Meter Data Management System Market by Component (Hardware, Software), Utility (Electricity, Gas, Water), Application (Smart Grid, Micro Grid, Energy Storage, EV Charging), End-User (Residential, Commercial & Industrial), and Region - Global Forecast to 2023

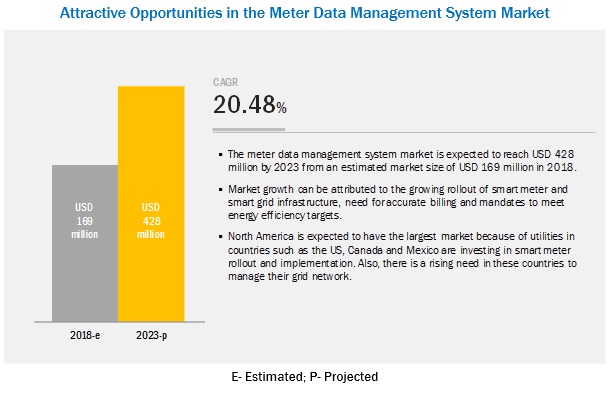

[139 Pages Report] The global meter data management system market is projected to reach a size of USD 428 million by 2023, at a CAGR of 20.48%, from an estimated USD 169 million in 2018. This growth can be attributed to factors such as growing government policies and legislative mandates for smart meters, need for grid reliability, and need for accurate utility bill generation.

By component type, the software segment accounts for the largest contributor in the meter data management system during the forecast period.

The report segments the meter data management system, by component type, into hardware and software. The software segment is expected to hold the largest market share by 2023. With the increasing smart meter installation, hundreds and millions of data is generated every 15 minutes and meter data management software is used to process, format, and correlate the data to support accurate billing.

The residential segment is expected to be the largest contributor during the forecast period.

The meter data management system by end-use is segmented into residential, commercial, and industrial users. The residential segment is expected to hold the largest market share and the fastest growing market with smart meter implementations being mandated across global regions in the residential sector. Furthermore, residential consumers will have access to their energy consumption data through meter data management system, that will in turn help them in improving their energy consumption.

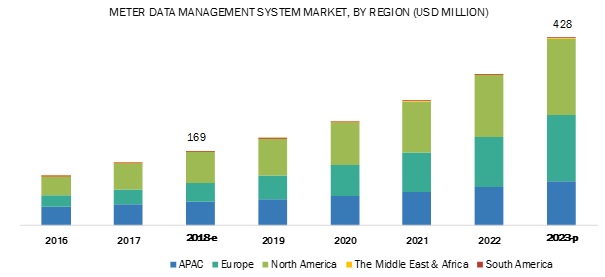

North America is expected to account for the largest market size during the forecast period.

In this report, the meter data management system market has been analyzed with respect to 5 regions, namely, North America, Europe, South America, Asia Pacific, and the Middle East & Africa. The market in North America is estimated to be the largest market from 2018 to 2023. Utilities in countries such as the US, Canada, and Mexico are deploying smart grid infrastructure and are looking to upgrade their grid network to prevent losses. Also, increasing need to generate accurate bills for consumers based on various tariff rates is driving the market.

The major players in the global meter data management system market are Itron (US), Siemens (Germany), Landis+Gyr (Switzerland), Honeywell (US) and Schneider Electric (France), ABB (Switzerland), Eaton (Ireland), Kamstrup (Denmark), DIEHL (Germany), and Alcara (US).

Scope of the Report

|

Report Metric |

Details |

|

Market Size available for years |

20162023. |

|

Base year considered |

2017. |

|

Forecast period |

20182023. |

|

Forecast units |

Value (USD). |

|

Segments covered |

Component, Utility Type, End-User, Application, and Region. |

|

Geographies covered |

Asia Pacific, North America, Europe, The Middle East & Africa, and South America. |

|

Companies covered |

Itron (US), Siemens (Germany), Landis+Gyr (Switzerland), Honeywell (US) and Schneider Electric (France), ABB (Switzerland), Eaton (Ireland), Kamstrup (Denmark), DIEHL (Germany), and Alcara (US). |

This research report categorizes the market based on component, utility type, end-user, application, and region.

On the basis of component, the market has been segmented as follows:

- Hardware

- Software

On the basis of end-user, the market has been segmented as follows:

- Residential

- Commercial

- Industrial

On the basis of utility type, the market has been segmented as follows:

- Electricity

- Gas

- Water

On the basis of application, the market has been segmented as follows:

- Smart grid

- Microgrid

- Energy Storage

- EV charging

- Others (Gas and Water Consumption)

On the basis of Region, the market has been segmented as follows:<

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Recent Developments

- In January 2019, Siemens was awarded a contract by ESB to roll out 25,000 smart meters across Ireland. It would deploy a remote reading system and a data management system for ESB.

Key Questions addressed by the report

- The report identifies and addresses key markets for meter data management system, which would help various stakeholders such as utilities, regulators, IT vendors, and meter vendors to review the growth in demand.

- The report helps system providers understand the pulse of the market and provides insights into drivers, restraints, opportunities, and challenges.

- The report will help key players understand the strategies of their competitors better and make better strategic decisions.

- The report addresses the market share analysis of key players in meter market, and with the help of this, companies can enhance their revenues in the respective market.

- The report provides insights about emerging geographies for meter data management system, and hence, the entire market ecosystem can gain competitive advantage from such insights.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regional Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Market Size Estimation

2.1.1 Ideal Demand-Side Analysis

2.1.1.1 Assumptions

2.1.2 Supply-Side Analysis

2.1.2.1 Calculation

2.1.3 Forecast

2.2 Some of the Insights of Industry Experts

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 28)

4.1 Attractive Opportunities in the Meter Data Management System Market During the Forecast Period

4.2 Meter Data Management System, By Region

4.3 Meter Data Management System, By Component

4.4 North American Meter Data Management System, By Utility Type & Country

4.5 Meter Data Management System, By End-User

4.6 Meter Data Management System, By Utility Type

4.7 Meter Data Management System, By Application

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Government Policies and Legislative Mandates for Smart Metering Infrastructure in the Us and Eu

5.2.1.2 Need for Grid Reliability and Outage Management

5.2.1.3 Need for Accurate Energy Bill Generation

5.2.2 Restraints

5.2.2.1 Cybersecurity and Vulnerability

5.2.2.2 Lack of Standards and Interoperability

5.2.3 Opportunities

5.2.3.1 Commitment to Smart City Programs By Major Economies

5.2.3.2 New Business Opportunities

5.2.4 Challenges

5.2.4.1 Improper Installation of Smart Meters

5.2.4.2 Delayed Realization of ROI

6 Meter Data Management System, By Component (Page No. - 38)

6.1 Introduction

6.2 Software

6.2.1 Increasing Number of New Applications and Supporting Legislations are Expected to Drive the Software Segment

6.3 Hardware

6.3.1 Emergence in Smart Metering Across the Globe is Expected to Drive the Hardware Segment

7 Meter Data Management System, By Utility Type (Page No. - 42)

7.1 Introduction

7.2 Electricity

7.2.1 Remote Access to Secure Data and Power Quality Data Management are Expected to Drive the Electricity Meter Data Management System Industry

7.3 Gas

7.3.1 Improving Gas Grid Networks and Improving Billing Accuracy are Expected to Drive the Gas Meter Data Management System Industry

7.4 Water

7.4.1 Minimizing Water Loss and Improving Water Supply are Expected to Drive the Water Meter Data Management System Industry

8 Meter Data Management System, By End-User (Page No. - 47)

8.1 Introduction

8.2 Residential

8.2.1 Increasing Implementation of Smart Meters and Increasing Demand for Modernization of Metering Infrastructure are Expected to Drive the Residential Sector

8.3 Commercial

8.3.1 Growing Commercial Trade Hubs and Energy Efficiency Regulations are Expected to Drive the Commercial Sector

8.4 Industrial

8.4.1 Growing Manufacturing, Processing, and Data Center Establishments are Expected to Drive the Industrial Sector

9 Meter Data Management System Markt, By Application (Page No. - 52)

9.1 Introduction

9.2 Smart Grid

9.2.1 Aging Grid Infrastructure and Smart Meter Mandates are Driving the Smart Grid Segment

9.3 Microgrid

9.3.1 Electrification of Remote Areas and Increasing Renewable Energy Installations are Driving the Microgrid Segment

9.4 Energy Storage

9.4.1 Need to Reduce Energy Costs and Growing Energy Storage Technologies are Driving the Energy Storage Segment

9.5 EV Charging

9.5.1 Growing Electric Vehicle Adoption and Need for Managing Grid Integrity are Driving the EV Charging Segment

9.6 Others

9.6.1 Rising Demand for Gas and Water and the Need to Be Competitive are Driving the Others Segment

10 Meter Data Management System Markt, By Region (Page No. - 59)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.1.1 Need for Accurate Measurement of Electricity Consumption and Economic Asset Management are Driving the Market for Meter Data Management System

10.2.2 Canada

10.2.2.1 Increasing Demand for Electricity and Growing Smart Grid Initiatives are Expected to Drive the Market

10.2.3 Mexico

10.2.3.1 Massive Smart Meters Rollout Plan is Expected to Drive the Meter Data Management System Industry

10.3 Asia Pacific

10.3.1 China

10.3.1.1 Increasing Need for Integrating Renewable Energy Generation is Driving the Market

10.3.2 India

10.3.2.1 Smart City Initiatives and Integration of Renewable Power Generation are Expected to Drive the Market

10.3.3 Japan

10.3.3.1 Expansion of Smart Meter Installations and Need for Real-Time Transmission are Driving the Market

10.3.4 Australia

10.3.4.1 Rising Energy Prices and Energy Efficiency Measures are Driving the Market

10.3.5 South Korea

10.3.5.1 Rising Smart Meter Implementation and Need for Curbing Carbon Emissions are Driving the Market

10.3.6 Rest of Asia Pacific

10.3.6.1 Rising Smart Meter Investment and Rollout are Driving the Market

10.4 Europe

10.4.1 UK

10.4.1.1 Need to Manage Energy Consumption and Dual Utility Smart Meter Rollout Plans are Driving the Market

10.4.2 Poland

10.4.2.1 Equal Access to Metering Data and Liberalization of the Electric Market are Driving the Market

10.4.3 France

10.4.3.1 Need to Supply Efficient Power and Mandatory Rollout of Smart Meters are Driving the Market

10.4.4 Spain

10.4.4.1 Need for Low Energy Costs and Increasing Smart Meter Installations are Driving the Market

10.4.5 Italy

10.4.5.1 Need for Real-Time Information and Second Wave Rollout of Smart Meters are Driving the Market

10.4.6 Rest of Europe

10.4.6.1 New Smart Meter Installations and Need for Better Smart Grid Infrastructure are Driving the Market

10.5 Middle East & Africa

10.5.1 Saudi Arabia

10.5.1.1 Rising Energy Prices and Need for Consumption Information are Driving the Market

10.5.2 UAE

10.5.2.1 Growing Energy Consumption and Smart Dubai Initiatives are Driving the Market

10.5.3 South Africa

10.5.3.1 Need to Contain Utility Debt and Growing Smart Meter Infrastructure Drives the Market

10.5.4 Rest of Middle East & Africa

10.5.4.1 Mandatory Installation of Smart Meters and Accuracy of Billing Drive the Market

10.6 South America

10.6.1 Brazil

10.6.1.1 Need for Reducing Energy Consumption and Distribution Generation is Driving the Market

10.6.2 Argentina

10.6.2.1 Regulatory Changes and Expansion of Transmission & Distribution Sector are Driving the Market

10.6.3 Colombia

10.6.3.1 Rollout Targets for Smart Meter Installation and Need for Energy Efficiency are Driving the Market

10.6.4 Rest of South America

10.6.4.1 Regulations and Smart Meter Development are Driving the Market

11 Competitive Landscape (Page No. - 100)

11.1 Overview

11.2 Market Share Analysis

11.3 Competitive Scenario

11.3.1 New Product Launches

11.3.2 Contracts & Agreements

11.3.3 Mergers & Acquisitions

11.4 Competitive Leadership Mapping

11.4.1 Visionary Leaders

11.4.2 Innovators

11.4.3 Dynamic

11.4.4 Emerging

12 Company Profile (Page No. - 107)

12.1 Company Benchmarking

(Business Overview, Products Offered, Recent Developments, and MnM View)*

12.2 Honeywell

12.3 Eaton

12.4 ABB

12.5 Siemens

12.6 Schneider Electric

12.7 Itron

12.8 Landis+Gyr

12.9 Kamstrup

12.10 DIEHL

12.11 Alcara

12.12 Sensus (Xylem)

12.13 Powel

*Details on Business Overview, Products Offered, Recent Developments, and MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 132)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (71 Tables)

Table 1 Smart Meter Rollout Targets and Supportive Legislations are the Major Determining Factors for the Meter Data Management System

Table 2 Meter Data Management System Market Snapshot

Table 3 Smart Meter Installation Plans Across Global Regions

Table 4 Per Capita Consumption of Energy Comparison Across Major Economies, 20162018, in Mwh/Capita

Table 5 Market Size, By Component, 20162023 (USD Thousand)

Table 6 Software: Global Market, By Region, 20162023 (USD Thousand)

Table 7 Hardware: Market Size, By Region, 20162023 (USD Thousand)

Table 8 Meter Data Management System Market Size, By Utility Type, 20162023 (USD Thousand)

Table 9 Electricity: Market Size, By Region, 20162023 (USD Thousand)

Table 10 Gas: Market Size, By Region, 20162023 (USD Thousand)

Table 11 Water: Market Size, By Region, 20162023 (USD Thousand)

Table 12 Market Size, By End-User, 20162023 (USD Thousand)

Table 13 Residential: Market Size, By Region, 20162023 (USD Thousand)

Table 14 Commercial: Market Size, By Region, 20162023 (USD Thousand)

Table 15 Industrial: Market Size, By Region, 20162023 (USD Thousand)

Table 16 Meter Data Management System Market Size, By Application, 20162023 (USD Thousand)

Table 17 Smart Grid: Global Market, By Region, 20162023 (USD Thousand)

Table 18 Microgrid: Market Size, By Region, 20162023 (USD Thousand)

Table 19 Energy Storage: Market Size, By Region, 20162023 (USD Thousand)

Table 20 EV Charging: Market Size, By Region, 20162023 (USD Thousand)

Table 21 Others: Market Size, By Region,20162023 (USD Thousand)

Table 22 Market, By Region,20162023 (USD Thousand)

Table 23 North America: Market Size, By Country, 20162023 (USD Thousand)

Table 24 North America: Market Size, By Component, 20162023 (USD Thousand)

Table 25 North America: Market Size, By Utility Type, 20162023 (USD Thousand)

Table 26 North America: Market Size, By End-User, 20162023 (USD Thousand)

Table 27 North America: Market Size, By Application, 20162023 (USD Thousand)

Table 28 US: Market Size, By Application, 20162023 (USD Thousand)

Table 29 Canada: Market Size, By Application, 20162023 (USD Thousand)

Table 30 Mexico: Market Size, By Application, 20162023 (USD Thousand)

Table 31 Asia Pacific: Market Size, By Country, 20162023 (USD Thousand)

Table 32 Asia Pacific: Market Size, By Component, 20162023 (USD Thousand)

Table 33 Asia Pacific: Market Size, By Utility Type, 20162023 (USD Thousand)

Table 34 Asia Pacific: Market Size, By End-User, 20162023 (USD Thousand)

Table 35 Asia Pacific: Market Size, By Application, 20162023 (USD Thousand)

Table 36 China: Market Size, By Application, 20162023 (USD Thousand)

Table 37 India: Market Size, By Application, 20162023 (USD Thousand)

Table 38 Japan: Market Size, By Application, 20162023 (USD Thousand)

Table 39 Australia: Market Size, By Application, 20162023 (USD Thousand)

Table 40 South Korea: Market Size, By Application, 20162023 (USD Thousand)

Table 41 Rest of Asia Pacific: Market Size, By Application, 20162023 (USD Thousand)

Table 42 Europe: Market Size, By Country, 20162023 (USD Thousand)

Table 43 Europe: Market Size, By Component, 20162023 (USD Thousand)

Table 44 Europe: Market Size, By Utility Type, 20162023 (USD Thousand)

Table 45 Europe: Market Size, By End-User, 20162023 (USD Thousand)

Table 46 Europe: Market Size, By Application, 20162023 (USD Thousand)

Table 47 UK: Market Size, By Application, 20162023 (USD Thousand)

Table 48 Poland: Market Size, By Application, 20162023 (USD Thousand)

Table 49 France: Market Size, By Application, 20162023 (USD Thousand)

Table 50 Spain: Market Size, By Application, 20162023 (USD Thousand)

Table 51 Italy: Market Size, By Application, 20162023 (USD Thousand)

Table 52 Rest of Europe: Market Size, By Application, 20162023 (USD Thousand)

Table 53 Middle East & Africa: Market Size, By Country, 20162023 (USD Thousand)

Table 54 Middle East & Africa: Market Size, By Component, 20162023 (USD Thousand)

Table 55 Middle East & Africa: Market Size, By Utility Type, 20162023 (USD Thousand)

Table 56 Middle East & Africa: Market Size, By End-User, 20162023 (USD Thousand)

Table 57 Middle East & Africa: Market Size, By Application, 20162023 (USD Thousand)

Table 58 Saudi Arabia: Market Size, By Application, 20162023 (USD Thousand)

Table 59 UAE: Market Size, By Application, 20162023 (USD Thousand)

Table 60 South Africa: Market Size, By Application, 20162023 (USD Thousand)

Table 61 Rest of Middle East & Africa: Market Size, By Application, 20162023 (USD Thousand)

Table 62 South America: Market Size, By Country, 20162023 (USD Thousand)

Table 63 South America: Market Size, By Component, 20162023 (USD Thousand)

Table 64 South America: Market Size, By Utility Type, 20162023 (USD Thousand)

Table 65 South America: Market Size, By End-User, 20162023 (USD Thousand)

Table 66 South America: Market Size, By Application, 20162023 (USD Thousand)

Table 67 Brazil: Market Size, By Application, 20162023 (USD Thousand)

Table 68 Argentina: Market Size, By Application, 20162023 (USD Thousand)

Table 69 Colombia: Market Size, By Application, 20162023 (USD Thousand)

Table 70 Rest of South America: Market Size, By Application, 20162023 (USD Thousand)

Table 71 Developments By Key Players in the Market, 20152019

List of Figures (33 Figures)

Figure 1 Software Segment is Expected to Lead the Meter Data Management System Market During the Forecast Period

Figure 2 Electricity Segment is Expected to Lead the Market During the Forecast Period

Figure 3 Residential Segment is Expected to Lead the Market During the Forecast Period

Figure 4 Smart Grid Segment is Expected to Lead the Market During the Forecast Period

Figure 5 North America Dominated the Meter Data Management System in 2017

Figure 6 Increased Implementation of Smart Meters is Driving the Market, 20182023

Figure 7 European Market is Expected to Grow at the Highest Cagr During the Forecast Period

Figure 8 Software Segment is Expected to Dominate the Meter Data Management System, By Component, During the Forecast Period

Figure 9 Electricity Segment and the Us Dominated the North American Meter Data Management System in 2017

Figure 10 Residential Segment is Expected to Dominate the Meter Data Management System, By End-User, During the Forecast Period

Figure 11 Electricity Segment is Expected to Dominate the Meter Data Management System, By Utility Type, During the Forecast Period

Figure 12 Smart Grid Segment is Expected to Dominate the Meter Data Management System, By Application, During the Forecast Period

Figure 13 Drivers, Restraints, Opportunities, and Challenges

Figure 14 Meter Data Management System Market, By Component, 20182023 (USD Thousand)

Figure 15 Market, By Utility Type, 20182023 (USD Thousand)

Figure 16 Residential Segment is Expected to Dominate the Market During the Forecast Period

Figure 17 Market, By Application, 20182023 (USD Thousand)

Figure 18 Regional Snapshot: the Market in the Middle East is Expected to Grow at the Highest Cagr During the Forecast Period

Figure 19 Market Share (Value), By Region, 2017

Figure 20 North America Electric Vehicle Supply Equipment Stock Comparison, Us vs. Canada, 20162017

Figure 21 North America: Regional Snapshot

Figure 22 Europe: Regional Snapshot

Figure 23 Key Developments in the Meter Data Management System During 20152019

Figure 24 Market Share Analysis, 2017

Figure 25 Meter Data Management System (Global) Competitive Leadership Mapping, 2017

Figure 26 Honeywell: Company Snapshot

Figure 27 Eaton: Company Snapshot

Figure 28 ABB: Company Snapshot

Figure 29 Siemens: Company Snapshot

Figure 30 Schneider Electric: Company Snapshot

Figure 31 Itron: Company Snapshot

Figure 32 Landis+Gyr: Company Snapshot

Figure 33 DIEHL: Company Snapshot

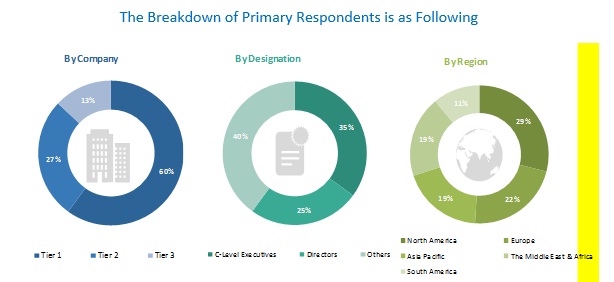

This study involved 4 major activities in estimating the current market size for meter data management system. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. Thereafter, the market breakdown and data triangulation was done to estimate the market size of the segments and subsegments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the global market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The meter data management system comprises several stakeholders such as utilities, regulators, IT vendors, meter vendors, meter communication vendors, and analytics vendor in the supply chain. The demand-side of this market is characterized by its applications such as residential, commercial, and industrial. The supply-side is characterized by advancements in smart metering technologies such as comprehensive and fast reacting products and increased emphasis on meter data management systems operational lifetime. Various primary sources from both, the supply- and demand-sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global meter data management system market and its dependent submarkets. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market shares in the respective regions have been determined through both primary and secondary research.

- The industrys supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both, the demand- and supply-sides, in the residential, commercial, and industrial sectors.

Report Objectives

- To define, describe, and forecast the global meter data management system by component, utility type, end-user, application, and region

- To provide detailed information on the major factors influencing the growth of the meter market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the market with respect to individual growth trends, prospects, and contribution of each segment to the market

- To analyze market opportunities for stakeholders and details of a competitive landscape for market leaders

- To forecast the growth of the market with respect to the major regions (Asia Pacific, Europe, North America, South America, and the Middle East & Africa)

- To strategically profile key players and comprehensively analyze their market rankings and core competencies

- To track and analyze the competitive developments such as contracts & agreements, expansions, new product developments, mergers & acquisitions, and partnerships in the market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the clients specific needs. The following customization options are available for this report:

Regional Analysis

- Further breakdown of the region or country-specific analysis

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Meter Data Management System Market