Metallocene Polyolefin (mPO) Market by Type (mPE & mPP), Application (Film & Sheet, Injection Molding, and Others), and by Region - Global Forecast to 2021

[168 Pages Report] Metallocene Polyolefin (mPO) Market is projected to reach USD 14.05 Billion by 2021, growing at a CAGR of 10.15% during the forecast period. The report segments the market by application into film & sheet, injection molding, and others (rotomolding, extrusion coating, fiber, blow molding, raffia, wire & cable, and pipes & panels); by type into metallocene polyethylene (mPE) and metallocene polypropylene (mPP); and by region into North America, Western Europe, Central & Eastern Europe, Asia-Pacific, the Middle East & Africa, and South America. Base year considered for the study is 2015, while the forecast period is between 2016 and 2021. The market is driven by downgauging and superior mechanical properties of metallocene polyolefin over the conventional polyolefin and increasing growth in the end-use industries.

Both, top-down and bottom-up approaches have been used to estimate and validate the size of the market, and estimate the size of various other dependent submarkets in the overall metallocene polyolefin market. The research study involved the extensive use of secondary sources, directories, and databases such as Hoovers, Bloomberg, Chemical Weekly, Factiva, ICIS, Securities and Exchange Commission (SEC), among other government and private websites, to identify and collect information useful for the technical, market-oriented, and commercial study of the metallocene polyolefin market.

To know about the assumptions considered for the study, download the pdf brochure

The value chain for the metallocene polyolefin manufacturers begins with research & product development and ends at the end-use industries. Different types of metallocene polyolefin are manufactured for various applications. They serve end-use industries that include film & sheet, injection molding, and others (rotomolding, extrusion coating, fiber, blow molding, raffia, wire & cable, and pipes & panels) for an array of applications.

This study answers several questions of the stakeholders, primarily which market segments to focus on in the next two to five years for prioritizing their efforts and investments. The stakeholders include metallocene polyolefin manufacturers, such as ExxonMobil Corporation (U.S.), The Dow Chemical Company (U.S.), LyondellBasel Industries Holdings B.V. (Netherlands), Chevron Phillips Chemical Company LLC (U.S.), Total SA (France), SABIC (Saudi Arabia), Japan Polychem Corporation Ltd, Braskem AG (Brazil), LG Chem Ltd. (South Korea), and others.

Key Target Audience:

- Manufacturers of metallocene polyolefin

- Traders, distributors, and suppliers of metallocene polyolefin

- The Association of Packaging and Processing Technologies and Society of Plastic Industry associations

- Government and regional agencies and research organizations

- Investment research firms

Scope of the Report:

This research report categorizes the metallocene polyolefin market on the basis of type, application, and region

On the Basis of Type:

- Metallocene Polyethylene (mPE)

- Metallocene Polypropylene (mPP)

On the basis of Application:

- Film & Sheet

- Injection Molding

- Others

On the basis of Region:

- North America

- Western Europe

- Central & Eastern Europe

- Asia-Pacific

- Middle East & Africa

- South America

The market is further analyzed on the basis of key countries in each of these regions.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific needs of the company. The following customization options are available for the report:

Regional Analysis:

- Country-level analysis of the metallocene polyolefin market, by type.

Company Information:

- Detailed analysis and profiling of additional market players.

The market size of metallocene polyolefin is estimated to reach USD 14.05 Billion by 2021, growing at a CAGR of 10.15% during the forecast period. The market is driven by increasing global demand for quality resins, rise in packaging industry, food industry developments, and technological advances. The rising demand for meatllocene polyolefin is mainly due to its superior properties over the conventional polyolefin, which is the major driving factor of this market.

Metallocene polyolefins are mainly used in applications, such as film & sheet, injection molding, and others (rotomolding, extrusion coating, fiber, blow molding, raffia, wire & cable, and pipes & panels). In 2015, the film & sheet application is estimated to account for the largest market share among all the applications, in terms of value, followed by injection molding and others. The food and non-food packaging industry is the major driver for the market. The injection molding application is estimated to register the highest CAGR, in terms of both value and volume, between 2016 and 2021 among all the applications.

Metallocene polyolefins are segmented into metallocene polyethylene (mPE) and metallocene polypropylene (mPP). In 2015, the mPE type is estimated to account for the largest market share, in terms of volume, and it is also projected to register the fastest growth in the meatllocene polyolefins market between 2016 and 2021 due to its technical advantages over the conventional polyolefins.

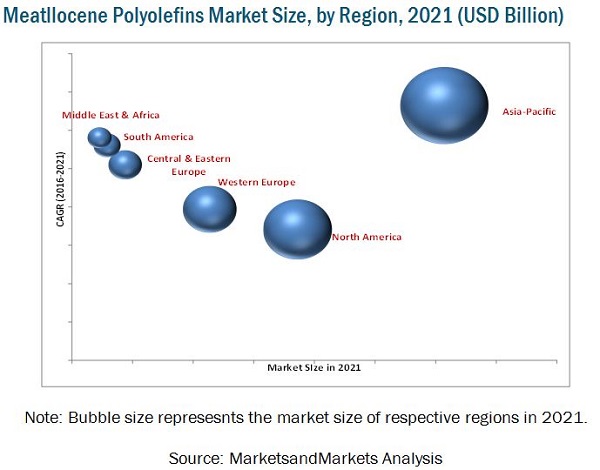

Asia-Pacific, North America, Western Europe, Central & Eastern Europe, the Middle East & Africa, and South America are considered as the main regions of the metallocene polyolefins market. Asia-Pacific dominates the metallocene polyolefins market owing to increased demand from the film & sheet application. The rising demand for quality resins with superior mechanical properties has significantly increased the growth of the regions process industry, which consequently has triggered the demand for metallocene polyolefins. Film & sheet and injection molding are the top 2 applications contributing to the growing demand for meatllocene polyolefins in Asia-Pacific. North America is the second-largest market for meatllocene polyolefins, globally. The mature market of Western Europe is projected to inhibit the growth of metallocene polyolefin market to some extent.

The metallocene polyolefins market faces bottlenecks to its growth due to the fluctuations in raw material prices, which is the major restraint in the usage of meatllocene polyolefins.

The global metallocene polyolefin market is dominated by leading players such as The Dow Chemical Company (U.S.) and ExxonMobil Corporation (U.S.). The diverse product portfolio, strategically positioned R&D centers, continuous adoption of development strategies, and technological advancements are the factors that are responsible for strengthening the market position of these companies in the metallocene polyolefins market. They have been adopting various organic and inorganic growth strategies, such as expansions, new technology developments, and new product launches to enhance their current market shares. This is expected to help the metallocene polyolefins market evolve in more applications and help expand their market shares.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Scope of the Study

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Key Data From Secondary Sources

2.1.2 Key Data From Primary Sources

2.1.2.1 Key Industry Insights

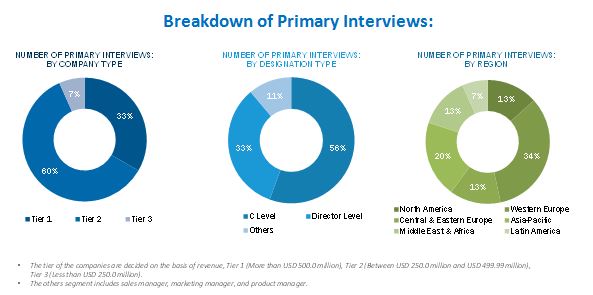

2.1.2.2 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions and Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in the mPO Market

4.2 mPO Market, By Type

4.3 mPO Market in Asia-Pacific

4.4 mPO Market Share, By Region

4.5 mPO Market: Top 5 Countries

4.6 mPO Market Attractiveness, By Application (2021)

4.7 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 39)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Type

5.2.2 By Application

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 High Productivity of Metallocene Catalyzed Polyolefins

5.3.1.2 Increasing Demand for mPOs in End-Use Applications

5.3.2 Restraints

5.3.2.1 Relatively Difficult to Process in Traditional Film-Blowing Equipment Compared to Substitutes

5.3.2.2 More Expensive Than Other Catalysts for Polyolefins

5.3.3 Opportunities

5.3.3.1 Potential Applications of mPE

5.3.3.2 Potential Applications of mPP

5.3.4 Challenges

5.3.4.1 Growing Price Cutting Pressures

6 Industry Trends (Page No. - 46)

6.1 Introduction

6.2 Value-Chain Analysis

6.3 Porters Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

6.4 Recent mPO Patents (2010-2016)

6.5 Market Share Analysis By Production Capacity of mPE for 2015

6.6 Revenue Pocket Matrix

6.6.1 Revenue Pocket Matrix for mPO

6.6.2 Revenue Pocket Matrix for End-Use Industries

7 mPO Market, By Type (Page No. - 57)

7.1 Introduction

7.2 mPE

7.2.1 Metallocene Linear Low Density Polyethylene (MLLDPE)

7.2.2 Metallocene High Density Polyethylene (MHDPE)

7.2.3 Others

7.3 mPP

8 mPO Market, By Application (Page No. - 66)

8.1 Introduction

8.2 Film & Sheet

8.3 Injection Molding

8.4 Others

9 mPO Market, By Region (Page No. - 75)

9.1 Introduction

9.2 North America

9.2.1 U.S.

9.2.2 Canada

9.2.3 Mexico

9.3 Western Europe

9.3.1 Germany

9.3.2 Italy

9.3.3 France

9.3.4 U.K.

9.3.5 Spain

9.3.6 Rest of Western Europe

9.4 Central & Eastern Europe

9.4.1 Russia

9.4.2 Poland

9.4.3 Rest of Central & Eastern Europe

9.5 Asia-Pacific

9.5.1 China

9.5.2 Japan

9.5.3 India

9.5.4 Malaysia

9.5.5 South Korea

9.5.6 Indonesia

9.5.7 Thailand

9.5.8 Rest of Asia-Pacific

9.6 Middle East & Africa

9.6.1 Turkey

9.6.2 Iran

9.6.3 Saudi Arabia

9.6.4 Uae

9.6.5 Rest of Middle East

9.6.6 Africa

9.7 South America

9.7.1 Brazil

9.7.2 Argentina

9.7.3 Rest of South America

10 Competitive Landscape (Page No. - 114)

10.1 Overview

10.2 Competitive Situations and Trends

10.3 Competitive Benchmarking

10.3.1 New Product Launches

10.3.2 Expansions

10.3.3 Agreements

10.3.4 Joint Ventures and Mergers & Acquisitions, 20112016

11 Company Profiles (Page No. - 123)

11.1 Introduction

11.2 Exxonmobil Corporation

11.2.1 Business Overview

11.2.2 Products Offered

11.2.3 Recent Developments

11.2.4 SWOT Analysis

11.2.5 MnM View

11.3 The DOW Chemical Company

11.3.1 Business Overview

11.3.2 Products Offered

11.3.3 Recent Developments

11.3.4 SWOT Analysis

11.3.5 MnM View

11.4 Total S.A.

11.4.1 Business Overview

11.4.2 Products Offered

11.4.3 Recent Development

11.4.4 SWOT Analysis

11.4.5 MnM View

11.5 Lyondellbasell Industries Holdings B.V.

11.5.1 Business Overview

11.5.2 Products Offered

11.5.3 Recent Development

11.5.4 SWOT Analysis

11.5.5 MnM View

11.6 Chevron Phillips Chemical Company LLC

11.6.1 Business Overview

11.6.2 Products Offered

11.6.3 Recent Developments

11.6.4 SWOT Analysis

11.6.5 MnM View

11.7 Sabic

11.7.1 Business Overview

11.7.2 Products Offered

11.7.3 Recent Development

11.7.4 MnM Analysis

11.8 Borealis AG

11.8.1 Business Overview

11.8.2 Products Offered

11.8.3 Recent Developments

11.8.4 MnM View

11.9 LG Chem Ltd.

11.9.1 Business Overview

11.9.2 Products Offered

11.9.3 Recent Development

11.9.4 MnM View

11.10 Prime Polymer Co. Ltd.

11.10.1 Business Overview

11.10.2 Products Offered

11.10.3 Recent Developments

11.10.4 MnM View

11.11 Ineos Group AG

11.11.1 Business Overview

11.11.2 Products Offered

11.11.3 MnM View

11.12 Gas Authority of India Ltd.

11.12.1 Business Overview

11.12.2 Product Offered

11.13 Daelim Industrial Corp. Ltd.

11.13.1 Business Overview

11.13.2 Products Offered

11.14 Sumitomo Chemical Corp. Ltd.

11.14.1 Business Overview

11.14.2 Products Offered

11.15 Japan Polychem Corporation Ltd.

11.15.1 Business Overview

11.15.2 Products Offered

11.16 UBE Industries Ltd.

11.16.1 Business Overview

11.16.2 Products Offered

11.17 Braskem S.A.

11.17.1 Business Overview

11.17.2 Product Offered

11.18 Nova Chemicals Ltd.

11.18.1 Business Overview

11.18.2 Product Offered

11.19 Daqing Petrochemical Co. Ltd.

11.19.1 Business Overview

11.19.2 Product Offered

12 Appendix (Page No. - 162)

12.1 Insights From Industry Experts

12.2 Discussion Guide

12.3 Introducing RT: Real-Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

List of Tables (76 Tables)

Table 1 mPE is Projected to Register the Largest Market Share Between 2016 and 2021

Table 2 Recent mPOs Patents (2010-2016)

Table 3 mPO Market Size, By Type, 2014-2021 (USD Million)

Table 4 mPO Market Size, By Type, 2014-2021 (Kiloton)

Table 5 mPE Market Size, By Type, 2014-2020 (USD Million)

Table 6 mPE Market Size, By Type, 2014-2021 (Kiloton)

Table 7 MLLDPE Market Size, By Region, 2014-2021 (USD Million)

Table 8 MLLDPE Market Size, By Region, 2014-2021 (Kiloton)

Table 9 MHDPE Market Size, By Region, 2014-2021 (USD Million)

Table 10 MHDPE Market Size, By Region, 2014-2021 (Kiloton)

Table 11 Others Market Size, By Region, 2014-2021 (USD Million)

Table 12 Others Market Size, By Region, 2014-2021 (Kiloton)

Table 13 mPP Market Size, By Region, 2014-2021 (USD Million)

Table 14 mPP Market Size, By Region, 2014-2021 (Kiloton)

Table 15 mPO Market Size, By Application, 2014-2021 (USD Million)

Table 16 mPO Market Size, By Application, 2014-2021 (Kiloton)

Table 17 mPO Market Size in Film & Sheet, By Region, , 2014-2021 (USD Million)

Table 18 mPO Market Size in Film & Sheet, By Region,, 2014-2021 (Kiloton)

Table 19 mPO Market Size in Injection Molding , By Region, 2014-2021 (USD Million)

Table 20 mPO Market Size in Injection Molding , By Region, 2014-2021 (Kiloton)

Table 21 mPO Market Size in Other Applications, By Region, 2014-2021 (USD Million)

Table 22 mPO Market Size in Other Applications, By Region, 2014-2021 (Kiloton)

Table 23 mPO Market Size, By Region, 20142021 (USD Million)

Table 24 mPO Market Size, By Region, 20142021 (Kiloton)

Table 25 North America: mPO Market Size, By Country, 20142021 (USD Million)

Table 26 North America: mPO Market Size, By Country, 20142021 (Kiloton)

Table 27 North America: mPO Market Size, By Type, 20142021 (USD Million)

Table 28 North America: mPO Market Size, By Type, 20142021 (Kiloton)

Table 29 North America: mPE Market Size, By Subtype, 20142021 (USD Million )

Table 30 North America: mPE Market Size, By Subtype, 20142021 (Kiloton)

Table 31 North America: mPO Market Size, By Application, 20142021 (USD Million)

Table 32 North America: mPO Market Size, By Application, 20142021 (Kiloton)

Table 33 Western Europe: mPO Market Size, By Type, 20142021 (USD Million)

Table 34 Western Europe: mPO Market Size, By Type, 20142021 (Kiloton)

Table 35 Western Europe: mPE Market Size, By Subtype, 20142021 (USD Million)

Table 36 Western Europe: mPE Market Size, By Subtype, 20142021 (Kiloton)

Table 37 Western Europe: mPO Market Size, By Country, 20142021 (USD Million)

Table 38 Western Europe: mPO Market Size, By Country, 20142021 (Kiloton)

Table 39 Western Europe: mPO Market Size, By Application, 20142021 (USD Million)

Table 40 Western Europe: mPO Market Size, By Application, 20142021 (Kiloton)

Table 41 Central & Eastern Europe: mPO Market Size, By Type, 20142021 (USD Million)

Table 42 Central & Eastern Europe: mPO Market Size, By Type, 20142021 (Kiloton)

Table 43 Central & Eastern Europe: mPE Market Size, By Subtype, 20142021 (USD Million)

Table 44 Central & Eastern Europe: mPE Market Size, By Subtype, 20142021 (Kiloton)

Table 45 Central & Eastern Europe: mPO Market Size, By Country, 20142021 (USD Million)

Table 46 Central & Eastern Europe: mPO Market Size, By Country, 20142021 (Kiloton)

Table 47 Central & Eastern Europe: mPO Market Size, By Application, 20142021 (USD Million)

Table 48 Central & Eastern Europe: mPO Market Size, By Application, 20142021 (Kiloton)

Table 49 Asia-Pacific: mPO Market Size, By Country, 20142021 (USD Million)

Table 50 Asia-Pacific: mPO Market Size, By Country, 20142021 (Kiloton)

Table 51 Asia-Pacific: mPO Market Size, By Type, 20142021 (USD Million)

Table 52 Asia-Pacific: mPO Market Size, By Type, 20142021 (Kiloton)

Table 53 Asia-Pacific: mPE Market Size, By Subtype, 20142021 (USD Million)

Table 54 Asia-Pacific: mPO Market Size, By Type, 20142021 (Kiloton)

Table 55 Asia-Pacific: mPO Market Size, By Application, 20142021 (USD Million)

Table 56 Asia-Pacific: mPO Market Size, By Application, 20142021 (Kiloton)

Table 57 Middle East & Africa: mPO Market Size, By Type, 20142021 (USD Million)

Table 58 Middle East & Africa: mPO Market Size, By Type, 20142021 (Kiloton)

Table 59 Middle East & Africa: mPE Market Size, By Subtype, 20142021 (USD Million)

Table 60 Middle East & Africa: mPE Market Size, By Subtype, 20142021 (Kiloton)

Table 61 Middle East & Africa: mPO Market Size, By Country, 20142021 (USD Million)

Table 62 Middle East & Africa: mPO Market Size, By Country, 20142021 (Kiloton)

Table 63 Middle East & Africa: mPO Market Size, By Application, 20142021 (USD Million)

Table 64 Middle East & Africa: mPO Market Size, By Application, 20142021 (Kiloton)

Table 65 South America: mPO Market Size, By Country, 20142021 (USD Million)

Table 66 South America: mPO Market Size, By Country, 20142021 (Kiloton)

Table 67 South America: mPO Market Size, By Type, 20142021 (USD Million)

Table 68 South America: mPO Market Size, By Type, 20142021 (Kiloton)

Table 69 South America: mPE Market Size, By Subtype, 20142021 (USD Million)

Table 70 South America: mPE Market Size, By Subtype, 20142021 (Kiloton)

Table 71 South America: mPO Market Size, By Application, 20142021 (USD Million)

Table 72 South America: mPO Market Size, By Application, 20142021 (Kiloton)

Table 73 New Product Launches, 20112016

Table 74 Expansions, 20112016

Table 75 Agreements, 20112016

Table 76 Joint Ventures and Mergers & Acquisitions, 20112016

List of Figures (64 Figures)

Figure 1 mPO: Research Design

Figure 2 Bottom-Up Approach

Figure 3 Top-Down Approach

Figure 4 Research Methodology: Data Triangulation

Figure 5 Asia-Pacific is Expected to Dominate the mPE Market During the Forecast Period

Figure 6 MLLDPE Market to Register the Highest Growth

Figure 7 Film & Sheet Application to Register the Highest Growth

Figure 8 Asia-Pacific Dominated mPO Market With the Highest Share (Volume) in 2015

Figure 9 mPO Market to Register High CAGR Between 2016 and 2021

Figure 10 mPE to Register the Fastest-Growth Rate Between 2016 and 2021

Figure 11 Film & Sheet is the Largest Application for mPO in Asia-Pacific

Figure 12 Asia-Pacific Accounted for the Largest Share in the mPO Market in 2015

Figure 13 Emerging Countries in Asia-Pacific to Drive the mPO Market Between 2016 and 2021

Figure 14 mPO in Film & Sheet Application Will Continue to Be the Most Attractive Market

Figure 15 mPO Market in North America is in the Maturity Stage

Figure 16 Drivers, Restraints, Opportunities, and Challenges in the mPO Market

Figure 17 Fluctuations in of Crude Oil Price, Jan 2011Jan 2015

Figure 18 Price Trend of Ethylene and Benzene, Jan 2014Jan 2015

Figure 19 mPO: Value-Chain Analysis

Figure 20 Exxonmobil Chemical and DOW Chemical Dominate the mPE Market

Figure 21 Revenue Pocket Matrix: By Type

Figure 22 Revenue Pocket Matrix: By End-Use Industry

Figure 23 mPE to Dominate mPO Market, 2016 vs 2021 (Kiloton)

Figure 24 MLLDPE to Dominate mPE Market, 2016 vs 2021 (Kiloton)

Figure 25 Asia-Pacific to Dominate MLLDPE Market, 2016-2021 (Kiloton)

Figure 26 South America Projected to Be Second Fastest-Growing MHDPE Market, 2016-2021 (USD Million)

Figure 27 North America Projected to Be Fastest-Growing mPP Market, 2016-2021 (Kiloton)

Figure 28 Film & Sheet Application Projected to Register Highest CAGR in Terms of Volume, 2016-2021

Figure 29 Asia-Pacific Market Projected to Witness High Grow Rate in Film Application, in Terms of Volume, 2016-2021

Figure 30 Asia-Pacific to Dominate mPE Market in Injection Molding Application, in Terms of Value, By 2021

Figure 31 India and China are Emerging as New Hotspots for mPO Market

Figure 32 Potential Markets for mPO, By Type

Figure 33 Potential Markets for mPO, By Application

Figure 34 North America Market Snapshot Demand to Be Driven By Increase in Purchasing Power Parity

Figure 35 Western Europe Market Snapshot: Demand to Be Driven By Packaging Segment in the mPO Market

Figure 36 China: Largest Market for mPO in Asia-Pacific

Figure 37 Companies are Projected to Adopt Expansions as the Key Growth Strategy During Forecast Period

Figure 38 Key Strategies Followed By Leading Market Players Between 2011 and 2016

Figure 39 Expansions: the Most Preferred Strategy Adopted By Companies

Figure 40 Battle for Market Share: Expansions to Be the Key Strategy, 20112016

Figure 41 Regional Revenue Mix of Top 5 Market Players

Figure 42 Exxonmobil Corporation: Company Snapshot

Figure 43 Exxonmobil Corporation: SWOT Analysis

Figure 44 The DOW Chemical Company: Company Snapshot

Figure 45 The DOW Chemical Company: SWOT Analysis

Figure 46 Total S.A.: Company Snapshot

Figure 47 Total S.A.: SWOT Analysis

Figure 48 Lyondellbasel Industries Holdings B.V.: Company Snapshot

Figure 49 Lyondellbasell Industries Holdings B.V.: SWOT Analysis

Figure 50 Chevron Phillips Chemical Company LLC: Company Snapshot

Figure 51 Chevron Phillips Chemical Company LLC: SWOT Analysis

Figure 52 Sabic: Company Snapshot

Figure 53 Borealis AG: Company Snapshot

Figure 54 LG Chem Ltd.: Company Snapshot

Figure 55 Prime Polymer Co. Ltd.: Company Snapshot

Figure 56 Ineos Group AG: Company Snapshot

Figure 57 Gail.: Company Snapshot

Figure 58 Daelim Industrial Corp. Ltd.: Company Snapshot

Figure 59 Sumitomo Chemical Corp. Ltd.: Company Snapshot

Figure 60 Japan Polychem Corporation Ltd.: Company Snapshot

Figure 61 UBE Industries Ltd.: Company Snapshot

Figure 62 Braskem S.A.: Company Snapshot

Figure 63 Nova Chemicals Ltd.: Company Snapshot

Figure 64 Daqing Petrochemical Co. Ltd.: Company Snapshot

Growth opportunities and latent adjacency in Metallocene Polyolefin (mPO) Market