Natural Language Processing (NLP) Market by Offering (Solutions, Services), Type (Rule-based, Statistical, Hybrid), Application (Sentiment Analysis, Social Media Monitoring), Technology (IVR, OCR, Auto Coding), Vertical & Region - Global Forecast to 2028

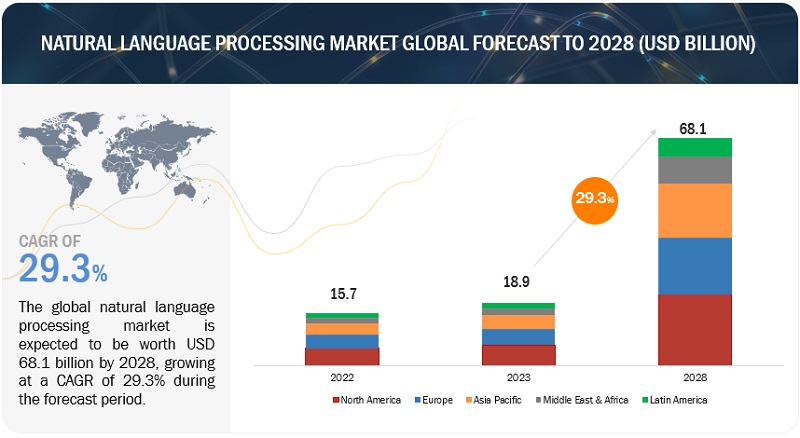

The global Natural Language Processing Market is projected to grow from $18.9 billion in 2023 to $68.1 billion by 2028, at a CAGR of 29.3% during the forecast period. The growth of the natural language processing market is driven by various factors, including advancements in text-analyzing computer programs, rising need for enterprise solutions to streamline business operations for better customer experience, surging demand for cloud-based NLP solutions to reduce overall costs and enhance scalability and demand for predictive analytics to reduce risks and identify growth opportunities.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Driver: Advancements in text-analyzing computer programs

NLP is a technology that enables the processing of human language in the form of text or voice data. It is used in various applications, such as voice-operated GPS systems, digital assistants, speech-to-text dictation software, and customer service chatbots. NLP combines computational linguistics with statistical, machine learning, and deep learning models to create a comprehensive understanding of human language, including the speaker or writer's intention and sentiment. IBM's Watson Natural Language Understanding (NLU) is a tool that analyzes unstructured data formats, including HTML, webpages, and social media, to identify concepts, keywords, categories, semantics, and emotions. It also performs text classification, entity extraction, Named Entity Recognition (NER), sentiment analysis, and summarization.

Restraint : Lack of contextual understanding leading to ambiguity

Natural Language Understanding (NLU) is a process that involves comprehending the context in which language is used. However, understanding the context can be quite challenging due to certain obstacles. Firstly, some words can have multiple meanings, resulting in ambiguity. To eliminate such ambiguities and ensure that such words are precisely understood in a specific document, linguistics has been continuously working on resolving the issue of word sense disambiguation. Secondly, text documents often use domain-specific discourse models, such as legal contracts, news articles, research reports, and many others. These documents have certain properties, such as domain discourse models, that need to be added to AI technology to enhance NLU.

Opportunity: Generative AI acting as catalyst for transforming NLP Market

Generative AI is a revolutionary technology that has transformed the Natural Language Processing (NLP) market. With advanced language models, such as GPT-3 and its successors, generative AI enables the automatic creation of human-like text, which opens doors to several innovative applications. It powers chatbots that can engage in coherent conversations, content generation for marketing and journalism, and personalized recommendations for users. Generative AI offers businesses a cost-effective way to engage their audiences by generating creative and contextually relevant content at scale.

Challenge: Lack of multilingual proficiency

The potential of NLP technology to revolutionize language-based technology has gained significant attention in recent years. However, most of the research and development in NLP has been focused on English and a few other popular languages, leaving a vast number of the world's languages underserved. With approximately 7,000 languages spoken globally, primarily in regions like Asia, addressing this linguistic diversity is crucial to ensure that technological advancements benefit a more inclusive global audience.

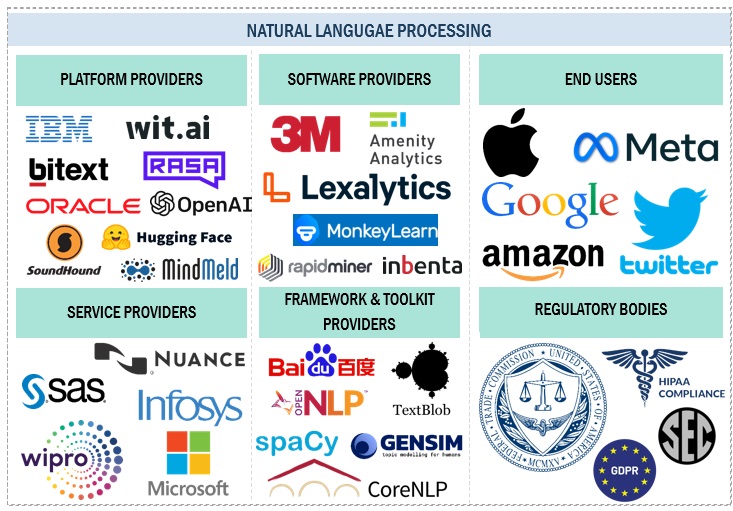

Natural Language Processing Market Ecosystem

The natural language processing market report covers market ecosystem which comprises platform providers, software providers, service providers, framework & toolkit providers, end users and regulatory bodies.

By Vertical, BFSI segment accounts for the largest market size during the forecast period

Businesses in the BFSI sector strive to retain customers, reduce expenses, increase revenue, and abide by changing regulations. NLP-based products aid BFSI firms in mitigating risks through tasks such as information retrieval, intent parsing, customer service, and compliance process automation. Major BFSI companies have implemented NLP solutions, such as JP Morgan Chase's COIN, which uses ML software to help its legal teams parse through legal documents. SAS Platform, through its cloud solution integration, claims to have assisted the Royal Bank of Scotland (RBS) in analyzing customer feedback and improving customer experiences using NLP.

Managed Services segment is projected to grow at the highest CAGR during the forecast period

Companies understand the importance of providing excellent client experiences, which is why they often seek out the best players in the market to provide managed services. However, managing these services while also focusing on core business procedures can be challenging. This is where managed services come in. They offer specialized skills to maintain and update NLP software and services, as well as providing pre- and post-deployment support to clients. Many organizations outsource these services to ensure timely support for their clients. MSPs are third-party companies that manage and provide support to the IT infrastructure of NLP providers under a subscription model or Service-Level Agreement (SLA). They are responsible for resolving all hardware and software-related issues.

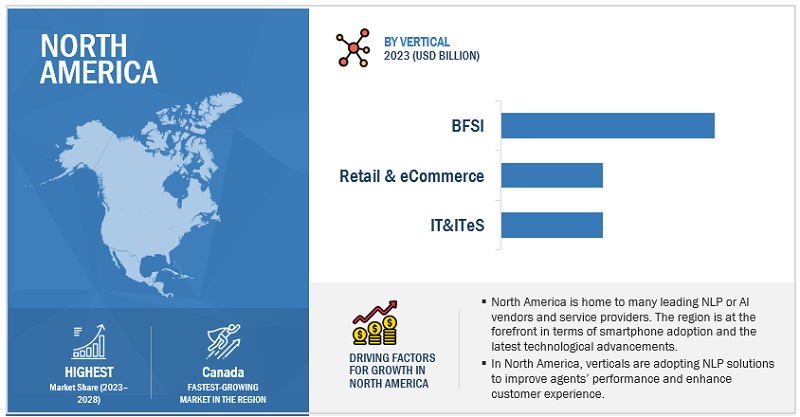

North America to account for the largest market size during the forecast period

North America comprises developed economies, such as the United States and Canada. Both countries have identified AI as a national policy priority area. Many organizations in the region, especially in the US, have integrated AI, ML, and deep learning technologies into their business processes to stay ahead of the market. AI-based technologies in customer support offer significant financial benefits to organizations that primarily offer call center services. The region's NLP market is experiencing rapid growth due to favorable conditions such as infrastructure development and high adoption of digital technologies. Large-scale investments in AI-enabled infrastructure by startups and established companies have resulted in the development of innovative AI-enabled solutions across various verticals.

Key Market Players

The major natural language processing solutions and service providers include IBM (US), Microsoft (US), Google (US), AWS (US), Meta (US), 3M (US), Baidu (China), Apple (US), SAS Institute (US), IQVIA (UK), Oracle (US), Salesforce (US), OpenAI (US), Inbenta (US), LivePerson (US), SoundHound AI (US), MindMeld (US), Veritone (US), Dolbey (US), Automated Insights (US), Bitext (US), Conversica (US), UiPath (US), Addepto (US), RaGaVeRa (India), Observe.ai (US), Eigen (US), Gnani.ai (India), Crayon Data (Singapore), Narrativa (US), deepset (US), Ellipsis Health (US), DheeYantra (US), Verbit.ai (US), Rasa (US), MonkeyLearn (US), TextRazor (England), and Cohere (Canada). These companies have used both organic and inorganic growth strategies such as product launches, acquisitions, and partnerships to strengthen their position in the natural language processingmarket.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2017–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

USD Billion |

|

Segments covered |

Offering (Solutions – [Deployment Mode], Services), Type, Application, Technology, Vertical, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

IBM (US), Microsoft (US), Google (US), AWS (US), Meta (US), 3M (US), Baidu (China), Apple (US), SAS Institute (US), IQVIA (UK), Oracle (US), Salesforce (US), OpenAI (US), Inbenta (US), LivePerson (US), SoundHound AI (US), MindMeld (US), Veritone (US), Dolbey (US), Automated Insights (US), Bitext (US), Conversica (US), UiPath (US), Addepto (US), RaGaVeRa (India), Observe.ai (US), Eigen (US), Gnani.ai (India), Crayon Data (Singapore), Narrativa (US), deepset (US), Ellipsis Health (US), DheeYantra (US), Verbit.ai (US), Rasa (US), MonkeyLearn (US), TextRazor (England), and Cohere (Canada). |

This research report categorizes the natural language processing market based on Offering, Application, End User, and Region.

By Offering:

-

Solutions

-

Type

- Platforms

- Software tools

-

Deployment Mode

- Cloud

- On Premises

-

Type

-

Services

-

Professional Services

- Training & Consulting

- System Integration & Implementation

- Support & Maintenance

- Managed Services

-

Professional Services

By Type:

- Rule-Based

- Statistical

- Hybrid

By Application:

- Customer Experience Management

- Virtual Assistants/Chatbots

- Social Media Monitoring

- Sentiment Analysis

- Text Classification & Summarization

- Employee Onboarding & Recruiting

- Language Generation & Speech Recognition

- Machine Translation

- Other Applications

By Technology:

- Optical Character Recognition

- Interactive Voice Response

- Auto Coding

- Text Analytics

- Speech Analytics

- Image & Pattern Recognition

- Simulation & Modeling

By Vertical:

- BFSI

- IT & ITeS

- Retail & eCommerce

- Healthcare and Life Sciences

- Transportation and Logistics

- Government and Public Sector

- Media & Entertainment

- Manufacturing

- Telecom

- Others (Education, Travel & Hospitality, Automotive, and Energy & Utilities)

By Region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Recent Developments:

- In August 2023, Meta introduced SeamlessM4T, a groundbreaking AI translation model that stands as the first to offer comprehensive multimodal and multilingual capabilities. This innovative model empowers individuals to communicate across languages through both speech and text effortlessly. Its impressive features include speech recognition for nearly 100 languages, speech-to-text translation for nearly 100 input and output languages, and speech-to-speech translation supporting almost 100 input languages and 36 output languages (including English).

- In August 2023, Google Cloud announced a partnership with AI21 Labs, an Israeli startup revolutionizing reading and writing through generative AI and large language models (LLMs). AI21 Labs utilizes Google Cloud's specialized AI/ML infrastructure to expedite model training and inferencing. This partnership enables customers to seamlessly integrate industry-specific generative AI capabilities through BigQuery connectors and functions.

- In March 2023, Baidu unveiled ERNIE Bot, its latest innovation in generative AI, featuring a knowledge-enhanced LLM. This cutting-edge technology can understand human intentions and provide precise, coherent, and fluent responses that approach human-level comprehension and communication.

- In February 2022, SoundHound AI expanded its partnership with Snap to offer automatic captioning for Snapchat videos. By utilizing SoundHound's Automatic Speech Recognition (ASR) software, Snapchatters can easily generate transcriptions of the audio content in their Snaps in real time. This feature enhances the accessibility and user experience for individuals who may prefer or require captions while viewing videos on the platform.

- In February 2022, Meta announced its latest innovation, the Universal Speech Translator, where Meta is designing novel approaches to translating from a speech in one language to another in real time so it can support languages without a standard writing system as well as those that are both written and spoken.

Frequently Asked Questions (FAQ):

What is Natural Language Prcoessing?

Natural Language Processing (NLP) refers to the branch of computer science, specifically the branch of Artificial Intelligence (AI), concerned with giving computers the ability to understand text and spoken words in much the same way human beings can. NLP drives computer programs that translate text from one language to another, respond to spoken commands, and quickly summarize large volumes of text—even in real time.

Which region is expected to hold the highest share in the natural language processing market?

NLP solutions and services have a huge potential to accelerate businesses. Today, companies use NLP solutions to automatically summarize large data sets and dashboards, machine translation, text classification, and sentiment analysis. NLP solutions and services also help organizations save time and money by enabling employees to focus on value-added tasks; in other words, they reduce the workforce’s efforts.

What is the market size of natural language processing?

The global market for natural language processing market is projected to grow from USD 18.9 billion in 2023 to USD 68.1 billion by 202, at a CAGR of 29.3% during the forecast period.

Which are the key drivers supporting the market growth for natural language processing?8

The key drivers supporting the market growth for natural language processing include advancements in text-analyzing computer programs, rising need for enterprise solutions to streamline business operations for better customer experience, surging demand for cloud-based NLP solutions to reduce overall costs and enhance scalability, demand for predictive analytics to reduce risks and identify growth opportunities.

Who are the key vendors in the market for natural language processing?

The key vendors in the global natural language processing market include are IBM (US), Microsoft (US), Google (US), AWS (US), Meta (US), 3M (US), Baidu (China), Apple (US), SAS Institute (US), IQVIA (UK), Oracle (US), Salesforce (US), OpenAI (US), Inbenta (US), LivePerson (US), SoundHound AI (US), MindMeld (US), Veritone (US), Dolbey (US), Automated Insights (US), Bitext (US), Conversica (US), UiPath (US), Addepto (US), RaGaVeRa (India), Observe.ai (US), Eigen (US), Gnani.ai (India), Crayon Data (Singapore), Narrativa (US), deepset (US), Ellipsis Health (US), DheeYantra (US), Verbit.ai (US), Rasa (US), MonkeyLearn (US), TextRazor (England), and Cohere (Canada).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The research study for the NLP market involved extensive secondary sources, directories, and several journals, including the Journal of the American Medical Informatics Association and The Association for Natural Language Processing Providers. Primary sources were mainly industry experts from the core and related industries, preferred NLP, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information and assess the market’s prospects.

Secondary Research

The market size of companies offering NLP solutions and services was arrived at based on secondary data available through paid and unpaid sources. It was also arrived at by analyzing the product portfolios of major companies and rating the companies based on their performance and quality.

In the secondary research process, various sources were referred to for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendor websites. Additionally, NLP spending of various countries was extracted from the respective sources. Secondary research was mainly used to obtain key information related to the industry’s value chain and supply chain to identify key players based on solutions, services, market classification, and segmentation according to offerings of major players, industry trends related to solutions, services, deployment modes, functionality, applications, verticals, and regions, and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and NLP expertise; related key executives from NLP solution vendors, SIs, professional service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using NLP solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of NLP solutions and services, which would impact the overall NLP market.

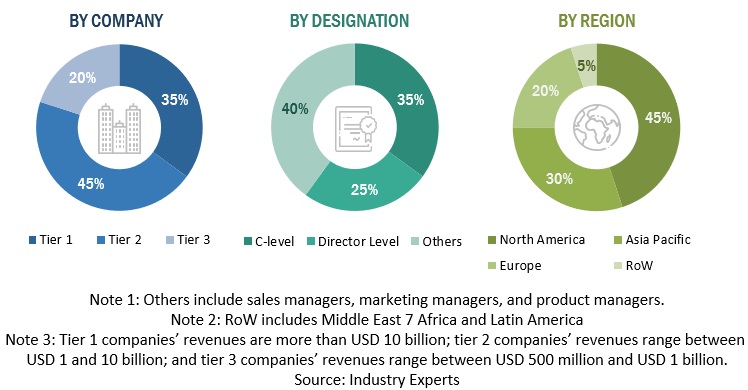

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

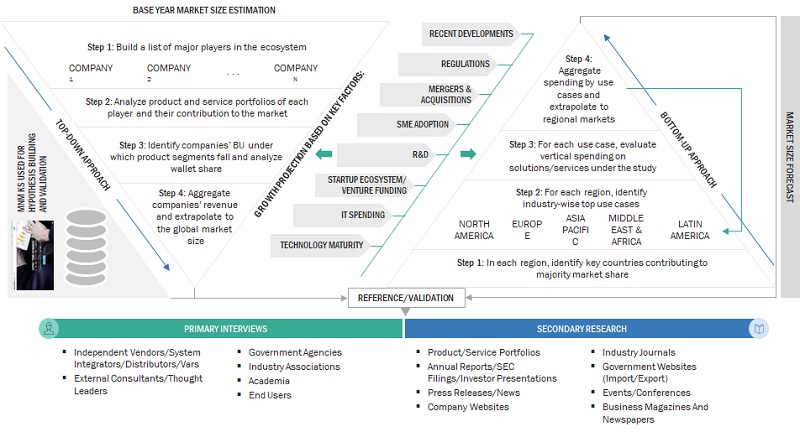

Market Size Estimation

Multiple approaches were adopted for estimating and forecasting the NLP market. The first approach involves estimating the market size by summation of companies’ revenue generated through the sale of solutions and services.

Market Size Estimation Methodology- Top-down approach

In the top-down approach, an exhaustive list of all the vendors offering solutions and services in the NLP market was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor’s offerings were evaluated based on the breadth of solutions and services, deployment modes, applications, and verticals. The aggregate of all the companies’ revenue was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets repository for validation.

Market Size Estimation Methodology-Bottom-up approach

In the bottom-up approach, the adoption rate of NLP solutions and services among different end users in key countries with respect to their regions contributing the most to the market share was identified. For cross-validation, the adoption of NLP solutions and services among industries, along with different use cases with respect to their regions, was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation.

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included the analysis of the NLP market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major NLP providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primaries, the exact values of the overall natural language processing market market size and segments’ size were determined and confirmed using the study.

Top-down and Bottom-up approaches

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

According to IBM, Natural Language Processing (NLP) refers to the branch of computer science—and more specifically, the branch of artificial intelligence or AI concerned with giving computers the ability to understand text and spoken words in much the same way human beings can. NLP combines computational linguistics rule-based modeling of human language with statistical, machine learning, and deep learning models.

According to the SAS Institute, NLP is a branch of artificial intelligence that helps computers understand, interpret, and manipulate human language. NLP draws from many disciplines, including computer science and computational linguistics, in its pursuit to fill the gap between human communication and computer understanding.

As per Google, NLP uses ML techniques to reveal the structure and meaning of the text. With natural language processing applications, organizations can analyze text and extract information about people, places, and events to understand social media sentiment and customer conversations better. NLP applications are used to derive insights from unstructured text-based data and give you access to extracted information to generate a new understanding of that data.

Stakeholders

- NLP Vendors

- NLP Solution Vendors

- Managed Service Providers

- Support And Maintenance Service Providers

- System Integrators (SIs)/Migration Service Providers

- Value-added Resellers (VARs) and Distributors

- Distributors and Value-added Resellers (VARs)

- System Integrators (SIs)

- Independent Software Vendors (ISV)

- Third-party Providers

- Technology Providers

Report Objectives

- To define, describe, and predict the Natural Language Processing (NLP) market by offering (solutions and services), type, application, technology, organization size, vertical, and region

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the NLP market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis as per Feasibility

- Further breakup of the North American Natural Language Processing Market

- Further breakup of the European Market

- Further breakup of the Asia Pacific Market

- Further breakup of the Middle East & Africa Market

- Further breakup of the Latin American Market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Natural Language Processing (NLP) Market