2

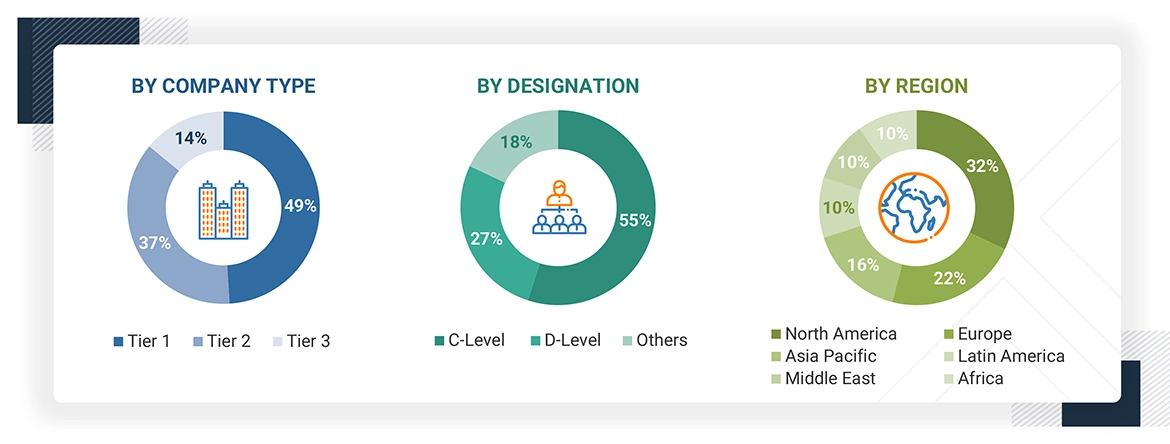

RESEARCH METHODOLOGY

33

5

MARKET OVERVIEW

Analyze Market Structure and Competitive Intensity to Anticipate New Growth Opportunities

48

5.2.1.1

Surge in global air traffic

5.2.1.2

Shift in passenger expectations

5.2.1.3

Rapid adoption of AI-powered predictive maintenance in aviation

5.2.2.1

Costly implementation and maintenance

5.2.2.2

Complex regulatory landscape

5.2.3.1

AI in predictive and prescriptive analytics

5.2.3.2

AI in air traffic management and urban air mobility

5.2.3.3

Rise of AI-powered air cargo

5.2.4.1

Cybersecurity and data integrity risks

5.2.4.2

Regulatory fragmentation and ethical uncertainty

5.3

TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

5.4.1

AVERAGE SELLING PRICE OF AI IN AVIATION SOLUTIONS OFFERED BY KEY PLAYERS

5.4.2

AVERAGE SELLING PRICE, BY REGION

5.5.1

AI SOLUTION PROVIDERS

5.7

KEY STAKEHOLDERS AND BUYING CRITERIA

5.7.1

KEY STAKEHOLDERS IN BUYING PROCESS

5.8

KEY CONFERENCES AND EVENTS, 2025–2026

5.10

INVESTMENT AND FUNDING SCENARIO

5.11.1.1

Flight data analytics

5.11.2

COMPLEMENTARY TECHNOLOGIES

5.11.2.1

Edge AI Hardware

5.11.2.2

Real-time connectivity

5.11.3

ADJACENT TECHNOLOGIES

5.11.3.1

Electric propulsion

5.11.3.2

More electric aircraft

5.12.1

HEATHROW AIRPORT: AI FOR PASSENGER FLOW OPTIMIZATION

5.12.2

AIRBUS: AI IN SKYWISE FOR PREDICTIVE MAINTENANCE

5.12.3

FAA: AI FOR AIR TRAFFIC FLOW MANAGEMENT

5.12.4

DELTA AIR LINES: AI FOR BAGGAGE AND IRREGULAR OPERATIONS

5.15

MACROECONOMIC OUTLOOK

5.16

IMPACT OF MEGATRENDS

5.16.1

DIGITAL TRANSFORMATION AND INDUSTRY 4.0

5.16.2

SUSTAINABILITY AND GREEN AVIATION

5.16.3

AUTONOMOUS AND URBAN AIR MOBILITY

6

AI IN AVIATION MARKET, BY BUSINESS FUNCTION

Market Size and Forecast to 2030 – USD Million

83

6.2.1

FOCUS ON STREAMLINING DECISION-MAKING AND ENHANCING SITUATIONAL AWARENESS

6.2.1.1

Use case: Etihad Airways uses Google Cloud AI to enhance route planning

6.2.1.2

Use case: British Airways applies AI to predict congestion delays

6.2.1.3

Use case: Singapore Airlines employs AI to monitor and mitigate in-flight track deviations

6.2.2

CREW SCHEDULING & DUTY TIME OPTIMIZATION

6.2.3

ROUTE PLANNING & AIRSPACE OPTIMIZATION

6.2.4

FUEL EFFICIENCY MODELING

6.2.5

WEATHER DISRUPTION REROUTING

6.2.6

ON-TIME PERFORMANCE MONITORING

6.3.1

NEED TO ENSURE OPERATIONAL CONTINUITY AND REGULATORY COMPLIANCE

6.3.1.1

Use case: Lufthansa Technik offers AVIATAR platform for operational efficiency

6.3.1.2

Use case: Air New Zealand implements AI-powered computer vision to automate aircraft inspections

6.3.1.3

Use case: Rolls-Royce employs AI in engine health monitoring

6.3.2

PREDICTIVE MAINTENANCE

6.3.3

VISUAL INSPECTION & DEFECT DETECTION

6.3.4

FAULT ISOLATION & DIAGNOSTICS

6.3.5

SPARE PARTS DEMAND FORECASTING

6.3.6

WARRANTY CLAIM OPTIMIZATION

6.3.7

REAL-TIME AIRCRAFT HEALTH MONITORING

6.3.8

AUTOMATED TROUBLESHOOTING & DIGITAL WORKFLOWS

6.4

AIRPORT OPERATIONS & GROUND HANDLING

6.4.1

INCREASE IN GLOBAL AIR TRAVEL AND CONGESTION

6.4.1.1

Use case: Changi Airport uses AI to optimize passenger flow management

6.4.1.2

Use case: Heathrow Airport deploys AI for baggage tracking and rerouting

6.4.1.3

Use case: Zurich Airport implements computer vision AI for tarmac safety

6.4.2

PASSENGER FLOW PREDICTION & CHECK-IN ALLOCATION

6.4.3

BAGGAGE TRACKING & REROUTING

6.4.4

TARMAC SAFETY REROUTING

6.4.5

GATE & GSE ASSIGNMENT OPTIMIZATION

6.4.6

AIRSIDE CONGESTION FORECASTING

6.5

PASSENGER EXPERIENCE & SERVICE

6.5.1

PASSENGER DEMAND FOR CONVENIENCE AND TRANSPARENCY

6.5.1.1

Use case: All Nippon Airways employs NLP-driven chatbots to handle passenger inquiries

6.5.1.2

Use case: KLM deploys AI-based real-time feedback analytics to enhance service recovery

6.5.1.3

Use case: Air France uses AI video analytics for risk monitoring

6.5.2

NLP-BASED VIRTUAL ASSISTANTS

6.5.3

EMOTION RECOGNITION & SENTIMENT ANALYSIS

6.5.4

REAL-TIME FEEDBACK ANALYTICS

6.5.5

PERSONALIZED IN-FLIGHT EXPERIENCE

6.5.6

PASSENGER SAFETY & RISK MONITORING

6.6.1

IMPLEMENTATION OF REAL-TIME FORECASTING AND DYNAMIC PRICING STRATEGIES

6.6.1.1

Use case: Lufthansa Group deploys AI-based fare optimization engines to adjust ticket pricing

6.6.1.2

Use case: American Airlines uses predictive AI models for route-level demand

6.6.1.3

Use case: Ryanair integrates AI to upsell baggage and ancillary products

6.6.2

DYNAMIC FARE OPTIMIZATION

6.6.3

ROUTE-LEVEL DEMAND FORECASTING

6.6.4

ANCILLARY REVENUE OPTIMIZATION

6.6.5

REVENUE LEAKAGE DETECTION

6.7

TRAINING & HUMAN CAPITAL

6.7.1

COMPLIANCE WITH EVOLVING AVIATION REGULATIONS

6.7.1.1

Use case: CAE integrates AI into full-flight simulators to enhance pilot training

6.7.1.2

Use case: Singapore Airlines adopts AI-based speech analysis to improve communication training

6.7.1.3

Use case: JetBlue uses predictive fatigue management tools to support crew wellness

6.7.2

AI-ENHANCED FLIGHT SIMULATION TRAINING

6.7.3

CABIN CREW CRM & LANGUAGE TRAINING AI

6.7.4

FATIGUE & WELLNESS PREDICTION

6.8

R&D & PRODUCT DEVELOPMENT

6.8.1

ESCALATING DEMAND FOR LIGHTER, GREENER, AND MORE EFFICIENT AIRCRAFT

6.8.1.1

Use case: Airbus incorporates AI into simulation frameworks to accelerate aircraft prototyping

6.8.1.2

Use case: Boeing leverages AI to reduce aircraft structural weight

6.8.1.3

Use case: Textron employs AI for component testing

6.8.2

DIGITAL TWIN MODELING FOR PROTOTYPING

6.8.3

AI FOR STRUCTURAL DESIGN & PERFORMANCE SIMULATION

6.8.4

AI-POWERED COMPONENT TESTING & QUALIFICATION

6.9

SUSTAINABILITY & EMISSION MANAGEMENT

6.9.1

REGULATORY PUSH FOR DECARBONIZATION

6.9.1.1

Use case: Heathrow Airport employs AI to optimize taxi time

6.9.1.2

Use case: Air France employs AI-based tools to monitor emissions

6.9.1.3

Use case: Lufthansa Group implements AI for taxi optimization and green routing

6.9.2

TAXI OPTIMIZATION & GREEN ROUTING

6.9.3

CARBON MONITORING & ESG REPORTING

7

AI IN AVIATION MARKET, BY SOLUTION

Market Size and Forecast to 2030 – USD Million

107

7.2.1

SURGE IN INVESTMENTS DUE TO INCREASED COMPLEXITY OF AI

7.3.1

EMPHASIS ON SAFETY, EXPLAINABILITY, AND REAL-TIME RESPONSIVENESS

7.3.2

AI DEVELOPMENT TOOLS

7.3.3

AI APPLICATION PLATFORMS

7.4.1

SHIFT TOWARD OUTCOME-BASED DEPLOYMENTS IN AVIATION INDUSTRY

7.4.3

INTEGRATED SERVICES

8

AI IN AVIATION MARKET, BY TECHNOLOGY

Market Size and Forecast to 2030 – USD Million

114

8.2.1

EXTENSIVE USE IN FLIGHT DELAY PREDICTION AND ANOMALY DETECTION

8.2.2

SUPERVISED LEARNING

8.2.3

UNSUPERVISED LEARNING

8.2.4

REINFORCEMENT LEARNING

8.3

NATURAL LANGUAGE PROCESSING

8.3.1

IMPROVED OPERATIONS DUE TO VOICE-ENABLED INTERFACES AND TEXT AUTOMATION

8.4.1

ABILITY TO INTERPRET AND ACT ON VISUAL INPUTS FROM AIR AND GROUND SYSTEMS

8.5.1

CRITICAL ROLE IN TRAINING AND AUTOMATION

8.6.1

MULTI-SENSOR INTEGRATION TO ENHANCE SITUATIONAL AWARENESS

9

AI IN AVIATION MARKET, BY END USER

Market Size and Forecast to 2030 – USD Million

120

9.2.1

SIGNIFICANT IMPACT OF AI ON COST SAVINGS AND OPERATIONAL EFFICIENCY

9.3.1

REGULATORY PUSH FOR SECURITY AND EMPHASIS ON PASSENGER SATISFACTION

9.4

AIRCRAFT MANUFACTURERS & SYSTEM INTEGRATORS

9.4.1

INCLINATION TOWARD REAL-TIME DECISION-MAKING AND AUTOMATED FLIGHT OPERATIONS

9.5.1

REDUCED AIRCRAFT-ON-GROUND TIME AND SPARE INVENTORY COSTS

10

AI IN AVIATION MARKET, BY REGION

Market Size and Forecast to 2030, Country Level Analysis – USD Million

124

10.2.2.1

Focus on operational efficiency and cost savings to drive market

10.2.3.1

Rapid adoption of AI to promote sustainability to drive market

10.3.2.1

Strong regulatory framework and advanced aviation infrastructure to drive market

10.3.3.1

Targeted investments from government and industry leaders to drive market

10.3.4.1

Increased adoption of AI to enhance automation across airports and airlines to drive market

10.3.5.1

Compliance with European Union’s digital and environmental goals to drive market

10.3.6.1

Need to manage high passenger volumes to drive market

10.4.2.1

Favorable government policies to drive market

10.4.3.1

Rise in passenger traffic and rapid digitalization to drive market

10.4.4.1

Domestic push for safety and enhanced passenger experience to drive market

10.4.5.1

Focus on smart airport infrastructure and traffic management to drive market

10.4.6.1

Rising government investments to drive market

10.4.7.1

Robust infrastructure and strong government backing to drive market

10.4.8

REST OF ASIA PACIFIC

10.5.2.1

Aviation modernization initiatives under Vision 2030 to drive market

10.5.3.1

Substantial investments in AI to elevate airport efficiency to drive market

10.5.4.1

Rapid integration of AI across aerospace operations to drive market

10.5.5

REST OF MIDDLE EAST

10.6.2.1

Presence of major aircraft manufacturers and airports to drive market

10.6.3.1

Ongoing modernization of airspace infrastructure to drive market

10.6.4.1

Rapid integration of AI for dynamic positioning and demand forecasting to drive market

10.6.5.1

Advancements in predictive maintenance to drive market

10.6.6

REST OF LATIN AMERICA

10.7.2.1

Emphasis on strengthening national airspace capacity to drive market

10.7.3.1

Integration of AI across airport operations and airline management to drive market

11

COMPETITIVE LANDSCAPE

Market Share Analysis (%) & Competitive Positioning Matrix

220

11.2

KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020–2024

11.3

REVENUE ANALYSIS, 2021–2024

11.4

MARKET SHARE ANALYSIS, 2024

11.5

BRAND/PRODUCT COMPARISON

11.6

COMPANY VALUATION AND FINANCIAL METRICS

11.7

COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

11.7.5.1

Company footprint

11.7.5.2

Region footprint

11.7.5.3

Solution footprint

11.7.5.4

Technology footprint

11.7.5.5

Business function footprint

11.8

COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

11.8.1

PROGRESSIVE COMPANIES

11.8.2

RESPONSIVE COMPANIES

11.8.5

COMPETITIVE BENCHMARKING

11.8.5.1

List of start-ups/SMEs

11.8.5.2

Competitive benchmarking of start-ups/SMEs

11.9

COMPETITIVE SCENARIO

12

COMPANY PROFILES

In-Depth Profiles of Key Players with SWOT, Financials, and Recent Developments

248

12.1.1

AMADEUS IT GROUP S.A.

12.1.1.1

Business overview

12.1.1.2

Products offered

12.1.1.3

Recent developments

12.1.2

HONEYWELL INTERNATIONAL INC.

12.1.4

AMAZON WEB SERVICES, INC. (AWS)

12.1.5

GENERAL ELECTRIC COMPANY

12.1.8

PALANTIR TECHNOLOGIES INC.

12.1.14

TATA CONSULTANCY SERVICES LIMITED (TCS)

12.2.2

ELENIUM AUTOMATION

12.2.3

ASSAIA INTERNATIONAL LTD.

12.2.7

AEROCLOUD SYSTEMS LTD.

12.2.9

GRAYMATTER SOFTWARE SERVICES PVT LTD

13.2

KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3

CUSTOMIZATION OPTIONS

TABLE 1

USD EXCHANGE RATE

TABLE 2

AVERAGE SELLING PRICE OF AI IN AVIATION SOLUTIONS OFFERED BY AMADEUS IT GROUP S.A., 2024 (USD MILLION)

TABLE 3

AVERAGE SELLING PRICE OF AI IN AVIATION SOLUTIONS OFFERED BY HONEYWELL INTERNATIONAL INC., 2024 (USD MILLION)

TABLE 4

AVERAGE SELLING PRICE OF AI IN AVIATION SOLUTIONS OFFERED BY MICROSOFT, 2024 (USD MILLION)

TABLE 5

AVERAGE SELLING PRICE OF AI IN AVIATION SOLUTIONS OFFERED BY AMAZON WEB SERVICES, INC., 2024 (USD MILLION)

TABLE 6

AVERAGE SELLING PRICE OF AI IN AVIATION SOLUTIONS OFFERED BY GENERAL ELECTRIC COMPANY, 2024 (USD MILLION)

TABLE 7

AVERAGE SELLING PRICE OF AI IN AVIATION SOLUTIONS, BY REGION, 2024 (USD MILLION)

TABLE 8

ROLE OF COMPANIES IN ECOSYSTEM

TABLE 9

INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS (%)

TABLE 10

KEY BUYING CRITERIA FOR TOP THREE END USERS

TABLE 11

KEY CONFERENCES AND EVENTS, 2025–2026

TABLE 12

NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13

EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14

ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15

MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 16

AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 17

LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 19

BUSINESS MODELS IN AI IN AVIATION MARKET

TABLE 20

AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2021–2024 (USD MILLION)

TABLE 21

AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2025–2030 (USD MILLION)

TABLE 22

AI IN AVIATION MARKET, BY FLIGHT OPERATION, 2021–2024 (USD MILLION)

TABLE 23

AI IN AVIATION MARKET, BY FLIGHT OPERATION, 2025–2030 (USD MILLION)

TABLE 24

AI IN AVIATION MARKET, BY MAINTENANCE & SAFETY, 2021–2024 (USD MILLION)

TABLE 25

AI IN AVIATION MARKET, BY MAINTENANCE & SAFETY, 2025–2030 (USD MILLION)

TABLE 26

AI IN AVIATION MARKET, BY AIRPORT OPERATIONS & GROUND HANDLING, 2021–2024 (USD MILLION)

TABLE 27

AI IN AVIATION MARKET, BY AIRPORT OPERATIONS & GROUND HANDLING, 2025–2030 (USD MILLION)

TABLE 28

AI IN AVIATION MARKET, BY PASSENGER EXPERIENCE & SERVICE, 2021–2024 (USD MILLION)

TABLE 29

AI IN AVIATION MARKET, BY PASSENGER EXPERIENCE & SERVICE, 2025–2030 (USD MILLION)

TABLE 30

AI IN AVIATION MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 31

AI IN AVIATION MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 32

AI IN AVIATION MARKET, BY INFRASTRUCTURE, 2021–2024 (USD MILLION)

TABLE 33

AI IN AVIATION MARKET, BY INFRASTRUCTURE, 2025–2030 (USD MILLION)

TABLE 34

AI IN AVIATION MARKET, BY SOFTWARE, 2021–2024 (USD MILLION)

TABLE 35

AI IN AVIATION MARKET, BY SOFTWARE, 2025–2030 (USD MILLION)

TABLE 36

AI IN AVIATION MARKET, BY SERVICE, 2021–2024 (USD MILLION)

TABLE 37

AI IN AVIATION MARKET, BY SERVICE, 2025–2030 (USD MILLION)

TABLE 38

AI IN AVIATION MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 39

AI IN AVIATION MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 40

AI IN AVIATION MARKET, BY MACHINE LEARNING, 2021–2024 (USD MILLION)

TABLE 41

AI IN AVIATION MARKET, BY MACHINE LEARNING, 2025–2030 (USD MILLION)

TABLE 42

AI IN AVIATION MARKET, BY COMPUTER VISION, 2021–2024 (USD MILLION)

TABLE 43

AI IN AVIATION MARKET, BY COMPUTER VISION, 2025–2030 (USD MILLION)

TABLE 44

AI IN AVIATION MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 45

AI IN AVIATION MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 46

AI IN AVIATION MARKET, BY REGION, 2021–2024 (USD MILLION)

TABLE 47

AI IN AVIATION MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 48

NORTH AMERICA: AI IN AVIATION MARKET, BY COUNTRY, 2021–2024 (USD MILLION)

TABLE 49

NORTH AMERICA: AI IN AVIATION MARKET, BY COUNTRY, 2025–2030 (USD MILLION)

TABLE 50

NORTH AMERICA: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2021–2024 (USD MILLION)

TABLE 51

NORTH AMERICA: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2025–2030 (USD MILLION)

TABLE 52

NORTH AMERICA: AI IN AVIATION MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 53

NORTH AMERICA: AI IN AVIATION MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 54

NORTH AMERICA: AI IN AVIATION MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 55

NORTH AMERICA: AI IN AVIATION MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 56

US: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2021–2024 (USD MILLION)

TABLE 57

US: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2025–2030 (USD MILLION)

TABLE 58

US: AI IN AVIATION MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 59

US: AI IN AVIATION MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 60

US: AI IN AVIATION MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 61

US: AI IN AVIATION MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 62

CANADA: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2021–2024 (USD MILLION)

TABLE 63

CANADA: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2025–2030 (USD MILLION)

TABLE 64

CANADA: AI IN AVIATION MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 65

CANADA: AI IN AVIATION MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 66

CANADA: AI IN AVIATION MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 67

CANADA: AI IN AVIATION MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 68

EUROPE: AI IN AVIATION MARKET, BY COUNTRY, 2021–2024 (USD MILLION)

TABLE 69

EUROPE: AI IN AVIATION MARKET, BY COUNTRY, 2025–2030 (USD MILLION)

TABLE 70

EUROPE: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2021–2024 (USD MILLION)

TABLE 71

EUROPE: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2025–2030 (USD MILLION)

TABLE 72

EUROPE: AI IN AVIATION MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 73

EUROPE: AI IN AVIATION MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 74

EUROPE: AI IN AVIATION MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 75

EUROPE: AI IN AVIATION MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 76

UK: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2021–2024 (USD MILLION)

TABLE 77

UK: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2025–2030 (USD MILLION)

TABLE 78

UK: AI IN AVIATION MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 79

UK: AI IN AVIATION MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 80

UK: AI IN AVIATION MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 81

UK: AI IN AVIATION MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 82

FRANCE: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2021–2024 (USD MILLION)

TABLE 83

FRANCE: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2025–2030 (USD MILLION)

TABLE 84

FRANCE: AI IN AVIATION MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 85

FRANCE: AI IN AVIATION MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 86

FRANCE: AI IN AVIATION MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 87

FRANCE: AI IN AVIATION MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 88

GERMANY: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2021–2024 (USD MILLION)

TABLE 89

GERMANY: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2025–2030 (USD MILLION)

TABLE 90

GERMANY: AI IN AVIATION MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 91

GERMANY: AI IN AVIATION MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 92

GERMANY: AI IN AVIATION MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 93

GERMANY: AI IN AVIATION MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 94

ITALY: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2021–2024 (USD MILLION)

TABLE 95

ITALY: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2025–2030 (USD MILLION)

TABLE 96

ITALY: AI IN AVIATION MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 97

ITALY: AI IN AVIATION MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 98

ITALY: AI IN AVIATION MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 99

ITALY: AI IN AVIATION MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 100

SPAIN: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2021–2024 (USD MILLION)

TABLE 101

SPAIN: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2025–2030 (USD MILLION)

TABLE 102

SPAIN: AI IN AVIATION MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 103

SPAIN: AI IN AVIATION MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 104

SPAIN: AI IN AVIATION MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 105

SPAIN: AI IN AVIATION MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 106

REST OF EUROPE: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2021–2024 (USD MILLION)

TABLE 107

REST OF EUROPE: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2025–2030 (USD MILLION)

TABLE 108

REST OF EUROPE: AI IN AVIATION MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 109

REST OF EUROPE: AI IN AVIATION MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 110

REST OF EUROPE: AI IN AVIATION MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 111

REST OF EUROPE: AI IN AVIATION MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 112

ASIA PACIFIC: AI IN AVIATION MARKET, BY COUNTRY, 2021–2024 (USD MILLION)

TABLE 113

ASIA PACIFIC: AI IN AVIATION MARKET, BY COUNTRY, 2025–2030 (USD MILLION)

TABLE 114

ASIA PACIFIC: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2021–2024 (USD MILLION)

TABLE 115

ASIA PACIFIC: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2025–2030 (USD MILLION)

TABLE 116

ASIA PACIFIC: AI IN AVIATION MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 117

ASIA PACIFIC: AI IN AVIATION MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 118

ASIA PACIFIC: AI IN AVIATION MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 119

ASIA PACIFIC: AI IN AVIATION MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 120

CHINA: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2021–2024 (USD MILLION)

TABLE 121

CHINA: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2025–2030 (USD MILLION)

TABLE 122

CHINA: AI IN AVIATION MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 123

CHINA: AI IN AVIATION MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 124

CHINA: AI IN AVIATION MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 125

CHINA: AI IN AVIATION MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 126

INDIA: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2021–2024 (USD MILLION)

TABLE 127

INDIA: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2025–2030 (USD MILLION)

TABLE 128

INDIA: AI IN AVIATION MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 129

INDIA: AI IN AVIATION MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 130

INDIA: AI IN AVIATION MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 131

INDIA: AI IN AVIATION MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 132

JAPAN: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2021–2024 (USD MILLION)

TABLE 133

JAPAN: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2025–2030 (USD MILLION)

TABLE 134

JAPAN: AI IN AVIATION MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 135

JAPAN: AI IN AVIATION MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 136

JAPAN: AI IN AVIATION MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 137

JAPAN: AI IN AVIATION MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 138

SOUTH KOREA: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2021–2024 (USD MILLION)

TABLE 139

SOUTH KOREA: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2025–2030 (USD MILLION)

TABLE 140

SOUTH KOREA: AI IN AVIATION MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 141

SOUTH KOREA: AI IN AVIATION MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 142

SOUTH KOREA: AI IN AVIATION MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 143

SOUTH KOREA: AI IN AVIATION MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 144

NEW ZEALAND: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2021–2024 (USD MILLION)

TABLE 145

NEW ZEALAND: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2025–2030 (USD MILLION)

TABLE 146

NEW ZEALAND: AI IN AVIATION MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 147

NEW ZEALAND: AI IN AVIATION MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 148

NEW ZEALAND: AI IN AVIATION MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 149

NEW ZEALAND: AI IN AVIATION MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 150

AUSTRALIA: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2021–2024 (USD MILLION)

TABLE 151

AUSTRALIA: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2025–2030 (USD MILLION)

TABLE 152

AUSTRALIA: AI IN AVIATION MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 153

AUSTRALIA: AI IN AVIATION MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 154

AUSTRALIA: AI IN AVIATION MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 155

AUSTRALIA: AI IN AVIATION MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 156

REST OF ASIA PACIFIC: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2021–2024 (USD MILLION)

TABLE 157

REST OF ASIA PACIFIC: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2025–2030 (USD MILLION)

TABLE 158

REST OF ASIA PACIFIC: AI IN AVIATION MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 159

REST OF ASIA PACIFIC: AI IN AVIATION MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 160

REST OF ASIA PACIFIC: AI IN AVIATION MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 161

REST OF ASIA PACIFIC: AI IN AVIATION MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 162

MIDDLE EAST: AI IN AVIATION MARKET, BY COUNTRY, 2021–2024 (USD MILLION)

TABLE 163

MIDDLE EAST: AI IN AVIATION MARKET, BY COUNTRY, 2025–2030 (USD MILLION)

TABLE 164

MIDDLE EAST: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2021–2024 (USD MILLION)

TABLE 165

MIDDLE EAST: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2025–2030 (USD MILLION)

TABLE 166

MIDDLE EAST: AI IN AVIATION MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 167

MIDDLE EAST: AI IN AVIATION MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 168

MIDDLE EAST: AI IN AVIATION MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 169

MIDDLE EAST: AI IN AVIATION MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 170

SAUDI ARABIA: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2021–2024 (USD MILLION)

TABLE 171

SAUDI ARABIA: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2025–2030 (USD MILLION)

TABLE 172

SAUDI ARABIA: AI IN AVIATION MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 173

SAUDI ARABIA: AI IN AVIATION MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 174

SAUDI ARABIA: AI IN AVIATION MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 175

SAUDI ARABIA: AI IN AVIATION MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 176

UAE: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2021–2024 (USD MILLION)

TABLE 177

UAE: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2025–2030 (USD MILLION)

TABLE 178

UAE: AI IN AVIATION MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 179

UAE: AI IN AVIATION MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 180

UAE: AI IN AVIATION MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 181

UAE: AI IN AVIATION MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 182

TURKEY: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2021–2024 (USD MILLION)

TABLE 183

TURKEY: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2025–2030 (USD MILLION)

TABLE 184

TURKEY: AI IN AVIATION MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 185

TURKEY: AI IN AVIATION MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 186

TURKEY: AI IN AVIATION MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 187

TURKEY: AI IN AVIATION MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 188

REST OF MIDDLE EAST: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2021–2024 (USD MILLION)

TABLE 189

REST OF MIDDLE EAST: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2025–2030 (USD MILLION)

TABLE 190

REST OF MIDDLE EAST: AI IN AVIATION MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 191

REST OF MIDDLE EAST: AI IN AVIATION MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 192

REST OF MIDDLE EAST: AI IN AVIATION MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 193

REST OF MIDDLE EAST: AI IN AVIATION MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 194

LATIN AMERICA: AI IN AVIATION MARKET, BY COUNTRY, 2021–2024 (USD MILLION)

TABLE 195

LATIN AMERICA: AI IN AVIATION MARKET, BY COUNTRY, 2025–2030 (USD MILLION)

TABLE 196

LATIN AMERICA: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2021–2024 (USD MILLION)

TABLE 197

LATIN AMERICA: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2025–2030 (USD MILLION)

TABLE 198

LATIN AMERICA: AI IN AVIATION MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 199

LATIN AMERICA: AI IN AVIATION MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 200

LATIN AMERICA: AI IN AVIATION MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 201

LATIN AMERICA: AI IN AVIATION MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 202

BRAZIL: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2021–2024 (USD MILLION)

TABLE 203

BRAZIL: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2025–2030 (USD MILLION)

TABLE 204

BRAZIL: AI IN AVIATION MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 205

BRAZIL: AI IN AVIATION MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 206

BRAZIL: AI IN AVIATION MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 207

BRAZIL: AI IN AVIATION MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 208

MEXICO: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2021–2024 (USD MILLION)

TABLE 209

MEXICO: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2025–2030 (USD MILLION)

TABLE 210

MEXICO: AI IN AVIATION MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 211

MEXICO: AI IN AVIATION MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 212

MEXICO: AI IN AVIATION MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 213

MEXICO: AI IN AVIATION MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 214

CHILE: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2021–2024 (USD MILLION)

TABLE 215

CHILE: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2025–2030 (USD MILLION)

TABLE 216

CHILE: AI IN AVIATION MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 217

CHILE: AI IN AVIATION MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 218

CHILE AI IN AVIATION MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 219

CHILE: AI IN AVIATION MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 220

ARGENTINA: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2021–2024 (USD MILLION)

TABLE 221

ARGENTINA: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2025–2030 (USD MILLION)

TABLE 222

ARGENTINA: AI IN AVIATION MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 223

ARGENTINA: AI IN AVIATION MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 224

ARGENTINA: AI IN AVIATION MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 225

ARGENTINA: AI IN AVIATION MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 226

REST OF LATIN AMERICA: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2021–2024 (USD MILLION)

TABLE 227

REST OF LATIN AMERICA: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2025–2030 (USD MILLION)

TABLE 228

REST OF LATIN AMERICA: AI IN AVIATION MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 229

REST OF LATIN AMERICA: AI IN AVIATION MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 230

REST OF LATIN AMERICA: AI IN AVIATION MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 231

REST OF LATIN AMERICA: AI IN AVIATION MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 232

AFRICA: AI IN AVIATION MARKET, BY COUNTRY 2021–2024 (USD MILLION)

TABLE 233

AFRICA: AI IN AVIATION MARKET, BY COUNTRY, 2025–2030 (USD MILLION)

TABLE 234

AFRICA: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2021–2024 (USD MILLION)

TABLE 235

AFRICA: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2025–2030 (USD MILLION)

TABLE 236

AFRICA: AI IN AVIATION MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 237

AFRICA: AI IN AVIATION MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 238

AFRICA: AI IN AVIATION MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 239

AFRICA: AI IN AVIATION MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 240

SOUTH AFRICA: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2021–2024 (USD MILLION)

TABLE 241

SOUTH AFRICA: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2025–2030 (USD MILLION)

TABLE 242

SOUTH AFRICA: AI IN AVIATION MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 243

SOUTH AFRICA: AI IN AVIATION MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 244

SOUTH AFRICA: AI IN AVIATION MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 245

SOUTH AFRICA: AI IN AVIATION MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 246

EGYPT: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2021–2024 (USD MILLION)

TABLE 247

EGYPT: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2025–2030 (USD MILLION)

TABLE 248

EGYPT: AI IN AVIATION MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 249

EGYPT: AI IN AVIATION MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 250

EGYPT: AI IN AVIATION MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 251

EGYPT: AI IN AVIATION MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 252

REST OF AFRICA: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2021–2024 (USD MILLION)

TABLE 253

REST OF AFRICA: AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2025–2030 (USD MILLION)

TABLE 254

REST OF AFRICA: AI IN AVIATION MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 255

REST OF AFRICA: AI IN AVIATION MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 256

REST OF AFRICA: AI IN AVIATION MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 257

REST OF AFRICA: AI IN AVIATION MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 258

KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020–2024

TABLE 259

AI IN AVIATION MARKET: DEGREE OF COMPETITION

TABLE 260

REGION FOOTPRINT

TABLE 261

SOLUTION FOOTPRINT

TABLE 262

TECHNOLOGY FOOTPRINT

TABLE 263

BUSINESS FUNCTION FOOTPRINT

TABLE 264

LIST OF START-UPS/SMES

TABLE 265

COMPETITIVE BENCHMARKING OF START-UPS/SMES

TABLE 266

AI IN AVIATION MARKET: PRODUCT LAUNCHES, 2021–2025

TABLE 267

AI IN AVIATION MARKET: DEALS, 2021–2025

TABLE 268

AI IN AVIATION MARKET: OTHERS, 2021–2025

TABLE 269

AMADEUS IT GROUP S.A.: COMPANY OVERVIEW

TABLE 270

AMADEUS IT GROUP S.A.: PRODUCTS OFFERED

TABLE 271

AMADEUS IT GROUP S.A.: DEALS

TABLE 272

HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

TABLE 273

HONEYWELL INTERNATIONAL INC.: PRODUCTS OFFERED

TABLE 274

HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES

TABLE 275

HONEYWELL INTERNATIONAL INC.: DEALS

TABLE 276

HONEYWELL INTERNATIONAL INC.: OTHERS

TABLE 277

MICROSOFT: COMPANY OVERVIEW

TABLE 278

MICROSOFT: PRODUCTS OFFERED

TABLE 279

MICROSOFT: DEALS

TABLE 280

MICROSOFT: OTHERS

TABLE 281

AMAZON WEB SERVICES, INC.: COMPANY OVERVIEW

TABLE 282

AMAZON WEB SERVICES, INC.: PRODUCTS OFFERED

TABLE 283

AMAZON WEB SERVICES, INC.: DEALS

TABLE 284

GENERAL ELECTRIC COMPANY: COMPANY OVERVIEW

TABLE 285

GENERAL ELECTRIC COMPANY: PRODUCTS OFFERED

TABLE 286

GENERAL ELECTRIC COMPANY: DEALS

TABLE 287

COLLINS AEROSPACE: COMPANY OVERVIEW

TABLE 288

COLLINS AEROSPACE: PRODUCTS OFFERED

TABLE 289

SITA: COMPANY OVERVIEW

TABLE 290

SITA: PRODUCTS OFFERED

TABLE 291

SITA: PRODUCT LAUNCHES

TABLE 293

PALANTIR TECHNOLOGIES INC.: COMPANY OVERVIEW

TABLE 294

PALANTIR TECHNOLOGIES INC.: PRODUCTS OFFERED

TABLE 295

PALANTIR TECHNOLOGIES INC.: DEALS

TABLE 296

LUFTHANSA TECHNIK: COMPANY OVERVIEW

TABLE 297

LUFTHANSA TECHNIK: PRODUCTS OFFERED

TABLE 298

LUFTHANSA TECHNIK: DEALS

TABLE 299

THALES: COMPANY OVERVIEW

TABLE 300

THALES: PRODUCTS OFFERED

TABLE 302

IBM CORPORATION: COMPANY OVERVIEW

TABLE 303

IBM CORPORATION: PRODUCTS OFFERED

TABLE 304

IBM CORPORATION: DEALS

TABLE 305

ACCENTURE: COMPANY OVERVIEW

TABLE 306

ACCENTURE: PRODUCTS OFFERED

TABLE 307

ACCENTURE: DEALS

TABLE 308

RAMCO SYSTEMS: COMPANY OVERVIEW

TABLE 309

RAMCO SYSTEMS: PRODUCTS OFFERED

TABLE 310

RAMCO SYSTEMS: PRODUCT LAUNCHES

TABLE 311

RAMCO SYSTEMS: OTHERS

TABLE 312

TATA CONSULTANCY SERVICES LIMITED: COMPANY OVERVIEW

TABLE 313

TATA CONSULTANCY SERVICES LIMITED: PRODUCTS OFFERED

TABLE 314

TATA CONSULTANCY SERVICES LIMITED: DEALS

TABLE 315

TATA CONSULTANCY SERVICES LIMITED: OTHERS

TABLE 316

WIPRO: COMPANY OVERVIEW

TABLE 317

WIPRO: PRODUCTS OFFERED

TABLE 320

INFOSYS LIMITED: COMPANY OVERVIEW

TABLE 321

INFOSYS LIMITED: PRODUCTS OFFERED

TABLE 322

INFOSYS LIMITED: DEALS

FIGURE 1

AI IN AVIATION MARKET SNAPSHOT

FIGURE 2

RESEARCH DESIGN MODEL

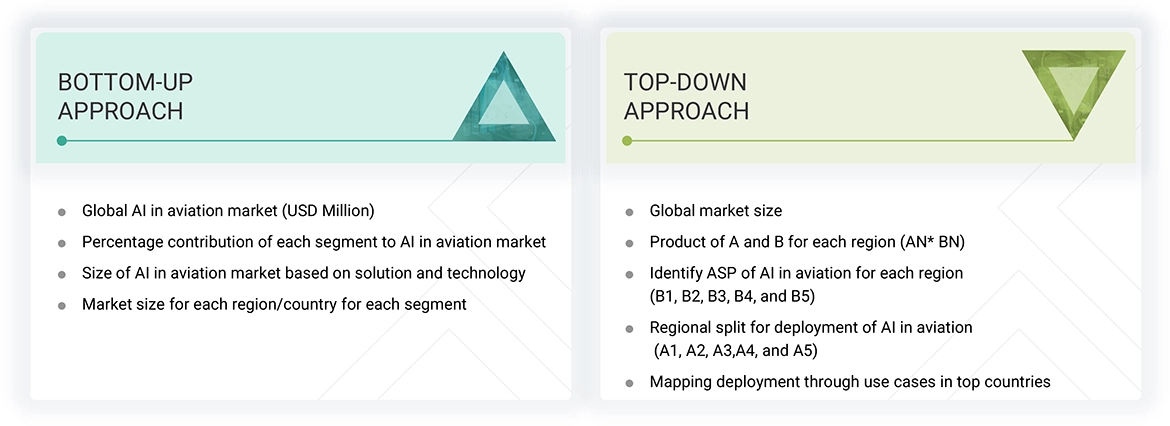

FIGURE 4

BOTTOM-UP APPROACH

FIGURE 5

TOP-DOWN APPROACH

FIGURE 6

DATA TRIANGULATION

FIGURE 7

SOFTWARE SEGMENT TO BE DOMINANT DURING FORECAST PERIOD

FIGURE 8

AIRLINES & OPERATORS TO SURPASS OTHER SEGMENTS DURING FORECAST PERIOD

FIGURE 9

GENERATIVE AI TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

FIGURE 10

ASIA PACIFIC TO EXHIBIT FASTEST GROWTH DURING FORECAST PERIOD

FIGURE 11

NEED FOR PREDICTIVE MAINTENANCE AND COST OPTIMIZATION IN AVIATION TO DRIVE MARKET

FIGURE 12

SOFTWARE TO SECURE LEADING POSITION DURING FORECAST PERIOD

FIGURE 13

GENERATIVE AI TO BE LARGEST SEGMENT DURING FORECAST PERIOD

FIGURE 14

AIRLINES & OPERATORS TO ACQUIRE MAXIMUM SHARE IN 2030

FIGURE 15

AI IN AVIATION MARKET DYNAMICS

FIGURE 16

TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

FIGURE 17

ECOSYSTEM ANALYSIS

FIGURE 18

VALUE CHAIN ANALYSIS

FIGURE 19

INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

FIGURE 20

KEY BUYING CRITERIA FOR TOP THREE END USERS

FIGURE 21

INVESTMENT AND FUNDING SCENARIO, 2020–2024

FIGURE 22

EVOLUTION OF TECHNOLOGY

FIGURE 23

TECHNOLOGY ROADMAP

FIGURE 24

PATENT ANALYSIS

FIGURE 25

BUSINESS MODELS IN AI IN AVIATION MARKET

FIGURE 26

AI IN AVIATION MARKET, BY BUSINESS FUNCTION, 2025–2030 (USD MILLION)

FIGURE 27

AI IN AVIATION MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

FIGURE 28

AI IN AVIATION MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

FIGURE 29

AI IN AVIATION MARKET, BY END USER, 2025–2030 (USD MILLION)

FIGURE 30

AI IN AVIATION MARKET, BY REGION, 2025–2030

FIGURE 31

NORTH AMERICA: AI IN AVIATION MARKET SNAPSHOT

FIGURE 32

EUROPE: AI IN AVIATION MARKET SNAPSHOT

FIGURE 33

ASIA PACIFIC: AI IN AVIATION MARKET SNAPSHOT

FIGURE 34

MIDDLE EAST: AI IN AVIATION MARKET SNAPSHOT

FIGURE 35

LATIN AMERICA: AI IN AVIATION MARKET SNAPSHOT

FIGURE 36

AFRICA: AI IN AVIATION MARKET SNAPSHOT

FIGURE 37

REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2021–2024

FIGURE 38

MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

FIGURE 39

BRAND/PRODUCT COMPARISON

FIGURE 40

FINANCIAL METRICS OF PROMINENT PLAYERS

FIGURE 41

VALUATION OF PROMINENT PLAYERS

FIGURE 42

COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

FIGURE 43

COMPANY FOOTPRINT

FIGURE 44

COMPANY EVALUATION MATRIX (START-UPS/SMES), 2024

FIGURE 45

AMADEUS IT GROUP S.A.: COMPANY SNAPSHOT

FIGURE 46

HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

FIGURE 47

MICROSOFT: COMPANY SNAPSHOT

FIGURE 48

AMAZON WEB SERVICES, INC.: COMPANY SNAPSHOT

FIGURE 49

GENERAL ELECTRIC COMPANY: COMPANY SNAPSHOT

FIGURE 50

PALANTIR TECHNOLOGIES INC.: COMPANY SNAPSHOT

FIGURE 51

LUFTHANSA TECHNIK: COMPANY SNAPSHOT

FIGURE 52

THALES: COMPANY SNAPSHOT

FIGURE 53

IBM CORPORATION: COMPANY SNAPSHOT

FIGURE 54

ACCENTURE: COMPANY SNAPSHOT

FIGURE 55

RAMCO SYSTEMS: COMPANY SNAPSHOT

FIGURE 56

TATA CONSULTANCY SERVICES LIMITED: COMPANY SNAPSHOT

FIGURE 57

WIPRO: COMPANY SNAPSHOT

FIGURE 58

INFOSYS LIMITED: COMPANY SNAPSHOT

Growth opportunities and latent adjacency in Artificial Intelligence (AI) in Aviation Market