Multi-Function Display (MFD) Market by Platforms (Land, Airborne, Naval), by Systems (Electronic Flight Displays, Head-up Displays, Helmet-Mounted Displays, Portable Multi-function Displays), by Technology (LED, LCD/AMLCD, TFT, OLED, Synthetic Vision), by Size (<5”, 5”-10”, 10”-15”), by Geography (North America, APAC, Europe, the Middle East, ROW) - Global Forecasts, Trends & Analysis to 2024 - 2035

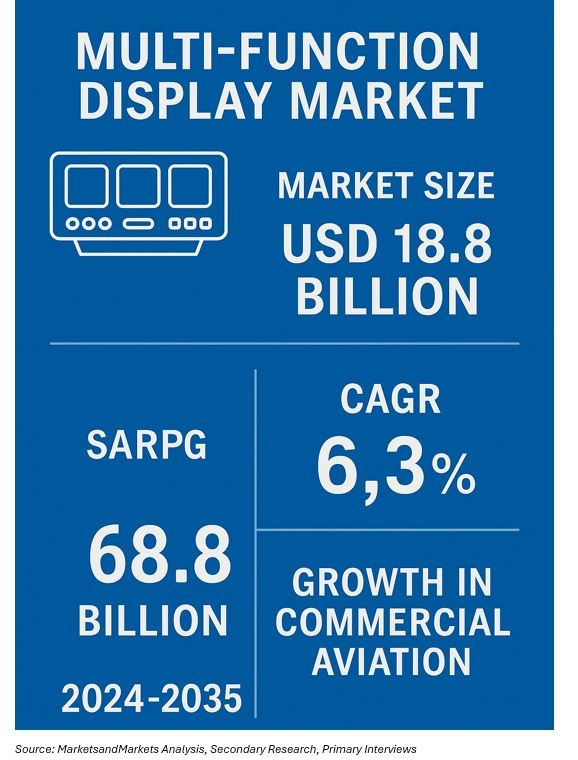

The multi-function display (MFD) market is evolving rapidly as cockpit and mission systems become increasingly digital, networked, and data-driven. The global market size is estimated at USD 9.8 billion in 2024 and is projected to reach USD 14.7 billion by 2035, registering a CAGR of 3.9% over the forecast period.

Growth is primarily driven by modernization programs across defense platforms, rising commercial-aircraft production, and demand for compact, high-resolution displays in both manned and unmanned vehicles. With real-time data visualization, synthetic vision, and integrated sensor feeds becoming central to situational awareness, multi-function displays serve as the human–machine interface at the core of modern avionics and combat systems.

The ongoing transition from analog to glass cockpits, coupled with emerging display technologies such as AMOLED and micro-LED, continues to redefine ergonomics, power consumption, and mission effectiveness across aerospace, ground, and maritime domains.

Market Dynamics

Drivers

A key growth driver for the multi-function display market is the global fleet modernization wave across both civil and defense sectors. Airlines and business-jet operators are adopting digital flight decks that integrate navigation, weather radar, engine data, and flight management into single-screen interfaces. Defense forces are upgrading legacy cockpits to ruggedized mission displays that enhance situational awareness under extreme environmental conditions.

In addition, increased demand for UAVs and eVTOL platforms has created new use cases for lightweight, modular MFDs. The expansion of augmented-reality (AR) and synthetic-vision capabilities is further reinforcing the trend toward multi-sensor integration on a single user interface.

Restraints

High cost of advanced display components, long certification timelines, and vulnerability to electromagnetic interference (EMI) and temperature extremes remain key restraints. In specific high-altitude or marine environments, display readability and reliability still pose engineering challenges.

Opportunities

Technological convergence is opening new opportunities. Touch-screen MFDs, 3D situational displays, and adaptive dimming technologies are reshaping cockpit and mission-station architectures. In the defense segment, investments in helmet-mounted displays (HMDs) and mission-data fusion offer additional growth potential. Meanwhile, the adoption of OLED and AMLCD technologies for enhanced contrast and sunlight readability is improving user experience in commercial aviation and armored vehicles alike.

Market Segmentation

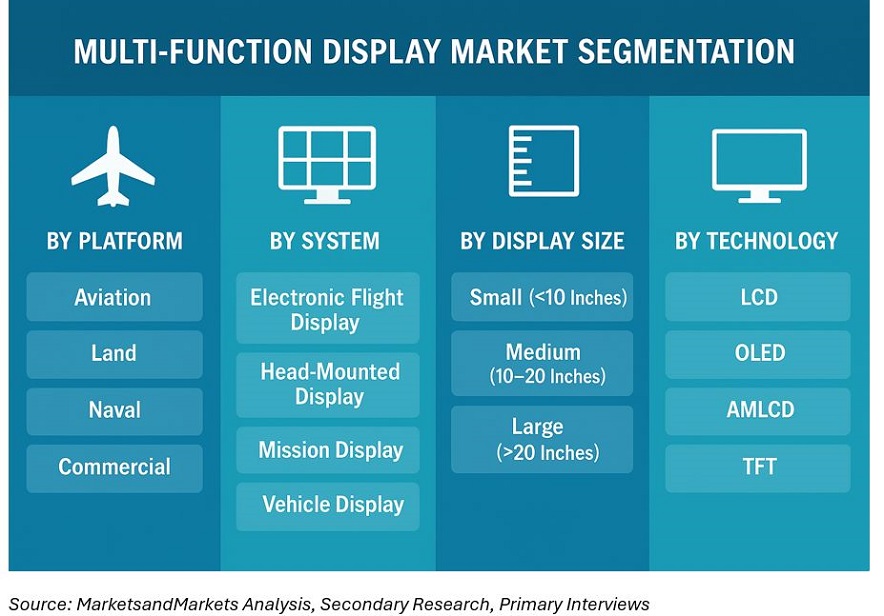

By Platform

The market spans aviation, land, naval, and commercial platforms.

- The aviation segment holds the largest share, encompassing both civil and military aircraft. Commercial aircraft rely on multi-function flight displays for navigation, terrain awareness, and performance monitoring, while fighter and trainer aircraft employ rugged MFDs for mission data and sensor fusion.

- The land segment includes armored vehicles, tactical trucks, and command centers where MFDs display targeting, logistics, and navigation data.

- The naval segment covers warship and submarine consoles used for sonar, radar, and fire-control visualization.

- The commercial and industrial segment (e.g., simulators and high-end automotive systems) represents a smaller but growing market as display technology becomes more affordable.

By System

The system segment is categorized into electronic flight displays (EFDs), head-mounted displays (HMDs), mission displays, and vehicle displays.

- Electronic flight displays dominate due to their widespread use in fixed-wing and rotary aircraft cockpits.

- Head-mounted displays are gaining traction for pilot cueing and battlefield visualization.

- Mission displays cater to airborne, naval, and ground combat systems requiring multi-sensor integration.

- Vehicle displays serve driver and commander roles in land-based defense and logistics applications.

By Display Size

Display configurations vary widely by platform: small (<10 inches) for compact vehicles and UAVs, medium (10–20 inches) for standard cockpits, and large (>20 inches) for command and control consoles. The medium-size segment leads the market due to its balance between readability and space optimization.

By Technology

Key technologies include LCD, OLED, AMLCD, and TFT.

- AMLCD remains the most widely adopted owing to its cost-effectiveness and maturity.

- OLED is rapidly gaining adoption for its superior contrast, faster refresh rates, and lower power consumption.

- TFT technology continues to evolve with improved brightness and temperature resilience, particularly in military-grade systems.

- Research into micro-LED is expected to shape next-generation display development after 2030.

By End User

The OEM segment dominates, supported by new aircraft and vehicle deliveries integrating multi-display cockpits and mission consoles. The aftermarket accounts for recurring retrofits, upgrades, and calibration services, particularly among defense and business jet operators.

Regional Analysis

North America

North America holds the largest market share, driven by the presence of major avionics OEMs, including Honeywell International, Collins Aerospace, and Garmin Ltd. The U.S. defense modernization programs, including F-15EX and UH-60V, sustain high MFD procurement volumes.

Europe

Europe ranks second, with key participants such as Thales Group, Saab AB, and BAE Systems supporting both civil and military programs. The European Union’s Clean Aviation initiatives are encouraging the adoption of lightweight, energy-efficient displays across new platforms.

Asia Pacific

The Asia Pacific is expected to register the fastest CAGR through 2035, driven by increasing air passenger traffic, fleet expansion in China and India, and indigenous aerospace programs such as the HAL Tejas, C919, and KF-21 Boramae. Growing demand for situational awareness in naval and land systems further strengthens regional growth.

Middle East & Africa

Fleet modernization and defense investments in the UAE, Saudi Arabia, and Israel are driving the adoption of ruggedized and night-vision-compatible MFDs.

Latin America

Latin America’s market is developing steadily through defense upgrades in Brazil and Mexico, as well as the introduction of modern avionics into regional fleets.

Competitive Landscape

The competitive environment is led by global avionics and display manufacturers, including Honeywell International Inc., Thales Group, Collins Aerospace (RTX Corporation), Garmin Ltd., Saab AB, BAE Systems plc, Esterline Technologies Corporation, and Elbit Systems Ltd.

Competition centers on innovation in ruggedization, touchscreen integration, low-latency rendering, and synthetic vision software compatibility. OEMs are pursuing modular open-systems architectures (MOSA) to streamline integration across legacy and new platforms. Partnerships between avionics OEMs and semiconductor/display-material suppliers are becoming increasingly common to ensure supply-chain resilience and long-term component availability.

Sustainability and Technology Outlook

MFD manufacturers are aligning with aviation’s broader sustainability goals by developing energy-efficient backlighting, longer lifespan panels, and RoHS-compliant display electronics. Software optimization reduces cooling loads and power consumption within the cockpit, directly contributing to lower auxiliary fuel burn. Digital twins and advanced testing tools now enable predictive maintenance of display units, extending service life and reducing waste.

Forecast Summary (2024–2035)

|

Year |

Market Size (USD Billion) |

CAGR (2024–2035) |

|

2024 |

9.8 |

|

|

2030 |

12.3 |

|

|

2035 |

14.7 |

3.9 % |

The multi-function display (MFD) market is transitioning toward software-centric architectures where human–machine interaction is optimized for speed, clarity, and mission safety. While civil aviation remains the largest consumer, defense and UAV markets provide consistent growth through modernization and digitalization initiatives. Vendors capable of blending ergonomic design, open architecture, and advanced visualization technologies will define competitive advantage over the next decade.

Frequently Asked Questions (FAQs)

Q1. What is the size of the global multi-function display market?

The market is valued at approximately USD 9.8 billion in 2024 and projected to reach USD 14.7 billion by 2035.

Q2. Which platform segment dominates the market?

Aviation platforms account for the largest share, driven by the modernization of civil and military cockpits.

Q3. Which region will witness the highest growth?

Asia Pacific is expected to record the highest CAGR, propelled by commercial fleet expansion and indigenous aircraft programs.

Q4. What are the key technologies shaping the MFD market?

OLED, AMLCD, and emerging micro-LED technologies are redefining display performance and energy efficiency.

Q5. Who are the major players in this industry?

Key players include Honeywell, Thales, Collins Aerospace, Garmin, Saab, BAE Systems, and Elbit Systems.

Table of Contents

1 Introduction (Page No. - 19)

1.1 Study Objectives

1.2 Report Description

1.3 Study Scope

1.3.1 Geographic Scope

1.4 Market Stakeholders

1.5 Forecast Assumptions

1.6 Research Methodology

1.6.1 Market Size Estimation

1.6.2 Market Breakdown & Data Triangulation

1.7 Key Data From Primary Sources

1.8 Key Data From Secondary Sources

1.9 Primary Research Insight: Business Development Director, Garmin Ltd.

2 Executive Summary (Page No. - 34)

3 Market Overview (Page No. - 35)

3.1 Market Definition

3.2 Market Segmentation

3.3 Aerospace & Defense Value Chain

3.4 Market Dynamics

3.4.1 Drivers

3.4.1.1 Technology Improvements

3.4.1.2 System Efficiency

3.4.1.3 Increase in Aircraft Orders

3.4.1.4 Increased Market For Ground Control Stations

3.4.2 Restraints

3.4.2.1 Defense Budget Cuts

3.4.2.2 Product Life Cycle

3.4.3 Challenges

3.4.3.1 Need For Interoperability

3.4.3.2 Complexity of the System

3.4.3.3 Training

3.4.4 Opportunities

3.4.4.1 Reflective Micro-Display Technologies

3.4.4.2 Automotive Industry

3.5 Product Lifecycle

3.6 Market Share Analysis

3.7 Environment Threat Opportunity Profile (ETOP) Analysis

4 Global Multi-Function Display Market, By Systems (Page No. - 58)

4.1 Electronic Flight Displays (EFD)

4.2 Heads-Up Display (HUD)

4.3 Helmet-Mounted Displays (HMD)

4.4 Portable and Flexible Multi-Function Display

5 Global Market, By Technology (Page No. - 75)

5.1 LED

5.2 OLED

5.3 LCD

5.4 AMLCD

5.5 TFT

5.6 Synthetic Vision

6 Regional Analysis (Page No. - 95)

6.1 Asia-Pacific: the Highest Growth Region

6.2 Europe

6.3 North America

6.4 the Middle East

6.5 ROW

7 Country Analysis (Page No. - 120)

7.1 Australia

7.2 Brazil

7.3 Canada

7.4 China

7.5 France

7.6 Germany

7.7 India

7.8 Indonesia

7.9 Israel

7.10 Russia

7.11 U.K.

7.12 U.S.

8 Competitive Landscape (Page No. - 181)

8.1 Market Share Analysis, By Company

8.2 Opportunity Analysis, By Region

8.3 Opportunity Analysis, By System

8.4 Market Strategy Analysis

8.5 Top Growing Countries

9 Company Profiles (Page No. - 188)

(Overview, Products & Services, Strategy & Insights, Developments, & MNM View)*

9.1 Rockwell Collins

9.2 SAAB AB

9.3 BAE Systems PLC

9.4 Thales SA

9.5 Garmin Ltd.

9.6 Barco NV

9.7 Raymarine

9.8 Northrop Grumman Corporation

9.9 Honeywell Aerospace

9.10 Esterline Technolgies Corporation

9.11 Avidyne Corporation

9.12 Aspen Avionics Inc.

9.13 Universal Avionics Systems Corporation

9.14 Astronautics Corporation of America

9.15 Samtel Group

*Details on Overview, Products & Services, Strategy & Insights, Developments, & MNM View Might Not Be Captured in Case of Unlisted Companies.

List of Tables (150 Tables)

Table 1 Bifurcation of the Years Taken Into Account

Table 2 Forecast Assumptions

Table 3 Impact Analysis of Drivers

Table 4 Impact Analysis of Restraints

Table 5 Global Multi-Function Display Market Size, By Region, 2014-2020 ($Billion)

Table 6 Global Market Size, By Procurement, 2014-2020 ($Million)

Table 7 ETOP Analysis: Multi-Function Display Systems Market

Table 8 Global Electronic Flight Display (EFD) Market Size, By Region, 2014-2020 ($Million)

Table 9 Global Heads-Up Display (HUD) Market Size, By Region, 2014-2020 ($Million)

Table 10 Global Helmet-Mounted Display (HMD) Market, By Region, 2014-2020 ($Million)

Table 11 Global Portable Multi-Function Display Market Size, By Region, 2014-2020 ($Million)

Table 12 Global Multi-Function LED Display Market Size, By Region, 2014-2020 ($Million)

Table 13 Global Multi-Function OLED Display Market Size, By Region, 2014-2020 ($Million)

Table 14 Global Multi-Function LCD Display Market Size, By Region, 2014-2020 ($Million)

Table 15 Global Multi-Function AMLCD Display Market Size, By Region, 2014-2020 ($Million)

Table 16 Global Multi-Function TFT Display Market Size, By Region, 2014-2020 ($Million)

Table 17 Global Synthetic Vision Display Market Size, By Region, 2014-2020 ($Million)

Table 18 Asia-Pacific: Multi-Function Display Market Size, By Platform, 2014-2020 ($Million)

Table 19 Asia-Pacific: Market Size, By System, 2014-2020 ($Million)

Table 20 Asia-Pacific: Market Size, By Technology, 2014-2020 ($Million)

Table 21 Asia-Pacific: Market Size, By Procurement, 2014-2020 ($Million)

Table 22 Europe: Multi-Function Display Market Size, By Platform, 2014-2020 ($Million)

Table 23 Europe: Market Size, By System, 2014-2020 ($Million)

Table 24 Europe: Market Size, By Technology, 2014-2020 ($Million)

Table 25 Europe: Market Size, By Procurement, 2014-2020 ($Million)

Table 26 North America: Multi-Function Display Market Size, By Platform, 2014-2020 ($Million)

Table 27 North America: Market Size, By System, 2014-2020 ($Million)

Table 28 North America: Market Size, By Technology, 2014-2020 ($Million)

Table 29 North America: Market Size, By Procurement, 2014-2020 ($Million)

Table 30 The Middle East: Multi-Function Display Market Size, By Platform, 2014-2020 ($Million)

Table 31 The Middle East: Market Size, By System, 2014-2020 ($Million)

Table 32 The Middle East: Market Size, By Technology, 2014-2020 ($Million)

Table 33 The Middle East: Market Size, By Procurement, 2014-2020 ($Million)

Table 34 ROW: Multi-Function Display Market Size, By Platform, 2014-2020 ($Million)

Table 35 ROW: Market Size, By System, 2014-2020 ($Million)

Table 36 ROW: Market Size, By Technology, 2014-2020 ($Million)

Table 37 ROW: Market Size, By Procurement, 2014-2020 ($Million)

Table 38 Australia: Market Landscape (2014)

Table 39 Australia: Multi-Function Display Market Size, By System, 2014-2020 ($Million)

Table 40 Australia: Market Size, By Technology, 2014-2020 ($Million)

Table 41 Australia: Market Size, By Procurement, 2014-2020 ($Million)

Table 42 Brazil: Market Landscape (2014)

Table 43 Brazil: Multi-Function Display Market Size, By System, 2014-2020 ($Million)

Table 44 Brazil: Market Size, By Technology, 2014-2020 ($Million)

Table 45 Brazil: Market Size, By Procurement, 2014-2020 ($Million)

Table 46 Canada: Market Landscape (2014)

Table 47 Canada: Market Size, By System, 2014-2020 ($Million)

Table 48 Canada: Market Size, By Technology, 2014-2020 ($Million)

Table 49 Canada: Market Size, By Procurement, 2014-2020 ($Million)

Table 50 China: Market Landscape (2014)

Table 51 China: Multi-Function Display Market Size, By System, 2014-2020 ($Million)

Table 52 China: Market Size, By Technology, 2014-2020 ($Million)

Table 53 China: Market Size, By Procurement, 2014-2020 ($Million)

Table 54 France: Market Landscape (2014)

Table 55 France: Multi-Function Display Market Size, By System, 2014-2020 ($Million)

Table 56 France: Market Size, By Technology, 2014-2020 ($Million)

Table 57 France: Market Size, By Procurement, 2014-2020 ($Million)

Table 58 Germany: Market Landscape (2014)

Table 59 Germany: Multi-Function Display Market Size, By System, 2014-2020 ($Million)

Table 60 Germany: Market Size, By Technology, 2014-2020 ($Million)

Table 61 Germany: Market Size, By Procurement, 2014-2020 ($Million)

Table 62 India: Market Landscape (2014)

Table 63 India: Market Size, By System, 2014-2020 ($Million)

Table 64 India: Market Size, By Technology, 2014-2020 ($Million)

Table 65 India: Market Size, By Procurement, 2014-2020 ($Million)

Table 66 Indonesia: Market Landscape (2014)

Table 67 Indonesia: Multi-Function Display Market Size, By System, 2014-2020 ($Million)

Table 68 Indonesia: Market Size, By Technology, 2014-2020 ($Million)

Table 69 Indonesia: Market Size, By Procurement, 2014-2020 ($Million)

Table 70 Israel: Market Landscape (2014)

Table 71 Israel: Multi-Function Display Market Size, By System, 2014-2020 ($Million)

Table 72 Israel: Market Size, By Technology, 2014-2020 ($Million)

Table 73 Israel: Market Size, By Procurement, 2014-2020 ($Million)

Table 74 Russia: Market Landscape (2014)

Table 75 Russia: Multi-Function Display Market Size, By System, 2014-2020 ($Million)

Table 76 Russia: Market Size, By Technology, 2014-2020 ($Million)

Table 77 Russia: Market Size, By Procurement, 2014-2020 ($Million)

Table 78 U.K.: Market Landscape (2014)

Table 79 U.K.: Multi-Function Display Market Size, By System, 2014-2020 ($Million)

Table 80 U.K.: Market Size, By Technology, 2014-2020 ($Million)

Table 81 U.K.: Market Size, By Procurement, 2014-2020 ($Million)

Table 82 U.S.: Market Landscape (2014)

Table 83 U.S.: Multi-Function Display Market Size, By System, 2014-2020 ($Million)

Table 84 U.S.: Market Size, By Technology, 2014-2020 ($Million)

Table 85 U.S.: Market Size, By Procurement, 2014-2020 ($Million)

Table 86 Rockwell Collins: Products & Their Description

Table 87 SAAB AB: Products & Their Description

Table 88 BAE Systems PLC: Products & Their Description

Table 89 Thales SA: Products & Their Description

Table 90 Garmin Ltd. : Products & Their Description

Table 91 Barco NV: Products & Their Description

Table 92 Raymarine: Products & Their Description

Table 93 Northrop Grumman: Products & Their Description

Table 94 Honeywell Aerospace: Products & Their Description

Table 95 Esterline Technologies: Products & Their Description

Table 96 Avidyne Corporation: Company Snapshot

Table 97 Avidyne Corporation: Products & Their Description

Table 98 Aspen Avionics Inc.: Company Snapshot

Table 99 Aspen Avionics: Products & Their Description

Table 100 Universal Avionics Systems Corporation: Company Snapshot

Table 101 Universal Avionics Systems Corporation: Products & Their Description

Table 102 Astronautics Corporation of America: Company Snapshot

Table 103 Astronautics Corporation of America : Products & Their Description

Table 104 Samtel Group: Company Snapshot

Table 105 Samtel Avionics: Products & Their Types

List of Figures (75 Figures)

Figure 1 Market Scope

Figure 2 Multi-Function Display System Stakeholders

Figure 3 Research Methodology

Figure 4 Market Size Estimation

Figure 5 Data Triangulation

Figure 6 Market Segmentation

Figure 7 Aerospace & Defense Value Chain

Figure 8 Market Drivers & Restraints

Figure 9 Multi-Function Display Systems Product Lifecycle

Figure 10 Global Market Share, By Region, 2014-2020

Figure 11 Global Market, By Platform, 2014-2020 ($Billion)

Figure 12 Global Market, By System, 2014-2020 ($Million)

Figure 13 Global Market, By Technology, 2014-2020 ($Million)

Figure 14 Global Market, By Size, 2014-2020 ($Million)

Figure 15 ETOP Analysis: Multi-Function Display Systems

Figure 16 Global Electronic Flight Display Market Size, 2014-2020 ($Million)

Figure 17 Global Heads-Up Display (HUD) Market Size, 2014-2020 ($Million)

Figure 18 Global Helmet-Mounted Display (HMD) Market Size, 2014-2020 ($Million)

Figure 19 Global Portable Multi-Function Display Market Size, 2014-2020 ($Million)

Figure 20 Global Multi-Function LED Display Market Size, 2014-2020 ($Million)

Figure 21 Global Multi-Function OLED Market Size, 2014-2020 ($Million)

Figure 22 Global Multi-Function LCD Market Size, 2014-2020 ($Million)

Figure 23 Global Multi-Function AMLCD Market Size, 2014-2020 ($Million)

Figure 24 Global Multi-Function TFT Market Size, 2014-2020 ($Million)

Figure 25 Global Synthetic Vision Display Market Size, 2014-2020 ($Million)

Figure 26 Asia-Pacific: Market Size, 2014-2020 ($Million)

Figure 27 Asia-Pacific: Market Size, By Procurement, Integration, & Maintenance, 2014-2020 ($Million)

Figure 28 Europe: Market Size, 2014-2020 ($Million)

Figure 29 Europe: Market Size, By Procurement, Integration, & Maintenance, 2014-2020 ($Million)

Figure 30 North America: Market Size, 2014-2020 ($Million)

Figure 31 North America: Market Size, By Procurement, Integration, & Maintenance, 2014-2020 ($Million)

Figure 32 The Middle East: Market Size, 2014-2020 ($Million)

Figure 33 The Middle East: Market Size, By Procurement, Integration, & Maintenance, 2014-2020 ($Million)

Figure 34 ROW: Market Size, 2014-2020 ($Million)

Figure 35 ROW: Market Size, By Procurement, Integration, & Maintenance, 2014-2020 ($Million)

Figure 36 Australia: Market Size, 2014-2020 ($Million)

Figure 37 Australia: Market Size, By Procurement, Integration, & Maintenance, 2014-2020 ($Million)

Figure 38 Brazil: Market Size, 2014-2020 ($Million)

Figure 39 Brazil: Market Size, By Procurement, Integration, & Maintenance, 2014-2020 ($Million)

Figure 40 Canada: Market Size, 2014-2020 ($Million)

Figure 41 Canada: Market Size, By Procurement, Integration, & Maintenance, 2014-2020 ($Million)

Figure 42 China: Market Size, 2014-2020 ($Million)

Figure 43 China: Market Size, By Procurement, Integration, & Maintenance, 2014-2020 ($Million)

Figure 44 France: Market Size, 2014-2020 ($Million)

Figure 45 France: Market Size, By Procurement, Integration, & Maintenance, 2014-2020 ($Million)

Figure 46 Germany: Market Size, 2014-2020 ($Million)

Figure 47 Germany: Market Size, By Procurement, Integration, & Maintenance, 2014-2020 ($Million)

Figure 48 India: Market Size, 2014-2020 ($Million)

Figure 49 India: Market Size, By Procurement, Integration, & Maintenance, 2014-2020 ($Million)

Figure 50 Indonesia: Market Size, 2014-2020 ($Million)

Figure 51 Indonesia: Market Size, By Procurement, Integration, & Maintenance, 2014-2020 ($Million)

Figure 52 Israel: Market Size, 2014-2020 ($Million)

Figure 53 Israel: Market Size, By Procurement, Integration, & Maintenance, 2014-2020 ($Million)

Figure 54 Russia: Market Size, 2014-2020 ($Million)

Figure 55 Russia: Market Size, By Procurement, Integration, & Maintenance, 2014-2020 ($Million)

Figure 56 U.K.: Market Size, 2014-2020 ($Million)

Figure 57 U.K.: Market Size, By Procurement, Integration, & Maintenance, 2014-2020 ($Million)

Figure 58 U.S.: Market Size, 2014-2020 ($Million)

Figure 59 U.K.: Market Size, By Procurement, Integration, & Maintenance, 2014-2020 ($Million)

Figure 60 Market Share Analysis, By Company

Figure 61 Opportunity Analysis, By Region

Figure 62 Multi-Function Display, Y-O-Y Growth, By Technology

Figure 63 Market Strategy Analysis

Figure 64 Top Growing Countries

Figure 65 Rockwell Collins: Company Snapshot

Figure 66 SAAB AB: Company Snapshot

Figure 67 SAAB AB: Strategy Matrix

Figure 68 BAE Systems PLC: Company Snapshot

Figure 69 Thales SA: Company Snapshot

Figure 70 Garmin: Company Snapshot

Figure 71 Barco NV: Company Snapshot

Figure 72 Raymarine: Company Snapshot

Figure 73 Northrop Grumman Corporation: Company Snapshot

Figure 74 Honeywell Aerospace: Company Snapshot

Figure 75 Esterline Technologies Corporation: Company Snapshot

Growth opportunities and latent adjacency in Multi-Function Display (MFD) Market