Membrane Contactor Market by Function (Hydrophobic, Hydrophilic), Type (PP, PTFE, PFA, PVDF, PMP), Application (Food Processing, Pharmaceutical Processing, Water & Wastewater Treatment, Inks & Coatings, Laboratory), and Region - Global Forecast to 2028

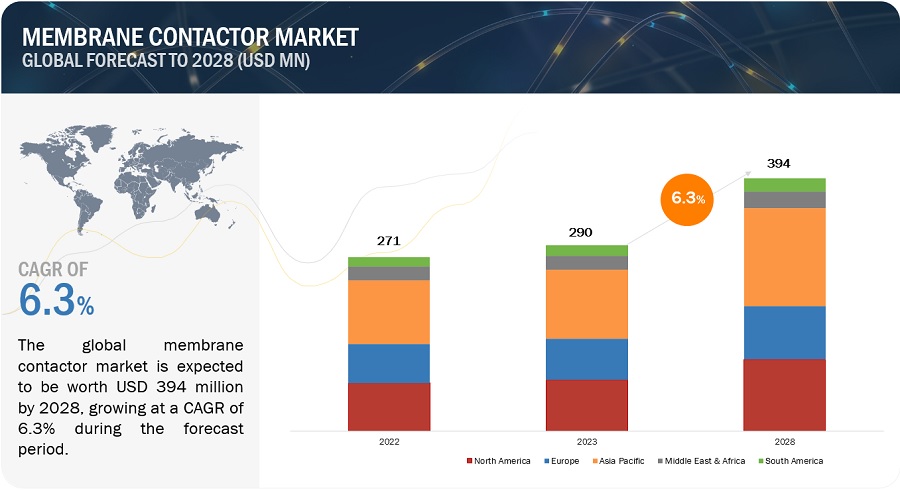

The membrane contactor market is projected to grow from USD 290 million in 2023 to USD 394 million by 2028, at a CAGR of 6.3% from 2023 to 2028. Membrane contactors are employed in a number of separation procedures, including liquid-liquid and gas-liquid separations. Membrane contactors can be made from a variety of materials, including polypropylene, polytetrafluoroethylene, composites, polymeric polymers, such as PMP (polymethylpentene), PVDF (polyvinylidene fluoride), and PFA (perfluoroalkoxy).

Attractive Opportunities in the Membrane Contactor Market

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: Increasing adoption in water and wastewater treatment

Membrane contactors have substantial prospects in water and wastewater treatment applications as the need for clean water rises. Membrane contactors are in high demand in municipal and industrial water treatment facilities due to the necessity for the efficient removal of pollutants such dissolved gases, organic compounds, and heavy metals. The need for effective water treatment technology is increasing as the world's water resources become more limited and the demand for clean water increases. With the use of membrane contactors, pollutants can be removed from water and high-quality water can be produced for a variety of uses, including drinking water, industrial processes, and agricultural irrigation.

Restraint: High capital and replacement cost of membranes

The membrane modules and related equipment must be purchased and installed upfront for membrane contactors. Materials for membranes, particularly specialized membranes such as ceramic or certain polymeric membranes, can be quite costly. The price of system integration, installation, and engineering design can also add to the overall capital expense. The high capital cost can restrain entry for some potential users, especially in small-scale applications or in areas with low financial resources.

Opportunity: Emerging applications in inkjet printing, ink filling, and coatings

Inkjet printing systems use membrane contactors for ink conditioning and degassing. They eliminate dissolved gases from the ink, such as oxygen or carbon dioxide, which can impair nozzle performance and print quality. Membrane contactors assist ink stability improvement, nozzle obstruction avoidance, and consistent drop creation during printing by degassing the ink. Systems for filling and moving ink can use membrane contactors. They help to ensure that high-quality ink is delivered to the printing system by facilitating the removal of dissolved gases or contaminants from the ink during the filling process. Additionally, membrane contactors can be used for ink recirculation. This maintains ink quality over a long period of usage by enabling continual purification and degassing of the ink.

Challenge: Technological limitations and optimization

Membrane contactors frequently need energy input for pumping, circulating, or upholding ideal operating conditions. It is essential to maximize energy efficiency to reduce operational costs and environmental effects. This entails maximizing flow rates, operating pressures, and energy recovery strategies such as pressure exchangers or sophisticated control algorithms. Mass transfer mechanisms are used by membrane contactors to separate or move gases or solutes across the membrane. However, there may be restrictions on mass transfer as a result of factors such as concentration polarization, fouling, or membrane selectivity. These restrictions may have an adverse effect on the effectiveness and performance of membrane contactors, thus posing a challenge for the membrane contactor market.

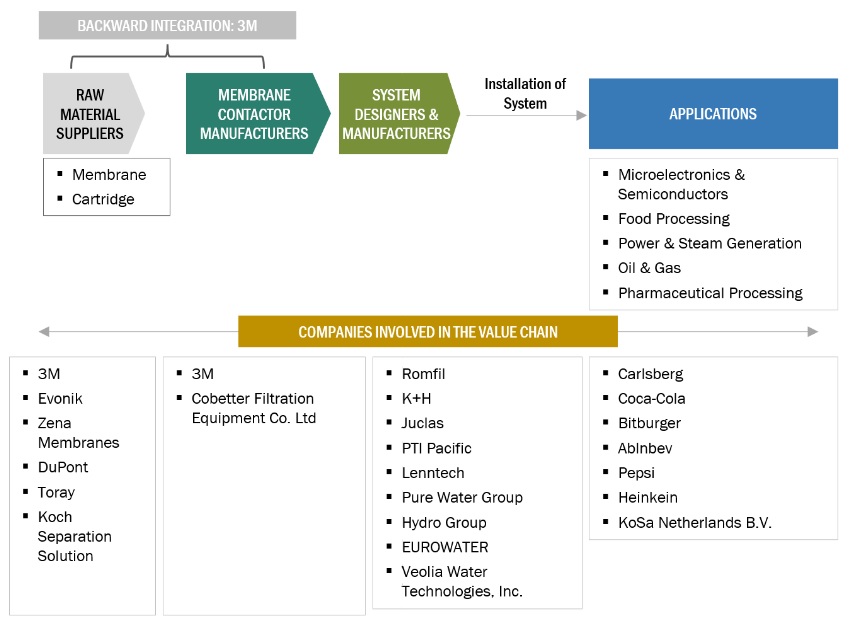

Membrane Contactor Market: Value Chain

Prominent companies in this market include well-established, financially stable membrane contactor manufacturers. These companies have been operating in the market for several years and possess a strong product portfolio and strong global sales and marketing networks. Prominent companies in this market include 3M (US), Romfil (Germany), JU.CLA.S Srl (Italy), KH TEC GmbH (Germany), Hangzhou Cobetter Filtration Equipment Co., Ltd. (China), PTI Pacific Pty. Ltd. (Australia), EUROWATER (Denmark), Hydro-Elektrik GmbH (Germany), Compact Membrane Systems (US), Veolia Water Technologies (France), Wuhan Tanal Industrial Co., Ltd. (China).

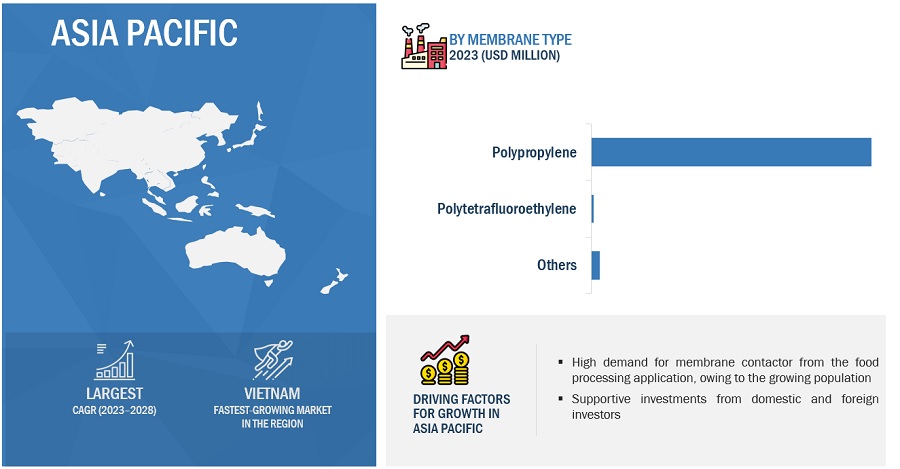

Based on membrane type, the polypropylene segment is estimated to have the largest market share in 2023.

The polypropylene segment is projected to be the largest membrane type during 2023 to 2028. When compared to some alternative membrane materials, such ceramic or specific polymeric membranes, polypropylene is a more affordable option. It is frequently used in membrane contactors, especially in applications where high-performance membranes are not needed, because it is readily available and has a low production cost. Good chemical resistance makes polypropylene appropriate for a variety of applications. It is not significantly degraded when exposed to a variety of chemicals, acids, and bases. The membrane's endurance and longevity in harsh settings is ensured by its chemical compatibility, thus increasing the demand of this segment.

Based on application, the pharmaceutical processing segment is estimated to grow at the second highest CAGR during the forecast period.

Pharmaceutical applications use membrane contactors for gas transfer operations. They can be used to liquid formulations to oxygenate, carbonate, or deoxygenate them. Membrane contactors, for instance, aid in raising the dissolved oxygen levels in the culture media during bioreactor or fermentation operations, encouraging optimum cell or microorganism development and production. Additionally, they can be used to remove dissolved gases from liquids, ensuring the stability and quality of the final product. Due to their capacity to carry out a variety of separation and purification operations, membrane contactors play a significant role in the processing of pharmaceuticals. This further propels growth of this segment.

Based on region, Asia Pacific is projected to account for the largest market share in 2023.

Significant issues with water scarcity, pollution, and the requirement for better water treatment facilities exist in the Asia Pacific region. Desalination, reverse osmosis, and gas transfer for aeration and deaeration are just some of the few water and wastewater treatment techniques that heavily rely on membrane contactors. The demand for membrane contactors in water treatment applications is being driven by the increasing population, urbanization, and industrial growth in nations such as China, India, and Southeast Asian countries.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

3M (US), Romfil (Germany), JU.CLA.S Srl (Italy), KH TEC GmbH (Germany), Hangzhou Cobetter Filtration Equipment Co., Ltd. (China), PTI Pacific Pty. Ltd. (Australia), EUROWATER (Denmark), Hydro-Elektrik GmbH (Germany), Compact Membrane Systems (US), Veolia Water Technologies (France), Wuhan Tanal Industrial Co., Ltd. (China), are among the major players leading the market through their geographical presence, enhanced production capacities, and efficient distribution channels.

Scope of the Report:

|

Report Metric |

Details |

|

Market Size Available for Years |

2018 to 2028 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD Million) |

|

Segments Covered |

Function, Membrane Type, Application, and Region |

|

Geographies Covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies Covered |

The major market players include 3M (US), Romfil (Germany), JU.CLA.S Srl (Italy), KH TEC GmbH (Germany), Hangzhou Cobetter Filtration Equipment Co., Ltd. (China), PTI Pacific Pty. Ltd. (Australia), EUROWATER (Denmark), Hydro-Elektrik GmbH (Germany), Compact Membrane Systems (US), Veolia Water Technologies (France), Wuhan Tanal Industrial Co., Ltd. (China), and others |

This research report categorizes the membrane contactor market based on function, membrane type, application, and region.

Based on function, the membrane contactor market has been segmented as follows:

- Hydrophobic

- Hydrophilic

Based on membrane type, the membrane contactor market has been segmented as follows:

- Polypropylene

- Polytetrafluoroethylene

- Others

Based on application, the membrane contactor market has been segmented as follows:

- Microelectronics & Semiconductors

- Water & Wastewater Treatment

- Food Processing

- Pharmaceutical Processing

- Power & Steam Generation

- Oil & Gas

- Others

Based on the region, the membrane contactor market has been segmented as follows:

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Vietnam

- Thailand

- Phillipines

- Rest of Asia Pacific

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

North America

- US

- Canada

- Mexico

-

Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Rest of Middle East & Africa

-

South America

- Brazil

- Argentina

- Rest of South America

Recent Developments

- In May 2023, 3M announced to invest about USD 150 million to boost its capacity to expand biotech manufacturing, a rapidly growing segment of the medical industry that is offering ground-breaking treatments to patients. With the help of the new investment, 3M will be able to produce and deliver crucial filtration equipment rapidly for bioprocessing, biological, and small molecule pharmaceutical manufacturing applications.

- In April 2020, EUROWATER collaborated with three research institutions, two water utilities, and one water technology company for the MEM2BIO project, which combines two technologies, namely, membrane filtration and biofiltration, to purify and offer drinking water in Denmark. This collaboration is expected to enhance the market for the company’s membrane degassing units.

- In July 2019, Hangzhou Cobetter Filtration Equipment Co., Ltd. (Cobetter Filtration) entered a partnership with Banner Industries (US). Under this partnership, Banner Industries will distribute products manufactured by Cobetter Filtration in the US market. This partnership is in line with Cobetter Filtration’s expansion strategy into the US market.

Frequently Asked Questions (FAQ):

What is the current size of the membrane contactor market?

The membrane contactor market is projected to grow from USD 290 million in 2023 to USD 394 million by 2028, at a CAGR of 6.3% from 2023 to 2028.

Which region is expected to hold the highest market share in the membrane contactor market?

The membrane contactor market in Asia Pacific is estimated to hold the highest market share, owing to high industrial growth in countries such as China, India, and Vietnam.

Which is the major application of membrane contactor?

The water & wastewater segment is the major application of membrane contactor.

Who are the major players operating in the membrane contactor market?

The major players operating in the market include 3M (US), Romfil (Germany), JU.CLA.S Srl (Italy), KH TEC GmbH (Germany), Hangzhou Cobetter Filtration Equipment Co., Ltd. (China), PTI Pacific Pty. Ltd. (Australia), EUROWATER (Denmark), Hydro-Elektrik GmbH (Germany), Compact Membrane Systems (US), Veolia Water Technologies (France), Wuhan Tanal Industrial Co., Ltd. (China).

What is the total CAGR expected to record for the membrane contactor market during 2023-2028?

The market is expected to record a CAGR of 6.3% from 2023-2028. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

-

5.1 MARKET DYNAMICSDRIVERS- Increasing adoption in water & wastewater treatment- Growing emphasis on gas separation and purificationRESTRAINTS- High capital and replacement cost of membranesOPPORTUNITIES- Potential usage in energy sector- Emerging applications in inkjet printing, ink filling, and coatingsCHALLENGES- Technological limitations and optimization

-

6.1 ECOSYSTEM

-

6.2 VALUE CHAIN ANALYSISRAW MATERIALSMANUFACTURE OF MEMBRANESMANUFACTURE OF MEMBRANE CONTACTORSDISTRIBUTION TO END USERS

-

6.3 PORTER'S FIVE FORCES ANALYSISBARGAINING POWER OF SUPPLIERSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSTHREAT OF NEW ENTRANTSINTENSITY OF COMPETITIVE RIVALRY

-

6.4 CASE STUDY ANALYSISEFFECTIVENESS OF MEMBRANE TECHNOLOGY FOR TRIHALOMETHANES (THM) REMOVALCOST SAVINGS USING 3M MEMBRANE CONTACTOR

-

6.5 TECHNOLOGY ANALYSISINTRODUCTION3M LIQUI-CEL MEMBRANE CONTACTOR

-

6.6 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.7 TARIFF AND REGULATORY LANDSCAPENORTH AMERICA- Clean Water Act (CWA)- Safe Drinking Water Act (SDWA)ASIA PACIFIC- Environmental protection Law (EPL)- Water resources law- Water pollution prevention and control law- Water prevention and control of pollution actEUROPE- Urban Wastewater treatment directive (1991)- Drinking water directive (1998)- The water framework directive (2000)REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

6.8 PATENT ANALYSISINSIGHTS

- 6.9 KEY CONFERENCES & EVENTS, 2023–2024

-

6.10 TRADE ANALYSISIMPORT-EXPORT SCENARIO

-

6.11 PRICING ANALYSISINDICATIVE PRICING ANALYSIS, BY MEMBRANE TYPE

- 7.1 INTRODUCTION

-

7.2 HYDROPHOBICMAINLY USED FOR REMOVING CARBON DIOXIDE FROM WATER OR OXYGENATING LIQUIDS SUCH AS WINE OR BEER

-

7.3 HYDROPHILICMAINLY USED TO ABSORB VOLATILE ORGANIC COMPOUNDS (VOCS) FROM AIR

- 8.1 INTRODUCTION

-

8.2 POLYPROPYLENECOST-EFFECTIVE PROPERTY TO DRIVE DEMAND

-

8.3 POLYTETRAFLUOROETHYLENEHIGH-PERFORMANCE THERMOPLASTIC CHARACTERISTICS OF POLYTETRAFLUOROETHYLENE TO DRIVE MARKET

- 8.4 OTHERS

- 9.1 INTRODUCTION

-

9.2 WATER & WASTEWATER TREATMENTINCREASING INVESTMENTS IN MAJOR WATER AND WASTEWATER PROJECTS TO DRIVE DEMAND

-

9.3 FOOD PROCESSINGWIDE APPLICATION OF MEMBRANE CONTACTORS FOR BEVERAGE CARBONATION TO DRIVE DEMAND

-

9.4 PHARMACEUTICAL PROCESSINGWIDE APPLICATION FOR ULTRAPURE WATER IN PHARMACEUTICAL PROCESSING TO DRIVE MARKET

-

9.5 MICROELECTRONICS & SEMICONDUCTORSDEGASSING FOR MICROELECTRONICS, SEMICONDUCTOR WAFERS, AND FLAT PANEL DISPLAYS TO DRIVE GROWTH

-

9.6 POWER & STEAM GENERATIONPREFERRED TECHNOLOGY FOR REMOVAL OF DISSOLVED OXYGEN AND CARBON DIOXIDE TO DRIVE DEMAND

-

9.7 OIL & GASAPPLICATION FOR SEPARATION OF GASSES AND HYDROCARBON RECOVERY PROCESSES TO DRIVE MARKET

- 9.8 OTHERS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICARECESSION IMPACTUS- US to lead membrane contactor market in North AmericaCANADA- Growth in oil & gas production to drive demandMEXICO- Growth in wastewater treatment to drive demand

-

10.3 ASIA PACIFICRECESSION IMPACTCHINA- Growing investment in wastewater treatment to enhance demandJAPAN- Growth of beverage industry to drive marketSOUTH KOREA- Government initiatives in water treatment to increase demandINDIA- Growth of beverage sector to drive demandVIETNAM- Growing preference for variety of beverages to drive demandTHAILAND- Increase in consumption of beverages such as beer to drive demandPHILIPPINES- Increasing urbanization, environmental awareness, and need for sustainable water resources to drive demandREST OF ASIA PACIFIC

-

10.4 EUROPERECESSION IMPACTUK- Growth of pharmaceutical and beverage sectors to drive marketGERMANY- Government initiatives in wastewater treatment industry to drive demandFRANCE- Water treatment industry to witness high government investmentsITALY- Growth in pharmaceutical sector to positively affect demand for membrane contactorSPAIN- Government focus on healthcare advancement to drive marketREST OF EUROPE

-

10.5 MIDDLE EAST & AFRICARECESSION IMPACTSAUDI ARABIA- Presence of oil & gas industry and government initiatives for development of natural gas resources to drive demandUAE- Rising pharmaceutical industry to drive growthEGYPT- Operation of network of wastewater treatment plants to create demandREST OF MIDDLE EAST & AFRICA

-

10.6 SOUTH AMERICARECESSION IMPACTBRAZIL- Growing demand for water & wastewater treatment to drive marketARGENTINA- Increasing oil & gas industry along with government initiatives to drive growthREST OF SOUTH AMERICA

- 11.1 INTRODUCTION

-

11.2 STRATEGIES ADOPTED BY KEY PLAYERSOVERVIEW OF STRATEGIES ADOPTED BY KEY MANUFACTURERS

-

11.3 MARKET SHARE ANALYSISLIST OF KEY MARKET PLAYERS, 2022MARKET SHARE OF KEY PLAYERSREVENUE ANALYSIS OF TOP 5 PLAYERS

- 11.4 COMPANY PRODUCT FOOTPRINT ANALYSIS

-

11.5 COMPANY EVALUATION MATRIX (TIER 1)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 11.6 COMPETITIVE BENCHMARKING

-

11.7 START-UP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

11.8 COMPETITIVE SCENARIOSDEALSOTHER DEVELOPMENTS

-

12.1 KEY PLAYERS3M- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHANGZHOU COBETTER FILTRATION EQUIPMENT CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCOMPACT MEMBRANE SYSTEMS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewROMFIL- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewWUHAN TANAL INDUSTRIAL CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewJU.CLA.S SRL- Business overview- Products/Solutions/Services offered- Recent developmentsKH TEC GMBH- Business overview- Products/Solutions/Services offered- Recent developmentsPTI PACIFIC PTY. LTD.- Business overview- Products/Solutions/Services offered- Recent developmentsEUROWATER- Business overview- Products/Solutions/Services offered- Recent developmentsHYDRO-ELEKTRIK GMBH- Business overview- Products/Solutions/Services offered- Recent developmentsVEOLIA WATER TECHNOLOGIES, INC.- Business overview- Products/Solutions/Services offered- Recent developments

-

12.2 OTHER PLAYERSLENNTECH B.V.PURE WATER GROUPEUWA HH EUMANN GMBHAPPLIED MEMBRANES, INC.

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

-

13.3 MEMBRANES MARKETMARKET DEFINITIONMARKET OVERVIEWMEMBRANES MARKET, BY MATERIALMEMBRANES MARKET, BY APPLICATION

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 MEMBRANE CONTACTOR MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 MEMBRANE CONTACTOR MARKET SNAPSHOT: 2023 VS. 2028

- TABLE 3 MEMBRANE CONTACTOR MARKET: ECOSYSTEM

- TABLE 4 MEMBRANE CONTACTOR MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 5 REPRESENTATION OF THE COST SAVINGS

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USES (%)

- TABLE 7 KEY BUYING CRITERIA FOR TOP THREE END USES

- TABLE 8 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 PATENTS: 3M INNOVATIVE PROPERTIES CO.

- TABLE 12 PATENTS: KURITA WATER IND LTD.

- TABLE 13 TOP 10 PATENT OWNERS DURING LAST 10 YEARS

- TABLE 14 MEMBRANE CONTACTOR MARKET: CONFERENCES & EVENTS, 2023–2024

- TABLE 15 IMPORT TRADE DATA FOR CENTRIFUGES, INCLUDING CENTRIFUGAL DRYERS; FILTERING OR PURIFYING MACHINERY AND APPARATUS, FOR LIQUIDS OR GASES

- TABLE 16 EXPORT TRADE DATA FOR CENTRIFUGES, INCLUDING CENTRIFUGAL DRYERS; FILTERING OR PURIFYING MACHINERY AND APPARATUS, FOR LIQUIDS OR GASES

- TABLE 17 IMPORT TRADE DATA FOR PARTS OF MACHINERY AND APPARATUS FOR FILTERING OR PURIFYING LIQUIDS OR GASES

- TABLE 18 EXPORT TRADE DATA FOR MACHINERY AND APPARATUS FOR FILTERING OR PURIFYING LIQUIDS OR GASES

- TABLE 19 AVERAGE SELLING PRICE BASED ON MEMBRANE TYPE (USD/SQUARE METER)

- TABLE 20 MEMBRANE CONTACTOR MARKET, BY MEMBRANE TYPE, 2018–2021 (USD THOUSAND)

- TABLE 21 MEMBRANE CONTACTOR MARKET, BY MEMBRANE TYPE, 2022–2028 (USD THOUSAND)

- TABLE 22 POLYPROPYLENE: MEMBRANE CONTACTOR MARKET, BY REGION, 2018–2021 (USD THOUSAND)

- TABLE 23 POLYPROPYLENE: MEMBRANE CONTACTOR MARKET, BY REGION, 2022–2028 (USD THOUSAND)

- TABLE 24 POLYTETRAFLUOROETHYLENE: MEMBRANE CONTACTOR MARKET, BY REGION, 2018–2021 (USD THOUSAND)

- TABLE 25 POLYTETRAFLUOROETHYLENE: MEMBRANE CONTACTOR MARKET, BY REGION, 2022–2028 (USD THOUSAND)

- TABLE 26 OTHER MEMBRANES: MEMBRANE CONTACTOR MARKET, BY REGION, 2018–2021 (USD THOUSAND)

- TABLE 27 OTHER MEMBRANES: MEMBRANE CONTACTOR MARKET, BY REGION, 2022–2028 (USD THOUSAND)

- TABLE 28 MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 29 MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 30 WATER & WASTEWATER TREATMENT: MEMBRANE CONTACTOR MARKET, BY REGION, 2018–2021 (USD THOUSAND)

- TABLE 31 WATER & WASTEWATER TREATMENT: MEMBRANE CONTACTOR MARKET, BY REGION, 2022–2028 (USD THOUSAND)

- TABLE 32 FOOD PROCESSING: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 33 FOOD PROCESSING: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 34 FOOD PROCESSING: MEMBRANE CONTACTOR MARKET, BY REGION, 2018–2021 (USD THOUSAND)

- TABLE 35 FOOD PROCESSING: MEMBRANE CONTACTOR MARKET, BY REGION, 2022–2028 (USD THOUSAND)

- TABLE 36 PHARMACEUTICAL PROCESSING: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 37 PHARMACEUTICAL PROCESSING: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 38 PHARMACEUTICAL PROCESSING: MEMBRANE CONTACTOR MARKET, BY REGION, 2018–2021 (USD THOUSAND)

- TABLE 39 PHARMACEUTICAL PROCESSING: MEMBRANE CONTACTOR MARKET, BY REGION, 2022–2028 (USD THOUSAND)

- TABLE 40 MICROELECTRONICS & SEMICONDUCTORS: MEMBRANE CONTACTOR MARKET, BY REGION, 2018–2021 (USD THOUSAND)

- TABLE 41 MICROELECTRONICS & SEMICONDUCTORS: MEMBRANE CONTACTOR MARKET, BY REGION, 2022–2028 (USD THOUSAND)

- TABLE 42 POWER & STEAM GENERATION: MEMBRANE CONTACTOR MARKET, BY REGION, 2018–2021 (USD THOUSAND)

- TABLE 43 POWER & STEAM GENERATION: MEMBRANE CONTACTOR MARKET, BY REGION, 2022–2028 (USD THOUSAND)

- TABLE 44 OIL & GAS: MEMBRANE CONTACTOR MARKET, BY REGION, 2018–2021 (USD THOUSAND)

- TABLE 45 OIL & GAS: MEMBRANE CONTACTOR MARKET, BY REGION, 2022–2028 (USD THOUSAND)

- TABLE 46 OTHER APPLICATIONS: MEMBRANE CONTACTOR MARKET, BY REGION, 2018–2021 (USD THOUSAND)

- TABLE 47 OTHER APPLICATIONS: MEMBRANE CONTACTOR MARKET, BY REGION, 2022–2028 (USD THOUSAND)

- TABLE 48 MEMBRANE CONTACTOR MARKET, BY REGION, 2018–2021 (USD THOUSAND)

- TABLE 49 MEMBRANE CONTACTOR MARKET, BY REGION, 2022–2028 (USD THOUSAND)

- TABLE 50 NORTH AMERICA: MEMBRANE CONTACTOR MARKET, BY COUNTRY, 2018–2021 (USD THOUSAND)

- TABLE 51 NORTH AMERICA: MEMBRANE CONTACTOR MARKET, BY COUNTRY, 2022–2028 (USD THOUSAND)

- TABLE 52 NORTH AMERICA: MEMBRANE CONTACTOR MARKET, BY MEMBRANE TYPE, 2018–2021 (USD THOUSAND)

- TABLE 53 NORTH AMERICA: MEMBRANE CONTACTOR MARKET, BY MEMBRANE TYPE, 2022–2028 (USD THOUSAND)

- TABLE 54 NORTH AMERICA: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 55 NORTH AMERICA: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 56 NORTH AMERICA: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 57 NORTH AMERICA: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 58 NORTH AMERICA: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 59 NORTH AMERICA: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 60 US: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 61 US: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 62 US: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 63 US: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 64 US: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 65 US: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 66 CANADA: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 67 CANADA: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 68 CANADA: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 69 CANADA: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 70 CANADA: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 71 CANADA: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 72 MEXICO: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 73 MEXICO: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 74 MEXICO: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 75 MEXICO: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 76 MEXICO: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 77 MEXICO: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 78 ASIA PACIFIC: MEMBRANE CONTACTOR MARKET, BY COUNTRY, 2018–2021 (USD THOUSAND)

- TABLE 79 ASIA PACIFIC: MEMBRANE CONTACTOR MARKET, BY COUNTRY, 2022–2028 (USD THOUSAND)

- TABLE 80 ASIA PACIFIC: MEMBRANE CONTACTOR MARKET, BY MEMBRANE TYPE, 2018–2021 (USD THOUSAND)

- TABLE 81 ASIA PACIFIC: MEMBRANE CONTACTOR MARKET, BY MEMBRANE TYPE, 2022–2028 (USD THOUSAND)

- TABLE 82 ASIA PACIFIC: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 83 ASIA PACIFIC: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 84 ASIA PACIFIC: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 85 ASIA PACIFIC: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 86 ASIA PACIFIC: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 87 ASIA PACIFIC: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 88 CHINA: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 89 CHINA: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 90 CHINA: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 91 CHINA: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 92 CHINA: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 93 CHINA: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 94 JAPAN: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 95 JAPAN: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 96 JAPAN: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 97 JAPAN: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 98 JAPAN: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 99 JAPAN: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 100 SOUTH KOREA: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 101 SOUTH KOREA: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 102 SOUTH KOREA: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 103 SOUTH KOREA: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 104 SOUTH KOREA: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 105 SOUTH KOREA: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 106 INDIA: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 107 INDIA: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 108 INDIA: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 109 INDIA: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 110 INDIA: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 111 INDIA: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 112 VIETNAM: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 113 VIETNAM: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 114 VIETNAM: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 115 VIETNAM: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 116 VIETNAM: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 117 VIETNAM: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 118 THAILAND: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 119 THAILAND: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 120 THAILAND: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 121 THAILAND: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 122 THAILAND: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 123 THAILAND: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 124 PHILIPPINES: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 125 PHILIPPINES: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 126 PHILIPPINES: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 127 PHILIPPINES: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 128 PHILIPPINES: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 129 PHILIPPINES: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 130 REST OF ASIA PACIFIC: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 131 REST OF ASIA PACIFIC: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 132 REST OF ASIA PACIFIC: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 133 REST OF ASIA PACIFIC: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 134 REST OF ASIA PACIFIC: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 135 REST OF ASIA PACIFIC: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 136 EUROPE: MEMBRANE CONTACTOR MARKET, BY COUNTRY, 2018–2021 (USD THOUSAND)

- TABLE 137 EUROPE: MEMBRANE CONTACTOR MARKET, BY COUNTRY, 2022–2028 (USD THOUSAND)

- TABLE 138 EUROPE: MEMBRANE CONTACTOR MARKET, BY MEMBRANE TYPE, 2018–2021 (USD THOUSAND)

- TABLE 139 EUROPE: MEMBRANE CONTACTOR MARKET, BY MEMBRANE TYPE, 2022–2028 (USD THOUSAND)

- TABLE 140 EUROPE: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 141 EUROPE: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 142 EUROPE: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 143 EUROPE: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 144 EUROPE: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 145 EUROPE: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 146 UK: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 147 UK: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 148 UK: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 149 UK: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 150 UK: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 151 UK: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 152 GERMANY: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 153 GERMANY: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 154 GERMANY: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 155 GERMANY: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 156 GERMANY: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 157 GERMANY: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 158 FRANCE: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 159 FRANCE: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 160 FRANCE: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 161 FRANCE: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 162 FRANCE: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 163 FRANCE: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 164 ITALY: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 165 ITALY: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 166 ITALY: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 167 ITALY: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 168 ITALY: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 169 ITALY: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 170 SPAIN: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 171 SPAIN: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 172 SPAIN: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 173 SPAIN: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 174 SPAIN: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 175 SPAIN: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 176 REST OF EUROPE: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 177 REST OF EUROPE: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 178 REST OF EUROPE: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 179 REST OF EUROPE: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 180 REST OF EUROPE: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 181 REST OF EUROPE: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 182 MIDDLE EAST & AFRICA: MEMBRANE CONTACTOR MARKET, BY COUNTRY, 2018–2021 (USD THOUSAND)

- TABLE 183 MIDDLE EAST & AFRICA: MEMBRANE CONTACTOR MARKET, BY COUNTRY, 2022–2028 (USD THOUSAND)

- TABLE 184 MIDDLE EAST & AFRICA: MEMBRANE CONTACTOR MARKET, BY MEMBRANE TYPE, 2018–2021 (USD THOUSAND)

- TABLE 185 MIDDLE EAST & AFRICA: MEMBRANE CONTACTOR MARKET, BY MEMBRANE TYPE, 2022–2028 (USD THOUSAND)

- TABLE 186 MIDDLE EAST & AFRICA: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 187 MIDDLE EAST & AFRICA: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 188 MIDDLE EAST & AFRICA: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 189 MIDDLE EAST & AFRICA: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 190 MIDDLE EAST & AFRICA: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 191 MIDDLE EAST & AFRICA: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 192 SAUDI ARABIA: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 193 SAUDI ARABIA: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 194 SAUDI ARABIA: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 195 SAUDI ARABIA: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 196 SAUDI ARABIA: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 197 SAUDI ARABIA: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 198 UAE: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 199 UAE: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 200 UAE: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 201 UAE: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 202 UAE: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 203 UAE: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 204 EGYPT: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 205 EGYPT: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 206 EGYPT: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 207 EGYPT: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 208 EGYPT: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 209 EGYPT: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 210 REST OF MIDDLE EAST & AFRICA: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 211 REST OF MIDDLE EAST & AFRICA: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 212 REST OF MIDDLE EAST & AFRICA: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 213 REST OF MIDDLE EAST & AFRICA: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 214 REST OF MIDDLE EAST & AFRICA: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 215 REST OF MIDDLE EAST & AFRICA: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 216 SOUTH AMERICA: MEMBRANE CONTACTOR MARKET, BY COUNTRY, 2018–2021 (USD THOUSAND)

- TABLE 217 SOUTH AMERICA: MEMBRANE CONTACTOR MARKET, BY COUNTRY, 2022–2028 (USD THOUSAND)

- TABLE 218 SOUTH AMERICA: MEMBRANE CONTACTOR MARKET, BY MEMBRANE TYPE, 2018–2021 (USD THOUSAND)

- TABLE 219 SOUTH AMERICA: MEMBRANE CONTACTOR MARKET, BY MEMBRANE TYPE, 2022–2028 (USD THOUSAND)

- TABLE 220 SOUTH AMERICA: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 221 SOUTH AMERICA: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 222 SOUTH AMERICA: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 223 SOUTH AMERICA: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 224 SOUTH AMERICA: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 225 SOUTH AMERICA: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 226 BRAZIL: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 227 BRAZIL: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 228 BRAZIL: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 229 BRAZIL: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 230 BRAZIL: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 231 BRAZIL: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 232 ARGENTINA: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 233 ARGENTINA: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 234 ARGENTINA: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 235 ARGENTINA: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 236 ARGENTINA: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 237 ARGENTINA: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 238 REST OF SOUTH AMERICA: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 239 REST OF SOUTH AMERICA: MEMBRANE CONTACTOR MARKET, BY APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 240 REST OF SOUTH AMERICA: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 241 REST OF SOUTH AMERICA: MEMBRANE CONTACTOR MARKET, BY FOOD PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 242 REST OF SOUTH AMERICA: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2018–2021 (USD THOUSAND)

- TABLE 243 REST OF SOUTH AMERICA: MEMBRANE CONTACTOR MARKET, BY PHARMACEUTICAL PROCESSING APPLICATION, 2022–2028 (USD THOUSAND)

- TABLE 244 MEMBRANE CONTACTOR MARKET: DEGREE OF COMPETITION

- TABLE 245 MEMBRANE CONTACTOR MARKET: MEMBRANE TYPE FOOTPRINT

- TABLE 246 MEMBRANE CONTACTOR MARKET: APPLICATION FOOTPRINT

- TABLE 247 MEMBRANE CONTACTOR MARKET: COMPANY REGION FOOTPRINT

- TABLE 248 MEMBRANE CONTACTOR MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 249 MEMBRANE CONTACTOR MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 250 MEMBRANE CONTACTOR MARKET: DEALS, 2019–2023

- TABLE 251 MEMBRANE CONTACTOR MARKET: EXPANSIONS, AND INVESTMENTS, 2019–2023

- TABLE 252 3M: COMPANY OVERVIEW

- TABLE 253 3M: PRODUCTS OFFERED

- TABLE 254 3M: OTHERS

- TABLE 255 HANGZHOU COBETTER FILTRATION EQUIPMENT CO., LTD.: COMPANY OVERVIEW

- TABLE 256 HANGZHOU COBETTER FILTRATION EQUIPMENT CO., LTD.: PRODUCTS OFFERED

- TABLE 257 HANGZHOU COBETTER FILTRATION EQUIPMENT CO., LTD.: DEALS

- TABLE 258 HANGZHOU COBETTER FILTRATION EQUIPMENT CO., LTD.: OTHERS

- TABLE 259 COMPACT MEMBRANE SYSTEMS: COMPANY OVERVIEW

- TABLE 260 COMPACT MEMBRANE SYSTEMS: PRODUCTS OFFERED

- TABLE 261 ROMFIL: COMPANY OVERVIEW

- TABLE 262 ROMFIL: PRODUCTS OFFERED

- TABLE 263 WUHAN TANAL INDUSTRIAL CO., LTD.: COMPANY OVERVIEW

- TABLE 264 WUHAN TANAL INDUSTRIAL CO., LTD.: PRODUCTS OFFERED

- TABLE 265 JU.CLA.S SRL: COMPANY OVERVIEW

- TABLE 266 JU.CLA.S SRL: PRODUCTS OFFERED

- TABLE 267 KH TEC GMBH: COMPANY OVERVIEW

- TABLE 268 KH TEC GMBH: PRODUCTS OFFERED

- TABLE 269 PTI PACIFIC PTY. LTD.: COMPANY OVERVIEW

- TABLE 270 PTI PACIFIC PTY. LTD.: PRODUCTS OFFERED

- TABLE 271 EUROWATER: COMPANY OVERVIEW

- TABLE 272 EUROWATER: PRODUCTS OFFERED

- TABLE 273 EUROWATER: DEALS

- TABLE 274 HYDRO-ELEKTRIK GMBH: COMPANY OVERVIEW

- TABLE 275 HYDRO-ELEKTRIK GMBH: PRODUCTS OFFERED

- TABLE 276 VEOLIA WATER TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 277 VEOLIA WATER TECHNOLOGIES, INC.: PRODUCTS OFFERED

- TABLE 278 VEOLIA WATER TECHNOLOGIES, INC.: DEALS

- TABLE 279 LENNTECH B.V.: COMPANY OVERVIEW

- TABLE 280 PURE WATER GROUP: COMPANY OVERVIEW

- TABLE 281 EUWA HH EUMANN GMBH: COMPANY OVERVIEW

- TABLE 282 APPLIED MEMBRANES, INC.: COMPANY OVERVIEW

- TABLE 283 MEMBRANES MARKET, BY MATERIAL, 2018–2021 (USD MILLION)

- TABLE 284 MEMBRANES MARKET, BY MATERIAL, 2018–2021 (MILLION SQUARE METER)

- TABLE 285 MEMBRANES MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

- TABLE 286 MEMBRANES MARKET, BY MATERIAL, 2022–2027 (MILLION SQUARE METER)

- TABLE 287 MEMBRANES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 288 MEMBRANES MARKET, BY APPLICATION, 2018–2021 (MILLION SQUARE METER)

- TABLE 289 MEMBRANES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 290 MEMBRANES MARKET, BY APPLICATION, 2022–2027 (MILLION SQUARE METER)

- FIGURE 1 MEMBRANE CONTACTOR MARKET SEGMENTATION

- FIGURE 2 MEMBRANE CONTACTOR MARKET: RESEARCH DESIGN

- FIGURE 3 MAIN MATRIX CONSIDERED TO CONSTRUCT AND ASSESS DEMAND FOR MEMBRANE CONTACTORS

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 6 METHODOLOGY FOR SUPPLY-SIDE SIZING OF MEMBRANE CONTACTOR MARKET (1/2)

- FIGURE 7 METHODOLOGY FOR SUPPLY-SIDE SIZING OF MEMBRANE CONTACTOR MARKET (2/2)

- FIGURE 8 MEMBRANE CONTACTOR MARKET: DATA TRIANGULATION

- FIGURE 9 WATER AND WASTEWATER TREATMENT TO BE LARGEST APPLICATION OF MEMBRANE CONTACTOR DURING FORECAST PERIOD

- FIGURE 10 POLYPROPYLENE TO BE LARGEST MEMBRANE TYPE DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC LED GLOBAL MEMBRANE CONTACTOR MARKET IN 2022

- FIGURE 12 MEMBRANE CONTACTOR MARKET DRIVEN BY RAPID EXPANSION OF WATER & WASTEWATER TREATMENT APPLICATION

- FIGURE 13 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 POLYPROPYLENE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 15 WATER & WASTEWATER TREATMENT SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 16 INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 MEMBRANE CONTACTOR MARKET: MARKET DYNAMICS

- FIGURE 18 ECOSYSTEM MAP OF MEMBRANE CONTACTOR MARKET

- FIGURE 19 MEMBRANE CONTACTOR MARKET: VALUE CHAIN

- FIGURE 20 MEMBRANE CONTACTOR MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USES

- FIGURE 22 KEY BUYING CRITERIA FOR TOP THREE END USES

- FIGURE 23 NUMBER OF GRANTED PATENTS, PATENT APPLICATIONS, AND LIMITED PATENTS

- FIGURE 24 PUBLICATION TRENDS: LAST 10 YEARS

- FIGURE 25 LEGAL STATUS OF PATENTS, 2013–2022

- FIGURE 26 TOP JURISDICTION, BY DOCUMENT, 2013–2022

- FIGURE 27 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS, 2013–2022

- FIGURE 28 POLYPROPYLENE SEGMENT TO LEAD MEMBRANE CONTACTOR MARKET DURING FORECAST PERIOD

- FIGURE 29 FOOD PROCESSING SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 30 ASIA PACIFIC TO BE LARGEST MEMBRANE CONTACTOR MARKET DURING FORECAST PERIOD

- FIGURE 31 NORTH AMERICA: MEMBRANE CONTACTOR MARKET SNAPSHOT

- FIGURE 32 ASIA PACIFIC: MEMBRANE CONTACTOR MARKET SNAPSHOT

- FIGURE 33 EUROPE: MEMBRANE CONTACTOR MARKET SNAPSHOT

- FIGURE 34 LIST OF KEY PLAYERS IN MEMBRANE CONTACTOR MARKET, 2022

- FIGURE 35 MEMBRANE CONTACTOR MARKET SHARE ANALYSIS, 2022

- FIGURE 36 REVENUE ANALYSIS OF KEY COMPANIES, 2018–2022

- FIGURE 37 MEMBRANE CONTACTOR MARKET: COMPANY FOOTPRINT

- FIGURE 38 COMPANY EVALUATION MATRIX: MEMBRANE CONTACTOR MARKET (TIER 1 COMPANIES), 2022

- FIGURE 39 START-UP/SME EVALUATION MATRIX: MEMBRANE CONTACTOR MARKET, 2022

- FIGURE 40 3M: COMPANY SNAPSHOT

- FIGURE 41 VEOLIA WATER TECHNOLOGIES, INC.: COMPANY SNAPSHOT

The study involved four major activities in estimating the current market size of membrane contactor. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizes with industry experts across the value chain of membrane contactor through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the size of the segments and sub-segments of the market.

Secondary Research

The research methodology used to estimate and forecast the access control market begins with capturing data on the revenues of key vendors in the market through secondary research. In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, Factiva, World Bank, and Industry Journals, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; notifications by regulatory bodies; trade directories; and databases. Vendor offerings have also been taken into consideration to determine market segmentation.

Primary Research

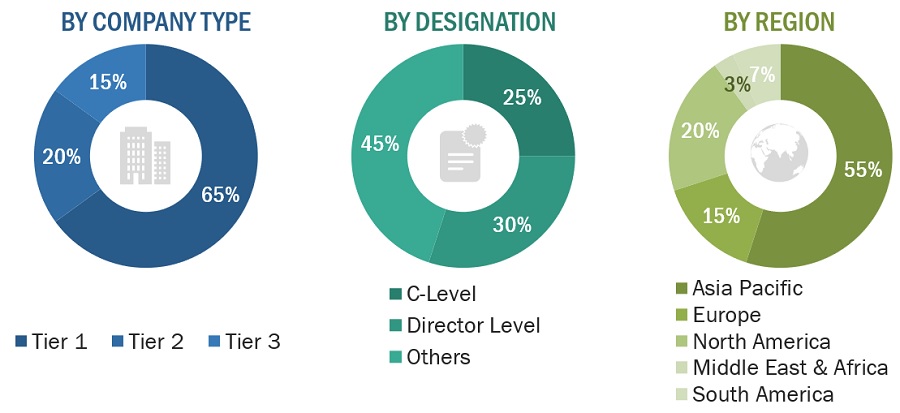

The membrane contactor market comprises several stakeholders, such as raw material suppliers, membrane contactor manufacturers, and regulatory organizations in the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the membrane contactor market. Primary sources from the demand side included directors, marketing heads, and purchase managers from various sourcing industries.

Following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the membrane contactor market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the membrane contactor market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Global Membrane Contactor Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Membrane Contactor Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the membrane contactor sources.

Market Definition

According to 3M, a membrane contactor is a device that offers effective dissolved gas control. These gas transfer devices, which use hollow fiber membrane technology, may add gases to compatible liquid streams or remove dissolved gases and bubbles from them. This could benefit facilities all over the world by increasing operating effectiveness, performance, and product quality.

A membrane contactor is a tool or system to transfer mass between two fluid phases over a semi-permeable membrane. It is frequently employed in a variety of processes, including liquid-liquid extraction, liquid-liquid contact, and liquid purification. As a barrier between the two fluid phases, the membrane in a contactor allows for the selective transmission of some components while blocking the passage of others.

Key Stakeholders

- Manufacturers of membrane contactors

- Manufacturers in end-use industries

- Traders, distributors, and suppliers of membrane contactors

- Regional manufacturers and chemical associations

- Contract manufacturing organizations (CMOs)

- Market research and consulting firms

- NGOs, governments, investment banks, venture capitalists, and private equity firms

- Environmental support agencies

Report Objectives:

- To analyze and forecast the market size of membrane contactors in terms of value.

- To provide detailed information regarding the major factors (drivers, restraints, challenges, and opportunities) influencing the regional market

- To analyze and forecast the global membrane contactor market on the basis of membrane type, application, and region.

- To analyze the opportunities in the market for stakeholders and provide details of a competitive landscape for market leaders.

- To strategically analyze the micro markets with respect to individual growth trends, growth prospects, and their contribution to the overall market

- To forecast the size of various market segments based on five major regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America, along with their respective key countries.

- To track and analyze competitive developments, such as investments, expansions, partnerships, acquisitions, collaborations, and acquisitions, in the market.

- To strategically profile the key players and comprehensively analyze their market shares and core competencies.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the client-specific needs.

The following customization options are available for the report:

- Additional country-level analysis of the membrane contactor market

- Profiling of additional market players (up to 4)

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Growth opportunities and latent adjacency in Membrane Contactor Market