Patient Registry Software Market: Growth, Size, Share, and Trends

Patient Registry Software Market by Disease (Diabetes, Cancer, Rare, Asthma, Kidney), Product (Drugs, Device), Use Case (Population Health, Research), End User ((Profit: Pharma, Payer, Hospital), (Non-Profit: Govt)) & Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global patient registry software market is projected to reach USD 3.61 billion by 2030, up from USD 2.25 billion in 2025, growing at a CAGR of 9.9% during the forecast period. The robust market growth is fueled by the increasing focus on patient-centric care and the shift toward value-based healthcare delivery.

KEY TAKEAWAYS

- The Asia Pacific is expected to grow at the fastest CAGR of 11.4% driven by rising incidences of diabetes, cardiovascular disease, and cancer, which spurred national efforts to implement disease-specific registries, such as the National Cancer Registry Programme and the Registry of People with Diabetes, supported by public-private partnerships.

- The site-based/clinical data (provider-recorded) registries segment accounted for largest share of 65.1% in 2024

- Key use cases such as medical research & clinical studies and quality improvement are increasingly utilizing patient registry software due to the rising emphasis on real-world evidence generation and growing demand for post-marketing surveillance

- Disease registries segment is expected to grow at a CAGR of 10.1%

- The cloud-based deployment model is expected to register highest CAGR of 12.2% due to the growing need for interoperable systems, rapid implementation of updates, and reduced reliance on on-site IT infrastructure.

- Profit registries are witnessing growing demand for patient registry software due to the rising demand from pharmaceutical, biotechnology, and medtech companies seeking robust real-world data for regulatory submissions, market access, and post-market surveillance.

- IBM, IQVIA, Health Catalyst were identified as some of the star players in the Patient Registry market (global), given their strong market share and product footprint.

- Verana Health, Pulse Infoframe Inc., Amplitude Clinical Outcomes among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The patient registry software market was valued at USD 2.07 billion in 2024 and is projected to reach USD 2.26 billion in 2025 to 3.61 billion by 2030, at a CAGR of 9.9% during the forecast period.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' businesses stems from customer trends or disruptions. Hot bets are the clients of patient registry software manufacturers, and target applications are also clients of these manufacturers. Changes, whether trends or disruptions, will influence the revenues of end users. This revenue impact on end users will, in turn, affect the revenue of hot bets, which will further influence the revenues of patient registry software manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing demand for real-world evidence (RWE)

-

Rising burden of chronic and rare diseases

Level

-

Data privacy and security concerns

-

Shortage of trained and skilled resources

Level

-

Integration with AI and analytics tools

-

Expansion of population health management and outcomes tracking

Level

-

Inconsistent data quality and completeness

-

Limited awareness among healthcare stakeholders

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing demand for real-world evidence (RWE)

The need for real-world evidence (RWE) in regulatory decision-making and value-based care is driving increased use of patient registry software. Disease-specific registries for chronic and rare conditions help track outcomes and evaluate safety. Programs like the US CMS’s Quality Payment Program encourage registry use, fostering structured data collection, better clinical insights, and broader adoption across healthcare systems worldwide.

Restraint: Data privacy and security concerns

Data privacy and security continue to pose significant challenges, as compliance with HIPAA, GDPR, and other regulations raises costs and increases complexity for vendors and providers. The threat of breaches and misuse discourages smaller players from adopting registries. Issues related to patient consent, cross-border data transfers, and secondary data use often delay implementation or restrict scope, ultimately limiting registry growth and market expansion.

Opportunity: Integration with AI and analytics tools

AI integration in patient registries offers opportunities to analyze long-term data, identify disease patterns, and customize treatments. Improved interoperability with EHRs and mobile apps allows seamless real-time data collection. Increasing adoption across Asia Pacific, the Middle East, and Latin America, supported by national digital health initiatives, further drives demand. Decentralized trials and remote monitoring broaden registry applications, strengthening long-term market growth.

Challenge: Inconsistent data quality and completeness

Registry effectiveness is limited by poor data quality, where missing, inaccurate, or non-standardized entries weaken reliability. Manual input errors, lack of interoperability, and inconsistent documentation create gaps. Retrospective or self-reported data introduce recall bias. Without automated validation tools, insights remain unreliable. Solving these issues requires standardized protocols, EHR integration, and AI-driven validation to ensure data accuracy, consistency, and trustworthiness.

patient registry software market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

AI-enabled registries integrating EHR data, claims, and real-world evidence for oncology and chronic disease tracking Improved clinical decision support, early diagnosis, predictive insights | Improved clinical decision support, early diagnosis, predictive insights |

|

Patient registries for clinical trials and post-marketing surveillance across pharma and biotech Accelerated drug development, enhanced recruitment/retention, regulatory compliance | Accelerated drug development, enhanced recruitment/retention, regulatory compliance |

|

Cloud-based disease registries for cardiovascular and diabetes care management | Better population health outcomes, reduced hospital readmissions, cost efficiency |

|

Rare disease and specialty registries integrating payer and provider datasets | Optimized care pathways, improved reimbursement accuracy, value-based care alignment |

|

Cloud-based patient registry solutions that integrate EHR, lab, and patient-reported data to support longitudinal tracking, analytics, and compliance | Improves clinical outcomes, enhances research and RWE, ensures regulatory compliance, boosts efficiency, and scales for national/global registries |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The patient registry software market ecosystem includes providers such as IBM, IQVIA, Veradigm, and Optum, offering interoperable, cloud-based platforms for disease tracking and research. Technology partners improve AI, analytics, and security capabilities. End users such as pharmaceutical companies, payers, providers, nonprofits, and governments use registries for evidence generation and care coordination. Regulators such as the FDA and EMA enforce standards, while funding agencies promote adoption, collectively advancing data-driven healthcare innovation. Collaboration across the entire value chain is essential for innovation and market growth.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Patient Registry Software Market, By Registry Type

The disease registry segment dominates the patient registry software market due to the growing burden of chronic and rare diseases. According to Rare Diseases International (2025), over 300 million people worldwide live with a rare disease, representing 3.5%–5.9% of the global population. This rising prevalence is driving demand for registries to enable early diagnosis, strengthen clinical research, and support targeted therapy development. Furthermore, integration with EHRs and wearable devices has enhanced their role in population health management by offering structured, real-world data.

Patient Registry Software Market, By Use Case

In 2024, the medical research and clinical studies segment led the patient registry software market, driven by increasing demand for real-world evidence (RWE) to support drug development and regulatory processes. Research institutions and life science companies use patient registries to collect longitudinal data for clinical trials and population studies. The focus on precision medicine and government funding to improve clinical research infrastructure further accelerates the adoption of registry software in this sector.

Patient Registry Software Market, By Deployment Model

In 2024, the cloud-based model segment led the patient registry software market, driven by the push for digital transformation, focusing on agility and cost savings. Cloud registries offer real-time data access, scalability, and integration with digital health tools and EHRs, making them attractive to hospitals and public health organizations for collaboration and remote data collection. Companies like Dacima Software and Arbor Metrix are experiencing growing demand for their cloud-native platforms, which provide automated analytics and secure, compliant hosting. Furthermore, the increase in SaaS adoption and government incentives for cloud infrastructure support the growth of this segment.

REGION

North America is expected to dominate the global patient experience technology market in 2025

The North America patient registry software market is projected to lead the global market in 2025, bolstered by advanced healthcare infrastructure, robust IT systems, and favorable regulations. Increasing adoption of EHRs, interoperability efforts, and remote patient monitoring for chronic disease management serve as key growth drivers. The presence of global giants such as Oracle, IBM, IQVIA, Optum, and Health Catalyst strengthens the US market. Innovative initiatives further demonstrate momentum—such as the National Pancreas Foundation’s registry launch and Health Catalyst’s CMS-approved Able Health Registry. These developments position patient registries as vital tools for improving health outcomes, advancing precision medicine, and supporting evidence-based healthcare decisions.

patient registry software market: COMPANY EVALUATION MATRIX

In the patient registry software market matrix, IBM (Star) leads with a strong market share and extensive product footprint, driven by its advanced interoperability solutions, AI-enabled analytics, and deep integration capabilities across healthcare ecosystems. Conduent Incorporated (Emerging Leader) is gaining visibility with its patient data management and workflow automation solutions, strengthening its position through innovation and niche product offerings. While IBM dominates through scale, global presence, and diversified registry solutions spanning clinical trials, disease registries, and population health management, Conduent Incorporated shows significant potential to move toward the Leaders’ Quadrant as demand for cloud-based, cost-efficient, and patient-centric registry platforms continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- IBM

- IQVIA

- Health Catalyst Inc.

- Oracle

- UnitedHealth Group

- Conduent Inc.

- Elekta

- Dassault Systèmes

- EvidentIQ (Dacima Software Inc.)

- MRO (Figmd, Inc.)

- ImageTrend, Inc.

- Global Vision Technologies, Inc.

- Syneos Health

- Veradigm LLC

- ESO

- Ordinal Data, Inc.

- Lumedx Corporation

- NEC Corporation (NEC Software Solutions UK Limited)

- Cedaron Medical

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 2.07 Billion |

| Market Forecast in 2030 (value) | USD 3.61 Billion |

| Growth Rate | CAGR of 9.9% from 2025–2030 |

| Years Considered | 2023–2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

WHAT IS IN IT FOR YOU: patient registry software market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Market Sizing & Segmentation (Module 1) | Estimated current market size of patient registry software for non-profits, medical specialty societies & patient organizations (US and global). Forecast of market growth for the next 5–6 years. Segmentation by registry type (direct-to-patient vs aggregated), adoption patterns, end users, and regions. Geographic breakdown by US and global, functionalities, products, and end users. Identification of new & emerging technologies and use cases. Analysis of key growth drivers (e.g., outcome-based healthcare, disease-specific data, research/clinical trials). Assessment of major challenges & barriers (data privacy, HIPAA compliance, budgets for non-profits & societies). | Clear visibility on market potential and opportunity sizing. Supports strategic resource allocation across regions and end-user groups. Enables prioritization of high-growth segments and technologies. Risk mitigation through early identification of regulatory and budgetary barriers. |

| Competition Landscape & Benchmarking (Module 2) | Identification of the top 10–15 global competitors with profiles on strengths, market share, and positioning. Evaluation of leadership strategies (unique products, superior tech, partnerships) Benchmarking of product types (direct-to-patient vs aggregated) and value propositions Analysis of how strategies contribute to market position. Mapping of differentiators that provide a competitive edge Tracking emerging trends & use cases for medical societies and patient orgs. Profiling new entrants and disruptive players | Insight into competitive intensity and market share dynamics. Guidance on countering or leveraging leading players’ strategies. Identification of whitespace opportunities & differentiation levels. Early awareness of disruptive innovations and market newcomers |

RECENT DEVELOPMENTS

- February 2025 : The Oklahoma State Department of Health partnered with Conduent to implement the AI-enabled Maven Disease Surveillance and Outbreak Management System. This cloud-based platform enhances real-time monitoring, tracking, and reporting of public health threats, thereby improving outbreak response and safeguarding Oklahoma’s 4 million residents

- June 2024 : IBM launched InfoSphere Master Data Management 14.0, which introduced improved data governance, seamless integration, advanced compliance features, and robust data management capabilities. These enhancements aim to accelerate digital transformation across enterprises.

- February 2024 : Health Catalyst's Able Health Registry received approval from the Centers for Medicare & Medicaid Services (CMS) as a Qualified Registry for the Quality Payment Program (QPP) for the 2024 performance year. This approval enables the registry to calculate and report QPP program measures, ultimately improving care quality and reducing the administrative burden on clinicians

Table of Contents

Methodology

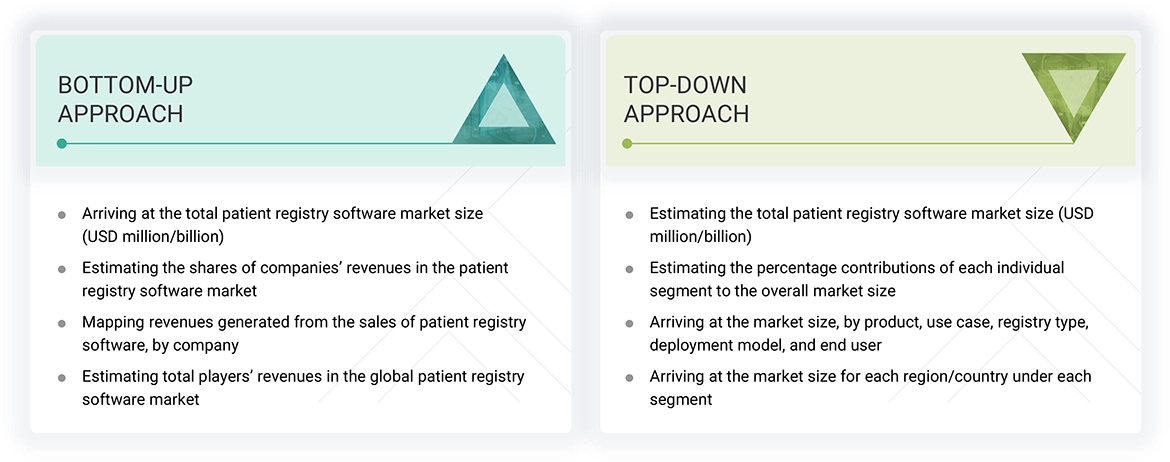

The study involved five major activities to estimate the current size of the patient registry software market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study involved the wide use of secondary sources, directories, and databases such as Dun & Bradstreet, Bloomberg Business, and Factiva; white papers, annual reports, and companies’ house documents; investor presentations; and the SEC filings of companies. The market for companies providing patient registry software solutions is assessed using secondary data from both paid and free sources. This involves analyzing the product portfolios of major players in the industry and evaluating these companies based on their performance and quality. Various resources were utilized in the secondary research process to gather information for this study. The sources include annual reports, press releases, investor presentations, white papers, academic journals, certified publications, articles by recognized authors, directories, and databases.

The secondary research process involved referring to various secondary sources to identify and collect information related to the study. These sources included annual reports, press releases, investor presentations of patient registry software vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

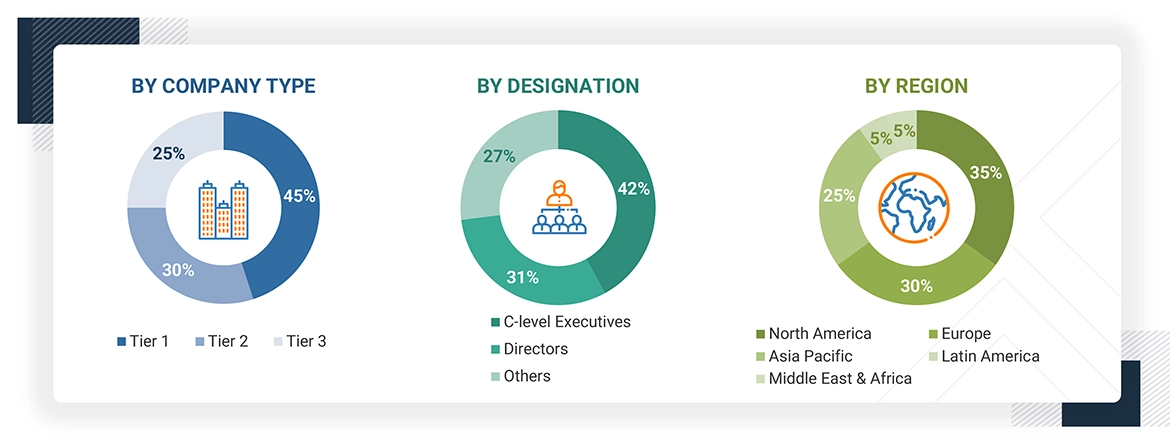

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources are mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess prospects.

Primary research was conducted to identify segmentation types, industry trends, key players, and key market dynamics such as drivers, restraints, opportunities, challenges, industry trends, and strategies adopted by key players.

After completing the market engineering process, which includes calculations for market statistics, market breakdown, size estimations, forecasting, and data triangulation, extensive primary research was conducted. This research aimed to gather information and verify the critical numbers obtained during the market analysis. Additionally, primary research was conducted to identify different types of market segmentation, analyze industry trends, evaluate the competitive landscape of patient registry software solutions offered by various players, and understand key market dynamics such as drivers, restraints, opportunities, challenges, industry trends, and strategies employed by key market participants.

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

Breakdown of Primary Respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (revenue share analysis of leading players) and top-down approach (assessment of utilization/adoption/penetration trends, by product, functionality, registry type, software, pricing model, deployment model, database type, end user, and region).

Data Triangulation

After arriving at the overall market size using the market size estimation processes, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides of the patient registry software market.

Market Definition

Patient registry software is a digital tool designed to systematically collect, store, manage, and analyze patient data related to specific diseases, conditions, treatments, or outcomes. This software enables real-world evidence generation, supports research efforts, and improves clinical decision-making. It allows for the long-term tracking of patient outcomes, enhances population health management, and aids in ensuring regulatory compliance and implementing quality improvement initiatives.

Stakeholders

- Patient Registry Software Vendors

- Government Bodies

- Healthcare Providers

- Clinical/Physician Centers

- Healthcare Professionals

- Health IT Service Providers

- Healthcare Associations/Institutes

- Venture Capitalists

- Maintenance and Support Service Providers

- Integration Service Providers

- Healthcare Payers

- Advocacy Groups

- Investors and Financial Institutions

- Industry Associations and Trade Groups

Report Objectives

- To define, describe, and forecast the global patient registry software market by product, use case, registry type, deployment model, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall patient registry software market

- To assess the patient registry software market with regard to Porter’s Five Forces, regulatory landscape, value chain, ecosystem map, patent analysis, and key stakeholders’ buying criteria

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the patient registry software market with respect to five main regions: North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players in the patient registry software market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments such as agreements, partnerships, and acquisitions; expansions; product launches & enhancements; and R&D activities in the patient registry software market

Key Questions Addressed by the Report

Which are the top industry players in the global patient registry market?

Prominent players in the patient registry market include IBM (US), IQVIA Holdings Inc. (US), Health Catalyst Inc. (US), Oracle (US), UnitedHealth Group (US), Conduent Inc. (US), Elekta (Sweden), Dassault Systèmes (France), and NEC Corporation (Japan).

Which registry type has been included in the patient registry market report?

This report includes disease registries (diabetes, cardiovascular, cancer, rare disease, asthma, chronic kidney, orthopedic, immunization, birth defect, and other disease registries) and product registries (medical device and drug registries).

Which geographical region is dominating the global patient registry market?

The patient registry market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest share, while Asia Pacific is expected to register the highest growth during the forecast period.

Which end-user segments have been included in the patient registry market report?

End users include profit registries (pharmaceutical, biotechnology, and medical device companies, payers, healthcare providers), non-profit registries (medical specialty societies, patient organizations), government & third-party administrators, and other end users.

What is the total CAGR expected to be recorded for the patient registry market during 2025–2030?

The global patient registry market is expected to record a CAGR of 9.8% during the forecast period from 2025 to 2030.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Patient Registry Software Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Patient Registry Software Market