Phase Change Materials Market

Phase Change Materials Market by Type (Organic PCM, Inorganic PCM, Eutectic PCM), Application (Building & Construction, HVAC, Cold Chain & Packaging, Thermal Energy Storage, Refrigeration & Equipment, Textiles, Electronics, Other Applications), and Region - Global Forecasts to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

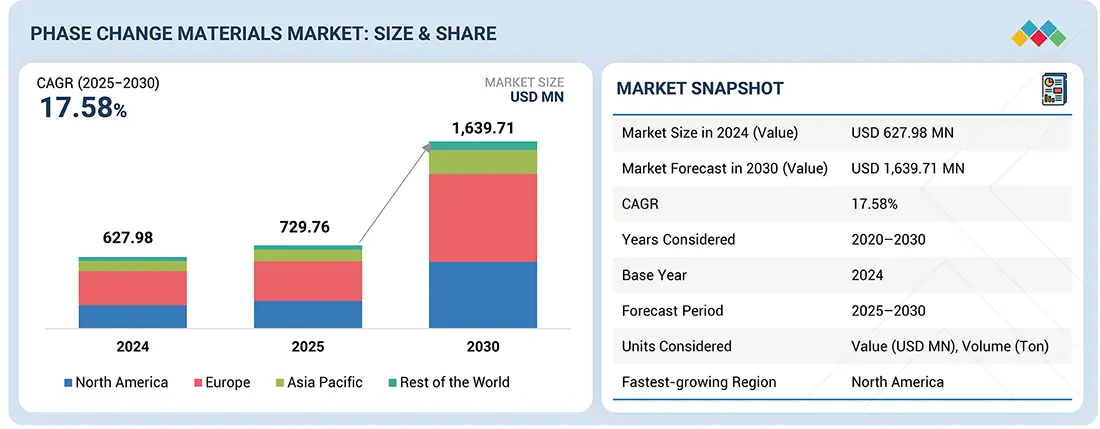

The phase change materials market is projected to reach USD 1,639.71 million by 2030 from the estimated USD 729.76 million in 2025, at a CAGR of 17.58% from 2025 to 2030. The growth of the phase change materials market is driven by the rising demand for energy-efficient solutions in buildings, packaging, and electronics. Increasing focus on sustainability, temperature control, and renewable energy integration further supports their widespread adoption across industrial and commercial applications.

KEY TAKEAWAYS

-

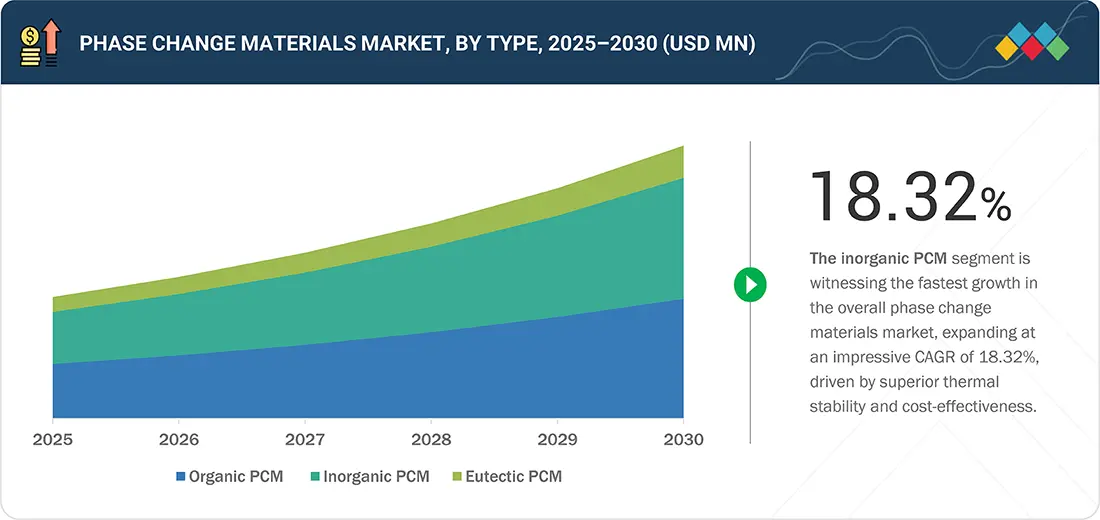

BY TYPEThe market for the inorganic phase change materials segment is expected to register a CAGR of 18.32% during the forecast period. Compared to their organic counterparts, inorganic phase change materials (PCMs) have better conductivity and thermal stability, which makes them perfect for industrial settings. These materials are inexpensive, non-flammable, have high latent heat values, and good thermal conductivity. Demand is being driven by a growing emphasis on thermal management and waste heat recovery across a variety of sectors. Inorganic PCMs are being promoted as environmentally sustainable solutions . Energy-efficient inorganic PCM solutions are being increasingly used in the textile, electronics, and construction sectors.

-

BY APPLICATIONThe cold chain & packaging application segment is projected to register the highest CAGR of 20.65% in the phase change materials market during the forecast period. The need for temperature-controlled logistics in the food, pharmaceutical, and biotechnology industries to guarantee product quality and safety is the main factor driving this growth. PCM adoption has been further accelerated by the growth of e-commerce deliveries of temperature-sensitive goods, the expansion of worldwide vaccine distribution, and the increase in perishable food consumption. In order to effectively maintain the necessary temperature ranges while using less energy, PCMs are being utilized in thermal packaging systems and refrigerated transportation. Government programs encouraging effective cold chain infrastructure and the move toward sustainable, non-refrigerant-based cooling solutions are also contributing to the robust market growth of this sector.

-

BY REGIONNorth America is witnessing the highest growth rate in the global phase change materials (PCM) market. Energy-efficient building solutions are a major focus in the region, and PCMs are being incorporated more and more into walls, insulation, and HVAC systems to lower energy use and adhere to strict environmental standards. Additionally, the use of PCM in temperature-controlled packaging and transportation has increased as a result of the growth of cold chain logistics, especially for pharmaceuticals, perishable foods, and biotechnology products. As PCMs aid in the management of heat in batteries and electronic components, the existence of the advanced electronics and automotive industries further increases demand. Technological developments in PCM encapsulation and materials, along with government incentives supporting sustainable energy management, are anticipated to maintain rapid growth throughout North America.

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including partnerships and investments. Cold Chain Technologies, LLC, a leading provider of thermal packaging solutions for the transportation of temperature-sensitive products for the life sciences industry, and Cellbox Solutions GmbH, a leading provider of live cell logistics solutions for research, development, and shipment of cell-based therapies and cellular diagnostics, have announced a collaboration to jointly expand the use of Cellbox solutions in the US.

The phase change materials (PCM) market includes materials that maintain temperature stability in a variety of applications, including electronics, cold chain logistics, building insulation, and textiles, by absorbing, storing, and releasing thermal energy during phase transitions. These materials lessen reliance on traditional heating or cooling systems and improve energy efficiency. This market is growing rapidly due to strict environmental regulations, growing awareness of sustainable energy management, and technological developments in material development and encapsulation. The PCM market is expected to witness significant growth in the global industrial and commercial sectors due to the growing use of smart buildings and renewable energy storage.

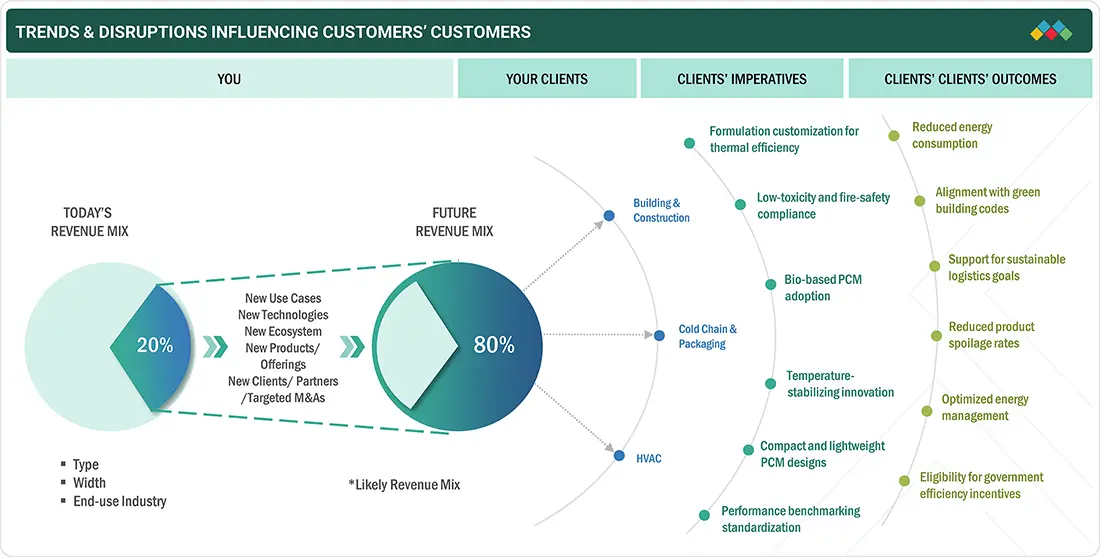

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The megatrends, including digital transformation and sustainability, will impact a company's revenue stream. The emerging trends and technologies in the industry include the development of bio-based phase change materials, advanced encapsulation techniques, smart sensor-integrated thermal systems, and AI-driven energy management platforms. The phase change materials market is expected to witness significant growth during the forecast period due to the increasing demand from applications such as building & construction, cold chain & packaging, HVAC, and others.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Regulations for reduction of greenhouse gas emissions

-

Use of phase change materials for temperature control and greater comfort

Level

-

Lack of awareness of benefits of phase change materials

-

Flammability and corrosiveness restricting usage of phase change materials

Level

-

Rise in need for cold chain logistics

-

R&D initiatives for enhanced phase change material efficiency

Level

-

High cost of switching from conventional materials

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Regulations for reduction of greenhouse gas emissions

Climate change and global warming are major environmental issues. By 2025, the European Union wants to cut greenhouse gas emissions by 20–25%, and up to 40% by 2030. New environmentally friendly technologies are needed to accomplish this goal. It is anticipated that the use of phase change materials will reduce the need for heaters and coolers, which will in turn reduce the demand for electricity. Businesses may be able to receive 10–20 times as many carbon credits by utilizing phase change materials in HVAC and building applications as opposed to other environmentally friendly insulating materials. To reduce emissions that are having an increasing negative impact on the atmosphere, strict regulations have been put in place. The Kyoto Protocol classifies nations and imposes carbon emission targets on them. It was ratified by 191 nations (all UN members except Andorra, Canada, South Sudan, and the US) in 1997 and went into effect in 2005. In its Fourth US Climate Action Report (USCAR) to the UNFCCC, the US detailed its efforts to cut greenhouse gas emissions. Carbon emission reduction regulations, like the UK's CRC Energy Efficiency Scheme, have made it mandatory for both public and private non-energy-intensive organizations to lower their carbon emissions.

Restraint: Lack of awareness of benefits of phase change materials

The major problem faced by the phase change material industry is the lack of awareness regarding the benefits of using phase change materials and their products. Companies marketing phase change materials are trying to increase awareness of their products and their advantages. The government also plays an important role in increasing awareness about phase change materials through regulations and subsidies. The advantages of using phase change materials, such as energy-saving and low greenhouse gas emissions, can compel governments to encourage and enforce their use, resulting in increased demand for phase change materials. Indirect regulations and policies in a few countries, such as China and Australia, are also creating awareness of phase change materials as the alternative for reducing energy consumption, greenhouse gases, and operating costs. For example, implementing carbon emission reduction regulations such as the CRC Energy Efficiency Scheme in the UK has made it mandatory for non-energy-intensive organizations in the public and private sectors to reduce carbon emissions.

Opportunity: Rise in need for cold chain logistics

The global phase change materials (PCM) market offers substantial growth prospects, because of the growing demand for effective cold chain logistics. The use of PCMs in thermal packaging and refrigerated transportation is being driven by the growing demand for temperature-sensitive products, including biotechnology goods, pharmaceuticals, vaccines, and perishable foods. PCMs are a crucial part of contemporary cold chains because they offer dependable temperature control, lower energy usage, and stop spoiling during storage and transportation. Furthermore, the need for sustainable, economical, and energy-efficient solutions has increased due to the growth of e-commerce and global supply chains. PCMs are positioned as a key technology in this trend, supporting global cold chain operations that are safe, effective, and scalable.

Challenge: High cost of switching from conventional materials

The high cost of moving away from conventional materials is a significant obstacle for the global phase change materials (PCM) market. A large upfront investment in material procurement, system redesign, and integration technologies is necessary when implementing PCMs in buildings, packaging, or cold chain systems. Due to lower initial costs, many end users still rely on conventional insulation, refrigeration, or thermal storage solutions. Furthermore, it can be costly to manufacture advanced PCMs with precise thermal properties, and additional infrastructure modifications might be necessary for large-scale deployment. Despite the long-term energy savings and efficiency benefits provided by PCM technologies, this cost barrier hinders market penetration, particularly in price-sensitive regions.

Phase Change Materials Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Battery thermal management systems in electric vehicles using PCMs to regulate lithium-ion battery temperatures during operation | Prevents overheating, extends battery life, improves performance, enhances safety, maintains optimal operating temperatures without additional energy consumption |

|

Pharmaceutical cold chain logistics for vaccine storage and transportation requiring precise temperature control throughout distribution networks | Maintains vaccine efficacy, ensures product integrity, reduces spoilage, enables temperature-stable shipping, protects sensitive biologics reliably worldwide |

|

Performance athletic apparel and footwear incorporating PCM technology for thermal regulation in extreme weather conditions and sports | Regulates body temperature, enhances athlete comfort, improves performance, provides passive cooling/heating, eliminates power requirements for temperature control |

|

Automotive cabin climate control and battery thermal management in electric and hybrid vehicles for enhanced passenger comfort | Reduces energy consumption, improves cabin comfort, extends vehicle range, provides efficient temperature regulation, enhances overall driving experience |

|

Outdoor clothing and gear with PCM-integrated fabrics for temperature regulation in extreme outdoor and adventure activities | Maintains wearer comfort, adapts to temperature changes, reduces layering needs, provides lightweight thermal protection, enhances outdoor performance |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

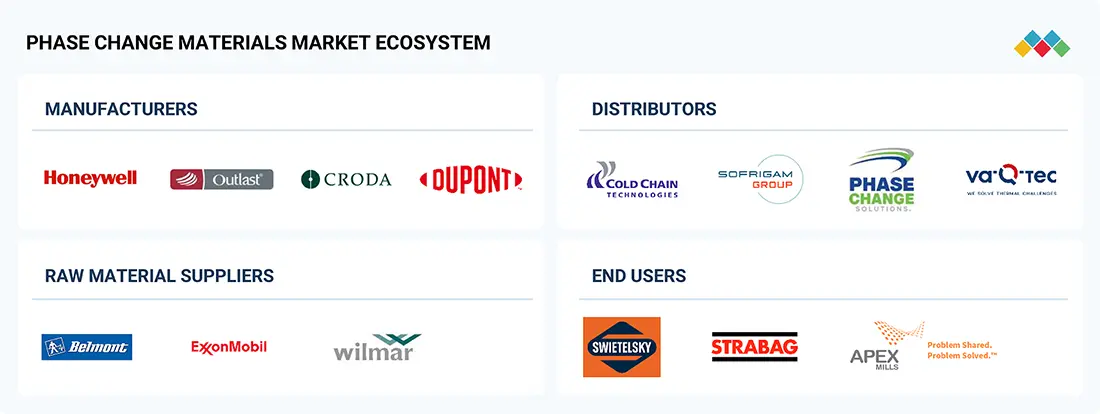

MARKET ECOSYSTEM

The phase change materials ecosystem includes companies manufacturing phase change materials in various types, such as organic PCM, inorganic PCM, and eutectic PCM. These are produced by companies such as Honeywell International Inc. (US), DuPont de Nemours, Inc. (US), Croda International Plc (UK), Boyd Corporation (US), Sasol Limited (South Africa), Outlast Technologies LLC (US), Climator Sweden AB (Sweden), Rubitherm Technologies GmbH (Germany), PureTemp LLC (US), and Phase Change Solutions (US).

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Phase Change Materials Market, By Type

The organic phase change materials segment account for the largest share of the overall market due to its extensive uses, broad availability, and adaptable qualities. These materials, which are mostly paraffin and fatty acids, are perfect for building insulation, thermal energy storage, textiles, and electronics cooling as they have consistent melting and solidification points, chemical stability, and non-corrosive behavior. Adoption is further increased by their simplicity of encapsulation and compatibility with a range of packaging and building materials. ICompared to some inorganic alternatives, organic PCMs are typically non-toxic, safer for end users, and more environmentally friendly. The demand for organic PCMs has been further bolstered by the increased emphasis on cold chain logistics, energy-efficient building designs, and sustainable energy solutions, which has allowed them to hold the largest market share worldwide.

Phase Change Materials Market, By Application

The building & construction application holds the second-largest share in the global phase change materials (PCM) market. The market in this segment is driven by the increasing emphasis on sustainable and energy-efficient building solutions. In order to absorb, store, and release thermal energy and lower the need for heating and cooling, PCMs are frequently incorporated into roofing materials, walls, ceilings, and floors. This reduces energy use and utility expenses, enhances occupant comfort, and helps maintain consistent indoor temperatures. PCM integration in the construction industry is further fueled by the growing acceptance of green building standards, government incentives for energy-efficient constructions, and growing awareness of lowering carbon footprints. Additionally, developers and architects can now more easily implement these solutions at scale, thanks to advancements in PCM encapsulation and compatibility with traditional building materials, which has sustained the market's robust growth.

REGION

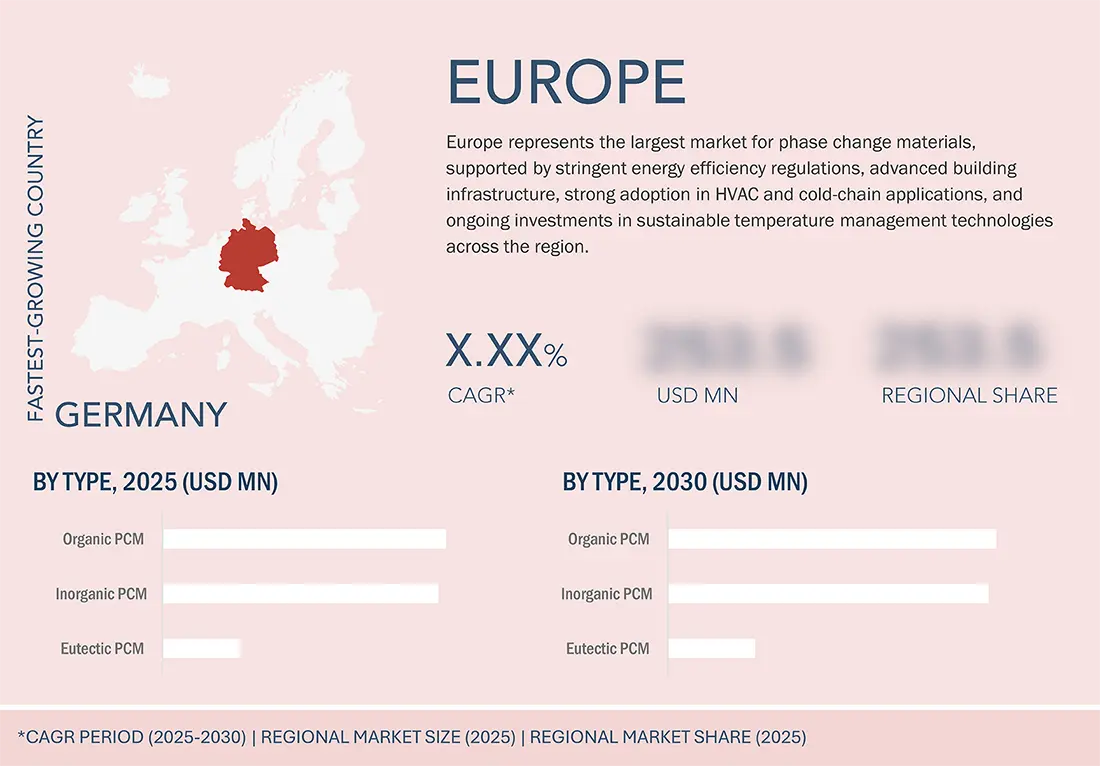

Europe to be largest region in global phase change materials market during forecast period

Strong regulatory frameworks, strict energy efficiency standards, and sophisticated infrastructure have taken Europe to the top of the global phase change materials (PCM) market. In order to save energy and preserve temperature stability, PCMs have been widely used in electronics, HVAC systems, cold chain logistics, and building insulation int he region. The use of PCM has been further increased by government programs encouraging the integration of renewable energy sources and sustainable building practices. The use of PCMs in residential, commercial, and industrial applications is also encouraged by Europe's emphasis on lowering carbon emissions and improving green building certifications. The existence of well-known PCM producers and ongoing R&D expenditures in encapsulation and material innovation further solidify Europe's dominant position in the global market, maintaining rapid expansion and uptake.

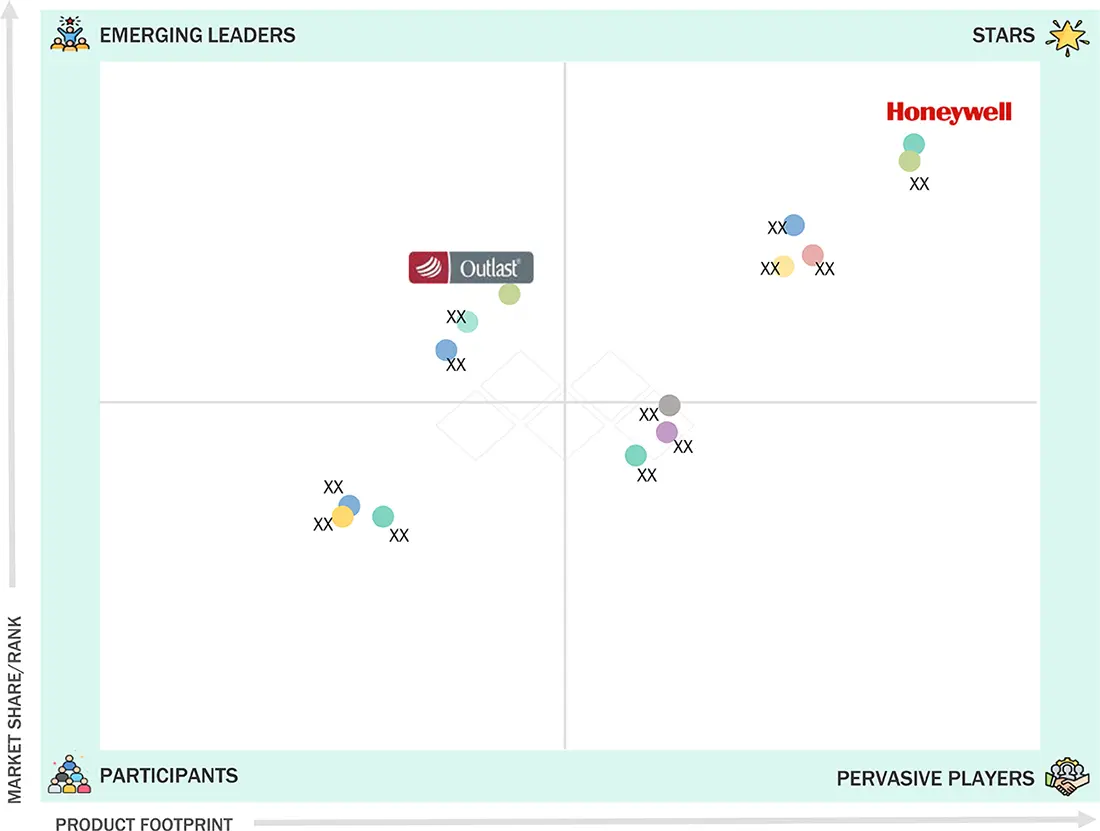

Phase Change Materials Market: COMPANY EVALUATION MATRIX

In the phase change materials market, Honeywell International Inc. (Star) leads with a strong market share and extensive product footprint, which enables it to serve the most regions in the world. Outlast Technologies LLC (Emerging Leader) is gaining visibility with its solutions in the phase change materials market, maintain its position through innovation and niche product offerings. While Honeywell International Inc. dominates through scale and a diverse portfolio, Outlast Technologies LLC shows significant potential to move toward the leaders’ quadrant as demand for phase change materials is rising continuously.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 627.98 Million |

| Market Forecast in 2030 (Value) | USD 1,639.71 Million |

| Growth Rate | CAGR of 17.58% from 2025-2030 |

| Years Considered | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Ton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Rest of the World |

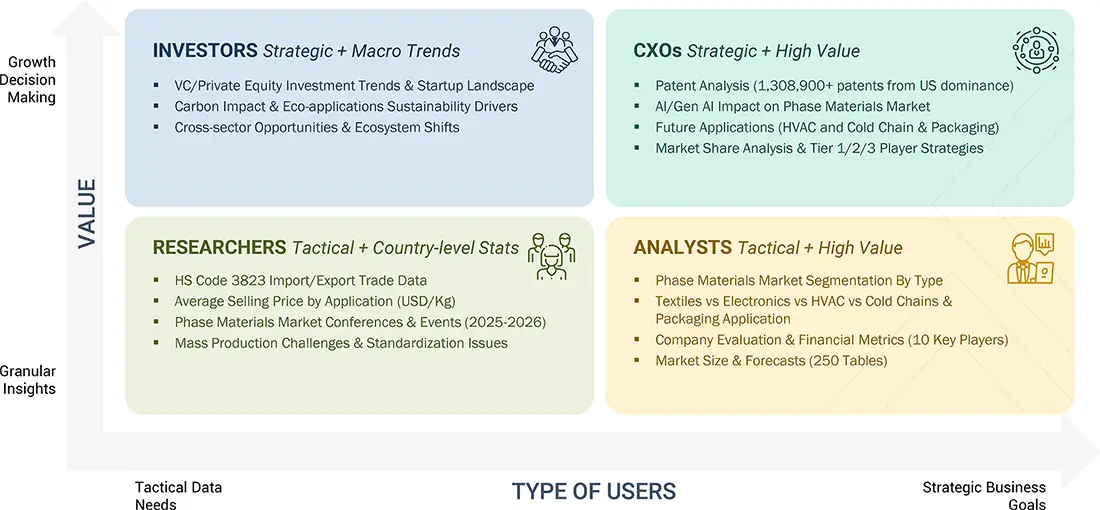

WHAT IS IN IT FOR YOU: Phase Change Materials Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Asia Pacific-based Phase Change Material Manufacturer |

|

|

| Europe-based Phase Change Material Manufacturer |

|

|

RECENT DEVELOPMENTS

- March 2024 : Cold Chain Technologies, LLC, a leading provider of thermal packaging solutions for the transportation of temperature-sensitive products for the life sciences industry, and Cellbox Solutions GmbH, a leading provider of live cell logistics solutions for research, development, and shipment of cell-based therapies and cellular diagnostics, have announced a collaboration to jointly expand the use of Cellbox solutions in the US.

- March 2021 : Cold Chain Technologies announced its expansion in Europe and the Middle East & African regions by opening new regional headquarters in the Netherlands.

- March 2021 : DuPont De Nemours, Inc. signed an agreement to acquire the performance materials segment of Laird Plc. This acquisition will strengthen the company’s market position and expand its global reach in the phase change materials market.

Table of Contents

Methodology

The study involved four major activities in estimating the size of the phase change materials market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to complete the overall market size estimation process. After that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

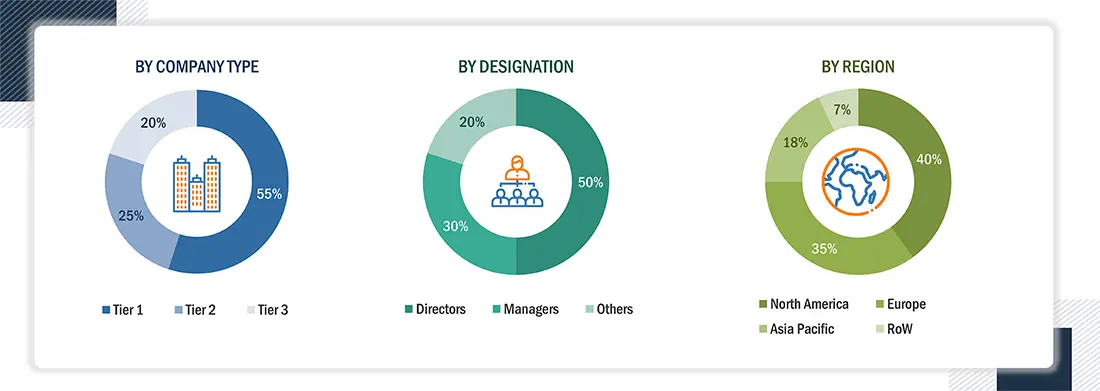

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold-standard and silver-standard websites, such as Factiva, ICIS, Bloomberg, and others. The findings of this study were verified through primary research, which involved conducting extensive interviews with key officials, including CEOs, VPs, directors, and other executives. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Primary Research

The phase change materials market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. Primary research from the demand side includes key opinion leaders in various end-use industries of phase change materials. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Notes: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2023/2024 available

in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Honeywell International Inc. |

Senior Manager |

|

Croda International Plc |

Innovation Manager |

|

Microtek Laboratories Inc. |

Vice President |

|

Sasol Limited |

Production Supervisor |

|

PureTemp LLC |

Sales Manager |

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the phase change materials market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Phase Change Materials Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size using the market size estimation processes explained above, the market was divided into several segments and subsegments. To complete the overall market engineering process and determine the exact statistics for each market segment and subsegment, data triangulation and market breakdown procedures were employed, as applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the phase change materials industry.

Market Definition

According to the Phase Change Material Industry Association (PCMIA), “Phase change materials are compounds that absorb, store, and release a large amount of heat at a relatively constant temperature by changing their physical state. When a phase change material freezes, it releases a large amount of energy as latent heat, whereas when such material melts, it absorbs a large amount of heat from the environment.” Heat stored in the materials is called latent heat, due to which, phase change materials are also known as latent heat storage materials. Phase change materials absorb and release heat by liquefying and solidifying at set temperatures. The natural latent heat property of phase change materials helps maintain a structure’s temperature and prevent sudden external changes. Fluctuations in ambient temperature recharge advanced phase change materials, making them suitable for everyday applications.

Stakeholders

- Phase change material manufacturers

- Phase change material distributors

- Raw material suppliers

- Government and research organizations

- Investment banks and private equity firms

Report Objectives

- To analyze and forecast the size of the global phase change materials market in terms of value and volume

- To provide detailed information about the important drivers, restraints, challenges, and opportunities influencing the market growth

- To define, describe, and segment the market based on type, application, and region

- To forecast the size of the market segments based on regions such as Asia Pacific, North America, Europe, and the Rest of the World

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contributions to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To analyze competitive developments such as expansions, partnerships & collaborations, mergers & acquisitions, agreements, and product launches in the market

- To strategically profile the key companies and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Phase Change Materials Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Phase Change Materials Market

SURESH

Apr, 2015

Irrelevant.

Ian

Apr, 2014

Phase change material market report.

Ian

Apr, 2014

Phase Change Material Market Report.

Eanest

Aug, 2014

General information on BIO Based PCM.

Yarlagadda

Feb, 2015

Specific interest on major suppliers of encapsulated organic phase change material in South East Asia.

Natalia

Mar, 2018

Information on the global market of the products and a description. .

Ann

Apr, 2015

flexible polyurethane foam market by Application.

BIJOY

Feb, 2014

Specific information on Phase Change Material market for automotive industry.

amadeo

Dec, 2014

Directory of global PCM manufacturers, including, key contacts data leading players and 2nd tier players..

ONKAR

Nov, 2015

Market information PCM materials for the thermal energy storage.

wisam

Sep, 2022

Do you have a phase change material (beeswax)?what is the price?And what are the specifications?I want to use it to cool photovoltaic panels.I want to mix it with glycerol, what do you think?.

yasuhiro

Aug, 2015

Phase Change Material (PCM) Market .

Maria

May, 2019

Specific information on the Phase Change Materials Market in food packaging applications.

shankar

May, 2014

Sample document for Phase Change Material Market Report.

Muhamad

Apr, 2015

Interested in Engine Controls market.

umesh

Mar, 2014

General information on fabrics market and current market trends.

Meruyert

Mar, 2019

Interested in PCM reports.

David

Feb, 2017

Interested to be listed in the Company Profiles section of the specific report.