: Market, By Product Type, 2017–2024 (USD Million)

Table 61 UK: Market, By Product Type, 2017–2024 (USD Million)

Table 62 France: Market, By Product Type, 2017–2024 (USD Million)

Table 63 Rest of Europe: Market, By Product Type, 2017–2024 (USD Million)

Table 64 Asia Pacific: Market, By Country, 2017–2024 (USD Million)

Table 65 Asia Pacific: Market, By Product Type, 2017–2024 (USD Million)

Table 66 Asia Pacific: Market, By Technology, 2017–2024 (USD Million)

Table 67 Asia Pacific: Market, By Application, 2017–2024 (USD Million)

Table 68 Asia Pacific: Market for Therapeutic Applications, By Type, 2017–2024 (USD Million)

Table 69 Asia Pacific: Market, By End User, 2017–2024 (USD Million)

Table 70 Japan: Medical Vacuum System Market, By Product Type, 2017–2024 (USD Million)

Table 71 China: Medical Vacuum System Market, By Product Type, 2017–2024 (USD Million)

Table 72 India: Medical Vacuum System Market, By Product Type, 2017–2024 (USD Million)

Table 73 Rest of Asia Pacific: Medical Vacuum System Market, By Product Type, 2017–2024 (USD Million)

Table 74 Latin America: Medical Vacuum System Market, By Country, 2017–2024 (USD Million)

Table 75 Latin America: Medical Vacuum System Market, By Product Type, 2017–2024 (USD Million)

Table 76 Latin America: Medical Vacuum System Market, By Technology, 2017–2024 (USD Million)

Table 77 Latin America: Medical Vacuum System Market, By Application, 2017–2024 (USD Million)

Table 78 Latin America: Medical Vacuum System Market for Therapeutic Applications, By Type, 2017–2024 (USD Million)

Table 79 Latin America: Medical Vacuum System Market, By End User, 2017–2024 (USD Million)

Table 80 Brazil: Medical Vacuum System Market, By Product Type, 2017–2024 (USD Million)

Table 81 Mexico: Medical Vacuum Systems Market, By Product Type, 2017–2024 (USD Million)

Table 82 Rest of Latin America: Medical Vacuum System Market, By Product Type, 2017–2024 (USD Million)

Table 83 Middle East & Africa: Medical Vacuum System Market, By Product Type, 2017–2024 (USD Million)

Table 84 Middle East & Africa: Medical Vacuum System Market, By Technology, 2017–2024 (USD Million)

Table 85 Middle East & Africa: Medical Vacuum System Market, By Application, 2017–2024 (USD Million)

Table 86 Middle East & Africa: Medical Vacuum System Market for Therapeutic Applications, By Type, 2017–2024 (USD Million)

Table 87 Middle East & Africa: Medical Vacuum System Market, By End User, 2017–2024 (USD Million)

Table 88 New Product Launches and Approvals

Table 89 New Aquisitions

Table 90 New Expansions

Table 91 New Agreements

List of Figures (38 Figures)

Figure 1 Research Design

Figure 2 Key Data From Secondary Sources

Figure 3 Key Data From Primary Sources

Figure 4 Breakdown of Primaries

Figure 5 Research Methodology: Hypothesis Building

Figure 6 Medical Vacuum System Market Estimation: Overall Methodology

Figure 7 Data Triangulation

Figure 8 Assumptions of the Research Study

Figure 9 Medical Vacuum System Market, By Product Type, 2018 vs 2024 (USD Million)

Figure 10 Medical Vacuum System Market, By Technology, 2018 vs 2024 (USD Million)

Figure 11 Medical Vacuum System Market Share, By Application, 2018 vs 2024

Figure 12 Medical Vacuum System Market Share, By End User, 2018 vs 2024

Figure 13 Medical Vacuum System Market: Geographical Snapshot

Figure 14 Technological Advancements in Vacuum Systems to Drive Market Growth

Figure 15 Standalone Vacuum Systems Segment to Hold the Largest Share of the Medical Vacuum System Market in 2018

Figure 16 Oil Sealed Rotary Vane Technology Segment is Estimated to Hold the Largest Share During the Forecast Period

Figure 17 Therapeutic Applications Dominated the Medical Vacuum System Market in 2018

Figure 18 Hospitals, Surgical Centers, and Ambulatory Care Centers are the Major End Users of the Market During 2018–2024

Figure 19 China is Expected to Grow at the Highest CAGR During 2018–2024

Figure 20 Medical Vacuum System Market: Drivers, Restraints, Opportunities, and Challenges

Figure 21 Portable and Compact Vacuum Systems Segment to Grow at the Highest Rate During the Forecast Period

Figure 22 Oil-Sealed Rotary Vane Technology to Offer Significant Growth Opportunity Among All the Technologies During the Forecast Period

Figure 23 Therapeutic Applications Dominate the Medical Vacuum System Market

Figure 24 Anesthesiology Applications Segment to Grow at the Highest Rate During the Forecast Period

Figure 25 Hospitals, Surgical Centers, and Ambulatory Care Centers to Grow at the Highest Rate in the End-User Market

Figure 26 North America: Medical Vacuum System Market Snapshot

Figure 27 Europe: Medical Vacuum System Market Snapshot

Figure 28 Global Medical Vacuum System Market, Competitive Leadership Mapping, 2018

Figure 29 Key Developments in the Global Medical Vacuum System Market, 2015–2018

Figure 30 Atlas Copco AB Held the Leading Position in the Medical Vacuum System Market in 2017

Figure 31 Allied Healthcare Products, Inc.: Company Snapshot (2017)

Figure 32 Asahi Kasei Group Company: Company Snapshot (2017)

Figure 33 Atlas Copco AB: Company Snapshot (2017)

Figure 34 Convatec: Company Snapshot (2017)

Figure 35 Drägerwerk AG & Co. KGaA: Company Snapshot (2017)

Figure 36 Gardner Denver: Company Snapshot (2017)

Figure 37 Integra Holding AG: Company Snapshot (2017)

Figure 38 Olympus: Company Snapshot (2017)

This study involved four major activities in estimating the current size of the global medical vacuum systems market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary research was conducted to obtain key information about market classification and segmentation, geographical scenario, key developments undertaken by major market players, and the identification of key industry trends. The secondary sources used for this study include annual reports, press releases, and investor presentations of companies; white papers; certified publications; and articles from recognized websites, databases, and directories.

Primary Research

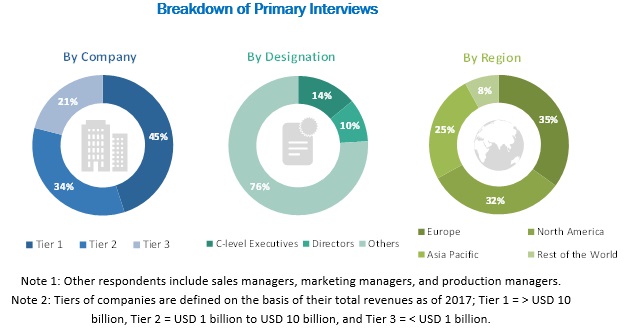

Extensive primary research was conducted after acquiring a preliminary understanding of the global medical vacuum systems market scenario through secondary research. Primary interviews were conducted with market experts from both the demand-side (such as doctors, and nursing staff from hospitals, surgical centers, ambulatory centers, as well as researchers and technicians from diagnostic laboratories, SNFs, and POLs, pharmaceutical & biotechnology manufacturers, research laboratories, and academic institutes) and supply-side respondents (such as medical vacuum pump and system manufacturers, suppliers, channel partners, and distributors) across North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. Approximately 30% and 70% of primary interviews were conducted with both the demand- and supply-side respondents, respectively. The primary data was collected through questionnaires, e-mails, online surveys, and telephonic interviews. A breakdown of primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Medical Vacuum Systems Market Estimation Methodology

- A detailed market estimation approach was followed to estimate and validate the size of the global medical vacuum systems market and other dependent submarkets.

- The key players in the global medical vacuum systems market were identified through secondary research, and their global market shares were determined through primary and secondary research.

- The research methodology includes the study of the annual and quarterly financial reports of top market players as well as interviews with industry experts to gather key insights on various market segments and subsegments.

- All segmental shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- Major macroindicators in play have been accounted for, viewed in detail, verified through primary research, and analyzed to understand their impact on market growth and various segments and subsegments.

- The above-mentioned data was consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Data Triangulation:

After deriving the overall medical vacuum systems market value from the market size estimation process explained above, the total market value data was split into several segments and subsegments. Data triangulation and market breakdown were undertaken to complete the overall market engineering process and arrive at the exact statistics for all segments, wherever applicable. The data was triangulated by studying various qualitative & quantitative variables as well as by analyzing regional trends for both the demand and supply-side macroindicators.

Report Objectives:

- To define, describe, and forecast the global medical vacuum systems market on the basis of product type, technology, application, end user, and region

- To provide detailed information regarding the major factors influencing the medical vacuum systems market (such as drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contributions to the global medical vacuum systems market

- To analyze key growth opportunities in the medical vacuum systems market for key stakeholders and provide details of the competitive landscape for key market players.

- To forecast the market value of various segments and/or subsegments with respect to five major regional segments—North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To profile key players in the global medical vacuum systems market and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments undertaken by major players in the global medical vacuum systems market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the medical vacuum systems market report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top five companies in the medical vacuum systems market

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Medical Vacuum System Market