Microplate Systems Market by Product (Microplate Reader (Multi-mode, Single-mode), Microplate Washer, Microplate Accessories), Application (Drug Discovery, Clinical Diagnostics) & End User (Hospital and Diagnostic Laboratories) - Global Forecast to 2026

Updated on : April 27, 2023

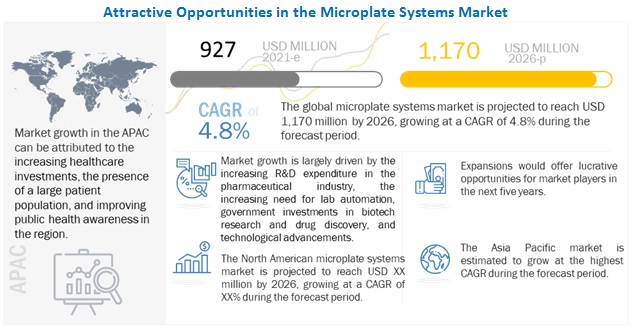

The global microplate systems market in terms of revenue was estimated to be worth $927 million by 2021 and is poised to reach $1,170 million by 2026, growing at a CAGR of 4.8% from 2021 to 2026. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. Growth of the market is driven mainly by the increasing R&D expenditure in the pharmaceutical industry, increasing focus on miniaturization, and the growing prevalence of diseases.

To know about the assumptions considered for the study, Request for Free Sample Report

Microplate Systems Market Dynamics

DRIVER: Increasing R&D expenditure in the biopharmaceutical company

The pharmaceutical and biotechnology industries are among the major end users in the microplate systems market. Microplate systems find high use in modern drug discovery and development activities and genomic & proteomic research, as they increase the test speed and accuracy, thus saving time and enabling researchers to focus on core tasks. Consequently, the increasing pace of R&D in the pharmaceutical industry—as evidenced by the rising expenditure in this area—can be taken as a key growth driver for the market.

According to PhRMA, the R&D expenditure of PhRMA member companies in the US increased from ~USD 26.0 billion in 2000 to USD 58.8 billion in 2015. In Europe, the pharmaceutical R&D expenditure increased from USD 16.5 billion (EUR 17.8 billion) in 2000 to USD 45.6 billion (EUR 37.5 billion) in 2019 (Source: EFPIA).

OPPORTUNITY: Growth in the pharmaceutical and biotechnology industries

In the last decade, the number of pharma companies has grown significantly, especially in the emerging markets. As of 2019, there are 1,131 publicly listed pharmaceutical and biotech companies across the Asia Pacific, indicating a significant presence of local as well as international players in the region.

According to the Pharmaceutical Research and Manufacturers Association (PhRMA), US firms conduct a majority of the world’s R&D in pharmaceuticals and hold the intellectual property rights to most new medicines. In addition, the biopharmaceutical industry has developed over 5,000 new medicines around the world, with ~3,400 compounds currently being studied in the US—more than in any other region around the world.

CHALLENGE: Survival of small players and new entrants

The survival of small players and new entrants in the microplate systems market is a significant challenge. Huge investments are required for the R&D and launch of innovative products in the market. Thus, to remain competitive in the market, companies have to invest heavily. Moreover, market players have to reduce operational costs to successfully survive in the market, which is very difficult for small players and new entrants.

The microplate reader segment of microplate systems market is expected to grow at the highest CAGR during the forecast period

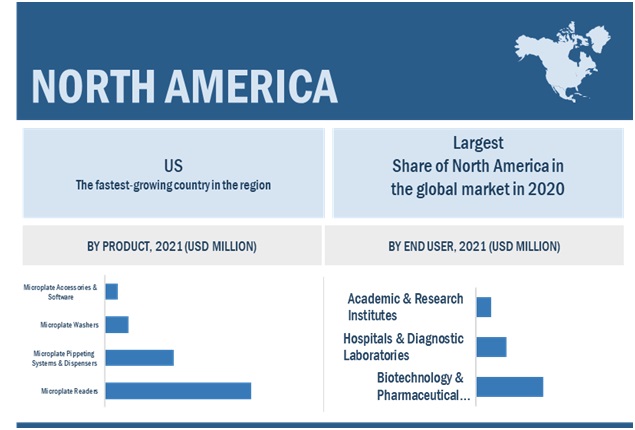

Based on the product, the market is segmented into microplate readers, microplate pipetting systems and dispensers, microplate washers, and microplate accessories & software. The consumables segment is projected to witness the highest growth during the forecast period. The increasing prevalence of diseases, the growing focus on drug discovery, and the rising R&D expenditure by pharmaceutical companies the major factors supporting the growth of this segment.

The application segment accounted for the largest share of the microplate systems market

By application, the market is segmented drug discovery, clinical diagnostics, genomics and proteomics research, and other applications. The drug discovery segment accounted for the largest market share in 2020. The large share of this segment can be attributed to The need for high-/ultra-high-throughput screening and reduced time-to-market for drugs.

Biotechnology and pharmaceutical companies for the largest share of the microplate systems market

Based on end-users, the market is segmented into biotechnology & pharmaceutical companies, hospitals & diagnostic laboratories, and academic & research institutes. The biotechnology and pharmaceutical segment accounted for the largest share of the microplate systems market in 2020. Increasing government support in the form of funding for biotech and pharma research are the major driving factor for this market.

North America accounted for the largest share of the microplate systems market

Based on the region, the market is segmented into North America, Europe, Asia Pacific, and the Rest of the World (RoW). In 2020, North America accounted for the largest share of the microplate systems market. The large share of North America can be attributed to factors such as government initiatives for cell-based research, the increasing acceptance of personalized medicine, increasing academic and government investments in diagnostic research, and increasing focus on drug discovery and development.

To know about the assumptions considered for the study, download the pdf brochure

Some of the major players operating in this market are Danaher Corporation (US), Agilent Technologies Inc. (US), Thermo Fisher Scientific Inc.(US). In 2020, Danaher Corporation held the leading position in the market. The company has a strong geographic presence across North America, Europe, and the Asia Pacific. Moreover, the company’s strong brand recognition and comprehensive product portfolio in the microplate systems market is its key strength. Agilent Technologies Inc.(US) held the second position in the microplate systems market in 2020.

Microplate Systems Market Report Scope

|

Report Metric |

Details |

|

Market Revenue in 2021 |

$927 million |

|

Projected Revenue by 2026 |

$1,170 million |

|

Revenue Rate |

Poised to grow at a CAGR of 4.8% |

|

Market Driver |

Increasing R&D expenditure in the biopharmaceutical company |

|

Market Opportunity |

Growth in the pharmaceutical and biotechnology industries |

This research report categorizes the microplate systems market to forecast revenue and analyze trends in each of the following submarkets:

By Product

-

Microplate Readers

-

Multi-mode Microplate Readers

- Filter-based Readers

- Monochromator-based Readers

- Hybrid Readers

-

Single-Mode Microplate Readers

- Fluorescence Plate Readers

- Absorbance Plate Readers

- Luminescence Plate Readers

-

Multi-mode Microplate Readers

- Microplate Pipetting Systems and Dispensers

- Microplate Washers

- Microplate Accessories & Software

By Application

- Drug Discovery

- Clinical Diagnostics

- Genomics and Proteomics Research

- Other Applications

By End User

- Biotechnology & Pharmaceutical Companies

- Hospitals & Diagnostic Laboratories

- Academic & Research Institutes

By Region

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Poland

- Portugal

- Hungary

- Czech Republic

- Finland

- Norway

- Sweden

- RoE

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Singapore

- RoAPAC

-

Rest of the World

- Latin America

- Middle East and Africa

Recent Developments:

- In 2020, Agilent Technologies Inc. launched the BenchCel Microplate Handler

- In 2019, Agilent Technologies Inc. acquired BioTek Instruments to strengthen its product portfolio

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global microplate systems market?

The global microplate systems market boasts a total revenue value of $1,170 million by 2026.

What is the estimated growth rate (CAGR) of the global microplate systems market?

The global market for microplate systems has an estimated compound annual growth rate (CAGR) of 4.8% and a revenue size in the region of $927 million in 2021.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 39)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS OF THE STUDY

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 MARKET STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 43)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 2 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

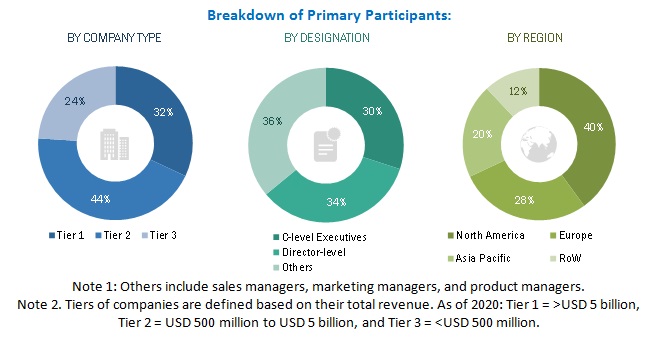

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 4 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

FIGURE 5 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

2.5 RISK ASSESSMENT/FACTOR ANALYSIS

TABLE 1 RISK ASSESSMENT

2.6 COVID-19 HEALTH ASSESSMENT

2.7 COVID-19 ECONOMIC ASSESSMENT

2.8 ASSESSMENT OF THE IMPACT OF COVID-19 ON THE ECONOMIC SCENARIO

3 EXECUTIVE SUMMARY (Page No. - 57)

FIGURE 3 MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2021 VS. 2026 (USD MILLION)

FIGURE 4 MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2021 VS. 2026 (USD MILLION)

FIGURE 5 MICROPLATE SYSTEMS MARKET, BY END USER, 2021 VS. 2026 (USD MILLION)

FIGURE 6 MICROPLATE SYSTEMS MARKET, BY REGION, 2021 VS. 2026 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 60)

4.1 MICROPLATE SYSTEMS MARKET OVERVIEW

FIGURE 7 INCREASING R&D EXPENDITURE IN THE PHARMACEUTICAL INDUSTRY TO DRIVE MARKET GROWTH DURING THE FORECAST PERIOD

4.2 MICROPLATE SYSTEMS MARKET, BY APPLICATION

FIGURE 8 DRUG DISCOVERY APPLICATION SEGMENT ACCOUNTED FOR THE LARGEST MARKET SHARE IN 2020

4.3 NORTH AMERICA: MICROPLATE SYSTEMS MARKET, BY PRODUCT AND COUNTRY, 2020

FIGURE 9 US DOMINATED THE NORTH AMERICAN MICROPLATE SYSTEMS MARKET IN 2020

4.4 GEOGRAPHICAL SNAPSHOT OF THE MICROPLATE SYSTEMS MARKET

FIGURE 10 CHINA TO REGISTER THE HIGHEST GROWTH DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 63)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 11 MICROPLATE SYSTEMS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing R&D expenditure in the biopharmaceutical industry

TABLE 2 R&D EXPENDITURE OF MAJOR BIOPHARMACEUTICAL COMPANIES, 2019 VS. 2020

5.2.1.2 Increasing focus on miniaturization

5.2.1.3 Growing focus on personalized medicine

FIGURE 12 RISING NUMBER OF PERSONALIZED MEDICINES, 2008–2020

5.2.1.4 Growing prevalence of diseases

5.2.2 RESTRAINTS

5.2.2.1 High cost of microplate systems

5.2.3 OPPORTUNITIES

5.2.3.1 Use of microplate readers for virus detection

5.2.3.2 Growth in the pharmaceutical and biotechnology industries

5.2.3.3 Potential for microplate systems in emerging countries

5.2.4 CHALLENGES

5.2.4.1 Survival of small players and new entrants

5.2.5 TRENDS

5.2.5.1 Rental agreements

5.3 COVID-19 IMPACT ANALYSIS

5.4 RANGES/SCENARIOS

5.4.1 MICROPLATE SYSTEMS MARKET

FIGURE 13 THE FOLLOWING SCENARIOS HAVE BEEN ASSESSED FOR THE MICROPLATE SYSTEMS MARKET

5.5 VALUE CHAIN ANALYSIS

FIGURE 14 MAJOR VALUE IS ADDED DURING THE MANUFACTURING & ASSEMBLY PHASES

5.6 SUPPLY CHAIN ANALYSIS

FIGURE 15 DISTRIBUTION—A STRATEGY PREFERRED BY PROMINENT COMPANIES

5.7 PORTER’S FIVE FORCES ANALYSIS

5.7.1 THREAT FROM NEW ENTRANTS

5.7.2 INTENSITY OF COMPETITIVE RIVALRY

5.7.3 BARGAINING POWER OF BUYERS

5.7.4 BARGAINING POWER OF SUPPLIERS

5.7.5 THREAT FROM SUBSTITUTES

5.8 TECHNOLOGY ANALYSIS

5.9 REGULATORY LANDSCAPE

FIGURE 16 510(K) APPROVAL PROCESS

5.10 PATENT ANALYSIS

5.11 TRADE ANALYSIS

5.11.1 TRADE ANALYSIS FOR MICROPLATE WASHERS

TABLE 3 IMPORT DATA FOR MICROPLATE WASHERS, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 4 EXPORT DATA FOR MICROPLATE WASHERS, BY COUNTRY, 2016–2020 (USD MILLION)

5.12 PRICING ANALYSIS

TABLE 5 PRICES OF MICROPLATE PRODUCTS

5.13 ECOSYSTEM ANALYSIS

5.13.1 ROLE IN ECOSYSTEM

5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.14.1 REVENUE SHIFT & REVENUE POCKETS FOR MICROPLATE SYSTEMS MANUFACTURERS

5.14.2 REVENUE SHIFT FOR MICROPLATE SYSTEMS

6 MICROPLATE SYSTEMS MARKET, BY PRODUCT (Page No. - 78)

6.1 INTRODUCTION

TABLE 6 MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 7 MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2020–2026 (USD MILLION)

6.2 MICROPLATE READERS

TABLE 8 MICROPLATE READERS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 9 MICROPLATE READERS MARKET, BY TYPE, 2020–2026 (USD MILLION)

6.2.1 MULTI-MODE MICROPLATE READERS

TABLE 10 MULTI-MODE MICROPLATE READERS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 11 MULTI-MODE MICROPLATE READERS MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 12 MULTI-MODE MICROPLATE READERS MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 13 MULTI-MODE MICROPLATE READERS MARKET, BY REGION, 2020–2026 (USD MILLION)

6.2.1.1 Filter-based readers

6.2.1.1.1 Filter-based readers are less expensive and more sensitive than monochromator-based microplate readers—a key factor driving market growth

TABLE 14 FILTER-BASED READERS MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 15 FILTER-BASED READERS MARKET, BY REGION, 2020–2026 (USD MILLION)

6.2.1.2 Monochromator-based readers

6.2.1.2.1 Advantages of monochromator-based readers to drive market growth

TABLE 16 MONOCHROMATOR-BASED READERS MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 17 MONOCHROMATOR-BASED READERS MARKET, BY REGION, 2020–2026 (USD MILLION)

6.2.1.3 Hybrid readers

6.2.1.3.1 Hybrid readers bring high flexibility, sensitivity, and convenience to laboratories—key factors supporting market growth

TABLE 18 HYBRID READERS MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 19 HYBRID READERS MARKET, BY REGION, 2020–2026 (USD MILLION)

6.2.2 SINGLE-MODE MICROPLATE READERS

TABLE 20 SINGLE-MODE MICROPLATE READERS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 21 SINGLE-MODE MICROPLATE READERS MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 22 SINGLE-MODE MICROPLATE READERS MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 23 SINGLE-MODE MICROPLATE READERS MARKET, BY REGION, 2020–2026 (USD MILLION)

6.2.2.1 Fluorescence plate readers

6.2.2.1.1 Better sensitivity and application range of fluorescence readers to drive market growth

TABLE 24 FLUORESCENCE PLATE READERS MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 25 FLUORESCENCE PLATE READERS MARKET, BY REGION, 2020–2026 (USD MILLION)

6.2.2.2 Absorbance plate readers

6.2.2.2.1 Absorbance readers help researchers gather data on the biological or chemical features of the test substance—a key factor driving market growth

TABLE 26 ABSORBANCE PLATE READERS MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 27 ABSORBANCE PLATE READERS MARKET, BY REGION, 2020–2026 (USD MILLION)

6.2.2.3 Luminescence plate readers

6.2.2.3.1 Highly efficient conversion of chemical energy to light makes luminescent readers a popular choice

TABLE 28 LUMINESCENCE PLATE READERS MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 29 LUMINESCENCE PLATE READERS MARKET, BY REGION, 2020–2026 (USD MILLION)

6.3 MICROPLATE PIPETTING SYSTEMS AND DISPENSERS

6.3.1 GROWING ADOPTION OF HIGH-THROUGHPUT SCREENING TO DRIVE MARKET GROWTH

TABLE 30 MICROPLATE PIPETTING SYSTEMS AND DISPENSERS MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 31 MICROPLATE PIPETTING SYSTEMS AND DISPENSERS MARKET, BY REGION, 2020–2026 (USD MILLION)

6.4 MICROPLATE WASHERS

6.4.1 TECHNOLOGICAL ADVANCEMENTS IN MICROPLATE WASHERS WILL SUPPORT MARKET GROWTH IN THE COMING YEARS

TABLE 32 MICROPLATE WASHERS MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 33 MICROPLATE WASHERS MARKET, BY REGION, 2020–2026 (USD MILLION)

6.5 MICROPLATE ACCESSORIES & SOFTWARE

6.5.1 MICROPLATE ACCESSORIES & SOFTWARE ACCOUNT FOR THE SMALLEST SHARE OF THE MICROPLATE SYSTEMS MARKET

TABLE 34 MICROPLATE ACCESSORIES & SOFTWARE MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 35 MICROPLATE ACCESSORIES & SOFTWARE MARKET, BY REGION, 2020–2026 (USD MILLION)

7 MICROPLATE SYSTEMS MARKET, BY APPLICATION (Page No. - 93)

7.1 INTRODUCTION

TABLE 36 MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 37 MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

7.2 DRUG DISCOVERY

7.2.1 INCREASING DEMAND FOR NEW AND ADVANCED DRUGS TO BOOST THE PACE OF DRUG DISCOVERY AND RESEARCH AND INCREASE THE ADOPTION OF MICROPLATE SYSTEMS

FIGURE 17 NUMBER OF CLINICAL STUDIES REGISTERED, 2011–2021 (MILLION)

TABLE 38 MICROPLATE SYSTEMS MARKET FOR DRUG DISCOVERY APPLICATIONS, BY REGION, 2017–2019 (USD MILLION)

TABLE 39 MICROPLATE SYSTEMS MARKET FOR DRUG DISCOVERY APPLICATIONS, BY REGION, 2020–2026 (USD MILLION)

7.3 CLINICAL DIAGNOSTICS

7.3.1 INCREASING INCIDENCE OF INFECTIOUS AND CHRONIC DISEASES TO DRIVE MARKET GROWTH

TABLE 40 GLOBAL INCIDENCE OF INFECTIOUS DISEASES

TABLE 41 MICROPLATE SYSTEMS MARKET FOR CLINICAL DIAGNOSTIC APPLICATIONS, BY REGION, 2017–2019 (USD MILLION)

TABLE 42 MICROPLATE SYSTEMS MARKET FOR CLINICAL DIAGNOSTIC APPLICATIONS, BY REGION, 2020–2026 (USD MILLION)

7.4 GENOMICS AND PROTEOMICS RESEARCH

7.4.1 INCREASING GENOMICS AND PROTEOMICS RESEARCH ACTIVITIES TO DRIVE GROWTH IN THIS APPLICATION SEGMENT

TABLE 43 MICROPLATE SYSTEMS MARKET FOR GENOMICS AND PROTEOMICS RESEARCH, BY REGION, 2017–2019 (USD MILLION)

TABLE 44 MICROPLATE SYSTEMS MARKET FOR GENOMICS AND PROTEOMICS RESEARCH, BY REGION, 2020–2026 (USD MILLION)

7.5 OTHER APPLICATIONS

TABLE 45 MICROPLATE SYSTEMS MARKET FOR OTHER APPLICATIONS, BY REGION, 2017–2019 (USD MILLION)

TABLE 46 MICROPLATE SYSTEMS MARKET FOR OTHER APPLICATIONS, BY REGION, 2020–2026 (USD MILLION)

8 MICROPLATE SYSTEMS MARKET, BY END USER (Page No. - 102)

8.1 INTRODUCTION

TABLE 47 MICROPLATE SYSTEMS MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 48 MICROPLATE SYSTEMS MARKET, BY END USER, 2020–2026 (USD MILLION)

8.2 BIOTECHNOLOGY & PHARMACEUTICAL COMPANIES

8.2.1 HIGH DEMAND FOR MICROPLATE SYSTEMS AMONG BIOTECHNOLOGY & PHARMACEUTICAL COMPANIES TO DRIVE MARKET GROWTH

FIGURE 18 GLOBAL R&D EXPENDITURE (PHARMA COMPANY MEMBER), 2001–2019 (USD BILLION)

TABLE 49 BIOTECHNOLOGY COMPANIES THAT RECEIVED NIH GRANTS IN 2020 (USD THOUSAND)

TABLE 50 MICROPLATE SYSTEMS MARKET FOR BIOTECHNOLOGY & PHARMACEUTICAL COMPANIES, BY REGION, 2017–2019 (USD MILLION)

TABLE 51 MICROPLATE SYSTEMS MARKET FOR BIOTECHNOLOGY & PHARMACEUTICAL COMPANIES, BY REGION, 2020–2026 (USD MILLION)

8.3 HOSPITALS & DIAGNOSTIC LABORATORIES

8.3.1 RISING INCIDENCE OF DISEASES TO DRIVE GROWTH IN THIS END-USER SEGMENT

TABLE 52 MICROPLATE SYSTEMS MARKET FOR HOSPITALS & DIAGNOSTIC LABORATORIES, BY REGION, 2017–2019 (USD MILLION)

TABLE 53 MICROPLATE SYSTEMS MARKET FOR HOSPITALS & DIAGNOSTIC LABORATORIES, BY REGION, 2020–2026 (USD MILLION)

8.4 ACADEMIC & RESEARCH INSTITUTES

8.4.1 INCREASING LIFE SCIENCE-BASED RESEARCH TO DRIVE THE GROWTH OF THIS SEGMENT

TABLE 54 MICROPLATE SYSTEMS MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY REGION, 2017–2019 (USD MILLION)

TABLE 55 MICROPLATE SYSTEMS MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY REGION, 2020–2026 (USD MILLION)

9 MICROPLATE SYSTEMS MARKET, BY REGION (Page No. - 109)

9.1 INTRODUCTION

TABLE 56 MICROPLATE SYSTEMS MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 57 MICROPLATE SYSTEMS MARKET, BY REGION, 2020–2026 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 19 NORTH AMERICA: MICROPLATE SYSTEMS MARKET SNAPSHOT

TABLE 58 NORTH AMERICA: MICROPLATE SYSTEMS MARKET, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 59 NORTH AMERICA: MICROPLATE SYSTEMS MARKET, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 60 NORTH AMERICA: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 61 NORTH AMERICA: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2020–2026 (USD MILLION)

TABLE 62 NORTH AMERICA: MICROPLATE READERS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 63 NORTH AMERICA: MICROPLATE READERS MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 64 NORTH AMERICA: MULTI-MODE MICROPLATE READERS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 65 NORTH AMERICA: MULTI-MODE MICROPLATE READERS MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 66 NORTH AMERICA: SINGLE-MODE MICROPLATE READERS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 67 NORTH AMERICA: SINGLE-MODE MICROPLATE READERS MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 68 NORTH AMERICA: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 69 NORTH AMERICA: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 70 NORTH AMERICA: MICROPLATE SYSTEMS MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 71 NORTH AMERICA: MICROPLATE SYSTEMS MARKET, BY END USER, 2020–2026 (USD MILLION)

9.2.1 US

9.2.1.1 Increasing funding for medical research is one of the major factors driving the growth of the microplate systems market in the US

TABLE 72 US: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 73 US: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2020–2026 (USD MILLION)

TABLE 74 US: MICROPLATE READERS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 75 US: MICROPLATE READERS MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 76 US: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 77 US: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 78 US: MICROPLATE SYSTEMS MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 79 US: MICROPLATE SYSTEMS MARKET, BY END USER, 2020–2026 (USD MILLION)

9.2.2 CANADA

9.2.2.1 High prevalence of cancer in Canada to support market growth

TABLE 80 CANADA: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 81 CANADA: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2020–2026 (USD MILLION)

TABLE 82 CANADA: MICROPLATE READERS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 83 CANADA: MICROPLATE READERS MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 84 CANADA: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 85 CANADA: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 86 CANADA: MICROPLATE SYSTEMS MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 87 CANADA: MICROPLATE SYSTEMS MARKET, BY END USER, 2020–2026 (USD MILLION)

9.3 EUROPE

TABLE 88 EUROPE: MICROPLATE SYSTEMS MARKET, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 89 EUROPE: MICROPLATE SYSTEMS MARKET, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 90 EUROPE: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 91 EUROPE: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2020–2026 (USD MILLION)

TABLE 92 EUROPE: MICROPLATE READERS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 93 EUROPE: MICROPLATE READERS MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 94 EUROPE: MULTI-MODE MICROPLATE READERS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 95 EUROPE: MULTI-MODE MICROPLATE READERS MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 96 EUROPE: SINGLE-MODE MICROPLATE READERS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 97 EUROPE: SINGLE-MODE MICROPLATE READERS MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 98 EUROPE: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 99 EUROPE: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 100 EUROPE: MICROPLATE SYSTEMS MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 101 EUROPE: MICROPLATE SYSTEMS MARKET, BY END USER, 2020–2026 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Increasing number of research activities focused on developing novel methods for cancer diagnosis to drive market growth

TABLE 102 GERMANY: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 103 GERMANY: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2020–2026 (USD MILLION)

TABLE 104 GERMANY: MICROPLATE READERS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 105 GERMANY: MICROPLATE READERS MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 106 GERMANY: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 107 GERMANY: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 108 GERMANY: MICROPLATE SYSTEMS MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 109 GERMANY: MICROPLATE SYSTEMS MARKET, BY END USER, 2020–2026 (USD MILLION)

9.3.2 UK

9.3.2.1 Government investments in the biotech industry to strengthen cell therapy manufacturing have resulted in the adoption of microplate products in the country

TABLE 110 UK: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 111 UK: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2020–2026 (USD MILLION)

TABLE 112 UK: MICROPLATE READERS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 113 UK: MICROPLATE READERS MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 114 UK: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 115 UK: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 116 UK: MICROPLATE SYSTEMS MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 117 UK: MICROPLATE SYSTEMS MARKET, BY END USER, 2020–2026 (USD MILLION)

9.3.3 FRANCE

9.3.3.1 Increasing investments in infrastructure development for R&D to support market growth in France

TABLE 118 FRANCE: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 119 FRANCE: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2020–2026 (USD MILLION)

TABLE 120 FRANCE: MICROPLATE READERS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 121 FRANCE: MICROPLATE READERS MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 122 FRANCE: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 123 FRANCE: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 124 FRANCE: MICROPLATE SYSTEMS MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 125 FRANCE: MICROPLATE SYSTEMS MARKET, BY END USER, 2020–2026 (USD MILLION)

9.3.4 ITALY

9.3.4.1 Increasing demand for technologically advanced instruments in research and diagnostic applications to support market growth in Italy

TABLE 126 ITALY: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 127 ITALY: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2020–2026 (USD MILLION)

TABLE 128 ITALY: MICROPLATE READERS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 129 ITALY: MICROPLATE READERS MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 130 ITALY: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 131 ITALY: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 132 ITALY: MICROPLATE SYSTEMS MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 133 ITALY: MICROPLATE SYSTEMS MARKET, BY END USER, 2020–2026 (USD MILLION)

9.3.5 SPAIN

9.3.5.1 Growth in the personalized medicine sector is driving research in the country, which is expected to support the growth of dependent industries such as microplate systems

TABLE 134 SPAIN: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 135 SPAIN: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2020–2026 (USD MILLION)

TABLE 136 SPAIN: MICROPLATE READERS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 137 SPAIN: MICROPLATE READERS MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 138 SPAIN: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 139 SPAIN: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 140 SPAIN: MICROPLATE SYSTEMS MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 141 SPAIN: MICROPLATE SYSTEMS MARKET, BY END USER, 2020–2026 (USD MILLION)

9.3.6 PORTUGAL

9.3.6.1 Growing demand for better disease management to drive market growth in Portugal

TABLE 142 PORTUGAL: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 143 PORTUGAL: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2020–2026 (USD MILLION)

TABLE 144 PORTUGAL: MICROPLATE READERS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 145 PORTUGAL: MICROPLATE READERS MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 146 PORTUGAL: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 147 PORTUGAL: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 148 PORTUGAL: MICROPLATE SYSTEMS MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 149 PORTUGAL: MICROPLATE SYSTEMS MARKET, BY END USER, 2020–2026 (USD MILLION)

9.3.7 POLAND

9.3.7.1 Growing demand for microplate systems for life science research and drug discovery to drive market growth in Poland

TABLE 150 POLAND: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 151 POLAND: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2020–2026 (USD MILLION)

TABLE 152 POLAND: MICROPLATE READERS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 153 POLAND: MICROPLATE READERS MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 154 POLAND: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 155 POLAND: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 156 POLAND: MICROPLATE SYSTEMS MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 157 POLAND: MICROPLATE SYSTEMS MARKET, BY END USER, 2020–2026 (USD MILLION)

9.3.8 CZECH REPUBLIC

9.3.8.1 Capability scale-up initiatives undertaken by prominent service providers to drive market growth in the country

TABLE 158 CZECH REPUBLIC: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 159 CZECH REPUBLIC: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2020–2026 (USD MILLION)

TABLE 160 CZECH REPUBLIC: MICROPLATE READERS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 161 CZECH REPUBLIC: MICROPLATE READERS MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 162 CZECH REPUBLIC: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 163 CZECH REPUBLIC: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 164 CZECH REPUBLIC: MICROPLATE SYSTEMS MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 165 CZECH REPUBLIC: MICROPLATE SYSTEMS MARKET, BY END USER, 2020–2026 (USD MILLION)

9.3.9 HUNGARY

9.3.9.1 Consolidation of laboratories to support the growth of the microplate systems market in Hungary

TABLE 166 HUNGARY: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 167 HUNGARY: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2020–2026 (USD MILLION)

TABLE 168 HUNGARY: MICROPLATE READERS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 169 HUNGARY: MICROPLATE READERS MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 170 HUNGARY: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 171 HUNGARY: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 172 HUNGARY: MICROPLATE SYSTEMS MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 173 HUNGARY: MICROPLATE SYSTEMS MARKET, BY END USER, 2020–2026 (USD MILLION)

9.3.10 FINLAND

9.3.10.1 Expansion and modernization of the healthcare infrastructure in Finland to drive market growth

TABLE 174 FINLAND: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 175 FINLAND: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2020–2026 (USD MILLION)

TABLE 176 FINLAND: MICROPLATE READERS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 177 FINLAND: MICROPLATE READERS MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 178 FINLAND: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 179 FINLAND: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 180 FINLAND: MICROPLATE SYSTEMS MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 181 FINLAND: MICROPLATE SYSTEMS MARKET, BY END USER, 2020–2026 (USD MILLION)

9.3.11 NORWAY

9.3.11.1 Growing funding for personalized medicine to support the growth of the microplate systems market in Norway

TABLE 182 NORWAY: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 183 NORWAY: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2020–2026 (USD MILLION)

TABLE 184 NORWAY: MICROPLATE READERS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 185 NORWAY: MICROPLATE READERS MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 186 NORWAY: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 187 NORWAY: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 188 NORWAY: MICROPLATE SYSTEMS MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 189 NORWAY: MICROPLATE SYSTEMS MARKET, BY END USER, 2020–2026 (USD MILLION)

9.3.12 SWEDEN

9.3.12.1 Increasing R&D expenditure for proteomics and genomics research—a key factor driving market growth in Sweden

TABLE 190 SWEDEN: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 191 SWEDEN: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2020–2026 (USD MILLION)

TABLE 192 SWEDEN: MICROPLATE READERS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 193 SWEDEN: MICROPLATE READERS MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 194 SWEDEN: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 195 SWEDEN: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 196 SWEDEN: MICROPLATE SYSTEMS MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 197 SWEDEN: MICROPLATE SYSTEMS MARKET, BY END USER, 2020–2026 (USD MILLION)

9.3.13 REST OF EUROPE

TABLE 198 ROE: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 199 ROE: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2020–2026 (USD MILLION)

TABLE 200 ROE: MICROPLATE READERS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 201 ROE: MICROPLATE READERS MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 202 ROE: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 203 ROE: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 204 ROE: MICROPLATE SYSTEMS MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 205 ROE: MICROPLATE SYSTEMS MARKET, BY END USER, 2020–2026 (USD MILLION)

9.4 ASIA PACIFIC

FIGURE 20 ASIA PACIFIC: MICROPLATE SYSTEMS MARKET SNAPSHOT

TABLE 206 ASIA PACIFIC: MICROPLATE SYSTEMS MARKET, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 207 ASIA PACIFIC: MICROPLATE SYSTEMS MARKET, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 208 ASIA PACIFIC: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 209 ASIA PACIFIC: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2020–2026 (USD MILLION)

TABLE 210 ASIA PACIFIC: MICROPLATE READERS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 211 ASIA PACIFIC: MICROPLATE READERS MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 212 ASIA PACIFIC: MULTI-MODE MICROPLATE READERS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 213 ASIA PACIFIC: MULTI-MODE MICROPLATE READERS MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 214 ASIA PACIFIC: SINGLE-MODE MICROPLATE READERS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 215 ASIA PACIFIC: SINGLE-MODE MICROPLATE READERS MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 216 ASIA PACIFIC: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 217 ASIA PACIFIC: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 218 ASIA PACIFIC: MICROPLATE SYSTEMS MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 219 ASIA PACIFIC: MICROPLATE SYSTEMS MARKET, BY END USER, 2020–2026 (USD MILLION)

9.4.1 JAPAN

9.4.1.1 Advanced healthcare infrastructure to support market growth in Japan

TABLE 220 JAPAN: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 221 JAPAN: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2020–2026 (USD MILLION)

TABLE 222 JAPAN: MICROPLATE READERS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 223 JAPAN: MICROPLATE READERS MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 224 JAPAN: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 225 JAPAN: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 226 JAPAN: MICROPLATE SYSTEMS MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 227 JAPAN: MICROPLATE SYSTEMS MARKET, BY END USER, 2020–2026 (USD MILLION)

9.4.2 CHINA

9.4.2.1 Increasing healthcare expenditure to drive market growth in China

TABLE 228 CHINA: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 229 CHINA: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2020–2026 (USD MILLION)

TABLE 230 CHINA: MICROPLATE READERS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 231 CHINA: MICROPLATE READERS MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 232 CHINA: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 233 CHINA: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 234 CHINA: MICROPLATE SYSTEMS MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 235 CHINA: MICROPLATE SYSTEMS MARKET, BY END USER, 2020–2026 (USD MILLION)

9.4.3 INDIA

9.4.3.1 Expanding healthcare sector in the country to drive market growth

TABLE 236 INDIA: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 237 INDIA: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2020–2026 (USD MILLION)

TABLE 238 INDIA: MICROPLATE READERS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 239 INDIA: MICROPLATE READERS MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 240 INDIA: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 241 INDIA: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 242 INDIA: MICROPLATE SYSTEMS MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 243 INDIA: MICROPLATE SYSTEMS MARKET, BY END USER, 2020–2026 (USD MILLION)

9.4.4 SOUTH KOREA

9.4.4.1 Growing number of biotechnology and pharmaceutical companies to support market growth in South Korea

TABLE 244 SOUTH KOREA: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 245 SOUTH KOREA: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2020–2026 (USD MILLION)

TABLE 246 SOUTH KOREA: MICROPLATE READERS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 247 SOUTH KOREA: MICROPLATE READERS MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 248 SOUTH KOREA: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 249 SOUTH KOREA: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 250 SOUTH KOREA: MICROPLATE SYSTEMS MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 251 SOUTH KOREA: MICROPLATE SYSTEMS MARKET, BY END USER, 2020–2026 (USD MILLION)

9.4.5 SINGAPORE

9.4.5.1 Government funding for research to develop new drugs to drive market growth in Singapore

TABLE 252 SINGAPORE: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 253 SINGAPORE: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2020–2026 (USD MILLION)

TABLE 254 SINGAPORE: MICROPLATE READERS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 255 SINGAPORE: MICROPLATE READERS MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 256 SINGAPORE: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 257 SINGAPORE: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 258 SINGAPORE: MICROPLATE SYSTEMS MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 259 SINGAPORE: MICROPLATE SYSTEMS MARKET, BY END USER, 2020–2026 (USD MILLION)

9.4.6 REST OF ASIA PACIFIC

TABLE 260 ROAPAC: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 261 ROAPAC: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2020–2026 (USD MILLION)

TABLE 262 ROAPAC: MICROPLATE READERS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 263 ROAPAC: MICROPLATE READERS MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 264 ROAPAC: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 265 ROAPAC: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 266 ROAPAC: MICROPLATE SYSTEMS MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 267 ROAPAC: MICROPLATE SYSTEMS MARKET, BY END USER, 2020–2026 (USD MILLION)

9.5 REST OF THE WORLD

TABLE 268 ROW: MICROPLATE SYSTEMS MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 269 ROW: MICROPLATE SYSTEMS MARKET, BY REGION, 2020–2026 (USD MILLION)

TABLE 270 ROW: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 271 ROW: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2020–2026 (USD MILLION)

TABLE 272 ROW: MICROPLATE READERS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 273 ROW: MICROPLATE READERS MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 274 ROW: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 275 ROW: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 276 ROW: MICROPLATE SYSTEMS MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 277 ROW: MICROPLATE SYSTEMS MARKET, BY END USER, 2020–2026 (USD MILLION)

9.5.1 LATIN AMERICA

9.5.1.1 Increasing number of cancer screening programs to support market growth

TABLE 278 LATIN AMERICA: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 279 LATIN AMERICA: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2020–2026 (USD MILLION)

TABLE 280 LATIN AMERICA: MICROPLATE READERS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 281 LATIN AMERICA: MICROPLATE READERS MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 282 LATIN AMERICA: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 283 LATIN AMERICA: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 284 LATIN AMERICA: MICROPLATE SYSTEMS MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 285 LATIN AMERICA: MICROPLATE SYSTEMS MARKET, BY END USER, 2020–2026 (USD MILLION)

9.5.2 MIDDLE EAST & AFRICA

9.5.2.1 Increasing incidence of cancer in the Middle East & Africa to drive market growth

TABLE 286 MIDDLE EAST & AFRICA: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 287 MIDDLE EAST & AFRICA: MICROPLATE SYSTEMS MARKET, BY PRODUCT, 2020–2026 (USD MILLION)

TABLE 288 MIDDLE EAST & AFRICA: MICROPLATE READERS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 289 MIDDLE EAST & AFRICA: MICROPLATE READERS MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 290 MIDDLE EAST & AFRICA: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 291 MIDDLE EAST & AFRICA: MICROPLATE SYSTEMS MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 292 MIDDLE EAST & AFRICA: MICROPLATE SYSTEMS MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 293 MIDDLE EAST & AFRICA: MICROPLATE SYSTEMS MARKET, BY END USER, 2020–2026 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 206)

10.1 OVERVIEW

FIGURE 21 KEY DEVELOPMENTS IN THE MICROPLATE SYSTEMS MARKET, JANUARY 2018–JUNE 2021

FIGURE 22 MARKET EVOLUTION MATRIX: JANUARY 2018 TO JUNE 2021

10.2 MARKET SHARE ANALYSIS

TABLE 294 MICROPLATE SYSTEMS MARKET: DEGREE OF COMPETITION

10.3 COMPANY EVALUATION MATRIX

10.3.1 STARS

10.3.2 EMERGING LEADERS

10.3.3 PERVASIVE PLAYERS

10.3.4 PARTICIPANTS

FIGURE 23 VENDOR DIVE: MICROPLATE SYSTEMS MARKET

10.4 COMPETITIVE LEADERSHIP MAPPING (SMES/START-UPS)

10.4.1 PROGRESSIVE COMPANIES

10.4.2 STARTING BLOCKS

10.4.3 RESPONSIVE COMPANIES

10.4.4 DYNAMIC COMPANIES

FIGURE 24 VENDOR DIVE MATRIX FOR SMES & START-UPS: MICROPLATE SYSTEMS MARKET

10.5 COMPETITIVE SCENARIO

10.5.1 PRODUCT LAUNCHES & APPROVALS

TABLE 295 KEY PRODUCT LAUNCHES & APPROVALS, JANUARY 2018–JUNE 2021

10.5.2 DEALS

TABLE 296 KEY DEALS, JANUARY 2018–JUNE 2021

10.5.3 OTHER DEVELOPMENTS

TABLE 297 OTHER KEY DEVELOPMENTS, JANUARY 2018–JUNE 2021

TABLE 298 COMPANY FOOTPRINT

TABLE 299 COMPANY PRODUCT FOOTPRINT

TABLE 300 COMPANY APPLICATION FOOTPRINT

TABLE 301 COMPANY GEOGRAPHICAL FOOTPRINT

11 COMPANY PROFILES (Page No. - 218)

11.1 KEY PLAYERS

(Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)*

11.1.1 DANAHER CORPORATION

TABLE 302 DANAHER CORPORATION: BUSINESS OVERVIEW

FIGURE 25 DANAHER CORPORATION: COMPANY SNAPSHOT (2020)

11.1.2 BIO-RAD LABORATORIES INC.

TABLE 303 BIO-RAD LABORATORIES INC.: BUSINESS OVERVIEW

FIGURE 26 BIO-RAD LABORATORIES INC.: COMPANY SNAPSHOT (2020)

11.1.3 PERKINELMER, INC.

TABLE 304 PERKINELMER, INC.: BUSINESS OVERVIEW

FIGURE 27 PERKINELMER, INC.: COMPANY SNAPSHOT (2020)

11.1.4 THERMO FISHER SCIENTIFIC

TABLE 305 THERMO FISHER SCIENTIFIC: BUSINESS OVERVIEW

FIGURE 28 THERMO FISHER SCIENTIFIC: COMPANY SNAPSHOT (2020)

11.1.5 AGILENT TECHNOLOGIES INC.

TABLE 306 AGILENT TECHNOLOGIES INC.: BUSINESS OVERVIEW

FIGURE 29 AGILENT TECHNOLOGIES INC.: COMPANY SNAPSHOT (2020)

11.1.6 TECAN

TABLE 307 TECAN: BUSINESS OVERVIEW

FIGURE 30 TECAN: COMPANY SNAPSHOT (2020)

11.1.7 CORNING INC.

TABLE 308 CORNING INC.: BUSINESS OVERVIEW

FIGURE 31 CORNING INC.: COMPANY SNAPSHOT (2020)

11.1.8 LONZA INC.

TABLE 309 LONZA INC.: BUSINESS OVERVIEW

FIGURE 32 LONZA INC.: COMPANY SNAPSHOT (2020)

11.1.9 BMG LABTECH

TABLE 310 BMG LABTECH: BUSINESS OVERVIEW

11.1.10 PROMEGA CORPORATION

TABLE 311 PROMEGA CORPORATION: BUSINESS OVERVIEW

11.1.11 BERTHOLD TECHNOLOGIES GMBH & CO.KG

TABLE 312 BERTHOLD TECHNOLOGIES GMBH & CO. KG: BUSINESS OVERVIEW

11.1.12 BIOCHROM

TABLE 313 BIOCHROM: BUSINESS OVERVIEW

11.1.13 RAYTO LIFE AND ANALYTICAL SCIENCES CO., LTD.

TABLE 314 RAYTO LIFE & ANALYTICAL SCIENCES CO., LTD.: BUSINESS OVERVIEW

11.1.14 BRUKER CORPORATION

TABLE 315 BRUKER CORPORATION: BUSINESS OVERVIEW

FIGURE 33 BRUKER CORPORATION: COMPANY SNAPSHOT (2020)

11.1.15 DYNEX TECHNOLOGIES

TABLE 316 DYNEX TECHNOLOGIES: BUSINESS OVERVIEW

*Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

11.2 START-UP/SME PLAYERS

11.2.1 ACCURIS INSTRUMENTS

TABLE 317 ACCURIS INSTRUMENTS: COMPANY OVERVIEW

11.2.2 BIOHIT OYJ

TABLE 318 BIOHIT OYJ: COMPANY OVERVIEW

11.2.3 CTK BIOTECH, INC.

TABLE 319 CTK BIOTECH: COMPANY OVERVIEW

11.2.4 ENZO LIFE SCIENCES, INC.

TABLE 320 ENZO LIFE SCIENCE, INC: COMPANY OVERVIEW

11.2.5 GREINER BIO-ONE INTERNATIONAL GMBH

TABLE 321 GREINER BIO-ONE INTERNATIONAL GMBH: COMPANY OVERVIEW

11.2.6 HUDSON ROBOTICS

TABLE 322 HUDSON ROBOTICS: COMPANY OVERVIEW

11.2.7 JASCO

TABLE 323 JASCO: COMPANY OVERVIEW

11.2.8 MICRO LAB INSTRUMENTS

TABLE 324 MICRO LAB INSTRUMENTS: COMPANY OVERVIEW

11.2.9 MINDRAY

TABLE 325 MINDRAY: COMPANY OVERVIEW

11.2.10 LTEK CORPORATION

TABLE 326 LTEK CORPORATION: COMPANY OVERVIEW

12 APPENDIX (Page No. - 263)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the microplate systems market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

Extensive primary research was conducted after acquiring knowledge about the global market scenario through secondary research. Primary interviews were conducted from both the demand (hospitals and diagnostic laboratories) and supply sides (microplate systems manufacturers and distributors).

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the microplate systems market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the microplate systems industry.

Report Objectives

- To define, describe, and forecast the global microplate systems market based on product, application, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, future prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of market segments with respect to four main regions—North America, Europe, Asia Pacific and the Rest of the World (RoW)2

- To strategically profile key players and comprehensively analyze their product portfolios, market shares, and core competencies3

- To track and analyze competitive developments such as acquisitions, new product launches, expansions, regulatory approvals, and agreements in the microplate systems market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

- Product Analysis: Product matrix, which gives a detailed comparison of the product portfolios of each company

- Geographic Analysis: Further breakdown of the Latin America, the Middle East and Africa microplate systems market into specific countries microplate systems market and further breakdown of the European microplate systems market into specific countries

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Microplate Systems Market