Mobile Video Surveillance Market Size, Share & Trends

Mobile Video Surveillance Market by Offering (Cameras, Dome, Panoramic, Box & Bullet, DVR, NVR, Network-attached Storage, Video Analytics, VMS, VSaaS), System (IP, Analog), Application (Public Transit, Fleet Management, Drones) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

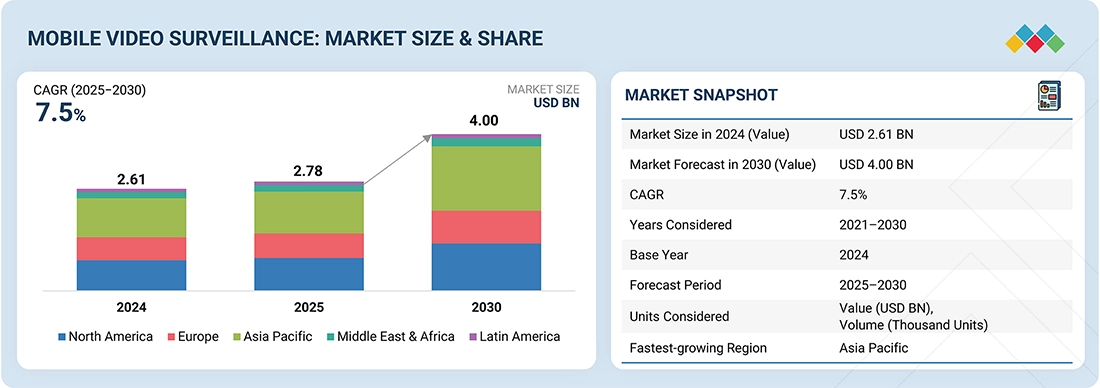

The mobile video surveillance market is projected to reach USD 4.00 billion by 2030 from USD 2.78 billion in 2025, at a CAGR of 7.5%. Mobile video surveillance employs camera systems installed on moving platforms such as vehicles, drones, and public transportation to capture real-time video footage. It facilitates continuous monitoring, recording, and transmission of visual data to support security, situational awareness, and operational efficiency.

KEY TAKEAWAYS

-

BY OFFERINGCameras are expected to dominate the market, driven by their critical role in capturing high-quality real-time footage for security, monitoring, and analytics across vehicles and remote environments.

-

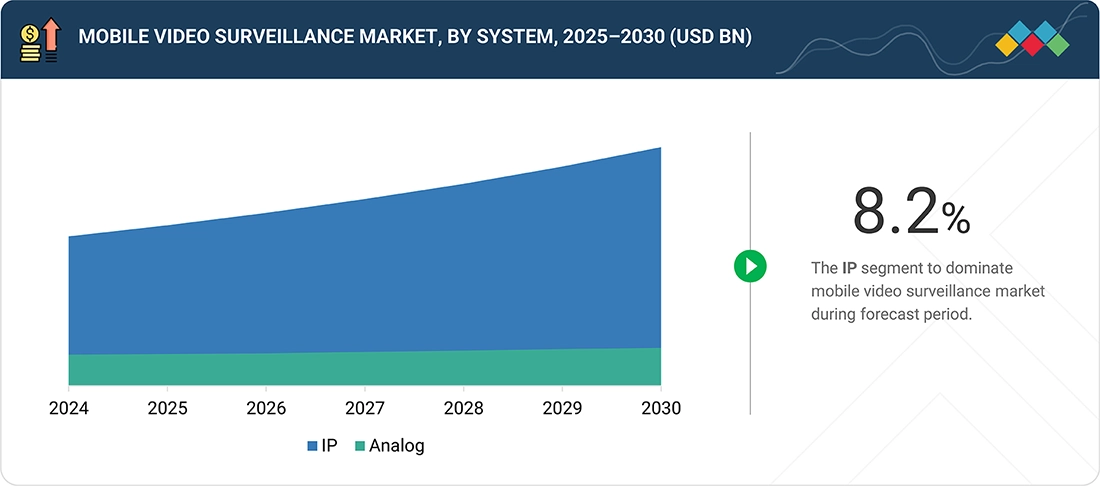

BY SYSTEMThe IP segment is expected to record a higher rate, driven by the growing demand for high-resolution, network-based monitoring systems that enable remote access, scalability, and seamless cloud integration.

-

BY APPLICATIONDrones are expected to register the highest growth rate, driven by their ease of deployment and seamless integration into command, control, communications, intelligence, surveillance, and reconnaissance systems.

-

BY VERTICALThe logistics and transportation vertical is expected to dominate the market, driven by the increasing instances of crime, harassment, vandalism, terrorism, and liability claims, along with the rising demand for efficient surveillance solutions to enhance safety and operational efficiency across global transportation networks.

-

BY REGIONAsia Pacific is expected to be the fastest-growing market during the forecast period, fueled by rapid urbanization and growing investments in smart city projects.

-

COMPETITIVE LANDSCAPEThe major market players, such as Hangzhou Hikvision Digital Technology Co., Ltd. (China), Motorola Solutions Inc. (US), Axis Communications AB (Sweden), have adopted both organic and inorganic strategies, including partnerships and investments, to cater to the growing demand for mobile video surveillance across various verticals.

The mobile video surveillance market is projected to grow rapidly over the next decade, driven by increasing demand for real-time monitoring, public safety, and asset protection. Verticals such as logistics & transportation and law enforcement adopt mobile surveillance systems for enhanced situational awareness and operational efficiency. The rise in criminal activities, accidents, and safety compliance requirements has further accelerated the need for advanced, connected, and AI-powered video surveillance solutions.

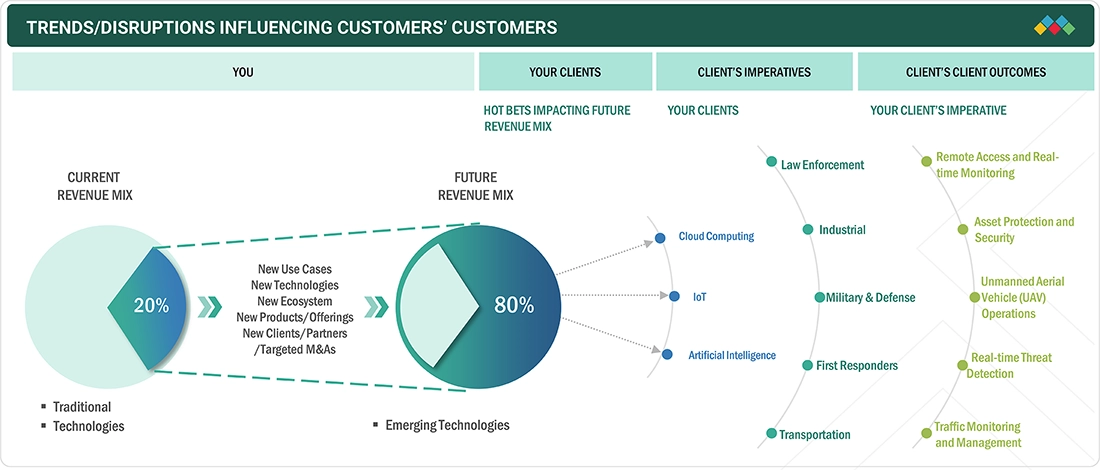

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' businesses emergest from the increasing adoption of AI-driven analytics for real-time threat detection. Disruptions stem from advancements in edge computing, enabling on-device processing and integrating IoT technologies for a more comprehensive and responsive surveillance ecosystem. These developments reshape the landscape, fostering the development of more efficient and intelligent mobile video surveillance solutions for businesses.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Escalating security concerns across multiple verticals

-

Rapid urbanization and development of smart cities

Level

-

Privacy and security concerns associated with wireless cameras

-

Bandwidth limitations of mobile video surveillance solutions

Level

-

Surging use of smart devices for wireless remote monitoring

-

Integration of mobile video surveillance with access control and alarm systems

Level

-

Cost constraints in implementing and maintaining mobile video surveillance systems

-

Highly competitive environment for companies offering mobile video surveillance solutions

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Escalating security concerns across multiple verticals

The growing need for enhanced safety and real-time monitoring drives the requirement for mobile video surveillance systems across many verticals, such as transportation, law enforcement, and industrial. Thus, rising security concerns, along with the need to prevent theft, vandalism, and unauthorized access, have pushed organizations and governments to invest in advanced mobile surveillance systems for reliable, on-the-go protection.

Restraint: Privacy and security concerns associated with wireless cameras

Privacy and security concerns associated with wireless cameras are major factors hindering the mobile video surveillance market growth. As cameras capture and transmit sensitive information over networks, there is a risk of data breaches and unauthorized access, leading to potential misuse of footage and legal implications for organizations.

Opportunity: Surging use of smart devices for wireless remote monitoring

The increasing integration of smart devices and IoT-based technologies presents significant opportunities for wireless remote monitoring in mobile video surveillance. Smart connectivity enables seamless data access, cloud-based analytics, and centralized control, allowing users to manage surveillance systems efficiently from anywhere.

Challenge: Cost constraints in implementing and maintaining mobile video surveillance systems

High costs associated with implementing and maintaining mobile video surveillance systems remain a major challenge. Expenses related to equipment, data storage, bandwidth, and regular upgrades often limit adoption, particularly among small and medium-sized enterprises or budget-constrained public sector organizations.

Mobile Video Surveillance Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Nobina required a reliable, secure, and easy-to-manage video surveillance solution for 2,000 buses across Denmark, Finland, Norway, and Sweden using over 7,000 Axis network cameras. | The system improved passenger and driver safety | Enabled central monitoring | Provided real-time or downloadable high-definition footage for timely police response and analysis |

|

Collin College Law Enforcement Academy integrated real-world policing technology into its training curriculum through Motorola V700 body cameras, providing recruits with hands-on experience with modern tools. | Recruits gain practical skills | Understand the benefits of body cameras | Are better prepared for accountability, transparency, and real-world policing challenges |

|

The City of Bologna deployed Wisenet cameras with vehicle counting, classification, and ANPR capabilities at 12 city access gates to monitor traffic in real time. | Traffic police can better manage current traffic | capture and store valuable data | Use insights to plan future urban mobility and enhance city security |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

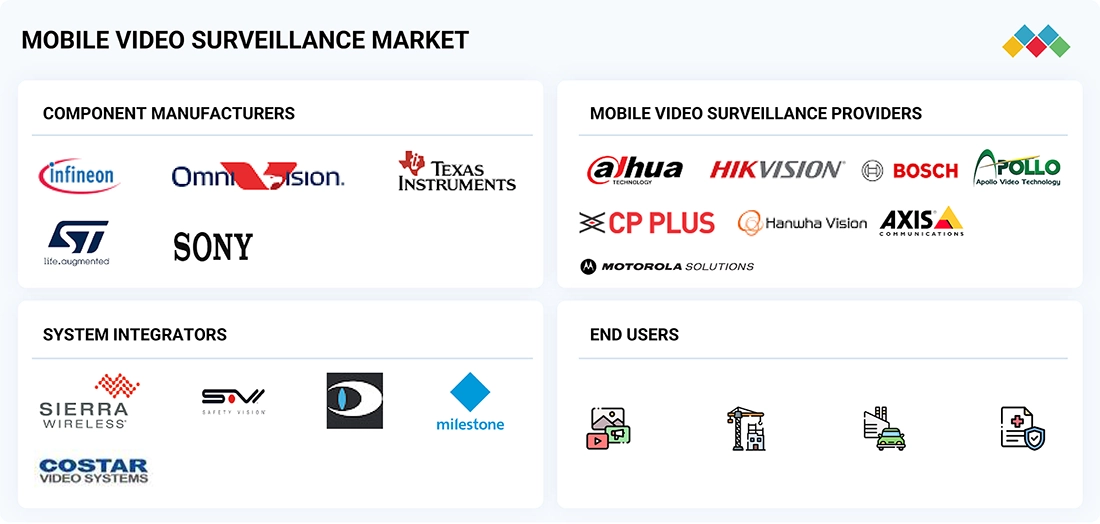

MARKET ECOSYSTEM

The mobile video surveillance ecosystem comprises component manufacturers, mobile video surveillance providers, system integrators, and end users. Mobile video surveillance end users include law enforcement, first responders, logistics & transportation users.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Mobile Video Surveillance Market, By Offering

Cameras accounted for the largest share of the overall market in 2024, and a similar trend is expected to be observed during the forecast period. The growth of this segment is driven by the increasing demand for real-time monitoring and security across transportation, law enforcement, and public safety applications. Cameras offer high-resolution imaging, advanced analytics, and the ability to integrate with cloud-based or centralized monitoring systems, making them indispensable for capturing, storing, and analyzing critical video data.

Mobile Video Surveillance Market, By System

The IP segment is expected to lead the overall mobile video surveillance market during the forecast period due to its ability to deliver high-resolution, real-time video over networked systems, enabling centralized monitoring and remote access from anywhere. IP cameras support advanced features such as AI-based analytics, motion detection, automatic alerts, and seamless integration with cloud storage, making them highly versatile for buses, trains, patrol vehicles, and other mobile platforms.

Mobile Video Surveillance Market, By Application

The public transit segment is expected to lead the overall mobile video surveillance market during the forecast period. As the need to ensure passenger safety, protect staff, and prevent vandalism or criminal activity across buses, trains, and metro systems increases, transit authorities are adopting video surveillance technology to monitor high-traffic areas in real time, deter misconduct, and provide evidence for investigations while also enhancing operational efficiency through analytics such as passenger counting and route monitoring.

Mobile Video Surveillance Market, By Vertical

The logistics & transportation segment is expected to account for the largest market share throughout the forecast period. This segment is driven by the critical need to protect cargo, monitor fleet operations, and ensure driver and public safety across long-haul and last-mile delivery networks. Companies increasingly deploy cameras to track vehicle movements in real time, prevent theft or accidents, optimize routes, and maintain regulatory compliance.

REGION

Asia Pacific is expected to be fastest-growing region in the global mobile video surveillance market during forecast period.

The Asia Pacific region is expected to record the highest CAGR during the forecast period. The market is driven by rapid urbanization, expanding public transportation networks, and increasing safety and security concerns across densely populated cities. Governments and private operators invest heavily in smart transportation solutions, law enforcement modernization, and fleet monitoring, boosting demand for advanced mobile surveillance systems. Additionally, the growing adoption of IP cameras, AI-based analytics, and cloud-enabled monitoring, coupled with supportive regulatory initiatives and rising awareness of passenger and cargo safety, is accelerating market growth in the region.

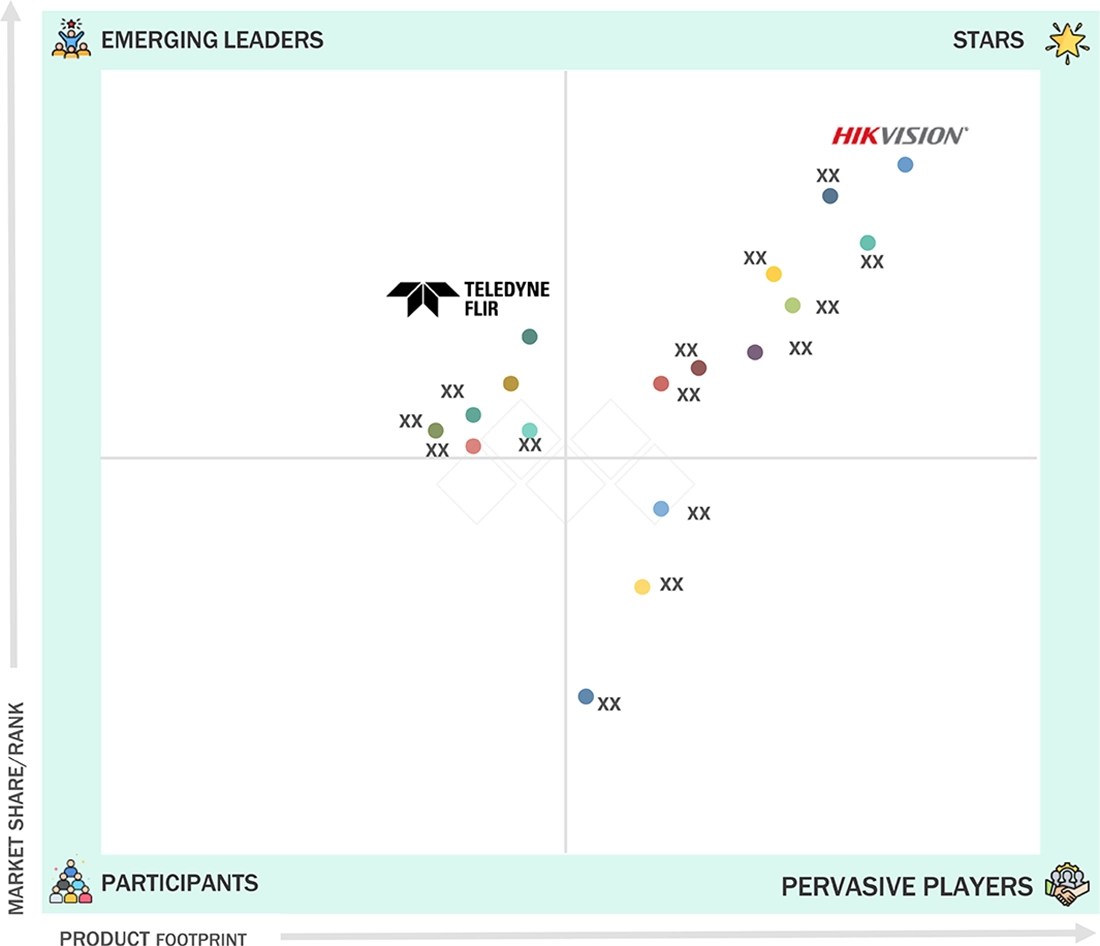

Mobile Video Surveillance Market: COMPANY EVALUATION MATRIX

In the evaluation matrix of the mobile video surveillance market, Hangzhou Hikvision Digital Technology Co., Ltd. (Star) leads with a strong market presence and a wide product portfolio, driving large-scale adoption across industries such as commercial and industrial. Teledyne FLIR LLC (Emerging Leader) is gaining traction with mobile video surveillance solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 2.61 Billion |

| Market Forecast in 2030 (Value) | USD 4.00 Billion |

| Growth Rate | CAGR of 7.5% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion) and Volume (Thousand Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, the Middle East & Africa, and South America |

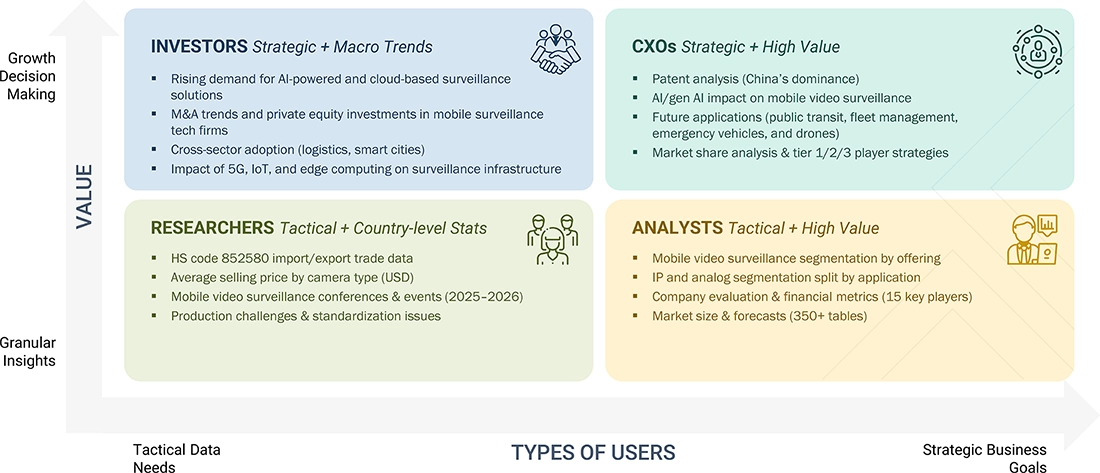

WHAT IS IN IT FOR YOU: Mobile Video Surveillance Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| US-based Security Camera Manufacturer |

|

|

| Europe Smart City Solution Provider |

|

|

| Asian Fleet Management Company |

|

|

| Middle East Government Agency |

|

|

| European Public Transport Operator |

|

|

RECENT DEVELOPMENTS

- July 2025 : Motorola Solutions, Inc. (US) partnered with the Ministry of Interior (Bulgaria) to equip Bulgaria’s National Police Service with 13,400 LTE-enabled V500 body cameras, paired with VideoManager evidence management software.

- March 2025 : Teledyne FLIR LLC (US) secured a contract with Middle East Task Company (METCO) to deliver its Lightweight Vehicle Surveillance System (LVSS)—a mobile, truck-bed–mounted surveillance unit featuring the TacFLIR 380HD thermal camera, Ranger R20SS radar (tracking up to 500 objects beyond 10 miles), plus mission support equipment and training.

- October 2023 : Axis Communications AB (Sweden) partnered with the Mall of America (US). MOA’s highly trained security officers are now equipped with Axis body-worn cameras designed to capture their surroundings for suspicious activity.

- September 2023 : Hangzhou Hikvision Digital Technology Co., Ltd. (China) partnered with Argeloji (Turkey) to integrate HikCentral software with Argeloji’s BlueOperation CMMS+ platform. The Argeloji BlueOperation platform connects with HikCentral via an IoT gateway using the BACnet protocol, which allows seamless integration with Hikvision devices such as cameras, access systems, intrusion detection systems, and network video recorders (NVRs).

Table of Contents

Methodology

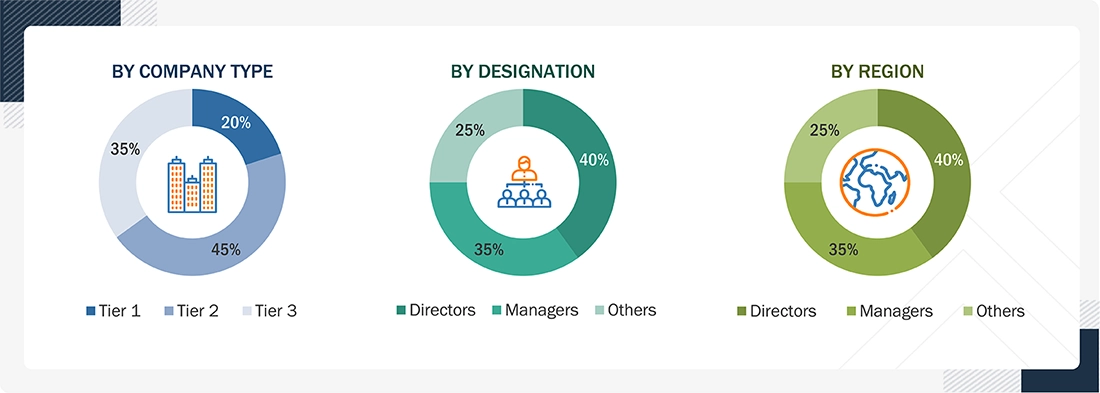

The research process for this study involved the systematic gathering, recording, and analysis of data on customers and companies operating in the mobile video surveillance market. This process involved the extensive use of secondary sources, directories, and databases (Factiva and Oanda) to identify and collect valuable information for the comprehensive, technical, market-oriented, and commercial study of the mobile video surveillance market. In-depth interviews were conducted with primary respondents, including experts from core and related industries, as well as preferred manufacturers, to obtain and verify critical qualitative and quantitative information and assess growth prospects. Key players in the mobile video surveillance market were identified through secondary research, and their market rankings were determined through a combination of primary and secondary research. This research involved studying the annual reports of top players and conducting interviews with key industry experts, including CEOs, directors, and marketing executives.

Secondary Research

Various sources were utilized in the secondary research process to identify and collect information relevant to this study. These include company annual reports, press releases, investor presentations, white papers, technology journals, certified publications, articles by recognized authors, directories, and databases.

Secondary research was primarily used to gather key information about the industry’s value chain, the total pool of market players, market classification according to industry trends at the most detailed level, regional markets, and key developments from both market and technology-oriented perspectives.

Primary Research

Primary research was also conducted to identify the segmentation types, key players, competitive landscape, and key market dynamics, including drivers, restraints, opportunities, challenges, and industry trends, as well as the key strategies adopted by players operating in the mobile video surveillance market. Extensive qualitative and quantitative analyses were performed on the complete market engineering process to list key information and insights throughout the report.

Extensive primary research has been conducted following the acquisition of knowledge about the mobile video surveillance market scenarios through secondary research. Several primary interviews were conducted with experts from the demand (vertical and region) and supply side (offering, system, application) across four major geographic regions: North America, Europe, Asia Pacific, and RoW. Approximately 60% and 40% of the primary interviews were conducted from the supply and demand sides, respectively. These primary data have been collected through questionnaires, emails, and telephonic interviews.

Notes: The three tiers of companies have been defined based on their total/segmental revenue as of 2024:

Tier 1 = > USD 1 billion, Tier 2 = USD 1 billion–USD 500 million, and Tier 3 = < USD 500 million.

Other designations include sales, marketing, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

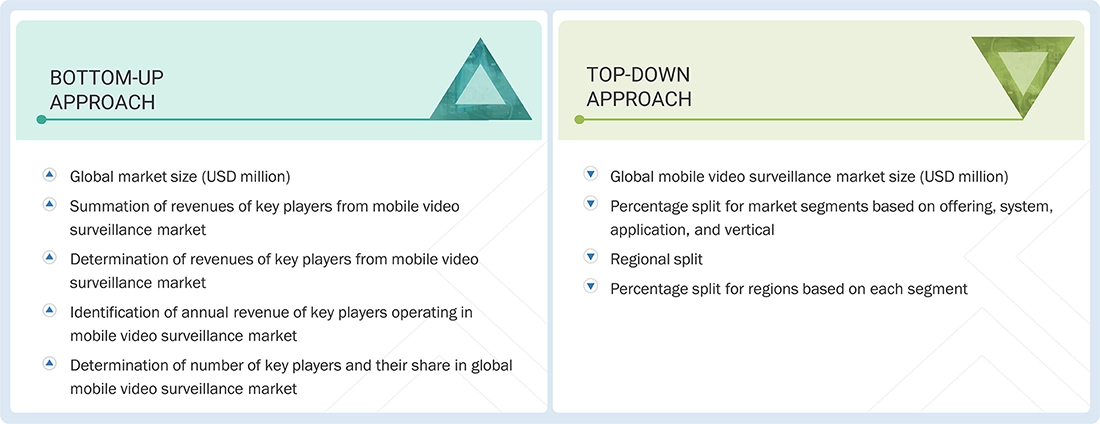

Market Size Estimation

In the complete market engineering process, top-down and bottom-up approaches and several data triangulation methods were implemented to estimate and validate the size of the mobile video surveillance market and various other dependent submarkets. Key players in the market were identified through secondary research, and their market share in the respective regions was determined through a combination of primary and secondary research. This entire research methodology involved studying the annual and financial reports of the top players, as well as conducting interviews with experts (including CEOs, VPs, directors, and marketing executives) to gather key insights (both quantitative and qualitative).

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Mobile Video Surveillance Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size through the estimation process, as explained above, the total market was divided into several segments and subsegments. To complete the overall market engineering process and obtain precise statistics for all segments and subsegments, market breakdown and data triangulation procedures were employed, as applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Additionally, the market has been validated using both top-down and bottom-up approaches.

Market Definition

Mobile video surveillance refers to the use of video surveillance systems designed to operate in a mobile or on-the-move environment. These systems capture, record, and monitor video footage in various mobile settings, such as vehicles, drones, public transportation, and other moving platforms. The primary goal of mobile video surveillance is to enhance security, safety, and situational awareness in dynamic or transient environments. The objectives of mobile video surveillance include enhancing situational awareness, improving security, and providing a proactive approach to monitoring activities in dynamic environments. The footage captured by mobile video surveillance systems helps in real-time monitoring, evidence gathering, and investigation.

Key Stakeholders

- Manufacturers and suppliers

- Technology providers

- System integrators

- Installers and service providers

- Government agencies

- Transportation authorities

- Private security firms

- Fleet management companies

- Regulatory authorities

- End-use industries

Report Objectives

- To estimate and forecast the size of the mobile video surveillance market, in terms of value, based on offering, system, vertical, application, and region

- To describe and forecast the market size, in terms of volume, based on the offering

- To describe and forecast the market size, in terms of value, for four major regions—North America, Europe, Asia Pacific, and RoW

- To provide detailed information regarding major factors such as drivers, restraints, opportunities, and challenges influencing market growth

- To provide a detailed overview of the value chain of the mobile video surveillance market

- To strategically analyze micromarkets1 about individual market trends, growth prospects, and contributions to the total market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with a detailed competitive landscape for the market leaders

- To analyze major growth strategies such as product launches, expansions, joint ventures, agreements, and acquisitions adopted by the key market players to enhance their position in the market

- To describe macroeconomic factors impacting the market in each region

- To analyze the AI/gen AI and 2025 US tariff impact on the mobile video surveillance market

Customization Options

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Mobile Video Surveillance Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Mobile Video Surveillance Market

Rajeev

Apr, 2019

Decongestion of road traffic , Safety & Security of travelers on Road , Smart Transportation Solutions are the part of this report? If yes, then what could be there market sizing?.

Olivier

Dec, 2022

Hi could I obtain the pdf brochure/ sample of this Mobile Video Surveillance market research? .