Metal Matrix Composite Market by Matrix Type (Aluminum MMC, Magnesium MMC, Copper MMC, Super Alloys MMC), Reinforcement Type, Production Technology, Reinforcement Material, End-Use Industry, and Region - Global Forecast to 2025

Updated on : April 17, 2024

Metal Matrix Composite Market

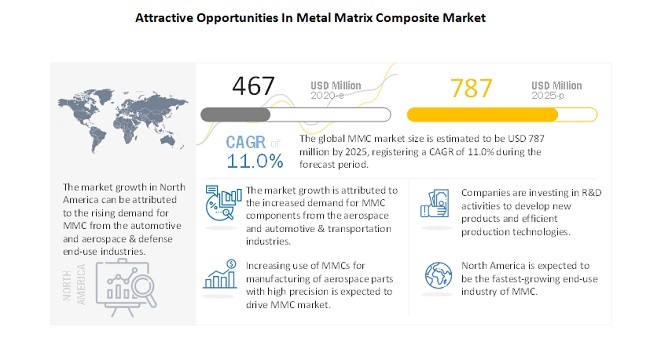

The Metal Matrix Composite Market size was valued at USD 467 million in 2020 and is projected to reach USD 787 million by 2025, growing at 11.0% cagr from 2020 to 2025. The market is growing due to the increasing usage of MMC in the automotive & transportation and aerospace sector.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on the global metal matrix composite market

COVID -19 has disastrously affected the aerospace & automotive sectors across the globe. The global aerospace industry has witnessed the most adverse and immediate consequences of the pandemic. The airline sector has faced the worst consequences due to lockdown across international and domestic borders. This has resulted in reduced passenger traffic and delayed the demand for new aircraft drastically. The novel coronavirus pandemic has created ripples across the global aerospace industry, affecting the global supply chains. This has resulted in delays or non-arrival of raw materials, disrupted financial flows, and absenteeism among production line workers. These factors have affected the world’s biggest commercial aircraft providers, Boeing and Airbus, and their constellation of suppliers.

In addition to this, more than 80% of automobile production is on halt due to the COVID-19 pandemic in North America. Europe and APAC are witnessing a similar situation. Companies such as Ford, General Motors, Fiat Chrysler Automobiles, Honda, and Tesla have stopped their production temporarily. Even if these companies resume production after the pandemic is over, economic instability and reduction in the purchasing power of consumers will have an adverse effect on the automotive industry and is expected to reduce the demand for metal matrix composite significantly

Driver: Increase in the use of MMCs for manufacturing structural aerospace composite parts

Fuel efficiency and low weight have always been the foremost factors for using MMC in the making of structural parts in the aerospace industry. Additionally, these composites have an excellent balance of specific strength and stiffness in comparison with traditional aerospace materials. The major applications of MMC are aero-structural components and parts in the aero-propulsion system, and its applications are increasing in aeronautical sub-systems with the development of new design, production systems, and certifications of MMCs. For instance, the Boeing 777 aircraft uses fan exit guide vanes in its Pratt and Whitney 4084, 4090, and 4098 engine made from aluminium MMC; and nozzle actuator links in the General Electric F110 engine made from titanium MMC. Also, a few applications of MMCs have been established in space systems, such as aluminum MMC tubes for the construction of each space shuttle orbital mid-fuselage, mid-frame, frame stabilizing struts, and nose landing gear, where dimensional stability with high performance is required.

The increasing global demand for aircraft and the increased number of space missions from various space agencies are expected to drive the MMC market in aerospace applications in the future.

Restraint: complicated manufacturing process

The variability of MMC’s properties is a challenge for the designers to develop composite components with high precision. Currently, there are very few design aids available, such as property database, performance standards, and standard test methods, which reduce the adoption rate of MMCs in emerging applications. There are production technologies such as casting, powder metallurgy, and liquid infiltration techniques that are used on a large scale, but this process requires high technical expertise to get the products with the required specifications.

Opportunity: Potential opportunities in new applications, such as robots, high-speed machinery, and high-speed rotating shafts

The end-user industries of MMC are primarily aerospace, ground transportation, and thermal management. Metal matrix composites possess high strength and stiffness and could be used in applications where weight saving is an important factor. These potential applications of MMCs include high-speed machinery, robots, and high-speed rotating shafts for automobiles and ships. MMC possesses a low coefficient of thermal expansion, which can be altered as per the requirements; this property has helped MMCs to penetrate into lasers, precision machinery, and electronic packaging applications. There is a huge growth potential for MMCs in the aforementioned applications due to new developments taking place in the MMC market.

To develop a low-cost, highly reliable manufacturing process one of the major challenges in the metal matrix composite Market

Currently, MMC manufacturing technologies are just beyond the stage of R&D and still need to be developed for mass production applications. So, the costs involved in the methods of producing MMCs are high, which increases the costs of the MMC products. This is due to the variable properties of MMCs and the unavailability of a standard database related to the manufacturing process and the specifications of MMC. It is used in space applications where high precision is extremely important, and the cost is a major factor in choosing the material for manufacturing in mass applications such as piston rod and IGBT circuit breakers. Several MMC manufacturers are investing their time and money to develop highly reliable and low-cost manufacturing processes.

In terms of value, Discontinuous reinforcement is the major segment in the global metal matrix composite market.

The discontinuous reinforcement holds the largest market share in the reinforcement type segment. Discontinuous MMCs are widely used in various automotive components such as piston rods, piston pins, valve spring caps, brake disks, brake pads, shafts, and others. The growing demand for automotive vehicles from emerging countries, such as China, India, and Brazil, is the major growth driver for the discontinuously reinforced MMC market.

In terms of value, Aluminum MMC is the largest segment in the global metal matrix composite market.

Aluminum MMC is the most widely used matrix type of metal matrix composite due to its superior properties such as lightweight, environmental resistance, and superior mechanical properties. Additionally, various reinforcements such as boron continuous fibers, Aluminum MMC is comparatively cheaper than other types of MMC products. It finds applications in various end-use industries, such as automotive & transportation, aerospace, and electrical & electronics. Some of the applications of aluminum MMCs include automotive engine moving parts such as piston pins and connecting rods.

Silicon Carbide is the largest segment in the global metal matrix composite market in the reinforcement material segment.

Silicon Carbide is the most widely used type of reinforcement material in the globalMMC market owing to high demand from the electrical & electronics, automotive, and others sectors. SiC reinforcement increases the tensile strength, hardness, density, and wear resistance of MMC. The particle distribution plays a vital role in the properties of the Al MMC and is improved by intensive shearing. SiC is the most preferred reinforcement material in MMC as it is used with various matrix systems such as aluminum, magnesium, and copper..

Powder metallurgy is the most widley used technology in the global metal matrix composite market.

Powder metallurgy is the most widely used technology to manufacture metal matrix composite. This high demand is attributed to increased adoptioin of hot pressing, ball mill mixing, extrusion, and vacuum pressing technology to manufacture metal matrix composite. Additionally, its compatibility with various materials and the increasing demand for powder metallurgically produced MMC products from industries, such as aerospace and ground transportations, are expected to drive the MMC market in powder metallurgy production technology.

Automotive & transportation to lead the market in the end-use industry segment of the metal matrix composite in terms of value and volume during the forecast period.

Automotive & transportation is the dominating end-use industry in the carbon capture, utilization, and sequestration market. This is due to the growing penetration of MMCs in applications, such as automotive brake pads, brake drums, rail brake discs, and others, as they offer superior properties The increased demand for automotive and passenger vehicles across the globe is expected to drive the demand for high-performance MMCs in the transportation sector. Similarly, increased applications of MMCs in railway coaches and locomotives help to reduce maintenance cost and power consumption. This is expected to boost the MMC market in this segment.

To know about the assumptions considered for the study, download the pdf brochure

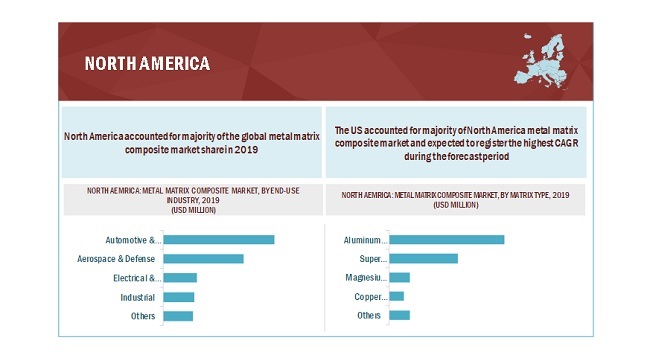

North America held the largest market share in the metal matrix composite market in terms of value.

North America held the largest share of the metal matrix composite market and the trend is expected to remain the same during the forecast period. This high market share is attributed to the presence of well-established automotive & transportation and aerospace & defense industries. Presence of major automobile and aircraft manufacturers in the US and Canada are responsible for the high consumption of MMC in the region. However, COVID-19 has adversely affected the entire globe that has led to a reduced demand for composites from various end-use industries. The North American automotive & aerospace industry is severely affected by the pandemic situation. Over USD 200 billion of market value has already been lost in the US aerospace industry. As per ACEA (European Automotive Manufacturers Association), due to factory shutdown.

Metal Matrix Composite Market Players

The key players in the global metal matrix composite market a Materion Corpoation (US), CPS Technologies Corporation (US), GKN Sinter Metals (US), 3M (US), Destsce Edelstaslwerke GmbH (Germany), Metal Matrix Cast Composites, LLC (US), Plansee SE (Austria), CeramTec (Germany), Sandvik AB (Sweden), and Ferrotec Corporation (US). These companies are involved in adopting various inorganic and organic strategies to increase their foothold in the industry. The study includes an in-depth competitive analysis of these companies in the metal matrix composite, with their company profiles, recent developments, and key market strategies.

Metal Matrix Composite Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2018–2025 |

|

Base year |

2019 |

|

Forecast period |

2020–2025 |

|

Units considered |

Volume (Ton) and Value (USD Million) |

|

Segments |

Matrix type, Reinforcement Type, Production Technology, Reinforcement Material, End-Use Industry, and Region |

|

Regions |

Europe, North America, APAC, MEA, and Latin America |

|

Companies |

Materion Corpoation (US), CPS Technologies Corporation (US), GKN Sinter Metals (US), 3M (US), Destsce Edelstaslwerke GmbH (Germany), Metal Matrix Cast Composites, LLC (US), Plansee SE (Austria), CeramTec (Germany), Sandvik AB (Sweden), Ferrotec Corporation (US), and Schlumberger Limited (US) . |

This research report categorizes the metal matrix composite market based on material, spacer thickness, application, industry, and region.

By Matrix type:

- Aluminum MMC

- Copper MMC

- Magnesium MMC

- Super Alloys MMC

- Others

By Reinforcement type:

- Continuous

- Discontinuous

- Particles

By Production Technology:

- Liquid Metal Infiltration

- Powder Metallurgy

- Casting

- Deposition techniques

By Reinforcement Material:

- Alumina

- Silicon Carbide

- Carbon Fiber

- Others

By End-Use Industry:

- Automotive & Transportation

- Aerospace & Defense

- Electrical & Electronics

- Industrial

- Others

By Region:

- North America

- Europe

- APAC

- MEA

- Latin America

Frequently Asked Questions (FAQ):

What are major production technology in the metal matrix composite market?

Liquid metal infiltration, powder metallurgy, casting, and deposition techniques are the major production technologies in the metal matrix composite market.

Which is the major reinforcement material in the metal matrix composite market?

Silicon Carbide, Alumina, Carbon Fiber are the major reinforcement material in eth market.

What are the major reinforcement type in the metal matrix composite market?

Continuous, discontinuous, and particles are the key reinforcement type in the market.

What are the challenges in the metal matrix composite market?

Developing low-cost fiber reinforcement and highly reliable coating for reinforcement-matrix interface is a major challenge for the metal matrix composite market.

Which matrix type in the metal matrix composite market holds the largest share?

Aluminum MMC holds the largest share in the metal matrix composite market.

What are the different end-use industries of metal matrix composite?

Automotive & transportation, aerospace & defense, electrical & electronics, and industrial are the major end-use industries in the market.

Who are the manufacturers of metal matrix composite?

Materion Corpoation (US), CPS Technologies Corporation (US), GKN Sinter Metals (US), 3M (US), Destsce Edelstaslwerke GmbH (Germany), Metal Matrix Cast Composites, LLC (US), Plansee SE (Austria), CeramTec (Germany), Sandvik AB (Sweden), and Ferrotec Corporation (US) among many others, are some of the manufacturers operating in the market.

What are the major end-use industry of metal matrix composite?

Automotive & transportation is the major industry of metal matrix composite market.

What are the major driver for metal matrix composite?

Increase in the use of MMCs for manufacturing structural aerospace composite parts is driving the market.

What is the biggest restraint for metal matrix composite?

Complicated manufacturing process is hindering the growth of metal matrix compositemarket growth. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 METAL MATRIX COMPOSITE MARKET SEGMENTATION

1.3.2 METAL MATRIX COMPOSITE MARKET, REGIONAL SCOPE

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

FIGURE 1 METAL MATRIX COMPOSITE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

FIGURE 2 METAL MATRIX COMPOSITE MARKET: SUPPLY-SIDE ESTIMATION METHOD

FIGURE 3 METAL MATRIX COMPOSITE MARKET: DEMAND-SIDE ESTIMATION METHOD

2.3 DATA TRIANGULATION

FIGURE 4 METAL MATRIX COMPOSITE MARKET: DATA TRIANGULATION

2.4 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 37)

FIGURE 5 ALUMINUM METAL MATRIX COMPOSITE TYPE DOMINATED THE MARKET IN 2019

FIGURE 6 DISCONTINUOUS SEGMENT DOMINATED THE MARKET IN 2019

FIGURE 7 AUTOMOTIVE & TRANSPORTATION IS THE KEY END-USE INDUSTRY IN THE METAL MATRIX COMPOSITE MARKET

FIGURE 8 POWDER METALLURGY DOMINATES THE PRODUCTION TECHNOLOGY SEGMENT

FIGURE 9 THE US LED THE METAL MATRIX COMPOSITE MARKET IN 2019

FIGURE 10 NORTH AMERICA ACCOUNTED FOR THE LARGEST MARKET SHARE IN 2019

4 PREMIUM INSIGHTS (Page No. - 42)

4.1 ATTRACTIVE OPPORTUNITIES IN THE METAL MATRIX COMPOSITE MARKET

FIGURE 11 HIGH DEMAND FROM AUTOMOTIVE & TRANSPORTATION END-USE INDUSTRY TO DRIVE THE MARKET

4.2 METAL MATRIX COMPOSITE MARKET, BY PRODUCTION TECHNOLOGY AND MATRIX TYPE, 2019

FIGURE 12 ALUMINUM METAL MATRIX COMPOSITE ACCOUNTED FOR THE LARGEST SHARE OF THE GLOBAL MARKET

4.3 METAL MATRIX COMPOSITE MARKET, BY REINFORCEMENT TYPE

FIGURE 13 DISCONTINUOUS REINFORCEMENT LEADS THE DEMAND

4.4 METAL MATRIX COMPOSITE MARKET, BY END-USE INDUSTRY

FIGURE 14 AUTOMOTIVE & TRANSPORTATION DOMINATES THE OVERALL MARKET

4.5 METAL MATRIX COMPOSITE MARKET, BY KEY COUNTRIES

FIGURE 15 CHINA TO REGISTER THE HIGHEST CAGR

5 MARKET OVERVIEW (Page No. - 45)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE METAL MATRIX COMPOSITE MARKET

5.2.1 DRIVERS

5.2.1.1 Increase in the use of MMCs for manufacturing structural aerospace composite parts

5.2.1.2 Increasing demand for lightweight and strong MMC from the aerospace & defense industry

5.2.2 RESTRAINTS

5.2.2.1 Complicated manufacturing process

5.2.2.2 Concerns about reparability and recyclability

5.2.2.3 Disruption in supply chain and lower demand due to COVID-19 pandemic

5.2.3 OPPORTUNITIES

5.2.3.1 Potential opportunities in new applications, such as robots, high-speed machinery, and high-speed rotating shafts

5.2.4 CHALLENGES

5.2.4.1 To develop a low-cost, highly reliable manufacturing process

5.2.4.2 To develop low-cost fiber reinforcement and highly reliable coating for reinforcement-matrix interface

5.2.4.3 Maintaining an uninterrupted supply chain and operating at full capacity

5.3 PORTER'S FIVE FORCES ANALYSIS

FIGURE 17 PORTER'S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 VALUE CHAIN ANALYSIS

FIGURE 18 VALUE CHAIN ANALYSIS: MAXIMUM VALUE IS ADDED DURING METAL MATRIX COMPOSITE DESIGN & PROCESSING PHASE

5.5 PRICING ANALYSIS

5.6 MANUFACTURING PROCESS ANALYSIS

5.7 PATENT ANALYSIS

5.7.1 METHODOLOGY

5.7.2 DOCUMENT TYPE

FIGURE 19 PUBLICATION TRENDS - FROM 2011 TO 2019

5.7.3 INSIGHTS

FIGURE 20 JURISDICTION ANALYSIS

5.7.4 TOP APPLICANTS OF METAL MATRIX COMPOSITE

FIGURE 21 TOP APPLICANTS OF METAL MATRIX COMPOSITE

5.8 METAL MATRIX COMPOSITE MARKET ECOSYSTEM

5.9 CASE STUDY

6 MACROECONOMIC OVERVIEW AND KEY TRENDS (Page No. - 54)

6.1 INTRODUCTION

6.2 TRENDS AND FORECAST OF GDP

TABLE 1 ANNUAL PERCENTAGE CHANGE OF GDP, BY REGION, APRIL 2020

6.3 IMPACT OF COVID-19 ON AEROSPACE INDUSTRY

TABLE 2 NUMBER OF AIRPLANE DELIVERIES, BY MANUFACTURERS, 2019

6.3.1 SHORT-TERM STRATEGIES TO MANAGE COST STRUCTURE AND SUPPLY CHAINS

6.3.2 NEW OPPORTUNITIES

6.4 IMPACT OF COVID-19 ON AUTOMOTIVE INDUSTRY

6.4.1 SHORT-TERM STRATEGIES TO MANAGE COST STRUCTURE AND SUPPLY CHAINS

6.4.2 NEW OPPORTUNITIES

7 METAL MATRIX COMPOSITE MARKET, BY MATRIX TYPE (Page No. - 58)

7.1 INTRODUCTION

FIGURE 22 ALUMINUM METAL MATRIX COMPOSITE TO DOMINATE THE METAL MATRIX COMPOSITE MARKET DURING THE FORECAST PERIOD

TABLE 3 METAL MATRIX COMPOSITE MARKET SIZE, BY MATRIX TYPE, 2018-2025 (USD MILLION)

TABLE 4 METAL MATRIX COMPOSITE MARKET SIZE, BY MATRIX TYPE, 2018-2025 (TON)

7.2 ALUMINUM METAL MATRIX COMPOSIT

7.2.1 THE SEGMENT HOLDS MAJORITY OF THE MARKET SHARE

FIGURE 23 NORTH AMERICA TO BE THE LARGEST METAL MATRIX COMPOSITE MARKET

TABLE 5 ALUMINUM METAL MATRIX COMPOSITE MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 6 ALUMINUM METAL MATRIX COMPOSITE MARKET SIZE, BY REGION, 2018-2025 (TON)

7.3 MAGNESIUM METAL MATRIX COMPOSITE

7.3.1 LOW-DENSITY AND CORROSION RESISTANCE PROPERTIES TO DRIVE THE DEMAND

TABLE 7 MAGNESIUM METAL MATRIX COMPOSITE MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 8 MAGNESIUM METAL MATRIX COMPOSITE MARKET SIZE, BY REGION, 2018-2025 (TON)

7.4 SUPER ALLOYS METAL MATRIX COMPOSITE

7.4.1 FASTEST-GROWING SEGMENT OWING TO HIGH DEMAND FROM THE AUTOMOTIVE SECTOR

TABLE 9 SUPER ALLOYS METAL MATRIX COMPOSITE MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 10 SUPER ALLOYS METAL MATRIX COMPOSITE MARKET SIZE, BY REGION, 2018-2025 (TON)

7.5 COPPER METAL MATRIX COMPOSITE

7.5.1 HIGH DEMAND FROM EUROPE AND NORTH AMERICA

TABLE 11 COPPER METAL MATRIX COMPOSITE MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 12 COPPER METAL MATRIX COMPOSITE MARKET SIZE, BY REGION, 2018-2025 (TON)

7.6 OTHER METAL MATRIX COMPOSITES

TABLE 13 OTHER METAL MATRIX COMPOSITE MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 14 OTHER METAL MATRIX COMPOSITE MARKET SIZE, BY REGION, 2018-2025 (TON)

8 METAL MATRIX COMPOSITE MARKET, BY PRODUCTION TECHNOLOGY (Page No. - 66)

8.1 INTRODUCTION

FIGURE 24 POWDER METALLURGY SEGMENT LEADS THE DEMAND IN THE METAL MATRIX COMPOSITE MARKET

TABLE 15 METAL MATRIX COMPOSITE MARKET SIZE, BY PRODUCTION TECHNOLOGY, 2018-2025 (USD MILLION)

TABLE 16 METAL MATRIX COMPOSITE MARKET SIZE, BY PRODUCTION TECHNOLOGY, 2018-2025 (TON)

8.2 LIQUID METAL INFILTRATION

8.2.1 INCREASING USAGE IN EUROPEAN COUNTRIES

TABLE 17 LIQUID METAL INFILTRATION: METAL MATRIX COMPOSITE MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 18 LIQUID METAL INFILTRATION: METAL MATRIX COMPOSITE MARKET SIZE, BY REGION, 2018-2025 (TON)

8.2.1.1 Gas pressure infiltration

8.2.1.2 Squeeze casting infiltration method

8.2.1.3 Others

8.3 POWDER METALLURGY

8.3.1 MOST WIDELY USED TECHNOLOGY IN THE MMC MARKET

FIGURE 25 NORTH AMERICA LEADS THE DEMAND IN POWDER METALLURGY METAL MATRIX COMPOSITE MARKET

TABLE 19 POWDER METALLURGY: METAL MATRIX COMPOSITE MARKET SIZE, BY REGION, 2018-2025 (USD MILLION) 70

TABLE 20 POWDER METALLURGY: METAL MATRIX COMPOSITE MARKET SIZE, BY REGION, 2018-2025 (TON) 70

8.3.1.1 Hot pressing

8.3.1.2 Ball mill mixing

8.3.1.3 Extrusion/rolling

8.3.1.4 Vacuum pressing

8.4 CASTING

8.4.1 GROWING USAGE IN PROCESS ALUMINUM MMC

TABLE 21 CASTING: METAL MATRIX COMPOSITE MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 22 CASTING: METAL MATRIX COMPOSITE MARKET SIZE, BY REGION, 2018-2025 (TON)

8.4.1.1 Stir casting

8.4.1.2 Gravity casting

8.4.1.3 Low-pressure casting

8.4.1.4 Compo-casting

8.5 DEPOSITION TECHNIQUES

8.5.1 CHEMICAL VAPOR DEPOSITION, SPRAY DEPOSITION, AND PHYSICAL VAPOR DEPOSITION ARE THE MOST WIDELY USED DEPOSITION TECHNIQUES

TABLE 23 DEPOSITION TECHNIQUES: METAL MATRIX COMPOSITE MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 24 DEPOSITION TECHNIQUES: METAL MATRIX COMPOSITE MARKET SIZE, BY REGION, 2018-2025 (TON)

8.5.1.1 Electroplating

8.5.1.2 Spray foaming

8.5.1.3 Chemical vapor deposition

9 METAL MATRIX COMPOSITE MARKET, BY REINFORCEMENT TYPE (Page No. - 75)

9.1 INTRODUCTION

FIGURE 26 DISCONTINUOUS REINFORCED TYPE TO DOMINATE THE METAL MATRIX COMPOSITE MARKET DURING THE FORECAST PERIOD

TABLE 25 METAL MATRIX COMPOSITE MARKET SIZE, BY REINFORCEMENT TYPE, 2018-2025 (USD MILLION)

TABLE 26 METAL MATRIX COMPOSITE MARKET SIZE, BY REINFORCEMENT TYPE, 2018-2025 (TON)

9.2 CONTINUOUS REINFORCEMENT

9.2.1 CONTINUOUS REINFORCEMENT PROVIDES HIGH STRENGTH TO MMC

TABLE 27 CONTINUOUS REINFORCED METAL MATRIX COMPOSITE MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 28 CONTINUOUS REINFORCED METAL MATRIX COMPOSITE MARKET SIZE, BY REGION, 2018-2025 (TON)

9.3 DISCONTINUOUS REINFORCEMENT

9.3.1 GROWING USAGE OF SHORT FIBERS AND WHISKERS IS FUELING THE DEMAND

FIGURE 27 NORTH AMERICA TO LEAD THE DISCONTINUOUS REINFORCED METAL MATRIX COMPOSITE MARKET DURING THE FORECAST PERIOD

TABLE 29 DISCONTINUOUS REINFORCED METAL MATRIX COMPOSITE MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 30 DISCONTINUOUS REINFORCED METAL MATRIX COMPOSITE MARKET SIZE, BY REGION, 2018-2025 (TON)

9.3.1.1 Whiskers

9.3.1.2 Short fibers

9.4 PARTICLES

9.4.1 MOST WIDELY USED PARTICLES ARE ALUMINA, SILICON CARBIDE, BORON CARBIDE, TITANIUM CARBIDE, AND TUNGSTEN CARBIDE

TABLE 31 PARTICLE REINFORCED METAL MATRIX COMPOSITE MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 32 PARTICLE REINFORCED METAL MATRIX COMPOSITE MARKET SIZE, BY REGION, 2018-2025 (TON)

10 METAL MATRIX COMPOSITE MARKET, BY REINFORCEMENT MATERIAL (Page No. - 81)

10.1 INTRODUCTION

FIGURE 28 SILICON CARBIDE SEGMENT LEADS THE DEMAND IN THE GLOBAL MARKET

TABLE 33 METAL MATRIX COMPOSITE MARKET SIZE, BY REINFORCEMENT MATERIAL, 2018-2025 (USD MILLION)

TABLE 34 METAL MATRIX COMPOSITE MARKET SIZE, BY REINFORCEMENT MATERIAL, 2018-2025 (TON)

10.2 SILICON CARBIDE

10.2.1 MOST-WIDELY USED REINFORCEMENT MATERIAL

FIGURE 29 NORTH AMERICA LEADS THE DEMAND IN SIC REINFORCED METAL MATRIX COMPOSITE MARKET

TABLE 35 SILICON CARBIDE REINFORCED METAL MATRIX COMPOSITE MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 36 SILICON CARBIDE REINFORCED METAL MATRIX COMPOSITE MARKET SIZE, BY REGION, 2018-2025 (TON)

10.3 ALUMINA

10.3.1 ALUMINA OFFERS SUPERIOR STABILITY AND EXHIBITS BETTER CORROSION & HIGH TEMPERATURE RESISTANCE

TABLE 37 ALUMINA REINFORCED METAL MATRIX COMPOSITE MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 38 ALUMINA REINFORCED METAL MATRIX COMPOSITE MARKET SIZE, BY REGION, 2018-2025 (TON)

10.4 CARBON FIBER

10.4.1 INCREASING PENETRATION OF CONTINUOUS REINFORCEMENT TYPE IS DRIVING THE DEMAND

TABLE 39 CARBON FIBER REINFORCED METAL MATRIX COMPOSITE MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 40 CARBON FIBER REINFORCED METAL MATRIX COMPOSITE MARKET SIZE, BY REGION, 2018-2025 (TON)

10.4.1.1 Graphite

10.4.1.2 Nanotubes

10.4.1.3 Other carbon fibers

10.5 OTHER REINFORCEMENTS

TABLE 41 OTHER REINFORCEMENT METAL MATRIX COMPOSITE MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 42 OTHER REINFORCEMENT METAL MATRIX COMPOSITE MARKET SIZE, BY REGION, 2018-2025 (TON)

11 METAL MATRIX COMPOSITE MARKET, BY END-USE INDUSTRY (Page No. - 88)

11.1 INTRODUCTION

FIGURE 30 AUTOMOTIVE & TRANSPORTATION TO BE THE LARGEST END-USE INDUSTRY OF METAL MATRIX COMPOSITE

TABLE 43 METAL MATRIX COMPOSITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION) 90

TABLE 44 METAL MATRIX COMPOSITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (TON)

11.2 AUTOMOTIVE & TRANSPORTATION

11.2.1 THE INDUSTRY HOLDS THE LARGEST SHARE IN THE MMC MARKET

FIGURE 31 NORTH AMERICA TO BE THE LEADING METAL MATRIX COMPOSITE MARKET IN AUTOMOTIVE & TRANSPORTATION

TABLE 45 METAL MATRIX COMPOSITE MARKET SIZE IN AUTOMOTIVE & TRANSPORTATION, BY REGION, 2018-2025 (USD MILLION)

TABLE 46 METAL MATRIX COMPOSITE MARKET SIZE IN AUTOMOTIVE & TRANSPORTATION, BY REGION, 2018-2025 (TON)

11.3 ELECTRICAL & ELECTRONICS

11.3.1 GROWING USAGE IN PRINTED CIRCUIT BOARDS TO DRIVE THE DEMAND

TABLE 47 METAL MATRIX COMPOSITE MARKET SIZE IN ELECTRICAL & ELECTRONICS, BY REGION, 2018-2025 (USD MILLION)

TABLE 48 METAL MATRIX COMPOSITE MARKET SIZE IN ELECTRICAL & ELECTRONICS, BY REGION, 2018-2025 (TON)

11.4 AEROSPACE & DEFENSE

11.4.1 GROWING DEMAND FROM EUROPEAN COUNTRIES TO DRIVE THE MARKET

TABLE 49 DEMAND FOR AIRPLANES, BY REGION, 2015 TO 2034

TABLE 50 METAL MATRIX COMPOSITE MARKET SIZE IN AEROSPACE & DEFENSE, BY REGION, 2018-2025 (USD MILLION)

TABLE 51 METAL MATRIX COMPOSITE MARKET SIZE IN AEROSPACE & DEFENSE, BY REGION, 2018-2025 (TON)

11.5 INDUSTRIAL

11.5.1 GROWING PENETRATION OF MMC IN ELECTROPLATED AND IMPREGNATED DIAMOND TOOLS

TABLE 52 METAL MATRIX COMPOSITE MARKET SIZE IN INDUSTRIAL, BY REGION, 2018-2025 (USD MILLION)

TABLE 53 METAL MATRIX COMPOSITE MARKET SIZE IN INDUSTRIAL, BY REGION, 2018-2025 (TON)

11.6 OTHER END-USE INDUSTRIES

TABLE 54 METAL MATRIX COMPOSITE MARKET SIZE IN OTHER INDUSTRIES, BY REGION, 2018-2025 (USD MILLION)

TABLE 55 METAL MATRIX COMPOSITE MARKET SIZE IN OTHER INDUSTRIES, BY REGION, 2018-2025 (TON)

12 METAL MATRIX COMPOSITE MARKET, BY REGION (Page No. - 99)

12.1 INTRODUCTION

FIGURE 32 CHINA TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 56 METAL MATRIX COMPOSITE MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 57 METAL MATRIX COMPOSITE MARKET SIZE, BY REGION, 2018-2025 (TON)

12.2 NORTH AMERICA

FIGURE 33 NORTH AMERICA: METAL MATRIX COMPOSITE MARKET SNAPSHOT

TABLE 58 NORTH AMERICA: METAL MATRIX COMPOSITE MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 59 NORTH AMERICA: METAL MATRIX COMPOSITE MARKET SIZE, BY COUNTRY, 2018-2025 (TON)

TABLE 60 NORTH AMERICA: METAL MATRIX COMPOSITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 61 NORTH AMERICA: METAL MATRIX COMPOSITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (TON)

TABLE 62 NORTH AMERICA: METAL MATRIX COMPOSITE MARKET SIZE, BY MATRIX TYPE, 2018-2025 (USD MILLION)

TABLE 63 NORTH AMERICA: METAL MATRIX COMPOSITE MARKET SIZE, BY MATRIX TYPE, 2018-2025 (TON)

TABLE 64 NORTH AMERICA: METAL MATRIX COMPOSITE MARKET SIZE, BY PRODUCTION TECHNOLOGY, 2018-2025 (USD MILLION)

TABLE 65 NORTH AMERICA: METAL MATRIX COMPOSITE MARKET SIZE, BY PRODUCTION TECHNOLOGY, 2018-2025 (TON)

TABLE 66 NORTH AMERICA: METAL MATRIX COMPOSITE MARKET SIZE, BY REINFORCEMENT TYPE, 2018-2025 (USD MILLION)

TABLE 67 NORTH AMERICA: METAL MATRIX COMPOSITE MARKET SIZE, BY REINFORCEMENT TYPE, 2018-2025 (TON)

TABLE 68 NORTH AMERICA: METAL MATRIX COMPOSITE MARKET SIZE, BY REINFORCEMENT MATERIAL, 2018-2025 (USD MILLION)

TABLE 69 NORTH AMERICA: METAL MATRIX COMPOSITE MARKET SIZE, BY REINFORCEMENT MATERIAL, 2018-2025 (TON)

12.2.1 CANADA

12.2.1.1 Aerospace & defense industry to drive the market

TABLE 70 CANADA: METAL MATRIX COMPOSITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 71 CANADA: METAL MATRIX COMPOSITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (TON)

12.2.2 US

12.2.2.1 Largest MMC market in the world

TABLE 72 US: METAL MATRIX COMPOSITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 73 US: METAL MATRIX COMPOSITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (TON)

12.3 EUROPE

FIGURE 34 EUROPE: METAL MATRIX COMPOSITE MARKET SNAPSHOT

TABLE 74 EUROPE: METAL MATRIX COMPOSITE MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 75 EUROPE: METAL MATRIX COMPOSITE MARKET SIZE, BY COUNTRY, 2018-2025 (TON)

TABLE 76 EUROPE: METAL MATRIX COMPOSITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 77 EUROPE: METAL MATRIX COMPOSITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (TON)

TABLE 78 EUROPE: METAL MATRIX COMPOSITE MARKET SIZE, BY MATRIX TYPE, 2018-2025 (USD MILLION)

TABLE 79 EUROPE: METAL MATRIX COMPOSITE MARKET SIZE, BY MATRIX TYPE, 2018-2025 (TON)

TABLE 80 EUROPE: METAL MATRIX COMPOSITE MARKET SIZE, BY PRODUCTION TECHNOLOGY, 2018-2025 (USD MILLION)

TABLE 81 EUROPE: METAL MATRIX COMPOSITE MARKET SIZE, BY PRODUCTION TECHNOLOGY, 2018-2025 (TON)

TABLE 82 EUROPE: METAL MATRIX COMPOSITE MARKET SIZE, BY REINFORCEMENT TYPE, 2018-2025 (USD MILLION)

TABLE 83 EUROPE: METAL MATRIX COMPOSITE MARKET SIZE, BY REINFORCEMENT TYPE, 2018-2025 (TON)

TABLE 84 EUROPE: METAL MATRIX COMPOSITE MARKET SIZE, BY REINFORCEMENT MATERIAL, 2018-2025 (USD MILLION)

TABLE 85 EUROPE: METAL MATRIX COMPOSITE MARKET SIZE, BY REINFORCEMENT MATERIAL, 2018-2025 (TON)

12.3.1 GERMANY

12.3.1.1 Automotive & transportation industry to fuel the growth

TABLE 86 GERMANY: METAL MATRIX COMPOSITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 87 GERMANY: METAL MATRIX COMPOSITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (TON)

12.3.2 FRANCE

12.3.2.1 Presence of leading aircraft manufacturers

TABLE 88 FRANCE: METAL MATRIX COMPOSITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 89 FRANCE: METAL MATRIX COMPOSITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (TON)

12.3.3 UK

12.3.3.1 Stringent government regulations are boosting the consumption of MMC

TABLE 90 UK: METAL MATRIX COMPOSITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 91 UK: METAL MATRIX COMPOSITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (TON)

12.3.4 REST OF EUROPE

TABLE 92 REST OF EUROPE: METAL MATRIX COMPOSITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 93 REST OF EUROPE: METAL MATRIX COMPOSITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (TON)

12.4 APAC

FIGURE 35 APAC: METAL MATRIX COMPOSITE MARKET SNAPSHOT

TABLE 94 APAC: METAL MATRIX COMPOSITE MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 95 APAC: METAL MATRIX COMPOSITE MARKET SIZE, BY COUNTRY, 2018-2025 (TON)

TABLE 96 APAC: METAL MATRIX COMPOSITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 97 APAC: METAL MATRIX COMPOSITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (TON)

TABLE 98 APAC: METAL MATRIX COMPOSITE MARKET SIZE, BY MATRIX TYPE, 2018-2025 (USD MILLION)

TABLE 99 APAC: METAL MATRIX COMPOSITE MARKET SIZE, BY MATRIX TYPE, 2018-2025 (TON)

TABLE 100 APAC: METAL MATRIX COMPOSITE MARKET SIZE, BY PRODUCTION TECHNOLOGY, 2018-2025 (USD MILLION)

TABLE 101 APAC: METAL MATRIX COMPOSITE MARKET SIZE, BY PRODUCTION TECHNOLOGY, 2018-2025 (TON)

TABLE 102 APAC: METAL MATRIX COMPOSITE MARKET SIZE, BY REINFORCEMENT TYPE, 2018-2025 (USD MILLION)

TABLE 103 APAC: METAL MATRIX COMPOSITE MARKET SIZE, BY REINFORCEMENT TYPE, 2018-2025 (TON)

TABLE 104 APAC: METAL MATRIX COMPOSITE MARKET SIZE, BY REINFORCEMENT MATERIAL, 2018-2025 (USD MILLION)

TABLE 105 APAC: METAL MATRIX COMPOSITE MARKET SIZE, BY REINFORCEMENT MATERIAL, 2018-2025 (TON)

12.4.1 CHINA

12.4.1.1 Fast-growing automotive sector in the country to fuel the growth

TABLE 106 CHINA: METAL MATRIX COMPOSITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 107 CHINA: METAL MATRIX COMPOSITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (TON)

12.4.2 JAPAN

12.4.2.1 Growing penetration of aluminum MMC in the country

TABLE 108 JAPAN: METAL MATRIX COMPOSITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 109 JAPAN: METAL MATRIX COMPOSITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (TON)

12.4.3 SOUTH KOREA

12.4.3.1 Growing implementation in automotive components

TABLE 110 SOUTH KOREA: METAL MATRIX COMPOSITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 111 SOUTH KOREA: METAL MATRIX COMPOSITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (TON)

12.4.4 INDIA

12.4.4.1 One of the fastest-growing economies in the world

TABLE 112 INDIA: METAL MATRIX COMPOSITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 113 INDIA: METAL MATRIX COMPOSITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (TON)

12.4.5 REST OF APAC

TABLE 114 REST OF APAC: METAL MATRIX COMPOSITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 115 REST OF APAC: METAL MATRIX COMPOSITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (TON)

12.5 LATIN AMERICA

TABLE 116 LATIN AMERICA: METAL MATRIX COMPOSITE MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 117 LATIN AMERICA: METAL MATRIX COMPOSITE MARKET SIZE, BY COUNTRY, 2018-2025 (TON)

TABLE 118 LATIN AMERICA: METAL MATRIX COMPOSITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 119 LATIN AMERICA: METAL MATRIX COMPOSITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (TON)

TABLE 120 LATIN AMERICA: METAL MATRIX COMPOSITE MARKET SIZE, BY MATRIX TYPE, 2018-2025 (USD MILLION)

TABLE 121 LATIN AMERICA: METAL MATRIX COMPOSITE MARKET SIZE, BY MATRIX TYPE, 2018-2025 (TON)

TABLE 122 LATIN AMERICA: METAL MATRIX COMPOSITE MARKET SIZE, BY PRODUCTION TECHNOLOGY, 2018-2025 (USD MILLION)

TABLE 123 LATIN AMERICA: METAL MATRIX COMPOSITE MARKET SIZE, BY PRODUCTION TECHNOLOGY, 2018-2025 (TON)

TABLE 124 LATIN AMERICA: METAL MATRIX COMPOSITE MARKET SIZE, BY REINFORCEMENT TYPE, 2018-2025 (USD MILLION)

TABLE 125 LATIN AMERICA: METAL MATRIX COMPOSITE MARKET SIZE, BY REINFORCEMENT TYPE, 2018-2025 (TON)

TABLE 126 LATIN AMERICA: METAL MATRIX COMPOSITE MARKET SIZE, BY REINFORCEMENT MATERIAL, 2018-2025 (USD MILLION)

TABLE 127 LATIN AMERICA: METAL MATRIX COMPOSITE MARKET SIZE, BY REINFORCEMENT MATERIAL, 2018-2025 (TON)

12.5.1 BRAZIL

12.5.1.1 Growing investment in the automotive sector in the country to replace traditional materials

TABLE 128 BRAZIL: METAL MATRIX COMPOSITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 129 BRAZIL: METAL MATRIX COMPOSITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (TON)

12.5.2 MEXICO

12.5.2.1 Second-largest MMC market in Latin America

TABLE 130 MEXICO: METAL MATRIX COMPOSITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 131 MEXICO: METAL MATRIX COMPOSITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (TON)

12.5.3 REST OF LATIN AMERICA

TABLE 132 REST OF LATIN AMERICA: METAL MATRIX COMPOSITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 133 REST OF LATIN AMERICA: METAL MATRIX COMPOSITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (TON)

12.6 MIDDLE EAST & AFRICA

TABLE 134 MEA: METAL MATRIX COMPOSITE MARKET SIZE, BY COUNTRY, 2018-2025 (TON)

TABLE 135 MEA: METAL MATRIX COMPOSITE MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 136 MEA: METAL MATRIX COMPOSITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 137 MEA: METAL MATRIX COMPOSITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (TON)

TABLE 138 MEA: METAL MATRIX COMPOSITE MARKET SIZE, BY MATRIX TYPE, 2018-2025 (USD MILLION)

TABLE 139 MEA: METAL MATRIX COMPOSITE MARKET SIZE, BY MATRIX TYPE, 2018-2025 (TON)

TABLE 140 MEA: METAL MATRIX COMPOSITE MARKET SIZE, BY PRODUCTION TECHNOLOGY, 2018-2025 (USD MILLION)

TABLE 141 MEA: METAL MATRIX COMPOSITE MARKET SIZE, BY PRODUCTION TECHNOLOGY, 2018-2025 (TON)

TABLE 142 MEA: METAL MATRIX COMPOSITE MARKET SIZE, BY REINFORCEMENT TYPE, 2018-2025 (USD MILLION)

TABLE 143 MEA: METAL MATRIX COMPOSITE MARKET SIZE, BY REINFORCEMENT TYPE, 2018-2025 (TON)

TABLE 144 MEA: METAL MATRIX COMPOSITE MARKET SIZE, BY REINFORCEMENT MATERIAL, 2018-2025 (USD MILLION)

TABLE 145 MEA: METAL MATRIX COMPOSITE MARKET SIZE, BY REINFORCEMENT MATERIAL, 2018-2025 (TON)

12.6.1 UAE

12.6.1.1 Automotive & transportation is the major end-use industry

TABLE 146 UAE: METAL MATRIX COMPOSITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 147 UAE: METAL MATRIX COMPOSITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (TON)

12.6.2 ISRAEL

12.6.2.1 Aerospace & defense sector to drive the MMC market

TABLE 148 ISRAEL: METAL MATRIX COMPOSITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 149 ISRAEL: METAL MATRIX COMPOSITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (TON)

12.6.3 REST OF MEA

TABLE 150 REST OF MEA: METAL MATRIX COMPOSITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 151 REST OF MEA: METAL MATRIX COMPOSITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (TON)

13 COMPETITIVE LANDSCAPE (Page No. - 143)

13.1 MARKET SHARE ANALYSIS

FIGURE 36 MARKET SHARE ANALYSIS

13.2 REVENUE ANALYSIS OF TOP MARKET PLAYERS, 2019

TABLE 152 REVENUE ANALYSIS OF TOP MARKET PLAYERS, 2019

13.3 COMPANY EVALUATION MATRIX

13.3.1 STAR

13.3.2 PERVASIVE

13.3.3 PARTICIPANTS

13.3.4 EMERGING LEADERS

FIGURE 37 METAL MATRIX COMPOSITE MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

13.4 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 38 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN THE METAL MATRIX COMPOSITE MARKET

13.5 BUSINESS STRATEGY EXCELLENCE

FIGURE 39 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN METAL MATRIX COMPOSITE MARKET

14 COMPANY PROFILES (Page No. - 149)

(Business Overview, Products Offered, SWOT Analysis, Winning Imperatives, Development and Growth Strategies, Threat from Competition and Right to Win)*

14.1 MATERION CORPORATION

FIGURE 40 MATERION CORPORATION: COMPANY SNAPSHOT

FIGURE 41 MATERION CORPORATION: SWOT ANALYSIS

14.2 CPS TECHNOLOGIES CORPORATION

FIGURE 42 CPS TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

FIGURE 43 CPS TECHNOLOGIES CORPORATION: SWOT ANALYSIS

14.3 GKN SINTER METALS

FIGURE 44 GKN SINTER METALS: SWOT ANALYSIS

14.4 3M

FIGURE 45 3M: COMPANY SNAPSHOT

FIGURE 46 3M: SWOT ANALYSIS

14.5 DESTSCE EDELSTASLWERKE GMBH

FIGURE 47 DESTSCE EDELSTASLWERKE GMBH: SWOT ANALYSIS

14.6 METAL MATRIX CAST COMPOSITES, LLC

14.7 PLANSEE SE

14.8 CERAMTEC

FIGURE 48 CERAMTEC: COMPANY SNAPSHOT

14.9 SANDVIK AB

FIGURE 49 SANDVIK AB: COMPANY SNAPSHOT

14.1 FERROTEC CORPORATION

14.11 OTHER COMPANIES

14.11.1 DWA ALUMINUM COMPOSITES

14.11.2 SITEK INSULATION

14.11.3 TALON COMPOSITES

14.11.4 FABRISONIC

14.11.5 MC 21

14.11.6 COMPOSITES METAL TECHNOLOGY

14.11.7 TISICS

14.11.8 AMETEK SPECIALTY METAL PRODUCTS

14.11.9 MBN NANOMATERIALIA

*Business Overview, Products Offered, SWOT Analysis, Winning Imperatives, Development and Growth Strategies, Threat from Competition and Right to Win might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 175)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

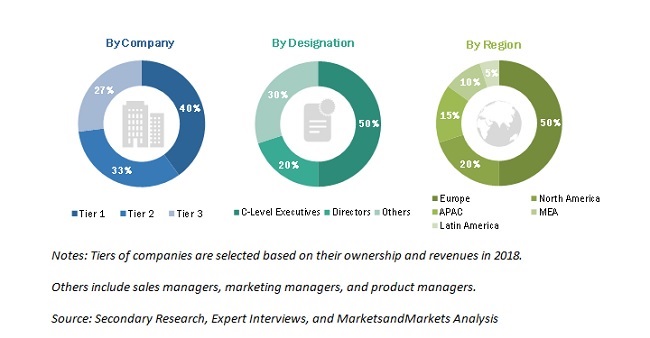

The study involves two major activities in estimating the current size of the metal matrix composite market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation procedures were used to determine the extent of market segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Factiva, were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The metal matrix composite market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of the oil & gas and power gas sectors. Advancements in technology and diverse applications in various end-use industries describe the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total metal matrix composite market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall metal matrix composite market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the whole market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, mainly from the oil & gas, power generation, iron & steel, cement, and chemical & petrochemical industries.

Report Objectives

- To analyze and forecast the global metal matrix composite market in terms of both value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze the market segmentation and forecast the market size on the basis of service and end-use industry

- To analyze and forecast the market size on five main regions, namely, Asia Pacific (APAC), Europe, North America, Middle East & Africa (MEA), and Latin America

- To strategically analyze the markets with respect to individual growth trends, future prospects, and contribution to the global market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of market leaders

- To analyze competitive development strategies, such as acquisition, new product launch, and expansion in the market

- To strategically profile key players and comprehensively analyze their market shares and core competencies*

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of Rest of APAC metal matrix composite market

- Further breakdown of Rest of European metal matrix composite market

- Further breakdown of Rest of North American metal matrix composite market

- Further breakdown of Rest of MEA metal matrix composite market

- Further breakdown of Rest of Latin American metal matrix composite market

Company Information

- Detailed analysis and profiling of additional market players (up to 10)

Growth opportunities and latent adjacency in Metal Matrix Composite Market