NVH Testing Market by Application (Impact Hammer Testing and Powertrain NVH Testing, Sound Intensity Measurement and Sound Quality Testing, Product Vibration Testing), Type (Hardware, Software), Vertical and Region- Global Forecast to 2028

Updated on : October 22, 2024

NVH Testing Market Size & Growth

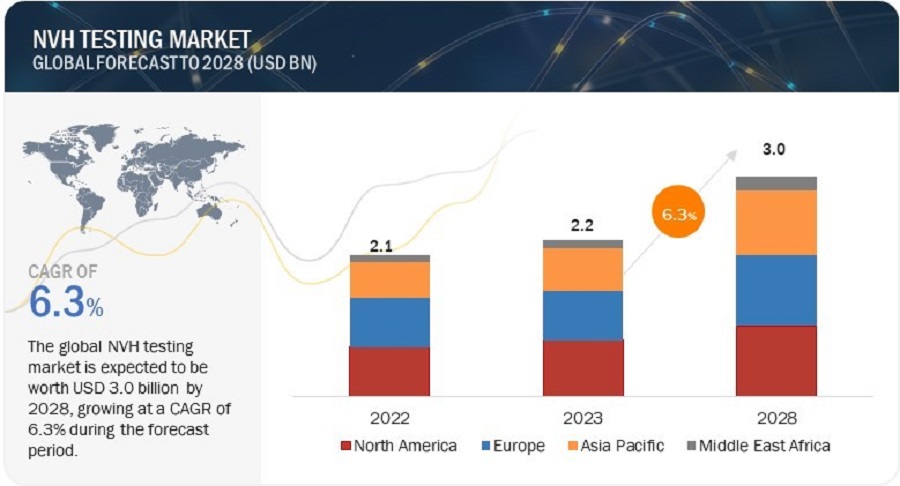

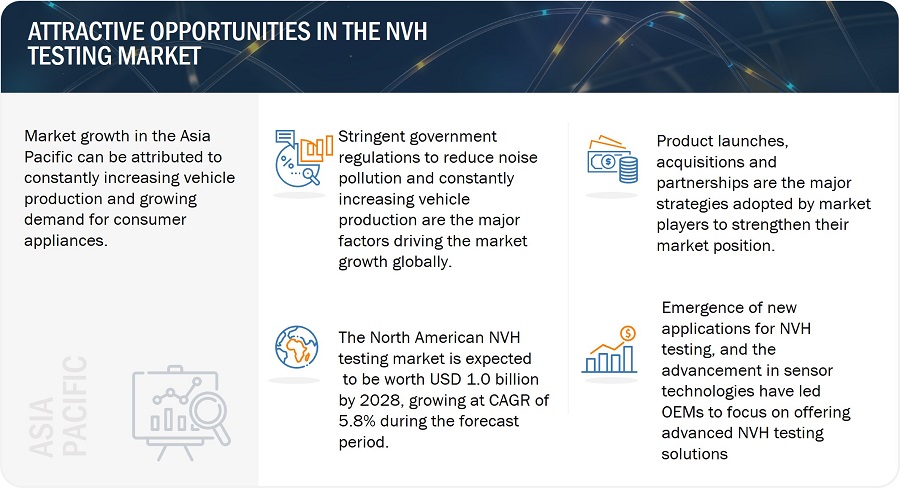

The NVH testing market size is estimated to be worth USD 2.2 billion in 2023 and is projected to reach USD 3.0 billion by 2028, growing at a CAGR of 6.3% between 2023 to 2028.

Stringent government regulation to reduce noise pollution, growing need for NVH testing in automotive vertical, and growing adoption of automated condition monitoring for smart factories are some of the major factors driving the market growth globally.

NVH Testing Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

NVH Testing Market Trends and Dynamics:

Driver: Growing need for NVH testing in automotive vertical

The main application sector of NVH test solutions pertains to the automotive industries, and with the growing demand for vehicles, the NVH tesing market is growing strongly. According to the International Organization of Motor Vehicle Manufacturers, the production stood at 55 million passenger cars and 33 million commercial vehicles globally, for the year 2020. Demand for automobiles has been on the rise, particularly in developing countries. The important driving factor in automotive NVH testing is generally customer experience, in which customers are demanding a smooth and quiet ride. In most instances, noise and vibrations tend to be huge turn-offs to customer satisfaction, which makes the need for NVH testing essential.

Noise and vibration problems started to be felt more with the increase in complexity due to the integration of electric and hybrid powertrains, advanced driver assistance systems, and other features in vehicles. This therefore calls for high demand in the Advanced NVH Testing Solutions to help solve such challenges. In addition, there are stern government regulations concerning noise emissions in the automotive sector, where every carmaker has to comply to avoid penalties. Other factors that contribute to the boom in automotive manufacturing include growth in population, increase in income levels of people, improvement in transport infrastructure, and easy finance availability, which in turn drives demand for more NVH testing equipment.

Restraint: Lack of Skilled Workforce

NVH testing is a crucial step in the development of products in a variety of sectors, including consumer electronics, automotive, and aerospace. The NVH testing industry needs qualified experts with training in testing procedures, data analysis, and troubleshooting. Many companies struggle with the shortage of skilled workforce in the NVH testing sector. This is due to several reasons such as lack of formal education and training related to NVH testing. Moreover, the constant growth of NVH testing market has led to a surge in demand for skilled professionals, thereby leading to increased wages. Furthermore, limited exposure to NVH testing is also a major factor in the lack of skilled workforce. These are the several reasons acting as restraints for the NVH testing market. However, the impact of this restraint is expected to reduce with time due to the growing awareness about the benefits of NVH testing and the subsequently increasing opportunities for market players. Besides, the skill gap is being overcome with the help of various training programs and collaborations that would further ease the workforce shortage. In addition, automation in testing and AI-driven testing tools will reduce human expertise intensity.

Opportunity: Shift toward electric vehicles

The rise of electric vehicles presents significant opportunities for the NVH testing market. Much quieter than internal combustion engine-based vehicles, EVs are making noises that used to go unheard-from the road, tires, or electric motors-much more apparent; this has created new NVH challenges for manufacturers. One of the major focal points of original equipment manufacturers has been the reduction and elimination of cabin noise in improving passenger comfort in EVs. With no noise of the engine, the advanced NVH testing solution requirements will have to be set for the new sources of noise and vibration.

In the future, electric vehicles will be in high demand, and their demand will surge upwards. NVH testing companies will also have to make the necessary adjustments in offering their products or services to cope with the peculiar needs of EVs, which highly contrast with those of ICE vehicles. In particular, electrification drives innovation, from creating new testing tools and methodologies. It is of high importance to solve the effects of NVH with increased accuracy and efficiency due to dynamic vehicle design cycles that are in great motion at an ever-increasing pace. Within the next several years, research and development opportunities for noise, vibration, and harshness testing companies will blossom due to the growing demand for the EV market. The farther into the future the industry moves, the more NVH testing companies are challenged to adapt and hone new skills to maintain the ever-evolving industry standards.

Challenge: Integration of NVH testing systems with other systems

The integration of NVH systems with other in-vehicle systems provides a number of opportunities, but some challenges are also involved in the process. In general, noise, vibration, and harshness performances integrated into either powertrain or suspension systems will work toward the realization of improved vehicle performance. This might also lead to interference with different components and may affect the functionality of other systems. Much complexity arises with the integration of NVH with the systems that presently exist, hence, the design is going to be considerably more complex, with increased chances of failure, lengthening development, and production time.

NVH systems also consist of both hardware and software parts that can face some compatibility and communication problems, especially if components are from different manufacturers. Quite often, such an integration process needs to be tuned and calibrated extensively, requiring special knowledge and equipment. Besides, in those cases when NVH systems interact with the critical components of the car, for instance with the brake system, thorough testing and validation are necessary to ensure the safety of the vehicle. These challenges, at the same time, provide great opportunities for improving comfort and performance in the vehicle. The demand for advanced NVH testing solutions is directly driven by the need to make such integrations seamless and reliable.

NVH Testing Market Ecosystem

The prominent players in the NVH testing market are National Instruments Corporation (US), Siemens Digital Industries Software (US), Brüel & Kjær (Denmark), Axiometrix Solutions (US), HEAD acoustics GmbH (Germany). These companies not only boast a comprehensive product portfolio but also have a strong geographic footprint.

NVH Testing Market Segmentation

Impact hammer testing and powertrain NVH testing accounted for the largest share of the NVH testing market in 2022

Impact hammer testing and powertrain NVH testing are the two major opportunities in the NVH testing market. In the impact hammer test, the device to be analyzed is kept on a vibration table on which real conditions are simulated. The impact hammer mechanically sends controlled impulses at several desired points on the device, while sensors capture the ensuing vibration in the form of data. This helps in determining unwanted frequencies of noise and vibration along with their source locations. Through such a study, an engineer is able to recommend appropriate design improvements or modifications so as to minimize undesirable noise and vibration levels. This then enhances product quality and durability.

Correspondingly, the powertrain NVH test primarily focuses on the assessment and refining the quality of powertrain systems within automotive. It detects potential areas and design changes, considering noise and vibration reduction, in order to ensure better performance of the powertrain system concerning efficiency and reliability. The NVH test methodology solutions will see rising demand due to growing vehicle production worldwide, including impact hammer testing and powertrain assessment. The growth in vehicle production, in return, requires the usage of advanced NVH testing technologies that guarantee high-quality and reliable vehicle performance. Hence, the trend acts like a driving factor for market growth and innovation in the sector.

Software to register the highest CAGR in the NVH testing market during the forecast period

The involvement of software for the analysis and optimization of noise, vibration, and harshness is increasing steadily, thus driving growth in the NVH testing market. In fact, there is an increased need to utilize advanced software solutions in monitoring, capturing, and analyzing noise and vibration. These utilities enable the simulation of how components or systems would perform in large detail under various conditions and provide useful insights into the sound quality analysis, modal analysis, acoustic simulation, and dynamic design optimization. Meeting future performance problems and enhancing the designs by simulations using software solutions increase the accuracy and effectiveness of NVH testing.

With growing demand for high-value NVH testing based on accurate measurement and evaluation of noise levels, the scope for software solutions has also increased, including data acquisition software, acoustic software, vibration measurement and analysis software, signal analysis software, and calibration software. These require continuous development and perfection to match up with the increasing demands of industries wanting to optimize their product noise and vibration characteristics. With this ever-evolving scenario of software, huge growth opportunities are foreseen in the NVH testing market as various sectors emerge to reduce unwanted noise in their respective products and enhance overall performance.

Power & Energy to register highest CAGR in the NVH testing market during the forecast period

The Power and Energy segment is expected to result in the highest CAGR for the NVH testing market. It will be driven mainly by the growing need to optimize performance, reliability, and safety for critical equipment such as generators, motors, transformers, and power transmission systems. NVH testing locates sources of noise and vibration with high accuracy, hence ensuring efficient design for stringent regulatory requirements. Turbines in power generation plants generate loud noise; on the other hand, equipment like transformers and air compressors emit low-frequency sounds, so NVH testing is needed to meet the government-enforced noise standards of these sources.

Furthermore, windmills are considered sources of environmental noise pollution too, urging the OEMs to focus on the noise reduction aspect by keeping the NVH level as low as possible in the product testing and development phase. With the rising stringency of noise ordinances, especially in generator and power transmission systems, higher-order NVH testing solutions would see a surge in demand. A decent opportunity would also lie in creating technologies that would assist the power and energy vertical in meeting shifting regulations and enhancing product efficiency. The sector, with that in mind, is targeted toward noise pollution reduction and works toward better system reliability, hence, this is a promising area for NVH testing advancements.

NVH Testing Industry Regional Analysis

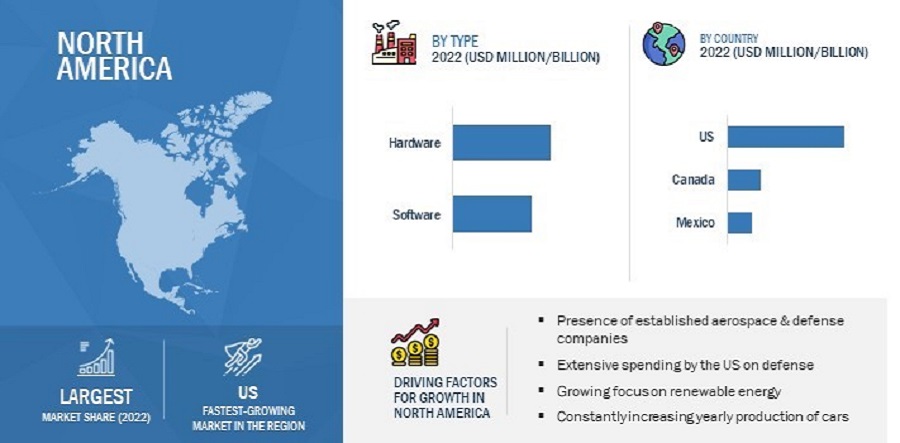

North America held for the largest share of the NVH testing market in 2022

North America has always been leading the NVH testing market, and it is expected to continue this lead with major contributions from the U.S. The presence of major players in the automotive and aerospace industries, namely Ford (US), General Motors (US), Boeing (US), and Lockheed Martin (US), along with global OEMs such as Toyota (Japan), BMW (Germany), and Volkswagen (Germany, has increased the demand for NVH testing in the region. This huge industrial base creates many opportunities for NVH testing, primarily because these firms are involved in developing and fine-tuning their vehicle models and complying with certain stringent noise-related regulations.

Increasing adoption of electric and autonomous vehicles in North America is creating demand for specific NVH testing solutions. While OEMs are striving to make quiet and efficient vehicles, NVH testing would refine the design and performance of the product. The increasingly stringent government regulations on permissible levels of noise will spur manufacturers into investing more in the latest NVH testing technologies. This increasing demand for innovative test solutions presents a great opportunity for NVH testing companies to capture major market share in North America. The regional focus on technological advances acts as a continued drive for the growth in the NVH testing market.

NVH Testing Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top NVH Testing Companies - Key Market Players

The major players in the NVH testing companies include

- National Instruments Corporation (US),

- Siemens Digital Industries Software (US),

- Brüel & Kjær (Denmark),

- Axiometrix Solutions (US),

- HEAD acoustics GmbH (Germany)

These companies have used both organic and inorganic growth strategies such as product launches, acquisitions, and partnerships to strengthen their position in the market.

NVH Testing Market Report Scope

|

Report Metric |

Details |

|

Estimated Value |

USD 2.2 billion in 2023 |

|

Expected Value |

USD 3.0 billion by 2028 |

|

Growth Rate |

CAGR of 6.3% |

|

Market size available for years |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million), Volume (Thousand Units) |

|

Segments covered |

By Type, Application, Vertical, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, and Rest of World |

|

Companies covered |

The major players in the NVH testing market are National Instruments Corporation (US), Siemens Digital Industries Software (US), Brüel & Kjær (Denmark), Axiometrix Solutions (US), HEAD acoustics GmbH (Germany), DEWESoft d.o.o (Slovenia), Prosig Ltd (UK), Signal.X Technologies LLC (US), and m+p international Mess- und Rechnertechnik GmbH (Germany), Norsonis AS (Norway). |

NVH Testing Market Highlights

The study segments the NVH testing market based on type, application, vertical, and region at the regional and global level.

|

Segment |

Subsegment |

|

By Type |

|

|

By Application |

|

|

By Vertical |

|

|

By Region |

|

Recent Developments in NVH Testing Industry

- In January 2023, imc Test & Measurement launched the Modbus Fieldbus Interface for the imc DAQ Platform. It seamlessly integrates any external sensor, device, or data source with a Modbus link.

- In May 2022, HEAD acoustics GmbH launched Qsource Shaker, which offers accurate acquisition of transfer functions and supports modal and transfer path analysis. It enables dynamic excitation when conventional vibration exciters cannot be structurally integrated or impulse hammers cannot be used. It can be mounted directly on the structure; the shaker needs no external support.

- In May 2021, Siemens Digital Industries Software announced the release of Simcenter Studio software, a web application dedicated to discovering better system architectures faster. Simcenter Studio offers a unique competitive advantage for designing products by finding the best possible system architectures in a shorter time, searching through thousands of possibilities using artificial intelligence and system simulation

- In August 2020, National Instruments Corporation launched the enterprise version of SystemLink Software. This new version enables increased visibility and control of test systems across an organization.

- In March 2020, Brüel & Kjær released a new version, 2019.1, of its NVH Simulator. This new version expands the ability to model electric and hybrid vehicles, along with over 200 other improvements and enhancements.

Frequently Asked Questions (FAQ):

What is the current size of the global NVH testing market?

The NVH testing market is estimated to be worth USD 2.2 billion in 2023 and is projected to reach USD 3.0 billion by 2028, at a CAGR of 6.3% during the forecast period. Stringent government regulations to reduce noise pollution and the increasing yearly production cars are the major factors driving the market growth.

Who are the winners in the global NVH testing market share?

Companies such as National Instruments Corporation (US), Siemens Digital Industries Software (US), Brüel & Kjær (Denmark), Axiometrix Solutions (US), and HEAD acoustics GmbH (Germany), fall under the winners category.

Which region is expected to hold the highest NVH testing market share?

North America is expected to dominate the NVH testing market during forecast period. Presence of established aerospace & defense companies, increasing yearly production of vehicles and growing focus on renewable energy are some of the major factors driving the market growth in the region.

What are the major drivers and opportunities related to NVH testing market?

Stringent government regulations to reduce noise pollution, growing need for NVH testing in automotive vertical, advancement in sensor technologies and shift toward electric vehicles are some of the major drivers and opportunities for NVH testing market.

What are the major strategies adopted by market players?

The key players have adopted product launches, acquisitions, and partnerships to strengthen their position in the NVH testing market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Stringent government regulations to reduce noise pollution- Growing need for NVH testing in automotive vertical- Growing adoption of automated condition monitoring for smart factoriesRESTRAINTS- Availability of rental NVH testing equipment- Reliability issues in prediction capabilities of NVH solutions- Lack of skilled workforceOPPORTUNITIES- Emergence of new applications for NVH testing solutions- Development of advanced sensor technologies- Shift toward electric vehiclesCHALLENGES- Difficulty in selecting NVH testing equipment- Integration of NVH systems with other systems- High retrofitting cost for incorporating NVH solutions

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 NVH TESTING MARKET ECOSYSTEM

-

5.5 KEY TECHNOLOGY TRENDSROAD-NOISE ACTIVE NOISE CONTROL SYSTEMFLEXIBLE POLYURETHANE FOAMNONWOVEN FIBER FELTSDIRECT-TO-METAL (DTM) TECHNOLOGYSCANNING LASER DOPPLER VIBROMETER (SLDV)TORSIONAL VIBRATION DAMPING

-

5.6 PRICING ANALYSISAVERAGE SELLING PRICE TREND

-

5.7 PATENT ANALYSIS

-

5.8 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.9 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.10 CASE STUDIESMEASURING UNCERTAIN SOUND FIELD INSIDE AIRBUS A320 AIRCRAFT (GERMANY)REDUCING COST OF AUTOMOTIVE SENSOR TEST SYSTEMS IN CONTINENTAL AUTOMOTIVE (US)INCREASING PERCENTAGE OF COMPLETED TRANSMISSIONS PASSING END-OF-LINE TESTING IN VOLKSWAGEN (AUSTRALIA)CREATION OF INFRASTRUCTURE FOR TEST DATA MANAGEMENT IN JAGUAR LAND ROVERIMPROVING NVH PERFORMANCE IN SUBARU

- 5.11 TRADE DATA

-

5.12 TARIFF AND REGULATIONSTARIFFSSTANDARDS- Global- Europe- Asia Pacific- North AmericaNOISE REGULATIONS- America- EUROPE- Asia Pacific- Rest of the World

-

5.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.14 KEY CONFERENCES & EVENTS, 2022–2023

- 6.1 INTRODUCTION

-

6.2 HARDWARESENSORS & TRANSDUCERS- Growing need to detect and quantify noise and vibration to drive demand for sensors and transducersANALYZERS- Need to measure noise and vibration to drive demand for analyzersMETERS- Increasing use of meters for NVH testing to create opportunities for market playersDATA ACQUISITION SYSTEMS- Need to acquire data and store it for further analysis to drive marketSIGNAL CONDITIONERS- Signal conditioners help modify signals for processing during NVH testingSHAKERS & CONTROLLERS- Need for vibration testing and modal analysis to drive demand for shakers and controllers

-

6.3 SOFTWAREDATA ACQUISITION SOFTWARE- Growing adoption of data acquisition systems to drive demand for data acquisition softwareACOUSTIC SOFTWARE- Acoustic software facilitates precise measurement and evaluation of sound levels during NVH testingVIBRATION MEASUREMENT & ANALYSIS SOFTWARE- Vibration measurement and analysis software help evaluate shock and vibration data acquired for NVH testingSIGNAL ANALYSIS SOFTWARE- Signal analysis software used for analysis of vibration and acoustic signals captured and stored in databaseCALIBRATION SOFTWARE- Calibration software used to improve quality of results, reduce errors, and standardize testing methods

- 7.1 INTRODUCTION

-

7.2 IMPACT HAMMER TESTING AND POWERTRAIN NVH TESTINGGROWING NEED TO REDUCE UNWANTED NOISE AND VIBRATION IN AUTOMOTIVE INDUSTRY TO DRIVE MARKET GROWTH

-

7.3 ENVIRONMENTAL NOISE MEASUREMENTNEED TO ADDRESS IMPACT OF NOISE ON HUMAN HEALTH AND ENVIRONMENT TO PROVIDE OPPORTUNITIES

-

7.4 PASS-BY NOISE TESTINGINCREASING MANDATES FOR REGULATING EFFECT OF EXTERNAL NOISE ON VEHICLES TO DRIVE MARKET

-

7.5 NOISE SOURCE MAPPINGNEED TO IDENTIFY NOISE SOURCES IN DIFFICULT-TO-ACCESS AREAS TO FUEL MARKET

-

7.6 SOUND INTENSITY MEASUREMENT AND SOUND QUALITY TESTINGGROWING DEMAND FOR CONSUMER APPLIANCES GLOBALLY TO PROPEL MARKET GROWTH

-

7.7 PRODUCT VIBRATION TESTINGINCREASING FOCUS ON QUALITY CONTROL AND IMPROVING LIFESPAN OF PRODUCTS TO DRIVE MARKET

-

7.8 MECHANICAL VIBRATION TESTINGNEED TO MINIMIZE VIBRATION TO INCREASE USER COMFORT TO FUEL MARKET GROWTH

-

7.9 BUILDING ACOUSTICSGROWING NEED TO ADDRESS NOISE CONCERNS IN BUILDINGS TO DRIVE MARKET

- 8.1 INTRODUCTION

-

8.2 AUTOMOTIVE & TRANSPORTATIONGROWING NEED TO MEET REGULATIONS AND QUALITY EXPECTATIONS OF CUSTOMERS TO DRIVE MARKETAEROSPACE & DEFENSENEED FOR NOISE CONTROL AND DEVELOPMENT OF DURABLE AIRCRAFT COMPONENTS TO DRIVE MARKET

-

8.3 POWER & ENERGYNEED TO IDENTIFY NOISE AND VIBRATION SOURCES TO DRIVE DEMAND FOR NVH TESTING SOLUTIONS

-

8.4 CONSUMER APPLIANCESINCREASING USE OF CONSUMER APPLIANCES TO CREATE OPPORTUNITIES FOR ADOPTION OF NVH TESTING

-

8.5 CONSTRUCTIONINCREASING NEED TO ENHANCE OCCUPANT COMFORT TO PUSH NVH TESTING MARKET FURTHER

-

8.6 INDUSTRIAL EQUIPMENTINCREASING NEED TO TEST NOISE AND VIBRATION LEVELS OF INDUSTRIAL EQUIPMENT TO DRIVE MARKET GROWTH

-

8.7 MINING & METALLURGYGROWING NEED TO REDUCE NOISE LEVELS GENERATED FROM MINING & METALLURGY EQUIPMENT TO DRIVE MARKET

- 8.8 OTHERS

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICARECESSION IMPACT ON NORTH AMERICAUS- Growing adoption of electric vehicles to drive market in USCANADA- Presence of aerospace and automotive manufacturing giants to drive market growthMEXICO- Increasing automotive exports to drive market

-

9.3 EUROPERECESSION IMPACT ON EUROPEGERMANY- Government funding and policies to support industrial transformation and create opportunities for NVH testingUK- Strict regulations for noise control and R&D investments in automotive industry to drive marketFRANCE- Rising adoption of smart factories to automate manufacturing processes to create demand for NVH testing solutionsITALY- Government support toward electric vehicle adoption to drive growth of NVH testing marketSPAIN- Presence of multinational brands and manufacturing plants in automotive sector to drive demand for NVH testing solutionsREST OF EUROPE

-

9.4 ASIA PACIFICRECESSION IMPACT ON ASIA PACIFICCHINA- Increasing government focus on adoption of electric vehicles to drive market growthINDIA- Presence of large automotive industry to drive marketJAPAN- Designing and developing hybrid and electric vehicles to drive marketSOUTH KOREA- Growing automotive, industrial, and telecom markets to provide growth opportunities for NVH testingAUSTRALIA- Growing adoption of electric vehicles to drive demand for NVH testing solutionsREST OF ASIA PACIFIC

-

9.5 REST OF THE WORLDRECESSION IMPACT ON ROWSOUTH AMERICA- Mining & metallurgy vertical to fuel NVH testingMIDDLE EAST & AFRICA- Increasing motor vehicles and stringent regulations to boost demand

- 10.1 INTRODUCTION

-

10.2 STRATEGIES ADOPTED BY KEY PLAYERSORGANIC/INORGANIC GROWTH STRATEGIESPRODUCT PORTFOLIOGEOGRAPHIC PRESENCEMANUFACTURING FOOTPRINT

- 10.3 MARKET SHARE ANALYSIS, 2022

- 10.4 HISTORICAL REVENUE ANALYSIS, 2018–2022

-

10.5 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

10.6 STARTUP/SME EVALUATION QUADRANTCOMPETITIVE BENCHMARKINGPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 10.7 COMPANY FOOTPRINT

-

10.8 COMPETITIVE SCENARIOPRODUCT LAUNCHES AND DEVELOPMENTSDEALSOTHERS

- 11.1 INTRODUCTION

-

11.2 KEY PLAYERSNATIONAL INSTRUMENTS CORPORATION- Business overview- Products/Solutions offered- Recent developments- MnM viewSIEMENS DIGITAL INDUSTRIES SOFTWARE- Business overview- Products/Solutions offered- Recent developments- MnM viewBRÜEL & KJÆR (SUBSIDIARY OF SPECTRIS)- Business overview- Products/Solutions offered- Recent developments- MnM viewAXIOMETRIX SOLUTIONS- Business overview- Products/Solutions offered- Recent developments- MnM viewHEAD ACOUSTICS GMBH- Business overview- Products/Solutions offered- Recent developments- MnM viewDEWESOFT D.O.O- Business overview- Products/Solutions offered- Recent developmentsPROSIG LTD- Business overview- Products/Solutions offered- Recent developmentsSIGNAL.X TECHNOLOGIES LLC- Business overview- Products/Solutions offered- Recent developmentsM+P INTERNATIONAL MESS- UND RECHNERTECHNIK GMBH- Business overview- Products/Solutions offered- Recent developmentsNORSONIC AS- Business overview- Products/Solutions offered- Recent developments

-

11.3 OTHER PLAYERSAB DYNAMICSBENSTONE INSTRUMENTSNVT GROUPECON TECHNOLOGIES CO., LTDESI GROUPERBESSD INSTRUMENTSATESTEO GMBH & CO. KGTHP SYSTEMSHONEYWELL INTERNATIONAL INC.KING DESIGN INDUSTRIAL CO. LTDKISTLER GROUPMÜLLER-BBM VIBROAKUSTIK SYSTEMEOROSPCB PIEZOTRONICS, INC.POLYTEC GMBH

- 12.1 INSIGHTS FROM INDUSTRY EXPERTS

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS

- TABLE 1 MARKET GROWTH ASSUMPTIONS

- TABLE 2 RISK ASSESSMENT: NVH TESTING MARKET

- TABLE 3 TOP 10 CITIES WORLDWIDE WITH AVERAGE AGE OF HEARING LOSS OF RESIDENTS

- TABLE 4 MARKET: SUPPLY CHAIN

- TABLE 5 AVERAGE SELLING PRICE OF MARKET, BY TYPE

- TABLE 6 PATENTS FILED DURING REVIEW PERIOD

- TABLE 7 TOP 20 PATENT OWNERS DURING REVIEW PERIOD

- TABLE 8 KEY PATENTS RELATED TO NVH TESTING

- TABLE 9 MARKET: PORTER’S FIVE FORCES ANALYSIS – 2022

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS OF NVH TESTING (%)

- TABLE 11 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS OF NVH TESTING

- TABLE 12 BRÜEL & KJÆR: MULTI-FIELD MICROPHONE MEASURED UNCERTAIN SOUND FIELD INSIDE AIRCRAFT CABIN

- TABLE 13 NATIONAL INSTRUMENTS: NI LABVIEW SYSTEM DESIGN SOFTWARE AND PXI MODULAR INSTRUMENTATION REDUCED COST OF AUTOMOTIVE SENSOR SYSTEMS

- TABLE 14 BRÜEL & KJÆR: DISCOM SYSTEMS INCREASED PERCENTAGE OF COMPLETED TRANSMISSIONS SUCCESSFULLY PASSING END-OF-LINE TESTING

- TABLE 15 NATIONAL INSTRUMENT: DIADEM SOFTWARE AND DATAFINDER SERVER EDITION CREATED AN INFRASTRUCTURE FOR TEST DATA MANAGEMENT IN JAGUAR LAND ROVER

- TABLE 16 BRÜEL & KJÆR: NVH SIMULATOR HELPS SUBARU FINE-TUNE SOUND PACKAGES AND IMPROVE NVH PERFORMANCE

- TABLE 17 HS CODE: 903180, EXPORT VALUES FOR MAJOR COUNTRIES, 2017–2021 (USD MILLION)

- TABLE 18 HS CODE: 903180, IMPORT VALUES FOR MAJOR COUNTRIES, 2017–2021 (USD MILLION)

- TABLE 19 MFN TARIFFS FOR PRODUCTS INCLUDED UNDER HS CODE: 903180 EXPORTED BY GERMANY

- TABLE 20 NVH TESTING MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2022–2023

- TABLE 21 MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 22 MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 23 HARDWARE: MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 24 HARDWARE: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 25 HARDWARE: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 26 HARDWARE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 27 HARDWARE: MARKET, BY TYPE, 2019–2022 (THOUSAND UNITS)

- TABLE 28 HARDWARE: MARKET, BY TYPE, 2023–2028 (THOUSAND UNITS)

- TABLE 29 HARDWARE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 30 HARDWARE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 HARDWARE: MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 32 HARDWARE: MARKET IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 33 HARDWARE: MARKET IN EUROPE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 34 HARDWARE: MARKET IN EUROPE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 35 HARDWARE: MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 36 HARDWARE: MARKET IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 37 HARDWARE: MARKET IN REST OF THE WORLD, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 38 HARDWARE: MARKET IN REST OF THE WORLD, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 39 SENSORS & TRANSDUCERS: NVH TESTING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 40 SENSORS & TRANSDUCERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 ANALYZERS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 42 ANALYZERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 METERS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 44 METERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 DATA ACQUISITION SYSTEMS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 46 DATA ACQUISITION SYSTEMS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 SIGNAL CONDITIONERS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 48 SIGNAL CONDITIONERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 SHAKERS & CONTROLLERS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 50 SHAKERS & CONTROLLERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 SOFTWARE: MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 52 SOFTWARE: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 53 SOFTWARE: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 54 SOFTWARE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 55 SOFTWARE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 56 SOFTWARE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 SOFTWARE: MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 58 SOFTWARE: MARKET IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 59 SOFTWARE: MARKET IN EUROPE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 60 SOFTWARE: MARKET IN EUROPE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 61 SOFTWARE: MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 62 SOFTWARE: MARKET IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 63 SOFTWARE: MARKET IN REST OF THE WORLD, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 64 SOFTWARE: MARKET IN REST OF THE WORLD, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 65 DATA ACQUISITION SOFTWARE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 66 DATA ACQUISITION SOFTWARE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 ACOUSTIC SOFTWARE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 68 ACOUSTIC SOFTWARE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 69 VIBRATION MEASUREMENT AND ANALYSIS SOFTWARE: NVH TESTING, BY REGION, 2019–2022 (USD MILLION)

- TABLE 70 VIBRATION MEASUREMENT AND ANALYSIS SOFTWARE: NVH TESTING, BY REGION, 2023–2028 (USD MILLION)

- TABLE 71 SIGNAL ANALYSIS SOFTWARE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 72 SIGNAL ANALYSIS SOFTWARE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 73 CALIBRATION SOFTWARE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 74 CALIBRATION SOFTWARE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 75 MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 76 MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 77 NVH TESTING MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 78 MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 79 AUTOMOTIVE & TRANSPORTATION: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 80 AUTOMOTIVE & TRANSPORTATION: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 81 AEROSPACE & DEFENSE: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 82 AEROSPACE & DEFENSE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 83 POWER & ENERGY: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 84 POWER & ENERGY: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 85 CONSUMER APPLIANCES: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 86 CONSUMER APPLIANCES: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 87 CONSTRUCTION: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 88 CONSTRUCTION: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 89 INDUSTRIAL EQUIPMENT: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 90 INDUSTRIAL EQUIPMENT: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 91 MINING & METALLURGY: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 92 MINING & METALLURGY: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 93 OTHERS: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 94 OTHERS: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 95 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 96 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 97 NORTH AMERICA: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 98 NORTH AMERICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 99 NORTH AMERICA: MARKET, BY HARDWARE TYPE, 2019–2022 (USD MILLION)

- TABLE 100 NORTH AMERICA: MARKET, BY HARDWARE TYPE, 2023–2028 (USD MILLION)

- TABLE 101 NORTH AMERICA: MARKET, BY SOFTWARE TYPE, 2019–2022 (USD MILLION)

- TABLE 102 NORTH AMERICA: MARKET, BY SOFTWARE TYPE, 2023–2028 (USD MILLION)

- TABLE 103 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 104 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 105 US: NVH TESTING MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 106 US: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 107 CANADA: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 108 CANADA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 109 MEXICO: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 110 MEXICO: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 111 EUROPE: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 112 EUROPE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 113 EUROPE: MARKET, BY HARDWARE TYPE, 2019–2022 (USD MILLION)

- TABLE 114 EUROPE: MARKET, BY HARDWARE TYPE, 2023–2028 (USD MILLION)

- TABLE 115 EUROPE: MARKET, BY SOFTWARE TYPE, 2019–2022 (USD MILLION)

- TABLE 116 EUROPE: MARKET, BY SOFTWARE TYPE, 2023–2028 (USD MILLION)

- TABLE 117 EUROPE: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 118 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 119 GERMANY: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 120 GERMANY: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 121 UK: NVH TESTING MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 122 UK: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 123 FRANCE: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 124 FRANCE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 125 ITALY: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 126 ITALY: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 127 SPAIN: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 128 SPAIN: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 129 REST OF EUROPE: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 130 REST OF EUROPE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 131 ASIA PACIFIC: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 132 ASIA PACIFIC: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 133 ASIA PACIFIC: MARKET, BY HARDWARE TYPE, 2019–2022 (USD MILLION)

- TABLE 134 ASIA PACIFIC: MARKET, BY HARDWARE TYPE, 2023–2028 (USD MILLION)

- TABLE 135 ASIA PACIFIC: MARKET, BY SOFTWARE TYPE, 2019–2022 (USD MILLION)

- TABLE 136 ASIA PACIFIC: MARKET, BY SOFTWARE TYPE, 2023–2028 (USD MILLION)

- TABLE 137 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 138 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 139 CHINA: NVH TESTING MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 140 CHINA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 141 INDIA: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 142 INDIA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 143 JAPAN: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 144 JAPAN: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 145 SOUTH KOREA: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 146 SOUTH KOREA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 147 AUSTRALIA: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 148 AUSTRALIA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 149 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 150 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 151 REST OF THE WORLD: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 152 REST OF THE WORLD: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 153 REST OF THE WORLD: MARKET, BY HARDWARE TYPE, 2019–2022 (USD MILLION)

- TABLE 154 REST OF THE WORLD: MARKET, BY HARDWARE TYPE, 2023–2028 (USD MILLION)

- TABLE 155 REST OF THE WORLD: MARKET, BY SOFTWARE TYPE, 2019–2022 (USD MILLION)

- TABLE 156 REST OF THE WORLD: MARKET, BY SOFTWARE TYPE, 2023–2028 (USD MILLION)

- TABLE 157 REST OF THE WORLD: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 158 REST OF THE WORLD: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 159 SOUTH AMERICA: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 160 SOUTH AMERICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 163 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN MARKET

- TABLE 164 MARKET SHARE ANALYSIS OF KEY COMPANIES IN MARKET, 2022

- TABLE 165 NVH TESTING MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 166 COMPETITIVE BENCHMARKING FOR STARTUPS/SMES: TYPE

- TABLE 167 COMPETITIVE BENCHMARKING FOR STARTUPS/SMES: VERTICAL

- TABLE 168 COMPETITIVE BENCHMARKING FOR STARTUPS/SMES: REGION

- TABLE 169 COMPANY FOOTPRINT

- TABLE 170 OFFERING FOOTPRINT

- TABLE 171 COMPANY VERTICAL FOOTPRINT

- TABLE 172 COMPANY REGION FOOTPRINT

- TABLE 173 PRODUCT LAUNCHES AND DEVELOPMENTS, 2019–2023

- TABLE 174 DEALS, 2019–2022

- TABLE 175 OTHERS, 2020–2022

- TABLE 176 NATIONAL INSTRUMENTS CORPORATION: BUSINESS OVERVIEW

- TABLE 177 NATIONAL INSTRUMENTS CORPORATION: PRODUCT LAUNCHES

- TABLE 178 NATIONAL INSTRUMENTS CORPORATION: DEALS

- TABLE 179 NATIONAL INSTRUMENTS CORPORATION: OTHERS

- TABLE 180 SIEMENS DIGITAL INDUSTRIES SOFTWARE: BUSINESS OVERVIEW

- TABLE 181 SIEMENS DIGITAL INDUSTRIES SOFTWARE: PRODUCT LAUNCHES

- TABLE 182 SIEMENS DIGITAL INDUSTRIES SOFTWARE: DEALS

- TABLE 183 BRÜEL & KJÆR: BUSINESS OVERVIEW

- TABLE 184 BRÜEL & KJÆR: PRODUCT LAUNCHES

- TABLE 185 BRÜEL & KJÆR: DEALS

- TABLE 186 AXIOMETRIX SOLUTIONS: COMPANY OVERVIEW

- TABLE 187 AXIOMETRIX SOLUTIONS: PRODUCT LAUNCHES

- TABLE 188 AXIOMETRIX SOLUTIONS: DEALS

- TABLE 189 AXIOMETRIX SOLUTIONS: OTHERS

- TABLE 190 HEAD ACOUSTICS GMBH: BUSINESS OVERVIEW

- TABLE 191 HEAD ACOUSTICS GMBH: PRODUCT LAUNCHES

- TABLE 192 HEAD ACOUSTICS GMBH: DEALS

- TABLE 193 DEWESOFT D.O.O: BUSINESS OVERVIEW

- TABLE 194 DEWESOFT D.O.O SOLUTIONS LAITERES INC.: PRODUCT LAUNCHES

- TABLE 195 DEWESOFT D.O.O: DEALS

- TABLE 196 DEWESOFT D.O.O: OTHERS

- TABLE 197 PROSIG LTD

- TABLE 198 PROSIG LTD: PRODUCT LAUNCHES

- TABLE 199 PROSIG LTD: DEALS

- TABLE 200 PROSIG LTD: OTHERS

- TABLE 201 SIGNAL.X TECHNOLOGIES LLC: BUSINESS OVERVIEW

- TABLE 202 SIGNAL.X TECHNOLOGIES LLC: PRODUCT LAUNCHES

- TABLE 203 SIGNAL.X TECHNOLOGIES LLC: DEALS

- TABLE 204 M+P INTERNATIONAL MESS- UND RECHNERTECHNIK GMBH: BUSINESS OVERVIEW

- TABLE 205 M+P INTERNATIONAL MESS- UND RECHNERTECHNIK GMBH: PRODUCT LAUNCHES

- TABLE 206 M+P INTERNATIONAL MESS- UND RECHNERTECHNIK GMBH: DEALS

- TABLE 207 M+P INTERNATIONAL MESS- UND RECHNERTECHNIK GMBH: OTHERS

- TABLE 208 NORSONIC AS: COMPANY OVERVIEW

- TABLE 209 NORSONIC AS: PRODUCT LAUNCHES

- TABLE 210 DEALS: NORSONIC AS

- FIGURE 1 NVH TESTING MARKET: SEGMENTATION

- FIGURE 2 MARKET: RESEARCH DESIGN

- FIGURE 3 BOTTOM-UP APPROACH

- FIGURE 4 TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS (APPROACH 1)

- FIGURE 6 MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS (APPROACH 2)

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 MARKET: GLOBAL SNAPSHOT

- FIGURE 9 HARDWARE TO ACCOUNT FOR LARGEST SHARE OF MARKET DURING FORECAST PERIOD

- FIGURE 10 SOUND INTENSITY MEASUREMENT AND SOUND QUALITY TESTING TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 AUTOMOTIVE & TRANSPORTATION VERTICAL TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 13 RISING VEHICLE PRODUCTION GLOBALLY TO OFFER GROWTH OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 14 HARDWARE TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 15 SOUND INTENSITY MEASUREMENT AND SOUND QUALITY TESTING TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 AUTOMOTIVE & TRANSPORTATION TO DOMINATE MARKET FROM 2023 TO 2028

- FIGURE 17 US AND HARDWARE SEGMENT HELD LARGEST SHARES OF MARKET IN NORTH AMERICA IN 2022

- FIGURE 18 MARKET DYNAMICS: NVH TESTING MARKET

- FIGURE 19 VEHICLE PRODUCTION, BY VEHICLE TYPE, 2015–2021 (MILLION UNITS)

- FIGURE 20 IMPACT ANALYSIS OF DRIVERS ON MARKET

- FIGURE 21 IMPACT ANALYSIS OF RESTRAINTS ON MARKET

- FIGURE 22 IMPACT ANALYSIS OF OPPORTUNITIES ON MARKET

- FIGURE 23 IMPACT ANALYSIS OF CHALLENGES ON MARKET

- FIGURE 24 MARKET: VALUE CHAIN ANALYSIS

- FIGURE 25 MARKET ECOSYSTEM

- FIGURE 26 MARKET PLAYER ECOSYSTEM

- FIGURE 27 AVERAGE SELLING PRICE TREND OF MARKET, BY TYPE

- FIGURE 28 NUMBER OF PATENTS GRANTED FOR NVH TESTING

- FIGURE 29 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS DURING REVIEW PERIOD

- FIGURE 30 MARKET: PORTER’S FIVE FORCES ANALYSIS, 2022

- FIGURE 31 IMPACT OF PORTER’S FIVE FORCES ON MARKET, 2022

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS OF NVH TESTING

- FIGURE 33 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS OF NVH TESTING

- FIGURE 34 HS CODE: 903180, EXPORT VALUES FOR MAJOR COUNTRIES, 2017–2021

- FIGURE 35 HS CODE: 903180, IMPORT VALUES FOR MAJOR COUNTRIES, 2017–2021

- FIGURE 36 REVENUE SHIFT FOR MARKET

- FIGURE 37 HARDWARE TO ACCOUNT FOR LARGEST SHARE OF MARKET FROM 2023 TO 2028

- FIGURE 38 AUTOMOTIVE & TRANSPORTATION VERTICAL TO ACCOUNT FOR LARGEST HARDWARE MARKET SHARE OF MARKET FROM 2023 TO 2028

- FIGURE 39 NORTH AMERICA TO HOLD LARGEST SHARE OF NVH TESTING HARDWARE MARKET FROM 2023 TO 2028

- FIGURE 40 AUTOMOTIVE & TRANSPORTATION VERTICAL TO ACCOUNT FOR LARGEST SHARE IN SOFTWARE MARKET FOR NVH TESTING FROM 2023 TO 2028

- FIGURE 41 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF SIGNAL ANALYSIS SOFTWARE IN MARKET

- FIGURE 42 SOUND INTENSITY MEASUREMENT AND SOUND QUALITY TESTING TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 43 AUTOMOTIVE & TRANSPORTATION TO ACCOUNT FOR LARGEST SHARE OF MARKET FROM 2023 TO 2028

- FIGURE 44 HARDWARE TO DOMINATE NVH TESTING MARKET FOR AUTOMOTIVE & TRANSPORTATION VERTICAL DURING FORECAST PERIOD

- FIGURE 45 SOFTWARE TO REGISTER HIGHEST CAGR FOR AEROSPACE & DEFENSE VERTICAL DURING FORECAST PERIOD

- FIGURE 46 HARDWARE MARKET TO DOMINATE POWER & ENERGY VERTICAL DURING FORECAST PERIOD

- FIGURE 47 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 48 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN MARKET

- FIGURE 49 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 50 EUROPE: MARKET SNAPSHOT

- FIGURE 51 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 52 KEY PLAYERS USED PRODUCT LAUNCHES AS KEY GROWTH STRATEGY FROM 2019–2023

- FIGURE 53 HISTORICAL REVENUE ANALYSIS FOR TOP 5 PLAYERS IN MARKET, 2018–2022 (USD MILLION)

- FIGURE 54 MARKET: KEY COMPANY EVALUATION QUADRANT, 2022

- FIGURE 55 NVH TESTING MARKET: STARTUP/SME EVALUATION QUADRANT, 2022

- FIGURE 56 NATIONAL INSTRUMENTS CORPORATION: COMPANY SNAPSHOT

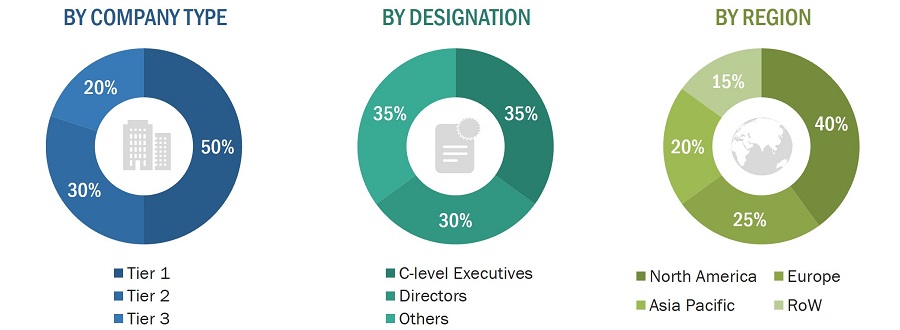

The research study involved 4 major activities in estimating the size of the NVH testing market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The validation of these findings, assumptions, and sizing with the help of primary research with industry experts across the value chain has been the next step. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information required for this study. The secondary sources include annual reports, press releases, and investor presentations of companies, white papers, and articles from recognized authors. Secondary research was mainly done to obtain key information about the market’s value chain, the pool of key market players, market segmentation according to industry trends, and regional outlook and developments from both market and technology perspectives.

Primary Research

In the primary research, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative insights required for this report. Primary sources from the supply side include experts such as CEOs, vice presidents, marketing directors, equipment manufacturers, technology and innovation directors, end users, and related executives from multiple key companies and organizations operating in the NVH testing market ecosystem.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches along with data triangulation methods have been used to estimate and validate the size of the NVH testing market and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- Initially, MarketsandMarkets focuses on top line investments and spending in the ecosystems. Further, major developments in the key market area have been considered

- Analyzing major original equipment manufacturers (OEMs) and studying their product portfolios and understanding different applications of the solutions offered by them

- Analyzing the trends related to the adoption of different types of hardware and software type solutions for different applications

- Tracking the recent and upcoming developments in the NVH testing market that include investments, R&D activities, product launches, collaborations, mergers and acquisitions, and partnerships, as well as forecasting the market size based on these developments and other critical parameters

- Conducting multiple discussions with key opinion leaders to know about different types of NVH testing solutions used and the applications for which they are used to analyze the breakup of the scope of work carried out by major companies

- Segmenting the market based on types with respect to applications wherein the types are to be used and deriving the size of the global application market

- Segmenting the overall market into various market segments

- Validating the estimates at every level through discussions with key opinion leaders, such as chief executives (CXOs), directors, and operation managers, and finally with the domain experts at MarketsandMarkets

Market Size Estimation Methodology-Bottom-up approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall NVH testing market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments, the data triangulation and market breakdown procedures have been used, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The NVH testing market size has been validated using both top-down and bottom-up approaches.

Market Definition

Noise, vibration, and harshness (NVH) testing includes analyzing and modifying the noise, vibration, and harshness that a system emits to enhance its performance and comfort. Undesirable sound or disruption in an electrical signal is known as noise. Acoustic noise is a term used to describe pressure waves or energy that flow through the air and produce audible disturbances. Vibration is the oscillation that causes noise and disturbance. Electrical system failures and the malfunction or breakdown of mechanical systems are the two major causes of vibrations. Testing and measurement of vibration-related parameters are carried out with shakers and controls. Harshness is a term used to characterize the severity and discomfort caused by vibration and noise. In contrast to noise and vibration, which can be quantified using sound pressure levels and frequency, respectively, harshness is a qualitative factor.

Stakeholders

- Raw Material Vendors

- Component Providers

- NVH Testing Solution Providers

- NVH Testing Software Providers

- System Integrators

- Original Equipment Manufacturers (OEMs)/Device Manufacturers

The main objectives of this study are as follows:

- Define, describe, and forecast the global noise, vibration, and harshness (NVH) testing market, in terms of value, based on type, application, vertical, and region

- To forecast the market size in terms of value, for various segments, for four main regions—North America, Europe, Asia Pacific, and Rest of the World

- To forecast the market size, in terms of volume, based on hardware type

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To provide detailed information regarding the value chain, ecosystem, average selling price (ASP) of hardware types, trade analysis (import and export scenarios), trends and disruptions impacting the customers’ business, key conferences & events, Porter’s five forces analysis, key stakeholders & buying criteria, and patent analysis in accordance with the NVH testing market

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities for the market stakeholders by identifying high-growth segments of the market

- To benchmark players within the market using the Company Evaluation Quadrant, which analyzes market players based on various parameters within the broad categories of market share/rank and product footprint

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

- To analyze the competitive landscape of the market

- To track and analyze competitive developments, such as partnerships, collaborations, agreements, joint ventures, mergers and acquisitions, expansions, product launches, and other developments in the market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Country-wise Information:

- Analysis for additional countries (up to five)

- Company Information:

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in NVH Testing Market

Hi Team I was browsing the web for NVH Testing and found your amazingly written piece. We have our own NVH Test Data Management Suite- ASI Datalab I would really appreciate if you could check this out and give it a shoutout.