Wearable Healthcare Devices Market: Growth, Size, Share, and Trends

Wearable Healthcare Devices Market by Product (Trackers, Smartwatch, Patches), Type (Diagnostic (Vital Sign, ECG, Glucose), Therapeutic (Pain, Insulin)), Grade (Consumer, Clinical), Channel (Online, Pharmacy), Application (RPM) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

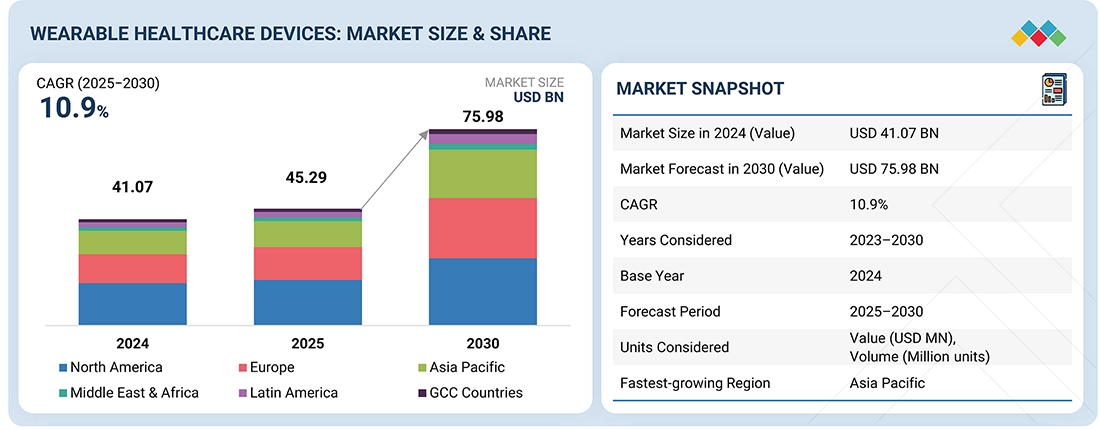

The wearable healthcare devices market is expected to grow from USD 45.29 billion in 2025 to USD 75.98 billion by 2030, registering a CAGR of 10.9% during the forecast period. Wearable healthcare devices are self-contained tools worn or attached to the body to monitor physiological and metabolic changes. They track health metrics such as sleep patterns, blood glucose, and vital signs, assist in diagnosing conditions like sleep apnea, and support therapeutic applications including pain management, rehabilitation, and respiratory care. Market growth is driven by rising health awareness, preventive care, and the prevalence of chronic conditions. Advances in AI, real-time monitoring, and EHR integration have expanded wearables from fitness tracking to clinical diagnostics and therapy. Investments, smartphone adoption, improved connectivity, and wireless monitoring are supporting expansion, while AI and 5G are expected to accelerate innovation. However, regulatory gaps, data security concerns, and clinical accuracy limitations may restrain growth.

KEY TAKEAWAYS

-

BY PRODUCTThe wearable healthcare devices market is segmented into trackers, smartwatches, patches, and smart clothing. Among these, smartwatches stand out for their multifunctional role, combining traditional fitness tracking with advanced clinical features that enhance both preventive care and remote patient monitoring.

-

BY TYPEThe wearable healthcare devices market is segmented into diagnostic & monitoring devices and therapeutic devices. Diagnostic & monitoring devices track key health indicators such as heart rate, temperature, SpO2, and blood pressure, while therapeutic devices are used in areas like pain management and respiratory support.

-

BY GRADEBy grade, the wearable healthcare devices market is segmented into consumer-grade and clinical-grade devices. Consumer-grade devices include smartwatches, fitness trackers, wristbands, and smart clothing that are easily accessible to the public without a prescription. These devices are widely used in fitness, wellness, and lifestyle management, offering features such as heart rate monitoring, ECG, and sleep tracking.

-

BY DISTRIBUTION CHANNELBy distribution channel, the wearable healthcare devices market is categorized into pharmacies, online channels, and hypermarkets. Pharmacies and hypermarkets serve immediate purchase needs, while online channels provide broader access to products such as smartwatches, fitness trackers, blood pressure monitors, and sleep monitoring devices.

-

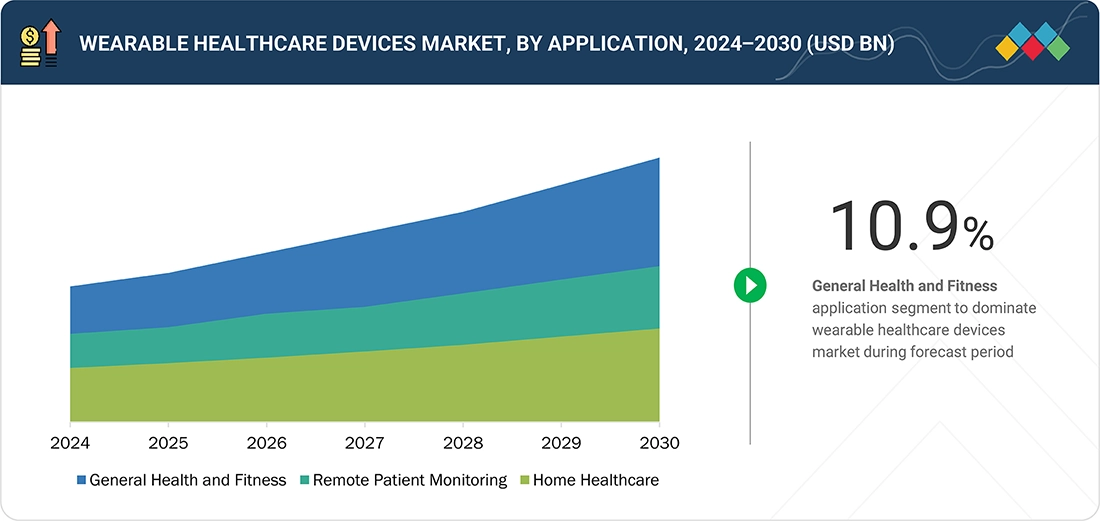

BY APPLICATIONThe wearable healthcare devices market is segmented into general health & fitness, remote patient monitoring, and home healthcare. General health & fitness wearables lead in demand due to their widespread use for preventive health, wellness tracking, and lifestyle management, followed by remote patient monitoring and home healthcare, which are increasingly adopted for chronic disease management and telehealth applications.

-

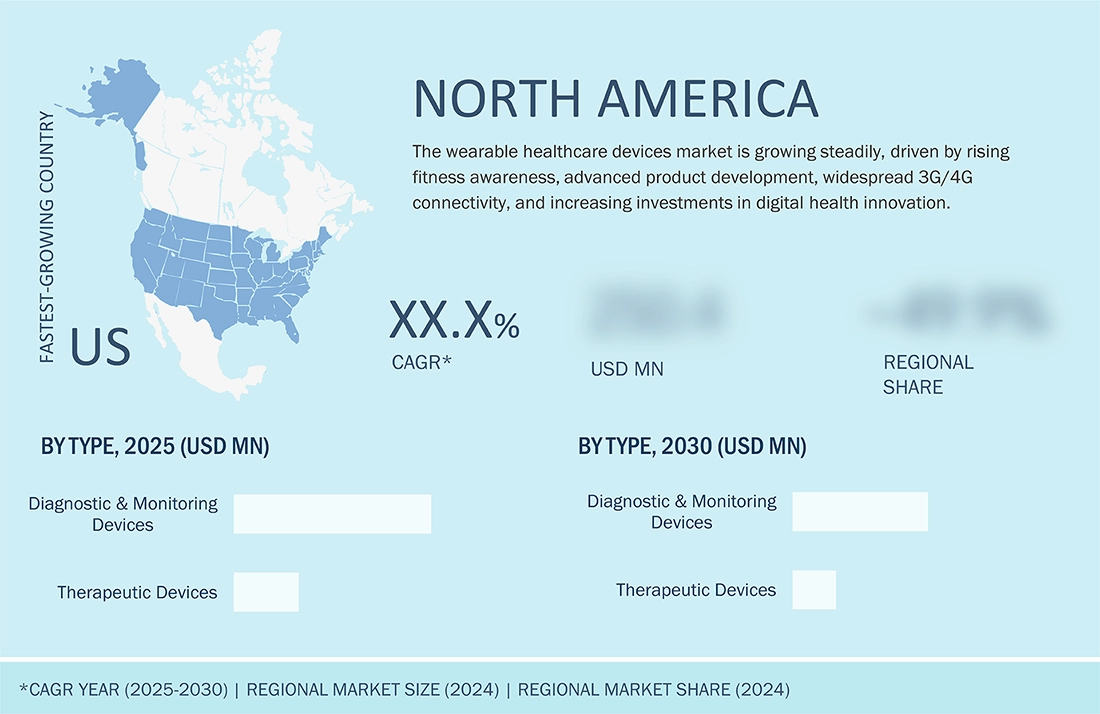

BY REGIONThe Asia Pacific market is expected to grow fastest, with a CAGR of 13.1%, driven by rising health consciousness, increasing adoption of digital health technologies, expanding telemedicine and eHealth initiatives, and growing use of consumer-grade wearables across countries like China, India, and Japan.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies, including product launches, partnerships, and acquisitions. Leading companies such as Apple Inc., Samsung, Abbott, DexCom, Inc., and Fitbit Inc. have strengthened their product portfolios and expanded their global presence to meet the rising demand for wearable healthcare devices. Continuous innovation in health-tracking features, clinically validated solutions, and fitness-focused monitoring capabilities has helped these players maintain competitive advantage in a rapidly evolving market.

The wearable healthcare devices market is driven by rising health consciousness and the shift toward lifestyle and home-based healthcare. Advances in wearable sensors, AI, and data analytics are improving early diagnosis and chronic disease management. Growth is further supported by the expanding geriatric population, rising prevalence of chronic illnesses, and increased investment in digital health solutions. Widespread smartphone adoption and 3G/4G connectivity enhance device usability. However, regulatory inconsistencies, data privacy concerns, and accuracy issues pose challenges, along with limited battery life and design complexities. Opportunities exist through AI and 5G integration, as well as the growing preference for wireless connectivity in healthcare, supporting further market expansion.

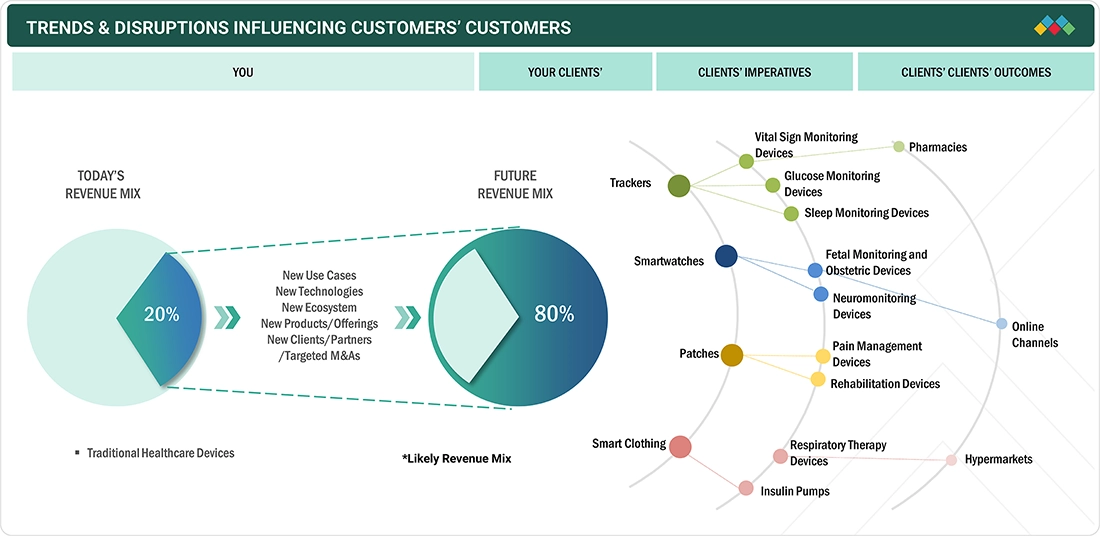

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Rising awareness about fitness is expected to drive growth in the wearable healthcare devices market during the forecast period. Technological advancements are also likely to reshape the business revenue mix in the coming years. Prioritizing user satisfaction and adapting to evolving consumer preferences are essential strategies for sustained growth in this dynamic industry. Many OEMs are currently missing opportunities to develop wearable devices specifically for chronic disease management. Collaborations with research institutions and pharmaceutical companies can enable the use of wearables for data collection and health monitoring in various studies. Companies that strategically embrace these trends and incorporate innovative features into their devices are poised to experience a significant shift in their revenue mix.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising health consciousness and shift toward lifestyle & home-based healthcare

-

Advancements in wearable technology

Level

-

Inconsistent regulations across regions

-

Challenges associated with data accuracy, privacy, and interpretation of wearable-generated information

Level

-

Expansion of AI and 5G applications in medical devices

-

Growing preference for wireless connectivity among healthcare providers

Level

-

Patent protection of wearable healthcare devices

-

Challenges due to limited battery life

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising health consciousness and shift toward lifestyle & home-based healthcare

Increasing health awareness and focus on lifestyle wellness are boosting global adoption of wearable healthcare devices. Smartwatches, fitness trackers, and wearable ECGs monitor vital metrics like heart rate, sleep, and activity, supporting preventive care and early intervention. According to the WHO (2023), over 74% of deaths are caused by non-communicable diseases, many preventable through lifestyle management. Rising hospital costs, particularly in the US (USD 4.5 trillion in 2022), drive reliance on home-monitoring tools. As healthcare shifts toward value-based models, wearables are integral to population health strategies and remote care across regions including the US, Germany, Japan, and China.

Restraint: Challenges in data accuracy, privacy, and interpretation of wearable-generated information

Wearable healthcare devices face challenges in data accuracy, standardization, and privacy. Many collect sensitive health data classified as PHI, raising concerns about ownership and cybersecurity. A 2023 JMIR mHealth and uHealth report highlighted inconsistencies in tracking metrics like heart rate and activity, limiting clinical reliability. Lack of standardized validation and limited integration into regulated workflows further restrict adoption. Privacy concerns over data collection, storage, and monetization create hesitancy among consumers and providers, especially in regions with strict regulations like the US and EU, hindering broader clinical use.

Opportunity: Expansion of AI and 5G applications in medical devices

AI and 5G are driving growth opportunities in wearable healthcare devices. By early 2023, global 5G subscribers exceeded 1.1 billion, enabling real-time data transfer for faster, more reliable monitoring. Combined with AI, wearables deliver predictive insights and automated alerts for early intervention in high-risk patients. AR and VR applications integrated with 5G wearables are explored for rehabilitation and pain management. As adoption rises, wearables become central to digital health ecosystems, improving patient engagement, clinical efficiency, and access to care worldwide.

Challenge: Design and integration challenges in wearable devices

Design and integration remain key challenges for wearable devices. They must combine clinical-grade accuracy with compact, lightweight, user-friendly designs suitable for continuous use. Incorporating multiple sensors, wireless modules, and batteries requires advances in miniaturization, thermal management, and materials. Power efficiency is crucial, as frequent charging may reduce compliance. User experience—including intuitive interfaces, seamless app integration, and appealing design—is essential. In clinical settings, ease of sanitization and regulatory compliance add complexity. Balancing medical functionality with consumer expectations makes innovation technically demanding and resource-intensive.

Wearable Healthcare Devices Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Provides smartwatches (Apple Watch series) with health features including heart rate tracking, ECG, blood oxygen monitoring (SpO2), sleep tracking, fall detection, and integration with Apple Health/HealthKit | Continuous health tracking, early detection of irregularities, seamless integration with iOS ecosystem, improved patient engagement, and actionable wellness insights |

|

Offers smartwatches (Galaxy Watch series) and trackers (Galaxy Fit) with sensors for heart rate, sleep, SpO2, stress, and fitness, integrated into the Samsung Health platform | Comprehensive wellness monitoring, easy-to-use interface, preventive health support, and connectivity across Android ecosystem |

|

Specializes in glucose monitoring patches (FreeStyle Libre systems) that provide continuous glucose monitoring (CGM) without routine finger pricks | Improved diabetes management, reduced discomfort, enhanced treatment compliance, and real-time glucose insights for better clinical and personal decision-making |

|

Develops continuous glucose monitoring patches (Dexcom G6/G7) that transmit real-time glucose data to smartphones and connected devices for ongoing diabetes management | Accurate glucose tracking, better glycemic control, remote monitoring for caregivers, reduced hypoglycemia risks, and improved patient outcomes |

|

Provides trackers (Charge, Inspire) and smartwatches (Versa, Sense) with features such as heart rate monitoring, sleep analysis, stress tracking, SpO2, and integration with Fitbit Health Solutions for wellness programs | Affordable wellness solutions, accessibility for a large user base, data-driven lifestyle improvement, and preventive healthcare support |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem of the wearable healthcare devices market comprises the key elements and stakeholders across the entire value chain. Product manufacturers—responsible for smartwatches, trackers, patches, and smart clothing—handle research, design, clinical validation, and commercialization of these devices. These products cater to applications such as general health & fitness tracking, home healthcare, and remote patient monitoring. Once developed, the devices are distributed to end users through various channels, including pharmacies, online platforms, and hypermarkets. End users range from individual consumers seeking wellness and lifestyle tools to patients managing chronic conditions at home or under clinical supervision. Regulatory bodies oversee device safety, data privacy, and compliance with applicable standards, with particular focus on clinical-grade products.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Wearable Healthcare Devices Market, By Product

By product, the smartwatches segment commanded the largest market share in 2024, driven by their ability to integrate clinical-grade monitoring with consumer-friendly design. Smartwatches track key metrics such as heart rate, ECG, SpO2, sleep, and stress while supporting medication reminders and health alerts. Their seamless connectivity with smartphones, cloud systems, and health platforms like Apple Health, Google Fit, and Samsung Health enhances user engagement. Regular updates, improved sensor accuracy, and AI-driven insights further strengthen adoption. The segment also benefits from growing smartphone penetration, rising preventive healthcare awareness, and wide availability across pharmacies, online channels, and retail stores. While trackers, patches, and smart clothing are gaining momentum in specialized areas, smartwatches remain the central driver of the wearable healthcare devices market due to their versatility and consumer acceptance.

Wearable Healthcare Devices Market, By Type

By type, diagnostic & monitoring devices held the largest market share in 2024, driven by rising demand for real-time health tracking and early disease detection. This segment includes vital sign monitors, glucose monitors, sleep monitors, neuromonitoring devices, and fetal & obstetric monitors. Their ability to continuously track critical physiological parameters supports the management of chronic conditions such as hypertension, diabetes, and sleep disorders. Advancements in miniaturization, sensor accuracy, and connectivity have made these devices more compact, user-friendly, and reliable. Integration with AI-powered analytics and at-home healthcare platforms has further boosted adoption. While therapeutic devices are steadily expanding, diagnostic & monitoring devices remain the backbone of the market due to their wider applicability, strong regulatory support, and increasing role in preventive healthcare.

Wearable Healthcare Devices Market, By Grade

By grade, consumer-grade wearable healthcare devices held the largest share of the wearable healthcare devices market in 2024, primarily due to the widespread adoption of smartphones, advancements in sensor miniaturization, and their seamless integration with mobile health applications. These devices are primarily intended for general wellness and do not meet the stringent clinical accuracy or regulatory standards required for medical diagnosis or treatment. Some devices, like the Apple Watch, have obtained regulatory approvals for specific features, but their main positioning remains consumer-focused. Their ability to monitor a broad range of physiological parameters, along with user-friendly features like Bluetooth connectivity, GPS, and smartphone sync, has made them popular among both tech-savvy users and aging populations seeking convenient, non-invasive health tools.

Wearable Healthcare Devices Market, By Distribution Channel

Online channels accounted for the largest share of the wearable healthcare devices market in 2024, driven by rapid e-commerce growth and rising consumer preference for digital shopping. Platforms like Amazon, Flipkart, BestBuy, and Alibaba offer 24/7 availability, detailed product comparisons, user reviews, and flexible payment options. Rising smartphone usage and improved internet connectivity have further fueled online sales. Challenges such as concerns over product authenticity, limited physical interaction, and return hassles are being addressed through better customer support, return policies, and product warranties. Direct sales through official manufacturer websites also enhance margins and brand loyalty. While pharmacies and hypermarkets remain relevant in some regions, online channels dominate due to their convenience, reach, and evolving digital experience.

Wearable Healthcare Devices Market, By Application

The general health & fitness segment is expected to hold the largest share of the wearable healthcare devices market during the forecast period. This dominance is driven by increasing consumer focus on preventive health, wellness tracking, and lifestyle management. Devices equipped with sensors and microcontrollers enable individuals to monitor key vital signs and make informed health decisions. Growing awareness of lifestyle-related diseases, rising popularity of wellness apps and platforms, and the classification of many devices as low-risk wellness products further support adoption. While remote patient monitoring and home healthcare are expanding due to aging populations and telehealth infrastructure, general health & fitness wearables remain the leading application area because of their mass-market appeal, daily usage, and seamless integration with consumer electronics.

REGION

Asia Pacific to be fastest-growing region in global wearable healthcare devices market during forecast period

Asia Pacific is projected to witness the highest CAGR in the wearable healthcare devices market during the forecast period. This growth is fueled by demographic, economic, and technological factors, including the rising prevalence of chronic diseases such as diabetes, cardiovascular conditions, and respiratory disorders. Wearable devices enable preventive care and remote monitoring, which are increasingly needed by elderly populations and tech-savvy consumers. Expanding telemedicine and eHealth initiatives in countries like India, along with ICT-based healthcare systems in Japan, support market adoption. Rising disposable incomes, smartphone proliferation, improved internet connectivity, and integration with health apps further enhance usage. With a large, diverse population, evolving regulatory support, and strong digital transformation, Asia Pacific is well-positioned as a hub for innovation and wearable healthcare adoption globally.

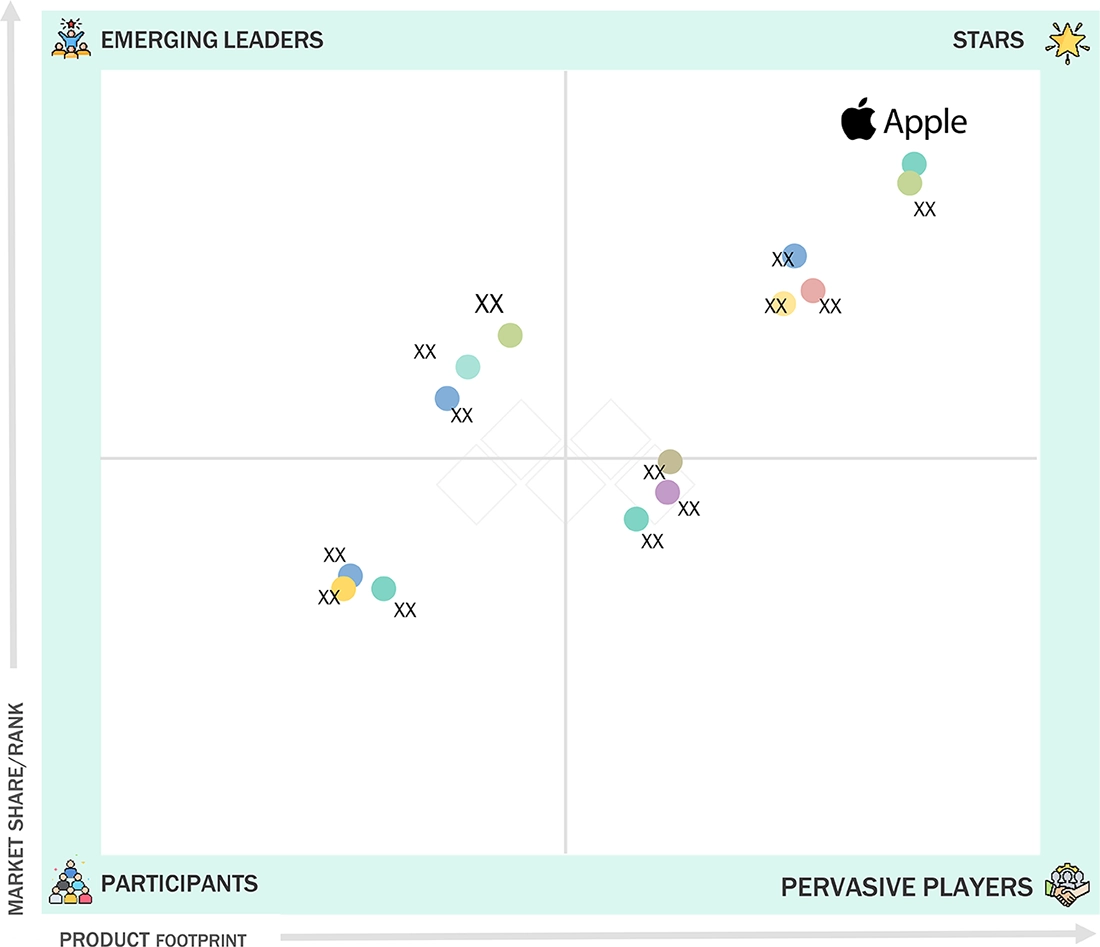

Wearable Healthcare Devices Market: COMPANY EVALUATION MATRIX

In the wearable healthcare devices market matrix, Apple Inc. (US) leads with a robust product ecosystem, continuous innovation, and strong brand loyalty, driving widespread adoption across consumer and clinical users. Samsung (South Korea) leverages advanced sensor technology and global reach to strengthen its position, particularly in smartwatches. Abbott (US) excels with clinically validated solutions in diabetes care, while DexCom, Inc. (US) dominates the continuous glucose monitoring (CGM) segment. Fitbit Inc. (US), backed by Alphabet Inc., continues to expand health monitoring features and grow its market share. While Apple maintains leadership through scale and innovation, Fitbit and other specialized players demonstrate strong potential for growth in the wearable healthcare ecosystem.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 41.07 Billion |

| Revenue Forecast in 2030 | USD 75.98 Billion |

| Growth Rate | CAGR of 10.9% from 2025-2030 |

| Actual Data | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Million Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa, and GCC Countries |

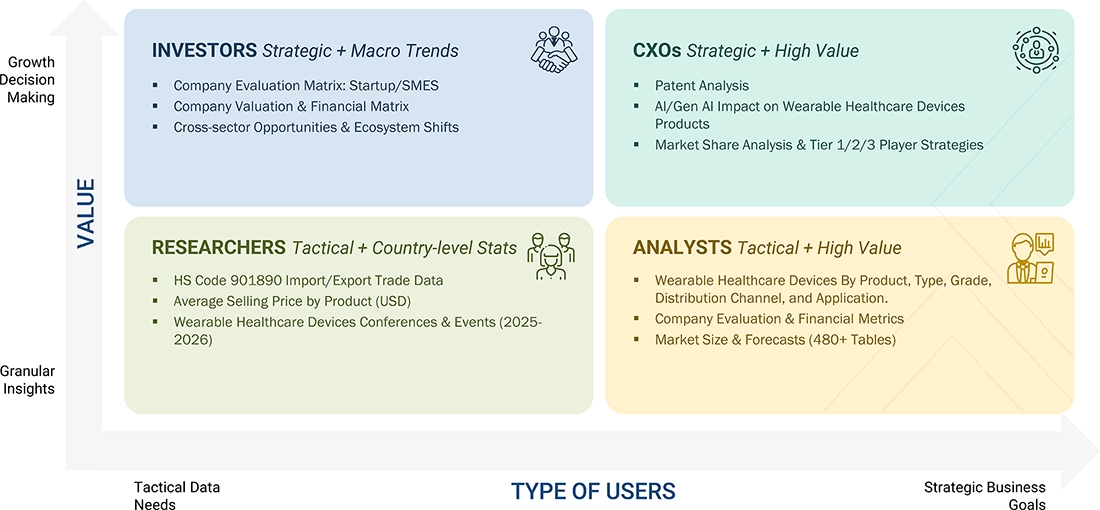

WHAT IS IN IT FOR YOU: Wearable Healthcare Devices Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | ||

| Company Information | ||

| Geographic Analysis |

RECENT DEVELOPMENTS

- July 2025 : Samsung Electronics Co., Ltd. (South Korea) acquired Xealth (US) to integrate wearable wellness data into clinical workflows.

- November 2024 : DexCom, Inc. (US) partnered with OURA (Finland) to distribute the OURA Ring through health programs covering 75 million participants.

- September 2024 : Apple Inc. (US) introduced the Apple Watch Series 10, featuring a slimmer design, sleep apnea alerts, and enhanced sensing capabilities.

- February 2024 : Samsung Electronics Co., Ltd. (South Korea) obtained FDA De Novo clearance for the Galaxy Watch’s sleep apnea detection feature.

Table of Contents

Methodology

The study involved major activities in estimating the current market size for the wearable healthcare devices market. Exhaustive secondary research was done to collect information on the wearable healthcare devices industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the wearable healthcare devices market.

The four steps involved in estimating the market size are:

Secondary Research

The secondary research process involves utilizing a variety of secondary sources, including directories, databases such as Bloomberg Businessweek, Factiva, and D&B Hoovers, as well as white papers, annual reports, investor presentations, and SEC filings from companies. Additionally, publications from government sources—such as the National Institutes of Health (NIH), US Food and Drug Administration (FDA), US Census Bureau, World Health Organization (WHO), Global Burden of Disease Study, and Centers for Medicare and Medicaid Services (CMS)—were referenced to identify and gather information for the global wearable healthcare devices market study. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends, to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

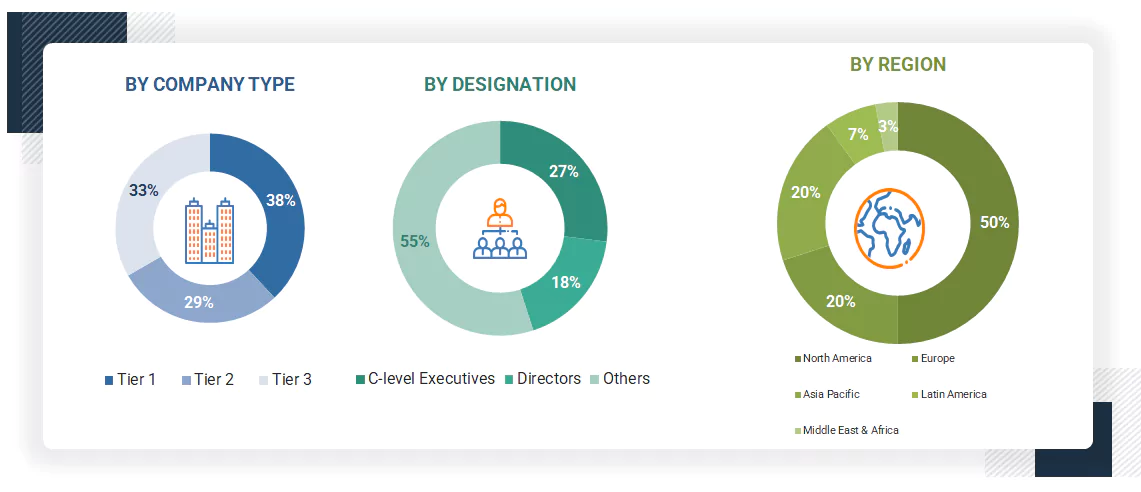

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing & sales directors, technology & innovation directors, and related key executives from various key companies and organizations in the wearable healthcare devices market. The primary sources from the demand side include biotechnology companies, CROs, pharmacies, medical device companies, and research academies and universities. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends & key market dynamics.

The following is a breakdown of the primary respondents:

Note 1: Others include sales, marketing, and product managers.

Note 2: Companies are classified into tiers based on their total revenues. As of 2024, Tier 1 = >USD 100 million, Tier 2 = USD 10 million to USD 100 million, and Tier 3 = < USD 10 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For the global market value, annual revenues were calculated based on the revenue mapping of major product manufacturers and OEMs active in the global wearable healthcare devices market. All the major service providers were identified at the global and/or country/regional level. Revenue mapping for the respective business segments/subsegments was done for the major players. The global wearable healthcare devices market was split into various segments and subsegments based on:

- List of major players operating in the product market at the regional and/or country level

- Product mapping of wearable healthcare device providers at the regional and/or country level

- Mapping of annual revenues generated by listed major players from wearable healthcare devices (or the nearest reported business unit/product category)

- Extrapolation of the revenue mapping of the listed major players to derive the global market value of the respective segments/subsegments

- Summation of the market value of all segments/subsegments to arrive at the global wearable healthcare devices market

The above-mentioned data was consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

The research methodology used to estimate the market size includes the following:

Data Triangulation

After arriving at the overall market size by applying the process mentioned above, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Wearable healthcare devices are autonomous devices that can be attached, worn, or held and are used to monitor and examine the metabolic & physiological changes that occur in the human body. These devices are also used to record data. Wearable healthcare devices diagnose many diseases, such as sleep apnea, and are used to monitor skin temperature, blood glucose levels, sleep patterns, general health parameters, and fitness. These devices are also used for various therapeutic applications such as pain management, rehabilitative services, and respiratory care.

Stakeholders

- Wearable healthcare device manufacturers

- Hospitals and ASCs

- Research and consulting firms

- Distributors of wearable healthcare devices

- Contract manufacturers of wearable healthcare devices

- Venture capitalists and investors

- Government organizations

Report Objectives

- To define, describe, segment, and forecast the wearable healthcare devices market by product, type, grade, distribution channel, application, and region

- To provide detailed information regarding the major factors influencing market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall wearable healthcare devices market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments with respect to five regions: North America, Europe, the Asia Pacific, Latin America, the Middle East & Africa, and the GCC Countries

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To benchmark players within the market using the proprietary Company Evaluation Matrix framework, which analyzes market players on various parameters within the broad categories of business and product excellence

- To study the impact of AI/Gen AI on the market, along with the macroeconomic outlook for each region

Key Questions Addressed by the Report

Which are the top industry players in the wearable healthcare devices market?

Key players include Apple Inc. (US), Samsung (South Korea), Abbott (US), DexCom, Inc. (US), Fitbit Inc. (US), Koninklijke Philips N.V. (Netherlands), OMRON Corporation (Japan), Garmin Ltd. (US), GE HealthCare (US), Masimo (US), Boston Scientific Corporation (US), iRhythm Technologies, Inc. (US), and CONTEC MEDICAL SYSTEMS CO., LTD. (China).

What are some of the major drivers for this market?

Major drivers include the rising prevalence of chronic diseases, growing health awareness, technological advancements, increasing smartphone integration, supportive regulatory approvals, a rapidly growing aging population, and the expansion of telehealth services.

Which products have been included in the global wearable healthcare devices market?

Product segments include trackers, smartwatches, patches, and smart clothing. Smartwatches held the largest market share in 2024.

What are the major applications of wearable healthcare devices?

Applications include general health and fitness, remote patient monitoring, and home healthcare. The general health and fitness segment accounted for the largest share in 2024 due to increased awareness of maintaining a healthy lifestyle.

Which region is lucrative for the global wearable healthcare devices market?

The Asia Pacific region is expected to witness the highest CAGR during the forecast period, driven by emerging markets like China and India offering strong growth opportunities.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Wearable Healthcare Devices Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Wearable Healthcare Devices Market

Gary

Jun, 2022

How recent technological advancemnets impacting the Wearable Healthcare Devices Market?.

James

Jun, 2022

How Does Historical Data Compare with Future Outlook?.

John

Jun, 2022

How are Wearable Devices Changing Healthcare Monitoring?.