mHealth Solutions Market by Apps (Women Health, Diabetes, Mental Health), Connected Devices (Glucose & Blood Pressure Monitor, Peak Flow Meter), Services (Remote Monitoring, Consultation), End User (Providers, Patients, Payers) & Region - Global Forecasts to 2028

Updated on : March 27, 2023

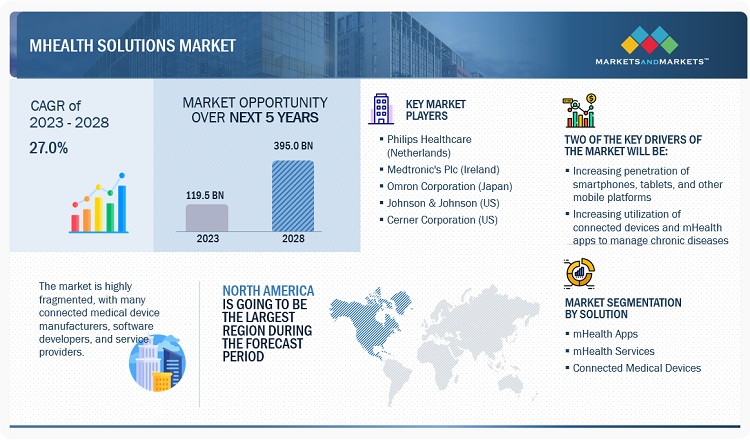

The global mHealth solutions market in terms of revenue was estimated to be worth $119.5 billion in 2023 and is poised to reach $395.0 billion by 2028, growing at a CAGR of 27.0% from 2023 to 2028.

The global market is expected to grow significantly in the coming years. Factors such as the increasing penetration of smartphones, tablets, and other mobile platforms; increasing utilization of connected devices and mHealth apps for the management of chronic diseases; cost containment in healthcare delivery; robust penetration of 3G and 4G networks; and rising focus on patient-centric healthcare delivery and increase in demand for home healthcare services are expected to drive market growth in the coming years.

On the other hand, lack of standards and regulations, the paucity of reimbursements, low guidance from physicians in selecting apps due to unawareness of technology, and resistance from traditional healthcare providers are expected to limit market growth to a certain extent.

Attractive Opportunities in mHealth Solutions Market

To know about the assumptions considered for the study, Request for Free Sample Report

mHealth Solutions Market Dynamics

Drivers: Growing penetration of 4G & 5G networks to ensure uninterrupted healthcare

The adoption of mHealth technology largely depends on technological advancements on the telecommunications front. In the past few years, the mHealth market has benefited from the growing penetration of high-speed connectivity, including 3G, 4G, and broadband services. In 2018, the number of broadband registered subscribers was 5.2 billion; it was expected to reach 6.5 billion subscribers in 2021.

The increasing utilization of mobile platforms in the healthcare industry to improve the accessibility of patient information and significant investments in the digital healthcare market are driving the adoption of 5G in the healthcare market. High-speed 5G networks can help quickly and reliably transport huge data files of medical imagery, improving both access to care and the quality of care. While augmented reality (AR), virtual reality (VR), and spatial computing are already being used in healthcare on a limited basis, 5G may eventually further enhance a doctor’s ability to deliver innovative, less invasive treatments. 5G has lower latency and higher capacity, which helps healthcare systems to offer remote monitoring for more patients. Furthermore, the high standard of virtual care and the presence & potential of 5G are expected to improve healthcare delivery significantly. On the other hand, 5G Enhanced Mobile Broadband (eMBB) technology?has helped ensure remote support and quality healthcare while reducing the chances of patient exposure to contagions (especially during the COVID-19 pandemic).

The high penetration of 4G/5G networks in the North American region supports video calling and high-speed data transfer to help deliver telemedicine services. 5G networks enable superior customer experience in terms of better picture quality, reduced image distortion for video calls, and quicker data transfer than those offered by 4G networks.

Wi-Fi has emerged as a dominant standard for wireless LANs worldwide. With a range of services running over Medical Mobility (MM) networks, it is possible to access real-time patient data through connected devices. As Bluetooth and Wi-Fi technologies become more pervasive, the healthcare industry will benefit from this technology evolution and enable greater penetration of connected medical devices in the coming years, thus paving the route for growth opportunities in mHealth.

Restraints: Resistance from traditional healthcare providers & limited guidance from physicians

The effective utilization of mobile apps and wireless technology can change the face of mHealth service delivery. However, patients typically find it difficult to look for healthcare apps due to the lack of guidance or support from their doctors. Many experienced or traditional healthcare providers are hesitant to adopt healthcare IT solutions or mHealth apps in their daily practices. Most of this reluctance is due to a lack of IT knowledge. Some healthcare professionals also feel that utilizing these apps is time-consuming, with limited or no clinical benefits. Furthermore, the lack of a standard metric to measure the benefits of these solutions has resulted in a general reluctance (among doctors and physicians) to utilize and prescribe these advanced technologies.

Thus, while physicians recognize the potential benefits of mobile healthcare apps, they remain wary of formally recommending apps to patients without evidence of their benefits, clear professional guidelines regarding their use in practice, and confidence in the security of personal health information that may be generated or transmitted by the app. Thus, patients do not use mHealth apps and devices to their full extent. This is expected to limit market growth to a certain extent.

The adoption of mobile medical apps by professionals can be potentially improved by increasing awareness among healthcare professionals and offering inputs or incentives to physicians for recommending mHealth technologies to their patients. Engaging physicians can also create awareness during phases of app development and clinical pilot testing of these apps. This would also help in ensuring the clinical relevance of the app and promoting its utility for achieving maximum clinical benefits.

Although the adoption of healthcare apps is gradually increasing, a lack of physician acceptance may result in lower-than-expected growth of the mHealth apps and solutions market in the coming years

Opportunities: Growing adoption of mHealth solutions in other mobile platforms

The prime aim of mHealth is to provide remote healthcare solutions leveraging advanced telecommunication technologies. Currently, this market is restricted to smartphone-linked solutions, although a few companies, such as Samsung, have introduced new platforms and smart TVs in the healthcare market. Other mHealth devices include next-generation watches, wearable medical devices, and portable medical devices capable of running medical software applications. Considering the fast adoption of mHealth, such new additions of hardware solutions in the market are expected to find greater acceptance among healthcare professionals and patients as long as they can offer remote monitoring or consultation services. However, the best possible way is to convert the daily used mobile gadgets into medical devices so that no additional cost is incurred in using the technology. The device manufacturer and software developer can seize these untapped market opportunities to introduce breakthrough technologies in the mHealth market.

Challenges: Lack of data security and concerns regarding data theft and healthcare fraud

Security concerns about proprietary data and applications are considered a major hindrance to the growth of the market. Since mobile healthcare is an emerging market, there are no standard frameworks to secure data stored and shared using healthcare apps. One of the major risks of using mHealth is the theft of Protected Health Information (PHI), such as health insurance numbers, by third parties who can commit healthcare fraud using confidential information. On the other hand, many organizations lack the resources to secure these technologies.

Since mobile phones play a critical role in the mHealth market, a simple loss or theft of a mobile device loaded with unencrypted patient data could cause a security breach with serious consequences. Such privacy breaches could lead to enforcement actions by the Department of Health and Human Services (HHS) under the Health Insurance Portability and Accountability Act (HIPAA) in the US. Although mobile healthcare offers various advantages, its security issues slow the adoption of mobile technology in the healthcare arena.

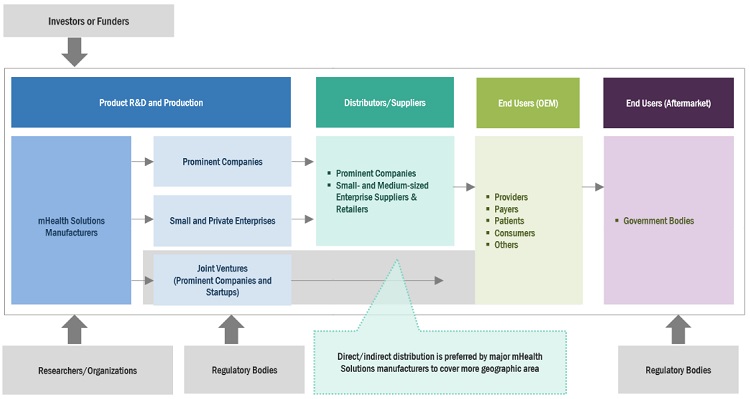

mHealth Solutions Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of mHealth Solutions. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Philips N.V. (Netherlands), Medtronic plc (Ireland), Johnson & Johnson (US), OMRON Healthcare Co., Ltd. (Japan), Cerner Corporation (US), Apple, Inc. (US), AliveCor, Inc. (US), AirStrip Technologies (US), athenahealth, Inc. (US), iHealth Lab Inc. (US), AT&T Inc. (US), AgaMatrix, Inc. (US), Cisco Systems, Inc. (US), Fitbit Inc. (US), OSP Labs (US), SoftServe (US), Garmin, Ltd. (US), Dexcom, Inc. (US), Tunstall Healthcare (UK), Teladoc Health, Inc. (US), ZTE Corporation (China), and My mHealth Limited (UK).

mHealth Services to register the highest growth in the product & service segment of mHealth Solutions market in 2022.

On the basis of product & service, the healthcare provider solutions segment to register highest growth. The mHealth services segment is expected to grow at the highest CAGR during the forecast period. The rising global adoption of smartphones, availability of high-speed networks, and rising demand for remote patient monitoring and consultation are the key factors driving the growth of the mHealth services segment

Healthcare providers is the highest growing end user segment of the mHealth solutions market

Based on end user, the healthcare providers segment is expected to grow at a significant CAGR during the forecast period.The easy availability of mobile phones has extended even to low and middle-income countries. Thus, most diseases and chronic conditions can be virtually screened globally. Chronic diseases demand frequent hospital visits, regular check-ups, and multiple lifestyle changes deemed necessary by a physician. mHealth can help efficiently influence the patient’s awareness of their condition, lifestyle interventions, clinical decisions, medication adherence, screening regimens, and rehabilitation support. Individuals suffering from chronic diseases have sought mHealth as a convenient and affordable approach to managing their disease. Owing to these factors, the market for providers in the mHealth solutions space is growing steadily.

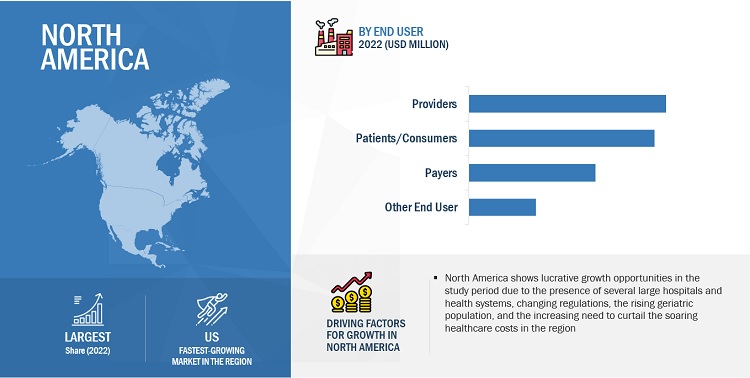

North America accounted for the largest share of the mHealth Solutions market during the forecast period.

In 2022, North America accounted for the largest share of the market, followed by Europe, Asia Pacific, Latin America, and the Middle East & Africa. The large share of North America can be attributed to factors such as the increasing penetration of smartphones and mHealth solutions, growing use of connected devices and mHealth apps for managing chronic diseases, and increasing healthcare expenditure

To know about the assumptions considered for the study, download the pdf brochure

The products and services market is dominated by a few globally established players such as Koninklijke Philips N.V. (Netherlands), Medtronic plc (Ireland), Johnson & Johnson (US), OMRON Healthcare Co., Ltd. (Japan), Cerner Corporation (US), Apple, Inc. (US), AliveCor, Inc. (US), AirStrip Technologies (US), athenahealth, Inc. (US), iHealth Lab Inc. (US), AT&T Inc. (US), AgaMatrix, Inc. (US), Cisco Systems, Inc. (US), Fitbit Inc. (US), OSP Labs (US), SoftServe (US), Garmin, Ltd. (US), Dexcom, Inc. (US), Tunstall Healthcare (UK), Teladoc Health, Inc. (US), ZTE Corporation (China), and My mHealth Limited (UK).

mHealth Solutions Market Report Scope:

|

Report Metric |

Details |

|

Market size available for years |

2021–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Million/Billion (USD) |

|

Segments covered |

Product & Services, End user, and region. |

|

Geographies covered |

North America, Europe, Asia Pacific, Latin America, and Middle East and Africa |

|

Companies covered |

Koninklijke Philips N.V. (Netherlands), Medtronic plc (Ireland), Johnson & Johnson (US), Omron Healthcare Co., Ltd. (Japan), Cerner Corporation (US), Apple, Inc. (US), AliveCor, Inc. (US), AirStrip Technologies (US), athenahealth, Inc. (US), iHealth Lab Inc. (US), AT&T Inc. (US), AgaMatrix, Inc. (US), Cisco Systems, Inc. (US), Fitbit Inc. (US), Vodafone Group Plc (UK), Qualcomm Technologies, Inc. (US), OSP Labs (US), SoftServe (US), Garmin, Ltd. (US), Dexcom, Inc. (US), Tunstall Healthcare (UK), Teladoc Health, Inc. (US), ZTE Corporation (China), Omada Health (US), and My Mhealth Limited (UK). |

The study categorizes the mHealth Solutions market based on product & services, end user at regional and global level.

By Product & Service

- Introduction

-

mHealth Apps

-

Healthcare Apps

-

Chronic care management apps

- Mental health & behavioral disorder management apps

- Diabetes management apps

- Blood pressure & ECG monitoring apps

- Cancer management apps

- Other chronic care management apps

-

General health & fitness apps

- Health tracking apps

- Obesity & weight management apps

- Fitness & nutrition apps

- Medication management apps

-

Women’s health apps

- Pregnancy apps

- Breastfeeding apps

- Fertility apps

- Other women’s health apps

- Personal health record apps

- Other healthcare apps

-

Chronic care management apps

-

Medical Apps

- Patient management & monitoring apps

- Medical reference apps

- Communication & consulting apps

- Continuing medical education apps

-

Healthcare Apps

-

Connected Medical devices

-

Vital Signs Monitoring Devices

- Blood pressure monitors

- Blood glucose meters

- ECG/heart rate monitors

- Pulse oximeters

- Peak flow meters

- Sleep apnea monitors

- Multiparameter trackers

- Fetal monitoring devices

- Neurological monitoring devices

- Other connected medical devices

-

Vital Signs Monitoring Devices

-

mHealth Services

- Remote monitoring services

- Diagnosis & Consultation services

- Treatment services

- Healthcare system strengthening services

- Fitness & wellness services

- Prevention services

By End User

- Introduction

- Healthcare Providers

- Healthcare Payers

- Patients/Consumers

- Other end users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- RoE

-

Asia Pacific

- Japan

- China

- India

- RoAPAC

-

Latin America

- Brazil

- Mexico

- RoLATAM

- Middle East & Africa

Recent Developments

- In February 2023 Vodafone (UK) partnered with Charité Berlin, Leipzig University Hospital (Berlin).The collaboration with Charité Berlin (one of Europe’s largest university hospitals), Leipzig University Hospital, and 16 other leading research and medical experts across Germany enabled Vodafone to explore future medical applications using 6G.

- In January 2023 Koninklijke Philips (Netherlands) partnered with Masimo (US). The partnership aimed to augment patient monitoring capabilities in home telehealth applications with the Masimo W1 advanced health-tracking watch.

- In January 2023, Garmin (US) launched Instinct Crossover in India, which delivers Garmin’s full suite of wellness features, including Sleep Score and Advanced Sleep Monitoring, and Health Monitoring activities.

Frequently Asked Questions (FAQ):

What is the projected market value of the global mHealth solutions market?

The global market of mHealth solutions is projected to reach USD 395.0 billion.

What is the estimated growth rate (CAGR) of the global mHealth solutions market for the next five years?

The global mHealth solutions market is projected to grow at a Compound Annual Growth Rate (CAGR) of 27.0% from 2023 to 2028.

What are the major revenue pockets in the mHealth solutions market currently?

In 2022, North America accounted for the largest share of the market, followed by Europe, Asia Pacific, Latin America, and the Middle East & Africa. The large share of North America can be attributed to factors such as the increasing penetration of smartphones and mHealth solutions, growing use of connected devices and mHealth apps for managing chronic diseases, and increasing healthcare expenditure

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing penetration of smartphones, tablets, and other mobile platforms- Increasing utilization of connected devices and mHealth apps to manage chronic diseases- Cost containment in healthcare delivery- Growing penetration of 4G & 5G networks to ensure uninterrupted healthcare- Rising focus on patient-centric healthcare delivery- Increasing demand for home healthcare servicesRESTRAINTS- Lack of standards & regulations and insufficient reimbursement- Resistance from traditional healthcare providers & limited guidance from physiciansOPPORTUNITIES- Growing adoption of mHealth solutions in other mobile platformsCHALLENGES- Authenticity and reliability- Patent protection for mHealth devices and apps- Lack of data security and concerns regarding data theft and healthcare fraud

-

6.1 INDUSTRY TRENDSINCREASING UTILIZATION OF MHEALTH SOLUTIONS FOR PERSONALIZED PATIENT ENGAGEMENTRISE OF DIGITAL THERAPEUTICSREMOTE MONITORING AND GROWING FOCUS ON CONSUMER-CENTRIC MOBILITY SOLUTIONSAPPLICATIONS OF CLOUD-BASED MHEALTH SOLUTIONS IN HEALTHCAREWEARABLE HEALTH SENSORSINCREASING DEMAND FOR URGENT CARE APPSFUTURE TRENDS IN MHEALTH DEVICESADOPTION ANALYSIS OF CONNECTED DEVICES

-

6.2 MHEALTH APPS: MARKET HIGHLIGHTSDEMAND AND SUPPLYADOPTION ANALYSISMHEALTH REVENUE TRENDSFUTURE TRENDS

-

6.3 MOBILE HEALTHCARE ECOSYSTEM: STAKEHOLDER ANALYSISMHEALTH DEVICE MANUFACTURERSAPPLICATION DEVELOPERSMHEALTH SERVICE PROVIDERSNETWORK PROVIDERS

- 7.1 INTRODUCTION

-

7.2 MHEALTH APPSHEALTHCARE APPS- Chronic care management apps- General health & fitness apps- Medication management apps- Women’s health apps- Personal health record apps- Other healthcare appsMEDICAL APPS- Patient management & monitoring apps- Medical reference apps- Communication & consulting apps- Continuing medical education apps

-

7.3 CONNECTED MEDICAL DEVICESVITAL SIGNS MONITORING DEVICES- Blood pressure monitors- Blood glucose meters- ECG/heart rate monitors- Pulse oximetersPEAK FLOW METERS- Increasing asthma prevalence to contribute to market growthSLEEP APNEA MONITORS- Rising instances of chronic snoring to drive demand for sleep apnea monitorsMULTIPARAMETER TRACKERS- Rising prevalence of chronic diseases to boost marketFETAL MONITORING DEVICES- Rising preterm births from successful in vitro fertilization to bolster growthNEUROLOGICAL MONITORING DEVICES- Increasing prevalence of neurological diseases to drive growthOTHER CONNECTED MEDICAL DEVICES

-

7.4 MHEALTH SERVICESREMOTE MONITORING SERVICES- Shift toward home healthcare to boost demandDIAGNOSIS & CONSULTATION SERVICES- Need to enhance healthcare access to propel demandTREATMENT SERVICES- Demand for remote treatment to boost marketHEALTHCARE SYSTEM STRENGTHENING SERVICES- Need to collate information and track outbreaks to support adoptionFITNESS & WELLNESS SERVICES- Rising health awareness in developed countries to boost adoptionPREVENTION SERVICES- Rising disease prevalence to propel demand for prevention services

- 8.1 INTRODUCTION

-

8.2 PROVIDERSPROVIDERS TO HOLD LARGEST MARKET SHARE

-

8.3 PATIENTS/CONSUMERSRISING DISEASE PREVALENCE AND EMERGENCE OF ADVANCED WEARABLE MONITORS TO DRIVE DEMAND

-

8.4 PAYERSPOTENTIAL TO REDUCE READMISSIONS AND OVERHEAD COSTS TO DRIVE ADOPTION

- 8.5 OTHER END USERS

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICANORTH AMERICA: IMPACT OF ECONOMIC RECESSIONUS- US to dominate North American marketCANADA- Need to curtail escalating healthcare costs to drive market

-

9.3 EUROPEEUROPE: IMPACT OF ECONOMIC RECESSIONGERMANY- Need for better and improved healthcare services to drive adoption of mHealthUK- High penetration of mobile apps and wearable devices to support growthFRANCE- Use of telehealth solutions and services through big data to boost marketITALY- Increasing government initiatives to implement eHealth to propel marketSPAIN- High phone penetration rate to support mHealth adoptionREST OF EUROPE

-

9.4 ASIA PACIFICASIA PACIFIC: IMPACT OF ECONOMIC RECESSIONCHINA- China to dominate Asia Pacific mHealth solutions marketJAPAN- Rising geriatric population and health expenditure to support market growthINDIA- Rising need to reduce healthcare costs to boost mHealth adoptionREST OF ASIA PACIFIC

-

9.5 LATIN AMERICALATIN AMERICA: IMPACT OF ECONOMIC RECESSIONBRAZIL- Brazil to dominate mHealth solutions market in Latin AmericaMEXICO- Rising need to curtail healthcare expenditure to drive mHealth adoptionREST OF LATIN AMERICA

-

9.6 MIDDLE EAST & AFRICARISING INTEREST IN BUILDING REGIONAL HEALTHCARE MOBILITY FRAMEWORKS TO FAVOR MHEALTH SEGMENTMIDDLE EAST & AFRICA: IMPACT OF ECONOMIC RECESSION

- 10.1 OVERVIEW

- 10.2 MARKET RANKING ANALYSIS

- 10.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

- 10.4 MHEALTH SOLUTIONS MARKET: R&D EXPENDITURE

-

10.5 COMPANY EVALUATION QUADRANT (2022)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

10.6 COMPANY EVALUATION QUADRANT FOR START-UPS/SMES (2022)PROGRESSIVE COMPANIESDYNAMIC COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKS

-

10.7 COMPETITIVE SCENARIOPRODUCT & SERVICE LAUNCHES & APPROVALSDEALS

-

11.1 KEY PLAYERSKONINKLIJKE PHILIPS N.V.- Business overview- Products & services offered- Recent developments- MnM viewMEDTRONIC PLC- Business overview- Products & services offered- Recent developments- MnM viewOMRON HEALTHCARE CO., LTD.- Business overview- Products & services offered- Recent developments- MnM viewJOHNSON & JOHNSON- Business overview- Products & services offered- Recent developments- MnM viewCERNER CORPORATION- Business overview- Products & services offered- Recent developments- MnM viewAPPLE, INC.- Business overview- Products & services offered- Recent developmentsALIVECOR, INC.- Business overview- Products & services offered- Recent developmentsAIRSTRIP TECHNOLOGIES- Business overview- Products & services offered- Recent developmentsATHENAHEALTH, INC.- Business overview- Products & services offered- Recent developmentsIHEALTH LABS, INC.- Business overview- Products & services offeredAT&T, INC.- Business overview- Products & services offered- Recent developmentsAGAMATRIX, INC.- Business overview- Products & services offeredCISCO SYSTEMS, INC.- Business overview- Products & services offered- Recent developmentsFITBIT, INC.- Business overview- Products & services offered- Recent developmentsVODAFONE GROUP PLC- Business overview- Products & services offered- Recent developmentsQUALCOMM TECHNOLOGIES, INC.- Business overview- Products & services offeredGARMIN LTD.- Business overview- Products & services offered- Recent developmentsTUNSTALL HEALTHCARE- Business overview- Products & services offered- Recent developments

-

11.2 ADDITIONAL COMPANIESSOFTSERVEOSP LABSOMADA HEALTHDEXCOM, INC.TELADOC HEALTH, INC.ZTE CORPORATIONMY MHEALTH LIMITED

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD

- TABLE 2 RISK ASSESSMENT: MHEALTH SOLUTIONS MARKET

- TABLE 3 MARKET DYNAMICS: MHEALTH SOLUTIONS MARKET

- TABLE 4 NOTABLE WEARABLE DEVICES OFFERED BY PLAYERS

- TABLE 5 NOTABLE URGENT CARE APPS OFFERED BY PLAYERS

- TABLE 6 REVENUE SOURCES: MHEALTH SOLUTIONS MARKET

- TABLE 7 MHEALTH SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 8 MHEALTH APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 9 MHEALTH APPS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 10 HEALTHCARE APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 11 HEALTHCARE APPS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 12 CHRONIC CARE MANAGEMENT APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 13 CHRONIC CARE MANAGEMENT APPS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 14 MENTAL HEALTH & BEHAVIORAL DISORDER MANAGEMENT APPS OFFERED BY KEY MARKET PLAYERS

- TABLE 15 MENTAL HEALTH & BEHAVIORAL DISORDER MANAGEMENT APPS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 16 DIABETES MANAGEMENT APPS OFFERED BY KEY MARKET PLAYERS

- TABLE 17 DIABETES MANAGEMENT APPS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 18 BLOOD PRESSURE & ECG MONITORING APPS OFFERED BY KEY MARKET PLAYERS

- TABLE 19 BLOOD PRESSURE & ECG MONITORING APPS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 20 CANCER MANAGEMENT APPS OFFERED BY KEY MARKET PLAYERS

- TABLE 21 CANCER MANAGEMENT APPS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 22 OTHER CHRONIC CARE MANAGEMENT APPS OFFERED BY KEY MARKET PLAYERS

- TABLE 23 OTHER CHRONIC CARE MANAGEMENT APPS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 24 GENERAL HEALTH & FITNESS APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 25 GENERAL HEALTH & FITNESS APPS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 26 HEALTH TRACKING APPS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 27 OBESITY & WEIGHT MANAGEMENT APPS OFFERED BY KEY MARKET PLAYERS

- TABLE 28 OBESITY & WEIGHT MANAGEMENT APPS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 29 FITNESS & NUTRITION APPS OFFERED BY KEY MARKET PLAYERS

- TABLE 30 FITNESS & NUTRITION APPS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 31 MEDICAL MANAGEMENT APPS OFFERED BY KEY MARKET PLAYERS

- TABLE 32 MEDICATION MANAGEMENT APPS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 33 WOMEN’S HEALTH APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 34 WOMEN’S HEALTH APPS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 35 PREGNANCY APPS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 36 BREASTFEEDING APPS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 37 FERTILITY APPS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 38 OTHER WOMEN’S HEALTH APPS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 39 PERSONAL HEALTH RECORD APPS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 40 OTHER HEALTHCARE APPS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 41 MEDICAL APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 42 MEDICAL APPS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 43 PATIENT MANAGEMENT & MONITORING APPS OFFERED BY KEY MARKET PLAYERS

- TABLE 44 PATIENT MANAGEMENT & MONITORING APPS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 45 MEDICAL REFERENCE APPS OFFERED BY KEY MARKET PLAYERS

- TABLE 46 MEDICAL REFERENCE APPS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 47 COMMUNICATION & CONSULTING APPS OFFERED BY KEY MARKET PLAYERS

- TABLE 48 COMMUNICATION & CONSULTING APPS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 49 MEDICAL EDUCATION APPS OFFERED BY KEY MARKET PLAYERS

- TABLE 50 CONTINUING MEDICAL EDUCATION APPS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 51 CONNECTED MEDICAL DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 52 CONNECTED MEDICAL DEVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 53 VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 54 VITAL SIGNS MONITORING DEVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 55 BLOOD PRESSURE MONITORS OFFERED BY KEY MARKET PLAYERS

- TABLE 56 BLOOD PRESSURE MONITORS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 57 BLOOD GLUCOSE METERS OFFERED BY KEY MARKET PLAYERS

- TABLE 58 BLOOD GLUCOSE METERS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 59 ECG MONITORS OFFERED BY KEY MARKET PLAYERS

- TABLE 60 ECG/HEART RATE MONITORS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 61 PULSE OXIMETERS OFFERED BY KEY MARKET PLAYERS

- TABLE 62 PULSE OXIMETERS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 63 PEAK FLOW METERS OFFERED BY KEY MARKET PLAYERS

- TABLE 64 PEAK FLOW METERS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 65 SLEEP APNEA MONITORS OFFERED BY KEY PLAYERS

- TABLE 66 SLEEP APNEA MONITORS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 67 MULTIPARAMETER TRACKERS OFFERED BY KEY MARKET PLAYERS

- TABLE 68 MULTIPARAMETER TRACKERS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 69 FETAL MONITORING DEVICES OFFERED BY KEY MARKET PLAYERS

- TABLE 70 FETAL MONITORING DEVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 71 NEUROLOGICAL MONITORING DEVICES OFFERED BY KEY MARKET PLAYERS

- TABLE 72 NEUROLOGICAL MONITORING DEVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 73 OTHER CONNECTED MEDICAL DEVICES OFFERED BY KEY MARKET PLAYERS

- TABLE 74 OTHER CONNECTED MEDICAL DEVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 75 MHEALTH SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 76 MHEALTH SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 77 REMOTE MONITORING SERVICES OFFERED BY KEY MARKET PLAYERS

- TABLE 78 REMOTE MONITORING SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 79 DIAGNOSIS & CONSULTATION SERVICES OFFERED BY KEY MARKET PLAYERS

- TABLE 80 DIAGNOSIS & CONSULTATION SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 81 TREATMENT SERVICES OFFERED BY KEY MARKET PLAYERS

- TABLE 82 TREATMENT SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 83 HEALTHCARE SYSTEM STRENGTHENING SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 84 FITNESS & WELLNESS SERVICES OFFERED BY KEY MARKET PLAYERS

- TABLE 85 FITNESS & WELLNESS SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 86 PREVENTION SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 87 MHEALTH SOLUTIONS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 88 MHEALTH SOLUTIONS MARKET FOR PROVIDERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 89 MHEALTH SOLUTIONS MARKET FOR PATIENTS/CONSUMERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 90 MHEALTH SOLUTIONS MARKET FOR PAYERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 91 MHEALTH SOLUTIONS MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 92 MHEALTH SOLUTIONS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 93 NORTH AMERICA: MHEALTH SOLUTIONS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 94 NORTH AMERICA: MHEALTH SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 95 NORTH AMERICA: MHEALTH APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 96 NORTH AMERICA: HEALTHCARE APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 97 NORTH AMERICA: CHRONIC CARE MANAGEMENT APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 98 NORTH AMERICA: GENERAL HEALTH & FITNESS APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 99 NORTH AMERICA: WOMEN’S HEALTH APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 100 NORTH AMERICA: MEDICAL APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 101 NORTH AMERICA: CONNECTED MEDICAL DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 102 NORTH AMERICA: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 103 NORTH AMERICA: MHEALTH SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 104 NORTH AMERICA: MHEALTH SOLUTIONS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 105 US: MHEALTH SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 106 US: MHEALTH APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 107 US: HEALTHCARE APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 108 US: CHRONIC CARE MANAGEMENT APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 109 US: GENERAL HEALTH & FITNESS APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 110 US: WOMEN’S HEALTH APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 111 US: MEDICAL APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 112 US: CONNECTED MEDICAL DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 113 US: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 114 US: MHEALTH SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 115 US: MHEALTH SOLUTIONS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 116 CANADA: MHEALTH SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 117 CANADA: MHEALTH APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 118 CANADA: HEALTHCARE APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 119 CANADA: CHRONIC CARE MANAGEMENT APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 120 CANADA: GENERAL HEALTH & FITNESS APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 121 CANADA: WOMEN’S HEALTH APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 122 CANADA: MEDICAL APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 123 CANADA: CONNECTED MEDICAL DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 124 CANADA: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 125 CANADA: MHEALTH SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 126 CANADA: MHEALTH SOLUTIONS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 127 EUROPE: MHEALTH SOLUTIONS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 128 EUROPE: MHEALTH SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 129 EUROPE: MHEALTH APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 130 EUROPE: HEALTHCARE APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 131 EUROPE: CHRONIC CARE MANAGEMENT APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 132 EUROPE: GENERAL HEALTH & FITNESS APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 133 EUROPE: WOMEN’S HEALTH APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 134 EUROPE: MEDICAL APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 135 EUROPE: CONNECTED MEDICAL DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 136 EUROPE: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 137 EUROPE: MHEALTH SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 138 EUROPE: MHEALTH SOLUTIONS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 139 GERMANY: MHEALTH SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 140 GERMANY: MHEALTH APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 141 GERMANY: HEALTHCARE APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 142 GERMANY: CHRONIC CARE MANAGEMENT APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 143 GERMANY: GENERAL HEALTH & FITNESS APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 144 GERMANY: WOMEN’S HEALTH APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 145 GERMANY: MEDICAL APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 146 GERMANY: CONNECTED MEDICAL DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 147 GERMANY: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 148 GERMANY: MHEALTH SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 149 GERMANY: MHEALTH SOLUTIONS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 150 UK: MHEALTH SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 151 UK: MHEALTH APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 152 UK: HEALTHCARE APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 153 UK: CHRONIC CARE MANAGEMENT APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 154 UK: GENERAL HEALTH & FITNESS APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 155 UK: WOMEN’S HEALTH APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 156 UK: MEDICAL APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 157 UK: CONNECTED MEDICAL DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 158 UK: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 159 UK: MHEALTH SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 160 UK: MHEALTH SOLUTIONS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 161 FRANCE: MHEALTH SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 162 FRANCE: MHEALTH APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 163 FRANCE: HEALTHCARE APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 164 FRANCE: CHRONIC CARE MANAGEMENT APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 165 FRANCE: GENERAL HEALTH & FITNESS APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 166 FRANCE: WOMEN’S HEALTH APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 167 FRANCE: MEDICAL APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 168 FRANCE: CONNECTED MEDICAL DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 169 FRANCE: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 170 FRANCE: MHEALTH SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 171 FRANCE: MHEALTH SOLUTIONS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 172 ITALY: MHEALTH SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 173 ITALY: MHEALTH APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 174 ITALY: HEALTHCARE APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 175 ITALY: CHRONIC CARE MANAGEMENT APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 176 ITALY: GENERAL HEALTH & FITNESS APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 177 ITALY: WOMEN’S HEALTH APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 178 ITALY: MEDICAL APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 179 ITALY: CONNECTED MEDICAL DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 180 ITALY: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 181 ITALY: MHEALTH SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 182 ITALY: MHEALTH SOLUTIONS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 183 SPAIN: MHEALTH SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 184 SPAIN: MHEALTH APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 185 SPAIN: HEALTHCARE APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 186 SPAIN: CHRONIC CARE MANAGEMENT APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 187 SPAIN: GENERAL HEALTH & FITNESS APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 188 SPAIN: WOMEN’S HEALTH APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 189 SPAIN: MEDICAL APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 190 SPAIN: CONNECTED MEDICAL DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 191 SPAIN: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 192 SPAIN: MHEALTH SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 193 SPAIN: MHEALTH SOLUTIONS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 194 REST OF EUROPE: MHEALTH SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 195 REST OF EUROPE: MHEALTH APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 196 REST OF EUROPE: HEALTHCARE APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 197 REST OF EUROPE: CHRONIC CARE MANAGEMENT APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 198 REST OF EUROPE: GENERAL HEALTH & FITNESS APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 199 REST OF EUROPE: WOMEN’S HEALTH APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 200 REST OF EUROPE: MEDICAL APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 201 REST OF EUROPE: CONNECTED MEDICAL DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 202 REST OF EUROPE: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 203 REST OF EUROPE: MHEALTH SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 204 REST OF EUROPE: MHEALTH SOLUTIONS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 205 ASIA PACIFIC: MHEALTH SOLUTIONS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 206 ASIA PACIFIC: MHEALTH SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 207 ASIA PACIFIC: MHEALTH APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 208 ASIA PACIFIC: HEALTHCARE APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 209 ASIA PACIFIC: CHRONIC CARE MANAGEMENT APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 210 ASIA PACIFIC: GENERAL HEALTH & FITNESS APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 211 ASIA PACIFIC: WOMEN’S HEALTH APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 212 ASIA PACIFIC: MEDICAL APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 213 ASIA PACIFIC: CONNECTED MEDICAL DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 214 ASIA PACIFIC: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 215 ASIA PACIFIC: MHEALTH SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 216 ASIA PACIFIC: MHEALTH SOLUTIONS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 217 CHINA: MHEALTH SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 218 CHINA: MHEALTH APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 219 CHINA: HEALTHCARE APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 220 CHINA: CHRONIC CARE MANAGEMENT APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 221 CHINA: GENERAL HEALTH & FITNESS APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 222 CHINA: WOMEN’S HEALTH APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 223 CHINA: MEDICAL APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 224 CHINA: CONNECTED MEDICAL DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 225 CHINA: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 226 CHINA: MHEALTH SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 227 CHINA: MHEALTH SOLUTIONS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 228 JAPAN: MHEALTH SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 229 JAPAN: MHEALTH APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 230 JAPAN: HEALTHCARE APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 231 JAPAN: CHRONIC CARE MANAGEMENT APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 232 JAPAN: GENERAL HEALTH & FITNESS APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 233 JAPAN: WOMEN’S HEALTH APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 234 JAPAN: MEDICAL APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 235 JAPAN: CONNECTED MEDICAL DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 236 JAPAN: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 237 JAPAN: MHEALTH SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 238 JAPAN: MHEALTH SOLUTIONS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 239 INDIA: MHEALTH SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 240 INDIA: MHEALTH APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 241 INDIA: HEALTHCARE APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 242 INDIA: CHRONIC CARE MANAGEMENT APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 243 INDIA: GENERAL HEALTH & FITNESS APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 244 INDIA: WOMEN’S HEALTH APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 245 INDIA: MEDICAL APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 246 INDIA: CONNECTED MEDICAL DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 247 INDIA: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 248 INDIA: MHEALTH SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 249 INDIA: MHEALTH SOLUTIONS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 250 REST OF ASIA PACIFIC: MHEALTH SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 251 REST OF ASIA PACIFIC: MHEALTH APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 252 REST OF ASIA PACIFIC: HEALTHCARE APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 253 REST OF ASIA PACIFIC: CHRONIC CARE MANAGEMENT APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 254 REST OF ASIA PACIFIC: GENERAL HEALTH & FITNESS APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 255 REST OF ASIA PACIFIC: WOMEN’S HEALTH APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 256 REST OF ASIA PACIFIC: MEDICAL APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 257 REST OF ASIA PACIFIC: CONNECTED MEDICAL DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 258 REST OF ASIA PACIFIC: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 259 REST OF ASIA PACIFIC: MHEALTH SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 260 REST OF ASIA PACIFIC: MHEALTH SOLUTIONS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 261 LATIN AMERICA: MHEALTH SOLUTIONS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 262 LATIN AMERICA: MHEALTH SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 263 LATIN AMERICA: MHEALTH APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 264 LATIN AMERICA: HEALTHCARE APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 265 LATIN AMERICA: CHRONIC CARE MANAGEMENT APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 266 LATIN AMERICA: GENERAL HEALTH & FITNESS APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 267 LATIN AMERICA: WOMEN’S HEALTH APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 268 LATIN AMERICA: MEDICAL APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 269 LATIN AMERICA: CONNECTED MEDICAL DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 270 LATIN AMERICA: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 271 LATIN AMERICA: MHEALTH SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 272 LATIN AMERICA: MHEALTH SOLUTIONS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 273 BRAZIL: MHEALTH SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 274 BRAZIL: MHEALTH APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 275 BRAZIL: HEALTHCARE APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 276 BRAZIL: CHRONIC CARE MANAGEMENT APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 277 BRAZIL: GENERAL HEALTH & FITNESS APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 278 BRAZIL: WOMEN’S HEALTH APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 279 BRAZIL: MEDICAL APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 280 BRAZIL: CONNECTED MEDICAL DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 281 BRAZIL: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 282 BRAZIL: MHEALTH SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 283 BRAZIL: MHEALTH SOLUTIONS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 284 MEXICO: MHEALTH SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 285 MEXICO: MHEALTH APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 286 MEXICO: HEALTHCARE APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 287 MEXICO: CHRONIC CARE MANAGEMENT APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 288 MEXICO: GENERAL HEALTH & FITNESS APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 289 MEXICO: WOMEN’S HEALTH APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 290 MEXICO: MEDICAL APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 291 MEXICO: CONNECTED MEDICAL DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 292 MEXICO: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 293 MEXICO: MHEALTH SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 294 MEXICO: MHEALTH SOLUTIONS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 295 REST OF LATIN AMERICA: MHEALTH SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 296 REST OF LATIN AMERICA: MHEALTH APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 297 REST OF LATIN AMERICA: HEALTHCARE APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 298 REST OF LATIN AMERICA: CHRONIC CARE MANAGEMENT APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 299 REST OF LATIN AMERICA: GENERAL HEALTH & FITNESS APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 300 REST OF LATIN AMERICA: WOMEN’S HEALTH APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 301 REST OF LATIN AMERICA: MEDICAL APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 302 REST OF LATIN AMERICA: CONNECTED MEDICAL DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 303 REST OF LATIN AMERICA: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 304 REST OF LATIN AMERICA: MHEALTH SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 305 REST OF LATIN AMERICA: MHEALTH SOLUTIONS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 306 MIDDLE EAST & AFRICA: MHEALTH SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 307 MIDDLE EAST & AFRICA: MHEALTH APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 308 MIDDLE EAST & AFRICA: HEALTHCARE APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 309 MIDDLE EAST & AFRICA: CHRONIC CARE MANAGEMENT APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 310 MIDDLE EAST & AFRICA: GENERAL HEALTH & FITNESS APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 311 MIDDLE EAST & AFRICA: WOMEN’S HEALTH APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 312 MIDDLE EAST & AFRICA: MEDICAL APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 313 MIDDLE EAST & AFRICA: CONNECTED MEDICAL DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 314 MIDDLE EAST & AFRICA: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 315 MIDDLE EAST & AFRICA: MHEALTH SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 316 MIDDLE EAST & AFRICA: MHEALTH SOLUTIONS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 317 PRODUCT & SERVICE LAUNCHES & APPROVALS, JANUARY 2020–MARCH 2023

- TABLE 318 DEALS, JANUARY 2020–MARCH 2023

- TABLE 319 KONINKLIJKE PHILIPS N.V.: BUSINESS OVERVIEW

- TABLE 320 MEDTRONIC PLC: BUSINESS OVERVIEW

- TABLE 321 OMRON HEALTHCARE CO., LTD.: BUSINESS OVERVIEW

- TABLE 322 JOHNSON & JOHNSON: BUSINESS OVERVIEW

- TABLE 323 CERNER CORPORATION: BUSINESS OVERVIEW

- TABLE 324 APPLE, INC.: BUSINESS OVERVIEW

- TABLE 325 ALIVECOR, INC.: BUSINESS OVERVIEW

- TABLE 326 AIRSTRIP TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 327 ATHENAHEALTH, INC.: BUSINESS OVERVIEW

- TABLE 328 IHEALTH LABS, INC.: BUSINESS OVERVIEW

- TABLE 329 AT&T, INC.: BUSINESS OVERVIEW

- TABLE 330 AGAMATRIX, INC.: BUSINESS OVERVIEW

- TABLE 331 CISCO SYSTEMS, INC.: BUSINESS OVERVIEW

- TABLE 332 FITBIT, INC.: BUSINESS OVERVIEW

- TABLE 333 VODAFONE GROUP PLC: BUSINESS OVERVIEW

- TABLE 334 QUALCOMM TECHNOLOGIES, INC.: BUSINESS OVERVIEW

- TABLE 335 GARMIN LTD.: BUSINESS OVERVIEW

- TABLE 336 TUNSTALL HEALTHCARE: BUSINESS OVERVIEW

- FIGURE 1 MHEALTH SOLUTIONS MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 PRIMARY SOURCES

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 8 DATA TRIANGULATION METHODOLOGY

- FIGURE 9 MHEALTH SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2023 VS. 2028 (USD BILLION)

- FIGURE 10 CONNECTED MEDICAL DEVICES MARKET, BY TYPE, 2023 VS. 2028 (USD BILLION)

- FIGURE 11 MHEALTH APPS MARKET, BY TYPE, 2023 VS. 2028 (USD BILLION)

- FIGURE 12 MHEALTH SERVICES MARKET, BY TYPE, 2023 VS. 2028 (USD BILLION)

- FIGURE 13 MHEALTH SOLUTIONS MARKET, BY END USER, 2023 VS. 2028 (USD BILLION)

- FIGURE 14 MHEALTH SOLUTIONS MARKET: REGIONAL SNAPSHOT

- FIGURE 15 INCREASING PENETRATION OF SMARTPHONES, TABLETS, AND OTHER MOBILE PLATFORMS TO DRIVE MARKET GROWTH

- FIGURE 16 MHEALTH APPS TO COMMAND LARGEST SHARE IN 2023

- FIGURE 17 MARKET IN CHINA TO GROW AT HIGHEST CAGR

- FIGURE 18 ASIA PACIFIC TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 19 DEVELOPING MARKETS TO REGISTER HIGHER GROWTH RATES

- FIGURE 20 SMARTPHONE USERS WORLDWIDE, 2016–2027

- FIGURE 21 NUMBER OF MOBILE BROADBAND SUBSCRIPTIONS, 2011–2021

- FIGURE 22 ADOPTION OF HIGH-GROWTH CONNECTED DEVICES DURING NEXT FIVE YEARS

- FIGURE 23 APPLICATION OF MHEALTH APPS DURING NEXT FIVE YEARS

- FIGURE 24 ADOPTION OF HIGH-GROWTH THERAPEUTIC APPS DURING NEXT FIVE YEARS

- FIGURE 25 MOBILE HEALTHCARE ECOSYSTEM

- FIGURE 26 MHEALTH REVENUE SHARE, BY STAKEHOLDER, 2022

- FIGURE 27 MHEALTH SOLUTIONS MARKET SEGMENTATION, BY PRODUCT & SERVICE

- FIGURE 28 NORTH AMERICA: MHEALTH SOLUTIONS MARKET SNAPSHOT, 2022

- FIGURE 29 ASIA PACIFIC: MHEALTH SOLUTIONS SNAPSHOT

- FIGURE 30 KEY DEVELOPMENTS OF MARKET PLAYERS BETWEEN JANUARY 2020 AND MARCH 2023

- FIGURE 31 MHEALTH APPLICATIONS AND DEVICES MARKET RANKING ANALYSIS, BY PLAYER, 2022

- FIGURE 32 MHEALTH SOLUTIONS MARKET: REVENUE ANALYSIS OF KEY PLAYERS

- FIGURE 33 R&D EXPENDITURE OF KEY PLAYERS (2020 VS. 2021)

- FIGURE 34 MHEALTH SOLUTIONS MARKET: COMPANY EVALUATION QUADRANT (2022)

- FIGURE 35 MHEALTH SOLUTIONS MARKET: COMPANY EVALUATION QUADRANT FOR START-UPS/SMES (2022)

- FIGURE 36 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT (2022)

- FIGURE 37 MEDTRONIC PLC: COMPANY SNAPSHOT (2021)

- FIGURE 38 OMRON CORPORATION.: COMPANY SNAPSHOT (2021)

- FIGURE 39 JOHNSON & JOHNSON: COMPANY SNAPSHOT (2021)

- FIGURE 40 CERNER CORPORATION: COMPANY SNAPSHOT (2021)

- FIGURE 41 APPLE, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 42 AT&T, INC.: COMPANY SNAPSHOT (2021)

- FIGURE 43 CISCO SYSTEMS, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 44 VODAFONE GROUP PLC: COMPANY SNAPSHOT (2022)

- FIGURE 45 QUALCOMM TECHNOLOGIES, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 46 GARMIN LTD.: COMPANY SNAPSHOT (2022)

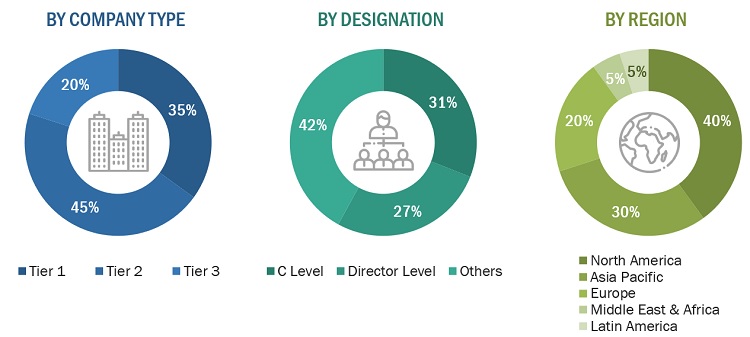

This research study involved the extensive use of both primary and secondary sources. Various factors affecting the industry were studied to identify segmentation types; industry trends; key players; the competitive landscape of the market; and key market dynamics, such as drivers, restraints, opportunities, challenges, and key player strategies.

Secondary Research

This research study involved widespread secondary sources; directories; databases, such as D&B, Bloomberg Business, and Factiva; white papers; annual reports; and companies’ house documents. Secondary research was used to identify and collect information for this extensive, technical, market-oriented, and commercial study of the mHealth solutions market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, technology perspectives, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various supply and demand sources were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, engineers, and related key executives from various companies and organizations operating in the mHealth solutions market. Primary sources from the demand side included personnel from hospitals (small, medium-sized, and large hospitals), ambulatory centers, diagnostic centers, TPAs, and stakeholders in corporate & government bodies.

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, and product managers.

Note: Tiers are defined based on a company’s total revenue, as of 2020: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the mHealth Solutions market was arrived at after data triangulation from different approaches. After each approach, the weighted average of approaches was taken based on the level of assumptions used.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

The individual shares of each mHealth product & service, and end-user segment were determined by assigning weights based on their utilization/adoption rate. Regional splits of the overall mHealth market and its subsegments are based on the adoption or utilization rates of the given products and services in the respective regions or countries

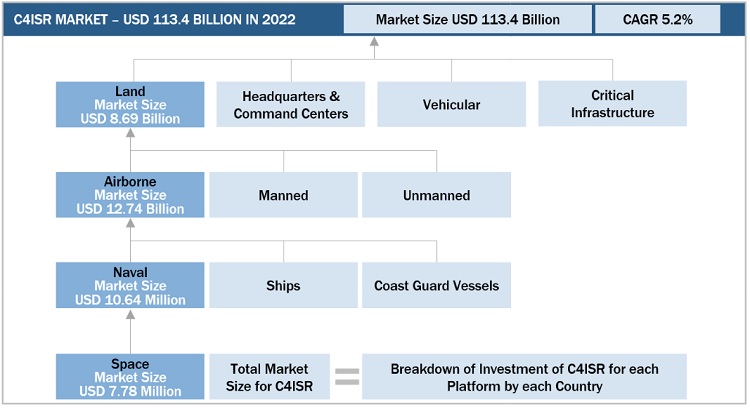

Global MHealth Solutions Market Size: Top-Down Approach

Market Definition

Mobile health (mHealth) refers to the use of mobile devices for collecting and distributing health-related data, remote delivery of care, and near real-time monitoring of patients. Connected medical devices and mHealth apps and solutions help clinicians document more accurate and complete records, improve productivity, access information, and communicate findings & treatments.

Key Stakeholders

- Healthcare application developers

- Medical device vendors

- Mobile network providers

- Connectivity providers

- Mobile platform developers

- Insurance providers (payers)

- Healthcare institutions (hospitals, medical schools, and outpatient clinics)

- Research and consulting firms

- Research institutes

- Contract research organizations (CROs)

- Contract manufacturing organizations (CMOs)

- Venture capitalists

Objectives of the Study

- To define, describe, segment, and forecast the mHealth solutions market by product & service, end user, and region

- To provide detailed information about the factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall mHealth solutions market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the mHealth solutions market in five main regions (along with their respective key countries): North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players in the mHealth solutions market and comprehensively analyze their core competencies2 and market shares.

- To track and analyze competitive developments such as acquisitions, product launches, expansions, collaborations, agreements, partnerships, investments, joint ventures, sales contracts, and R&D activities of the leading players in the mHealth solutions market

- To benchmark players within the mHealth solutions market using the Competitive Leadership Mapping framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offering

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the RoAPAC mHealth solutions market into South Korea, Australia, New Zealand, and others

- Further breakdown of the RoE mHealth solutions market into Belgium, Russia, the Netherlands, Switzerland, and others

- Further breakdown of the RoLA mHealth solutions market into Argentina, Colombia, Chile, and others

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in mHealth Solutions Market

Thanks for the extensive information. The healthcare-based mobile app market is multiplying. Experts are integrating new technologies into mobile applications to offer advanced levels of client interface and experience. As of 2019, most connected mHealth solutions market uses mobile apps to provide better client services.