Non-Woven Adhesives Market by Technology (Hot-melt), Type (SBC, APAO, EVA), Application (Baby Care, Feminine Hygiene, Adult Incontinence, Medical), and Region - Global Forecast to 2025

Updated on : August 25, 2025

Non-woven Adhesives Market

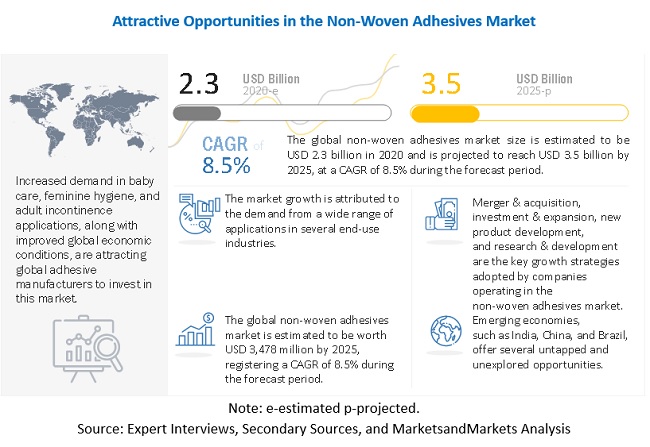

The global non-woven adhesives market was valued at USD 2.3 billion in 2020 and is projected to reach USD 3.5 billion by 2025, growing at 8.5% cagr from 2020 to 2025. The key market driver is the growing usage of non-woven adhesives in baby care, feminine hygiene, and adult incontinence applications. Along with that, the rising awareness for high-quality products and growing demand from APAC, the Middle East & Africa, and South America are driving the growth. However, the growth of the non-woven adhesives market is stagnant in the baby diaper market in developed regions, and the market is affected by the volatility in raw material prices.

To know about the assumptions considered for the study, Request for Free Sample Report

The outbreak of the novel coronavirus or COVID-19 wreaked havoc on the global economy. The global economy entered recession due to the pandemic, with the lockdown of international borders and the shutdown of economic activities across countries to prevent the spread of COVID-19.

Impact of COVID-19 on Non-woven Adhesives Market

According to the IMF, a recession as bad as the global economic crisis of 2008 or worse hit the global economy during 2020. The IMF warned of a total output loss of USD 9 trillion in the world economy between 2020 and 2021. The extent of the economic damage still depends on how the virus spreads throughout Europe, the US, and other major economies.

- According to economists, the Chinese economy is likely to be hit further by reduced global demand for its products due to the effect of the pandemic. As the coronavirus pandemic escalates, the growth rate falls sharply against the backdrop of volatile markets and growing credit stress.

- The economy of China has been hit far harder than projected, although a tentative stabilization has begun. In European countries and the US, increasing restrictions on travel & transportation and prolonged lockdown have reduced the demand during the first quarter of 2020. However, the market is expected to recover by the end of the year.

- Central banks have swung into action and are undertaking some combination of sharply reduced policy rates, resumed assets purchase, and liquidity injections. Fiscal authorities have generally lagged but have begun to loosen the purse strings. As per MarketsandMarkets analysis, larger and more targeted spending to the most affected groups is expected.

- Restrictions on movement in Europe and the US are putting a severe dent in economic activities. India and Southeast Asian countries are also facing major disruption in their economies.

Non-woven Adhesives Market Dynamics

Increasing urban population

The ever-increasing urban population is a major factor in the increase in the demand for non-woven hygiene adhesives. The total global population is expected to reach 9.7 billion by 2050. India is expected to overtake China as the world’s most populous country by 2027. In sub-Saharan Africa, the population is projected to double by 2050. The working-age population is growing in emerging countries rapidly. Projection by the UN shows that one in six people will be over the age of 65 by 2050. The positive shift in living standards is leading to the demand for hygiene products such as baby diapers, feminine sanitary pads, adult diapers, and medical products. This is propelling the demand for non-woven hygiene adhesives. In the APAC region, the shift of population from rural to urban areas has elevated the growth rate of the non-woven hygiene adhesives market. Moreover, the COVID-19 is increasing the demand for non-woven hygiene adhesives in medical care products.

Restraint Stagnant growth in the baby diaper segment in matured markets

Declining birth rates and very high diaper penetration rate in matured markets such as the US, Japan, and in the Western European countries has led to stagnant growth for non-woven products in these countries, as the baby diaper segment is a major consumer of non-woven hygiene adhesives. The growth of the market in these countries remains challenged by falling birth rates. Moreover, baby diaper penetration is already about 98% in these matured markets.

Opportunity: Growing opportunities in the APAC region for manufacturing adhesives

Stringent government regulations regarding emission of VOCs and production of chemical-based products in developed regions are offering opportunities for global players to invest in emerging economies, where regulations are relatively lax. The European government has imposed many strict policies, which have encouraged the use and production of biodegradable chemicals in the region.

Policies and regulations governing this manufacturing sector are less stringent in developing regions such as APAC and the Middle East & Africa, thereby providing abundant opportunities to the adhesive manufacturers to establish manufacturing facilities in these regions. The market for non-woven hygiene adhesives and its end-use products in APAC and South America is still developing and, with the continuous progress in technology, opportunities in these regions will increase.

Challenge :Stringent policies and time-consuming regulatory approvals

The adhesive industry is facing a challenge from regulatory authorities in Europe and North America. Regulators such as the Control of Substances Hazardous to Health (COSHH), European Union (EU), Registration, Evaluation, Authorisation, and Restriction of Chemicals (REACH), Globally Harmonized System (GHS), and Environmental Protection Agency (EPA) regulate the usage of adhesives in various non-woven applications. Non-woven hygiene adhesives producers in these regions have to evolve their processes to comply with new policies constantly. In addition, the lengthy regulatory approval process poses challenges for the manufacturers.

The hot-melt segment is expected to lead the non-woven adhesives market, in terms of volume, during the forecast period.

The hot-melt segment is expected to lead the non-woven adhesives market, in terms of volume, between 2020 and 2025. Hot-melt-based adhesives are extensively used in products such as baby diapers, pet & medical pads, tissues, and towel & napkin. The market for hot-melt-based non-woven adhesives is well-established in North America and Europe.

Hot-melt-based adhesives are placed in a fluid medium with an absorbent material held within the disposable article. The article changes color when the hot-melt moisture indicator material comes in contact with the source of moisture. Hot-melt adhesives used for disposable articles are based on EVA, SBC, and APAO.

The baby care segment is projected to account for the largest share in the non-woven adhesives market.

Baby care is the major application of non-woven adhesives; the growth of the segment is backed by a continuous rise in demand from emerging countries. The global baby care market is witnessing high growth owing to the rise in infant population, along with increasing awareness about baby hygiene through social media and other promotional activities.

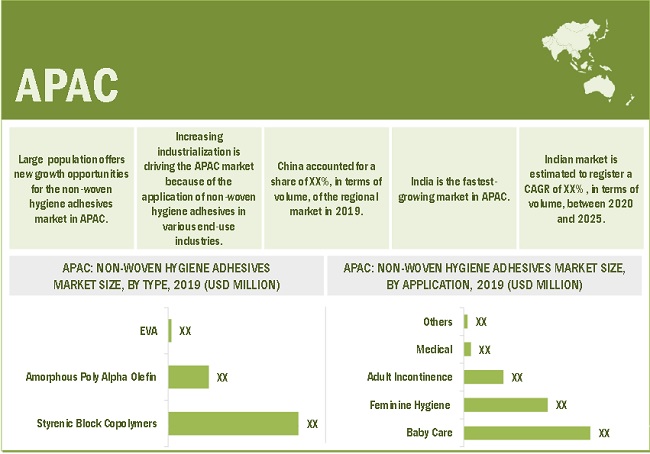

APAC to be the fastest growing non-woven adhesives market and accounts for the largest market share during the forecast period.

Many non-woven and hygiene products manufacturers are setting up or expanding their manufacturing bases in this region to take advantage of the low manufacturing and labor cost. The increasing demand for quality hygiene products, growing population, and increasing applications have led to innovations and developments in the end-use industries, making it a strong industrial hub.

A few large companies, such as Henkel AG (Germany), H.B. Fuller (US), and Arkema (France), due to price sensitivity, dominate the Indian non-woven hygiene adhesives market. They provide quality products as compared to their competitors and formulate the products according to the specific requirements of customers. These companies spend more on branding and try to attract customers by boosting awareness regarding non-woven hygiene products.

The rising use of non-woven products is expected to generate demand for non-woven hygiene adhesives in different non-woven hygiene and medical applications during the forecast period. Factors such as increasing number of working women and aging populations are expected to increase the demand for hygiene products due to the ease of use and disposal. In June 2016, Kimberly-Clark (US) invested nearly USD 282 million for new manufacturing lines for Huggies baby wipes and diaper pants in Tuas, Singapore. Such developments are expected to push the demand for non-woven hygiene adhesives in the Asian market.

The increase in disposable income has led to higher spending by the middle and upper-class population in India, driving the demand for baby diapers and feminine hygiene products. The steady increase in the number of working women has helped boost the baby care and feminine hygiene industries in India. Expecting an increase in birth rate, Nobel Hygiene (India) invested around USD 11 million to set up a new diaper manufacturing plant in Nashik (India) in 2016 for the production of adult and baby diaper products. This investment helped the company to launch a brand for baby and adult diapers products in the Indian market. Such developments are expected to drive the non-woven hygiene adhesives market in the region.

Several niche applications such as medical, pet care and bath tissues are expected to grow in the region during the forecast period, which is estimated to drive the non-woven hygiene adhesives market. For instance, in March 2017, Japanese firm Oji Holdings (Japan) planned to expand its foothold in Southeast Asia by selling disposable diapers for babies in Vietnam and Cambodia. Such developments are expected to boost the demand for non-woven hygiene adhesives in the APAC disposable hygiene market.

The non-woven hygiene adhesives market in the APAC region is growing due to the high economic growth rate and heavy investments in the adhesives industry. The advantage of shifting production facilities to the APAC region is the low-cost of production and the ability to better cater to the local emerging markets.

To know about the assumptions considered for the study, download the pdf brochure

APAC has been the most favorable destination for manufacturers of hygiene products and personal care goods. The rising demand from consumers is driving the demand for hygiene products, which is expected to drive the market in APAC during the forecast period. China and India have been the driving forces behind the rapid expansion of end-use industries, not only in APAC, but also, globally. In 2019, the demand for adhesives also increased in other countries of APAC (South Korea, Indonesia, Malaysia, Thailand, Australia, and the Philippines). This is due to the strong growth of birth rate and the rising demand for hygiene products from the growing middle-class population.

Non-woven Adhesives Market Players

Key players profiled in the report include Henkel AG (Germany), H.B. Fuller (US), Arkema (France), Moresco Corporation (Japan), Beardow Adams (Adhesives) Ltd. (UK), Lohmann- Koester GmbH & Co.KG (Germany), ADTEK Malaysia Sdn Bhd (Malaysia), Colquimica Adhesives (Portugal), Savare Specialty Adhesives (Italy), and Palmetto Adhesives Company, Inc. (US).

These players have adopted various growth strategies to expand their presence and increase their shares in the non-woven adhesives market.

Non-woven Adhesives Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2016 - 2025 |

|

Base Year |

2019 |

|

Forecast period |

2020–2025 |

|

Units Considered |

Value (USD Million), Volume (Kiloton) |

|

Segments |

Technology, Type, Application, and Region |

|

Regions |

APAC, North America, Europe, Middle East & Africa, and South America |

|

Companies |

Henkel AG (Germany), H.B. Fuller (US), Arkema (France), Moresco Corporation (Japan), Beardow Adams (Adhesives) Ltd. (UK), Lohmann- Koester GmbH & Co.KG (Germany), ADTEK Malaysia Sdn Bhd (Malaysia), Colquimica Adhesives (Portugal), Savare Specialty Adhesives (Italy), and Palmetto Adhesives Company, Inc. (US) A total of 25 players are covered. |

This report categorizes the global non-woven adhesives market based on technology, type, application, and region.

Based on technology, the non-woven adhesives market has been segmented as follows:

- Hot-melt

- Others (Water-based technology)

Based on type, the non-woven adhesives market has been segmented as follows:

- Amorphous Poly Alpha Olefin (APAO)

- Styrenic Block Copolymers (SBC)

- Ethylene Vinyl Acetate (EVA)

Based on application, the non-woven adhesives market has been segmented as follows:

- Baby Care

- Feminine Hygiene

- Adult Incontinence

- Medical

- Others (meat pads, poultry pads, pet care, and bath tissue & paper towels)

Based on region, the non-woven adhesives market has been segmented as follows:

- APAC

- North America

- Europe

- Middle East & Arica

- South America

Recent Developments

- In February 2021, Henkel launched Technomelt Supra ECO—a new range of hot melt adhesives, which provides greater sustainability and lower CO2 emissions, while the performance remains the same. With this new development, the company’s presence in the adhesives industry is expected to increase and cater to a broad range of applications.

- In December 2020, H.B. Fuller announced readily available adhesive grades with hot melt advanced technology for extreme cold storage of vaccines and medication packaging. Advantra Adhesives provide a secure bond at -94°F with tamper-evident fiber tear.

- In November 2020, Tailormade polyolefin adhesive range of Technomelt Advance was developed by Henkel with a partner for the personal hygiene industry to minimize chemical odor and Volatile Organic Compoundsþ (VOCs) emission. The MED range is for medical facemasks, isolation gowns, and surgical drapes.

- In November 2020, H.B. Fuller has launched Full-Care 5885 to meet the industry’s growing demand for natural-based hygiene articles. This adhesive offers great value by combining high-performance 100% cotton bonding at low cost in use.

- In September 2020, Arkema announced an industrial adhesives plant in Japan. Those new capacities will enable Bostik to serve its Japanese customers in the continuously growing markets of diapers, hygiene, packaging, labeling, transportation, and electronics. This investment is in line with Bostik’s growth and geographical expansion strategy. Bostik, the adhesive solutions segment of Arkema, continues the development of its industrial adhesives business and announces the start-up of a new plant in Nara, Japan, within the Bostik-Nitta JV, 80% owned by the group.

- In July 2020, Arkema proposed the acquisition of Fixatti (Belgium), a company that specialized in high-performance thermobonding adhesive powders. This will enable Bostik to strengthen its global offering of hot melt adhesive solutions.

- In February 2020, Henkel Adhesives Technologies has officially inaugurated its new production facility in Kurkumbh (near Pune), India. With a total investment of about USD 57 million, the business unit aims to serve the growing demand of Indian industries for high-performance solutions in adhesives, sealants, and surface treatment products. Designed as a smart factory, the new plant enables a wide range of Industry 4.0 operations and meets the highest standards for sustainability.

- In January 2020, Bostik completed the acquisition of LIP Bygningsartikler AS (LIP), the Danish leader in tile adhesives, waterproofing systems, and floor preparation solutions, on 3rd January 2020. This acquisition is in line with Arkema’s strategy to continuously grow its adhesives business through bolt-on acquisitions, which complement Bostik’s geographic presence, product ranges, and technologies.

- In July 2019, the Henkel Corporation, a leading global manufacturer of adhesive technologies, laundry & home care, and beauty care products, announced that it would expand its operations in Salisbury. The company will invest up to USD 45 million in new equipment and a series of improvements at its Salisbury facility, including a new state-of-the-art production area for UV acrylic adhesives used in tapes and labels within the packaging and consumer goods industry.

- In September 2018, Henkel invested USD 146.90 million to build a global Innovation Center for Adhesive Technologies at the company's headquarters in Dusseldorf. The building also serves as a global customer center where the company presents new solutions for adhesives, sealants, and functional coatings.

- In August 2018, Bostik acquired industrial adhesives of Nitta Gelatin Inc. by the Bostik-Nitta joint venture in Japan. This acquisition helped the company construct a new adhesives plant in Japan and helped in the development of fast-growing non-woven markets for hygiene applications. It also helped in the packaging, labeling, transportation, electronics, and industrial markets.

- In November 2017, H.B. Fuller acquired Adecol Ind. (Brazil), a renowned manufacturer of quality adhesive technologies in Brazil with nearly USD 40 million revenue for the 2016 fiscal year. With this acquisition, the company is able to effectively deliver specialty adhesive products to key customers in the Mercosur region.

- In October 2017, H.B. Fuller acquired Royal Adhesives & Sealants (US) for USD 1.57 billion. The acquisition has expanded the company's product offering in engineering, durable assembly, and construction adhesives and made H.B. Fuller the world’s largest supplier of adhesives for insulating glass and commercial roofing applications. Of the top adhesives manufacturers, H.B. Fuller is the only one singularly focused on adhesive and sealant technologies.

- In August 2017, Arkema (Bostik) expanded its manufacturing capacities of Hot-Melt Pressure Sensitive Adhesives (HMPSAs) with the opening of a new facility in Gujarat, India. It supports the growing demand for the company’s products in both Indian and export markets.

- In July 2017, Henkel strengthened its adhesive technologies business and complemented its technology portfolio with the successful closing of the acquisitions of the global Darex Packaging Technologies business and the Sonderhoff Group. Darex supplied high-performance sealants and coatings for the metal packaging industry around the world. It served various global customers producing beverage, food or aerosol cans. The Sonderhoff Group was a leading manufacturer of innovative foamed-in-place gasketing solutions and had broad expertise in developing and manufacturing customized dosing equipment. The acquisitions helped Henkel in strengthening the portfolio and enhanced its position as a global market and technology leader.

- In January 2017, H.B. Fuller purchased the industrial adhesives business of Wisdom Adhesives Worldwide (US), a provider of adhesives for the packaging, paper converting, and assembly markets. Wisdom’s highly successful go-to-market strategy, based on a focused product line, ultra-fast delivery and virtual service, has complemented H.B. Fuller’s full value solutions. The acquisition has strengthened the company's leading position in the adhesives market segment within the Americas’ adhesive business.

Frequently Asked Questions (FAQ):

Does this report covers the new applications of non-woven adhesives?

Yes the report covers the new applications of non-woven adhesives.

Does this report cover the volume tables in addition to value tables?

Yes the report covers the market both in terms of volume as well as value

What is the current competitive landscape in the non-woven adhesives market in terms of new applications, production, and sales?

The market has various large, medium, and small-scale players operating across the globe. Many players are constantly investing and expanding to developing countries where the demand is constantly growing; thereby boosting sales.

Which all countries are considered in the report?

US, China, Japan, Germany, UK and France are major countries considered in the report. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 37)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET INCLUSIONS AND EXCLUSIONS

1.3.1 MARKET INCLUSIONS

1.3.2 MARKET EXCLUSIONS

1.4 MARKET SCOPE

1.4.1 NON-WOVEN HYGIENE ADHESIVES MARKET SEGMENTATION

1.4.2 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 40)

2.1 RESEARCH DATA

FIGURE 1 NON-WOVEN HYGIENE ADHESIVES MARKET: RESEARCH DESIGN

2.2 SECONDARY DATA

2.2.1 KEY DATA FROM SECONDARY SOURCES

2.3 PRIMARY DATA

2.3.1 KEY PRIMARY DATA SOURCES

2.3.1.1 Key data from primary sources

2.3.1.2 Key industry insights

2.3.1.3 Breakdown of primary interviews

2.4 MARKET SIZE ESTIMATION

2.4.1 TOP-DOWN APPROACH

FIGURE 2 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

FIGURE 3 MARKET SIZE ESTIMATION: NON-WOVEN HYGIENE ADHESIVES MARKET

2.4.2 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.4.3 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.5 DATA TRIANGULATION

FIGURE 6 NON-WOVEN HYGIENE ADHESIVES MARKET: DATA TRIANGULATION

2.6 ASSUMPTIONS

2.7 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 48)

TABLE 1 NON-WOVEN HYGIENE ADHESIVES MARKET SNAPSHOT (2020 VS. 2025)

FIGURE 7 APAC TO BE THE LARGEST NON-WOVEN HYGIENE ADHESIVES MARKET

FIGURE 8 CHINA TO LEAD THE APAC NON-WOVEN HYGIENE ADHESIVES MARKET

FIGURE 9 SBC SEGMENT TO DOMINATE THE NON-WOVEN HYGIENE ADHESIVES MARKET

FIGURE 10 MEDICAL TO BE THE FASTEST-GROWING APPLICATION OF NON-WOVEN HYGIENE ADHESIVES

FIGURE 11 APAC TO BE THE FASTEST-GROWING MARKET FOR NON-WOVEN HYGIENE ADHESIVES

4 PREMIUM INSIGHTS (Page No. - 53)

4.1 ATTRACTIVE OPPORTUNITIES FOR MARKET PLAYERS

FIGURE 12 EMERGING ECONOMIES OFFER LUCRATIVE GROWTH POTENTIAL FOR MARKET PLAYERS

4.2 NON-WOVEN HYGIENE ADHESIVES MARKET, BY TYPE

FIGURE 13 EVA SEGMENT TO REGISTER THE HIGHEST CAGR IN OVERALL NON-WOVEN HYGIENE ADHESIVES MARKET

4.3 NON-WOVEN HYGIENE ADHESIVES MARKET, DEVELOPED VS. DEVELOPING COUNTRIES

FIGURE 14 NON-WOVEN HYGIENE ADHESIVES MARKET TO GROW FASTER IN DEVELOPING COUNTRIES THAN IN DEVELOPED COUNTRIES

4.4 APAC NON-WOVEN HYGIENE ADHESIVES MARKET, BY APPLICATION AND COUNTRY, 2019

FIGURE 15 BABY CARE SEGMENT AND CHINA ACCOUNTED FOR LARGEST SHARES

4.5 GLOBAL NON-WOVEN HYGIENE ADHESIVES MARKET ATTRACTIVENESS

FIGURE 16 INDIA TO REGISTER THE HIGHEST CAGR BETWEEN 2020 AND 2025

5 MARKET OVERVIEW (Page No. - 56)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: NON-WOVEN HYGIENE ADHESIVES MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing urban population

TABLE 2 APAC: URBANIZATION PROSPECTS

5.2.1.2 Rising penetration of disposable hygiene products

5.2.1.3 Market growth in emerging economies

5.2.1.4 Huge investments in developing countries of APAC

5.2.1.5 Increasing demand in medical care due to the COVID-19 pandemic

5.2.2 RESTRAINTS

5.2.2.1 Stagnant growth in the baby diaper segment in matured markets

5.2.2.2 Volatile raw material prices

FIGURE 18 FLUCTUATIONS IN CRUDE OIL PRICE BETWEEN 2020 AND 2021

5.2.3 OPPORTUNITIES

5.2.3.1 Growing opportunities in the APAC region for manufacturing adhesives

5.2.3.2 Growing population and changing lifestyle

5.2.4 CHALLENGES

5.2.4.1 Stringent policies and time-consuming regulatory approvals

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 19 PORTER’S FIVE FORCES ANALYSIS: NON-WOVEN HYGIENE ADHESIVES MARKET

5.3.1 INTENSITY OF COMPETITIVE RIVALRY

5.3.2 BARGAINING POWER OF BUYERS

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 THREAT OF SUBSTITUTES

5.3.5 THREAT OF NEW ENTRANTS

5.4 MACROECONOMIC OVERVIEW AND KEY TRENDS

5.4.1 INTRODUCTION

5.4.2 TRENDS AND FORECAST OF GDP

TABLE 3 TRENDS AND FORECAST OF GDP, ANNUAL PERCENTAGE CHANGE

5.4.2.1 Economic Outlook of the US

TABLE 4 US: ECONOMIC OUTLOOK

5.4.2.2 Economic Outlook of Germany

TABLE 5 GERMANY: ECONOMIC OUTLOOK

5.4.2.3 Economic Outlook of China

TABLE 6 CHINA: ECONOMIC OUTLOOK

5.4.2.4 Economic Outlook of India

TABLE 7 INDIA: ECONOMIC OUTLOOK

5.5 COVID-19 IMPACT ANALYSIS

5.5.1 COVID-19 ECONOMIC ASSESSMENT

5.5.2 MAJOR ECONOMIC EFFECTS OF COVID-19

5.5.3 EFFECTS ON GDP OF COUNTRIES

FIGURE 20 GDP FORECASTS OF G20 COUNTRIES IN 2020

5.5.4 SCENARIO ASSESSMENT

FIGURE 21 FACTORS IMPACTED ECONOMY OF SELECT G20 COUNTRIES IN 2020

6 NON-WOVEN HYGIENE ADHESIVES MARKET, BY TECHNOLOGY (Page No. - 69)

6.1 INTRODUCTION

FIGURE 22 HOT-MELT SEGMENT TO DOMINATE THE NON-WOVEN HYGIENE ADHESIVES MARKET

TABLE 8 NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 9 NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 10 NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2016–2019 (KILOTON)

TABLE 11 NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2020–2025 (KILOTON)

6.2 HOT-MELT

6.2.1 HIGH DEMAND FOR HOT-MELT-BASED ADHESIVES IN DIAPER AND FEMININE HYGIENE APPLICATIONS TO DRIVE THE MARKET

TABLE 12 HOT-MELT-BASED NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 13 HOT-MELT-BASED NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

TABLE 14 HOT-MELT-BASED NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 15 HOT-MELT-BASED NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY REGION, 2020–2025 (KILOTON)

6.3 OTHERS

6.3.1 OTHER TECHNOLOGY INCLUDES WATER-BASED TECHNOLOGY.

TABLE 16 OTHER TECHNOLOGIES-BASED NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 17 OTHER TECHNOLOGIES-BASED NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 18 OTHER TECHNOLOGIES-BASED NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 19 OTHER TECHNOLOGIES-BASED NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY REGION, 2020–2025 (KILOTON)

7 NON-WOVEN HYGIENE ADHESIVES MARKET, BY TYPE (Page No. - 75)

7.1 INTRODUCTION

FIGURE 23 SBC SEGMENT TO DOMINATE THE NON-WOVEN HYGIENE ADHESIVES MARKET

TABLE 20 NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 21 NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 22 NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 23 NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY TYPE, 2020–2025 (KILOTON)

7.2 AMORPHOUS POLY ALPHA OLEFIN (APAO)

7.2.1 APAO NON-WOVEN HYGIENE ADHESIVES OFFER HIGHER COST-EFFECTIVENESS THAN OTHER ADHESIVES

TABLE 24 APAO NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 25 APAO NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 26 APAO NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 27 APAO NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY REGION, 2020–2025 (KILOTON)

7.3 STYRENIC BLOCK COPOLYMER (SBC)

7.3.1 ABILITY TO FUNCTION AT HIGHER TEMPERATURES INCREASING THE USE OF SBC NON-WOVEN HYGIENE ADHESIVES

TABLE 28 SBC NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 29 SBC NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 30 SBC NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 31 SBC NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY REGION, 2020–2025 (KILOTON)

7.4 ETHYLENE VINYL ACETATE (EVA)

7.4.1 INCREASING DEMAND FOR NON-WOVEN FABRICS TO DRIVE THE EVA SEGMENT

TABLE 32 EVA NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 33 EVA NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 34 EVA NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 35 EVA NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY REGION, 2020–2025 (KILOTON)

8 NON-WOVEN HYGIENE ADHESIVES MARKET, BY APPLICATION (Page No. - 83)

8.1 INTRODUCTION

TABLE 36 NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 37 NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 38 NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 39 NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

FIGURE 24 MEDICAL TO BE THE FASTEST-GROWING APPLICATION OF NON-WOVEN HYGIENE ADHESIVES

8.2 BABY CARE

8.2.1 GROWING AWARENESS ABOUT HYGIENE PRODUCTS IN DEVELOPING COUNTRIES TO BOOST THE MARKET IN THIS SEGMENT

TABLE 40 NON-WOVEN HYGIENE ADHESIVES MARKET SIZE IN BABY CARE APPLICATION, BY REGION, 2016–2019 (USD MILLION)

TABLE 41 NON-WOVEN HYGIENE ADHESIVES MARKET SIZE IN BABY CARE APPLICATION, BY REGION, 2020–2025 (USD MILLION)

TABLE 42 NON-WOVEN HYGIENE ADHESIVES MARKET SIZE IN BABY CARE APPLICATION, BY REGION, 2016–2019 (KILOTON)

TABLE 43 NON-WOVEN HYGIENE ADHESIVES MARKET SIZE IN BABY CARE APPLICATION, BY REGION, 2020–2025 (KILOTON)

8.3 FEMININE HYGIENE

8.3.1 MARKET IN THIS SEGMENT S PROPELLED BY INCREASE IN WORKING WOMEN POPULATION AND GROWING SANITARY HYGIENE AWARENESS AMONG WOMEN

TABLE 44 NON-WOVEN HYGIENE ADHESIVES MARKET SIZE IN FEMININE HYGIENE APPLICATION, BY REGION, 2016–2019 (USD MILLION)

TABLE 45 NON-WOVEN HYGIENE ADHESIVES MARKET SIZE IN FEMININE HYGIENE APPLICATION, BY REGION, 2020–2025 (USD MILLION)

TABLE 46 NON-WOVEN HYGIENE ADHESIVES MARKET SIZE IN FEMININE HYGIENE APPLICATION, BY REGION, 2016–2019 (KILOTON)

TABLE 47 NON-WOVEN HYGIENE ADHESIVES MARKET SIZE IN FEMININE HYGIENE APPLICATION, BY REGION, 2020–2025 (KILOTON)

8.4 ADULT INCONTINENCE

8.4.1 GROWING ELDERLY POPULATION BOOSTING THE DEMAND FOR ADULT INCONTINENCE PRODUCTS

TABLE 48 NON-WOVEN HYGIENE ADHESIVES MARKET SIZE IN ADULT INCONTINENCE APPLICATION, BY REGION, 2016–2019 (USD MILLION)

TABLE 49 NON-WOVEN HYGIENE ADHESIVES MARKET SIZE IN ADULT INCONTINENCE APPLICATION, BY REGION, 2020–2025 (USD MILLION)

TABLE 50 NON-WOVEN HYGIENE ADHESIVES MARKET SIZE IN ADULT INCONTINENCE APPLICATION, BY REGION, 2016–2019 (KILOTON)

TABLE 51 NON-WOVEN HYGIENE ADHESIVES MARKET SIZE IN ADULT INCONTINENCE APPLICATION, BY REGION, 2020–2025 (KILOTON)

8.5 MEDICAL

8.5.1 MEDICAL SEGMENT IS ONE OF THE PROMINENT CONSUMERS OF NON-WOVEN HYGIENE ADHESIVES

TABLE 52 NON-WOVEN HYGIENE ADHESIVES MARKET SIZE IN MEDICAL APPLICATION, BY REGION, 2016-2019 (USD MILLION)

TABLE 53 NON-WOVEN HYGIENE ADHESIVES MARKET SIZE IN MEDICAL APPLICATION, BY REGION, 2020-2025 (USD MILLION)

TABLE 54 NON-WOVEN HYGIENE ADHESIVES MARKET SIZE IN MEDICAL APPLICATION, BY REGION, 2016–2019 (KILOTON)

TABLE 55 NON-WOVEN HYGIENE ADHESIVES MARKET SIZE IN MEDICAL APPLICATION, BY REGION, 2020–2025 (KILOTON)

8.6 OTHERS

TABLE 56 NON-WOVEN HYGIENE ADHESIVES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2016–2019 (USD MILLION)

TABLE 57 NON-WOVEN HYGIENE ADHESIVES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2020–2025 (USD MILLION)

TABLE 58 NON-WOVEN HYGIENE ADHESIVES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2016–2019 (KILOTON)

TABLE 59 NON-WOVEN HYGIENE ADHESIVES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2020–2025 (KILOTON)

9 NON-WOVEN HYGIENE ADHESIVES MARKET, BY REGION (Page No. - 95)

9.1 INTRODUCTION

FIGURE 25 INDIA TO REGISTER HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

FIGURE 26 APAC LEADS THE GLOBAL NON-WOVEN HYGIENE ADHESIVES MARKET

TABLE 60 NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 61 NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 62 NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 63 NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY REGION, 2020–2025 (KILOTON)

9.2 APAC

FIGURE 27 APAC: NON-WOVEN HYGIENE ADHESIVES MARKET SNAPSHOT

TABLE 64 APAC: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 65 APAC: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 66 APAC: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2016–2019 (KILOTON)

TABLE 67 APAC: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2020–2025 (KILOTON)

TABLE 68 APAC: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 69 APAC: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 70 APAC: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 71 APAC: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY TYPE, 2020–2025 (KILOTON)

TABLE 72 APAC: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 73 APAC: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 74 APAC: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 75 APAC: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

TABLE 76 APAC: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 77 APAC: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 78 APAC: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 79 APAC: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY COUNTRY, 2020–2025 (KILOTON)

9.2.1 CHINA

9.2.1.1 Country’s large population is a major driver of the market

TABLE 80 CHINA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 81 CHINA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION 2020–2025 (USD MILLION)

TABLE 82 CHINA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 83 CHINA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

9.2.2 INDIA

9.2.2.1 Rising population and hygiene awareness in India expected to drive the market

TABLE 84 INDIA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 85 INDIA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 86 INDIA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 87 INDIA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

9.2.3 JAPAN

9.2.3.1 Increased export of hygiene products boosting the demand for non-woven hygiene adhesives

TABLE 88 JAPAN: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 89 JAPAN: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 90 JAPAN: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 91 JAPAN: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

9.2.4 SOUTH KOREA

9.2.4.1 Growth in diaper industry to positively influence the demand for adhesives in South Korea

TABLE 92 SOUTH KOREA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 93 SOUTH KOREA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 94 SOUTH KOREA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 95 SOUTH KOREA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

9.2.5 TAIWAN

9.2.5.1 Domestic demand and improved investments driving the market in Taiwan

TABLE 96 TAIWAN: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 97 TAIWAN: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 98 TAIWAN: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 99 TAIWAN: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020-2025 (KILOTON)

9.2.6 THAILAND

9.2.6.1 Strong investment activities to drive the non-woven hygiene adhesives market

TABLE 100 THAILAND: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 101 THAILAND: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 102 THAILAND: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 103 THAILAND: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

9.2.7 MALAYSIA

9.2.7.1 Government’s efforts to promote hygiene awareness expected to spur demand for non-woven hygiene adhesives

TABLE 104 MALAYSIA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 105 MALAYSIA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 106 MALAYSIA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 107 MALAYSIA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

9.2.8 REST OF APAC

TABLE 108 REST OF APAC: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 109 REST OF APAC: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 110 REST OF APAC: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 111 REST OF APAC: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

9.3 NORTH AMERICA

FIGURE 28 NORTH AMERICA: NON-WOVEN HYGIENE ADHESIVES MARKET SNAPSHOT

TABLE 112 NORTH AMERICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 113 NORTH AMERICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 114 NORTH AMERICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2016–2019 (KILOTON)

TABLE 115 NORTH AMERICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2020–2025 (KILOTON)

TABLE 116 NORTH AMERICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 117 NORTH AMERICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 118 NORTH AMERICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 119 NORTH AMERICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY TYPE, 2020–2025 (KILOTON)

TABLE 120 NORTH AMERICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 121 NORTH AMERICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 122 NORTH AMERICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 123 NORTH AMERICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

TABLE 124 NORTH AMERICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 125 NORTH AMERICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 126 NORTH AMERICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 127 NORTH AMERICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY COUNTRY, 2020–2025 (KILOTON)

9.3.1 US

9.3.1.1 High demand for adhesives in the country is driving the market

TABLE 128 US: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 129 US: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 130 US: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 131 US: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

9.3.2 CANADA

9.3.2.1 Baby care and feminine hygiene are major consumers of non-woven hygiene adhesives in Canada

TABLE 132 CANADA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 133 CANADA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 134 CANADA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 135 CANADA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

9.3.3 MEXICO

9.3.3.1 Medical expected to be fastest-growing application of non-woven hygiene adhesives market

TABLE 136 MEXICO: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 137 MEXICO: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 138 MEXICO: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 139 MEXICO: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

9.4 EUROPE

FIGURE 29 EUROPE: NON-WOVEN HYGIENE ADHESIVES MARKET SNAPSHOT

TABLE 140 EUROPE: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 141 EUROPE: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 142 EUROPE: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2016–2019 (KILOTON)

TABLE 143 EUROPE: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2020–2025 (KILOTON)

TABLE 144 EUROPE: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 145 EUROPE: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 146 EUROPE: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY TYPE, 2016–2023 (KILOTON)

TABLE 147 EUROPE: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY TYPE, 2020–2025 (KILOTON)

TABLE 148 EUROPE: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 149 EUROPE: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 150 EUROPE: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 151 EUROPE: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

TABLE 152 EUROPE: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 153 EUROPE: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 154 EUROPE: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 155 EUROPE: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY COUNTRY, 2020–2025 (KILOTON)

9.4.1 GERMANY

9.4.1.1 Strong economy and manufacturing sector driving demand for non-woven hygiene adhesives

TABLE 156 GERMANY: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 157 GERMANY: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 158 GERMANY: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 159 GERMANY: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

9.4.2 FRANCE

9.4.2.1 Increasing demand for hygiene products augmenting the demand for adhesives in hygiene products

TABLE 160 FRANCE: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 161 FRANCE: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 162 FRANCE: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 163 FRANCE: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

9.4.3 UK

9.4.3.1 Government’s efforts to promote medical industry expected to drive demand for non-woven hygiene adhesives

TABLE 164 UK: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 165 UK: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 166 UK: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 167 UK: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

9.4.4 ITALY

9.4.4.1 Stringent regulations on VOC content and growing awareness about hygiene products to drive the market

TABLE 168 ITALY: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 169 ITALY: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 170 ITALY: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 171 ITALY: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

9.4.5 RUSSIA

9.4.5.1 Stable economic growth and increasing investment expected to expand end-use industries of non-woven hygiene adhesives

TABLE 172 RUSSIA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 173 RUSSIA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 174 RUSSIA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 175 RUSSIA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

9.4.6 TURKEY

9.4.6.1 Improved standard of living expected to boost demand for non-woven hygiene adhesives

TABLE 176 TURKEY: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 177 TURKEY: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 178 TURKEY: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 179 TURKEY: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

9.4.7 NETHERLANDS

9.4.7.1 Expansion of end-use industries expected to drive the market for non-woven hygiene adhesives

TABLE 180 NETHERLANDS: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 181 NETHERLANDS: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 182 NETHERLANDS: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 183 NETHERLANDS: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

9.4.8 SPAIN

9.4.8.1 Growing aging population expected to fuel demand for non-woven hygiene adhesives

TABLE 184 SPAIN: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 185 SPAIN: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 186 SPAIN: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 187 SPAIN: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

9.4.9 REST OF EUROPE

TABLE 188 REST OF EUROPE: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 189 REST OF EUROPE: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 190 REST OF EUROPE: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 191 REST OF EUROPE: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

9.5 MIDDLE EAST & AFRICA

FIGURE 30 MIDDLE EAST & AFRICA: NON-WOVEN HYGIENE ADHESIVES MARKET SNAPSHOT

TABLE 192 MIDDLE EAST & AFRICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 193 MIDDLE EAST & AFRICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 194 MIDDLE EAST & AFRICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2016–2019 (KILOTON)

TABLE 195 MIDDLE EAST & AFRICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2020–2025 (KILOTON)

TABLE 196 MIDDLE EAST & AFRICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 197 MIDDLE EAST & AFRICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 198 MIDDLE EAST & AFRICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 199 MIDDLE EAST & AFRICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY TYPE, 2020–2025 (KILOTON)

TABLE 200 MIDDLE EAST & AFRICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 201 MIDDLE EAST & AFRICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 202 MIDDLE EAST & AFRICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 203 MIDDLE EAST & AFRICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

TABLE 204 MIDDLE EAST & AFRICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 205 MIDDLE EAST & AFRICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 206 MIDDLE EAST & AFRICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 207 MIDDLE EAST & AFRICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY COUNTRY, 2020–2025 (KILOTON)

9.5.1 UAE

9.5.1.1 Feminine hygiene and baby care segments expected to drive the non-woven hygiene adhesives market

TABLE 208 UAE: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 209 UAE: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 210 UAE: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 211 UAE: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

9.5.2 SAUDI ARABIA

9.5.2.1 Rising demand from baby care and feminine hygiene applications driving the non-woven hygiene adhesives market

TABLE 212 SAUDI ARABIA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 213 SAUDI ARABIA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 214 SAUDI ARABIA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 215 SAUDI ARABIA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

9.5.3 SOUTH AFRICA

9.5.3.1 Growing industrialization and urbanization primarily driving the market in the country

TABLE 216 SOUTH AFRICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 217 SOUTH AFRICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 218 SOUTH AFRICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 219 SOUTH AFRICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

9.5.4 REST OF MIDDLE EAST & AFRICA

TABLE 220 REST OF MIDDLE EAST & AFRICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 221 REST OF MIDDLE EAST & AFRICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 222 REST OF MIDDLE EAST & AFRICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 223 REST OF MIDDLE EAST & AFRICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

9.6 SOUTH AMERICA

FIGURE 31 SOUTH AMERICA: NON-WOVEN HYGIENE ADHESIVES MARKET SNAPSHOT

TABLE 224 SOUTH AMERICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 225 SOUTH AMERICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 226 SOUTH AMERICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2016–2019 (KILOTON)

TABLE 227 SOUTH AMERICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2020–2025 (KILOTON)

TABLE 228 SOUTH AMERICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 229 SOUTH AMERICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 230 SOUTH AMERICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 231 SOUTH AMERICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY TYPE, 2020–2025 (KILOTON)

TABLE 232 SOUTH AMERICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 233 SOUTH AMERICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 234 SOUTH AMERICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 235 SOUTH AMERICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

TABLE 236 SOUTH AMERICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY COUNTRY, 2016–2023 (USD MILLION)

TABLE 237 SOUTH AMERICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 238 SOUTH AMERICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 239 SOUTH AMERICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY COUNTRY, 2020–2025 (KILOTON)

9.6.1 BRAZIL

9.6.1.1 Brazil expected to account for largest share of the South American market

TABLE 240 BRAZIL: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 241 BRAZIL: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 242 BRAZIL: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 243 BRAZIL: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

9.6.2 ARGENTINA

9.6.2.1 Strategic Industrial Plan 2020 by the government will boost demand for adhesives

TABLE 244 ARGENTINA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 245 ARGENTINA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE,BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 246 ARGENTINA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 247 ARGENTINA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

9.6.3 COLOMBIA

9.6.3.1 Rebound in economic growth likely to boost the demand for non-woven hygiene adhesives

TABLE 248 COLOMBIA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 249 COLOMBIA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 250 COLOMBIA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 251 COLOMBIA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

9.6.4 REST OF SOUTH AMERICA

TABLE 252 REST OF SOUTH AMERICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 253 REST OF SOUTH AMERICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 254 REST OF SOUTH AMERICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 255 REST OF SOUTH AMERICA: NON-WOVEN HYGIENE ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

10 COMPETITIVE LANDSCAPE (Page No. - 175)

10.1 COMPETITIVE LEADERSHIP MAPPING

10.1.1 TERMINOLOGY/NOMENCLATURE

10.1.1.1 Visionary leaders

10.1.1.2 Dynamic differentiators

10.1.1.3 Innovators

FIGURE 32 NON-WOVEN HYGIENE ADHESIVES MARKET: COMPETITIVE LEADERSHIP MAPPING, 2019

10.2 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 33 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN NON-WOVEN ADHESIVE MARKET

10.3 BUSINESS STRATEGY EXCELLENCE

FIGURE 34 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN NON-WOVEN ADHESIVE MARKET

10.3.1 SMALL & MEDIUM-SIZED ENTERPRISES (SMSE)

10.3.1.1 Progressive companies

10.3.1.2 Starting blocks

10.3.1.3 Responsive companies

10.3.1.4 Dynamic companies

FIGURE 35 NON-WOVEN HYGIENE ADHESIVES MARKET (SMSE) COMPETITIVE LEADERSHIP MAPPING, 2019

10.4 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 36 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN NON-WOVEN ADHESIVE MARKET

10.5 BUSINESS STRATEGY EXCELLENCE

FIGURE 37 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN NON-WOVEN ADHESIVE MARKET

10.6 MARKET RANKING, 2019

FIGURE 38 MARKET RANKING OF KEY PLAYERS, 2019

10.7 COMPETITIVE SCENARIO

FIGURE 39 INVESTMENT & EXPANSION IS THE KEY STRATEGY ADOPTED BY COMPANIES BETWEEN 2017 AND 2020

10.7.1 INVESTMENT & EXPANSION

TABLE 256 INVESTMENT & EXPANSION, 2017–2020

10.7.2 MERGER & ACQUISITION

TABLE 257 MERGER & ACQUISITION, 2017–2020

10.7.3 NEW PRODUCT LAUNCH

TABLE 258 NEW PRODUCT LAUNCH, 2017–2020

11 COMPANY PROFILES (Page No. - 187)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

11.1 HENKEL AG

FIGURE 40 HENKEL AG: COMPANY SNAPSHOT

FIGURE 41 HENKEL AG: SWOT ANALYSIS

11.2 H.B. FULLER

FIGURE 42 H.B. FULLER: COMPANY SNAPSHOT

FIGURE 43 H.B. FULLER: SWOT ANALYSIS

11.3 ARKEMA (BOSTIK)

FIGURE 44 ARKEMA: COMPANY SNAPSHOT

FIGURE 45 ARKEMA: SWOT ANALYSIS

11.4 MORESCO CORPORATION

FIGURE 46 MORESCO CORPORATION: COMPANY SNAPSHOT

11.5 BEARDOW & ADAMS (ADHESIVES) LTD.

11.6 LOHMANN-KOESTER

11.7 ADTEK MALAYSIA SDN BHD

11.8 COLQUIMICA ADHESIVES

11.9 SAVARE SPECIALTY ADHESIVES

11.10 PALMETTO ADHESIVES COMPANY, INC.

11.11 OTHER KEY COMPANIES

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

12 ADJACENT/RELATED MARKETS (Page No. - 205)

12.1 INTRODUCTION

12.2 LIMITATION

12.3 ADHESIVES & SEALANTS

12.3.1 MARKET DEFINITION

12.3.2 MARKET OVERVIEW

12.3.3 ADHESIVES MARKET, BY FORMULATING TECHNOLOGY

TABLE 259 ADHESIVES MARKET SIZE, BY FORMULATING TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 260 ADHESIVES MARKET SIZE, BY FORMULATING TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 261 ADHESIVES MARKET SIZE, BY FORMULATING TECHNOLOGY, 2016–2019 (KILOTON)

TABLE 262 MARKET SIZE, BY FORMULATING TECHNOLOGY, 2020–2025 (KILOTON)

12.3.3.1 Water-based

12.3.3.2 Solvent-based

12.3.3.3 Hot-melt

12.3.3.4 Reactive & others

12.3.4 ADHESIVES MARKET, BY APPLICATION

TABLE 263 ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 264 ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 265 ADHESIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 266 ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

12.3.4.1 Paper & packaging

12.3.4.2 Building & construction

12.3.4.3 Woodworking

12.3.4.4 Automotive & transportation

12.3.4.5 Consumer & DIY

12.3.4.6 Leather & footwear

12.3.4.7 Assembly

12.3.4.8 Electronics

12.3.4.9 Medical

12.3.4.10 Others

12.3.5 ADHESIVES & SEALANTS MARKET, BY REGION

TABLE 267 ADHESIVES MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 268 ADHESIVES MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 269 ADHESIVES MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 270 ADHESIVES MARKET SIZE, BY REGION, 2020–2025 (KILOTON)

12.3.5.1 Asia Pacific

12.3.5.2 North America

12.3.5.3 Europe

12.3.5.4 South America

12.3.5.5 Middle East & Africa

13 APPENDIX (Page No. - 216)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

Non Woven Lamination Market:

The Non Woven Lamination Market involves the process of bonding layers of non-woven fabric together to create a composite material with enhanced properties. Non-woven lamination is used in various applications, such as packaging, hygiene products, medical textiles, and automotive textiles.

The Non Woven Lamination Market and the Non-Woven Adhesives Market are closely connected. Non-woven adhesives are used to bond layers of non-woven fabric together during the lamination process. They are specifically designed for use with non-woven fabrics and offer high-strength bonding.

The growth of the Non Woven Lamination Market is expected to have a positive impact on the Non-Woven Adhesives Market. The increasing demand for non-woven laminates is expected to drive the demand for non-woven adhesives, as they are essential for the lamination process. Additionally, the development of new and improved non-woven adhesives is expected to create new opportunities for the Non-Woven Adhesives Market.

Futuristic Growth Use-Cases of Non Woven Lamination Market:

The Non Woven Lamination Market is expected to witness significant growth in the future due to the increasing demand for lightweight, durable, and cost-effective composite materials. Some of the futuristic growth use-cases of the market include the increasing use of non-woven laminates in the production of environmentally-friendly packaging materials, the growing demand for non-woven laminates in the healthcare industry for use in medical textiles, and the rising demand for non-woven laminates in the automotive industry for use in interior components.

Top Players in Non Woven Lamination Market:

The top players in the Non Woven Lamination Market include Berry Global Inc., Ahlstrom-Munksjö, DowDupont Inc., Toray Industries Inc., and Johns Manville, among others. These companies are investing in research and development activities to develop new and improved non-woven laminates with advanced properties and to improve the efficiency of their production processes.

Other Industries Impacted by Non Woven Lamination Market:

The Non Woven Lamination Market is expected to impact several other industries in the future, including the packaging, hygiene products, medical textiles, and automotive industries. Non-woven laminates are widely used in these industries for applications such as packaging materials, diapers, wound dressings, and automotive interior components. The increasing demand for non-woven laminates is expected to create new opportunities for these industries and to drive innovation in their respective fields.

Speak to our Analyst today to know more about Non Woven Lamination Market!

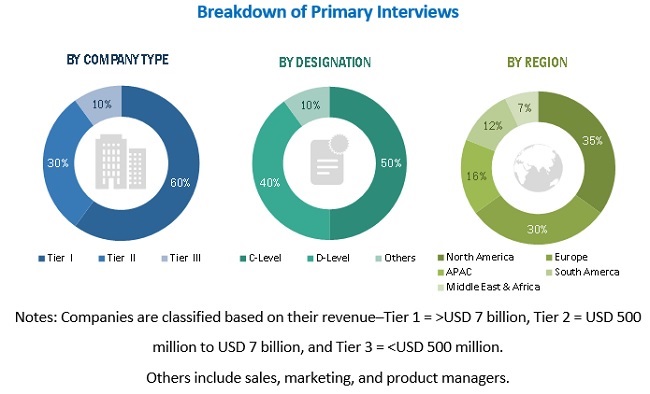

The study involves four major activities in estimating the market size of non-woven adhesives. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of each segment.

Secondary Research

In the secondary research process, sources, such as annual reports, press releases, and investor presentations of companies; white papers; publications from recognized websites; and databases, have been referred to for identifying and collecting information. Secondary research has been used to obtain critical information about the supply chain of the industry, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

After the complete market estimation process (which includes calculations for market statistics, market breakdown, market size estimations, market forecast, and data triangulation), extensive primary research has been conducted to gather information and to verify and validate the critical numbers arrived at. Primary research has also been conducted to identify segmentation, industry trends, Porter’s Five Forces analysis, key players, competitive landscape, strategies of key players, and key market dynamics such as drivers, restraints, opportunities, and challenges.

In the primary research process, different primary sources from the supply and demand sides have been interviewed to obtain qualitative and quantitative information. The primary sources include industry experts, such as CEOs, vice presidents, marketing directors, technology & innovation directors, and related key executives from various companies and organizations operating in the non-woven adhesives market.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the market size of non-woven adhesives for various applications in each region. The research methodology used to estimate the market size includes the following steps:

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the submarkets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data has been consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and sub-segments. The data triangulation and market breakdown procedures have been used, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments. The data has been triangulated by studying various factors and trends from the demand and supply sides. In addition, the market has been validated using the top-down and bottom-up approaches. Then, it has been verified through primary interviews. Hence, for every data, there are three sources — the top-down approach, the bottom-up approach, and expert interviews. Only when the values arrived at from the three points matched, the data has been assumed to be correct.

Report Objectives

- To define, describe, and forecast the global non-woven hygiene adhesives in terms of value and volume

- To provide information about the factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To analyze and forecast the market size by technology, type, and application

- To analyze and forecast the market size with respect to five main regions (along with their respective key countries), namely, North America, Europe, Asia Pacific (APAC), the Middle East & Africa, and South America

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide details of a competitive benchmarking of the market leaders

- To track and analyze competitive developments such as investment & expansion, new product launch, and merger & acquisition in the market

- To strategically profile key players in the market and comprehensively analyze their core competencies

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix that gives a detailed comparison of product portfolio of each company.

Regional Analysis

- Further breakdown of a region with respect to a particular country

Company Information

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Non-Woven Adhesives Market