Network Switches Market Size, Share, Statistics and Industry Growth Analysis Report by Type (Fixed Configuration Switches, Modular Switches), End User, Switching Port (100 MBE & 1 GBE, 2.5 GBE & 5 GBE, 10 GBE, 25 GBE & 50 GBE, 100 GBE, 200 GBE & 400 GBE) and Region – Global Forecast to 2028

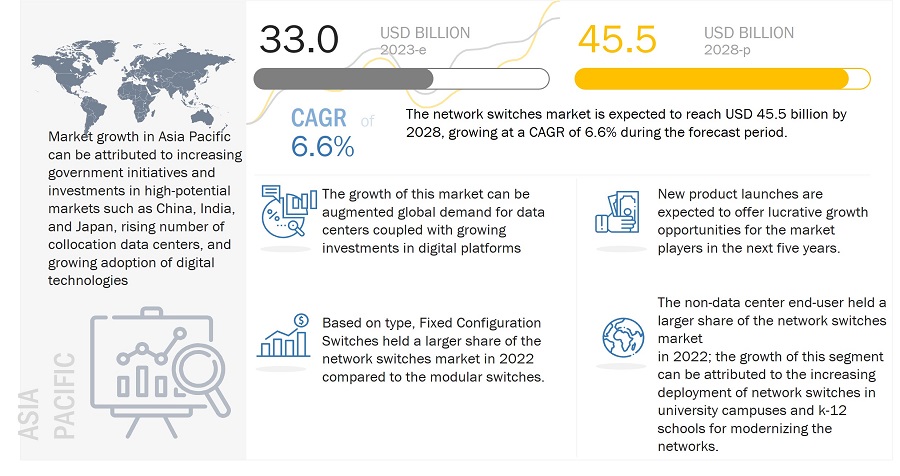

[338 Pages Report] The Network Switches Market Size is projected to grow from USD 33.0 Billion in 2023 to reach USD 45.5 Billion by 2028; it is expected to grow at a Compound Annual Growth Rate (CAGR) of 6.6% from 2023 to 2028.

The need for simplified networking communication management and automation and growing investments in digital platforms coupled with the augmented global demand for data centers is expected to fuel the growth of the network switches market. However, high operational cost of network switches limiting the growth of the network switches industry.

Network Switches MarketForecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Network Switches Market Dynamics

Drivers: Augmented global demand for data centers

Data centers are playing a major role with rising technologies like IoT, AI and 5G. The global data center market is expected to register an impressive growth rate of 7.5%. The market garnered a valuation of USD 101.79 Billion in 2022 and is expected to accumulate a market value of USD 209.8 Billion by 2032. The increase in cloud migration has accelerated growth and expansion of data centers globally, causing major data center operators to expand their footprints. In 2021, U.S. users absorbed 500 megawatts (MW) of data space. Most of the absorption was driven by hyperscalers, the largest occupiers of data centers, which are mostly cloud services firms including Google Cloud, Amazon Web Services (AWS) and Microsoft. For instance, in 2019 Google Cloud plans to build new data centers in Nebraska, South Carolina, Virginia, Nevada and Texas. Similarly, Microsoft unveiled an aggressive plan to build 50 to 100 new data centers across the U.S. These investments will boost the demand for data center network switches. Additionally, there has been a rising number of smart devices like smartphones, IoT based devices, smart TVs, autonomous vehicles, and home appliances. This surge is expected to drive the integration of the chips in the data center servers, which will provide lucrative opportunities for the global network switch market growth.

Restraint: Technological complexity involved in network switches making it vulnerable towards security attacks

Routers, switches, and firewalls, collectively known as Network Infrastructure Devices, which are most important elements of any network. In terms of security, they should be the most hardened devices, however, due to their importance, administrators are seldom inclined to update them to ensure they do not inadvertently affect any network uptime. Network misconfigurations cost companies an average of 9% of annual revenues. It is found of that 96% of the organizations overlook routers and switches auditing resulting in vulnerabilities. One of the most common security weaknesses found in routers and switches is that some network engineers fail to change the default configurations of the devices. This can include administrator login credentials or security settings. This makes easy for hackers to gain access to enterprise servers, causing severe data breaches.

Opportunity: Rising data volumes across enterprises

IT infrastructure has seen tremendous shift with developments in technologies like edge computing, AI, IoT, 5G and Machine learning applications. The application of these technologies across different industry verticals like healthcare & life science, finance, smart agriculture, smart infrastructure, manufacturing retail, logistics, aviation, and defense systems. Additionally, 5G has given huge boost to many industries with its high-speed data transmission and internet coverage to every corner made customer span even wider. With growing customer base and applications, the data loads have increased significantly. These data volumes had to be transferred to servers and storage systems at higher bandwidth, which require advanced network switches for carrying out these operations.

Globally 2.5 quintillion bytes data is generated per day. By 2025 this data volumes are further expected to reach 463 exabytes globally. Some major giants like Google, Facebook, Microsoft, and Amazon store at least 1,200 petabytes of information. Adding to this by 2025, there would be 75 billion Internet-of-Things (IoT) devices in the world which adds to data loads across local servers and data center operations. All these trends will bring in more opportunities for network switches market across advancing countries.

Challenge: High operational cost of network switches

Network switches are extremely good for networking operations. They can move enormous amounts of data in milliseconds without ever having to slow down. This makes them perfect for applications which require high bandwidth and low latency – like gamers, video editors and cryptocurrency miners. The R&D cost of network switches is marginally high. The cost of switch goes high with added features like processors, memory, cabling, and connectors. The latest hardware being produced by bigger companies such as Intel and Broadcom usually cost a hundred dollars just for small 5-port models and can easily skyrocket up to thousands of dollars for a 24-48 port switch. However, the cost of the switch gets cheaper with technology becoming more efficient. Additionally, the added security features which is one of the most important aspects of network switch in the present generation, adds up to the overall cost of network switch. Network switches usually last for around four to five years, whereas an industrial switch lasts for 10 years, and hence gradual maintenance is required for uninterrupted functionality. An issue in any of the port of the network switch disrupts the performance of other ports and this creates more load on other ports making the operation difficult. Furthermore, the replacement cost is more since after every cycle these switches have to be replaced with new ones. This increases the cost of operation. Large-scale firms which extract larger data install switches with high durability, but the cost of procurement is quite high.

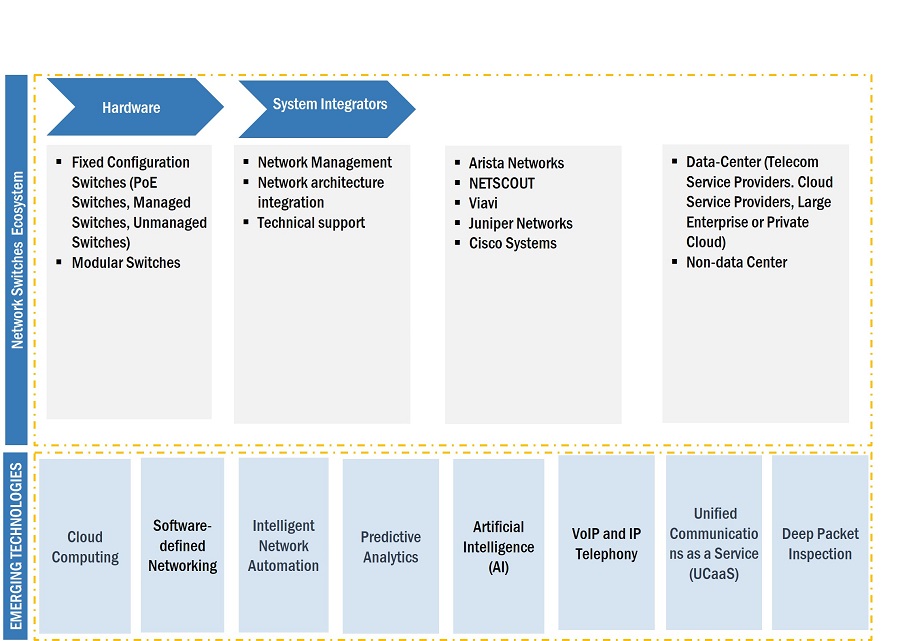

Network Switches Ecosystem

PoE Fixed Configuration Switches to exhibit highest growth during the forecast period.

The fixed configuration network switches include managed, unmanaged and PoE switches. The market for PoE Fixed Configuration Switches is expected to grow at the highest CAGR during the forecast period. The proliferation of power over automation and data center & enterprise networking are major factors influencing the power over ethernet market growth. With PoE network switch, there is no need for users to purchase and install additional electrical wires and outlets, which creates significant savings on installation and maintenance costs and time. Thus, these switches are cost-efficient. Thus , there would be a significant demand for the adoption of PoE switches in the near future.

Network Switchesfor cloud service providers data center end user segment is expected to grow at a significant CAGR from during forecast period

The cloud service providing industry is set to rise owing to the high efficiency and economies of scale offered by cloud computing. Cloud service providers offer services to several customers from a common shared infrastructure and help companies to save their IT infrastructure cost. Various cloud initiatives by different companies are bringing the network switch market forward. Also, these network switches over cloud assist the connectivity within data centers to support service delivery and back-office functions. To fulfill the bandwidth requirements over managed and unmanaged networks, cloud service providers are increasingly adopting switching solutions to scale up the existing infrastructure and to amend at a higher bandwidth solution. The advancements in networking technologies in this industry demand high scalability and management solutions, which are effectively being addressed by network switches. Thus, there would be an increase in the adoption of network switches by cloud service providers during the forecast period.

100 GBE switching port to hold a significant market share during forecast period

100 GBE switching port is expected to hold a larger market share during the forecast period. The network switch market's transition to 100GbE as the most popular network connection speed is an indication of the strong customer adoption of public cloud services. 100GbE has been the de facto switch port speed in some of the largest hyperscale cloud service provider data center networks since the last few years. As data centers started to move away from 40 GbE and the cost of 100 GbE networking equipment started to fall, 100 GbE networks started to be widely adopted. In the average enterprise, data center traffic is also ratcheting up, and 100 Gigabit Ethernet ports are expected to become commonplace in the next couple of years.

Managed switches to hold largest share of the fixed configuration network switches market during the forecast period

The fixed configuration network switches include managed, unmanaged and PoE switches. Managed switches are aimed at users that require a response time of milliseconds. Among fixed-configuration switches, managed switches are designed to deliver the most comprehensive set of features to provide the best application experience, the highest levels of security, the most precise control and management of the network, and the greatest scalability. Managed switches offer various benefits which is paving way for the increased adoption of these switches for different applications. Managed switches are especially suitable for organizations that need to manage and troubleshoot their network remotely and securely; allowing network managers to reach optimal network performance and reliability. Managed switches also offer powerful features like VLANs, LACP, as well as all advanced filter and multicast algorithms needed today to easily prioritize, partition and organize a reliable high-speed network.

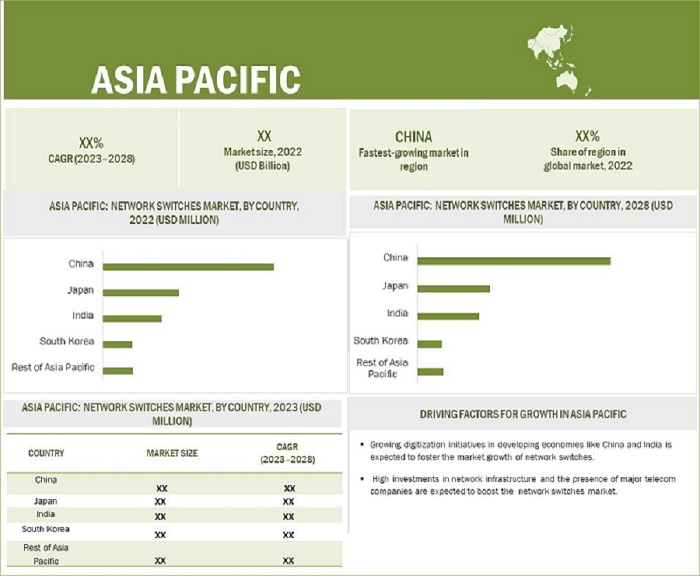

Network Switches market in Asia Pacific estimated to grow at the fastest rate during the forecast period

The network swiches market in Asia Pacific is expected to grow at the highest CAGR during the forecast period. Increasing government initiatives and investments from technologically developing countries in Asia Pacific, such as India, Japan, and China, are driving the increasing deployments of data centers in the region, which in turn is expected to drive the market for network switches. Also, the increasing number of small- and medium-scale enterprises and the adoption of digital technologies in them further drive the demand for network switches. Moreover, the increasing penetration of the internet and the rising population of internet users in the region creates a massive amount of data that drives the demand for cloud-based services. All these parameters generate the need for deployment of network switches across the network infrastructure in data centers.

Network Switches Market Statistics by Region

To know about the assumptions considered for the study, download the pdf brochure

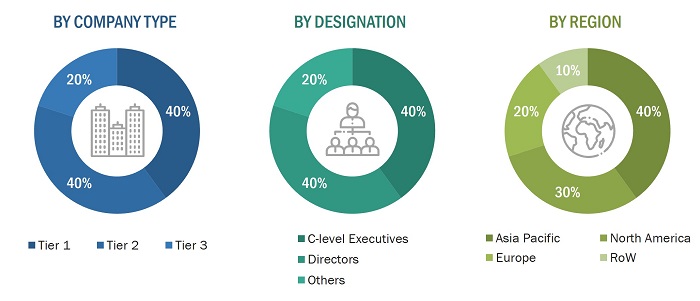

In the process of determining and verifying the market size for several segments and subsegments gathered through secondary research, extensive primary interviews have been conducted with key industry experts in the network switches market space. The break-up of primary participants for the report has been shown below:

- By Company Type: Tier 1 – 40%, Tier 2 – 40%, and Tier 3 – 20%

- By Designation: C-level Executives – 40%, Directors –40%, and Others – 20%

- By Region: North America –30%, Asia Pacific– 40%, Europe – 20%, and RoW – 10%

Key Market Players

Major vendors in the Network Switches Companies include Cisco Systems (US), Huawei Technologies (China), HPE Aruba (US), Juniper Networks (US), Arista Networks (US), NETGEAR (US), D-Link Corporation (US), Extreme Networks (US), NVIDIA Corporation (US), TRENDnet (US), Lantronix (US). Apart from this, Alcatel Lucent Enterprise (France), Dell Technologies (US), Pica8, Inc. (US), Larch Networks (US), STORDIS (Germany), IP Infusion (US), Buffalo Americas, Inc. (US), Linksys (US), TELEFLY Telecommunications Equipment Co., Ltd. (China), Allied Telesis (Japan), Moxa (Taiwan) are among a few emerging companies in the network switches market.

Network Switches Market Report Scope:

|

Report Metric |

Details |

|

Estimated Market Size in 2023 |

USD 33.0 Billion |

|

Projected Market Size in 2028 |

USD 45.5 Billion |

|

Growth Rate |

CAGR of 6.6% |

|

Market size available for years |

2019—2028 |

|

Base year |

2022 |

|

Forecast period |

2023—2028 |

|

Segments covered |

Type, End User, Switching Port and Region |

|

Geographic regions covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies covered |

Cisco Systems (US), Huawei Technologies (China), HPE Aruba (US), Juniper Networks (US), Arista Networks (US), NETGEAR (US), D-Link Corporation (US), Extreme Networks (US), NVIDIA Corporation (US), TRENDnet (US), Lantronix (US), Alcatel Lucent Enterprise (France), Dell Technologies (US), Pica8, Inc. (US), Larch Networks (US), STORDIS (Germany), IP Infusion (US), Buffalo Americas, Inc. (US), Linksys (US), TELEFLY Telecommunications Equipment Co., Ltd. (China), Allied Telesis (Japan), Moxa (Taiwan), Black Box Corporation (US), Belden Inc. (US) and TP-Link (China) |

Network Switches Market Highlights

This research report categorizes the network switches market based on Type, End User, Switching Port and Region

|

Aspect |

Details |

|

Network Switches Market, Type : |

|

|

Network Switches Market, by Switching Port: |

|

|

Network Switches Market, by End User: |

|

|

Network Switches Market, By Region: |

|

Recent Developments

- In June 2022, Cisco Systems (US) introduced new Nexus 9000 400G performance options at scale with a migration path to 800G performance in the near future. It has a new compact, modular chassis that offers up to 64 ports of 400G line-rate performance (or up to 128 ports of 100/200G performance). The Nexus 9400 is an ideal solution for customers who want the flexibility of modular line cards in a 4 RU compact form factor leveraging a single 25.6 Tbps industry leading Cisco ASIC. Use cases include compact spine designs and efficient multi-plane scale-out fabric designs enabling gradual transition from 100G to 200G to 400G links.

- In June 2022, HPE Aruba (US) introduced 400GbE switches that designed for the most demanding environments. The Aruba CX 9300-32D is a next-generation 12.8Tbps, 1U fixed configuration switch with 32 ports of 400GbE that supports port breakouts for 200G, 100G, and 25G. The switch is designed to provide flexible, cost-effective, high-density 100/200/400GbE for servers, storage, and intra-fabric connectivity.

- In January 2022, Cisco Systems (US) has announced its Cisco Catalyst 9000 portfolio, based on the powerful Unified Access Data Plane (UADP) ASIC silicon, to bring more enterprise-grade switching capabilities to the industrial edge for industries operating in harsh environments and supporting critical infrastructure like utilities, oil and gas, roadways, and rail.

Frequently Asked Questions (FAQ):

What will be the dynamics for the adoption of network switches market based on type?

The fixed configuration switches segment held the largest share of the network switches market in 2022 and is expected to retain its dominant position throughout the forecast period. Fixed configuration switches include managed, unmanaged and PoE switches. The reason for the growth can be attributed to the fact that fixed configuration switches provide ethernet switching solutions for a variety of applications, including enterprise branch offices, campus, midsize companies, and small and medium-sized business (SMB), and provide access security, sustainability, operations excellence, and enhanced work experience. These factors play a vital role in fueling the demand for fixed configuration switches across the globe.

Which switching port will contribute more to the overall market share by 2028?

The 100 MBE & 1 GBE switching port will contribute the most to the network switches market. The market for 100 MBE & 1 GBE switching port segment is expected to account for largest share of the network switches market during the forecast period. This can be attributed to the increasing adoption of 100 MBE & 1 GBE switching ports in non-data center applications like small businesses, campuses of universities and k-12 schools. For many small businesses, a 1 GbE switch is sufficient when transferring data. These devices support a bandwidth of up to 1000Mbps which is a drastic improvement on the 100Mbps of Fast Ethernet.

How will technological developments such as Artificial Intelligence (AI) technology, machine learning (ML) technology change the network switches landscape in the future?

Today, many Ethernet switches feature software, or they can connect with software that takes in and analyzes data that the switch collects. By applying artificial intelligence (AI) and machine learning (ML), that data can be turned into actionable data and used to optimize smart environments. Several established network switches vendors are introducing network switches that possess advanced AI/ML capabilities.

Which region is expected to adopt network switches at a fast rate?

Asia Pacific region is expected to adopt network switches at the fastest rate. Developing countries such as India and China are expected to have a high potential for the future growth of the market.

What are the key market dynamics influencing market growth? How will they turn into strengths or weaknesses of companies operating in the market space?

Network operators are looking for a more simplified network management systems which can not only make the operation automatic but also reduce the effort of managing such a huge network channel. Switches allow devices to share and transfer data, enabling communication between devices on the network. Switches work by processing packets of data and routing them to the intended destination. A simplified network switches consisting of network switches can reduce cost, minimize downtime, and provide the performance and resiliency needed to support an agile business.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the size for network switches market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were used to identify and collect information important for this study. These include annual reports, press releases & investor presentations of companies, white papers, technology journals, and certified publications, articles by recognized authors, directories, and databases.

Secondary research was mainly used to obtain key information about the supply chain of the industry, the total pool of market players, classification of the market according to industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspectives.

Primary research was also conducted to identify the segmentation types, key players, competitive landscape, and key market dynamics such as drivers, restraints, opportunities, challenges, and industry trends, along with key strategies adopted by players operating in the network switches market. Extensive qualitative and quantitative analyses were performed on the complete market engineering process to list key information and insights throughout the report.

Primary Research

Extensive primary research has been conducted after acquiring knowledge about the network switches market scenario through secondary research. Several primary interviews have been conducted with experts from both demand (end users) and supply side (network switches providers) across 4 major geographic regions: North America, Europe, Asia Pacific, and RoW. Approximately 80% and 20% of the primary interviews have been conducted from the supply and demand side, respectively. These primary data have been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both the top-down and bottom-up approaches were implemented, along with several data triangulation methods, to estimate and validate the size of the network switches market and various other dependent submarkets. Key players in the market were identified through secondary research, and their market share in the respective regions was determined through primary and secondary research. This entire research methodology included the study of annual and financial reports of the top players, as well as interviews with experts (such as CEOs, VPs, directors, and marketing executives) for key insights (quantitative and qualitative).

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Network Switches Market: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process as explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, market breakdown and data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both demand and supply sides. Along with this, the market has been validated using top-down and bottom-up approaches.

"The Growing Importance of Ethernet Switches in the Network Switches Market: Enabling High-Performance and Secure Communication in the Era of Cloud Computing, Big Data, and IoT"

The network switches market is a growing industry, driven by the increasing adoption of cloud computing, big data, and the Internet of Things (IoT). Ethernet switches are a key product in this market, accounting for the majority of the market share. Ethernet switches allow devices on a network to communicate with each other and are available in different configurations, such as unmanaged switches, managed switches, and smart switches. The increasing demand for high-speed data transfer and efficient data management, advanced network security, and network virtualization is driving the growth of the network switches market. Overall, Ethernet switches play a critical role in enabling high-performance and secure communication in various applications, and this market is expected to continue to grow in the future.

"The Benefits of Fixed Configuration Switches in Local Area Networks: Cost-Effective and Easy-to-Manage Solution for Small to Medium-Sized Businesses and Home Offices"

Fixed configuration switches are an important type of Ethernet switch in the network switches market. These switches provide a way for devices on a local area network to communicate with each other by forwarding and filtering data packets. They are commonly used in small to medium-sized businesses, home offices, and branch offices where the network requirements are well defined and not expected to change frequently. Fixed configuration switches have a fixed number of ports and functionalities, which cannot be changed, making them a popular choice for organizations that have predictable network requirements and do not require the flexibility of modular switches. These switches are often more affordable than modular switches and are easier to install and manage.

"Modular Switches: Providing Greater Flexibility and Scalability in the Network Switches Market"

Modular switches are an important type of Ethernet switch in the network switches market, which provide greater flexibility and scalability compared to fixed configuration switches. They consist of a chassis and interchangeable line cards that determine the number and type of ports available on the switch. Modular switches are commonly used in large enterprise networks, data centers, and service provider networks, where complex and frequently changing network requirements demand high bandwidth, high availability, and advanced security features. With the increasing demand for high-speed data transfer, advanced network security, and network virtualization, the market for modular switches is expected to grow in the coming years. As organizations move to cloud-based services and adopt emerging technologies like the Internet of Things (IoT), modular switches are becoming an increasingly important component of the network infrastructure.

Growth Opportunities for Ethernet Switches

- Cloud Computing: The increasing adoption of cloud computing is driving the demand for high-performance Ethernet switches that can handle large amounts of data traffic and ensure reliable connectivity. Ethernet switches with advanced management features, such as virtualization and automation, will be particularly in demand in this area.

- Internet of Things (IoT): The growing number of IoT devices, which require reliable and secure connectivity, will drive the demand for Ethernet switches. As more IoT devices are connected to the network, there will be a need for switches that can handle the increased data traffic and provide advanced security features to protect against cyber threats.

- Network Security: With the increasing prevalence of cyber threats, there is a growing need for Ethernet switches that provide advanced network security features, such as access control, firewalls, and intrusion prevention systems.

- 5G Networks: The rollout of 5G networks is expected to drive the demand for high-performance Ethernet switches that can handle the increased data traffic and provide low-latency connectivity. Ethernet switches with advanced features, such as Quality of Service (QoS) and Network Slicing, will be particularly in demand in this area.

Report Objectives

- To define, describe, and estimate the network switches market based on type, switching port, end user, and region.

- To forecast the size of the market, by region—North America, Europe, Asia Pacific, and the Rest of the World (RoW)—in terms of value

- To forecast the network switches market size, in terms of volume, by type

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the network switches market

- To strategically analyze the micromarkets1 with respect to the individual growth trends, prospects, and their contribution to the network switches market

- To map the competitive landscape based on company profiles, key player strategies, and key developments.

- To provide a detailed overview of the network switches value chain and ecosystem

- To provide information about the key technology trends and patents related to the network switches market.

- To provide information regarding trade data related to the network switches market.

- To identify the key players operating in the network switches market and comprehensively analyze their market shares and core competencies2.

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the network switches market

- To benchmark the market players using the proprietary company evaluation matrix framework, which analyzes them on various parameters within the broad categories of market ranking/share and product portfolio.

- To analyze competitive developments such as contracts, acquisitions, product launches, collaborations, partnerships, and research and development (R&D) in the network switches

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix that gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 7)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Network Switches Market