Micro-Electro-Mechanical System (MEMS) Market by Sensor Type (Inertial Sensor, Pressure Sensor, Microphone), Actuator Type (Optical, Radio Frequency), Vertical (Automotive, Consumer Electronics, Industrial) and Region - Global Forecast to 2029

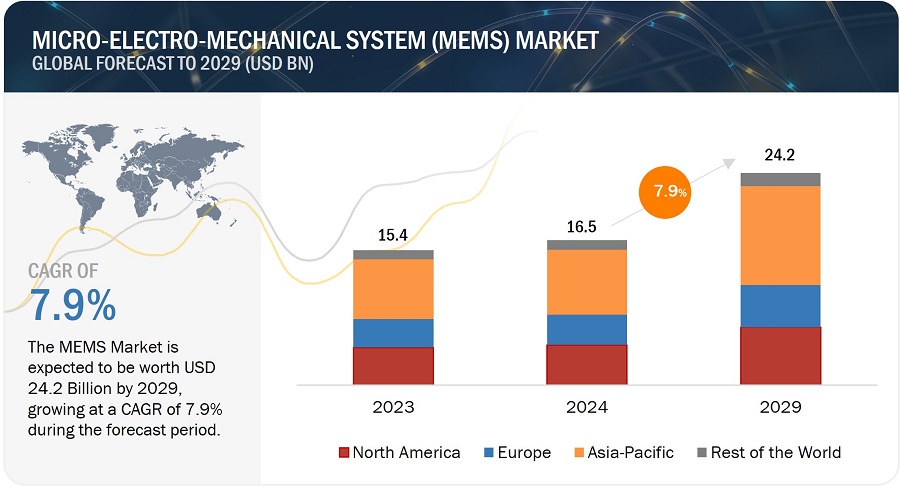

[321 Pages Report] The Micro-electro-mechanical System (MEMS) market was valued at USD 16.5 billion in 2024 and is estimated to reach USD 24.2 billion by 2029, registering a CAGR of 7.9% during the forecast period. The growth of MEMS market is driven by the growing adoption of RF MEMS technology in consumer electronics and LTE networks, rising adoption of Smart consumer electronics, growing deployment of miniaturization of devices, and widening application scope of MEMS technology.

Micro-Electro-Mechanical System (MEMS) Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Drivers: Rising demand for minituarization of devices.

The miniaturization enabled by MEMS technology opens up new possibilities for innovative applications in various fields. For example, in healthcare, miniaturized MEMS devices are used for medical diagnostics, drug delivery systems, and minimally invasive surgical tools. For instance, MEMS-based biosensors can detect biomarkers in bodily fluids for early disease diagnosis.. The automotive industry is embracing miniaturization to enhance vehicle performance, safety, and efficiency. MEMS sensors for airbag deployment, tire pressure monitoring, stability control, and navigation systems are becoming increasingly compact, enabling seamless integration into modern vehicles while optimizing space utilization and reducing weight. For instance, In January 2024, Melexis introduced the Triphibian microelectromechanical system pressure sensor tailored for automotive use. This miniaturized MEMS pressure sensor can manage measurements of gas and liquid media ranging from 2 to 70 bar.

Restraint: Lack of standardized fabrication processes for MEMS

Developing customized fabrication processes for MEMS devices incurs high development costs and time-intensive research and development efforts. Without standardized processes, manufacturers must invest significant resources in optimizing fabrication techniques for each individual device, leading to longer development cycles and higher overall costs. This can deter smaller companies and startups from entering the MEMS market, limiting competition and innovation. Without standardized procedures for quality control and testing, manufacturers may struggle to ensure consistent performance and durability across their products. This can undermine customer confidence and lead to reluctance in adopting MEMS technology, particularly in safety-critical applications such as automotive and medical devices.

Opportunities: Widening application scope of MEMS technology

MEMS technology is increasingly being leveraged in healthcare and biomedical applications to enable remote monitoring, diagnostics, and personalized medicine. MEMS sensors for vital signs monitoring, such as heart rate, blood pressure, and oxygen saturation, are integrated into wearable health monitors, fitness trackers, and medical devices, enabling continuous health tracking and early detection of medical conditions. MEMS-based lab-on-a-chip devices facilitate rapid and portable diagnostic testing for infectious diseases, cancer biomarkers, and genetic disorders, revolutionizing healthcare delivery and improving patient outcomes. In January 2022, A.M. Fitzgerald & Associates (AMFitzgerald) and MEMS Infinity, a Sumitomo Precision Products company, have partnered to expedite the commercialization of thin-film PZT MEMS chip technologies for medical ultrasound imaging applications. As medical ultrasound continues to evolve and penetrate new healthcare sectors, the demand for MEMS-based ultrasound sensors is expected to rise, driving the overall growth of the MEMS market.

Challenge: Shortage of skilled designers

MEMS devices involve intricate design, precise fabrication processes, and rigorous testing procedures, necessitating a skilled workforce with expertise in microelectronics, mechanical engineering, materials science, and semiconductor manufacturing. However, the demand for skilled MEMS professionals often outstrips the supply, leading to challenges in recruitment and talent retention within the industry. MEMS design requires a deep understanding of electromechanical principles, sensor technology, and system integration. The shortage of skilled designers can lead to delays in product development and innovation.

MEMS Ecosystem

The market for Inertial Sensor segment to hold largest market share during the forecast period.

Intertial sensor accounts for largest market share in the MEMS market, driven by the increasing demand in automotive industry. Rising government regulations and growing awareness of ADAS benefits, automotive OEMs such as Hyundai, Mahindra, Toyota, Kia, and MG, are gearing up to introduce ADAS-equipped vehicles. Hyundai Motor India plans to equip all models in its portfolio with Advanced Driver Assistance Systems (ADAS) within the next three years. As vehicle manufacturers integrate advanced driver assistance and autonomous driving systems, the need for accurate and reliable MEMS inertial sensors becomes paramount. These sensors contribute to optimizing energy efficiency, extending driving range, and enhancing vehicle dynamics and performance. The rising demand for ADAS in vehicles presents an opportunity for MEMS-based sensors to cater to the growing demand for advanced safety systems in automotive applications.

RadIio frequency actuator segment to grow at the highest CAGR in the actautor segment in the MEMS market during the forecast period.

In mobile devices, particularly smartphones, RF MEMS are utilized to address engineering challenges related to device size and component configuration. They enable the coverage of multiple frequency bands, support carrier aggregation across disparate bands, and facilitate beamforming directly on the device, complementing the capabilities of cell base stations. Smartphones, Internet of Things (IoT) devices and wearables, the are the major application areas of RF MEMS. The development of flexible RF technology is driven by the need for lightweight and reconfigurable communication components, especially for 5G mobile smartphones. Flexible electronics offer several advantages, including flexibility, miniaturization, and high integration. These qualities make them suitable for various applications, such as bio-integrated electronics and conformal integration on complex structural surfaces.

Consumer electronics segment in application to the highest market share of the MEMS market during the forecast period

MEMS (Microelectromechanical Systems) have emerged as indispensable components in smartwatches, offering a host of advantages that surpass traditional technologies. Their miniature size enables seamless integration into compact smartwatch designs, while their low power consumption ensures extended battery life, a critical factor for wearables. MEMS sensors provide exceptional precision and accuracy, facilitating features like motion tracking, heart rate monitoring, and pressure sensing with unprecedented accuracy. As MEMS technology becomes increasingly affordable, it has become the go-to choose for mass-market wearables. In January 2024, France-based SilMach introduced TheTimeChanger, the world’s first watch featuring a revolutionary MEMS movement, offering lower power usage, anti-magnetic operation, and thinner profiles compared to Lavet motors, exceeding COSC precision standards.

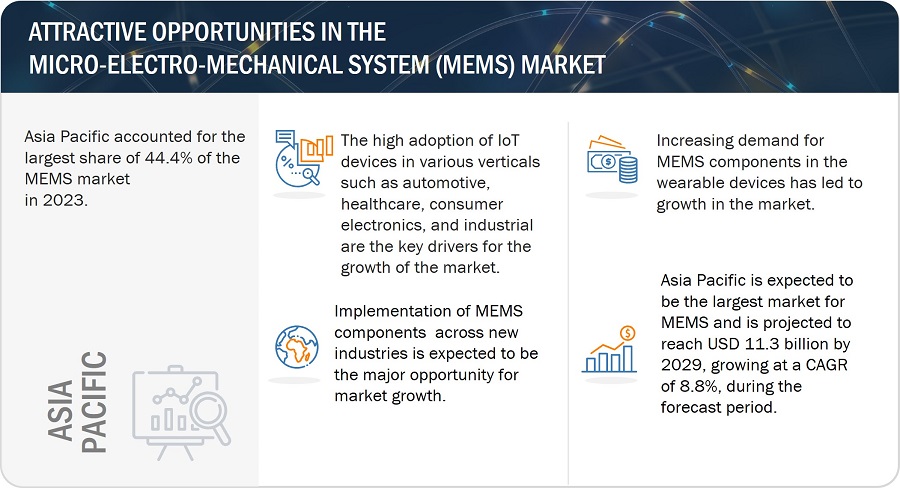

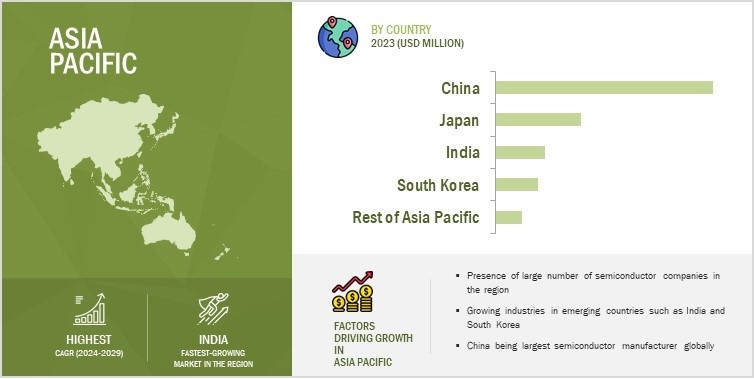

The MEMS market in Asia Pacific is estimated to account for largest share during the forecast period.

Asia Pacific accounts for the prominent market for consumer electronics, industrial, and automobiles. This region has become a global focal point for large investments and business expansion opportunities. As automakers prioritize the development and production of electric vehicles to meet emission targets and consumer demand, there is a growing need for MEMS sensors and devices to support the functionality and performance of these vehicles, thereby fueling the growth of the MEMS market in the region. According to data on Vahan, in 2023, India saw a surge in electric vehicle (EV) registrations, reaching 1,529,614 units, a 49% increase from the previous year.

Micro-Electro-Mechanical System (MEMS) Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Major vendors in the MEMS companies include Robert Bosch GmbH (Germany), Broadcom (US), Qorvo, Inc (US), STMicroelectronics (Switzerland), Texas Instruments (US), Goertek microelectronics Inc (China), Hewlett Packard Enterprise Development LP (US), TDK Corporation (Japan), Knowles Electronics, LLC (US), Infineon Technologies AG (Germany), Honeywell International (US), Analog Devices, Inc (US), among others.

Apart from this, TE Connectivity (Switzerland), NXP Semiconductors (Netherlands), Panasonic Holdings Corporation (Japan), Murata Manufacturing Co., Ltd (Japan), AAC Technologies (China), Amphenol Corporation (US), Sensata Technologies, Inc, (US), Melexis (Belgium), SiTime Corporation (US), Alps Alpine Co., Ltd (Japan), Collins Aerospace Systems (US), Teledyne FLIR (US), Flusso Ltd. (UK), Usound (Austria), Merit Medical Systems, Inc. (US), Mikrosens Elektronik (Turkey), Fibersystem AB (Sweden), Menlo Micro, Inc (US), Winsen (China), Safran (France), are among a few emerging companies in the MEMS market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2020—2029 |

|

Base year |

2023 |

|

Forecast period |

2024—2029 |

|

Segments covered |

Sensor Type, Actuator Type, Vertical, and Region |

|

Geographic regions covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies covered |

The major players include Robert Bosch GmbH (Germany), Broadcom (US), Qorvo, Inc (US), STMicroelectronics (Switzerland), Texas Instruments (US), Goertek microelectronics Inc (China), Hewlett Packard Enterprise Development LP (US), TDK Corporation (Japan), Knowles Electronics, LLC (US), Infineon Technologies AG (Germany), Honeywell International (US), Analog Devices, Inc (US), and Others- total 32 players have been covered. |

Micro-electro-mechanical System (MEMS) Market

Highlights

This research report categorizes the MEMS market into Sensor Type, Actuator Type, Vertical, and Region.

|

Segment |

Subsegment |

|

By Sensor Type: |

|

|

By Actuator Type: |

|

|

By Vertical: |

|

|

By Region: |

|

Recent Developments

- In January 2024, TDK Corporation has unveiled a range of MEMS sensors for consumer, industrial, and automotive applications, alongside an advanced edge machine learning solution, reflecting the growing market demand for MEMS technology.

- In October 2023, Analog Devices collaborates with Envision Energy to integrate MEMS sensor technology into smart wind turbines, aiming to enhance safety by monitoring vibration and tilt in real-time. This collaboration advances green energy efforts by adding intelligence at the edge for safer windmill operation and design..

Key Questions Addressed in the Report

What is the total CAGR expected to be recorded for the MEMS market during 2024-2029?

The global MEMS market is expected to record a CAGR of 7.9% from 2024-2029.

Which regions are expected to pose significant demand for the MEMS market from 2024-2029?

North America & Asia Pacific are expected to pose significant demand from 2024 to 2029. Major economies such as US, Germany, China, Japan, and India are expected to have a high potential for the future growth of the market.

What are the major market opportunities for the MEMS market?

Advancements in sensor fusion technology, Widening application scope of MEMS technology, and Proliferation of advance packaging trend in MEMS industry are the significant market opportunities in the MEMS market during the forecast period.

Which are the significant players operating in the MEMS market?

Key players operating in the MEMS market are Robert Bosch GmbH (Germany), Broadcom (US), Qorvo, Inc (US), STMicroelectronics (Switzerland), Texas Instruments (US), Goertek microelectronics Inc (China), Hewlett Packard Enterprise Development LP (US), TDK Corporation (Japan), Knowles Electronics, LLC (US), Infineon Technologies AG (Germany), Honeywell International (US), and Analog Devices, Inc (US).

What are the major Verticals of the MEMS market?

Consumer electronics, automotive, industrial, and healthcare verticals are are the major verticals of MEMS market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

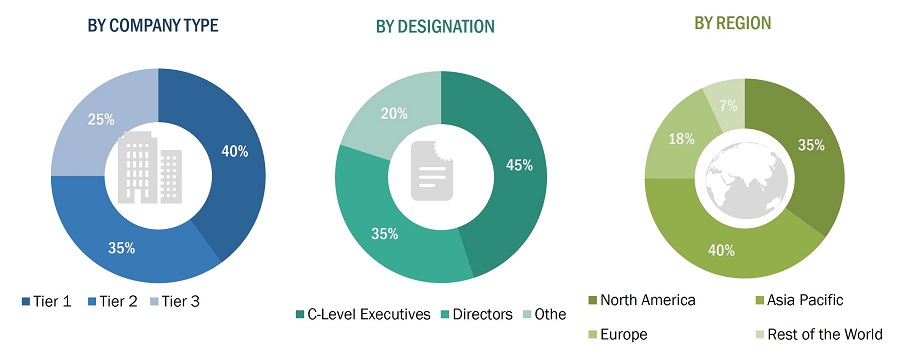

The research process for this study included the systematic gathering, recording, and analysis of data about customers and companies operating in the MEMS market. This research study involved the extensive use of secondary sources, directories, and databases (Factiva, Oanda, and OneSource) to identify and collect valuable information for this extensive, technical, market-oriented, and commercial study of the MEMS market. In-depth interviews were conducted with various primary respondents, including experts from core and related industries and preferred manufacturers, to obtain and verify critical qualitative and quantitative information as well as to assess the growth prospects of the market. Key players in the MEMS market were identified through secondary research, and their market rankings were determined through primary and secondary research. This research included studying annual reports of top players and interviewing key industry experts, such as CEOs, directors, and marketing executives.

In the primary research process, various key correspondents from the supply and demand sides were interviewed to obtain the qualitative and quantitative information relevant to this report. Primary sources from the supply side include CEOs, vice presidents, marketing directors, business development executives, end-users, and related executives from various key companies and organizations operating in the MEMS market.

Secondary Research

In the secondary research, various sources were referred to, to identify and collect information important for this study. Secondary sources included corporate filings, such as annual reports, investor presentations, and financial statements; trade, business, and professional associations; white papers, MEMS products-related journals, and certified publications; articles by recognized authors; directories; and databases.

Secondary research was conducted to obtain key information regarding the industry supply chain, market value chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments from both market and technology-oriented perspectives. Data from secondary research was collected and analyzed to determine the overall market size, which was further validated by primary research.

Primary Research

Extensive primary research was accomplished after understanding and analyzing the MEMS market scenario through secondary research. Several primary interviews were conducted with key opinion leaders from both demand- and supply-side vendors across four major regions—North America, Europe, Asia Pacific, and RoW. Approximately 30% of the primary interviews were conducted with the demand side and 70% with the supply side. Primary data was collected through questionnaires, emails, and telephonic interviews. In our canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in the report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been used, along with several data triangulation methods, to estimate and forecast the size of the market and its segments and subsegments listed in the report. Extensive qualitative and quantitative analyses have been carried out on the complete market engineering process to list the key information/insights pertaining to MEMS market.

The key players in the market have been identified through secondary research, and their rankings in the respective regions have been determined through primary and secondary research. This entire procedure involved the study of the annual and financial reports of top players and interviews with industry experts such as chief executive officers, vice presidents, directors, and marketing executives for quantitative and qualitative key insights. All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in this report.

MEMS Market: Bottom-Up Approach

The bottom-up approach has been employed to arrive at the overall size of the MEMS market from the revenues of key players and their share in the market.

MEMS Market: Top-Down Approach

In the top-down approach, the overall size of the MEMS market was used to estimate the size of the individual markets (mentioned in the market segmentation) derived through percentage splits from secondary and primary research.

For the calculation of the size of specific market segments, the overall size of the MEMS market was considered to implement the top-down approach. The bottom-up approach was also implemented for the data extracted from secondary research to validate the obtained market size of different segments.

The market share of each company was estimated to verify the revenue share used earlier in the bottom-up approach. With the data triangulation procedure and validation of data through primaries, the sizes of the overall parent market and each individual market were determined and confirmed in this study.

Data Triangulation

After arriving at the overall market size from the market size estimation process explained earlier, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the MEMS market has been validated using both top-down and bottom-up approaches.

Market Definition

MEMS (micro-electro-mechanical system) is a miniature machine that has both mechanical and electronic components. MEMS consists of microsensors, micro actuators, microelectronics, and mechanical microstructures, all integrated onto the same silicon chip. The MEMS has feature sizes ranging from micrometers to millimeters. MEMS devices can be varied among simple structures without moving elements, to highly complex electromechanical microsystems with various moving elements under the control of integrated microelectronics.

Key Stakeholders

- Raw material and manufacturing equipment suppliers

- Electronic design automation (EDA) and design tool vendors

- Wafer manufacturers

- Government bodies, venture capitalists, and private equity firms

- Integrated device manufacturers (IDMs)

- Owners of intellectual property related to MEMS components

- MEMS technology platform developers

- MEMS component manufacturers

- Maintenance and service providers

- Distributors and traders

- Research organizations

- Semiconductor Foundry Service Provider

- Organizations, forums, alliances, and associations

- End-users from verticals, such as aerospace, defense, industrial, and consumer electronics, among others

Report Objectives

- To describe and forecast the micro-electro-mechanical system (MEMS) market size, by sensor type, actuator type, and vertical, in terms of value

- To forecast the market size, in terms of value, across North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To describe and forecast the micro-electro-mechanical system (MEMS) market size, by sensor type, actuator type, in terms of volume

- To present detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To provide an ecosystem analysis, case study analysis, patent analysis, technology analysis, ASP analysis, Porter’s Five Forces analysis, and regulations pertaining to the market.

- To offer a comprehensive overview of the value chain of MEMS market ecosystem

- To critically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies.

- To assess the opportunities in the market for stakeholders and describe the competitive landscape of the market

- To analyze competitive developments such as collaborations, agreements, partnerships, product developments, and research and development (R&D) in the market

- To evaluate the impact of the recession on the MEMS market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 7)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Micro-Electro-Mechanical System (MEMS) Market

Good day, I have send this request to know more analysis data for study the trends for MEMS Market.

I need the information about MEMS market to make an investment for manufacturing MEMS-based devices.