North America HVAC Contained Server Market by Form Factor (Below 20 U, 20 to 40 U, Above 40 U), Cooling Capacity (Below 6,000 BTU, 6,000 to 10,000 BTU, Above 10,000 BTU), Organization Size, Vertical, and Country - Forecast to 2022

[95 Pages Report] The Heating, Ventilation, and Air Conditioning (HVAC) contained server market size is projected to grow from USD 634.8 Million in 2017 to USD 1,540.4 Million by 2022, at a Compound Annual Growth Rate (CAGR) of 19.4%. The integrated HVAC contained server solution is sometimes referred to as climate controlled cabinets, smart closets, and smart cabinets. It acts as a cost-effective alternative to installing a complete data center with a cabinet cooling system, which in turn, saves company space and money. The key market vendors offer a variety of cabinets with different specifications to suit the varied business needs of enterprises, making the cabinets ideal for remote locations, wiring closets, and industrial sites. Temperature controlled protection is one of the major benefits offered, and it enables enterprises to install servers and other equipment without additional cooling or costly infrastructure. Factors such as exponential increase in server rack densities, rapid deployment and less construction period, and significant cost savings achieved by server owners are fueling the growth of the HVAC contained servers across the globe. The base year considered for this study is 2016 and the forecast period considered is 20172022.

Objectives of the Study

- To describe and forecast the North America HVAC contained server market by form factor, cooling capacity, organization size, vertical, and country

- To forecast the market size of the North American region and encompassed countries the US and Canada

- To analyze subsegments with respect to the individual growth trends, future prospects, and contributions to the total market

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for stakeholders and to provide details of competitive landscape for major players

- To profile key players and comprehensively analyze their core competencies and positioning

- To track and analyze competitive developments, such as mergers and acquisitions; new product developments; and partnerships, agreements, and collaborations in the market

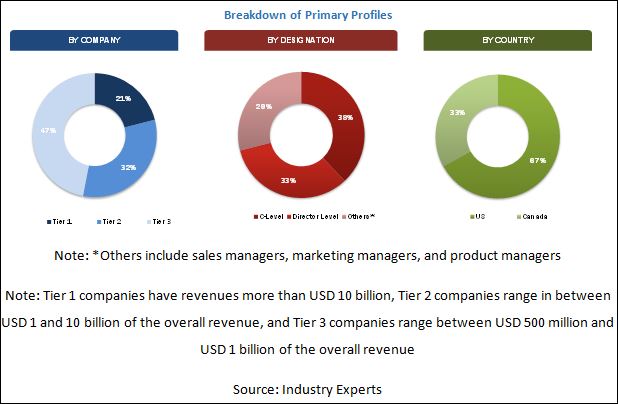

The research methodology used to estimate and forecast the North America HVAC contained server market begins with capturing data on key vendor revenues through secondary research. Vendor offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the North America HVAC contained server market from the revenue of the key players in the market. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key people, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments. The breakdown of primary profiles is depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The North America HVAC contained server ecosystem comprises vendors, such as Black Box Corporation (Pennsylvania, US), Vertiv Co. (Ohio, US), Schneider Electric SE (Rueil-Malmaison, France), STULZ GmbH (Hamburg, Germany), Hitachi Systems (Tokyo, Japan), Tripp Lite (Illinois, US), Rackmount Solutions (Texas, US), EIC Solutions, Inc. (Pennsylvania, US), Crenlo (Minnesota, US), and Karis Technologies Inc. (Toronto, Canada). Other stakeholders of the North America HVAC contained server market include distributors, resellers, connectivity service providers, system integrators, and software solution providers.

Key Target Audience For North America HVAC Contained Server Market

- HVAC contained server vendors

- Equipment providers

- Distributors

- Resellers

- Connectivity service providers

- System integrators

- Software solution providers

The research study answers several questions for the stakeholders, primarily which market segments to focus in the next 25 years for prioritizing the efforts and investments.

Scope of the Report

The research report categorizes the North America HVAC contained server market to forecast the revenues and analyze the trends in each of the following submarkets:

By Form Factor

- Below 20 U

- 20 to 40 U

- Above 40 U

North America HVAC Contained Server Market By Cooling Capacity

- Below 6,000 BTU

- 6,000 to 10,000 BTU

- Above 10,000 BTU

By Organization Size

- Small and Medium-sized Enterprises (SMEs)

- Large enterprises

By Vertical

- Banking, Financial Services, and Insurance (BFSI)

- IT and telecom

- Manufacturing

- Retail

- Education

- Healthcare

- Government and defense

- Others (media and entertainment, and transportation and logistics)

By Country

- The US

- Canada

Available Customizations

With the given market data, MarketsandMarkets offers customizations based on the companys specific needs. The following customization options are available for the report:

Company Information

Detailed analysis and profiling of additional market players (up to 5).

The North America Heating, Ventilation, and Air Conditioning (HVAC) contained server market size is expected to grow from 634.8 Million in 2017 to USD 1,540.4 Million by 2022, at a Compound Annual Growth Rate (CAGR) of 19.4% during the forecast period. The HVAC contained server setup is also sometimes referred to as climate controlled cabinets, smart closets, and smart cabinets, and it protects essential electronic components with high quality cooling units. It also addresses the need to install a complete data center by providing a simple, fully integrated infrastructure that has precision cooling, Uninterrupted Power Supply (UPS), power management, and monitoring technologies in an enclosed system. The air conditioning capacity is designed considering the rack equipment and volume. This saves considerable amount of capital and operational costs for the enterprises. Some of the factors driving the North America HVAC contained server market are an exponential increase in server rack densities, proliferation of Small and Medium-sized Enterprises (SMEs) and startups, and significant cost savings achieved by the server owners.

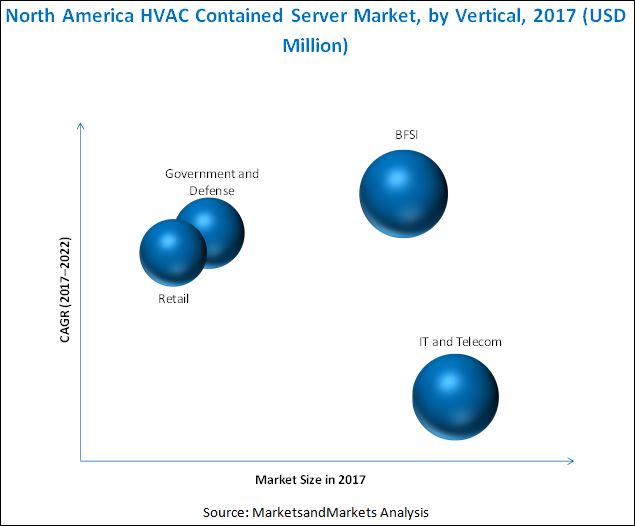

The North America HVAC contained server market report has been broadly classified on the basis of form factor forms into below 20 U, 20 to 40 U, and above 40 U; cooling capacities into below 6,000 BTU, 6,000 to 10,000 BTU, and above 10,000 BTU; and organization sizes into large enterprises and SMEs. The market has also been segmented into various verticals, including Banking, Financial Services, and Insurance (BFSI); IT and telecom; government and defense; healthcare; education; retail; manufacturing; and others (media and entertainment, and transportation and logistics), and on the basis of countries into the US and Canada.

The 20 to 40 U form factor is projected to grow at the highest rate, and is expected to continue its dominance during the forecast period. The 20 to 40 U range of servers provides an ideal blend of processing power, storage, and functionality. These servers are getting increasingly deployed by businesses, as they provide more features than the below 20 U rack servers.

The below 6,000 BTU cooling capacity is projected to hold the largest market share in 2017, and is expected to grow during the forecast period. The main reason for the high demand is that this range of cooling capacity has a low power requirement, and hence is more economical. This cooling capacity is ideal for deployment in small-sized businesses.

The SMEs segment is moving toward the adoption of HVAC contained server market, and growing rapidly at the highest CAGR during the forecast period. SMEs face intense competition from large enterprises; thus, to gain a competitive edge, they are adopting HVAC contained servers, which would enable energy-efficient cooling, safety, and availability of costly IT equipment in harsh weather conditions, thus enhancing the business productivity. This trend is expected to continue among the SMEs during the forecast period.

The BFSI vertical is projected to grow at the highest CAGR during the forecast period. The increasing demand for HVAC contained server centers in the BFSI vertical is driven by the shift toward digitization and big data. The BFSI vertical is expected to hold crucial customer information, and with the increasing number of customers, it has resulted in an exponential data growth in the banking and financial services industry.

The decline in demand for server hardware due to consolidation and virtualization might pose as a restraint for the market. Still, vendors are anticipated to take advantage of opportunities, such as rapid growth in server traffic, and the huge demand for Internet of Things (IoT) and edge computing, which are increasing the need for HVAC contained servers. Less awareness about HVAC contained servers, and the issue of manufacturing server cabinets according to varying rack sizes and volume are expected to pose challenges to the overall market growth.

The major vendors providing HVAC contained servers in North America are Black Box Corporation (Pennsylvania, US), Vertiv Co. (Ohio, US), Schneider Electric (Rueil-Malmaison, France), STULZ GmbH (Hamburg, Germany), Hitachi Systems (Tokyo, Japan), Tripp Lite (Illinois, US), Rackmount Solutions (Texas, US), EIC Solutions, Inc. (Pennsylvania, US), Crenlo (Minnesota, US), and Karis Technologies Inc. (Toronto, Canada). These players have adopted various strategies, such as new product developments, acquisitions, and partnerships to serve the market. Continuous technology innovation is an area of focus for these players to maintain its competitive position in the market and promote customer satisfaction.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 11)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Key Industry Insights

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 21)

4 Premium Insights (Page No. - 23)

4.1 Attractive Market Opportunities in the North America HVAC Contained Server Market

4.2 Market Share of Form Factor and Cooling Capacity, 2017

4.3 Market Top 3 Verticals, 20172022

5 Market Overview (Page No. - 26)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Exponential Increase in Server Rack Densities

5.2.1.2 Significant Cost Savings Achieved By Server Owners

5.2.1.3 Proliferation of SMES and Startups Worldwide

5.2.1.4 Rapid Deployment and Less Construction Period

5.2.1.5 Need to Eliminate Overcooling

5.2.2 Restraints

5.2.2.1 Decline in Demand for Server Hardware Due to Consolidation and Virtualization

5.2.3 Opportunities

5.2.3.1 Rapid Growth in Data and Server Traffic

5.2.3.2 Global Focus on Carbon Footprint of Servers

5.2.3.3 Huge Demand for IoT and Edge Computing

5.2.4 Challenges

5.2.4.1 Less Awareness About HVAC Contained Servers in the Market

5.2.4.2 Manufacturing HVAC Contained Server Cabinets According to Rack Size and Volume

5.3 Associations and Standards

5.3.1 Introduction

5.3.2 National Electrical Manufacturers Association (NEMA)

5.3.3 American National Standards Institute (ANSI)

5.3.4 American Society of Heating, Refrigerating, and Air Conditioning Engineers (ASHRAE)

5.3.5 Canadian Standards Association Group (CSA)

5.3.6 United States Environmental Protection Agency (US EPA)

5.4 Ecosystem

6 North America HVAC Contained Server Market Analysis, By Form Factor (Page No. - 32)

6.1 Introduction

6.2 Below 20 U

6.3 20 to 40 U

6.4 Above 40 U

7 Market Analysis, By Cooling Capacity (Page No. - 36)

7.1 Introduction

7.2 Below 6,000 BTU

7.3 6,000 to 10,000 BTU

7.4 Above 10,000 BTU

8 Market Analysis, By Organization Size (Page No. - 40)

8.1 Introduction

8.2 Small and Medium-Sized Enterprises

8.3 Large Enterprises

9 North America HVAC Contained Server Market Analysis, By Vertical (Page No. - 44)

9.1 Introduction

9.2 Banking, Financial Services, and Insurance

9.3 IT and Telecom

9.4 Manufacturing

9.5 Retail

9.6 Education

9.7 Healthcare

9.8 Government and Defense

9.9 Others

10 Geographic Analysis (Page No. - 53)

10.1 Introduction

10.1.1 United States

10.1.2 Canada

11 Competitive Landscape (Page No. - 60)

11.1 Introduction

11.1.1 Visionary Leaders

11.1.2 Innovators

11.1.3 Dynamic Differentiators

11.1.4 Emerging Companies

11.2 Competitive Benchmarking

12 Company Profiles (Page No. - 63)

(Overview, Financials, Products & Services, Strategy, and Developments)*

12.1 Black Box Corporation

12.2 Vertiv Co.

12.3 Schneider Electric Se

12.4 Stulz GmbH

12.5 Hitachi Systems

12.6 Tripp Lite

12.7 Rackmount Solutions

12.8 EIC Solutions, Inc.

12.9 Crenlo

12.10 Karis Technologies Inc.

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 87)

13.1 Key Industry Insights

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Related Reports

13.6 Author Details

List of Tables (32 Tables)

Table 1 United States Dollar Exchange Rate, 20142016

Table 2 North America HVAC Contained Server Market Size and Growth Rate, 20152022 (USD Million, Y-O-Y %)

Table 3 Market Size, By Form Factor, 20152022 (USD Million)

Table 4 Below 20 U: Market Size, By Country, 20152022 (USD Million)

Table 5 20 to 40 U: Market Size, By Country, 20152022 (USD Million)

Table 6 Above 40 U: Market Size, By Country, 20152022 (USD Million)

Table 7 North America HVAC Contained Server Market Size, By Cooling Capacity, 20152022 (USD Million)

Table 8 Below 6,000 BTU: Market Size, By Country, 20152022 (USD Million)

Table 9 6,000 to 10,000 BTU: Market Size, By Country, 20152022 (USD Million)

Table 10 Above 10,000 BTU: Market Size, By Country, 20152022 (USD Million)

Table 11 Market Size, By Organization Size, 20152022 (USD Million)

Table 12 Small and Medium-Sized Enterprises: Market Size, By Country, 20152022 (USD Million)

Table 13 Large Enterprises: Market Size, By Country, 20152022 (USD Million)

Table 14 Market Size, By Vertical, 20152022 (USD Million)

Table 15 Banking, Financial Services, and Insurance: Market Size, By Country, 20152022 (USD Million)

Table 16 IT and Telecom: Market Size, By Country, 20152022 (USD Million)

Table 17 Manufacturing: Market Size, By Country, 20152022 (USD Million)

Table 18 Retail: Market Size, By Country, 20152022 (USD Million)

Table 19 Education: Market Size, By Country, 20152022 (USD Million)

Table 20 Healthcare: Market Size, By Country, 20152022 (USD Million)

Table 21 Government and Defense: Market Size, By Country, 20152022 (USD Million)

Table 22 Others: Market Size, By Country, 20152022 (USD Million)

Table 23 North America HVAC Contained Server Market Size, By Country, 20152022 (USD Million)

Table 24 United States HVAC Contained Server Market Size and Growth Rate, 20152022 (USD Million, Y-O-Y %)

Table 25 United States HVAC Contained Server Market Size, By Form Factor, 20152022 (USD Million)

Table 26 United States HVAC Contained Server Market Size, By Cooling Capacity, 20152022 (USD Million)

Table 27 United States HVAC Contained Server Market Size, By Vertical, 20152022 (USD Million)

Table 28 Canada HVAC Contained Server Market Size and Growth Rate, 20152022 (USD Million, Y-O-Y %)

Table 29 Canada HVAC Contained Server Market Size, By Form Factor, 20152022 (USD Million)

Table 30 Canada HVAC Contained Server Market Size, By Cooling Capacity, 20152022 (USD Million)

Table 31 Canada HVAC Contained Server Market Size, By Vertical, 20152022 (USD Million)

Table 32 North America HVAC Contained Server Market Vendor Ranking, 2017

List of Figures (24 Figures)

Figure 1 North America HVAC Contained Server Market Segmentation

Figure 2 Market Research Design

Figure 3 Breakdown of Primary Interviews: By Company, Designation, and Country

Figure 4 Data Triangulation

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Market Assumptions

Figure 8 Exponential Increase in Server Rack Densities is Contributing to the Growth of the North America HVAC Contained Server Market During the Forecast Period

Figure 9 20 to 40 U Form Factor and Below 6,000 BTU Cooling Capacity are Estimated to Have the Largest Market Shares in 2017

Figure 10 Banking, Financial Services, and Insurance Vertical is Expected to Grow at the Highest CAGR

Figure 11 Market Drivers, Restraints, Opportunities, and Challenges

Figure 12 Market Ecosystem

Figure 13 The 20 to 40 U Form Factor is Estimated to Have the Largest Market Size in 2017

Figure 14 The Below 6,000 BTU Segment is Expected to Have the Largest Market Size During the Forecast Period

Figure 15 Small and Medium-Sized Enterprises Segment is Expected to Have A Larger Market Size During the Forecast Period

Figure 16 IT and Telecom Vertical is Estimated to Hold the Largest Market Size in 2017

Figure 17 North America: Market Snapshot

Figure 18 The United States is Estimated to Hold A Larger Market Size in 2017

Figure 19 North America HVAC Contained Server Market Competitive Leadership Mapping, 2017

Figure 20 Product Offerings

Figure 21 Business Strategies

Figure 22 Black Box Corporation: Company Snapshot

Figure 23 Schneider Electric Se: Company Snapshot

Figure 24 Hitachi Systems: Company Snapshot

Growth opportunities and latent adjacency in North America HVAC Contained Server Market