Microcapsule Market by Technology (Spray, Emulsion and Dripping), End-user Industry (Pharmaceuticals & Healthcare, Food, Household & Personal Care, Textiles, Agrochemicals), Shell Material, Core Material & Region - Global Forecast to 2026

Updated on : September 03, 2025

Microcapsule Market

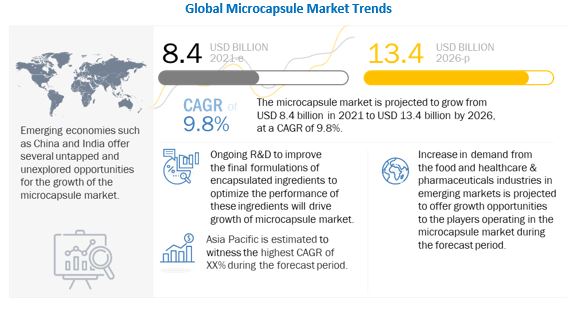

The global microcapsule market was valued at USD 8.4 billion in 2021 and is projected to reach USD 13.4 billion by 2026, growing at 9.8% cagr from 2021 to 2026. The market is on course for intense growth across different end-user industry verticals such as pharmaceuticals & healthcare, food, household & personal care, textiles, agrochemicals, and others. Manufacturers, producing microcapsule, are taking initiatives, and making huge investments in product launches and various business partnerships to improve the quality of their products and to augment their microcapsule business segment revenue.

To know about the assumptions considered for the study, download the pdf brochure

COVID-19 Impact on the Global Microcapsule Market

The pandemic is estimated to have an impact on various factors of the value chain of the microcapsule market, which is expected to reflect during the forecast period, especially in the year 2020. The various impact of COVID-19 are as follows:

Impact on Pharmaceuticals Industry

Microcapsules are extensively used in the pharmaceutical industry to treat renal diseases, cardiovascular diseases, colorectal cancer, inflammatory bowel disease, anemia, etc. Microencapsulated drugs are also being used for hormone therapy, gastrointestinal disorders, diabetes, pulmonary diseases, periodontitis, and hypertension. Although operational during the pandemic, the pharmaceutical industry also faces some challenges in terms of restricted raw material supplies and logistics.

Impact on Food Industry

In the food industry, various minerals and vitamins are added to functional food products, such as cereals, dairy products, bakery products, yogurts, and infant food, to enhance their nutritional value. Omega-3 microcapsules are also extensively applied in food products, such as dairy, infant formulas, and commercial bread. However, these added compounds may change the original flavor and may cause an unpleasant taste. Thus, microencapsulation is used in food products for odor and taste masking. The application of microcapsules in the food industry also provides protection to the added vitamins and minerals against adverse conditions, such as temperature and humidity.

The COVID-19 pandemic will create a positive impact on the demand for microcapsule in the food industry, as there is expected to be extensive growth in the demand for functional and nutraceutical food products during the forecast period.

Microcapsule Market Dynamics

Driver: Increased adoption of encapsulation technology by food and beverage manufacturing companies

Microcapsules are extensively used in the food industry for the encapsulation of food flavors, minerals and amino acids, vitamins, fats, oils, acidulants, and other food additives. Microencapsulation in the food & beverages industry also aims to maintain the taste, color, and nutritional value of food products while increasing their shelf life and ensuring the stability of food products. For instance, eicosapentaenoic acid (EPA) and docosahexaenoic acid (DHA) levels in milk can be increased without any adverse effects on its flavor by the addition of microencapsulated fish oil. However, if the fish oil is directly added to the milk, it may alter the natural flavor of the milk. Similarly, in home-baked pizzas, sodium bicarbonate is encapsulated to provide timely release of the active ingredients to retain the taste and structure of the pizzas.

The growing preference for natural, functional, and fortified products and nutritional and sports beverages, owing to the increased awareness about the importance of healthy food, daily hectic schedules, and high disposable income, create the need for microencapsulation since natural ingredients, such as vitamins, phytonutrients, antimicrobials, antioxidants, enzymes, and probiotic organisms, are typically more unstable and reactive than their synthetic counterparts. Therefore, these natural ingredients require microencapsulation to ensure protection from external environmental factors and other ingredients in the product. Microencapsulation is a competitive technology and tool that enables manufacturers to add value to their food products and beverages through innovative features, such as superior nutrient delivery, improved flavor stability, and enhanced sensory characteristics. All these factors contribute to the growth of the microcapsule market. The thriving food industry is expected to drive microcapsule market growth3D printing technology is transforming the manufacturing process in the automotive industry. The technology has helped the industry in making more complex and lighter structures at optimized costs. Many Formula 1, supercars, and concept cars are using 3D-printed parts. For example, BMW is collaborating with major 3D printing companies, including EOS GmbH Electro Optical Systems (Germany) and Carbon (US), to manufacture 3D-printed parts for commercial vehicles.

Additionally, elastomeric 3D printing materials are being used in manufacturing consumer products such as cell phone cases, earbuds, midsoles, saddles, and helmet liners. Due to their flexibility and high tensile strength, elastomeric additives also find applications, such as hearing aids, surgical tool handles, and prototypes, in the medical industry.

Opportunity: Ongoing technological advances to tap niche markets

With the increasing demand for microencapsulated products, various companies are substantially investing in R&D activities. Among numerous applications, advanced microencapsulation technology can target niche application areas, such as the use of PCMs in the energy sector and cancer and brain tumor-specific drug delivery.

Market players in PCMs are focusing on the development of new microencapsulation technologies and improvements in latent heat storage capacity, as well as the evaluation of different phase change temperature options to enhance the performance of their products. However, no technologies are available for microencapsulated PCMs having a temperature above 500°C (932°F), which is required in the energy sector. Therefore, the growing focus on addressing this need is expected to provide opportunities for the market.

Challenge: Maintaining stability of microencapsulated ingredients in varying atmospheric conditions

Optimization of the physical and chemical properties of microcapsules is necessary to achieve the stability of microencapsulated ingredients. Manufacturers find it challenging to maintain the stability of these ingredients in varying environmental conditions. The parameters for the optimization of properties include microencapsulation process type, material type, and capacity of the microsphere. All the properties of microcapsules including permeability, mechanical stability, cell viability, controlled release, targeted delivery, drug stability, and shelf life need to be optimized. Achieving these parameters while maintaining the stability of the encapsulated ingredients is challenging because of varying atmospheric conditions, such as temperature, humidity, and pressure.

Despite the adoption of advanced technologies, some combinations of the microcapsule material pose a challenge to produce the final product with the required stability of the encapsulated ingredient, for example, a combination of moisture-sensitive ingredients with liquid food.

The carbohydrates segment is estimated to be the fastest-growing segment of the microcapsule market from 2021 to 2026.

There are various types of shell materials available for producing microcapsule, which include melamine-formaldehyde, carbohydrates, gums & resins, other polymers, lipids and proteins. Among all these materials, carbohydrates segment is estimated to record highest growth in the microcapsule market during the forecast period. This is mainly due to the growing use of carbohydrates shell material in the food industry.

Spray technology led the microcapsule market during 2019-2026

Based on technology, the spray technologies held the largest share of the global market in 2020. High demand for spray technologies is due to their prominent use in the food industry owing to their flexibility and ease of use. Further, dripping technologies is expected to witness the highest CAGR from 2021 to 2026. This is majorly due to the various advantages offered by dripping technologies. For instance, the major advantages of dripping technologies are biocompatibility and low particle size distribution.

Pharmaceuticals & healthcare segment to lead the microcapsule market during 2019-2026

Based on end-user industry, the pharmaceuticals & healthcare segment dominates the market during the forecast period. The growing use of microcapsules in the pharmaceuticals and healthcare industry for various applications such as the controlled release of drugs and taste masking boosts the growth of this segment. Food segment is projected to be the second-largest industry in the microcapsule market in 2021.

North America dominated the microcapsule market, in 2020.

North America is the largest region in the microcapsule market. The market in this region is majorly driven by the growing demand and increasing consumer awareness about value-added products in various areas, such as nutrition, food, healthcare, and personal care. Therefore, companies focus on manufacturing functional and fortified products using novel technologies, such as microencapsulation.

Microcapsule Market Players

The key market players in the microcapsule market are BASF SE (Germany), Syngenta Crop Protection AG (Switzerland), Royal FrieslandCampina N.V. (Netherlands), Koninklijke DSM N.V. (Netherlands), Givaudan S.A. (Switzerland), Firmenich S.A. (Switzerland), Symrise AG (Germany), International Flavors & Fragrances (US), Lycored Corp. (Israel), and Sensient Technologies Corporation (US). These players have adopted expansions, acquisitions, product launches, investments, partnerships, joint ventures, mergers, collaborations, agreements, and divestments as their growth strategies to meet the growing demand for microcapsules.

Microcapsule Market Report Scope

|

Report Metric |

Details |

|

Market Size Available for Years |

2019–2026 |

|

Base Year Considered |

2020 |

|

Forecast Period |

2021–2026 |

|

Forecast Units |

Value (USD Million ) |

|

Segments Covered |

Shell Material, Core Material, End-user Industry, Technology, and Region |

|

Geographies Covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies Covered |

BASF SE (Germany), International Flavors & Fragrances (US), Koninklijke DSM N.V. (Netherlands), Symrise AG (Germany), Givaudan S.A. (Switzerland), Sensient Technologies Corporation (US), Royal FrieslandCampina N.V. (Netherlands), Syngenta Crop Protection AG (Switzerland), Lycored Corp. (Israel), Koehler Innovative Solutions (Germany), Balchem Corporation (US), Capsulæ SAS (France), TasteTech Ltd. (UK), MicroCapsules Technologies (MCT) (France), INSILICO Co. Ltd. (South Korea), Matsumoto Yushi Seiyaku Co., Ltd. (Japan), Encapsys (US), Arcade Beauty (US), Reed Pacific (Australia), Firmenich SA (Switzerland), Ronald T. Dodge Company (US), Microtek Laboratories, Inc. (US), INNOBIO (China), GAT Microencapsulation GmbH (Austria), BRACE GmbH (Germany), and Tagra Biotechnologies Ltd. (Israel). |

This research report categorizes the microcapsule market based on shell material, core material, end-user industry, technology, and region.

Based on shell material the microcapsule market has been segmented as follows:

- Melamine Formaldehyde

- Lipids

- Gums & Resins

- Carbohydrates

- Proteins

- Other Polymers (Polyvinyl alcohol (PVA), polyethylene glycol (PEG), poly lactic-co-glycolic acid (PLGA), polymethyl methacrylate (PMMA), isocyanate, polyamides, polyureas, polyurethanes, phenol-formaldehyde, and biodegradable polymers.

Based on Core Material, the microcapsule market has been segmented as follows:

- Agricultural Inputs

- Food Additives

- Pharmaceutical & Healthcare Drugs

- Fragrances

- Phase Change Materials

- Others (Construction chemicals, household and personal care products, inks, and energy molecules)

Based on End-user Industry the microcapsule market has been segmented as follows:

- Pharmaceuticals & Healthcare

- Food

- Household & Personal Care

- Textiles

- Agrochemicals

- Others (Chemicals, waste treatment, packaging, construction, paper, and printing)

Based on Technology, the microcapsule market has been segmented as follows:

- Spray Technologies

- Emulsion Technologies

- Dripping Technologies

- Others (Pan coating, fluid-bed coating, physico-chemical, and chemical technologies)

Based on Region microcapsule market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Recent Developments

- In August 2018, BASF SE’s animal nutrition division launched the Lucantin NXT product line in the European Union, which would be gradually followed in other countries. The carotenoid formulation of Lucantin NXT met the regulation (EC) No. 2017/962, which requires the withdrawal of ethoxyquin (EQ) as a feed additive. The product launch helped the company expand and strengthen its geographical footprint in the microcapsule animal nutrition market.

- In May 2019, Givaudan S.A. launched Spherulite R10, a microencapsulated stabilized retinol. This product is manufactured using a microencapsulation technology called spherulite technology that offers faster and superior anti-aging clinical efficacy than free retinol. The product development helped the company to enhance its position in the beauty industry on a global level.

Frequently Asked Questions (FAQ):

What is the current size of the global microcapsule market?

The market size of the microcapsule is estimated at USD 8,396 million in 2021 and is projected to reach USD 13.4 billion by 2026, at a CAGR of 9.8% from 2021 to 2026.

Who are the leading players in the global microcapsule market?

The leading companies in the microcapsule market include BASF SE (Germany), Syngenta Crop Protection AG (Switzerland), Royal FrieslandCampina N.V. (Netherlands), Koninklijke DSM N.V. (Netherlands), Givaudan S.A. (Switzerland), Firmenich S.A. (Switzerland), Symrise AG (Germany), International Flavors & Fragrances (US), Lycored Corp. (Israel), and Sensient Technologies Corporation (US). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MICROCAPSULE MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 STAKEHOLDERS

1.6 LIMITATIONS

1.7 INCLUSIONS & EXCLUSIONS

1.8 SUMMARY OF CHANGES MADE IN REVAMPED VERSION

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 1 MICROCAPSULE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.2 MATRIX CONSIDERED FOR DEMAND SIDE

FIGURE 2 MAIN MATRIX CONSIDERED WHILE CONSTRUCTING AND ASSESSING DEMAND FOR MICROCAPSULES

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 5 METHODOLOGY FOR DEMAND-SIDE SIZING OF MICROCAPSULE MARKET

FIGURE 6 METHODOLOGY FOR SUPPLY-SIDE SIZING OF MICROCAPSULE MARKET (1/2)

FIGURE 7 METHODOLOGY FOR SUPPLY-SIDE SIZING OF MICROCAPSULE MARKET (2/2)

2.3.2.1 Calculations for supply-side analysis

2.3.3 FORECAST

2.3.4 APPROACH 3: (BASED ON GLOBAL MARKET)

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3.5 APPROACH 4: (BASED ON TYPE, BY REGION)

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.4 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

2.5 DATA TRIANGULATION

FIGURE 10 MICROCAPSULE MARKET: DATA TRIANGULATION

2.5.1 KEY ASSUMPTIONS WHILE CALCULATING DEMAND-SIDE MARKET SIZE

2.5.2 LIMITATIONS

2.5.3 RISK ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 45)

TABLE 1 MICROCAPSULE MARKET SNAPSHOT

FIGURE 11 PHARMACEUTICALS & HEALTHCARE INDUSTRY TO CAPTURE LARGEST SIZE OF MICROCAPSULE MARKET FROM 2021 TO 2026

FIGURE 12 SPRAY TECHNOLOGIES ESTIMATED TO HOLD LARGER SIZE OF MICROCAPSULE MARKET THAN EMULSION, DRIPPING, AND OTHER TECHNOLOGIES IN 2021

FIGURE 13 PHARMACEUTICAL & HEALTHCARE DRUGS TO LEAD MICROCAPSULE MARKET, IN TERMS OF SIZE, DURING FORECAST PERIOD

FIGURE 14 NORTH AMERICA ACCOUNTED FOR LARGEST SHARE OF MICROCAPSULE MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 SIGNIFICANT OPPORTUNITIES IN MICROCAPSULE MARKET

FIGURE 15 INCREASE IN DEMAND FROM FOOD AND HEALTHCARE & PHARMACEUTICALS INDUSTRIES TO DRIVE MICROCAPSULE MARKET GROWTH

4.2 MICROCAPSULE MARKET, BY REGION

FIGURE 16 MICROCAPSULE MARKET IN ASIA PACIFIC EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.3 MICROCAPSULE MARKET, BY END-USER INDUSTRY

FIGURE 17 PHARMACEUTICALS & HEALTHCARE INDUSTRY TO HOLD LARGEST SIZE OF MICROCAPSULE MARKET IN 2026

4.4 MICROCAPSULE MARKET, BY TECHNOLOGY

FIGURE 18 DRIPPING TECHNOLOGIES TO EXHIBIT HIGHEST CAGR IN MICROCAPSULE MARKET DURING FORECAST PERIOD

4.5 NORTH AMERICAN MICROCAPSULE MARKET, BY END-USER INDUSTRY AND COUNTRY

FIGURE 19 US AND PHARMACEUTICALS & HEALTHCARE INDUSTRY ACCOUNTED FOR LARGEST SHARE OF NORTH AMERICAN MICROCAPSULE MARKET, BY COUNTRY AND END-USER INDUSTRY, RESPECTIVELY, IN 2020

4.6 MICROCAPSULE MARKET, BY CORE MATERIAL

FIGURE 20 PHARMACEUTICAL & HEALTHCARE DRUGS ESTIMATED TO ACCOUNT FOR LARGEST SIZE OF MICROCAPSULE MARKET IN 2026

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

TABLE 2 COMMON METHODS OF MICROENCAPSULATION, BY TECHNIQUE

TABLE 3 COMPARATIVE STUDY: ADVANTAGES AND DISADVANTAGES OF MICROENCAPSULATION TECHNIQUES

5.2 MARKET DYNAMICS

FIGURE 21 FORCES INFLUENCING MICROCAPSULE MARKET

5.2.1 DRIVERS

5.2.1.1 Increased adoption of encapsulation technology by food and beverage manufacturing companies

5.2.1.1.1 High demand for functional and fortified food and beverage products

5.2.1.2 Escalated demand for microencapsulation from pharmaceuticals industry

TABLE 4 MOST WIDELY USED MICROENCAPSULATED DRUGS IN PHARMACEUTICALS INDUSTRY

5.2.1.2.1 Controlled drug delivery

5.2.1.2.2 Targeted drug delivery

5.2.1.3 Elevated use of microencapsulation technology in agrochemicals industry

5.2.1.3.1 Use of controlled release technique to enhance efficiency of agrochemicals

5.2.1.3.2 Adoption of controlled release technique for convenience

5.2.1.3.3 Implementation of microencapsulated delivery system to reduce application dose, minimize labor requirement, ensure economic and efficient paste management, thereby reducing overall cost

5.2.1.3.4 Deployment of microencapsulated agrochemicals owing to rising environmental concerns

5.2.1.4 Increased focus of market players on R&D activities to increase market share

5.2.1.5 Widespread applications of microcapsules

TABLE 5 KEY FUNCTIONS OF MICROENCAPSULATION TECHNOLOGY, BY END-USER INDUSTRY

FIGURE 22 IMPACT OF DRIVERS ON MICROCAPSULE MARKET

5.2.2 OPPORTUNITIES

5.2.2.1 Ongoing technological advances to tap niche markets

5.2.2.1.1 Rising need for multi-component delivery systems

5.2.2.2 Emerging economies to provide high-growth opportunities

5.2.2.2.1 Strong focus on technological innovations and healthy eating and nutritional needs by governments in developing countries

FIGURE 23 IMPACT OF OPPORTUNITIES ON MICROCAPSULE MARKET

5.2.3 CHALLENGES

5.2.3.1 Maintaining stability of microencapsulated ingredients in varying atmospheric conditions

5.2.3.2 Stringent regulatory policies pertaining to use of formaldehyde, especially in Europe and Asia Pacific

TABLE 6 REGULATIONS ON MAXIMUM PERMISSIBLE RESIDUE LEVEL OF FORMALDEHYDE IN TEXTILES (PARTS PER MILLION OR PPM OR): EUROPE

TABLE 7 REGULATIONS ON MAXIMUM PERMISSIBLE RESIDUE LEVEL OF FORMALDEHYDE IN TEXTILES (PARTS PER MILLION OR PPM): ASIA PACIFIC

5.2.3.3 Selection of application-specific and appropriate microencapsulation technique and shell materials

5.2.4 OUTBREAK AND RAPID SPREAD OF COVID-19

FIGURE 24 IMPACT OF CHALLENGES ON MICROCAPSULE MARKET

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 25 PORTERS FIVE FORCES ANALYSIS

TABLE 8 IMPACT OF PORTER’S FIVE FORCES ON MICROCAPSULE MARKET, 2020

TABLE 9 IMPACT OF PORTER’S FIVE FORCES ON MICROCAPSULE MARKET, 2021–2026

5.3.1 THREAT OF SUBSTITUTES

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 INDUSTRY TRENDS

TABLE 10 FUTURE TRENDS IN APPLICATION OF MICROCAPSULES IN INDUSTRIES

5.4.1 FOOD INDUSTRY

6 VALUE CHAIN ANALYSIS (Page No. - 72)

6.1 INTRODUCTION

6.2 VALUE CHAIN ANALYSIS

FIGURE 26 MICROENCAPSULATION: DEVELOPMENT AND PRODUCTION PHASE ACCOUNTS FOR MAXIMUM CONTRIBUTION TO CUMULATIVE VALUE

6.3 ECOSYSTEM MARKET MAP OF MICROCAPSULE MARKET

7 MICROCAPSULE MARKET: PATENT ANALYSIS (Page No. - 74)

7.1 INTRODUCTION

7.2 METHODOLOGY

7.2.1 DOCUMENT TYPE

FIGURE 27 NUMBER OF GRANTED PATENTS VS. TOTAL NO. OF PATENT APPLICATIONS FILED FOR MICROCAPSULES

7.3 MICROCAPSULE MARKET: PATENT PUBLICATION TRENDS (2010-2020)

FIGURE 28 PUBLICATION TRENDS, 2010–2020

7.3.1 INSIGHTS

7.4 JURISDICTION ANALYSIS: TOP GEOGRAPHIES

FIGURE 29 TOP JURISDICTION, BY DOCUMENT

7.5 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

FIGURE 30 TOP ASSIGNEES

TABLE 11 LIST OF PATENTS BY PROCTER & GAMBLE

TABLE 12 LIST OF PATENTS BY BASF SE

TABLE 13 LIST OF PATENTS BY FIRMENICH & CIE

TABLE 14 LIST OF PATENTS BY SEKISUI CHEMICAL CO. LTD.

TABLE 15 LIST OF PATENTS BY INTERNATIONAL FLAVORS & FRAGRANCES INC.

TABLE 16 LIST OF PATENTS BY ENCAPSYS LLC

TABLE 17 TOP 20 PATENT OWNERS (US) FROM 2010 TO 2020

8 COVID-19 IMPACT ON MICROCAPSULE MARKET (Page No. - 82)

8.1 INTRODUCTION

8.1.1 COVID-19 IMPACT ON LIVES AND LIVELIHOOD

8.1.1.1 Economic outlook by International Monetary Fund (IMF)

TABLE 18 COVID-19 IMPACT: ECONOMIC OUTLOOK, 2020–2021

8.1.1.2 Stimulus package by G-20 countries

TABLE 19 RELIEF PACKAGES ANNOUNCED BY G-20 COUNTRIES

8.1.2 IMPACT OF COVID-19 ON MICROCAPSULE MARKET: PHARMACEUTICALS INDUSTRY

8.1.2.1 Introduction

8.1.2.2 impact on value chain: raw material supply

8.1.2.2.1 Short-term hold on new business strategies

8.1.2.2.2 New business opportunity for small-scale companies

8.1.3 IMPACT OF COVID-19 ON MICROCAPSULE MARKET: FOOD INDUSTRY

8.1.3.1 Introduction

8.1.3.2 Growing awareness about functional and fortified food products

8.1.3.3 Surging demand for omega-3 and natural anti-oxidants

8.1.3.4 Ongoing research activities supporting growing demand for nutraceutical food products

8.1.3.5 Escalating demand for probiotic supplements

8.1.4 IMPACT OF COVID-19 ON MICROCAPSULE MARKET: TEXTILES INDUSTRY

8.1.4.1 Declining market for fashion clothing

8.1.4.2 Continuously operating facilities providing medical and military clothing services

8.1.5 CONCLUSION

9 REGULATORY FRAMEWORK GOVERNING MICROCAPSULE MARKET (Page No. - 88)

9.1 INTRODUCTION

9.2 CODEX ALIMENTARIUS COMMISSION (CAC)

9.2.1 JOINT EXPERT COMMITTEE ON FOOD ADDITIVES (JECFA)

9.3 FOOD AND DRUG ADMINISTRATION (FDA)

9.4 EUROPEAN COMMISSION

9.5 COUNTRY-WISE REGULATORY AUTHORITIES FOR MICROENCAPSULATION IN FOOD

9.5.1 NORTH AMERICA

9.5.1.1 US

9.5.1.2 Canada

9.5.2 EUROPE

9.5.3 ASIA PACIFIC

9.5.3.1 Japan

9.5.3.2 India

9.5.3.3 China

9.5.4 REST OF THE WORLD

9.5.4.1 Brazil

9.5.4.2 Australia and New Zealand

9.6 RESTRICTIONS PROPOSED BY ECHA ON INTENTIONALLY ADDED MICROPLASTICS:

9.6.1 CONCERNS OVER MICROPLASTICS OBSERVED BY ECHA:

TABLE 20 SUMMARY OF IMPACT OF PROPOSED RESTRICTION ON COMMERCIALIZATION OF MICROPLASTICS FOR 20-YEAR ANALYTICAL PERIOD

TABLE 21 SUMMARY OF IMPACT OF LABELLING OR REPORTING REQUIREMENTS FROM 2021 ONWARD

9.7 OTHER LEGISLATIONS ON INTENTIONALLY ADDED MICROPLASTICS

9.7.1 LEGISLATION FOR EU MEMBER STATES ON INTENTIONALLY ADDED MICROPLASTICS

9.7.1.1 Belgium

9.7.1.2 France

9.7.1.3 Ireland

9.7.1.4 Italy

9.7.1.5 Sweden

9.7.1.6 United Kingdom

9.7.2 LEGISLATION FOR COUNTRIES OUTSIDE OF EU ON INTENTIONALLY ADDED MICROPLASTICS

9.7.2.1 Canada

9.7.2.2 USA

9.7.2.3 New Zealand

9.7.2.4 Australia

10 MICROCAPSULE MARKET, BY TECHNOLOGY (Page No. - 100)

10.1 INTRODUCTION

TABLE 22 MICROENCAPSULATION TECHNOLOGIES

FIGURE 31 MICROCAPSULE MARKET, BY TECHNOLOGY, 2021 VS. 2026 (USD MILLION)

TABLE 23 MICROENCAPSULATION TECHNIQUES WITH THEIR RELATIVE PARTICLE SIZE RANGES

TABLE 24 MICROCAPSULE MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 25 MICROCAPSULE MARKET, BY TECHNOLOGY, 2020–2026 (USD MILLION)

10.2 SPRAY TECHNOLOGIES

10.2.1 SPRAY DRYING

10.2.1.1 Surging demand for fortified food products to drive implementation of spray drying microencapsulation technology

10.2.2 SPRAY CHILLING

10.2.2.1 Increasing production of functional and rich foods to propel market for spray chilling microencapsulation technology

TABLE 26 MICROCAPSULE MARKET FOR SPRAY TECHNOLOGIES, BY REGION, 2016–2019 (USD MILLION)

TABLE 27 MICROCAPSULE MARKET FOR SPRAY TECHNOLOGIES, BY REGION, 2020–2026 (USD MILLION)

10.3 EMULSION TECHNOLOGIES

10.3.1 IN-SITU POLYMERIZATION

10.3.1.1 Rapid advances in polymerization techniques used to microencapsulate drugs, colors, and fragrances to create requirement for in-situ polymerization

10.3.2 COACERVATION

10.3.2.1 Increased demand for essential oils, flavors, and fragrances to spur adoption of coacervation technique

10.3.3 SOL-GEL ENCAPSULATION

10.3.3.1 Surged use of sol-gel encapsulation technique in microencapsulation of construction materials to propel market growth

TABLE 28 MICROCAPSULE MARKET FOR EMULSION TECHNOLOGIES, BY REGION, 2016–2019 (USD MILLION)

TABLE 29 MICROCAPSULE MARKET FOR EMULSION TECHNOLOGIES, BY REGION, 2020–2026 (USD MILLION)

10.4 DRIPPING TECHNOLOGIES

10.4.1 SPINNING DISK/ROTATIONAL SUSPENSION SEPARATION

10.4.1.1 Atomization, high production, and scalability requirements to result in high demand for spinning disk/rotating suspension separation technique

10.4.2 CENTRIFUGAL EXTRUSION

10.4.2.1 Escalating demand for microencapsulated active ingredients in pharmaceuticals industry to provide opportunity for implementation of centrifugal extrusion technology

TABLE 30 MICROCAPSULE MARKET FOR DRIPPING TECHNOLOGIES, BY REGION, 2016–2019 (USD MILLION)

TABLE 31 MICROCAPSULE MARKET FOR DRIPPING TECHNOLOGIES, BY REGION, 2020–2026 (USD MILLION)

10.5 OTHERS

TABLE 32 MICROCAPSULE MARKET FOR OTHER TECHNOLOGIES, BY REGION, 2016–2019 (USD MILLION)

TABLE 33 MICROCAPSULE MARKET FOR OTHER TECHNOLOGIES, BY REGION, 2020–2026 (USD MILLION)

11 MICROCAPSULE MARKET, BY END-USER INDUSTRY (Page No. - 109)

11.1 INTRODUCTION

TABLE 34 MICROENCAPSULATION METHODS AND APPLICATIONS

FIGURE 32 MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2021 VS. 2026 (USD MILLION)

TABLE 35 MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2016–2019(USD MILLION)

TABLE 36 MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2020–2026 (USD MILLION)

11.2 PHARMACEUTICALS & HEALTHCARE

11.2.1 GROWING USE OF MICROCAPSULES FOR APPLICATIONS SUCH AS CONTROLLED RELEASE OF DRUGS AND TASTE MASKING BOOSTS GROWTH OF THIS SEGMENT

11.2.2 CONTROLLED RELEASE

11.2.3 SPECIFIC DRUG DELIVERY

TABLE 37 MICROENCAPSULATED DRUGS AND BIOPHARMACEUTICS

11.2.4 TASTE MASKING

TABLE 38 MICROCAPSULE MARKET FOR PHARMACEUTICALS & HEALTHCARE INDUSTRY, BY REGION, 2016–2019 (USD MILLION)

TABLE 39 MICROCAPSULE MARKET FOR PHARMACEUTICALS & HEALTHCARE INDUSTRY, BY REGION, 2020–2026 (USD MILLION)

11.3 FOOD

11.3.1 INCREASING APPLICATION AREAS OF MICROCAPSULES IN FOOD INDUSTRY ACCELERATING MARKET GROWTH OF THIS SEGMENT

TABLE 40 METHODS FOR MICROENCAPSULATING FOOD INGREDIENTS

11.3.2 PROBIOTICS

TABLE 41 APPLICATIONS OF MICROENCAPSULATION IN PROBIOTIC BACTERIA

11.3.3 ANTIOXIDANTS

11.3.4 VITAMINS

11.3.5 FOOD COLORANTS

11.3.6 FOOD FLAVORS

TABLE 42 MICROCAPSULE MARKET FOR FOOD INDUSTRY, BY REGION, 2016–2019 (USD MILLION)

TABLE 43 MICROCAPSULE MARKET FOR FOOD INDUSTRY, BY REGION, 2020–2026 (USD MILLION)

11.4 HOUSEHOLD & PERSONAL CARE

11.4.1 GROWING ATTENTION OF CONSUMERS WORLDWIDE ON BUYING HEALTH, HYGIENE, AND BEAUTY PRODUCTS LEADING TO INCREASED DEMAND FOR MICROCAPSULES IN THIS SEGMENT

11.4.2 ESSENTIAL OILS

11.4.3 POLYPHENOLIC COMPOUNDS

11.4.4 FRAGRANCES AND PERFUMES

TABLE 44 MICROCAPSULE MARKET FOR HOUSEHOLD & PERSONAL CARE INDUSTRY, BY REGION, 2016–2019 (USD MILLION)

TABLE 45 MICROCAPSULE MARKET FOR HOUSEHOLD & PERSONAL CARE INDUSTRY, BY REGION, 2020–2026 (USD MILLION)

11.5 TEXTILES

11.5.1 RISING POPULARITY OF THERMOCHROMIC MATERIALS TO FUEL DEMAND FOR MICROCAPSULES IN TEXTILES INDUSTRY

11.5.2 THERMOCHROMIC MATERIALS

11.5.2.1 Leuco dyes

11.5.2.2 Liquid crystals

11.5.2.3 Pigments

11.5.3 FRAGRANCE FINISHING

11.5.4 FIRE RETARDANTS

11.5.5 WATERPROOFING

11.5.6 SOFTENERS AND ANTISTATIC COMPOUNDS

11.5.7 DETERGENT ADDITIVES

11.5.8 FRAGRANCES AND PERFUMES

TABLE 46 MICROCAPSULE MARKET FOR TEXTILES INDUSTRY, BY REGION, 2016–2019 (USD MILLION)

TABLE 47 MICROCAPSULE MARKET FOR TEXTILES INDUSTRY, BY REGION, 2020–2026 (USD MILLION)

11.6 AGROCHEMICALS

11.6.1 INCREASING AWARENESS REGARDING ADVANTAGES OF MICROCAPSULES IN AGRICULTURE TO ACCELERATE MARKET GROWTH

TABLE 48 MICROCAPSULE MARKET FOR AGROCHEMICALS INDUSTRY, BY REGION, 2016–2019 (USD MILLION)

TABLE 49 MICROCAPSULE MARKET FOR AGROCHEMICALS INDUSTRY, BY REGION, 2020–2026 (USD MILLION)

11.7 OTHERS

TABLE 50 APPLICATIONS OF MICROENCAPSULATION IN CONSTRUCTION MATERIALS

TABLE 51 MICROCAPSULE MARKET FOR OTHER INDUSTRIES, BY REGION, 2016–2019 (USD MILLION)

TABLE 52 MICROCAPSULE MARKET FOR OTHER INDUSTRIES, BY REGION, 2020–2026 (USD MILLION)

12 MICROCAPSULE MARKET, BY SHELL MATERIAL (Page No. - 130)

12.1 INTRODUCTION

TABLE 53 SHELL MATERIALS USED IN MICROCAPSULES

FIGURE 33 MICROCAPSULE MARKET, BY SHELL MATERIAL, 2020 VS. 2026 (USD MILLION)

TABLE 54 MICROCAPSULE MARKET, BY SHELL MATERIAL, 2016–2019 (USD MILLION)

TABLE 55 MICROCAPSULE MARKET, BY SHELL MATERIAL, 2020–2026 (USD MILLION)

12.2 MELAMINE FORMALDEHYDE

12.2.1 WIDE APPLICATION AREAS OF MELAMINE FORMALDEHYDE BOOST MARKET GROWTH

TABLE 56 MICROCAPSULE MARKET FOR MELAMINE FORMALDEHYDE, BY REGION, 2016–2019 (USD MILLION)

TABLE 57 MICROCAPSULE MARKET FOR MELAMINE FORMALDEHYDE, BY REGION, 2020–2026 (USD MILLION)

12.3 CARBOHYDRATES

12.3.1 SIGNIFICANT ADOPTION OF CARBOHYDRATES AS SHELL MATERIAL OWING TO THEIR PROPERTIES SUCH AS BIOCOMPATIBILITY, SOLUBILITY, AND INNATE BIOACTIVITY FUELS MARKET GROWTH

TABLE 58 MICROCAPSULE MARKET FOR CARBOHYDRATES, BY REGION, 2016–2019 (USD MILLION)

TABLE 59 MICROCAPSULE MARKET FOR CARBOHYDRATES, BY REGION, 2020–2026 (USD MILLION)

12.4 GUMS & RESINS

12.4.1 HIGH DEMAND FOR MICROENCAPSULATED GUMS & RESINS FROM FUNCTIONAL FOOD INDUSTRY ACCELERATES MARKET GROWTH

TABLE 60 MICROCAPSULE MARKET FOR GUMS & RESINS, BY REGION, 2016–2019 (USD MILLION)

TABLE 61 MICROCAPSULE MARKET FOR GUMS & RESINS, BY REGION, 2020–2026 (USD MILLION)

12.5 OTHER POLYMERS

12.5.1 CONSIDERABLE ADOPTION OF POLYUREA/URETHANE AS SHELL MATERIAL AMONG ALL AVAILABLE OTHER POLYMERS DUE TO ITS VERSATILITY, LONGEVITY, AND STRENGTH CREATES MARKET OPPORTUNITIES

TABLE 62 MICROCAPSULE MARKET FOR OTHER POLYMERS, BY REGION, 2016–2019 (USD MILLION)

TABLE 63 MICROCAPSULE MARKET FOR OTHER POLYMERS, BY REGION, 2020–2026 (USD MILLION)

12.6 LIPIDS

12.6.1 STRENGTHENED USE OF EMULSIFIED LIPIDS IN MICROENCAPSULATION SUPPORTS GROWTH OF MARKET FOR LIPIDS AS SHELL MATERIALS

TABLE 64 MICROCAPSULE MARKET FOR LIPIDS, BY REGION, 2016–2019 (USD MILLION)

TABLE 65 MICROCAPSULE MARKET FOR LIPIDS, BY REGION, 2020–2026 (USD MILLION)

12.7 PROTEINS

12.7.1 INCREASED DEMAND FOR GELATIN-BASED MICROCAPSULES AND PROBIOTIC PRODUCTS TO ELEVATE GROWTH OF MARKET FOR PROTEINS AS SHELL MATERIALS

TABLE 66 MICROCAPSULE MARKET FOR PROTEINS, BY REGION, 2016–2019 (USD MILLION)

TABLE 67 MICROCAPSULE MARKET FOR PROTEINS, BY REGION, 2020–2026 (USD MILLION)

13 MICROCAPSULE MARKET, BY CORE MATERIAL (Page No. - 140)

13.1 INTRODUCTION

TABLE 68 MICROCAPSULE PROCESS AND APPLICABLE CORE MATERIAL AND ITS PARTICLE SIZE

FIGURE 34 MICROCAPSULE MARKET, BY CORE MATERIAL, 2021 VS. 2026 (USD MILLION)

TABLE 69 MICROCAPSULE MARKET, BY CORE MATERIAL, 2016–2019 (USD MILLION)

TABLE 70 MICROCAPSULE MARKET, BY CORE MATERIAL, 2020–2026 (USD MILLION)

13.2 PHARMACEUTICAL & HEALTHCARE DRUGS

13.2.1 GROWING DEMAND FOR MASKING BITTER FLAVOR OR NATURAL COLOR OF ORAL PHARMACEUTICAL & HEALTHCARE DRUGS TO BOOST MICROCAPSULE MARKET GROWTH

TABLE 71 POTENTIAL BENEFITS OF MICROCAPSULES IN NUTRACEUTICALS SECTOR

TABLE 72 MICROCAPSULE MARKET FOR PHARMACEUTICAL & HEALTHCARE DRUGS, BY REGION, 2016–2019 (USD MILLION)

TABLE 73 MICROCAPSULE MARKET FOR PHARMACEUTICAL & HEALTHCARE DRUGS, BY REGION, 2018–2025 (USD MILLION)

13.3 FOOD ADDITIVES

13.3.1 INCREASING USE OF ACIDULANTS, FLAVORING AND COLORING AGENTS, AND VITAMINS AND MINERALS AS CORE MATERIALS IN FORTIFIED FOODS TO STIMULATE MARKET FOR FOOD ADDITIVES

TABLE 74 MICROCAPSULE MARKET FOR FOOD ADDITIVES, BY REGION, 2016–2019 (USD MILLION)

TABLE 75 MICROCAPSULE MARKET FOR FOOD ADDITIVES, BY REGION, 2020–2026 (USD MILLION)

13.4 FRAGRANCES

13.4.1 LEADING POSITION OF NORTH AMERICA IN GLOBAL MICROCAPSULE MARKET FOR FRAGRANCES TO SUPPORT MARKET GROWTH IN COMING YEARS

TABLE 76 MICROCAPSULE MARKET FOR FRAGRANCES, BY REGION, 2016–2019 (USD MILLION)

TABLE 77 MICROCAPSULE MARKET FOR FRAGRANCES, BY REGION, 2020–2026 (USD MILLION)

13.5 AGRICULTURAL INPUTS

13.5.1 RISING FOCUS OF GROWERS ON MITIGATING ENVIRONMENTAL AND HEALTH RISKS BY USING AGRICULTURAL INPUTS AS CORE MATERIALS TO CREATE MARKET OPPORTUNITIES

TABLE 78 MICROCAPSULE MARKET FOR AGRICULTURAL INPUTS, BY REGION, 2016–2019 (USD MILLION)

TABLE 79 MICROCAPSULE MARKET FOR AGRICULTURAL INPUTS, BY REGION, 2020–2026 (USD MILLION)

13.6 PHASE CHANGE MATERIALS

13.6.1 SURGING ADOPTION OF PCM AS CORE MATERIALS IN TEXTILES AND CONSTRUCTION INDUSTRY TO PROPEL MARKET GROWTH

TABLE 80 MICROCAPSULE MARKET FOR PHASE CHANGE MATERIALS, BY REGION, 2016–2019 (USD MILLION)

TABLE 81 MICROCAPSULE MARKET FOR PHASE CHANGE MATERIALS, BY REGION, 2020–2026 (USD MILLION)

13.7 OTHERS

TABLE 82 MICROCAPSULE MARKET FOR OTHERS, BY REGION, 2016–2019 (USD MILLION)

TABLE 83 MICROCAPSULE MARKET FOR OTHERS, BY REGION, 2020–2026 (USD MILLION)

14 MICROCAPSULE MARKET, BY REGION (Page No. - 150)

14.1 INTRODUCTION

FIGURE 35 GLOBAL MICROCAPSULE MARKET, REGIONAL SNAPSHOT

TABLE 84 MICROCAPSULE MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 85 MICROCAPSULE MARKET, BY REGION, 2020–2026 (USD MILLION)

14.2 NORTH AMERICA

TABLE 86 NORTH AMERICA: MICROCAPSULE MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 87 NORTH AMERICA: MICROCAPSULE MARKET, BY COUNTRY, 2020–2026 (USD MILLION)

FIGURE 36 NORTH AMERICA: MICROCAPSULE MARKET SNAPSHOT

TABLE 88 NORTH AMERICA: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2016–2019 (USD MILLION)

TABLE 89 NORTH AMERICA: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2020–2026 (USD MILLION)

TABLE 90 NORTH AMERICA: MICROCAPSULE MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 91 NORTH AMERICA: MICROCAPSULE MARKET, BY TECHNOLOGY, 2020–2026 (USD MILLION)

TABLE 92 NORTH AMERICA: MICROCAPSULE MARKET, BY CORE MATERIAL, 2016–2019 (USD MILLION)

TABLE 93 NORTH AMERICA: MICROCAPSULE MARKET, BY CORE MATERIAL, 2020–2026 (USD MILLION)

TABLE 94 NORTH AMERICA: MICROCAPSULE MARKET, BY SHELL MATERIAL, 2016–2019 (USD MILLION)

TABLE 95 NORTH AMERICA: MICROCAPSULE MARKET, BY SHELL MATERIAL, 2020–2026 (USD MILLION)

14.2.1 US

14.2.1.1 Strategic acquisitions by and collaborations between market players to boost innovation in microencapsulation technology incorporated in food and beverage products

TABLE 96 US: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2016–2019 (USD MILLION)

TABLE 97 US: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2020–2026 (USD MILLION)

TABLE 98 US: MICROCAPSULE MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 99 US: MICROCAPSULE MARKET, BY TECHNOLOGY, 2020–2026 (USD MILLION)

14.2.2 CANADA

14.2.2.1 High demand for microcapsules in food & beverages industry in Canada driving market growth

TABLE 100 CANADA: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2016–2019 (USD MILLION)

TABLE 101 CANADA: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2020–2026 (USD MILLION)

TABLE 102 CANADA: MICROCAPSULE MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 103 CANADA: MICROCAPSULE MARKET, BY TECHNOLOGY, 2020–2026 (USD MILLION)

14.2.3 MEXICO

14.2.3.1 Robust growth expected in food and agrochemicals industries in coming years to spike demand for microcapsules

TABLE 104 MEXICO: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2016–2019 (USD MILLION)

TABLE 105 MEXICO: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2020–2026 (USD MILLION)

TABLE 106 MEXICO: MICROCAPSULE MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 107 MEXICO: MICROCAPSULE MARKET, BY TECHNOLOGY, 2020–2026 (USD MILLION)

14.3 ASIA PACIFIC

TABLE 108 ASIA PACIFIC: MICROCAPSULE MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 109 ASIA PACIFIC: MICROCAPSULE MARKET, BY COUNTRY, 2020–2026 (USD MILLION)

FIGURE 37 ASIA PACIFIC: MICROCAPSULE MARKET SNAPSHOT

TABLE 110 ASIA PACIFIC: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2016–2019 (USD MILLION)

TABLE 111 ASIA PACIFIC: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2020–2026 (USD MILLION)

TABLE 112 ASIA PACIFIC: MICROCAPSULE MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 113 ASIA PACIFIC: MICROCAPSULE MARKET, BY TECHNOLOGY, 2020–2026 (USD MILLION)

TABLE 114 ASIA PACIFIC: MICROCAPSULE MARKET, BY CORE MATERIAL, 2016–2019 (USD MILLION)

TABLE 115 ASIA PACIFIC: MICROCAPSULE MARKET, BY CORE MATERIAL, 2020–2026 (USD MILLION)

TABLE 116 ASIA PACIFIC: MICROCAPSULE MARKET, BY SHELL MATERIAL, 2016–2019 (USD MILLION)

TABLE 117 ASIA PACIFIC: MICROCAPSULE MARKET, BY SHELL MATERIAL, 2020–2026 (USD MILLION)

14.3.1 CHINA

14.3.1.1 Microcapsule market in China is particularly driven by pharmaceuticals and healthcare industry

TABLE 118 CHINA: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2016–2019 (USD MILLION)

TABLE 119 CHINA: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2020–2026 (USD MILLION)

TABLE 120 CHINA: MICROCAPSULE MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 121 CHINA: MICROCAPSULE MARKET, BY TECHNOLOGY, 2020–2026 (USD MILLION)

14.3.2 JAPAN

14.3.2.1 Food and household & personal care industries support microcapsule market growth in Japan

TABLE 122 JAPAN: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2016–2019 (USD MILLION)

TABLE 123 JAPAN: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2020–2026 (USD MILLION)

TABLE 124 JAPAN: MICROCAPSULE MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 125 JAPAN: MICROCAPSULE MARKET, BY TECHNOLOGY, 2020–2026 (USD MILLION)

14.3.3 SOUTH KOREA

14.3.3.1 Microcapsule market in South Korea is set to grow with bolstering demand for pharmaceuticals

TABLE 126 SOUTH KOREA: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2016–2019 (USD MILLION)

TABLE 127 SOUTH KOREA: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2020–2026 (USD MILLION)

TABLE 128 SOUTH KOREA: MICROCAPSULE MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 129 SOUTH KOREA: MICROCAPSULE MARKET, BY TECHNOLOGY, 2020–2026 (USD MILLION)

14.3.4 INDIA

14.3.4.1 Pharmaceuticals, food, and personal care industries to support market growth in India

TABLE 130 INDIA: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2016–2019 (USD MILLION)

TABLE 131 INDIA: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2020–2026 (USD MILLION)

TABLE 132 INDIA: MICROCAPSULE MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 133 INDIA: MICROCAPSULE MARKET, BY TECHNOLOGY, 2020–2026 (USD MILLION)

14.3.5 INDONESIA

14.3.5.1 Spray technologies accounted for largest share of microcapsule market in Indonesia in 2020

TABLE 134 INDONESIA: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2016–2019 (USD MILLION)

TABLE 135 INDONESIA: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2020–2026 (USD MILLION)

TABLE 136 INDONESIA: MICROCAPSULE MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 137 INDONESIA: MICROCAPSULE MARKET, BY TECHNOLOGY, 2020–2026 (USD MILLION)

14.3.6 MALAYSIA

14.3.6.1 Pharmaceuticals industry expected to spur demand for microcapsules in country

TABLE 138 MALAYSIA: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2016–2019 (USD MILLION)

TABLE 139 MALAYSIA: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2020–2026 (USD MILLION)

TABLE 140 MALAYSIA: MICROCAPSULE MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 141 MALAYSIA: MICROCAPSULE MARKET, BY TECHNOLOGY, 2020–2026 (USD MILLION)

14.3.7 REST OF ASIA PACIFIC

TABLE 142 REST OF ASIA PACIFIC: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2016–2019 (USD MILLION)

TABLE 143 REST OF ASIA PACIFIC: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2020–2026 (USD MILLION)

TABLE 144 REST OF ASIA PACIFIC: MICROCAPSULE MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 145 REST OF ASIA PACIFIC: MICROCAPSULE MARKET, BY TECHNOLOGY, 2020–2026 (USD MILLION)

14.4 EUROPE

TABLE 146 EUROPE: MICROCAPSULE MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 147 EUROPE: MICROCAPSULE MARKET, BY COUNTRY, 2020–2026 (USD MILLION)

FIGURE 38 EUROPE: MICROCAPSULE MARKET SNAPSHOT

TABLE 148 EUROPE: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2016–2019 (USD MILLION)

TABLE 149 EUROPE: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2020–2026 (USD MILLION)

TABLE 150 EUROPE: MICROCAPSULE MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 151 EUROPE: MICROCAPSULE MARKET, BY TECHNOLOGY, 2020–2026 (USD MILLION)

TABLE 152 EUROPE: MICROCAPSULE MARKET, BY CORE MATERIAL, 2016–2019 (USD MILLION)

TABLE 153 EUROPE: MICROCAPSULE MARKET, BY CORE MATERIAL, 2020–2026 (USD MILLION)

TABLE 154 EUROPE: MICROCAPSULE MARKET, BY SHELL MATERIAL, 2016–2019 (USD MILLION)

TABLE 155 EUROPE: MICROCAPSULE MARKET, BY SHELL MATERIAL, 2020–2026 (USD MILLION)

14.4.1 GERMANY

14.4.1.1 Increased demand for microcapsules from food industry to propel market growth

TABLE 156 GERMANY: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2016–2019 (USD MILLION)

TABLE 157 GERMANY: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2020–2026 (USD MILLION)

TABLE 158 GERMANY: MICROCAPSULE MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 159 GERMANY: MICROCAPSULE MARKET, BY TECHNOLOGY, 2020–2026 (USD MILLION)

14.4.2 UK

14.4.2.1 Escalated use of microcapsules in nutritional and pharmaceutical products to accelerate market growth in UK

TABLE 160 UK: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2016–2019 (USD MILLION)

TABLE 161 UK: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2020–2026 (USD MILLION)

TABLE 162 UK: MICROCAPSULE MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 163 UK: MICROCAPSULE MARKET, BY TECHNOLOGY, 2020–2026 (USD MILLION)

14.4.3 FRANCE

14.4.3.1 High adoption of microcapsules in food and agrochemical applications to stimulate market growth in coming years

TABLE 164 FRANCE: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2016–2019 (USD MILLION)

TABLE 165 FRANCE: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2020–2026 (USD MILLION)

TABLE 166 FRANCE: MICROCAPSULE MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 167 FRANCE: MICROCAPSULE MARKET, BY TECHNOLOGY, 2020–2026 (USD MILLION)

14.4.4 ITALY

14.4.4.1 Heightened need for pharmaceutical production to spur market growth in Italy

TABLE 168 ITALY: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2016–2019 (USD MILLION)

TABLE 169 ITALY: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2020–2026 (USD MILLION)

TABLE 170 ITALY: MICROCAPSULE MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 171 ITALY: MICROCAPSULE MARKET, BY TECHNOLOGY, 2020–2026 (USD MILLION)

14.4.5 SPAIN

14.4.5.1 Sustainable development of food-processing industry will encourage demand for microcapsules in Spain

TABLE 172 SPAIN: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2016–2019 (USD MILLION)

TABLE 173 SPAIN: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2020–2026 (USD MILLION)

TABLE 174 SPAIN: MICROCAPSULE MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 175 SPAIN: MICROCAPSULE MARKET, BY TECHNOLOGY, 2020–2026 (USD MILLION)

14.4.6 REST OF EUROPE

TABLE 176 REST OF EUROPE: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2016–2019 (USD MILLION)

TABLE 177 REST OF EUROPE: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2020–2026 (USD MILLION)

TABLE 178 REST OF EUROPE: MICROCAPSULE MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 179 REST OF EUROPE: MICROCAPSULE MARKET, BY TECHNOLOGY, 2020–2026 (USD MILLION)

14.5 MIDDLE EAST & AFRICA

TABLE 180 MIDDLE EAST & AFRICA: MICROCAPSULE MARKET, BY GEOGRAPHY, 2016–2019 (USD MILLION)

TABLE 181 MIDDLE EAST & AFRICA: MICROCAPSULE MARKET, BY GEOGRAPHY, 2020–2026 (USD MILLION)

TABLE 182 MIDDLE EAST & AFRICA: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2016–2019 (USD MILLION)

TABLE 183 MIDDLE EAST & AFRICA: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2020–2026 (USD MILLION)

TABLE 184 MIDDLE EAST & AFRICA: MICROCAPSULE MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 185 MIDDLE EAST & AFRICA: MICROCAPSULE MARKET, BY TECHNOLOGY, 2020–2026 (USD MILLION)

TABLE 186 MIDDLE EAST & AFRICA: MICROCAPSULE MARKET, BY CORE MATERIAL, 2016–2019 (USD MILLION)

TABLE 187 MIDDLE EAST & AFRICA: MICROCAPSULE MARKET, BY CORE MATERIAL, 2020–2026 (USD MILLION)

TABLE 188 MIDDLE EAST & AFRICA: MICROCAPSULE MARKET, BY SHELL MATERIAL, 2016–2019 (USD MILLION)

TABLE 189 MIDDLE EAST & AFRICA: MICROCAPSULE MARKET, BY SHELL MATERIAL, 2020–2026 (USD MILLION)

14.5.1 SAUDI ARABIA

14.5.1.1 Microcapsule market in Saudi Arabia majorly driven by growing aging population

TABLE 190 SAUDI ARABIA: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2016–2019 (USD MILLION)

TABLE 191 SAUDI ARABIA: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2020–2026 (USD MILLION)

TABLE 192 SAUDI ARABIA: MICROCAPSULE MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 193 SAUDI ARABIA: MICROCAPSULE MARKET, BY TECHNOLOGY, 2020–2026 (USD MILLION)

14.5.2 SOUTH AFRICA

14.5.2.1 Growing pharmaceuticals sector driving microcapsule market growth in country

TABLE 194 SOUTH AFRICA: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2016–2019 (USD MILLION)

TABLE 195 SOUTH AFRICA: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2020–2026 (USD MILLION)

TABLE 196 SOUTH AFRICA: MICROCAPSULE MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 197 SOUTH AFRICA: MICROCAPSULE MARKET, BY TECHNOLOGY, 2020–2026 (USD MILLION)

14.5.3 REST OF MIDDLE EAST & AFRICA

TABLE 198 REST OF MIDDLE EAST & AFRICA: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2016–2019 (USD MILLION)

TABLE 199 REST OF MIDDLE EAST & AFRICA: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2020–2026 (USD MILLION)

TABLE 200 REST OF MIDDLE EAST & AFRICA: MICROCAPSULE MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 201 REST OF MIDDLE EAST & AFRICA: MICROCAPSULE MARKET, BY TECHNOLOGY, 2020–2026 (USD MILLION)

14.6 SOUTH AMERICA

TABLE 202 SOUTH AMERICA: MICROCAPSULE MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 203 SOUTH AMERICA: MICROCAPSULE MARKET, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 204 SOUTH AMERICA: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2016–2019 (USD MILLION)

TABLE 205 SOUTH AMERICA: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2020–2026 (USD MILLION)

TABLE 206 SOUTH AMERICA: MICROCAPSULE MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 207 SOUTH AMERICA: MICROCAPSULE MARKET, BY TECHNOLOGY, 2020–2026 (USD MILLION)

TABLE 208 SOUTH AMERICA: MICROCAPSULE MARKET, BY CORE MATERIAL, 2016–2019 (USD MILLION)

TABLE 209 SOUTH AMERICA: MICROCAPSULE MARKET, BY CORE MATERIAL, 2020–2026 (USD MILLION)

TABLE 210 SOUTH AMERICA: MICROCAPSULE MARKET, BY SHELL MATERIAL, 2016–2019 (USD MILLION)

TABLE 211 SOUTH AMERICA: MICROCAPSULE MARKET, BY SHELL MATERIAL, 2020–2026 (USD MILLION)

14.6.1 BRAZIL

14.6.1.1 Expansion of microcapsule companies in Brazil presents market growth opportunities

TABLE 212 BRAZIL: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2016–2019 (USD MILLION)

TABLE 213 BRAZIL: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2020–2026 (USD MILLION)

TABLE 214 BRAZIL: MICROCAPSULE MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 215 BRAZIL: MICROCAPSULE MARKET, BY TECHNOLOGY, 2020–2026 (USD MILLION)

14.6.2 ARGENTINA

14.6.2.1 Growth of food industries boosts demand for microcapsules in Argentina

TABLE 216 ARGENTINA: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2016–2019 (USD MILLION)

TABLE 217 ARGENTINA: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2020–2026 (USD MILLION)

TABLE 218 ARGENTINA: MICROCAPSULE MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 219 ARGENTINA: MICROCAPSULE MARKET, BY TECHNOLOGY, 2020–2026 (USD MILLION)

14.6.3 REST OF SOUTH AMERICA

TABLE 220 REST OF SOUTH AMERICA: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2016–2019 (USD MILLION)

TABLE 221 REST OF SOUTH AMERICA: MICROCAPSULE MARKET, BY END-USER INDUSTRY, 2020–2026 (USD MILLION)

TABLE 222 REST OF SOUTH AMERICA: MICROCAPSULE MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 223 REST OF SOUTH AMERICA: MICROCAPSULE MARKET, BY TECHNOLOGY, 2020–2026 (USD MILLION)

15 COMPETITIVE LANDSCAPE (Page No. - 212)

15.1 KEY PLAYERS’ STRATEGIES

TABLE 224 OVERVIEW OF KEY STRATEGIES ADOPTED BY TOP PLAYERS, 2018–2020

15.2 MARKET EVALUATION FRAMEWORK

FIGURE 39 MICROCAPSULE MARKET EVALUATION FRAMEWORK FOR ALL PLAYERS, 2018–2020

15.3 MARKET SHARE ANALYSIS

FIGURE 40 MARKET SHARE ANALYSIS OF TOP 5 PLAYERS VS. OTHER PLAYERS IN MICROCAPSULE MARKET

TABLE 225 MICROCAPSULE MARKET: END-USER INDUSTRY FOOTPRINT

TABLE 226 MICROCAPSULE MARKET: COMPANY REGIONAL FOOTPRINT

15.4 COMPANY EVALUATION MATRIX (TIER 1)

15.4.1 TERMINOLOGY/NOMENCLATURE

15.4.1.1 Star

15.4.1.2 Emerging leader

15.4.1.3 Pervasive

15.4.1.4 Participant

FIGURE 41 COMPANY EVALUATION MATRIX FOR MICROCAPSULE MARKET (TIER 1)

15.5 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 42 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN MICROCAPSULE MARKET

15.6 BUSINESS STRATEGY EXCELLENCE

FIGURE 43 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN MICROCAPSULE MARKET

15.7 SME MATRIX, 2020

15.7.1 PROGRESSIVE COMPANY

15.7.2 RESPONSIVE COMPANY

15.7.3 STARTING BLOCK

15.7.4 DYNAMIC COMPANY

FIGURE 44 MICROCAPSULE MARKET: EMERGING COMPANIES COMPETITIVE LEADERSHIP MAPPING, 2020

15.8 COMPETITIVE SITUATIONS AND TRENDS

15.8.1 PRODUCT LAUNCHES

TABLE 227 MICROCAPSULE MARKET: PRODUCT LAUNCHES, JANUARY 2018 TO DECEMBER 2020

15.8.2 DEALS

TABLE 228 MICROCAPSULE MARKET: DEALS, JANUARY 2018 TO DECEMBER 2020

15.8.3 OTHER DEVELOPMENTS

TABLE 229 MICROCAPSULE MARKET: EXPANSIONS, INVESTMENTS, AND INNOVATIONS, JANUARY 2018 TO DECEMBER 2020

16 COMPANY PROFILES (Page No. - 235)

(Business overview, Products offered, Recent developments, Impacts of COVID-19 & MnM View)*

16.1 MAJOR COMPANIES

16.1.1 BASF SE

FIGURE 45 BASF SE: COMPANY SNAPSHOT

TABLE 230 BASF SE: BUSINESS OVERVIEW

16.1.2 INTERNATIONAL FLAVORS & FRAGRANCES

FIGURE 46 INTERNATIONAL FLAVORS & FRAGRANCES: COMPANY SNAPSHOT

TABLE 231 INTERNATIONAL FLAVORS & FRAGRANCES: BUSINESS OVERVIEW

16.1.3 KONINKLIJKE DSM N.V.

FIGURE 47 KONINKLIJKE DSM N.V.: COMPANY SNAPSHOT

TABLE 232 KONINKLIJKE DSM N.V.: BUSINESS OVERVIEW

16.1.4 SYMRISE AG

FIGURE 48 SYMRISE AG: COMPANY SNAPSHOT

TABLE 233 SYMRISE AG: BUSINESS OVERVIEW

16.1.5 GIVAUDAN S.A.

FIGURE 49 GIVAUDAN S.A.: COMPANY SNAPSHOT

TABLE 234 GIVAUDAN S.A.: BUSINESS OVERVIEW

16.1.6 ROYAL FRIESLANDCAMPINA N.V.

FIGURE 50 ROYAL FRIESLANDCAMPINA N.V.: COMPANY SNAPSHOT

TABLE 235 ROYAL FRIESLANDCAMPINA N.V.: BUSINESS OVERVIEW

16.1.7 SYNGENTA CROP PROTECTION AG

FIGURE 51 SYNGENTA CROP PROTECTION AG: COMPANY SNAPSHOT

TABLE 236 SYNGENTA CROP PROTECTION AG: BUSINESS OVERVIEW

16.1.8 SENSIENT TECHNOLOGIES CORPORATION

FIGURE 52 SENSIENT TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

TABLE 237 SENSIENT TECHNOLOGIES CORPORATION: BUSINESS OVERVIEW

16.1.9 LYCORED CORP.

TABLE 238 LYCORED CORP.: BUSINESS OVERVIEW

16.1.10 KOEHLER INNOVATIVE SOLUTIONS

TABLE 239 KOEHLER INNOVATIVE SOLUTIONS: BUSINESS OVERVIEW

16.1.11 BALCHEM CORPORATION

FIGURE 53 BALCHEM CORPORATION: COMPANY SNAPSHOT

TABLE 240 BALCHEM CORPORATION: BUSINESS OVERVIEW

16.1.12 CAPSULÆ SAS

TABLE 241 CAPSULÆ SAS: BUSINESS OVERVIEW

16.1.13 TASTETECH LTD.

TABLE 242 TASTETECH LTD.: BUSINESS OVERVIEW

16.1.14 MICROCAPSULES TECHNOLOGIES (MCT)

TABLE 243 MICROCAPSULES TECHNOLOGIES (MCT): BUSINESS OVERVIEW

16.1.15 INSILICO CO. LTD.

TABLE 244 INSILICO CO. LTD.: BUSINESS OVERVIEW

16.1.16 MATSUMOTO YUSHI SEIYAKU CO., LTD.

FIGURE 54 MATSUMOTO YUSHI SEIYAKU CO., LTD.: COMPANY SNAPSHOT

TABLE 245 MATSUMOTO YUSHI SEIYAKU CO., LTD.: BUSINESS OVERVIEW

16.1.17 ENCAPSYS

TABLE 246 ENCAPSYS: BUSINESS OVERVIEW

16.1.18 ARCADE BEAUTY

TABLE 247 ARCADE BEAUTY: BUSINESS OVERVIEW

16.1.19 REED PACIFIC

TABLE 248 REED PACIFIC: BUSINESS OVERVIEW

16.1.20 FIRMENICH SA

TABLE 249 FIRMENICH SA: BUSINESS OVERVIEW

*Details on Business overview, Products offered, Recent developments, Impacts of COVID-19 & MnM View might not be captured in case of unlisted companies.

16.2 ADDITIONAL PLAYERS

16.2.1 RONALD T. DODGE COMPANY

TABLE 250 RONALD T. DODGE COMPANY: BUSINESS OVERVIEW

16.2.2 MICROTEK LABORATORIES, INC.

TABLE 251 MICROTEK LABORATORIES, INC.: BUSINESS OVERVIEW

16.2.3 INNOBIO

TABLE 252 INNOBIO: BUSINESS OVERVIEW

16.2.4 GAT MICROENCAPSULATION GMBH

TABLE 253 GAT MICROENCAPSULATION GMBH: BUSINESS OVERVIEW

16.2.5 BRACE GMBH

TABLE 254 BRACE GMBH: BUSINESS OVERVIEW

16.2.6 TAGRA BIOTECHNOLOGIES LTD.

TABLE 255 TAGRA BIOTECHNOLOGIES LTD.: BUSINESS OVERVIEW

17 APPENDIX (Page No. - 301)

17.1 DISCUSSION GUIDE

17.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

17.3 AVAILABLE CUSTOMIZATIONS

17.4 RELATED REPORTS

17.5 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the microcapsule market. Exhaustive secondary research was done to collect information on the market, peer markets, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the microcapsule value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this study include Hoovers, Bloomberg, BusinessWeek, and Dun & Bradstreet, were referred for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles by recognized authors, authenticated directories, and databases. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by primary research.

Primary Research

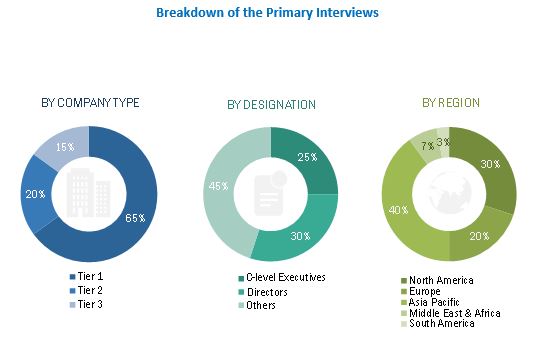

The microcapsule market comprises several stakeholders, such as raw material suppliers, manufacturers, distributors, service providers, and regulatory organizations in the supply chain.

As part of the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report on the microcapsule market. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the microcapsule market. Primary sources from the demand side included directors, marketing heads, and purchase managers from various end-use industries.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

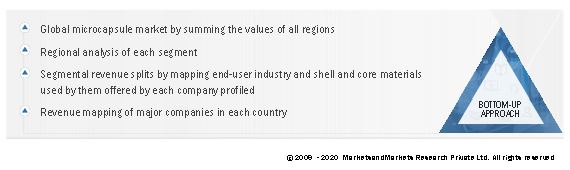

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the microcapsule market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the microcapsule market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Global microcapsule market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition to this, the market size was validated using both top-down and bottom-up approaches.

Report Objectives

Market Intelligence

- To determine and project the size of the microcapsule market with respect to shell material, core material, end-user industry, technology, and region, over five years, from 2021 to 2026

- To identify attractive opportunities in the market by determining the largest and the fastest-growing segments across key regions

- To project the size of the market segments, in terms of value, with respect to five regions: Asia Pacific, North America, Europe, the Middle East & Africa, and South America

- To provide detailed information regarding the crucial factors influencing the growth of the market (drivers, opportunities, and challenges)

- To analyze competitive developments, such as expansions, acquisitions, product launches, investments, partnerships, joint ventures, mergers, collaborations, agreements, and divestments in the microcapsule market

- To analyze the demand-side factors based on the impact of macroeconomic and microeconomic factors on different segments of the market across different regions

Competitive Intelligence

- To identify and profile key players in the microcapsule market

- To determine the market share of key players operating in the market

- To provide a comparative analysis of market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- To understand the competitive landscape of the market and identify key growth strategies adopted by the leading players across key regions

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Further country-level breakdown of the Rest of Europe into Denmark and Poland in the microcapsule market

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Microcapsule Market